Outlook for Week 50/2022

RBA and BOC rate statements, US Services PMI...

The upcoming week will be my last trading week for this year.

I will publish a review issue with the usual central bank and economic data releases every week until the next regular issue with the full macro outlook on January 7/8.

Welcome to issue #35 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary. The final section contains the top three macro charts for the week and is brought to you by Daily Chartbook

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Before diving in, I’d like to shout out to The Morning Hark !

The Morning Hark is a great way to stay on top of what’s going on in markets. If you like fx:macro, you will love The Morning Hark so check it out!

One more thing. You seem to like newsletters, so here's a great way to discover new stuff to read for free: The Sample. They will regularly send you an issue of a different semi-random newsletter you might be interested in. If you sign up using my referral link, I get bonus points and my newsletter will be forwarded to others to check out.

Table of Contents

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Economic Calendar for next week

Important levels to watch and look out for in FX futures

Downloads and Links

Difftext of the Summary from last week: link

Central bank crib sheets for the upcoming week:

Week in Review

Central Banks

RBA Rate Statement (06.12.22)

The RBA hiked by 25 bps to a policy rate of 3.10% as expected. Here's the summary of the statement and the difftext below:

Guidance remains largely unchanged: further interest rate increases over the period ahead expected, not on a pre-set course

Growth is expected to moderate in 2023

Central forecast for GDP growth is around 1.5% in 2023 and 2024

Inflation is expected to increase further over the months ahead, peak around 8% in Q4, and decline next year

Central forecast for CPI is a decline to a little over 3% over 2024

BOC Rate Statement (07.12.22)

The BOC hiked rates by 50 bps to 4.25% as expected. Here's the summary and the difftext below:

Guidance changed: the Governing Council “will be considering whether interest rates need to rise further”, and the “… will continue to take action as required” was scrapped as was “The Board expects to increase rates further"

Growth will stall through this year and the first half of next year

Q3 GDP growth was stronger than expected, the economy continues to operate in excess demand

CPI is still too high, 3-month changes in core CPI have come down indicating that price pressures may be losing momentum

Confab, Speakers, News

European Central Bank

Villeroy (Neutral). Sun: ECB should raise interest rates by 50 bps in December, expects rate hikes will continue after that, unable to forecast when they would stop, expects inflation to be beaten by around 2024-25, France and Europe will escape a hard landing, recession next year is unlikely. Fri: Economic growth in France will probably be slightly positive in 2023, a temporary recession cannot be excluded.

Makhlouf. Mon: 50 bps is the minimum hike for December, expects that is where "we will end up", it is premature to talk about the terminal rate, expects further rate hikes next year, have to be open to policy rates moving into restrictive territory for a period in 2023, we haven't reached a stage where we are confident inflation is under control.

Lane. Tue: Expects more rate hikes but "a lot has been done already", must take past rate hikes into account when considering next ones, unclear if inflation peak has been reached or still to come next year.

Herodotou. Tue: There will be more rate hikes but we are very near neutral rate, too early to estimate the extent of the December hike, QT must be clear and transparent, does not see a hard landing for the Eurozone, no material de-anchoring of inflation expectations.

Kazimir. Wed: Many reasons to keep tightening in December, one inflation figure is not sufficient to slow rate hikes, any European recession will most likely be brief.

Bank of England

Dhingra (Dove). Sun: Higher interest rates could lead to a deeper and longer recession if tightening continues at current pace, falling real wages are indicative that there's no wage price spiral yet.

Bank of Canada

Kozicki. Thu: We are moving from how much to raise rates to whether to raise rates, decisions will be more data-dependent, still prepared to be forceful if we're surprised to the upside on inflation (on a question regarding this: was speaking hypothetically about what would happen if there were a large shock), we have raised rates rapidly and they are working their way through the economy, still needs a more sustained moderation of demand.

Bank of Japan

Kuroda. Tue: We have not achieved stable 2% inflation accompanied by wage rises, likely to see wages rise in next year's wage negotiations, even if wages rise by 3% the BOJ will maintain its current easy policy until inflation reaches 2%, benefits of current monetary policy outweigh the costs, the BOJ will likely debate a path to an exit from easy monetary policy when achieving the inflation target comes in sight.

Suzuki. Tue: Will keep monitoring FX market with a sense of urgency, will respond to FX moves in an appropriate way, excess FX volatility and disorderly moves hurt the economy.

Nakamura. Wed: Must maintain monetary easing, economy is still recovering from pandemic effects, current price increases are not accompanied by wage hikes, consumer inflation likely to slow next year.

Takata. Sat: Japan's economy not yet in a phase where we can and yield curve control, too soon to start discussing concreted methods of ending it, careful messaging needed when the time comes.

Economic Data

Monday, 05.12.22

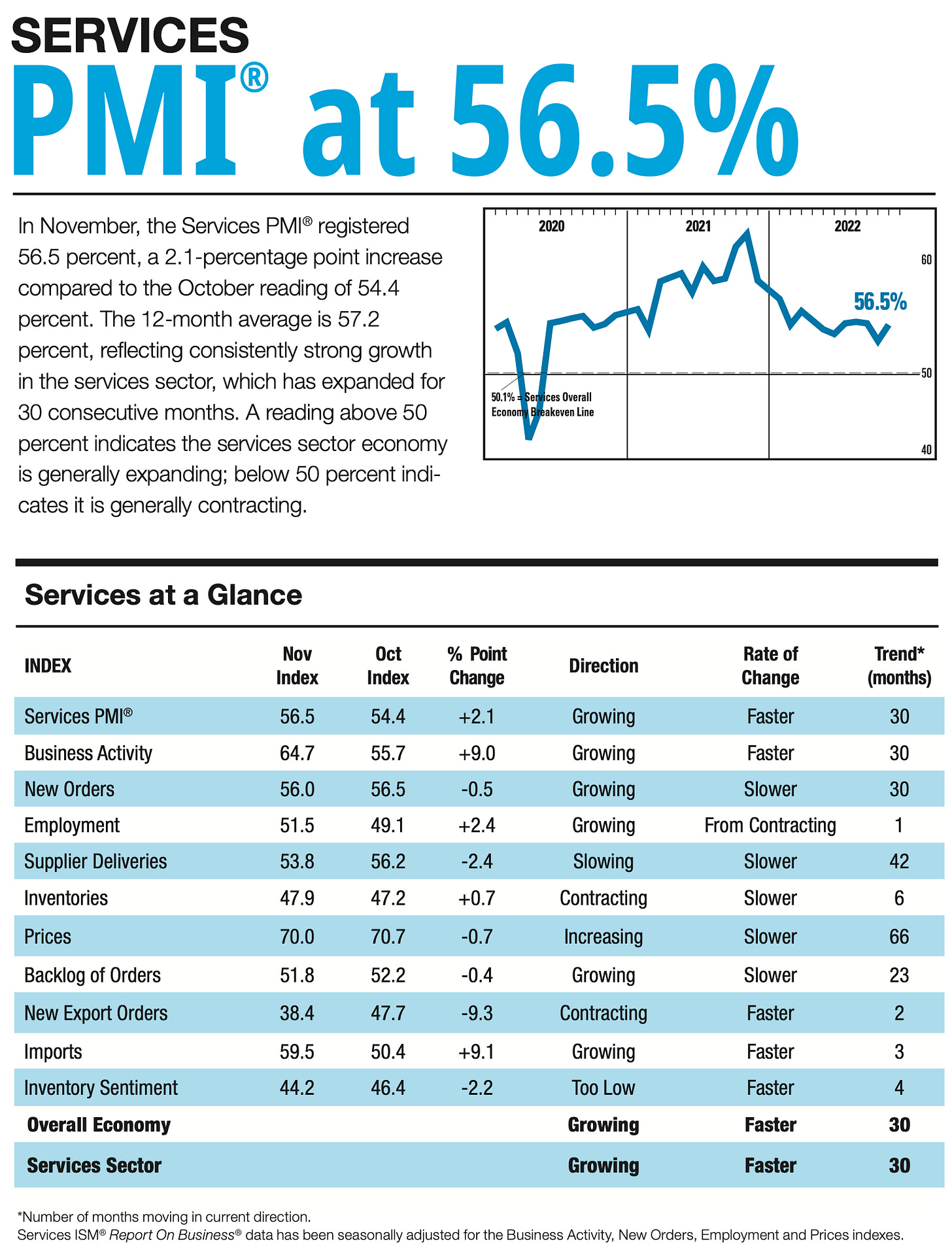

Highlights from the US ISM Services PMI:

Tuesday, 06.12.22

Wednesday, 07.12.22

Thursday, 08.12.22

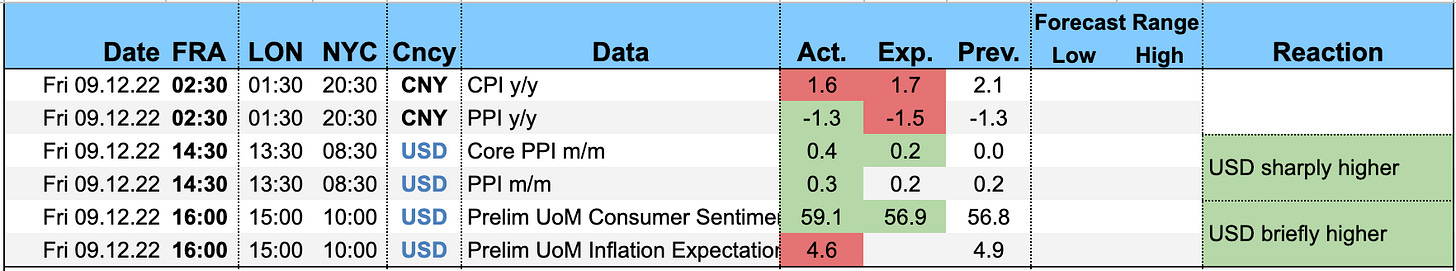

Friday, 09.12.22

Market Analysis

Growth and Inflation

The Atlanta Fed GDPNow model estimates Q4 growth at 3.2%:

The NY Fed Weekly Economic Index ticked down to 1.18:

The Cleveland Fed Yield-Curve model is pointing south for the second half of 2023 and estimates negative growth for November next year:

The recession probability for H2 2023 is also rising sharply:

Citi Economic Surprise Indexes:

USD sideways

EUR and CAD higher

GBP and NZD a bit lower

AUD looks like it's rolling over

CHF not moving off its low, JPY lower

The Bloomberg PMI heatmap:

The US is weakening

The Eurozone is still bad but has been worse

Switzerland and Australia are two of the few green spots

China has improved since September, Asia is heterogenous with Taiwan still deep in the red, Hong Kong worsening and South Korea improving a bit

Noteworthy is Brazil that went from neutral straight to deep red

Inflation breakevens haven't made a new low yet but they keep trending lower overall:

5y5y inflation expectation swaps continue to trade sideways:

The inflations expectations ETF RINF is also trading sideways:

Citi Inflation Surprise Indexes:

USD, EUR, NZD and CHF lower

GBP up a tad, AUD, CAD and JPY also higher

Yields

Looking at the chart and table below:

UK and German yields look strongest

Aussie and Canadian yields look weakest

Yield curves along the 2s10s spread continue to flatten globally:

The bear flattening in the NZD and the GBP is particularly noteworthy:

Central Banks

The Fedwatch meeting probabilities haven't moved much since last week:

The FOMC meeting next week is priced at 50 bps with a 78.2% probability

The following meeting in February is a coin-toss between 25 and 50 bps but there's a 10.5% chance of another 75 bps hike

The terminal rate is seen somewhere in the 4.75-5.25% range

The pricing for rate cuts in December 2023 has become more aggressive

As for the upcoming FOMC meeting: the probability for a 50 bps hike has remained pretty stable over the last few weeks:

Sectors and Flows

The currency strength chart is pretty interesting:

The strongest currencies over three months are GBP and NZD, the weakest are CAD, USD and AUD

Over one month, NZD is the strongest followed by JPY; the weakest are CAD and USD again

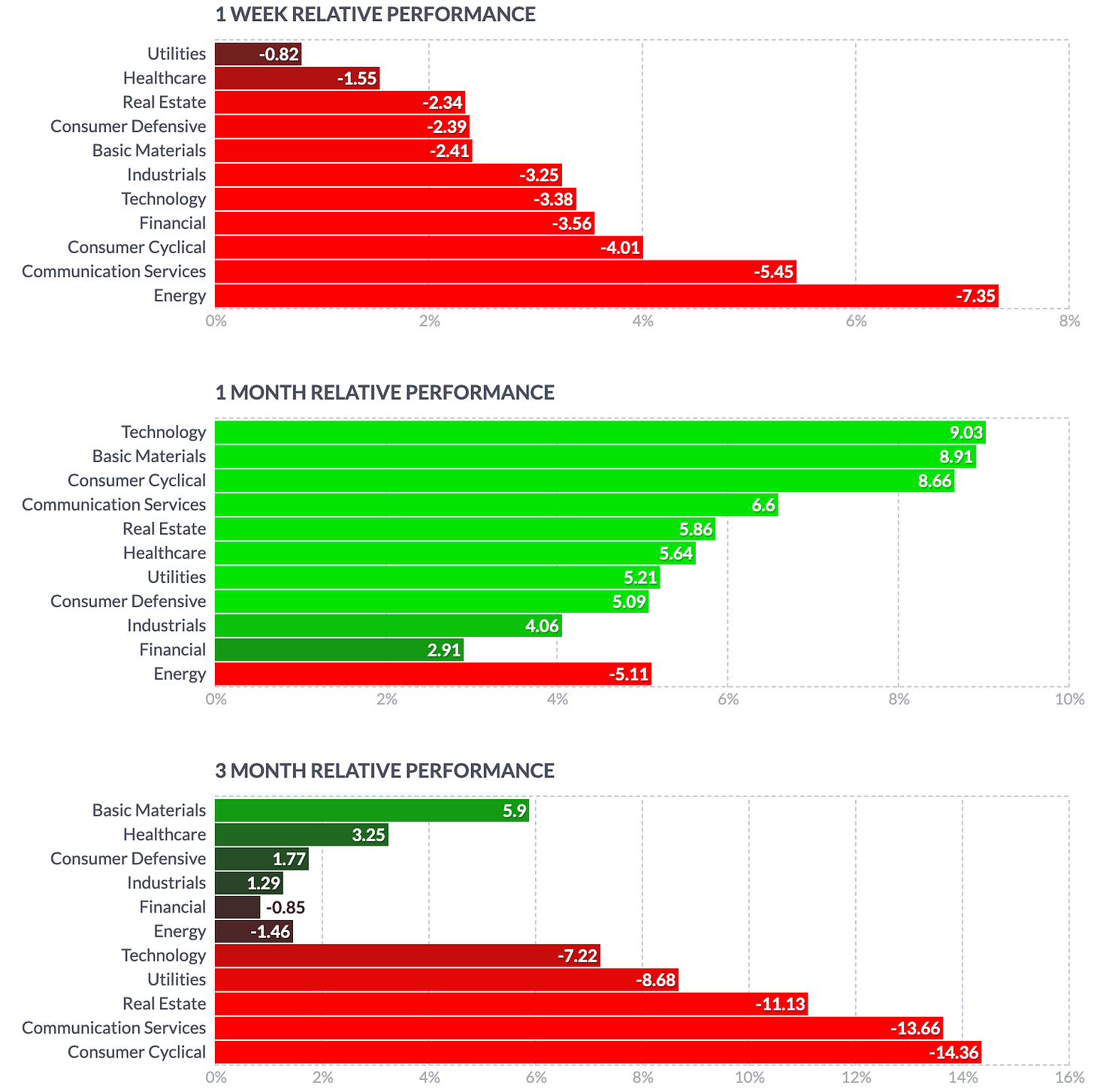

Equity sector peformance is a bit messy:

The outperformers over three months were OIH (Oil Services), XME (Metals, Mining), XLV (Healthcare) and XLB (Basic Materials)

The underperformers were: XLY (Consumer Discretionary), XOP (Oil & Gas), XLU (Utilities), VUG (Growth)

A different look at sectors:

Last week has been clearly defensive in terms of sector performance with Utilities and Healthcare outperforming Cyclicals, Communication (Tech) and Energy

The monthly performance is more reflationary with Tech, Materials and Cyclicals ahead of defensive sectors, and Energy being the exception

International stock market indexes:

Three European indexes are leading: the EuroStoxx, the DAX and the CAC40

The rally in the Hang Seng has been impressive and it doesn't look like it has stalled so far

The underperformers are the US indexes: Nasdaq and Russell

Sector charts:

Consumer Discretionary, Communication Services remain near lows

Industrials, Materials, Healthcare, Staples are near highs

Energy has sold off quite a bit, Financials are lower as well

Sentiment and Positioning

AAII Bull-Bear Spread is somewhere in a neutral range:

Currency sentiment:

Bullish sentiment in AUD and CAD

Bearish sentiment in CHF and NZD

A different sentiment source:

USDCHF is still the currency pair with the most bullish sentiment

EURCHF also has sentiment stacked against CHF

EUR mostly has bearish sentiment, i.e. vs. USD and vs. JPY

It's the first time in months that I see anything else than SI on the top spot here… CL having that much positive retail sentiment can't be a good sign

Commitment of Traders

Equity indexes are all lower for the week, their Relative Strength (Levy) remains around 1, positioning is well off extremes for all four indexes

Treasuries were mixed this week, all of them have recovered and have an RSL of very close to 1.00

Positioning in treasuries has become extreme quite one-sided with Large Speculators being at or near extreme short positions in all treasury futures except for the 10-year and the Ultra bond futures; the 5-year even has seen a +2.18 SD commercial movement (and a corresponding -1.96 Large Trader selling) this week

Currency futures were mixed for the week, 6E still has positioning at a bearish extreme, 6C near a bullish extreme

Energy futures are all below their 26-week moving averages (i.e. RSL <1), and they're all negative for the week; positioning in CL and NG remains bullish

Metals were up this week, their RSL has improved considerably over the last few weeks, notably SI and HG; positioning isn't near extremes in any of them

Grains and softs were mixed

COT/TFF dealer positioning for currency futures:

6C is at a bullish 2-year extreme

Citi PAIN indexes: it's a bit like watching paint dry but the USD long hasn't budged so far.

Market Risks

Credit spreads: high-yield spreads just refuse to move up or down, IG spreads are back below 2%:

The Credit Spread Index remains elevated, and it remains higher compared to the S&P's last high:

Currency volatilities have been trading lower across the board:

The VIX term structure is in contango with a near-2$ premium between the front month futures:

Volatility indexes:

MOVE has made a higher low and once again diverges from VIX to the upside

VVIX is near its low

Skew is flat with TDEX, SDEX and VIX/VOLI near lows

CNN Fear & Greed Index is neutral:

Various

The NYSE Advance/Decline line is tracking price without a clear divergence:

The percentage of S&P500 and Nasdaq 100 stocks above their 200-day moving averages has stopped moving higher:

But the number of stocks above their 50-day moving averages is still holding above/around their +2 SD band:

25-delta risk reversals:

USDCAD is priced lower

USDCHF is priced higher

Seasonality is bullish AUD, GBP, EUR, JPY, NZD, CHF and bearish USD.

The Blackrock Geopolitical Risk Indicator made a new high:

Top 3 Macro Charts of the Week

This section is brought to you by Daily Chartbook

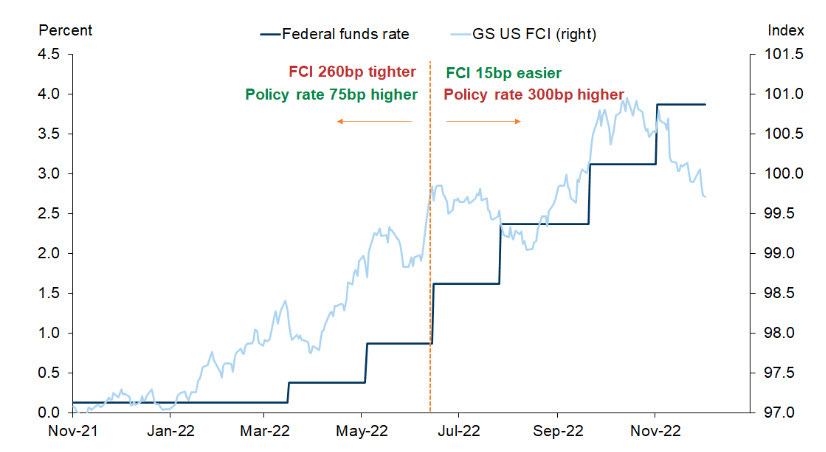

1. Easing conditions (I). "US financial conditions are now easier than they were BEFORE the Fed deployed four consecutive 75 bps rate hikes".

2. Rates forecast. "GS forecasts interest rates will remain high in 2023".

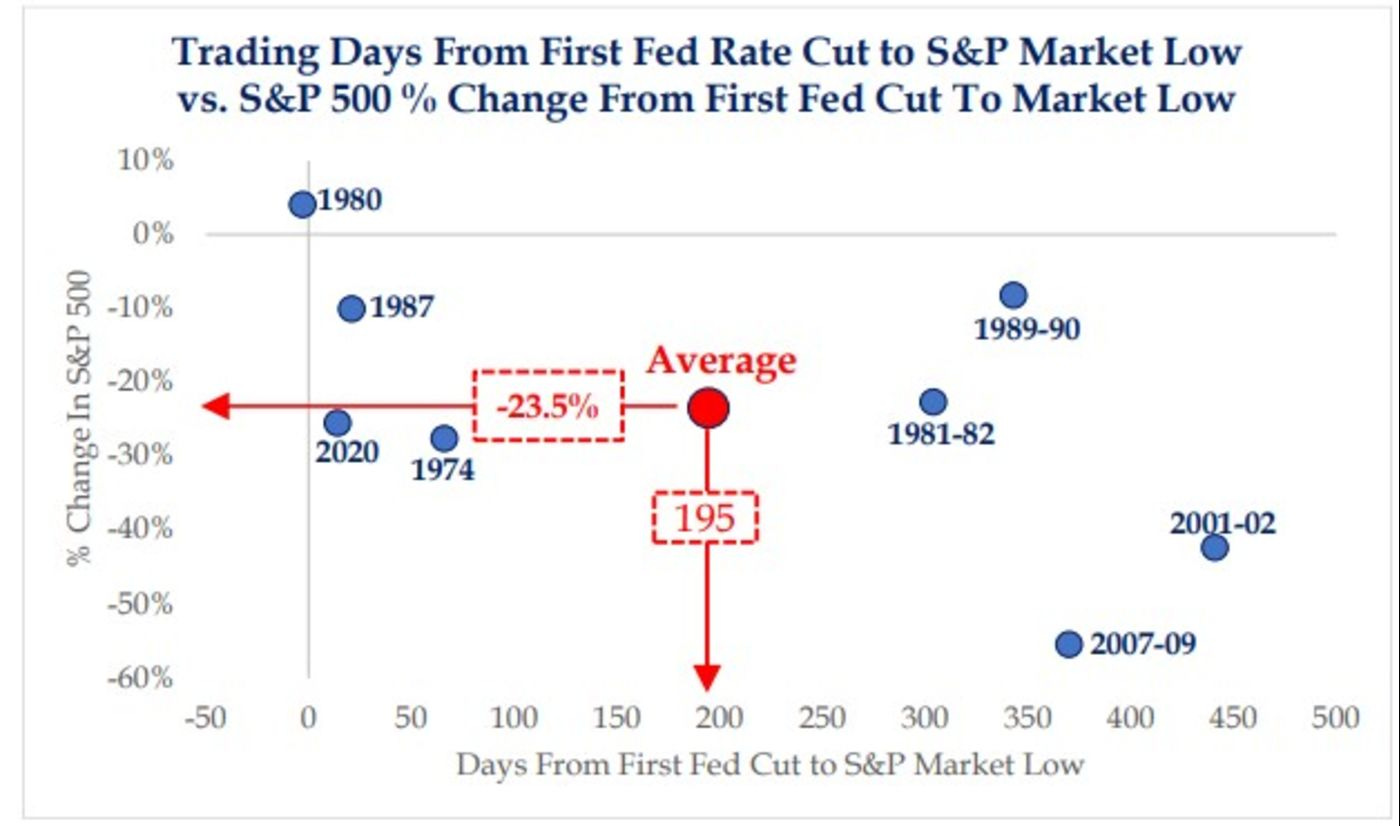

3. After the first cut… "After the first rate cut, the S&P 500 fell in all but one of the previous easing cycles. On average, the index dropped 24% before finding a bottom".

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 47/2022 | 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 37/2022

ECB

Rate Statements: 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 47/2022 | 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 43/2022 | 36/2022

BOE

Rate Statements: 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 37/2022

RBA

Rate Statements: 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 47/2022 | 41/2022 | 34/2022 Crib Sheets: 40/2022

BOC

Rate Statements: 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022

SNB

Rate Statements: 44/2022 | 39/2022 | 25/2022 Crib Sheets: 37/2022

BOJ

Rate Statements: 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: DALL-E 2 “Looking at the last trading week of the year.”

thank you, appreciate and have a great holidays season after this week!