Outlook for Week 12/2023

"If you personalize losses, you can't trade." - Bruce Kovner

Welcome to issue #47 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary.

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

The cover image is AI-generated via Midjourney. If you want to guess the prompt, I put it at the end of the newsletter.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Before we get started, I’d like to give a shout-out to Yuri from Snippet Finance!

Snippet Finance is an easy-to-read newsletter with highly curated and bite-sized content on macro, stocks and investing. Here’s an example:

I know you like long newsletters (because you are reading this one right now), but I’m sure you will also like Yuri’s. Also, check out his website where he posts daily for more great content and his Twitter @SnippetFinance!

Table of Contents

Summary (Playbook, Calendar, Levels, FX Drivers, Downloads)

Week in Review: a) Central Banks, b) Economic Data

Market Analysis: a) Growth and Inflation, b) Yields, c) Central Banks and the US Dollar, d) Sectors and Flows, e) Sentiment and Positioning, f) Market Risks, g) Various

Top 3 Macro Charts of the Week

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Please check out this article about what this summary aims to provide and what its limitations are.

My conviction level in almost everything is usually pretty low but currently, it's even lower: the market is driven by sentiment rather than fundamentals, and a lot of things don't make sense to me, are ambiguous or outright contradictory.

Economic Calendar for next week

Important levels to watch and look out for in FX futures

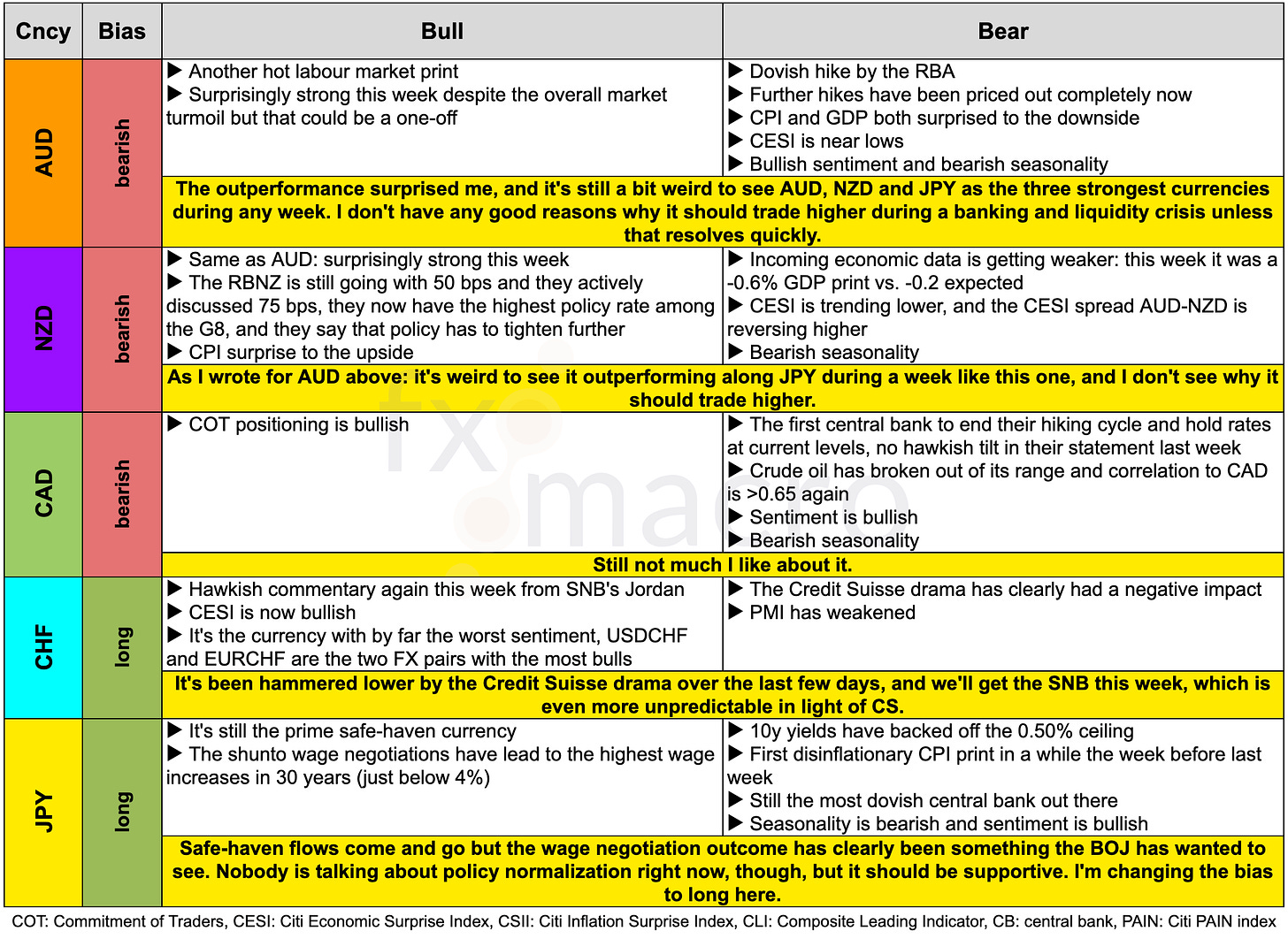

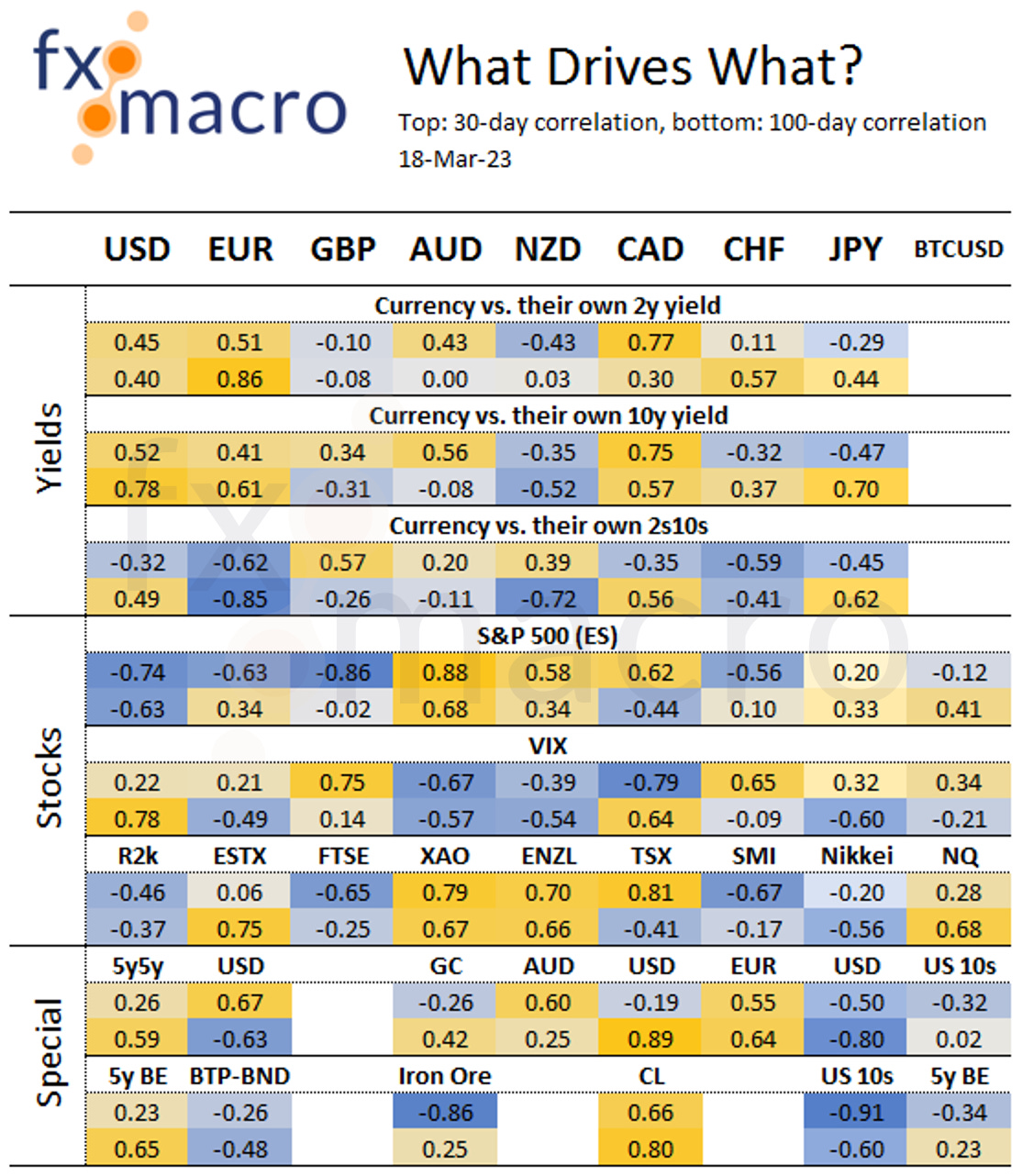

Currency Drivers

For an explanation check out this link.

Downloads and Links

Difftext of the Summary from last week: link to diffchecker.com

Central bank speaker recap for the week:

Central bank speaker recaps for the upcoming events (summarized comments since the last meetings):

Week in Review

Central Banks

ECB Rate Statement (16.03.23)

The ECB hiked by 50 bps as expected:

No guidance on further policy actions: the elevated level of uncertainty reinforces the importance of a data-dependent approach

APP to continue unchanged at 15 bln EUR per month on average until the end of June 2023

The GC is monitoring the current market situation closely, and the ECB’s policy toolkit is fully equipped to provide liquidity to the Eurozone financial system if necessary

The baseline path for headline inflation has been revised down to 5.3%, 2.9% and 2.1% (in 2023-25)

Core inflation is expected to average 4.6% in 2023 (higher than the December projection), 2.5% in 2024 and 2.2% in 2025

Baseline projections for growth have been revised up to 1.0% for 2023, and down to 1.5% in 2024 and 2025

Confab, Speakers, News

European Central Bank

Stournas. Tue: We don't see SVB having an impact on Eurozone banks or Greek ones.

Lagarde (Dove). Thu: Monitoring market tensions closely, the decision today was adopted by a very large majority, no other option was proposed, three to four members did not support the policy action, dissenters wanted more time, impossible to determine what the rate path will be, the policy action we will take will be data-dependent, no trade-off between price stability and financial stability, stand ready to provide new facilities if needed, the economy will recover over the coming quarters, underlying price pressures remain strong, wage pressures are strengthening.

De Guindos (Dove). Thu: Banks are resilient with robust liquidity positions.

Kazimir. Fri: We are not at the finish line and need to continue with rate hikes, no need to speculate about May decision, core inflation is sticky and upside risks to inflation are dominating.

Villeroy (Neutral). Fri: We sent a strong message of confidence, our priority is to fight inflation, European banks are very solid and not in the same situation as US banks.

Simkus (Hawk). Fri: The terminal rate has not been reached yet, still believes that yesterday was not the last rate hike.

Sources. Mon: MNI Sources: ECB "hopes to push ahead with its plans for a 50 bps hike". Wed: Reuters: policymakers are still leaning towards 50 bps as they expect inflation to remain high in the coming years, unlikely to give up on the idea considering the damage to their credibility. Thu: Reuters: ECB members agreed to go ahead with 50 bps hike after SNB threw lifeline to Credit Suisse, debate was about whether to hike by 50 bps or leaving rates unchanged, 25 bps was not discussed. Bloomberg: ECB feared that ditching a 50 bps hike would panic investors, several more hawkish members see the terminal rate well above the current 3%. Fri: Reuters: ECB supervisors were told at meeting that exposure to Credit Suisse is immaterial, deposits across supervised banks remained stable, conclusion was that there is no contagion to Euro zone banks. Econostream with an ECB insider: I do support another 50 bps hike in May unless the economy or core HICP soften, no doubt that we are still in tightening mode, no hurry to decide our next move, 50 bps hike is not much when real interest rates are clearly negative, 4.5% terminal rate only if inflation turns out unexpectedly persistent.

Swiss National Bank

Jordan. Weekend: Inflation is too high and we're doing everything we can to bring it back into the area of price stability, this is our main task.

Bank of Japan

Suzuki. Wed: Will discuss joint agreement with the incoming BOJ governor, premature to comment on specifics, it's the goal of the government to achieve pace of wage rises higher than that of inflation. Fri: Japan's financial system remains stable, financial institutions have ample capital base, closely coordinating with the BOJ and other central banks in taking response to financial situations.

Kuroda. Wed: BOJ must maintain current monetary easing but there will also likely be scope to consider steps to address side-effects.

Economic Data

Monday, 13.03.23

Tuesday, 14.03.23

Wednesday, 15.03.23

Thursday, 16.03.23

Friday, 17.03.23

Market Analysis

Growth and Inflation

The Atlanta Fed GDPNow model stands at 3.2%:

The NY Fed Weekly Economic Index ticked up to 0.96:

Citi Economic Surprise Indexes:

USD, GBP and CHF are all higher

EUR and NZD are both lower

AUD, CAD and JPY are sideways

I like to look at the CESI spread between Australia and New Zealand, and it's been improving quite a bit over the last few weeks:

The Bloomberg PMI heatmap is unchanged from last week:

The US and the UK are improving

Canada, the Eurozone and Japan remain unchanged

Germany has weakened deeper into the red

Switzerland has worsened

Hong Kong and Taiwan have been improving further, China is now green as well, South Korea still in the red,

Brazil and Mexico have improved

All in all, this looks very optimistic

Breakeven inflation rates were down again this week:

Same for 5y5y forward inflation expectations:

And RINF:

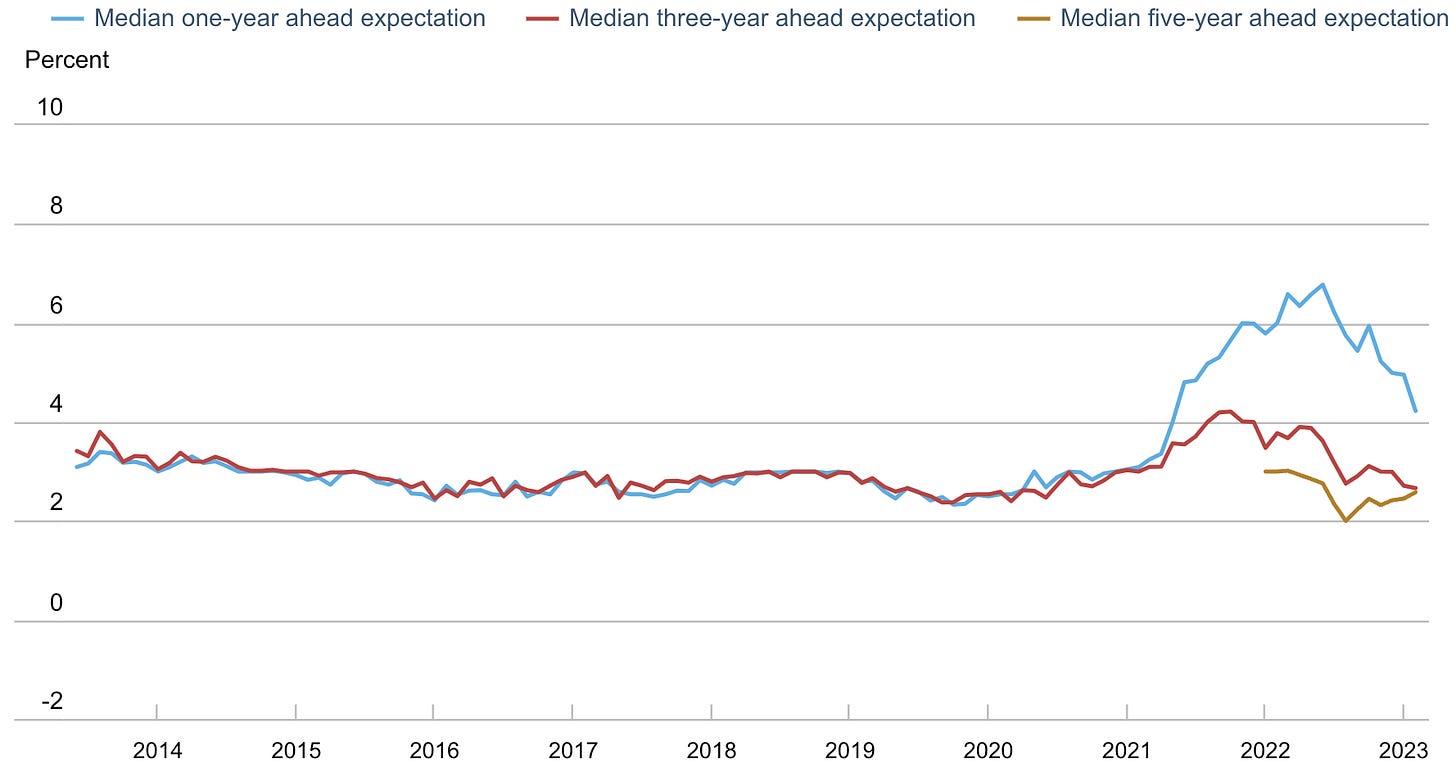

The NY Fed Survey of Consumer Expectations also showed a decline in 1-year ahead expectations:

Citi Inflation Surprise Indexes update only once per month, so they remain unchanged from last week:

Ticks up in USD, EUR, CHF and JPY

Ticks down in GBP, AUD, NZD and CAD

As I’ve written before, I don’t think the CSII captures the current inflation dynamics very well

Yields

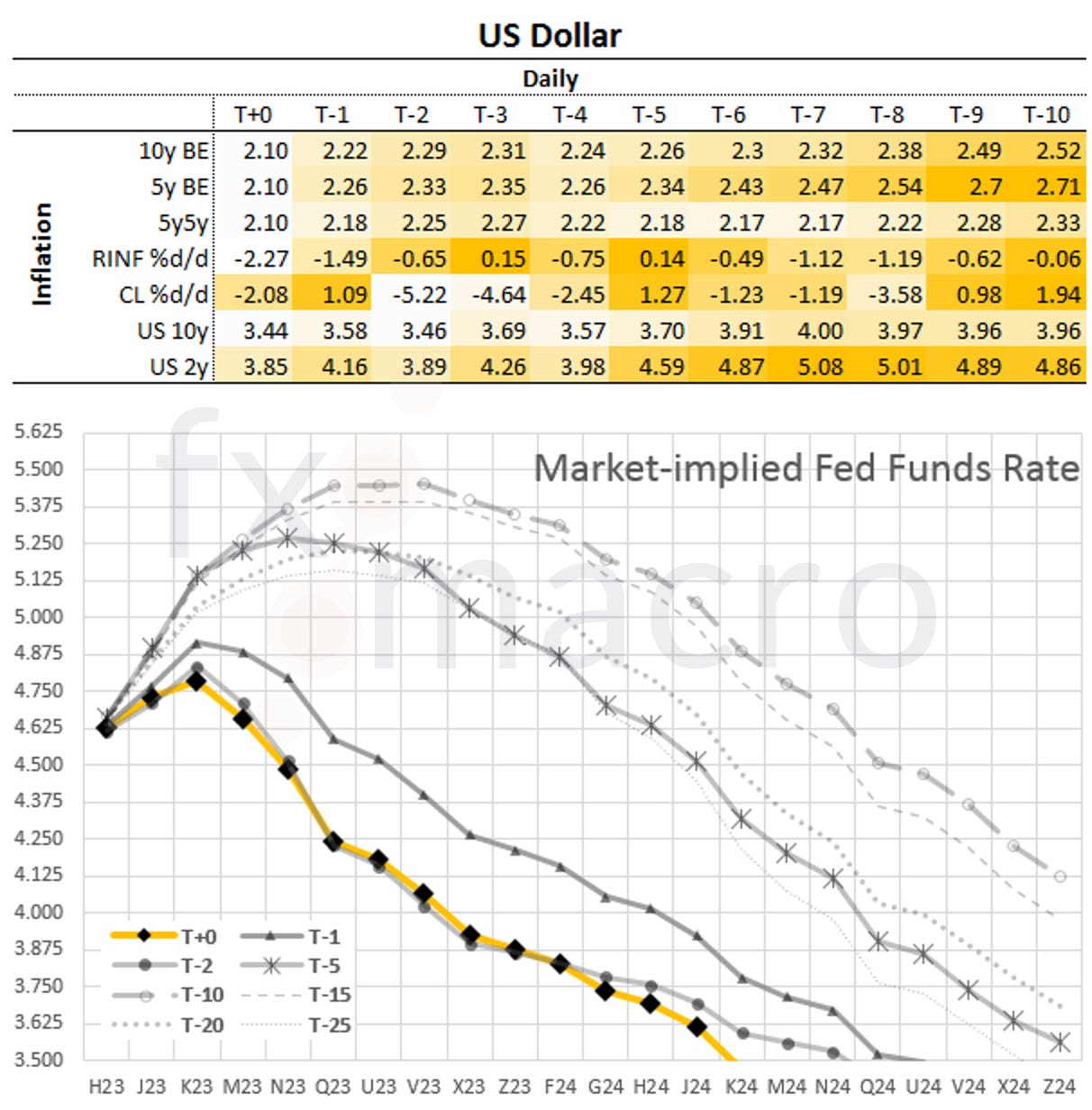

See chart and table below:

2y and 10y yields have fallen globally

Japanese 10y yields have backed off the 0.5% ceiling

New Zealand and UK are the two economies with yields holding up relatively well compared to the rest

Yield curves have steepened across the board:

The steepening is mostly driven by the front end of the curves:

Central Banks and the US Dollar

There have been pretty dramatic changes to the FOMC target rate probabilities according to FedWatch:

The current FFR is 4.50-4.75%, and the meeting next week is priced at 25 bps with a 62% probability and the remainder for no change

The May meeting is a coin toss between a rate cut, a hold or a further hike with the highest odds for no change

From June on, cuts are priced in for about every other meeting

The repricing of the Fed hiking path is clearly visible:

Here are the implied Fed Funds rates over the last two weeks: we’ve gone from an expected terminal rate of 5.6% to now 4.8%, and while it was priced in for October, this has shifted forward to May.

Sectors and Flows

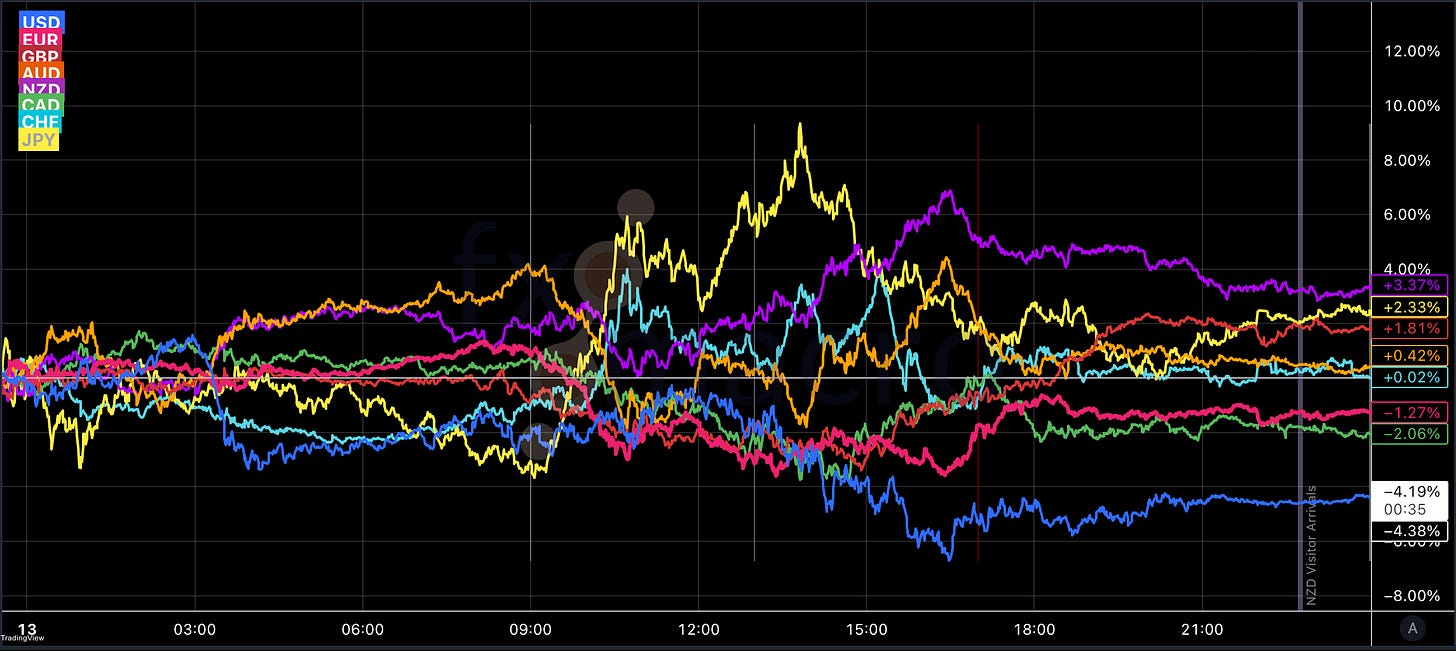

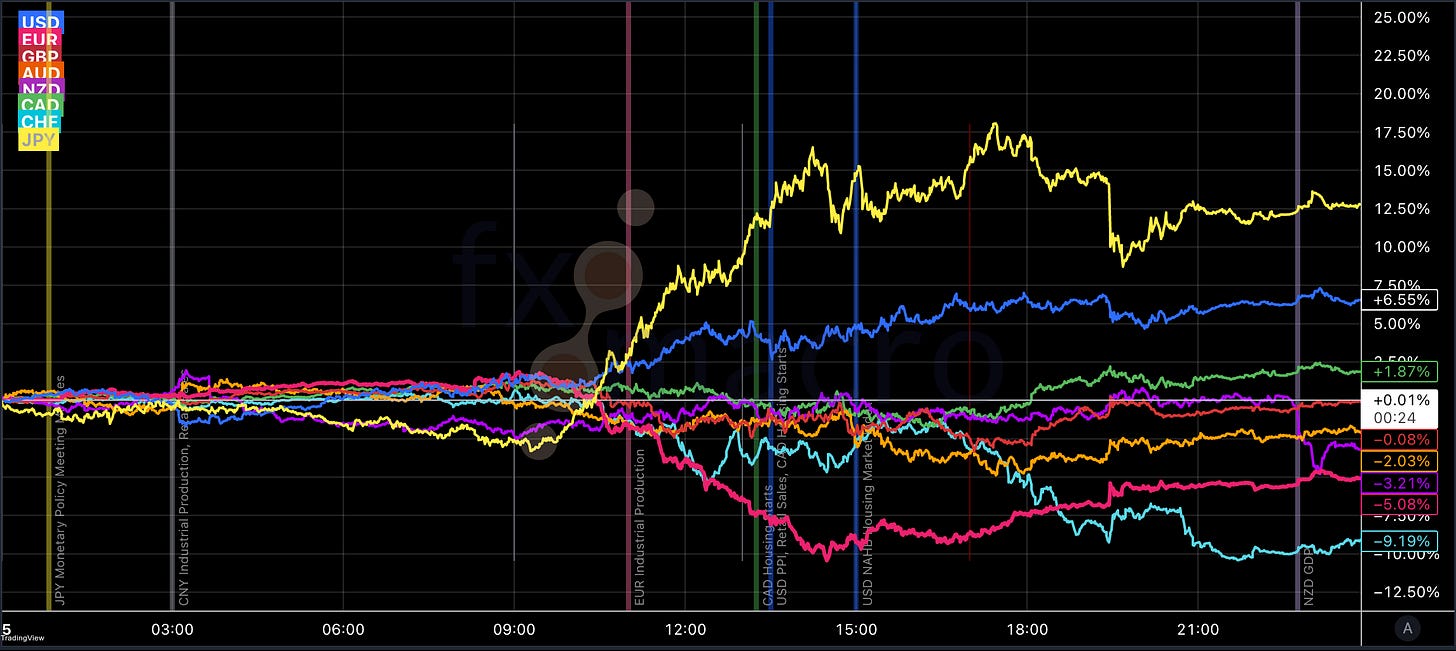

Currency strength:

The JPY is outperforming on short, middle and longer timeframes

NZD showed some surprising strength this week, as did AUD

EUR, CHF and USD were the underperformers this week

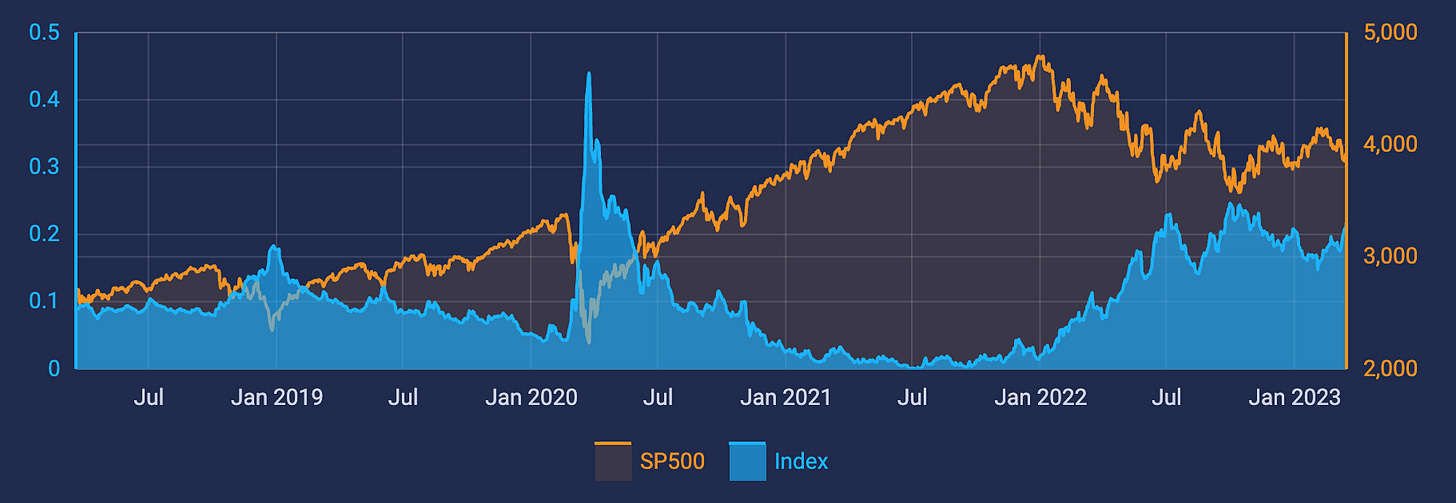

ETF flows look a bit ambiguous: we see flows out of SPY and corporate credit, out of XLE and XLF but into KRE, the regional banking ETF with all the troubled names in it. All in all, I interpret it as a flight to quality with Treasury and dividend ETFs being the net gainers.

Equity sector performance:

Semiconductors and Tech are the outperformers

Growth has been outperforming Value

The laggards are Oil Services and Exploration, Financials, Metals/Mining and Energy

Seen from a different angle: the outperformance of Tech and Communication on hopes for rate cuts, and the underperformance of Energy looks like the market is pricing in a hard landing at the moment:

Sector breadth is pretty weak with just one sector positive over 30 days:

Sector ETF charts: nothing that clearly stands out for me.

International stock indexes:

Nasdaq is the clear outperformer, Russell 2k has the worst performance

The FTSE 100 has pretty much imploded and European indexes have lost quite a bit of their strength over the last month

Asian indexes have also performed relatively well

Sentiment and Positioning

AAII Bull-Bear spread has worsened further; it’s still about 10 points away from bearish extremes seen last year:

Currency sentiment:

Bullish sentiment for AUD, CAD and JPY

Bearish sentiment for CHF

Here’s a different sentiment source:

USDCHF and EURCHF are still the currency pairs with the most extreme bullish sentiment

EURJPY and GBPJPY have the most bearish sentiment

Changes in sentiment are seen among the major indexes with bulls increasing sharply in UK, German and French stock indexes

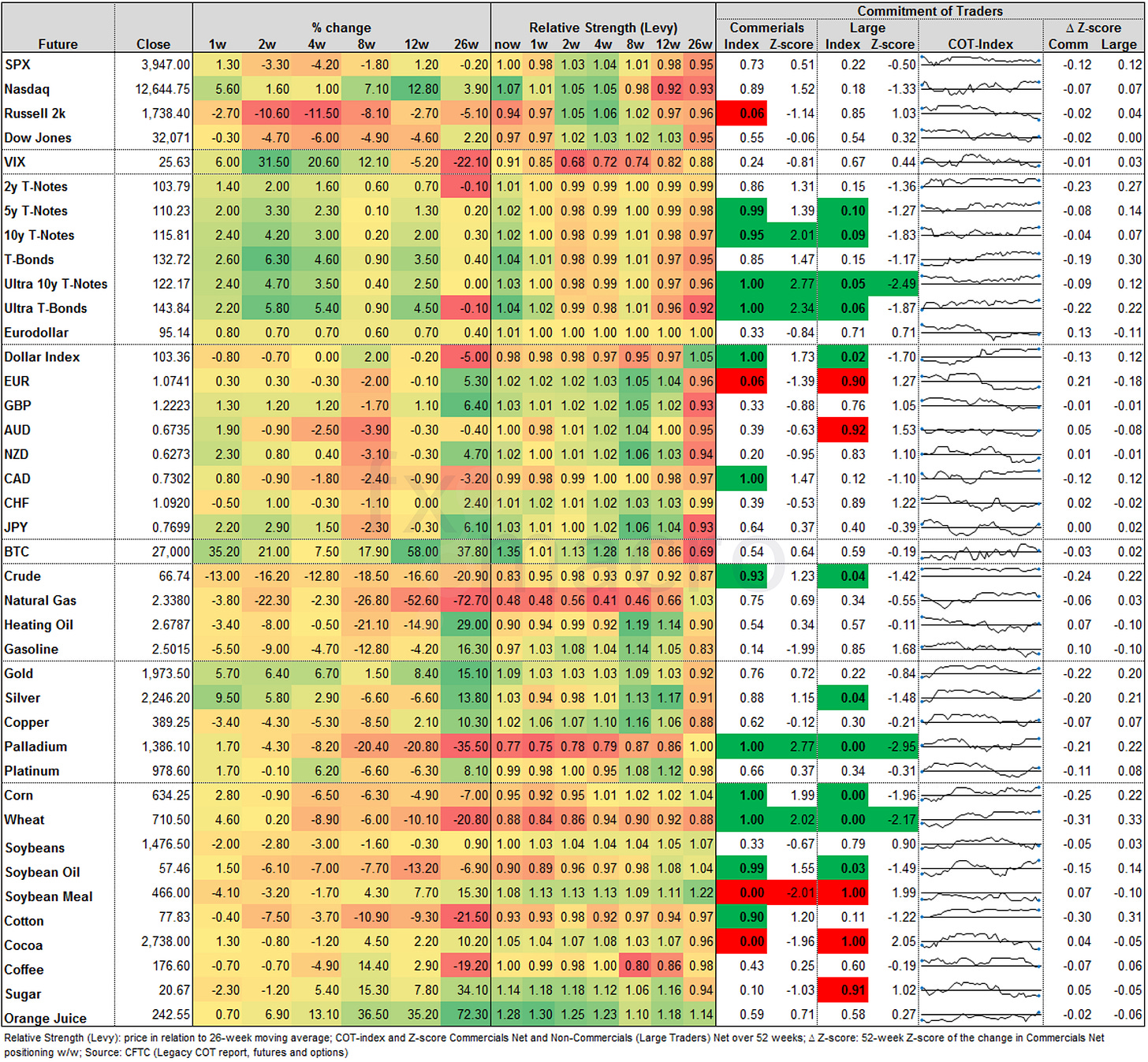

The CFTC has now released Commitment of Traders data that’s one week old, so I have updated the table below:

Equity futures were mixed with NQ being the outperformer by far and RTY trailing pretty far behind. Positioning isn’t at extreme levels except in RTY where the COT index is near a 52-week low, which isn’t bullish at all.

Treasury futures were all positive this week. Positioning is bullish for most of them with Commercials net positions at/near 52-week extreme highs and Large Traders at/near 52-week lows.

Currency futures were mixed. Positioning is remarkably unchanged since we last had good data to look at in January: in DXY it is bullish, in 6E it’s bearish and in 6C it’s still rather bullish.

Energy futures had another bad week with CL down 13% and an RSL of just 0.83, NG is unable to catch a break either. Positioning in CL is bullish as it has been for the most part of recent months.

Metals had GC and SI performing well but HG down again. Positioning is bullish in PA.

COT/TFF dealer net positions for currency futures:

6E positions are at multi-year low

6C positions are at a three-year high

Citi PAIN indexes show a pretty steep flight back into the USD:

Here's the combined COT/PAIN chart:

Market Risks

Credit spreads have widened and with a pretty high rate of change. Spreads in IG have shown some movement for the first time in months:

The Credit Spread Index has moved higher as well:

Currency volatility is relatively low and it hasn't moved much higher over the last two weeks despite the recent market turmoils:

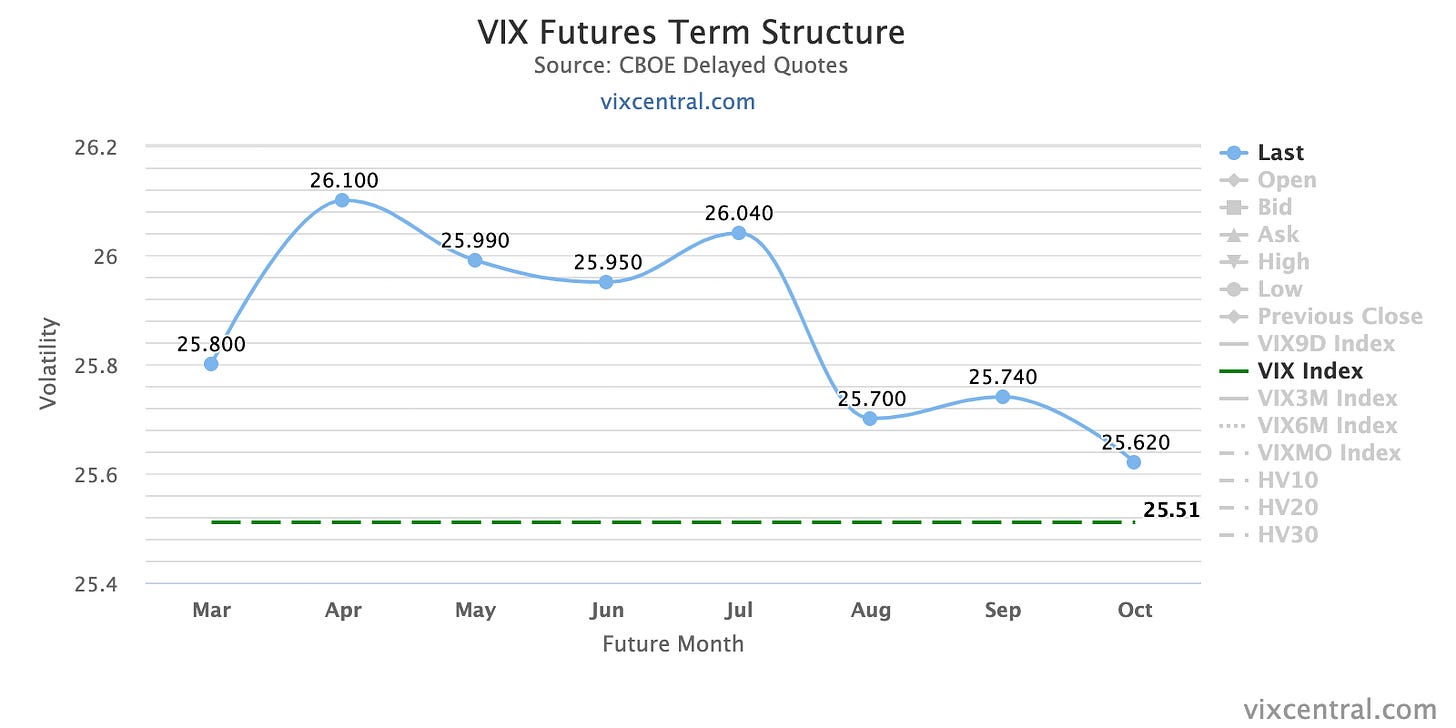

The VIX term structure is flat with an amplitude of just 0.5 points between its highest and lowest points, and spot VIX is below the entire curve. It's not looking pretty but far from what it would look like in a panic.

Volatility indexes have moved quite a bit recently:

VIX is at 25.50, so not overly high

VVIX closed at 125, which is high but not at extreme levels that would indicate exhaustion

MOVE almost reached 200 this week and closed at 180: definitely a worrying sign

VIX/VIX3M is still below 1, so 30-day volatility is still below 3-month vol

Skew has steepened sharply with VIX/VOLI, SDEX and TDEX all higher, and while the rate of change has been stark, absolute levels of skew are still nowhere near they used to be one year ago: people haven't hedged for a while and they realize it would be a good idea

CNN's Fear & Greed Index is in Extreme Fear territory:

Various

The NYSE Advance/Decline Line isn't doing anything out of the ordinary:

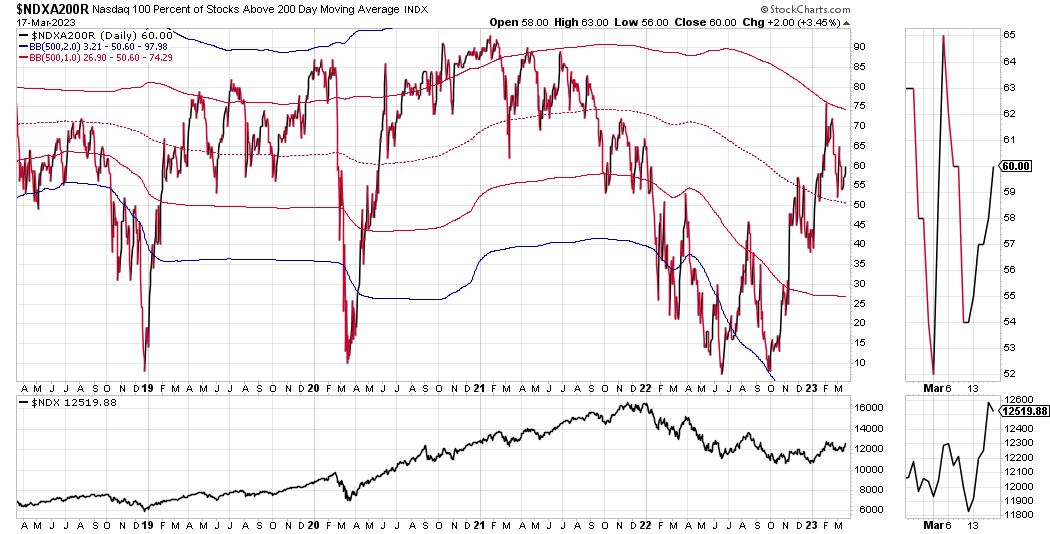

S&P 500 stocks above their 200-day moving averages dropped sharply over the last two weeks. The metric for Nasdaq 100 is holding up pretty well in contrast:

The same is true for the shorter-term 50-day moving average metric for both indexes:

25-delta risk reversals: I'm not seeing anything useful here.

Finally, a look at the market dashboard:

The Nasdaq stands out in terms of the trend metrics

Distribution days are still too high

We've seen quite a few days with VIX reversals where VIX spiked during the day and closed significantly lower

No help yet from the Put/Call ratio or a spike in down volume

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 06/2023 | 50/2022 | 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 09/2023 | 02/2023 | 47/2022 | 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

ECB

Rate Statements: 06/2023 | 50/2022 | 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 10/2023 | 04/2023 | 47/2022 | 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 11/2023 | 05/2023 | 50/2022 | 43/2022 | 36/2022

BOE

Rate Statements: 06/2023 | 50/2022 | 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

RBA

Rate Statements: 11/2023 | 07/2023 | 50/2022 | 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 09/2023 | 51/2022 | 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 07/2023 | 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 09/2023 | 47/2022 | 41/2022 | 34/2022 Meeting Minutes: 07/2023 Crib Sheets: 40/2022

BOC

Rate Statements: 11/2023 | 05/2023 | 50/2022 | 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022

SNB

Rate Statements: 50/2022 | 44/2022 | 39/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

BOJ

Rate Statements: 11/2023 | 04/2023 | 51/2022 | 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 05/2023 | 52/2022 | 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: Midjourney with the prompt: navy man wearing abraham lincoln's hat sitting on a shark peeking through the ocean

Thanks. Awesome as usual.

Hey man thanks for sharing these are very helpful