Outlook for Week 45/2022

It's been a pretty turbulent week with three central banks and more...

Welcome to issue #30 of fx:macro!

This week we have reached the 2,000 subscriber mark for the newsletter:

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary. The final section contains the top three macro charts for the week and is brought to you by Daily Chartbook.

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Before we get started, I’d like to give a shout-out to Yuri from Snippet Finance!

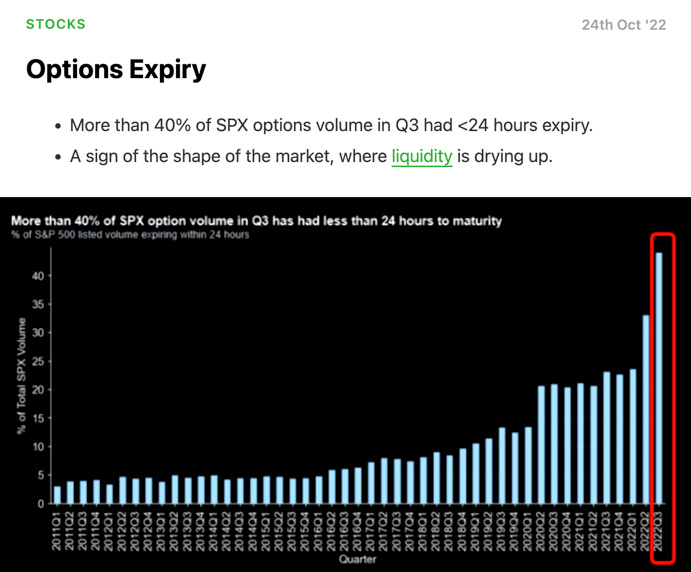

Snippet Finance is an easy-to-read newsletter with highly curated and bite-sized content on macro, stocks and investing. Here’s an example:

I know you like long newsletters (because you are reading this one right now), but I’m sure you will also like Yuri’s. Also, check out his website where he posts daily for more great content and his Twitter @SnippetFinance!

Table of Contents

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Economic Calendar for next week

The Daylight Savings Time Shift reverts the time difference between Europe and the US back to normal. Plus, Friday is a US bank holiday.

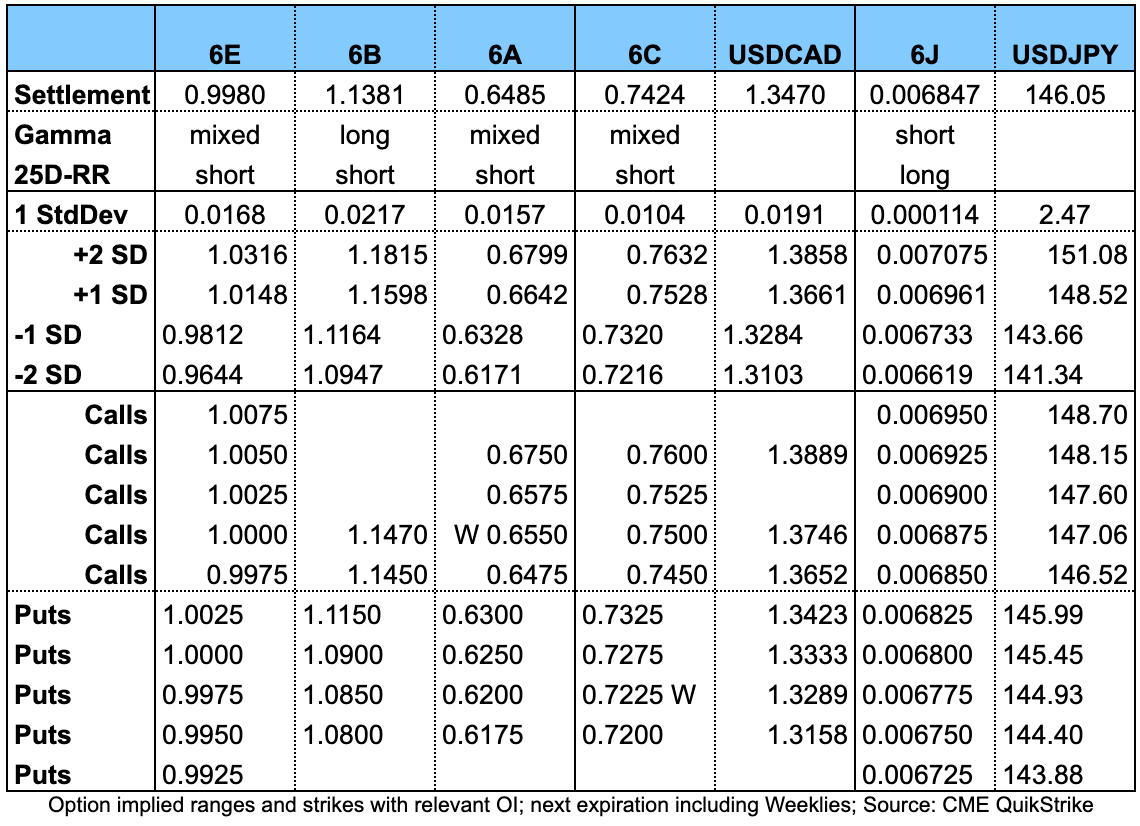

Important levels to watch and look out for in the Majors

Downloads and Links

Difftext of the Summary from last week: here

Central bank speaker recap for the week:

This contains everything except Friday's comments by Brainard and Kashkari.

Before diving in, I’d like to shout out to The Morning Hark!

For me, it’s a must-read every day. Here’s what’s in it:

Overnight action in key asset classes including commodities, fixed income and crypto,

Current macro themes with a review of the previous day’s economic data releases, central bank speakers and more,

Main highlights ahead with a comprehensive list of upcoming data and events,

The top 5 trending posts on app.harkster.com, and

A section with links to more in-depth pieces or useful information on current macro themes.

The Morning Hark is a great way to stay on top of what’s going on in markets. If you like fx:macro, you will love The Morning Hark, so check it out!

Week in Review

Central Banks

RBA Rate Statement (01.11.22)

The RBA hiked by 25 bps to 2.85% as expected. Summary and difftext below:

Forward guidance remains unchanged: size and timing of future rate hikes will be determined by incoming data

Inflation is too high, returning it to target requires a more sustainable balance between demand and supply

A further increase in inflation is expected in the coming months

The peak is now forecast at around 8% later this year

A decline in inflation is expected next year

Central forecast: 4.75% over 2023 and a little above 3% over 2024

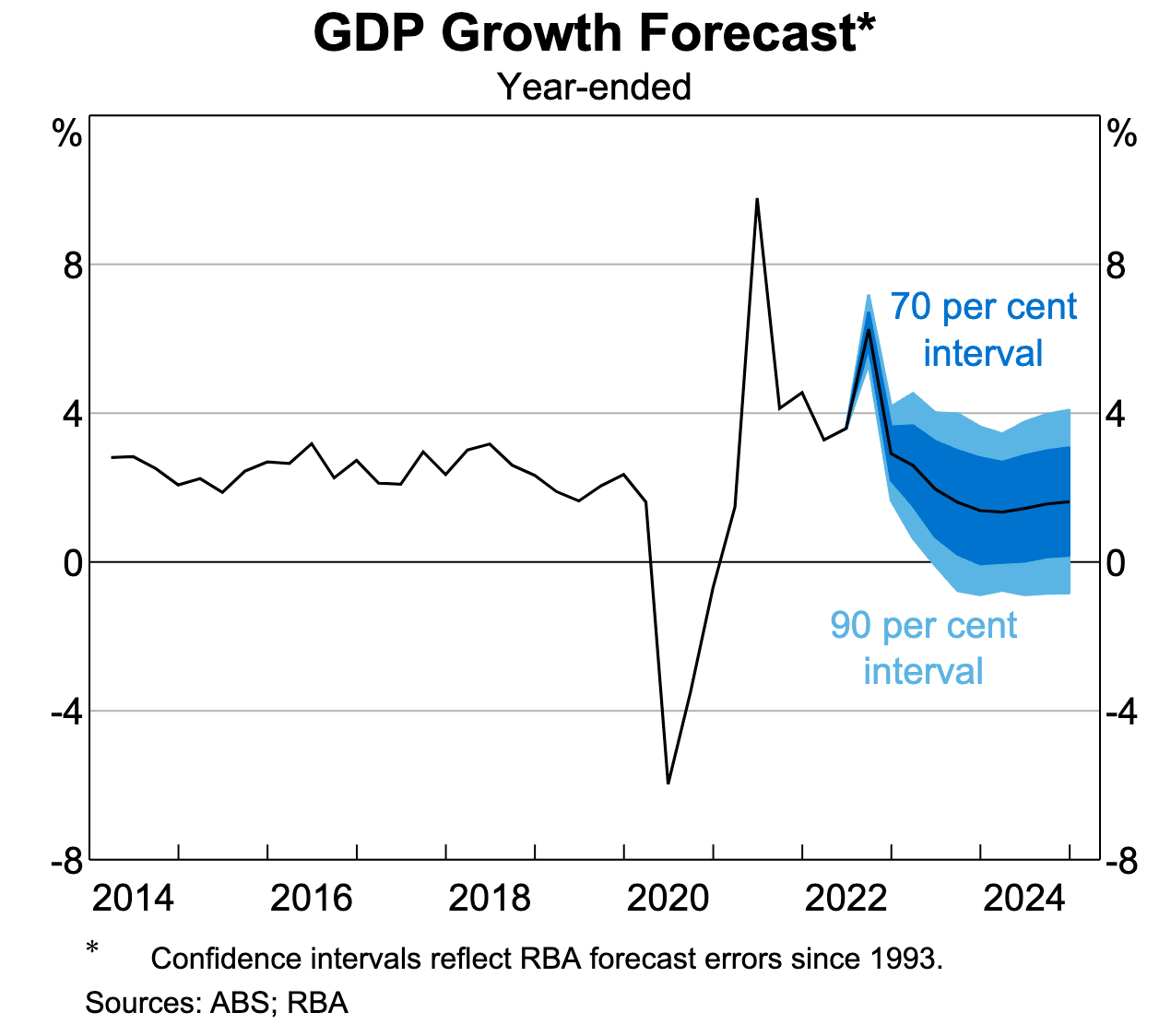

The GDP forecast has been revised down a little, now: around 3% this year, and 1.5% in 2023 and 2024

The labour market remains tight, unemployment rate expected to remain around the current level over the coming months

Monetary policy operates with a lag, the full effect of rate increases is yet to be felt in mortgage payments

Higher interest rates are putting pressure on the budgets of many households

FOMC Rate Decision (02.11.22)

The Fed hiked by 75 bps as expected. The newly inserted wording about "determining the future path of rate hikes" and the stuff they will take into account sounds a lot more dovish than anticipated.

Check out this section from The Morning Hark for a great post-mortem.

Below you’ll find the difftext. Powell’s comments are further down with the other central bank speakers.

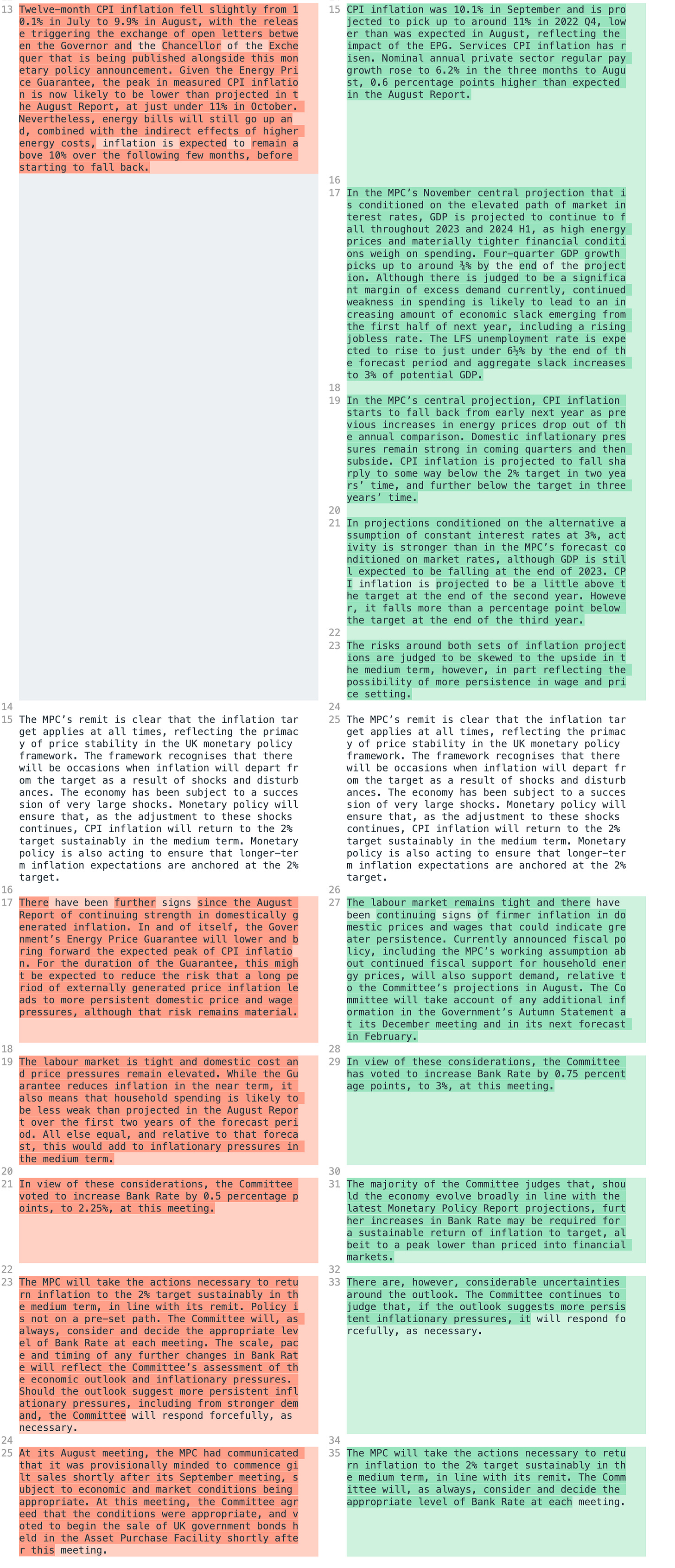

Bank of England Rate Decision (03.11.22)

Check out this section in The Morning Hark for a great narrative analysis/recap.

The BoE hiked by 75 bps as expected to 3.00% but on a very dovish note:

Vote split 7-1-1 with Dhingra voting for 50 bps and Tenreyro for 25 bps

Guidance: Further increases in the bank rate “may be” required at a peak lower than priced into financial markets

Government support via the Energy Price Guarantee (EPG) will mechanically limit increases in the energy component of CPI but could boost inflation in other sectors; further measures will be announced by the government on November 17

Financial conditions have tightened materially

CPI is expected to pick up to around 11% in Q4 (lower than previously due to EPG) and fall back from early next year and to be back “some way below” 2% in two years and further below the target in three years

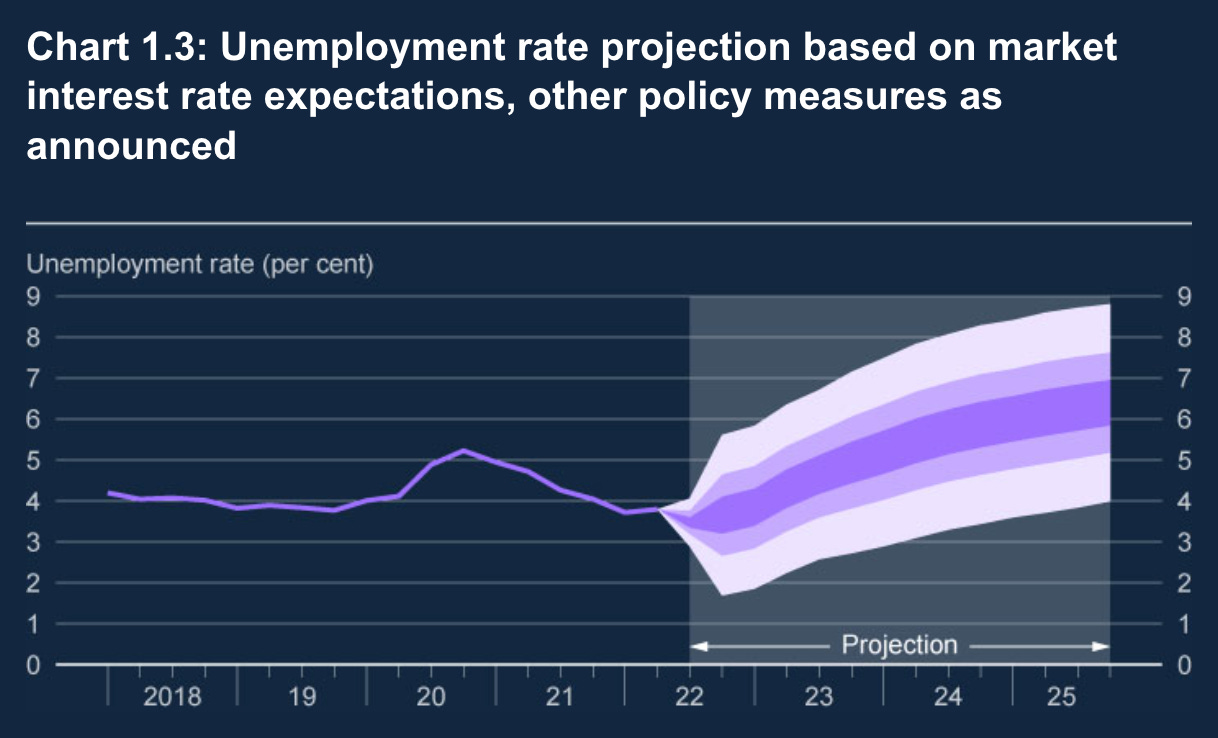

GDP is expected to fall all throughout 2023 and 2024H1

Unemployment is projected to pick up to just under 6.5% by the end of the forecast period

From the Meeting Minutes:

From the Monetary Policy Report:

The Bank Rate is the market-implied rate, not the BoE projection.

RBA Statement on Monetary Policy (04.11.22)

Just the highlights:

Confab, Speakers, News

Federal Reserve

Powell (Neutral). Wed: At some point it will become appropriate to slow the pace of rate increases, could be at the next meeting or the one after that, had a discussion at this meeting about slowing pace of hikes, very premature to think about pausing, we have a ways to go on rates. CPI and labour data suggests ultimate level of rates will be higher than anticipated, we will stay the course until the job is done. Price stability is the bedrock of our economy, economy has slowed significantly, activity in housing has weakened, jobs market still extremely tight, inflation still well-above our goal, we're seeing the effects of financial conditions tightening but it will take time for full effects to be realized.

Barkin (Neutral). Thu: Not sure what we'll do in December, could potentially have a higher end-point on rates with rates rising for longer than expected, now real rates are positive so you could credibly say we have our foot on the break, jobs growth was about what I expected.

Collins (Neutral). Thu: All options should be on the table at next meeting including 75 and 25 bps, it's premature to comment on the ultimate level of rates, time for the Fed to shift focus from size of rate hikes to the ultimate destination, smaller hikes may be likely to become more appropriate in the future, still open to 75 bps if needed, rates are now in restrictive territory, recognizes risks of hiking too far, signs inflation is starting to moderate, doesn't believe a big slowdown is needed to achieve price stability.

Kashkari (Hawk, prev. Dove). Fri: Strong jobs report for October demonstrates why we need to keep raising rates higher than previously forecast in order to keep inflation under control, expects to issue a higher forecast for the benchmark rate next year at the December meeting compared to September.

Brainard (Dove). Fri: It's key for the Fed and regulators to monitor financial stability risks, current macroeconomic environment increases the likelihood of financial shocks.

Evans (Neutral). Fri: Fed Funds peak likely to be revised slightly higher in December, looking for the right level or restrictiveness, 50 bps is still a very large hike, ample capacity to hike with smaller increments, we're not front-loading anymore, inflation lags more than the real economy, inflation reports are still likely to be disappointing.

European Central Bank

Knot (Hawk). Weekend: Not done with normalizing policy, will raise rates again significantly in December, 75 bps hike is possible but too early to say with six more weeks to go and a lot of economic numbers coming out, from 2023 rate hikes will probably be smaller, not even at half-time in fight against inflation, prospect of a recession increasingly likely.

Visco (Dove). Mon: Rates must continue to rise further, no doubt that rates are not yet in line with 2% inflation target, we should not underestimate the risk of normalizing rates too fast given the worsening economic outlook, pace of rate hikes and their end point can't be pre-determined, no signs of inflation expectations and price stability becoming decoupled, have to pay attention to the effects of our decisions on financial stability.

Lagarde (Dove). Tue: We will have further rate increases in the future, no definitive number of hikes as forward guidance has been abandoned, going meeting-by-meeting, destination is clear and we're not there yet. Thu: Must deliver on price mandate no matter what, still a way to go on rates, will do whatever is required and use all instruments, tools do include a reduction of the balance sheet. A recession won't be sufficient to tame inflation, have to be attentive to spillovers from the Fed. Fri: Rate path will depend on the contingencies we face, have to raise rates to levels that will deliver our 2% inflation target, we would have to take additional actions if inflation became sticky.

Nagel (Hawk). Tue: Still a long way to go on rate hikes, ECB must be more stubborn than inflation. Thu: Willl not speculate when rate hikes end, we are in a different situation than the US, passive balance sheet runoff is one way to do QT.

De Cos (Dove). Tue: We have yet to reach the end of rate increases, progress on winding down monetary policy accommodation is significant, reduction in bond portfolio should start at the beginning of the year.

Mahklouf. Wed: Premature to say if we need to go 50 or 75 bps in December but could also be another number.

Buch (Bundesbank financial stability chief). Wed: There are many risks to financial stability at the moment, each individual risk may seem manageable but it can become dangerous if several occur at the same time.

Kazaks (Hawk). Thu: Rates need to go "much higher", 50 and 75 bps both possible in December, no need to pause at the turn of the year, must remain on tightening path, recession is already a baseline scenario but it should be a shallow one. Impossible to determine the terminal rate at the moment.

Panetta. Thu: Need to bring inflation back to 2% as soon as possible, clear upside risks to medium-term inflation outlook, further policy adjustment needed, a bigger-than-expected rate hike could be interpreted as signalling a higher terminal rate and add volatility.

Centeno. Thu: A good part of rate hikes should already have been done, we're much closer to the neutral rate now, inflation should reach its peak in Q4 2022, we can avoid at least a severe recession.

Visco (Dove). Thu: BTP-Bund spread is still too high, new Italian government not on a different path to the previous one, market expectations of a 3.00% terminal rates are within the ranges the ECB could reach.

De Guindos (Dove). Fri: Monetary policy aims to reduce demand and ensure inflation expectations remain anchored, supply bottlenecks easing but energy shock expected to increasingly weigh on activity and inflation.

Stournas. Fri: If fiscal policy is very relaxed then interest rates are going to the sky which we don't want.

Bank of England

Bailey (Neutral). Thu: We should not increase the bank rate too far, the bank rate will have to go up by less than currently priced in financial markets, nobody should read a 75 bps hike as a new normal. Market liquidity is not back to where it was. Fri: Size of the APF can now be adjusted down from £966 bn to £886 bn after conclusion of emergency gilt purchases, will not sell gilts into febrile markets where sales might increase the level of dysfunction.

Ramsden (Hawk). Thu: Majority of the MPC thinks we will have to hike further, it's likely that further rate rises will be necessary, we don't think it's likely they have to go as high as 5.25%.

Mann (Hawk). Thu: Rates do not have to be as high as the market suggests, we must do more as inflation continues to rise and domestic inflation drivers continue to gain momentum.

Hauser (director of markets). Fri: We must execute a timely and orderly unwind of the assets accumulated as part of the financial stability purchase operations, QE unwind is not the Bank's active tool for monetary policy but it does support tightening process.

Pill. Fri: Raising rates to 5.25% previously seen by markets would be overtightening, keeping bank rate at 3% would lead to inflation being a little too high in 2 years. On gilt sales from the temporary purchases this year: "wait and see", hopes to talk more about it in one or two weeks. We still think there's more to do on inflation pressures, not for us to tell markets how to price assets, the challenge is to set policy such that economic slowdown is sufficient to ensure inflation will be consistent with target and also avoid overshoot in the other direction. We need to raise bank rate and shrink QT portfolio, recent disturbances have not detracted us from key goal.

Reserve Bank of Australia

Lowe. Tue: Raising rates at a slower pace was judged to be appropriate, need to strike a balance between doing too much and too little, rates will need to go higher but not on a pre-set path, will return to larger rate increases if necessary but will also hold rates steady for a while if the situation requires it.

Reserve Bank of New Zealand

Hawkesby. Wed: Will consider tightening policy faster and slower at the next policy meeting, risks to the global economy are to the downside, unemployment and wage numbers were broadly in line with our expectations.

Orr. Thu: NZ banks are among the most resilient in the world, laser-focus on returning inflation to 1-3% target, high confidence the RBNZ can get inflation under control, labour shortage is the most constraining factor for businesses in NZ.

Bank of Canada

Macklem. Weekend: Does not have any concerns about the BOC's independence being under threat despite getting a lot of tough questions. Tue: Next rate hike may be another bigger step or maybe a more normal step, 50 bps is bigger than normal. We expect policy rate will need to rise further, have yet to see a generalized decline in price pressures, inflation has stopped rising rapidly but not yet begun to decline, we are getting closer to the end of this tightening phase but we're not there yet, still far from the goal of low and stable inflation. If CAD is weaker than we project we would have to do more on interest rates.

Swiss National Bank

Jordan. Wed: Cannot rule out that more rate hikes are needed to ensure price stability.

Bank of Japan

Kinoshita (ex-MOF bureaucrat). Tue: FX intervention not intended to keep yen at a certain level but rather at preventing speculators from triggering volatile moves.

Suzuki. Tue: Further sharp yen weakening is unfavourable when inflation is an issue. Will respond appropriately to sharp FX moves, cannot tolerate excessive volatility on speculative trading. Will carry on with diplomatic efforts with overseas authorities on exchange rate policies. Wed: Exchange rates are set by the market, various factors affect FX rates, interventions in September and October were conducted against excessive FX movement driven by speculative trading, stable yen weakening is also problematic, will not say when we intervene in order not to reveal our tactics, must adhere to fiscal discipline to maintain trust in the yen.

Kuroda. Tue: BOJ must maintain easy policy to support economy, in close contact with government, BOJ and government policies complement each other, aiming to achieve inflation target in a stable manner accompanied by steady wage increases. Wed: Dollar's solo strength won't last indefinitely, appropriate to continue monetary easing to support the economy for now, no need to raise rates, most appropriate policy is to put downward pressure on the yield curve via YCC. Tweak to monetary policy will be necessary if prospects rise for inflation to head towards 2% accompanied by wage hikes. Upward revision in BOJ's October report reflects our view that prices are likely to gradually rise accompanied by wage increases, cost-push inflation driven by import costs likely to start dissipating in 2023.

People’s Bank of China

Yi Gang. Wed: China's economy is broadly on track, inflation remains subdued, growth rate within a reasonable range, monetary policy remains supportive of the economy.

Economic Data

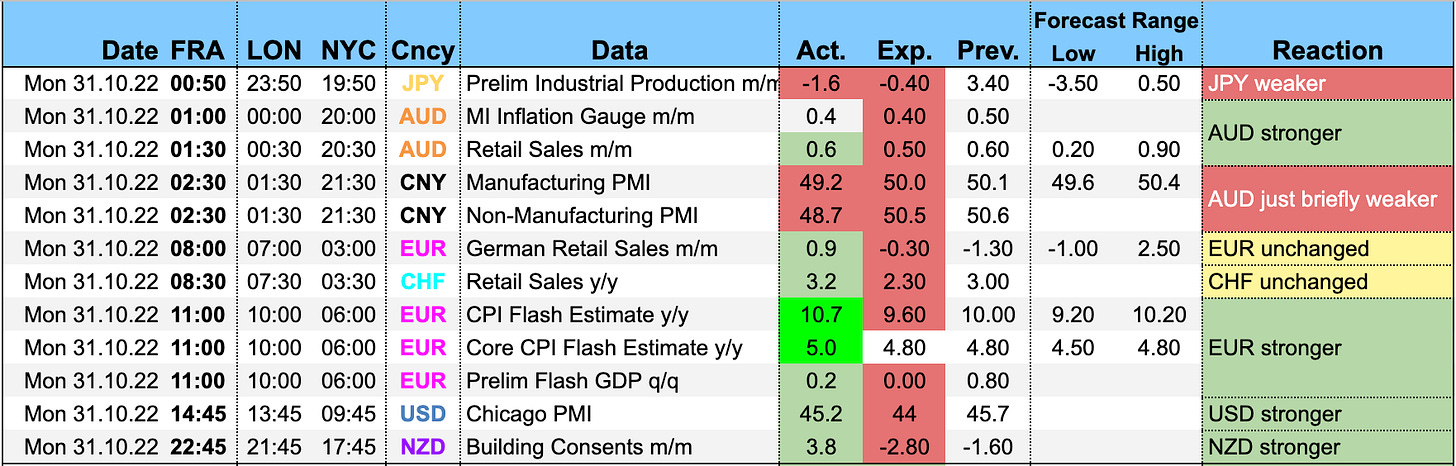

Monday, 31.10.22

Tuesday, 01.11.22

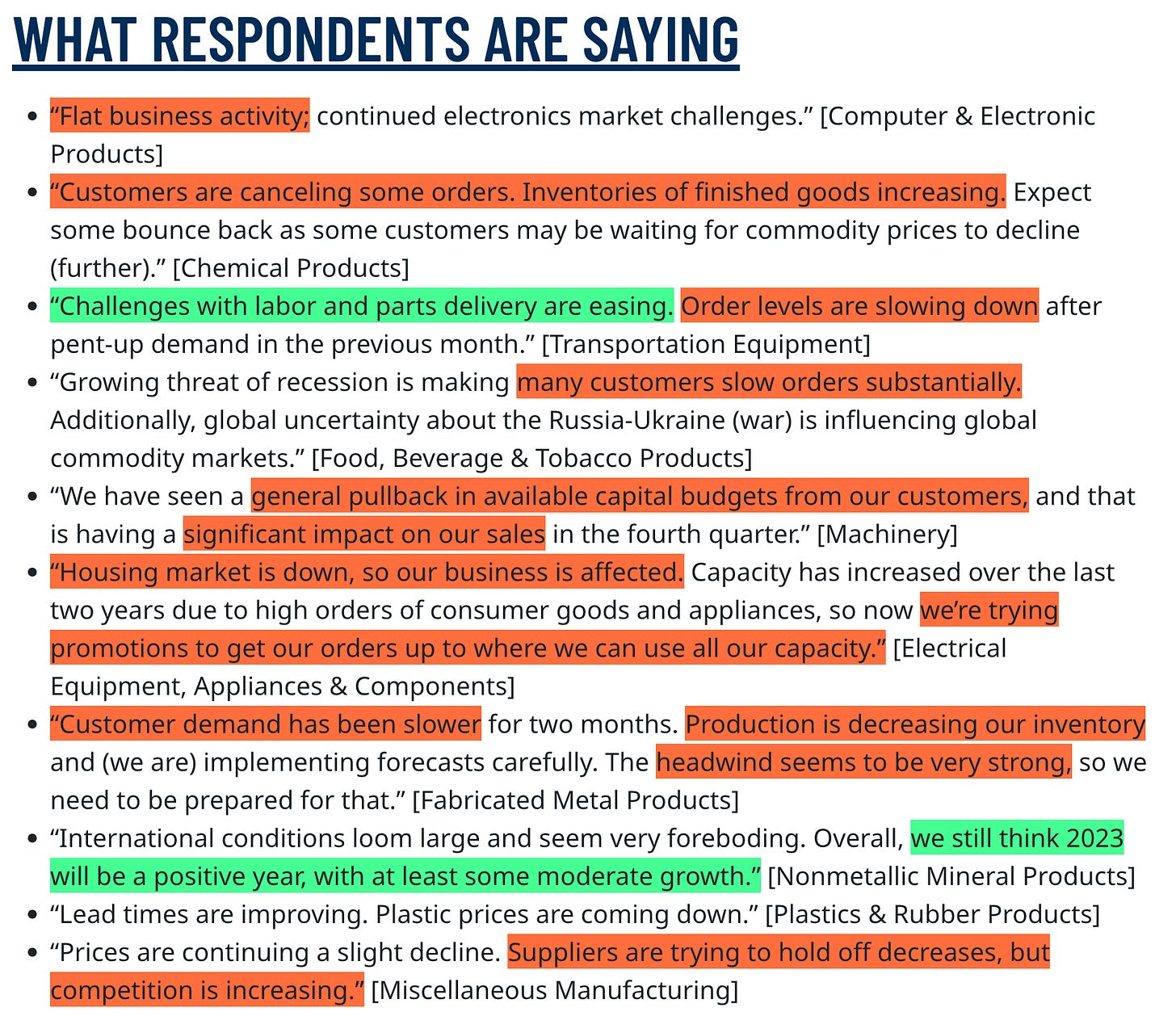

Here are the highlights from the ISM Manufacturing PMI:

Wednesday, 02.11.22

Thursday, 03.11.22

Highlights from the Aussie PMIs:

“The latest RBA interest rate decision and ongoing global inflationary pressures appeared to have weighed on economic conditions and affected the Australian private sector economy’s performance according to the latest PMI data. Demand declined at the fastest rate since September 2021, which led to weaker overall business activity.

“Meanwhile price pressures intensified once again in the service sector despite the easing of demand, thus outlining the constraints that private sector firms continue to face at the start of the fourth quarter.

“While the worsening of price pressures backs the further tightening of monetary policy, this will be set against a backdrop of contracting business activity which renders greater caution from the central bank.”

Here are the highlights from the ISM Services PMI:

Friday, 04.11.22

Market Analysis

Growth and Inflation

The Atlanta Fed GDPNow model estimates Q4 growth at 3.6%:

The NY Fed Weekly Economic Index stands at 2.23:

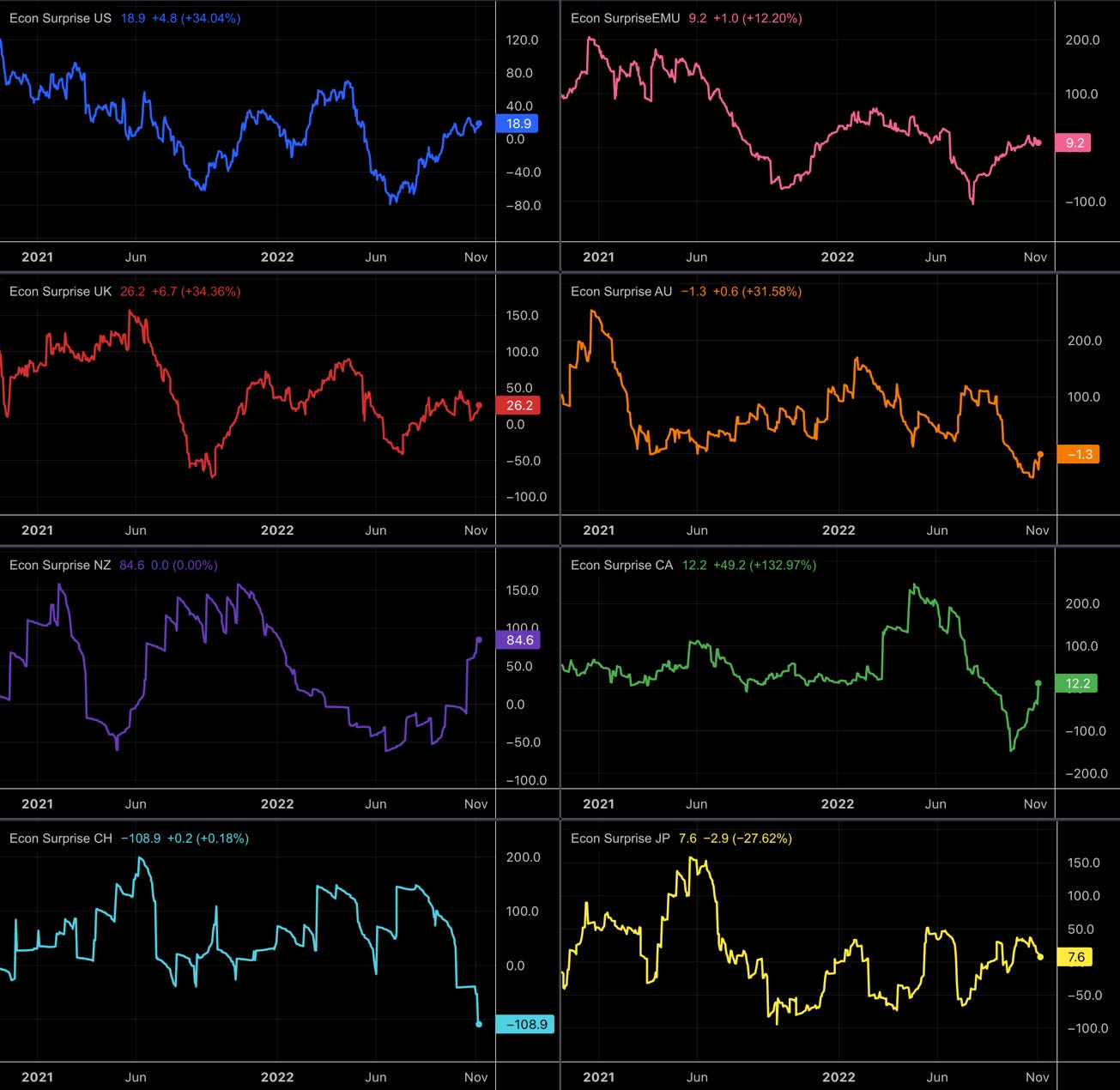

Citi Economic Surprise Indexes:

USD moving higher

EUR, GBP and JPY have stalled

CAD picking up a bit from lows

NZD and CAD higher

CHF tanking further

Bloomberg PMI heatmap:

Mostly red with hardly any bright (i.e. green) spots

Eurozone, Germany and the UK worsened

US and Canada also worse in October compared to September

Switzerland and Australia still green

China did improve a bit

South Korea stable, Taiwan also stable (but just because there's no deeper shade of red)

India is still doing pretty good

5y5y forward inflation expectations are, once again, right in the middle of their range:

Longer-term inflation expectations haven't come down so far:

Breakevens are in no man's land, moving sideways:

Citi Inflation Surprise Indexes:

USD, AUD, CAD have all picked up a little

NZD is higher as well

CHF dropped sharply

JPY is moving higher

Yields

See chart and table below:

New Zealand and the US have been the outperformers

UK 10y yield has fallen the most but much of that is probably still fallout from the government shakeup and mini-budget

Visually the German 2y and 10y yields also look pretty strong

Yield curves at the 2s10s spread:

The US curve has flattened and inverted further especially after Wednesday's FOMC press conference

The UK curve has been bull steepening on the dovish BoE hike

Central Banks

FOMC meeting probabilities according to FedWatch:

The December meeting is priced for a 50 bps hike at a 52% chance

The other 48% price a 75 bps

Even though 25 bps have been mentioned (Collins this week, Evans going a bit in that direction) it's still priced at 0%

The following meeting in February remains at 50 bps being most likely

The terminal rate has been upped to 5.00-5.25% with some decent probabilities to the upside

Short-term interest rate spreads show the changing expectations over time. Fed Funds Futures for 2023 went from pricing two 25 bps cuts in July to three hikes of the same size:

Sectors and Flows

Currency strength:

USD is still the strongest over three months but it has levelled off

EUR is the second-strongest over three and one months

NZD has gained significant strength and is the leader over one month and one week

AUD could not catch up, it's the second-worst performing currency over one month

GBP had a rough week and has given up pretty much all the (surprising) strength after the government implosion

JPY is still the weakest over one and three months

Equity sectors:

Three energy ETFs in the following chart, and they're all at the top

Everything else is either in the red or just barely green

Semiconductors (SMH), Tech (XLK), Growth (VUG), Consumer Discretionary (XLY) had the worst performance

Metals (XME), Financials (XLF), Value (VTV), Staples (XLP) are relative outperformers

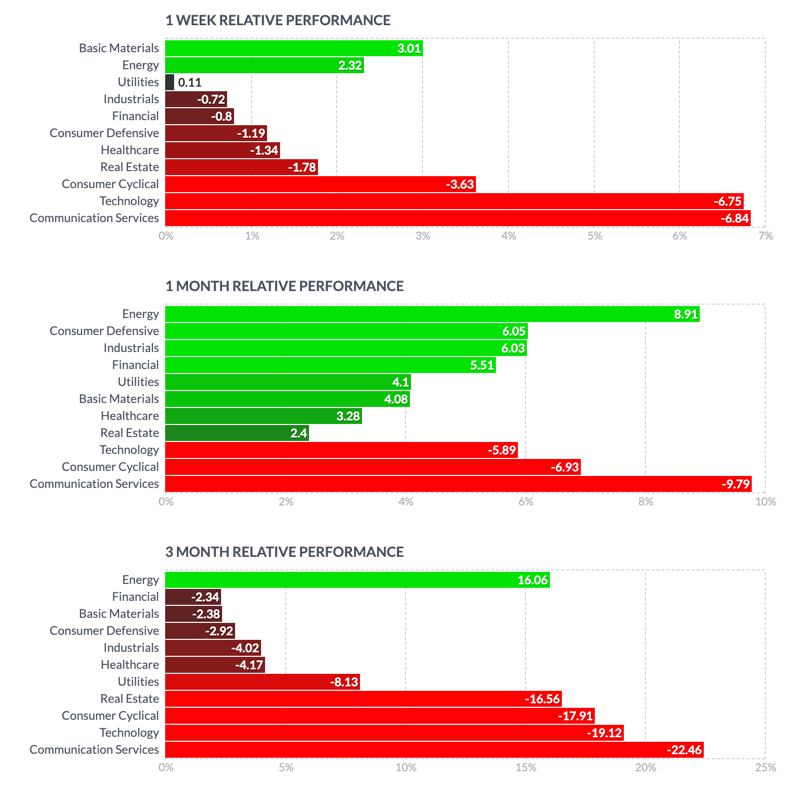

A different look at sector performance:

Defensive sector performance over the last week

It's a bit more mixed over one month but still pretty bearish with Cyclicals, Communication/Tech at the bottom, and Energy and Defensives at the top

Over three months, it's virtually the same

International stock market indexes:

Brazil and India still at the top

Nasdaq (QQQ) back near lows

Hong Kong (HSI) has seen some decent upside

Taiwan (TW50C) still going nowhere

A look at sector charts:

BNY Mellon iFlow:

Equity flows still broadly negative, especially in US stocks

Utilities are the only equity sector with positive flows

Currency flows are negative for AUD, CHF, GBP; positive for USD

Carry flows have been back to neutral for a short while

Sentiment and Positioning

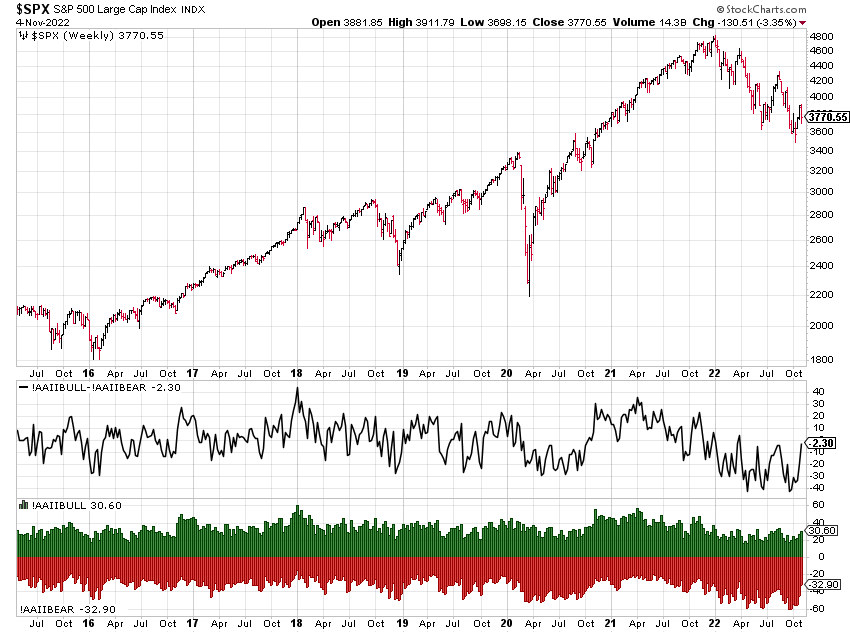

The AAII Bull-Bear spread has continued its rebound as is now in a neutral range:

Currency sentiment:

Not much change from last week, most currencies are somewhere around neutral bull/bear sentiment

CAD and CHF are the outliers with bearish sentiment

Vice versa for NZD

A different sentiment source:

Not actively trading it but the changes in Silver and Gold shorts are eye-catching

The bearish sentiment on USD in USD-pairs seems to have vanished mostly… most US pairs are somewhere towards the middle now

Yen sentiment is still overwhelmingly bullish JPY

Commitment of Traders:

Equities had a mostly bad week:

Levy Relative Strength (RSL) is bad in the Nasdaq, okay-ish in the SPX and better in the R2k and the Dow Jones

Commercial/Large Trader positioning isn't helpful: no side is crowded with the only exception being speculative positions (Large Traders) in the Nasdaq at extreme short levels

Treasuries also had negative returns over the week, RSL remains as bad as it was over the last weeks

Large Traders are now at or near extremes in their shorts for most of the treasury futures

Currencies were mixed vs. the dollar

Commercials and Large Trader net positioning in 6E is at bearish extremes

Energy futures were positive for the week

Metals were mostly positive with Silver up 8.5% and Copper up 7.5% (but mostly 1-day events)

Grains were also positive

Softs had a positive week as well, Cotton is up 20.6%

Cotton, Cocoa and Coffee all have very supportive Commercial/Large Trader positioning

COT/TFF Dealer net positioning for currency futures:

6C is near its 104-week high

CitiFX PAIN Indexes are virtually unchanged from last week: CHF and GBP remain the most crowded shorts while the other G8s have pared back their short positions vs. the dollar:

Market Risks

Credit spreads are anaemic, neither moving up nor down much:

The Credit Spread Index has at least made a new high when the ES made a new low:

Currency volatility: still elevated but broadly moving lower:

The VIX term structure is in a flat contango from the first to the last contract:

Volatility indexes:

MOVE has come down considerably from 160 to below 130 despite bonds selling off further

VVIX is below 80 and at the lowest point on the chart

VIX has been dropping in a straight line, and VIX/V3M has steepened accordingly

SDEX, VIX/VOLI and TDEX continued to move lower and are at lows too

This is as bullish as it can get

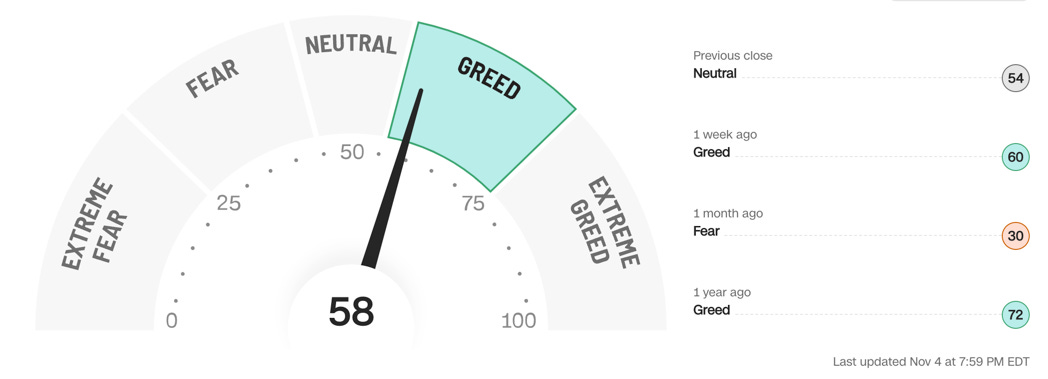

The CNN Fear & Greed Index is still in Greed territory:

Various

The NYSE Advance/Decline Line is still tracking price one-to-one:

Index components above their 200-day moving averages are still below -1 SD but they've been holding up better than expected, especially when we compare their latest moves with the ones in July/August and what stocks were doing then.

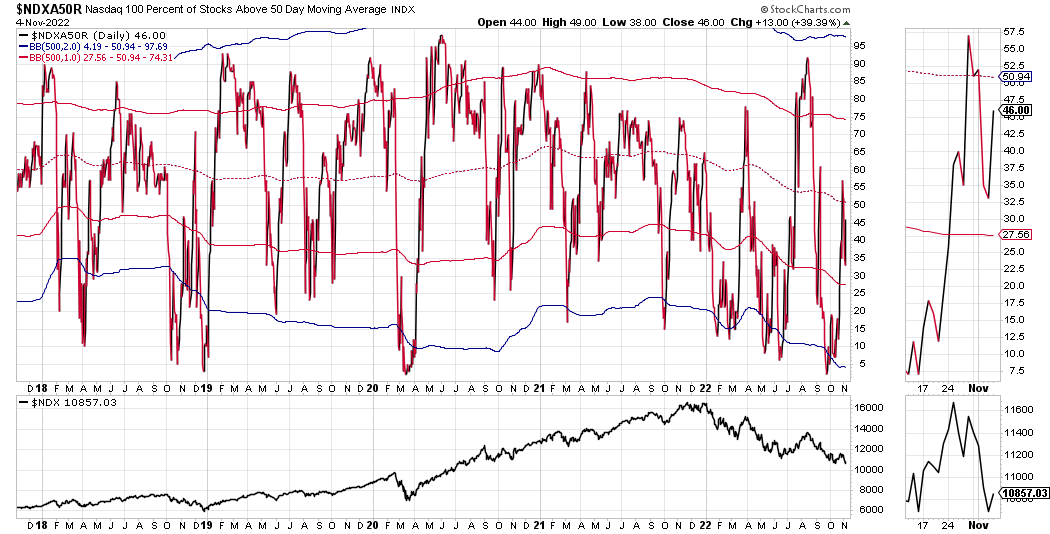

The same goes for the short-term metric of stocks above their 50-day moving averages. That one is squarely back at neutral levels:

25-delta risk reversals:

Upside in EURUSD, GBPUSD, AUDUSD, NZDUSD

Downside in USDCAD

The priced downside in USDJPY is getting smaller

It's a bit esoteric but I do take note of the behaviour of options pricing. What's striking is that the options market is betting against the US dollar.

Top 3 Macro Charts of the Week

This section is brought to you by Daily Chartbook.

1. Priorities. "As prices rise people are spending more on what they need, and less on what they desire".

2. Plunging container demand. "Maersk, a bellwether for global trade, says container demand will drop as much as 4% this year and keep contracting in 2023".

3. Cash levels up. "Individual investors increased the share of cash in their portfolios to around 25%, the highest level since March 2020".

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 39/2022 | 31/2022 FOMC Meeting Minutes: 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 37/2022

ECB

Rate Statements: 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 43/2022 | 36/2022

BOE

Rate Statements: 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 37/2022

RBA

Rate Statements: 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 41/2022 | 34/2022 Crib Sheets: 40/2022

BOC

Rate Statements: 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022

SNB

Rate Statements: 44/2022 | 39/2022 | 25/2022 Crib Sheets: 37/2022

BOJ

Rate Statements: 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: DALL-E 2 “Image of a pivot as a mirage in the desert.”

thx for your work, great as usual. you can check also this indicator https://gatecenter.org/en/bottleneck in order to enhanced the container rates graph

Of course! Thank you...strange that those acronyms are hard to search for.