Review of Week 25/2023

"Luck is what happens when preparation meets opportunity." - Seneca

Due to other commitments, this is a short version of the newsletter that only contains a review of this week's relevant events and data. I’ll probably be sending a short version of the newsletter next weekend too (that week will be short anyway due to the July 4th holiday).

Another thing before we get started: Substack has introduced subscriber referrals. That's a reward system where readers can earn perks for inviting others to subscribe. I haven't enabled it yet - mainly because I don't have a good idea of what would be good rewards. If you have one, feel free to leave it in the comments or reach out directly.

Welcome to issue #61 of fx:macro!

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

The cover image is AI-generated via Midjourney. If you want to guess the prompt, I put it at the end of the newsletter.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Table of Contents

Summary (

Playbook, Calendar, Levels,FX Drivers, Downloads)Week in Review: a) Central Banks, b) Economic Data

Market Analysis: a) Growth and Inflation, b) Yields, c) Central Banks and the US Dollar, d) Sectors and Flows, e) Sentiment and Positioning, f) Market Risks, g) VariousTop 3 Macro Charts of the Week

Summary

Currency Drivers

For an explanation check out this link.

Downloads and Links

Central bank overview with each central bank's last rate statement, press conference and minutes:

Central bank speaker recap for the week:

Week in Review

Central Banks

RBA Minutes (20.06.23)

The Minutes were received dovishly by the market with AUD sharply lower and 2s2s bull steepening. Here are the highlights:

BOC Minutes (20.06.23)

Here are the highlights from the BOC's meeting minutes:

SNB Rate Decision (22.06.23)

The SNB hiked rates by 25 bps to 1.75%:

Guidance unchanged: Further hikes cannot be ruled out, the SNB remains willing to be active in the FX market with the focus currently being on selling foreign currency

Reason for the hike: inflationary pressure has increased again over the medium term

Inflation has declined significantly in recent months due to lower oil and gas prices; the new inflation forecast is below that of March for 2023 due to lower energy prices and a stronger CHF, and above the March projection from 2024 due to second-round effects

Average annual inflation is projected at 2.2% for 2023 and 2024, and 2.1% for 2025

Swiss GDP was solid in Q1 2023, the SNB expects modest growth for the rest of the year at around 1%, unemployment will likely rise slightly

The forecast for Switzerland and the global economy is subject to high uncertainty, the major risk is a more pronounced economic slowdown abroad

BoE Rate Decision (22.06.23)

The Bank of England hiked rates by 50 bps to 5.00%:

Guidance unchanged: If there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required.

Quarterly GDP growth via business surveys expected to be around 0.25% during the middle of the year, household spending has strengthened a little, unemployment is flat and employment has risen, Average Weekly Earnings have increased above expectations but are projected to ease of the rest of the year

CPI has fallen to 0.3% higher than projected in May and is expected to fall significantly further during this year

Services CPI and core goods CPI have also been stronger than projected, services CPI is expected to remain unchanged in the near term and core goods CPI is expected to decline later this year

Second-round effects in prices and wages are likely to take longer to unwind than they did to emerge, recent data suggests more persistence of inflation because of the tightness in the labour market and the resilience of demand

Gilt yields, especially in the short end, and mortgage rates have risen materially since the last meeting, the full effect of the increase in the bank rate will not be felt for some time due to the greater share of fixed-rate mortgages

From the meeting minutes:

Confab, Speakers, News

Federal Reserve

Goolsbee (Neutral). Weekend: Pausing for now to scope out economic developments, there are conflicting pieces of evidence coming from the economy: is it too hot and we need to do more or have we done enough on rates over the last year?, we're just going to have to play it by ear I guess. Wed: Decision last week was a close call for me, have not decided yet on July, the Feds framework is "wait and see", perfectly appropriate to have a reconnaissance mission now, trying to figure out if we have done enough and how much more needs to be done, probably won't gain enough info in 6 weeks but will learn more, over the next couple months will get a sense if goods inflation is coming down, the lags argument is a tremendously important one.

Jefferson (Neutral). Tue: I remain focused on returning inflation to 2%, inflation has started to abate, must remain attentive to inflation and banking-sector stress, US banking system is sound and resilient, I remain attuned to any threats to banking system stability. Wed: Recent bank troubles present downside economic risk, watching commercial real estate for risks.

Cook (Neutral). Tue: Focused on inflation until the job is done. Wed: We are not there yet on getting inflation back to target, there isn't much here to indicate any unease about hiking in July.

Kugler. Tue: Deeply committed to setting monetary policy to reduce inflation and promote maximum employment, important to bring inflation down to 2% target. Wed: Both sides of the Fed's mandate are important, pushing inflation down is the Fed's main mission now.

Powell (Neutral). Wed: Nearly all FOMC participants expect it will be appropriate to raise rates somewhat further by year end, the two hikes pencilled into the dot plot is a pretty good guess of what will happen, a big majority believes in raising rates twice this year, the level for rates and speed of hikes are separate, it may make sense to move rates higher at more moderate pace, the Fed is now moderating the pace of rate hikes, will continue to make our decisions meeting by meeting, we never use the word pause and wouldn't use that here today, the process of getting inflation back to 2% "has a long way to go", will take time to see full effects of policy tightening, tighter credit likely to weight on economic activity but extent remains uncertain, longer-term inflation expectations appear to remain well anchored, factors contributing to inflation decline are happening but later than expected, it is important that the balance sheet doesn't just grow with every cycle, balance sheet should be smaller than now but need a buffer against scarce reserves, don't want to be in the same position as last reduction cycle, there is a gradual cooling in the labour market but we're not there yet, still significant labour shortages, the US dollar is still the dominant reserve currency. Thu: A strong majority feels there is a little further to go on rate hikes, decision last week was to move more slowly, we kept rates on hold to give ourselves more time to make a decision, headline inflation has come down but that's largely from energy and food and not principally a function of monetary policy, we still have a long way to go, we have not seen much progress in the way of services inflation, we expect inflation to move down this year, I see a path for inflation to continue falling with little increase in unemployment.

Bostic (Neutral). Wed: Further rate hikes may needlessly drain the economy, wants to give the economy more time to adjust to rate hikes before doing more, policy has not been restrictive for long enough for its effects to be felt so it's prudent to wait, maintaining the current rate will be passive tightening of the real rate that will still aid in fighting inflation, risk of inflation rebounding is "not my baseline", some further slowing of the labour market may be necessary, contagion that was feared from earlier bank failures has not materialized. Fri: Expects jobless rate to rise from historically low level, not seeing elements of risk appearing in the economy, credit risk is likely coming and real estate could pose a risk, the banking sector is quite strong.

Bowman (Neutral). Thu: Additional rate hikes will be needed to reach sufficiently restrictive level, inflation still "unacceptably high" despite drop in headline number, core inflation has essentially plateaued since the fall of 2022, will look for inflation on a consistent downward path in deciding appropriate policy steps at coming meetings.

Barkin (Neutral). Fri: Will not prejudge the July meeting, would be content with more hikes if inflation is not progressing towards the goad, would support rate cuts when there is conviction that inflation is heading down, still a good way from the 2% inflation target, demand is still elevated compared with its pre-pandemic trend and boosting inflation but it does seem it's weakening.

Daly (Neutral). Fri: Two more rate hikes this year is a "very reasonable" projection, it's only a projection and we don't know for sure, prudent to slow the pace of hikes as we approach destination, risks over overtightening and undertightening are about balanced, strongly supported June decision to hold rates and watch the data, credit tightening so far is consistent with what would have been expected without March banking turmoil.

European Central Bank

Lane. Mon: Another hike in July seems appropriate and then we will see in September, September is still far away, inflation will come down fairly quickly in the next couple of years, need to be data-dependent on the inflation outlook. Fri: Not seeing a wage price spiral but more like an inverse spiral, wages "inevitably" need to catch up and that will slow disinflation, it's a catch-up phase not a spiral.

Schnabel (Neutral). Mon: We need to keep raising interest rates until we see convincing evidence that developments in underlying inflation are consistent with headline inflation returning to 2%, risks to the inflation outlook are tilted to the upside, a monetary policy stance that errs on the side of determination insures against costly policy mistakes, rules suggest that the optimal rate path would have been steeper, the fact that we underestimated inflation persistence last year raises the probability that we are also underestimating inflation today, we need to remain highly data-dependent and err on the side of doing too much rather than too little. Wed: Domestic inflation is driven by profits and wages.

Kazimir. Mon: We need to raise rates again in July, regarding September I'm awaiting analysis of cumulative impact of past ECB measures, stopping rate hikes too soon is "much more significant" risk than overtightening, tightening is the only reasonable way ahead. Wed: Further policy tightening in September is not certain, would need to have core inflation under control to stop tightening, we need more data ahead of September.

Stournas. Mon: Cannot exclude a further rate hike but can't say now, we are data driven, might keep terminal rates for six months or a year, we are definitely close to the end of rate hikes, a further decrease in inflation is expected.

De Guindos (Dove). Mon: There is no doubt inflation will ease, underlying prices could face more limitations in that slowdown.

Simkus (Hawk). Mon: No doubt rates will be raised in July, no need to rush with September assessment. Tue: Would not be surprised if we raised rates in September, we'll be in a floor system for some time into the future, open to discussing if we could to more with APP than stopping reinvestments.

Vujcic. Tue: Have to consider risks of doing too much vs. doing too little, core inflation pressures remain in the Eurozone, bringing down inflation is more art than science, sometimes a soft landing is not possible.

Villeroy (Neutral). Tue: The duration of terminal rate is more important than the level, future rate decisions to depend on inflation data, inflation is past the peak in France and the Eurozone.

Rehn (Neutral). Tue: We will bring interest rates to levels sufficiently restrictive and keep them there as long as necessary, the rise in CPI is slowing but not to the extent desired, inflation ex energy and food is only falling gradually, it is important that core inflation is on a steady and sustained decline.

Nagel (Hawk). Wed: Confident that inflation will come back to target, there is still a way to go, have to be stubborn because inflation is stubborn, it would be a first-order error to give up on raising rates too early, not seeing a credit crunch. Thu: Rates have not peaked and eventual peak must be held for an extended period until inflation is broken, tight labour market could result in persistent inflationary pressures.

De Cos (Dove). Fri: We will hike rates again in July but not possible to say what comes after that, we still have ground to cover, core inflation is more resistant than expected.

Bank of England

Hall. Tue: Recent moves in yields have once again tested liability-driven investment funds.

Bailey (Neutral). Thu: We are not signalling what will come next on rates, it was absolutely imperative that the BoE raised rates today, the pattern of persistence and sticky inflation is seen in other countries too, cannot continue to have the current level of wage increases, cannot have companies building profit margins that cause prices to rise at their current rates, not seeking to precipitate a recession.

Reserve Bank of Australia

Bullock. Tue: Policy is not on a pre-set path, not being "bloody minded", higher rates are the only tool the RBA has to curb inflation, employment and the economy need to grow below trend for a while, the economy would be more sustainable with unemployment at 4.5%, the labour market will invariably soften but it remains tight by most measures, we have been willing to accept a more gradual return of inflation to target than many other central banks, it is important that the government does not add to demand.

Swiss National Bank

Jordan. Thu: We cannot rule out further monetary policy tightening, most likely we will have to tighten policy again but we can also take a more gradual approach, gradual approach is appropriate at present and we can look again in September, tighter monetary policy has strengthened the Swiss Franc but underlying inflation pressure has risen further, Swiss inflation is not a luxury problem, even though we are in a very fortunate position it is still very important to bring inflation down, there is a danger inflation may become entrenched above 2%, inflation caused by higher rents is not a reason to refrain from future rate hikes.

Maechler. Thu: The SNB has sold foreign currencies in recent quarters, will continue to do that if it is appropriate for monetary policy, remain ready to buy foreign currencies if there is excessive Franc appreciation.

Bank of Japan

Kanda. Mon: Welcomes US dropping Japan from its monitoring list in latest currency report.

Suzuki. Tue: Closely watching FX moves, no comment on FX levels, FX stability is important, should move stably reflecting fundamentals. Fri: Firmly watching FX moves, sharp currency moves are undesirable, FX rates should be set by the market reflecting fundamentals, does not want to comment on FX levels.

Adachi. Wed: Too early to tweak monetary policy, appropriate to continue monetary easing under YCC framework, if bond market functioning remains in current state chance of tweaking YCC in July is low, inflation has risen faster than I expected, personally thinking it's hard to make a strong call on inflation outlook at our next policy meeting in July, longer-run downside risks to our price outlook appear to be bigger than upside risks, what we fear most is a premature policy shift that would put Japan back to deflation, impact of falling raw material prices on CPI will appear with a lag of about 9 months, want to look at several months' price data and speed of price moves to gauge price trend, must be mindful of downside risks surrounding Japan's economy given risks to global economy.

Ueda. Wed: Will patiently maintain easy monetary policy to achieve 2% inflation target, Japanese CPI is likely to slow towards the middle of the current fiscal year, Japan's economy is picking up.

Kishida. Wed: Mobilising all policy steps to ensure wage growth, positive signs are emerging in Japan's economy.

Noguchi. Thu: Japan's economy is to recover moderately, new guidance shows the BOJ's strong commitment to patiently keep monetary easing, inflation expectations are yet to be anchored at 2%, need to carefully gauge for now whether the norm for inflation and wages is changing, must consider tradeoff between economic stimulus effect and market functioning when setting allowance for 10-year yield target, the shape of the yield curve is smooth as a whole, December decision to widen the allowance band around the yield target was not monetary policy, necessary for wages to rise more than the 2% inflation target, important for wages to rise continuously and not just once, Yen decline last year was too rapid, FX should move stably reflecting fundamentals, we are finally seeing benefits of weak Yen appearing such as more firms shifting production back to Japan.

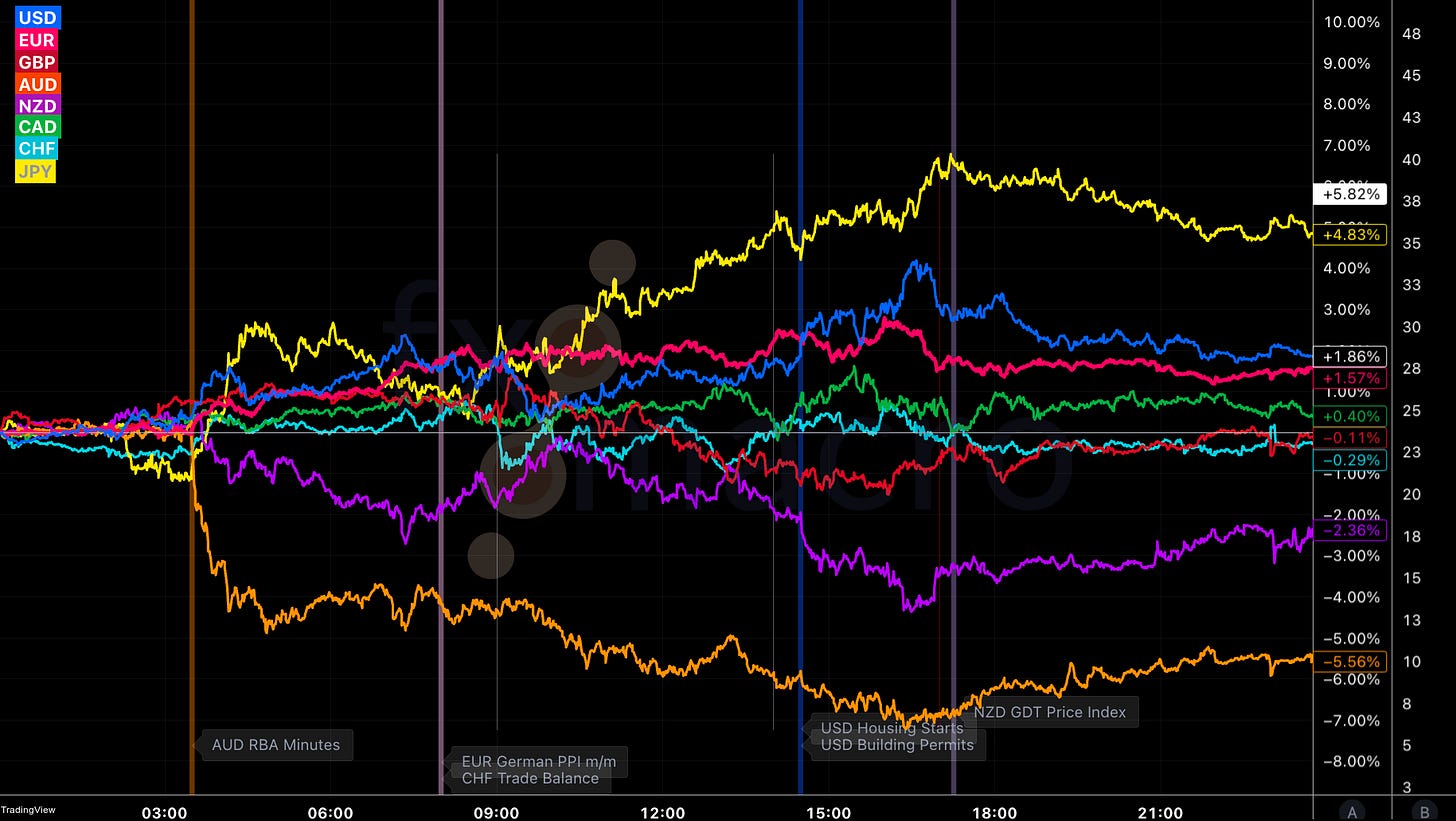

Economic Data

Monday, 19.06.23

Tuesday, 20.06.23

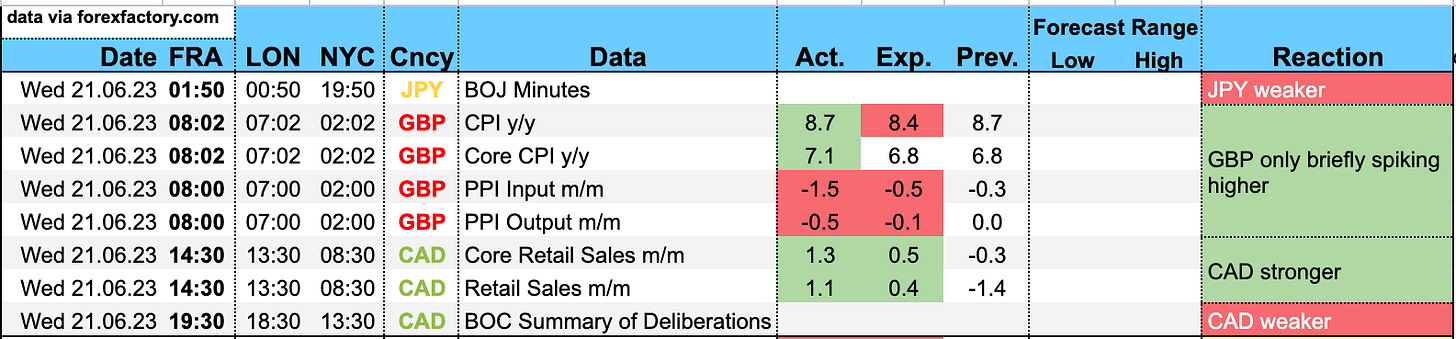

Wednesday, 21.06.23

Thursday, 22.06.23

Friday, 23.06.23

"In manufacturing, all signs point to a contraction in the second quarter, while a slowdown in growth is evident in the services sector.

"In the goods-producing sector, the HCOB PMI output index signalled an even sharper decline in June than in May. At the same time, the index of factory new orders, which was already declining, fell again. According to Destatis, the range of the order backlog fell from a high level to 7.3 months in April, a trend that is likely to continue. Production is therefore expected to decline in the coming months, but because of the still robust order backlog, we do not expect an abrupt slump.

"The German economy is supported by the services sector, which according to the HCOB PMI expanded quite strongly throughout the second quarter, although the pace of growth slowed somewhat in June. Service providers continue to face relatively strong input prices increases, but they are also able to pass on much of the higher costs to customers, another sign of their strength.

"The overall good condition of the service sector is also underscored by the fact that companies actually increased their staff slightly more than in the previous month. It is noticeable, however, that the export business of service providers, which includes tourism, has weakened, after this area had been assessed quite positively in recent months."

"If the ECB only had to control goods prices, then Frankfurt would toast the end of inflation, because even in June the PMI survey shows that purchasing and selling prices have fallen significantly. Moreover, given the recession in manufacturing indicated by the PMI, one would start with interest rate cuts. But this picture is incomplete. In the more important part of the economy, the private services sector, prices continue to rise, and that's why the core rate of inflation has been so slow to decline."

"In addition to the persistent discrepancy that has already been observed for several months between manufacturing on the one hand and services on the other, there are also clear regional differences. In France, for example, activity in the service sector contracted in June according to the PMI survey, whereas in Germany it continues to expand, albeit at a slower pace. This is also reflected in new orders, which are falling in France but rising in Germany - again at a declining rate. High inflation and more difficult financing costs are cited as reasons for this weakness in France, which may also have suffered economically from intense strike and protest activity in spring."

"After Eurozone GDP fell for the second time in a row in the first quarter, the probability has increased somewhat that the GDP change will again carry a negative sign in the current quarter, due in part to weak services activity in France. Even if our baseline scenario of slightly positive Eurozone growth in the second quarter still becomes reality, the downward trend in the Composite PMI points to a difficult second half of the year as companies across all sectors face deteriorating order books."

“June's flash PMI survey indicates that the UK economy has lost momentum again after a brief growth spurt in the spring, and looks set to weaken further in the months ahead.

“Most notably, consumer spending on services, which was a core growth driver in the spring, is now showing signs of faltering as the reality of higher interest rates, the increased cost of living and gloom about the outlook sets in and overrides the brief boost to spending enjoyed from the pandemic tailwind. The manufacturing sector meanwhile continues to report recessionary conditions.

“One notable area of resilience in the economy is the labour market, with jobs growth accelerating in June as companies in the service sector continue to fill vacancies. While falling backlogs of work suggest this hiring trend could also fade in the coming months as the economy weakens, for now it is generating higher wage growth, in turn feeding through to still-elevated inflation pressures in the service sector. As such, the survey’s price gauges point to consumer price inflation remaining well above the Bank of England's target into 2024, which will add to the case for further interest rate hikes.

“Thus, while the June survey reveals the economy to be cooling as a result of higher interest rates, the stubbornly elevated price growth in the service sector suggests the Bank of England will consider its fight against inflation as still a work in progress. However, such rate hikes will clearly add further to the likelihood of a recession later in the year, which is looking increasingly inevitable as collateral damage in the fight against inflation.”

“The overall rate of expansion of business activity in the US remained robust in June, consistent with GDP rising at a rate of 1.7% to put second quarter growth in the region of 2%.

“Growth remains dependent on service sector spending, however, with manufacturing slipping back into decline after three months of growth. While improving supply conditions had helped boost manufacturing production in prior months, an increasingly severe downturn in new orders mean factories are running out of work.

“The situation is brighter in the service sector, where demand is proving resilient and the recent pause in rate hikes appears to have helped boost business optimism for the year ahead.

“The question remains as to how resilient service sector growth can be in the face of the manufacturing decline and the lagged effect of prior rate hikes. Any further rate hikes will of course have a further dampening effect on this sector which is especially susceptible to changes in borrowing costs.

“The tightness of the labor market remains a concern, and upward wage pressure remains a key driver of higher costs in the service sector. However, it is encouraging to see the overall rate of selling price inflation for goods and services drop to the lowest since late 2020 in a sign that the Fed is winning its fight against inflation.”

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 25/2023 | 19/2023 | 13/2023 | 06/2023 | 50/2022 | 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 22/2023 | 15/2023 | 09/2023 | 02/2023 | 47/2022 | 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

ECB

Rate Statements: 25/2023 | 19/2023 | 12/2023 | 06/2023 | 50/2022 | 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 22/2023 | 17/2023 | 10/2023 | 04/2023 | 47/2022 | 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 11/2023 | 05/2023 | 50/2022 | 43/2022 | 36/2022

BOE

Rate Statements: 20/2023 | 13/2023 | 06/2023 | 50/2022 | 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

RBA

Rate Statements: 24/2023 | 19/2023 | 15/2023 | 11/2023 | 07/2023 | 50/2022 | 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 21/2023 | 17/2023 | 09/2023 | 51/2022 | 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 19/2023 | 07/2023 | 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 22/2023 | 15/2023 | 09/2023 | 47/2022 | 41/2022 | 34/2022 Meeting Minutes: 07/2023 Crib Sheets: 40/2022

BOC

Rate Statements: 24/2023| 15/2023 | 11/2023 | 05/2023 | 50/2022 | 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022 Summary of Deliberations: 18/2023

SNB

Rate Statements: 13/2023 | 50/2022 | 44/2022 | 39/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

BOJ

Rate Statements: 25/2023 | 18/2023 | 11/2023 | 04/2023 | 51/2022 | 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 20/2023 | 13/2023 | 05/2023 | 52/2022 | 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: Midjourney with the prompt: a lake within wonderful and epic nature. Under the surface the water turns into a data lake with green code lines like in matrix. --ar 16:9

Love your work mate. Quick question when (if) you have the time - in the heatmap when we're looking at correlations of say GBP and FTSE, is that GBPUSD or a trade weighted Index? Was trying to work up something similar and was getting different correls 😅