Outlook for Week 05/2023

We've had the Bank of Canada and a lot of PMIs before next week's FOMC, ECB and BOE rate decisions...

Welcome to issue #41 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary. The final section contains the top three macro charts for the week and is brought to you by Daily Chartbook.

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

The cover image is AI-generated via DALL-E 2. If you want to guess the prompt, I put it at the end of the newsletter.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

One more thing. You seem to like newsletters, so here's a great way to discover new stuff to read for free: The Sample. They will regularly send you an issue of a different semi-random newsletter you might be interested in. If you sign up using my referral link, I get bonus points and my newsletter will be forwarded to others to check out.

Before diving in, I’d like to give a shout-out to The Morning Hark !

TMH is a great way to stay on top of what’s going on in markets. If you like fx:macro, you will love TMH, so check it out and subscribe!

Table of Contents

Summary (Playbook, Calendar, Levels, FX Drivers, Downloads)

Week in Review: a) Central Banks, b) Economic Data

Market Analysis: a) Growth and Inflation, b) Yields, c) Central Banks and the US Dollar, d) Sectors and Flows, e) Sentiment and Positioning, f) Market Risks, g) Various

Summary

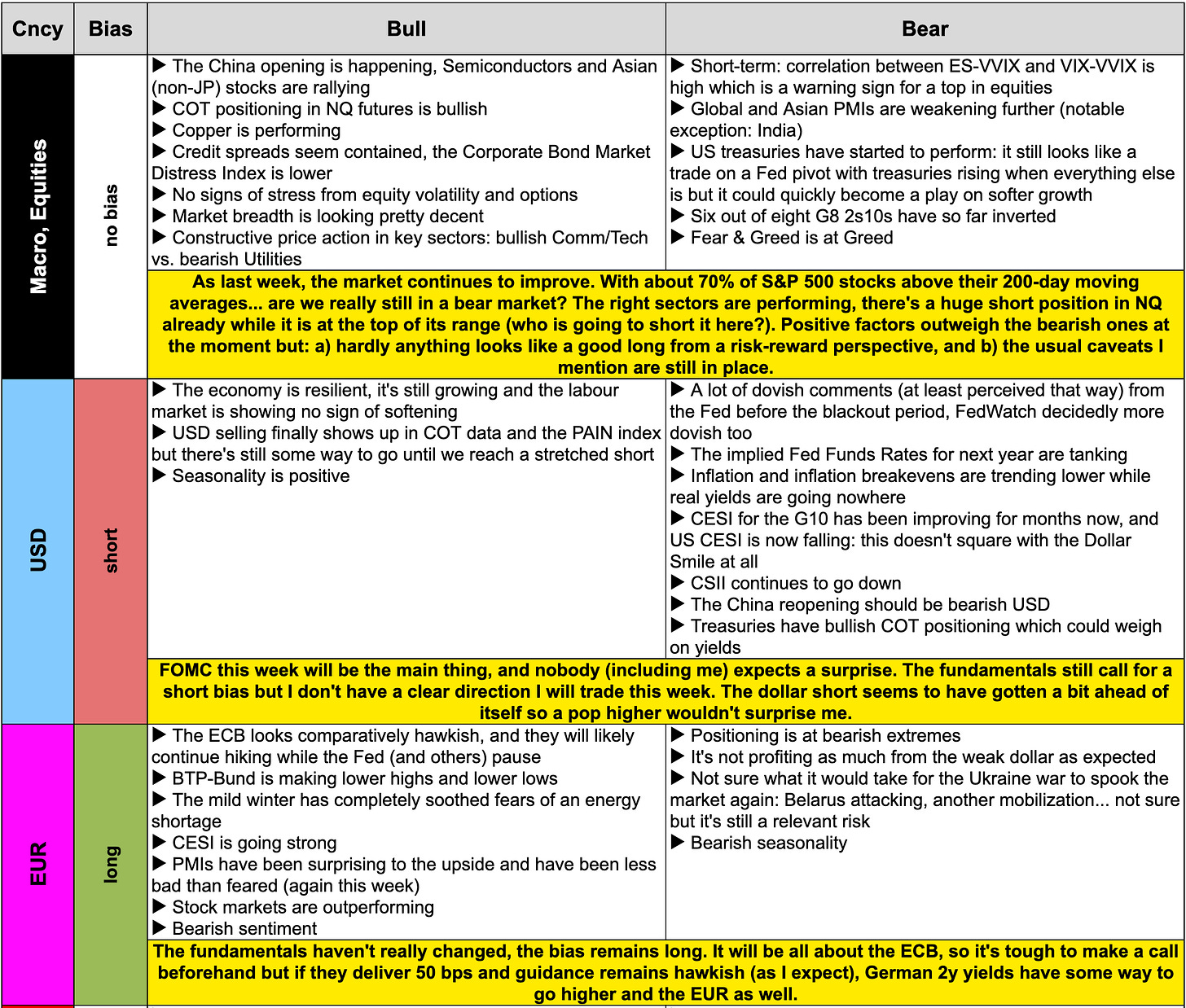

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

It feels like not much has changed, though…

Economic Calendar for next week

Important levels to watch and look out for in FX futures

Currency Drivers

For an explanation check out this link.

Downloads and Links

Difftext of the Summary from last week: link to diffchecker.com

Central bank speaker recap for the week:

Central bank crib sheets for the upcoming meeting (summarized comments from central bankers since their last meetings in preparation for next week):

Week in Review

Central Banks

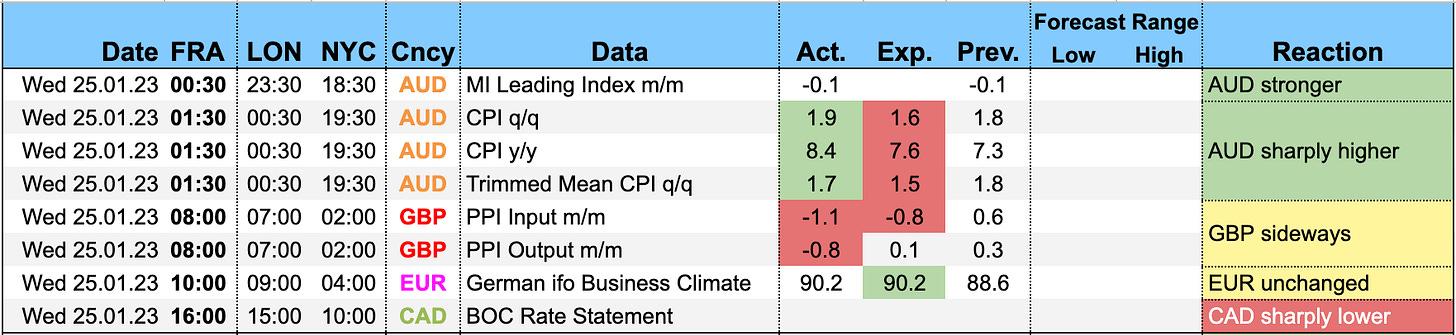

Bank of Canada Rate Decision (25.01.22)

The BOC hiked by 25 bps to 4.50% as expected. Summary and difftext below:

Guidance changed: the GC expects to “hold the policy rate at its current level while it assesses the impact of the cumulative interest rate increases” if the economy evolves broadly in line with the projections; left the door open to further hikes “if needed”

QT is left unchanged and complements the “restrictive stance of the policy rate”

Financial conditions remain restrictive but have eased since October

The Canadian economy is stronger than expected and remains in excess demand, labour markets are tight

Household spending and consumption growth are moderating, and housing market activity has declined substantially

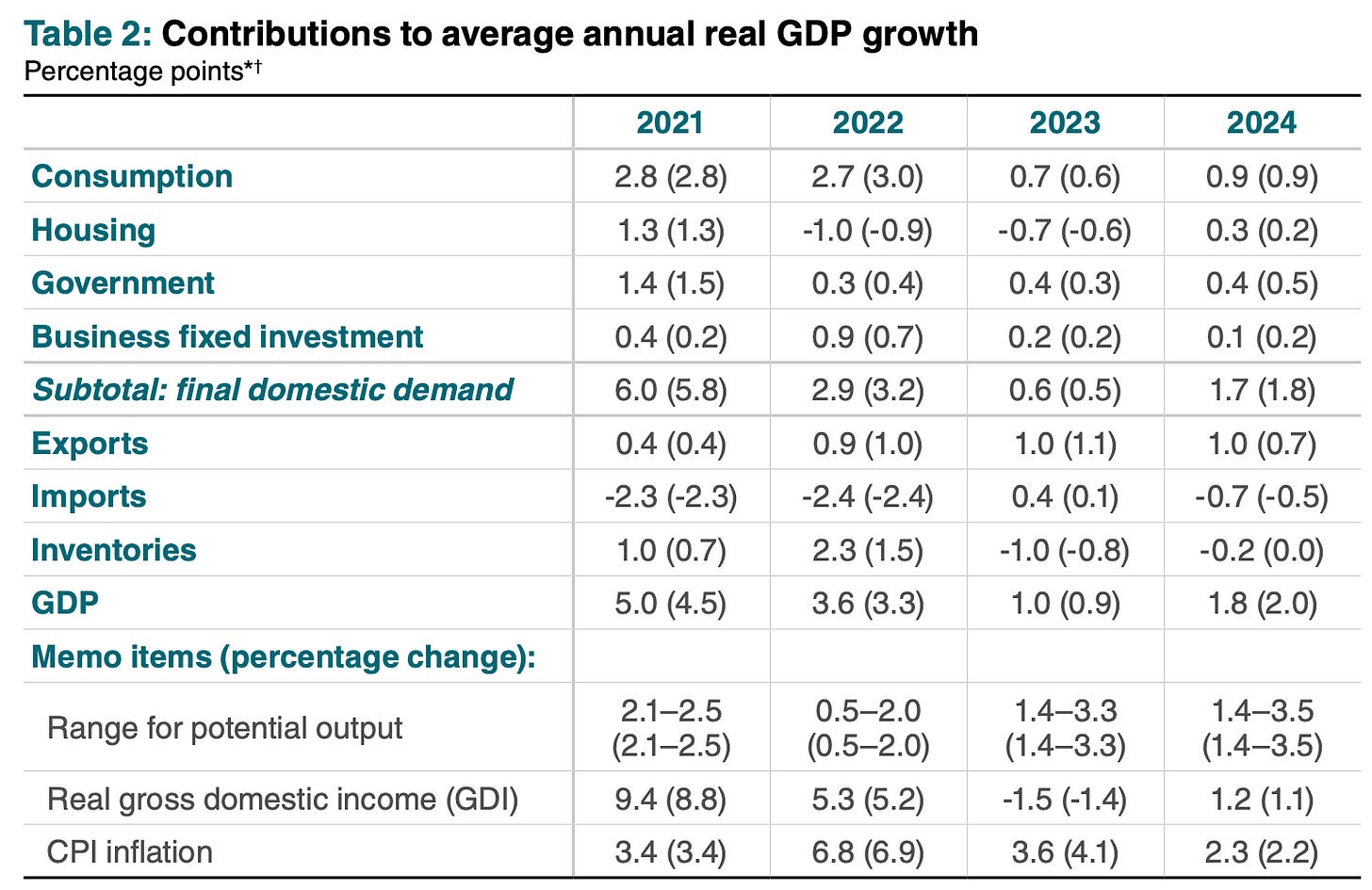

GDP projection: about 1% in 2023 and about 2% in 2024

Inflation has declined, core inflation has likely peaked, the projection is that CPI will come down significantly this year to around 3% and to the 2% target in 2024

Key data from the Monetary Policy Report:

BOJ Summary of Opinions (26.01.22)

On the economy and inflation:

A positive stance has been observed among firms toward raising wages, as well as toward passing on cost increases to selling prices. This may lead to a virtuous cycle between economic activity and prices through a boost to corporate profits.

The momentum for wage hikes has grown, and it is possible that a certain degree of base pay increases will be realized, especially among large firms. However, there have been cautious views among some firms on raising wages. Since it will take time for wages to see a sustained increase, there needs to be support from macroeconomic policy.

The year-on-year rate of increase in the consumer price index (CPI) is likely to be relatively high in the short run due to the effects of a pass-through to consumer prices of cost increases led by a rise in import prices. The rate of increase is then expected to decelerate toward the middle of fiscal 2023 due to a waning of these effects, as well as to the effects of pushing down energy prices from the government's economic measures.

The year-on-year rate of increase in the CPI is expected to fall below 2 percent from fiscal 2023, and at this point, there is still a long way to go to achieve the price stability target.

In order to achieve the price stability target of 2 percent, a shift to demand-pull inflation is necessary, and the inflation rate for general services warrants close monitoring.

On Monetary Policy:

The Bank needs to continue with the current yield curve control, considering the outlook that it will take time to achieve the price stability target of 2 percent in a sustainable and stable manner. It is important that the Bank carefully explain this point and continue with appropriate market operations.

The modification of the conduct of yield curve control decided at the previous MPM is a measure that is aimed solely at making monetary easing more sustainable through improvement in the functioning of financial markets.

It is necessary for the Bank to take some time to examine the effects that the modification of the conduct of yield curve control has on market functioning.

It may take some time for the market to calm down and for market functioning to recover. The Bank should carefully explain that it needs to continue with monetary easing, that its accommodative policy stance has not been changed, and that it will take time to achieve the price stability target of 2 percent in a sustainable and stable manner because wage increases have not yet become full-fledged.

It is expected that continuing with nimble conduct of market operations while making use of the Funds-Supplying Operations against Pooled Collateral will improve market functioning.

Confab, Speakers, News

European Central Bank

Rehn (Hawk). Weekend: Sees reasons for "significant" rate hikes before summer.

Knot (Hawk). Weekend: Expects to raise rates by 50 bps in February and March and more steps to follow in May and June, too early to tell if the ECB could slow down the pace of hikes by summer, we are still far away from a step down to 25 bps, at some point risks surrounding the inflation outlook will become more balanced.

Kazimir. Mon: We need to deliver two more 50 bps hikes, not certain how high rates should go or how long they should stay there, inflation easing is good news but not enough reason to slow the pace of hikes, core inflation trend is the most important for me.

Visco (Dove). Mon: Possible to reach 2% inflation without particularly negative consequences, Italy can deal with the impact of a gradual but necessary rate of policy tightening, German-Italian 10y spread at 180 bps still far higher than our estimates based on fundamentals, alarms about effects that further rate hikes could have on the Italian economy cannot be shared.

Stournas. Mon: Interest rate hikes must be more gradual.

Lagarde (Dove). Mon: We have made it clear that the ECB interest rates will still have to rise significantly at a steady pace, we will stay the course to ensure a timely return of inflation to our target, we must deliver on our goals.

Nagel (Hawk). Tue: We need to keep tightening to dampen price pressures. Wed: Interest rates need to rise further, would not be surprised if rates need to rise further after March, there's still a risk inflation could be higher than expected, the economy is proving to be more robust than we thought a few months ago.

Villeroy (Neutral). Tue: The ECB will probably reach peak rates by summer.

Panetta. Tue: We should not pre-commit beyond February, will assess policy in March based on new projections, can bring down inflation with well-calibrated and non-mechanical hikes, anxiously optimistic about inflation after recent good readings.

Simkus (Hawk): ECB should continue with 50 bps hikes unequivocally, no grounds to depart from path laid out in December, tightening may not finish before the summer, core inflation remains strong and demonstrates that the fight against inflation is not over.

Makhlouf. Wed: We need to continue to hike rates at our meeting next week, also need to increase rates in March, future policy decisions need to continue to be data-dependent, rates will have to rise significantly at a steady pace to reach levels sufficiently restrictive.

Vasle. Wed: 50 bps hikes at the next two meetings is appropriate and should be everyone's base case at this point, what happens after that is far less certain.

Bank of Canada

Macklem. Wed: This is a conditional pause and dependent on the economy developing as forecast, we are pausing to assess whether we've done enough, the full effect of rate hikes is yet to be felt, it is far too early to think about rate cuts, not even thinking about cutting rates, the bar is higher than it was last time for further rate hikes, risks to inflation are balanced, the economy didn't cool as much as expected in H2, we will act if evidence accumulates that inflation isn't coming down, this won't be based on one indicator, if service price inflation is stickier than expected we would likely need to raise further, biggest near-term risk to the Canadian economy would be if the rapid Chinese reopening caused global commodity and oil prices to rise.

Rogers. Wed: House prices have come down from extreme levels, the housing market is broadly evolving with our expectations, we do expect housing to come back but we think there's a little bit further to go for the housing market to come down.

Bank of Switzerland

Schlegel. Tue: Cannot rule out further interest rate rises at present, too early to sound the all clear for inflation in Switzerland, anticipates weak growth dynamic in the coming quarters.

Bank of Japan

Official. Wed: Citing Kuroda as their source: BOJ will resolutely stick to easy policy, aims to regain market functionality by tweaking yield curve control operations.

Kishida. Wed: Specific monetary policy tools are up to the BOJ to decide including yield curve control, negative rates and ETF purchases, decision on next BOJ governor will be made while watching future economic trends, premature to talk about a revision to the joint statement since the next BOJ governor has not been decided. Fri: Economy falling back to deflation cannot be ruled out, domestic demand-driven inflation remains weak, BOJ's December policy decision was an operational tweak to enhance monetary easing effects smoothly.

Kanda. Thu: Sharp one-sided currency moves as seen last year cannot be tolerated, there's no change to this thinking, the BOJ targets price stability and we target currency stability.

Economic Data

Monday, 23.01.23

Australian PMIs

“Australia’s economy has started 2023 on a softer footing than what we experienced through much of 2022. This welcome slowdown of economic activity is evident across both the manufacturing sector and service industries although the January Flash Services PMI has improved slightly from December.

"All the prices indicators across the services and manufacturing sector remain elevated in early 2023. Inflation is likely to have ‘peaked’ below 8% in the final quarter of 2022, but the PMI price measures suggest underlying inflation pressures will not dissipate quickly.

"The employment index in both the manufacturing and services surveys rose in January to be comfortably above the 50 level. This latest result suggests labour demand is not slowing quickly in response to a softening of economic activity. Strong labour demand and very tight labour markets across the Australian economy suggest that we will see further upward pressure on wage growth in 2023.

"Inflation pressures may abate somewhat but the risk for the RBA is that inflation remains stubbornly high well into 2023. This could maintain upward pressure on inflation expectations and wages growth. On this basis it seems premature for the RBA to pause the current tightening cycle.

"We expect the RBA to hike the cash rate by 25bp in each of February and March before an extended pause. Further rate hikes may be required later in 2023 if the economy and inflation prove more resilient than current consensus forecasts suggest."

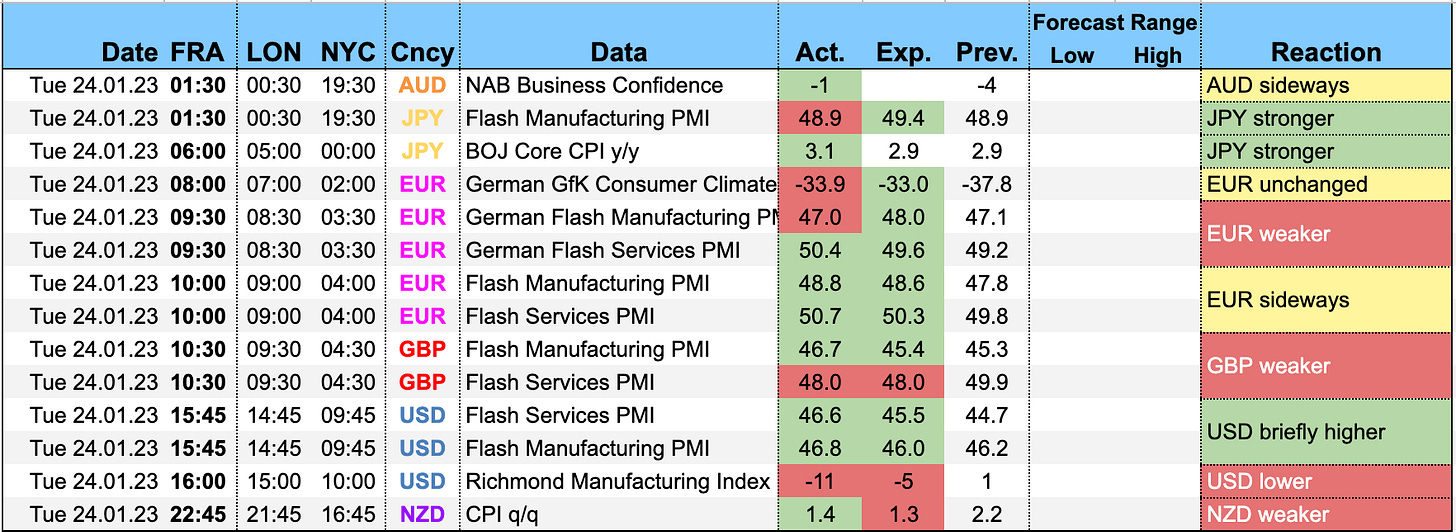

Tuesday, 24.01.23

German PMIs

“January’s flash PMI, which at 49.7 showed business activity in Germany on a more stable footing at the start of the year and was broadly in line with market consensus, lends support to the notion that a recession in the eurozone’s largest economy is by no means a foregone conclusion. There was even a return to growth in services activity after six straight months of decline, although the increase was only marginal and achieved on somewhat shaky foundations as inflows new business remained in decline.

“Alongside easing supply-chain strains, January’s preliminary survey also pointed to a continued slowdown in rates of inflation. However, whilst we’re seeing underlying cost pressures ease quite rapidly in manufacturing, it’s a different story in services where inflation remains far stickier thanks in large part to the influence of growing wage demands. The rate of increase in average prices charged for goods and services cooled only slightly and remained historically elevated in January, to suggest that core inflation is likely to continue running hot in the near term at least. Signs of continued labour market resilience will only serve to reinforce the stubbornness of inflation.

“Business confidence continues to recover from last October’s low point, but it nevertheless remains subdued compared to the situation prior to Russia’s invasion of Ukraine, particularly in manufacturing where we’re still seeing notable weakness in new orders and perhaps the beginning of a period of stock depletion as supply-chain concerns fade. Optimism has returned amid easing recession risks, but firms remain cautious about the outlook.”

Eurozone PMIs:

“A steadying of the eurozone economy at the start of the years adds to evidence that the region might escape recession. The survey suggests that a nadir was reached back in October, since when fears over the energy market in particular have been alleviated by falling prices, helped by the warmer than usual weather and generous government assistance. At the same time, supply chain stress has eased, benefitting producers most notably in Germany, and more recently the reopening of the Chinese economy has helped to restore confidence in the broader global economic outlook for 2023, propelling business optimism sharply higher.

“The region is by no means out of the woods yet, however, as demand continues to fall – merely dropping at a reduced rate – and an upturn in the rate of inflation of selling prices for both goods and services will add encouragement to the hawks to push for further monetary policy tightening. The case for higher interest rates is fuelled further by the upturn in employment growth recorded during the month and signs of higher wages driving the latest upturn in price pressures.

“A case for policy caution is supported by the survey merely indicating a stagnation of the eurozone economy, hinting that a renewed slide into contraction should not be ruled out as borrowing costs rise, but the survey undoubtedly brings welcome good news to suggest that any downturn is likely to be far less severe than previously feared and that a recession may well be avoided altogether.”

UK PMIs:

“January saw a second-rate level of performance from private sector business with the sharpest fall in output since January 2021, but some bright spots appeared on the horizon in terms of inflation and optimism to balance out the gloomy numbers.

“Manufacturing firms took another hammering and sank further into negative territory at 46.6, as the lower levels of interest in customer orders took their toll but it was the poor performance of services business that was the main drag. Slight improvements in the rate of inflation will only start to trickle down through the remainder of 2023 and though it was manufacturers that fared the best with the weakest rise for goods prices since October 2020, consumers and businesses won’t see wholesale improvements quickly.

“Though the country still teeters on the precipice of a recession, supply chain managers commented on improved times for raw material deliveries and optimism amongst private sector firms was the best for eight months signalling the downturn may not be as long and protracted as feared.”

US PMIs:

“The US economy has started 2023 on a disappointingly soft note, with business activity contracting sharply again in January. Although moderating compared to December, the rate of decline is among the steepest seen since the global financial crisis, reflecting falling activity across both manufacturing and services.

“Jobs growth has also cooled, with January seeing a far weaker increase in payroll numbers than evident throughout much of last year, reflecting a hesitancy to expand capacity in the face of uncertain trading conditions in the months ahead. Although the survey saw a moderation in the rate of order book losses and an encouraging upturn in business sentiment, the overall level of confidence remains subdued by historical standards. Companies cite concerns over the ongoing impact of high prices and rising interest rates, as well as lingering worries over supply and labor shortages.

“The worry is that, not only has the survey indicated a downturn in economic activity at the start of the year, but the rate of input cost inflation has accelerated into the new year, linked in part to upward wage pressures, which could encourage a further aggressive tightening of Fed policy despite rising recession risks.”

Wednesday, 25.01.23

Thursday, 26.01.23

Friday, 27.01.23

Market Analysis

Growth and Inflation

The chart for the Atlanta Fed GDPNow has not been updated to show Q1 yet but the initial estimate is 0.7%.

The NY Fed Weekly Economic Index decreased to 0.71:

The Atlanta Fed yield-curve-predicted GDP growth model signals a further decline in growth in the coming months and a recession probability north of 60%:

Citi Economic Surprise Indexes:

USD sideways-to-lower

EUR still going higher

GBP, AUD, JPY trending sideways

NZD has rolled over

CAD is weakening

There are only a few updates on the Bloomberg PMI heatmap, and all of them show no change:

Breakeven inflation rates and 5y5y forward inflation expectations have ticked up this week. The market is talking about immaculate disinflation but it’s not showing up here:

RINF also bounced off the bottom of its range:

Citi Inflation Surprise Indexes have not updated and remain unchanged:

USD, EUR, CHF all heading lower

GBP looks like it has topped out

AUD sideways

CAD picked up again

JPY has turned lower

Notably, we have seen inflation surprises, especially in Asia over the last few weeks: New Zealand, Australia, Japan.

Yields

See chart and table below:

Japanese yields look strongest

Kiwi, Swiss and Canadian 2y and 10y yields are more or less flat

Everything else looks similarly and weaker

A quick look at yield curves at the 2s10s spread: nothing brand new going on here.

Central Banks and the US Dollar

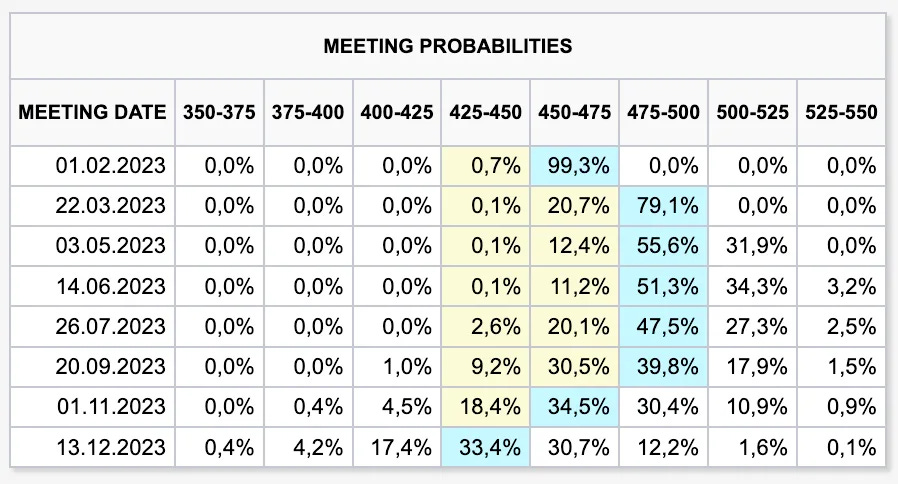

FOMC meeting probabilities according to FedWatch are virtually unchanged before the FOMC statement next week:

A 25 bps hike is priced in with a 98% probability

The March meeting is expected to deliver another 25 bps hike for a terminal rate of 4.75-5.00%

The first rate cut is seen in November

The market-implied Fed Funds rate hasn't moved much over the last few days. The market is still pricing in a steeply declining FFR with about one 25 bps cut per month starting in 2024:

Sectors and Flows

Currency strength:

AUD strength is back over short and medium time frames

NZD is considerably weaker but remains ahead over three months

USD shows no sign of getting back on track while CAD has shown some strength recently

EUR remains somewhere in the middle, and it's not gaining from the dollar weakness

GBP… it feels as if it's outperforming all the time but it's somewhere in the middle of the pack

Equity sector performance:

SMH (Semiconductors), XME and XLB (Metals, Mining, Basic Materials) are the outperformers

XOP (Oil/Gas Exploration), XLV (Healthcare), XLP (Staples) are the underperformers

Noteworthy is the divergence between OIH +7.9%, XOP -7.2% and XLE +1.8%

Sector breadth is virtually unchanged. Tech, Consumer Discretionary, and Communications are the clear drivers of the recent rally. Defensives like Utilities and Healthcare have been underperforming even on a 52-week horizon:

A different look at sector performance that shows a clearly reflationary short-term picture:

Sector charts:

The rally in XLC is relentless

XLK is lagging XLC

XLI, XLB, XLE and XLF are glued to the upper edge of the chart

XLP has broken lower and is re-testing its breakout level, XLU looks similar

This does look pretty impressive overall.

International stock market indexes:

Hang Seng outperforming massively

European indexes (and Taiwan) follow a fair bit behind

Japan, India and Brazil are the underperformers

Sentiment and Positioning

AAII Bull-Bear spread is virtually unchanged from the previous week, and it’s near the top of its 1-year range: there’s euphoria but it’s still relatively contained.

Currency sentiment: only the CHF and EUR have bearish sentiment.

A different sentiment source:

USDCHF remains the currency pair with the most bullish sentiment

All JPY pairs are bullish on the yen

Commitment of Traders and futures performance:

Equity futures put in a good week with the NQ up 4.70%. The NQ is still the only index with bullish positioning, and that even increased last week.

Treasury futures were mostly down this week. Positioning is still a lot more bullish than bearish.

Currencies were mixed vs. the dollar. The extremes in positioning remain virtually unchanged: long DXY and 6C, short 6E and 6J.

Energy futures are all down for the week with NG continuing to tank, it's RSL at just 0.43, i.e. it's 57% below its 26-week moving average. Positioning in NG has been pared back a bit but remains bullish overall.

Metals also were mixed-to-down, Relative Strength metrics solidly above 1, except for Palladium. Positioning is completely uninteresting at this point.

Grains and softs were mostly higher this week. Positioning remains bullish in Wheat, Cotton and Coffee.

COT/TFF dealer net positioning for currency futures:

The USD short is still ploughing ahead, and there's still room for it to go further

EUR is at a 2-year short extreme

CAD is at a 2-year long extreme

Citi PAIN indexes: the dollar long is finally getting pared back, and the market is getting into AUD, CAD, NZD and JPY:

Market Risks

Credit spreads remain anaemic as ever:

The NY Fed Corporate Bond Market Distress Index shows no sign of stress in credit markets:

Currency volatility:

The VIX term structure is in a decently steep contango:

Volatility indexes:

VIX is at 18.50 and thus below the 20 level that has been a floor all through 2022

MOVE is at 101, also at a relative low

Skew measures continue to steepen. As I've written before, I do believe this is a warning sign because volatility is cheap and people will use it to buy cheap OTM puts

The Market Dashboard shows that trend metrics are solidly bullish while distribution days prove to be a bit more sticky. We've had a warning signal from the correlation between ES and VVIX last week, and this has flashed again on Friday. Also, the correlation between VIX and VVIX has been abnormally low, which is also a warning sign.

The following chart shows the ES/VVIX correlation signals that occurred over the months:

CNN Fear & Greed index has moved further up into greed territory:

Various

The NYSE Advance/Decline Line continues its way to the moon:

The percentage of index components above their 200-day moving averages is going higher as well:

The same is true for the shorter-term 50-day moving average metric:

50-day risk reversals:

USDCAD is priced lower

USDJPY is priced higher

EURUSD and AUDUSD both look like options pricing isn't keeping up with price

Seasonality… new month, new seasonals:

EUR, CHF and JPY negative

DXY positive

Top 3 Macro Charts of the Week

This section is brought to you by Daily Chartbook.

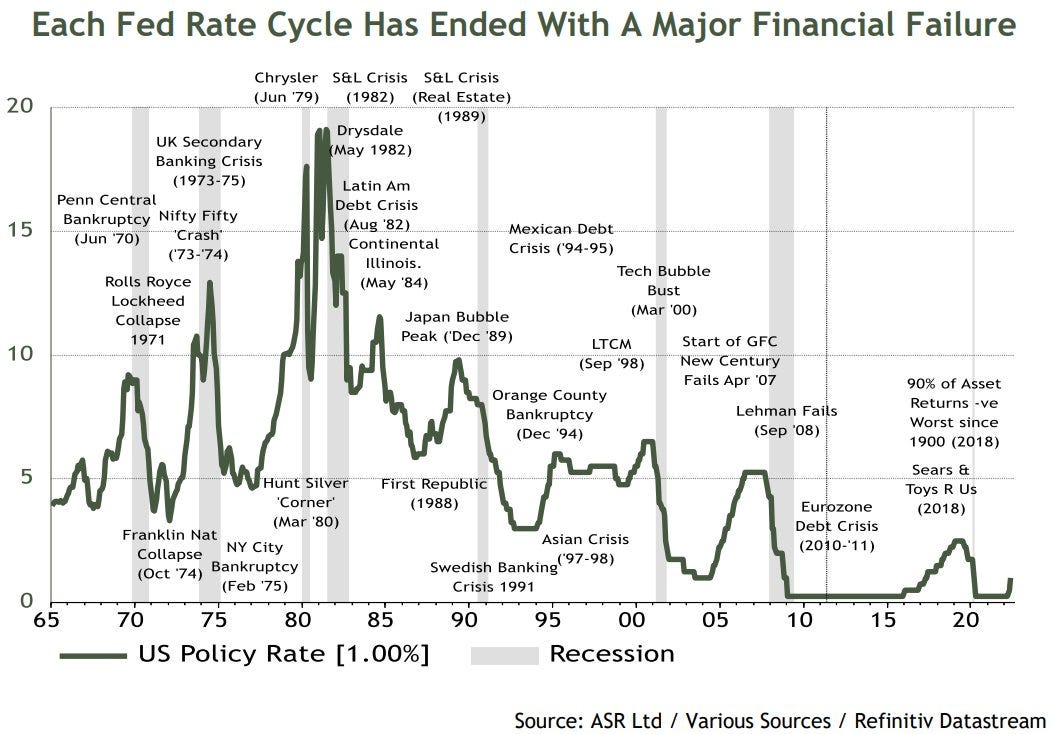

1. End of cycle. "Historically, we've had a major financial failure or a credit event towards the end of a Fed rate cycle".

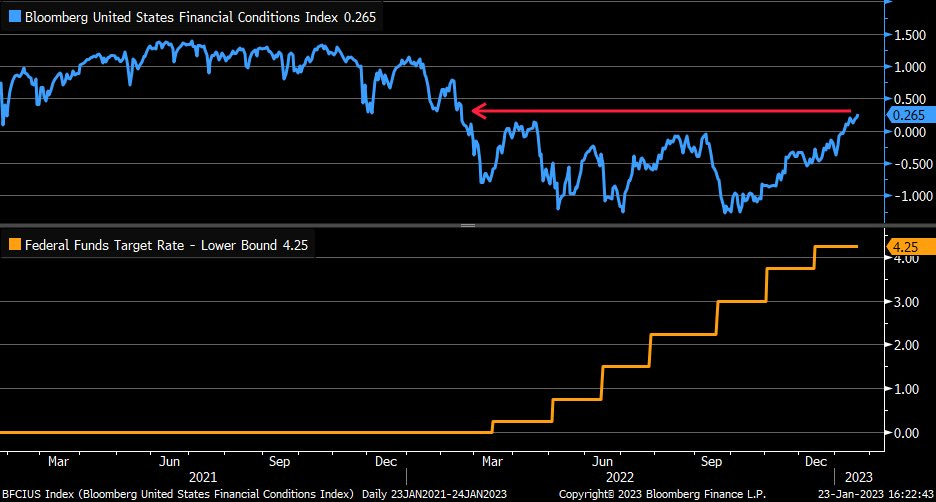

2. Financial conditions (I). "Index has risen (eased) back to where it was in February 2022, when fed funds rate was at 0%".

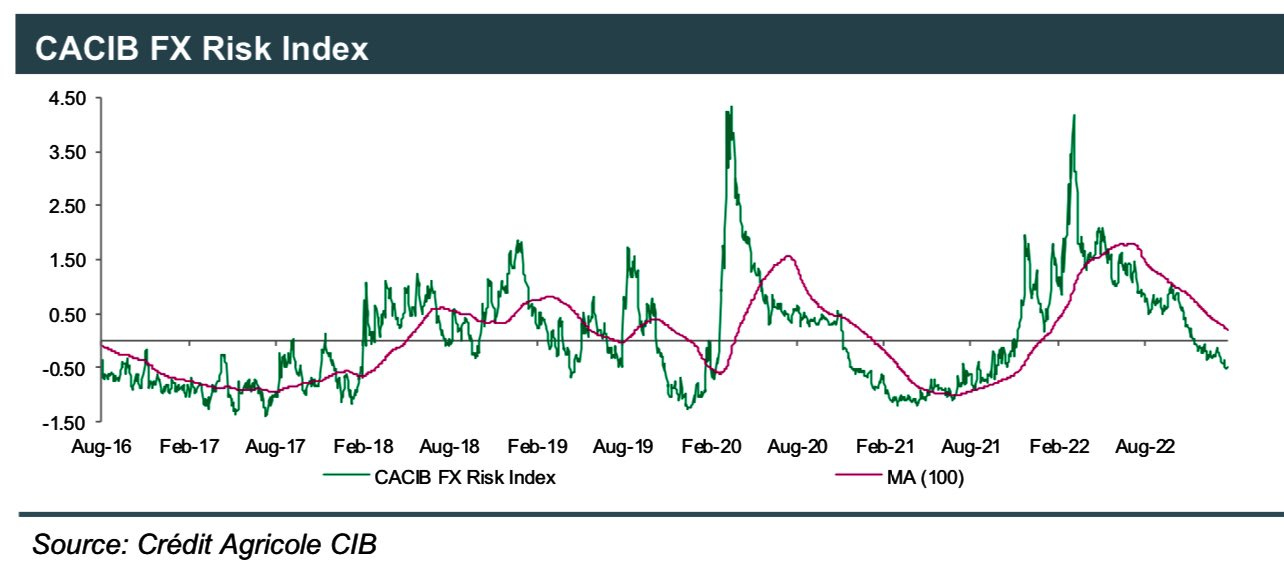

3. Risk index. "At -0.50 (vs -0.47 last week) our Risk Index shows that investors are becoming ever more optimistic. The trend in the Index remains lower. Investors are the most optimistic they have been in nearly 18 months".

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 50/2022 | 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 02/2023 | 47/2022 | 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

ECB

Rate Statements: 50/2022 | 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 04/2023 | 47/2022 | 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 50/2022 | 43/2022 | 36/2022

BOE

Rate Statements: 50/2022 | 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 50/2022 | 37/2022

RBA

Rate Statements: 50/2022 | 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 51/2022 | 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 47/2022 | 41/2022 | 34/2022 Crib Sheets: 40/2022

BOC

Rate Statements: 50/2022 | 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022

SNB

Rate Statements: 50/2022 | 44/2022 | 39/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

BOJ

Rate Statements: 04/2023 | 51/2022 | 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 52/2022 | 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: DALL-E 2 “What does it look like when things aren't changing much?”

The content is simply amazing! The best central bank activity summary you can find out there and it is FREE! Reading through the content you can quickly realize how much effort FX is putting into it.

Keep up the good work! I love it!

Awesome content! Very thorough and detailed breakdown of macro drivers.

For next week's FOMC meeting, all the talk is around rate policy and pivots. But do you think the Fed could use action/comments on the balance sheet and QT to try and tighten financial conditions? Powell has specifically called out loosening financial conditions, and I imagine they do want to pause rate hikes to assess the impact to the economy.

So maybe there is a more direct link to impacting the financial markets/conditions via balance sheet discussion, and how that might impact fixed income and equities.

Curious to know your thoughts. Thanks again!