Review of Week 52/2022

A pretty quiet week

Happy New Year everyone!

I'm very grateful for your support and wish you a happy, healthy and successful 2023!

Welcome to issue #37 of fx:macro!

As there hasn't been going on much during the last two weeks, this edition is also just the Review part. The next regular issue with the full macro analysis will be out on the coming weekend.

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Before diving in, I’d like to shout out to The Morning Hark!

The Morning Hark is a great way to stay on top of what’s going on in markets. If you like fx:macro, you will love The Morning Hark so check it out!

Table of Contents

Summary (Playbook, Calendar, Levels, Downloads)Week in Review

Central Banks

Economic Data

Market AnalysisGrowth and InflationYieldsCentral BanksSectors and FlowsSentiment and PositioningMarket RisksVarious

Top 3 Macro Charts of the Week

Week in Review

Central Banks

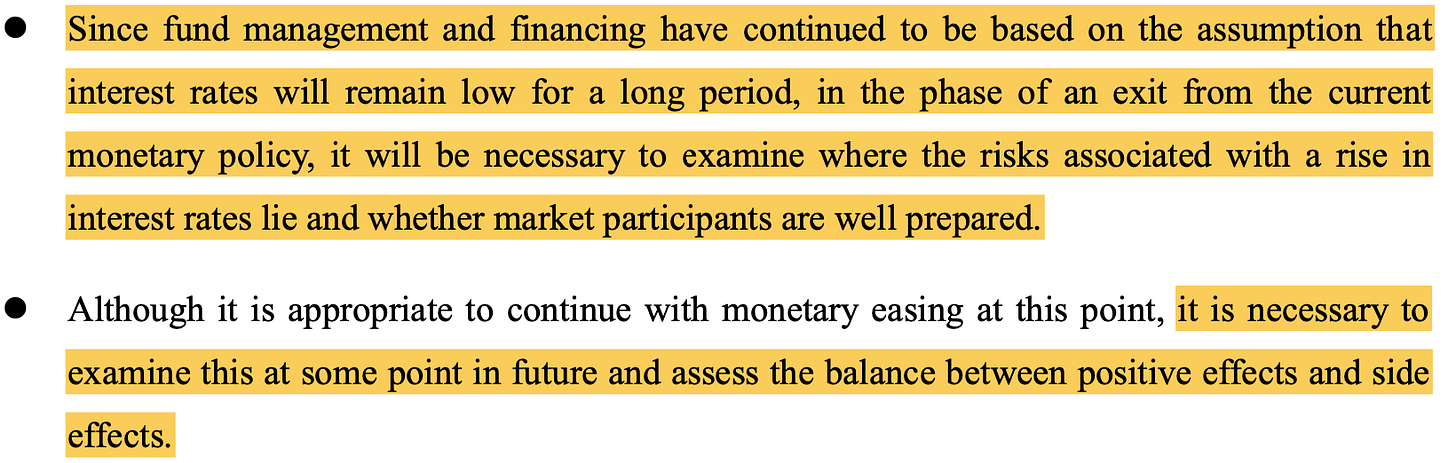

BOJ Summary of Opinions (28.12.22)

Here are the highlights from the Summary of the last policy meeting:

Confab, Speakers, News

European Central Bank

Schnabel (Neutral). Sat: ECB must be prepared to take the heat and raise rates further including by more than the market expects, whether we still need to go higher will depend on the inflation outlook, focus is on medium-term inflation expectations rather than current readings, sees little risk of raising rates too far given real interest rates are still very low.

Knot (Hawk). Mon: The risk of us doing too little is still the bigger risk we are just at the beginning of the second half of the hiking cycle, the ECB will achieve quite a decent pace of tightening through half-percentage point hikes before a peak by the summer.

Bank of Japan

Kuroda. Mon: Must continue to support the economy with monetary easing, yield band has widened but we will continue with easy monetary policy, 2% inflation target has not yet been achieved sustainably accompanied by wage growth, the BOJ must scrutinize whether changes in corporate price-setting behaviour as seen recently becomes the new norm in Japan.

Kishida. Mon: It is premature to state now whether the joint statement will be revised, it is something for after the new BOJ governor has been decided.

Nakao (ex-MOF). Tue: The BOJ should alter the current easing policy framework as side effects mount, latest BOJ moves have been good and are seen as an effort to reduce burden on the next governor in unwinding monetary stimulus, 2% inflation target may be making monetary policy inflexible.

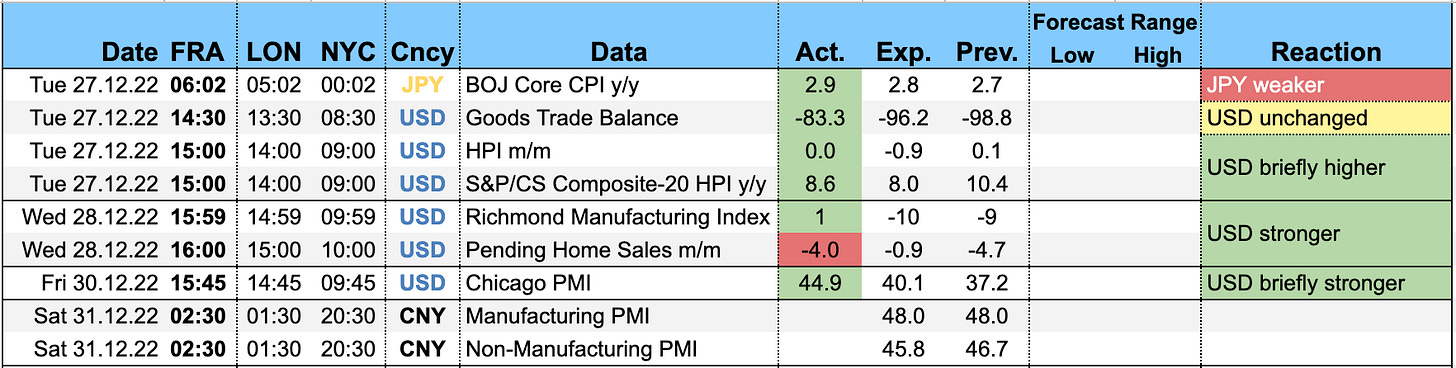

Economic Data

Monday, 26.12.22

Tuesday, 27.12.22

Wednesday, 28.12.22

Thursday, 29.12.22

Friday, 30.12.22

Top 3 Macro Charts of the Week

This section is brought to you by Daily Chartbook:

1. Equal- vs. cap-weighted. "It's unusual to see the equal-weighted S&P 500 index outperform the cap-weighted version for an extended period like it is now. The only similar analog is the Dotcom bust".

2. Volatility vs. strength. "Going back 5+ decades, few years have seen as many 1% daily swings as we have had in 2022 & none have seen fewer days with new highs > new lows. 2008 & 1974 were the most similar".

3. Buying conditions. "Buying conditions improved very marginally but home-buying attitudes remain near multi-decade record lows".

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 50/2022 | 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 47/2022 | 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

ECB

Rate Statements: 50/2022 | 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 47/2022 | 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 50/2022 | 43/2022 | 36/2022

BOE

Rate Statements: 50/2022 | 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 50/2022 | 37/2022

RBA

Rate Statements: 50/2022 | 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 47/2022 | 41/2022 | 34/2022 Crib Sheets: 40/2022

BOC

Rate Statements: 50/2022 | 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022

SNB

Rate Statements: 50/2022 | 44/2022 | 39/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

BOJ

Rate Statements: 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo credit: DALL-E 2 “End of year fireworks”