This is another short issue with the recap of the major events, data and central bank speakers. Next week, we'll be back to normal coverage. Please note that I'll be transitioning to a mostly PDF-based newsletter in the coming weeks. This issue contains the material in the usual newsletter-based format and also a PDF version in the Downloads section. Please check it out and let me know if you have any feedback or suggestions.

Welcome to issue #64 of fx:macro!

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

The cover image is AI-generated via Midjourney. If you want to guess the prompt, I put it at the end of the newsletter.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Here's a shout-out to a great newsletter I just discovered recently:

The Rollup - Markets & macro from outside the mainstream 🤙 Curated investing news from YouTube, Substack, Twitter and more

I always find a link to an interesting article or podcast I've missed during the week in there.

Table of Contents

Summary (

Playbook,Calendar,Levels,FX Drivers, Downloads)Week in Review: a) Central Banks, b) Economic Data

Market Analysis: a) Growth and Inflation, b) Yields, c) Central Banks and the US Dollar, d) Sectors and Flows, e) Sentiment and Positioning, f) Market Risks, g) VariousTop 3 Macro Charts of the Week

Summary

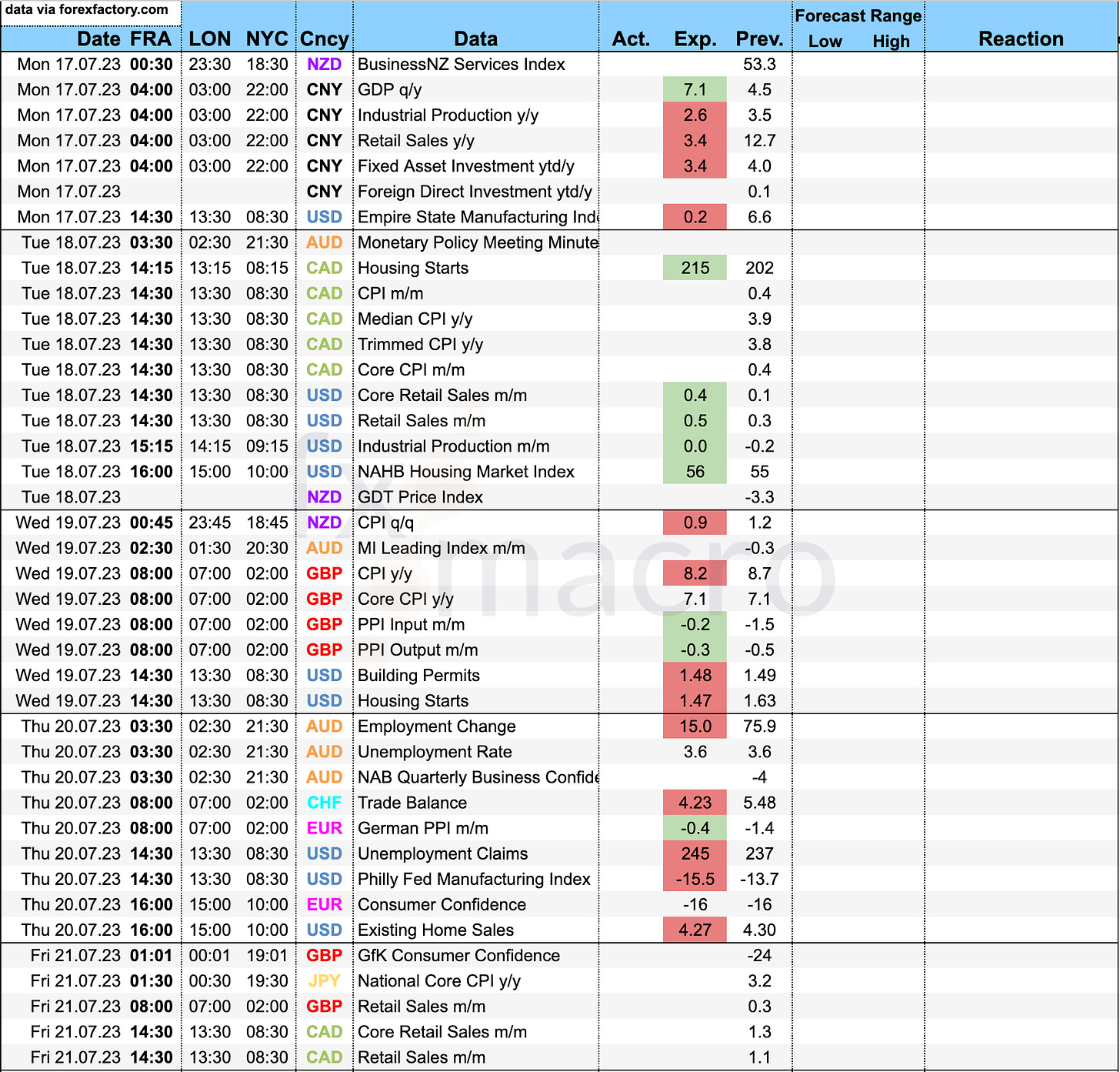

Economic Calendar for next week

If you want a quick and easy way to hook a customized economic calendar into your favourite calendar app then check out this link.

Important levels to watch and look out for in FX futures

Currency Drivers

For an explanation check out this link.

Downloads and Links

Central bank overview with the summaries of each of the latest rate decisions, rate statements and minutes:

Central bank speaker recap for the week:

Intraday seasonalities for currencies and major asset classes (NEW!):

Another weekly review in PDF format that contains the same material as below except for the central bank speakers. I will transition to a PDF-based newsletter in the coming weeks, so if you have any feedback (layout, readability, whatever else) don't hesitate to put it in the comments or reach out to me by replying to this mail:

Week in Review

Central Banks

RBNZ Rate Statement (12.07.23)

The RBNZ left the OCR unchanged as expected:

Guidance unchanged: The OCR will need to remain at a restrictive level for the foreseeable future

Global inflation is coming down, global growth is weakening and has led to lower export prices for the New Zealand's goods

Domestic inflation is expected to continue its decline; core inflation is expected to decline as capacity constraints ease (previously: core inflation pressures will remain until capacity constraints ease)

There are now signs of labour market pressures dissipating (previously: signs of labour shortages easing and vacancies declining)

They removed the sentence that the lack of demand is the main constraint on activity

Here are the highlights from the minutes:

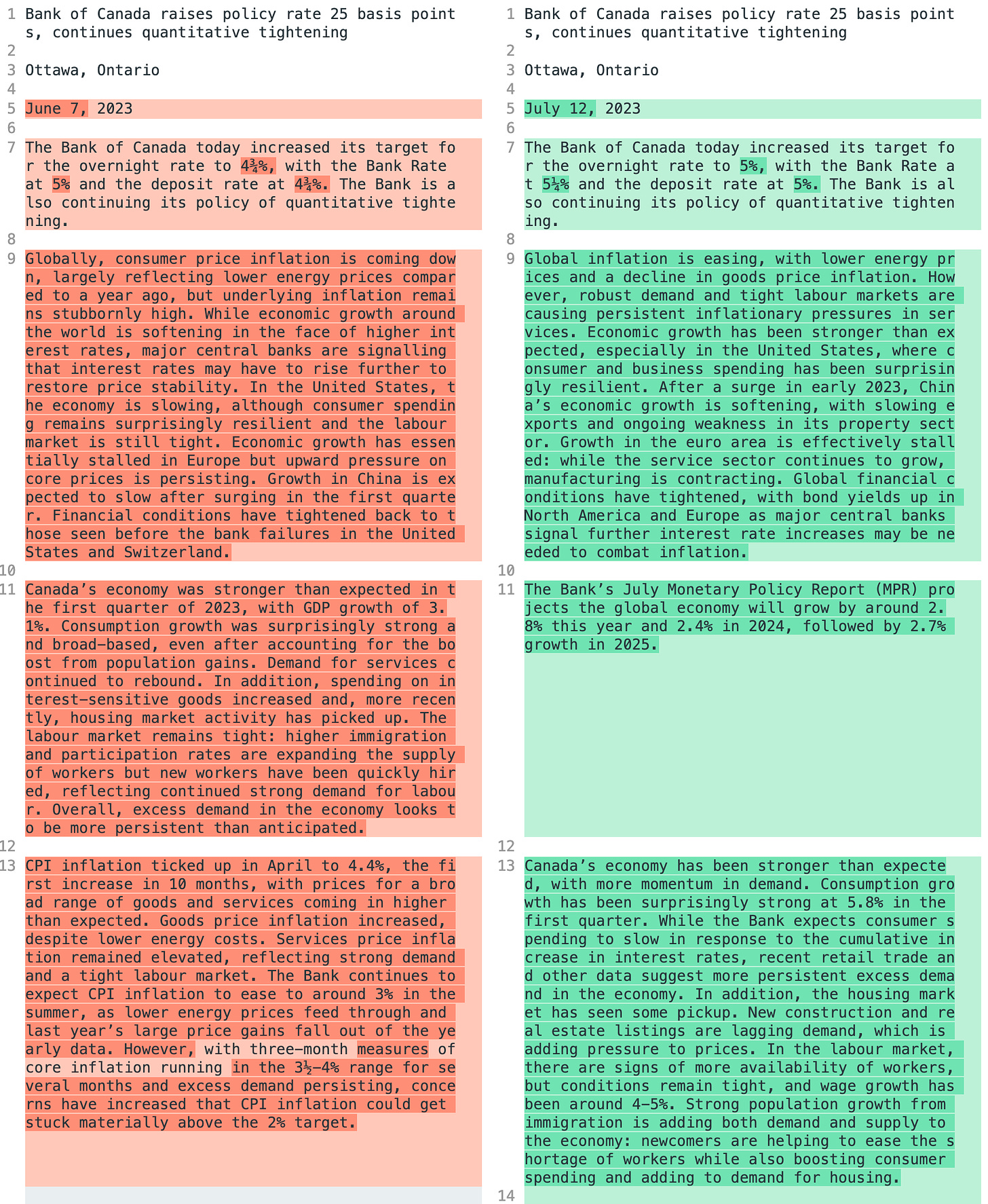

BOC Rate Statement (12.07.23)

The Bank of Canada raised rates by 25 bps to 5.00%:

Reasons for hike: accumulation of evidence of excess demand and more persistent core inflation

Dropped statement from June that rates are not sufficiently restrictive

Global inflation is easing but pressures in services inflation remain

Global growth has been stronger than expected, especially in the US; projection: 2.8% this year, 2.4% next year and 2.7% in 2025

Domestic growth projections: 1.8% this year, 1.2% next year, 2.4% in 2025

Domestic inflation projections: around 3% next year, gradual decline to 2% in the middle of 2025; the decline is slower than forecast in January and April

The GC remains concerned that progress towards 2% inflation could stall

Canadian growth and consumption have been stronger than expected, signs of persistent excess demand, the housing market has picked up, the labour market remains tight despite signs of more availability of workers, immigration is boosting demand and helping ease labour shortages

Canadian inflation has dropped largely due to energy prices and base effects, less from underlying inflation; underlying price pressures appear more persistent than anticipated

From the Monetary Policy Report:

ECB Minutes (13.07.23)

Members broadly concurred with the assessment that inflation was still projected to remain too high for too long, calling into question whether it was returning to target in a timely manner.

Doubts were expressed about whether a particular emphasis on core inflation was justified, as it was not seen to be a leading indicator of future headline inflation. It was argued that the Governing Council should not put too much emphasis on core inflation, as its mandate related to headline inflation.

It was cautioned that strong wage growth was becoming a key driver of inflation, and convincing evidence that underlying inflation had peaked was still lacking but according to recent data releases core inflation had stabilised and might have reached a turning point.

Members generally concurred that interest rates had reached restrictive territory, while it remained unclear at what point the stance would become sufficiently restrictive.

A very broad consensus supported the 25 basis point rate increase proposed, while a preference was also initially expressed for a 50 bps hike in view of the risk of high inflation becoming more persistent.

A very broad consensus also prevailed in favour of confirming the end of reinvestments under the APP as of July.

Confab, Speakers, News

Federal Reserve

Barr (Neutral). Mon: Inflation is far too high, we are quite attentive to bringing it down to target, we have made a lot of progress on inflation, still have a bit of work to do, the need for regulators to focus on bank resilience broadly has been reinforced by recent bank failures.

Mester (Hawk). Mon: The Fed will need to tighten somewhat further to lower inflation, no decision yet on the need for a July hike, the outlook for the terminal rate matches or is just above June's median forecast, there was a preference for a June hike but there's an understanding as to why there wasn't any action taken, closer to the end of the tightening campaign than to the start, policy is less restrictive compared to history, raising rates again will reduce the risk of more action in the future, the economy has proven stronger than expected, core inflation remains too high and broad-based, wage pressures remain too high to get inflation back to 2%, business leaders' fears of a recession have declined, too early to say the neutral rate has shifted much.

Daly (Neutral). Mon: There is more we need to do to raise rates, risks have become more balanced, sees the need for two more rate hikes this year to bring inflation back to 2% goal, the precise number of hikes may be adjusted based on economic data, the risk of underacting continues to outweigh the risk of overacting but these risks are becoming more balanced. Thu: Going to continue to work on rate hikes until we are sure that inflation is on the path to come back down toward 2%, the good news on inflation this week is indeed good news but too early to say we can declare victory, saying that we needed two hikes was a way to keep optionality open, cumulative effects of monetary tightening still to work their way through the system, thought that the banking crisis could be worth 1 to 2 tightenings but not seeing that impact, as inflation starts coming down we can start lowering the nominal rate to bring real rates down to neutral levels, wants to start heading towards the neutral rate as we approach 2% on inflation.

Bostic (Neutral). Mon: There's no expectation of needing to raise rates further, this is a hard judgment call, the path forward is no longer obvious, even with a 25 bps move at the next meeting it will still require patience, it's a "pretty straightforward story" that inflation could return to 2% without rates rising further, a lot of the strength in the economy is due to pandemic support, inflation is too high and not sustainable, there are no expectations for a daramatic sea change in inflation, the biggest risk is not moving inflation back to target and all of the Fed is in consensus on that view, the trajectory on inflation right now is "in the right direction", policy is clearly in restrictive territory and the Fed can be patient, would not be comfortable if inflation stalls or expectations rise, right now expectations are pretty well anchored.

Barkin (Neutral). Wed: Inflation is still too high, still a question whether inflation can settle while labour market remains as strong as it is, comfortable doing more with policy if incoming data does not confirm inflation will return to target.

Kashkari (Hawk). Wed: May need to raise rates further if high inflation persists, the fight against inflation must succeed, bank supervisors should ensure all banks are prepared to withstand higher rate environment.

Waller (Hawk). Thu: September is a live meeting for monetary policy, in favour of raising rates at the July meeting, likely to need two more 25 basis point rate hikes this year, the bulk of past rate hikes already have impacted economy, economic strength gives the Fed space to hike further, fighting inflation remains main goal, cooler CPI data is welcome but need to see if it is sustained, inflation has shown false dawns before, the jobs market has slowed but remains strong, a soft landing for the economy is still possible.

Goolsbee (Dove). Fri: There is a path to curb inflation without recession.

European Central Bank

Villeroy (Neutral). Weekend: We will soon reach the high point of interest rates, this will not be a peak but a high plateau on which we will have to remain for a sufficiently long time to fully transmit all the effects of monetary policy, raising the inflation target is not a good idea. Tue: We are close to the peak of interest rates, we will need to stay at the peak for a while, starting to see good news on inflation, inflation will continue to decline and will be back at 2% by 2025.

Centeno. Sunday: Inflation is coming down faster than the way up, expects inflation under 3% by the end of the year.

Nagel (Hawk). Mon: Inflation remains too high, a hard landing can be avoided.

Herodotou. Mon: Inflation is worse than high rates, monetary policy is the only tool to fight inflation, high interest rates won't be permanent.

Vujcic. Wed: September ECB meeting is very open, slowing down the pace of rate hikes is certainly a possibility, even if we pause we will say we can resume hiking, not discussing outright bond sales.

Lane. Wed: The full economic impact of tightening will play out over the next couple years.

Visco. Thu: We are not very far from the peak in interest rates, he "somewhat disagrees" with the preference for further tightening.

Stournas. Thu: We said a July hike was likely but data since has become weaker, September hike is not a given particularly since data points to a stagnation in Q3, emphasizes data-dependence.

Bank of England

Bailey (Neutral). Mon: Inflation is unacceptably high, the aim is to bring it down to 2% target, headline inflation is expected to decrease significantly over the rest of the year, the economy has shown unexpected resilience, both price and wage increases at current rates are inconsistent with the inflation target. Wed: The UK economy and financial system have been resilient so far, the FPC will remain vigilant as the impact of higher rates feeds through, tighter bank lending standards reflect appropriate risk judgment.

Cunliffe (Dove). Wed: This interest rate cycle has been fast but the amplitude may not be large by historic standards, will put out proposals for money market fund reforms later this year.

Reserve Bank of Australia

Lowe. Wed: It remains to be determined whether there is more work to be done on monetary policy, possible that some further tightening is required, very conscious that policy operates with a lag and full effects have yet to be felt, from 2024 the RBA Board will meet eight times a year compared with 11 times currently, the governor will hold a press conference after each policy meeting to explain the decision.

Bank of Canada

Macklem. Wed: The GC did discuss possibility of keeping rates unchanged but cost of delaying action was larger than the benefit of waiting, the clear consensus was that monetary policy needed to be more restrictive, further rate decisions will be guided by assessment of incoming data and outlook for inflation, monetary policy is working but underlying inflationary pressures are proving more stubborn, higher interest rates are needed, prepared to raise rates further, trying to balance the risks of under and over tightening, if we don't do enough now we'll likely have to do even more later, in the bank's forecast there's a path to price stability while maintaining growth.

Bank of Japan

Kanda. Thu: Closely watching FX market moves.

People's Bank of China

Liu. Fri: Will keep credit growth appropriate, will step up support for key sectors, will step up counter-cyclical adjustments, will guide banks to increase lending to small firms, China's economy needs time to return to normal after the pandemic, sees no deflationary risks in H2, CPI could go lower in July and rebound in August.

Economic Data

Monday, 10.07.23

Tuesday, 11.07.23

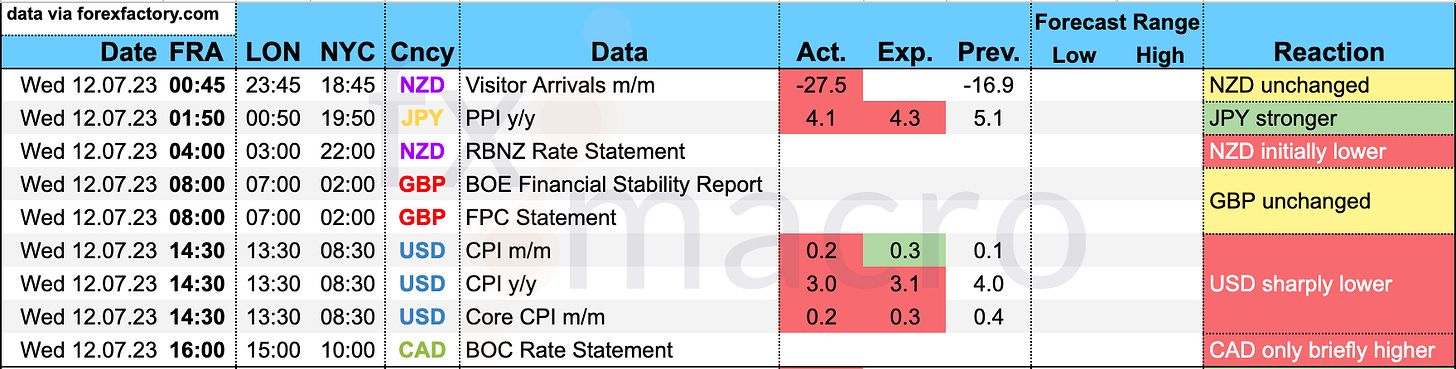

Wednesday, 12.07.23

Thursday, 13.07.23

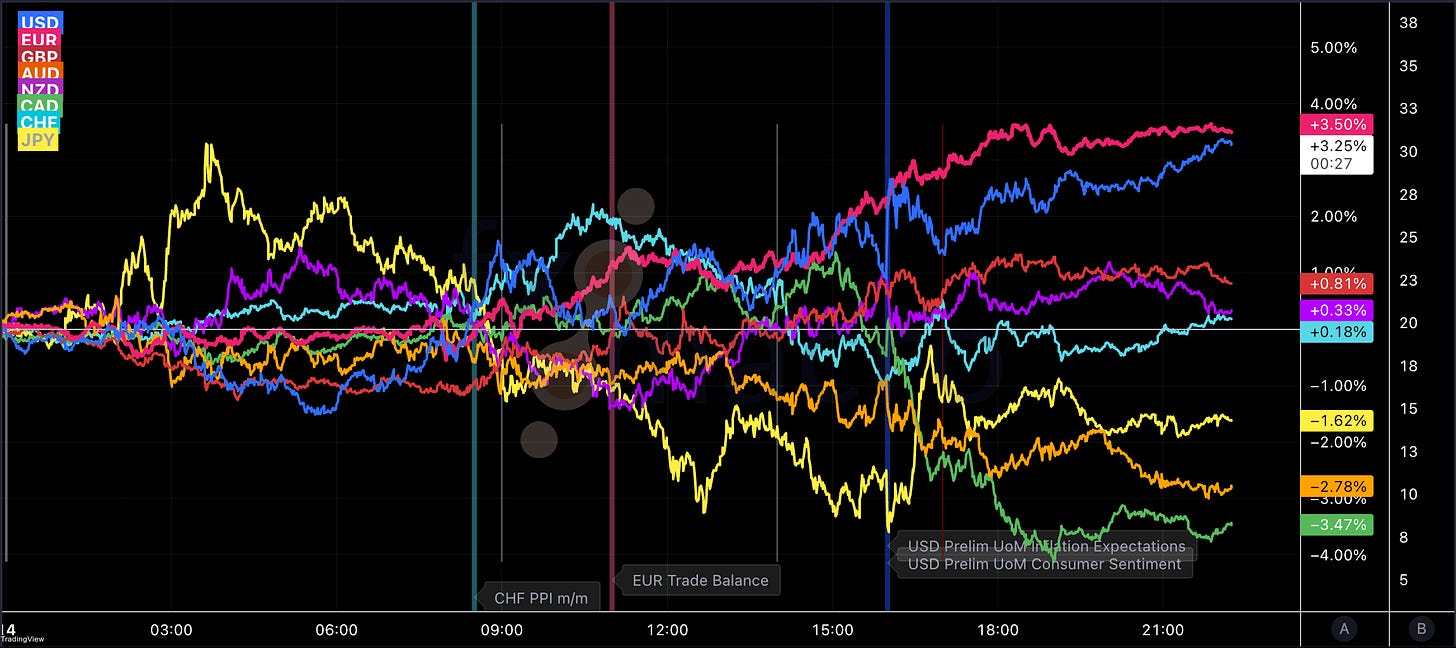

Friday, 14.07.23

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 25/2023 | 19/2023 | 13/2023 | 06/2023 | 50/2022 | 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 28/2023 | 22/2023 | 15/2023 | 09/2023 | 02/2023 | 47/2022 | 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

ECB

Rate Statements: 25/2023 | 19/2023 | 12/2023 | 06/2023 | 50/2022 | 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 22/2023 | 17/2023 | 10/2023 | 04/2023 | 47/2022 | 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 11/2023 | 05/2023 | 50/2022 | 43/2022 | 36/2022

BOE

Rate Statements: 25/2023 | 20/2023 | 13/2023 | 06/2023 | 50/2022 | 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

RBA

Rate Statements: 28/2023 | 24/2023 | 19/2023 | 15/2023 | 11/2023 | 07/2023 | 50/2022 | 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 25/2023 | 21/2023 | 17/2023 | 09/2023 | 51/2022 | 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 19/2023 | 07/2023 | 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 22/2023 | 15/2023 | 09/2023 | 47/2022 | 41/2022 | 34/2022 Meeting Minutes: 07/2023 Crib Sheets: 40/2022

BOC

Rate Statements: 24/2023| 15/2023 | 11/2023 | 05/2023 | 50/2022 | 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022 Summary of Deliberations: 25/2023 | 18/2023

SNB

Rate Statements: 25/2023 | 13/2023 | 50/2022 | 44/2022 | 39/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

BOJ

Rate Statements: 25/2023 | 18/2023 | 11/2023 | 04/2023 | 51/2022 | 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 26/2023 | 20/2023 | 13/2023 | 05/2023 | 52/2022 | 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: Midjourney with the prompt: red orange mix bull

great work because indeed "There is no substitute for hard work." ... thank you!