FX and Macro Outlook for Week 30/2022

RBA Minutes, BOJ and ECB Rate Decisions, a ton of PMIs and lots of charts

Welcome to edition #15 of FX & Macro Weekly.

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts, because they are basically the reasoning behind the conclusions I present in the Summary. The final section is a collection of things I read during the week that influence my thinking.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

I'm trying to gauge what parts of the newsletter people are interested in most, so here's a short poll for you. Thanks for participating!

One more thing. You seem to like newsletters, so here's a great way to discover new stuff to read for free: The Sample. They will regularly send you an issue of a different semi-random newsletter you might be interested in. If you sign up using my referral link, I get bonus points and my newsletter will be forwarded to others to check out.

Now let's get started…

Table of Contents

Executive Summary (Playbook, Calendar, Levels)

Week in Review

Central Banks

Economic Data

Market Analysis

Growth and Inflation

Yields

Central Banks

Sectors and Flows

Sentiment and Positioning

Market Risks

Various

Other Stuff I've been looking at

Executive Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Relevant market risks I have on my radar (it's obviously not a comprehensive list and mostly unchanged from last week):

Europe: huge uncertainty regarding future of gas flows from Russia; an unexpected resolution of the conflict seems very unlikely, but it could escalate on multiple fronts (gas, energy, militarily) very quickly

UK: the Northern Ireland protocol still remains unresolved

Japan: the BOJ making an unexpected U-turn

Global markets: the risk from commodity market squeezes spilling over seems to have diminished a bit

China/Taiwan: keeping an eye on the Taiwanese stock market as a risk gauge

Economic Calendar for next week

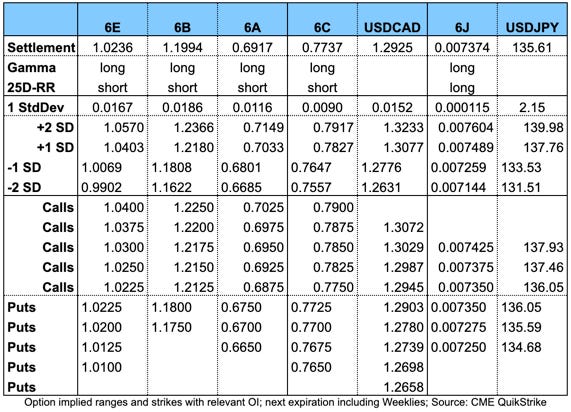

Important levels to watch and look out for in the Majors

Week in Review

Central Banks

RBA Meeting Minutes (19.07.)

Not much new information with a touch on the hawkish side (link to full text). Relevant points:

The current level of the cash rate is well below the lower range of estimates for the nominal neutral rate. This suggests that further increases in interest rate will be needed to return inflation to the target over time.

If inflation expectations rise, the level of nominal interest rates required to return inflation to the target will be higher than otherwise.

Inflation in Australia had increased significantly and was expected to increase further in the near term. Global factors, including COVID-19-related disruptions to supply chains and the war in Ukraine, accounted for much of the increase in inflation. However, domestic factors were also playing a role. Strong demand, a tight labour market and capacity constraints in some sectors were contributing to the upward pressure on prices. The east coast floods earlier in the year had also affected some prices, and the July floods would likely result in this persisting for a longer period of time.

Employment had grown significantly in preceding months and the unemployment rate was at a multi-decade low. Job vacancies and advertisements were at high levels and further declines in unemployment and underemployment were expected.

As for the policy decision:

BOJ Statement on Monetary Policy (21.07.)

Overall nothing new as expected. The statement is virtually unchanged except for their comments on the domestic economy. Difftext below (link to full text):

They also published a new Outlook for Economic Activity and Prices (link). Relevant points (emphasis mine):

Japan's economy is likely to recover toward the middle of the projection period, with the impact of the novel coronavirus (COVID-19) and supply-side constraints waning, although it is expected to be under downward pressure stemming from a rise in commodity prices due to factors such as the situation surrounding Ukraine. Thereafter, as a virtuous cycle from income to spending intensifies gradually, Japan's economy is projected to continue growing at a pace above its potential growth rate.

The year-on-year rate of change in the consumer price index (CPI, all items less fresh food) is likely to increase toward the end of this year due to rises in prices of such items as energy, food, and durable goods. Thereafter, the rate of increase is expected to decelerate because the positive contribution of the rise in energy prices to the CPI is likely to wane.

ECB Rate Decision (21.07.)

The ECB surprised with a 50 bps hike. Summary and difftext below (link to full text):

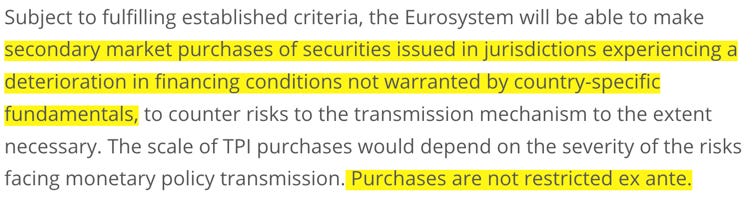

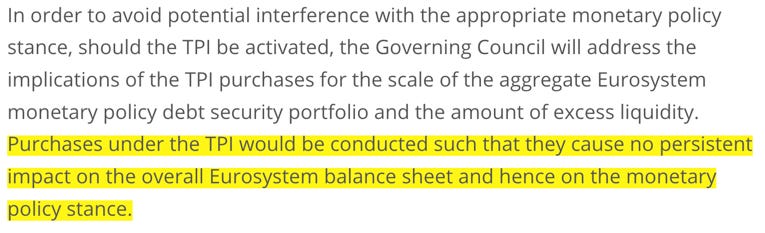

Approved the Transmission Protection Instrument (TPI), see below for more details

Further normalization of interest rates will be appropriate at upcoming meetings

Meeting-by-meeting approach to rate decisions, policy rate will be data-dependent

TPI purchases not restricted ex ante, can be activated to counter “unwarranted, disorderly market dynamics that pose a serious thread to the transmission of monetary policy”

Flexibility of PEPP reinvestments remains first line of defence against fragmentation

They also issued a press release detailing the Transmission Protection Instrument a bit more:

Confab, Speakers, News

Federal Reserve

Sources. Weekend: via Wallstreet Journal's Timiraos (same guy from last meeting's leak) saying it will be 75 bps in July

European Central Bank

Lagarde (Dove). Thu post-statement:

Council members "rallied to consensus” of 50 bps hike

ECB is accelerating exit but not changing the ultimate point of arrival

Price pressures broadening, expects inflation to remain undesirably high for some time

Decision on TPI was unanimous, all member states can be eligible, activation will be discretionary, will not hesitate to do so if needed

Does not see a recession as a baseline

Sat: will keep raising rates as long as necessary to bring inflation down to target over medium term, next steps are data-dependent

Villeroy (Neutral). Fri: starting rate hikes earlier does not mean terminal rate will be higher, determined to activate TPI if needed, no pre-defined limits on amount of possible purchases

Kazimir. Fri: possible to expect 25 bps or 50 bps in September (!), rate hike was the beginning of a series of similar steps, will take a while to get inflation back to desired levels

De Cos (Dove). Fri: we are data-dependent, will see about future interest rate increases September, political situation in Italy was not behind the creation of TPI

Nagel (Hawk). Fri: expects favourable growth in 2022 and 2023, future rate increases will be data-dependent, confident that TIP will withstand legal challenges

Sources.

Tue: Reuters report, two sources, policy makers will discuss 25 bps vs. 50 bps on Thursday, policymakers coming closer to a deal to support peripheral bond market in exchange for reforms and budget discipline

Thu post-statement: small number of GC members would have preferred a 25 bps hike, currently no unwarranted fragmentation in any Eurozone country according to internal metrics, TPI not expected to be triggered immediately, no particular country was discussed, PEPP reinvestments currently seen as sufficient to contain fragmentation

Bank of England

Saunders (Hawk). Mon: bank rate of 2% or higher next year isn't unlikely or implausible, doesn't think we're done with rate hikes, neutral is higher than 1% but lower than pre-GFC

Bailey (Neutral). Tue: 50 bps on the table at next meeting but not locked in, time to discuss strategy for beginning to sell gilts, details about that will be published along with the MPR in August, looking at a reduction around £50-100 bn in the first year

Reserve Bank of Australia

Lowe. Weekend: unlikely that crypto “things” will be used as a form of money, they need regulation, to job of regulators is to regulate not create (digital currencies)

Bullock. Tue: further rate increases needed in coming months, need to get rates up to neutral, neutral is a “fair bit higher” than where we are, house prices would have to fall a fair way to become a systemic concern, people will have jobs to service their mortgages because of strong labour market

Bank of Japan

Kuroda. Thu post-statement: will not hesitate to ease further if necessary, raising rates a little bit will not stop yen weakness, price increases will not be sustained, rapid yen weakening undesirable, no plan to widen YCC cap of 0.25%, higher yields hamper monetary easing, not thinking about allowing yields to go up for sake of market functionality

People's Bank of China

Yi Gang. Weekend: PBOC will provide stronger support to the economy, the economy faces certain downward pressures due to pandemic and external factors, domestic inflation is relatively low

Economic Data

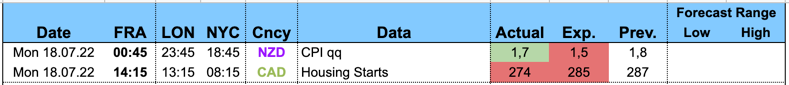

Monday, 18.07.22

New Zealand CPI: above consensus, NZD initially stronger. Alongside that the BusinessNZ Services Index was published (emphasis mine):

Activity levels for New Zealand's services sector in June displayed almost identical levels to last month, according to the BNZ - BusinessNZ Performance of Services Index (PSI).

The PSI for June was 55.4 (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). This was up 0.1 point from May, and above the long-term average of 53.6 for the survey.

BusinessNZ chief executive Kirk Hope said that it was pleasing to see two consecutive months of healthy activity in the sector. The fact that the two key sub-indexes of New Orders/Business (61.7) and Activity/Sales (56.5) remained at very healthy levels of expansion has more than compensated with other issues at play, such as supplier deliveries (47.8) still stuck in contraction.

Canadian Housing Starts: below forecast, AUD stronger

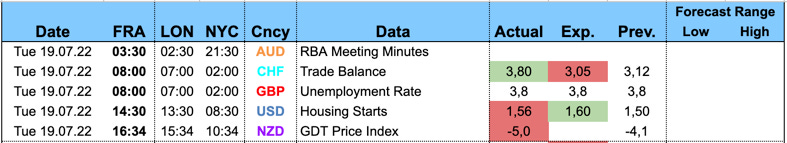

Tuesday, 19.07.22

RBA Meeting Minutes: covered above, AUD stronger

Swiss Trade Balance: above forecast, CHF stronger

UK Labour Market Report: Unemployment Rate unchanged (in line), Claimant Counts -20k (worse than -41.2k exp.), Average Earnings Index -6,2% (below 6.7% exp.). GBP weaker.

US Housing Starts: below forecast, USD weaker

Global Dairy Trade Price Index: below previous print, NZD unchanged

Wednesday, 20.07.22

German PPI: below forecast, EUR stronger

UK CPI: above forecast, GBP weaker

Canadian CPI: below consensus, CAD weaker

Eurozone Consumer Confidence: below expectations, EUR weaker

US Existing Home Sales: below forecast, USD mixed

Thursday, 21.07.22

Kiwi Trade Balance: below forecast, NZD weaker

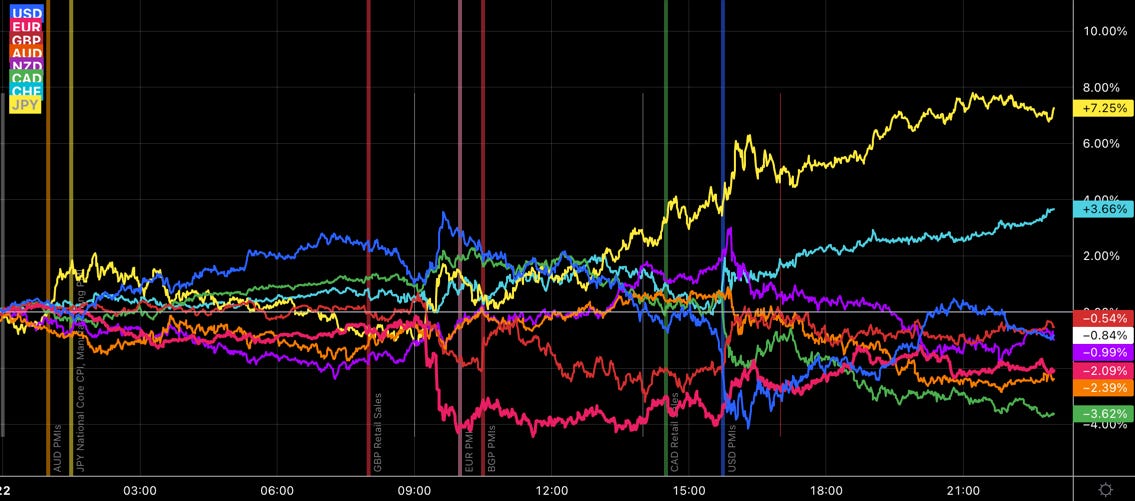

BOJ and ECB Rate Decisions are covered above: JPY did not react, EUR was knee-jerk higher on 50 bps hike but subsequently lost all of its momentum and reversed lower

US Philly Fed Manufacturing Index and Unemployment Claims: both weaker, USD price action was overshadowed by the ECB rate statement

The Philly Fed Manufacturing Business Outlook Survey made a bit of headlines, because its headline number(s) declined significantly. Also, the sub-indexes of Prices Paid and Prices Received came down hard from their highs:

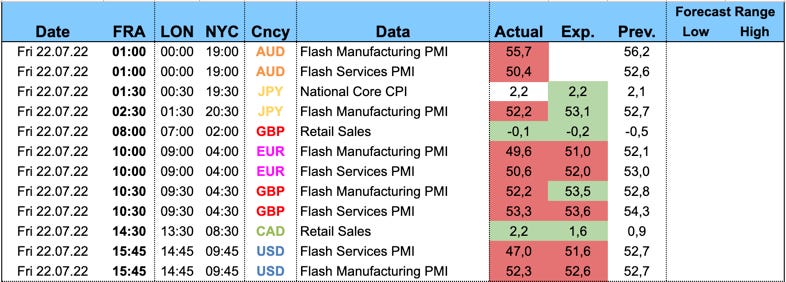

Friday, 22.07.22

Aussie PMIs: below previous prints, AUD weaker

Japanese National Core CPI: in line, Flash Manufacturing PMI: weaker. JPY lower.

UK Retail Sales: above consensus, GBP unchanged

Eurozone Flash PMIs: below forecast, Manufacturing below 50. EUR weaker.

UK Flash PMIs: both weaker, but remaining above 50. GBP initially stronger.

Canadian Retail Sales: better than expected, CAD unchanged

US PMIs: both below forecast, Services below 50. USD weaker.

There was a ton of PMI releases on Friday. Here are the relevant bits from the surveys, and mostly they are not looking good (emphases are mine):

Australian PMI:

Australia’s private sector economy expanded for a sixth consecutive month in July, according to the S&P Global Flash Australia Composite PMI. However, latest survey data has pointed to a further deceleration in the rate of private sector growth. Panellists suggested that interest rate increases, alongside persistent inflationary pressures, have been a pivotal factor contributing to the weakened private sector improvement this month. Further interest rate increases by Australia’s central bank present a downside risk to the private sector, with sentiment slipping to a 27-month low.

“On the positive side, employment levels continue to rise at a solid pace. Firms also continue to report challenges in filling vacancies, indicating that we can hope to see continued improvement in workforce numbers in the coming months as staffing levels are rebuilt.”

Japanese PMI:

“Flash PMI data indicated that activity at Japanese private sector businesses rose at a softer rate during July. The expansion in output was the softest recorded since March and only marginal (…).

“Positively, there was tentative evidence that price pressures were peaking, as the rate of input cost inflation eased for the first time in six months among private sector firms, yet remained rapid overall. This also contributed to the slowest, albeit still solid, rise in output charges since April.

Eurozone PMI:

“The eurozone economy looks set to contract in the third quarter as business activity slipped into decline in July and forward-looking indicators hint at worse to come in the months ahead.

Although only modest at present, a steep loss of new orders, falling backlogs of work and gloomier business expectations all point to the rate of decline gathering further momentum as the summer progresses.

“Of greatest concern is the plight of manufacturing, where producers are reporting that weaker than expected sales have led to an unprecedented rise in unsold stock. Production will likely need to be reduced as companies adapt to this weaker demand environment, in turn widely linked to rising prices.

“In services, the boost to demand from the reopening of the economy has faded and growth is now at a near- standstill, with customers often deterred by the increased cost of living and concerns about the outlook.

“Business expectations for the year ahead have meanwhile fallen to a level rarely seen over the past decade as concerns grow about the economic outlook, fuelled in part by rising worries over energy supply and inflation but also reflecting tighter financial conditions.

“One ray of light was a further marked cooling of inflationary pressures from the survey gauges of both input costs and selling prices, which should feed through to lower consumer price inflation. However, at present, these inflation gauges remain higher than at any time prior to the pandemic, underscoring the unenviable challenge facing policymakers of taming inflation while avoiding a hard landing for the economy.”

UK PMI:

“UK economic growth slowed to a crawl in July, registering the slowest expansion since the lockdowns of early-2021. Although not yet in decline, with pent-up demand for vehicles and consumer-oriented services such as travel and tourism helping to sustain growth in July, the PMI is now at a level consistent with just 0.2% GDP growth. Forward-looking indicators suggest worse is to come. Manufacturing order books are now deteriorating for the first time in one and a half years as inflows of new work are insufficient to keep workforces busy, which is usually a precursor to output and jobs being cut in coming months. Raw material buying has already slumped and hiring has slowed as companies reassess their requirements for the coming months in the face of worsening demand conditions.

“On a brighter note, inflationary pressures have cooled markedly, stemming from fewer supply shortages and more discounting in response to the weakened demand environment. Companies' costs are growing at the slowest rate since last September, which should help alleviate some of the upward pressures on inflation from energy and food in the coming months.”

US PMI:

“The preliminary PMI data for July point to a worrying deterioration in the economy. Excluding pandemic lockdown months, output is falling at a rate not seen since 2009 amid the global financial crisis, with the survey data indicative of GDP falling at an annualised rate of approximately 1%. Manufacturing has stalled and the service sector’s rebound from the pandemic has gone into reverse, as the tailwind of pent-up demand has been overcome by the rising cost of living, higher interest rates and growing gloom about the economic outlook.

“An increased rate of order book deterioration, with backlogs of work dropping sharply in July, reflects an excess of operating capacity relative to demand growth and points to output across both manufacturing and services being cut back further in coming months unless demand revives. However, with companies’ expectations of future growth slumping to the lowest since the early days of the pandemic, any such revival is not being anticipated. Instead, firms are already reassessing their production and workforce needs, resulting in slower employment growth.

“Although supply constraints remained problematic, constraining economic activity, the weakening demand environment has helped to alleviate inflationary pressures. Average prices charged for goods and services consequently rose at a much reduced rate in July, the rate of inflation still running high by historical standards but now down to a 16-month low to provide some much needed good news amid the ongoing cost of living crisis.”

Market Analysis

Growth and Inflation

Atlanta Fed GDPNow stands at -1.6% for Q2.

The NY Fed Weekly Economic Index estimates 4-quarter GDP growth of 2.89%:

Citi Economic Surprise Indexes:

USD trending lower, EUR and CAD plummeting

GBP improving, JPY not moving lower either

Purchasing Manager Indexes (also covered above):

Weaker across the board, but especially pronounced in the Eurozone

Relative outperformer is the UK

5y5y forward inflation expectations pretty much unchanged from last week near the bottom of their trading range.

Inflations expectations ETF not moving either:

Citi Inflation Surprise Indexes remain unchanged:

UK, Canadian and Swiss inflation still continue to surprise to the upside

Eurozone, Australian and Japanese inflation surprises are negative

Yields

See chart and table below:

All G8s weaker

CHF and NZD look strongest in the short-term

Flattening 2s10s in most currencies

Longer-term charts seem bearish for most 10s, here US10y looking toppy:

Yield curves for all G8s along the 2s10s spread are flattening. Not a good sign for global growth.

Central Banks

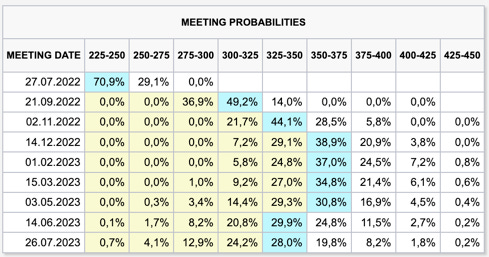

Latest Fedwatch probabilities:

75 bps in the coming week is now about 80% likely, 20% for 100 bps, so pricing has become a bit more dovish in the front-end

September is being priced for 50 bps at about 53% while last week pricing was more skewed towards a 75 bps hike

Terminal rate has also been priced a tad lower

Short-term interest rates have been moving accordingly and are pricing in lower hiking expectations for this and next year:

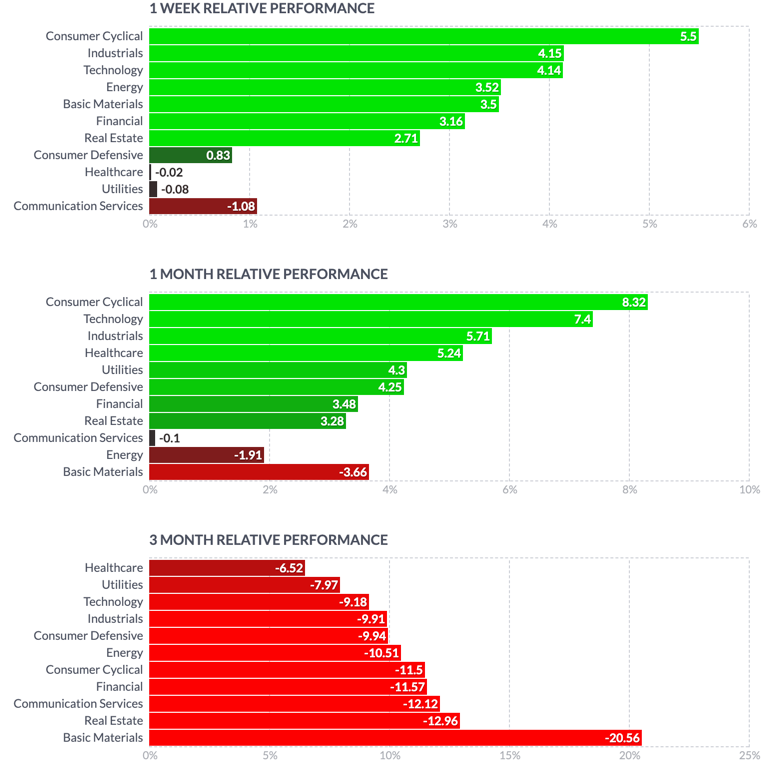

Sectors and Flows

Currency strength: Swissie and CAD are strongest, EUR and GDP the weakest over a 1-month horizon.

Equity sector performance:

Consumer Discretionary (XLY) in the lead… why?

Tech and Semiconductors (XLK and SMH) also performing very well

Oil, Metals and Mining, Energy, Basic Materials all lagging

It's been a reflationary week (and month) in stocks, but the longer-term picture hasn't changed so far:

Sector ETF charts:

International stock markets looking quite “healthy” over one month. The Nasdaq is leading, followed by the Russell (!).

Commodities are mostly in the red over one month, Natural Gas and Palladium being the exceptions:

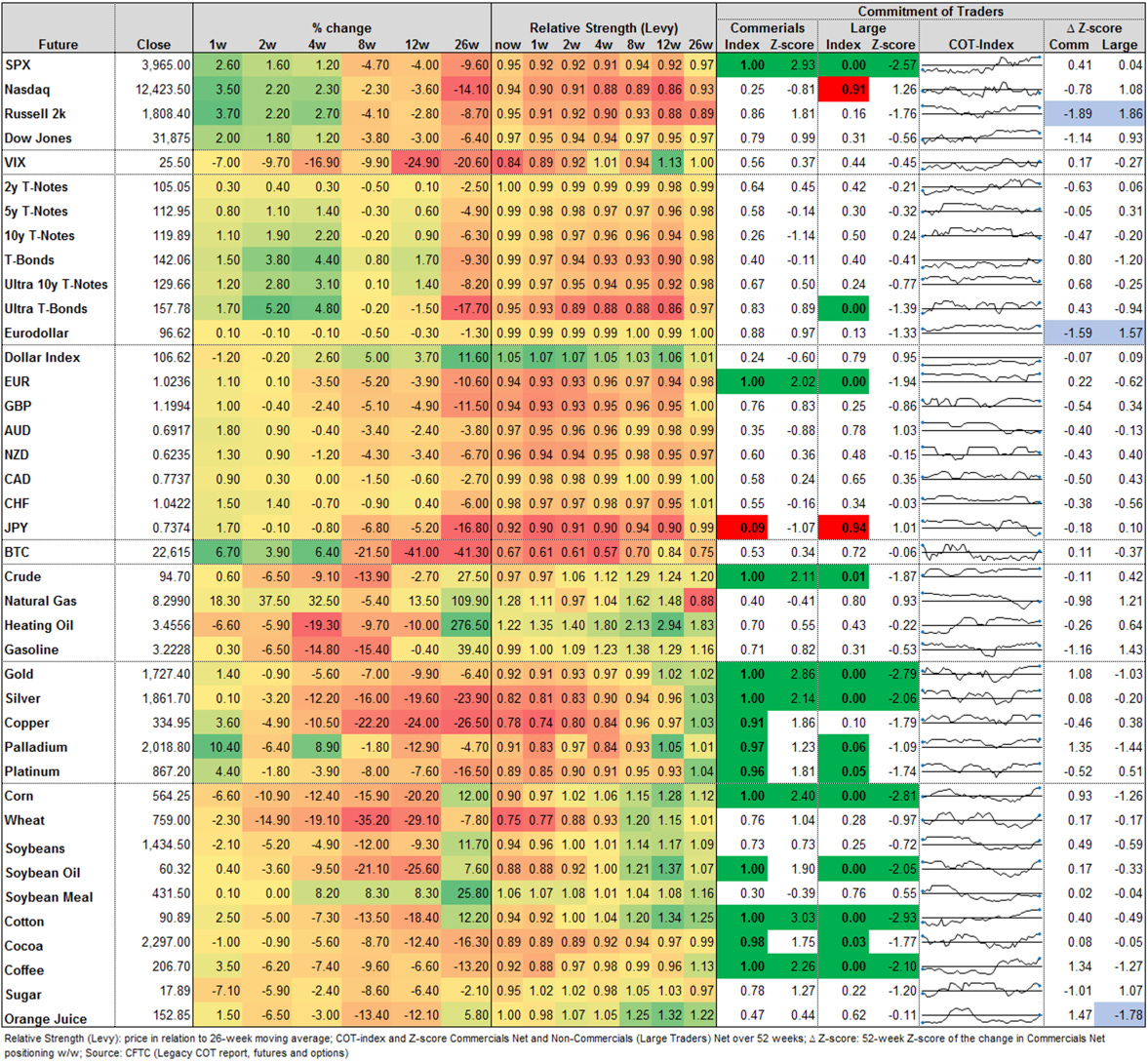

Sentiment and Positioning

AAII Bull-Bear spread is narrowing again with Bears exceeding Bulls by just 12.6%.

Currency sentiment:

USD pairs mostly bearish USD, except for USDCAD and USDJPY

All JPY pairs bullish for JPY

Commitment of Traders:

Equity index performance has turned positive, Commercials are still positioned at long extreme in the ES. Relevant Commercial selling and Large Trader buying in the R2k, but not reading much into that.

Bond futures have turned positive as well, but Levy Relative Strength still below 1.

Metals still weak, but mostly positive for the week. Levy Relative Strength way below 1, especially for copper. Commercial and Large Trader positioning very supportive of moves higher.

Grains and Softs mixed.

COT/TFF Dealer positioning for currency futures shows 6E at a 104-week high. Other futures aren't at extremes.

Citi PAIN indexes still show a pretty stretched long-dollar position vs. all other G8s:

Market Risks

High-yield spreads have come down from their highs, but remain wide.

Spreads for IG coroporates haven't moved much:

Overall Credit Spread Index also off highs, but still elevated.

FX volatility remains elevated:

The VIX term structure is looking a bit wobbly with the year-end-rally-dip in December. Front-end has a premium of about 2.5 over spot and decent steepness, though.

Volatility indexes are still surprisingly calm, even though MOVE remains above 120. VVIX continues to lead VIX lower.

My threshold is a VIX/VVIX correlation of 0.20 or lower (right now it's at 0.48):

Skew has steepened a bit, VIX/VOLI move up as well, but people are still not buying tail hedges:

Various

Breadth is moving! The percentage of S&P and Nasdaq stocks below their 100-day MA is still at/below -1 SD, but it's moving at least.

CNN's Fear & Greed Index in Fear territory, but just a tad below Neutral:

Metals, High Yield vs. Treasuries and the Korean Won aren't buying the rally in stocks. I've borrowed this idea from another great substack: Credit From Macro to Micro.

25-delta risk reversals: pricing moved for a stronger JPY again, GBP also priced higher.

Other Stuff I've been looking at

Failed high-yield settlements are skyrocketing:

Skew and fear correlate:

Global growth impulse is weakening further:

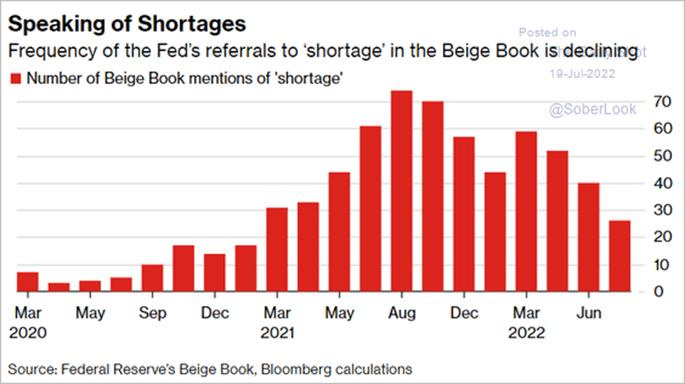

Supply chain pressures seem to be easing:

Emerging Market bonds are having a hard time:

… as do Chinese Property Bonds:

Links to relevant central bank releases in previous editions of this newsletter:

Awesome, great informations!

A lot of good data here, great resource