I will be on holiday for the next 3-4 weeks. While I plan to keep up with the markets, I don't know yet whether I will be able to put together the full analysis, only parts of it or just the summary. I do plan to publish the central bank content and the review parts in any case, though.

Welcome to issue #48 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary.

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

The cover image is AI-generated via Midjourney. If you want to guess the prompt, I put it at the end of the newsletter.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Before we get started, I’d like to give a shout-out to Yuri from Snippet Finance!

Snippet Finance is an easy-to-read newsletter with highly curated and bite-sized content on macro, stocks and investing. Here’s an example:

I know you like long newsletters (because you are reading this one right now), but I’m sure you will also like Yuri’s. Also, check out his website where he posts daily for more great content and his Twitter @SnippetFinance!

Table of Contents

Summary (Playbook, Calendar, Levels, FX Drivers, Downloads)

Week in Review: a) Central Banks, b) Economic Data

Market Analysis: a) Growth and Inflation, b) Yields, c) Central Banks and the US Dollar, d) Sectors and Flows, e) Sentiment and Positioning, f) Market Risks, g) Various

Top 3 Macro Charts of the Week

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Please check out this article about what this summary aims to provide and what its limitations are.

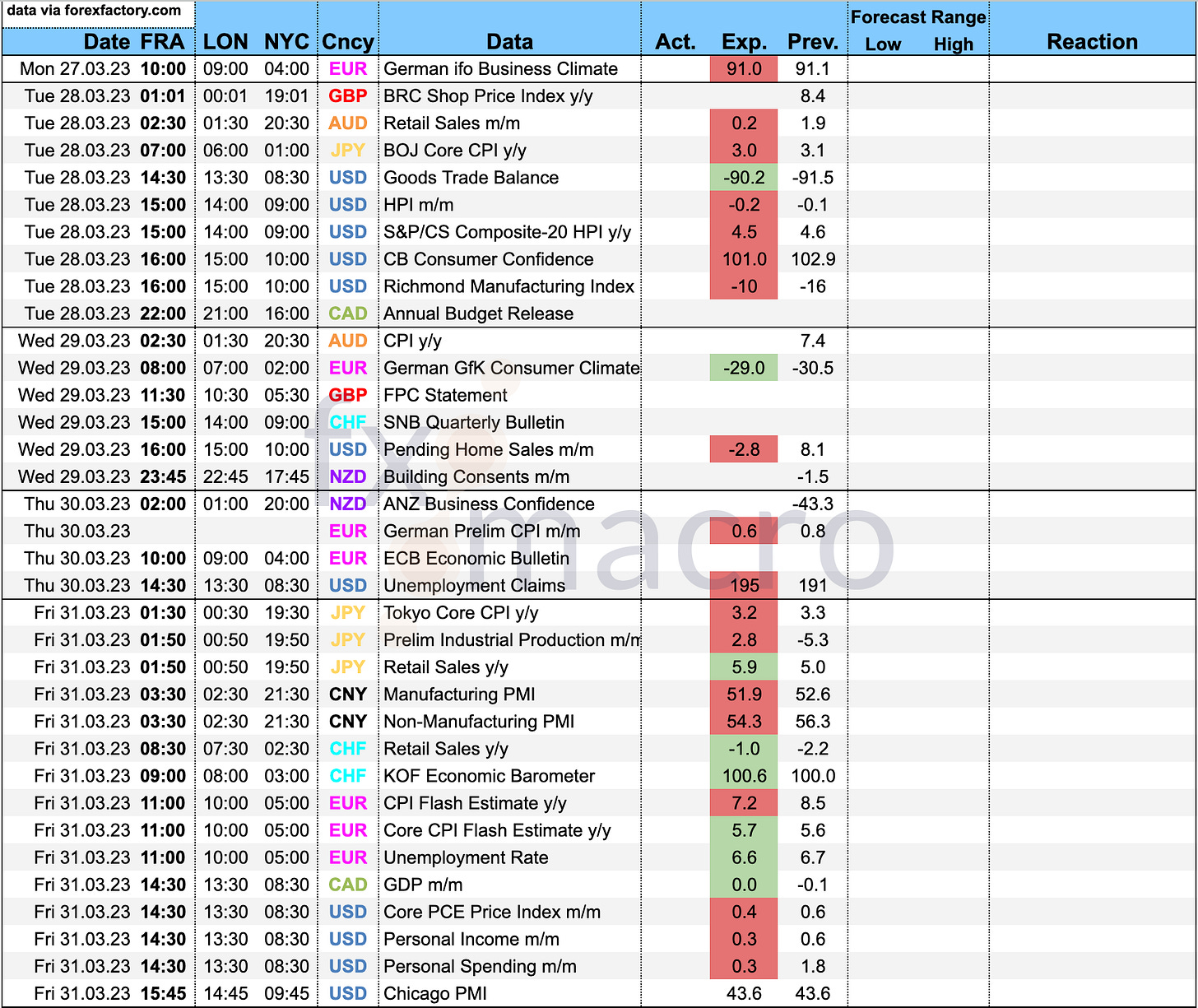

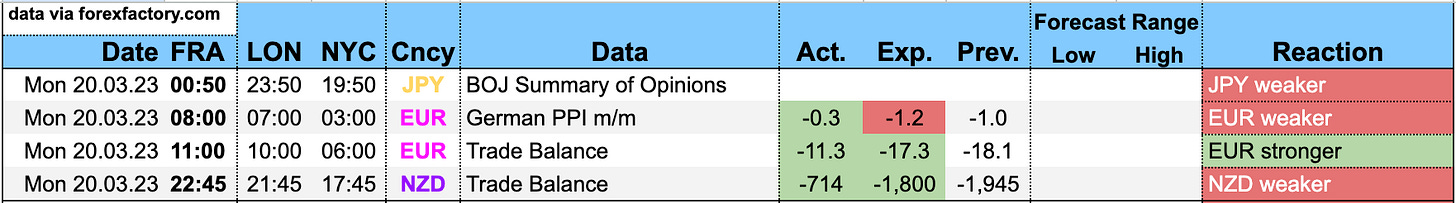

Economic Calendar for next week

Important levels to watch and look out for in FX futures

Currency Drivers

For an explanation check out this link.

Downloads and Links

Difftext of the Summary from last week: link to diffchecker.com

Central bank speaker recap for the week:

Week in Review

Central Banks

BOJ Summary of Opinions (20.03.23)

There were no surprises in the SOP, so here are just the highlights:

RBA Meeting Minutes (21.03.23)

The RBA agreed to “reconsider the cause for a pause” at their next meeting:

BOC Summary of Deliberations (22.03.23)

There was nothing materially new in the BOC Minutes. Here are the highlights from the section on the monetary policy decision:

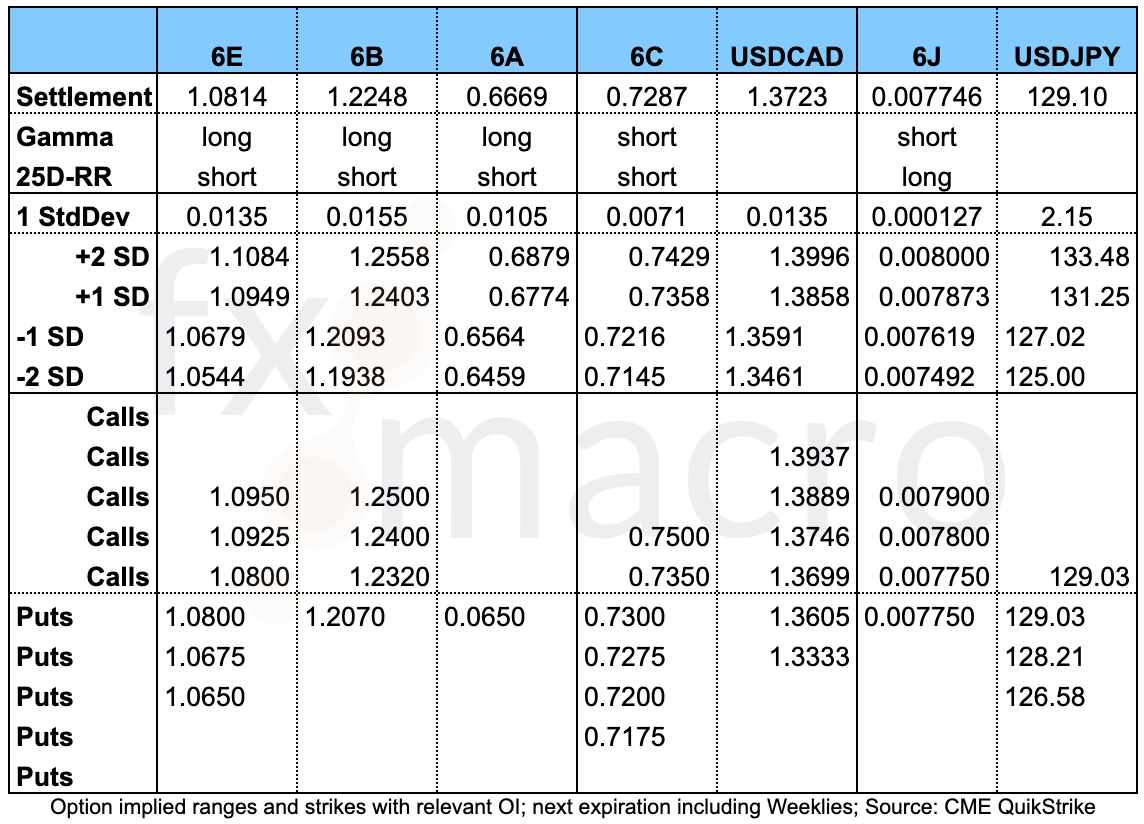

FOMC Rate Decision (22.03.23)

The Fed hiked by 25 bps as expected, and the shift in language was pretty dovish:

Guidance changed to: “The Committee anticipates that some additional policy firming may be appropriate” from: “anticipates that ongoing increases” will be appropriate

The US banking system remains resilient, recent developments will likely result in tighter credit conditions and will weigh on economic activity and inflation

From the Summary of Economic Projections:

GDP has been downgraded by 0.1% this year and 0.4% next year

PCE and Core PCE have both been upgraded for this year, Core PCE also for next year

The Fed funds rate projection remains unchanged at 5.1% for 2023 but was upped by 0.2% to 4.3% for next year

Here's the current dot plot and embedded the one from December:

SNB Rate Decision (23.03.23)

The SNB hiked by 50 bps to a policy rate of 1.5% as expected:

Guidance remains unchanged: additional rises in the policy rate cannot be ruled out, the SNB remains willing to be active in the FX market

The focus of FX activities has been on the selling of foreign currency for some quarters now

Countering a “renewed increase in inflationary pressure” with the rate hike, price increases are now broad-based; the inflation forecast is higher than in December because of stronger second-round effects and inflation increasing again abroad

Growth is likely to remain modest for the rest of the year and increase by around 1% in 2023

The measures taken by the SNB and FINMA regarding Credit Suisse have put a halt to the crisis

Bank of England Rate Decision (23.03.23)

The BoE hiked rates by 25 bps to 4.25%:

Vote split 7-2 in favour of the hike, two members preferred to leave rates unchanged

Guidance remains unchanged: if there were to be evidence of more persistent inflationary pressures then further tightening would be required

CPI increased unexpectedly in the latest release by remains likely to fall over the rest of the year, cost and price pressures have remained elevated

CPI is still expected to fall significantly in Q2/23 to a lower rate than anticipated in the February report

The likely near-term paths of GDP and employment are somewhat stronger than expected previously

The FPC judges that the UK banking system maintains robust capital and strong liquidity positions, the UK banking system remains resilient

Fiscal support that was announced in the spring budget could increase GDP by 0.3% over the coming years relative to the February report, real household income could remain flat due to the Energy Price Guarantee being extended

Here are the highlights from the Minutes:

Confab, Speakers, News

Federal Reserve

Powell (Neutral). Wed: We will continue to closely monitor banking conditions and we will use all the tools needed, banking events will result in tighter credit conditions and that's why we removed the line about "ongoing" tightening, we could think of the banking turmoil as a rate hike or perhaps more than that, "some firming" refers to our policy rate but I would focus on the words "may" and "some", almost all on the FOMC see growth risks weighted tot he downside, inflation is still well above our longer-run goal, no one should doubt we will bring it down, we expect the labour market to come into balance over time, longer-term inflation expectations appear well-anchored, disinflation is absolutely occurring, banking issues could have minimal effect or result in significant tightening but we just don't know yet, if we have to raise rates higher we will, no talks about changing the balance sheet runoff.

Bostic (Neutral). Fri: Rate hike was not an easy decision, there was a lot of debate at the last meeting, some were willing to say that uncertainty is really big and we should wait, inflation is still too high and the Fed needed to remain focused on that, clear signs that the banking system is safe and resilient.

Bullard (Hawk). Fri: Inflation is too high, still in a position to see disinflation this year, inflation expectations are relatively low, we will see if the Fed needs to react more or not, raised his own terminal rate forecast by 25 bps to 5.50-5.75%, sees 80% chance financial stress abates and discussion shifts back to inflation, a recession is a lower-probability outcome, probability of a global crisis from recent stress is low.

Barkin (Neutral). Fri: The case for raising rates this week was pretty clear, labour markets are tight, bringing inflation down creates better conditions for jobs.

European Central Bank

Visco (Dove). Mon: Monetary policy will account for the fact that the current situation will impact on lending and cost of capital, Eurozone banks do not have liquidity or capital issues, the Eurozone needs to quickly have a deposit protection tool like the one in the US.

Lagarde (Dove). Mon: Inflation is projected to stay too high for too long, interest rates remain our primary tool for setting monetary policy, wage pressures have strengthened on the back of robust labour markets and employees are aiming to recoup some of the purchasing power, very confident that capital and liquidity positions of Eurozone banks are well in excess of requirements, without financial tensions we would have indicated further hikes would be needed. Wed: We are neither committed to raise rates further nor are we finished on rate hikes, uncertainty around the rate path has increased, inflation is still high and underlying dynamics remain strong, we must and we will bring inflation down to target. Fri: The ECB is fully equipped to provide liquidity to the financial system, no tradeoff between price stability and financial stability, the ECB has tools to address both issues, will decide future rates based on incoming data, we need to progress on completing the banking union, further work necessary to create truly European capital markets.

Stournas. Mon: Policy will be data-dependent from now on, European banking system is well-equipped with capital. Fri: The ECB should not commit to any rate moves in advance.

Centeno (Dove). Mon: It is not so much the level of interest rates that is high but the speed of the rise, latest developments in European banking sector give us confidence in the decisions taken. Fri: Does not see rate hikes beyond what's already in the market, Eurozone banks not showing signs of tension.

Villeroy (Neutral). Mon: We cannot allow inflation to settle into the system, France should avoid a recession, welcomes UBS' purchase of Credit Suisse, regulation of French and European banks is better than that in the US.

Holzmann (Hawk). Mon: Would not rule out more 50 bps hikes but also wouldn't say they will necessarily come either. Thu: Recent events will be taken into account at the next ECB meeting but currently have not shown significant effect.

Kazaks (Hawk). Tue: Not possible to say we are done hiking rates, European banks are well capitalized, no reason to compare things with how it was in 2008.

Enria. Tue: There is no direct read-across of the US events to Eurozone banks, our banks generally operate with a more diversified customer base.

Nagel (Hawk). Tue: ECB's job is not done yet, must be bold and decisive, fight against inflation is not over, policymakers need to be "even more stubborn" in inflation fight, there is some way to go before reaching restrictive territory on rates, price pressures are strong and broad-based, expansionary fiscal measures risk fuelling inflation further, inflation projections contain upside risks, Eurozone banking system is resilient. Fri: It is necessary to raise policy rates to sufficiently restrictive levels, current interest rate level is not high in comparison to rates of inflation, recent wage deals are inconsistent with price stability and will prolong the period of high inflation, seeing signs of second-round effects from inflation-induced wage increases back to prices.

Lane. Tue: There are reasons to believe underlying inflation measures will ease over time, inflation falling is predicated on wage growth peaking this year.

Rehn (Hawk). Wed: ECB will prioritize price stability over financial stability.

Müller (Hawk). Thu: Inflation is still too high, the ECB should not hesitate to fight inflation.

Knot (Hawk). Thu: The ECB is unlikely to be done with rate hikes, still thinking we need a hike in May but size is uncertain, inflation risks are clearly tilted to the upside, second-round wage effects are increasingly visible, could gradually move to a full stop in APP reinvestments if there is no more market turmoil.

Sources. Wed: ECB source: increasingly confident the Eurozone banking system has withstood the financial turmoil allowing the ECB to resume rate hikes in due course.

Bank of England

Bailey (Neutral). Thu: We have raised rates a lot already and we don't know if 4.25% will be a peak in rates, seeing signs that inflation is peaking, we believe inflation will fall quite rapidly before summer, much more hopeful now that the UK won't enter a recession, does not believe we will see a repeat of a 2008 banking crisis. Fri: Very relieved that inflation is no longer rising like it was last year, interest rates will rise again if firms hike prices, if all prices try to beat inflation we will get higher inflation, risk of recession this year has gone down quite a lot, pretty string likelihood we will avoid a recession this year.

Mann (Hawk). Thu: We may be entering a different regime where central banks will have to work much harder in order to rein in inflation. Fri: Voted for 25 bps partly because inflation expectations have begun to moderate, the BoE has "quite a way" towards an appropriate level of monetary tightness; inflation expectations, credit conditions, inflation rate and demand will be important for May rate decision.

Reserve Bank of Australia

Kent. Mon: Will take account of financial conditions when deciding on rates, likely to take longer than usual to see full effect of higher rates on households, will respond as necessary to bring inflation down in a reasonable time, Australian banks are unquestioningly strong, not involved in the central bank swap operation.

Reserve Bank of New Zealand

Conway. Thu: We have to do more on rates if inflation expectations don't fall, inflation is high and widespread, incredibly determined to get inflation and inflation expectations back to target, no conflict between monetary policy and financial stability, the optimal path for interest rates has become less clear, expects New Zealand to enter a mild recession later this year as a consequence of monetary policy, the OCR is comfortably above neutral and having the desired contractionary effect.

Swiss National Bank

Jordan. Thu: We are raising rates to counter renewed increase in inflationary pressure, convinced that tightening of monetary policy is absolutely necessary, currently there is some necessity to tighten policy and we will look again in three months, inflation still clearly above the range for price stability, inflationary pressures have risen since December, willing to be active in FX market, recent focus has been on selling FX, Credit Suisse could have triggered a bigger financial crisis, takeover by UBS is a done deal.

Bank of Japan

Suzuki. Wed: Important for exchange rates to move stably and reflect fundamentals.

Economic Data

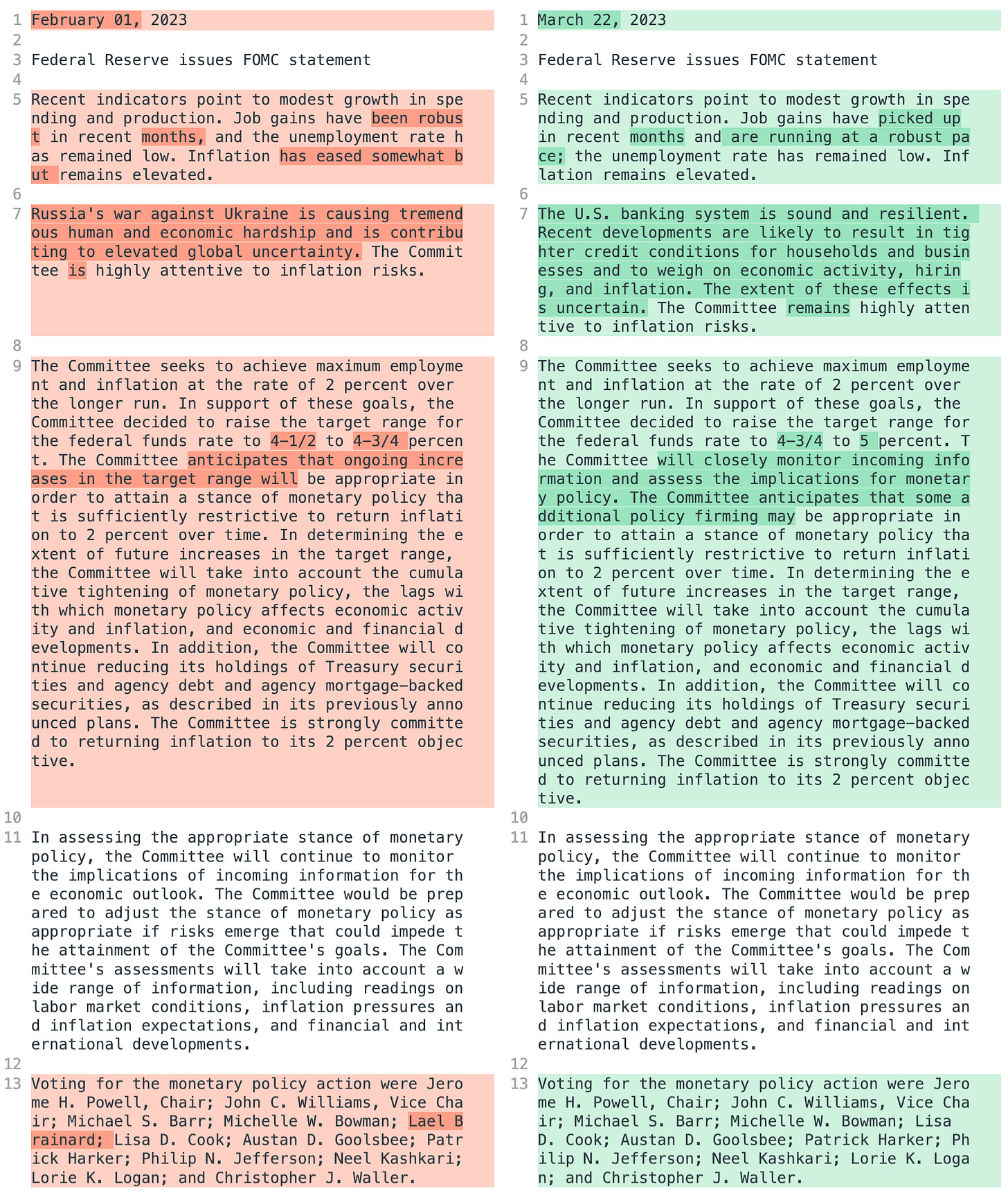

Monday, 20.03.23

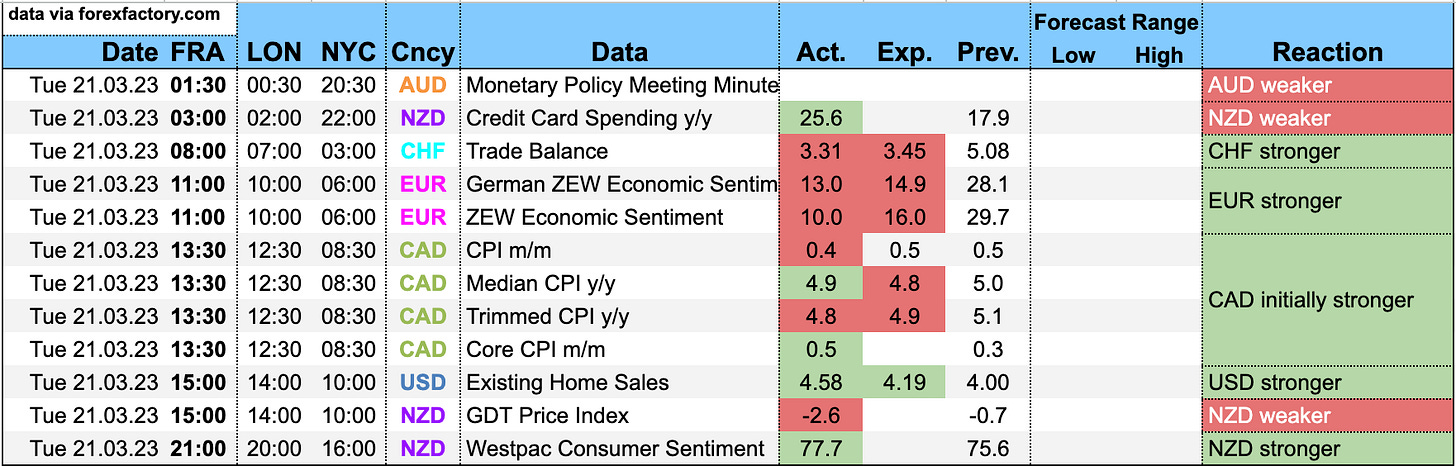

Tuesday, 21.03.23

Wednesday, 22.03.23

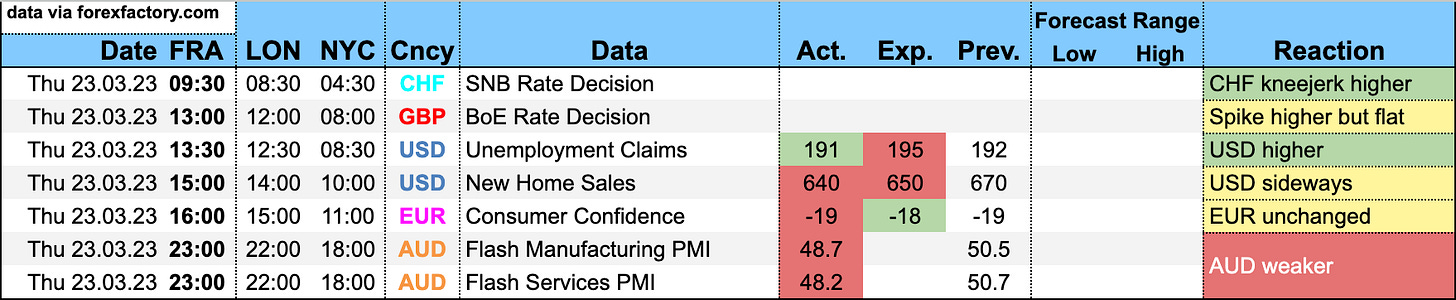

Thursday, 23.03.23

Some highlights from the Australian PMIs:

The Flash PMI results for March confirm that the economic slowdown that commenced in 2022 is continuing into 2023. The composite output and new orders indexes fell in March to be at the lowest levels since the Delta lockdowns in 2021. The March results are consistent with a soft landing for the Australian economy in 2023 and 2024 as the economy responds to higher interest rates.

The Judo Bank Australian PMI employment indexes suggest that Australian businesses are still looking to expand their workforce levels in early 2023 which should ensure that any potential rise in the unemployment rate in response to weaker economic growth will be moderate.

The price indexes are now at the lowest level since early 2021 providing further confirmation that Australian inflation has peaked in late 2022. The price indexes remain well above levels seen prior to the pandemic and suggest that there remains a high level of uncertainty about how far inflation will fall in 2023.

Against a highly uncertain global financial environment many are expecting the RBA to pause the tightening cycle. Recent strong employment numbers and uncertainty over the extent to which inflation will come down in 2023 point to a very close decision at the next RBA Board meeting in early April.

Friday, 24.03.23

German PMIs:

“The German economy took another small step in the right direction in March, according to latest flash PMI data. Business activity increased for a second straight month and the rate of growth picked up, although it remained only modest overall due to continued weakness in manufacturing.

“The manufacturing sector lacks momentum right now, with new orders remaining in decline amid a period of caution among clients and excess inventory levels. Unsurprisingly, growth expectations in the sector remain low.

“A key feature of the latest data was a deepening decline in manufacturing input costs, as material and energy prices retreat from their highs over the past two years and we see greater balance across supply chains.

“The supplier delivery times index surged higher in a sign of rapidly improving material availability, registering more than ten points above its previous record that was set just a month earlier. Notably, because the supplier delivery times index is inverted in the calculation of the manufacturing PMI, its sharp rise has helped push the PMI to its lowest for almost three years.

“The service sector did all the heavy lifting in terms of driving growth in March, and it’s also increasingly becoming the main source of inflationary pressure as pricing power in the manufacturing sector wanes.”

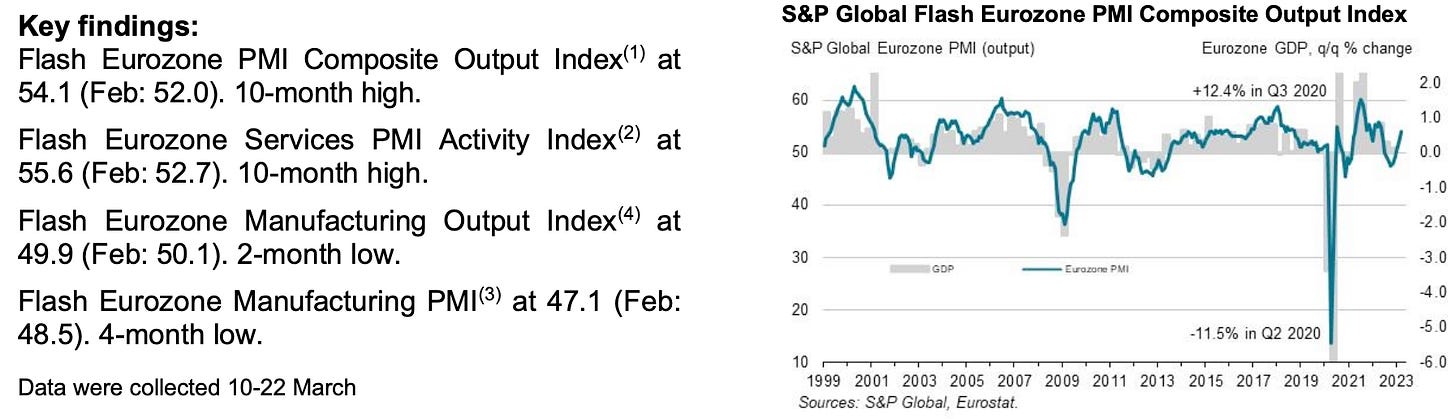

Eurozone PMIs:

“The eurozone economy is showing fresh signs of life as we enter spring, with business activity growing at its fastest rate for ten months in March. The survey is consistent with GDP growth of 0.3% in the first quarter, accelerating to an equivalent rate of 0.5% in March alone.

“Growth has been buoyed since the lows of late last year as recession fears and energy market worries fade, inflation pressures ease and the unprecedented supply chain delays seen during the pandemic are replaced with record improvements to supplier delivery times. Business confidence is also so far showing encouraging resilience in the face of further interest rate hikes and the uncertainty caused by recent banking sector stress.

“However, although inflationary pressures continue to moderate, the rate at which prices charged for goods and services are rising remains higher than anything seen in the survey history prior to the pandemic. Such stubborn inflationary pressures, fueled primarily by the service sector and rising wage costs, will be a concern to policymakers and suggests that more work may be needed in terms of bringing inflation down to target.

“Growth is also very unbalanced, driven almost solely by the service sector with manufacturing largely stalled and struggling to sustain production in the face of falling demand.”

UK PMIs:

“A relatively stable result for UK private sector business in March, even with the slight fall in manufacturing output. Customer demand picked up, supported by improvements in inflation rates and a solid rise in service business.

“The service sector continued on its robust growth path for the second month in a row and new orders accelerated at the fastest pace since March 2022 as confidence amongst consumers began to return. Overall activity would have been stronger if services businesses could have found more candidates with the right skills and experience as the labour market in the UK remains tight.

“The manufacturing sector’s undoing remained falling pipelines of new work. In spite of supply chain strength returning, less work resulted in job shedding and lower purchasing volumes as the sector failed to gain momentum and fell into contraction again.

“In contrast to recent consumer price inflation figures, the latest data showed that cost rises for businesses seem to be easing. With optimism the strongest since March 2022, private sector businesses are relieved that the UK appears to have dodged a recession, technically at least, though customs delays and the painful price increases in items such food and fuel remain challenges for the year ahead.”

And finally, the US PMIs:

“March has so far witnessed an encouraging resurgence of economic growth, with the business surveys indicating an acceleration of output to the fastest since May of last year.

“The PMI is broadly consistent with annualized GDP growth approaching 2%, painting a far more positive picture of economic resilience than the declines seen throughout the second half of last year and at the start of 2023.

“The upturn is uneven, however, being driven largely by the service sector. Although manufacturing eked out a small production gain, this was mainly a reflection of improved supply chains allowing firms to fulfil backlogs of orders that had accumulated during the post-pandemic demand surge. Tellingly, new orders have now fallen for six straight months in manufacturing. Unless demand improves, there seems little scope for production growth to be sustained at current levels.

“In services, there are more encouraging signs, with demand blossoming as we enter spring. It will be important to assess the resilience of this demand in the face of the recent tightening of interest rates and the uncertainty caused by the banking sector stress, which so far only seems to have had a modest impact on business growth expectations.

“There is also some concern regarding inflation, with the survey’s gauge of selling prices increasing at a faster rate in March despite lower costs feeding through the manufacturing sector. The inflationary upturn is now being led by stronger service sector price increases, linked largely to faster wage growth.”

Market Analysis

Growth and Inflation

The Atlanta Fed GDPNow model ticked lower this week to 3.2% for Q1:

The NY Fed Weekly Economic Index stands at 1.06:

Citi Economic Surprise Indexes:

USD, GBP and CHF are rising

EUR and NZD are falling

AUD, CAD and JPY are sideways

Bloomberg PMI heatmap:

The PMIs we have seen so far for March aren't looking much better…

Germany and the UK have worsened

Australia is worsening

The US has improved

The Eurozone remains red

It's important to note that these are only Manufacturing PMIs. We've seen divergent moves between Services and Manufacturing PMIs with the former outperforming for a few months now in a few economies.

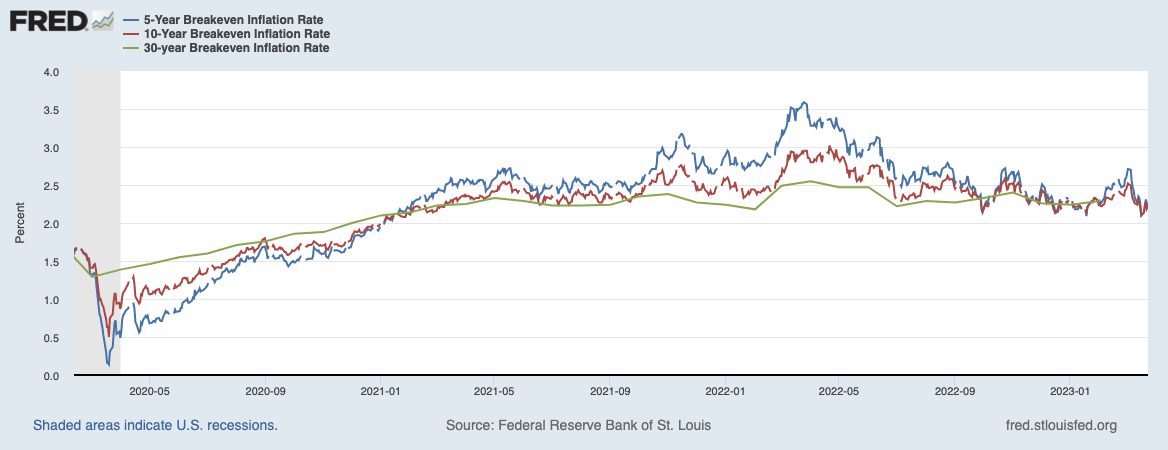

Breakeven inflation rates are up this week but they remain near the lower edge of their range:

5y5y forward inflation and RINF are trading sideways:

Citi Inflation Surprise Indexes update only once per month, so they remain unchanged from last week:

Ticks up in USD, EUR, CHF and JPY

Ticks down in GBP, AUD, NZD and CAD

As I’ve written before, I don’t think the CSII captures the current inflation dynamics very well

Yields

See chart and table below:

2y and 10y yields are coming down pretty much across the board

One notable exception is CHF where both have actually gone up, the other is CNY which has been holding up pretty well

Here are the G8 2s, 10s and 2s10s: the curves are mostly steeper but overall it's a fairly parallel move of both 2y and 10y yields lower.

The steepening of the yield curves and the high rate of change in the US, Canadian and German curves are clearly visible:

Central Banks and the US Dollar

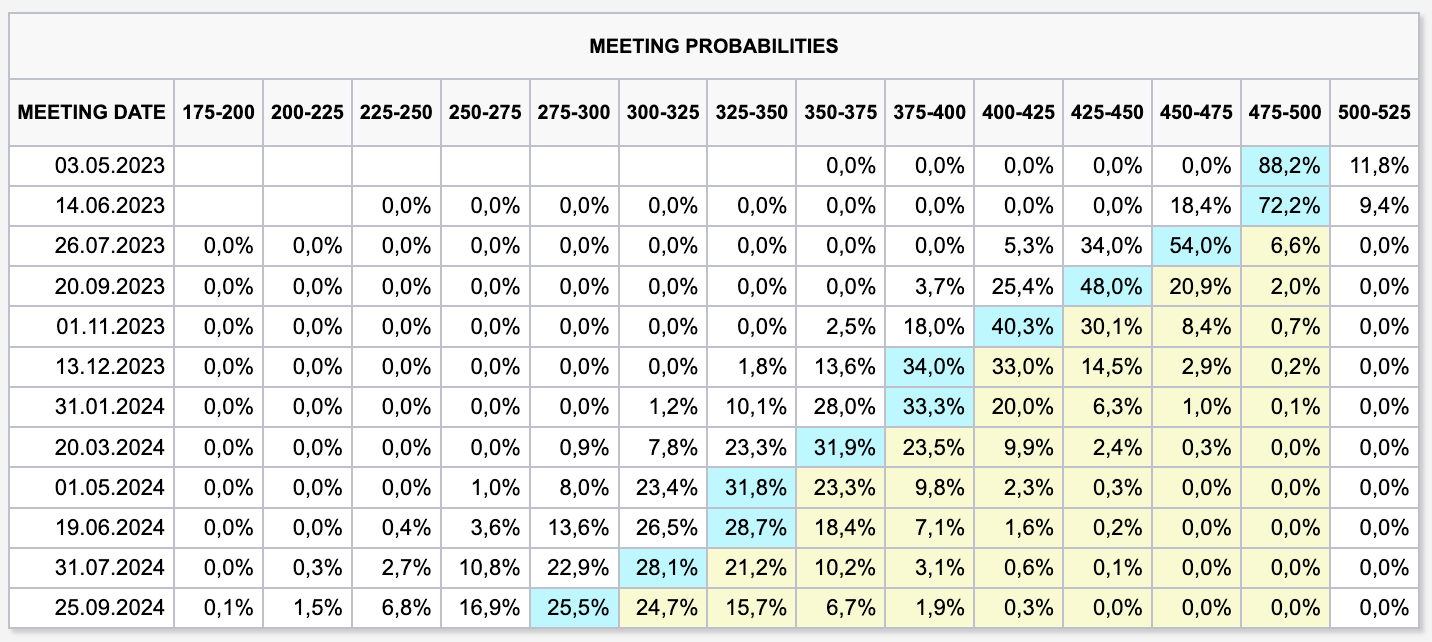

FedWatch is currently pricing an unchanged Fed Funds Rate for the May meeting:

88% chance of a hold vs. 12% for a 25 bps hike

The meeting in June is also priced for a hold

The first rate cut is expected for July, and interestingly there's a even 34% probability for a 50 bps cut

All in all, the market expects 100 bps worth of rate cuts this year

The implied Fed Funds Rate path is now somewhere in the middle of the last few days’ range:

The peak in the Fed Funds Rate is expected for May, and that's been fairly constant among all the ups and downs over the last two weeks:

Sectors and Flows

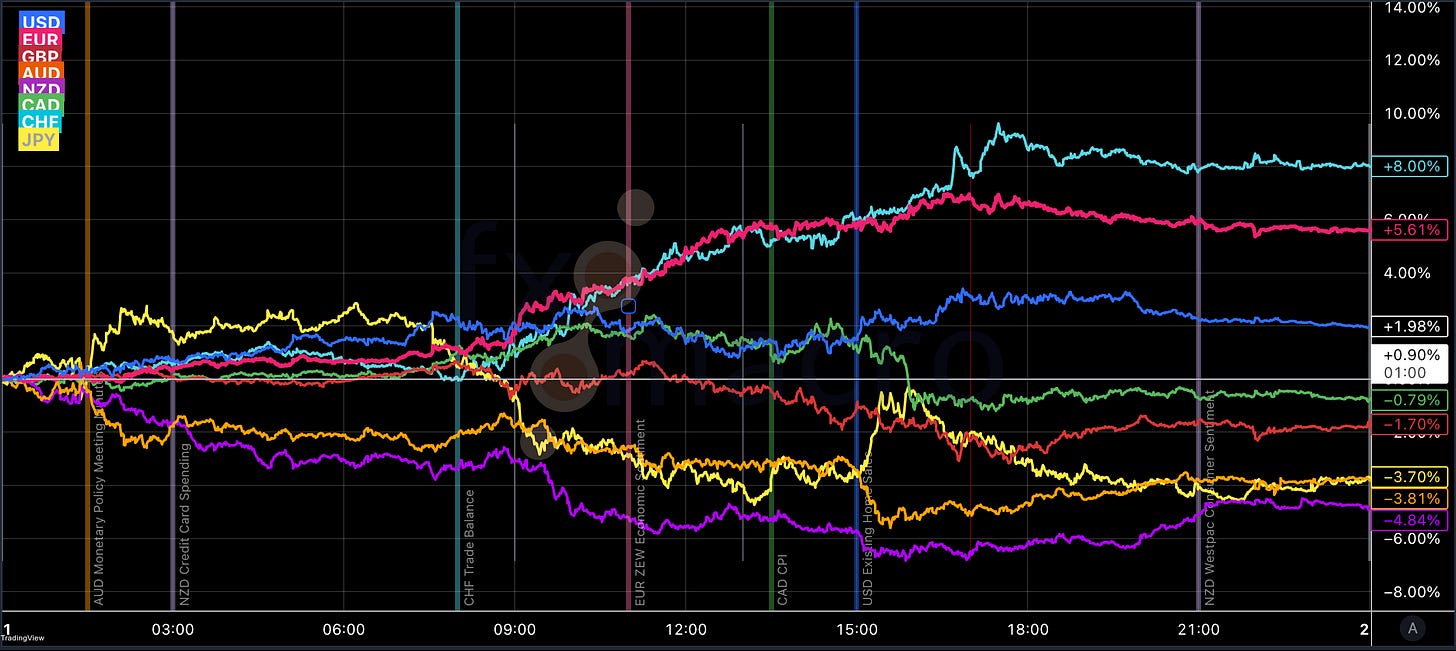

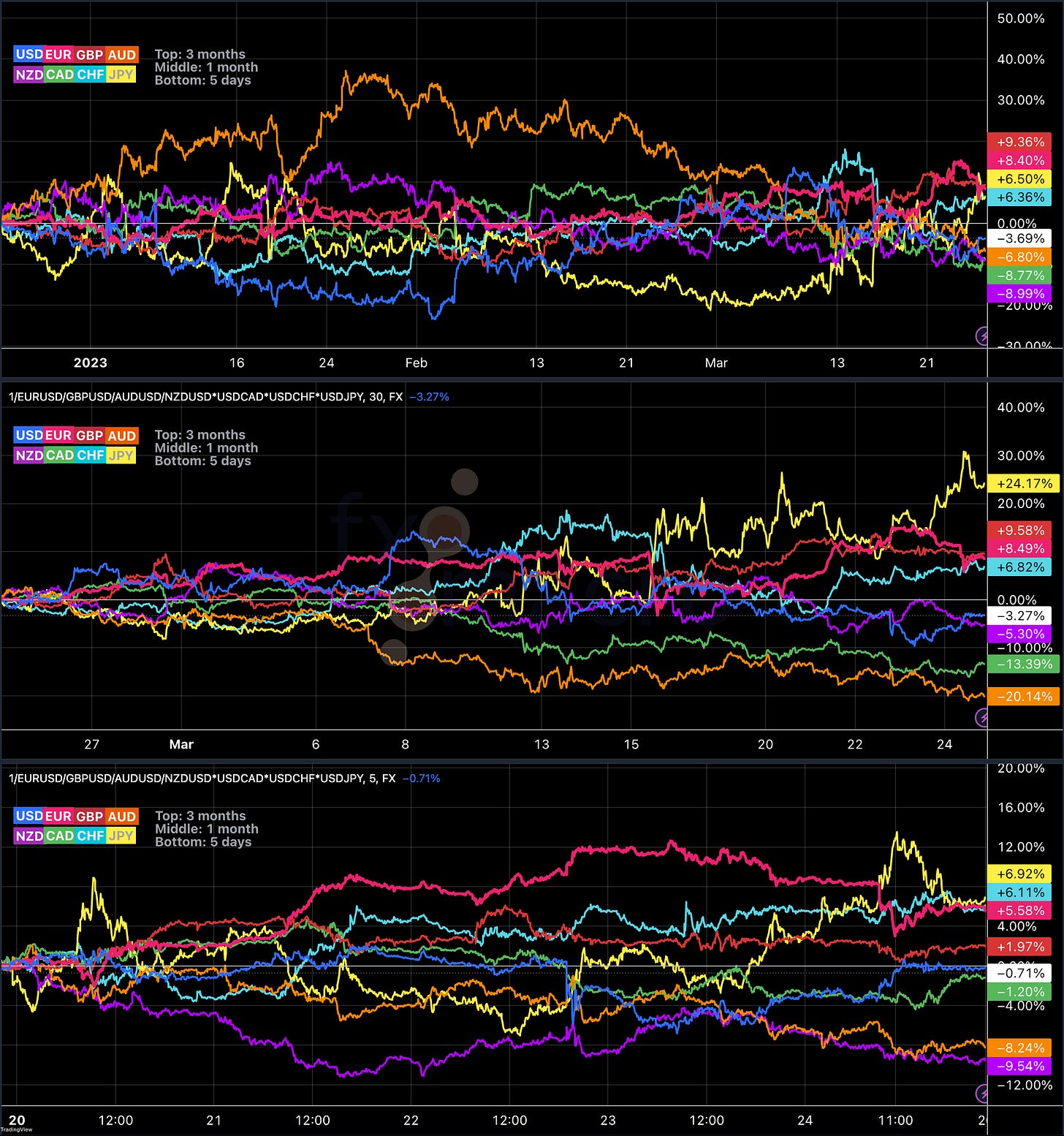

Currency strength:

JPY is the clear outperformer over one month, and it's been gaining strength since the banking crisis has started

GBP, EUR and CHF are also positive over one month

AUD is a consistent underperformer along with CAD and NZD

Here are the currency indexes over one year:

Fund Flows are staggering. Money market funds saw inflows of more than $111 billion just over the last week in the US, and over $10 billion in Europe:

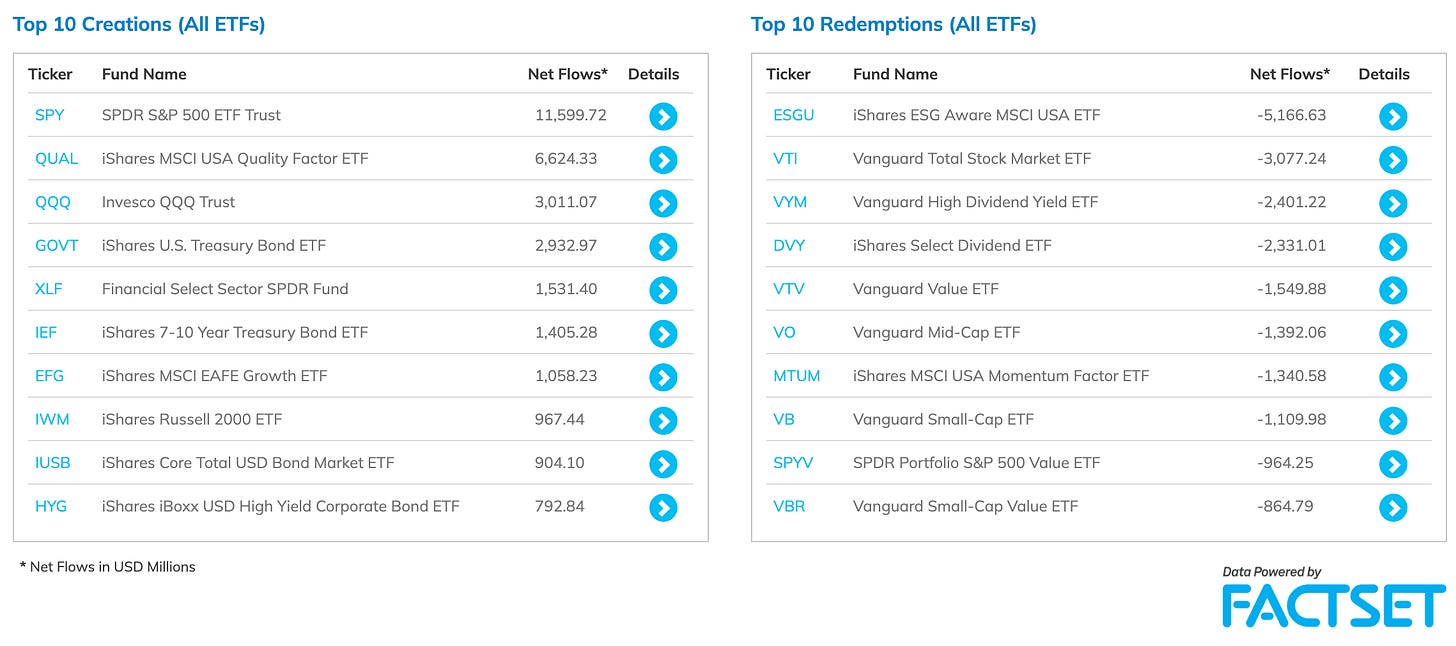

ETF flows saw heavy flows into SPY 0.00%↑ and QQQ 0.00%↑:

Equity sector performance:

Semiconductors, Tech and Growth are outperforming

Energy, Financials, Metals, Value are underperforming

Communication and Tech are the only two sectors with a positive performance over one month, Financials are down over 10%:

Sector breadth has improved a bit, and if we look at the 2-week performance window, i.e. roughly the timeframe of the banking crisis, it's not looking too bad with Energy and Financials both being down less than Communication and Tech are higher:

Sector thumbnail charts:

International stock markets:

The Nasdaq is outperforming, Taiwan's TW50 is a fairly close second

The Russell 2000 has the worst performance

Brazil and the UK come in next to last

The outperformance of European indexes has come to an end

Sentiment and Positioning

The AAII Bull-Bear spread has remained virtually unchanged compared to the week before:

Currency Sentiment:

Bullish sentiment on AUD, CAD and NZD increased since last week

Bearish sentiment is extreme for CHF, and it even increased since last week

Different sentiment source:

USDCHF, AUDUSD, EURCHF and NZDUSD have the most bullish sentiment

USDCAD has the most bearish sentiment by far

Commitment of Traders data is finally up-to-date again:

Equity futures were all positive this week. Positioning is very interesting: RTY is near bearish extremes, YM has Commercials at a bullish extreme, one-week position changes have been extreme for ES with Commercials buying 2.16 SD and Large Traders selling -2.34 SD.

VIX futures were once again deeply negative. Commercials are near a bearish extreme.

Treasury futures were mixed, extreme positions have been pared back significantly, only UB is still at/near bullish extremes. One-week changes in ZT and ZB have been bearish, the latter with changes >3 SD.

Currency futures were mixed this week as well, DX remains in bullish territory positioning-wise, 6C is still at a bullish extreme and 6E is near a bearish one.

Bitcoin has shown some surprising strength, it maintains a RSL of 1.37, i.e. it is 37% above its 26-week moving average.

Energy futures had one of their better weeks recently, positioning in CL remains at a bullish extreme.

Metals are all positive for the week, HG was up 4.7% and its RSL is 1.06. Positioning is neutral except for PA where Commercials and Large Traders remain near a bullish extreme

Grains were weaker except for ZC. Positioning in ZC and ZL is still very bullish, ZW is still far from bearish but it left extreme territory.

Softs were all higher this week with CT being the exception. CT also has Commercials/Large Traders at a bullish extreme.

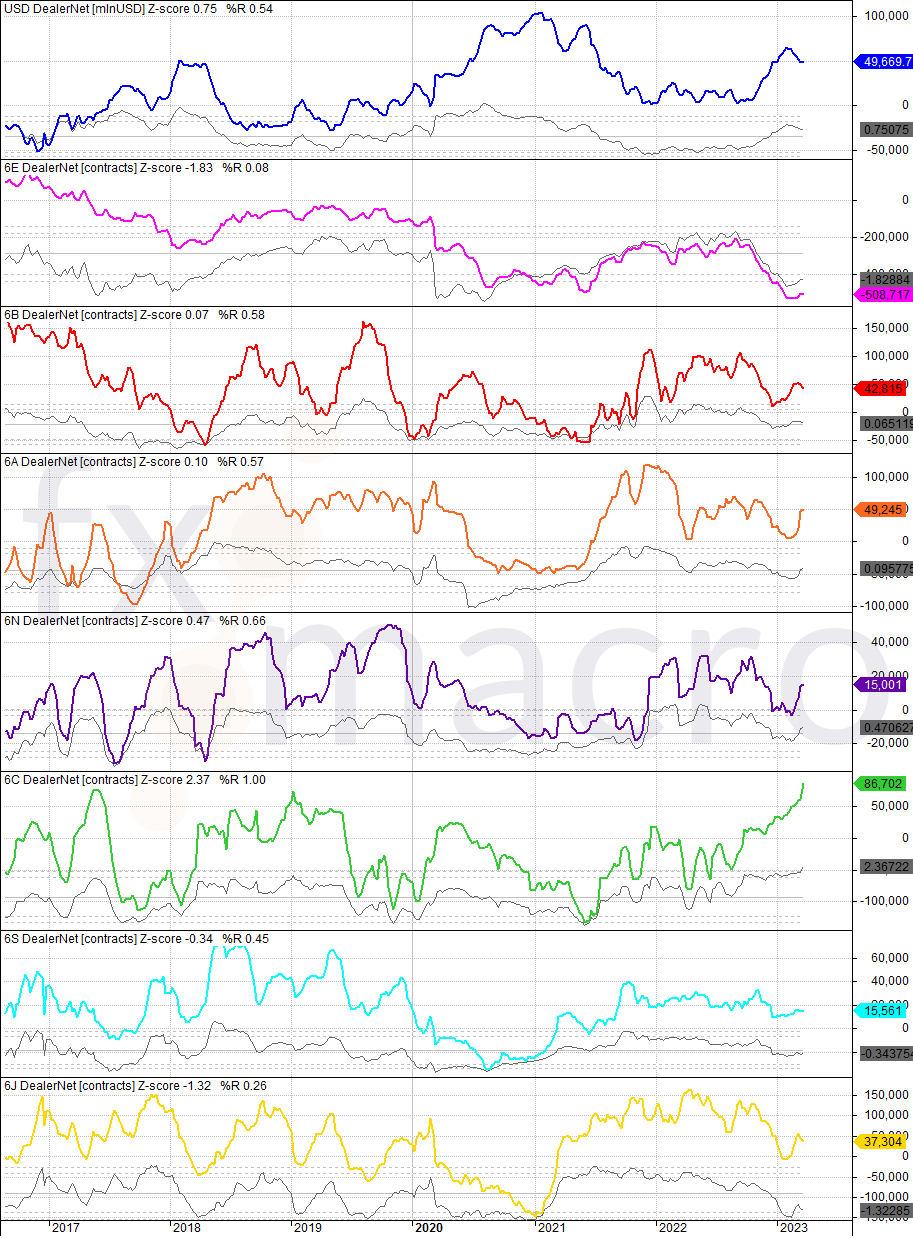

COT/TFF dealer net positions for currency futures:

6E is still near a bearish extreme

6C dealer net positions have shot higher over the last week to the highest in years; everyone is short 6C

Citi PAIN indexes show that the flight into USD has stalled somewhat:

Here's the combined COT/PAIN chart:

Market Risks

HY-OAS has widened and has held its level over the last two weeks; the picture looks similar for IG spreads:

The Credit Spread Index has approached its 2022 highs:

Currency volatility remains subdued:

The VIX term structure is on contango for the next few months, spot VIX is below the entire curve:

Volatility indexes:

VIX is at 21.73, MOVE has gone higher again over the last few days to 174

VVIX continues to drop, it is below 100 again

Skew has flattened again but it remains well above 2022 levels, i.e. OTM puts are still in demand

CNN Fear & Greed index is in Fear territory:

Various

The NYSE Advance/Decline Line is still not doing anything out of the ordinary:

The percentage of S&P 500 and Nasdaq stocks above their 200-day moving averages looks decidedly better for the Nasdaq:

The shorter-term 50-day metric is at levels for the S&P 500 that could be regarded as oversold in a bull market, and in the Nasdaq it's pretty much neutral:

25-delta risk reversals:

AUDUSD and NZDUSD are both seen higher

USDCAD is seen lower

Seasonality for April:

AUD, GBP, CAD and EUR are bullish

JPY, NZD and CHF are neutral

USD is bearish

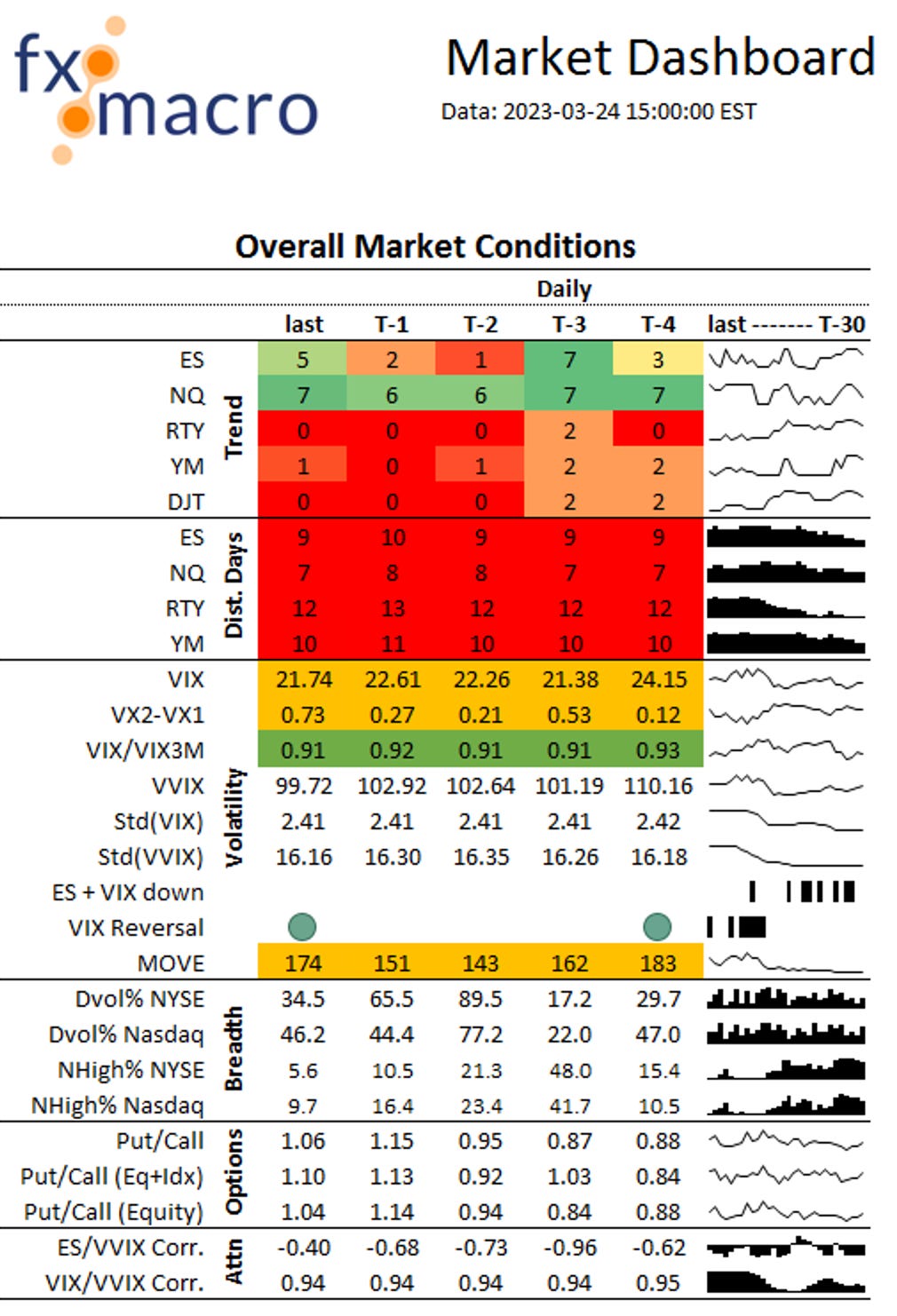

Finally, a look at the Market Dashboard:

Trend metrics have improved for ES and NQ but they remain dire for the other three indexes

Distribution days remain stubbornly high

The number of intraday VIX reversals has dropped a bit but they're still happening

MOVE had a bit of an intra-week drop but it's back near where we started

Put/Call ratios and breadth metrics show no signs of exhaustion to the downside (but to be fair, we haven't seen too much downside in stocks so far)

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 06/2023 | 50/2022 | 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 09/2023 | 02/2023 | 47/2022 | 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

ECB

Rate Statements: 12/2023 | 06/2023 | 50/2022 | 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 10/2023 | 04/2023 | 47/2022 | 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 11/2023 | 05/2023 | 50/2022 | 43/2022 | 36/2022

BOE

Rate Statements: 06/2023 | 50/2022 | 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

RBA

Rate Statements: 11/2023 | 07/2023 | 50/2022 | 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 09/2023 | 51/2022 | 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 07/2023 | 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 09/2023 | 47/2022 | 41/2022 | 34/2022 Meeting Minutes: 07/2023 Crib Sheets: 40/2022

BOC

Rate Statements: 11/2023 | 05/2023 | 50/2022 | 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022

SNB

Rate Statements: 50/2022 | 44/2022 | 39/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

BOJ

Rate Statements: 11/2023 | 04/2023 | 51/2022 | 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 05/2023 | 52/2022 | 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: Midjourney with the prompt: Sky burial, Tibetan funeral practice where the deceased are placed on a mountaintop to be eaten by scavenging vultures, bones, human remains, excarnation, himalayan mountain, macabre, dystopian, surreal

Thank you for taking the time to put all of this together.

Thanks. Enjoy the holiday