Outlook for Week 18/2023

“As a speculator you must embrace disorder and chaos.” – Louis Bacon

Welcome to issue #53 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary.

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

The cover image is AI-generated via Midjourney. If you want to guess the prompt, I put it at the end of the newsletter.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Check out Bond Blogger's Credit Wrap if you want to get an excellent summary of market-moving news over the last week. Highly recommended, also make sure to follow him on Twitter @IlliquidTrader!

Table of Contents

Summary (Playbook, Calendar, Levels, FX Drivers, Downloads)

Week in Review: a) Central Banks, b) Economic Data

Market Analysis: a) Growth and Inflation, b) Yields, c) Central Banks and the US Dollar, d) Sectors and Flows, e) Sentiment and Positioning, f) Market Risks, g) Various

Top 3 Macro Charts of the Week

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Please check out this article about what this summary aims to provide and what its limitations are.

Economic Calendar for next week

Important levels to watch and look out for in FX futures

Currency Drivers

For an explanation check out this link.

Downloads and Links

Difftext of the Summary from last week: link to diffchecker.com

Central bank speaker recap for the week:

FOMC Crib Sheet for the upcoming meeting with all summarized comments since the February meeting:

ECB Crib Sheet for the upcoming meeting with all summarized comments since the February meeting:

Week in Review

Central Banks

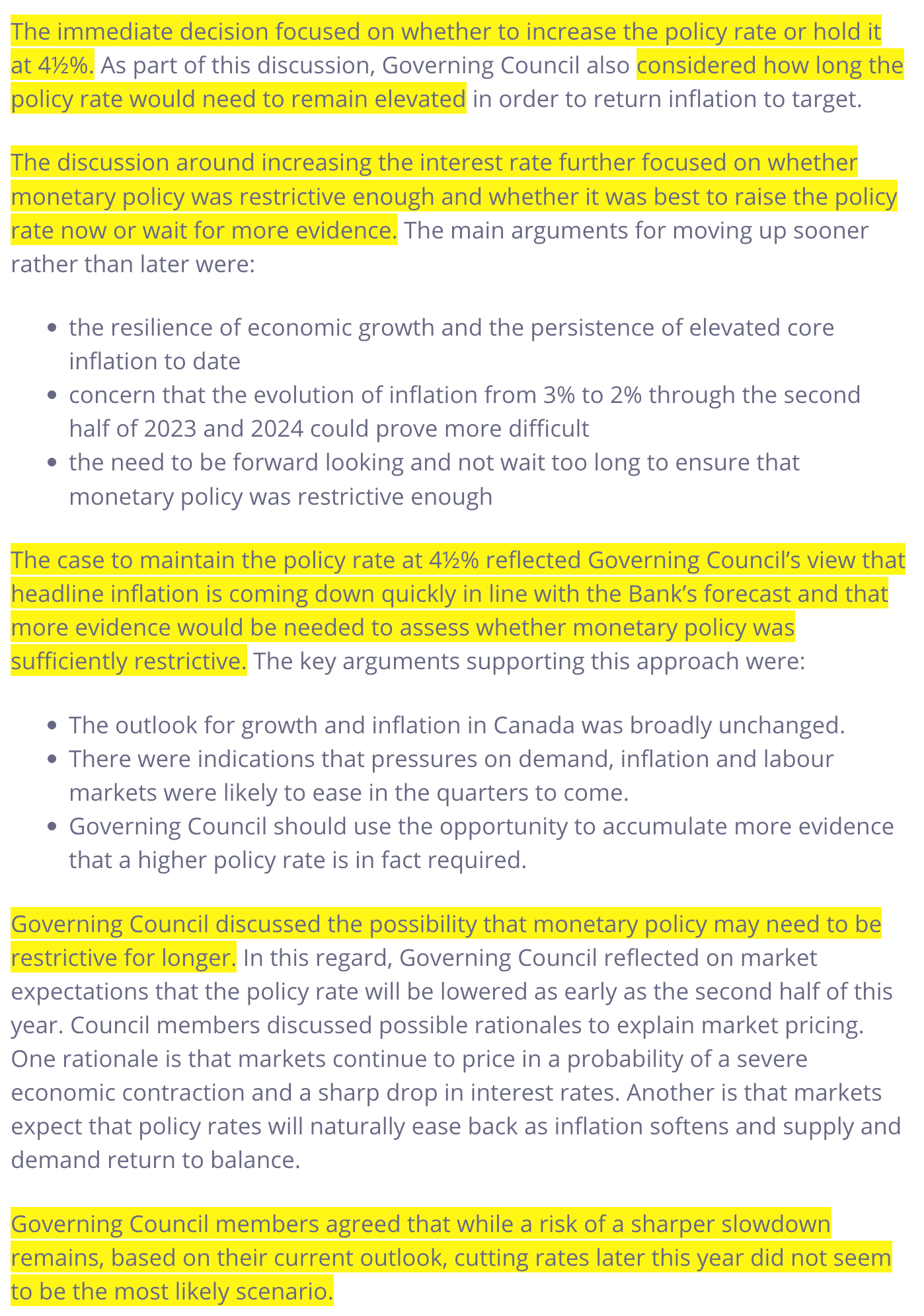

BOC Summary of Deliberations (26.04.23)

The BOC debated whether to hike or hold rates at their last meeting on April 12th. Here are the highlights from the minutes:

BOJ Rate Decision (28.04.23)

The BOJ left virtually everything aspect of monetary policy unchanged but announced a policy review “with a planned time frame of around one to one and a half years.”

From the Outlook for Economic Activity and Prices:

CPI and Core CPI projections for 2023 have been upped from 1.6 to 1.8% and from 1.8 to 2.5%, respectively

CPI and Core CPI are seen at 2.0% and 1.7% in 2024, up slightly from the January projections of 1.8% and 1.6%

Confab, Speakers, News

European Central Bank

Wunsch (Neutral). Mon: Wouldn't be surprised if rates hit 4% at some point, inflation numbers are not going in the right direction yet, waiting on wage growth and core inflation to cool before reaching the point of pausing.

Schnabel (Neutral). Mon: 50 bps is not off the table, far too early to declare victory on inflation, thinks core inflation will peak in the next few months but it's not clear that it will happen very soon, need to see a sustained decline in core inflation that gives us confidence that our measures are starting to work, not seeing a recession under most recent ECB projections.

Villeroy (Neutral). Mon: We have travelled most of the rate hike journey, some wage increase catch-up with inflation is normal, there may be a need for some additional rate hikes but they must be limited in number and size.

Makhlouf. Mon: It is too early to plan for a pause in our tightening of policy, will be especially focused on incoming data at our next policy decision, based on the evidence we have today rates will need to stay at restrictive levels.

Lane. Tue: Latest data suggests we have to hike rates again in May, still not the right time to stop raising rates, further hikes beyond May will depend on the data, does not think Europe is in a 1970's style situation with regards to inflation.

Vujcic. Wed: There is no choice but to raise rates further.

De Guindos (Dove). Wed: Wages are going to accelerate, the labour market in the Eurozone is quite impressive.

Herodotou. Wed: Rate hikes are beginning to have an impact on the economy, core inflation is sticky and we have to work on that, recent financial-market tensions may have an additional impact on financing conditions in addition to our monetary policy, we need to gauge that and see how it could potentially contribute to our monetary policy stance.

Sources. Tue: Econostream: ECB more likely to hike by 25 bps rather than 50 bps, risk of doing too little currently still greater than the risk of doing too much, it would require "quite a negative" inflation surprise in April.

Bank of England

Broadbent (Neutral). Tue: We would have tightened policy sooner had we seen inflation shocks coming, the BoE's policy approach has not been optimal, the UK has second-round effects but not a wage-price spiral, not ruling out particular monetary policy moves in advance.

Pill. Tue: “Somehow in the UK, someone needs to accept that they’re worse off and stop trying to maintain their real spending power by bidding up prices, whether higher wages or passing the energy costs through onto customers”, risk is that monetary policy does too much, inflation may dip below the 2% target in 2 years.

Swiss National Bank

Jordan. Fri: At most recent monetary policy assessment in March we emphasized that we would continue to tighten monetary policy if necessary, prices went up more than we would have liked in the first three months of 2023.

Bank of Japan

Ueda.

Mon: BOJ must maintain monetary easing as trend inflation is still below 2%, if it can be foreseen that trend inflation reaches 2% the BOJ must head for policy normalization, import prices are being passed on to domestic prices more than expected, how to revise YCC will depend on various factors such as economic conditions and the pace of inflation at that time, conditions for tweaking YCC are inflation forecasts at 6 months, 1 year and 18 months ahead must be quite strong and close to 2%, can't say how the BOJ would specifically tweak YCC.

Tue: Appropriate to maintain easy monetary policy and YCC given current economic and price developments, Japan's bond yield curve is currently smooth as a whole, if wages and inflation rise more than expected the BOJ will tighten monetary policy such as by increasing interest rates, trend inflation remains below 2% but gradually accelerating, monetary policy steps taken now will affect the economy and prices in 6-18 months ahead, tightening policy now could push down inflation in the future which is already likely to slow on dissipating effect of import costs, the risk of undershooting forecasts is bigger than the risk of overshooting.

Wed: Monetary policy is not aimed at funding government spending, consideration towards the government's debt-financing cost won't constrain necessary monetary policy moves, cost-push inflation driven by rising raw material costs seems to be subsiding in Japan.

Fri: Appropriate to continue monetary easing, will not hesitate to ease further if necessary, risk from tightening too hastily is larger than monetary policy falling behind the curve, inflation likely to slow below 2% in latter half of the year, there is a good chance to judge achievement of the 2% inflation target this year even before next year's shunto negotiations, policy review period is set to one-and-a-half years, that does not mean there will be no policy changes during that time, review is not aimed at conducting specific policy measures, no idea what kind of policy the review may lead to, any policy shifts should be carried out if necessary and not rely on policy review period, policy review does not signify that monetary easing was ineffective, the chance of starting exit from easy policy in the next 1.5 years is not zero but chance of it being delayed to 2-4 year later is also not zero unfortunately.

Suzuki. Tue: There may be some movements in Japan's monetary policy in the future, which poses various challenges in sustaining stable debt issuance.

Economic Data

Monday, 24.04.23

Tuesday, 25.04.23

Wednesday, 26.04.23

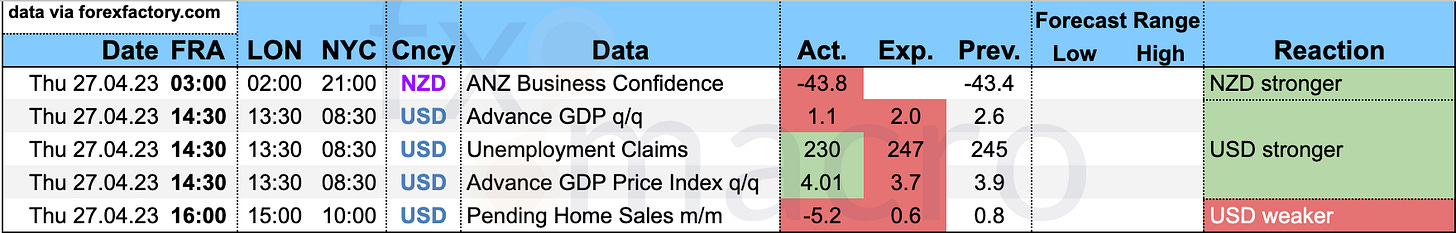

Thursday, 27.04.23

Friday, 28.04.23

Market Analysis

Growth and Inflation

Atlanta Fed GDPNow:

The initial GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2023 is 1.7 percent on April 28. The initial estimate of first-quarter real GDP growth released by the US Bureau of Economic Analysis on April 27 was 1.1 percent, equal to the final GDPNow model nowcast released on April 26 after rounding.

The NY Fed Weekly Economic Index estimates four-quarter GDP growth at 1.13%. It has been around this level since the start of the year, and the 13-week average has levelled out:

The Cleveland Fed Yield-Curve Predicted GDP Growth model went further negative. It sees the up peak in May and turns negative by November:

The recession probability for March 2024 is approaching 80%:

Citi Economic Surprise Indexes:

USD, EUR, NZD and CAD are all lower

GBP is still holding up

AUD is attempting to get off the floor

The Bloomberg PMI heatmap is unchanged from last week:

The US remains unchanged

The UK, Eurozone, Germany and France are all weakening

Australia and Canada are weaker

Switzerland is unchanged

Most of Asia is weaker as well: China, Taiwan, Vietnam

Breakeven inflation rates continue to trade sideways-to-lower:

5y5y forward inflation expectations and RINF are also meandering sideways:

Citi Inflation Surprise Indexes have not yet updated:

USD, EUR, NZD, CAD and JPY are all lower

GBP, AUD and CHF are flat

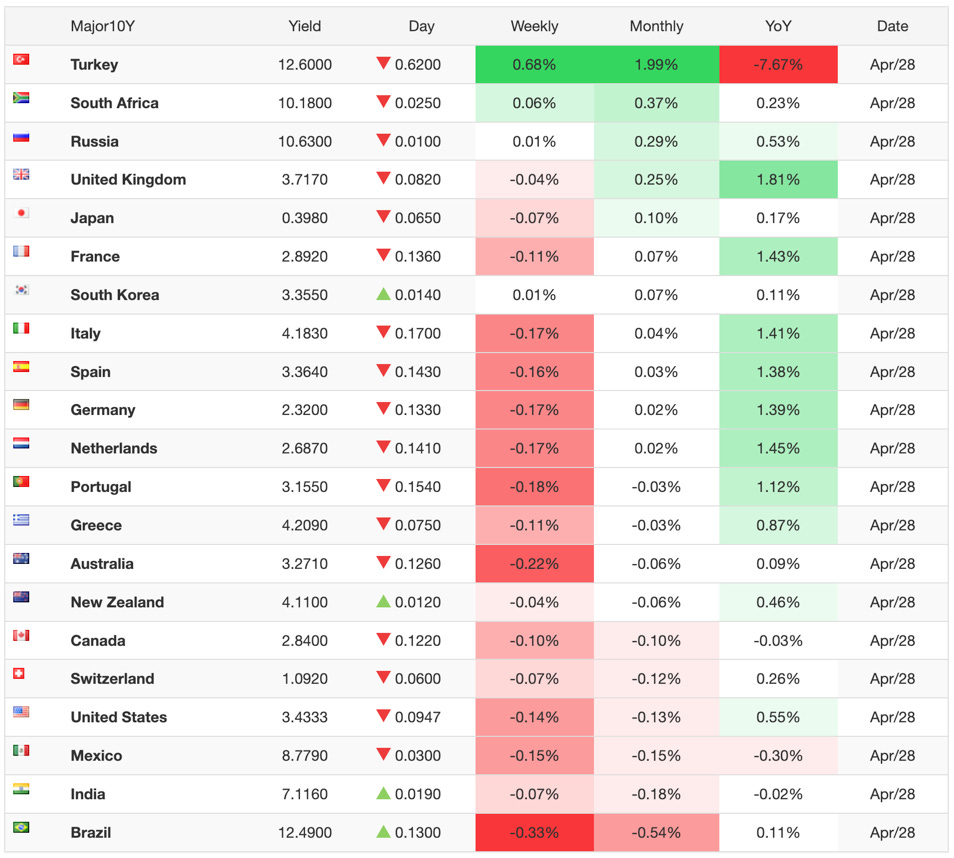

Yields

See chart and table below:

Mostly sideways action in 2y and 10y yields over the last months

UK yields look strongest with 2s outperforming 10s lately in a bear flattening

Chinese yields have been declining

A closer look at 2y and 10y yields as well as the 2s10s spread:

Bear flattening in the UK curve

Other than that I'm not seeing much here

Global yield curves compared: 2s10s have been mostly trading sideways throughout this year without any clear direction:

Central Banks and the US Dollar

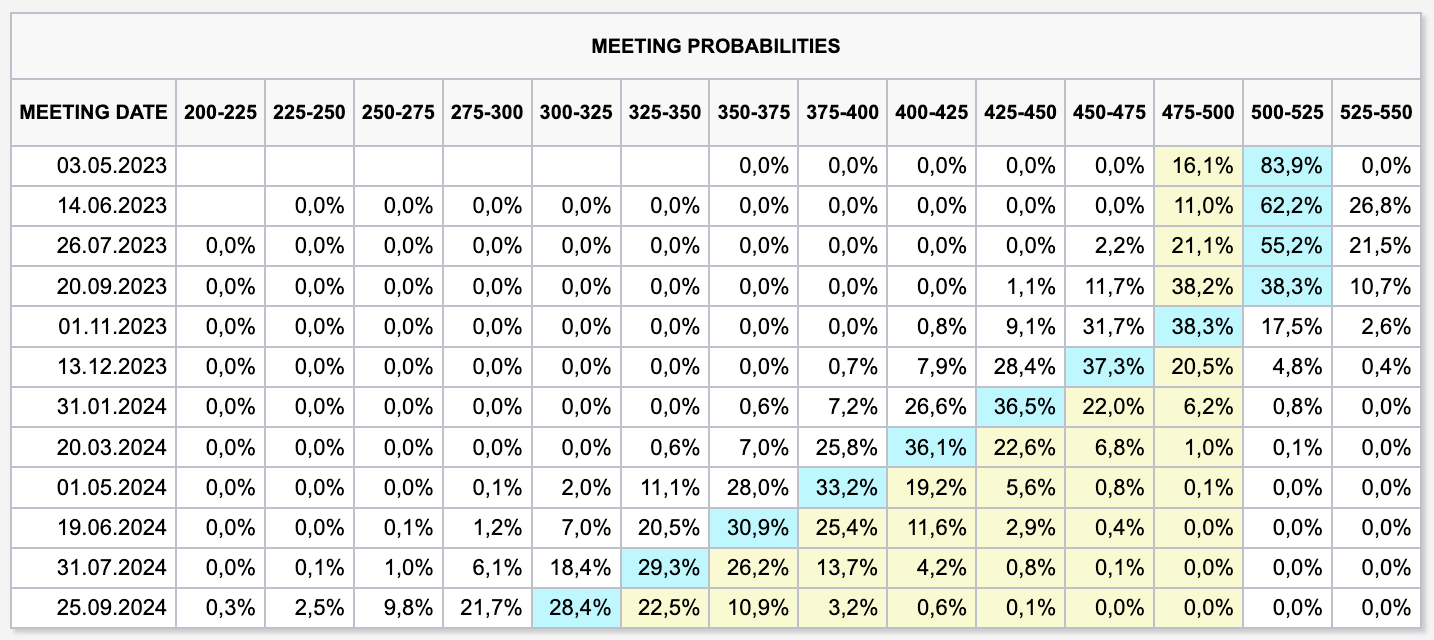

The next FOMC meeting is just a few days away. The lastest meeting probabilities according to FedWatch:

84% chance of a 25 bps hike this week with the remaining 16% for a policy hold; this is a tad more dovish than one week ago

The rest of the policy path remains virtually unchanged

Markets are pricing the three meetings after the next one with no change to the FFR, and then about one 25 bps cut at every meeting from November

The uncertainty has increased a bit with the probabilities of potential hikes and cuts in the next few months slightly higher than last week

The market-implied FFR shows a clear path lower:

Here's the same data in a different format:

The ASX RBA Rate Indicator shows that the market-implied expectation of this week's RBA rate decision is 100% for no change to the policy rate:

Sectors and Flows

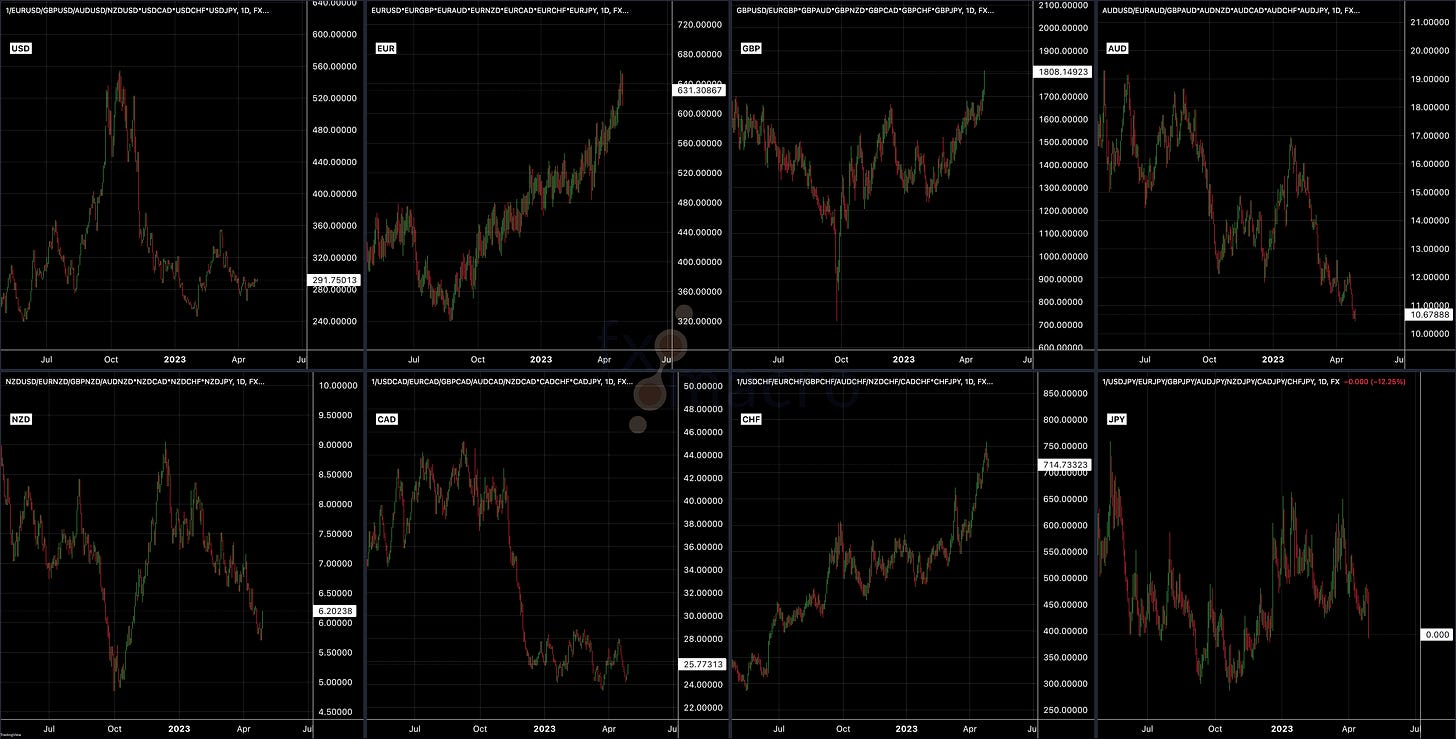

Currency strength:

CHF, EUR and GBP have been the outperformers over three and one months

JPY, AUD and NZD have been the underperformers over the same timeframes

USD and CAD are right in the middle

Currency indexes:

Equity sector performance:

Tech and Growth are the outperformers, Semiconductors aren't far behind

Consumer Staples and Healthcare also performed well

Oil Services and Exploration as well as Metals/Mining are the underperformers, Financials aren't doing too well either

Same thing, different chart:

Tech and Communication are leading

Defensive sectors like Healthcare, Consumer Staples, Utilities have outperformed offensive sectors over one month and especially over three months

It's definitely not what I'd expect in a bull market

It looks a bit different in the thumbnail charts:

Tech and Communication are performing well, both are at highs

Staples are also at a high but Healthcare and Utilities are just somewhere in the middle of their ranges

Sector breadth has also improved with all sector ETFs now positive over 30 days:

International stock markets:

The Nasdaq is outperforming everyone, European indexes are doing well again

Nikkei and TOPIX have also performed on the weaker yen

Hang Seng and Bovespa are lagging

Sentiment and Positioning

The current regime is bad news is good news and good news is bad news with the correlation between the S&P 500 and the Citi Economic Surpris Index deeply negative:

The AAII Bull-Bear spread is neutral:

Currency Sentiment:

Bullish sentiment for AUD, CAD, JPY, NZD

Bearish sentiment for CHF, GBP, EUR

The only currency with neutral sentiment is USD

It's pretty interesting because sentiment mirrors the currency performance very well

Different sentiment source:

USDCHF is still the most bullish currency pair, EURCHF is in third place

AUDUSD and NZDUSD are both bullish

EURJPY, GBPJPY and USDJPY are all three bearish

Commitment of Traders and futures performance:

Equity futures were mixed with everyone positive except for RTY. Positioning is still at bullish extremes for both ES and YM, and more bearish than bullish for RTY.

Treasury futures ended all positive with Commercial and/or Large Trader net positions still favourable.

Currency futures were mixed with DX, 6A, 6S and 6J lower and the rest higher for the week. Positioning hasn't changed meaningfully: DX is still near a bullish extreme, while 6E, 6B and 6S are at or very close to bearish extremes.

Bitcoin also had a positive week, its Relative Strength (RSL) remains well above 1.00

Energy futures were lower except for NG. Positioning is neutral for all four futures.

Metals were mostly weaker, only GC managed to end the week positively. HG hasn't been performing for weeks, its RSL has dipped below 1 again, i.e. it's trading around its 26-week moving average. Positioning in GC and SI is fast approaching bearish 52-week extremes, PL is already there. The 1-week change in Commercial and Large/Trader net positions for HG could be a short-term bullish signal at +2.96 and -3.23 SD.

Grains were all lower, positioning remains bullish in ZC, ZW and ZO.

Softs had a mixed week with SB outperforming. Positioning in CT is bullish and in CC and SB it's bearish.

COT/TFF dealer net positions for currency futures:

6E is at a multi-year low

6C is off its high

Citi PAIN indexes haven't changed much:

Here's the combined COT/PAIN chart:

EUR: Large Trader net positions aren't confirming the high in EURUSD

CHF: Same thing, Large Trader nets have barely moved while CHFUSD (inverted!) has made a new high

Market Risks

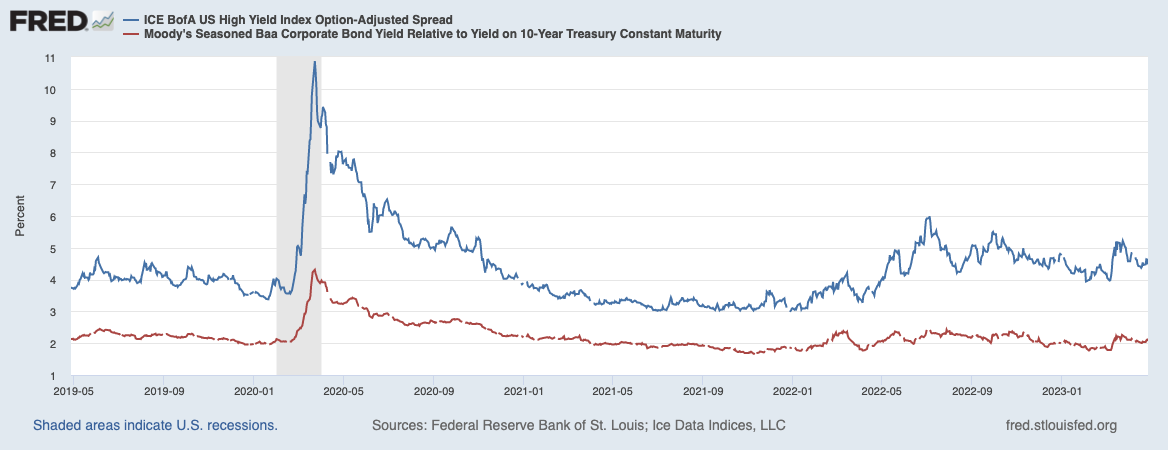

HY-OAS and IG spreads are well below their recent banking-crisis highs:

The same is true for the Credit Spread Index:

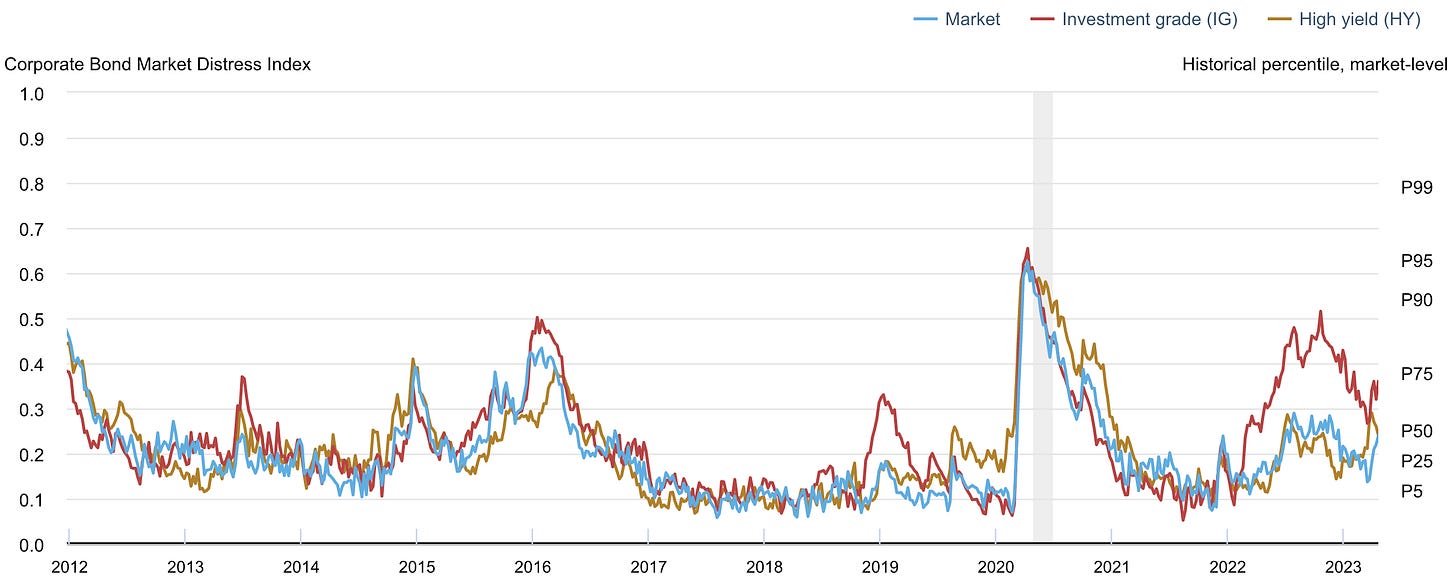

The NY Fed Corporate Bond Market Distress Index ticked up a but for both HY and IG markets signalling a small increase in market stress, and market functioning deteriorating slightly:

Currency volatility continues to decline, especially in USDJPY:

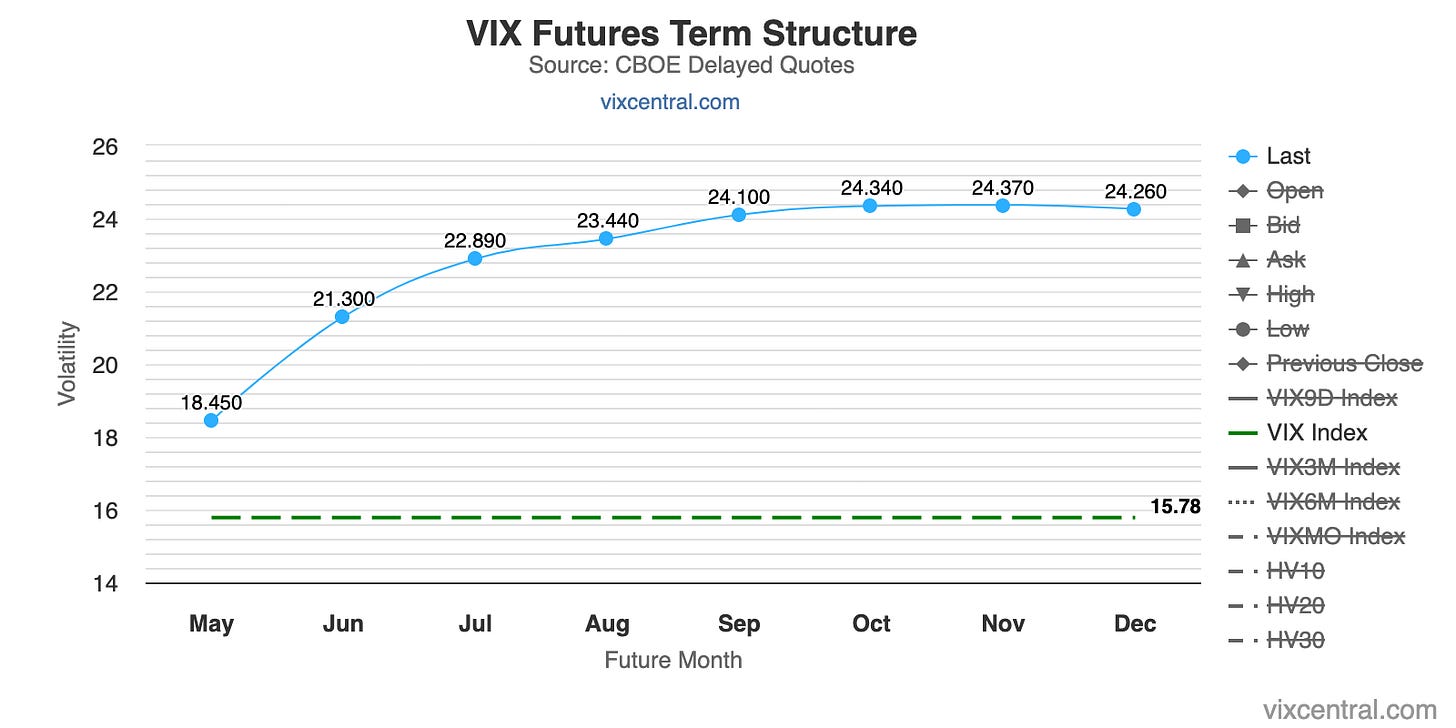

The VIX term structure looks normal overall with a pretty steep premium of 2.67 points of VX1 over cash and 2.85 points between the front-month futures:

Volatility indexes:

VVIX has come down and is now at 87, VIX has dropped to below 16

MOVE is still elevated but at least it's not moving higher

VOLI (ATM IV) is at the same level as at the beginning of 2022

Skew is sideways with VIX/VOLI higher

The VIX/VVIX correlation has dropped below 0.20. This can be a sign of higher volatility ahead, especially when the correlation normalizes and moves back up again:

CNN Fear & Greed is in Greed territory:

Various

The NYSE Advance/Decline Line still isn't doing anything out of the ordinary:

S&P 500 and Nasdaq 100 stocks above their 200-day moving averages still don't look healthy:

And it looks even worse for the shorter-term 50-day MA metric:

25-delta risk reversals:

AUDUSD and NZDUSD are priced higher

Finally, a look at the Market Dashboard:

Trend Metrics are mixed with RTY being the bearish outlier here

Distribution Days are too high for every index

Volatility metrics are mostly green with the steepness in the front end of the VIX term structure (and VIX/VIX3M) already mentioned above

Put/Call ratios have been quiet

The VIX/VVIX correlation dip has been discussed above, the spike in ES/VVIX correlation is also a bit worrying

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 13/2023 | 06/2023 | 50/2022 | 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 15/2023 | 09/2023 | 02/2023 | 47/2022 | 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

ECB

Rate Statements: 12/2023 | 06/2023 | 50/2022 | 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 17/2023 | 10/2023 | 04/2023 | 47/2022 | 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 11/2023 | 05/2023 | 50/2022 | 43/2022 | 36/2022

BOE

Rate Statements: 13/2023 | 06/2023 | 50/2022 | 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

RBA

Rate Statements: 15/2023 | 11/2023 | 07/2023 | 50/2022 | 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 17/2023 | 09/2023 | 51/2022 | 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 07/2023 | 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 15/2023 | 09/2023 | 47/2022 | 41/2022 | 34/2022 Meeting Minutes: 07/2023 Crib Sheets: 40/2022

BOC

Rate Statements: 15/2023 | 11/2023 | 05/2023 | 50/2022 | 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022

SNB

Rate Statements: 13/2023 | 50/2022 | 44/2022 | 39/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

BOJ

Rate Statements: 11/2023 | 04/2023 | 51/2022 | 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 13/2023 | 05/2023 | 52/2022 | 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: Midjourney with the prompt: Mt. Fuji sunrise beautiful

I look at it as another piece of the where is the leverage/liquidity puzzle, where is the balloon getting stretched.

Option vol Per Cem Karsen video: What I took away was that by guaranteeing all size bank deposits, the Fed/USTreas have sold OTM puts into the financial system and at the coming meeting will talk tough to continue implicitly sell calls into the financial markets. Wings have been sold therefore guts have been heavy.

https://www.kaivolatility.com/hubfs/media/Macro%20and%20Flows%20Videos/20230421_Macro%20and%20Flows_e16_720p.mp4