Outlook for Week 19/2023

“People calculate too much and think too little.” – Charlie Munger

Welcome to issue #54 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary. If you're short on time or just don't like long newsletters then just skip them.

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

The cover image is AI-generated via Midjourney. If you want to guess the prompt, I put it at the end of the newsletter.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Check out Bond Blogger's Credit Wrap if you want to get an excellent summary of market-moving news over the last week. Highly recommended, also make sure to follow him on Twitter @IlliquidTrader!

Table of Contents

Summary (Playbook, Calendar, Levels, FX Drivers, Downloads)

Week in Review: a) Central Banks, b) Economic Data

Market Analysis: a) Growth and Inflation, b) Yields, c) Central Banks and the US Dollar, d) Sectors and Flows, e) Sentiment and Positioning, f) Market Risks, g) Various

Top 3 Macro Charts of the Week

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Please check out this article about what this summary aims to provide and what its limitations are.

It's tough to love any currency at the moment, and even the long bias in CHF is a bit half-hearted.

Economic Calendar for next week

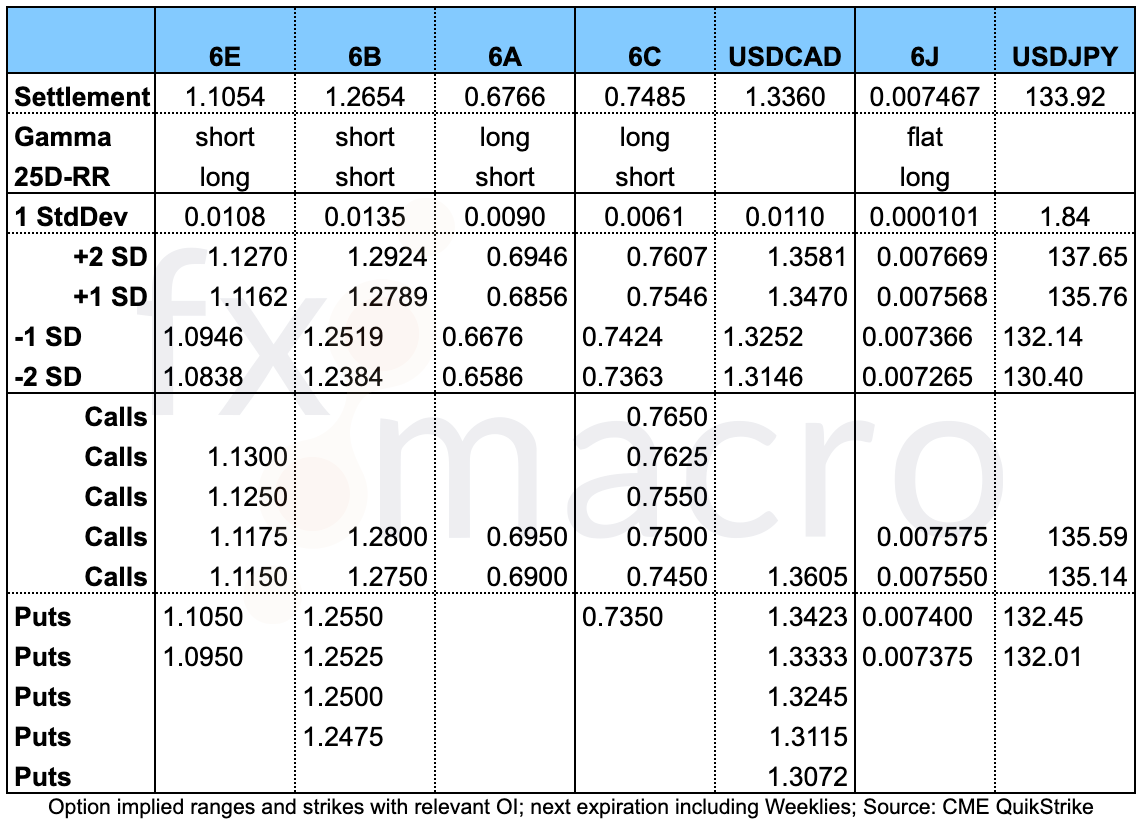

Important levels to watch and look out for in FX futures

Currency Drivers

For an explanation check out this link.

Downloads and Links

Difftext of the Summary from last week: diffchecker.com

Central bank speaker recap for the week:

Bank of England crib sheet for next week (all comments since their last MPC meeting):

Week in Review

Central Banks

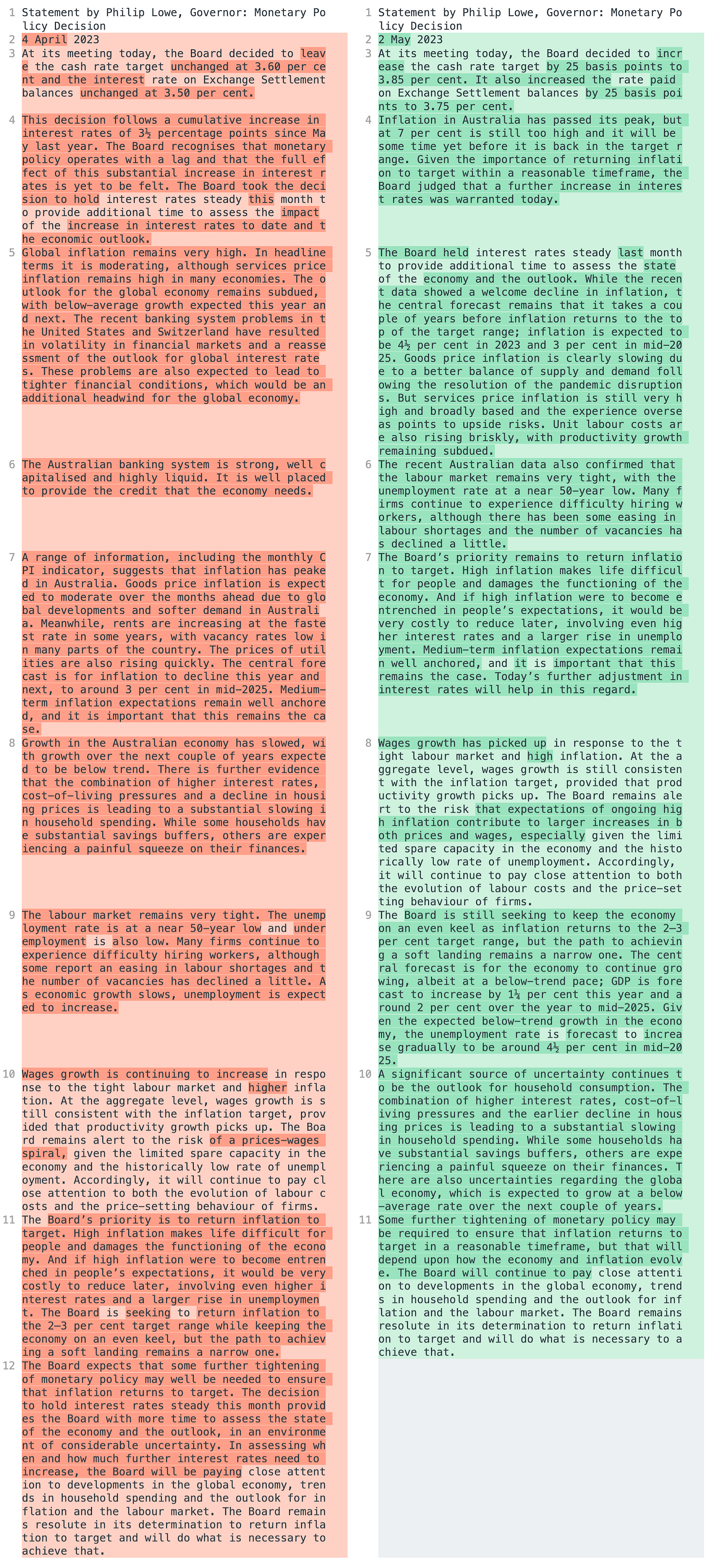

RBA Rate Statement (02.05.23)

The RBA put in a surprise hike by 25 bps:

Forward guidance changed slightly from “some further tightening may well be needed” for “inflation to return to target” to “some further tightening may be required” to ensure inflation “returns to target within a reasonable timeframe”.

Inflation has passed its peak but is still too high; important to return inflation to target within a reasonable timeframe

Inflation is expected to be 4.5% in 2023 and 3% in mid-2025

Goods price inflation is slowing but services price inflation is very high and broad-based

Unit labour costs are also rising briskly

GDP forecast at 1.25% this year and around 2% over the year to mid-2025

FOMC Statement (03.05.23)

The Fed hiked interest rates by 25 bps to 5.00-5.25% as expected.

The phrase that the Committee “anticipates that some additional” tightening “may be appropriate” was removed. The phrase about “determining the extent of future” rate hikes to attain a “sufficiently restrictive” policy stance was softened to “determining the extent to which additional policy firming may be appropriate”.

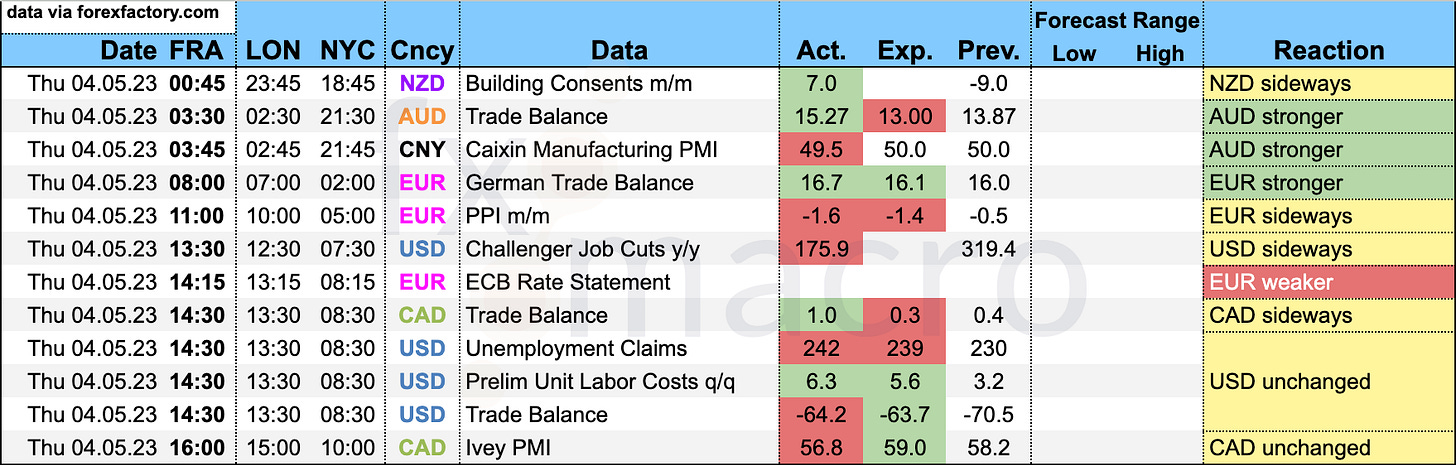

ECB Rate Decision (04.05.23)

The ECB hiked rates by 25 bps as expected:

No mention of further rate increases, the GC will follow a data-dependent approach

Past rate increases are “transmitted forcefully”

No mention of financial stability in the banking sector

The GC expects to end APP reinvestments from July 2023

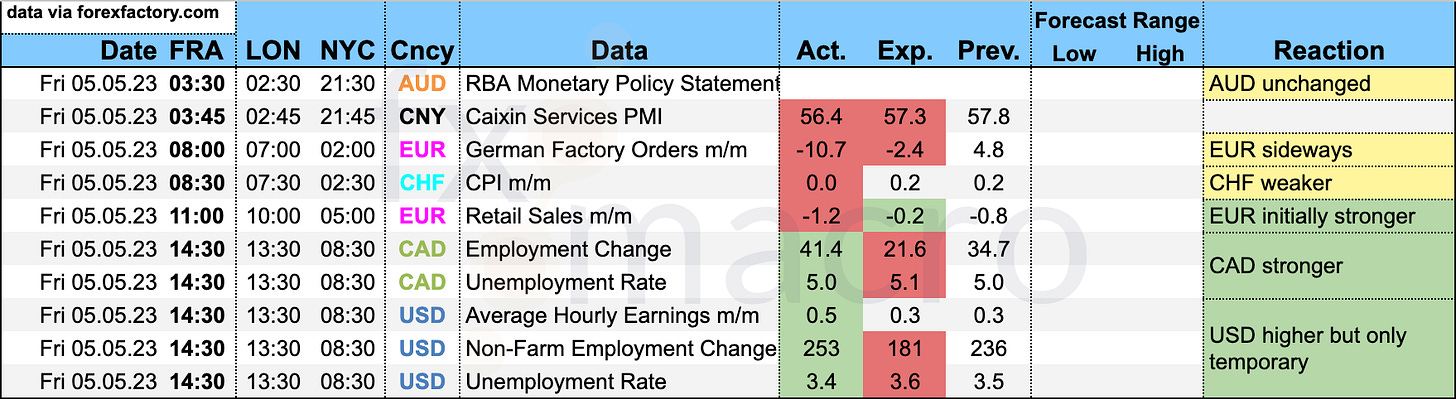

RBA Statement on Monetary Policy (05.05.23)

Just the most important table and charts from the SOMP:

GDP growth is now projected lower for this year and a bit higher towards the end of 2024 compared to the February SOMP

The CPI projection has also been lowered by 50 bps for this year and remains unchanged for 2024

Confab, Speakers, News

Federal Reserve

Powell (Neutral). Wed: Prepared to do more if warranted, it is a meaningful change to no longer say we anticipate more firming of policy, real rates are around 2% so policy is tight, we're possibly at a sufficiently restrictive level or not far off, we think we need to stay at this rate for a while, no decision on pause was made today and we will decide on June in June, we will take a data dependent approach, the extent of effects of credit tightening remain uncertain, we won't have to raise rates quite as high due to banking stresses, future policy actions will depend on how events unfold, reducing inflation likely to require below-trend growth and some softening of jobs market, there are some signs that labour supply and demand are coming back into balance, nominal wage growth has shown some signs of easing, the US banking system is sound and resilient, committed to learning the right lessons from the banking rout.

Bullard (Hawk). Fri: Quarter-point hike this week was a good step, this puts the Fed above 5% but there's a lot of inflation in the economy, ready to be data-dependent with an "open mind" on whether to pause or hike at the June meeting, policy is at the "low end" of restrictive zone and it's not clear enough for a downward path of inflation, should not have a recession as a base case, the base case is slow growth and declining inflation, labour market is very tight and will take time to cool, sense is that regional banks will do just fine, ultimate impact of bank stress on the economy will be small, we can achieve a soft landing.

European Central Bank

Lagarde (Dove). Thu: We know that we have more ground to cover, 25 bps hike had almost unanimous support, some suggested 50 bps and some said 25 bps but no one said no change, not making any commitment to rate cuts at any point, this is not a pause, very strong consensus around the path we chose, we are continuing the hiking process, this is a journey and we have not arrived yet, will continue to follow a data-dependent approach, reports from corporates regarding borrowing suggest that rates are restrictive, corporate demand for bank loans was "really, really down", price pressures remain strong, incoming information broadly supports medium-term outlook formed at the previous meeting, private domestic demand and consumption likely to remain weak, no longer says growth risks are to the downside.

Villeroy (Neutral). Fri: Favours smaller rate hikes, change in rate increase rhythm is an important signal, there will likely be several more hikes but we have done the essential, our goal is to win the fight against inflation without triggering a recession.

Müller (Hawk). Fri: It is prudent to allow previous hikes to make an impact.

Simkus (Hawk). Fri: Interest rates are not high enough and will need to be raised further, we will keep rates high for a sufficiently long time to get inflation back to 2%.

Visco (Dove). Fri: The peak of ECB interest rates may not be too far off, market's view of the terminal rate is "an important reference point" for the ECB, policy can only be moving towards higher rates, must proceed with caution, policy is being transmitted into the economy in an "energetic" way.

Sources. Thu: Reuters: Some ECB policymakers see 2-3 rate hikes ahead, Holzmann was the lone holdout but didn't have a vote at the meeting, policymakers reached a deal on smaller hike in return for guidance for more hikes ahead and an APP wind down, policymakers don't see the need to sell APP bonds.

Reserve Bank of Australia

Lowe. Tue: The Board had a strong consensus to raise rates, some further tightening may be required to get inflation back to target range within a reasonable timeframe, don't need to get inflation back to target straight away but can't take too long, we are taking a bit more time than other countries but there is a limit, will do what is necessary to bring inflation back to target, not on a pre-set course, AUD had responded to change in rates outlook since April pause.

Kohler. Wed: Has some confidence that goods inflation will moderate this year, rise in energy costs is smaller than forecast six months ago, tight labour market and services demand to fuel domestic inflation pressures.

Bank of Canada

Macklem. Thu: If we see signs inflation remains stuck materially above 2% we could hike again, not thinking about rate cuts, expects inflation to decline to about 3% this summer, encouraged by progress so fare but the way back down to 2% is going to be more difficult, the lesson from history on inflation is not to be half-hearted, persistent wage growth in 4-5% range will make it hard to reach 2% target, not terribly worried about pressure on CAD, housing market probably still has got some weakening to do.

Swiss National Bank

Jordan. Fri: We cannot exclude further tightening of monetary policy, inflation is still an issue in Switzerland.

Bank of Japan

Ueda. Tue: Risks to Asia's economy are smaller than those in other parts of the world, China's economy is in good shape now due to reopening but could face pressure longer-term from heightening geopolitical risks.

Economic Data

Monday, 01.05.23

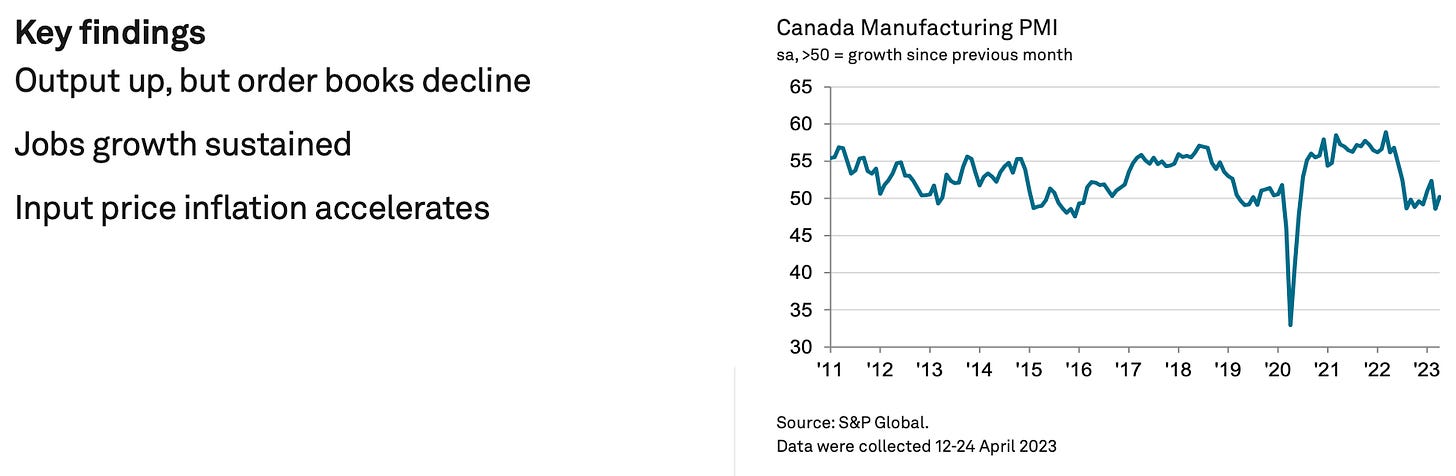

Highlights from the Canadian Manufacturing PMI:

“Although Canada’s manufacturing sector returned to growth in April, it did so only marginally with underlying data suggesting the recovery remained on shaky ground. Output and employment growth were sustained, but another drop in new orders is probably the most notable development. Clients are hesitant in their spending decisions, unsure of the direction of the economy at a time when prices remain high.

“Cost inflation especially remains stubbornly high, with prices increasing to the strongest degree of the year so far. But manufacturers found themselves facing a tricky dilemma: although margins are under pressure from elevated costs, equally underwhelming demand is bearing down on their pricing power. No wonder then that firms continued to adopt cautious approaches to purchasing and stock management, and that confidence in the future took a knock in April.”

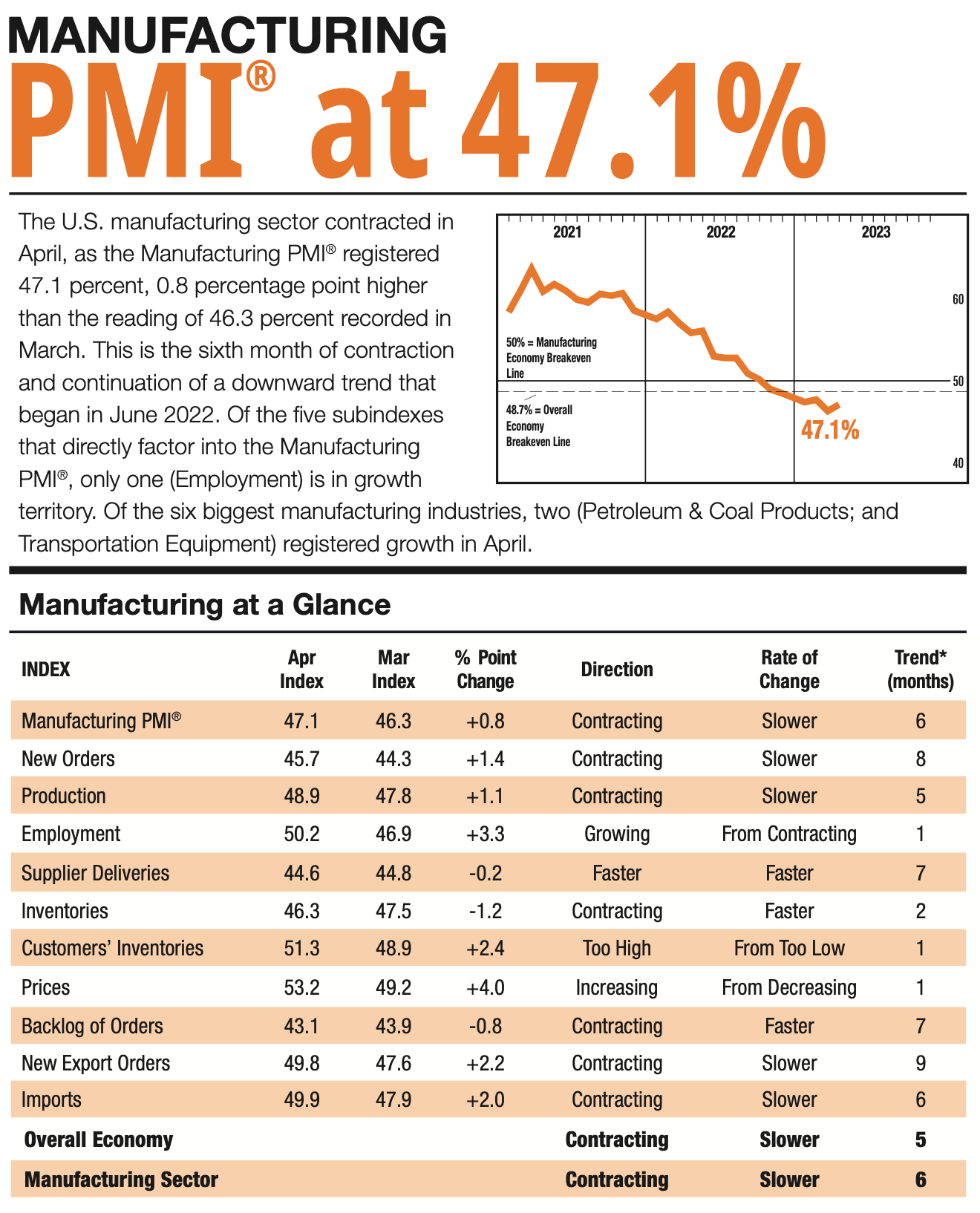

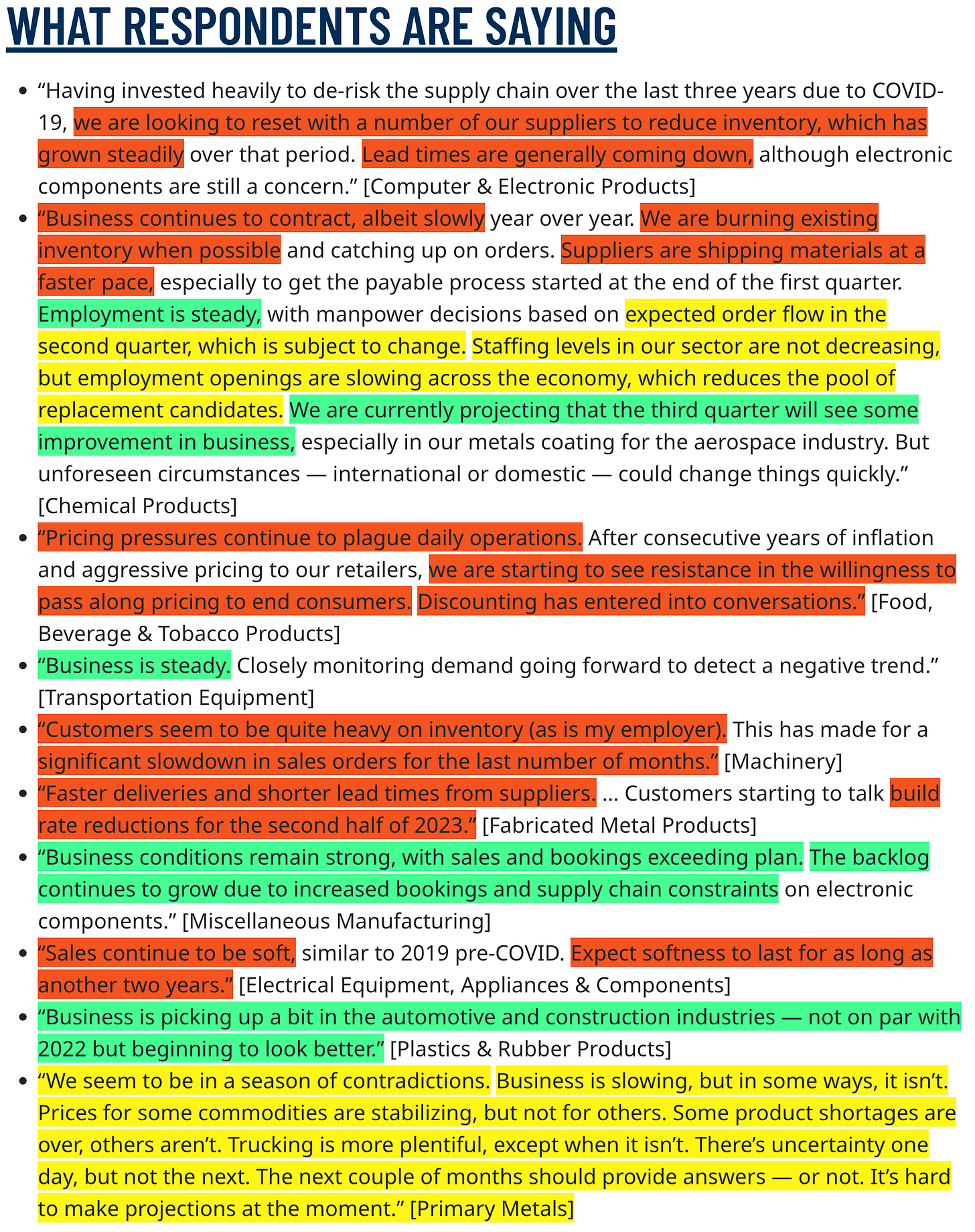

The ISM Manufacturing PMI:

Tuesday, 02.05.23

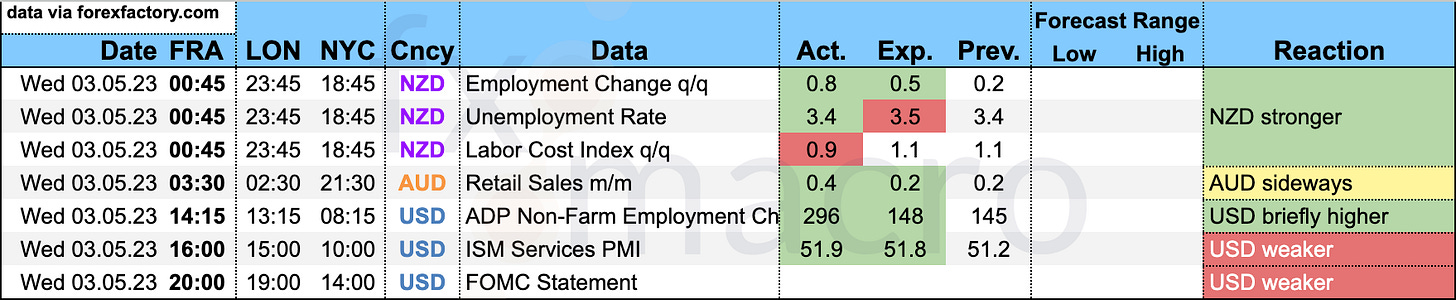

Wednesday, 03.05.23

The ISM Services PMI:

Thursday, 04.05.23

Friday, 05.05.23

Market Analysis

Growth and Inflation

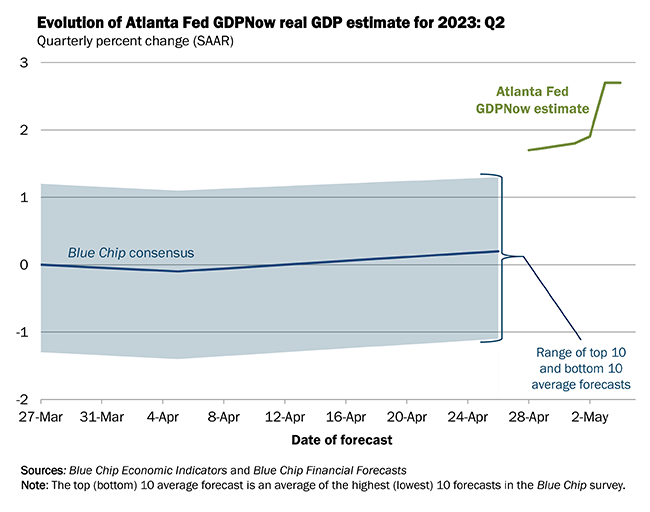

The Atlanta Fed GDPNow model estimates annual real-GDP growth at 2.7%:

The NY Fed Weekly Economic Index continues to trend sideways and printed 0.92 this week:

Citi Economic Surprise Indexes:

USD, EUR, CAD and CHF are all going lower

GBP is still up

AUD has picked up from lows

NZD is weak

JPY isn't going anywhere

The CESI spread AUD vs. NZD has been rising for a while:

Bloomberg PMI heatmap:

The US and Canada are unchanged

The Eurozone and Switzerland are weaker, the UK remains unchanged

Australia is weaker, Japan is unchanged

China and South Korea aren't improving, Hong Kong and Vietnam have weakened

Breakeven inflation rates continue to go sideways to lower within their range:

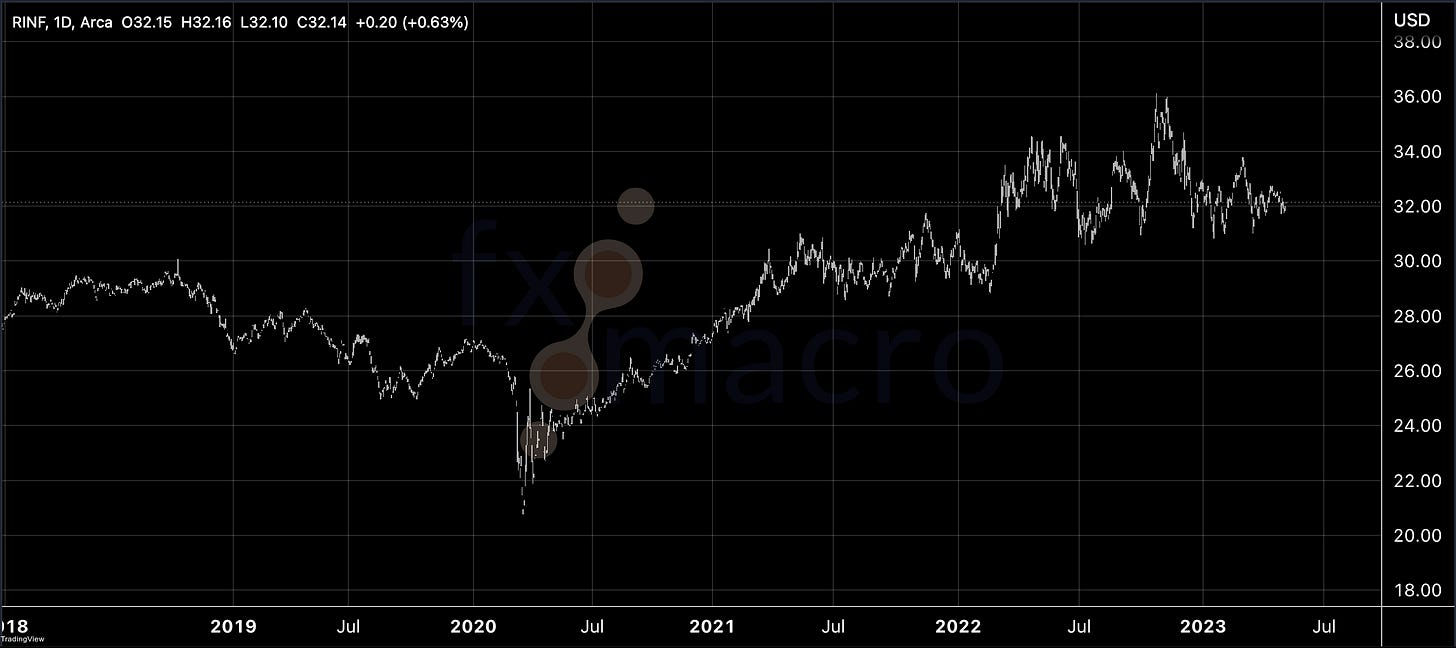

5y5y forward inflation rates and RINF are also moving sideways:

Citi Inflation Surprise Indexes:

USD, NZD and CHF are lower

EUR, CAD and JPY are sideways

GBP and AUD are up

Yields

See chart and table below:

The one thing that stands out is the relative outperformance of UK yields vs. US and German counterparts

Chinese yields continue to head lower

Here's a closer look at 2s, 10s and 2s10s:

UK yields are holding up there, the UK curve has bear flattened

The Aussie curve is also bear flattening

Global yield curves at the 2s10s spread have mostly gone sideways for the last few months now:

Central Banks and the US Dollar

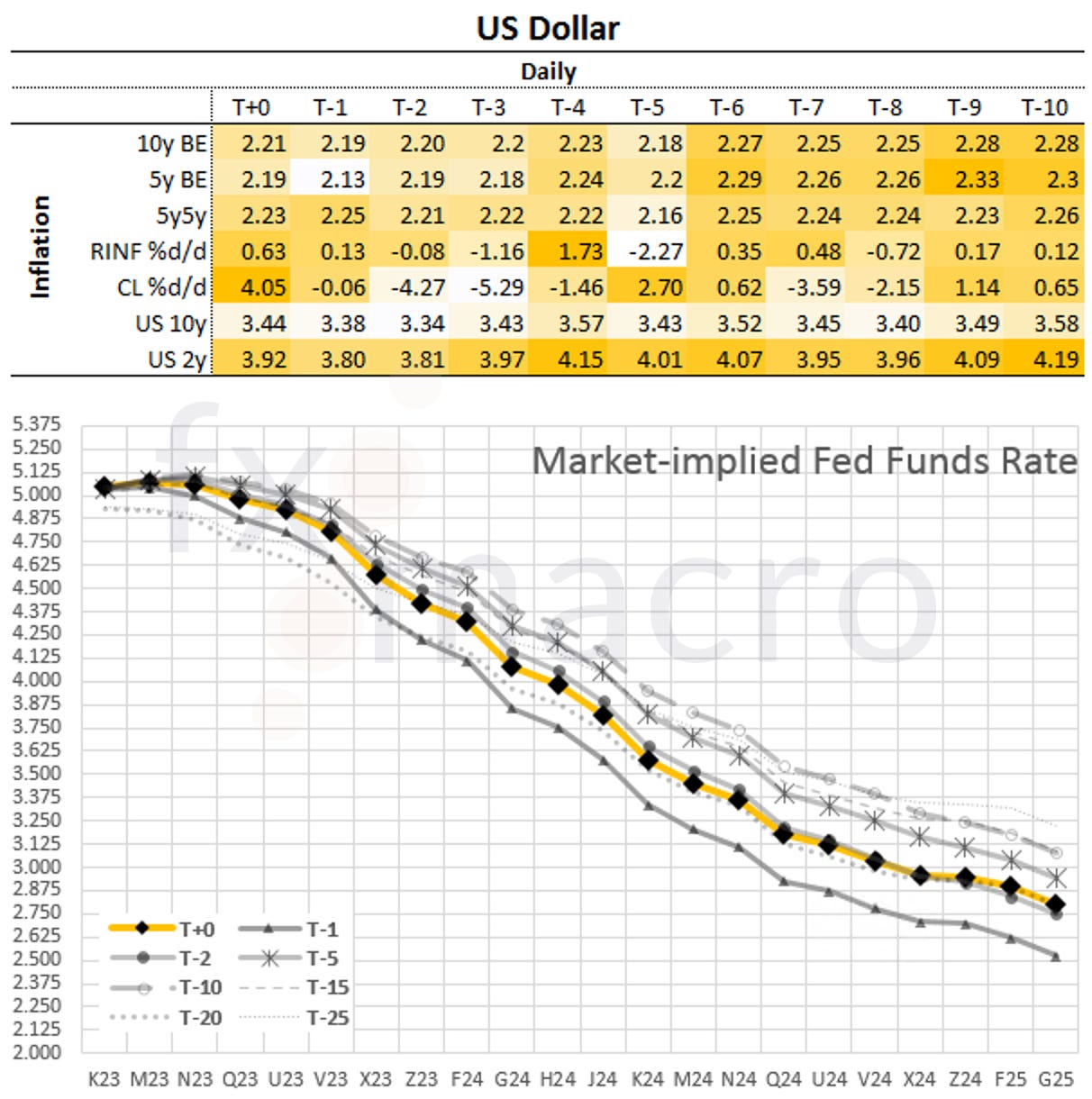

The latest FOMC meeting probabilities according to FedWatch:

The next two meetings are both priced for no change with a 9% chance of a 25 bps hike in June

The first rate cut is now priced in for September, one meeting earlier than last week (even though it was a very close call then)

The rate cut path is pretty much unchanged with one cut expected at each subsequent meeting

The Fed Funds forward curve doesn't taper out before the end of 2024:

Here's the same data in a different format:

Sectors and Flows

Currency strength:

CHF is the outperformer over one month and also over three months

GBP is going strong over both timeframes as well

JPY has underperformed over both one and three months

AUD and NZD were the strongest currencies this week, EUR, USD and CHF were the weakest currencies

Currency indexes:

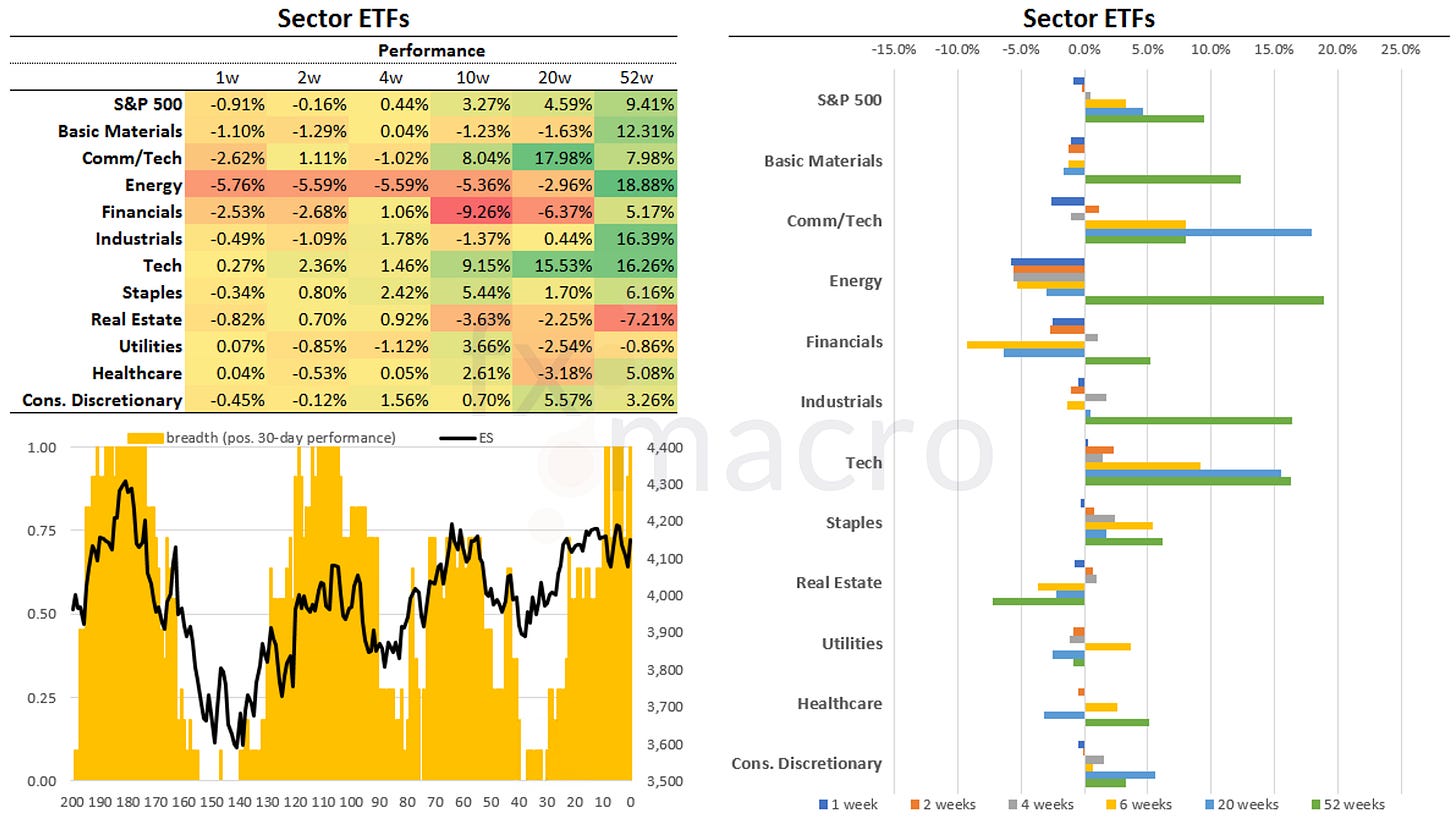

Equity sector performance:

Tech is in the lead, followed by Consumer Staples and Utilities

The underperformers are Oil Services, Metals/Mining and Financials

Growth is still outperforming Value

On different timeframes, sector performance looks messy with offensive and defensive sectors all over the place:

Sector breadth is looking healthy with all sectors positive over 30 days:

Sector thumbnail charts:

International stock market indexes:

The Nasdaq, Japan and Europe are the outperformers

Hang Seng, Taiwan, Brazil, Australia (and the R2k) are the underperformers

Sentiment and Positioning

The AAII Bull-Bear spread has dipped a bit this week but remains in no-man's land:

Currency sentiment:

Bullish sentiment in AUD, CAD, JPY, NZD

Bearish sentiment: CHF, GBP, EUR

Neutral: USD

Different sentiment source:

USDCHF, EURCHF and EURGBP are the three currency pairs with the most bullish sentiment

JPY pairs all have bearish sentiment

Commitment of Traders and futures performance:

Equity indexes were mostly lower, except for for NQ which was flat. Positioning in ES remains at a bullish extreme for both Commercials and Large Traders

Treasury futures had a positive week except for the long end. Positioning remains on the bullish side for most futures

Currency futures were positive except for the DX and the 6E. As for positioning, nothing has changed materially: DX and 6C are still near bullish extremes, and 6E, 6B and 6S are at/near bearish extremes. 6A has also been creeping towards a long for a while now.

Bitcoin was barely positive but its Relative Strength is holding comfortably above 1.

Energy futures were all negative for the week, Relative Strength metrics look poor, and even NG doesn't seem to recover in any meaningful way. Positioning is bullish in HO but very neutral in every other future.

Metals were mixed again with GC and SI positive vs. HG, PA and PL negative for the week. Commercials and Large Traders are at bearish extremes for GC, SI and PL.

Grains had a mostly positive week. Positioning is very bullish for every future except for ZS but that's been moving in the right direction as well lately. 1-week net positioning changes are at/above +2 SD for Commercials and -2 SD for Large Traders in ZC and ZM, which could be short-term bullish.

Softs were mixed, positioning is bearish in CC and SB.

COT/TFF Dealer Net positions in currency futures:

6E is still at its multi-year short

6C is on the way up to the recent high

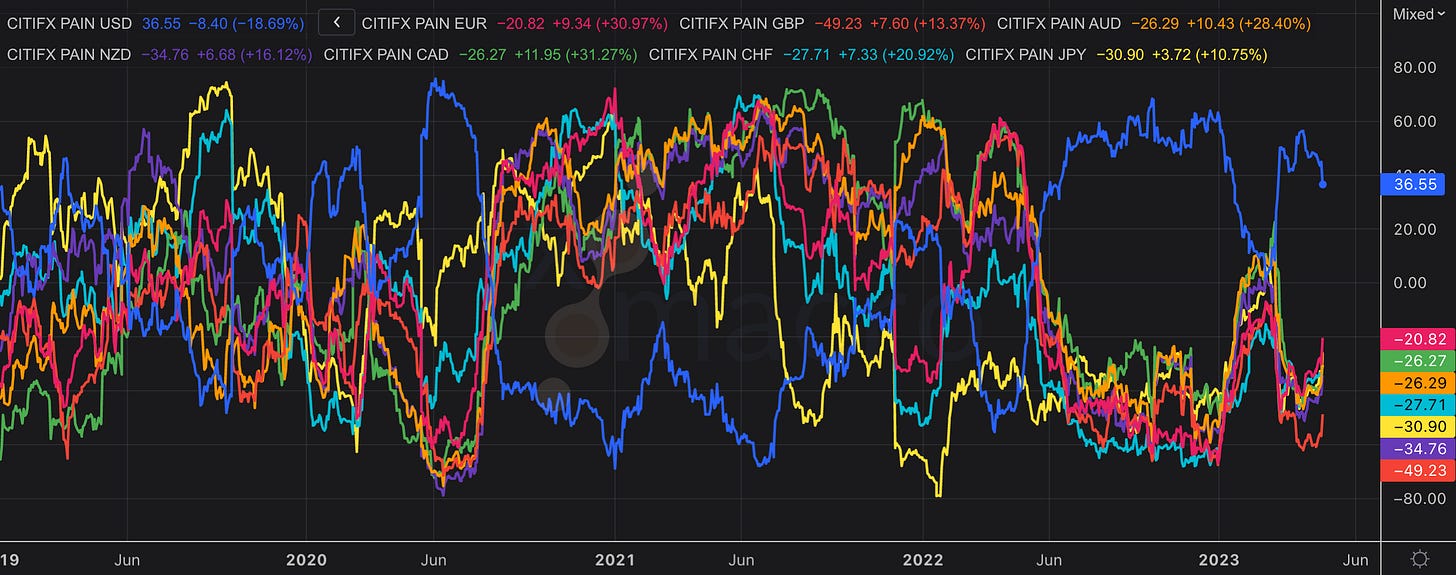

Citi PAIN indexes:

The USD long has been pared back a bit this week

Combined COT/PAIN chart: the divergence between Non-Comm (i.e. Large Traders) and spot in USDCHF is notable, and in EUR they're also not confirming the move higher:

Market Risks

Credit spreads have widened a bit (data is as of Thursday):

The Credit Spread Index remained unchanged:

Currency volatilities continue to go lower:

The VIX term structure looks normal for the next months out. The VX1 premium is at a rich 2.2, the premium of VX2 is also above 2 points.

Volatility indexes:

VIX is at 17, VVIX at 92. There's a bit of a divergence again with VVIX moving higher while VIX is going south. It's not looking too dramatic.

MOVE is at 130 and also trading higher rather than lower

Skew has steepened with VIX/VOL, SDEX and TDEX all higher

Overall, nothing is screaming that something is wrong

The correlation between VIX and VVIX is recovering, and when VIX is low this often means that it could pick up:

The CNN Fear & Greed Index remains in Greed territory:

Various

The NYSE Advance/Decline Line has lost a bit of steam but it's not showing a divergence:

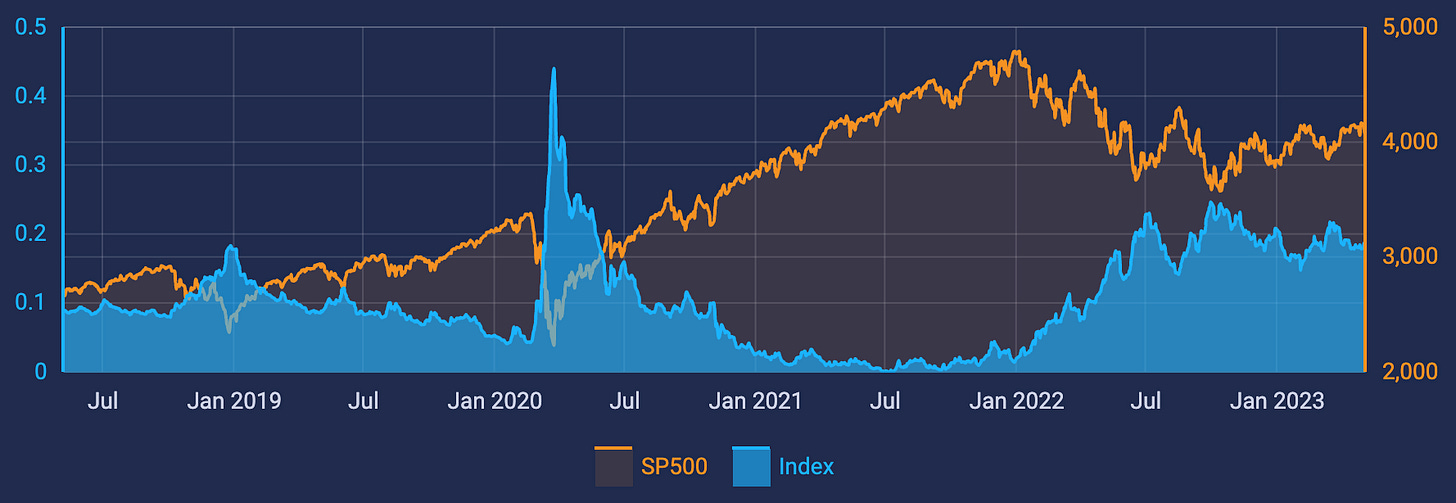

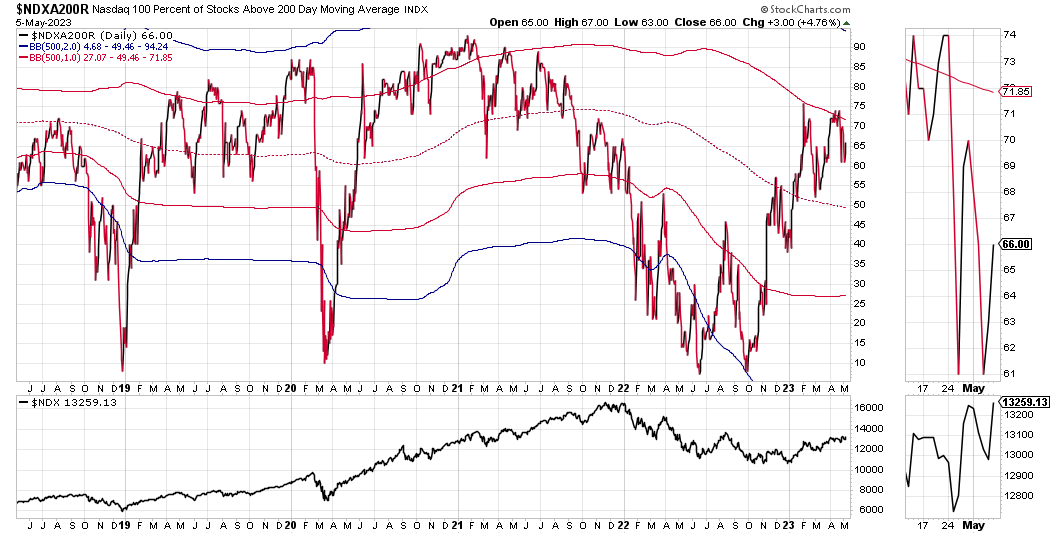

The percentage of stocks above their 200-day moving averages haven't picked up. This breadth metric has put in a lower high with a clear divergence for the S&P 500, and for the Nasdaq 100 it's also not looking healthy, especially over the last three weeks or so where the index made a new high but breadth deteriorated:

The same is true for the 50-day moving average metric:

25-delta risk reversals:

USDCAD is priced lower

Other than that I don't see anything interesting here at the moment

Market dashboard:

Trend metrics are doing well for the ES, NQ and YM. The Russell 2000 and the Dow Jones Transportation indexes are weak.

Distribution days refuse to come down across the board. That's not a sign of a healthy market.

Volatility metrics are okay, MOVE is still elevated.

The VIX/VVIX correlation was discussed above: it's going positive again, which can lead to vol popping higher

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 13/2023 | 06/2023 | 50/2022 | 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 15/2023 | 09/2023 | 02/2023 | 47/2022 | 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

ECB

Rate Statements: 12/2023 | 06/2023 | 50/2022 | 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 17/2023 | 10/2023 | 04/2023 | 47/2022 | 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 11/2023 | 05/2023 | 50/2022 | 43/2022 | 36/2022

BOE

Rate Statements: 13/2023 | 06/2023 | 50/2022 | 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

RBA

Rate Statements: 15/2023 | 11/2023 | 07/2023 | 50/2022 | 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 17/2023 | 09/2023 | 51/2022 | 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 07/2023 | 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 15/2023 | 09/2023 | 47/2022 | 41/2022 | 34/2022 Meeting Minutes: 07/2023 Crib Sheets: 40/2022

BOC

Rate Statements: 15/2023 | 11/2023 | 05/2023 | 50/2022 | 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022 Summary of Deliberations: 18/2023

SNB

Rate Statements: 13/2023 | 50/2022 | 44/2022 | 39/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

BOJ

Rate Statements: 18/2023 | 11/2023 | 04/2023 | 51/2022 | 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 13/2023 | 05/2023 | 52/2022 | 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: Midjourney with the prompt: “king charles III portrait after having too many beers”

Midjourney was news to me. Started looking into it and wasn't surprised by the very creepy turn it immediately took: https://interestingengineering.com/culture/midjourney-bans-xi-jinping-images

Wound up in this comment box, which is apparently floating about in cyberspace unmoored to the context from whence it sprang, when I clicked on a 'like-your-inane-comment' button in gmail claiming someone or something liked a comment-dropping I left behind in Substack ...? So here goes nothing back at you ...

:( why do my AI images come out looking like the contents of an un-flushed toilet bowel after a bout of food poisoning on a cruise ship?