Outlook for Week 17/2023

"The greatest tragedies occur when people forget about uncertainty." - Peter Bernstein

Welcome to issue #52 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary.

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

The cover image is AI-generated via Midjourney. If you want to guess the prompt, I put it at the end of the newsletter.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Table of Contents

Summary (Playbook, Calendar, Levels, FX Drivers, Downloads)

Week in Review: a) Central Banks, b) Economic Data

Market Analysis: a) Growth and Inflation, b) Yields, c) Central Banks and the US Dollar, d) Sectors and Flows, e) Sentiment and Positioning, f) Market Risks, g) Various

Top 3 Macro Charts of the Week

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Please check out this article about what this summary aims to provide and what its limitations are.

Economic Calendar for next week

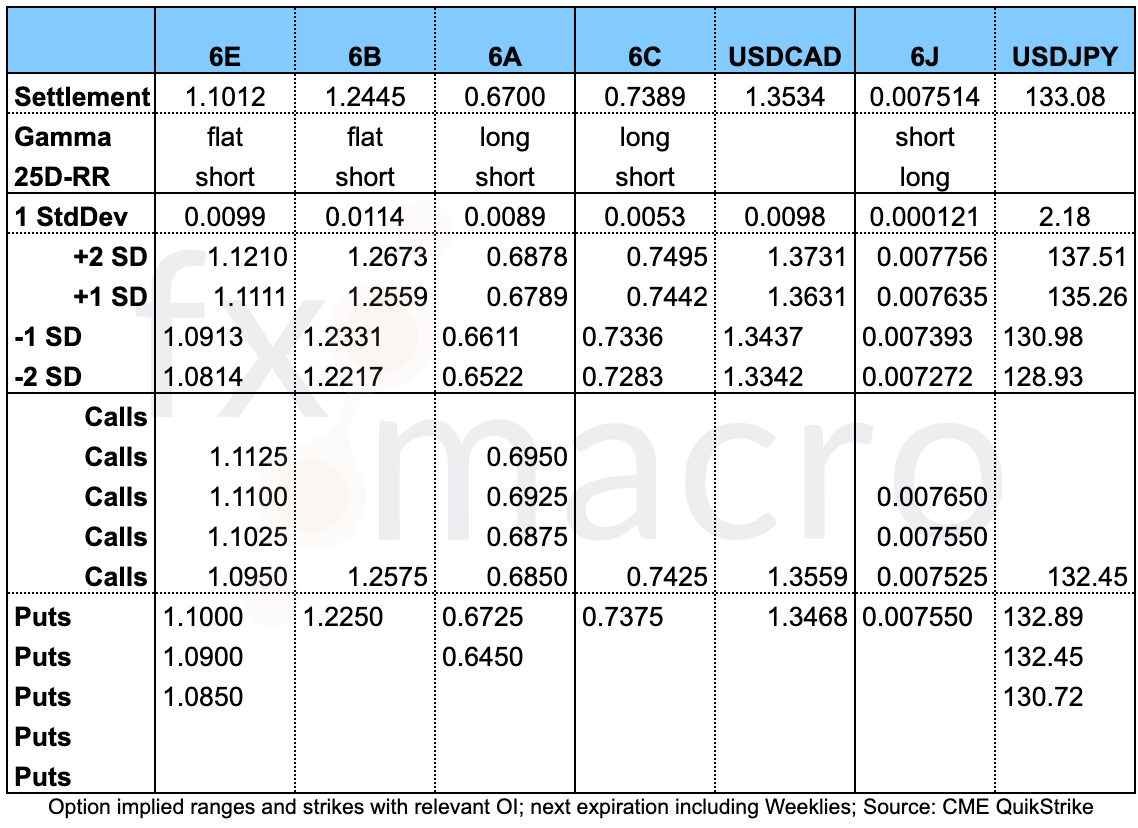

Important levels to watch and look out for in FX futures

Currency Drivers

For an explanation check out this link.

Downloads and Links

Difftext of the Summary from last week: diffchecker.com

Central bank speaker recap for the week:

Week in Review

Central Banks

RBA Minutes (18.04.23)

Here are the highlights from the RBA Minutes:

ECB Minutes (20.04.23)

Here are the highlights from the minutes:

Confab, Speakers, News

Federal Reserve

Barkin (Neutral). Mon: Wants further evidence that inflation is settling back to target, the economy is operating just fine at the current level of rates, reassured by what he's seeing in the banking sector.

Bullard (Hawk). Tue: Sees restrictive policy rate between 5.50-5.75%, bias to hold for longer until inflation is contained, not much clear progress on inflation means interest rates need to continue to rise, the Fed should avoid extensive forward guidance at the next meeting and keep options open, recession predictions ignore the strength of the labour market.

Bostic (Neutral). Tue: Sees one more rate hike and then hold, inflation still remains too high and there's still a lot to do, does not see inflation falling below 3.5% and that's still well above the 2% target, the economy continues to be extremely resilient, we will have to see some weakening in the economy, have only moved into a restrictive stance in the fall, the banking system seems to be stable but you never know when the next show may drop, uncertainty will lead bankers to be more cautious and do some work for the Fed, shorter-term inflation expectations not really surprising, important to get the balance sheet back down to a size that is appropriate. Thu: Inflation is too high and the Fed needs to bring it down.

Bowman (Neutral). Tue: Watching very closely for potential signs of more bank stress. Thu: The Fed is focused on lowering inflation, clearly need to continue to work to bring it down, bankers are seeing fewer lending opportunities because they see an economic slowdown being likely within the next year.

Goolsbee (Neutral). Wed: Still waiting to see if there are further credit events to drop, message is to be prudent and patient, the things to watch until the next Fed meeting are prices and credit.

Williams (Neutral). Wed: Inflation is still too high and the Fed will act to lower price pressures, tighter credit conditions will weigh on growth, will take time to gauge the impact of tighter banking conditions, likely to take two years to get inflation back to 2% target, will take time for Fed's actions to lower inflation, expects inflation to ease to 3.25% this year, expects gradual rise in unemployment rate to 4-4.5% over the next year.

Mester (Hawk). Thu: The Fed has more work to do, need to hike policy rate to over 5% and hold there for a while, how high and for how long depends on the economy, doesn't want to give a decision on the May move until the meeting, much closer to the end of the rate hike journey, welcome progress in balancing demand and supply, watching to see the impact of tighter financial conditions, stresses in the banking sector have eased, expects inflation to ease to 3.75% this year and unemployment to rise to 4.5-4.75%, active tool of monetary policy is interest rates and not the balance sheet.

Logan (Neutral). Thu: Inflation has been much too high, watching if the economy evolves as forecast and for any clear change in underlying factors.

Harker (Neutral). Thu: Some additional tightening is needed and we will need to hold rates high for a while, expects to see tighter credit conditions on bank stress, expects inflation to fall to 3-3.5% this year, 2% in 2025, expects unemployment to rise to 4.4% this year.

Cook (Neutral). Fri: We're trying to figure out where the Fed needs to stop with rate rises, monetary policy is moving into a more uncertain phase, high inflation has become embedded in the economy, path back to 2% likely to be uneven and bumpy, inflation pressures have been abating but core prices still sticky, wage growth and hiring have slowed down.

European Central Bank

Kazaks (Hawk). Mon: The option in May is a 25 bps or a 50 bps move.

Lagarde (Dove). Mon: Once the 2% inflation objective is reached we can discuss the target goal.

Lane. Tue: The baseline for May is a rate hike but 25 vs. 50 bps is data-dependent, very much in a wait-and-see mode, it would be appropriate to keep rates at the plateau level for a while before returning back to normal.

De Cos (Dove). Wed: There is ground to cover on rates if March baseline holds, watching inflation expectations and the latest data has been good.

Schnabel (Neutral). Wed: Underlying inflation remains sticky, inflation momentum is staying high for all components except for energy. Thu: Headline inflation has started to decline but core inflation proves sticky, energy components are falling quickly but many other components are still on the rise.

Knot (Hawk). Thu: Too early to talk about a pause in rate hikes, may have to hike rates again in June and July, we are now in what I would call mildly restrictive territory, inflation is still much too high, not uncomfortable with market pricing of the terminal rate.

Visco (Dove). Thu: The risk of doing too much is at least as much as the risk of doing too little, Eurozone demand is still below trend. Fri: We are yet to see the full effect of rate hikes, need to be cautious about setting policy and go meeting by meeting, core prices are still reflecting "stubborn" inflation.

Rehn (Hawk). Fri: There is no reason for us to abandon restrictive policy or exit it prematurely, the path to sustainable growth is narrow but it can be traversed with a proactive and balanced policy.

De Guindos (Dove). Fri: Will stick to communicating policy on a meeting-by-meeting basis, will not shift to forward guidance for the months ahead.

Bank of England

Cunliffe (Dove). Mon: It will not be possible to give stablecoin holders protection against failure of the coin.

Tenreyro (Dove). Thu: The BoE may have tightened a bit too much, the inflation target is flexible and intended to respond to shocks.

Ramsden (Hawk). Fri: High inflation is a bigger risk than overtightening, need to make sure that monetary inflation does not develop, focused on staying the course on tightening.

Bank of Canada

Macklem. Tue: Prepared to raise rates further if policy is not restrictive enough to get inflation all the way down to the 2% target, expects it will take until the end of 2024 to get inflation to 2%, by summer at 3%, continues to be more concerned about the upside risks, we need inflation expectations to come down further, services price inflation and wage growth need to moderate, past policy rises are working their way through the economy, we need weak growth as demand is running too strong, probably need to see the unemployment rate move up to slow demand.

Swiss National Bank

Schlegel. Wed: Swiss inflation is low in international comparison but still too high and above the level we associate with price stability, cannot rule out further rate hikes.

Jordan. Wed: We expect inflation to decline this year but it is too soon to sound the all clear, the risk of a correction in the housing market exists, house prices in Switzerland have risen faster than fundamental factors like incomes.

Bank of Japan

Uchida. Tue: Fiscal constraints won't undermine the ability to carry out monetary policy.

Ueda. Tue: Buying government debt is part of monetary policy and not aimed at monetizing government debt will achieve inflation target but it may take time, positive signs are emerging in prices and wage growth, no immediate need to review 2013 joint statement.

Shimizu. Wed: Appropriate to continue monetary easing policy for the time being, CPI likely to slow below 2% around the middle of fiscal year 2023.

Economic Data

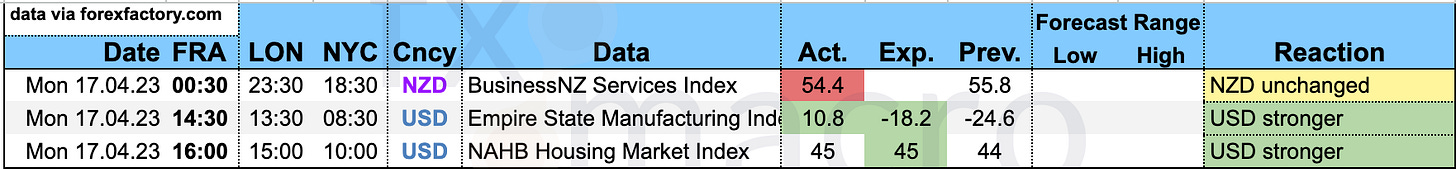

Monday, 17.04.23

Tuesday, 18.04.23

Wednesday, 19.04.23

Thursday, 20.04.23

Friday, 21.04.23

The Australian PMIs:

The April services results reinforces that if there is a risk to the soft landing view of the Australian economic outlook, it is for a more resilient economy rather than a hard landing.

There is nothing in these results that suggests that the Australian economy is headed for recession. To the contrary, they point to a lift in Australia’s economic momentum through the middle of 2023.

The risk to inflation is from excess demand in the economy putting upward pressure on domestic prices in energy, housing, and labour markets. The good news is that services input costs rose at a slower pace in April continuing the downtrend that has been in place since mid-2022. The bad news is that the service input prices index remains well above a level consistent with the RBA’s 2% to 3% inflation target.

[The next RBA rate decision] will most likely hinge on the March quarter CPI to be released on 26th April. The April flash PMI, strong employment outcomes in March and a resurgence in parts of the housing market all suggest that another rate hike in May is more likely than not."

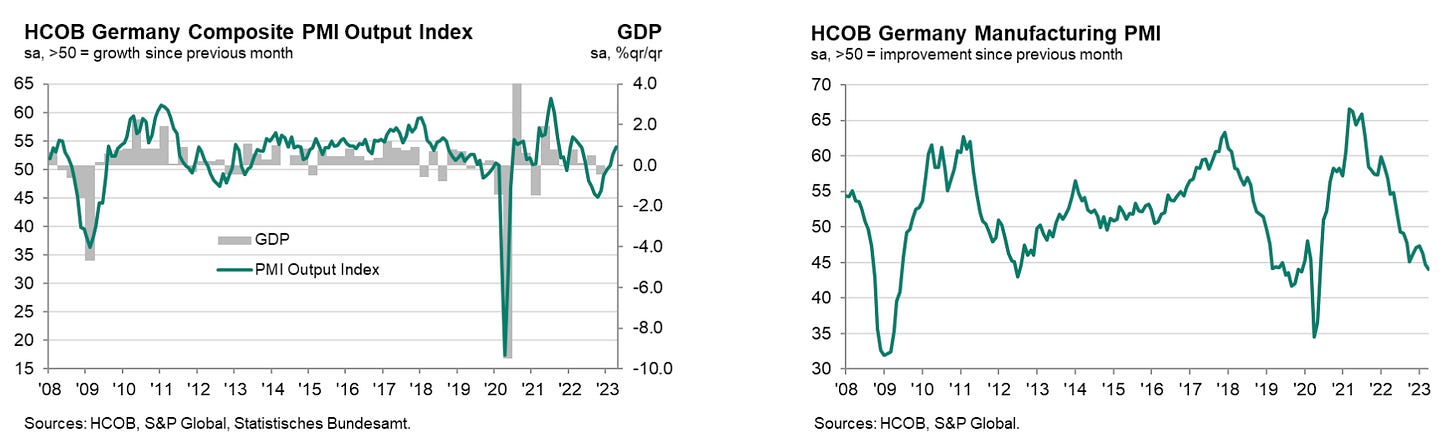

The German PMIs:

In April, the German economy continued its recovery which started in the first quarter of the year. The driving force is the service sector, which is characterized by continued optimism towards the outlook. The latter is reflected, for example, in the willingness to increase the pace of hiring.

[…] the HCOB manufacturing output index remains in growth territory, although the reading of 50.3 suggests that the sector is still lacking momentum.

Manufacturing companies appear to be continuing to expand their profit margins. This is because the corresponding HCOB PMI indices show firms have once again been able to increase selling prices while input prices have fallen at an accelerated pace, which is also consistent with the observation that delivery times have once again shortened significantly.

In the services sector, firms' ability to push through higher prices has softened slightly, whilst they continue to face strong input cost increases. The expected high wage settlements could further complicate the situation for firms in the service sector, although in macroeconomic terms they should benefit from higher incomes and correspondingly higher consumption.

The labour market will remain tight in Germany. In the services sector, companies actually hired more staff than in the previous month, according to the HCOB PMI survey, but employment also rose again, though moderately, in the weaker-positioned manufacturing sector. This is good news both for the people and from a broader economic perspective.

The Eurozone PMIs:

The HCOB Purchasing Managers' Indices for the euro zone show a very friendly overall picture of an economy that continues to recover. However, a closer look reveals that growth is very unevenly distributed. For example, the gap between the partly booming services sector on the one hand and the weakening manufacturing sector on the other has widened further. The sharp decline in output in France's manufacturing sector is also noteworthy, while this sector is still expanding slightly in Germany.

Price developments in the services sector are likely to continue to worry the European Central Bank (ECB). Neither input prices nor sales prices are showing any significant slowdown in the upward momentum of prices according to the HCOB PMI survey. Services prices play a particularly large role in the core inflation rate on which the ECB is currently focusing. This increases the likelihood that the ECB will tighten monetary policy more, or for longer.

In terms of manufacturing prices, the trend of falling prices continues. This is matched by the observation that delivery times have continued to shorten sharply, so that buyers are obviously gradually gaining the upper hand in price negotiations. In addition, the fall in energy prices is also playing a decisive role here.

For the future, companies are rather positive not only in the services sector, but also for the manufacturing sector. According to the companies surveyed, the reasons for this optimism include a diminishing fear of a resurgence of the energy crisis, supply chains that are functioning better again, and the expectation that inflation has passed its zenith. The latter is coupled with the hope that the ECB will pause its interest rate hikes soon.

The UK PMIs:

“Flash PMI surveys signalled an acceleration of economic growth to the fastest for a year in April, building on a modest return to growth in the first quarter of the year.

“Growth is lopsided, however, with surging demand for services contrasting with an ongoing downturn in demand for goods. Even within the service sector, growth is dependent on consumers switching spending from goods to services and a revival of financial services activity, both of which are areas susceptible to the impact of higher interest rates and the ongoing cost of living squeeze. Business services and manufacturing are clearly struggling.

“However, for now the key takeaway is that the economy as a whole is not only showing encouraging resilience but has gained growth momentum heading into the second quarter, the latest PMI reading broadly indicative of GDP rising at a robust quarterly rate of 0.4%.

“Inflationary pressures have meanwhile continued to cool in manufacturing, but price pressures have picked up in services following the resurgence of demand.

“This combination of faster growth and elevated price pressures put a twelfth rate hike by the Bank of England an increasingly done deal when it next meets on 11th May, and will add to speculation that further hikes may be needed.”

The US PMIs:

“The latest survey adds to signs that business activity has regained growth momentum after contracting over the seven months to January. The latest reading is indicative of GDP growing at an annualized rate of just over 2%.

“Growth is also reassuringly broad-based, led by services thanks to a post-pandemic shift in spending away from goods, though goods producers are also reporting signs of demand picking up again.

“Jobs growth has accelerated alongside the resurgence of demand, aided by reports of vacancies being more easily filled, reflecting improved supply of candidates and higher wages.

“However, the upturn in demand has also been accompanied by a rekindling of price pressures. Average prices charged for goods and services rose in April at the sharpest rate since September of last year, the rate of inflation having now accelerated for three successive months. This increase helps explain why core inflation has proven stubbornly elevated at 5.6% and points to a possible upturn – or at least some stickiness – in consumer price inflation.”

Market Analysis

Growth and Inflation

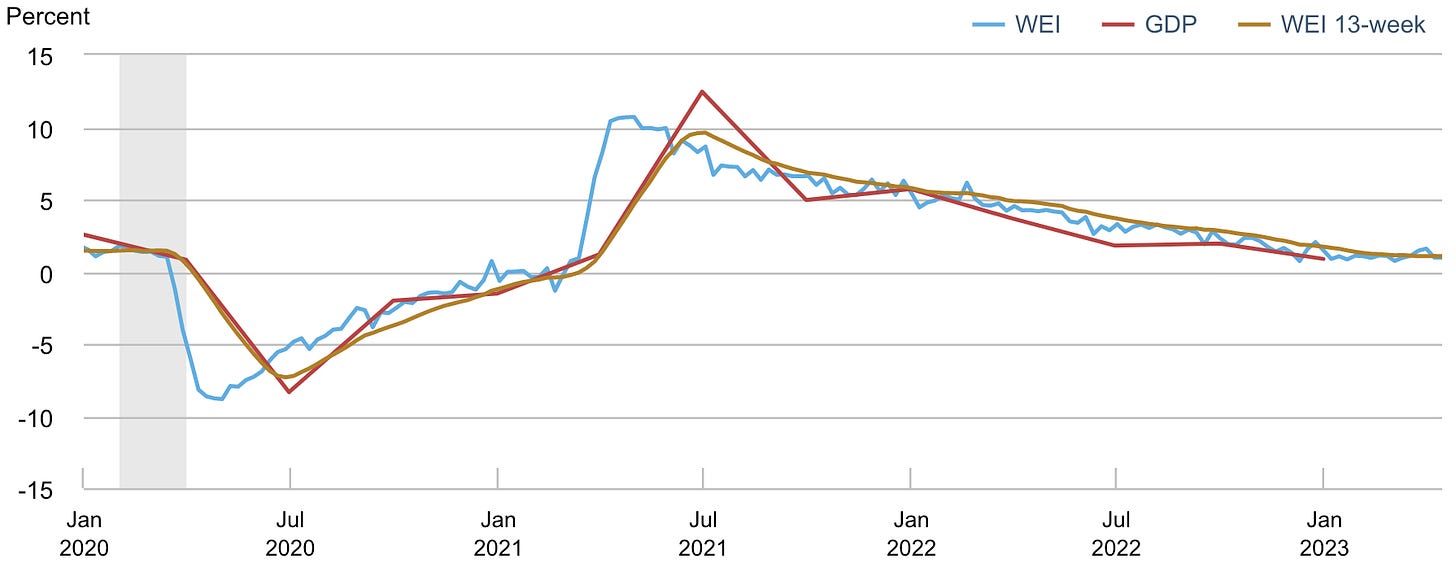

The Atlanta Fed GDPNow model estimates Q1 growth at 2.5%:

The NY Fed Weekly Economic Index remained unchanged at 0.97%:

Citi Economic Surprise Indexes:

USD is lower-to-sideways

EUR, NZD and CAD are going lower

GBP is the strongest looking one

AUD has picked up

CHF and JPY are going sideways

The CESI spread between AUD and NZD has been going higher for a few weeks now:

Bloomberg PMI heatmap:

The US remains unchanged

The UK, Eurozone, Germany and France are all weakening

Australia and Canada are weaker

Switzerland is unchanged

Most of Asia is weaker as well: China, Taiwan, Vietnam

Note that these are only Manufacturing PMIs, which have been a lot weaker than Services PMIs lately

Inflation breakevens are still rangebound near the bottom of their range:

Nothing new from 5y5y forward inflation rates or from RINF either:

Citi Inflation Surprise Index:

USD, EUR, NZD, CAD and JPY are all lower

GBP, AUD and CHF are flat

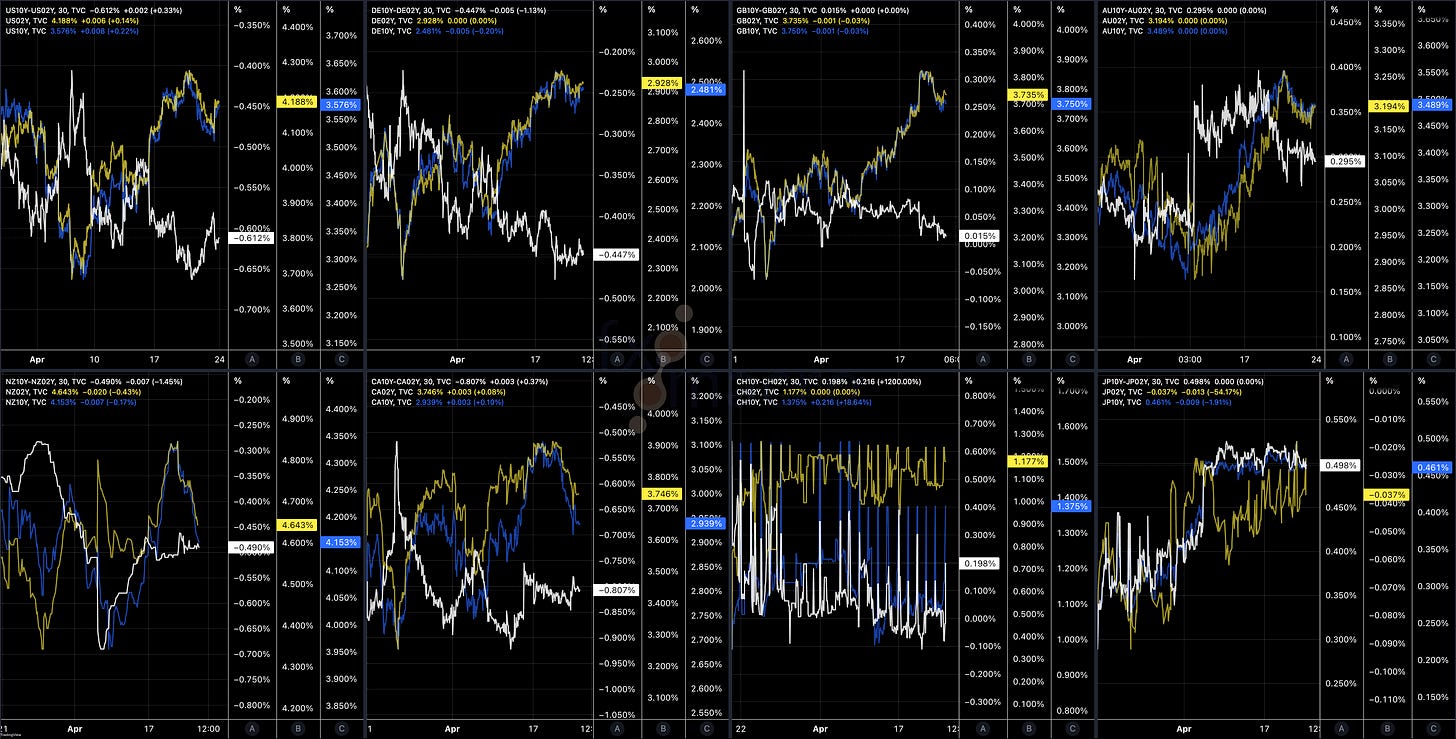

Yields

See chart and table below:

UK and German yields look strongest

Swiss and Chinese yields look weakest

Here’s a closer look at 2y and 10y yields, and the 2s10s:

Yield curves are mostly flattening

The UK and Canadian curves are holding up pretty well

The Aussie curve has steepened and the Japanese curve is also steeper

The 2s10s in comparison:

Central Banks and the US Dollar

FOMC meeting probabilities according to FedWatch:

The May meeting is priced at 25 bps with a 89% probability; the remaining 11% are for a no-change

The terminal rate is seen at 5.00-5.25% until the September meeting, which is two months longer than last week

The first rate cut is priced in for November (last week: September)

Rate cuts are priced at about one 25 bps cut per meeting until September 2024

The implied Fed Funds forward curve shows that rate cuts have been pushed further out over the last few weeks and that rates are expected to be held at the terminal rate for longer than before:

This is the same data in tabular form:

Sectors and Flows

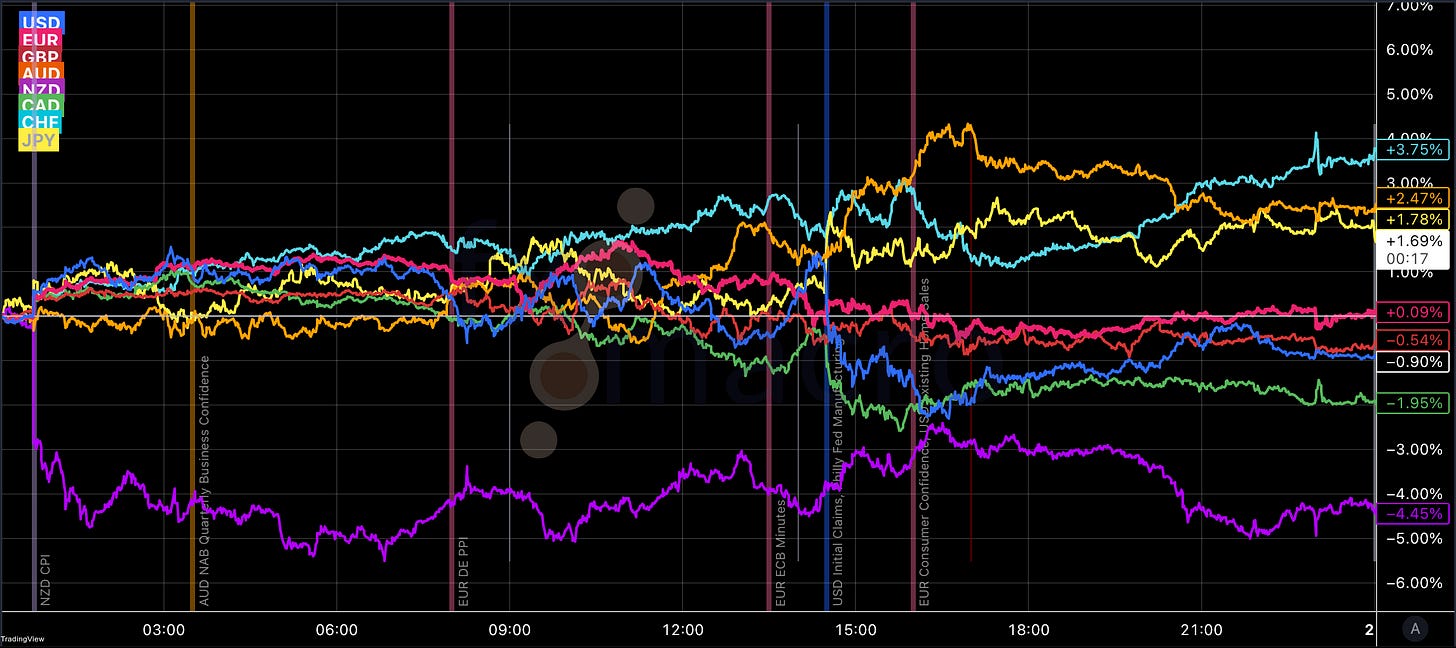

Currency strength:

CHF and EUR are both the outperformers over three months and one month

AUD, NZD and JPY are the underperformers

USD performance has been mediocre

Currency indexes over one year:

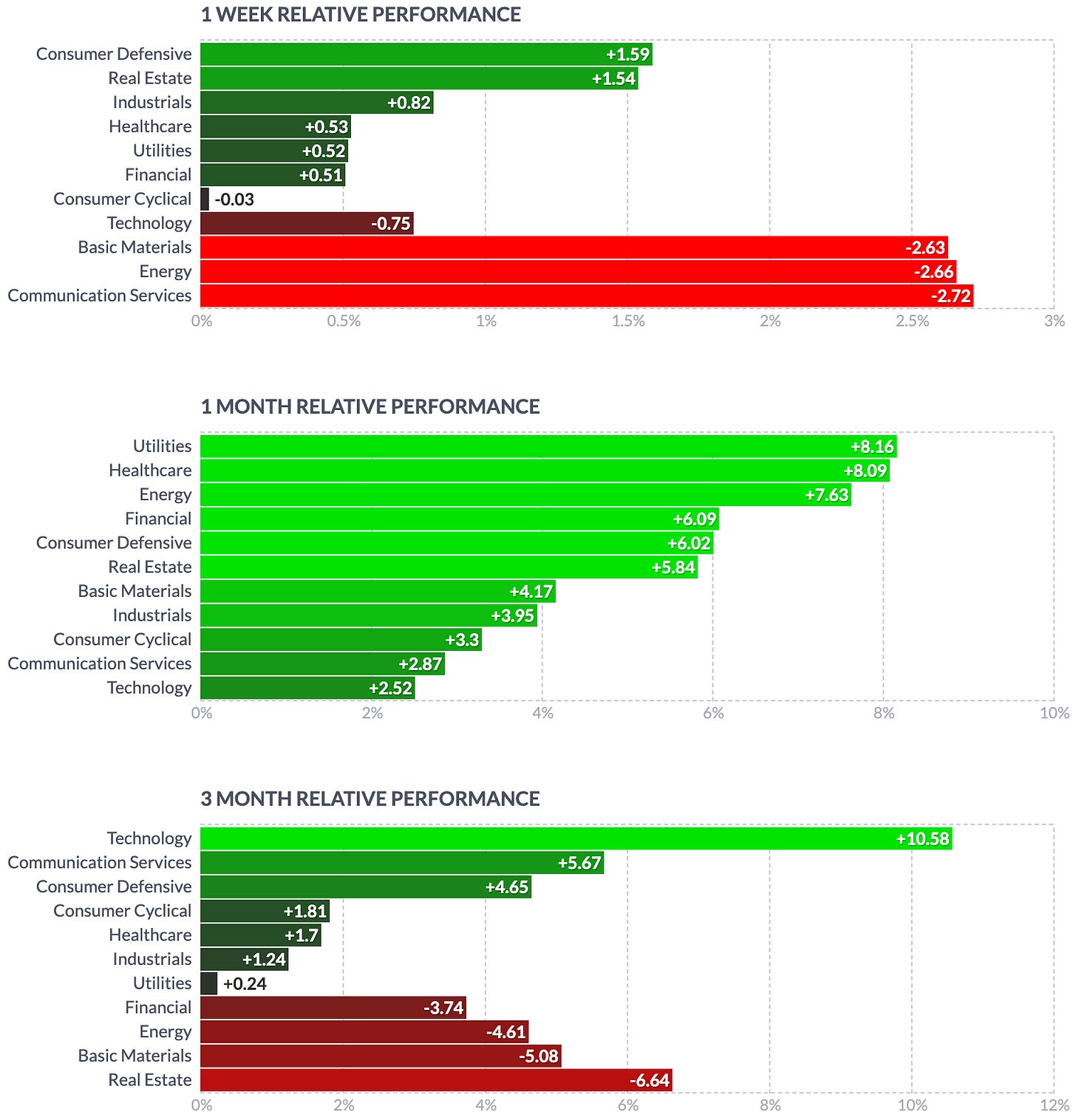

Equity sector performance:

Energy is the outperformer with XOP somewhere near the top of the chart and OIH near the bottom

Consumer Staples, Healthcare and Utilities are also performing well

Semiconductors, Metals/Mining, Industrials and Tech are the underperformers

Similar data, different chart: the rotation seems to be into defensive sectors.

Sector breadth is lagging:

Sector ETF charts:

International stock markets:

This is a bit of a mixed bag…

Korea is the outperformer, Taiwan is the underperformer

Europe is again leading

Brazil and India are positive but far from stellar

Overall, the rally of the last month has been more or less global

Sentiment and Positioning

AAII Bull-Bear sentiment is pretty much neutral:

Currency sentiment:

NZD has the most bullish sentiment, CAD comes in second, AUD in third

CHF continues to have the most bearish sentiment

Different sentiment source:

USDCHF and EURCHF are the currency pairs with the most bullish sentiment

AUDUSD and NZDUSD are also very bullish

Commitment of Traders:

Equity futures were mixed this week, Relative Strength (Levy) also paints a bit of a mixed picture with NQ well above 1.00 and the RTY at 0.97. Positioning in ES is bullish with both Commercials and Large Traders at extremes.

Treasury futures were all lower this week, positioning in ZF, ZB and TN is bullish

1-week changes in Commercial and Large Trader positions is at -5/+5 SD for Eurodollar GE, which is weird, and I don't have an explanation for it

Currency futures were mostly weaker, and positioning in DX remains at bullish extremes while 6E and 6B are still at/near bearish extremes; 6S has also become a crowded long

Bitcoin is down 10.4% for the week but its RSL holds at 1.24

Energy futures had a mixed week with only NG ending the week positive; positioning is neutral

Metals were mixed as well, HG has lost quite a bit of momentum with an RSL at 1.01; positioning is neutral for all futures

Grains were mostly lower while softs were mostly higher; positioning is bullish for ZW and ZL while it's bearish for CT and SB

COT/TFF Dealer net positioning for currency futures:

6E is near its multi-year low, 6B has been bought heavily over the last weeks

6C has dropped off its peak but it's still a crowded short

Citi PAIN doesn't hold any surprises with USD being long vs. everyone else:

Here's the combined COT/PAIN chart:

Market Risks

HY and IG spreads haven't reached levels seen prior to the banking crisis but they're well below crisis levels:

The Credit Spread Index looks pretty similar:

Currency volatility is relatively low and it's declining overall:

Volatility indexes:

VIX is below 17, MOVE is at 120

While VIX has declined, VVIX has diverged higher, which is worrisome because VVIX can lead VIX

VIX/VIX3M is decently steep

Skew is steepening again with SDEX taking out the March high, VIX/VOLI at highs and TDEX rising but still below “Skewmageddon” levels seen in March

Taken together, I'm cautious with VVIX diverging and OTM put demand increasing

The CNN Fear & Greed Index stands at Greed:

It might not feel like it but the BlackRock Geopolitical Risk Indicator is pretty much neutral right now:

Various

The NYSE Advance/Decline Line isn't doing anything out of the ordinary:

The percentage of index components above their 200-day moving averages has put in a divergence for the S&P 500 where breadth makes a lower high while the index is at a resistance level; there's also a divergence in the Nasdaq 100 with the index having made a new high but breadth is lagging:

For the shorter-term 50-day moving averages it's even more extreme: in the S&P 500 every index high has had a lower breadth high since November, same for the Nasdaq 100:

25-delta risk reversals:

USDCAD is priced lower

Other than that I don't see anything interesting here

New month, new seasonality:

Bullish: USD

Bearish: AUD, GBP, EUR, NZD

Finally, a look at the Market Dashboard:

Trend metrics look reasonably healthy (except for the R2k) but the number of Distribution Days is still way too high for every index

Vol metrics are okay too

MOVE is still a bit elevated at >120

Breadth and Options haven't shown any life but with recent market action that's to be expected

On Friday, the VIX/VVIX correlation dropped to levels that tend to precede pops higher in vol

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 13/2023 | 06/2023 | 50/2022 | 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 15/2023 | 09/2023 | 02/2023 | 47/2022 | 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

ECB

Rate Statements: 12/2023 | 06/2023 | 50/2022 | 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 10/2023 | 04/2023 | 47/2022 | 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 11/2023 | 05/2023 | 50/2022 | 43/2022 | 36/2022

BOE

Rate Statements: 13/2023 | 06/2023 | 50/2022 | 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

RBA

Rate Statements: 15/2023 | 11/2023 | 07/2023 | 50/2022 | 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 09/2023 | 51/2022 | 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 07/2023 | 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 15/2023 | 09/2023 | 47/2022 | 41/2022 | 34/2022 Meeting Minutes: 07/2023 Crib Sheets: 40/2022

BOC

Rate Statements: 15/2023 | 11/2023 | 05/2023 | 50/2022 | 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022

SNB

Rate Statements: 13/2023 | 50/2022 | 44/2022 | 39/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

BOJ

Rate Statements: 11/2023 | 04/2023 | 51/2022 | 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 13/2023 | 05/2023 | 52/2022 | 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: Midjourney with the prompt: "Create an eerie image of a misty forest at night, with a hanged person in the back and a creepy atmosphere. The viewer can feel a sense of dread and uncertainty, as if they're being watched by something ominous and unseen.”

Extremely helpful article!!! thank you very much for putting these together every week