fx:macro Outlook for Week 37/2022

Three central banks, a milestone for the newsletter and a holiday next week...

Next weekend there will only be a short review edition but no outlook due to a short holiday break. The next regular issue will be out on 24./25.09. for week 39/22.

Welcome to issue #22 of fx:macro! As I've posted this week on Twitter, we've hit the mark of 1,000 subscribers:

Thanks to everyone who subscribed, I'm glad you're here! If you haven't subscribed yet, here's your chance:

And here's a link to this week's podcast write-up. It's a bit on the doom-and-gloom side, but it was a very interesting conversation between Ed D’Agostino and Louis Gave. Check it out if you like:

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary. The final section is a collection of things I read during the week that influence my thinking.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

One more thing. You seem to like newsletters, so here's a great way to discover new stuff to read for free: The Sample. They will regularly send you an issue of a different semi-random newsletter you might be interested in. If you sign up using my referral link, I get bonus points and my newsletter will be forwarded to others to check out.

Now let's get started…

Table of Contents

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

I've had some readers reach out to me, saying that sometimes a lot of the summary seems to be unchanged. That's true, and that's why I'm trading forex: the overall picture isn't changing rapidly. To be a bit more transparent, I've decided to include a link to diffchecker.com that highlights the differences between the following table and the one in the last edition of fx:macro.

Relevant market risks I have on my radar (it's obviously not a comprehensive list and mostly unchanged from last week):

Europe:

Italian elections coming up, risk of a Euro-sceptic right-wing PM

huge uncertainty regarding the future of gas flows from Russia;an unexpected resolution of the conflict seems very unlikely, but it could escalate on multiple fronts (gas, energy,militarily) very quickly

UK:we should be getting an idea this week on how the Tory leadership contest and Liz Truss will impact marketsGlobal markets: the risk from commodity market squeezes spilling over seems to have diminished a bit; it's become a major factor in energy and electricity markets

China/Taiwan: keeping an eye on the Taiwanese stock market as a risk gauge

Economic Calendar for next week

Important levels to watch and look out for in the Majors

Week in Review

Central Banks

RBA Rate Decision (06.09.)

The RBA increased the cash rate by 0.5% to 2.25% as expected in a dovish hike. Link to full statement here, relevant points and difftext below:

Softened the commitment to bringing inflation back down a bit from: “high priority" to: “board is committed”

The economy has now “deteriorated” instead of “outlook downgraded”

Inflation is now expected to increase further over the months ahead

Wage growth has picked up and is increasing briskly in some parts of the economy

Guidance changed from “expects further steps in the process of normalising monetary conditions” to “expects to increase interest rates further”, which implies that monetary conditions have been normalized and the interest rate is now somewhere near the neutral rate

BOC Rate Decision (07.09.)

The Bank of Canada hiked interest rates by 0.75% as expected to 3.25%. Relevant points from the statement and difftext below (link to full text):

Guidance: the policy rate will need to rise further, the bank will be assessing how much higher interest rates will need to go to return inflation to target

Headline inflation eased because of lower gasoline prices but price pressures are broadening, especially in services

Growth was a bit weaker than expected at 3.3% in Q2, but domestic demand is very strong. The housing market is pulling back as anticipated.

The bank expects growth to moderate further during the rest of the year.

ECB Rate Decision (08.09.)

The ECB hiked rates by 0.75% to 1.25% as expected. Relevant points from the statement and difftext below (link to full text):

The rate hike is considered a “major step” that “frontloads” the transition to interest rate levels consistent with bringing inflation back down to 2% target

The Governing Council expects to raise interest rates further, remains data-dependent and follows a meeting-by-meeting approach

Inflation is expected to stay above target for an extended period, projections have been revised upwards significantly to averages of 8.1%, 5.5% and 2.3% in 2022, 2023 and 2024

Growth is now expected to stagnate later this year and Q1/23, projections are now for GDP to grow 3.1%, 0.9% and 1.9% in 2022, 2023 and 2024

Suspended the two-tier system for excess reserves by setting the multiplier to zero

APP remains unchanged

Confab, Speakers, News

Federal Reserve

Barkin (Neutral). Wed: Have a bias towards moving more quickly rather than more slowly, wouldn't be surprised by rates above 3.5% during 2023, destination is real rates in positive territory and keep them there until convinced that inflation can be put to bed.

Mester (Hawk). Wed: Will decide preferred rate hike increase at the September meeting, need to raise rates "somewhat above 4%" by early next year and then hold there, better for markets to focus on the path of rates instead of a single meeting, does not anticipate rate cuts next year. Not convinced inflation has peaked yet, wage growth still higher than what is consistent with 2% inflation.

Collins (Neutral). Wed: Inflation is simply too high, restoring price stability is job number one.

Brainard (Dove). Wed: Policy rate needs to rise further, needs "several months of low monthly (core) inflation readings", at some point in the tightening cycle risks will become more two-sided.

Powell (Neutral). Thu: We need to keep going until we get the job done, history cautions against loosening prematurely, not influenced by political considerations, hopes to achieve a period of below-trend growth.

Evans (Neutral). Thu: Could very well do 75 bps in September, expects rates at 3.25-3.5% by year-end but doesn't have “heartburn” about getting to 3.75-4.00%, prefers to raise rates and hold for some time rather than raise and cut. Labour market is tight but will slow down, we are increasing rates expeditiously, job number one is to get inflation back down to 2%, we'll muddle through with positive growth this year. Expects inflation below 3% next year and a terminal rate of 4%.

Waller (Hawk). Fri: Supports another significant hike in September but looking further out he can't tell about the appropriate path of policy. Expects that it will require hikes until at least early next year for inflation to come down meaningfully and persistently, if the economy follows the path of the SEP he would support peaking rates near 4%. Can be really aggressive on inflation if unemployment stays below 5%, have to get in rate hikes now before labour market really goes down.

George (Neutral). Fri: Strong resolve to bring inflation back down to target, would like to see a soft landing but there could be a more difficult path to bring inflation under control, MBS portfolio may require sales down the road.

European Central Bank

Lagarde (Dove). Thu post-ECB press conference: Determined action had to be taken, today was not an isolated decision, the decision was unanimous but different views around the table, next hike not necessarily 75 bps, hikes will probably take place at the next 3-4 meetings ("more than two, less than five"). Still not at neutral rate, "so far away" from a policy setting that will be enough to bring inflation down.

Knot (Hawk). Fri: Curbing inflation dynamic is the only concern, inflation uncertainty is too high to give forward guidance.

Kazimir. Fri: 75 bps rate hike was inevitable and right, inflation is unacceptably high, priority is to continue fiercely with normalization of policy, discussion around what level of rates the ECB aims to reach is premature.

Villeroy (Neutral). Fri: Nobody should speculate about the size of next move, our will and capacity to deliver on mandate cannot be subject to any doubt. Inflation should be brought back to around 2% by 2024. Can't exclude a limited recession.

Sources: Thu: Do not exclude a 75 bps hike in October if the inflation outlook warrants another big step, Lane was more hawkish at today's meeting, QT expected to be discussed at October meeting.

Bank of England

Mann (Hawk). Mon: Fast and forceful tightening is superior to a gradual approach, a drift in medium-term inflation expectations is already apparent, cannot be complacent, the better we control medium-term inflation expectations the less tight for long monetary policy will have to be.

Tenreyo (Dove). Wed: Should be going slowly on rate hikes when there is a lot of uncertainty, even without a rate hike in August rates were sufficient to return inflation to target, a more gradual approach reduces the risk of overshooting.

Bailey (Neutral). Wed: There are dollar-specific factors at work regarding weak currency but there's also a UK story to sterling weakness. Fed is much more focused on bringing demand shock under control. Nothing we say today should be taken as a clue to what we will do on rates next week. Gas market is under stress, margin calls in energy markets have risen sharply, markets are very thin.

Pill. Wed: QT will take market conditions into account, it's not intended to disrupt markets, if QT causes too much tightening we can offset that with less interest rate increases. Higher energy bills on corporates is potentially a massive shock, recession remains a possibility later this year.

Reserve Bank of Australia

Lowe. Thu: Further rate hikes required but not on a pre-set path, case for slower pace of rate hikes becomes stronger as the level of rates rises, conscious of lags in operation of monetary policy, neutral cash rate is at least 2.5%.

Reserve Bank of New Zealand

Silk. Wed: The bank is well placed to manage wind-down of monetary policy tools, OCR is the primary tool to conduct monetary policy.

Bank of Canada

Rogers. Thu: Policy rate needs to rise further, getting inflation back to 2% will take some time, a period of lower growth is needed to bring demand back in line with supply, we will not rest easy until we can get inflation back to target.

Swiss National Bank

Jordan. Thu: ECB hike by 75 bps today not fully surprising, positive for the SNB if other central banks normalize policy, wouldn't create problems for the SNB if the ECB hiked by 100 bps, no decision yet on September meeting, can't say inflation has reached a peak yet. SNB makes monetary policy decisions at regular meetings unless under severe time pressure. No comment on currency intervention, doesn't rule out anything.

Maechler. Thu: Too early to call trend on inflation coming down, important to move step by step.

Bank of Japan

Suzuki (FinMin). Tue: Watching FX moves with a sense of urgency, recent FX volatility is high, important for the exchange rate to stably reflect economic fundamentals. Wed: Recent moves in the exchange rate are one-sided and rather rapid, FX rates should reflect fundamentals. Thu: Won't rule out any options on FX, closely watching currency moves with a sense of urgency, sharp moves undesirable, important for FX to move stably reflecting economic fundamentals.

Matsuno (Chief Cabinet Secretary). Wed: Ready to take appropriate actions on FX market movements if necessary, concerned by recent rapid one-sided moves, sharp fluctuations in exchange rate not desirable, important for FX moves to stably reflect economic fundamentals, watching with a high sense of urgency.

Watanabe (Ex-MOF). Wed: No need for Japan to intervene in currency market, solo intervention would be meaningless as current moves driven by dollar gains and markets would know Tokyo has limits, USDJPY is overshooting somewhat, may hit 145 but that won't last long. Doesn't think the BOJ will raise rates just to stem yen falls.

Kuroda. Fri: Rapid FX moves undesirable, will watch carefully.

Here's a guide from Bloomberg on what to watch for in BOJ rhetoric when it comes to escalations and possible currency interventions:

Economic Data

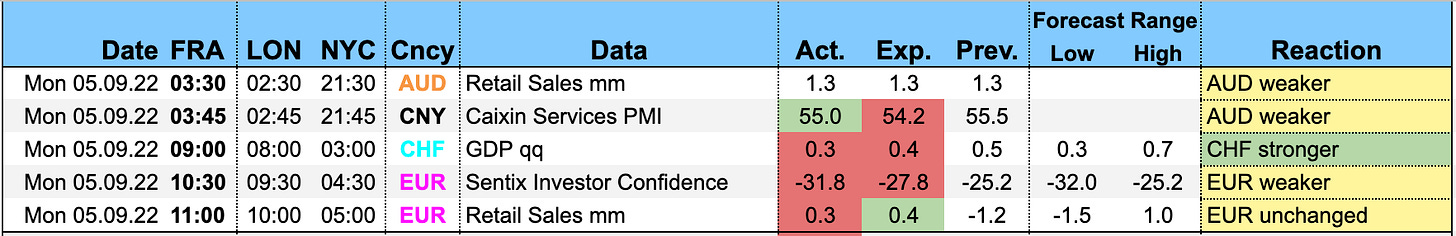

Monday, 05.09.22

Tuesday, 06.09.22

The RBA Rate Statement was covered in more detail above.

Highlights from the US ISM Services PMI (link to full report):

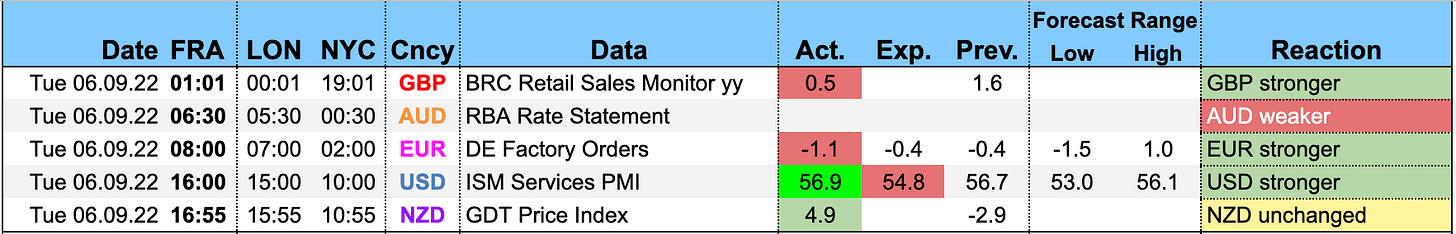

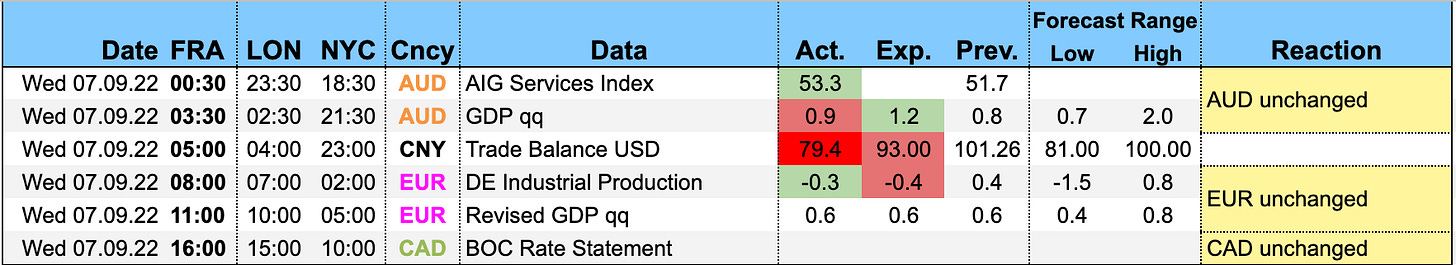

Wednesday, 07.09.22

The BOC Rate Statement was covered in more detail above.

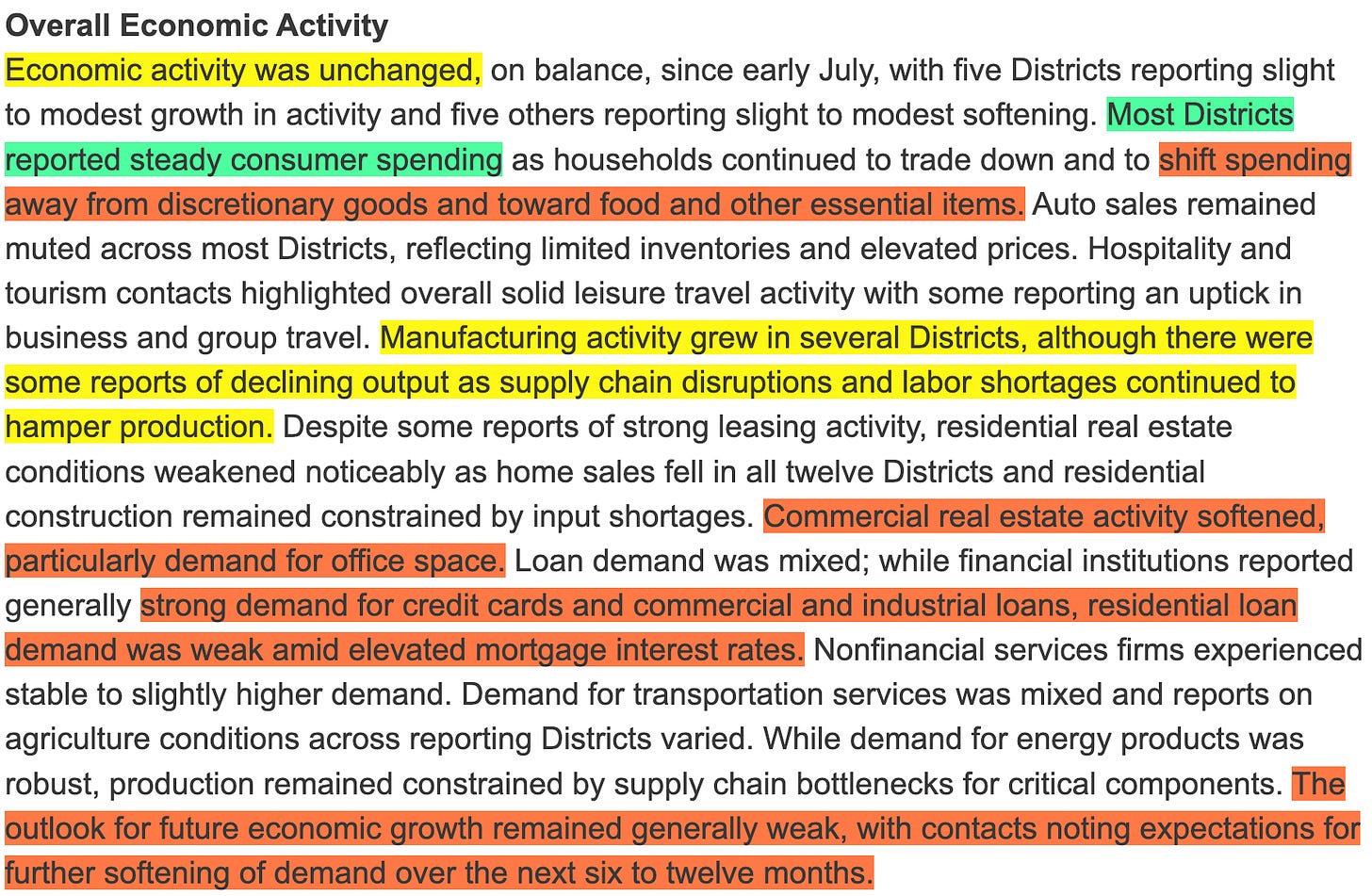

The Fed Beige Book was released on Wednesday (link to full text), here are the relevant parts:

Thursday, 08.09.22

The ECB Rate Decision was covered above in detail.

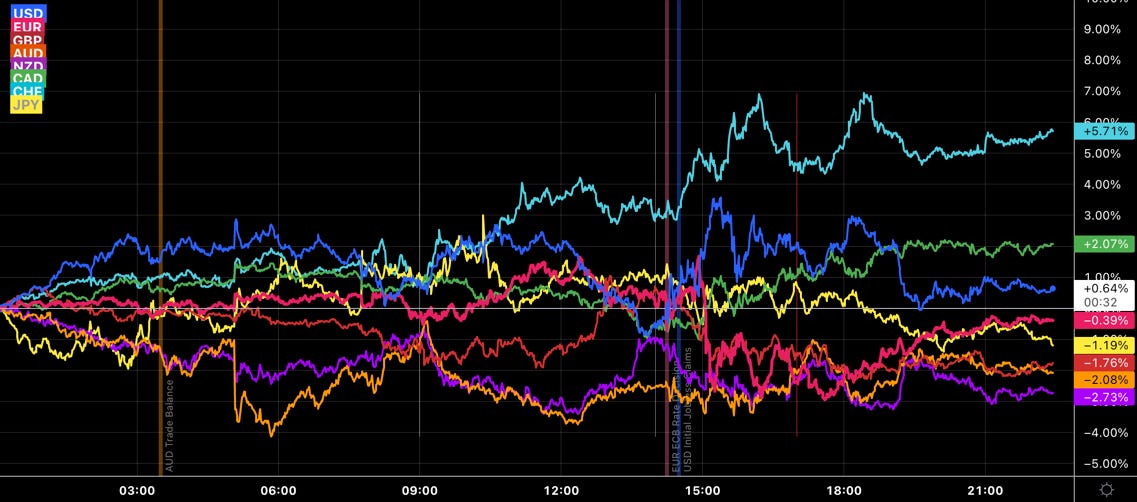

The sharp move lower in AUD around 05:00 was caused by Lowe's speech (link to full text) that was perceived as dovish.

Friday, 09.09.22

Market Analysis

Growth and Inflation

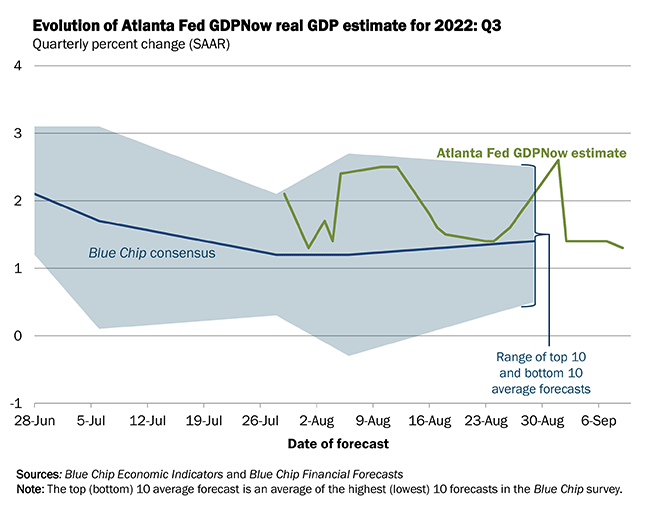

The Atlanta Fed GDPNow model estimates Q3 GDP growth at 1.3%:

The NY Fed Weekly Economic Index stands at 3.21:

Citi Economic Surprise Indexes:

USD, EUR and GBP are up

AUD and CAD are down

NZD, CHF and JPY are somewhere in between

There haven't been a lot of updates in the PMI heatmap, but it continues to look worse overall each month. The following readings are unchanged from last week:

Canada and the UK weaker

The US is the relative outperformer along with Europe and Japan, all of which remain unchanged

In Asia, South Korea and Taiwan have weakened further

Also, several emerging markets have been weakening considerably over the last few months: Mexico, Brazil, Czech Republic, Turkey, Poland.

This is obvious from the Global, EM and DM Citi Economic Surprise Indexes as well. The divergence we've seen since early Q2 has almost completely collapsed:

5y5y forward inflation expectation swaps are trading somewhere in their longer-term range at 2.33:

Similar picture for the Inflations Expectations ETF RINF:

Citi Inflation Surprise Indexes have been updated last week:

USD, AUD and CAD sharply lower

EUR and CHF a bit lower as well

GBP is up, NZD is up a bit more

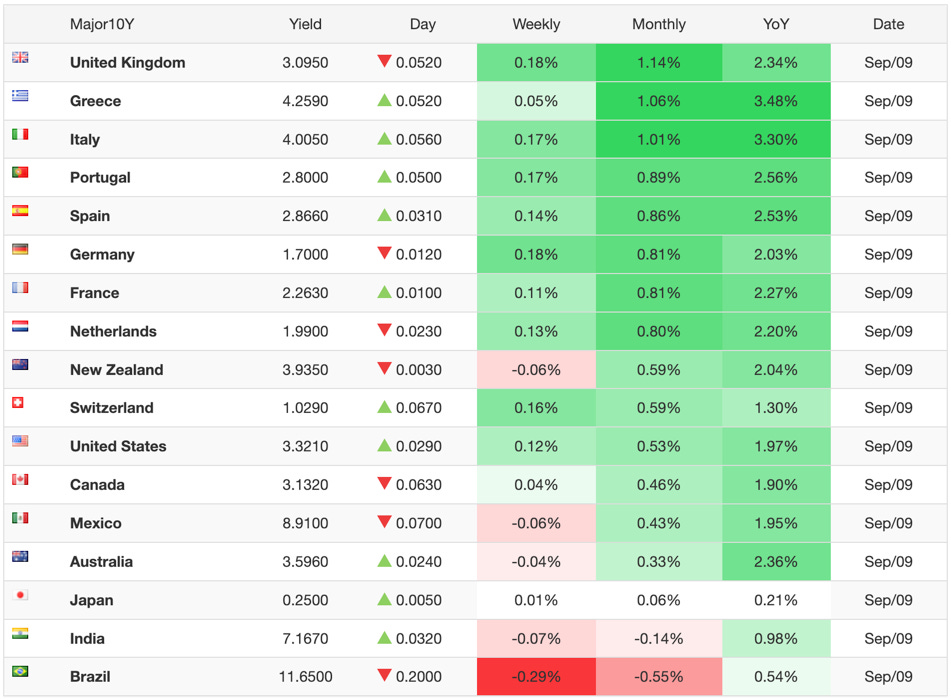

Yields

See chart and table below:

UK and European yields are the strongest

AUD and NZD look weakest

This week saw some pretty rapid bull steepening in UK 2s10s. Other than that, the steepening in the US curve over the last month or so appears anaemic as the entire curve is shifting upwards.

Central Banks

According to CME's FedWatch, 75 bps at the September FOMC meeting are now virtually a done deal:

The probability for 75 bps is now 91% vs. 57% last week

Probabilities for next year have been upped a bit, the terminal rate is now seen at 4.00-4.25%

Short-term interest rate futures also pricing in the steeper path in the front and a smallish (if at all) rate cut in 2023:

Sectors and Flows

Currency strength:

CHF and USD are the undoubted outperformers over three and one months

GBP and JPY have the worst performance over these time periods

The EUR has gained some strength recently

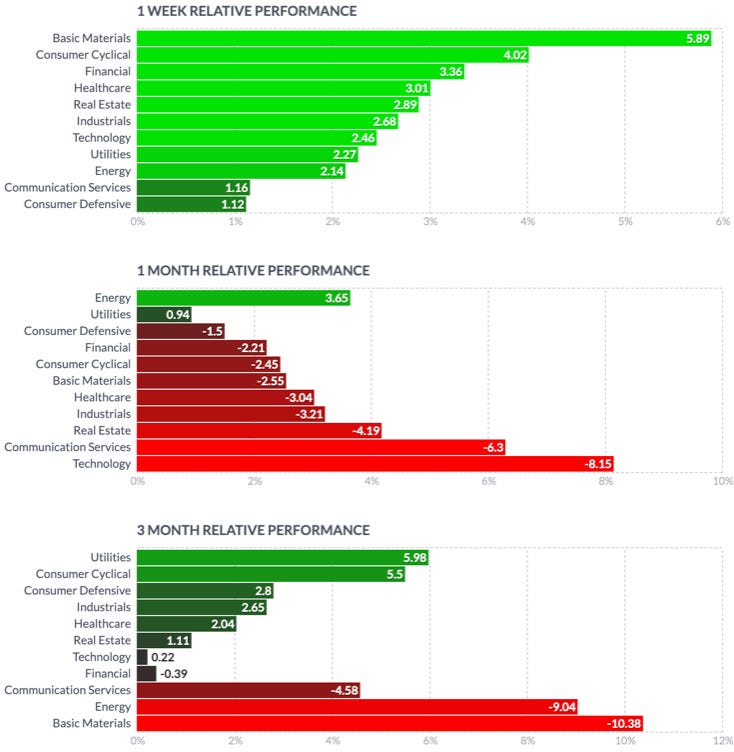

Equity sector performance over one month:

Outperformers are once again energy (OIH, XOP, XLE) and metals/mining (XME)

Everything else is far behind

Semiconductors and Tech (SMH, XLK) are the underperformers

Overall defensive and offensive sectors are relatively close together with the exception of tech and semiconductors

Energy being the best performing sector again isn't reassuring, especially since everything else isn't giving any clear indication of where we stand.

Same picture here although it looks a bit less confusing and more defensive on the 1-month timeframe and very clear over three months:

Sector thumbnail charts:

International stock markets over one month:

Brazil and India are in the lead

Japan's Topix and Nikkei are surprising-not-surprising: the JPY is imploding, benefitting exports, Japanese stocks are up. At least that seems to be the net effect factoring in massively higher costs to import raw materials, logistics and lower demand.

The major European indexes have the weakest performance: Germany, France, EuroStoxx

Sentiment and Positioning

The AAII Bull-Bear spread is nearing its lower extreme again:

Currency sentiment:

CHF, CAD and USD have the most bearish sentiment

NZD, JPY and GBP have the most bullish sentiment

The reading for CHF is surprising as is the divergence between Aussie and Kiwi sentiment

Different sentiment source:

GBPUSD shorts have increased for the week but the reading is still very bullish as are all other USD pairs (bearish sentiment for USD)

All JPY pairs are bullish JPY sentiment-wise

There have been some pretty huge percentage changes for the bears in German, French and UK stocks as well as in Crude Oil

Commitment of Traders and futures performance:

Equities had a pretty positive week, bringing their RSL back close to 1

Commercial positioning in the ES is still supportive of a move higher, YM (Dow Jones) has seen significant 1-week Commercial buying and Large Trader selling with Z-scores of 1.59 and 1.79

Treasuries are down for the week, Commercial/Large Trader positioning looks bullish in the 2-year to 10-year futures

Energy was mostly negative with NG down 9% for the week.

Metals were all positive but when you look at their Relative Strength it's just a drop in the bucket. The Commercial net position in Silver has increased this week and remains positive, all other metals except for Palladium have very bullish COT data.

Grains and Softs were mixed.

COT/TFF data for currency futures:

Aggregate Dealer net positioning for the USD is near a two-year low with a %R of just 0.01

Dealer positioning in 6E is consecutively near a multi-year high

Positioning in the 6J is rapidly approaching its multi-year high from earlier this year

Citi PAIN indexes remain similar to last week: USD positioning is near record-high vs. all other G8 currencies:

Market Risks

Credit spreads haven't done much this week in the overall scheme of things: HY-OAS and IG spreads trade in their ranges, but the Credit Spread Index is close to this year's highs:

Currency volatility has picked up in the JPY this week:

The VIX term structure is in a flat contango:

Once again, volatility isn't signalling any stress even below the surface:

VIX is at 23, MOVE at 121, no major divergence there

VVIX remains subdued

TDEX is low and skew is flat (SDEX)

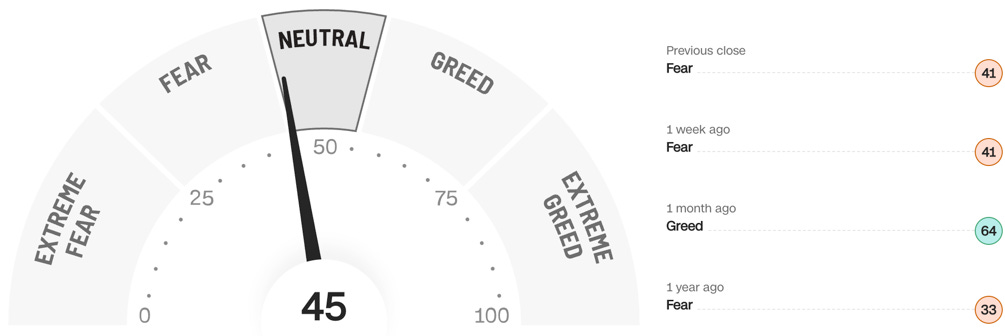

CNN Fear & Greed Index is neutral:

Various

Market breadth isn't much of a help or a hindrance for equities here:

The A/D line is tracking price pretty well right now, up and down

S&P 500 and Nasdaq 100 stocks above their 100-day moving averages is about where we would expect them given recent market action

Various other measures are still cautious:

Copper/Gold and Silver/Gold remain weak

Financials/Utilities making new lows

The Korean Won is being wrecked by USD strength and points lower

The notable exception is the LQD/TLT ratio but that spread hasn't been helpful the entire year

25-delta risk reversals:

Bullish divergences in EURUSD (higher low), and in AUDUSD and NZDUSD (moving up while price moves lower)

Bearish divergence in USDCNY

Other Stuff I've been looking at

Unfortunately, I didn't have enough time to fill up this section during the week.

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 31/2022

FOMC Meeting Minutes: 34/2022 | 28/2022 | 25/2022

ECB

Rate Statement 30/2022

Meeting Minutes: 35/2022 | 28/2022 | 21/2022

Economic Forecasts: 21/2022

Crib Sheets: 36/2022

BOE

Rate Statement: 32/2022 | 25/2022

Financial Stability Reports: 28/2022

RBA

Rate Statements: 32/2022 | 28/2022

Meeting Minutes: 34/2022 | 30/2022 | 26/2022 | 21/2022

Statement on Monetary Policy 32/2022

RBNZ

Rate Statements: 34/2022

BOC

Crib Sheets: 36/2022

SNB

Rate Statements: 25/2022

BOJ

Rate Statement: 30/2022 | 25/2022

Rate Summary of Opinions: 31/2022

Photo Credit: DALL-E (“A photo of hawks flying near a lightning storm”)