Outlook for Week 04/2023

Hawkish ECB Minutes, the BOJ disappointing expectations, and the Bank of Canada next week...

Welcome to issue #40 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary. The final section contains the top three macro charts for the week and is brought to you by Daily Chartbook.

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

The cover image is AI-generated via DALL-E 2. If you want to guess the prompt, I put it at the end of the newsletter.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Before diving in, I’d like to give a shout-out to

TMH is a great way to stay on top of what’s going on in markets. If you like fx:macro, you will love TMH, so check it out and subscribe!

Table of Contents

Summary (Playbook, Calendar, Levels, FX Drivers, Downloads)

Week in Review: a) Central Banks, b) Economic Data

Market Analysis: a) Growth and Inflation, b) Yields, c) Central Banks and the US Dollar, d) Sectors and Flows, e) Sentiment and Positioning, f) Market Risks, g) Various

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Economic Calendar for next week

Important levels to watch and look out for in FX futures

Currency Drivers

For an explanation check out this link.

Downloads and Links

Difftext of the Summary from last week: link

Central bank speaker recap for the week:

Week in Review

Central Banks

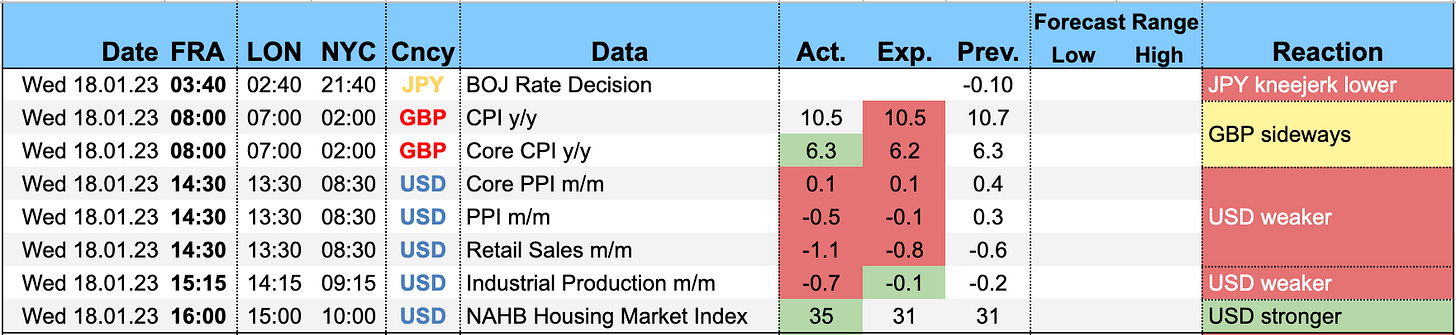

BOJ Rate Decision (18.01.22)

Here's the summary and difftext below:

No change to the -0.1% policy rate

Yield Curve Control and the ±0.5% band on the 10-year yield remain unchanged

Extended their Fund-Provisioning Measure to Stimulate Bank Lending

No change to forward guidance

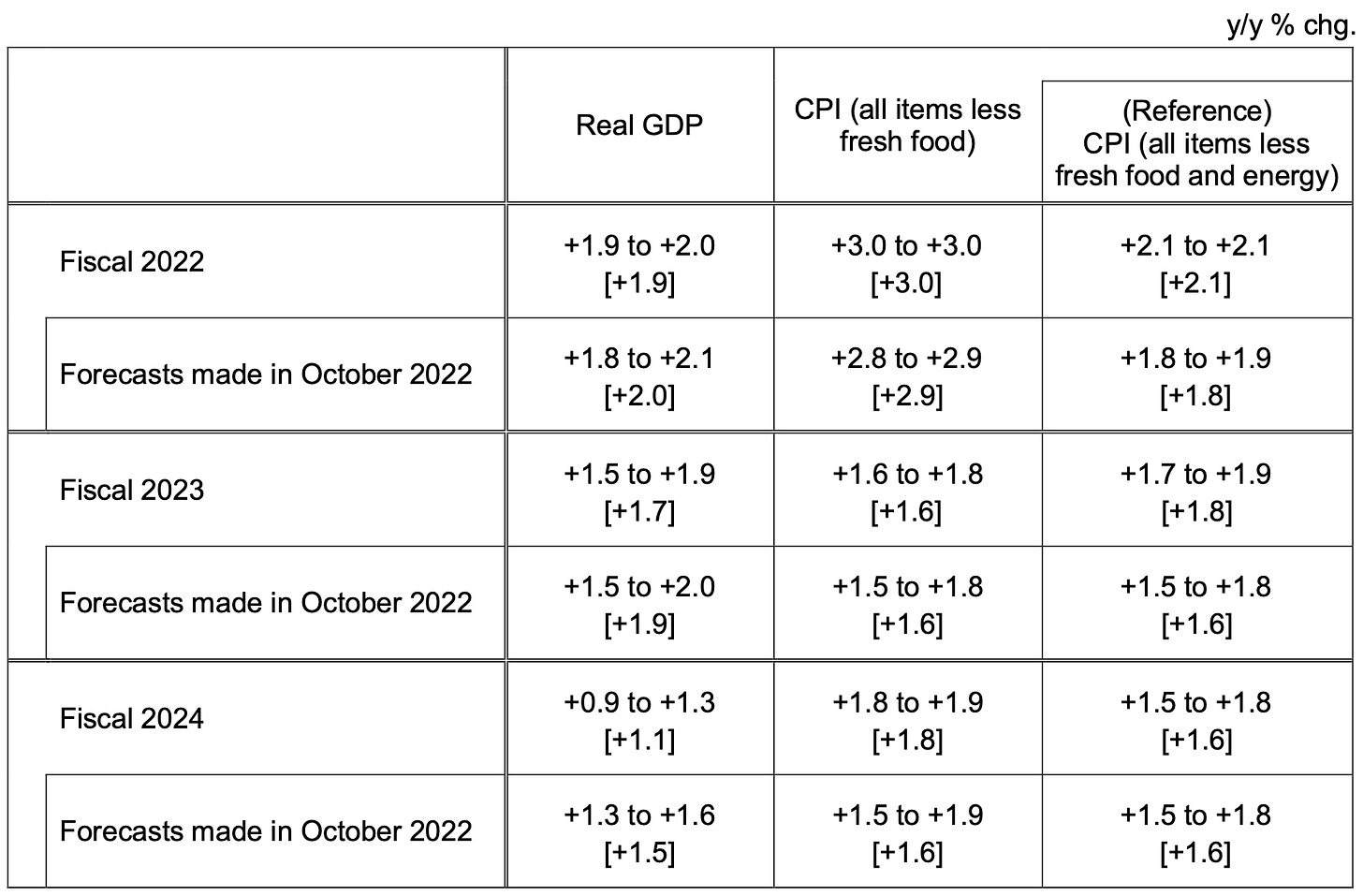

And here are the projections from the Outlook for Economic Activity and Prices:

GDP for 2023 was downgraded from 1.9% in October to 1.7%

GDP for 2024 was downgraded from 1.5% to 1.1%

CPI ex fresh food was unchanged for 2023 and upped from 1.6% to 1.8%

CPI ex fresh food and energy was upped from 1.6% to 1.8% this year and left unchanged next year

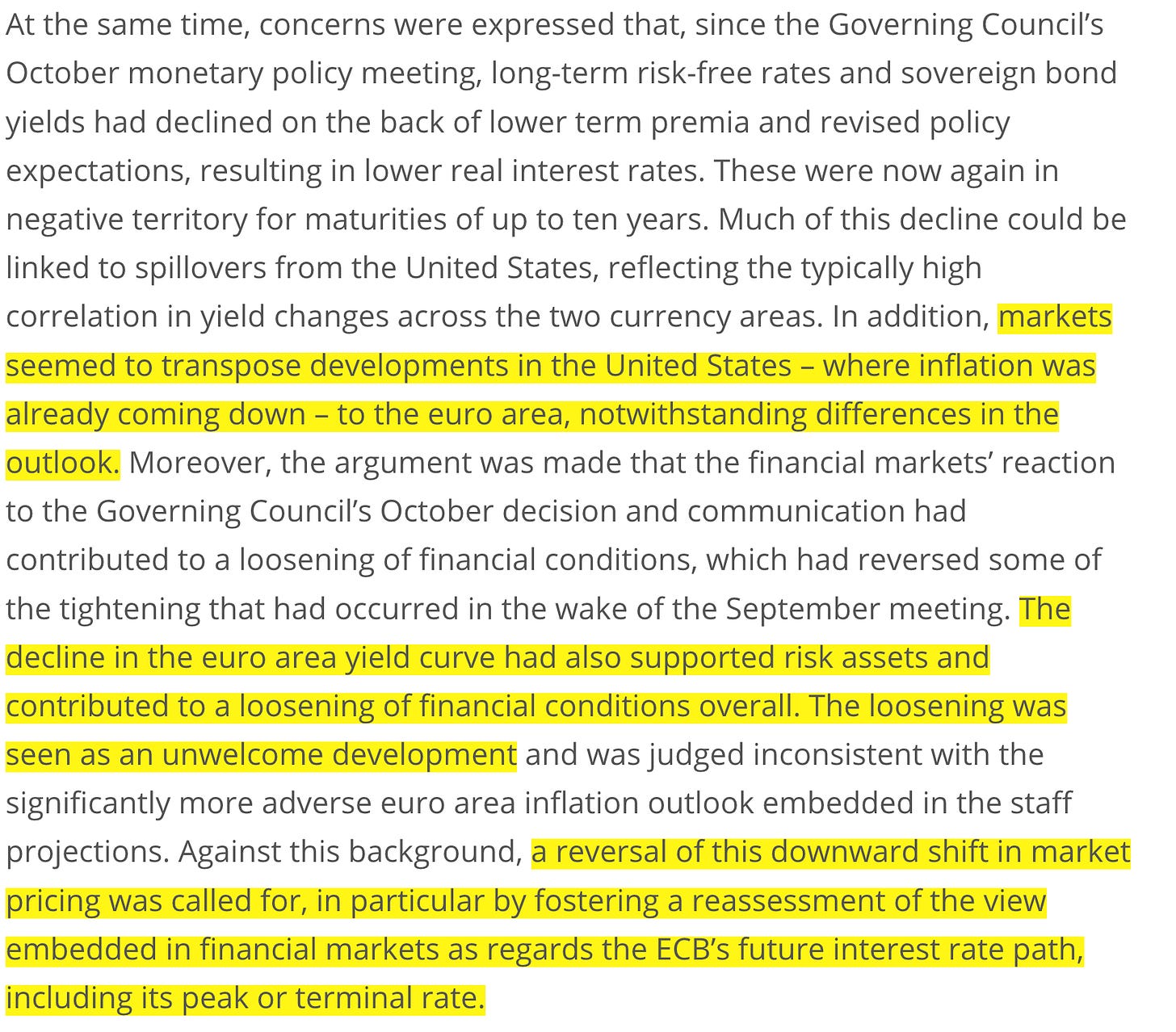

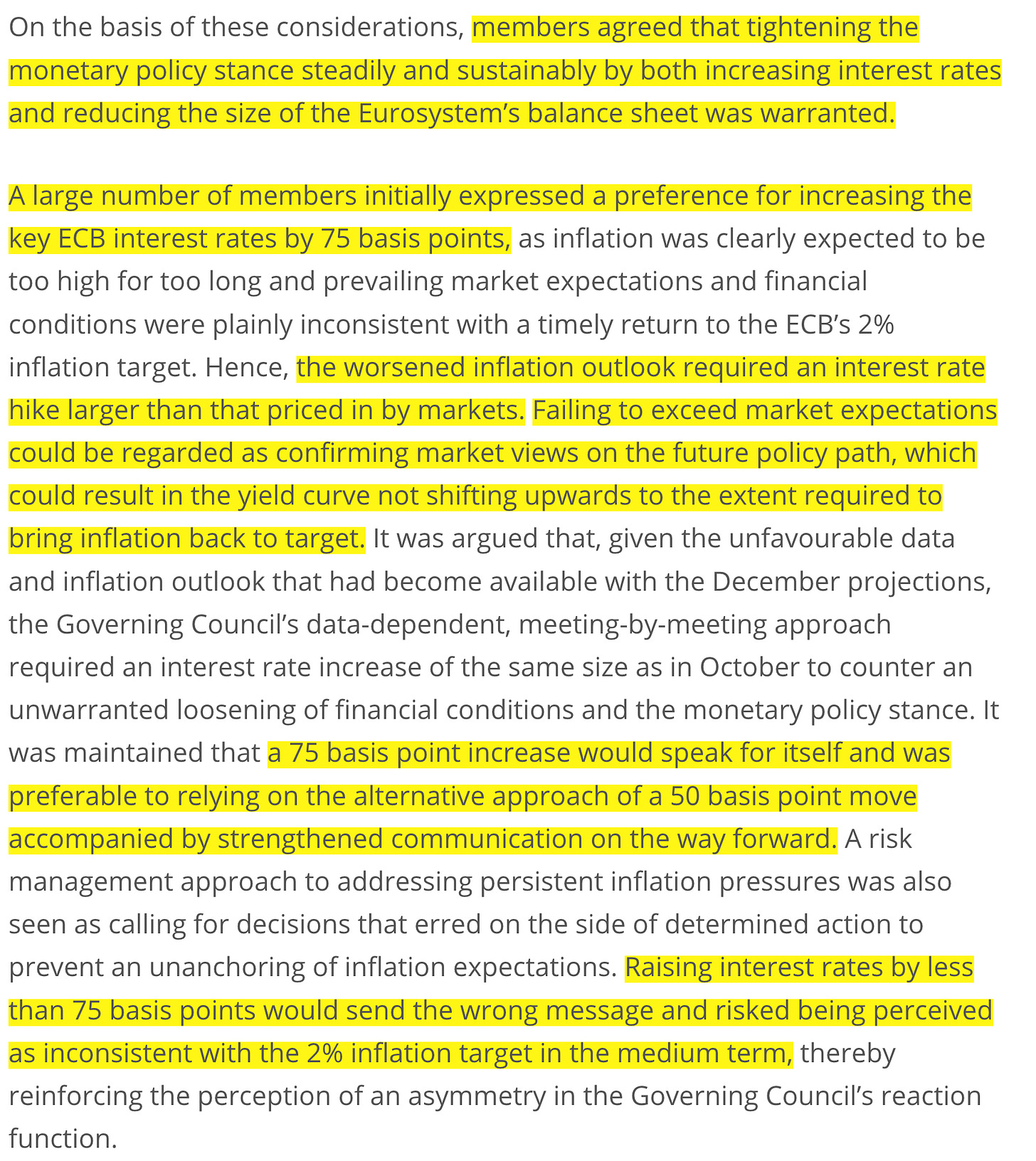

ECB Minutes (19.01.22)

The Minutes were a pretty hawkish read. The entire document is definitely worth going through. Here are some highlights, mostly from the section on monetary policy:

Confab, Speakers, News

Federal Reserve

Barkin (Neutral). Tue: Terminal rate will depend on the path of inflation, we want to see inflation "convincingly back to target", inflation news was very encouraging over the last three months.

Bullard (Hawk). Wed: Current policy "not quite" restrictive, needs to be over 5% at least, 50 bps at the next meeting is appropriate, wants to err on the tighter side to allow disinflationary process to take hold, the Fed wants to "guarantee" inflation will be on a steady path back to target, easing recession risk in Europe and China reopening could fuel inflation.

Mester (Hawk). Wed: Rates should be a "little bit" above 5.00-5.25%, we need to keep going and we'll discuss at the next meeting how much to do, would need to see inflation moving down faster before supporting a pause, we have to continue raising and then hold for a while, good signs that things are moving in the right direction.

George (Neutral). Wed: Fed must restore price stability and that means 2% inflation. Fri: Encouraging to see inflation coming down, have to be a little more patient in assessing if it is on a sustainable path, we continue to see service sector inflation, need to see more progress on that to have more confidence.

Harker (Neutral). Wed: Reiterates support for moving to 25 bps hikes, FFR neds to get above 5%, the time for supercharging rate hikes is over, expects Fed to raise rates "a few more times" this year, policy is nearing "end game" and does not need to be set at very restrictive levels, will take a while before the Fed eases rates, expects inflation to moderate to 3.5% this year, inflation will fall back to target in 2025. Fri: It is time to shift to 25 bps hikes, sees rates going towards 5%, how high rates go will be shaped by inflation.

Logan (Neutral). Thu: Supports slowing the pace of rate hikes at the upcoming meeting, not helpful to lock in peak rate or precise rate path, if slower pace of hikes eases conditions this can be offset by gradually raising rates to a higher level than previously expected, slower pace does not signal any less commitment to achieving inflation goal, likely to need to raise rates until "convincing evidence" inflation is on track towards 2%, may need to raise rates further even after a pause if outlook or financial conditions call for it, decision on balance sheet reductions won't intersect with decisions on Fed policy rate.

Collins (Neutral). Thu: It's appropriate to slow the pace or rate hikes, policy rate needs to rise to likely just above 5%, then we need to hold rates for some time, risks are now more two-sided.

Brainard (Dove). Thu: We have tightened a lot and we are starting to see effects on inflation, now in an environment where there are risks on both sides, recent downshift in pace of hikes allows the Fed to assess more data as it moves policy to sufficiently restrictive levels, wages do not appear to be driving inflation.

Waller (Hawk). Fri: Favours a 25 bps hike at the upcoming meeting and continued policy tightening beyond that, we are talking about maybe 75 bps more of hikes, will have to keep rates high and not cut rates by the end of 2023, I need six months for a pause and not just three, market perception of the terminal rate is not far from where we are, expectations for rate cuts later this year are driven by optimism inflation will melt away, hard to talk the market out of its forecast, if loosening financial conditions means inflation takes off again we will have to do a lot more, you can't put a lot of weight on just a few months of inflation data, most likely will slow balance sheet runoff when reserves 10-11% of GDP.

European Central Bank

Rehn (Hawk). Mon: Sees significant rate hikes at the next meetings. Wed: Significant rate hikes are justified near term to keep inflation expectations under control.

De Cos (Dove). Mon: Significant interest rate increases are expected to continue, untargeted fiscal assistance can fuel inflation.

Lane. Mon: We need to raise rates more, need to bring them into restrictive territory, peak will depend on how the economy responds, governments need to pull back from high deficits, significant fiscal adjustment will be needed in the coming years, much of the disinflation this year will be due to base effects, difficulty may be in ensuing the final phase of disinflation, does not believe the chronic low-inflation equilibrium we had before the pandemic will return.

Centeno. Tue: Q4 growth in Europe likely to be positive, the economy has been surprising us quarter after quarter.

Villeroy (Neutral). Tue: A resilient economy makes rate hikes easier. Wed: Too early to speculate what we will do in March, Lagarde's 50 bps guidance is still valid, cannot say where the terminal rate will be but should be there by summer, the pace of rate hikes is probably less important this year, must stay the course in battle against inflation.

Knot (Hawk). Thu: Market developments as of late not entirely welcome, markets may be mispricing future rate hikes, will be in tightening mode at least until mid-year, Eurozone could avoid a recession but growth will be slow, underlying signs of inflation in the Eurozone shows no signs of abating.

Lagarde (Dove). Thu: Will stay the course on rate hikes, will continue raising interest rates and leave them in restrictive territory for as long as it takes to bring inflation back to 2%, inflation is way too high, the job market in Europe has never been as vibrant as it is now. Fri: "Stay the course" is my mantra on monetary policy, fiscal policy should not force monetary policy to do more, the ECB does not target an exchange rate for the EUR.

Holzmann (Hawk). Fri: Expects multiple 50 bps rate hikes at least in H1, core inflation is at 5% which is 2.5 times our target, there could be rate hikes if headline inflation has fallen significantly but core has not, reluctant to say inflation has peaked because core inflation has not, could take two to three years to bring inflation down to target.

Sources. Tue: ECB is pondering slower hikes after 50 bps in February, no decision on size of March rate increase has been taken, any slowdown in tightening shouldn't be viewed as the ECB going soft on its mandate.

Bank of England

Bailey (Neutral). Mon: Expects inflation to fall in the year ahead, major risk is a UK labour shortage, negative short-term impact from Covid in China expected to be short-lived. Thu: Not targeting a specific peak rate but we did not include the comment on the market being out of line in the December statement, the fall in December inflation is the beginning of a sign that a corner has been turned, expects inflation to fall quite rapidly this year, we think there will be a shallow recession by historic standards.

Swiss National Bank

Jordan. Thu: "Some tightening" probably still needed, we are roughly at 1% now and inflation is still above 2% so it's clear some tightening is probably in the cards, inflation is much broader and it's everywhere in services, rents, etc.; we have to make sure second-round effects do not dominate the inflationary process. Fri: Absolute priority should be to bring inflation down, we should not underestimate second round effects, not easy to bring inflation back to 2% since firms are not hesitating to increase prices, monetary policy was too expansionary everywhere in hindsight.

Schlegel. Thu: Further interest rate hikes not ruled out, hard to determine at what level the terminal interest rate lies, the SNB does not expect a recession in Switzerland.

Bank of Japan

Matsuno (Chief Cabinet Secretary). Mon: Expects the BOJ to continue with appropriate monetary policy, no comment on JGB yields.

Suzuki (FinMin). Tue: Will nominate "most appropriate" person as new BOJ governor, won't make any prediction on future course of monetary policy, bond yields are set by various factors, will strive to conduct debt management so as not to lose market confidence.

Nishimura (TradeMin). Wed: Nearing phase where monetary easing can be stopped, BOJ is going to maintain current stance until there is more clarity but policy is going to be normalized in the future.

Kuroda. Wed: Will continue with monetary easing and will not hesitate to ease monetary policy further, will conduct flexible market operations, not expecting 10y JBGs trading higher than 0.50%, need more time to assess impact of YCC band on market functioning, cannot say we have reached a state where prices are expected to grow sustainably, aims to achieve 2% inflation target sustainably alongside wage growth, will make use of fund-supplying operations against pooled collateral to defend yield curve control. Fri: Change in yield curve policy last month was not a mistake, Japanese economy is still recovering, we expect wages to rise further, expects inflation to start declining from February to below 2% next year, still haven't achieved 2% inflation target in a sustainable manner, we have eradicated deflation during my tenure at least.

Ito. Thu: BOJ's next step may be to widen 10y band, could raise it to 0.75% or 1.00% by mid-year, likely won't tweak yield curve control at least until April, may abandon negative rates this year depending on inflation and wage developments.

Economic Data

Monday, 16.01.23

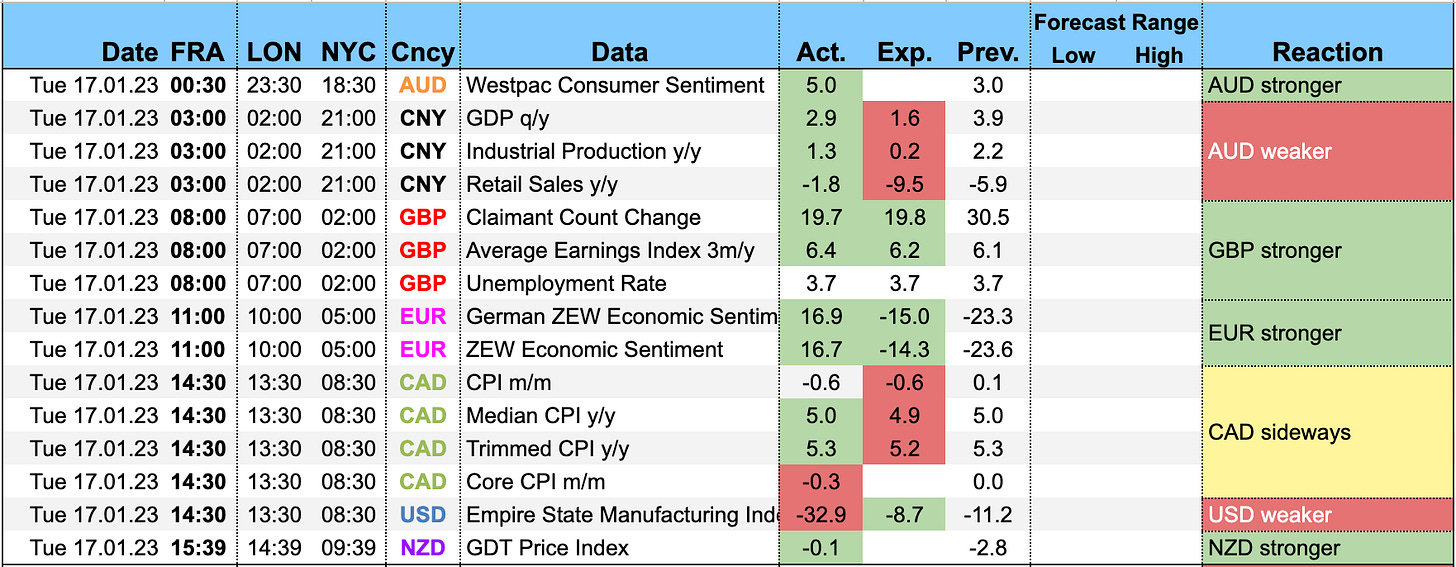

Tuesday, 17.01.23

Wednesday, 18.01.23

Thursday, 19.01.23

Friday, 20.01.23

Market Analysis

Growth and Inflation

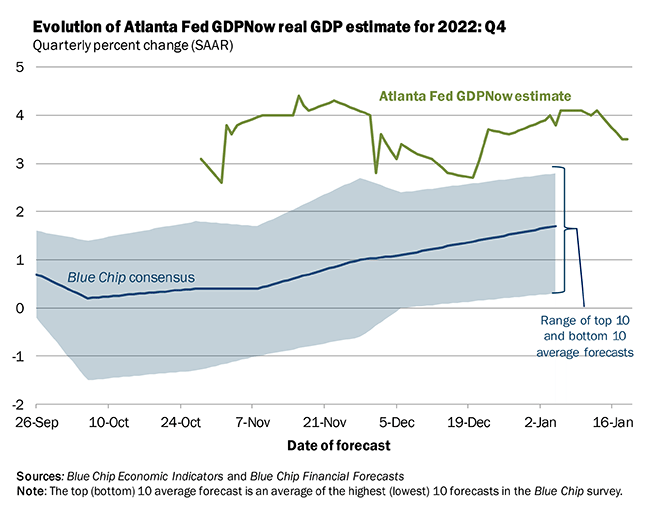

The Atlanta Fed GDPNow remains at 3.5% for Q4. The first forecast for Q1 will be released on Friday.

The NY Fed Weekly Economic Index stands at 1.22:

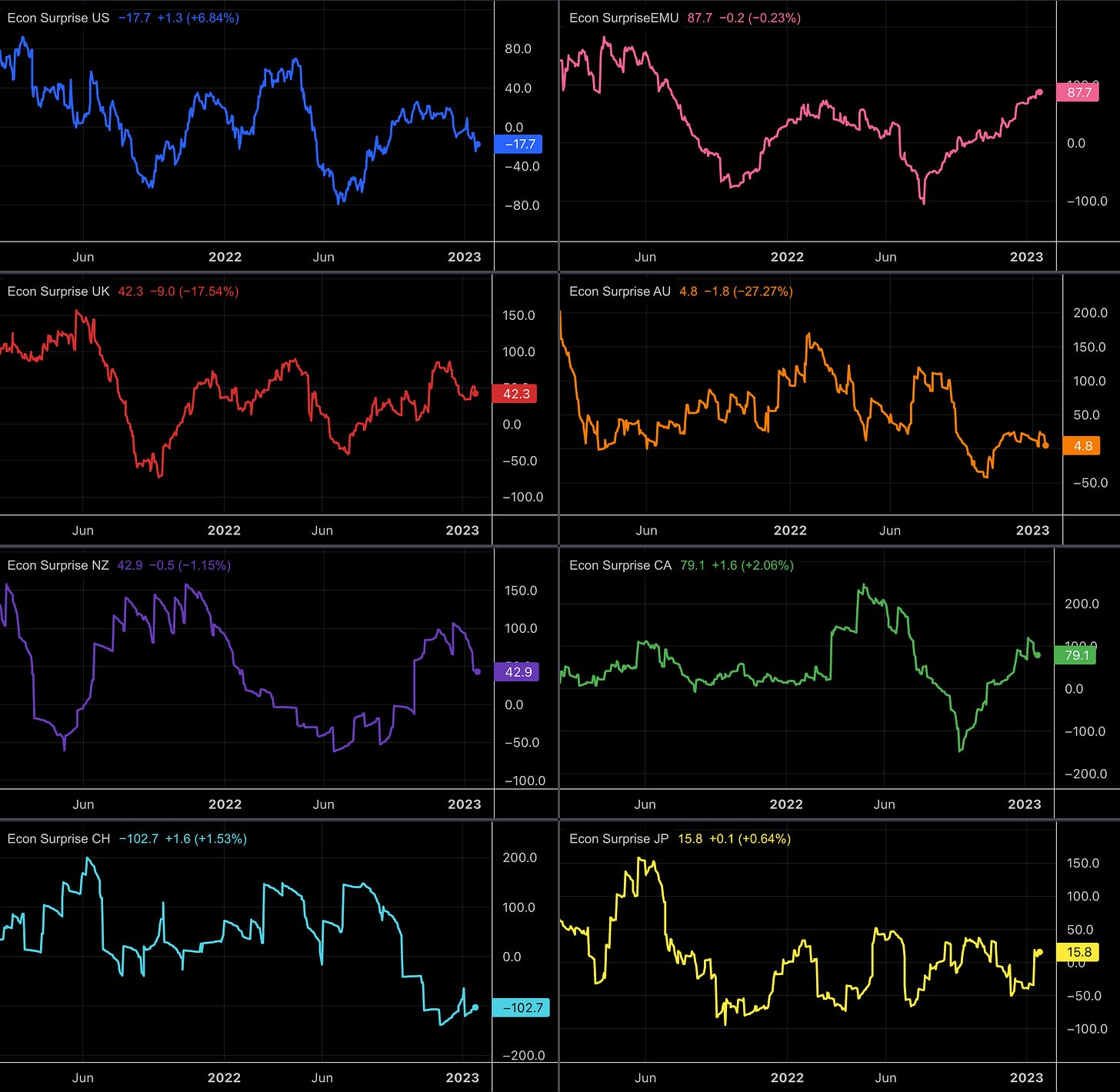

Citi Economic Surprise Indexes:

USD heading lower while EUR and CAD continue to trend higher

GBP and AUD are sideways

NZD is falling

CHF remains low, JPY is mostly sideways

The Bloomberg PMI heatmap still doesn't have any prints for January, and PMIs will be out next week, so it's a) a bit stale and b) unchanged from the last two weeks:

US weaker

UK still red and no sign of improvement

Eurozone still red but Germany has been improving

Canada has improved a bit in November but stalled

Switzerland still green

Australia has weakened, Japan as well

Taiwan still deep in the red but not as bad as in November, Vietnam and South Korea weakening, Hong Kong has improved a bit, China remains neutral and unchanged

Brazil has taken quite a hit, India going strong

Breakeven inflation rates are trading at their support level making lower high after lower high:

5y5y forward inflation expectations also remain within their trading range:

And RINF can't seem to break away to the downside, either:

Citi Inflation Surprise Indexes remain unchanged:

USD, EUR, CHF all heading lower

GBP looks like it has topped out

AUD sideways (last print surprised to the upside, though)

CAD picked up again

JPY has turned lower

Yields

See charts and table below:

Japenese 2y and 10y yields look strongest

German and Swiss 2s are higher

Australian and Kiwi 2s and 10s look very weak

Yield curves at the 2s10s spread: German and Swiss spreads making new lows, the Japanese curve is the only one that's steepening.

Central Banks and the US Dollar

The Fed has entered its blackout period before the next FOMC meeting. The target rate probabilities according to FedWatch:

The probability for a 25 bps hike is now 99%, and there's a very small probability for a hold

The terminal rate is still seen at 4.75-5.00% but the probabilities below that have increased while the probabilities above have decreased

The market now prices two rate cuts towards the end of the year while it priced in one cut in December last week.

All in all, it's a dovish shift that was solidified by last week's (and Friday's) comments from the Fed

The market-implied terminal Fed Funds rate shifted markedly lower over the last ten trading days, and it gets pretty wild if we go farther out on the curve into 2024: the market expects about five 25 bps cuts between June this year and May of next year.

Sectors and Flows

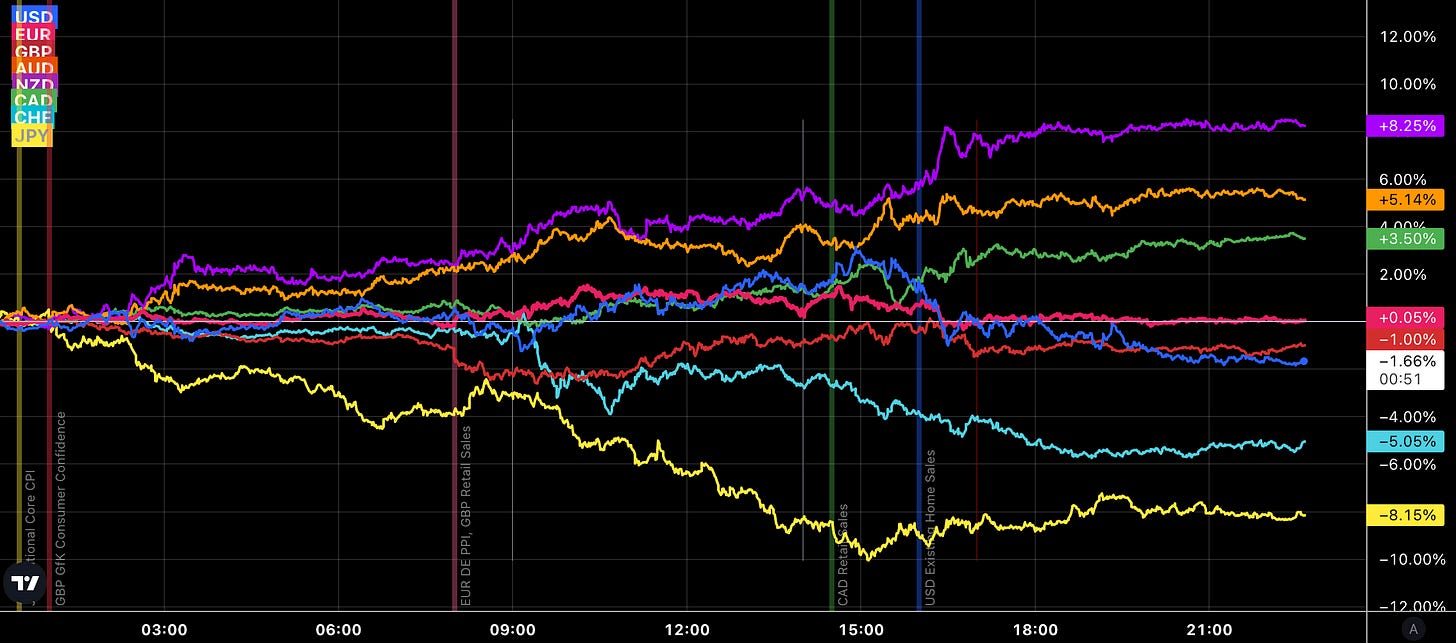

Currency strength:

JPY dominates the 3-month horizon but it was the weakest currency this week

USD underperforms over one and three months

GBP and NZD were the strongest currencies this week

Equity sector performance:

Semiconductors (SMH), Metals and Materials (XME, XLB), Oil Services (OIH) are the outperformers

Consumer Discretionary (XLY), Oil/Gas Exploration (XOP) are the underperformers

Value is outperforming Growth (VTV vs. VUG)

Sector breadth isn't going in any clear direction, Tech and Consumer Discretionary have been performing very well over about 10 weeks now:

The market is playing reflation:

Sector charts show a breakout XLC (Communications/Tech) out of its wide trading range to the upside, and XLU (Utilities) breaking away to the downside:

International stock markets continued their recent trends with Hong Kong and Europe outperforming everything else, and US and Japanese markets underperforming:

Sentiment and Positioning

AAII sentiment has improved and the bull-bear spread is nearing 2022 highs. Not what I would call euphoria but a decidedly better mood than during most of last year:

The TD Ameritrade Investor Movement Index (IMX) is still near lows:

Currency sentiment:

CHF and EUR are bullish

CAD is bearish

Everything else is mostly neutral

A different sentiment source:

EURCHF and USDCHF are both very bearish on CHF (i.e. bullish sentiment)

JPY pairs are mostly bearish on JPY except for USDJPY which is neutral

Commitment of Traders and futures performance:

Stocks were mixed this week with NQ outperforming. Positioning in NQ is bullish with Large Speculators at a 52-week low for net positions and Commercials near a 52-week high.

VIX futures had a -2.35 SD change in Commercial net positions and a +1.96 SD change in Large Trader net positions, which suggests short-term lower volatility

Treasuries were mostly positive for the week, positioning is now bullish in most of these futures, and there were bullish 1-week position changes in ZN and ZB.

Currencies were mixed vs. the dollar, 6E and 6N still have a bearish Commercial/Large Trader positioning while the DX and 6C have bullish positioning going on. The JPY (6J) is noteworthy because its positioning has been becoming more and more bearish over the last weeks.

Bitcoin… I don't believe in COT data for that one, but: positioning is as bullish as it can get.

Energy futures were positive this week with the exception of NG. Positioning in CL has softened but NG remains at bullish extremes.

Metals were mixed as well.

Grains and Softs also had a mixed week. Positioning is bullish for Wheat, Cotton and Coffee while Soybean Meal has bearish Commercial and Large Trader positioning going on.

COT/TFF dealer net positioning for currency futures:

The 6C is near a long

The 6E is near a low

The market's 6J short position (i.e. the dealers’ long position) is getting pared back

CitiFX PAIN Indexes:

The USD long is getting pared back further

Everything else is getting bought but there's no clear outperformer as far as I can see

Market Risks

Credit spreads are near the bottom of their ranges:

The Credit Spread Index has made a lower high and a lower low:

Currency volatility has dropped sharply in JPY and is trading sideways-to-lower for everyone else:

The VIX term structure is in contango:

Volatility indexes show a bit of movement:

VIX is holding around 20, MOVE isn't going lower either

VIX/VIX3M has been flattening despite VIX declining

VIX/VOLI, SDEX and TDEX are all going up showing a steeper skew, i.e. demand for OTM puts

I still don't find it too worrying: it's reasonable with VIX being at its lowest point in a long while, everyone's distrustful of the market's performance after a wild year

CNN Fear & Greed remains in greed territory:

Various

The fx:macro Market Dashboard shows a mixed picture:

Trend metrics swing wildly (which is expected since they are based on moving averages and we've been effectively in a sideways market for months now)

There's still a high number of distribution days (also a feature of sideways markets)

Volatility metrics are pretty quiet

The standard deviation of VVIX is low but that only counts if the standard deviation of VIX is low too

VIX/VVIX correlation is still below 0.20, which is often followed by higher volatility with a bit of lag

The NYSE Advance/Decline Line is going to the moon. I'm not putting much weight into a bullish divergence like this but it's definitely not a bearish sign:

The percentage of index components above their 200-day moving averages is holding up reasonably well although it's lagging for the Nasdaq (hew high in price but no new high in the breadth measure):

25-delta risk reversals:

USDCAD is priced lower

USDJPY and USDCNY are priced higher

Top 3 Macro Charts of the Week

This section is brought to you by Daily Chartbook.

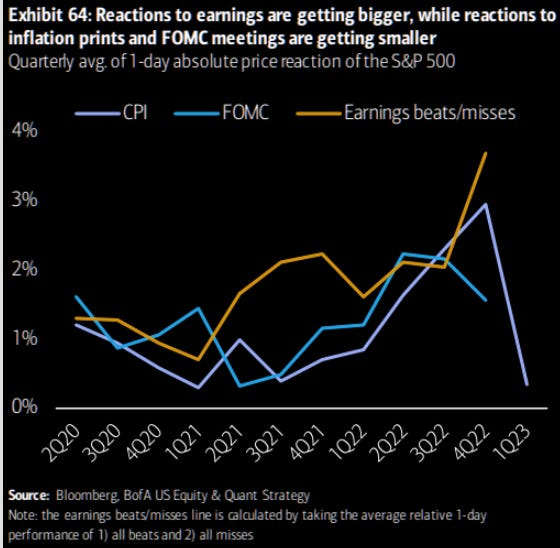

1. Shifting narrative. "Reactions to earnings are getting bigger, while reactions to inflation prints and FOMC meetings are getting smaller".

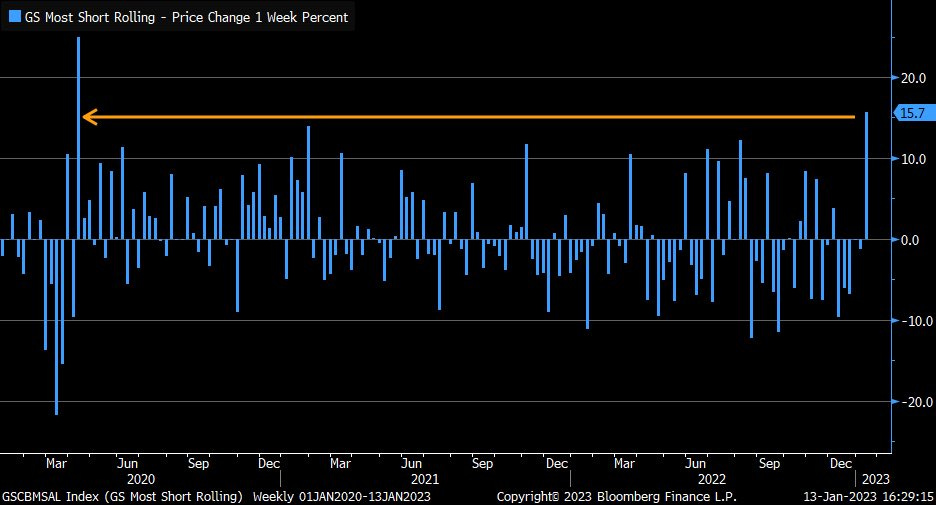

2. Most shorted. "Stocks that are heavily shorted (basket tracked by Goldman Sachs) surged 15.7% last week, most for a week since April 2020".

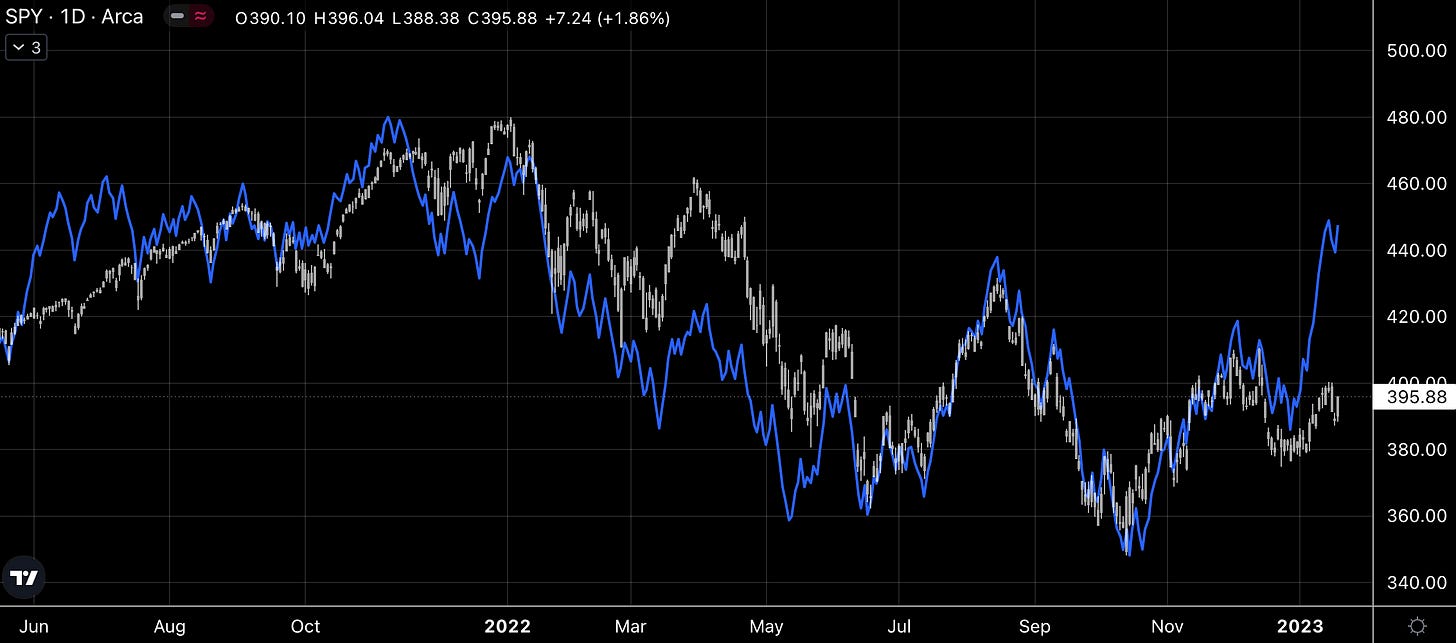

3. S&P vs. liquidity. "Morgan Stanley fears a market correction as liquidity starts draining".

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 50/2022 | 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 02/2023 | 47/2022 | 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

ECB

Rate Statements: 50/2022 | 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 47/2022 | 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 50/2022 | 43/2022 | 36/2022

BOE

Rate Statements: 50/2022 | 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 50/2022 | 37/2022

RBA

Rate Statements: 50/2022 | 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 51/2022 | 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 47/2022 | 41/2022 | 34/2022 Crib Sheets: 40/2022

BOC

Rate Statements: 50/2022 | 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022

SNB

Rate Statements: 50/2022 | 44/2022 | 39/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

BOJ

Rate Statements: 51/2022 | 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 52/2022 | 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: DALL-E 2 “A fictional Japanese dollar bill.”

It was great .thank you so much

great take, thank you!