Review of Week 50/2022

The Fed, SNB, BoE and ECB as well as a lot of other data...

Since this was my last trading week for the year, I will only publish the review part today as well as next weekend to stay up-to-date. The next full issue of fx:macro will be out in January.

Welcome to issue #35 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary. The final section contains the top three macro charts for the week and is brought to you by Daily Chartbook

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Before diving in, I’d like to shout out to The Morning Hark!

The Morning Hark is a great way to stay on top of what’s going on in markets. If you like fx:macro, you will love The Morning Hark so check it out!

Table of Contents

Market AnalysisGrowth and InflationYieldsCentral BanksSectors and FlowsSentiment and PositioningMarket RisksVarious

Summary

Downloads and Links

Central bank speaker recap for the week:

Week in Review

Central Banks

FOMC Rate Decision (14.12.22)

The Fed hiked 50 bps as expected to a target rate of 4.25-4.50%. Below are the relevant points regarding the statement and the projections. Also, check out this summary by Harkster.

The statement remained virtually unchanged from the one in November:

Here are the relevant points from the Summary of Economic Projections:

The GDP projection has been upped for this year and is projected lower than in September for 2023 and 2024

The projected Unemployment Rate is higher than in September for the coming years

The inflation and core inflation projections have been upped as well

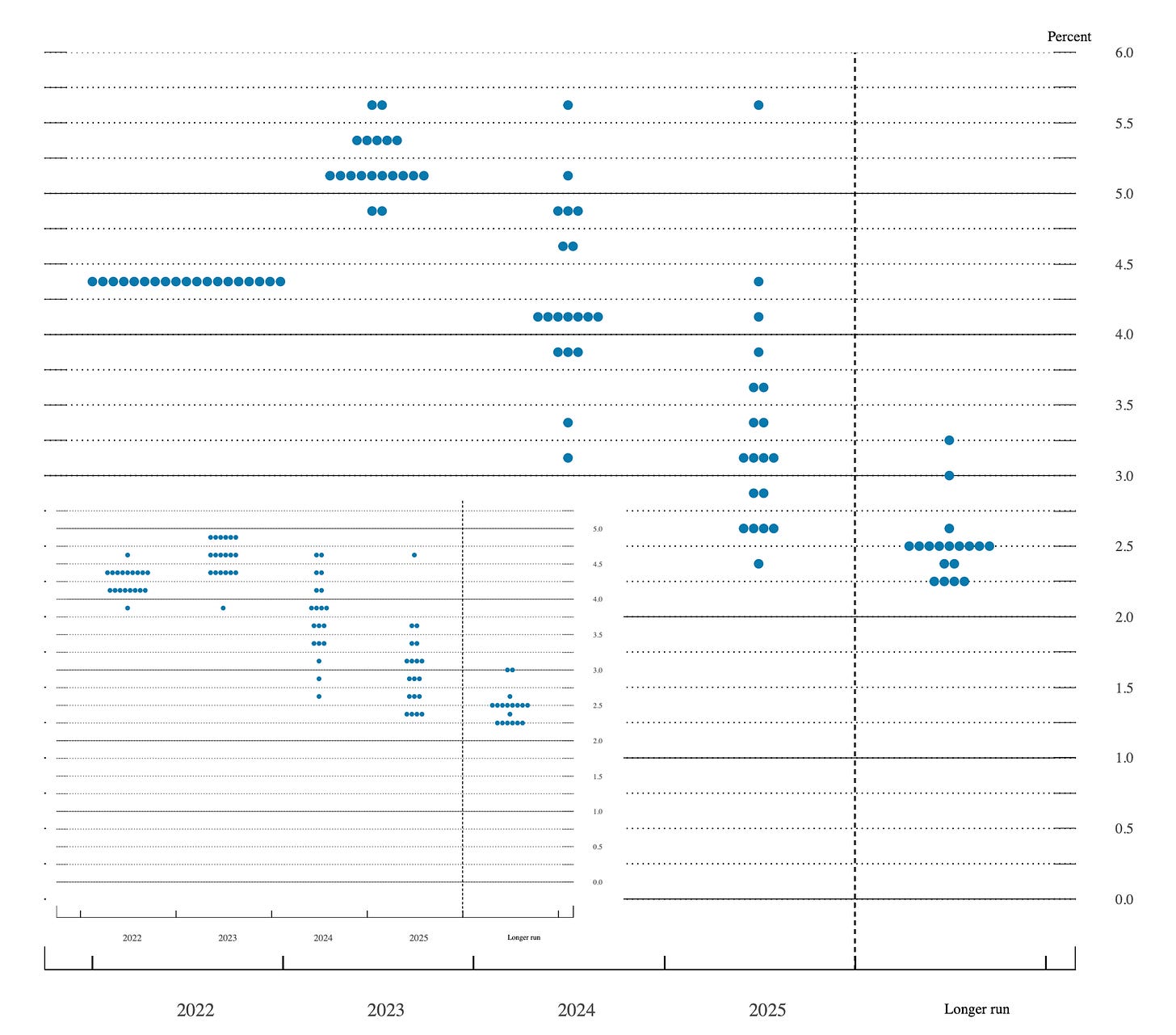

Here’s the current dot plot with the one from September inlined:

Only two policymakers see the FFR below 5.00% in 2023, and the distribution of dots is tighter compared to September

2024 and 2025 see significant rate cuts

The longer-run rate has seen a slight shift upwards

SNB Rate Decision (15.12.22)

The SNB hiked their policy rate by 50 bps as expected to 1.00%. Here are the main points from the statement and the difftext below:

Guidance: Additional rate rises cannot be ruled out

Inflation has declined but remains clearly above what the SNB equates with price stability, and will likely remain elevated for the time being

The new inflation forecast reflects somewhat lower oil prices in 2022 since the September forecast, and stronger inflationary pressures from abroad as well as price increases broadening

Domestic GDP growth: 1% in Q3 and about 2% for 2022; projected for next year: 0.5% because of weaker demand from, abroad and high energy prices

BoE Rate Decision (15.12.22)

The Bank of England hiked by 50 bps as widely expected to 3.50%. Here’s the summary from the statement and the difftext below:

Vote split: 6 votes for 50 bps, 2 votes for a hold (Dhingra, Tenreyro), 1 vote for 75 bps (Mann)

Guidance: “further rate increases may be required” (unchanged) but they dropped the “albeit to a peak lower than priced into financial markets” caveat.

The labour market remains tight, evidence of inflationary pressures in domestic prices and wages that could indicate greater persistence justifies a further forceful monetary policy response

Here are the highlights from the minutes:

ECB Rate Decision (15.12.22)

The ECB hiked rates by 50 bps in line with expectations. Here’s the summary of the statement and the difftext below, also check out this summary by Harkster.

The GC expects to raise interest rates further (unchanged from the last statement) and judges that rates will still have to rise significantly at a steady pace to reach sufficiently restrictive levels (new)

Keeping rates at restrictive levels will over time reduce inflation (new)

Future decisions will continue to be data-dependent and follow a meeting-by-meeting approach

APP: Principal payments will not be reinvested in full from March 2023

Holdings will decline “at a measured and predictable pace”

The target will be an average decline of 15 bln EUR/month until the end of Q2/23

Details will be announced in February

Staff projections for inflation have been revised higher:

Headline: 8.4% for 2022, 6.3% for 2023, 3.4% for 2024 and 2.3% for 2025

ex food and energy: 3.9% for 2022, 4.2% in 2023, 2.8% for 2024, 2.4% for 2025

The economy may contract in this quarter and the next, a recession would be short-lived and shallow, growth projections have been revised lower: 3.4% in 2022, 0.5% in 2023, 1.9% in 2024, 1.8% in 2025

ECB staff projections:

Note how core HICP (ex energy and food) will keep rising next year despite headline HICP falling

Unit Labour Costs have been upgraded significantly for next year

Real GDP 2023 has been revised lower (note Exports)

Confab, Speakers, News

Federal Reserve

Powell (Neutral). Wed: We've covered a lot of ground, full effects of tightening yet to be felt, have more work to do, expects ongoing rate hikes to get sufficiently restrictive, still some way to go on rate hikes, policy is getting close to sufficiently restrictive, labour market still extremely tight, inflation risks still to the upside, inflation expectations remain well anchored but that's not a reason to be complacent, historical record cautions against prematurely loosening policy, important for financial conditions to reflect our policy restraint, estimated peak FFR could move up or down depending on data, earlier this year it was important to move quickly on rates but now the ultimate level of rates is more important, strong view we need to hold rates at peak until we are really confident inflation is coming down in a sustained way.

Williams (Neutral). Fri: We're well on the way to where we need to be, 6-7% definitely not my baseline but will be data-dependent, possible the Fed will hike more than the FOMC terminal rate forecast, expects inflation at 3-3.5% and the economy growing modestly next year, some favourable things underway e.g. supply chains and goods prices.

Daly (Neutral). Fri: I don't know why markets are so optimistic about inflation, rates are mostly in restrictive territory, expects a higher peak rate and held for longer than some bond investors have predicted, we see nothing but hope in the inflation data and not confidence, everyone at the Fed expects rates to hold for all of 2023, we do not want to repeat the mistake of not doing enough, have to account for policy lags, 11 months as a starting point for how long to hold rates is reasonable but will be determined by data, I am aligned with the median projection in the SEP.

Mester (Hawk). Fri: Expects the Fed to hike by more than its median forecast, will need to maintain rates for an extended period once hikes are done, will have to keep FFR above 5% next year, tentative signs inflation rises are stabilizing but not calling a peak, sees growth slowing but not negative.

European Central Bank

Lagarde (Neutral). Thu: Obvious we should expect 50 bps hikes for a period of time, info predicates 50 bps next meeting, possibly next one as well, possibly thereafter, we are not pivoting, we are not wavering, we have more ground to cover than the Fed, there was a very broad majority on the decision and that we should show perseverance but not everybody agreed on actual tactics. Size of QT was chosen because it represents roughly half of redemptions over time. Price pressures are strong across all sectors, wage growth is strengthening, depreciation of the euro has added to inflation.

Villeroy (Neutral). Fri: Must not speculate on the number of rate hikes, important to have proportionate hikes, too early to talk about the terminal rate, we should escape a hard landing for the economy.

Rehn (Neutral). Fri: There is quite some way to go with rate hikes, not convinced that markets have priced the terminal rate right, 50 bps likely in February and March.

Holzmann (Hawk). Fri: The choice was between a hawkish 50 bps hike or dovish 75 bps, need to go deep into restrictive territory if needed, does not want to comment on where the terminal rate is.

Centeno. Fri: Very low probability of returning to 75 bps rate hikes.

Knot (Hawk). Fri: The Fed is closer to the end of rate hikes than the ECB, doesn't expect to entirely close the interest rate gap with the Fed.

Sources. Thu: More than one-third of ECB officials wanted to hike by 75 bps. Lagarde offered back-to-back 50 bps hikes on stiff opposition from policymakers who wanted to hike by 75 bps, this could mean three 50 bps hikes, 8-10 policymakers remained sceptical and about 6 of them held out even after the compromise.

Bank of England

Bailey (Neutral). Tue: UK inflation is too high, demand is slowing and rates have been rising, households and businesses are more resilient than during previous periods. Thu: We think we've seen the first glimmer inflation is below where we thought, we still need to raise rates to offset pressures from tight labour market, there's a long way to go.

Cunliffe (Dove). Tue: Households will be squeezed and this will affect consumption.

Reserve Bank of New Zealand

Hawkesby. Wed: We need to do more to lower inflation, so far higher rates have had little impact, the natural rate has risen, we need to keep up with inflation, shortage of workers is the most pressing constraint on the economy.

Statement. Wed: Actual and expected inflation are too high and need to be reduced, we expect spending to slow and unemployment to rise as more people join the workforce next year, we anticipate the level of employment to remain high.

Bank of Canada

Macklem. Mon: Interest rate hikes have begun to work but need time to feed through the economy, if inflation sticks much higher rates will be needed and the economy will have to slow even more sharply, we will adjust the policy setting if inflationary forces are stronger than we expect or if inflation starts to come in below our forecasts, we should see much clearer evidence next spring that inflation is moving down, over the long term it seems likely we won't have the same disinflationary forces we've had for the last 30 years.

Swiss National Bank

Jordan. Thu: Further rate hikes cannot be ruled out, SNB has been selling foreign currencies to ensure appropriate monetary conditions, will continue to do so if appropriate, will also buy forex to check excessive appreciation pressure on the franc, no specific terminal rate for interest rates, price increases are spreading across goods and services, Swiss inflation has declined since August but it is too early to sound the all clear.

Bank of Japan

Economic Data

Monday, 12.12.22

Tuesday, 13.12.22

Wednesday, 14.12.22

Thursday, 15.12.22

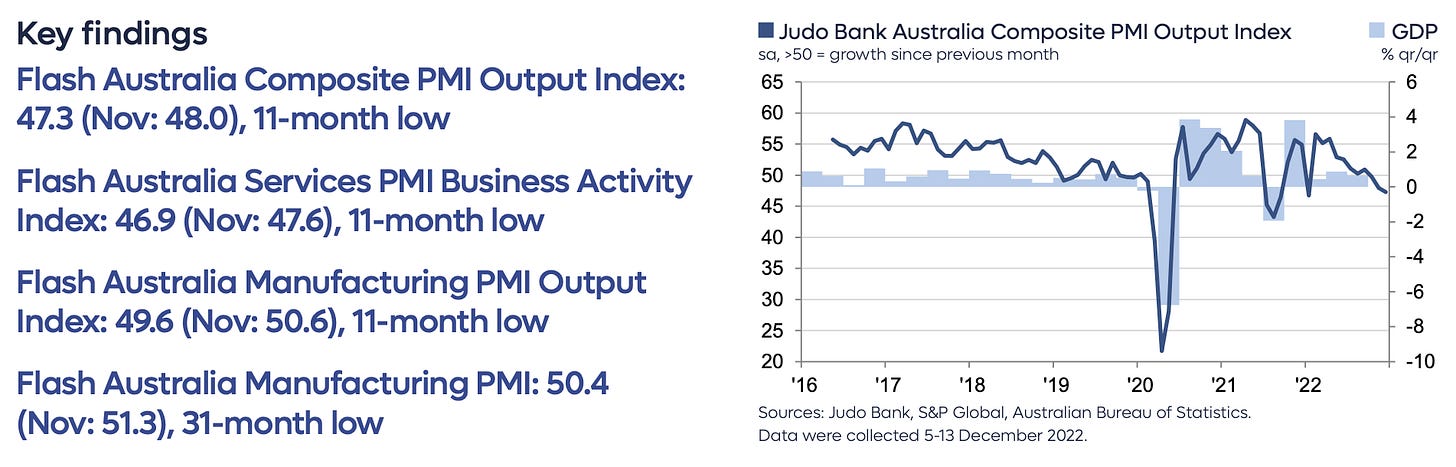

Key info from the Australian PMIs:

"The Flash PMIs for December reveal a slowdown in activity across the Australian economy as we finish 2022. The service sector is clearly slowing having recorded three consecutive readings below 50 in the December quarter. The Flash Services PMI for December, at 46.9, is fast approaching levels typically associated with a contraction in economic activity.

"The December results are one of the most up to date readings on the Australian economy and show that higher interest rates are starting to have the desired impact on activity. The Flash PMI readings for December are still well above levels that would normally be associated with recession. What we are seeing could be the first signs of a desired soft landing for the Australian economy in 2023.

"The demand for labour is also slowing, particularly in the services sector, reflecting softer activity and forward orders. Slower demand for labour will take pressure off a super-tight labour market and reduce upward pressure on wages in 2023.

"Unfortunately, there are few signs of an easing of inflation with cost pressures across the supply chain still elevated in December. This combination of slower activity and elevated inflation raises the spectre of stagflation in 2023. More likely, these inflation pressures will dissipate if economic activity remains subdued.

Friday, 16.12.22

Here are the highlights from the German PMIs:

“The latest flash PMI survey paints a somewhat less gloomy picture of Germany’s economy as we head towards the end of the year. Although still in contraction territory, the headline index pointed to a shallower downturn in overall business activity in December, as the declines in both manufacturing and services eased.

“Price pressures remain historically elevated, reflecting in large part the continued pass-through of high energy costs, but even here there are some positive signs as rates of both input cost and output charge inflation fell to multi-month lows due to weaker demand and easing supply chain frictions.

“Supplier delivery times showed another notable improvement in December, giving some support to production levels during the month thanks to better material availability. However, we continue to see a trend where new orders are falling much quicker than output, which, if it continues, bodes ill for future activity as firms eat up their backlogs of work.

“A backdrop of falling demand, high inflation and tightening financial conditions explains why businesses, particularly manufacturers, remain downbeat about the outlook. That said, nerves have settled somewhat compared to the situation three months ago, when concerns about the energy crisis were at their peak, in a further sign that the expected recession could be shallower than first feared.”

The highlights from the Eurozone PMIs:

“While the further fall in business activity in December signals a strong possibility of recession, the survey also hints that any downturn will be milder than thought likely a few months ago. The data for the fourth quarter are consistent with GDP contracting at a quarterly rate of just less than 0.2%, and forward-looking indicators are currently boding well for the rate of decline to ease further in the first quarter.

“The manufacturing downturn has moderated especially markedly in December, led by Germany and linked to a combination of improving supply conditions and reduced fears of energy constraints. The service sector malaise has also calmed, in part driven by signs of reduced fears over the cost of living squeeze and, in the financial service sector, reduced concerns over the tightening of financial conditions.

“The outlook for inflation is especially encouraging, with supply chains now improving for the first time since the pandemic began and firms’ costs growing at a sharply reduced rate, feeding through to lower rates of increase for prices charged for both goods and services.

“The downside is that this improving inflation outlook is primarily a symptom of falling demand, which has removed pricing power from many companies and their suppliers, and the business environment remains one in which confidence remains very subdued by historical standards. Thus, while the downturn is looking likely to be less steep this winter than previously anticipated by many, there remain few signs of any meaningful return to growth evident as 2022 comes to an end.”

Highlights from the UK PMIs:

“Customers were tightening their belts all round in December as new order levels continued to fall in manufacturing and services industries, and for the first time since February 2021 the UK’s stricken economy affected job creation, especially across the UK’s manufacturing sector.

“The manufacturing sector suffered another sharp drop in output that was the fastest since August as weak demand and damaged supply chains affected the delivery of raw materials and items such as electronic components. Without a strong economic wind behind them manufacturers started to doubt the need for their current headcounts and shed jobs at a quicker pace.

“Service sector activity evened out after their patchy performance over the last couple of months and performed better in December but were still blighted by high costs.

“The sustained rise in price pressures will pour fuel on the fire of squeezed business margins, hot on the heels of another interest rate rise making borrowing more difficult. The rise in optimism may be a small light on the horizon, but remains at a historically low level, supply chain managers believe there is little room for manoeuvre for private sector businesses.”

And finally, here are the US PMIs:

“Business conditions are worsening as 2022 draws to a close, with a steep fall in the PMI indicative of GDP contracting in the fourth quarter at an annualised rate of around 1.5%. Jobs growth has meanwhile slowed to a crawl as firms across both manufacturing and services take a much more cautious approach to hiring amid the slump in customer demand.

“The upside is that weaker demand has taken pressure off supply chains which had been stretched during the pandemic. December saw a second successive month of faster supplier delivery times, a phenomenon which not only signals improving supply conditions but also tends to herald the shifting of pricing power away from the seller towards the buyer.

“Hence price pressures continue to moderate sharply. In fact, December saw the largest monthly cooling of firms’ input cost inflation seen in the 13 year history of the survey barring only the lockdown related slump in April 2020.

“In short, the survey data suggest that Fed rate hikes are having the desired effect on inflation, but that the economic cost is building and recession risks are consequently mounting.”

Top 3 Macro Charts of the Week

This section is brought to you by Daily Chartbook

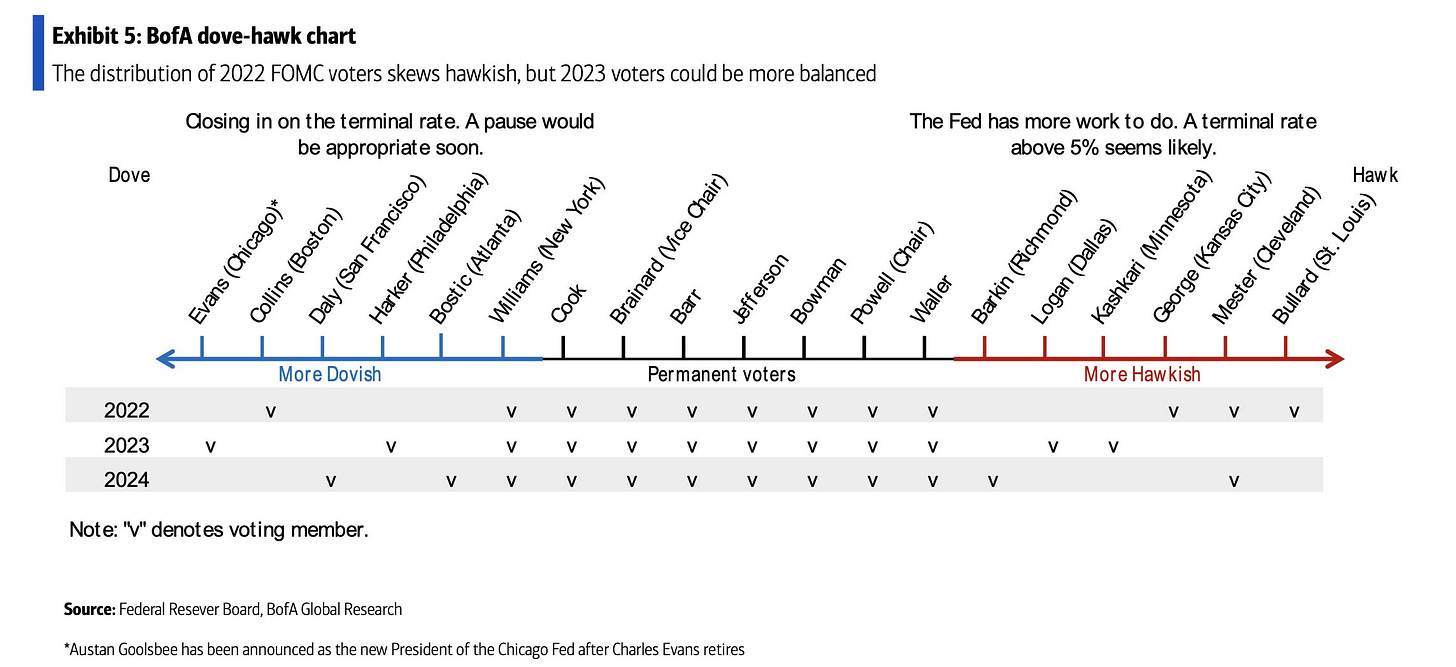

1. Dove-hawk chart. "The distribution of 2022 FOMC voters skews hawkish, but 2023 voters could be more balanced".

2. No capitulation. "We are far from the BIG low. We need big selling before buying this market".

3. Buybacks (I). "Share buybacks also keeping the market afloat despite the Fed hiking rates and cutting its balance sheet".

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 47/2022 | 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

ECB

Rate Statements: 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 47/2022 | 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 50/2022 | 43/2022 | 36/2022

BOE

Rate Statements: 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 50/2022 | 37/2022

RBA

Rate Statements: 50/2022 | 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 47/2022 | 41/2022 | 34/2022 Crib Sheets: 40/2022

BOC

Rate Statements: 50/2022 | 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022

SNB

Rate Statements: 44/2022 | 39/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

BOJ

Rate Statements: 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo credit: DALL-E 2 “A beautiful winter landscape at Christmas time.”

Love the side-by-side language comparisons of monetary policy statements. Well done.

Great take, thank you !

Would love 1-day a coverage on SNB alone ... a publicly listed central bank ... and mutual fund :) ;) :P