Outlook for Week 22/2023

“No one can upset you unless you give them permission.” - Rob Hanna

Welcome to issue #57 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary. If you're short on time or just don't like long newsletters then just skip them.

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

The cover image is AI-generated via Midjourney. If you want to guess the prompt, I put it at the end of the newsletter.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Table of Contents

Summary (Playbook, Calendar, Levels, FX Drivers, Downloads)

Week in Review: a) Central Banks, b) Economic Data

Market Analysis: a) Growth and Inflation, b) Yields, c) Central Banks and the US Dollar, d) Sectors and Flows, e) Sentiment and Positioning, f) Market Risks, g) Various

Top 3 Macro Charts of the Week

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Please check out this article about what this summary aims to provide and what its limitations are.

Economic Calendar for next week

Important levels to watch and look out for in FX futures

Currency Drivers

For an explanation check out this link.

Downloads and Links

Difftext of the Summary from last week: diffchecker.com

Central bank speaker recap for the week:

Week in Review

Central Banks

RBNZ Rate Decision (24.05.23)

The RBNZ hiked by 25 bps to a policy rate of 5.50%:

Guidance: The OCR will need to remain restrictive for the foreseeable future

Global growth is weakening and inflation is easing

Domestic inflation and inflation expectations are expected to continue declining

Signs of labour shortages are easing and the main constraint of businesses is a lack of demand instead of labour shortages; house prices have eased to more sustainable levels

Expects migration to ease back to pre-Covid-19 levels over the coming quarters

From the meeting minutes:

From the Monetary Policy Statement:

The peak OCR is forecast at 5.50% (the current level)

FOMC Minutes (24.05.23)

There was little to no new information in the Minutes. Here are the highlights:

Confab, Speakers, News

Federal Reserve

Kashkari (Hawk). Weekend: Open to the idea of moving a little bit more slowly on rate hikes, would object to any kind of declaration that we're done, if the committee chooses to skip a meeting to get more information that could make sense, a skip to get more information is very different than saying we're done. Mon: It's a close call whether to raise or pause in June, it may be that we have to go north of 6% but that isn't clear yet, not seeing evidence that banking stress is doing the Fed's job on inflation, services inflation seems "pretty darn entrenched", it is way too early to declare the all clear on banking problems.

Bullard (Hawk). Mon: The Fed will have to go higher this year by perhaps 50 bps, the September dot plot was based on slow growth and inflation improvements that have not occurred, core measures of inflation have not changed much in recent months, the Fed should err on the side of doing more, recession arguments are overstated, base case remains relatively slow growth for the rest of the year and into 2024.

Daly (Neutral). Mon: Prudent to refrain from commenting on Fed policy action, declined to say what the Fed should do at the June meeting, wants to see if policy tightening is affecting the economy, still a lot of data before June meeting, tighter credit conditions may be like 1-2 rate hikes, would be historical anomaly to get 2% inflation with sub-4% unemployment, seems reasonable to see unemployment to go above 4%.

Barkin (Neutral). Mon: Will not prejudge June meeting outcome, still looking to be convinced inflation is in a steady decline, the Fed would have to think hard about the design of a CBDC if Congress did authorize it. Thu: Demand is definitely cooling in part because it was overstimulated during the pandemic, rate hikes are also helping to reduce demand, some businesses are still saying they need to raise prices, the labour market is quite tight.

Bostic (Neutral). Mon: Comfortable waiting a little bit to see how the economy plays out, will take decisions one meeting at a time and let things play out. Wed: Best case scenario is the Fed will not consider a rate cut well into 2024, will base rate decisions on data, does not want to be locked into a pre-determined path, expects to see stress in the jobs market when inflation is falling towards the target.

Logan (Neutral). Tue: Backstop should be available whenever banks need it including nights, weekends or holidays.

Waller (Hawk). Wed: Does not expect data in the next couple of months to make it clear the terminal interest rate has been reached, does not support stopping hikes unless there is clear evidence that inflation is moving down to 2% target, prudent risk management may suggest skipping a hike in June and leaning towards July, need to maintain flexibility for June meeting, concerned about the lack of progress on inflation, a rebound in housing market is raising questions about how sustained lower rent increases will be, doesn't like that we have MBS on the balance sheet, there are good yield curve inversions and that may be what we have now, a good inversion is when it suggests inflation will come down.

Collins (Neutral). Thu: The Fed may be at or near a time to pause rate hikes, a pause would give the Fed space to measure impact, inflation is too high but there are promising signs of moderation, banking sector likely to weigh on demand.

Mester (Hawk). Fri: Everything is on the table for June, still more data to see ahead of the June meeting, doesn't know exactly how tight monetary policy is right now, does think they will have to tighten "a bit more", important not to under-tighten, the Fed has made slow progress on inflation and that's concerning, may have to revise up her inflation projections in the June SEP, hasn't seen much sign that banking stress is affecting credit conditions.

European Central Bank

Lagarde (Dove). Weekend: We are not done yet, we are not pausing based on the information I have today, the inflation outlook is too high for too long, we have covered a large chunk of the journey towards taming inflation and bringing it back to our target, so many things can go wrong that we cannot give forward guidance. Tue: Rates are yet to reach sufficiently restrictive levels, rates are to stay restrictive as long as necessary.

Villeroy (Neutral). Mon: The primary question today is not how much further to hike rates but how large the pass-through is of what is already in the pipe, expects that we will be at the terminal rate not later than September, how long we maintain rates is now more important than the precise terminal level, we can hike or pause at the next three meetings, in the current tightening cycle the lag in policy transmission may be at the upper end of 1-2 year range. Thu: Rates should peak in the next three meetings, rates are clearly in restrictive territory, we have completed most of the rate hike journey, monitoring the passthrough of "massive" past rate hikes.

Lane. Mon: The markets believe that inflation will come back to 2% in the foreseeable future. Fri: The ECB shouldn't predict where rate hikes will end, no sense of certainty on the terminal rate, uncertainty in inflation dynamics is high, food inflation will reverse later this year, energy price fall will feed into core prices but timeframe is uncertain, there is some upside risks to wage growth.

De Cos (Dove). Mon: The ECB still has some way to go to tight monetary policy, interest rates will have to remain in restrictive territory for extended periods to achieve inflation goal.

Nagel (Hawk). Tue: Several more rate hikes are needed to tame inflation, will need to maintain peak rate for a sufficiently long time until inflation has fallen sustainably.

De Guindos (Dove). Tue: The non-bank financial sector remains particularly exposed to asset price corrections and credit risk should corporate sector fundamentals deteriorate substantially, more concerned about conflict between monetary and fiscal policy than about financial instability. Thu: Wages pose upside risk to inflation outlook, fiscal policy is an important factor for inflation, governments should roll back related support measures as the energy crisis fades, banking tensions add to downside inflation risks.

Panetta. Wed: The GC is to decide in October whether to launch preparation phase to develop and test a digital Euro, the ECB would issue a digital Euro but not distribute it.

Knot (Hawk). Thu: We need at least two more rate hikes, both should be 25 bps each, totally open-minded on what happens with rates after summer, should stay put for a significant period of time, market pricing of rate cuts is overly optimistic, headline inflation peak behind us but not sure if at peak of underlying inflation, most of the impact of the ECB's tightening is still in the pipeline.

Vujcic. Fri: It is questionable if we will be able to get to 2% inflation in the next two years, inflation momentum is still persistent.

Makhlouf. Fri: My lead option is to hike rates in June and July, open about subsequent decisions, haven't seen wage settlements that raise concerns on a Eurozone level, very relaxed about market pricing of rates.

Bank of England

Bailey (Neutral). Tue: We are nearer to the peak on interest rates, rate hikes must be conducted very carefully, cannot try to fight inflation with very severe increase in rates, inflation has turned the corner, services inflation is tracking more or less as we thought in February, further policy tightening would be required if there's evidence of more persistent pressures. Wed: Our projections show that we will meet the inflation target this year, quite a lot of inflation is imported, today's numbers showed a welcome fall below double digits, food inflation is taking longer to fall than was expected, I don't think "spiral" is the right word to use when asked about core inflation in wages, inflation expectations are coming down.

Mann (Hawk). Tue: Can't make a judgment on peak interest rates yet, the situation is data-dependent.

Pill. Tue: Longer-term inflation expectations have not drifted away from target.

Haskel (Hawk). Thu: Further increases in the bank rate cannot be ruled out, April core inflation was higher than expected.

Reserve Bank of Australia

Jacobs. Wed: The balance sheet is starting to unwind pandemic bond purchases, around AUD 20 bln have matured, pace will increase to about AUD 35-45 bln per year.

Reserve Bank of New Zealand

Orr. Wed: The latest data is satisfactory, it's been a long battle, today was the first time the monetary policy committee went to a vote over the decision, expects to keep a restrictive policy for some time, it's not longer about a labour shortage but now about a demand shortage. Thu: Rates are restrictive and well above neutral, both growth and inflation are weaker than expected, we can alter our assessment if need to do so.

Conway. Wed: The labour market is becoming less pressured.

Silk. Fri: The cash rate needs to stay on hold for an extended period, can now hold and see what develops, must be watchful of over-tightening policy.

Bank of Japan

Ueda. Thu: Changing YCC target from 10-year to 5-year zone would be among options if the BOJ were to tweak policy in the future, inflation likely to slow ahead but if this projection proves wrong we will act swiftly, must avoid tightening policy prematurely, starting to see good signs in the economy but there is still some ways to achieve inflation target in a stable and sustainable manner, don't think the BOJ's current balance sheets consisting of massive JGBs and ETFs is normal for a central bank. Fri: Must avoid tightening policy prematurely, falling raw material costs likely to slow inflation in coming months, the BOJ could make tweaks to YCC if the balance between the benefit and the cost of the policy shifts, if the BOJ were to modify YCC in the future there are various ways of doing so, shortening the duration of targeted bonds to the 5-year zone, won't comment on whether we would definitely do so or how likely this would be.

Suzuki. Fri: Closely watching FX moves, exchange rates should be set by market based on fundamentals.

Economic Data

Monday, 22.05.23

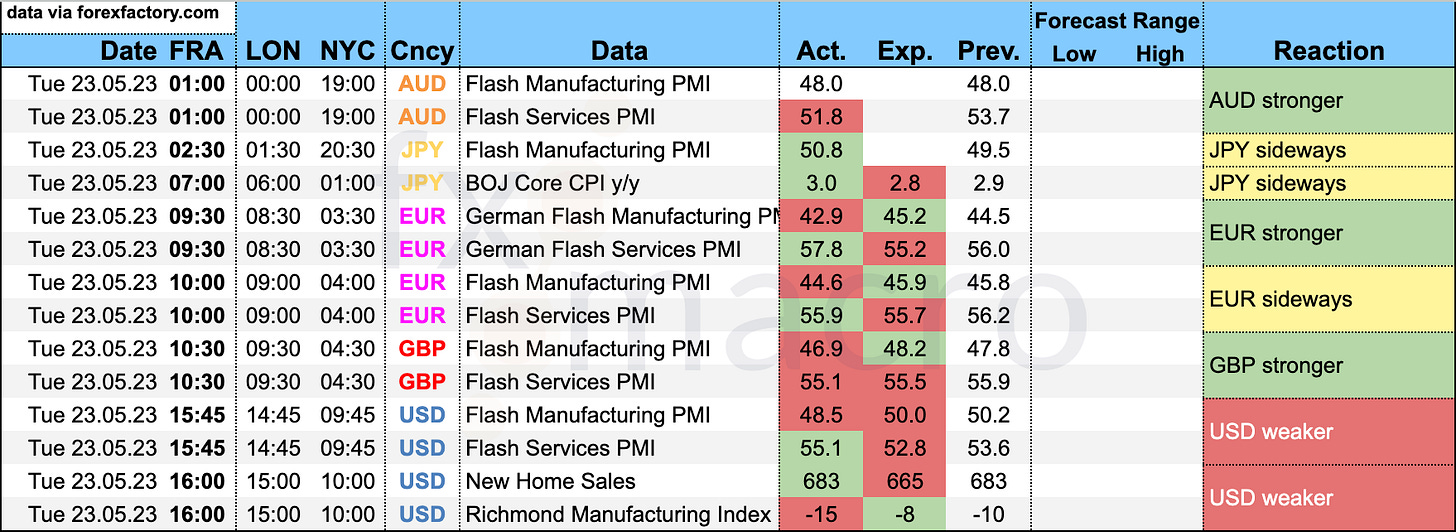

Tuesday, 23.05.23

“The May Flash result shows a small retracement from the strong April outcome reinforcing the view that overall economic activity in Australia is holding up well as we enter the winter months.

“Both the output and new orders results are in expansionary territory. Over the past two months, we have seen the best readings since the middle of 2022. This brings into question whether the economic slowdown of the past year has run its course.

“Underlying the overall index is an ongoing divergence in performance between the manufacturing sector and services industries. […]

“The manufacturing indicators do not signal recession. We would need to see a further marked deterioration in the manufacturing survey to be concerned about a sharper downturn.

“The recent strength in services results stands in contrast to manufacturing. Far from the risk of recession, the services PMI suggests that the risk is that the Australian economy is experiencing a pick-up in activity since February. […]

“The pick-up in the services PMI is consistent with a stronger housing market in recent months, rising population growth and a pick-up in job advertising. Last week’s labour market data on employment and wages have bought the RBA some time, but the Flash PMIs highlight that it is still too early to call an end to the monetary policy tightening cycle.

”While the signs of weakness in the manufacturing sector have become even more obvious, the rate of expansion in the services sector has accelerated, an unusual divergence between these two sectors in terms of magnitude. The good condition of the services sector suggests that consumer spending is doing better than expected, despite the inflation driven loss of household purchasing power. Manufacturing, on the other hand, is likely to be dragged down by the slump in Chinese manufacturing that has begun in the second quarter according to official data.

”Strength in the services sector is outweighing weakness in manufacturing, with the composite index indicating accelerating growth from the previous month. The ghost of a prolonged recession is thus effectively off the table, despite zero growth at the start of the year.

”The discussion about so-called greedflation in Germany may be fuelled by the PSI price data in the services sector. This is because while the upward momentum in input prices has weakened, it has increased in sales prices. This raises the suspicion that companies in this sector have been able to increase their profit margins on average and are keeping inflation high in this way.

”In the manufacturing sector, the most striking thing is the significant drop in new orders, and specifically in foreign demand, which has virtually collapsed according to the PSI survey. This means that the order backlog in German industry, which according to Destatis still ensured production for more than seven months in March, is likely to have fallen sharply and will approach 2018 and 2019 levels of just under six months over the course of the year. This is all the more true given that some companies surveyed also reported that customers had cancelled orders due in part to the ongoing uncertainty. However, the expected decline in order backlog could come to a halt at the turn of the year, when there may be a gradual recovery in the global economy.”

"Eurozone GDP is likely to have grown in the second quarter thanks to the healthy state of the services sector. However, the manufacturing sector is a powerful drag on the momentum of the economy as a whole. German companies from this sector are particularly hard on the brakes, as new orders here have fallen even more significantly than in France and the production index is also pointing sharply downward.”

"Overall, companies in the manufacturing sector are less optimistic about their production over the next twelve months. This is matched not only by the significant decline in new orders, but also by lower inventories of intermediate inputs and lower purchases thereof. However, according to Eurostat, the order situation is by no means catastrophic, as in the second quarter order books for the major euro countries were still well above their long-term average.”

"The European Central Bank will have a headache with the PMI price data. This is because selling prices in the services sector actually rose more than in the previous month. It is precisely price developments in this sector that the ECB is watching with a wary eye. The upward movement that can still be observed here is keeping the central bank from taking an interest rate pause.”

"A welcome development for the people of the eurozone is that companies continue to hire more workers. Even in the weakening industrial sector, employment is increasing, as shown by the corresponding PMI component. The risk of a recessionary downward spiral in the form of falling employment, lower consumer demand triggered by this, which in turn causes companies to downsize, is therefore rather low in these times of demographically induced labour shortages.”

“The UK economy enjoyed another month of strong growth in May, with the expansion continuing to be driven by surging post-pandemic demand in the service sector, notably from consumers and for financial services, with hospitality activities buoyed further by the Coronation. The surveys are consistent with GDP rising 0.4% in the second quarter after a 0.1% rise in the first quarter.

“However, this growth spurt is driving renewed inflationary pressures, as service providers struggle to meet demand and hence not only offer higher wages to attract staff but also find themselves able to charge more for their services.

“It's a different story in manufacturing, where spending is being diverted away from goods to services, and many companies are also winding down their inventories, exacerbating the downturn in demand and driving both output and prices lower.

“The UK is therefore seeing a tale of two economies, with the divergence between manufacturing and services posing difficulties for policymakers. However, it's the far larger service sector that will typically dictate policy, meaning these survey results are nothing but hawkish in suggesting the Bank of England has more work to do to quash stubbornly high inflationary pressures in the services economy.”

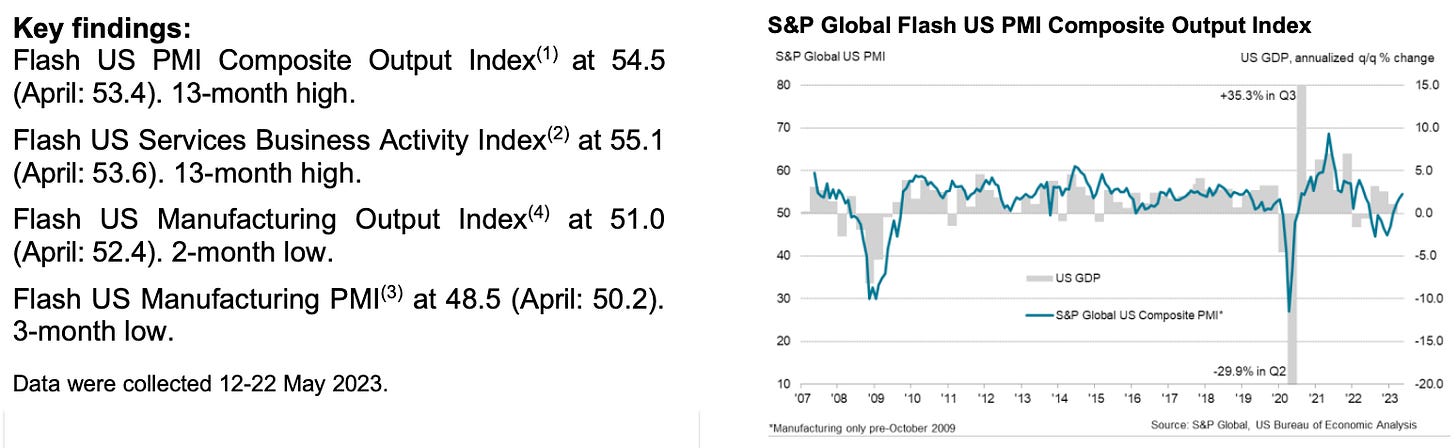

“The US economic expansion gathered further momentum in May, but an increasing dichotomy is evident. While service sector companies are enjoying a surge in post-pandemic demand, especially for travel and leisure, manufacturers are struggling with over-filled warehouses and a dearth of new orders as spending is diverted from goods to services.

“The inflation picture is also changing. Whereras manufacturing prices spiked higher during the pandemic due to strong demand and deteriorating supply, it is now the service sector’s turn to be hiking prices amid resurgent demand and an inability to cope with order inflows due to a lack of capacity.

“Jobs growth has accelerated as service providers companies seek to meet demand, but this tightening labour market amid strong demand will be a concern as a fuel of further inflationary pressures.”

Wednesday, 24.05.23

Thursday, 25.05.23

Friday, 26.05.23

Market Analysis

Growth and Inflation

The Atlanta Fed GDPNow model ticked lower to +1.9%:

The NY Fed Weekly Economic Index increased to 1.17:

The Cleveland Fed Yield-Curve-Predicted Growth model sees a 79% probability for a recession:

Citi Economic Surprise Indexes:

The US and UK ticked up again, Canada is also higher

The Eurozone is falling further

Australia has stalled, and New Zealand, Switzerland and Japan are not moving much

Bloomberg PMI heatmap:

This doesn’t look good so far…

The US, UK, the Eurozone and Germany all have worsened

From last month, most of the important Asian economies are unchanged or weaker: China, Hong Kong, South Korea, Taiwan

Breakeven inflation rates continue to trade sideways:

The 5-year minus 10-year spread nosedives further:

5-year, 5-year forward inflation expectations and RINF are up this week:

Citi Inflation Surprise Indexes:

Updated monthly, so no update until next week

USD, NZD and CHF are lower

EUR, CAD and JPY are sideways

GBP and AUD are up

Yields

See chart and table below:

UK yields are the outperformers

German, Kiwi, Swiss and Japanese yields are up to sideways

The drop in Kiwi 2-year yields after this week’s dovish RBNZ

A closer look at 2s, 10s and 10s10s:

The US, UK and Canadian curves are all bear flattening with 2s outperforming 10s

The Kiwi curve has bull steepened

Global 2s10s are mostly flatter with six out of eight G8 curves inverted at some point over the last year:

Central Banks and the US Dollar

CME’s FedWatch saw a hawkish repricing of the upcoming FOMC meetings:

The June meeting is now expected to see a 25 bps hike to 5.25-5.50% at a 64% chance with the remainder of the probabilities for a no-change.

The meetings in July and September are priced for a hold with increased odds for a further hike.

The expected rate at the end of the year has been upped by 50 bps to 3.75-4.00%.

The hawkish repricing can also be seen in the Fed Funds forward curve, which has shifted higher in recent days and weeks:

In the following table, you can see the implied terminal rate being pushed higher and rate cuts being pushed further out in time:

Sectors and Flows

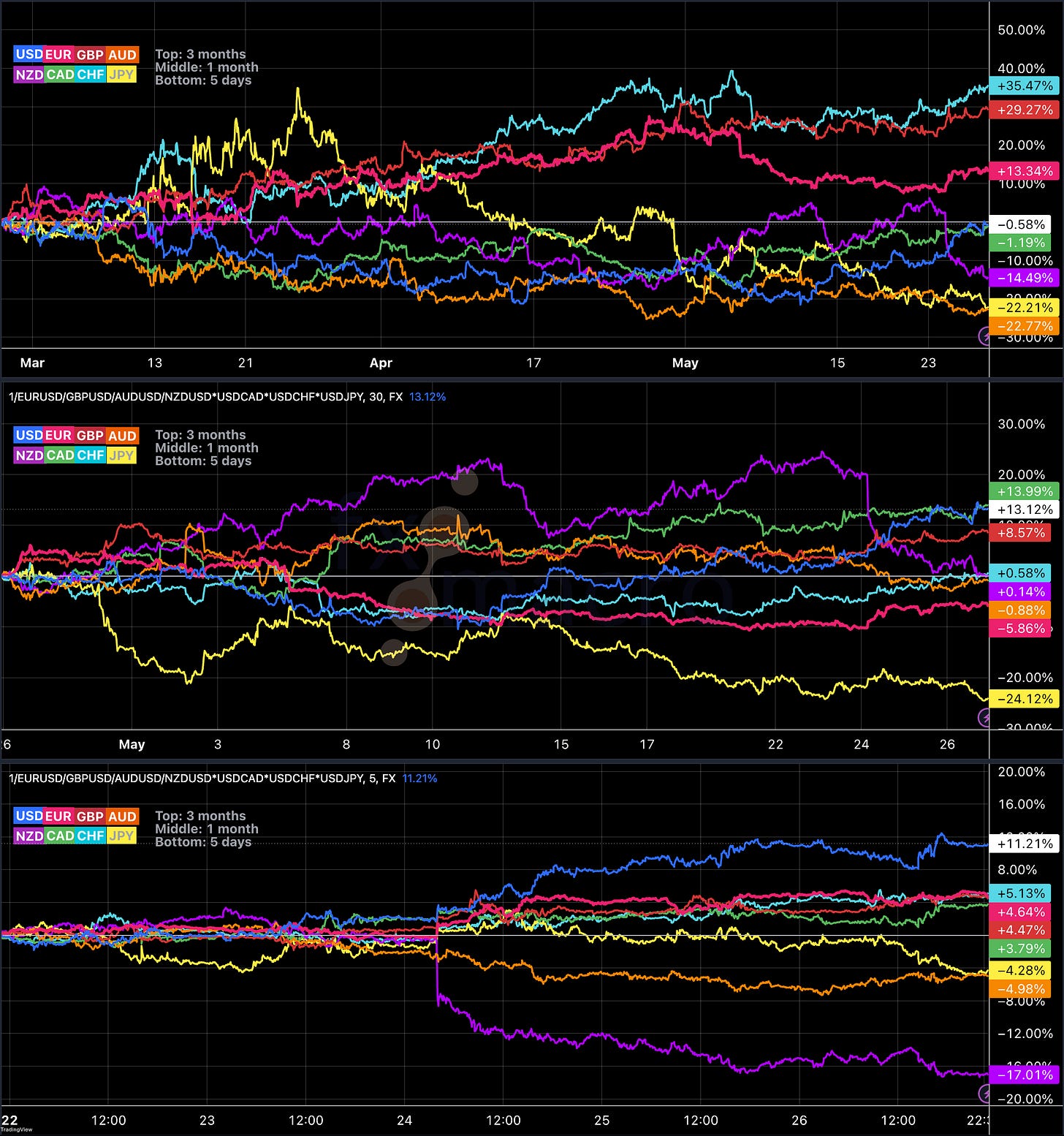

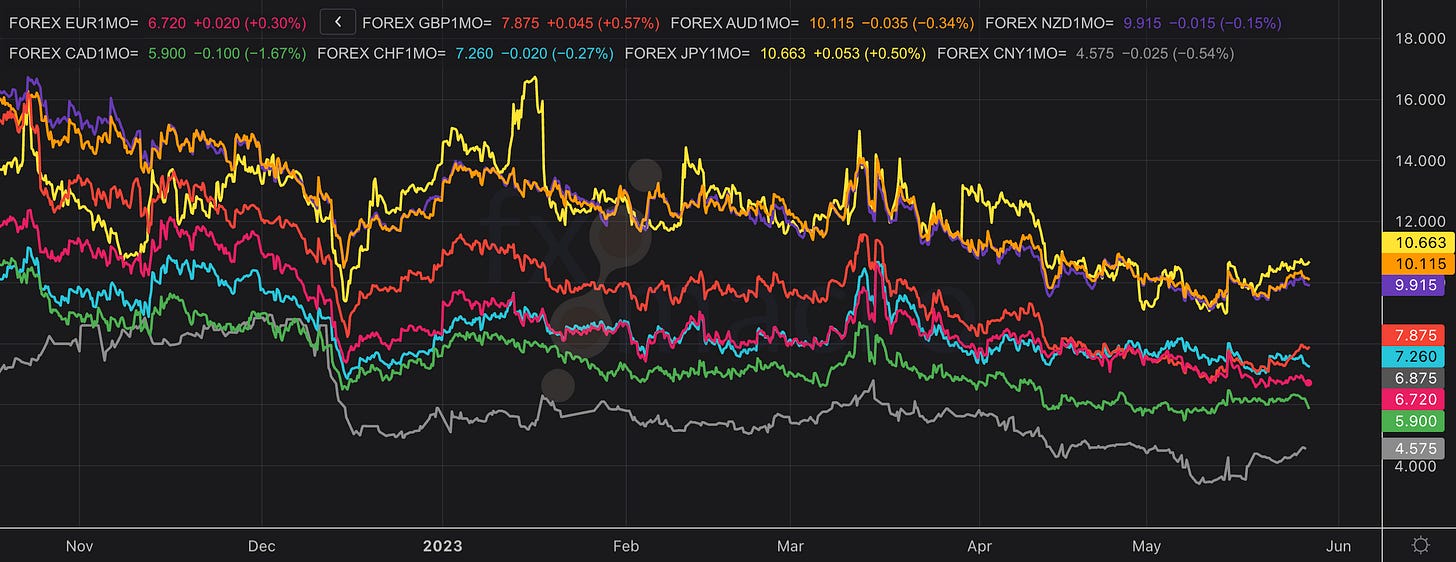

Currency strength:

The longer-term outperformers are CHF and GBP with EUR still holding up well

On the other side, AUD, JPY and NZD have underperformed over three months

JPY also didn’t perform well over one month and one week

NZD was the weakest currency by far this week

Overall, this doesn’t fit very well with the risk-on environment we’re seeing

Equity sectors:

Semiconductors, Tech and Consumer Discretionary are the outperformers over one month and the only sectors that have done better than the S&P 500

Utilities, Energy, Metals/Mining, Healthcare, Staples are all underperforming

Growth is outperforming Value

Similar data, different chart:

The outperformance of Tech and Communications is staggering

Everything else is in the red

Sector breadth has worsened further with now just one quarter of sector ETFs positive over 30 days:

Sector thumbnail charts:

To cut it short: everything that’s not Tech, Communications or Consumer Discretionary looks like it’s in rough shape

Utilities are near this year’s low

Financials don’t manage to put in a bounce

Global equity indexes:

Aside from the Nasdaq, the outperformers are Japan and South Korea

Most European markets are somewhere in the middle

The worst performer is the Russell 2000 followed by Hang Seng and the UK’s FTSE

Sentiment and Positioning

The AAII Bull-Bear spread is a) not moving much and b) neutral:

Currency sentiment:

Bullish sentiment (bearish currency): AUD, EUR, JPY, NZD

Bearish sentiment (bullish currency): CHF, USD

A different sentiment source:

AUDUSD and NZDUSD are the two pairs with the most bullish sentiment

EURCHF and USDCHF come in third and fourth place, i.e. bearish sentiment CHF

USDCAD sentiment is bearish

GBPJPY, EURJPY and USDJPY all have bearish sentiment, i.e. bullish sentiment in JPY

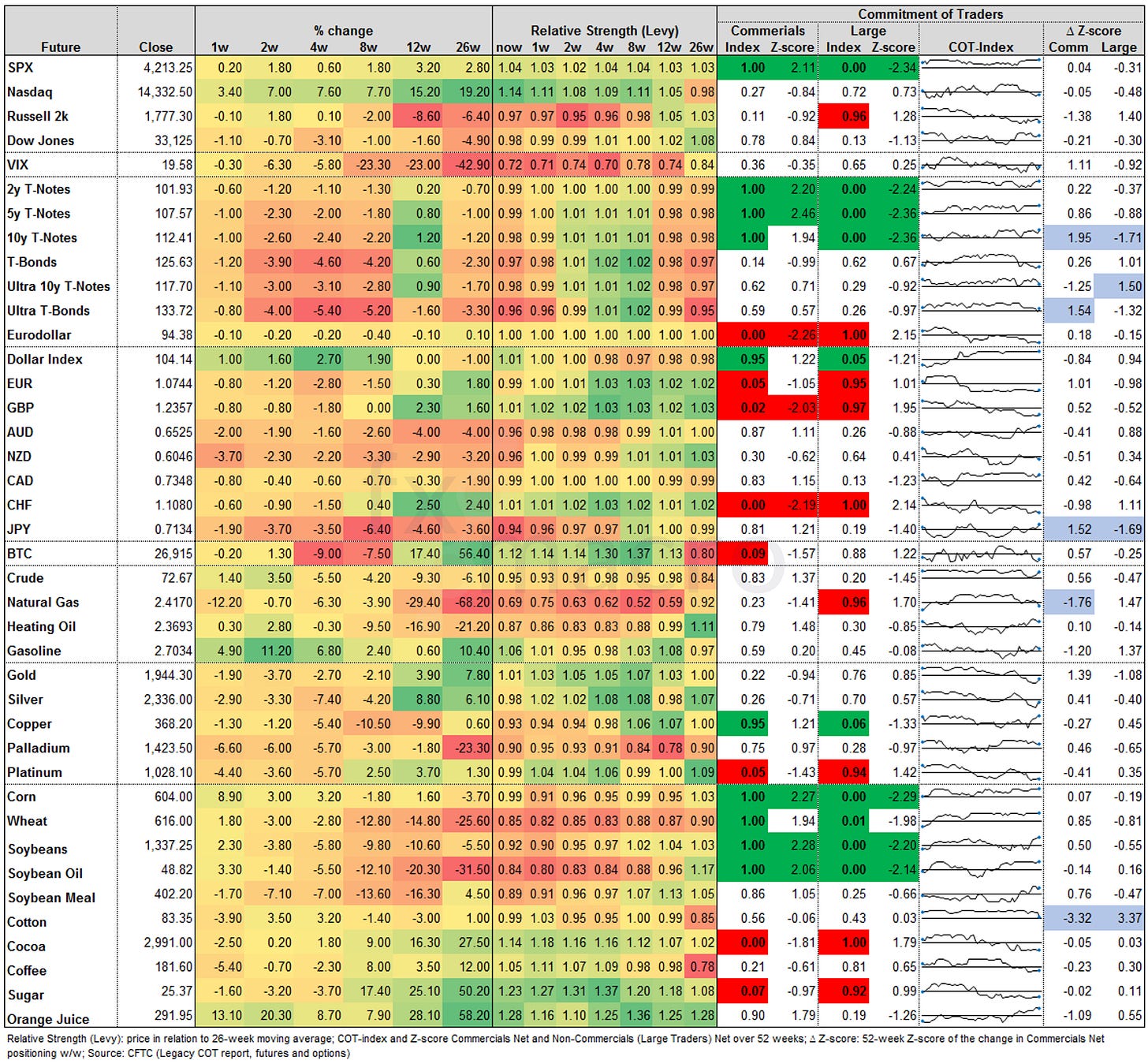

Commitment of Traders and futures performance:

Equity futures were again mixed with the ES eeking out a small gain, NQ outperforming and both RTY and YM negative. Positioning in ES remains at a bullish extreme.

Treasury futures are all negative for the week with positioning at bullish extremes in ZT, ZF and ZN.

Currency futures are all lower except for DX. 6N was hit hardest. Positioning remains broadly unchanged with DX still bullish and 6E, 6B and 6S bearish.

Bitcoin was flat this week.

Energy futures had a mixed week with NG down double-digits again. Commercial and Large Trader positioning is interesting in NG because it has become more bearish as price has gone lower.

Metals are all down this week with PA and PL leading the losses. HG is lower as well but managed to put in a nice bounce on Friday. Positioning is bullish in HG and bearish in PL.

Grains are mostly higher, positioning is still at bullish extremes in ZC, ZW, ZS and ZL.

Softs were lower as well except for OJ with positioning at/near bearish extremes in CC and SB.

COT/TFF Dealer net positions for FX futures:

6E is still near its low

6C is still near its high

Citi PAIN indexes show the USD long has recovered a bit but overall positioning seems to be mostly flat:

Here’s the combined COT/PAIN chart:

The latest moves in DX, 6E and 6B aren’t confirmed by Large Trader positions

Market Risks

Credit spreads still aren’t going anywhere:

The Credit Spread Index is also moving sideways:

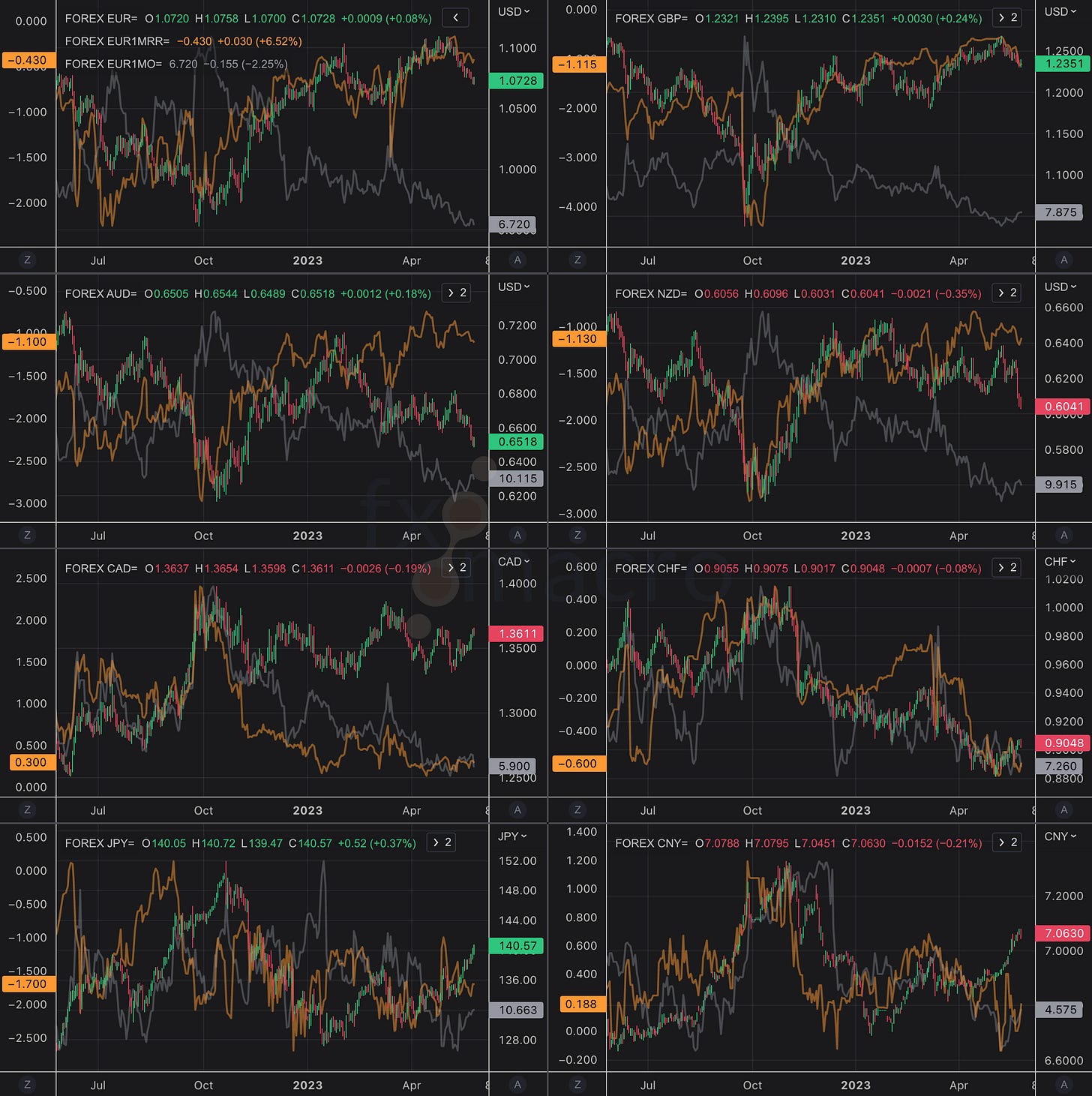

Currency volatility has picked up a bit with the recent dollar strength:

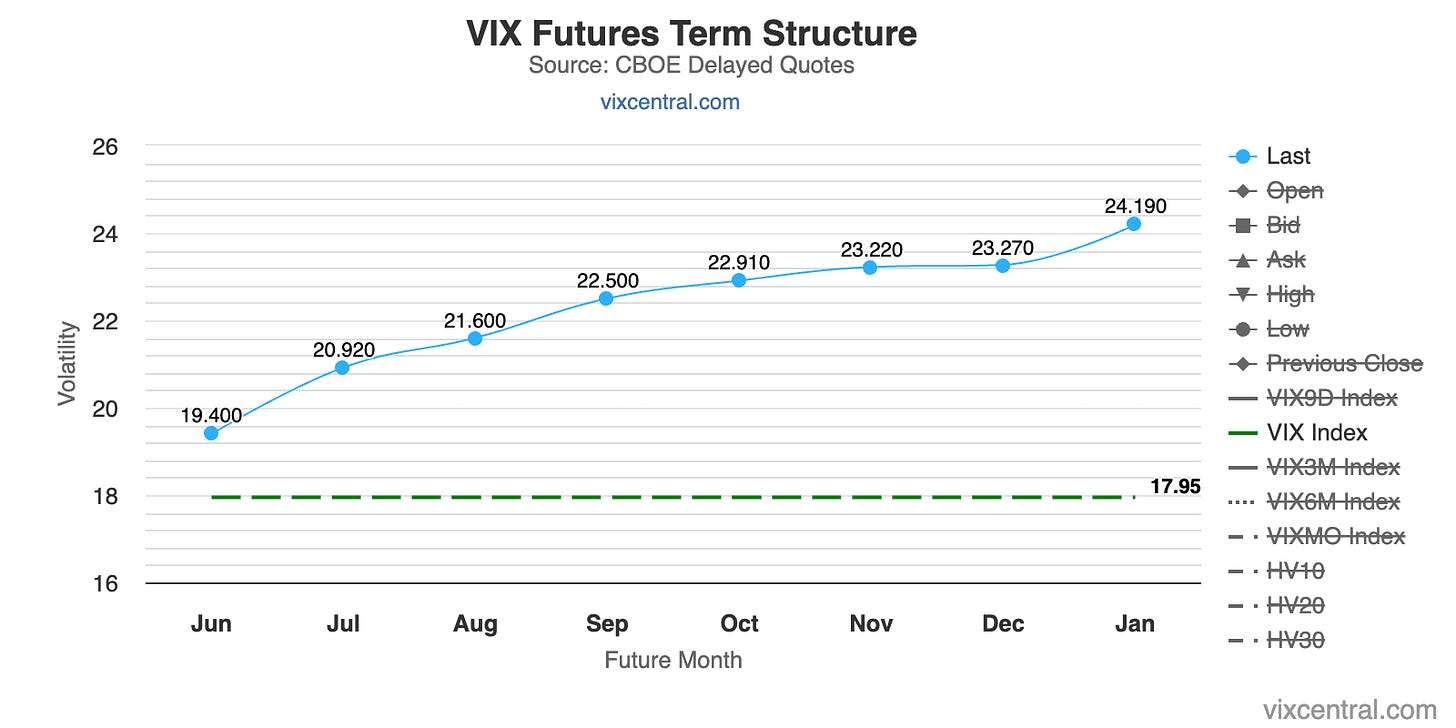

The VIX term structure looks unremarkable with a decently steep contango:

Volatility indexes:

VIX stands at around 18, MOVE at 145 and VVIX at 96

VVIX is making higher highs and higher lows while VIX is just going sideways

MOVE hasn’t really diverged but it’s not going down either

Skew is steepening further with the VIX/VOLI ratio at the highest in over a year and SDEX and TDEX going higher

As last week, I'm still conflicted: it's not looking catastrophic, steepening skew is not a predictor of volatility going higher and we're coming from very low levels anyway. But: VVIX and MOVE aren't signalling an all-clear.

The CNN Fear & Greed Index is still in greed territory:

Various

The NYSE Advance/Decline Line is acting weaker while the S&P 500 is making new highs:

The percentage of index components above their 200-day moving averages also continues to go down week by week for the S&P 500 while it's holding up a bit better for the Nasdaq 100:

And it looks similar for the 50-day moving averages:

25-delta risk reversals:

USDCAD, USDJPY and USDCNY all look like they should be lower

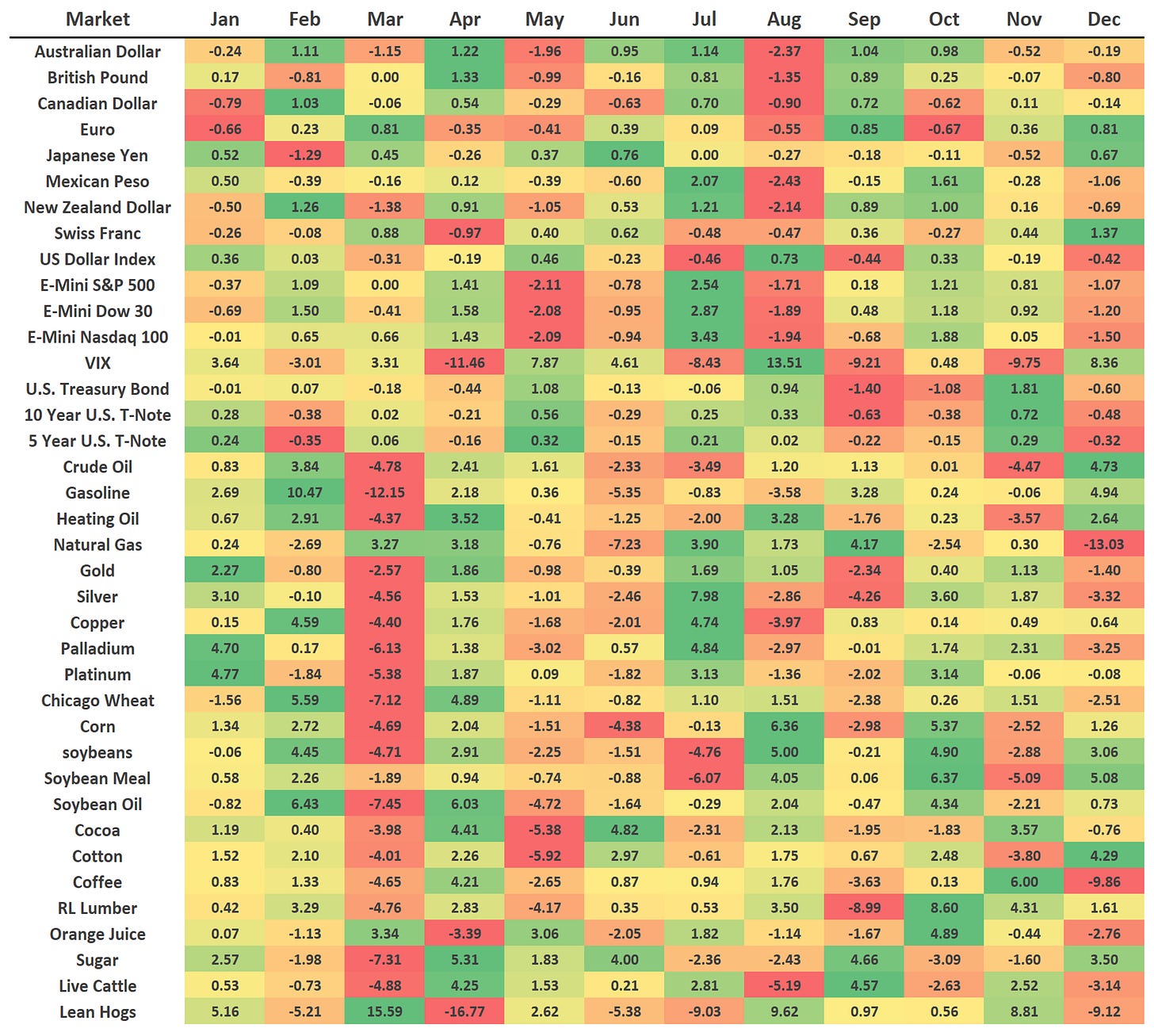

Seasonality for June:

AUD, JPY, CHF are bullish

CAD is bearish

Market dashboard:

Trend metrics: ES and NQ are in good shape as opposed to the Russell, Dow Jones Industrial and Transportation Indexes

Distribution days are still too high even for ES and NQ

Volatility metrics are unremarkable, MOVE is still too high

Breadth and put/call ratios haven't flashed any signals

Correlation metrics also didn't do anything

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 19/2023 | 13/2023 | 06/2023 | 50/2022 | 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 15/2023 | 09/2023 | 02/2023 | 47/2022 | 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

ECB

Rate Statements: 19/2023 | 12/2023 | 06/2023 | 50/2022 | 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 17/2023 | 10/2023 | 04/2023 | 47/2022 | 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 11/2023 | 05/2023 | 50/2022 | 43/2022 | 36/2022

BOE

Rate Statements: 20/2023 | 13/2023 | 06/2023 | 50/2022 | 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

RBA

Rate Statements: 19/2023 | 15/2023 | 11/2023 | 07/2023 | 50/2022 | 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 21/2023 | 17/2023 | 09/2023 | 51/2022 | 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 19/2023 | 07/2023 | 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 15/2023 | 09/2023 | 47/2022 | 41/2022 | 34/2022 Meeting Minutes: 07/2023 Crib Sheets: 40/2022

BOC

Rate Statements: 15/2023 | 11/2023 | 05/2023 | 50/2022 | 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022 Summary of Deliberations: 18/2023

SNB

Rate Statements: 13/2023 | 50/2022 | 44/2022 | 39/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

BOJ

Rate Statements: 18/2023 | 11/2023 | 04/2023 | 51/2022 | 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 20/2023 | 13/2023 | 05/2023 | 52/2022 | 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: Midjourney with the prompt: Memorial day in the upside down

I can't thank enough for your precious and unique work. Thank you!

Great as always!