Due to other commitments, I’ll be sending a short version of the newsletter next weekend and probably the one after that.

Welcome to issue #60 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary. If you're short on time or just don't like long newsletters then just skip them.

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

The cover image is AI-generated via Midjourney. If you want to guess the prompt, I put it at the end of the newsletter.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Table of Contents

Summary (Playbook, Calendar,

Levels,FX Drivers, Downloads)Week in Review: a) Central Banks, b) Economic Data

Market Analysis: a) Growth and Inflation, b) Yields, c) Central Banks and the US Dollar, d) Sectors and Flows, e) Sentiment and Positioning, f) Market Risks, g) Various

Top 3 Macro Charts of the Week

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Please check out this article about what this summary aims to provide and what its limitations are.

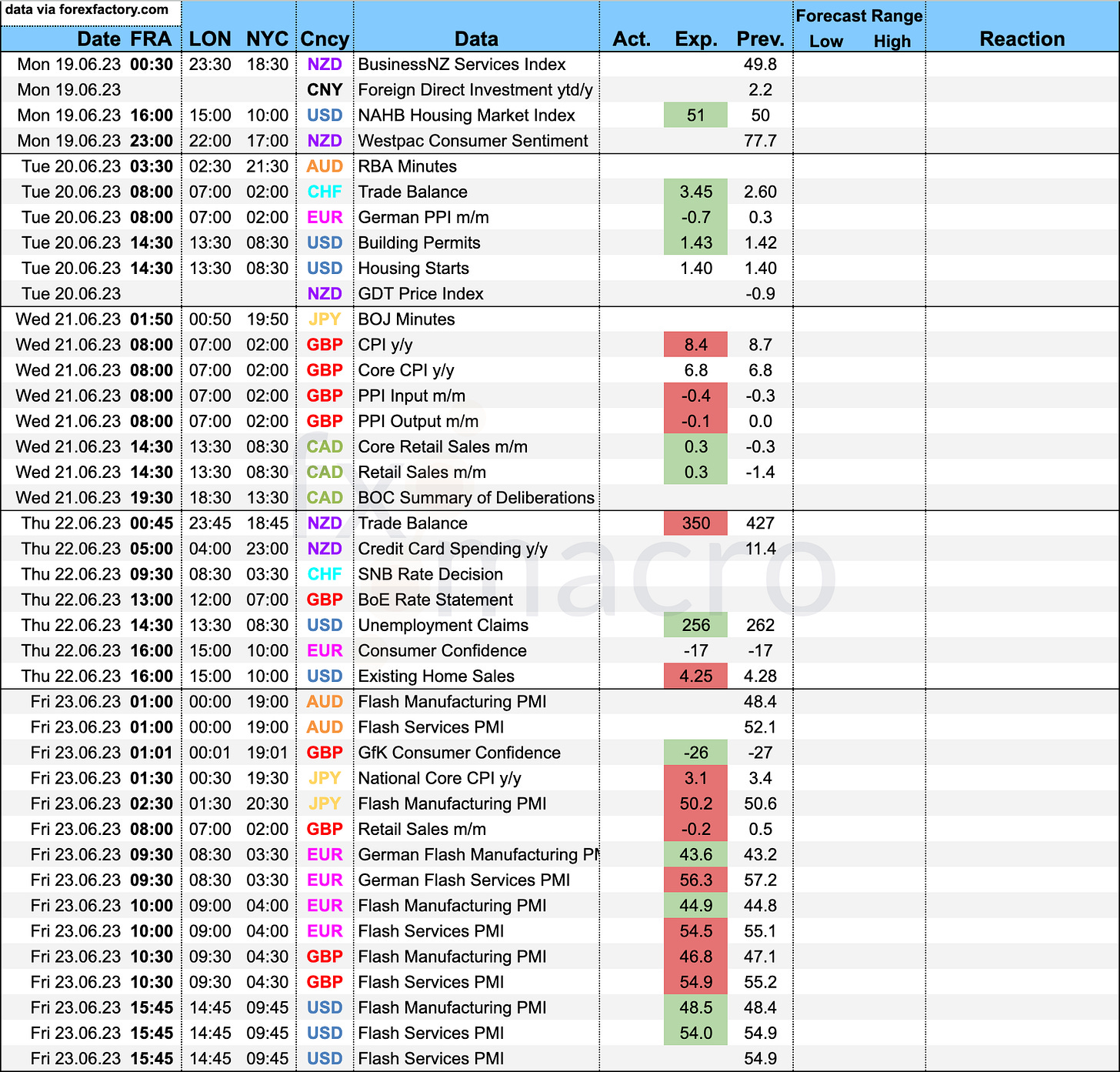

Economic Calendar for next week

If you want a quick and easy way to hook a customized economic calendar into your favourite calendar app then check out this link.

Important levels to watch and look out for in FX futures

QuikStrike was unavailable, unfortunately.

Currency Drivers

For an explanation check out this link.

Downloads and Links

Difftext of the Summary from last week: diffchecker.com

Central bank speaker recap for the week:

Summarised comments for the BoE and SNB since their last meetings:

Week in Review

Central Banks

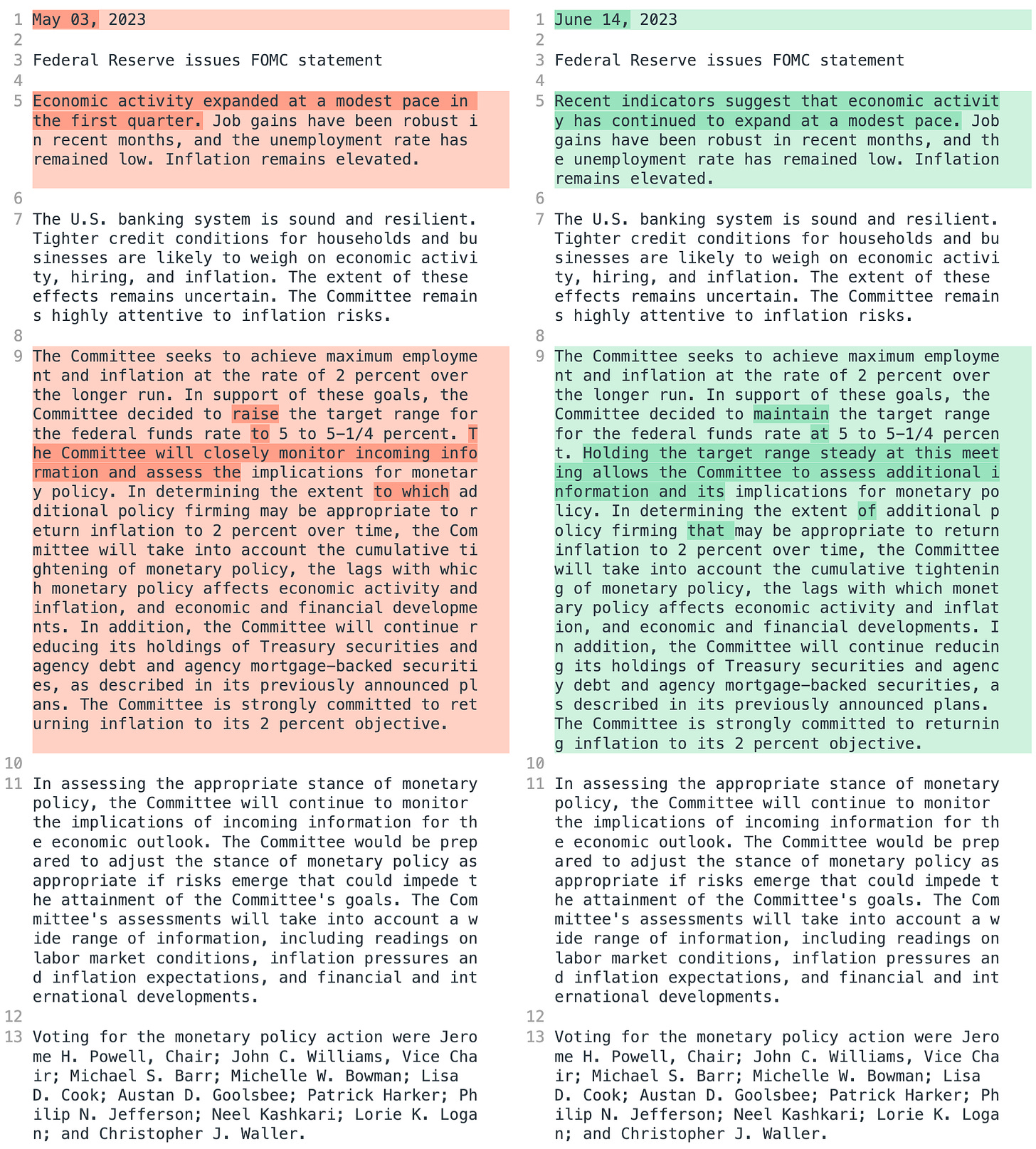

FOMC Statement (14.06.23)

The Fed left rates unchanged at their June meeting. Given reason: holding the rate steady allows the Committee to assess additional information and implications for monetary policy. Virtually everything else was left unchanged:

From the Summary of Economic Projections:

GDP growth has been upgraded from 0.4 to 1.0% this year and lowered by 0.1% in 2024 and 2025

PCE inflation has been lowered from 3.3 to 3.2% for this year and left unchanged for the next two years; it remains above the 2% target through 2025

Core PCE inflation for this year is seen at 3.9 vs. 3.6% in March and 2.6% in 2024

The projected Fed funds rate has been revised higher through the entire projection horizon: 5.6 vs. 5.1% for this year, 4.6 vs. 4.3% next year, and 3.4 vs. 3.1% in 2025

Here’s the dot plot with the one from March overlaid:

ECB Rate Decision (15.06.23)

The ECB hiked rates by 0.25% as expected:

Hiked because inflation is projected to remain too high for too long

Rates will be brought to sufficiently restrictive levels and will be kept there for as long as necessary

Will continue to follow a data-dependent approach

APP reinvestments will be discontinued as of July 2023

Inflation is expected to average 5.4% this year, 3.0% next year and 2.2% in 2025

Underlying price pressures remain strong although some show tentative signs of softening

GDP growth is projected to be 0.9% this year, 1.5% next year, 1.6% in 2025

From the ECB staff projections:

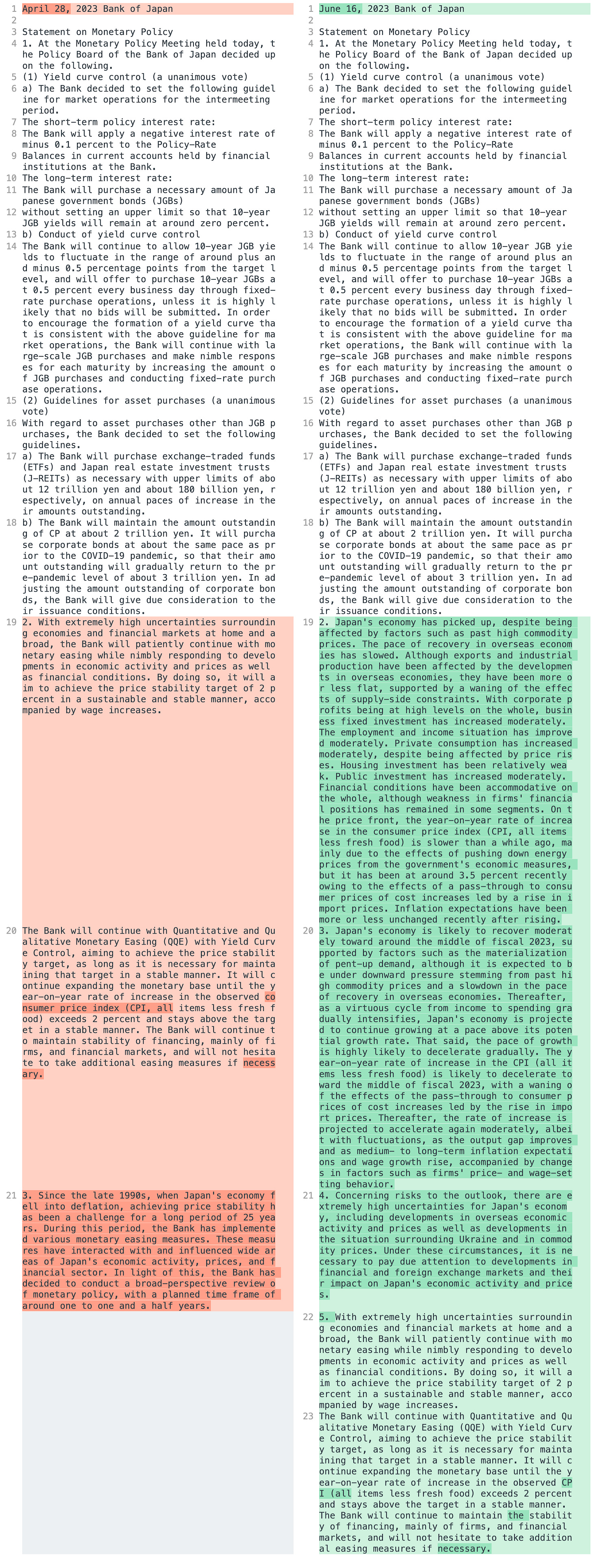

BOJ Rate Decision (16.06.23)

The BOJ left rates and the parameters of their YCC unchanged:

Will patiently continue with monetary easing, will continue QQE with yield curve control, will continue to expand the monetary base, will not hesitate to take additional easing measures

The Japanese economy has picked up, exports and imports have been more or less flat despite a slowdown in overseas economies

Financial conditions have been accommodative

The rate of increase in CPI ex fresh food has slowed mainly due to the government’s measures to lower energy prices

CPI y/y is likely to decelerate towards the middle of FY 2023 and to pick up again afterwards

The economy is likely to recover moderately towards the middle of FY 2023

Confab, Speakers, News

Federal Reserve

Powell (Neutral). Wed: The full effects of our policy have yet to be felt, nearly all policymakers view some further rate hikes this year as appropriate, inflation has moderated somewhat but still has a long way to go, if the economy evolves as expected the median of participants sees 5.6% FFR at year-end, Fed projections are not a plan or a decision, will continue to make our decisions meeting by meeting, have not made a decision about July, I expect July to be a live meeting, it's common sense to go a bit slower on rate hikes as we near the destination, inflation risks are still to the upside, not seeing a lot of progress on core PCE, rate cuts are not appropriate this year and no policymaker saw rate cuts this year, economic data came in consistent with but on the high side of expectations, the conditions we need to see in place to get inflation down are coming into place including lower growth labour slack, we don't know the full extent of the banking turmoil.

Waller (Hawk). Fri: The US economy is still ripping along, it's disturbing that core inflation is not improving, will probably require more tightening, so far it looks as if the idea of labour market softening without much rise in unemployment is holding up, it's still not clear that recent bank failures have had a material effect on credit conditions.

Barkin (Neutral). Fri: Comfortable doing more on interest rates if the coming data doesn't confirm that slowing demand is returning inflation to the 2% target, higher rates may create the risk of a more significant slowdown, experience of the 1970s shows that the Fed should not back off its inflation fight too soon, inflation has proven stubbornly persistent, still looking to be convinced that weakening demand will control it.

European Central Bank

Lagarde (Dove). Thu: Rates to remain restrictive as long as necessary, we are not thinking about pausing, we are not done, we are not at the destination, a hike in July is likely unless there is a material change, we are not satisfied with the inflation outlook, 2.2% inflation in 2025 is not satisfactory, very broad consensus behind today's decision, does not want to comment on the terminal rate, borrowing costs have increased steeply and loan growth has slowed, will continue to follow a data-dependent approach, wage increases are becoming an increasingly important component of inflation, the labour market remains a source of strength, longer-term inflation expectations warrant monitoring, the Eurozone economy has stagnated in recent months, manufacturing continues to weaken as services remain resilient, outlook for growth and inflation is highly uncertain. Fri: We will continue to follow a data-dependent approach after July, it is very likely we will continue to increase rates at our next policy meeting in July.

Wunsch (Neutral). Fri: Could hike again in September unless core inflation drops substantially, core inflation holding around 5% could require a rate hike in September and possibly beyond, not yet seeing a beginning slowdown in core inflation.

Centeno. Fri: Rates should remain in restrictive territory for some time after the summer, policy is on restrictive terrain, it's not a support to growth, we must act to control inflation.

Holzmann (Hawk). Fri: Has no view on what should happen with rates beyond July but if things continue as they are then further action will be needed, key question is how persistent core inflation is.

Rehn (Neutral). Fri: Future decisions will continue to follow a data-dependent approach.

Nagel (Hawk). Fri: We may need to keep raising rates after the summer break, still a long way to reach the inflation target.

Villeroy (Neutral). Fri: Nobody should rush to a premature conclusion about our calendar nor our terminal rate, the duration of high interest rates matters more than the level, persistence matters more than the peak, we are data-driven and not forecast-driven.

Sources. Thu: Bloomberg: The ECB will be set for a tough debate on a September hike in July, several officials favour the expected July hike to be the last of the cycle. Thu: ECB policymakers see topic of rates corridor gaining relevance later this year, began debate on evening out the interest rates corridor but discarded a move this week and see no decision in July.

Bank of England

Mann (Hawk). Weekend: Britain and other rich nations should consider a carbon tax, UK government should move economic policy away from being an emergency response tool and onto a more sustainable footing. Mon: UK data and surveys have remained positive since May's BoE forecasts, there is still a question in my mind about how tight UK financial conditions really are, wage increases of 4% would make it a challenge to return CPI to 4%, drop in inflation expectations was important for me to switch my vote to 25 bps from 50 bps.

Haskel (Hawk). Mon: Further rate hikes cannot be ruled out, important that we lean against the risks of inflation momentum, monitoring indicators of inflation momentum closely.

Greene (Dove). Tue: It is reasonable to expect inflation to come down fairly quickly, inflation should come down over the next year, UK inflation expectations are pretty well anchored, it is right to be concerned about second-round effects, if UK inflation drivers are persistent the BoE needs to lean against this, there is always a risk of over-tightening given lags, engaging in stop-start monetary policy can end up with a worse outcome, important not to allow inflation expectations to become unanchored, my current out-of-consensus call is on China's recovery and not the UK's, expects Chinese recovery to be consumption-led instead of investment-led and to exceed 5% growth target.

Bailey (Neutral). Tue: Latest jobs data shows a very tight labour market, labour supply is recovering very slowly.

Dhingra (Dove). Tue: No doubt that inflation is still far too high, it's beginning to ease off its peak last year, current economic data suggests a slow recovery from major supply shocks accompanied by ongoing hardship for the most disadvantaged in society, monetary policy effects on inflation are not immediate due to transmission lags, despite the overall effectiveness of policy transmission the current cycle is likely to be slower due to a high stock of fixed-rate mortgages.

Bank of Japan

Matsuno. Thu: Important for FX to move stably reflecting economic fundamentals, closely watching FX moves, desirable for exchange rates to move in a stable manner, no comment on day-to-day moves, no change in stance that we will take appropriate action.

Suzuki. Fri: No comment on FX levels, exchange rates should move stably reflecting fundamentals, closely watching FX moves, sharp moves are undesirable.

Ueda. Fri: We have not changed policy because Japan's inflation is not sustainable, expects inflation to slow towards the middle of FY 2023, more time is needed to meet the 2% inflation target, it is possible that inflation will fall below 2% in the future, responding to an inflation undershoot after a premature rate hike is more difficult than responding to an overshoot, various indicators showed improvement in bond market functioning, side-effects of yield curve control policy has subsided, need to pay attention to exchange rates and financial markets, no comment on the exchange rate, there are both positive and negative impacts of a weak yen, important for FX moves to stably reflect economic fundamentals.

Economic Data

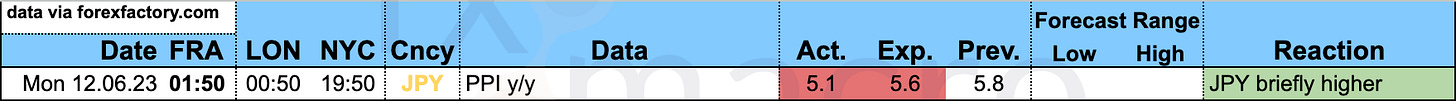

Monday, 12.06.23

Tuesday, 13.06.23

Wednesday, 14.06.23

Thursday, 15.06.23

Friday, 16.06.23

Market Analysis

Growth and Inflation

The Atlanta Fed GDPNow model estimates Q2 growth at 1.8%, a tad lower than the week before:

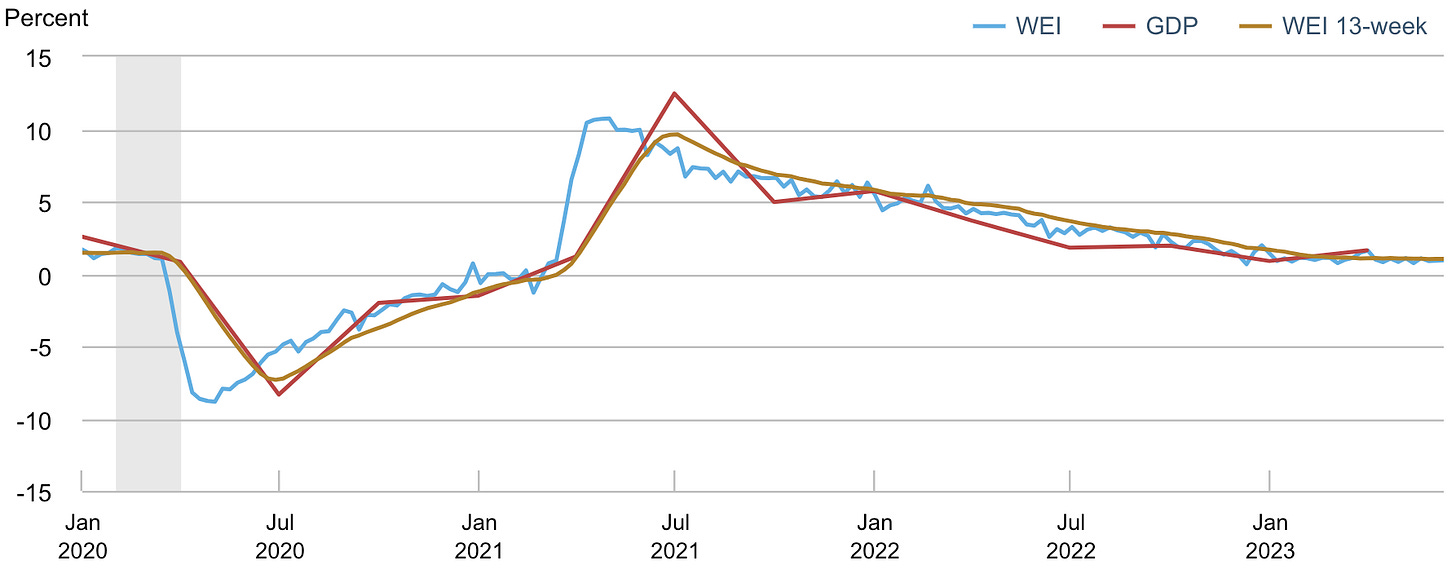

The NY Fed's Weekly Economic Index is trending sideways and stands at 0.93:

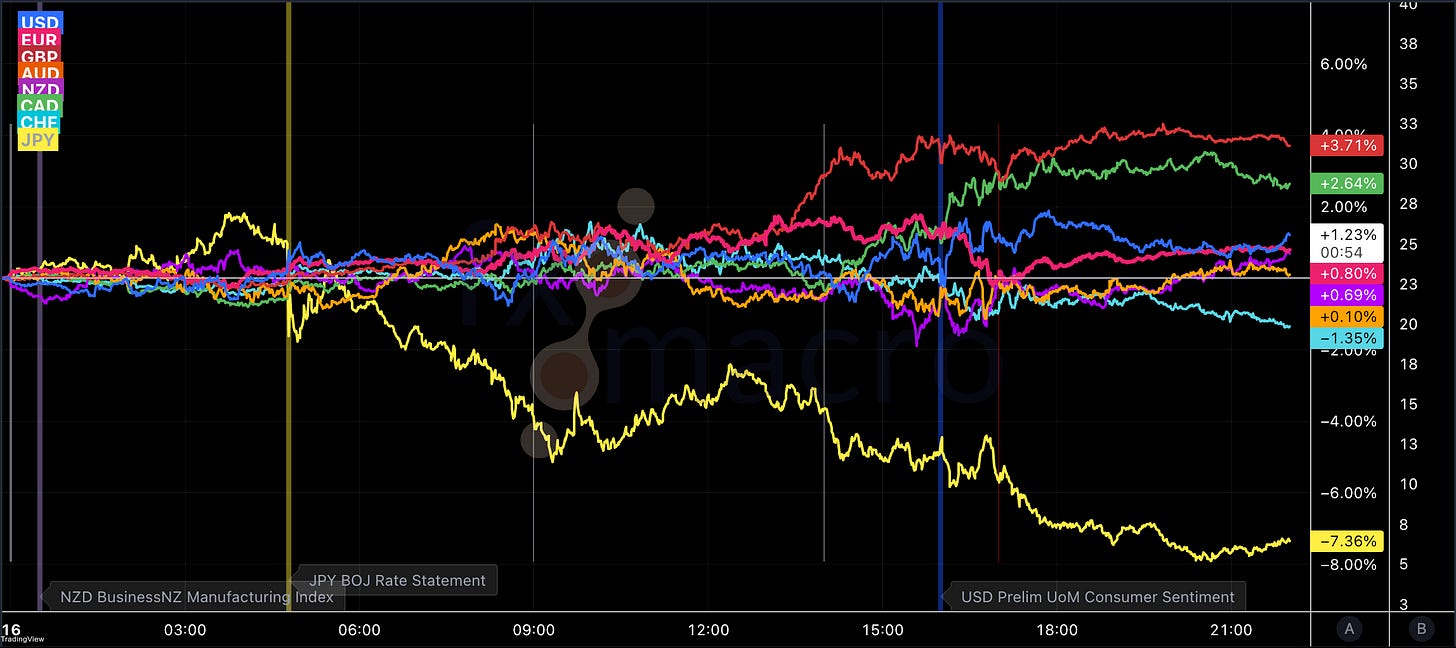

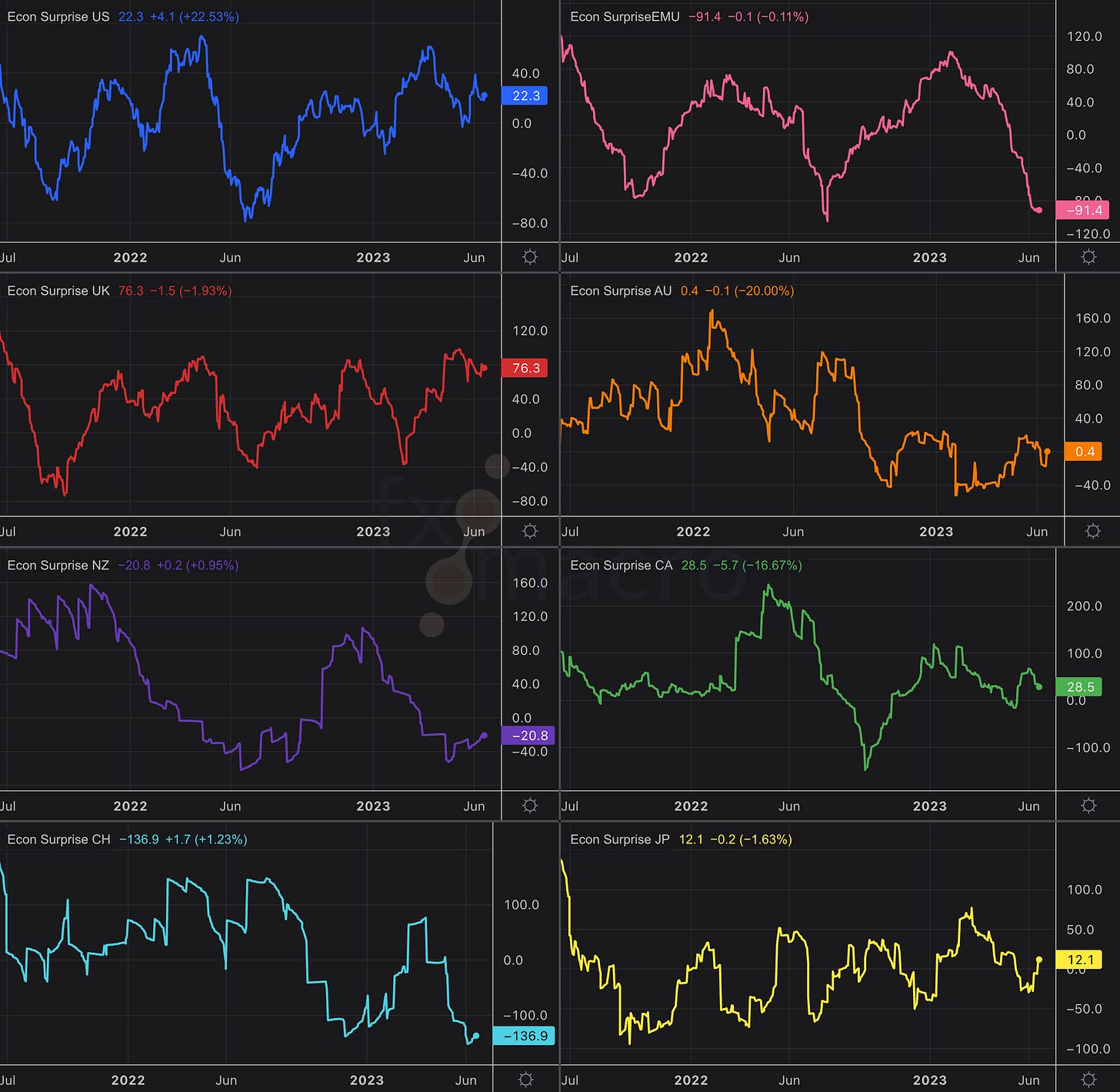

Citi Economic Surprise Indexes:

USD, CAD and GBP are going sideways

EUR has dropped sharply and might have bottomed out

AUD isn't improving, NZD is picking up a bit

CHF is still low, JPY is moving higher again

The CESI spread EUR-USD has stalled but it’s not confirming EURUSD’s move higher:

There haven’t been any updates to the Bloomberg PMI heatmap this week:

The US is worse, Canada unchanged

The Eurozone and Switzerland have worsened, Germany remains deeply red

The UK remains unchanged

China, Japan, South Korea and Australia are unchanged

Taiwan is weaker

Breakeven inflation rates, 5y5y forward inflation expectations and RINF are all going sideways with breakevens trending more to the downside:

Citi Inflation Surprise Indexes are updated monthly and thus remain unchanged from last week:

Ticks up in USD, CAD and JPY

Ticks down in EUR and GBP, and bigger drops in AUD, NZD, CHF

NY Fed Consumer Inflation Expectations are lower for 1-year expectations and up for 3- and 5-year metrics:

Yields

See chart and table below:

Aussie and UK yields look strongest

Swiss yields are going nowhere

US 10s are rangebound, 2s are higher; same for German yields

2-year, 10-year yields and 2s10s:

Bear flattening in USD, EUR, GBP, AUD, CAD

Both 2s and 10s have performed especially well in GBP and AUD

Global 2s10s:

The US yield curve is almost back at the level of inversion it was before the banking crisis hit in March

The rate of change in flattening is increasing visually

Central Banks and the US Dollar

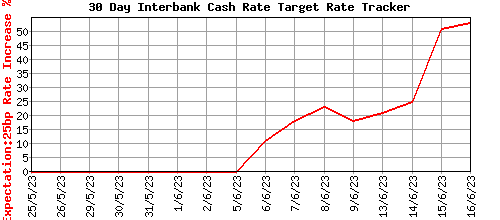

After FOMC is before FOMC. Here are the current meeting probabilities according to CME’s FedWatch:

The July meeting is priced at 25 bps with a 74% probability and at no-change with 26%

Compared to last week (i.e. before the FOMC decision), the probabilities for the upcoming meetings have shifted higher

The remaining meetings this year are all expected to see no change in the policy rate, the probabilities are skewed more to the downside than to the upside

The first cut is seen in January 2024, and the cutting cycle is expected to play out similar to what was priced in last week

The Fed Funds forward curve shows the change in implied expectations starting from X23 (November) onwards over the last week:

Here's the same data in table format. The change after the FOMC statement (T-3) is pretty clear: the terminal rate has been pushed out towards V23 (October):

Expectations for another RBA hike have been increasing and are now a tad above 50%:

Sectors and Flows

Currency strength:

GBP is outperforming over three months, and over one month and one week second only to AUD

JPY has underperformed massively on all three timeframes

USD was the second-weakest currency this week; it's mostly flat over one month

NZD is underperforming compared to AUD

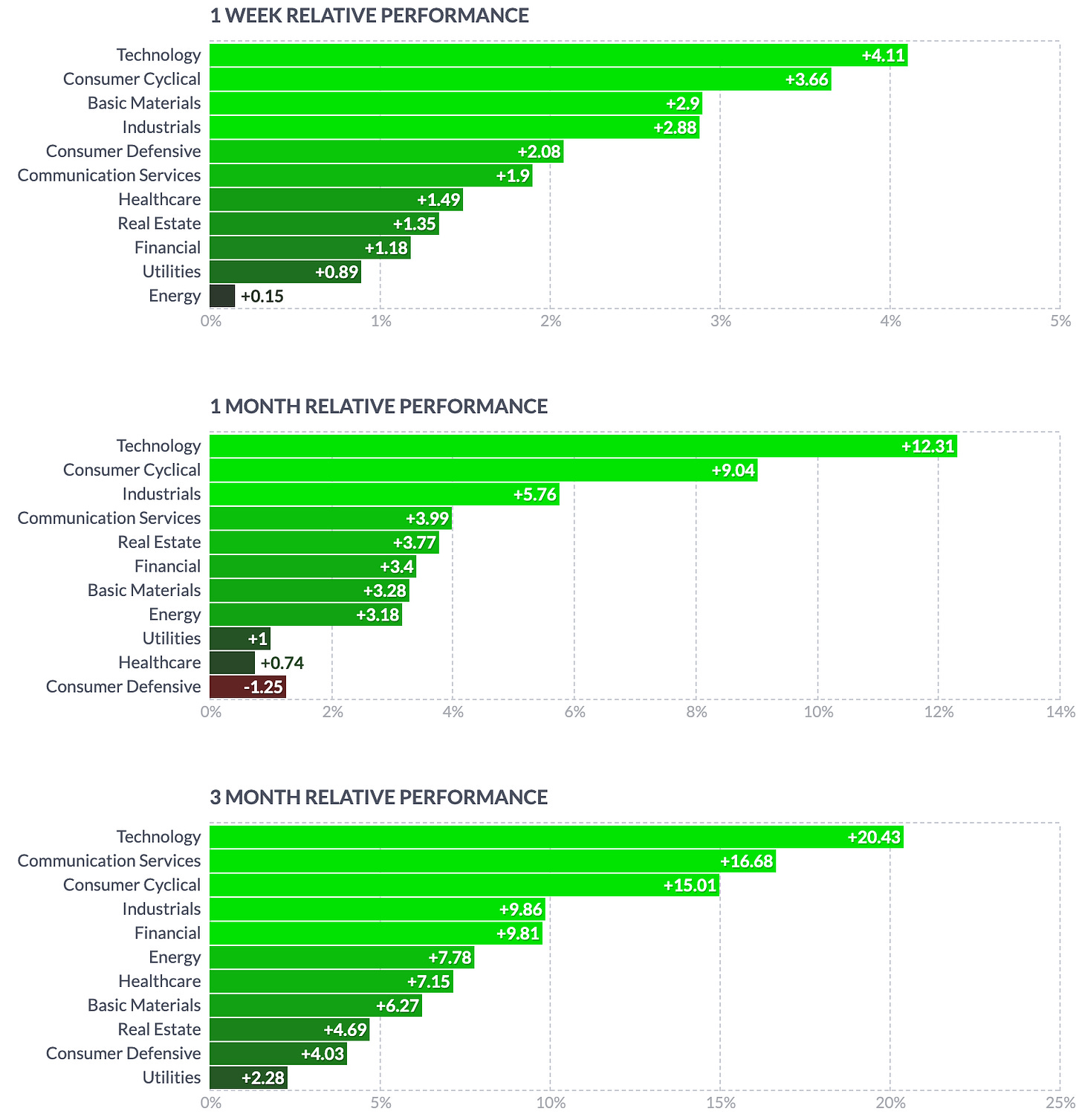

Equity sector performance:

Semiconductors, Tech, Consumer Discretionary are still the sectors that outperform

The Russell 2000 has caught up with the S&P 500 performance-wise over the last month

Growth is still outperforming Value by a wide margin

The underperformers are: Staples, Utilities, Healthcare, Energy

Similar data, different graph:

Virtually all sectors are positive over one week, one month and three months

Tech, Communications, Consumer Cyclicals are the outperformers

Defensive sectors are lagging behind

Sector breadth has improved a bit with almost 75% of sectors positive over 30 days:

Sector thumbnail charts:

SPX, XLY, XLC and XLK have been going up relentlessly

XLE is looking like it's weakly trying to form a base, XLF also looks like it might be bottoming out, same for XLRE

International stock markets:

Outperformer by a wide margin is the Japanese Nikkei (as well as TOPIX)

The Nasdaq comes in second place

Every index is positive over three months

The FTSE 100 is the underperformer

European indexes remain in the middle of the field

Sentiment and Positioning

The AAII Bull-Bear spread has increased this week: it's the highest in well over one year, and it's approaching the exuberance zone around 30.

Currency sentiment:

Bullish sentiment: NZD, JPY

Bearish sentiment: CHF, GBP

Different sentiment source:

USDCHF and EURCHF are still the two FX pairs with the most bullish sentiment

The four JPY pairs are the ones with the most bearish sentiment

Commitment of Traders and futures performance:

Equity futures were positive this week, the Relative Strength (RSL) for NQ increased to 1.17, which means NQ is now 17% above its 26-week moving average; positioning is neutral in all four futures, the extreme Commercial long position in ES is being pared back

Treasury futures are all down for the week with the exception of the ultra-long end UB; positioning is still bullish in ZT and ZF

Currency futures are mostly higher except for DX and 6J; positioning in DX has pared back from its bullish extreme, 6B is still bearish, 6A and 6J are still bullish

Bitcoin hasn’t been moving too much, its RSL is slowly dropping towards 1 as the 26-week moving average is catching up

Energy futures were all positive this week with NG up 16.8%; CL positioning is bullish

Metals were mixed with GC and SI negative, and HG and PA positive; positioning in PA remains at its bullish extreme

Grains are all up for the week, and Commercial/Large Trader positioning has pared back from extremes

Softs were mixed with CT still bearish from a positioning standpoint and OJ still bullish

COT/TFF dealer net positions for currency futures:

The extreme short in 6E has been pared back (note, data is as of Tuesday, so does not include FOMC)

The short in 6B is still increasing and it’s approaching a 2-year low

6C is still long near its multi-year extreme

6J is approaching levels we’ve seen last year

Citi PAIN indexes show an increasing long position in USD vs. everything else:

Here’s the combined COT/PAIN chart, it looks like the moves in a few currencies are beginning to diverge from PAIN:

Market Risks

Credit spreads have narrowed over the last few weeks but HY spreads remain elevated:

The Credit Spread Index isn’t declining either:

Currency volatility is dropping further:

The VIX term structure is in a steep contango:

Volatility indexes:

VIX is at 13.5, VVIX at 90.7, and MOVE at 104.4

VVIX isn’t declining further: overall it’s somewhere in its “normal range” but it has been in the 70s recently

VIX/VIX3M is steepening further

Skew metrics have flattened more including this time VIX/VOLI

Overall, nothing to see here: lower volatility, market running higher, nobody hedging, the options market is saying that the current market has legs

The CNN Fear & Greed Index remains in extreme greed territory:

Various

The NYSE Advance/Decline Line has improved over the last two weeks but the divergence between the AD line and the S&P 500 is still there:

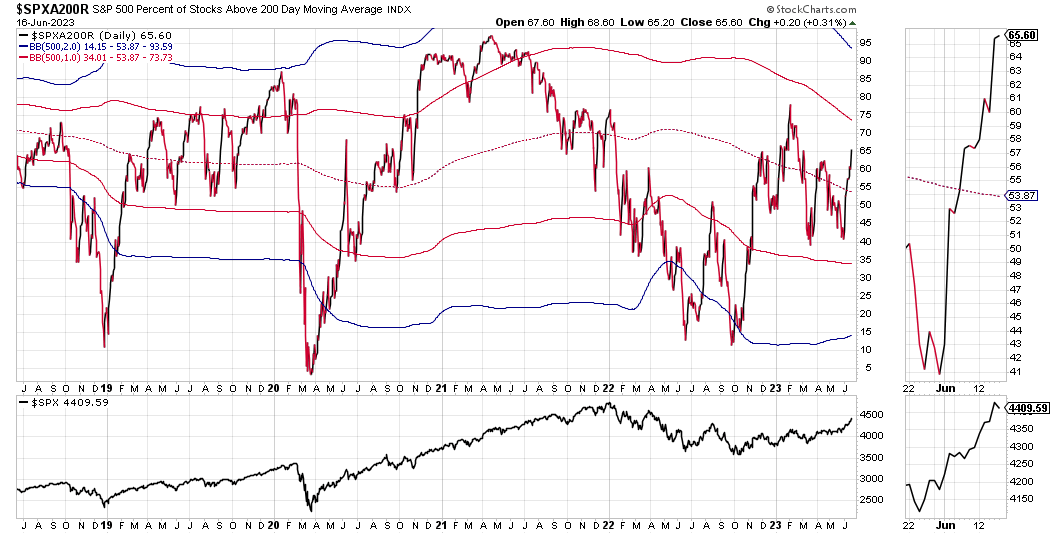

The percentage of index components above their 200-day moving averages also has improved dramatically over the last two weeks, especially for the Nasdaq 100:

The same is true for the shorter-term 50-day moving average metric:

25-delta risk reversals:

USDJPY: the rate of change of the risk reversal looks like there’s still some upside

USDCNY: the risk reversal is seeing dollar weakness here

Market Dashboard:

Trend metrics are solidly green for every index now

Distribution days have rolled off but remain high, especially in RTY and YM

Volatility metrics, breadth and put/call ratios are unremarkable

The ES/VVIX correlation crossed 0.20 last week and remains a warning signal for a short-term top in SPX

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 19/2023 | 13/2023 | 06/2023 | 50/2022 | 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 22/2023 | 15/2023 | 09/2023 | 02/2023 | 47/2022 | 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

ECB

Rate Statements: 19/2023 | 12/2023 | 06/2023 | 50/2022 | 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 22/2023 | 17/2023 | 10/2023 | 04/2023 | 47/2022 | 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 11/2023 | 05/2023 | 50/2022 | 43/2022 | 36/2022

BOE

Rate Statements: 20/2023 | 13/2023 | 06/2023 | 50/2022 | 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

RBA

Rate Statements: 24/2023 | 19/2023 | 15/2023 | 11/2023 | 07/2023 | 50/2022 | 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 21/2023 | 17/2023 | 09/2023 | 51/2022 | 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 19/2023 | 07/2023 | 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 22/2023 | 15/2023 | 09/2023 | 47/2022 | 41/2022 | 34/2022 Meeting Minutes: 07/2023 Crib Sheets: 40/2022

BOC

Rate Statements: 24/2023| 15/2023 | 11/2023 | 05/2023 | 50/2022 | 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022 Summary of Deliberations: 18/2023

SNB

Rate Statements: 13/2023 | 50/2022 | 44/2022 | 39/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

BOJ

Rate Statements: 18/2023 | 11/2023 | 04/2023 | 51/2022 | 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 20/2023 | 13/2023 | 05/2023 | 52/2022 | 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: Midjourney with the prompt: Christine Lagarde riding a bear running after a big Bitcoin itself on a powerful bull stempunk photo Realistic