Outlook for Week 28/2023

"The wisest mind has something yet to learn" - George Santayana

Just another quick update again: this is a full-length issue. The one next weekend will be a short one again thanks to a well-deserved holiday.

Welcome to issue #63 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary. If you're short on time or just don't like long newsletters then just skip them.

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

The cover image is AI-generated via Midjourney. If you want to guess the prompt, I put it at the end of the newsletter.

Here's a shout-out to a great newsletter I just discovered recently:

The Rollup - Markets & macro from outside the mainstream 🤙 Curated investing news from YouTube, Substack, Twitter and more

I always find a link to an interesting article or podcast I've missed during the week in there.

If you like fx:macro, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Table of Contents

Summary (Playbook, Calendar,

Levels,FX Drivers, Downloads)Week in Review: a) Central Banks, b) Economic Data

Market Analysis: a) Growth and Inflation, b) Yields, c) Central Banks and the US Dollar, d) Sectors and Flows, e) Sentiment and Positioning, f) Market Risks, g) Various

Top 3 Macro Charts of the Week

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Please check out this article about what this summary aims to provide and what its limitations are.

Economic Calendar for next week

If you want a quick and easy way to hook a customized economic calendar into your favourite calendar app then check out this link.

Important levels to watch and look out for in FX futures

CME Website was down, so no levels this week

Currency Drivers

For an explanation check out this link.

Downloads and Links

Difftext of the Summary from last week: diffchecker.com

Cental bank overview with the summaries of each of the latest rate decisions, rate statements and minutes:

Central bank speaker recap for the week:

Week in Review

Central Banks

RBA Rate Statement (04.07.23)

The RBA left rates unchanged:

Reasons for no change:

1) high uncertainty regarding the economic outlook,

2) past rate increases will continue working to bring supply and demand into balance,

3) more time to assess the impact of past hikes

Guidance unchanged: Some further tightening may be required to ensure inflation returns to target in a reasonable timeframe

Inflation has passed its peak but is too high and will remain for some time yet

The Board's priority is to return inflation to target within a reasonable timeframe

Growth has slowed, the labour market has eased but remains very tight, wages have picked up

Wage growth is still consistent with the inflation target if productivity growth picks up

The Board remains alert to the risk of inflation expectations contributing to price and wage increases

Expects the economy to grow even as inflation returns to target (previously: seeking to keep the economy on an even keel), the path to achieving this is narrow

FOMC Minutes (05.07.23)

The Minutes were a bit more hawkish than expected with "some participants” favouring a 25 bps hike instead of a hold. Here are two quotes and below are the highlights from the section on the monetary policy decision:

Participants agreed that inflation was unacceptably high and declines in inflation had been slower than they had expected.

Participants noted that the full effects of monetary tightening had likely yet to be observed, though several highlighted the possibility that much of the effect of past monetary policy tightening may have already been realized.

Confab, Speakers, News

Federal Reserve

Williams (Neutral). Wed: Slowing down rate rises makes sense right now, future rate rises are still in play, fully supported the Fed's decision to hold rates steady at the June FOMC, not content with where inflation is right now, open question how fast inflation will cool next year, fighting inflation remains the Fed's main job, the economy has handled rate hikes "reasonably well", surprised to see the resilience of the housing market, the economy still has a strong demand for labour.

Logan (Neutral). Thu: More rate hikes are likely necessary, would have been okay with a June hike, challenging and uncertain environment enabled June pause, very concerned whether inflation will cool quickly enough, skeptical about the lagged impact of past rate hikes, the housing market may have bottomed out, the Fed has room to shrink the balance sheet for quite some time.

Goolsbee (Neutral). Fri: Sees 1-2 more rate hikes this year, I haven't seen anything that says one or two more hikes this year is wrong, still undecided on July hike, I feel like we're on the golden path to "no recession and the inflation target", the job market is outstanding, there's a lag to monetary policy, inflation is down somewhat but needs to come down more,

European Central Bank

Nagel (Hawk). Mon: Inflation is not retreating as we would like it to, still have a way to go with policy tightening, policy signals are clearly pointing in the direction of further tightening. Wed: Interest rates must rise further but too early to say how far, price stability won't come by itself, wary of proclaiming a new era of high interest rates. Thu: Rates to stay restrictive for an extended period of time, rates will have to remain high for a longer period, does not see the threat of excessive tightening, can't say yet where rates will peak.

Visco (Dove). Wed: Does not agree with the idea of tightening too much over tightening too little, more rate hikes is not the only way to curb inflation, can also aim to maintain rates adequately high for a sufficient period of time, rate decision is taken on a meeting by meeting basis and depends on incoming data.

De Guindos (Dove). Fri: We will continue to follow a data-dependent approach, evolution of core inflation will be key to future policy decisions, September meeting is an open question, our job is not yet done, need clear indications that inflation will converge to 2% target, underlying price pressures remain strong but most indicators have started to show some signs of softening, now beginning to see impact of rate hikes on parts of the economy.

Lagarde (Dove). Fri: We still have work to do to bring inflation back down to target, inflation has started to decline, the priority is to maintain price stability.

Bank of England

Greene (Dove). Mon: It would be a mistake for central bankers to assume inflation and rates will automatically go back to pre-Covid levels.

Bailey (Neutral). Thu: Cannot give a date on when interest rates will start to come down, expects inflation to fall markedly but it will still be hard for borrowers.

Swiss National Bank

Maechler. Thu: Inflation is still very high, does not rule out further rate increases.

Bank of Japan

Matsuno. Mon: Improvement in the BOJ Tankan reflects gradual recovery of the economy, will continue to closely monitor trends in overseas economies and prices.

Kanda. Tue: Communicating with various countries including the US over currencies.

Suzuki. Tue: Keeping in close high-level contact with the US on FX.

Uchida. Thu: Will maintain yield curve control from the perspective of sustaining easy monetary conditions, will continue YCC for the time being, seeing signs of change in corporate wage and price setting behaviours, risk of missing 2% inflation with premature policy shift is bigger than being too late in tightening policy, rapid and one-sided Yen declines are undesirable, the exchange rate must move stably reflecting economic fundamentals.

Economic Data

Monday, 03.07.23

Tuesday, 04.07.23

“The Canadian manufacturing sector turned in another subdued performance during June, with the headline PMI remaining inside contraction territory, dragged down by further falls in both output and new orders. Reports of subdued market demand, both at home and abroad, were widespread, with clients reportedly hanging back from committing to new business given the uncertain economic outlook.

“Elsewhere in the last report, the record improvement in vendor delivery times is on the one hand welcome news, adding to a sense of prevailing market stability following the disruptions of the pandemic. This has clearly helped to ensure that inflationary pressure remain under broad control. However, with a lack of market demand the principal factor behind the shortening of lead times, its hard to get away from the sense of subdued industrial performance heading into the second half of the year.”

Wednesday, 05.07.23

Thursday, 06.07.23

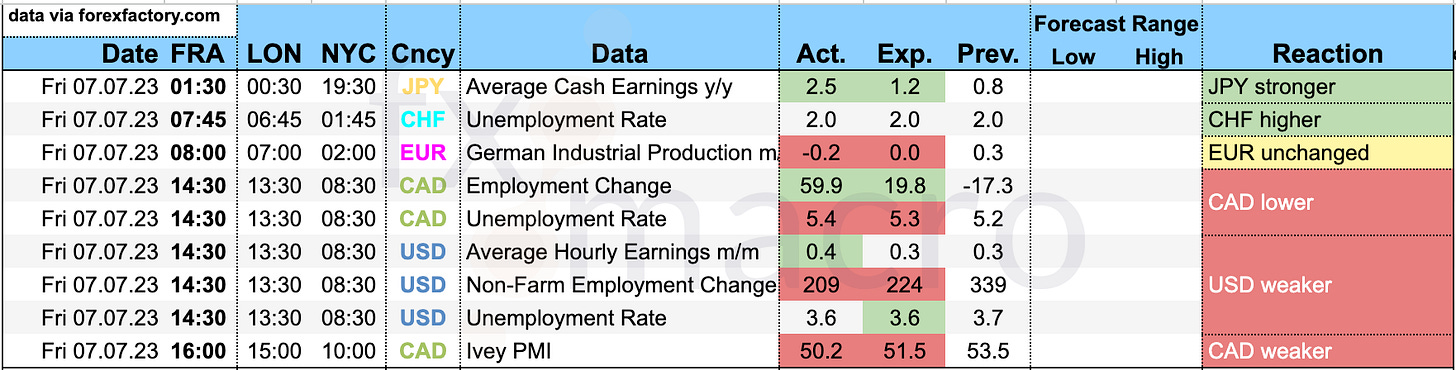

Friday, 07.07.23

Market Analysis

Growth and Inflation

The Atlanta Fed GDPNow model estimates Q2 growth at 2.1%:

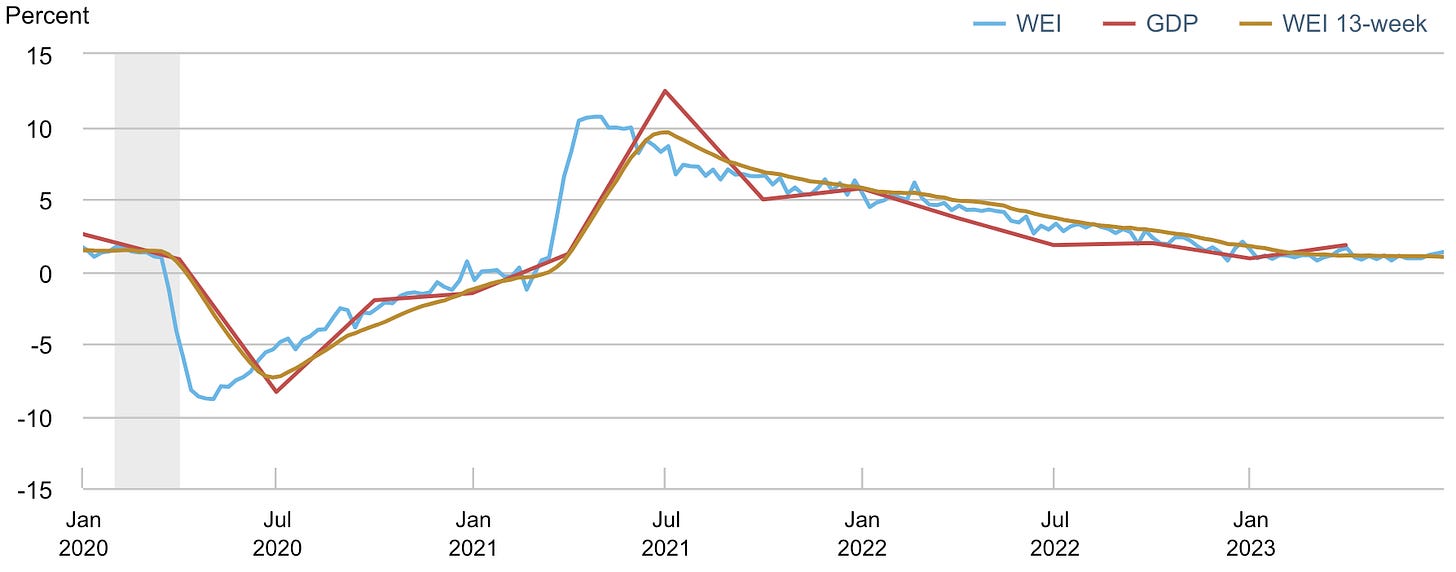

The NY Fed Weekly Economic Index ticked up to 1.32:

Citi Economic Surprise Indexes:

USD is up and at highs, EUR is down and has picked up a tiny bit from the low

GBP has moved sideways near its high

AUD is improving, NZD is off lows too

CAD and JPY are going sideways

CNY is dropping further

The CESI spread EUR-USD is also at an extreme level (disregarding Covid):

One thing that shows GBP's strength is that it hasn't reacted bearishly to any data release in the last five weeks or so:

OECD Composite Leading Indicators:

China is still going higher

The UK is also going up but flattening out

The US has bottomed out and has increased slightly

Canada is still in a downtrend albeit flattening out

Germany has made a turn lower

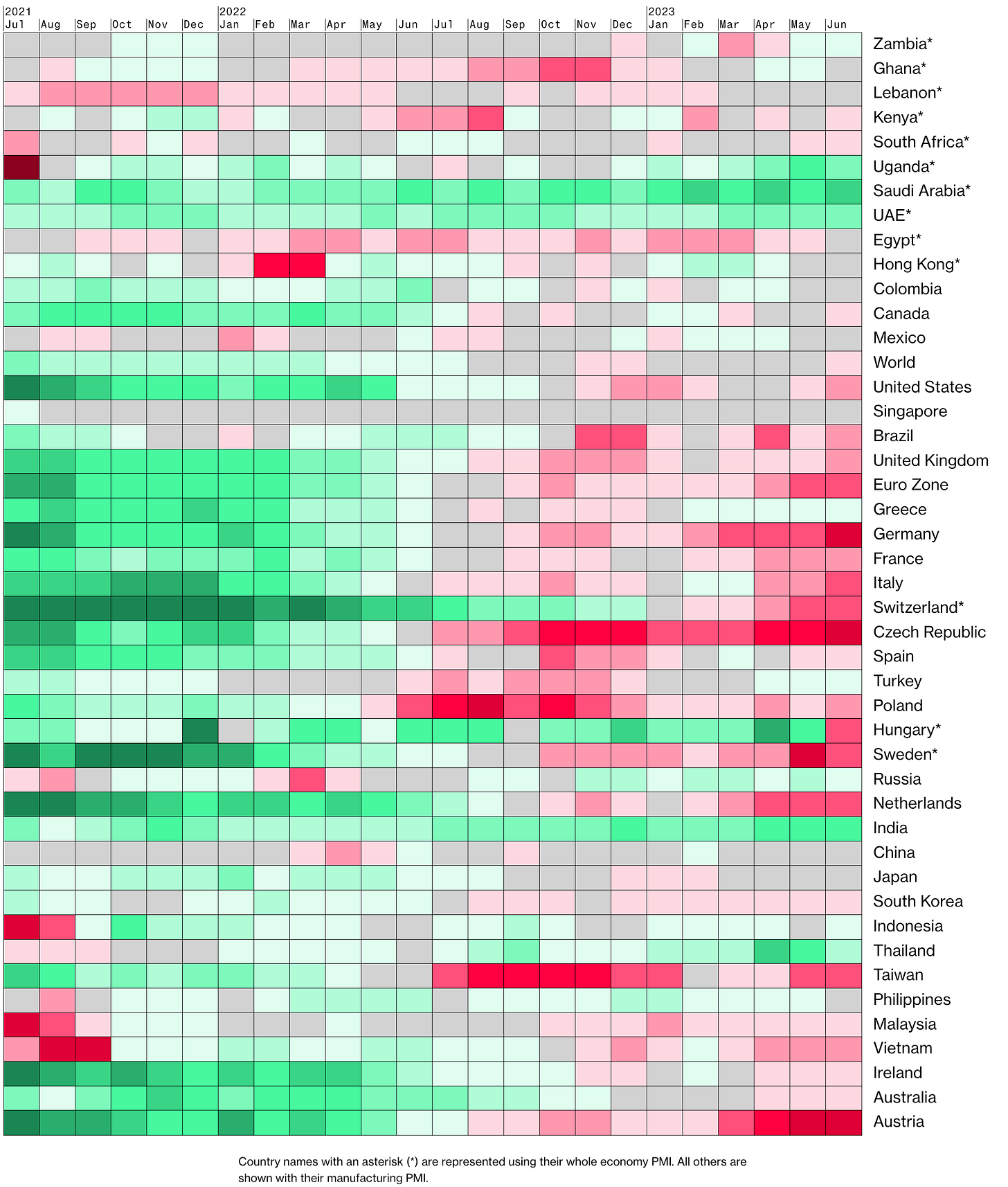

Bloomberg PMI heatmap:

Canada, the US, the UK, and Germany have all become worse in June

The Eurozone and Switzerland remain at deeply red levels

China and Japan remain neutral

South Korea, Taiwan and Vietnam remain red

India is looking pretty good

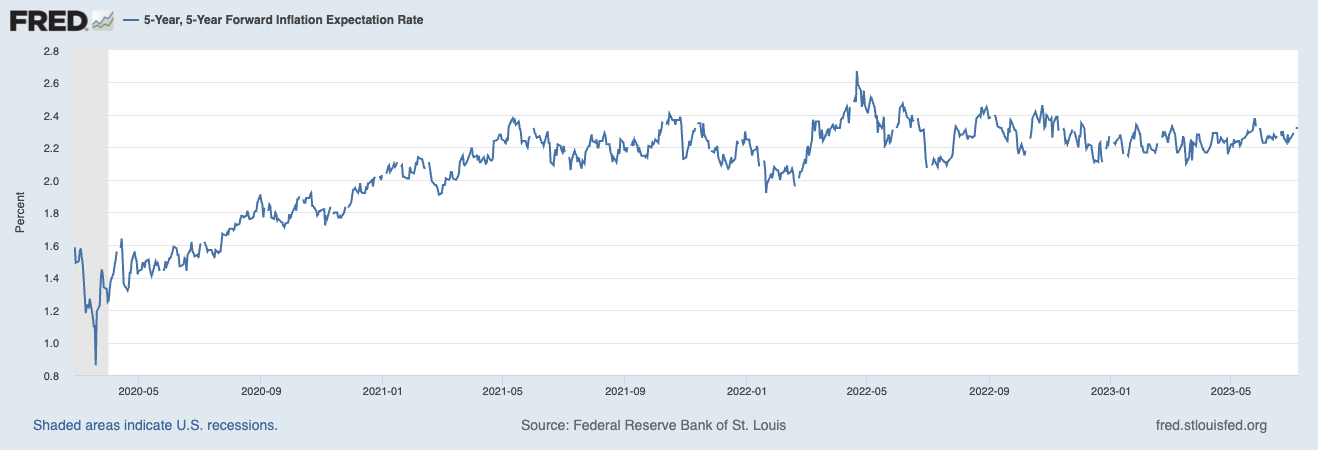

Breakeven inflation rates, 5y5y forward inflation expectations and RINF are all going sideways:

Citi Inflation Surprise Indexes:

Ticks lower in USD, EUR, CAD

A larger drop in JPY

Ticks higher in NZD, CHF, CNY

Yields

See chart and table below:

The UK and the US have been the 10y yield outperformers

Canadian yields look lacklustre compared to everyone else

2-year, 10-year yields and 2s10s:

2s10s mostly bear steepened this week

NZD is the only real exception with a flatter (bear flattening) curve into the RBNZ next week

GBP 2y yields rate-of-change is looking pretty insane, the bear steepening this week was also pretty muted compared to the move over the previous month

Global 2s10s show that everyone except for Japan and China is still inverted:

Central Banks and the US Dollar

Latest FOMC meeting probabilities according to FedWatch:

The July meeting is priced with a 25 bps hike at a 93% probability

September sees a 71% chance of another 25 bps hike to 5.50%-5.75%

Further hikes are priced at smaller probabilities into 2024

The first rate cut is priced in for May 2024

The policy rate at the end of 2024 has been priced higher continuously and is now 4.00-4.25%

The Fed Funds forward curve has shifted higher the further out we go:

The terminal rate remains priced in for November (X23 future):

Here's a chart that shows how many BOJ and MOF officials are coming out with comments each day. Back in September/October last year, there was a clear cluster before they intervened in FX markets. In comparison, right now there's just a slight pick-up:

Sectors and Flows

Currency strength:

JPY has underperformed massively over three months and one month

GBP is still going strong with the best performance over three months and one month

USD is mostly in the middle but has underperformed over one month and the last week

Currency strength charts:

Equity sector performance:

Outperformers: Semiconductors, Consumer Discretionary, Tech, Growth

Underperformers: Utilities, Energy, Healthcare, Oil/Gas Exploration, Metals/Mining, Staples, Value

Similar data, different chart:

Cyclicals, Tech have performed well on all three timeframes

Healthcare, Utilities, Consumer Defensive have underperformed

Overall, it’s a reflationary picture here

Sector breadth looks decent with about three-quarters of sectors positive over 30 days:

Sector ETF charts:

International stock markets:

Nikkei, Bovespa, Nasdaq and TOPIX are by far the outperformers

Hang Seng has the worst performance

Sentiment and Positioning

AAII Bull-Bear spread is high but not at extreme levels around 30 yet. Still, it’s the highest since November 2021:

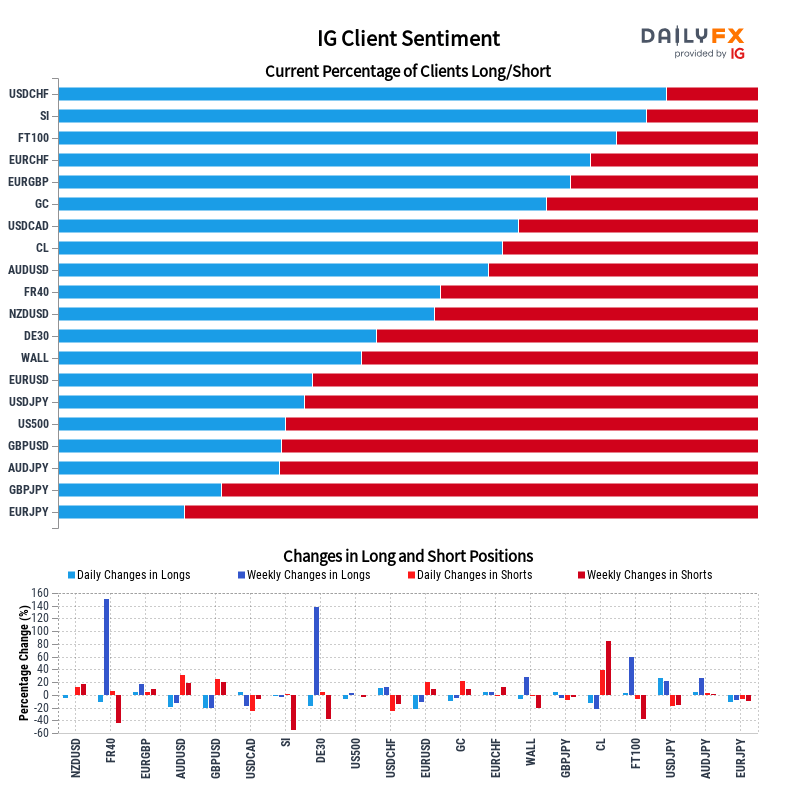

Currency sentiment:

Bullish sentiment (bearish price): AUD, NZD

Bearish sentiment (bullish price): CHF, GBP

Different sentiment source:

USDCHF, EURCHF are the two pairs with the most bullish sentiment

EUR pairs mostly have bullish sentiment except for the most important one: EURUSD

JPY pairs all have bearish sentiment

Commitment of Traders and futures performance:

Equity futures had a negative week, positioning is neutral

Treasury futures were all lower too, positioning ist at/near bullish extremes for most of them

Currency futures were mostly higher except for 6C; positioning in 6B is near a bearish extreme while 6J is at a bullish extreme

Bitcoin still has a Relative Strength (RSL) of 1.12, which means it’s trading comfortably above its 26-week moving average; COT positioning is very bullish, that is if you believe in COT data for BTC

Energy futures were mixed with everything at least slightly higher except for NG; positioning in NG is noteworthy because it’s so bearish despite the weak price action; Commercial/Large Trader positioning in CL is near bullish extremes

Metal futures ended the week positive, HG remains subdued with an RSL of only 0.95; positioning in PA remains bullish

Grains had a bit of a wild ride over the last few weeks, positioning is neutral for all of these futures

Softs were mixed this week, positioning remains bearish for CC and bullish for SB

COT/TFF dealer net positions for currency futures:

6B is still close to its multi-year short position

6C has had a quite significant rate of change going from net long to net short

6J is still not at its high

Citi PAIN indexes show the USD being bought vs. everything else though it’s not at extreme levels yet:

Combined COT/PAIN chart:

Market Risks

IG spreads are trading barely above 2021 levels, HY OAS are still elevated:

The Credit Spread Index also remains elevated despite the rally in stocks:

Currency volatility has picked up a bit in JPY but remains relatively low overall:

The VIX term structure is in contango:

Volatility indexes:

VIX is at 14.82, VVIX at 94.49, MOVE at 130

Skew has flattened over the last weeks, which could reflect a bit of complacency because market participants aren’t hedging

Overall: nothing to see here

CNN Fear & Greed remains in extreme greed territory:

Various

The NYSE Advance/Decline Line has finally made a new high:

The percentage of stocks above their 200-day moving averages doesn’t look too exciting for the S&P 500 but it’s not terrible either. For the Nasdaq 100, it looks more encouraging:

The shorter 50-day moving average metric looks pretty healthy for both indexes:

25-delta risk reversals:

USDCHF is priced higher

USDCNY is priced lower, implying dollar weakness

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 25/2023 | 19/2023 | 13/2023 | 06/2023 | 50/2022 | 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 22/2023 | 15/2023 | 09/2023 | 02/2023 | 47/2022 | 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

ECB

Rate Statements: 25/2023 | 19/2023 | 12/2023 | 06/2023 | 50/2022 | 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 22/2023 | 17/2023 | 10/2023 | 04/2023 | 47/2022 | 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 11/2023 | 05/2023 | 50/2022 | 43/2022 | 36/2022

BOE

Rate Statements: 25/2023 | 20/2023 | 13/2023 | 06/2023 | 50/2022 | 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

RBA

Rate Statements: 24/2023 | 19/2023 | 15/2023 | 11/2023 | 07/2023 | 50/2022 | 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 25/2023 | 21/2023 | 17/2023 | 09/2023 | 51/2022 | 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 19/2023 | 07/2023 | 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 22/2023 | 15/2023 | 09/2023 | 47/2022 | 41/2022 | 34/2022 Meeting Minutes: 07/2023 Crib Sheets: 40/2022

BOC

Rate Statements: 24/2023| 15/2023 | 11/2023 | 05/2023 | 50/2022 | 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022 Summary of Deliberations: 25/2023 | 18/2023

SNB

Rate Statements: 25/2023 | 13/2023 | 50/2022 | 44/2022 | 39/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

BOJ

Rate Statements: 25/2023 | 18/2023 | 11/2023 | 04/2023 | 51/2022 | 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 26/2023 | 20/2023 | 13/2023 | 05/2023 | 52/2022 | 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: Midjourney with the prompt: a fancy surfer in portugal

Would appreciate your thoughts on the BRICS countries possibly announcing going to a gold standard in August. Seems bearish for USD. Bullish for Brics currencies?

thank you, great coverage!