I will be on holiday for the next three weeks or so. While I plan to keep up with the markets, I don't know yet whether I will be able to put together the full analysis, only parts of it or just the summary. I do plan to publish the central bank content and the review parts in any case, though.

This issue contains only the review part.

Welcome to issue #49 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary.

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

The cover image is AI-generated via Midjourney. If you want to guess the prompt, I put it at the end of the newsletter.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

One more thing. You seem to like newsletters, so here's a great way to discover new stuff to read for free: The Sample. They will regularly send you an issue of a different semi-random newsletter you might be interested in. If you sign up using my referral link, I get bonus points and my newsletter will be forwarded to others to check out.

Table of Contents

Summary (

Playbook,Calendar,Levels,FX Drivers, Downloads)Week in Review: a) Central Banks, b) Economic Data

Market Analysis: a) Growth and Inflation, b) Yields, c) Central Banks and the US Dollar, d) Sectors and Flows, e) Sentiment and Positioning, f) Market Risks, g) VariousTop 3 Macro Charts of the Week

Summary

Economic Calendar for next week

Currency Drivers

For an explanation check out this link.

Downloads and Links

Central bank speaker recap for the week:

Week in Review

Central Banks

Confab, Speakers, News

Federal Reserve

Kashkari (Hawk). Weekend: Unclear how much the current banking stresses lead to a wider credit crunch, such a crunch would slow down the US economy, monitoring this very closely, too soon to make any forecasts about the next FOMC meeting. Thu: We have very high inflation but it's not being driven by wages, we can get back to pre-pandemic economy with low inflation and low unemployment once we get inflation down, the one area of particular concern is core services ex housing has not come down, still have more work to do on bringing services inflation down.

Barr (Neutral). Mon: The US banking system is sound and resilient, it appeared contagion from SVB could be far-reaching and damage the broader banking system, we are prepared to use all of our tools for any size institution as needed to keep the system safe, recent actions demonstrate we are committed to ensuring all deposits are safe. Wed: We will make a meeting-by-meeting judgement on interest rates, we need stronger rules on capital and liquidity for banks of $100 bln and above.

Jefferson (Neutral). Mon: Inflation has come down and "should fall back" towards 2% target as demand falls, the Fed is still learning how much tight monetary policy has influenced the economy and inflation.

Barkin (Neutral). Thu: Supported 25 bps hike at the last meeting given substantial inflation pressure and banking resilience, declines to commit to a view on whether to hike at the next meeting, comfortable with meeting-by-meeting approach to see if a quarter-point hike is needed or not, tracking things like weekly credit card spending to see if demand is beginning to settle, deposit flows among US banks are relatively stable, not every bank failure becomes a Lehman Brothers, sees risks in commercial real estate.

Collins (Neutral). Thu: Some additional tightening will be needed, after hiking again we will likely hold steady for the remainder of the year, Fed forecast of one more hike in 2023 looks reasonable, supported the most recent 25 bps hike, premature to say what the Fed will do at the next meeting, financial sector stress has taken some pressure off the Fed to hike rates, likely that lending cutbacks will restrain the economy, prior to the banking stress would have expected the Fed to raise rates more than the prior projection, the economy is stronger than expected but likely still feeling shift in Fed policy to a more restrictive stance. Fri: We need to get conditions sufficiently tight and then hold, it's early days in judging whether the Fed has gone as far as it needs to go, data on PCE is good news, we need to balance risk of doing too much vs. not doing enough, weaker jobs report in March unlikely to change the monetary policy outlook.

Williams (Neutral). Fri: Economic outlook is uncertain, data will drive monetary policy, expects inflation to cool to 3.25% this year and the unemployment rate to tick up to around 4.5%, banks are resilient and well capitalized.

European Central Bank

Schnabel (Neutral). Weekend: Headline inflation has begun to drop but core inflation remains sticky, financial stresses so far mainly in financial markets and businesses. Mon: No real concern about financial stability risks although the situation is fragile, no sign of weakening in the labour market, balance sheet will not return to levels from before the crisis, should only be large enough to ensure sufficient liquidity, banks might want to hold much higher liquidity buffers than in the past. Wed: Underlying inflation in the Eurozone is proving sticky, rise in unit labour costs indicates possible second-round effects on inflation.

De Guindos (Dove). Mon: Appropriate not to pre-commit to the outcome of monetary policy meetings, open-minded with respect to the future, the question is how the events in the US banking system and Credit Suisse will impact the Eurozone economy, will have to assess whether they will lead to additional tightening of financial conditions.

De Cos (Dove). Mon: Recent tensions have generated a further tightening of financial conditions, that is also having an effect on outlook for economic activity and inflation, those factors have to e taken into account at our next meetings, financial stability is a necessary prerequisite to ensure price stability. Tue: Uncertain financial conditions may create persistent increase in banks' funding costs, macroeconomic deterioration has not been reflected in credit quality.

Nagel (Hawk). Mon: Inflation is still too high, we must be resolute in the fight against inflation, QT should be accelerated from the summer onwards.

Centeno. Mon: The size of rate hike increment will depend on data but it's clear we need to preserve price stability, banking problems will have an impact on our decisions, we have the tools for "whatever it takes" for banks, inflation expectations are still anchored, not seeing signs of second-round effects on wage setting, the pace of QT must be consistent with monetary policy stance and preserve market functioning.

Müller (Hawk). Tue: Still possible to hike rates further, we must be worried about the upside risks to inflation, there may be more differing opinions at the next ECB meeting.

Enria. Tue: Current events confirm that strong banking supervision is needed more than ever, there have been some fast outflows of bank deposits in some cases, on fall of Deutsche Bank's shares: disquiet among investors is a concern, bank CDS market is small and opaque, advocated having CDS centrally cleared.

Lagarde (Dove). Tue: Long-term inflation expectations are near 2% but warrant monitoring, wages are growing faster supported by robust employment prospects, parameters for reducing APP will be closely in line with what we've done previously, we expect activity to remain weak in the near term, risks to growth and inflation have become more balanced. Fri: Core inflation is still significantly too high, must return to 2% inflation, rate hike push is starting to work.

Kazimir. Wed: We should continue to raise rates but possibly at a slower pace, inflation is too high for too long, core inflation will be key in determining the next decision, we agreed not to give guidance about May policy meeting, ready to take any steps to secure price and financial stability.

Lane. Wed: Rates must rise if banking tension has no or fairly limited impact, no reason to expect major problems, banking sector tensions seen settling down.

Villeroy (Neutral). Fri: We may still have a little way to go with rate hikes although we've committed most of our rate hiking journey, time lags after hikes means powerful impact yet to come, we estimates it takes 1-2 years for interest rates to affect inflation.

Sources. Mon: Bloomberg: Schnabel pushed for the ECB statement to include that more hikes are possible.

Bank of England

Bailey (Neutral). Mon: If signs of persistent inflationary pressures become evident further tightening would be required, the full effect of the higher level of the bank rate is still working its way through, the path of inflation will not be entirely smooth, evidence has pointed to more resilient activity in the economy, we have seen some big strains in parts of the global banking system emerge. Tue: We are in a period of heightened tension and alertness, doesn't think recent bank problems are causing stress in the UK, seeing some evidence of a tightening in credit conditions but not critical, creditor hierarchy in the UK is a cardinal principle, guaranteeing all bank deposits should not be the norm.

Mann (Hawk). Wed: It is going to be tough for the BoE to do its job in H2, headline inflation will be falling while core remains stubbornly high.

Bank of Canada

Gravelle. Wed: Way too early to talk about the normalization of rates given high inflation, continues to expect inflation to come down in the months ahead but will need to see further slowing in core inflation to get back to 2%, QT likely to end sometime around the end of 2024 or H1 2025, the bar is very high for the BOC to use large-scale bond purchases.

Swiss National Bank

Schlegel. Thu: We were not too late with measures regarding Credit Suisse, even my first meeting as SNB Vice President in August 2022 revolved around CS.

Maechler. Thu: SNB remains ready to be active in FX markets, foreign currency sales have been mainstay of FX activities for some quarters.

Bank of Japan

Kuroda. Tue: Too early to debate exit from easy monetary policy, sustainable inflation target has not been reached, more time needed. Wed: Wage pressure is heightening, Japan is closer than before to sustainably hit 2% inflation target.

Uchida. Wed: Will judge trend inflation by looking at various indicators, difficult to get markets to price in YCC adjustment early, will not be communicating on monetary policy ahead of meetings.

Suzuki. Wed: Rises in long-term interest rate would squeeze policy expenditure by causing an increase in interest rate payments. Thu: Specific policy is up to the BOJ to decide, expects the new BOJ governor Ueda to firmly conduct monetary policy.

Himino. Wed: Important to maintain current easy policy to support the economy.

Peoples's Bank of China

Xuan. Thu: Regulatory oversight quality of the digital economy will be improved, new forms of finance should not be blindly accepted and recognized, digital currencies and new inventions in cryptocurrencies are not fixing issues in finance but can create new issues.

Economic Data

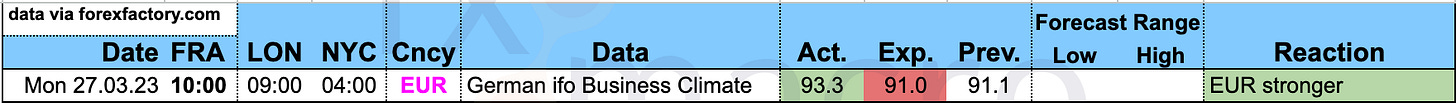

Monday, 27.03.23

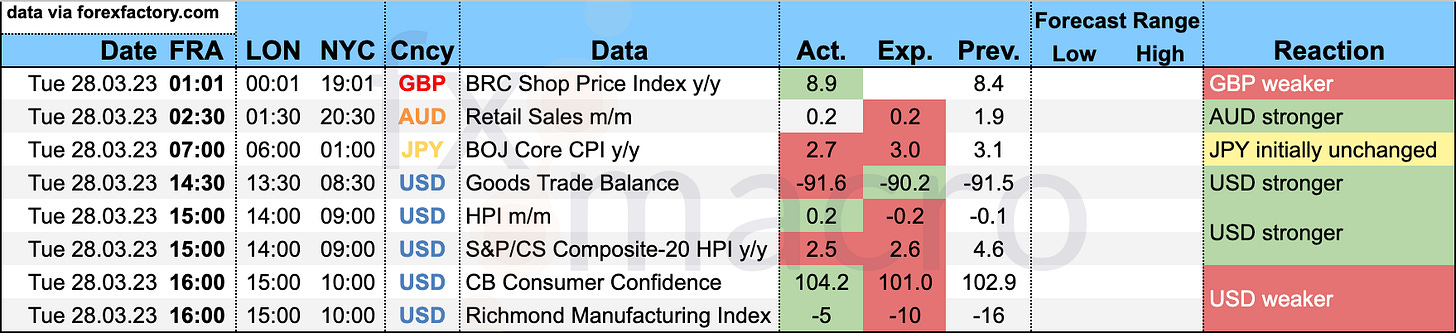

Tuesday, 28.03.23

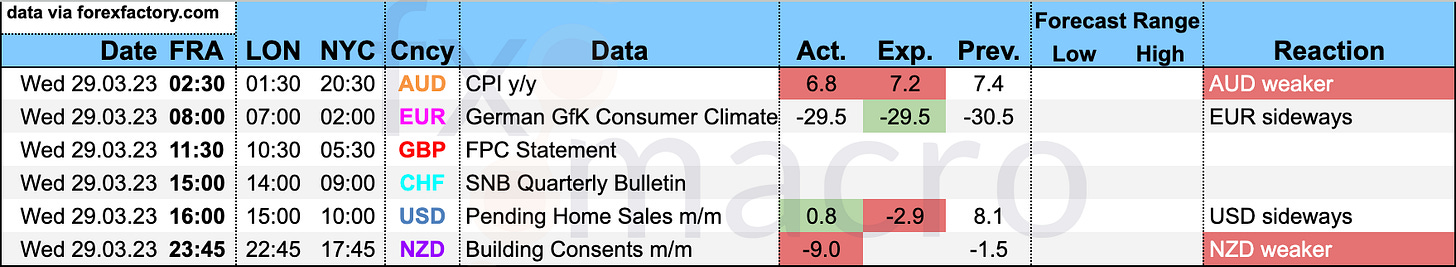

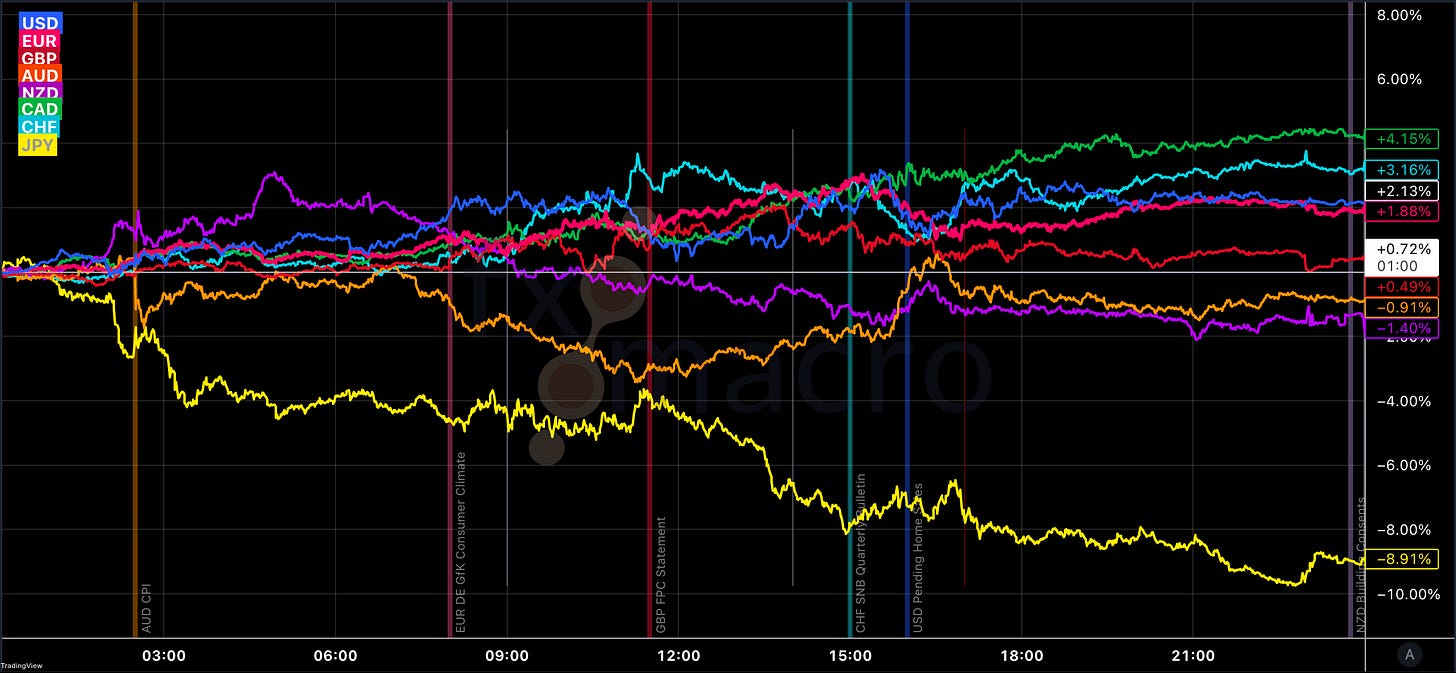

Wednesday, 29.03.23

Thursday, 30.03.23

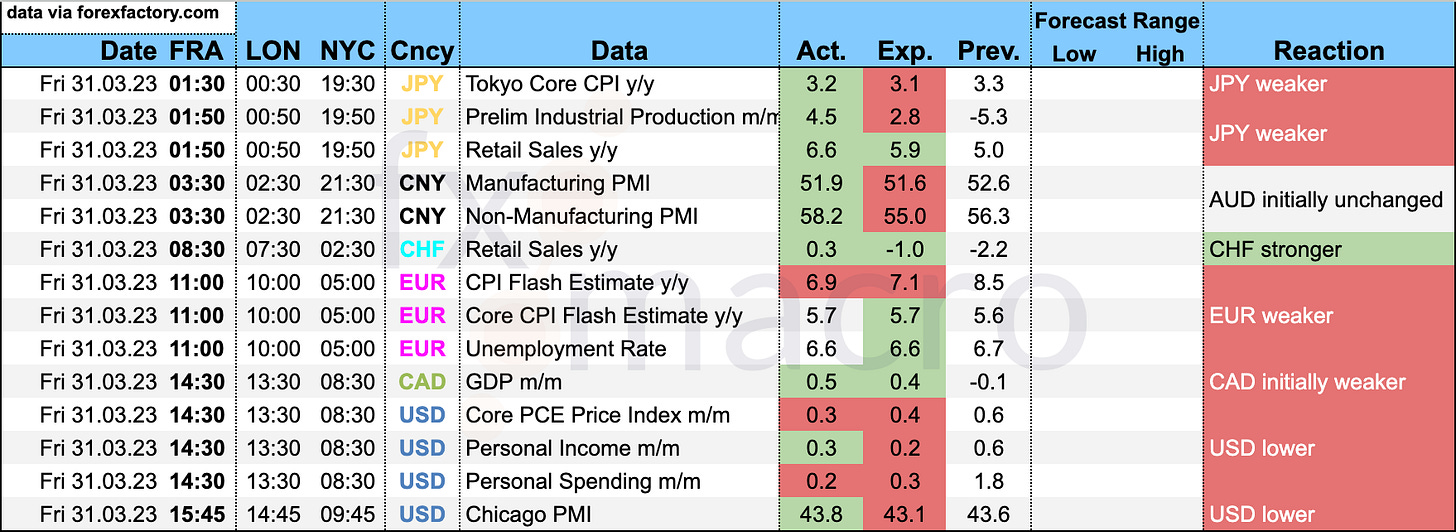

Friday, 31.03.23

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 13/2023 | 06/2023 | 50/2022 | 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 09/2023 | 02/2023 | 47/2022 | 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

ECB

Rate Statements: 12/2023 | 06/2023 | 50/2022 | 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 10/2023 | 04/2023 | 47/2022 | 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 11/2023 | 05/2023 | 50/2022 | 43/2022 | 36/2022

BOE

Rate Statements: 13/2023 | 06/2023 | 50/2022 | 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

RBA

Rate Statements: 11/2023 | 07/2023 | 50/2022 | 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 09/2023 | 51/2022 | 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 07/2023 | 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 09/2023 | 47/2022 | 41/2022 | 34/2022 Meeting Minutes: 07/2023 Crib Sheets: 40/2022

BOC

Rate Statements: 11/2023 | 05/2023 | 50/2022 | 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022

SNB

Rate Statements: 13/2023 | 50/2022 | 44/2022 | 39/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

BOJ

Rate Statements: 11/2023 | 04/2023 | 51/2022 | 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 13/2023 | 05/2023 | 52/2022 | 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: Midjourney with the prompt: Please create a banner design on the theme of uyked. The image has a palm tree on the right side of the composition and it is in the foreground, its crown is made of hemp leaf. A little further in the center of the composition are silhouettes of people at a rave. All this conveys the atmosphere of a holiday and vivid impressions. The composition is made in a modern, artistic, digital style. The lighting is bright and the whole picture is designed to catch the eye of a potential buyer. Arrange the text "Weekend" according to the principles of the golden section in relation to the whole picture. The text is bright and emotional. The whole composition is made in neon style arabic ,--v4

For those following the Citi Economic Surprise Index and the 25-delta risk reversals, here are the current data.

Enjoy your holiday. Would it be possible for you to put in the Economic Surprise Index and the Risk Reversals? Hard to get this data without Refinitiv.

happy easter and enjoy your break!