Outlook for Week 42/2022

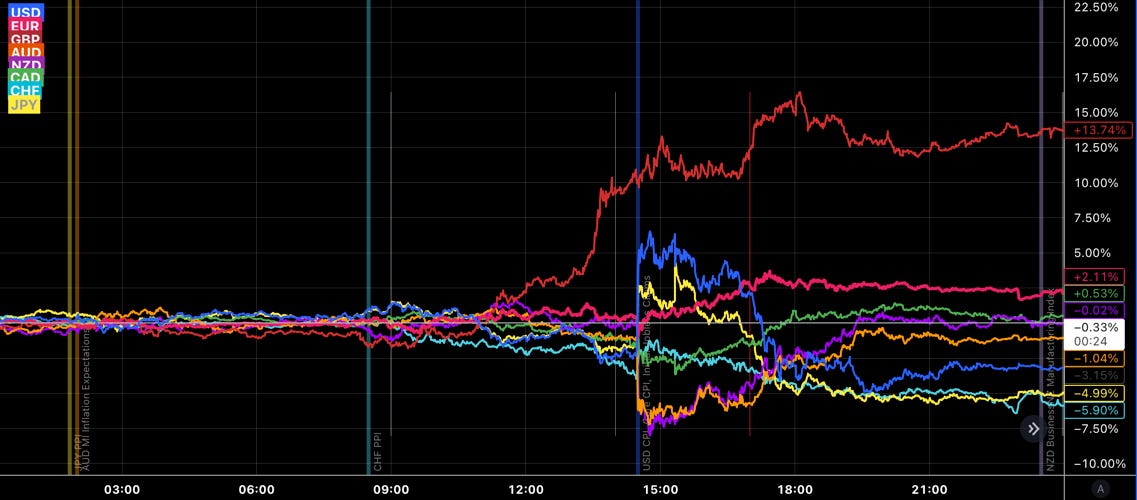

There's nothing to suggest that anything has become better for markets after Thursday's hot CPI print

Welcome to issue #27 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary. The final section is a collection of things I read during the week that influence my thinking. If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

One more thing. You seem to like newsletters, so here's a great way to discover new stuff to read for free: The Sample. They will regularly send you an issue of a different semi-random newsletter you might be interested in. If you sign up using my referral link, I get bonus points and my newsletter will be forwarded to others to check out.

Before diving in, I’d like to shout out to The Morning Hark!

For me, it’s a must-read every day. Here’s what’s in it:

Overnight action in key asset classes including commodities, fixed income and crypto,

Current macro themes with a review of the previous day’s economic data releases, central bank speakers and more,

Main highlights ahead with a comprehensive list of upcoming data and events,

The top 5 trending posts on app.harkster.com, and

A section with links to more in-depth pieces or useful information on current macro themes.

The Morning Hark is a great way to stay on top of what’s going on in markets. If you like fx:macro, you will love The Morning Hark, so check it out!

Table of Contents

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Relevant market risks I have on my radar (it's obviously not a comprehensive list and mostly unchanged from last week). If you have any suggestions, please don’t hesitate to leave a comment:

Europe:

More and more headlines and articles about energy nationalism… could spill over into monetary policy if push comes to shove

An unexpected resolution of the Ukraine war seems very unlikely, but it could escalate very quickly

especially given the mobilization and referendums

UK: the fallout from the close shave in the gilt market and UK pension funds isn’t clear yet

Global markets:

The UK pension funds are a canary in the coal mine that signals that cracks can appear anywhere out of seemingly nowhere

The risk from commodity market squeezes spilling over seems to have diminished a bit; it's become a major factor in energy and electricity markets

China/Taiwan: keeping an eye on the Taiwanese stock market as a risk gauge

Economic Calendar for next week

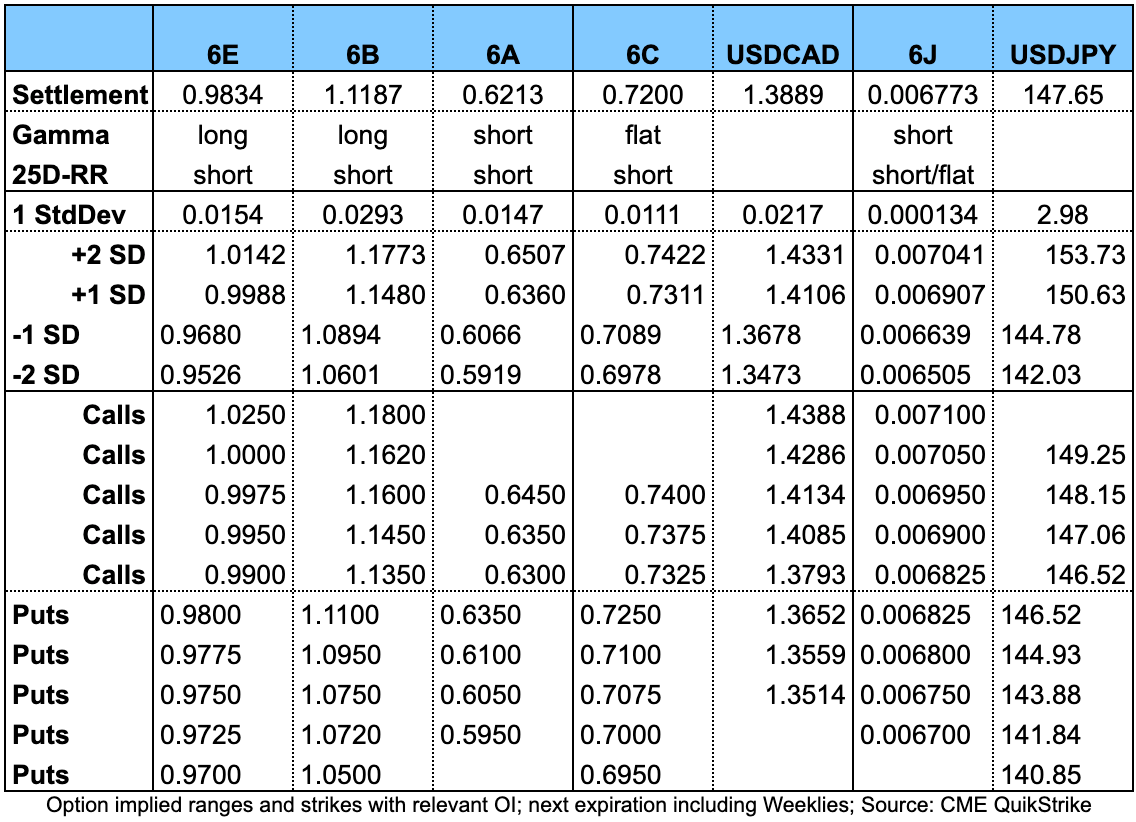

Important levels to watch and look out for in the Majors

Downloads and Links

Difftext of the Summary from last week: link

Central bank speaker recap for the week in PDF format:

Week in Review

Central Banks

FOMC Meeting Minutes (12.10.22)

The Minutes didn’t provide too much of a surprise because most of what was in there has been said by various Fed speakers over the last couple of weeks:

More hikes will be necessary

Participants want to hike-and-hold instead of hike-and-cut rates

Balance sheet reduction was not questioned but “a couple of participants” were in favour of considering MBS sales

Most participants agreed that a large part of the economy has not yet responded to the Fed’s tightening

Calls for a bit more caution and an emphasis on two-sided risks by “some participants” show that there’s a small but clearly perceptible crack in the unanimously hawkish front

Here are some of the highlights from the release:

Confab, Speakers, News

Federal Reserve

Evans (Neutral). Mon: Sees raising the Fed Funds Rate to "a bit above 4.5% early next year" and then remaining there for some time, thinks inflation can be brought down relatively quickly without a recession.

Brainard (Dove). Mon: Monetary policy will be restrictive for some time, easing prematurely is a risk but at some point risks become more two-sided. Output has decelerated more than anticipated but full effect of policy tightening will be felt in the coming quarters, effect on price setting may take longer, paying close attention to global risks, liquidity in core financial markets is fragile.

Mester (Hawk). Tue: Not ready to say how big November rate hike should be. Housing market will see more impact from monetary policy, persistence of inflation is concerning, economy's fundamental state is still good, can't say of much balance sheet will shrink, Fed is aware of global markets and economic conditions but has a domestic mandate.

Kashkari (Dove). Wed: 50 bps vs. 75 bps rate hike is a judgment call, Fed is quite a ways away from stopping rate hikes, will need to raise to perhaps 4.5% and stay there for a while to assess the economy, have not seen much evidence underlying inflation is softening. Strong dollar is creating challenges for countries around the world but our job is focused on bringing inflation down.

Bowman (Neutral). Wed: Sizable rate hikes should remain on the table, fully supported Fed's 75 bps hikes, not yet clear how high rates will have to go, policy rate needs to rise to restrictive level and remain there "for some time", slower rate of rate increases appropriate if inflation starts to decline, outlook for growth and inflation has significant two-sided risks.

George (Neutral). Fri: Supports ongoing rate increases, we need to move rates into restrictive territory, how restrictive remains to be seen, rates have to move higher for a sustained period, moving too fast could disrupt financial markets, advocates slower and steadier rate increases to allow time to see lags in policy, supersized rate increases may cause oversteer. CPI on Thursday was a reminder that we have more work to do. UK pension fund crisis is a reminder that events can interfere with CB work and that we have to be mindful in the US. Stock market is not our focus.

Daly (Neutral). Fri: CPI shows that inflation is not cooperating, no doubt we need more restrictive policy, not talking about pausing or stopping, will stop raising rates when appropriate and then hold there for a while, Fed's SEP is reasonable and a good guidepost for policy, 4.5-5.0% most likely the top of the FFR, not hearing signs of recession, labour market is very strong and needs to cool further.

Cook (Neutral). Fri: Need ongoing rate hikes and see inflation actually falling in data, labour market is very strong and inflation is hot, doesn't want stop-and-go policy, US is not an economy in isolation but our mandate is domestic, very aware of international developments.

Bullard (Hawk). Fri: September inflation data warrants more front-loading though not necessarily higher rates overall, appropriate for rates to reach 4.50-4.75% by year-end, hikes in 2023 should be data-dependent, sees Core PCE below 3% by end of 2023, still fair amount of potential for soft landing, current inversion of the yield curve not an indicator of recession risk, doesn't see markets as unduly stressed.

European Central Bank

Villeroy (Neutral). Mon: ECB engaged in bringing down inflation to 2% target "in two to three years" from now, inflation at around 2% is still the right target. Tue: Debate about 50 or 75 bps at next meeting is premature in such volatile markets, ECB can move more slowly after neutral rate is reached, concerns over a recession must not stop the ECB from hiking rates, quick recession is preferable to stagflation.

Knot (Hawk). Mon: Will have to take a significant interest rate step in October, too early to say how big that step needs to be, significant moves will be needed in 2023 as well, the market seems to underestimate the upward risks in the inflation outlook, expects inflation to go down in 2023 but unclear how fast. Wed: We're way below neutral, need "at least two more singificant hikes" before entering neutral range, will need to go into restrictive territory, no indication that 75 bps hike can't achieve target. QT should be predictable and gradual. No convincing sign of wage-price spiral.

Centeno (Dove). Mon: Normalization of policy is absolutely necessary but must be gradual, policymakers cannot become a factor of instability.

Lane. Tue: A weaker or slower transmission of monetary policy would require further tightening, stronger or faster transmission would require a less-tight policy stance, we remain attentive to the spread between different money market rates and collateral scarcity concerns.

Lagarde (Dove). Wed: Discussion on QT has started and will continue, interest rate increases are the most effective and appropriate tool in current circumstances. Fri: Expects to raise rates further over next several meetings, inflation is far too high and likely to stay above target for an extended period of time, financial markets still appear to be pricing in outcomes that could turn out to be too optimistic.

Holzmann (Hawk). Wed: A 75 bps hike followed by 50 bps would get us to neutral, 100 bps would be excessive.

Nagel (Hawk). Thu: Current data point to "robust" interest rate move, policy normalization is far from complete, developments in German real estate market represent normalization. Fri: It is critical to tighten monetary policy, not thinking about the neutral rate, ECB balance sheet is too large and needs to be reduced, shrinkage should start next year.

Wunsch (Hawk). Thu: Expects policy rate to top 2% at the end of the year, maybe exceed 3% "at some point".

Kazaks (Hawk). Thu: ECB should raise rates 75 bps in October and go for another big step in December, 50 vs. 75 bps in December is up for discussion, rate hikes should then slow but may be complemented by other measures like balance sheet reduction.

Simkus (Hawk). Thu: Expects a 75 bps move at the next meeting and 50 bps in December.

De Guindos (Dove). Fri: Will do whatever it takes to bring inflation down, our response will depend on how the data evolves over coming months, we are going to face a very difficult combination of low growth including a technical recession and high inflation.

Kazimir. Fri: 75 bps rate hike appropriate this month, further increases may be needed, we won't stop at neutral, rates must rise above neutral, reduction of balance sheet can wait until 2023.

Vasle. Fri: 75 bps hikes at both October and December meetings may be appropriate, rates need to reach restrictive territory, decisions should be made meeting-by-meeting after December, once rates reach neutral it's appropriate to discuss QT, discussion and decision on QT should happen in 2023.

Rehn (Neutral). Fri: Anticipates that QT will begin once neutral is reached in first half of 2023, likelihood of an adverse scenario has significantly increased, Eurozone economy is significantly weakening.

Sources. Thu: Reuters: ECB staff puts target rate at 2.25% according to a new internal model called Target-Consistent Terminal Rate. Model was presented to policymakers last week but reception was mixed.

Bank of England

Bailey (Neutral). Tue: Pension funds have three days left to rebalance, unprecedented volatility in long end of gilt market, very important to make clear gilt purchases are financial stability intervention.

Spokesperson. Wed: Gilt purchases are a temporary operation, closely monitoring LDI funds as for whatever asset prices prevail after BOE stops buying gilts, working on tougher regulation. UK vulnerable to loss of foreign investor appetite. Share of households with high mortgage debt servicing levels will reach pre-GFC peak in late 2023 if interest rates rise as markets expect.

Reserve Bank of Australia

Ellis. Wed: RBA policy is no longer expansionary, nominal neutral rate for Australia is at least 2.5%, it's not a policy destination, inflation expectations over one year are well anchored at the 2-3% target.

Bank of Canada

Macklem. Fri: If recent depreciation of the CAD vs. the USD persists then we will have more work to do on interest rates, broad consensus at IMF/World Bank meeting that inflation is the most immediate threat to prosperity. Economy will still be in excess demand, labour market tight and inflation too high regardless of September CPI.

Swiss National Bank

Jordan. Tue: Central banks are more politically vulnerable as inflation rises, central bank independence is crucial to fight inflation effectively.

Bank of Japan

Suzuki (FinMin). Tue: Watching FX moves closely with a sense of urgency, will respond appropriately. Wed: Closely watching FX moves with a sense of urgency, will take necessary steps if needed, what's important is the speed of FX move. Thu: Wants to take appropriate action vs. excess currency volatility with regards to the yen, did not hold bilateral meeting with US Treasury Secretary, US has shown clear understanding toward Japan's FX intervention in September.

Kanda (MoF official). Tue: Always ready to take necessary steps against excess FX volatility. I can make a decision on FX intervention from anywhere - even from an airplane.

Kishida (PM). Tue: BOJ needs to maintain policy until wages rise, urges companies to increase wages, government will prepare measures to help companies raise salaries even as they pass on increasing input costs. Fri: Sharp FX volatility involving speculative moves is undesirable, need to consider taking appropriate steps on currency moves, important to coordinate with international community on FX.

Matsuno (Chief Cabinet Secretary). Tue: Will take appropriate steps on excessive FX moves, closely watching with a sense of urgency, no comment on day-to-day currency moves. Wed: Closely watching FX moves with a sense of urgency, will take necessary steps, no comment on day-to-day currency moves. Thu: Closely watching FX moves with a strong sense of urgency, no comment on day-to-day FX moves.

Kuroda. Wed: Will continue with monetary easing to achieve 2% inflation target in stable and sustainable manner, Japan's inflation will slow down once fuel and energy price rises start to wane, wages are rising but insufficiently, fast and uni-directional currency movements caused by speculation are bad for the economy, have to watch impact on economy carefully, government's FX intervention was quite appropriate. Thu: BOJ should continue to support the Japanese economy, hiking interest rates would be the wrong thing to do.

People’s Bank of China

Yi Gang. Fri: Will accelerate implementation of prudent monetary policy to provide stronger support for the real economy, emphasis is on infrastructure construction, will quicken the pace of utilization of loans to support the real estate market.

Economic Data

Monday, 10.10.22

Chinese Caixin Services PMI came in much weaker at 49.3 on Saturday vs. 54.5 expected.

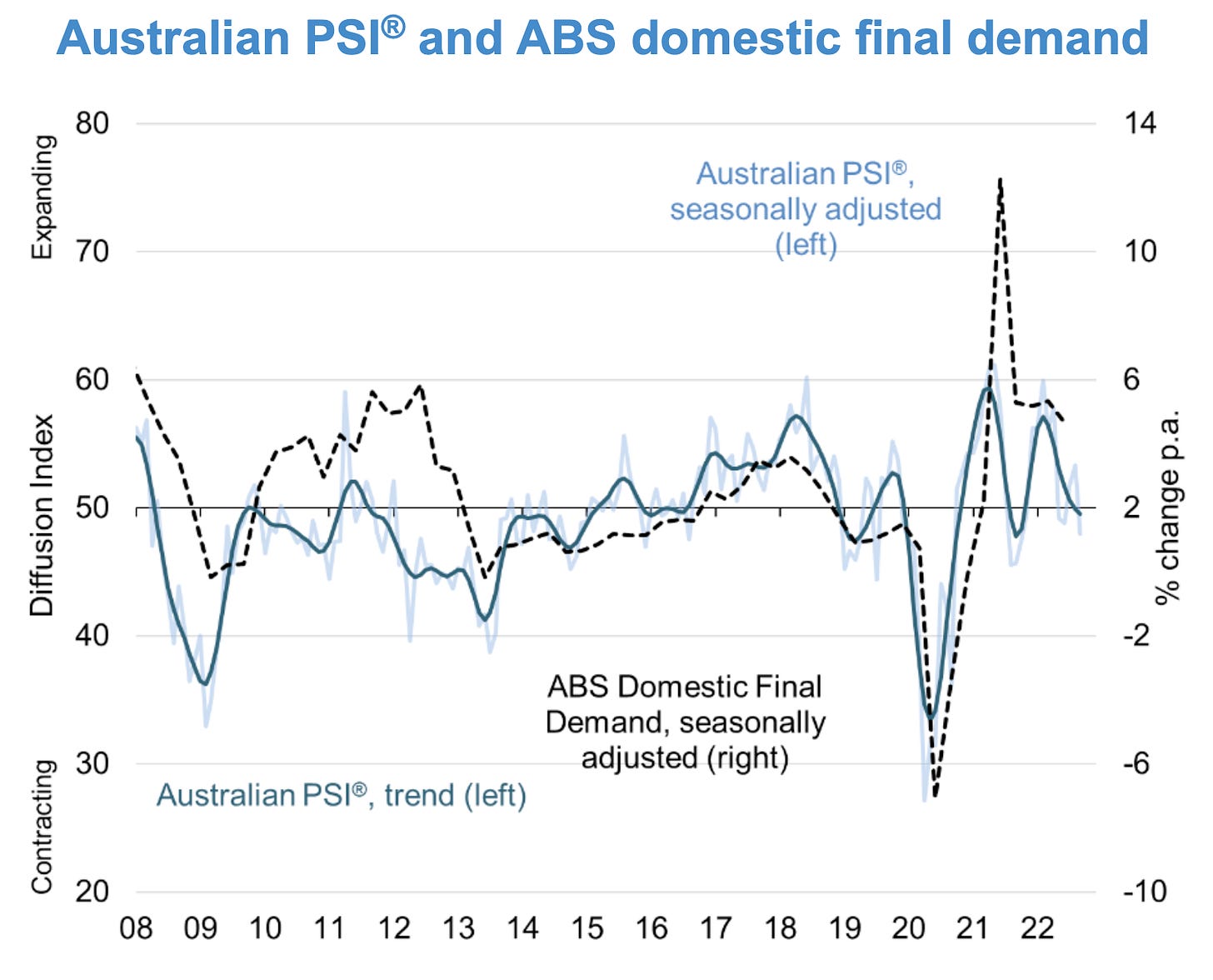

From the Australian AIG Services Index:

The Australian PSI® fell 5.3 points into contraction in September, following two months of mild growth.

All service sector activity indicators were lower than August, and most are now in contraction. Employment and inventories are still expanding but at a slower pace than the previous month.

The input price indicator rose while sales prices slowed – indicating increased pressure on margins.

Services capacity utilisation fell to 79.1, the lowest result since November 2021.

Labour shortages and concerns over economic uncertainty were key themes for businesses.

Tuesday, 11.10.22

Wednesday, 12.10.22

Thursday, 13.10.22

Friday, 14.10.22

Market Analysis

Growth and Inflation

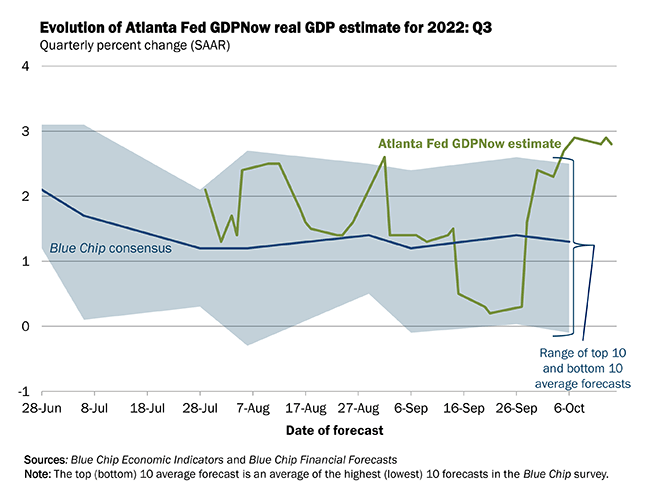

The latest GDPNow reading estimates annualized Q3 GDP growth at 2.8%:

The NY Fed Weekly Economic Index declined to 2.19:

Citi Economic Surprise Indexes:

USD higher

EUR, GBP and NZD sideways

AUD lower, CAD and CHF still down

The Bloomberg PMI heatmap remains unchanged from last week:

Hong Kong and Japan worsened, China, Taiwan and South Korea were already in the red last week

The UK and Eurozone are worsening as well

The US and Australia are relative outperformers

Canada has improved from bad to so-so

5y5y forward inflation expectations traded up this week, especially after Thursday’s hot CPI print:

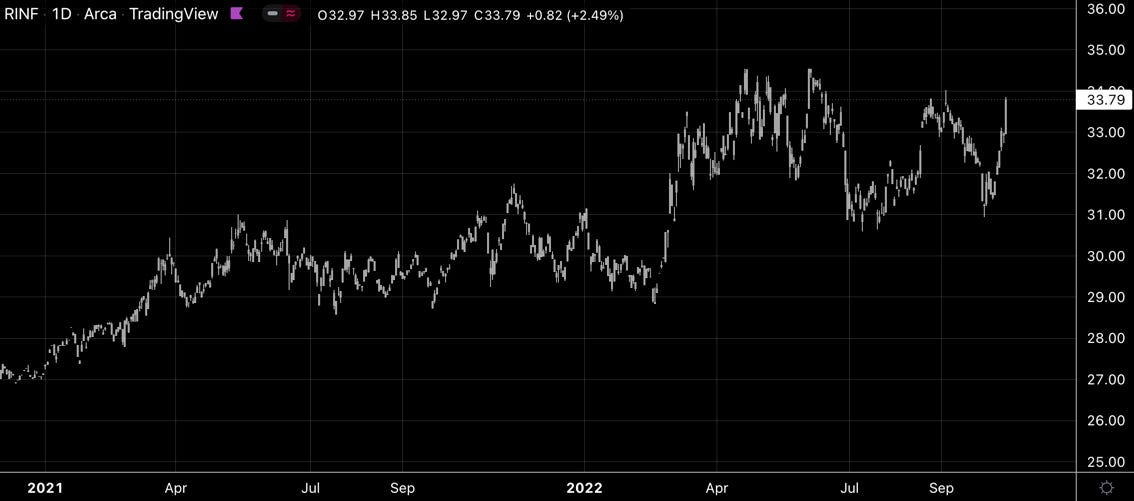

Similar story in RINF:

Breakeven inflation rates have also traded up somewhat although the overall downtrend remains intact:

Citi Inflation Surprise Indexes haven’t updated for the month yet:

USD and EUR continue to trend down

GBP dropped quite a bit over the last month

CAD also dropping

CHF remains up

Yields

Looking at the chart and table below:

New highs in US yields

NZ yields look strongest despite a mediocre 1-month performance

UK is up 116 bps in one month and sitting near highs despite/because of everything that’s been going on there

Yield curves along the 2s10s spread:

Central Banks

Some significant re-pricing of target rate probabilities according to FedWatch:

The November meeting is now assigned a near-100% chance of 75 bps

December sees another 75 bps hike followed by 25 bps in February

The terminal rate is seen at 4.75-5.00% but with some decent probabilities to the upside of that

As before, the first rate cut isn’t priced in until December 2023

Short-term interest rates:

The spike to the upside in U22-Z22 spreads on Thursday’s CPI is clearly visible, Z23-Z24 spreads spiked lower

The theme of more front-loading this year and hike-and-hold next year continues

Sectors and Flows

Currency strength:

USD is the strongest currency over long and medium timeframes

CHF still shows strength over 3 months but has since lost momentum

EUR is relatively strong as well on all timeframes

GBP… what a ride, ended the week as the strongest currency

AUD has been underperforming for a while now, NZD has gained some relative strength since the divergence between the RBA and RBNZ

Equity sectors:

It’s clearly visible that the last bounce in equities was largely driven by Energy and Mining (XOP, XLE, OIH, XME)

Semiconductors (SMH), Tech (XLK) are the relative underperformers

Growth (VUG) is underperforming Value (VTV)

Utilities (XLU) are the third-weakest sector, I still don’t fully understand why… have read one theory that UK pension funds have a lot of exposure and had to deleverage, not sure how much of that is the cause for XLU’s weakness

A different look at equity sectors: not looking good either, Defensives and Healthcare near the top, Cyclicals and Tech at/near the bottom of the graphs:

Equity sector charts: if we assume Thursday with its humungous rally is a possible turning point for another bear market rally then it’s fair to say it didn’t get any follow-through from any sector on Friday:

International stock markets: there doesn’t seem to be too much change compared to the last few weeks. Brazil and India are still the outperformers while Hong Kong and Taiwan are the underperformers.

BNY Mellon iFlow:

Equity flows out of G10 markets continue

Significant flows out of AUD and CHF, and into USD this week

Carry flows are still negative

Sentiment and Positioning

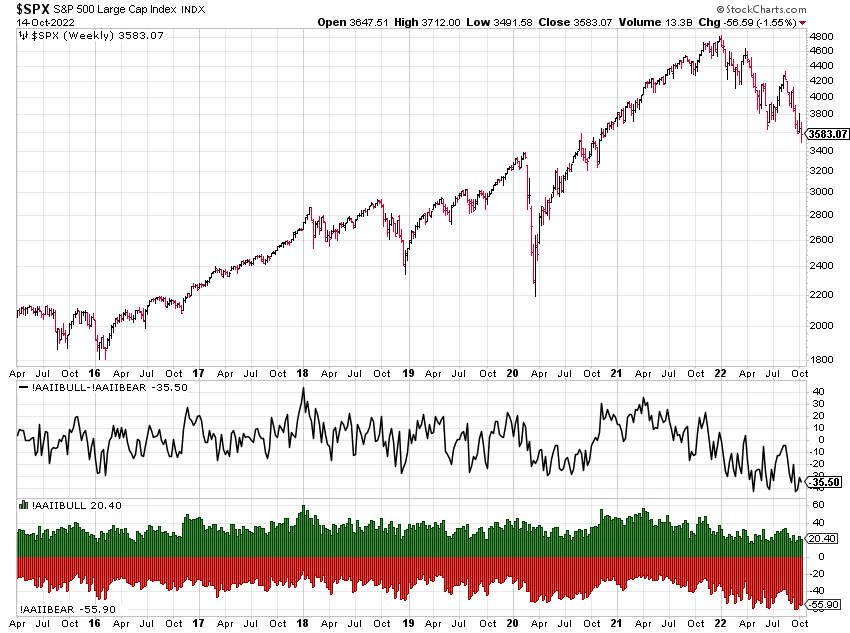

The AAII Bull-Bear spread is still deeply depressed:

Currency sentiment:

AUD sentiment has improved since the dovish RBA hike two weeks ago…

CAD bullish sentiment was 31% last week and has jumped to a neutral 47%

GBP had 60% bulls last week, that number has declined to 50%

Most currencies are somewhere in a neutral range, USD and CHF being the exceptions

Different sentiment source:

Silver bulls are back (or: silver bears have cut their short positions in half compared to the previous week)

AUDUSD and NZDUSD are the currency pairs with the most bearish USD sentiment

JPY pairs all have bullish sentiment on the yen

TD Ameritrade Investor Movement Index has declined significantly over the last months and now sits near lows:

Here are some interesting points from the IMX:

Nvidia (NVDA), Intel (INTC), and Advanced Micro Devices (AMD) were net bought by the TD Ameritrade client population, viewing the recent run of underperformance by semiconductor names as a possible opportunity to increase exposure in a few of the industry giants. Apple (AAPL) has been an outperformer among its megacap peers throughout 2022 but reports that the iPhone maker was scrapping plans to boost production sent the stock lower as the stock finished down over 15% during the period. TD Ameritrade clients used this an opportunity to increase exposure in the tech giant and were net buyers of AAPL during the period. AT&T (T) cratered nearly 15% to new YTD lows during the period, but TD Ameritrade clients net bought the struggling telecom giant, seeing opportunity in the recent weakness.

Additional popular names bought include Tesla (TSLA), Amazon (AMZN), Alphabet (GOOGL)/(GOOG), Microsoft (MSFT), and AMC Entertainment (AMC).

Netflix (NFLX) continued its recent run of relative outperformance as optimism surrounding the planned launch of the ad-supported version of its streaming platform remained. TD Ameritrade clients saw this outperformance as an opportunity to reduce exposure in the streaming giant. Exxon Mobil (XOM) and BP (BP) have outperformed in 2022, but with the weakness in crude oil during the September period both names retreated. TD Ameritrade clients also reduced exposure in social media company Snap (SNAP), as its struggles continued despite the company's plans to refocus on user and revenue growth amid a broader restructuring plan. Roblox (RBLX) was another name that TD Ameritrade clients reduced exposure in as the stock declined almost 10% during the period, despite reporting year-over-year (y/y) growth in daily active users, estimated bookings, and revenue for the month of August.

Additional names sold include Morgan Stanley (MS), Alibaba (BABA), Nio (NIO), Wells Fargo (WFC), and Walmart (WMT).

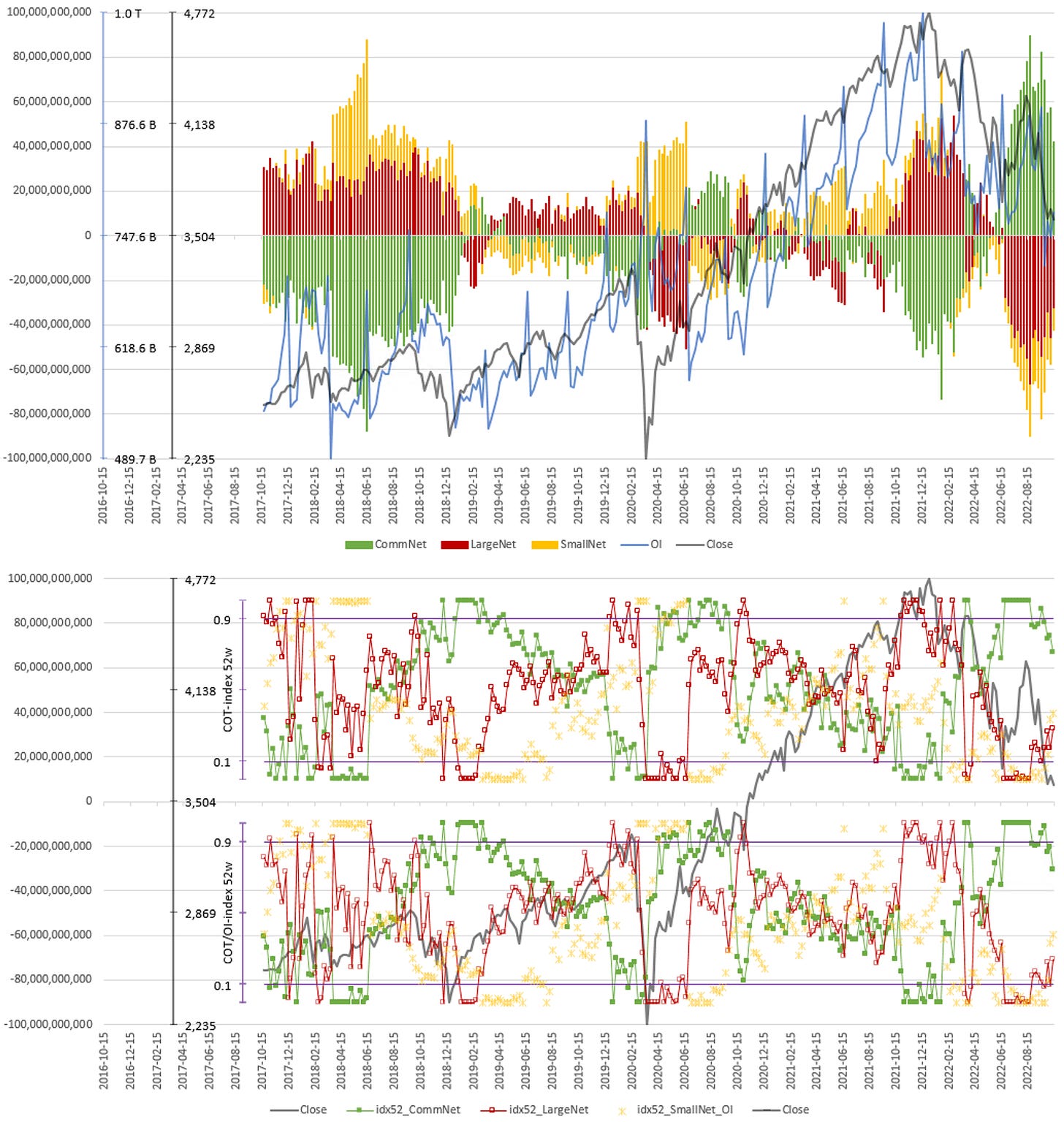

Commitment of Traders and futures performance:

Stock indexes broadly declined this week, Relative Strength is weak around 0.90. Commercial and Large Trader positioning is well of extremes. I’ve included a combined equity positioning chart below that illustrates that point.

Treasury futures are all lower for the week as well, positioning is extreme in the short end.

Currencies are a bit mixed with only 6B outperforming; RSL remains weak for all currencies except the DXY. Commercial/Large Trader positioning is at/near bullish extremes in NZD and CAD.

Energy futures also had a down week, Commercial/Large Trader positioning remains bullish in NG.

Metals were mixed with Silver the clear underperformer and Copper up for the week. Relative Strength is weak in all metals except for PA and PL, COT positioning isn’t at extreme levels.

Grains and Softs have been mixed as well. Cotton remains at a bullish extreme in Commercial net positioning.

Here’s the chart of combined equity positioning: Commercial net positions are well off highs and their Large Trader counterpart is well off lows, as is the positioning of Small Specs. No help for equities from that chart.

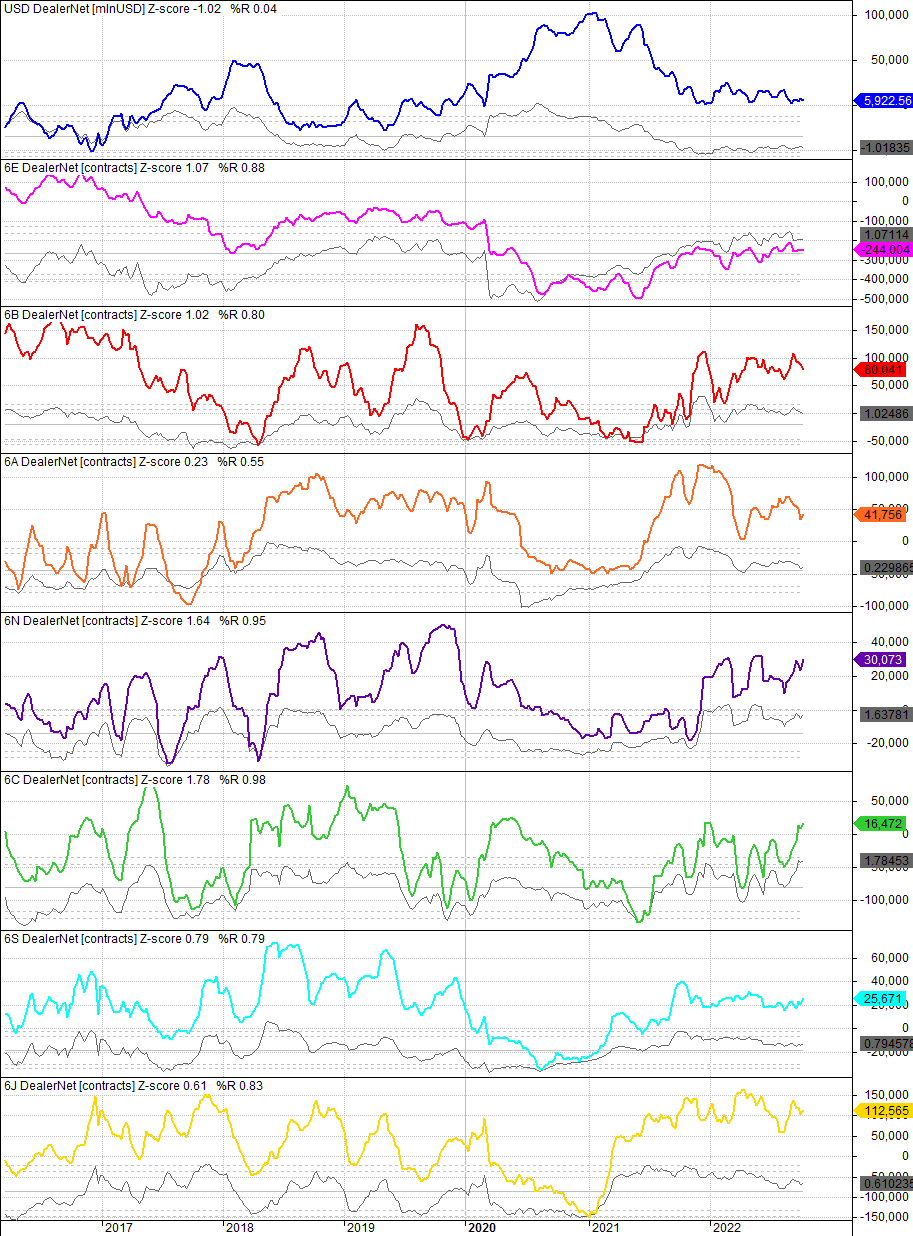

COT/TFF Dealer net positioning for FX futures:

USD is near lows

6N and 6C are approaching 104-week highs

CitiFX PAIN indexes:

No significant changes compared to last week

USD is still the crowded long vs. everything else, especially CHF and EUR

Market Risks

It’s a bit bit of a zoomed-out view but so far we’ve not seen any narrowing of credit spreads on Thursday or Friday:

Credit Spread Index also sitting at highs:

Currency volatility remains high:

Spot VIX is trading above the entire VIX term structure. The difference between the highest and the lowest contract is only about $1.30, so it’s a pretty flat backwardation.

Volatility indexes:

MOVE is at 153 and at/above recent highs

VIX looks a bit more contained at 32

VVIX prints barely above 100: we’ve seen the phenomenon of a relatively low VVIX dragging VIX lower before this year, so if VVIX declines rapidly again, it’s probable that this will dampen vol again

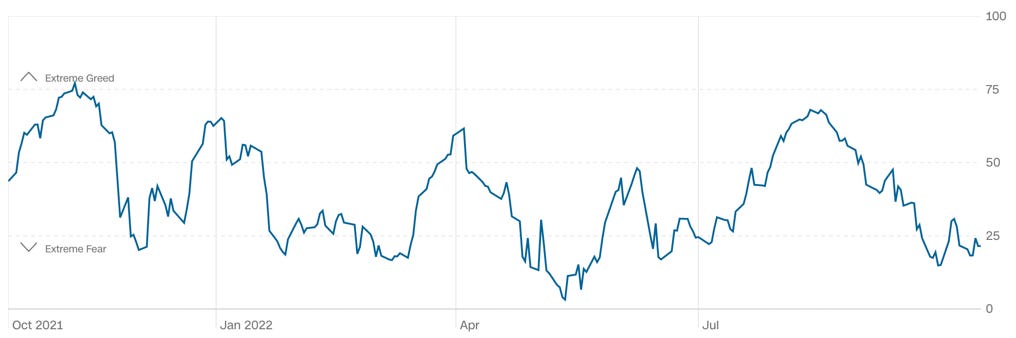

The CNN Fear & Greed Index remains in extreme fear territory but refuses to go lower:

Various

The NYSE Advance/Decline Line continues to follow price.

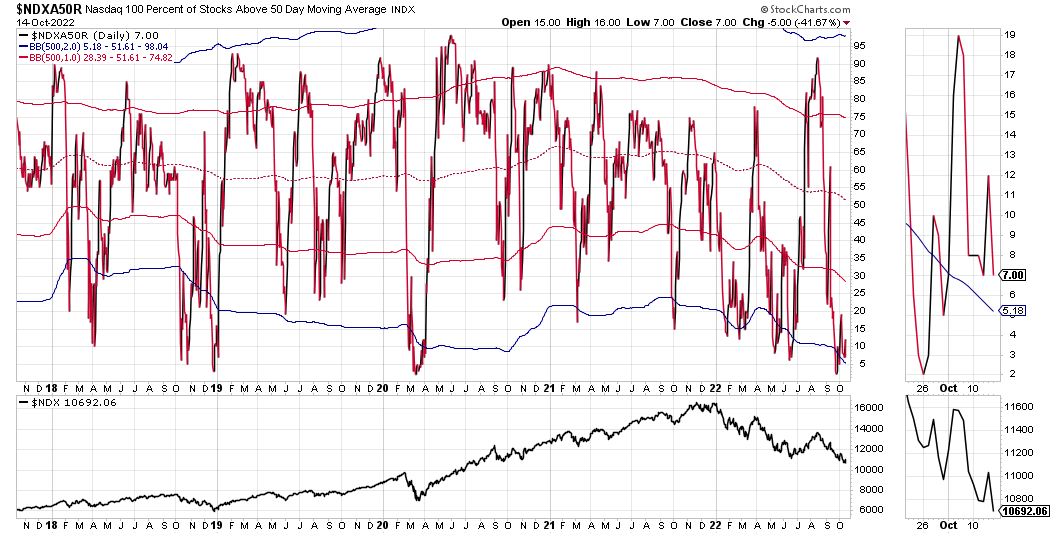

The percentages of S&P500 and Nasdaq 100 stocks above their 50-day moving averages aren’t bouncing off lows, either, and remain at around -2 SD. As I’ve written above: if we assume Thursday is a possible turning point in the market, there’s nothing in these breadth indicators confirming that. There’s only been one data point past Thursday, though.

25-delta risk reversals:

The repricing of skew in GBPUSD has come to an end for now… it looks like the market has calmed down somewhat

AUDUSD and NZDUSD seeing some upside, CADUSD some downside

The risk reversal in USDJPY has come off lows despite a new high in price: the market seems to see less need to hedge against another FX intervention.

Other Stuff I've been looking at

Once again I’m afraid I didn’t have time to save and collect all the good charts I’ve seen on Twitter during the week.

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 39/2022 | 31/2022 FOMC Meeting Minutes: 34/2022 | 28/2022 | 25/2022 Crib Sheets: 37/2022

ECB

Rate Statements: 37/2022 | 30/2022 Meeting Minutes: 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 36/2022

BOE

Rate Statements: 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 37/2022

RBA

Rate Statements: 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 41/2022 | 34/2022 Crib Sheets: 40/2022

BOC

Rate Statements: 37/2022 Crib Sheets: 36/2022

SNB

Rate Statements: 39/2022 | 25/2022 Crib Sheets: 37/2022

BOJ

Rate Statements: 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 41/2022 | 31/2022

Photo Credit: DALL-E 2 “A goldfish in a bowl with the world outside burning”

Yes!

Moneymaker! Rj