FX and Macro Outlook for Week 31/2022

FOMC, BOJ Summary of Opinions and a Regime Shift...

Welcome to edition #16 of FX & Macro Weekly.

First of all, thanks to everyone who subscribed so far! I'm truly humbled by all the positive feedback I've gotten.

When I started this whole thing I didn't put much thought into the details (or fairly essential stuff) like: what's the name going to be, what will the logo look like, what's a good Twitter handle and so on. Now that a bit of time has passed, I've decided to give it a bit of an overhaul, so here's your heads-up:

I will change the name of the newsletter to: fx│macro

There's going to be a new logo soon (goodbye blue and pink?).

I've changed my Twitter handle from @fxmacroweekly to @fxmacroguy (no need for you to update anything).

Maybe some other minor tweaks.

I will continue to publish on Saturday and the content of the newsletter won't change. So it will still be FX & Macro Weekly, but with a less boring name and a better look.

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts, because they are basically the reasoning behind the conclusions I present in the Summary. The final section is a collection of things I read during the week that influence my thinking.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

One more thing. You seem to like newsletters, so here's a great way to discover new stuff to read for free: The Sample. They will regularly send you an issue of a different semi-random newsletter you might be interested in. If you sign up using my referral link, I get bonus points and my newsletter will be forwarded to others to check out.

Now let's get started…

Table of Contents

Summary (Playbook, Calendar, Levels)

Executive Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

A few words about how I see the current market:

Powell's comments have led to what I believe is a short-term regime shift from QT to perceived-pseudo-QE (which isn't really QE but a lot less QT).

The whole macro picture is still so weak that I find it really hard to write down: we're in a reflation trade now. I don't know how long it will last, but my guess is: until we get a sense how the September FOMC meeting might play out.

The ECB has ditched forward guidance, now the Fed has followed suit. Central bank speakers and economic data will have much more impact when trading, creating more whipsaws and more small-timeframe volatility. (Thankfully you're reading a newsletter that has that covered.)

Strong opinions, weakly held. Being nimble. Trading the market, not expectations. That's going to be even more essential for the coming weeks.

Here are two useful overviews of central bank speakers for the upcoming rate decisions this week: BOE Crib Sheet 2022_07.pdf and RBA Crib Sheet 2022_07.pdf. Feel free to share!

Relevant market risks I have on my radar (it's obviously not a comprehensive list and mostly unchanged from last week):

Europe: huge uncertainty regarding future of gas flows from Russia; an unexpected resolution of the conflict seems very unlikely, but it could escalate on multiple fronts (gas, energy, militarily) very quickly

UK: the Northern Ireland protocol still remains unresolved

Global markets: the risk from commodity market squeezes spilling over seems to have diminished a bit

China/Taiwan: keeping an eye on the Taiwanese stock market as a risk gauge

Economic Calendar for next week

Important levels to watch and look out for in the Majors

Week in Review

Central Banks

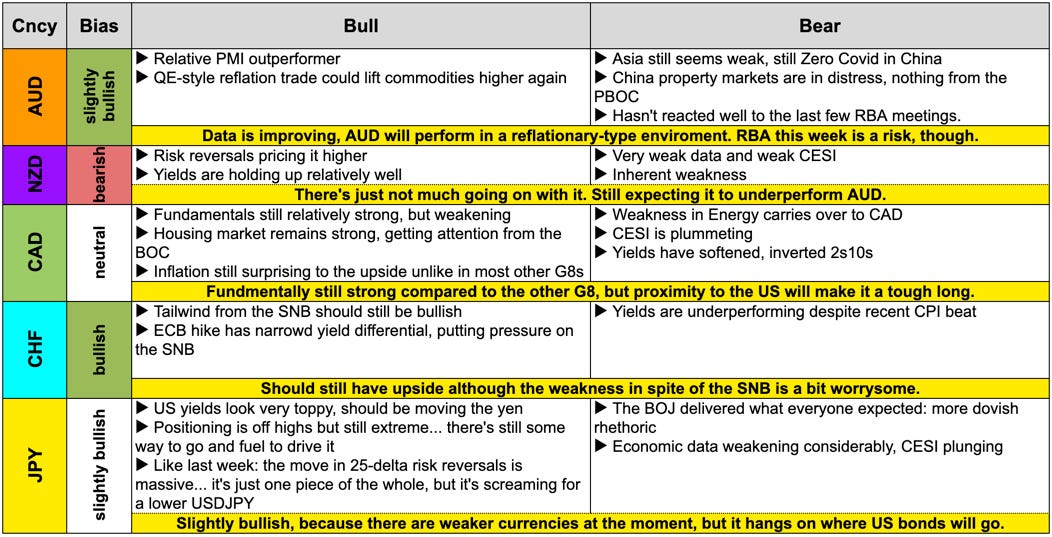

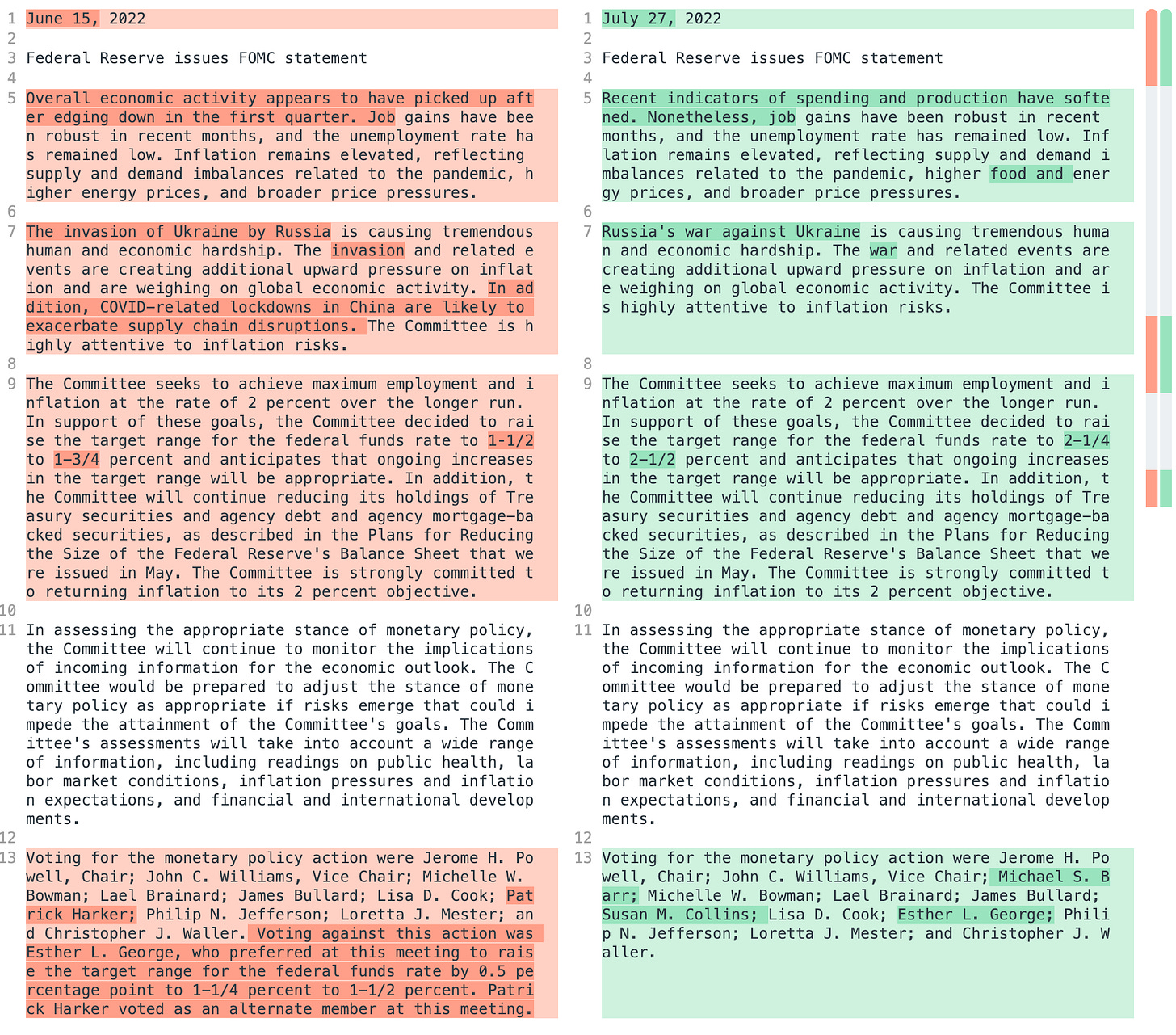

FOMC Statement (27.07.)

The Fed hiked by 75 bps to 2.25-2.5% as expected. Summary and difftext below:

Unanimous decision

Acknowledges that spending and production have softened

Supply chain disruptions with regards to China and Covid-19 have been removed from the statement

Balance sheet reduction going ahead as planned (Treasuries: $30 bn/month, MBS: $17.5 bn/month)

Otherwise unchanged

Bank of Japan Summary of Opinions (29.07.)

Link to the full document, here's the summary.

On monetary policy:

For the time being [the bank] should not hesitate to take additional easing measures if necessary. It is appropriate for the Bank to maintain the current forward guidance for the policy rates.

In this situation, it is appropriate that the Bank encourage wage increases through monetary easing, aiming to achieve the price stability target in a sustainable and stable manner.

Given that a rise in some determinants of underlying inflation, such as services prices, and CPI inflation exceeding 2 percent in a stable manner have not come in sight, it is natural to continue the current monetary easing.

On the economy:

Japan's economy has picked up. It is likely to recover with the impact of the novel coronavirus (COVID-19) and supply-side constraints waning, although it is expected to be under downward pressure stemming from a rise in commodity prices.

Firms' and households' inflation expectations have risen. In addition, the expected growth rate of Japan's economy probably has increased, which is consistent with firms' solid business fixed investment plans. Given these factors, the likelihood of wage inflation seems to be increasing as firms' expectations for future sales growth rise.

Risks to Japan's economic outlook are skewed to the downside, particularly regarding a resurgence of COVID-19 at home and abroad, prolonged supply-side constraints, and a decline in asset prices that reflects monetary tightening in major economies.

On prices:

The year-on-year rate of change in the consumer price index (CPI, all items less fresh food) has been at around 2 percent. Inflation expectations have risen. Toward the end of this year, the year-on-year rate of change in the CPI is likely to increase due to rises in prices of such items as energy, food, and durable goods. Thereafter, the rate of increase is expected to decelerate because the positive contribution of the rise in energy prices to the CPI is likely to wane.

Sustained wage hikes and an increase in value-added are becoming important issues for business management.

Confab, Speakers, News

Federal Reserve

Powell (Neutral).

Wed. Post-FOMC opening statement: inflation is much too high, labour market extremely tight, price pressures broad, wage growth elevated. Looking for "compelling evidence" inflation is coming down, Employment Cost Index on Friday will be important indicator, watching PCE and CPI but prefers PCE, another unusually large rate hike could be appropriate but it's data-dependent, does not think he would do September 2020-style forward guidance again.

Wed. Post-FOMC Q&A: not providing clear guidance anymore, time to go by a meeting-by-meeting basis. Need to get policy to at least a moderately restrictive level, 3.0-3.5% is what the SEP says on moderately restrictive level at end of the year. Rate hike have been large, their effect has not been felt by the economy, so there's probably some significant additional tightening ahead. Latest inflation report was worse than expected, necessary to have growth slowing down and have a period of growth below potential to create some slack, expects some softening in the labour market.

Waller (Hawk). Fri: Soft landing is a plausible outcome.

Bostic (Dove). Fri: Inflation needs to be addressed, Fed will have to do more on interest rates, depends on data in the next months, US is not in a recession.

European Central Bank

Largarde (Dove). Sun: Will raise rates for as long as it takes to bring inflation back to target.

Holzmann (Hawk). Mon: ECB may have to accept moderate recession, will take the economy into account when raising rates, we'll seen in autumn if we do another 50 bps or less.

Kazaks. Mon: Should be open to discussion of bigger rate hikes, big rate hikes may not yet be over, hopes TPI will not need to be used, we will know fragmentation when we see it.

Visco (Dove). Mon: Current spread (BTP-Bund) currently much higher than justified by fundamentals. Thu: Activating TPI depends on whether Italian spreads reflect macro fundamentals, have to avoid sending too strong messages, have to be prudent but progressive in normalizing policy stance.

De Cos (Dove). Tue: Inflation risks remain on the upside and have intensified. Risks include lasting deterioration in the Eurozone and persistently high energy and food prices.

De Guindos (Dove). Fri: Main factor guiding decisions will be the evolution of inflation, depreciation of the EUR has been one of the factors driving inflation.

Reserve Bank of New Zealand

Orr. Tue: RBNZ is undertaking a review of its recent performance in conducting monetary policy. Will compare inflation and employment outcomes to targets and assess decisions taken at various times based on information available at that time.

Swiss National Bank

Publication: National Bank Brief (publication designed for "schools and the general public, not listed as an "economic publication"): SNB may take monetary policy measures at any time between regular assessment dates if necessary

Spokesperson. Fri: Record H1 loss has no influence on monetary policy, price stability remains central bank mandate.

Bank of Japan

Takata (Hawk). Mon: Current YCC Is sustainable, exit strategy is always something the BOJ has to be thinking about, but not now.

Tamura. Mon: Japan my soon see positive cycle kick off with rising wages, policy exit will then become focus of discussion. Rapid FX moves undesirable, exchange rate must move stably, reflecting fundamentals.

Amamiya. Tue: BOJ must support economy with monetary easing, recovery not solid, wage growth uncertain. Aiming for 2% inflation sustainably, not just a temporary rise.

Economic Data

Monday, 25.07.22

German ifo Business Climate: below forecast, EUR stronger

Tuesday, 26.07.22

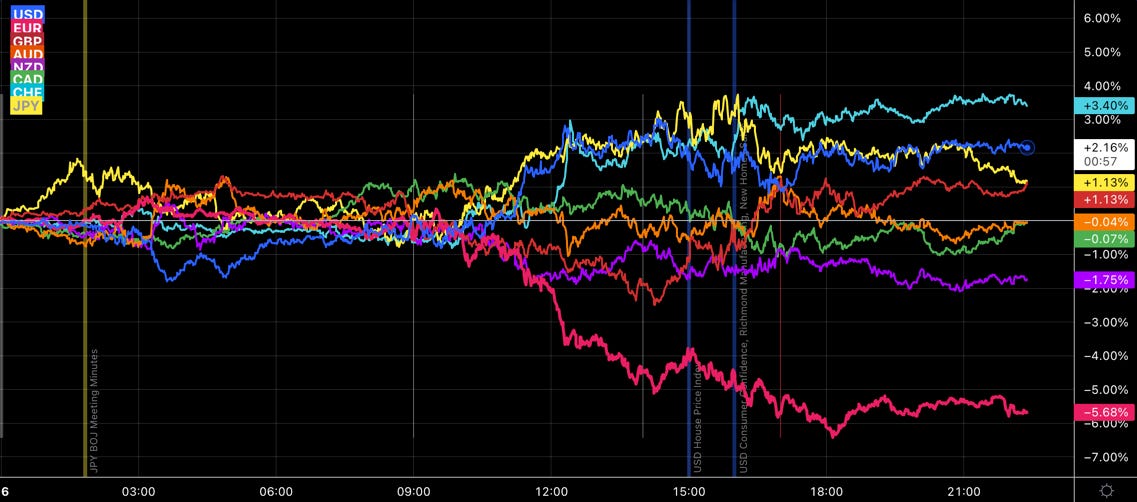

BOJ Meeting Minutes: JPY weaker. The minutes aren't covered in detail, because they belong to the June 16 meeting and are completely stale.

US House Price Index: below consensus, USD weaker.

US Consumer Confidence and New Home Sales: both below forecast range. Richmond Manufacturing: upside surprise. USD weaker.

Here's the summary and chart from the CB Consumer Confidence:

Wednesday, 27.07.22

Aussie CPI: below consensus, AUD weaker

German GfK Consumer Climate: below forecast range, EUR weaker.

US Durable Goods: above forecast range, USD stronger. Pending Home Sales: below consensus, USD stronger.

FOMC Statement: see above, equities liked it, USD weaker.

Thursday, 28.07.22

Kiwi ANZ Business Confidence: better than last month, NZD weaker.

Aussie Retail Sales: below forecast range, AUD weaker.

German Prelim CPI: above estimate, EUR stronger.

US Advance GDP: below forecast range, Unemployment Claims: worse than expected. USD weaker.

The highlights from the ANZ Business Confidence survey (link):

Friday, 29.07.22

BOJ Summary of Opinions: summary above, JPY weaker.

French Flash GDP: above forecast range, French Prelim CPI: higher than forecast. EUR broadly unchanged.

Eurozone HICP and Prelim GDP: both beat expectations, the latter far above top estimate. EUR initially weaker.

Canadian GDP: above consensus, CAD stronger

US Core PCE: above consensus, Chicago PMI: below forecast range. USD weaker.

Market Analysis

Growth and Inflation

The first print of the Atlanta Fed GDPNow model is at 2.1% for Q3.

The NY Fed Weekly Economic Index puts annual GDP growth at 3.10%.

The Cleveland Fed has a model that tries to predict growth and recessions from the yield curve, see the following two charts. It's not a very good model in the current environment, but interesting anyway: it is predicting a downturn in growth and a rising probability of a recession… albeit only next year Q2/Q3.

Citi Economic Surprise Indexes:

Not looking good across the board

Australia and Switzerland are the two not-too-bad outliers

GBP looks relatively strong compared to the others

Purchasing Manager Indexes are unchanged from last week:

Weaker across the board, but especially pronounced in the Eurozone

Relative outperformer is the UK

5y5y forward inflation expectations have ticked up:

Inflations expectations ETF is up as well:

Citi Inflation Surprise Indexes are unchanged from last week:

UK, Canadian and Swiss inflation still continue to surprise to the upside

Eurozone, Australian and Japanese inflation surprises are negative

Yields

See chart and table below:

All G8 2s and 10s moving lower

JPY 10s now well off the 0.25% cap

USD, GBP and NZD look strongest

AUD and CAD look weakest

2s10s are inverted for the USD and CAD. There's no steepening as you would expect in a reflation, instead we see a bear flattening… the front-end is being bought because the Fed is perceived to be less hawkish, and longer duration is being bought because we're in a recession. That's not bullish. In the lower timeframe it's clear that most of the post-FOMC steepening has already been priced out again:

Central Banks

Fedwatch target rate probabilities have changed significantly after this week's FOMC meeting:

Pricing is now 72% for a 50 bps hike in September while it was 49% for 75 bps last week.

The terminal rate has also been priced lower to 3.25-3.50% (from 3.50-3.75%).

The first rate cut is now projected to come as early as May 2023.

Short-term interest rates: pricing for 2023 rate cuts still around 2-3 25 bps cuts, hiking expectations for the remainder of this year slowly moving lower:

Sectors and Flows

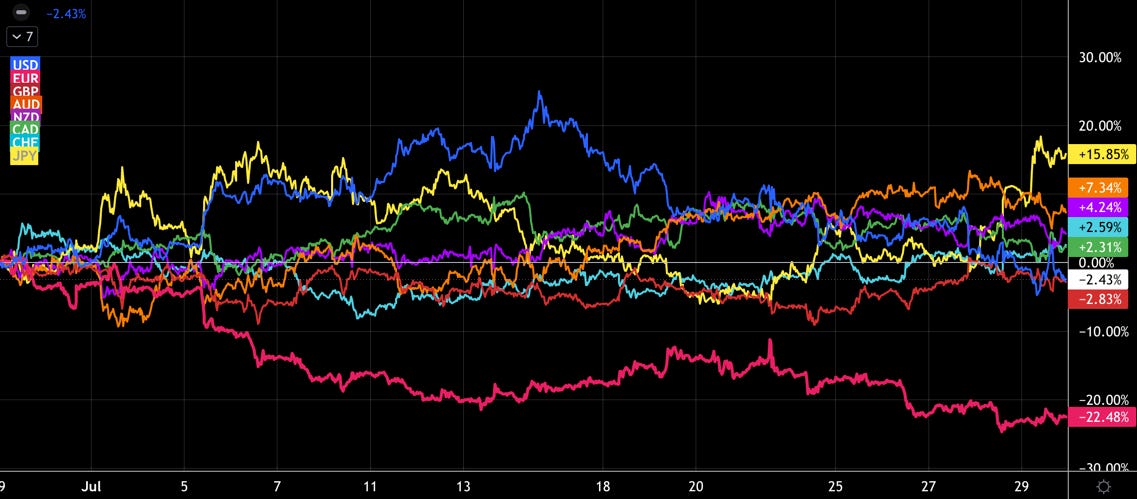

Currency strength over one month: JPY is the strongest, EUR the weakest.

Flows for the AUD, CHF and JPY are mostly positive. Equity flows still broadly negative:

Equity sector performance: all sectors are back in the green over one month.

Consumer Discretionary (XLY), Semiconductors (SMH), Tech (XLK) are leading

Growth (VUG) outperforming Value (VTV)

Defensive sectors are lagging: Staples (XLP), Healthcare (XLV)

Another look at sector performance: not clearly reflationary, but more of a QE-style rising-tide-lifting-all-boats rally:

The outperformance of XLY is clearly visible on the sector charts. But there is no real reflation without Financials (XLF, bottom row, middle column):

International stock market indexes are mostly up as well:

Nasdaq, Russell 2k and the French CAC40 in the lead

Asian indexes are lagging pretty significantly with the Hang Seng at -7.8%. Taiwan and Japan also at the low end.

Sentiment and Positioning

AAII Bull-Bear Spread has improved slightly, but it's still pretty low overall. It's going to be interesting to see next week what kind of impact the FOMC has had in retail investor optimism.

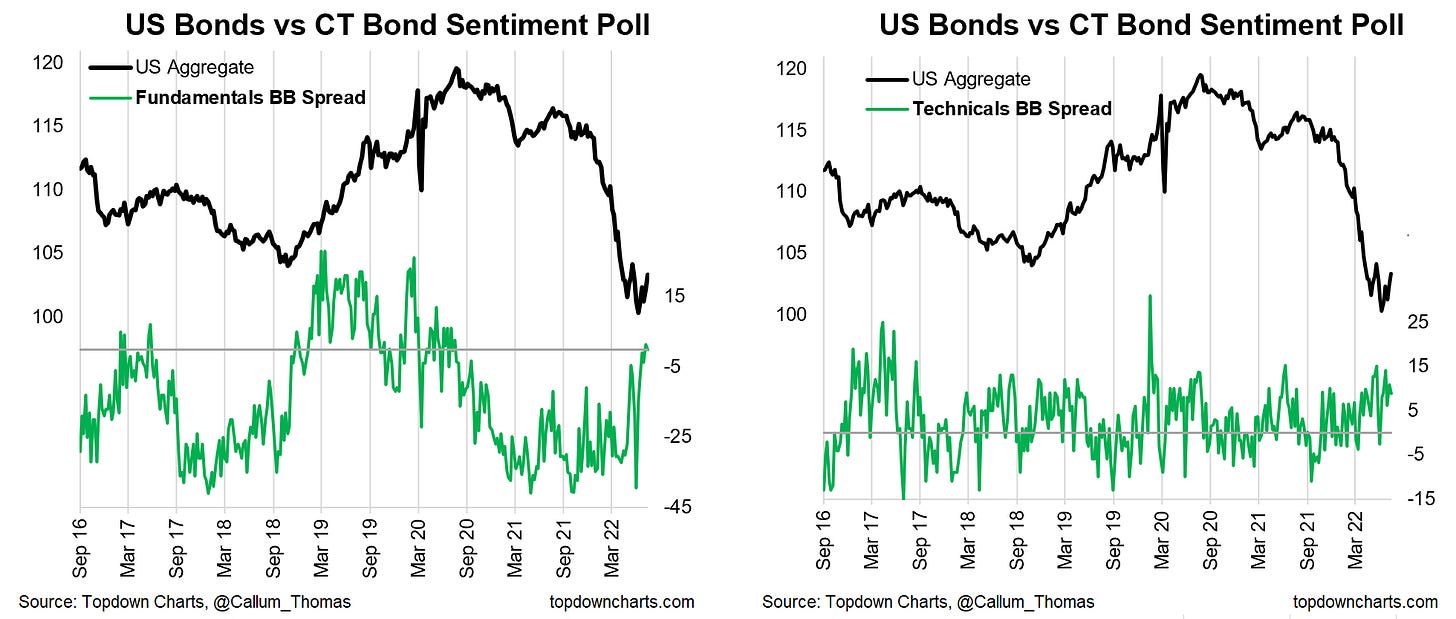

The Fundamental Bull-Bear spread in bonds has rebounded significantly. Data is from July 25th, so pre-FOMC:

Currency sentiment (don't have last week's data to compare):

CAD, CHF and AUD have the worst sentiment

JPY with the most bulls

Different sentiment source:

EURCHF and EURGBP with a lot of bulls

USD pairs with moderately few USD bulls

All JPY pairs have positive sentiment for the yen

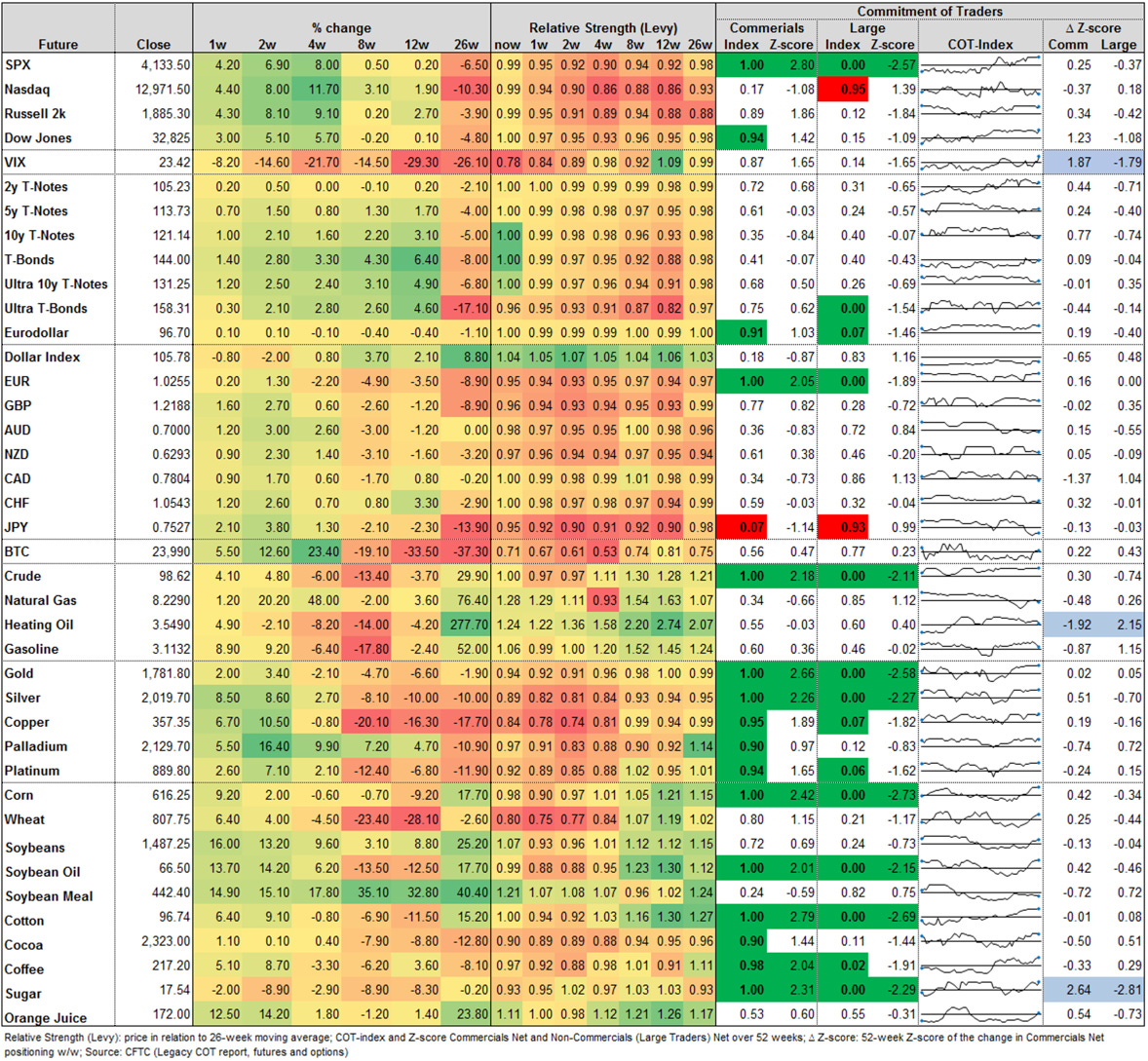

Commitment of Traders:

Commercial and Large Trader net positioning in the ES still very bullish. Equity performance has turned green over a few weeks, Levy Relative Strength is back very close to 1. Relevant Commercial buying (and consecutive Large Trader selling) in VIX futures, though.

Commercials are very long the 6E.

Metals also had a fair bit of positive performance this week, but Levy Relative Strength is still far below 1, especially in copper. Commercial/Large Trader positioning is still very bullish.

Grains and Softs were mostly positive.

COT/TFF Dealer net positioning for currency futures:

6E still near a 2-year high

6J has moved down from the high, still quite a lot of room to the downside

Citi PAIN Indexes haven't changed much since last week: USD still near the top end of the scale vs. all other currencies near the bottom. Notably, the JPY short hasn't moved much, either.

Market Risks

High-yield spreads are still elevated. Given the rally in equities I would have expected them to narrow quite a bit more.

IG spreads thoroughly unimpressed:

Credit Spread Index remains elevated as well:

Another look at credit: the NY Fed Corporate Bond Market Distress Index. It's updated monthly with weekly data, last update was July 27th:

Currency volatilities have declined somewhat:

The VIX term structure looks pretty healthy in the front-end and a bit flat further out.

Different volatility indexes also signal a pretty calm (complacent?) environment. VVIX is at 80 now (!), MOVE is below 120 and VIX just a bit above 20. Not the typical bear-market view.

VOLI (at-the-money VIX-equivalent) is plummeting, so the move higher in SDEX and TDEX are probably not really people buying hedges and OTM puts, the relative IV of OTM strikes is driven higher by the decline in ATM IV.

Various

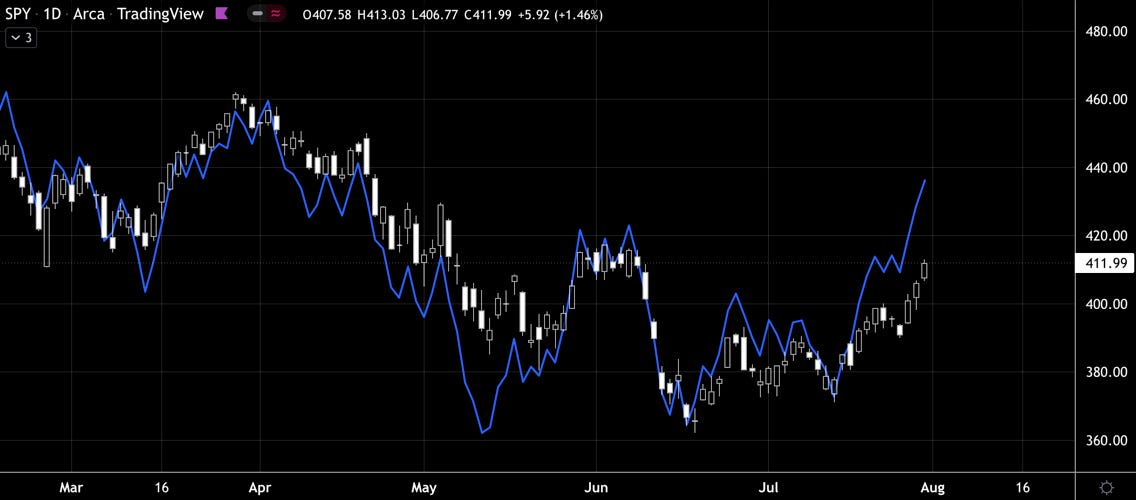

Market breadth has improved quite significantly: the NYSE Advance/Decline line has made a new high and its momentum to the upside is impressive.

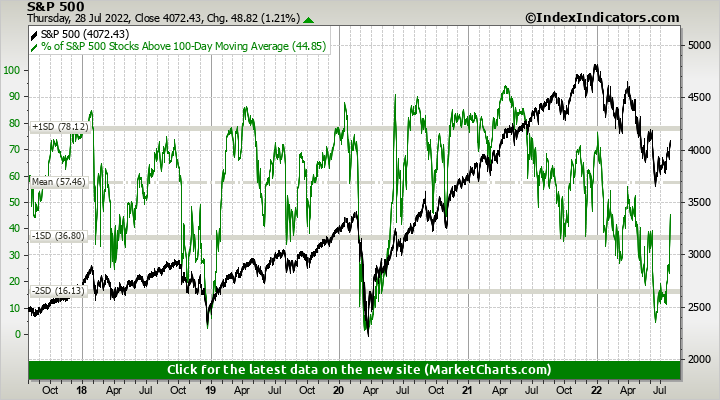

Same thought, different angle: the number of S&P 500 and Nasdaq 100 stocks above their 100-day moving averages has bounced hard. Still below the mean, but it's a pretty significant signal.

Industrial Metals (HG/CL ratio), sectors (XLF/XLU) and the Korean Won aren't believing the post-FOMC narrative of less QT:

25-delta risk reversals:

It's amazing how well they “predicted” the short-squeeze in the JPY. There's still some way to go lower for USDJPY given the size of the risk reversal move in June

EUR is being priced a bit higher, but overall there's not much going on right now.

Margin debt as a percentage of total market value has decreased to -1 SD by the end of June:

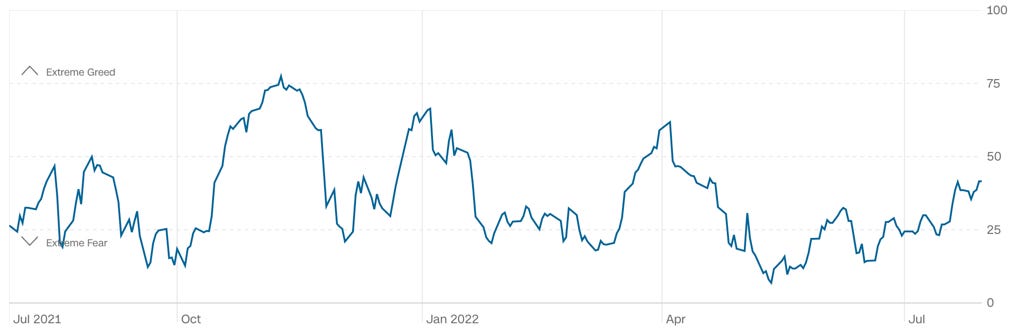

CNN Fear & Greed Index is pretty unspectacular at the moment:

Seasonality in August is negative for AUD, GBP, NZD and positive for JPY.

Other Stuff I've been looking at

Interesting look at hedge fund performance according to strategy:

Goldman Sentiment Indicators:

The number of stocks trading below cash is extreme:

Morgan Stanley estimates the probability of a recession over the next 12 months at 36%:

Housing is the business cycle:

… and house prices in New Zealand are coming down… at least they're not rising as fast as over the last years:

Sector sensitivity to CPI and ISM Manufacturing (resulting moves of a 1-point change in CPI or ISM Manufacturing):

Links to relevant central bank releases in previous editions of this newsletter:

my life is saved, best thing I've found.

Thanks for the hard work ser.

Best Macro related Substack on the whole internet !!