Outlook for Week 20/2023

"The whole world is simply nothing more than a flow chart for capital." - Paul Tudor Jones

Welcome to issue #55 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary. If you're short on time or just don't like long newsletters then just skip them.

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

The cover image is AI-generated via Midjourney. If you want to guess the prompt, I put it at the end of the newsletter.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Table of Contents

Summary (Playbook, Calendar, Levels, FX Drivers, Downloads)

Week in Review: a) Central Banks, b) Economic Data

Market Analysis: a) Growth and Inflation, b) Yields, c) Central Banks and the US Dollar, d) Sectors and Flows, e) Sentiment and Positioning, f) Market Risks, g) Various

Top 3 Macro Charts of the Week

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Please check out this article about what this summary aims to provide and what its limitations are.

Economic Calendar for next week

Important levels to watch and look out for in FX futures

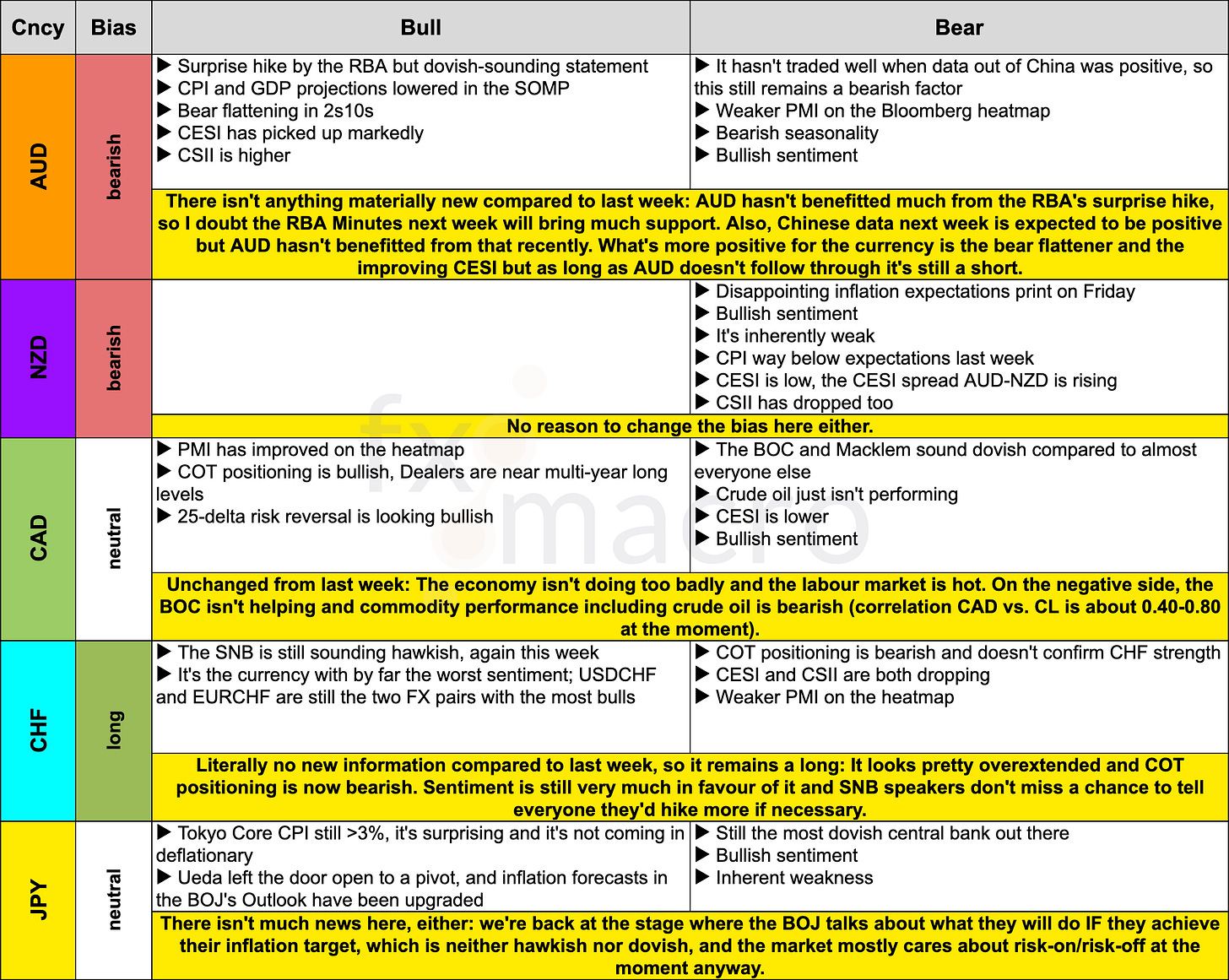

Currency Drivers

For an explanation check out this link.

Downloads and Links

Difftext of the Summary from last week: diffchecker.com

Central bank speaker recap for the week:

Week in Review

Central Banks

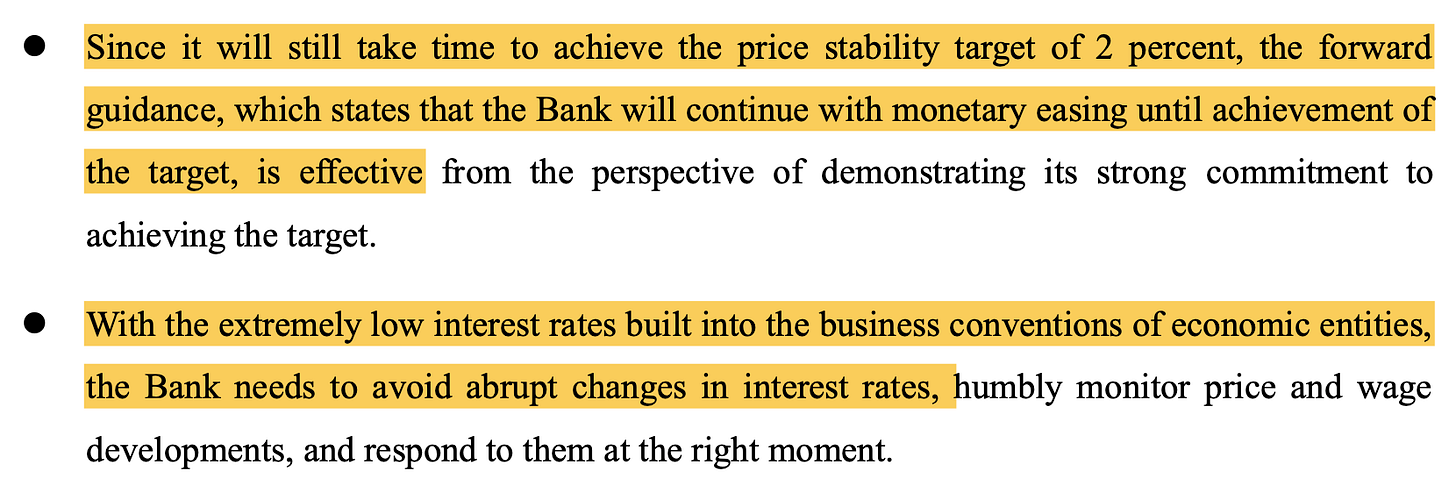

BOJ Summary of Opinions (11.05.23)

Here are the highlights of the BOJ's SOP:

BoE Rate Decision (11.05.23)

The Bank of England hiked by 25 bps as expected to a policy rate of 4.25%:

Vote split: 7 members in favour, 2 members voted for no change

Guidance remains unchanged: “If there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required.”

Rate hike in order to “continue to address the risk of more persistent strength in domestic price and wage setting”

UK GDP expected to be flat over H1/2023, banking sector stress is expected to only have a small impact on UK GDP growth, activity has been less weak than expected in February

The labour market is expected to remain tighter in the near term than in the February report, unemployment is projected to remain below 4% until the end of 2024

CPI was 10.2% in Q1 which is higher than expected in February and March, it is expected to fall sharply from April and to decline to a little above 1% at the two and three-year timeframes

Risks to the inflation outlook are skewed towards the upside

From the Meeting Minutes:

[I removed the screenshots because they were from the previous meeting minutes. Sorry for the mix-up and thank you to the readers who pointed out the mistake! 15.05.2023, 10:41]

From the Monetary Policy Report:

The GDP projection has been upped from -0.7 to 0.0% for Q2 and from -0.3% to +0.9% for Q2 2024 from February

The CPI projection has been lowered for this year and upgraded significantly from +1.0 to +3.4% for Q2 next year

The projected unemployment rate has been lowered through the projection horizon

The Bank Rate is seen at 4.4% vs. 4.3% in Q2 this year, at 4.4% vs. 4.1% in Q2 next year and 3.8% vs. 3.5% in Q2 2025

Confab, Speakers, News

Federal Reserve

Goolsbee (Neutral). Weekend: Way too premature to expect a June rate hike, we know that credit conditions like the ones we are seeing now in the past have been correlated with recessions and credit crunches, bank situation has to give you some pause. Mon: Too early to make a call on rates for June meeting, getting vibes that a credit squeeze is beginning, must be data-dependent and watch credit conditions, weighing how much Fed work is being done by tighter credit, recession is a possibility. Fri: Inflation is too high but at least it's coming down, hopes inflation can ease without a recession.

Williams (Neutral). Tue: The Fed hasn't said it's done raising rates, does not see any reason to cut rates this year, will raise rates if needed, the Fed needs to be data-dependent, tighter credit may blunt how far the Fed goes with rate hikes, does not see tighter credit knocking the economy totally off course, acute phase of bank stress is over, not seeing a wage-price spiral, confident that the Fed is on the right path to lower inflation to 2% target, core services ex housing inflation still shows persistent inflation.

Jefferson (Neutral). Tue: Inflation has come down and the economy has started to slow in an orderly fashion, banks have started to raise lending standards.

Barkin (Neutral). Wed: The Fed's message last week was "explicitly not a pause" on rates or "even necessarily a peak" but provides the optionality to do more if needed and the option to wait if waiting is appropriate.

Kashkari (Hawk). Thu: Tight monetary policy may be needed for "extended time", inflation has come down but is still above target, bank turmoil can be a source of slowing for the economy, it is conceivable that once we get inflation down to 2% we could have a conversation about changing the target, if markets are right and inflation will fall quickly one would imagine rates could normalize, if high inflation is more embedded then rates will need to stay higher for longer, I am now on the more hawkish end of Fed policy spectrum, we will be back in a low inflation and low rate environment once this period of high inflation ends.

Waller (Hawk). Thu: Climate change does not pose a serious risk to large banks or to US financial stability, it is not the Fed's job to be a climate policymaker, the issue is not whether climate poses risks from acute events like severe weather but if those are distinct from other possible shocks, transition to lower-carbon economy likely to be gradual and predictable and not pose risks to banks.

Bowman (Neutral). Fri: Additional rate hikes are "likely appropriate" if inflation stays high and the labour market stays tight, policy rate will need to remain sufficiently restrictive for some time, uncertain if it is already sufficiently restrictive to bring inflation down, policy action is not on a pre-set course, recent data have not provided consistent evidence that inflation is on a downward path.

European Central Bank

Knot (Hawk). Mon: Rate hikes are starting to have an impact but more will be needed, policy works with a certain delay so the biggest effects of what we've done so far are still in the pipeline, supported last week's 25 bps hike, could support further hikes above 5% if needed.

Lane. Mon: There is still a lot of momentum in food and core inflation.

Kazaks (Hawk). Tue: Rate-hiking may not be finished in July, doing too little remains the greater danger, bet on spring 2024 rate cuts is "significantly premature", not impossible for the ECB to hike or pause as the Fed cuts.

Kazimir. Tue: Slowing hikes lets the ECB go higher for longer, there's plenty of ground to cover, according to available statistics the ECB will need to maintain raising rates for longer than expected, projections point to September as the earliest time to judge the effectiveness of measures and if inflation is moving towards the target.

Vasle. Tue: Inflation is becoming increasingly stubborn, our job on inflation is not yet complete, we need to see a change in core inflation, more rate hikes will be required, avoiding a recession is possible.

Schnabel (Neutral). Tue: No doubt that we will have to do more on inflation, rate cuts are highly unlikely for the foreseeable future.

Nagel (Hawk). Tue: Interest rates should rise further, could have imagined a 50 bps hike at the last meeting but is okay with the 25 bps, the market is not always right about the ECB terminal rate. Wed: We are not done hiking yet, approaching the final stretch of rate hikes, still work to be done on core inflation, we are holding the course on monetary policy. Thu: Meeting-by-meeting approach is the right path for the ECB, nothing is off the table for the September meeting, moving closer to restrictive territory but not there yet, need at least a year-and-a-half to see core inflation closer to 2%. Fri: Latest rate hike won't be the last, inflation is still too high and too strong, need to be sure that the inflation wave ends.

Vujcic. Tue: More rate hikes will be required to return inflation to target.

Stournas. Wed: Barring any drastic changes rate hikes will be over this year, we are close to the end of the tightening cycle, cannot say how many more rate hikes are still needed, may possibly return to very low rates again but don't know that yet.

Lagarde (Dove). Wed: We still have more ground to cover in the fight against inflation, have to move in a very deliberate and decisive way, there are factors that can induce significant upside risks to the inflation outlook, have to be extremely attentive to potential risks and particularly wage increases.

Centeno. Wed: ECB rates to remain high for some time after rate peak, rates should start to come down some time in 2024, interest rate adjustment is still underway.

Villeroy (Neutral). Wed: We have travelled most of the way on rate hikes, what's still lying ahead is "more marginal", it is the future impact of past rate hikes that should for the most part allow us to reach out objective within two years.

De Cos (Dove). Thu: We are now closer to the final cycle of rate hikes.

De Guindos (Dove). Thu: There can be more rate hikes, how many depends on the data, rate decision had a very high consensus, don't believe anybody who names a terminal rate, markets can be wrong about terminal rates, inflation will undoubtedly fall, worried about core inflation and services, underlying inflation will fall too, we have to assess the impact of interest rate hikes on financing conditions.

Sources. Wed: Bloomberg: some ECB members are saying a September hike may be needed.

Bank of England

Bailey (Neutral). Thu: We are approaching the point when we should be able to let level of rates rest, we have not yet seen evidence that allows us to be sure rates can stay on hold, outlook for growth and unemployment has improved, economic activity has been stronger than expected recently, there has been greater resilience in the economy than what we anticipated, good reasons to expect inflation to fall sharply from April, we have to stay the course, past rate hikes will weigh more on the economy in the coming quarters, will adjust the bank rate as necessary to return inflation to target sustainably, no bias in our setting of rates looking forward at this point.

Ramsden (Hawk). Thu: We see no de-anchoring of inflation expectations in market-based measures.

Broadbent (Neutral). Thu: Second-round effects have driven wage growth, we expect falling global prices to drag on wage growth.

Pill. Fri: There may be more work to do to bring inflation down but we are seeing evidence that we are moving in a more favourable direction on the inflation outlook, latest BoE decision reflects the belief that inflation risks are still persistent, not intending to give a directional bias on future rate decisions.

Saunders (Hawk, ex-MPC). Thu: Interest rates may well have peaked, if they go up it's only one further hike, there's a strong likelihood that inflation will undershoot the BoE's forecast by quite a large margin in April.

Swiss National Bank

Jordan. Wed: Cannot rule out further rate hikes, inflation is above price stability range and higher than we want, current monetary policy is not restrictive enough, willing to use FX sales as a policy tool if needed.

Bank of Japan

Ueda. Tue: If the BOJ's inflation target is met in a sustainable and stable manner we will end YCC and shrink the balance sheet, seeing some bright signs including on inflation expectations, inflation expectations have heightened and remain at elevated levels. Wed: Not yet at a stage to discuss how the BOJ will exit easy policy, will debate exit strategy and communicate appropriately when price target is nearly achieved, ETF purchases help to underpin consumption and capex by preventing volatile market moves from hurting public confidence, too early to debate specific ways in which the BOJ could sell ETFs.

Economic Data

Monday, 08.05.23

Tuesday, 09.05.23

Wednesday, 10.05.23

Thursday, 11.05.23

Friday, 12.05.23

Market Analysis

Growth and Inflation

The Atlanta Fed GDPNow model remains unchanged at 2.7%:

The NY Fed Weekly Economic Index ticked up a bit and stands at 1.03:

OECD Composite Leading Indicators:

China, Japan and Germany have picked up a bit

Canada, France and the US remain weak

Citi Economic Surprise Indicators:

USD, EUR, CAD and CHF are all falling

GBP is still up

AUD has picked up from lows

NZD isn't going higher

The Global CESI has been going lower for a while too with the EM index going higher and the DM index tanking:

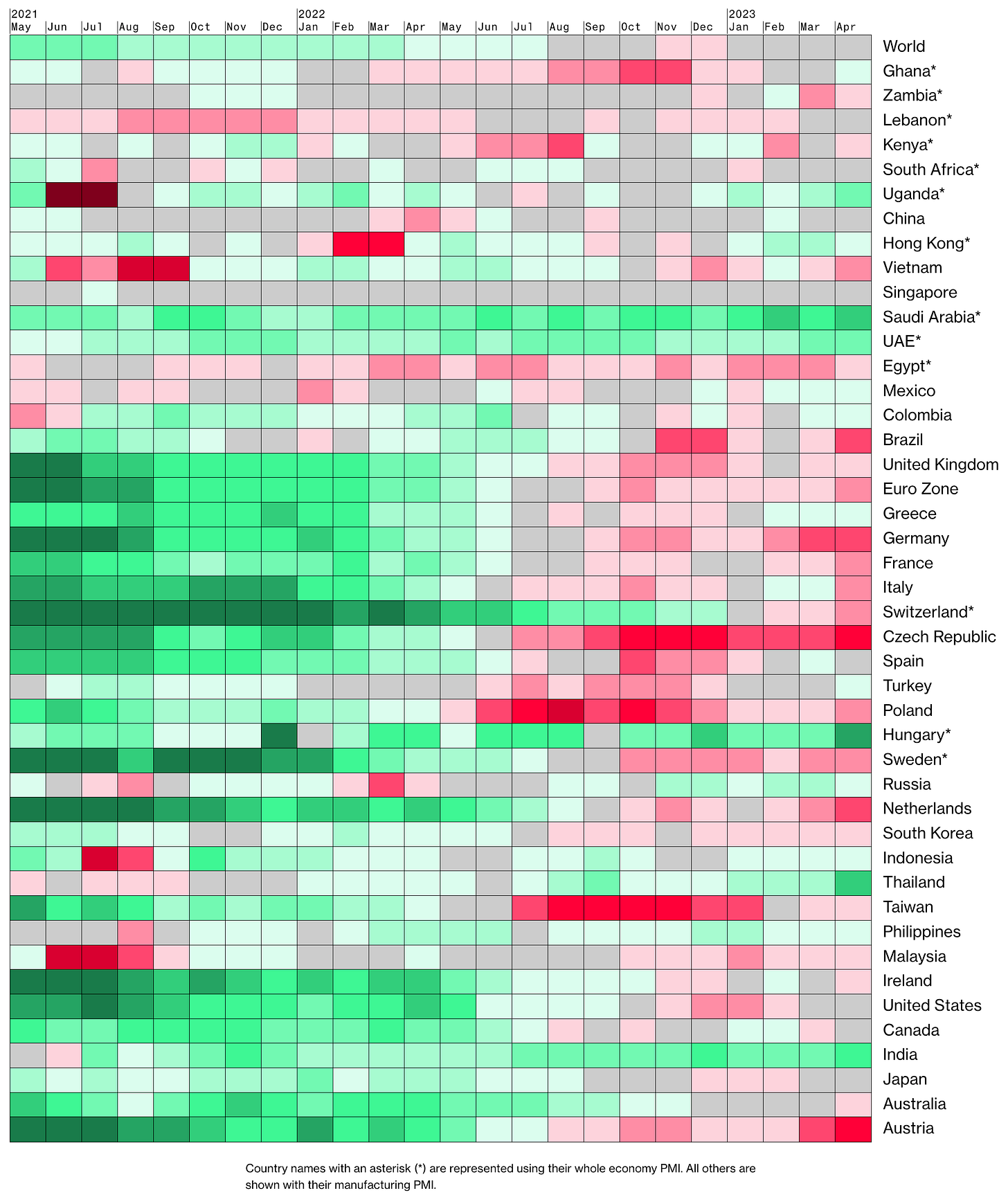

There haven't been any changes to the Bloomberg PMI heatmap:

The US is unchanged

Canada has improved

The Eurozone and Switzerland are weaker, the UK remains unchanged

Australia is weaker, Japan is unchanged

China and South Korea aren't improving, Hong Kong and Vietnam have weakened

Breakeven inflation rates are once again at their relative low, and the 5-year is now below the 10-year breakeven rate:

5y5y forward inflation expectations and RINF just aren't moving:

The NY Fed Consumer Inflation Expectations ticked down for the 1-year metric and increased for the 3- and 5-year numbers:

The Citi Inflation Surprise Index is unchanged from last week:

USD, NZD and CHF are lower

EUR, CAD and JPY are sideways

GBP and AUD are up

Yields

See chart and table below:

The only country that stands out is the UK with 2s and 10s that look relatively resilient

Everyone else is going sideways

Japanese 10s have backed off the 0.5% cap

A closer look at 2y and 10y yields, and at the 2s10s:

Global 2s10s still aren't moving much, the Australian curve has flattened in recent weeks:

Central Banks and the US Dollar

Latest FOMC meeting probabilities according to FedWatch:

The June meeting is still priced with a no-change at about 85% probability but the upside has a bit of a higher probability compared to last week

The July meeting is also priced at no-change but with more weight to the dovish side

The rest of the implied rate path is virtually identical albeit the probabilities on the hawkish side are mostly higher compared to one week ago

The implied path of the Fed Funds Rate is mostly unchanged but further out more on the dovish side compared to the last weeks:

Here's the same data over the last two weeks: the terminal rate remained virtually unchanged and the expectation is mostly for June/July:

Sectors and Flows

Currency strength:

GBP, CHF and EUR are the strongest over three months, AUD, JPY and NZD are the weakest currencies

Performance over one month is more mixed with CHF still the outperformer and JPY the underperformer

Last week, USD has regained its strength, followed by JPY and CHF while everyone else was negative for the week

Currency indexes:

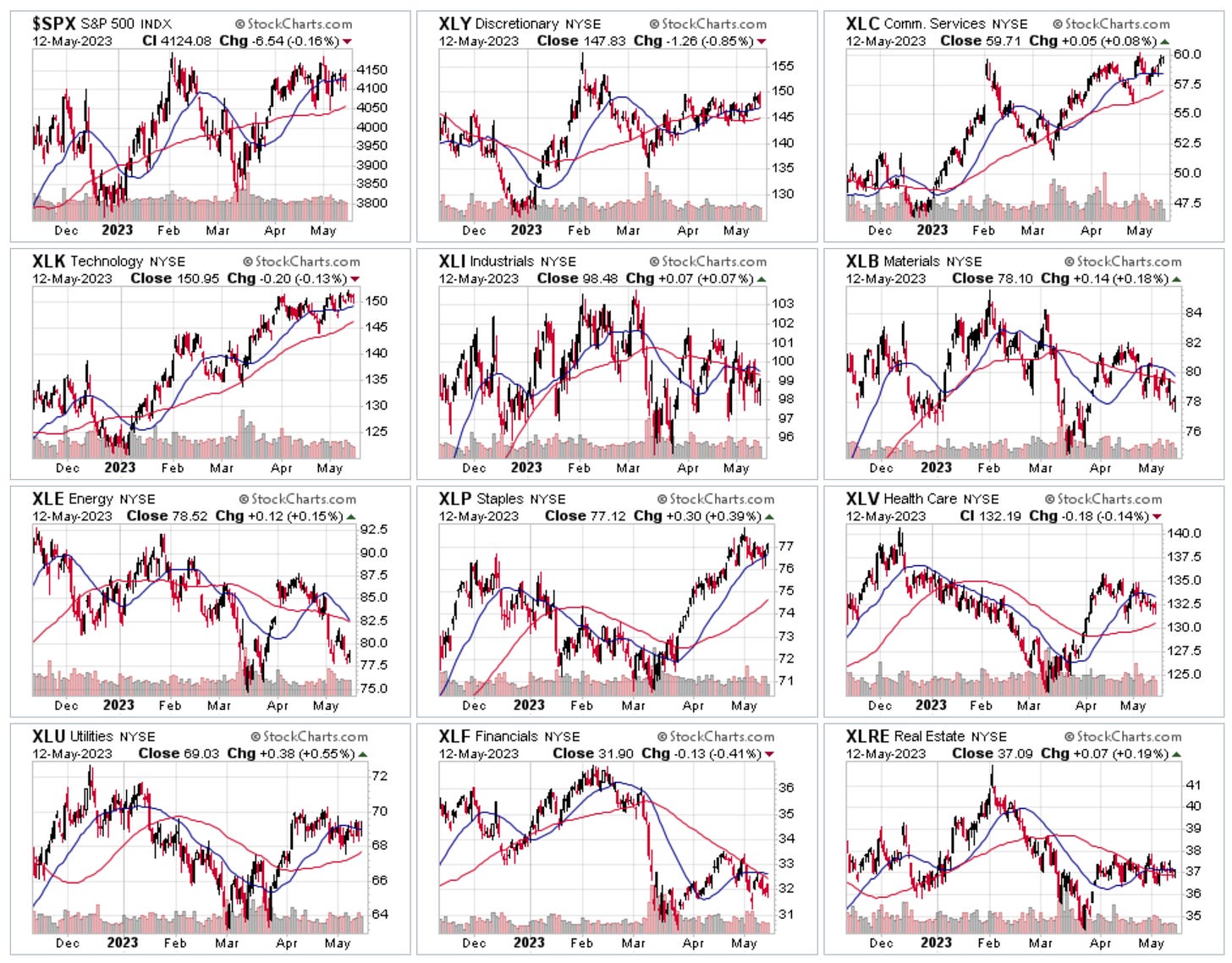

Equity sector performance:

It's pretty interesting to see that SPY is flat over three months but the only three positive sectors are XLK, XLP and XLY… what an odd combination

The underperformers are Energy and Metals/Mining

A different look at sectors:

Tech is the big outperformer and Energy is the big laggard

Sector breadth is still okay with about 75% of sectors positive over 30 days:

Sector thumbnail charts:

XLE is close to its lows

XLF is going lower

International stock markets:

The Nasdaq is the best-performing index

Japanese and European indexes are performing well

The rest of the world is pretty close together

Hang Seng and the R2k are the worst-performing indexes

Sentiment and Positioning

The AAII Bull-Bear spread remains neutral:

Currency sentiment:

Bullish sentiment in: AUD, CAD, JPY and NZD

Bearish sentiment in: CHF

Different sentiment source:

EURCHF and USDCHF are still two of the three currencies with the most bullish sentiment

USD pairs are mostly bearish USD

JPY pairs are mostly bullish JPY

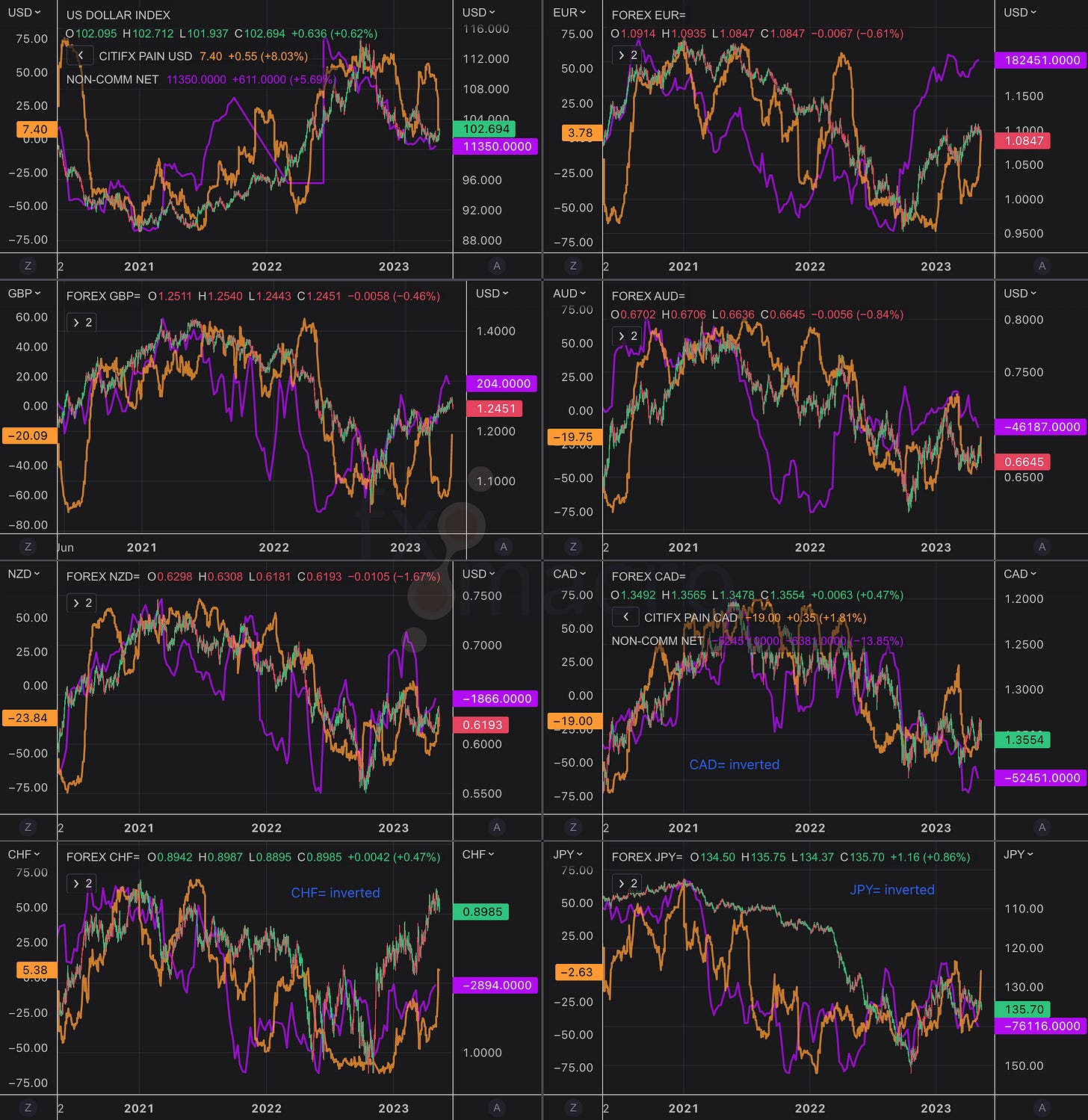

Commitment of Traders and futures performance:

Equity futures were all negative this week except for NQ. Positioning in ES remains bullish.

Treasury futures were negative for the week, Commercial and Large Trader positioning is still at bullish extremes in ZT and ZF, and it leans bullish in ZN and TN.

Currency futures ended the week lower except for DX. Positioning remains bullish DX and bearish 6E, 6B and 6S.

Bitcoin is down about 11% for the week, its Relative Strength is also lower but still above 1.00.

Energy futures were mixed with NG and RB positive and CL and HO negative. RSL of all four futures is well below 1, and positioning is neutral even though the COT-index has picked up for CL, HO and RB.

Metals were mixed, HG still isn’t performing with an RSL of 0.94. Positioning in GC, SI and PL is bearish while the COT-index has picked up and is on the way to a bullish extreme for HG

Grains were mostly lower this week but positioning is more or less bullish for each future

Softs were also mostly lower, positioning is bearish for CC and SB, and bullish for OJ

COT/TFF Dealer net positions for currency futures:

6E is still at lows

6C is moving lower again from its high

Citi PAIN indexes:

This week saw some big moves with USD longs pared back vs. everyone else

Here’s the combined COT/PAIN chart:

The moves in PAIN would suggest a lower USD, and a higher EUR, CHF and JPY

I’m not getting too excited here because it’s a noisy signal when compared to the spot prices

Market Risks

Credit spreads remain elevated but mostly trade sideways:

The same is true for the Credit Spread Index:

Currency volatility is still on the way down:

The VIX term structure looks unremarkable:

Volatility indexes:

VIX is at 17 and MOVE at 120

VVIX is at around 11 and diverging to the upside again

VIX/VIX3M is still steep

Skew is steepening with SDEX, TDEX and VIX/VOLI all rising

Not sure what to make of it: VVIX has diverged from VIX a few times recently and people buying vol and OTM puts shouldn’t be unexpected with VIX at 17 and the ES at resistance. With MOVE heading lower I’d lean towards the not-concerned side.

The CNN Fear & Greed Index is still at Greed:

The BlackRock Geopolitical Risk Indicator ticked lower again:

Various

The NYSE Advance/Decline Line is diverging to the downside from SPX. Also, the gauge of offensive vs. defensive sectors has been going lower:

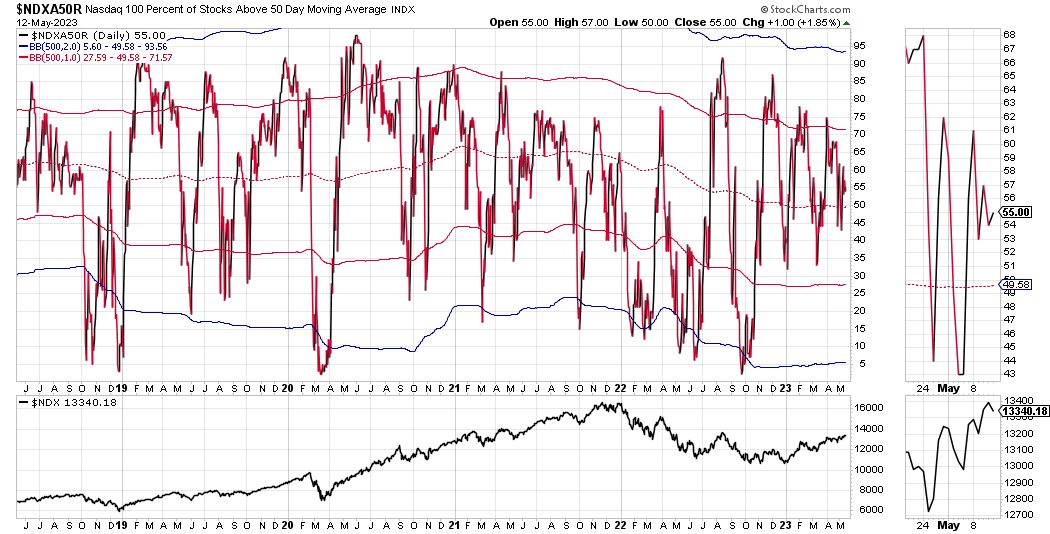

The percentage of S&P500 and Nadaq 100 stocks above their 200-day moving averages continues to deteriorate:

The same is true for the 50-day moving averages where we make one lower high after the other:

25-delta risk reversals:

USDCAD is priced lower

Market dashboard:

Trend metrics are still divided between ES and NQ on the bullish side and RTY and DJT on the bearish side

Distribution days are still way too high for every index

Volatility metrics are unremarkable, as is breadth and put/call ratios

The VIX/VVIX correlation is back above 0.20

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 19/2023 | 13/2023 | 06/2023 | 50/2022 | 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 15/2023 | 09/2023 | 02/2023 | 47/2022 | 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

ECB

Rate Statements: 19/2023 | 12/2023 | 06/2023 | 50/2022 | 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 17/2023 | 10/2023 | 04/2023 | 47/2022 | 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 11/2023 | 05/2023 | 50/2022 | 43/2022 | 36/2022

BOE

Rate Statements: 13/2023 | 06/2023 | 50/2022 | 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

RBA

Rate Statements: 19/2023 | 15/2023 | 11/2023 | 07/2023 | 50/2022 | 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 17/2023 | 09/2023 | 51/2022 | 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 19/2023 | 07/2023 | 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 15/2023 | 09/2023 | 47/2022 | 41/2022 | 34/2022 Meeting Minutes: 07/2023 Crib Sheets: 40/2022

BOC

Rate Statements: 15/2023 | 11/2023 | 05/2023 | 50/2022 | 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022 Summary of Deliberations: 18/2023

SNB

Rate Statements: 13/2023 | 50/2022 | 44/2022 | 39/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

BOJ

Rate Statements: 18/2023 | 11/2023 | 04/2023 | 51/2022 | 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 13/2023 | 05/2023 | 52/2022 | 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: Midjourney with the prompt: A very hot evening in future Baghdad. A lot of people are sitting outside on the terrasses of cafes, chatting, drinking tea and smoking the shisha pipe. Palm trees, cityscape, backstreets, tropical, futuristic, neon lights, moonlight, arabpunk, cyberpunk, 80s cyberpunk, dystopia, highly detailed, 64k --ar 16:9

Thank you. Great as always. Question regarding the offensive/defensive stocks formula. Shouldn´t it be (XLK*XLF*XLB*XLI)/(XLY*XLU*XLP*XLV). Because in this form you are constructing two indices in realtion to each other. But your formula is constructing one offensice index and then in relation to each single defensice sector ETF?

Really nice work!!!