Another short issue due to holidays. Next weekend should hopefully be back to regular coverage.

Welcome to issue #51 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary.

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

The cover image is AI-generated via Midjourney. If you want to guess the prompt, I put it at the end of the newsletter.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Check out Bond Blogger's Credit Wrap if you want to get an excellent summary of market-moving news over the last week. Highly recommended, also make sure to follow him on Twitter @IlliquidTrader!

Table of Contents

Summary (Playbook, Calendar,

Levels,FX Drivers, Downloads)Week in Review: a) Central Banks, b) Economic Data

Market Analysis: a) Growth and Inflation, b) Yields, c) Central Banks and the US Dollar, d) Sectors and Flows, e) Sentiment and Positioning, f) Market Risks, g) VariousTop 3 Macro Charts of the Week

Summary

Economic Calendar for next week

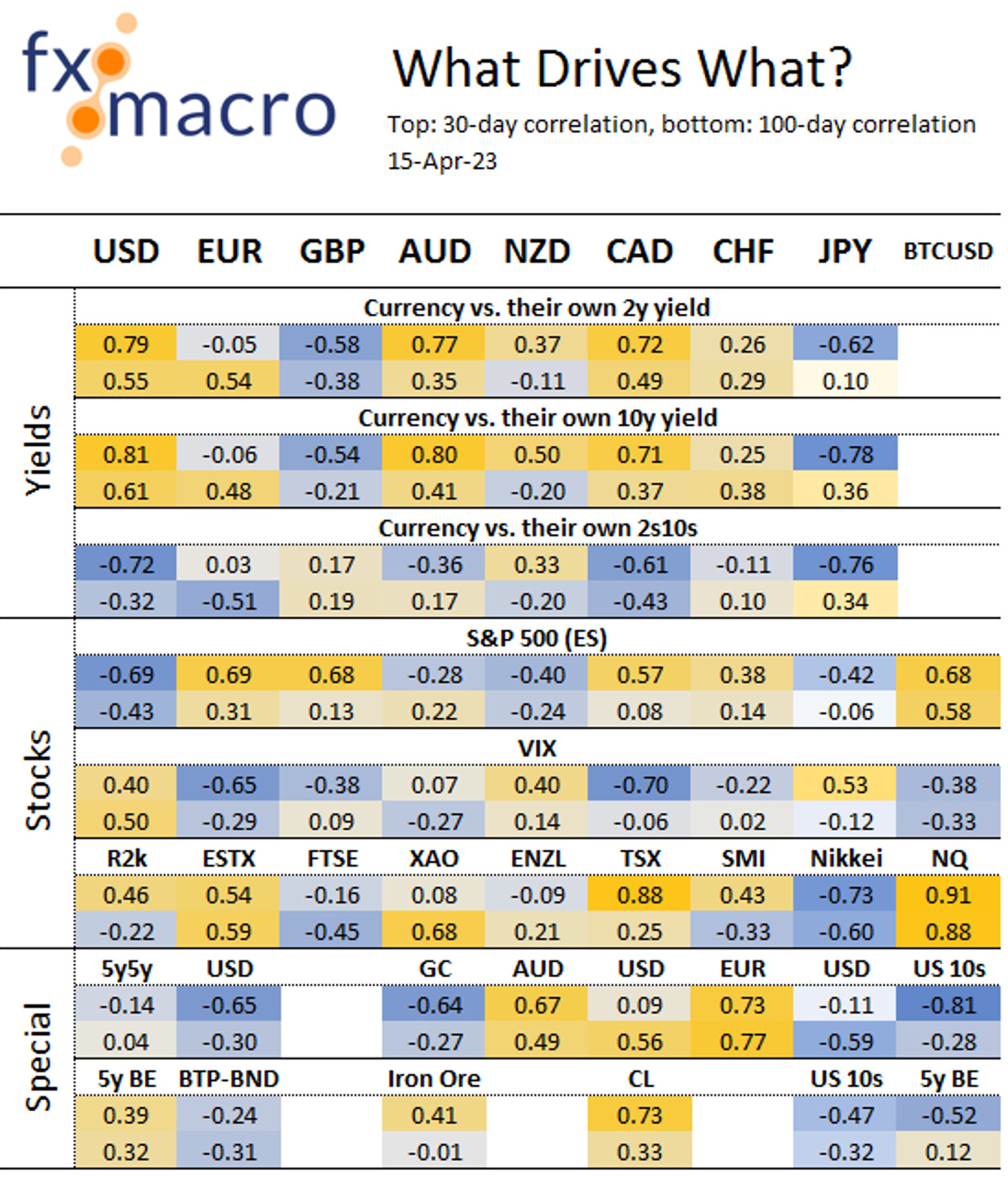

Currency Drivers

For an explanation check out this link.

Downloads and Links

Central bank speaker recap for the week:

Week in Review

Central Banks

Bank of Canada Rate Statement (12.04.23)

The BOC left rates unchanged at 4.50% as expected:

Guidance is largely unchanged: the BOC will continue to assess whether policy is sufficiently restrictive and remains prepared to raise rates further if necessary, QT will continue without changes

Domestic growth in Q1 looks to be stronger than projected in January, demand is still exceeding supply and the labour market remains tight

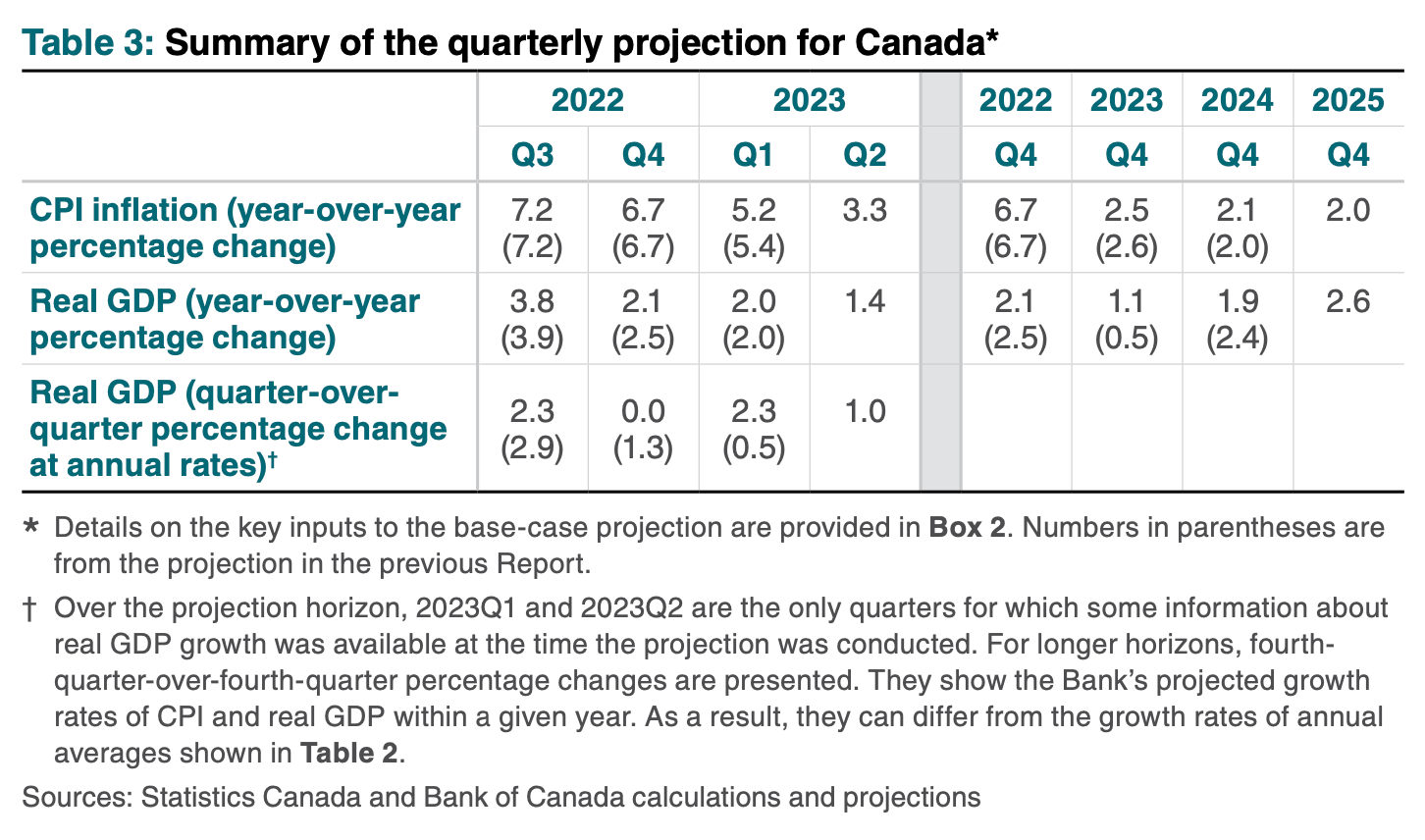

Restrictive monetary policy is still working its way through the economy, GDP growth is expected to be weak for the remainder of the year: the projection is 1.4% this year, 1.3% next year and 2.5% in 2025

CPI is expected to fall quickly to around 3% in the middle of the year, then decline more gradually to 2% by the end of 2024; recent data reinforces the GC's confidence in that forecast

From the Monetary Policy Report:

FOMC Meeting Minutes (12.04.23)

There was not a lot of new information in the Minutes. Here are some of the key passages:

Confab, Speakers, News

Federal Reserve

Williams (Neutral). Mon: Happy to see market rate expectations are reactive to data, expects inflation back at 2% in 2025, core services ex housing has been very persistent, doesn't worry that the market's view on interest rate is different from the Fed's, hasn't seen clear signs of a credit tightening, rate rises by the Fed were not the driver of trouble at banks sparking recent stresses. Tue: One more rate hike is a reasonable starting place, inflation is still way above our 2% goal, we are somewhat restrictive on monetary policy now, seeing some slowing in demand for labour but it's not strong, we need to stay in a data-dependent mode, does not think we need to adjust balance sheet policy anytime soon.

Goolsbee (Neutral). Tue: The right monetary policy calls for prudence and patience, we need to assess the potential impact of financial stress on the real economy, the foremost thing on his mind ahead of the May meeting is credit availability, worried about commercial real estate. Fri: If credit conditions are tightening then this does the Fed's work, inflation is coming down but there's a clear stickiness in some numbers, wants to see all the data before deciding on May, a mild recession is definitely on the table as a possibility.

Harker (Neutral). Tue: Full impact of monetary policy can take 18 months to be felt, already seeing promising signs that the Fed's actions are working, looking closely at data to determine "what if any" additional actions may be needed, have to be careful not to overdo it, will need more action if we see inflation not dropping, recent inflation readings are "disappointing", have to be absolutely dedicated to the 2% inflation target, bank stress is not over but has calmed down.

Kashkari (Hawk). Tue: Less optimistic on the pace of the fall in inflation than the bond market, sees inflation at mid-3% by the end of the year and closer to 2% in 2024, tightening credit conditions and higher rates could lead to a downturn or a recession.

Barkin (Neutral). Wed: We are certainly past peak inflation but still a ways to go, need multiple months of inflation headed towards goal, not seeing evidence of inflation cracking yet, not hearing there is much change in bank lending at the moment, watching credit conditions.

Bostic (Neutral). Fri: Recent developments are consistent with us hiking one more time, this can allow us to pause and reassess, we've got a lot of momentum suggesting we're on the path to 2%, rate increases in the past year now only starting to bite and full impact may take some time.

Waller (Hawk). Fri: Recent data show the Fed hasn't made much progress on inflation, further hikes are needed, the extent of further rate increases depends on data, policy will need to remain tight for "substantial" period and longer than markets anticipate, still uncertain how SVB failure and bank stress will impact broader credit conditions, significant credit tightening could offset the need for rate hikes but difficult to judge in real time.

European Central Bank

De Cos (Dove). Mon: Core inflation is expected to remain elevated for the rest of the year, if baseline scenario published in March is confirmed then there is still ground to be covered in terms of monetary policy, ECB is prepared to respond to ensure financial stability.

Villeroy (Neutral). Tue: Smaller steps may be more appropriate as the bank is approaching the terminal rate, moving away from a sprint to a long-distance race, we now face the risk of entrenched inflation which lies in the underlying core component, inflation has become more widespread and potentially more persistent, monetary policy is most effective in tackling underlying inflation, expects price growth back at 2% by the end of 2024 or 2025. Wed: We still have a little way to go with rate hikes, too early to discuss the size of the May move, deferred effect of our past rate hikes will be more significant than one of our future decisions.

Holzmann (Hawk). Wed: Inflation outlook argues for another 50 bps hike in May, need to keep raising rates noticeably beyond May, may also be able to accelerate QT from July.

De Guindos (Dove). Wed: Recent core inflation data in the Eurozone is sticky, we are not as optimistic on core inflation as on headline inflation, rate decisions to be data dependent, provisional data points to positive growth in Q1 in the Eurozone.

Nagel (Hawk). Thu: Too early to speculate about rate cuts, earlier mistakes should be avoided, core inflation will show movement in the right direction before the summer break, there is no threat of a systemic crisis from the banking sector.

Vasle. Thu: Considering 25 and 50 bps rate hike options for May, underlying inflation is moving in the wrong direction, we have to keep tightening monetary policy, focused on core inflation.

Kazaks (Hawk). Thu: Rates will need to go up more to tame inflation, would not exclude a 50 bps hike in May, risk of recession is non-trivial.

Lagarde (Dove). Fri: Expects Eurozone inflation to continue to fall, rapid wage growth is keeping core inflation up and will remain high for some time, lagged price pressures fade out, growth outlook remains tilted to the downside.

Wunsch (Neutral). Fri: May policy decision is between 25 and 50 bps rate hikes, will depend in large parts on April core inflation, market pricing of the terminal rate is reasonable, no quick rate cuts likely after that.

Simkus (Hawk). Fri: The ECB isn't done hiking rates, May rate hike will either be 50 or 25 bps depending on the data, seeing headline inflation fall on energy, core is expected to peak next month or shortly afterwards.

Sources. Thu: Reuters: Debate on next ECB rate move converging on 25 bps, debate not over with one small group still making the case for 50 bps, another small group advocating no change, some sources said they would prefer not to give guidance about the move in June. Fri: Reuters: A growing number of policymakers are calling for a full halt to QE reinvestment in H2, balance sheet reduction is moving too slowly given priority to inflation, none of the five sources advocated outright bond sales.

Bank of England

Bailey (Neutral). Wed: We don't know yet where the BoE's balance sheet reduction will need to stop in terms of necessary levels of reserves, watching QT very carefully and not seeing any concerning signs, does not believe we're facing a systemic banking crisis, appropriate and desired liquidity buffers are in question.

Pill. Thu: High frequency indicators of momentum in wage developments appear to be easing, still expects CPI in Q2 to fall, expects China to rebound quite strongly and to account for one-third of global growth, latest data is somewhat disappointing but much better than BoE forecasts from late last year.

Tenreyro (Dove). Fri: We need to be patient over the impact of past rate hikes on inflation, important not to over-adjust policy while the impact of past rate rises is feeding through.

Reserve Bank of Australia

Bullock. Wed: Would have paused on rates even without global banking stress, rates are in restrictive territory and we can stop for a minute and watch, no signs that domestic banks are tightening lending due to global stress.

Bank of Canada

Macklem. Wed: Encouraged that inflation is declining, considered whether rates may need to stay restrictive for longer, discussed whether the bank had raised rates enough, remains more concerned about the upside risks to the forecast, recent data has reinforced our view that inflation will fall to around 3% this year in a pretty rapid decline, we've come a long way from the 8% inflation last summer, rate hikes are feeding through, market's expectation that we're going to cut later this year doesn't look like the most likely scenario to us, we need to see some easing in the labour market, forecasting small increases in growth but that doesn't rule out a couple of negative quarters. Thu: There is a little bit of spillover of financial stress in Canada but it has been quite muted, prepared to provide liquidity if there were to be a serious global financial event and markets froze.

Bank of Japan

Ueda. Mon: A small rate hike would not be a big issue for the financial system but Japan is not in a situation where rates can be raised significantly, appropriate to continue negative interest rates for now, we are at a stage now to wait and see on December policy tweaks, current monetary easing stance is "intense", no immediate need to change 2013 joint statement. Wed: Inflation is likely to slow, BOJ will carry on with monetary easing until inflation target is reached stably and sustainably, the BOJ should pay more attention to the risk of failing to achieve the 2% inflation target with a premature end to easing than to the risk of falling behind the curve on inflation. Fri: BOJ will maintain current levels of monetary easing, expects global growth to recover after a slowdown period, expects Japan's wages to continue rising under that view and inflation to drop below 2% again.

Himino. Mon: Aiming to achieve price target together with wage hikes.

Uchida. Mon: BOJ is facing task of making various efforts to sustain monetary easing. Wed: Will continue monetary easing in order to achieve price stability target sustainably and stably, CPI gains will narrow towards the middle of this fiscal year due to fiscal measures.

Suzuki. Tue: Gov. Ueda explained that he has no intention of changing the joint statement, inappropriate to guide fiscal policy by depending on BOJ debt buying.

Shimizu. Fri: Necessary to conduct monetary easing and to support the economy to provide a favourable environment for firms to raise wages.

People's Bank of China

Yi Gang. Fri: Expects 2023 growth in China around 5%, economy and property sector are rebounding, inflation is low.

Economic Data

Monday, .01.23

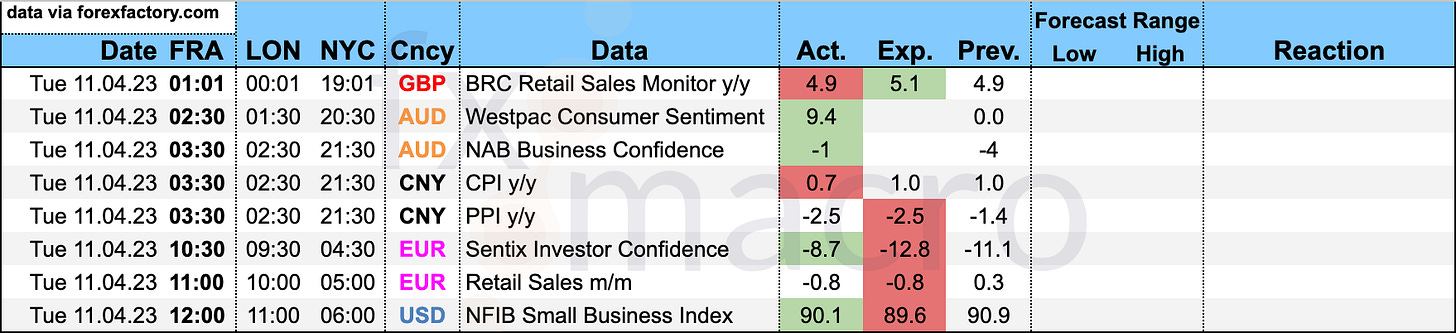

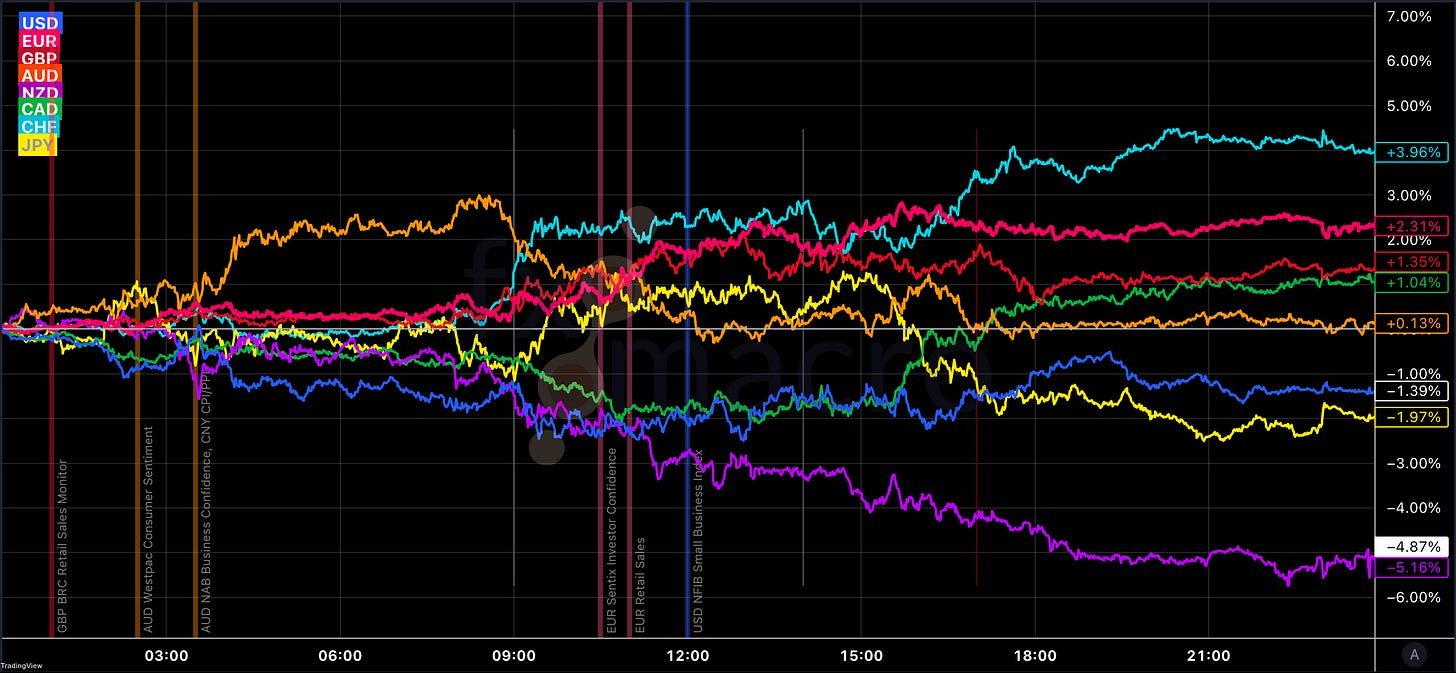

Tuesday, 11.04.23

Wednesday, 12.04.23

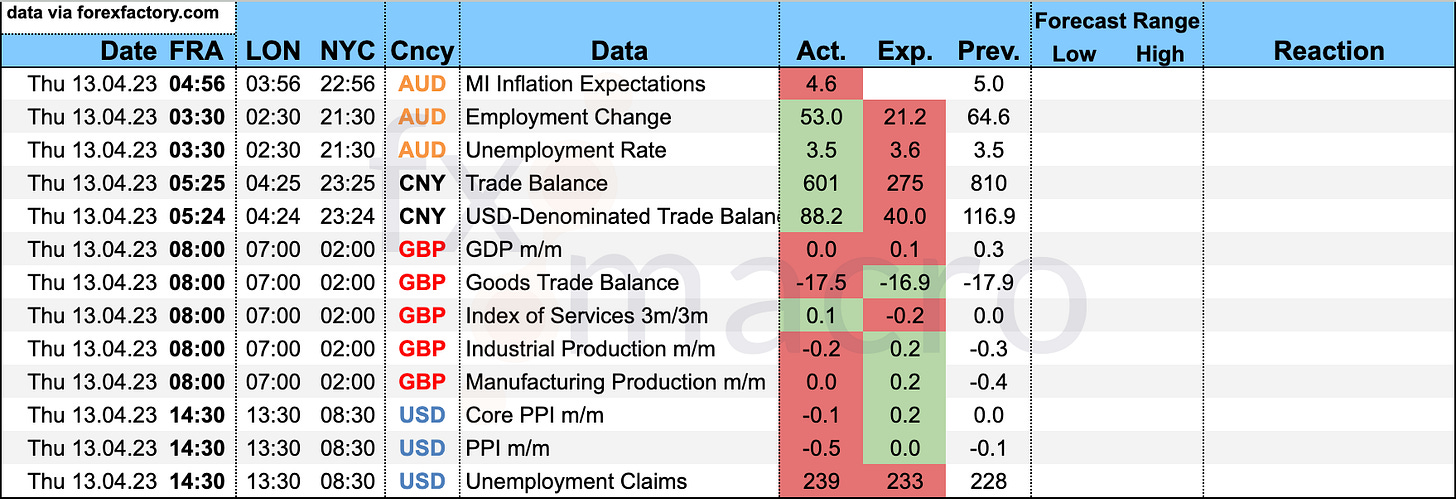

Thursday, 13.04.23

Friday, 14.04.23

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 13/2023 | 06/2023 | 50/2022 | 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 09/2023 | 02/2023 | 47/2022 | 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

ECB

Rate Statements: 12/2023 | 06/2023 | 50/2022 | 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 10/2023 | 04/2023 | 47/2022 | 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 11/2023 | 05/2023 | 50/2022 | 43/2022 | 36/2022

BOE

Rate Statements: 13/2023 | 06/2023 | 50/2022 | 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

RBA

Rate Statements: 15/2023 | 11/2023 | 07/2023 | 50/2022 | 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 09/2023 | 51/2022 | 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 07/2023 | 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 15/2023 | 09/2023 | 47/2022 | 41/2022 | 34/2022 Meeting Minutes: 07/2023 Crib Sheets: 40/2022

BOC

Rate Statements: 11/2023 | 05/2023 | 50/2022 | 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022

SNB

Rate Statements: 13/2023 | 50/2022 | 44/2022 | 39/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

BOJ

Rate Statements: 11/2023 | 04/2023 | 51/2022 | 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 13/2023 | 05/2023 | 52/2022 | 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: Midjourney with the prompt: holidaze watercolor illustration white panelled surf shack

Looking forward to full Edition. Happy holidays