Outlook for Week 24/2023

"Hope is a bogus emotion that only costs you money." – Jim Cramer

Thanks to everyone who participated in last week's poll!

Welcome to issue #59 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary. If you're short on time or just don't like long newsletters then just skip them.

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

The cover image is AI-generated via Midjourney. If you want to guess the prompt, I put it at the end of the newsletter.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Table of Contents

Summary (Playbook, Calendar, Levels, FX Drivers, Downloads)

Week in Review: a) Central Banks, b) Economic Data

Market Analysis: a) Growth and Inflation, b) Yields, c) Central Banks and the US Dollar, d) Sectors and Flows, e) Sentiment and Positioning, f) Market Risks, g) Various

Top 3 Macro Charts of the Week

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Please check out this article about what this summary aims to provide and what its limitations are.

Economic Calendar for next week

If you want a quick and easy way to hook a customized economic calendar into your favourite calendar app then check out this link.

Important levels to watch and look out for in FX futures

Currency Drivers

For an explanation check out this link.

Downloads and Links

Difftext of the Summary from last week: diffchecker.com

Central bank speaker recap for the week:

FOMC crib sheet with summarized comments from every Fed speaker since the May meeting:

ECB crib sheet:

Week in Review

Central Banks

RBA Rate Statement (06.06.23)

The RBA surprised with a 25 bps hike:

Guidance remains unchanged: Some further tightening may be required but that will depend on how the economy and inflation evolve

Inflation has passed its peak but is still too high, today's increase in the policy rate will provide greater confidence that it will return to target in a reasonable timeframe

Recent data indicate that the upside risks to the inflation outlook have increased

The Board remains alert to the risk of inflation expectations contributing to larger price and wage increases

BOC Rate Statement (07.06.23)

The BOC hiked rates by 25 bps to 4.75%:

Monetary policy has not been sufficiently restrictive so far

Guidance:

Dropped the “remains prepared to raise the policy rate further if needed” part

Mentions that they will watch the evolution of excess demand, inflation expectations, wage growth and corporate pricing behaviour when assessing the dynamics of core inflation and the outlook for CPI

CPI is coming down globally but underlying inflation remains stubbornly high

Domestic growth has been stronger than expected, spending on interest-sensitive goods and housing has picked up, excess demand in the economy is more persistent than anticipated

Concerns have increased that CPI could get stuck materially above 2%, three-month measures of core inflation has been running in the 3.5-4% range for months, still expects CPI to ease to around 3% in the summer

Confab, Speakers, News

Federal Reserve

European Central Bank

Vujcic. Mon: Inflation risks are tilted to the upside, wage pressures are still very lively.

Lagarde (Dove). Mon: No clear evidence that underlying inflation has peaked, price pressures remain strong, our rate hikes are being transmitted forcefully to financing conditions, full effects of our monetary policy measures are starting to materialize, it is very likely we will stop all reinvestments in APP.

Nagel (Hawk). Mon: Several more rate hikes are still necessary, not certain rates will peak this summer, rates must be held until there is no doubt inflation is returning to 2% in the near term, underlying price pressures remain far too high and show little signs of abating, cautiously optimistic about German growth prospects over the rest of the year.

Knot (Hawk). Tue: Will keep tightening policy until we see inflation returning to 2% but this must be done step-by-step, inflation is still way too high but the worst is behind us, seeing first signs that policy tightening is being transmitted to the real economy. Wed: The outlook for policy rates after July is unclear, will become more data-dependent after rate hikes in June and July, should not hesitate to keep raising rates if inflation stays high, peak interest rates will have to be maintained for a long time to keep inflation in check, upward risks to inflation are expected to dominate in years to come, prolonged tightening might still lead to stress in financial markets, inflation expectations in markets seem optimistic.

Schnabel (Neutral). Wed: We have more ground to cover on rates, will depend on data how much more rates will have to increase, we need to see convincing evidence that inflation returns to our 2% target in a sustained and timely manner, a peak in underlying inflation would not be enough to declare victory, the impact of our policy on inflation is expected to peak in 2024, there is great uncertainty over the strength and speed of this process.

Makhlouf. Wed: Once we've reached a peak on rates they are likely to stay there for a while, not going to say how long that will be, rate hikes beyond summer would be a question of judgement, I'd be interested how the people pricing rate cuts by the end of the year are coming to that conclusion.

Reserve Bank of Australia

Lowe. Wed: Some further tightening of monetary policy may be needed depending on how the economy and inflation evolve, too early to declare victory in the battle against inflation, evidence indicates that higher rates are working and inflation is coming down, April CPI reading hasn't changed that assessment, we'll get into trouble if we accept that all workers need to be compensated for inflation.

Bank of Canada

Beaudry. Thu: Gives no indication of what the BOC might do with July or future rate decisions, decision to hike was not taken lightly, the details behind April's headline inflation were concerning, 3-month measures of core inflation remain elevated and seem to have lost their downward momentum, still expects headline inflation near 3% in the summer but largely due to lower energy prices and base effects, it is more likely long-term rates will remain elevated relative to pre-pandemic levels than the opposite, there is a meaningful risk the neutral rate could go up, this does not directly affect the way we're thinking about monetary policy right now, there appears to be more momentum in demand than we expected, surprised by Q1 consumption growth and even more by the rebound in goods spending.

Swiss National Bank

Jordan. Thu: Inflation is more persistent than we have thought, really important to bring Swiss inflation to level of price stability.

Bank of Japan

Ueda. Tue: Will continue monetary easing until inflation target is achieved, inflation and expectations are heightening, changes are emerging gradually to deflationary mindset. Wed: Will discuss exit from easy policy when we can foresee achieving the price target, too early to debate specific strategy on how the BOJ could sell ETFs in the future. Fri: Will patiently maintain current monetary easing, we can create a positive economic cycle where wages rise both on nominal and real basis by supporting the economy, taking into account the effect and cost of policy measures, we project that CPI will slow in the latter half of the current FY, we are seeing change in corporate price-setting behaviour that works to push up inflation, seeing strong growth in this year's wage negotiations, consideration towards fiscal policy won't hamper the BOJ from making necessary decisions upon exit from ultra-loose policy.

Sources. Fri: Bloomberg: still seeing a need to continue with monetary stimulus, hitting price goal is out of sight, little need to tweak YCC in June, sees inflation as stronger than expected.

People's Bank of China

Vice Governor. Thu: USD strength is hardly sustainable as the US is nearing the end of its hiking cycle, the external impact on the Yuan is expected to weaken.

Yi Gang. Fri: Expects inflation to gradually rebound in H2 this year, high base effects are still in play, has confidence to reach official growth target, Q2 GDP expected to be high mainly due to base effects.

Economic Data

Monday, 05.06.23

Tuesday, 06.06.23

Wednesday, 07.06.23

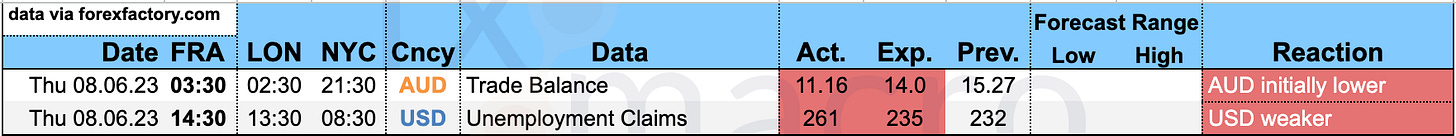

Thursday, 08.06.23

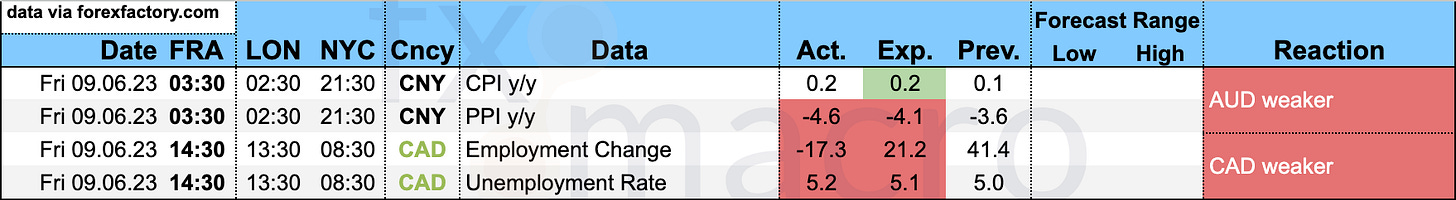

Friday, 09.06.23

Market Analysis

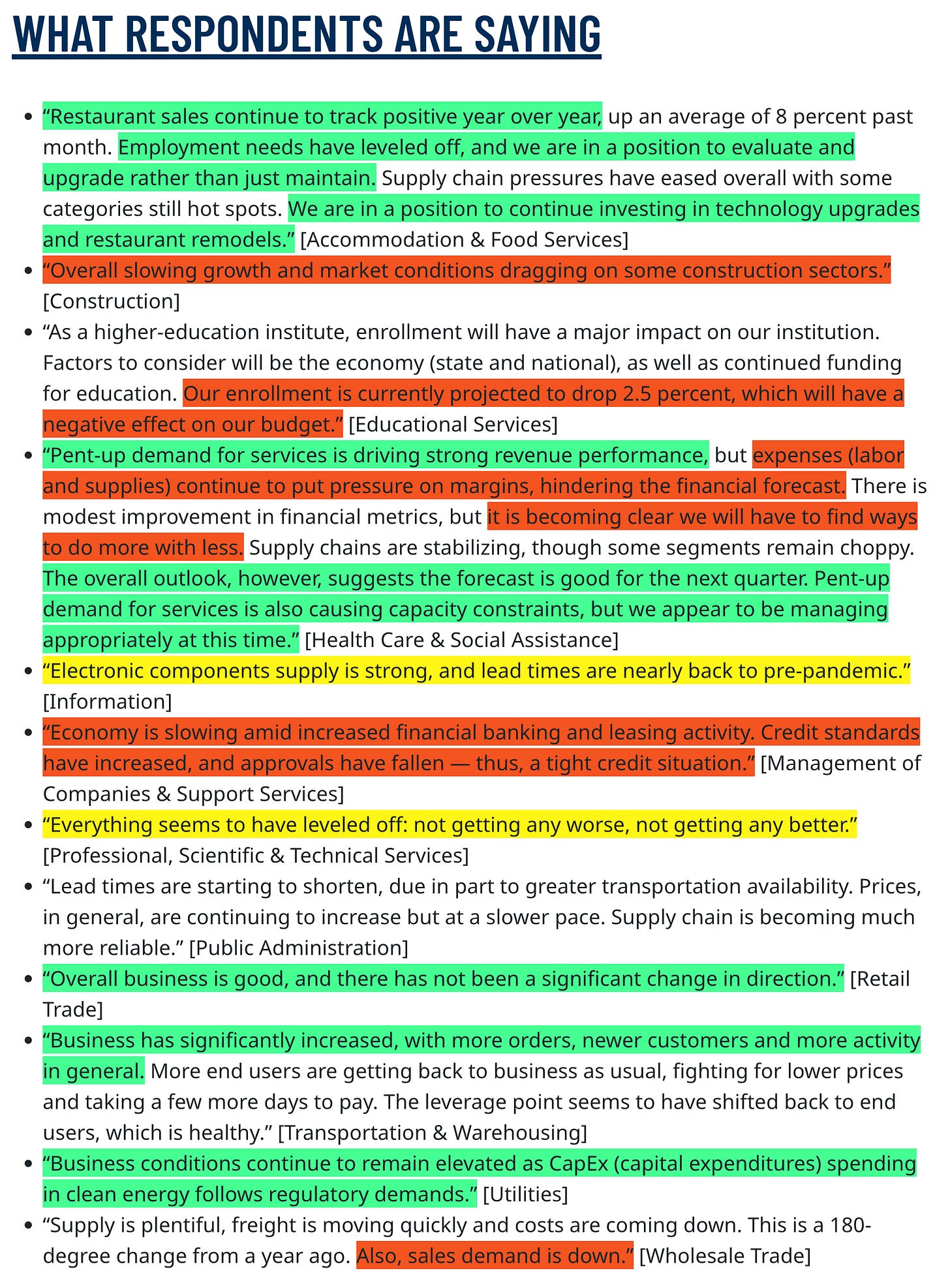

Growth and Inflation

The Atlanta Fed GDPNow model estimates real GDP growth for Q2 at 2.2%:

The NY Fed Weekly Economic Index printed at 0.96 and is going sideways:

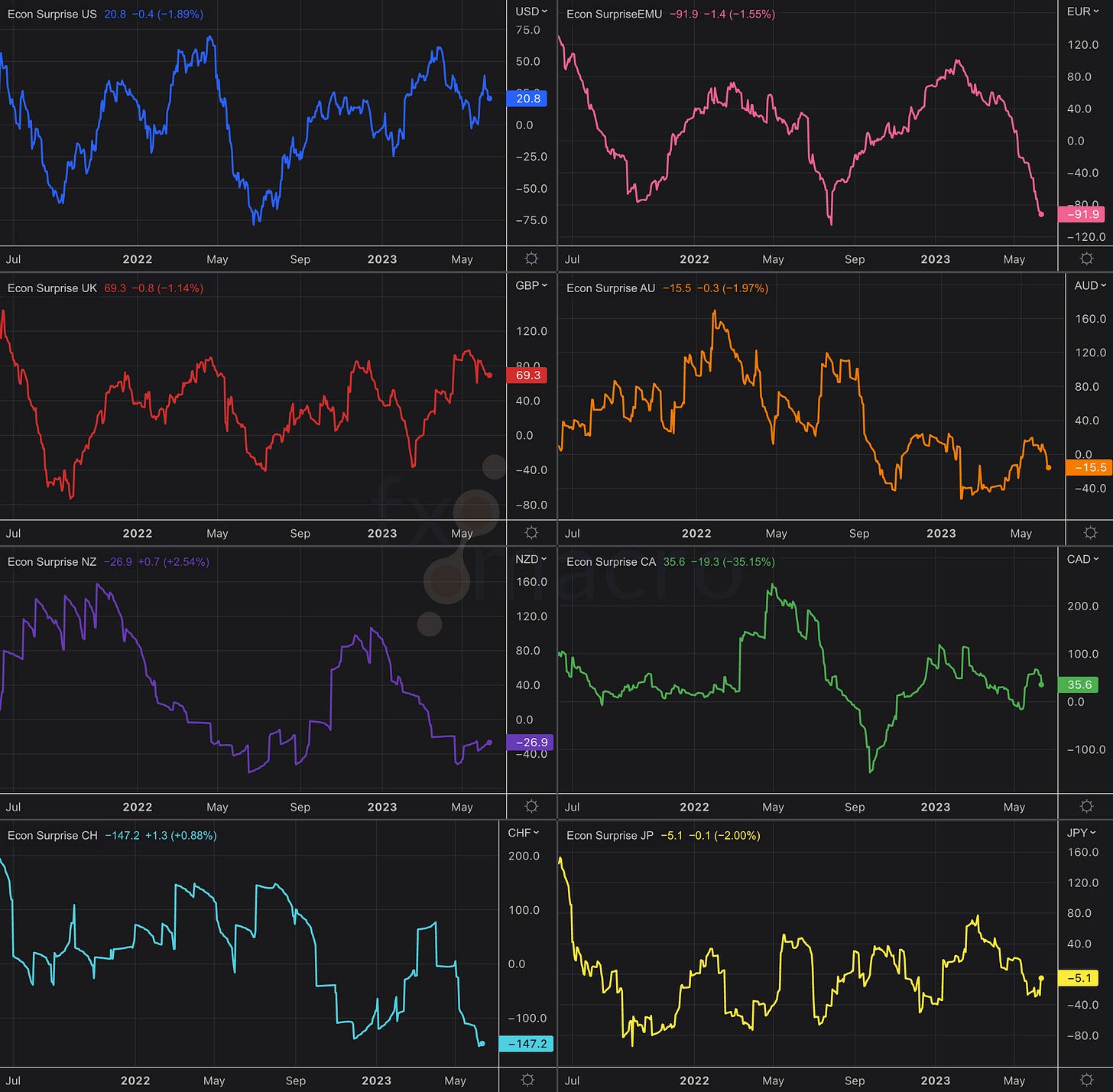

Citi Economic Surprise Indexes:

USD, CAD and AUD dropped a bit

EUR is nosediving

GBP is still near its high

NZD and CHF are at or near lows

JPY is going sideways

The CESI spread EUR-USD is still dropping, which is bearish for EURUSD:

OECD Composite Leading Indicators:

Canada has clearly the worst CLI: dropping and in last place

China is rising and comes in first, Australia looks weak in comparison

The UK has the highest rate of change higher

The US is still dropping

Bloomberg PMI heatmap:

The US is worse, Canada unchanged

The Eurozone and Switzerland have worsened, Germany remains deeply red

The UK remains unchanged

China, Japan, South Korea and Australia are unchanged

Taiwan is weaker

Breakeven inflation rates are sideways-to-lower:

5y5y forward inflation expectations are in the middle of their 2-year range:

Citi Inflation Surprise Index:

Ticks up in USD, CAD and JPY

Ticks down in EUR and GBP, and bigger drops in AUD, NZD, CHF

Yields

See chart and table below:

2y and 10y yields are rising globally, exceptions are Switzerland, Japan and China

2y yields are going up more than 10y yields, i.e. bear flattening in most yield curves

AUD and CAD yields look strongest

USD, DE and GBP yields have flattened out

2s, 10s and 2s10s:

Bear flattening in USD, EUR, GBP, AUD, CAD and CHF

NZD is the outlier with a steeper curve driven by higher 10s

Global 2s10s are now mostly inverted after the Aussie curve became negative last week. The outliers are Japan and China:

Central Banks and the US Dollar

The latest FOMC meeting probabilities according to FedWatch:

The upcoming meeting this week is priced with a policy hold at 70% probability, the remaining 30% are for a 25 bps hike

The July meeting is expected to deliver a 25 bps hike with a >50% chance

Rate cuts aren't priced in before 2024

The Fed Funds forward curve hasn't changed much in the front end over the last two weeks or so:

Here's the same data in a different format. The peak FFR is seen in the August expiration and that has been unchanged for two weeks:

The implied expectations for the next RBA meeting in July have gone up in the wake of their recent surprise hike:

Sectors and Flows

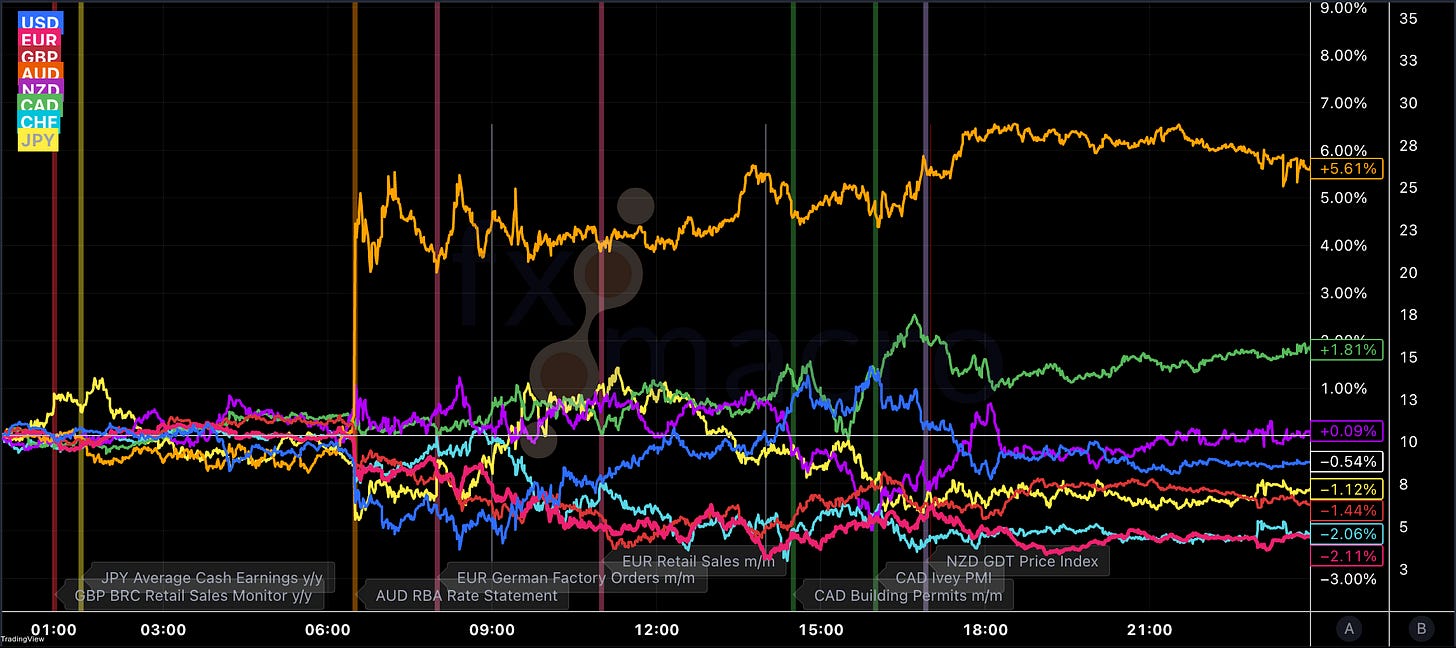

Currency strength:

GBP and CHF are the outperformers over three months, JPY is the underperformer

USD has done well over one month, worse over three months and terrible last week

AUD has outperformed this week by a wide margin but over longer timeframes it remains somewhere in the middle

NZD was dragged higher by AUD recently but remains one of the underperformers over one and three months

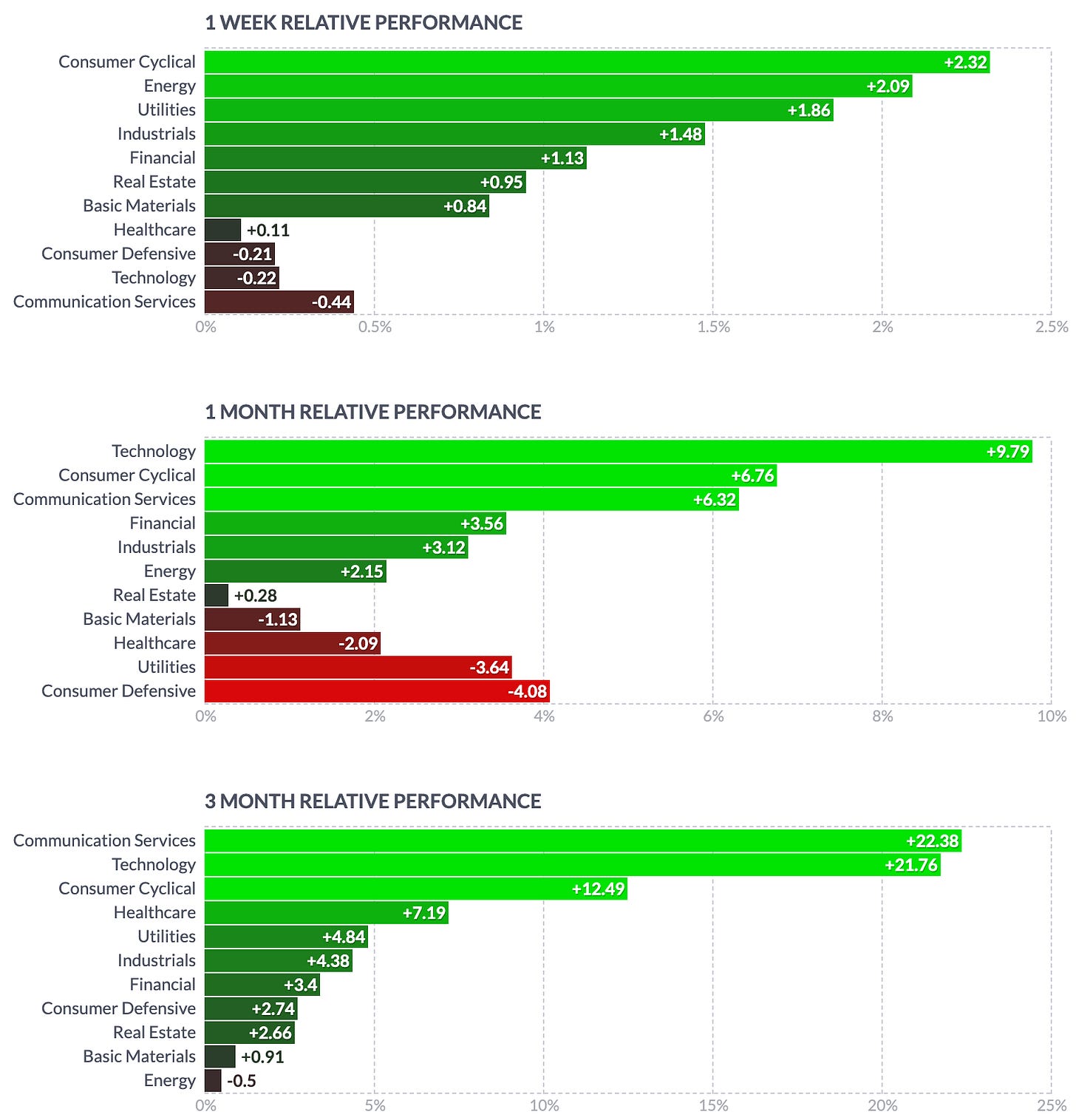

Equity sector performance:

Semiconductors, Tech and Consumer Discretionary are the only sectors that have outperformed the SPX

Energy, Metals/Mining are the underperformers over three months

Healthcare, Staples, Utilities are barely positive and have outperformed Industrials, Materials, Energy and Financials

Growth is outperforming Value

Here's a look at similar data in a different chart:

Sector breadth is still weak with less than 50% of sectors positive over 30 days while the SPX is making news highs:

Sector thumbnail charts:

XLF looks like it is forming some kind of base, same for XLRE

XLU, XLV, XLP, XLB are all looking weak

XLC is a 45º straight line, XLK and SPX look like textbook bull flags

Global equity indexes:

QQQ is still the outperformer by far

Japanese equities, Brazil and South Korea have also performed well

The UK's FTSE 100 carries the red lantern, the Hang Seng is the second-weakest index

European markets are somewhere in the middle

Sentiment and Positioning

The AAII Bull-Bear spread has hit a new 18-month high at 20.20:

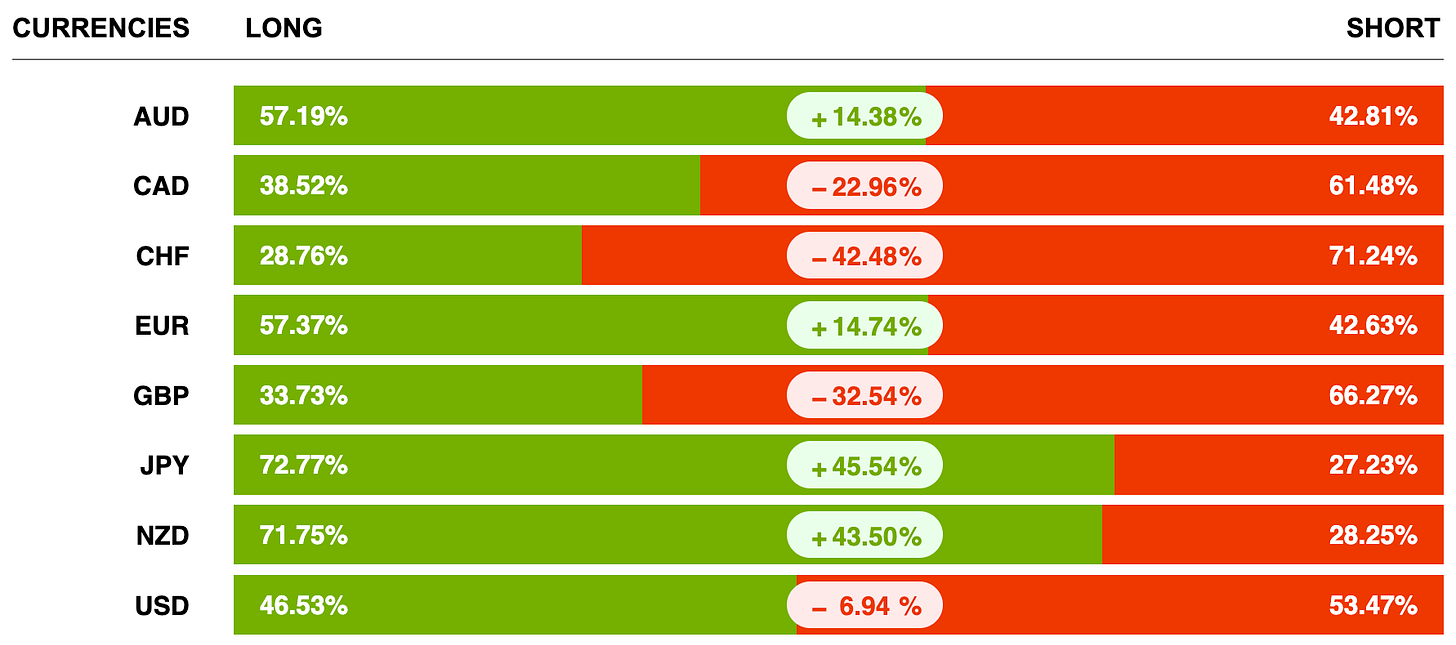

Currency sentiment:

Bullish sentiment: JPY, NZD

Bearish sentiment: CAD, CHF, GBP

A different sentiment source:

USDCHF and EURCHF are the two pairs with the most bullish sentiment

EURGBP and USDCAD are the third and fourth most bullish FX pairs

The four JPY pairs are the ones with the most bearish sentiment

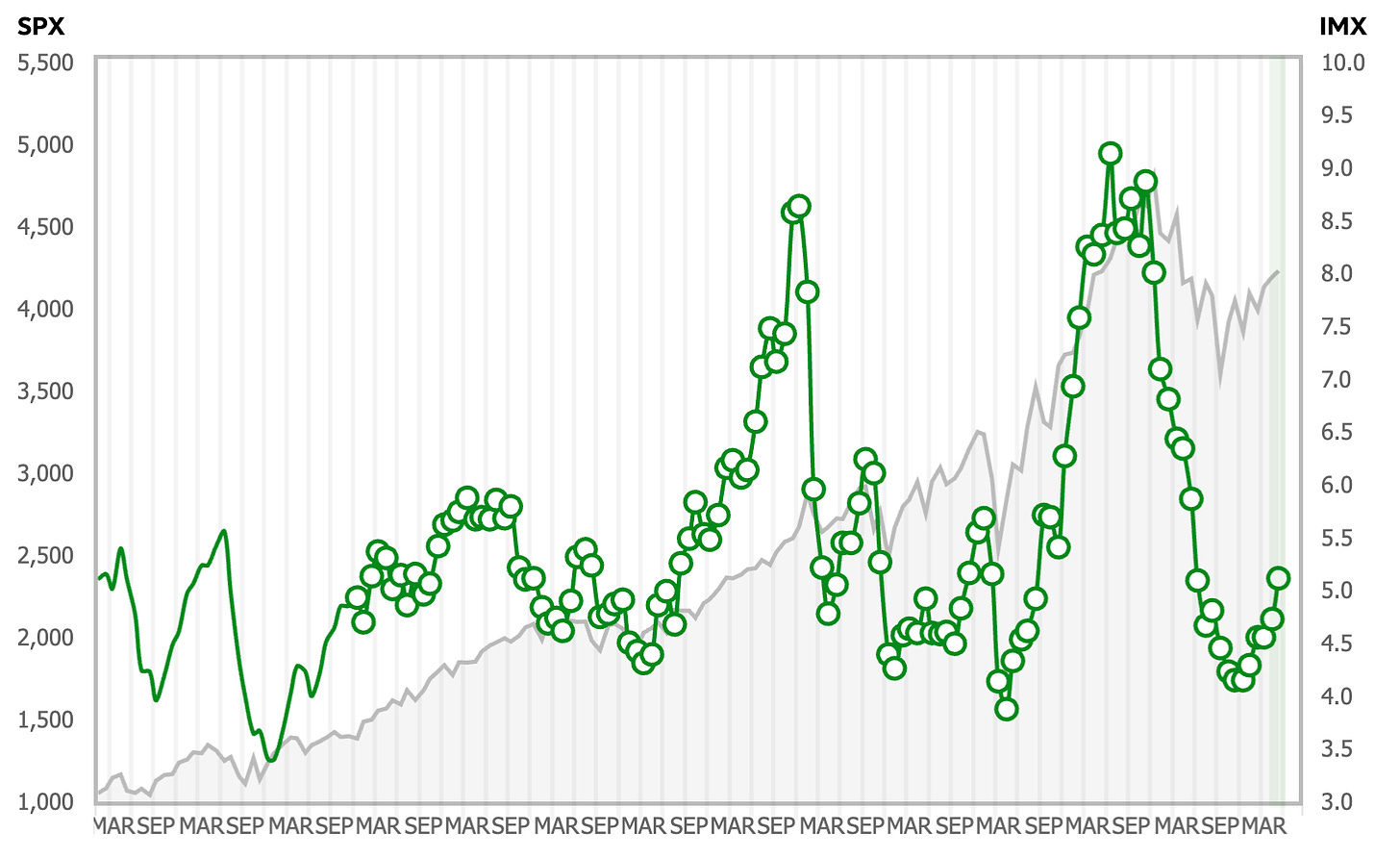

The TD Ameritrade Investor Movement Index continues to tick higher:

Commitment of Traders:

Equity futures were mostly positive with only NQ lower on the week. Relative Strength (RSL) is above 1 for all of them. Positioning is broadly neutral but the 1-week change in net positions for Commercials is at almost -2 SD and for Large Traders it is above +2 SD, which can be a short-term bearish signal.

Treasury futures are all lower this week, positioning remains bullish in ZT, ZF and ZN.

Currency futures were all positive vs. negative DX. Positioning is bullish in DX, 6A and 6J, and bearish 6E.

Bitcoin hasn't moved much, its RSL is dropping as the 26-week moving average is catching up from below.

Energy futures were mixed with CL lower. Positioning is becoming more bullish for CL and remains neutral for NG, HO and RB.

Metals had a mostly positive week with only PA lower. HG remains weak with its RSL below 1. Positioning is bullish only in PA.

Grains were mixed with ZL outperforming by a wide margin. Relative Strength for grain futures is below 1, and Commercial/Large Trader positioning is mostly at or near bullish extremes.

Softs were mixed as well. Positioning in CT is at a bearish extreme.

COT/TFF dealer net positions for currency futures:

6E is near its low

6A has seen an increase in dealer positions but remains below its 2-year high

6C is still heavily shorted vs. dealers near multi-year highs

Citi PAIN indexes: positioning seems to be fairly neutral for most currencies.

Here's the combined COT/PAIN chart:

Market Risks

Credit spreads are doing nothing. IG spreads are at the same level they were at in 2021, and HY spreads are elevated but they're not widening (positive) but they're not contracting either despite the rally in stocks (negative):

The same is true for the Credit Spread Index:

Currency volatility continues to decline across the board:

The VIX term structure is in contango:

Volatility indexes:

VIX is at 13.84 (!), VVIX below 90, MOVE has dropped to 115

VIX/VIX3M is steepening

Skew metrics have fallen with TDEX and SDEX collapsing within a few days, the only outlier being VIX/VOLI which remains high (no idea why)

Overall, the compression in volatility is remarkable… 13 handle in VIX, OTM put demand to hedge is low…

The correlation between ES and VVIX has spiked again. This can be a short-term reversal signal with a few days lag:

The CNN Fear & Greed Index has ticked up into extreme greed territory:

The BlackRock Geopolitical Risk Indicator continues to decline:

Various

The NYSE Advance/Decline line has improved considerably over the last few days but the divergence with a lower high vs. a new high in stocks remains for now:

The percentage of S&P500 and Nasdaq 100 stocks above their 200-day moving averages has improved somewhat but is still making lower highs for the S&P:

The shorter 50-day moving average metric is at least not looking terrible anymore:

25-delta risk reversals: The only thing I see here is NZDUSD upside being hedged:

Market dashboard:

Trend metrics are all green

Distribution days are slowly rolling off

Volatility metrics, breadth and put/call ratios are unremarkable

ES/VVIX correlation has spiked as discussed above

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 19/2023 | 13/2023 | 06/2023 | 50/2022 | 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 22/2023 | 15/2023 | 09/2023 | 02/2023 | 47/2022 | 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

ECB

Rate Statements: 19/2023 | 12/2023 | 06/2023 | 50/2022 | 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 22/2023 | 17/2023 | 10/2023 | 04/2023 | 47/2022 | 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 11/2023 | 05/2023 | 50/2022 | 43/2022 | 36/2022

BOE

Rate Statements: 20/2023 | 13/2023 | 06/2023 | 50/2022 | 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

RBA

Rate Statements: 19/2023 | 15/2023 | 11/2023 | 07/2023 | 50/2022 | 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 21/2023 | 17/2023 | 09/2023 | 51/2022 | 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 19/2023 | 07/2023 | 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 22/2023 | 15/2023 | 09/2023 | 47/2022 | 41/2022 | 34/2022 Meeting Minutes: 07/2023 Crib Sheets: 40/2022

BOC

Rate Statements: 15/2023 | 11/2023 | 05/2023 | 50/2022 | 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022 Summary of Deliberations: 18/2023

SNB

Rate Statements: 13/2023 | 50/2022 | 44/2022 | 39/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

BOJ

Rate Statements: 18/2023 | 11/2023 | 04/2023 | 51/2022 | 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 20/2023 | 13/2023 | 05/2023 | 52/2022 | 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: Midjourney with the prompt: Every living spirit that has ever lived is focused and concentrated through the crystal ball that is suspended above the portal that joins all things into one cohesive thought, in a torii.

Great analysis, i love the depth of your research. Thank you so much, please keep this going.

Always learning something new from ur report .

Thanks sir 🙇♂️