Welcome to issue #46 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary.

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

The cover image is AI-generated via Midjourney. If you want to guess the prompt, I put it at the end of the newsletter.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

A quick note: if you like the Market Dashboard and correlation matrixes I use and want to build something like it yourself, check out the 35-page guide with >50 screenshots I’ve put together:

Before we get started, I’d like to give a shout-out to one of the best trading newsletters out there. I read every one of their pieces, often twice:

Table of Contents

Summary (Playbook, Calendar, Levels, FX Drivers, Downloads)

Week in Review: a) Central Banks, b) Economic Data

Market Analysis: a) Growth and Inflation, b) Yields, c) Central Banks and the US Dollar, d) Sectors and Flows, e) Sentiment and Positioning, f) Market Risks, g) Various

Top 3 Macro Charts of the Week

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

I’ve written an article this week that explains what the following summary table aims to provide. You can check out the whole post with this link or jump straight to the relevant section with this one.

The table looks like I hate pretty much everything at the moment, and that's sort of true. Let's dumb it down a bit for my own clarity (and mental health):

The RBA and the BoC are the most newly-dovish central banks, so AUD and CAD are no longs.

The BoE has dialled back and they're already at the stage where further hikes aren't certain, so GBP is… meh.

The Fed has already switched gears as well but the assessment of what they will do changes with every new data point, and USD with it.

The ECB and the SNB are still hiking, so EUR and CHF are probably the best longs.

The NZD is the outlier with its hawkish RBNZ but it's just being overrun by its proximity to AUD and the overall risk-off environment.

There you have it. It's probably a better assessment of what I've put in the table above.

Economic Calendar for next week

Important levels to watch and look out for in FX futures

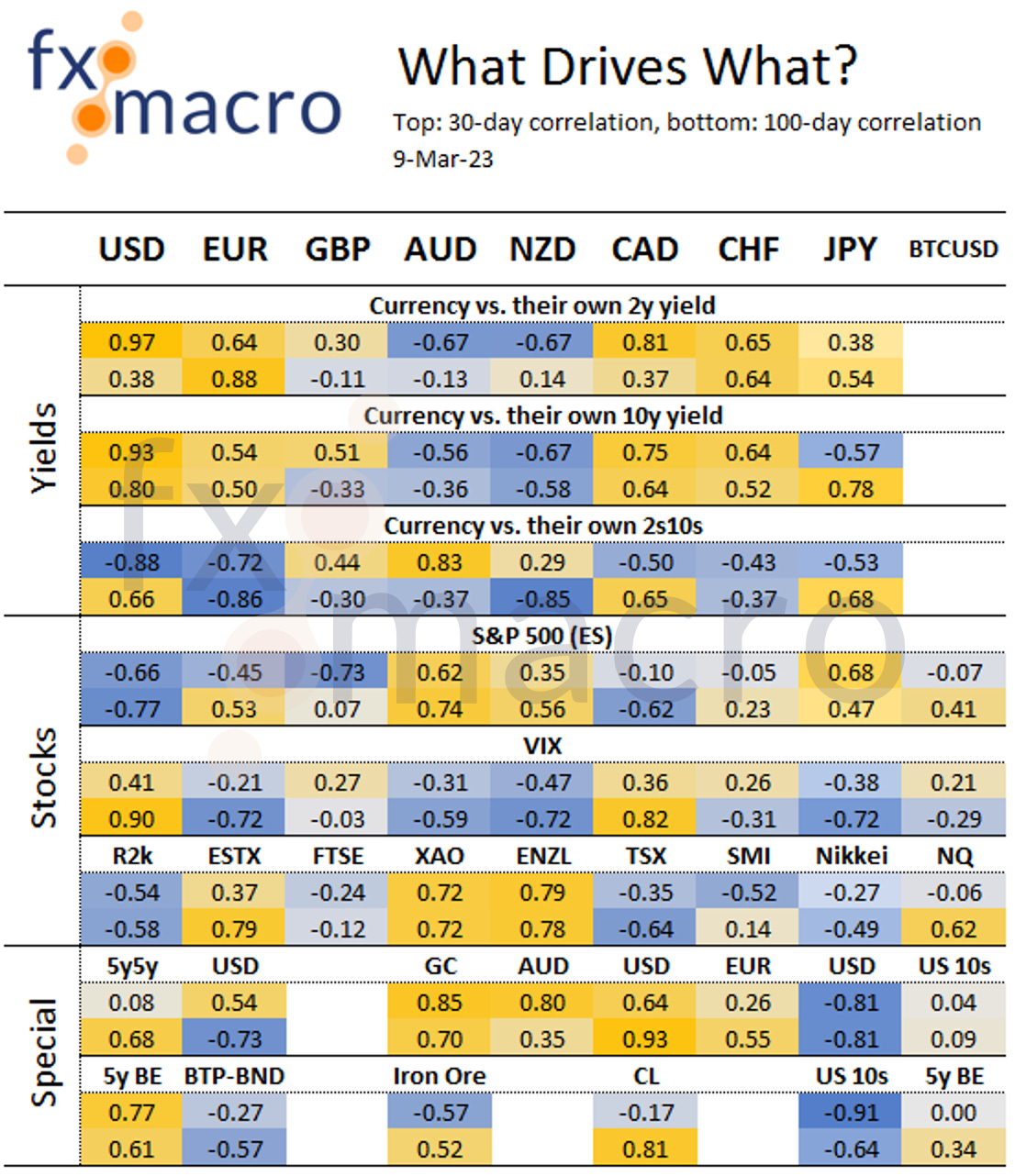

Currency Drivers

For an explanation check out this link.

Downloads and Links

Difftext of the Summary from last week: link to diffchecker.com

Central bank speaker recap for the week:

And the ECB Crib Sheet with all their comments since their last meeting:

Week in Review

Central Banks

RBA Rate Decision (07.03.22)

The RBA hiked by 25 bps to a policy rate of 3.60% as expected but with a dovish tilt. Here are the relevant bits of the statement and the difftext below:

Guidance changed:

Further tightening will be needed (from: further rate increases will be needed in the months ahead)

The Board will now assess “when and how much” rates have to rise instead of just “how much”

Headline inflation is moderating, service price inflation remains elevated

Monthly CPI suggests inflation has peaked in Australia

The central forecast is for inflation to decline this year and to be around 3% in mid-2025

Growth is expected to be below trend for the next couple of years

Wage growth is still consistent with the inflation target

BOC Rate Statement (08.03.23)

The BOC held its policy rate at 4.5% as expected:

Guidance is unchanged: they expect the policy rate to remain at its current level if economic developments are evolving broadly in line with their projections

Current policy stance is restrictive, QT will continue

Prepared to increase the policy rate further if needed (unchanged from previous statement)

Canadian growth was flat in Q4 and below the Bank’s projections

The latest data is in line with the Bank’s projections for CPI to come down

The labour market remains very tight

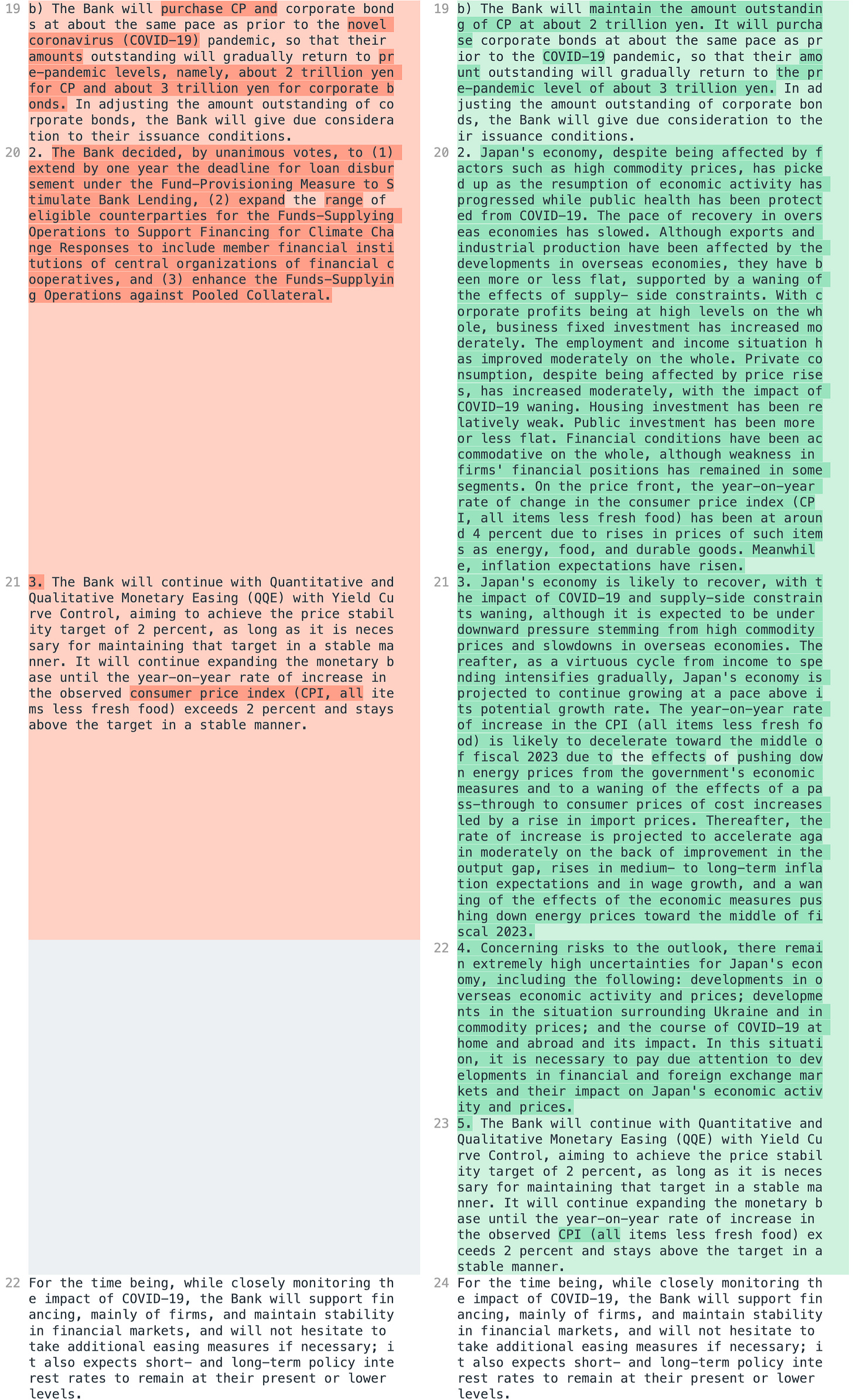

BOJ Rate Statement (10.02.23)

The BOJ left every relevant thing unchanged at this last meeting with Kuroda at the helm, you can see that in the difftext below. Here’s the summary of the rest:

Japan’s economy has picked up but is expected to be under downward pressure from high commodity prices and a global slowdown

Supply-side constraints have eased, supporting exports and industrial output despite a slowing recovery overseas, employment and income have improved moderately

CPI (all items ex fresh food) is likely to decelerate towards the middle of FY 2023, and likely to accelerate again after that; inflation expectations have risen

Confab, Speakers, News

Federal Reserve

Daly (Neutral). Weekend: Further policy tightening maintained for a longer term will likely be necessary, impact of policy is still ahead, inflation is still high and we have to think about continuous tightening, the disinflation momentum we need is far from certain, beginning to think the labour market has a shortage of workers, reshoring and the continued decline in labour force participation could mean more inflationary pressures ahead.

Powell (Neutral). Tue: We are prepared to increase the pace of hikes if the totality of incoming data indicates faster tightening is warranted, ongoing increases in the policy rate are likely appropriate, ultimate level of interest rates likely to be higher than previously anticipated due to latest economic data being stronger than expected, the ultimate rate we write down in the dot plot may well be higher than December, history cautions against loosening policy prematurely, will continue to make our decisions meeting by meeting, little sign of disinflation so far in core services excluding housing, we need to lower core services inflation ex housing to get inflation back to 2%, housing services will come down in 6-12 months. Wed: Have not made any decision about the March meeting, decision is data dependent and we will be guided by incoming data, the data we've seen so far this year suggests that the ultimate level of rates will need to be higher but we have some more data to come in before the meeting, as of today the data suggests a higher level.

Barr (Neutral). Thu: Crypto is still potentially transformative but needs appropriate guardrails.

European Central Bank

Lagarde (Dove). Weekend: Further rate increase is now "very very likely", in the short term core inflation is going to be high, must continue to take whatever measures necessary to bring inflation back to 2% and we will do so.

Lane. Mon: Hiking rates beyond March fits with what inflation pressures are suggesting, inflation pressures are still strong but there are some signs of easing, stronger pressures from food-related costs and labour market developments, weaker pressures from energy and supply-side bottlenecks.

Holzmann (Hawk). Mon: The ECB should raise rates by 50 bps at each of the next four meetings, hopes peak interest rates will be reached within the next 12 months, expects it will take a very long time for inflation to come down, we have a very large balance sheet and we probably need to be a bit more aggressive to reduce this to a reasonable level.

De Cos (Dove). Tue: Core inflation to stay high in the short term and then ease gradually.

Stournas. Tue: Will not pre-commit to specific further rate increase amid backdrop of headline inflation declining, confident that credit rating agencies will upgrade Greek bonds within months.

Knot (Hawk). Tue: ECB can be expected to keep raising rates for quite some time after March.

Visco (Dove). Wed: Does not appreciate colleagues' statements on prolonged rate hikes, the GC has agreed not to offer forward guidance, monetary policy should be guided by data as it becomes available, monetary policy will have to remain prudent.

Villeroy (Neutral). Thu: Inflation is still too high and should peak during the first semester, we will bring inflation back to 2% by end-2024 or end-2025.

Bank of England

Mann (Hawk). Tue: More needs to be done on rates, concerned about the persistence of inflation, question is how much is priced into the sterling, weak pound is quite significant for inflation, there has been quite a hawkish tone from the Fed and the ECB.

Dhingra (Dove). Wed: Prudent strategy would be to hold policy steady, many tightening effects are yet to fully take hold, overtightening poses a more material risk at this point.

Reserve Bank of Australia

Lowe. Wed: Closer to the point of a pause for rate hikes, further tightening likely to be required to bring inflation back to target, if the data suggests a pause prior to the next meeting we will do that, timing of pause will be determined by data and our assessment of the outlook, recent rate hikes have moved policy into restrictive territory, risk of a wage-price spiral remains low, inflation in services and rents still growing briskly.

Bank of Canada

Rogers. Thu: If the economy develops as forecast we shouldn't need to raise rates further, will need to see more evidence to fully assess whether policy is restrictive enough to return inflation to target, still more worried about the upside risk to inflation, near-term US and European outlooks could point to higher inflationary pressure in Canada, if the Canadian dollar depreciates imports will become more expensive and that will put upward pressure on prices.

Swiss National Bank

Jordan. Tue: We cannot rule out that we will have to tighten monetary policy again, ready to sell currencies, we can use interest rates but also sell foreign currencies to get the right conditions, can't always avoid second and third-round effects.

Bank of Japan

Matsuno. Thu: We need to discuss the joint statement with the new BOJ governor.

Kuroda. Fri: Will not hesitate to ease further if necessary, premature to debate specifics on exit from monetary easing, exit must be conducted only when 2% inflation is achieved sustainably, Japanese economy is picking up, large monetary stimulus helped push up the economy, regrettable that 2% inflation goal has not been achieved sustainably but it's still possible, expects Ueda to be able to achieve price and financial stability.

Economic Data

Monday, 06.03.23

Tuesday, 07.03.23

Wednesday, 08.03.23

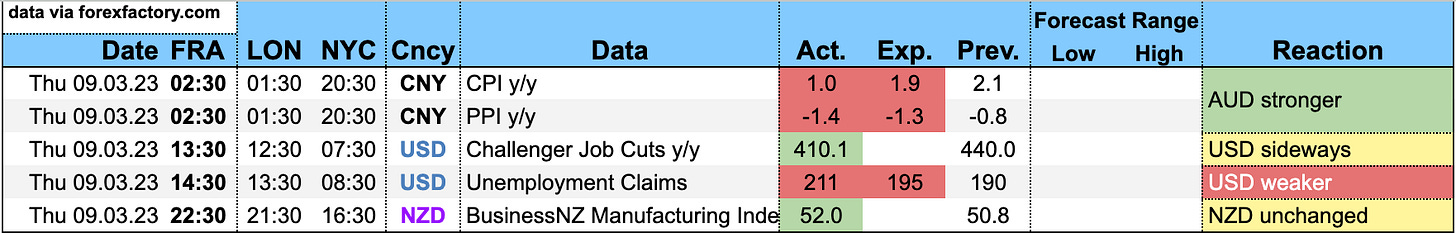

Thursday, 09.03.23

Friday, 10.03.23

Market Analysis

Growth and Inflation

The Atlanta Fed GDPNow model estimates Q1 growth at 2.6%:

The NY Fed Weekly Economic Index ticked down to 0.76:

Citi Economic Surprise Indexes:

USD, GBP and CHF are all higher

EUR and NZD are lower

AUD, CAD and JPY are going sideways

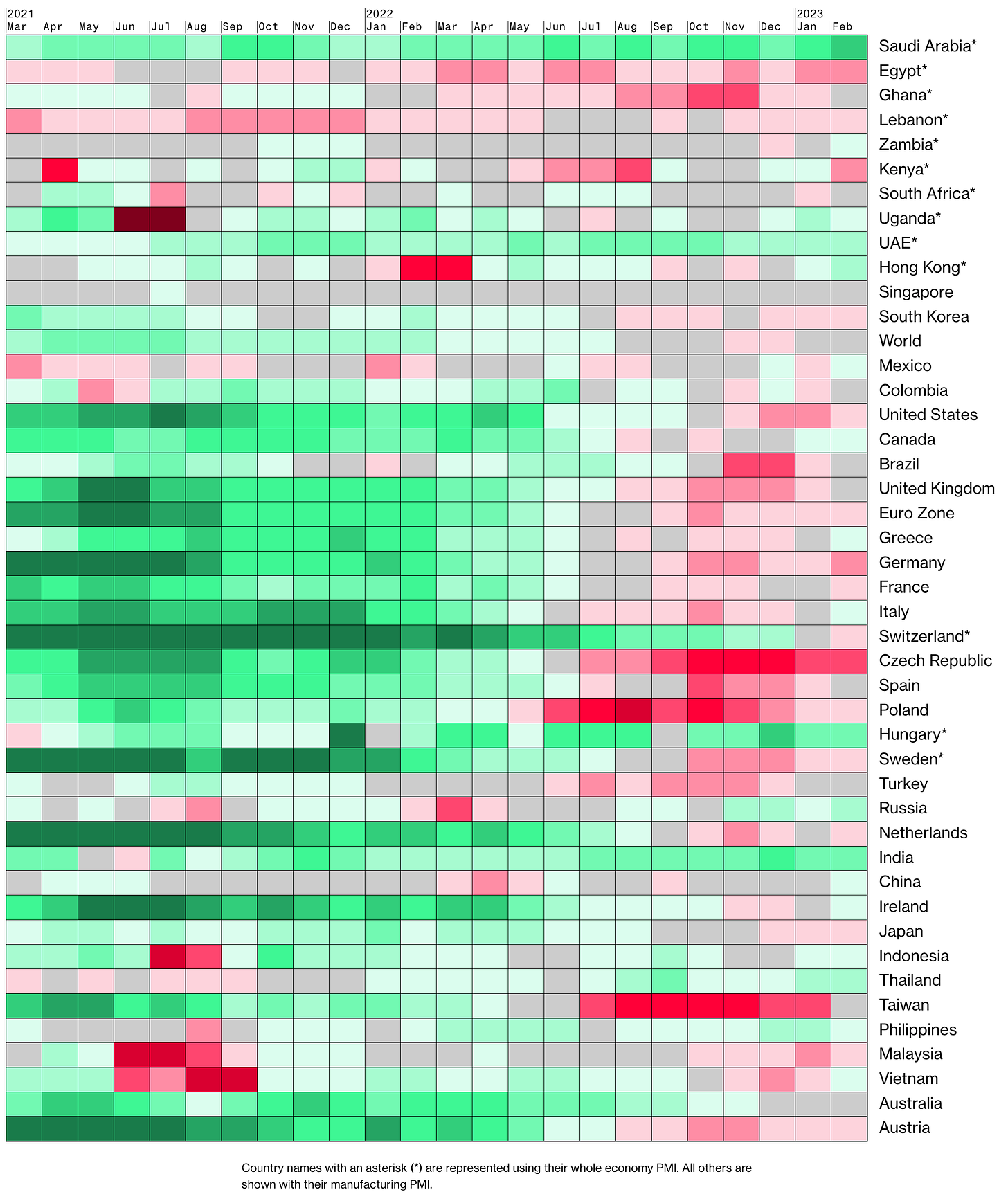

The Bloomberg PMI heatmap is unchanged from last week:

The US and the UK are improving

Canada, the Eurozone and Japan remain unchanged

Germany has weakened deeper into the red

Switzerland has worsened

Hong Kong and Taiwan have been improving further, China is now green as well, South Korea still in the red

Brazil and Mexico have improved

All in all, this looks very optimistic

Breakeven inflation rates have come down quite hard this week but remain within their longer-term range:

The 5y5y forward inflation expectation rate is also lower:

And RINF too:

Citi Inflation Surprise Indexes update only once per month, so they remain unchanged from last week:

Ticks up in USD, EUR, CHF and JPY

Ticks down in GBP, AUD, NZD and CAD

As I’ve written before, I don’t think the CSII captures the current inflation dynamics very well

Yields

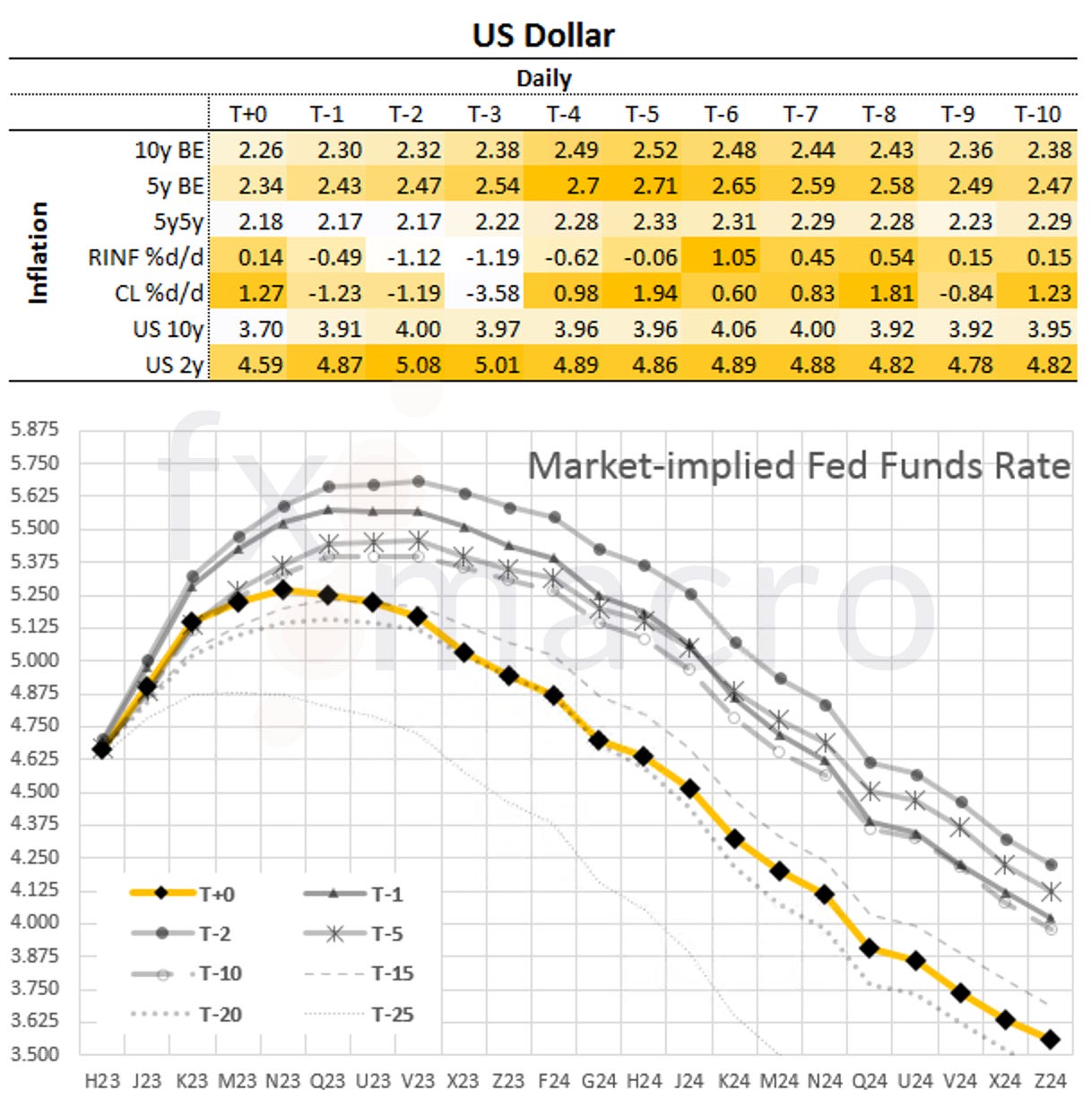

See chart and table below:

Yields came down last week across the board

USD and CAD look like they're the ones with the most negative rate of change

AUD seems to be the weakest

EUR and GBP are holding

NZD is only looking good because they missed the action on Friday afternoon

The moves in yields have been stark, especially on Friday and especially in US 2y and 10y yields. The curve bull steepened despite the flight to quality into the longer end, so the Fed put comes into play again:

Here's a bit of a high-level view of the G8 2s10s yield curves. The only curve that has not yet inverted is the Aussie one (and Japan, of course, but they don't count):

Central Banks and the US Dollar

We have about 11 days to go before the next FOMC statement. Target rate probabilities according to FedWatch had quite a ride this week. The current situation is:

68% for a 50 bps hike, 32% for 25 bps

The terminal rate is seen higher than last week at 5.50-5.75%; the data for September to December seems to be faulty

The first rate cut is priced in for March 2024 as it was last week

The Fed Funds forward curve has basically imploded on Friday:

Here's the same data as a table. The terminal rate is now more than 40 bps lower than two trading days ago. It has also shifted “forward” in time, i.e. it's now priced in the N23 future (July) instead of V23 (October).

As a side note, after this week's RBA meeting, expectations for another hike by the RBA in April are currently just around 30%:

Sectors and Flows

Currency strength:

This week saw a pretty clear risk-on/risk-off picture with CHF and JPY outperforming and AUD, NZD and CAD lagging

Over a one-month timeframe, things are a bit more mixed with USD and CHF on top and AUD underperforming badly

Here are the currency indexes in their raw form, and you can see how impressive the overall strength in the EUR has been, how AUD has sold off since February and the new-found strength in CHF:

Equity sector performance:

Semiconductors, Oil Services, Metals, and Tech are still the outperformers

Healthcare, Utilities, and Staples are the underperformers

Things have taken quite a turn from last week:

Defensives are now the relative outperformers over one month

Other defensive sectors are found somewhere more towards the middle (Utilities, Healthcare)

Tech and Communication Services are still leading over a 3-month timeframe

Sector breadth has deteriorated further, less than one quarter of sector ETFs is now positive over 30 days:

Sector ETF charts look worse than last week, which isn't too surprising given overall market action. The implosion of XLF (bottom row, middle) is impressive:

International stock markets:

Pretty much everyone is holding up vs. the US indexes

Europe is still outperforming

Hang Seng is the underperformer

Sentiment and Positioning

The AAII Bull-Bear spread is virtually unchanged from last week:

Currency sentiment:

AUD longs have gotten even more optimistic compared to last week

Same for CAD

CHF is the most hated currency at the moment

JPY and NZD sentiment is bullish

It's a bit of a weird picture because the only currency with a relevant amount of bears is the CHF

IG Sentiment also shows that the Swissy is pretty un-loved at the moment because USDCHF and EURCHF are the currency pairs with the most bearish sentiment on CHF:

Commitment of Traders data is still not available, so once again please disregard the COT data in the following table.

Stocks had a rough week with the RTY down over 8%. The Relative Strength (RSL) has also taken a bit of a hit.

The VIX future is up 24% this week.

Treasury futures are all positive

Currency futures ended the week mixed with 6A, 6N and 6C down.

Bitcoin is also down about 11% this week; it's now trading around its 26-week moving average, i.e. its RSL is about 1.

Energy futures were all lower this week, NG posting double-digit losses again.

Metals were mostly negative except for GC, which posted a small gain.

Grains and softs were mostly weaker this week. The weakness in ZC, ZW and ZL has been ongoing for weeks and months now.

The missing COT data makes me feel like we're flying blind.

An interesting change in the Citi PAIN index that shows flows back into USD and out of everything else:

Here's the combined COT/PAIN chart:

Market Risks

High yield and IG spreads have ticked up (data is as of Thursday, so they don't include yesterday's market action):

The Credit Spread Index also ticked higher:

Currency volatility has increased a bit but it's still pretty much contained:

Rollercoaster is probably the accurate description of what the VIX term structure looks like. But: it's essentially flat because the y-axis only covers 1.25 points in total. It's a backwardation but barely so, and that's surprising in light of Friday's VIX spike:

Volatility indexes:

VIX spiked to a high of almost 29 on Friday but closed over four points lower

VVIX has made it above 100 for the first time in months

MOVE is at 140

The 1-day move in far-OTM skew (TDEX) shows how the market has scrambled for puts to hedge

The CNN Fear & Greed index has made it to Extreme Fear:

The US 5y CDS continues to go higher:

Various

The NYSE Advance/Decline line is tracking price:

The percentage of index constituents above their 200-day moving averages has come down to well below 50% for the S&P 500, and it seems to hold up a bit better for the Nasdaq:

The shorter-term 50-day moving average metric is looking similar, and the S&P 500 is almost in oversold territory:

25-delta risk reversals:

There has been a repricing in favour of the USD in EUR, AUD, NZD and CAD over the last few days

USDCHF is the exception as risk reversals are pricing it lower

Finally, a look at the market dashboard:

Trend metrics have worsened, only the NQ is sort of holding up (which fits in with the better breadth data compared the the S&P we've seen above)

Distribution days are back in double-digits for everyone except for the Nasdaq

VIX and MOVE are both elevated, the front-end of the VIX curve is flat but not inverse, VIX/VIX3M is still in contango

We had a VIX reversal signal on Friday, and on Thursday we had a day with >90% down volume, which are both possible signs of a short-term oversold market and a possible bounce

Put/Call ratios are now all above 1 but not at extremes typically seen at major lows

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 06/2023 | 50/2022 | 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 09/2023 | 02/2023 | 47/2022 | 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

ECB

Rate Statements: 06/2023 | 50/2022 | 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 10/2023 | 04/2023 | 47/2022 | 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 05/2023 | 50/2022 | 43/2022 | 36/2022

BOE

Rate Statements: 06/2023 | 50/2022 | 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

RBA

Rate Statements: 07/2023 | 50/2022 | 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 09/2023 | 51/2022 | 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 07/2023 | 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 09/2023 | 47/2022 | 41/2022 | 34/2022 Meeting Minutes: 07/2023 Crib Sheets: 40/2022

BOC

Rate Statements: 05/2023 | 50/2022 | 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022

SNB

Rate Statements: 50/2022 | 44/2022 | 39/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

BOJ

Rate Statements: 04/2023 | 51/2022 | 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 05/2023 | 52/2022 | 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: Midjourney with the prompt: “Doomsday clock in a destroyed city”

Thanks sir! My view USD may continue weaken as money flows to Treasury and gold due to banking crisis.

Excellent summary as usual. Thank you putting the effort. Few understand the amount of work required to produce such varied data points.