Outlook for Week 15/2023

"It’s not what we do once in a while that shapes our lives. It’s what we do consistently." - Tony Robbins

I am currently a bit limited tech-wise but I hope it worked out well. Let me know if there are any issues with the screenshots.

Welcome to issue #50 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary.

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

The cover image is AI-generated via Midjourney. If you want to guess the prompt, I put it at the end of the newsletter.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Before we get started, I’d like to give a shout-out to Yuri from Snippet Finance!

Snippet Finance is an easy-to-read newsletter with highly curated and bite-sized content on macro, stocks and investing. Here’s an example:

I know you like long newsletters (because you are reading this one right now), but I’m sure you will also like Yuri’s. Also, check out his website where he posts daily for more great content and his Twitter @SnippetFinance!

Table of Contents

Summary (Playbook, Calendar, Levels, FX Drivers, Downloads)

Week in Review: a) Central Banks, b) Economic Data

Market Analysis: a) Growth and Inflation, b) Yields, c) Central Banks and the US Dollar, d) Sectors and Flows, e) Sentiment and Positioning, f) Market Risks, g) Various

Top 3 Macro Charts of the Week

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Please check out this article about what this summary aims to provide and what its limitations are.

Economic Calendar for next week

Important levels to watch and look out for in FX futures

Currency Drivers

For an explanation check out this link.

Downloads and Links

Difftext of the Summary from last week: diffchecker.com

Central bank speaker recap for the week:

Week in Review

Check out Bond Blogger's Credit Wrap if you want to get an excellent summary of market-moving news over the last week. Highly recommended, also make sure to follow him on Twitter @IlliquidTrader!

Central Banks

RBA Rate Statement (04.04.23)

The RBA left rates unchanged at 3.60% as expected:

Guidance changed slightly: the Board now expects that “some further tightening may well be required” (before: “further tightening will be needed”)

The full effect of rate hikes is yet to be felt, voted to hold rates steady to assess the impact of interest rates so far

Monthly CPI in Australia has likely peaked; rents and utilities continue to increase quickly while goods inflation is expected to moderate

Domestic growth has slowed and is expected to be below trend over the next couple of years

Wages growth continues to increase, the labour market remains very tight

RBNZ Rate Statement (05.04.23)

The RBNZ hiked rates by 50 bps, more than the expected 25 bps, to a policy rate of 5.25%:

Forward guidance changed to “maintaining the current level of lending rates is necessary” from “monetary conditions need to tighten further”

Inflation is still too high and persistent, employment is beyond its maximum sustainable level

Demand continues to outpace supply but there are signs of easing and slowing of economic activity

Domestic growth is expected to slow through 2023

From the Meeting Minutes:

Confab, Speakers, News

Federal Reserve

Cook (Neutral). Weekend: Appropriate path of Fed policy rate may be lower than otherwise if tighter financial conditions constrain the economy, monetary policy is now in restrictive territory, recent bank developments may suggest greater headwinds for financial conditions and the economy, may have more work to do if data continues to show economic strength. Mon: The disinflationary process is on the way but we are not there yet, Fed's focus is on inflation.

Waller (Hawk). Weekend: Recent data is consistent with the idea that inflation can be brought down quickly with relatively little harm to the jobs market.

Bullard (Hawk). Mon: The Fed needs rates above 5%, the market should listen to me on the rate outlook, the market is focusing too much on banking strains. Thu: Financial stress is relatively low despite conditions having become tighter, we need to stay at it to get inflation back to 2%, financial stress has abated for now, 85% probability that financial stress will continue to abate, not clear to him that there will be much of a pullback in lending.

Mester (Hawk). Tue: Will need to raise rates above 5% and keep them there for a while, was very comfortable with recent 25 bps hike, doesn't share the market's outlook for cutting rates this year, how much more tightening is needed depends on the economy and how it reacts, balance sheet cuts aiding rate-hike cycle, expects inflation to ease to 3.75% by the end of the year and 2% by 2025.

European Central Bank

De Guindos (Dove). Weekend: Headline CPI likely to fall this year, underlying inflation likely to stay firm, interplay between higher wages/prices/profit levels may fuel longer-term inflation.

Holzmann (Hawk). Mon: Another 50 bps rate hike is still on the cards if financial stress from the global banking system doesn't get worse, bank failures could have a comparable effect to interest rate hikes by curbing credit growth, Sunday's OPEC cut not likely to have a major impact on the path ahead.

Simkus (Hawk). Mon: The "larger part" of the ECB's rate increases is over.

Makhlouf. Tue: Policy rate will need to be kept at a restrictive level to dampen demand, must remain steadfast and ready to act as required to ensure we reach our target over the medium-term, must remain alert to longer lags in the transmission of monetary policy, so far there has been no indication that inflation expectations have become de-anchored, short-term volatility in financial markets does not translate into risks for the macroeconomic outlook.

Centeno. Tue: The risk of default on mortgages in Portugal is low because of the strong labour market and interest rates and mortgage payments have been higher in the past.

Vujcic. Wed: Further rate hikes may be needed to address core inflation, biggest part of the tightening cycle is now behind us.

Vasle. Wed: Core inflation is still clearly in an upwards trend.

Lane. Wed: Food inflation is still rising now, big debate this year will be on services inflation. Thu: ECB's May decision will depend on three factors: the inflation outlook, the underlying dynamic and not just the overall inflation rate, and how quickly interest rate increases are restricting the economy and bringing inflation down; if the macro projections remain on track by May then a rate hike will be appropriate.

Stournas. Fri: Greece's economy to grow by 2.2% in 2023, up from 1.5% estimated in December.

Knot (Hawk). Fri: Unclear whether the ECB should raise rates by 25 or 50 bps in May, have to decide that during the meeting, a lot more economic data will be out by then.

Bank of England

Pill. Mon: Inflation is still much too high, UK banking system is strong. Tue: There is still a lot of policy in the pipelines still to come through given the lags in monetary policy transmission, caution is needed in assessing inflation prospects because of the potential persistence of domestically generated inflation, will come to my own conclusion about the Bank Rate on the basis of data flow and its interpretation.

Tenreyro (Dove). Tue: A looser stance is needed to meet the inflation target and to avoid a significant inflation undershoot, can be achieved through a lower bank rate today or in the future, with the current high level of the bank rate it would require an earlier and faster reversal, sees inflation falling well below target in absence of further shocks.

Reserve Bank of Australia

Lowe. Wed: Decision to hold rates steady does not imply rate rises are necessarily over, the Board expects that some further tightening may well be needed, prepared to have slightly slower return to the inflation target than other central banks, pause is consistent with our practice in earlier rate cycles, balance of risks leans towards further rate hikes, premature to talk about rate cuts, recent high inflation hasn't been driven by excessive wages growth, wage outcomes have been consistent with inflation returning to target, the Board is conscious that monetary policy operates with a lag.

Bank of Switzerland

Schlegel. Mon: Will continue to raise rates if necessary, currently Swiss interest rates aren't particularly high, no danger to financial stability, we are going to do everything we can to get inflation down to our target range, will continue market interventions and sell forex if necessary.

Bank of Japan

Momma (ex BOJ official). Wed: BOJ could end YCC in April, recent drop in global bond yields has created favourable conditions, long-term yields now won't rise abruptly even if YCC is scrapped, end of YCC could come with forward guidance that the BOJ won't raise rates until it is certain to have achieved 2% inflation target, does not expect a change of the policy rate at all for the next 18 months.

Kuroda. Fri: There is a broadening trend where rising inflation is reflected in wages, job market tightening is laying groundwork for higher wages.

Economic Data

Monday, 03.04.23

Highlights from the Canadian Manufacturing PMI:

“The recovery of Canada’s manufacturing economy stalled during March, with renewed falls in both production and new orders signalled. Broader macroeconomic uncertainty, and the negative impact of rising prices on client purchasing power were key factors that weighed on market demand.

“Nonetheless, despite these setbacks, there were some positive news to take from the survey, namely that price pressures continued to fall over the month amid reports of better supply-side stability. These are welcome developments given their roles in constraining manufacturing sector performance since the onset of the pandemic in 2020. And despite some residual challenges persisting – cost inflation remains high for instance – firms are growing in confidence, with optimism rising to its strongest in nearly a year and hiring activity being sustained.”

US ISM Manufacturing:

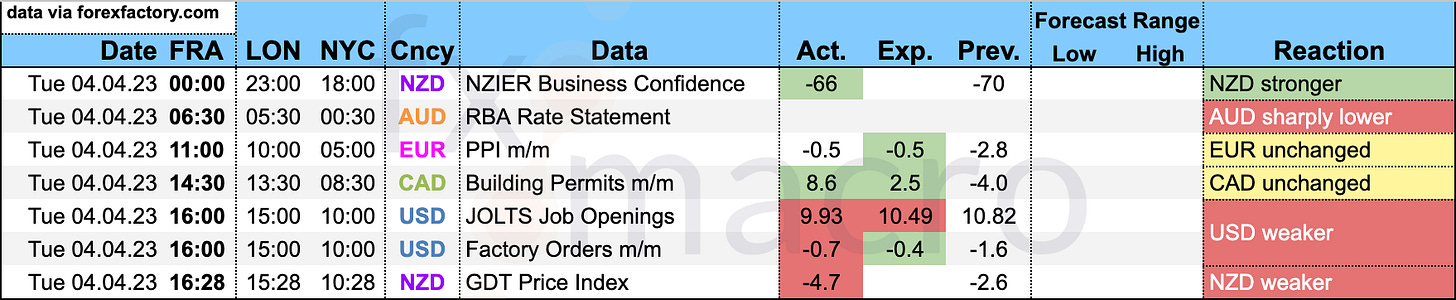

Tuesday, 04.04.23

Wednesday, 05.04.23

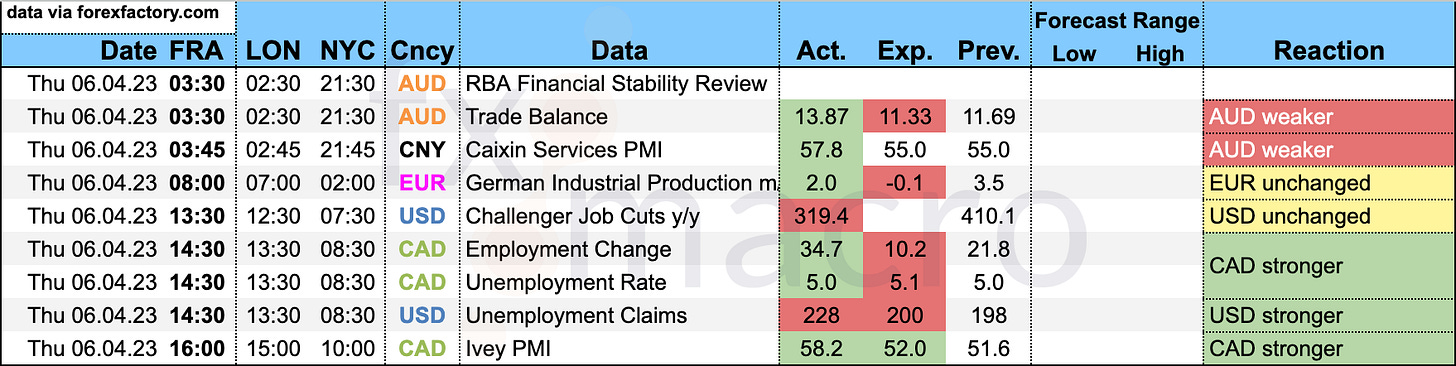

Thursday, 06.04.23

Friday, 07.04.23

Market Analysis

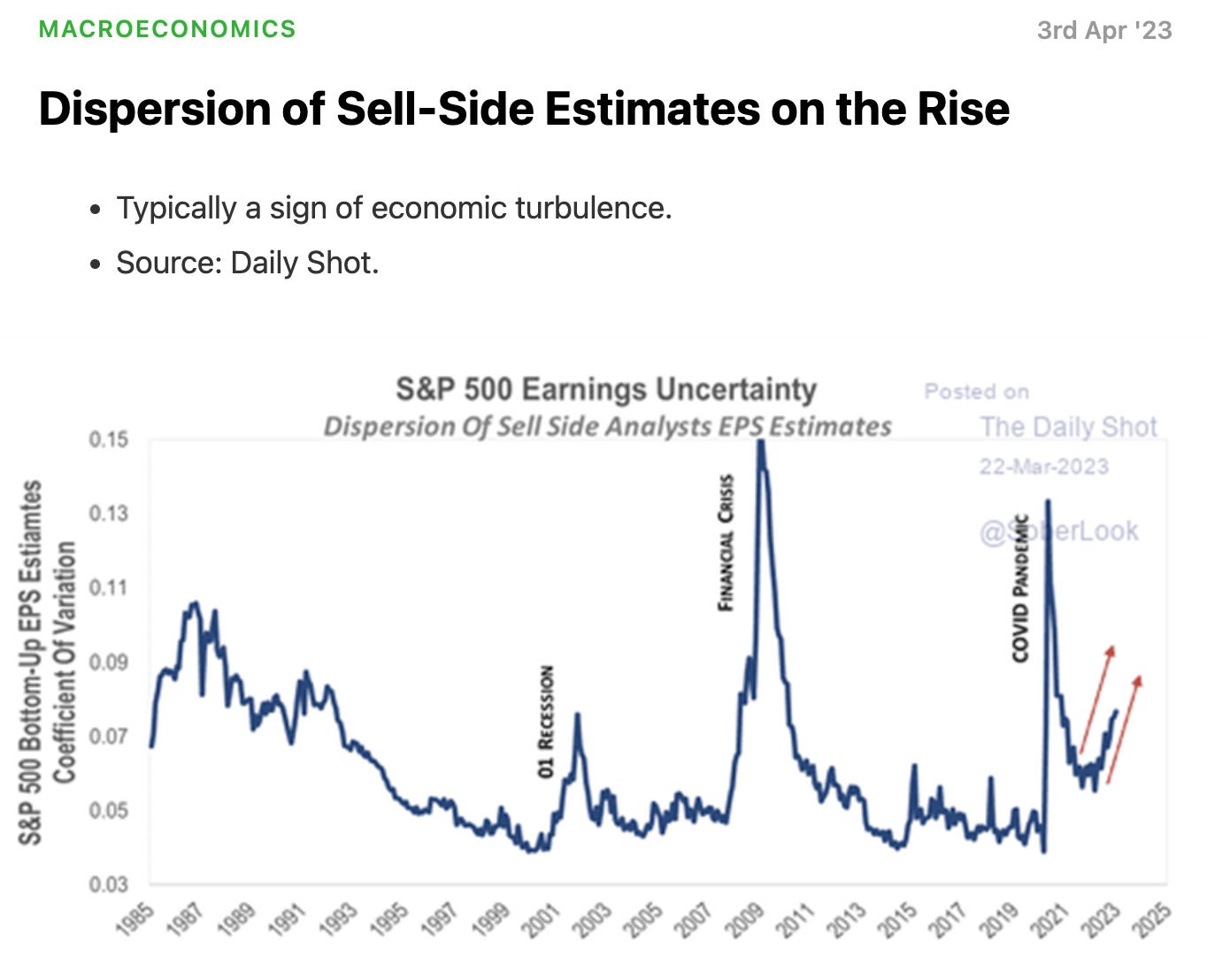

Growth and Inflation

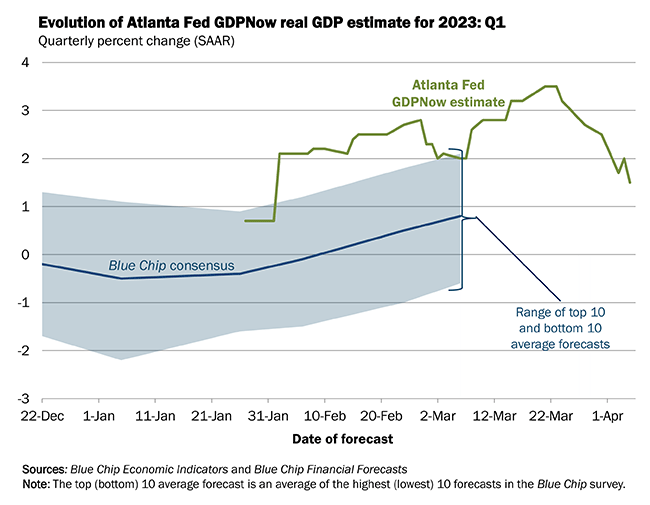

The Atlanta Fed GDPNow has ticked down to 1.5% for Q1:

The NY Fed Weekly Economic Index is at 1.71 right now:

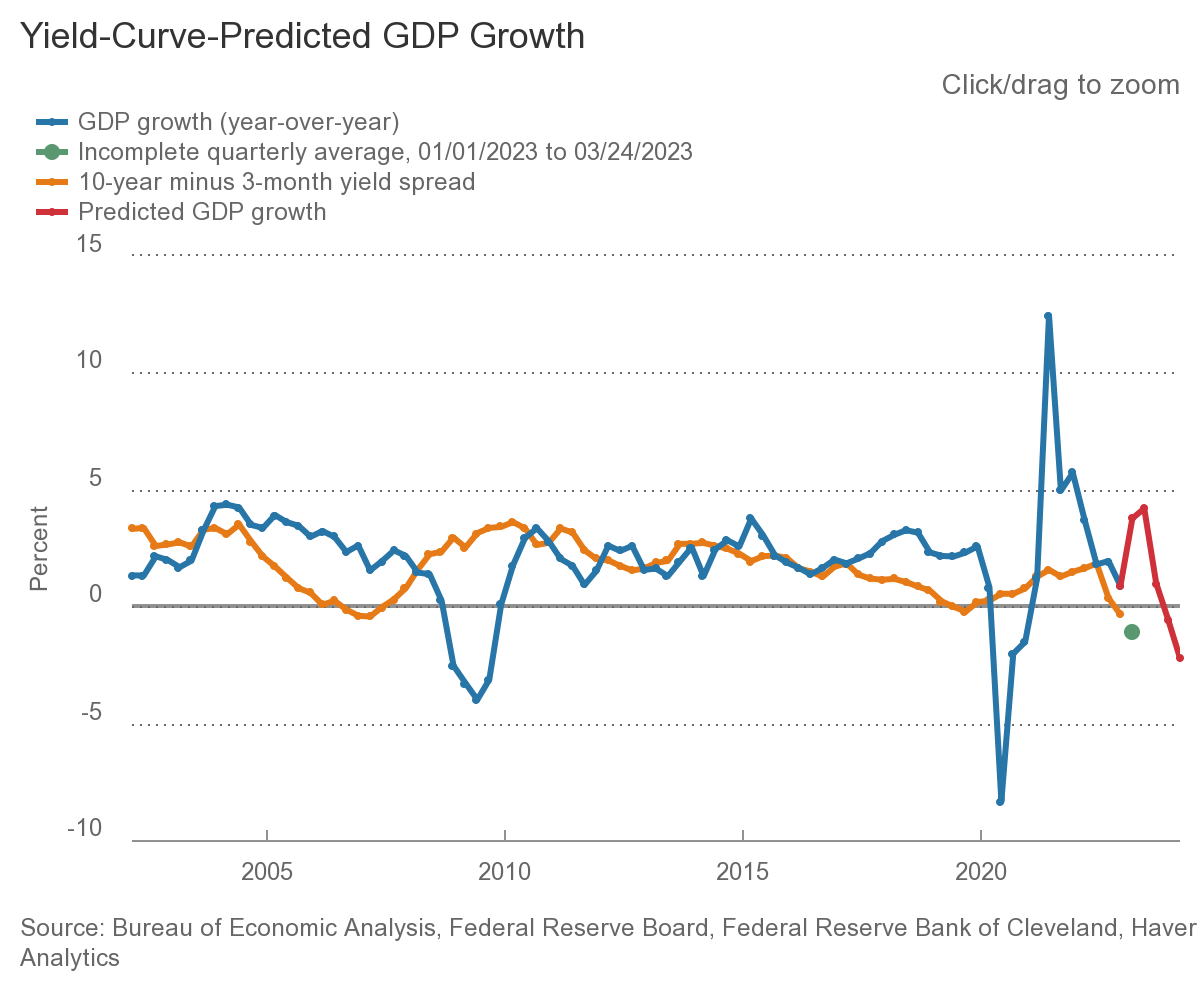

The Cleveland Fed's Yield-Curve-Predicted GDP Growth model showed a further decline. Note, the data points are quarterly and the last one is March 2024:

The implied recession probability remains above 60%:

Citi Economic Surprise Indexes:

USD and CHF both dropped

EUR and maybe GBP are levelling out

AUD, NZD, CAD and JPY are going sideways

Bloomberg PMI heatmap:

The US and Japan are improving

Canada and the UK have worsened

The Eurozone remains stable while Germany has weakened further

Switzerland remains unchanged

China has weakened again, South Korea isn't improving, Vietnam is worse, Taiwan as well

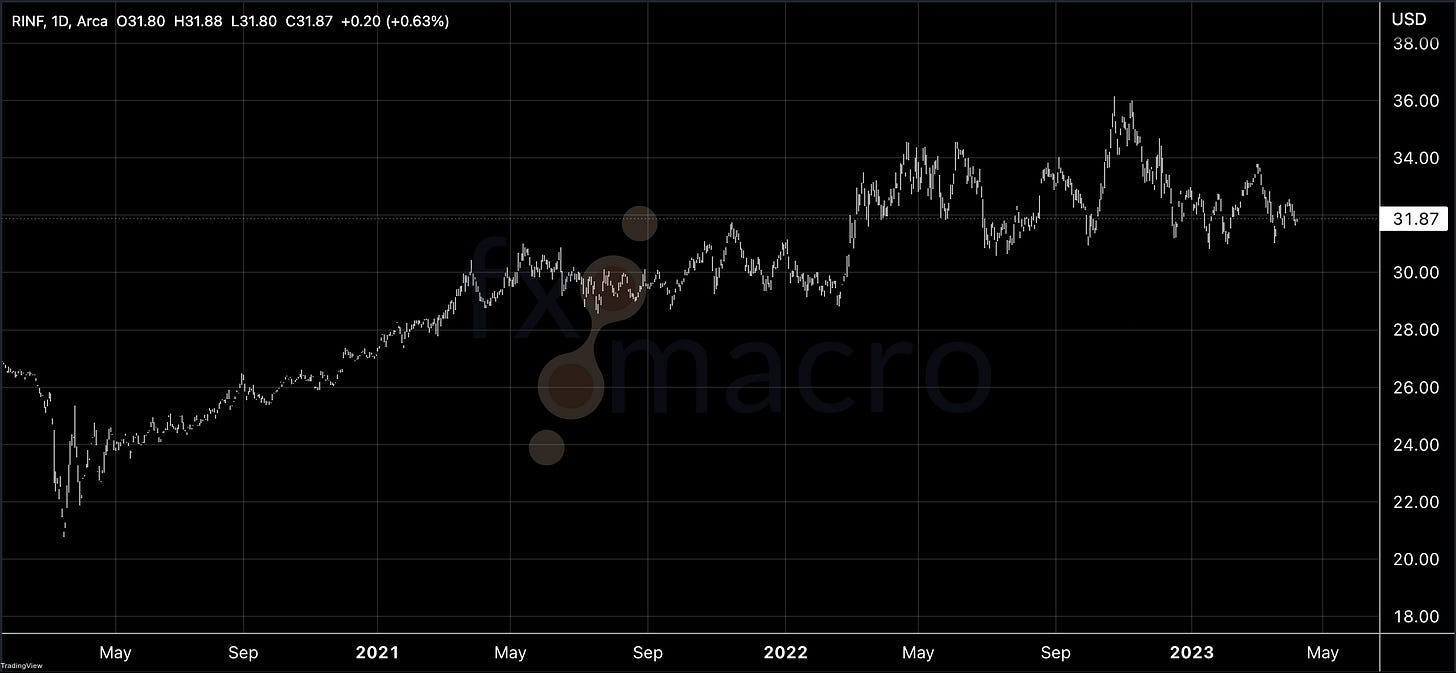

Breakeven inflation rates continue to go sideways:

As does the 5y5y forward inflation expectation rate:

And RINF:

Citi Inflation Surprise Indexes:

Pretty much every index is lower: USD, EUR, NZD, CAD, JPY

Everyone else is unchanged: GBP, AUD, CHF

Yields

See chart and table below:

2y and 10y yields are coming down across the board

Japan and Switzerland look like the relative outperformers

2-year and 10-year yields are mostly trading lower in parallel but there's a bit of bear flattening going on in NZD yields and the JPY curve re-steepened again:

The steepening of the US 2s10s spread has stalled:

Central Banks and the US Dollar

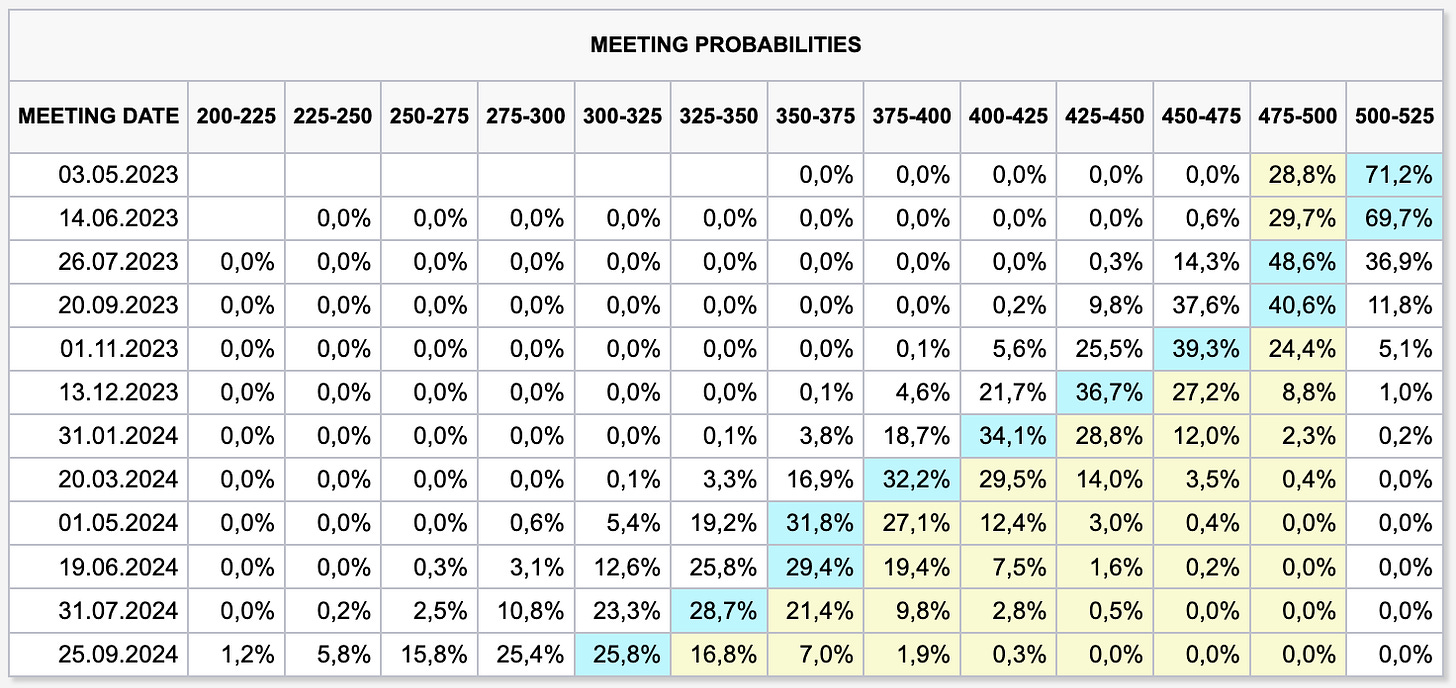

FOMC meeting probabilities according to FedWatch:

The current FFR is 4.75-5.00%, and the May meeting is priced at 25 bps with a 71% probability and at no-change with 29%, a tad more hawkish than last week

The meeting in June is also priced between a 25 bps hike and no-change with about the same probabilities

The first 25 bps cut is expected in July, and the expected pace of rate cuts is about the same as last week

The Fed Funds forward curve is sloping down accordingly, and it is flattening out only towards the end of 2024, so the market is expecting about 15 months of rate cuts at this point before reaching an FFR of about 3%:

Sectors and Flows

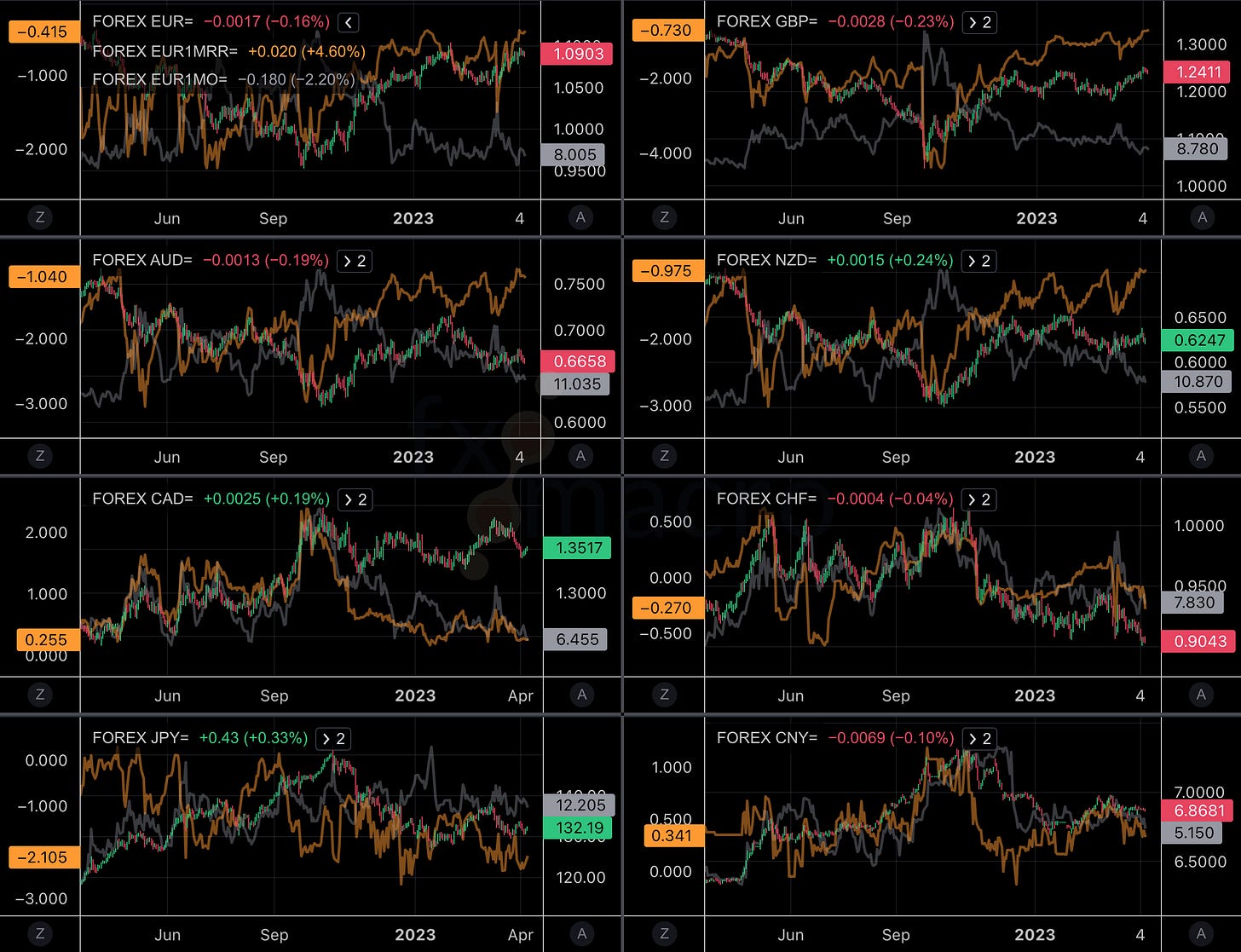

Currency Strength:

The same currencies are outperforming and underperforming on all three timeframes, respectively

GBP, EUR, CHF and JPY are the outperformers

CAD, NZD, AUD and USD are the underperformers

Currency indexes look like this over one month:

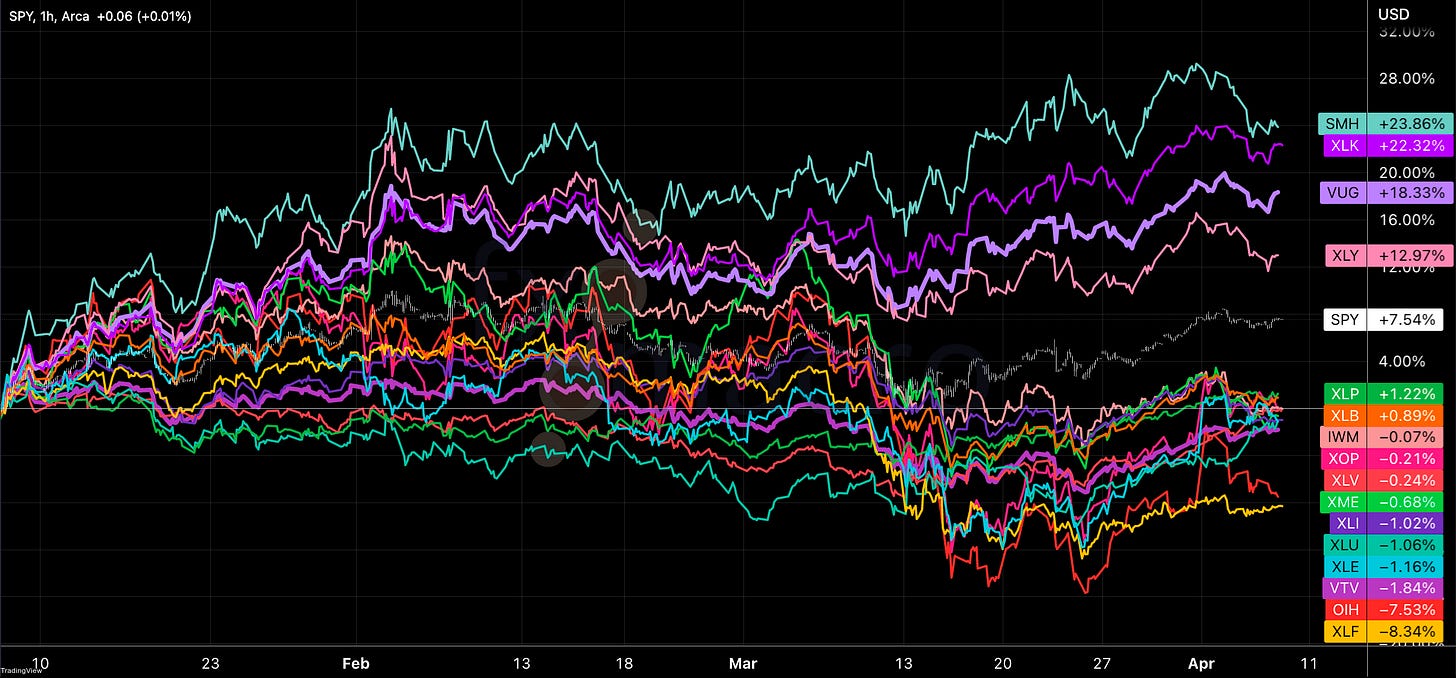

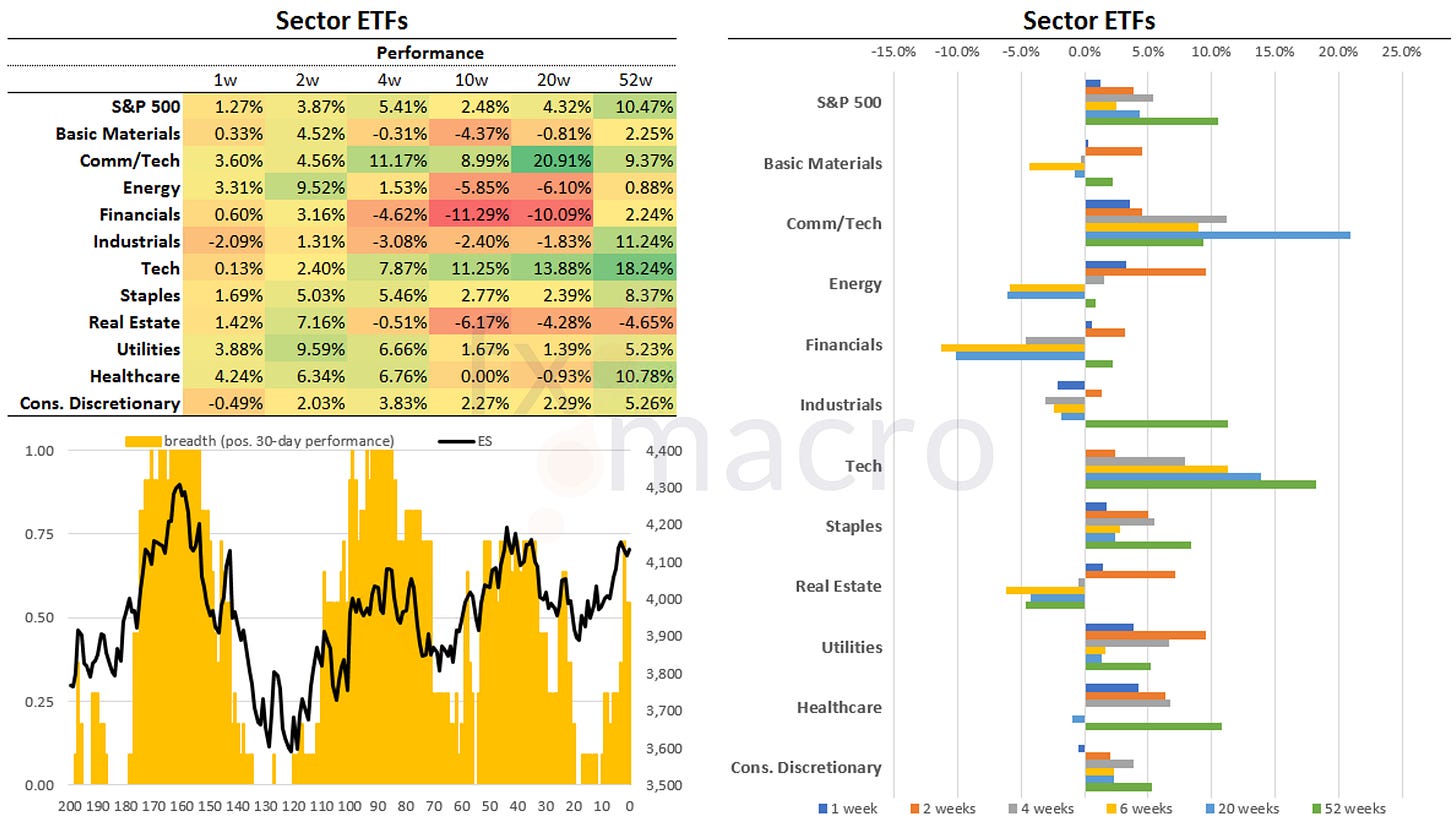

Equity sector performance:

Others have already pointed it out but this rally is mostly carried by a very small number of sectors (and stocks)

Tech is up 22%, Consumer Discretionary (with AMZN and TSLA making up more than one third of their assets) is up 13%, and every sector is lower or just barely positive

Financials are the laggards

The spread between non-Tech sectors is quite small with XLP at +1.22% and XLE at -1.16% over three months, XLF being the outlier due to the banking crisis

Similar data, different chart:

Tech and Communication Services are outperforming on all timeframes

Defensive sectors like Healthcare and Utilities have been performing well this week and this month too

Sector breadth is lagging in the following chart too but it's not looking as bad as it does above:

Sector thumbnail charts:

International stock indexes:

The Nasdaq is outperforming by a wide margin

Asian indexes like the KOSPI and TW50C are also performing well

Bovespa and Sensex remain the underperformers

Sentiment and Positioning

AAII Bull-Bear spread is sharply higher and around neutral now:

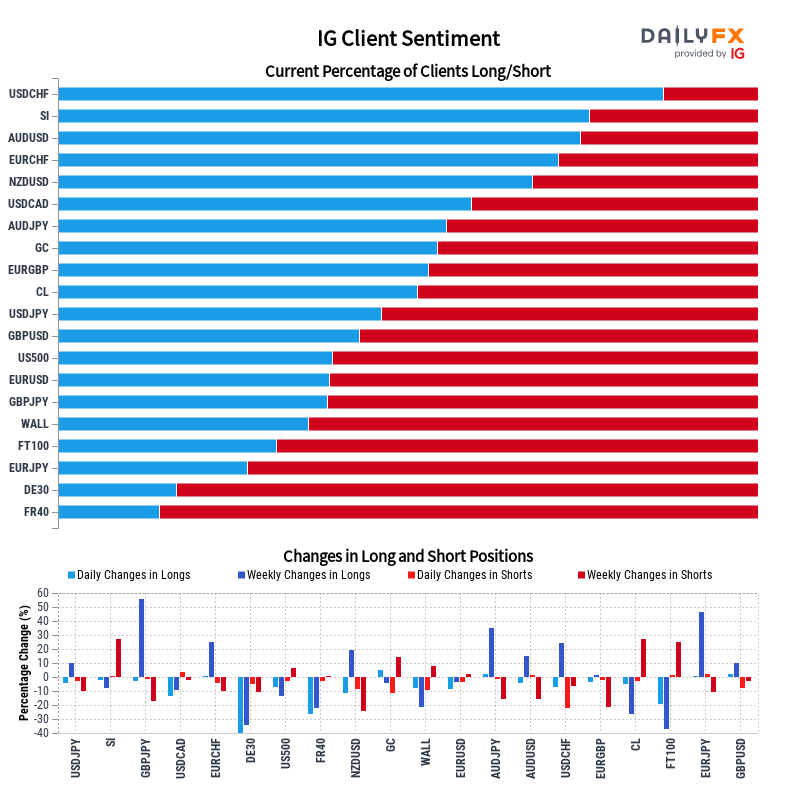

Currency sentiment:

AUD, NZD and JPY have bullish sentiment

CHF has bearish sentiment

Different sentiment source:

USDCHF and EURCHF are among the currencies with the most bullish sentiment

AUDUSD and NZDUSD both have high levels of bulls too

EURJPY and GBPJPY are the most bearish currency pairs

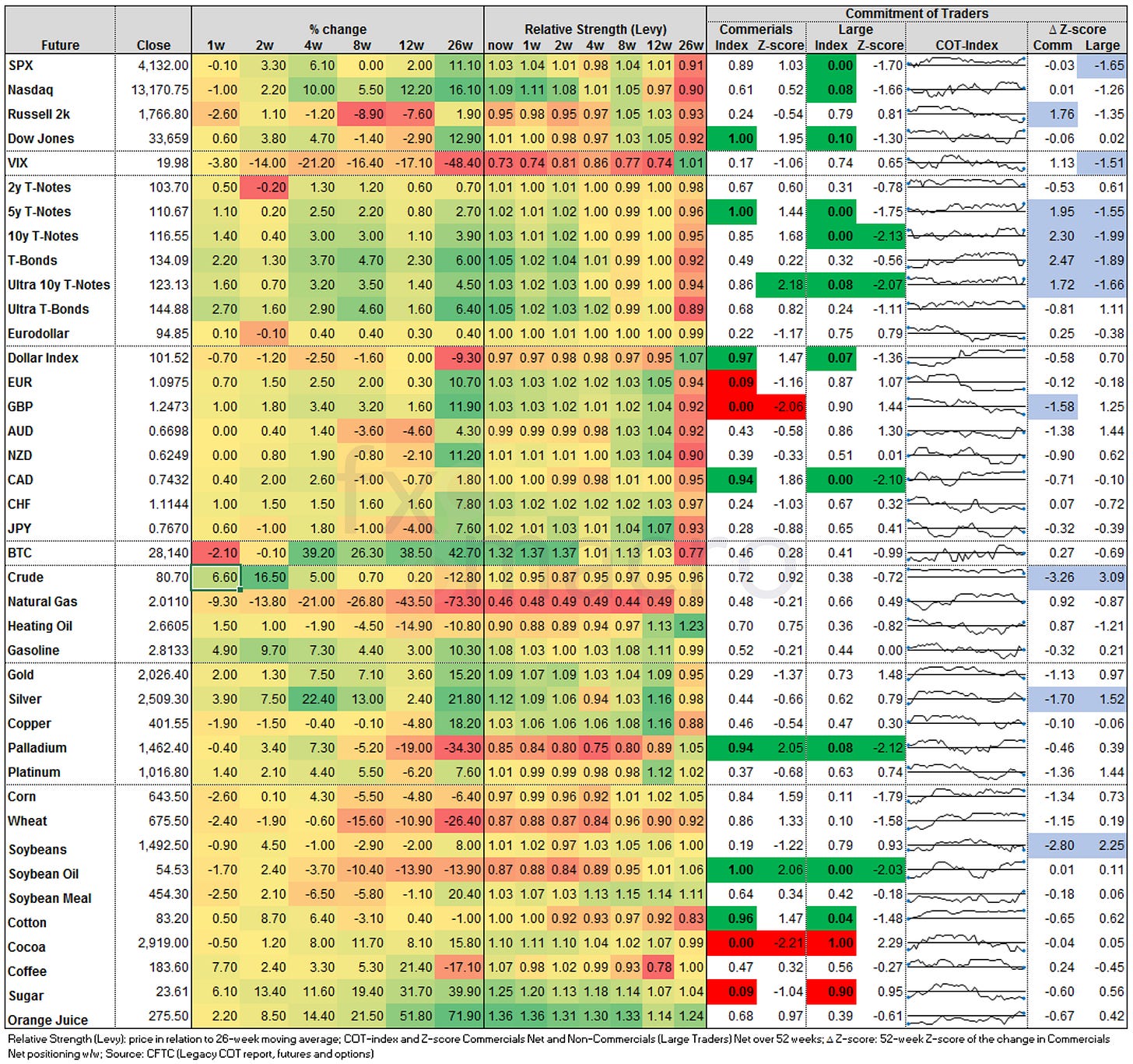

Commitment of Traders data and futures performance:

Equity futures were mixed this week with RTY underperforming again. Positioning-wise, Large Traders are at extreme net short levels for every future except the RTY, and Commercials are at an extreme for the YM too.

Treasury futures were all positive, positioning is at bullish extremes for Large Traders and Commercials in a few futures, and one-week positioning changes are mostly bullish too.

Currency futures had a mixed-to-positive week, positioning is still bullish DXY and 6C, and bearish 6E and now also 6B.

Bitcoin is holding up pretty well with an RLS of 1.32.

Energy futures were mixed with NG continuing to decline: it is down more than 73% over the last 26 weeks. CL was up 6.6% but: the 1-week change in Commercial and Large Trader positioning is at -3.3 SD and +3.1 SD, respectively, so that's bearish short-term.

Metals were mixed too with GC and SI performing well. Positioning-wise, only PA is near a bullish extreme.

Grains and softs were mixed with grains lower and softs more positive than negative. ZL positioning is getting more bullish each week, CC is at a bearish extreme, SB is near one as well.

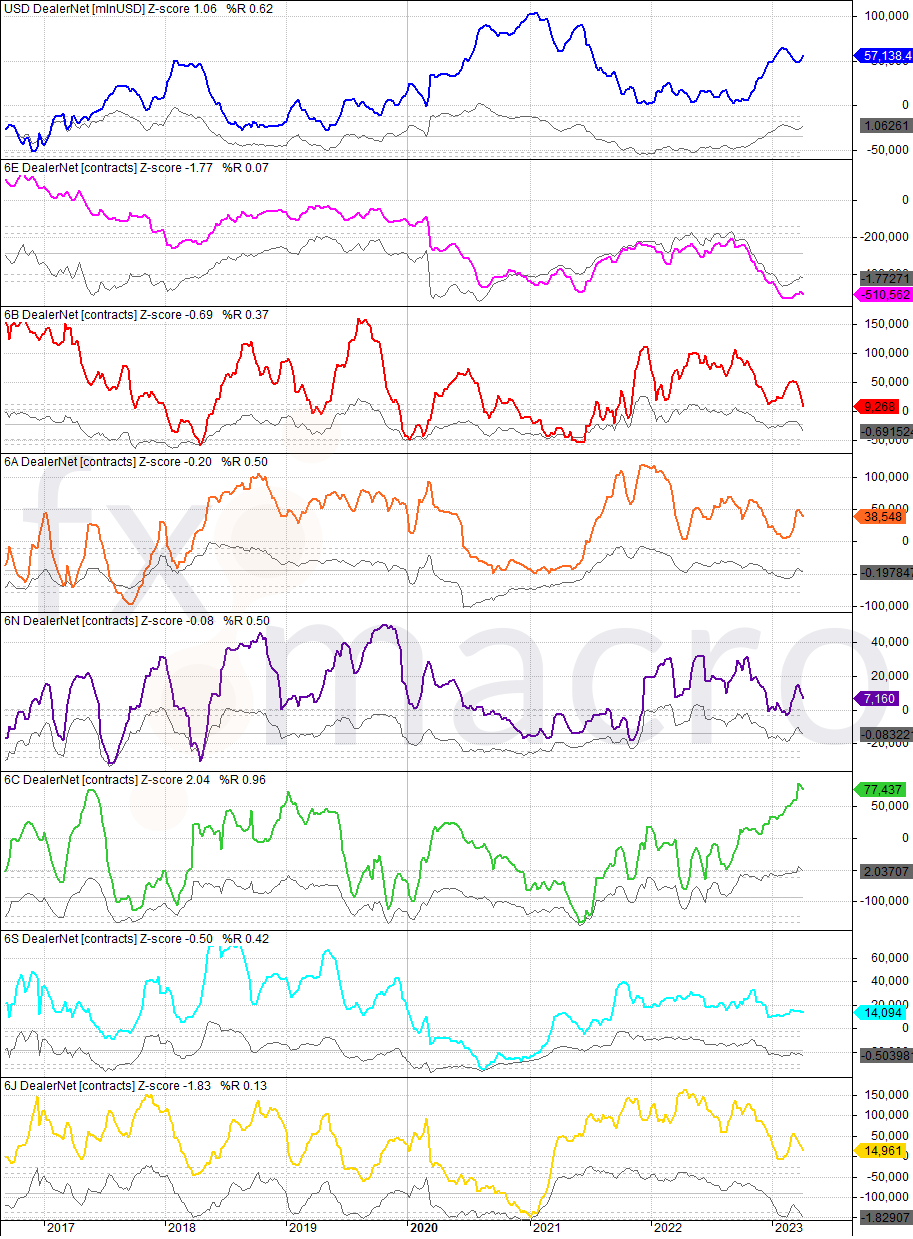

COT/TFF dealer net positions for currency futures:

6E is near a bearish extreme

6C is near its multi-year bullish extreme

Citi PAIN indexes: USD is getting bought again vs. everything else.

Here's the combined COT/PAIN chart:

Market Risks

HY-OAS aren't coming down (data is as of Wednesday), and IG spreads haven't tightened.

The Credit Spread Index has been going up since February:

Currency volatility continues to trade lower:

The VIX term structure looks decent with a 1.6-point premium in the front-month future and about 1.5 in the second month.

Volatility indexes:

MOVE hasn't come down further, it's still at 147

VIX is below 20 again, VVIX has calmed too and now reads 85

VIX/VIX3M has steepened and remains well below 1.00

Skew has flattened somewhat with SDEX, VIX/VOLI and TDEX all lower, i.e. less demand for OTM puts

The CNN Fear & Greed index is slightly elevated:

Various

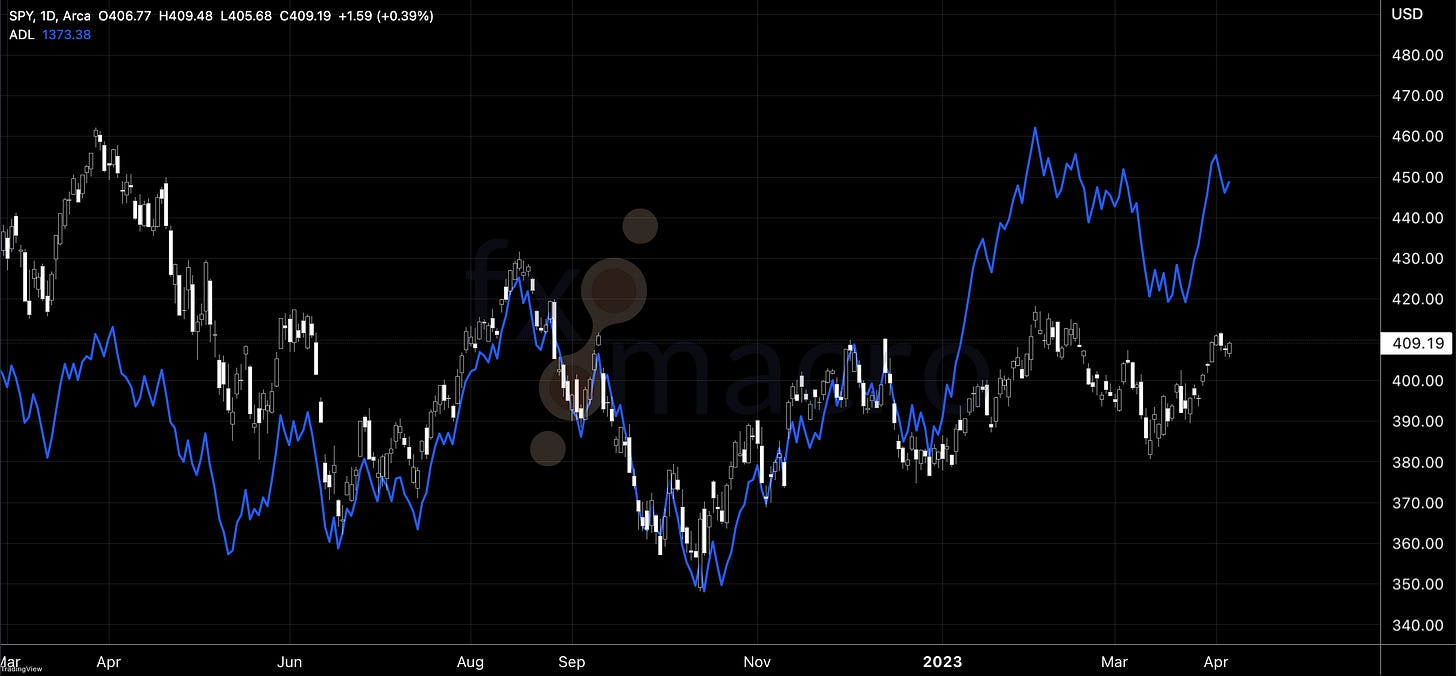

The NYSE Advance/Decline Line is tracking the S&P, so no divergence there:

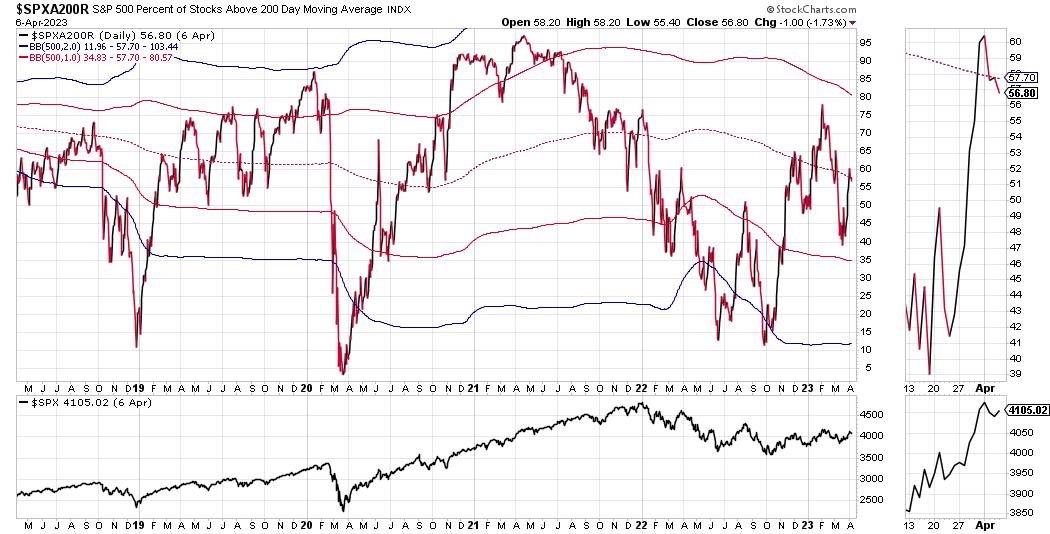

The percentage of S&P 500 and Nasdaq 100 stocks above their 200-day moving average isn't looking too bad either at first glance but: there's a divergence in the metric for the Nasdaq where the index made a new high but the number of stocks above the 200-day MA hasn't, and the S&P is almost back at its last high but the breadth metric is looking a fair bit weaker:

Looking at the 50-day moving averages, there's a clear trend now that this is the third lower high of breadth in the S&P and also the Nasdaq: each of the Nasdaq's highs since October has seen less participation:

25-delta risk reversals:

AUDUSD and NZDUSD are priced higher

USDCAD is being priced lower

Finally, a look at the Market Dashboard:

Not too much going on, the only thing I find noteworthy is the discrepancy between trend metrics in ES, NQ and YM vs. the RTY and the Dow Jones Transportation Index

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 13/2023 | 06/2023 | 50/2022 | 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 09/2023 | 02/2023 | 47/2022 | 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

ECB

Rate Statements: 12/2023 | 06/2023 | 50/2022 | 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 10/2023 | 04/2023 | 47/2022 | 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 11/2023 | 05/2023 | 50/2022 | 43/2022 | 36/2022

BOE

Rate Statements: 13/2023 | 06/2023 | 50/2022 | 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

RBA

Rate Statements: 11/2023 | 07/2023 | 50/2022 | 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 09/2023 | 51/2022 | 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 07/2023 | 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 09/2023 | 47/2022 | 41/2022 | 34/2022 Meeting Minutes: 07/2023 Crib Sheets: 40/2022

BOC

Rate Statements: 11/2023 | 05/2023 | 50/2022 | 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022

SNB

Rate Statements: 13/2023 | 50/2022 | 44/2022 | 39/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

BOJ

Rate Statements: 11/2023 | 04/2023 | 51/2022 | 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 13/2023 | 05/2023 | 52/2022 | 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: Midjourney with the prompt: seamless pattern of vibrant colorful easter eggs

excellent