Outlook for Week 10/2023

"It doesn't matter how slowly you go as long as you don't stop." - Confucius

Welcome to issue #45 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary.

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

The cover image is AI-generated via DALL-E 2. If you want to guess the prompt, I put it at the end of the newsletter.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

A quick note: if you like the Market Dashboard and correlation matrixes I use and want to build something like it yourself, check out the 35-page guide with >50 screenshots I’ve put together:

Before we get started, I’d like to give a shout-out to one of the best trading newsletters out there. I read every one of their pieces, often twice:

Table of Contents

Summary (Playbook, Calendar, Levels, FX Drivers, Downloads)

Week in Review: a) Central Banks, b) Economic Data

Market Analysis: a) Growth and Inflation, b) Yields, c) Central Banks and the US Dollar, d) Sectors and Flows, e) Sentiment and Positioning, f) Market Risks, g) Various

Top 3 Macro Charts of the Week

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Correction (04.03.22, 21:00 GMT): In the summary for JPY I wrote: “Still, with US treasury yields topping out at some point and my bias for the dollar, I will be looking for shorts”. Of course, I got the decisive word wrong: I will be looking for longs this week, not shorts.

Another correction (06.03.22, 21:00 GMT): Thanks to the reader who noticed that I had not updated the bias and colour for EUR despite my conclusion summary. I've changed that.

Economic Calendar for next week

Important levels to watch and look out for in FX futures

Currency Drivers

For an explanation check out this link.

Downloads and Links

Difftext of the Summary from last week: link to diffchecker.com

Central bank speaker recap for the week:

Week in Review

Central Banks

ECB Minutes (02.03.23)

There were few things in the Minutes that were really news:

There was broad support for hiking rates by 50 bps

It was “generally felt” that concerns of overtightening were premature

There was a bit of disagreement on the communication strategy of guidance for the March meeting

There was a discussion about giving more weight to the risks of overtightening than the apparent broad consensus

Here are the highlights:

Confab, Speakers, News

Federal Reserve

Jefferson. Mon: There is a lot of resolve at the Fed to do what it takes to bring inflation down, under no illusion that it will be easy to get inflation back to target, could take some time, inflation may be more persistent but we can't overreact to one data point.

Kashkari (Hawk). Wed: Open-minded on 25 vs. 50 bps at the next meeting but signals in the dot plot are more important, in December thought rates need to go to 5.4% and hold, leaning towards continuing to push up this policy path, says he doesn't overreact to one month of data, inflation is not yet driven by the labour market, wage growth too high to be consistent with 2% inflation, rate hikes so far have not brought down services inflation.

Bostic (Neutral). Wed: Rates need to rise to 5-5.25% and stay there well into 2024, Fed is not there yet on inflation battle. Thu: Firmly in the 25 bps camp, we could be in a position to pause by mid-to-late simmer, the Fed may have to do more given inflation, won't decide on proper path of policy until the next meeting, policy should begin to bite in the Spring, risks are now roughly balanced, will need to have some kind of slowdown in labour market but not catastrophic.

Collins (Neutral). Thu: Number of additional hikes will be determined by incoming data. Fri: More hikes will be needed to lower inflation, we have more work to do, will likely need to stay at the stopping point for rate hikes for a potentially extended period of time.

Waller (Hawk). Thu: May need to raise rates beyond December 5.1-5.4% central tendency if incoming jobs and inflation data does not pull back from strong readings in January, last month's data challenged my view that we are making significant progress on moderating activity and reducing inflation, the labour market is tightening instead of loosening, the FOMC's dual mandate objectives will be achieved but there may be some bumps on the path, any fears we might face two-sided risk in achieving dual mandate was blown away by January jobs numbers, we have not made as much progress on both headline and core inflation as thought, the fight to bring down inflation will be slower and longer than expected just a month or two ago.

Logan (Neutral). Fri: US financial sector increasingly vulnerable to shocks, markets are falling behind on ability to support treasury market during stress, central bank interventions in treasuries should be rare, need to clarify bond buying when done for market support.

Bowman (Neutral). Fri: Key issue for central banks is how to clearly distinguish asset purchases from monetary policy actions, the pandemic showed the effectiveness of lending programs as backstops to support market functioning in times of stress.

Barkin (Neutral). Fri: We can raise rates further than forecast if inflation persists, does not expect rate cuts this year, inflation is likely past its peak, view is still in step with the FOMC, inflation expectations are well-anchored but under-surface movements warrant caution.

European Central Bank

Lagarde (Dove). Weekend: There's every reason to believe we will do another 50 bps in March, after that we will see, we are data-dependent, will do more hikes if inflation doesn't return to our target of 2% in a timely manner. Wed: Pace of further hikes beyond March will be decided on the basis of data, essential to balance too-gradual recalibration with excessive tightening. Thu: We still have to pursue higher rates, don't know peak level yet, will have to stay at higher levels for longer, future rate path will be data-dependent, have to use all the tools at our disposal to bring inflation down, price decline is not stable, bringing down inflation will take some time.

Visco (Dove). Weekend: Can't say what the terminal rate will be because it's data-dependent, we'll be more restrictive if we need to be.

Vujic. Mon: Markets are right to price in 50 bps at the March meeting, must persevere as long as core inflation persists, not the ECB's role to say where the terminal rate should be, will soon be in restrictive territory, must consider both headline and core inflation, headline inflation is set to fall.

Lane. Tue: The case for a 50 bps hike in March remains solid, rate plateau should be held for some time, could be in restrictive territory for a number of quarters, need lower realized underlying inflation for rate hikes to end.

Nagel (Hawk). Wed: Further significant rate hikes beyond March are needed, rate cut talk is a "non-starter", favours a steeper reduction in APP portfolio from July onwards, drop in energy prices has no essential bearin on the ECB's medium-term inflation projections.

Villeroy (Neutral). Wed: Would be desirable to reach terminal rate by summer, September at the latest, now entering a new phase of monetary policy that's more comparable to a long-distance race.

Schnabel (Neutral). Thu: The current size of our balance sheet is larger than necessary to effectively implement our monetary policy stance, current estimates suggest that the amount of central bank reserves currently held by the banking sector exceeds the level necessary to steer short-term market rates close to our key policy rate even under a floor system by a significant margin.

Wunsch (Neutral). Fri: Looking at rates of 4% should not be excluded, won't make any judgment on where rates would have to go without seeing the developments of core inflation, have to do more if core inflation remains at the current level and if we don't get any signals that it is going down.

De Guindos (Dove). Fri: Interest rate path after March will be data-dependent, headline inflation will continue to decline and could fall below 6% around mid-year, core inflation could have a more stable performance.

Vasle. Fri: Expects additional rate hikes after the one in March.

Müller (Hawk). Fri: March rate hike most likely not the last, rates will have to stay high for some time, high core inflation is more worrisome than headline inflation.

Bank of England

Bailey (Neutral). Wed: Further rate hikes may be appropriate but nothing is decided, would caution against suggesting either that we are done with rate hikes or that we will inevitably do more, if we do too little on rates now we have to do more later on, inflation has been slightly weaker and activity and wages slightly stronger (emphasis on "slightly" in both cases).

Pill. Thu: GDP is projected to fall slightly over the coming quarters, the current momentum in economic activity may be slightly stronger than anticipated, GDP expected to be close to zero in Q1, the labour market is tighter than unemployment rate would suggest.

Hauser. Fri: BoE executive director for markets: last year's events revealed material weaknesses in pension fund and LDI risk management, public backstops must not be a substitute for a failure to achieve the appropriate level of private insurance against liquidity risk.

Reserve Bank of New Zealand

Orr. Fri: Need to bring inflation back to target range, need to do it over a reasonable horizon so as not to unnecessarily crash the economy.

Bank of Japan

Ueda. Mon: Appropriate and necessary to keep easy policy despite various side-effects emerging, positive signs emerging on trend inflation, not considering altering the 2% inflation target for now, inflation is not determined by monetary policy alone, extremely important to convey intention of monetary policy to financial markets, if maintaining current policy does not push up trend inflation we need to come up with more sustainable easing framework, does not think continuing YCC will cause hyperinflation.

Wakatabe. Mon: 2% inflation target has not yet been achieved.

Uchida. Tue: Too early to seek an exit from monetary stimulus, no need to revise the joint statement immediately, Japan no longer in a situation described as deflation after years of stimulus, changing the 2% inflation goal is unthinkable, Japan is no longer in a situation described as deflation, monetary easing is needed from now on as well, shouldn't review policy just because there are side-effects.

Himino. Tue: Best approach is to support the economy with easy policy until inflation reaches the BOJ's target excluding the impact of import price increases, must think of various scenarios when steering smooth exit from easy policy.

Nakagawa. Wed: Easy monetary policy is important for the time being, recent rise in inflation driven by a handful of goods and will likely slow in pace of increase, economy likely to expand above potential growth, strong uncertainty how much wages will rise.

Takata. Thu: Must maintain current massive monetary easing, Japan has not yet experienced sustained price increases accompanied by wage increases, CPI likely to have a slower pace of increases in second half of FY2023, outlook for wage negotiations difficult to foresee due to economic uncertainty overseas.

Suzuki. Fri: Government will address rising energy and food prices, up to the BOJ to decide how to dispose of its ETF holdings, expects the BOJ to conduct policy appropriately.

People’s Bank of China

Yi Gang. Fri: Will keep liquidity reasonably ample, will not resort to flood-like stimulus, China's economy is improving but there are still uncertainties, will steer monetary policy mainly on domestic conditions, expects inflation to be modest and under control, will keep prices and the yuan exchange rate stable.

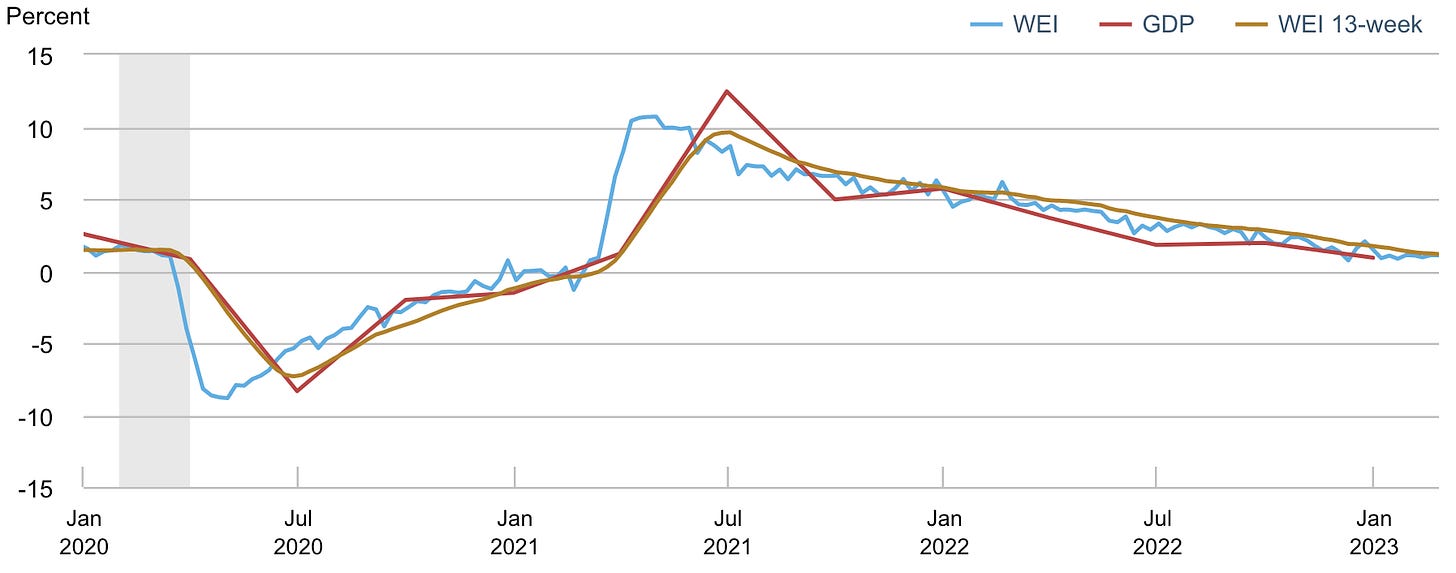

Economic Data

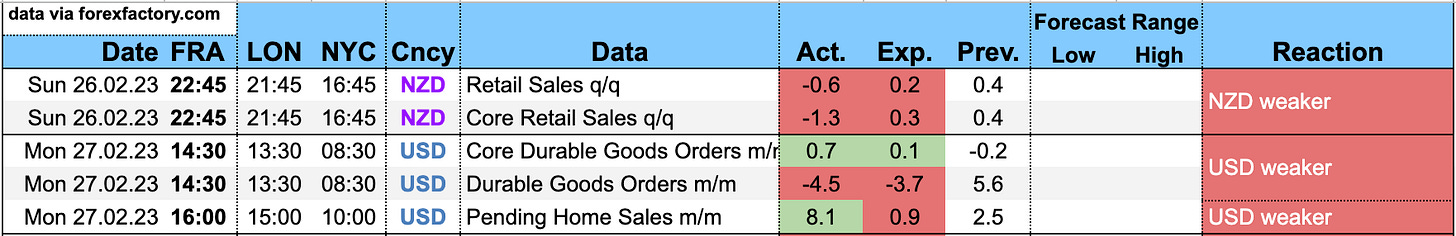

Monday, 27.02.23

Tuesday, 28.02.23

Wednesday, 01.03.23

Here's the gist of the Canadian Manufacturing PMI:

“February’s data provided a relatively positive set of data concerning the health of the Canadian manufacturing economy. Growth rates for a range of variables improved, most notably for output and new orders amid reports of firmer market demand.

“Lower inflation was also seen as a supportive demand factor, and firms themselves experienced a drop of cost inflation since the previous month to a multi-year low. Amid signs of more stability in supply chains, these factors all helped to support an improvement in confidence over the month and partly explained another round of job creation in the sector.”

And here's the US ISM Manufacturing PMI:

Thursday, 02.03.23

Friday, 03.03.23

Here are the highlights from the ISM Services PMI:

Market Analysis

Growth and Inflation

The Atlanta Fed GDPNow model ticked down a bit to 2.3%:

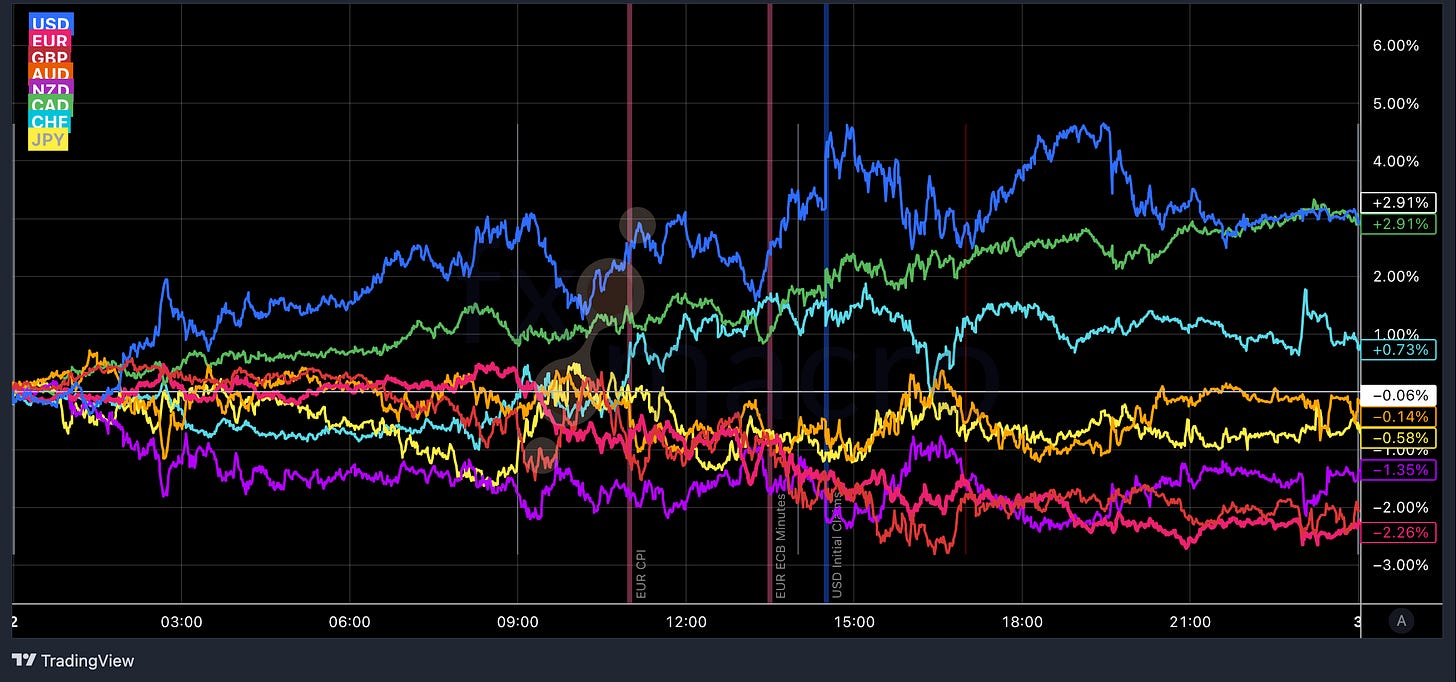

The NY Fed Weekly Economic Index remained unchanged:

Citi Economic Surprise Indexes:

USD is going higher

EUR has rolled over

GBP and CHF are attempting a bounce

AUD and NZD are at the low or going lower

CAD is going sideways

JPY is creeping higher

Bloomberg PMI heatmap:

The US and the UK are improving

Canada, the Eurozone and Japan remain unchanged

Germany has weakened deeper into the red

Switzerland has worsened

Hong Kong and Taiwan have been improving further, China is now green as well, South Korea still in the red,

Brazil and Mexico have improved

All in all, this looks very optimistic

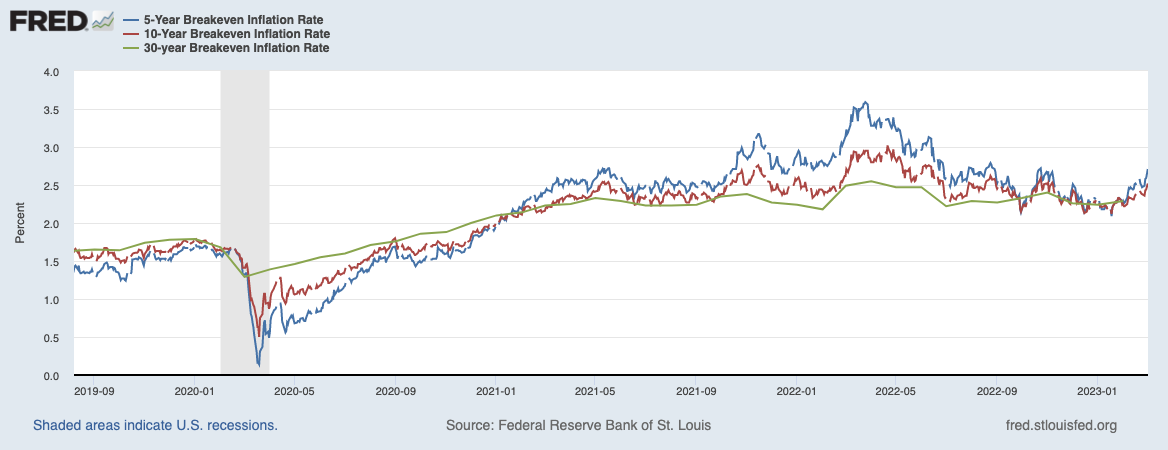

Breakeven inflation rates are slowly but steadily going higher:

5y5y forward inflation rates are also up:

And RINF has also gone higher:

Citi Inflation Surprise Indexes:

Ticks up in USD, EUR, CHF and JPY

Ticks down in GBP, AUD, NZD and CAD

As I’ve written before, I don’t think the CSII captures the current inflation dynamics very well

Yields

See the chart and table below:

Yields are moving in pretty straight lines from bottom left to top right

GBP yields look a bit flatter, AUD has lost momentum as well

If anyone knows what’s up with UK 2y yields, please let me know! The move on Friday one week ago doesn’t make sense to me, I remember Tenreyro speaking but I doubt that was the reason for a 40-something bps move.

It’s the same here: 2s and 10s mostly moving in parallel, the German 2s10s flattening further while everyone else’s yield curves are mainly going sideways:

Central Banks and the US Dollar

We have about 18 days to go until the next FOMC meeting. FedWatch is giving us the following target rate probabilities:

The March meeting is expected to deliver 25 bps with a 72% chance, and 50 bps at 28%, which is about the same as last week

The two meetings after that are both priced at 25 bps each

The terminal rate is still seen at 5.25-5.50% but the upside probabilities have increased a bit and the probabilities to the downside are lower now than last week

The first rate cut is expected for March 2024

The Fed Funds forward curve has been steadily moving higher over the last weeks: four weeks ago (T-20 days) the expectation was for a rate of about 4.125% in March next year (H24 contract), now the expectation is for about 100 bps higher at 5.125%:

Here’s the same data as numbers for the last ten days:

The RBA is meeting next week. A 25 bps hike is priced in at 78%:

Sectors and Flows

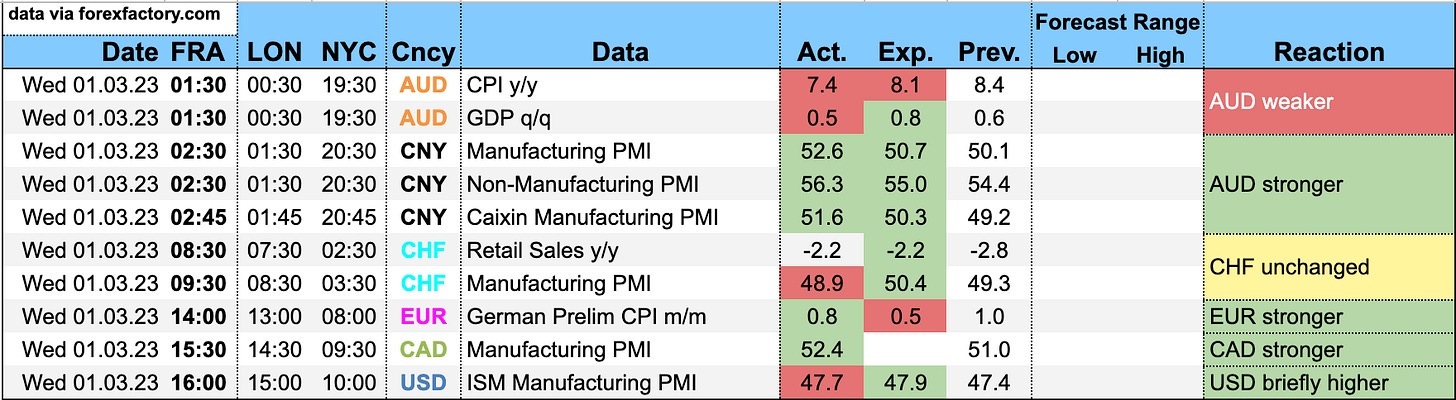

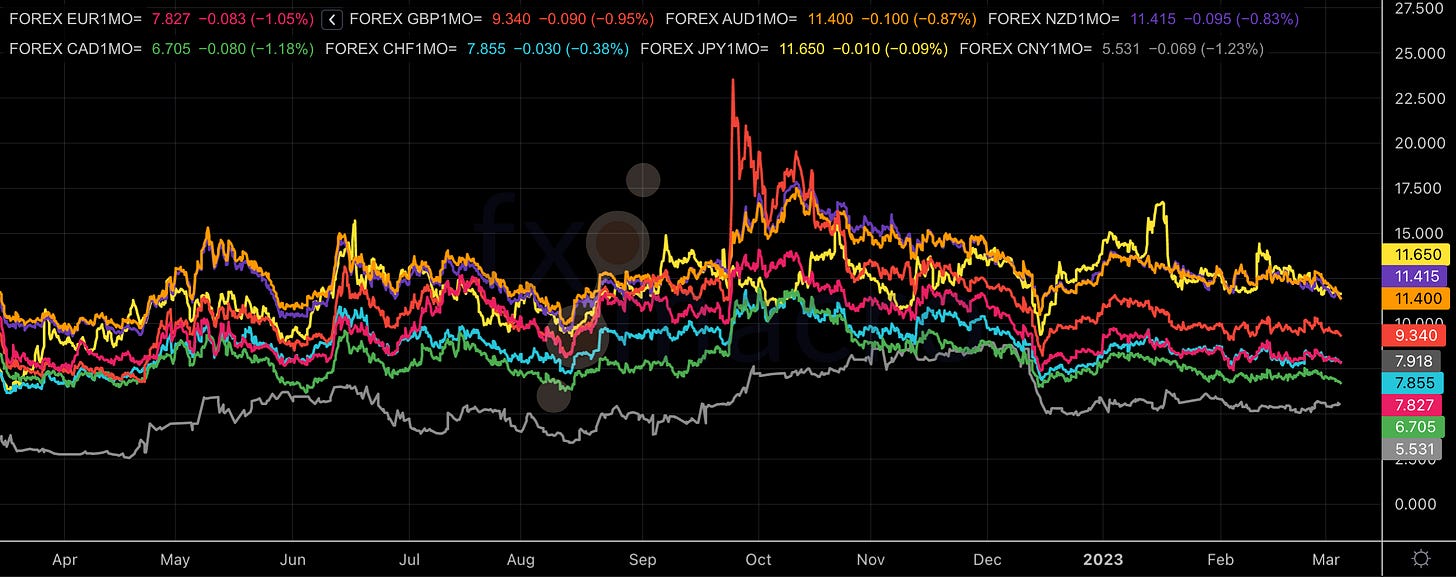

Currency strength:

The long-term horizon over three months looks unconvincing, everything is mostly going sideways. EUR comes out on top, NZD and GBP are underperforming.

Over one month things look a bit more clear: USD is by far the outperformer, JPY, AUD and NZD are the losers.

And this week, NZD marked the spot at the top while USD and CAD can be found at the bottom.

All in all, it’s not a very clear picture.

Here are the currency indexes all in one chart (3 months): everything’s trading sideways in some form, only the USD is trading up and the JPY is trading a bit lower.

The ETF flows out of equities and duration continue, and money is flowing into short-term treasuries. And then there’s the weird stuff like the flows into ARKK:

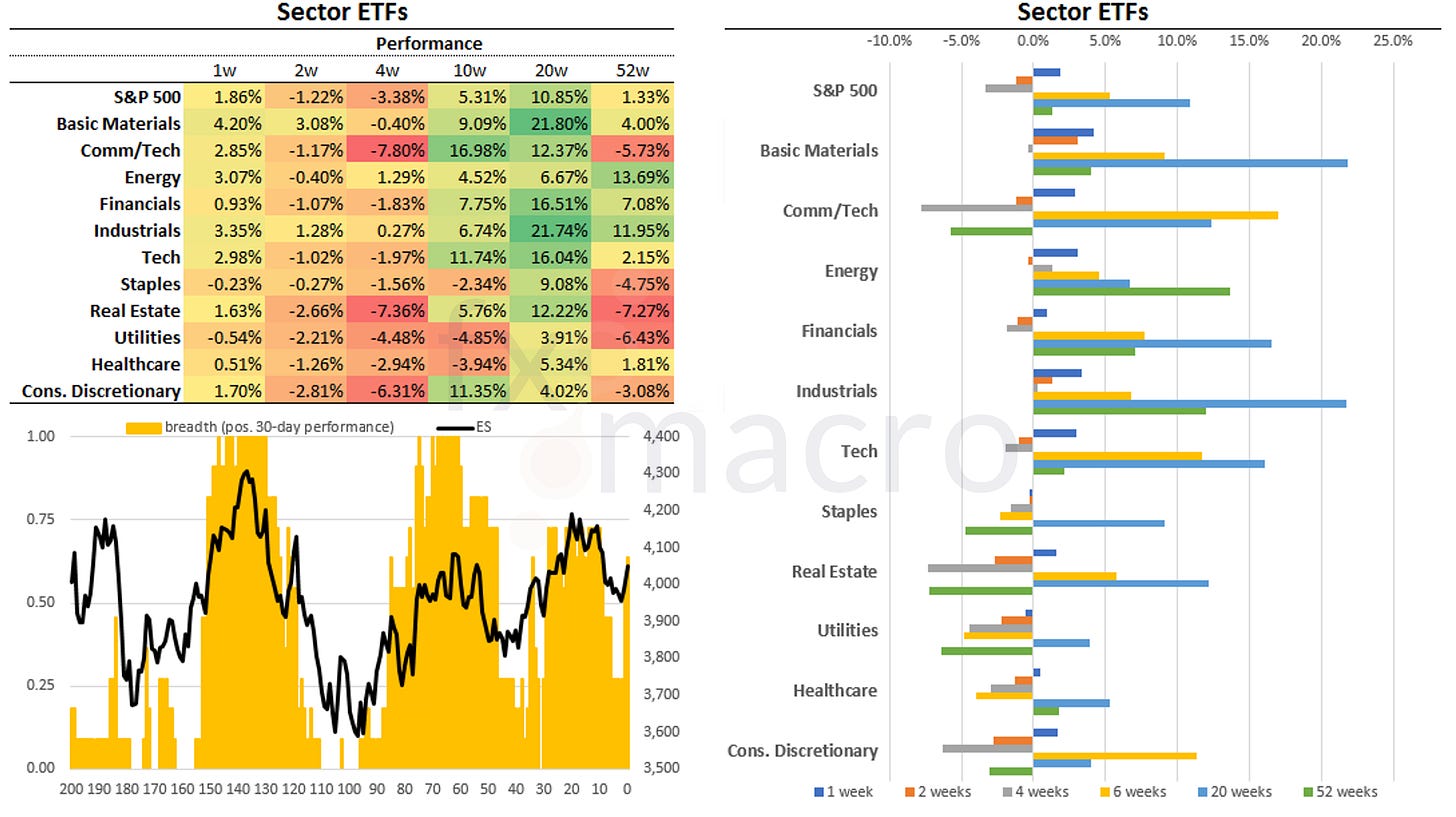

Equity sector performance:

Outperformers: Semiconductors (SMH), Metals/Mining (XME), Oil Services (OIH)

Underperformers: Healthcare (XLV), Utilities (XLU), Oil/Gas Exploration (XOP), Staples (XLP), Energy (XLE)

We’ve seen a bit of a reflationary week in equity sectors. One month it’s a bit more mixed even though Tech does come up near the top and Utilities near the bottom of the chart:

Sector breadth has picked up a bit:

Sector ETF charts:

The longer I look at it, the more I like it…

XLP holding a key level, XLC bouncing from support, XLK off a support

XLI and XLB are at highs

XLE is holding its range

XLP not performing, don’t get me startet on the XLV chart

XLU is looking like it’s putting in a bit of a bounce on high volume but it’s definitely not a bullish chart

XLRE… okay, whatever

So, the charts of offensive sectors look strong, and those of defensive sectors look weak. That’s a lot clearer to me than the performance charts above.

International stock market indexes:

Europe is still outperforming across the board with the EuroStoxx, DAX, IBEX, CAC, FTSE leading by a pretty wide margin

Bovespa and Sensex still aren't performing

Japanese indexes are also comparatively weak

Sentiment and Positioning

The AAII Bull-Bear spread has come down quite a bit:

Currency sentiment:

Bullish sentiment in AUD, CAD, JPY

Bearish sentiment in CHF

A look at a different sentiment source:

Sentiment is bullish in USDCHF and EURCHF, i.e. bearish in CHF

Sentiment is bullish for JPY in most JPY pairs

AUDUSD is the pair with the most bullish sentiment

EURJPY and USDCAD are the pairs with the most bearish sentiment

Commitment of Traders and futures performance:

We still do not have current and/or good-quality COT data:

Please disregard the COT data in the following table, I have not updated the data since the last good release

Equities had a positive week, all Relative Strength numbers are above 1, i.e. the futures are trading above their 26-week moving averages

VIX futures crushed by more than 12% this week

Treasuries were mostly flat-to-lower with the exception of the UB

Currency futures were weaker for the week, DXY was lower

Bitcoin also ended the week down but its RSL is still holding well above 1

Energy futures were all positive, NG is up over 18% this week and 25% over two weeks; its RSL recovered a bit to 0.56 but it remains well below 1 (i.e. NG is trading 54% below its 26-week moving average)

Metals ended the week higher

Grains and softs were mostly lower

Citi PAIN indexes show flat positioning and no big changes this week:

Market Risks

Credit spreads tightened a bit this week:

The Credit Spread Index remains elevated and off the most recent low:

Currency volatilities have been declining:

The VIX term structure is in contango:

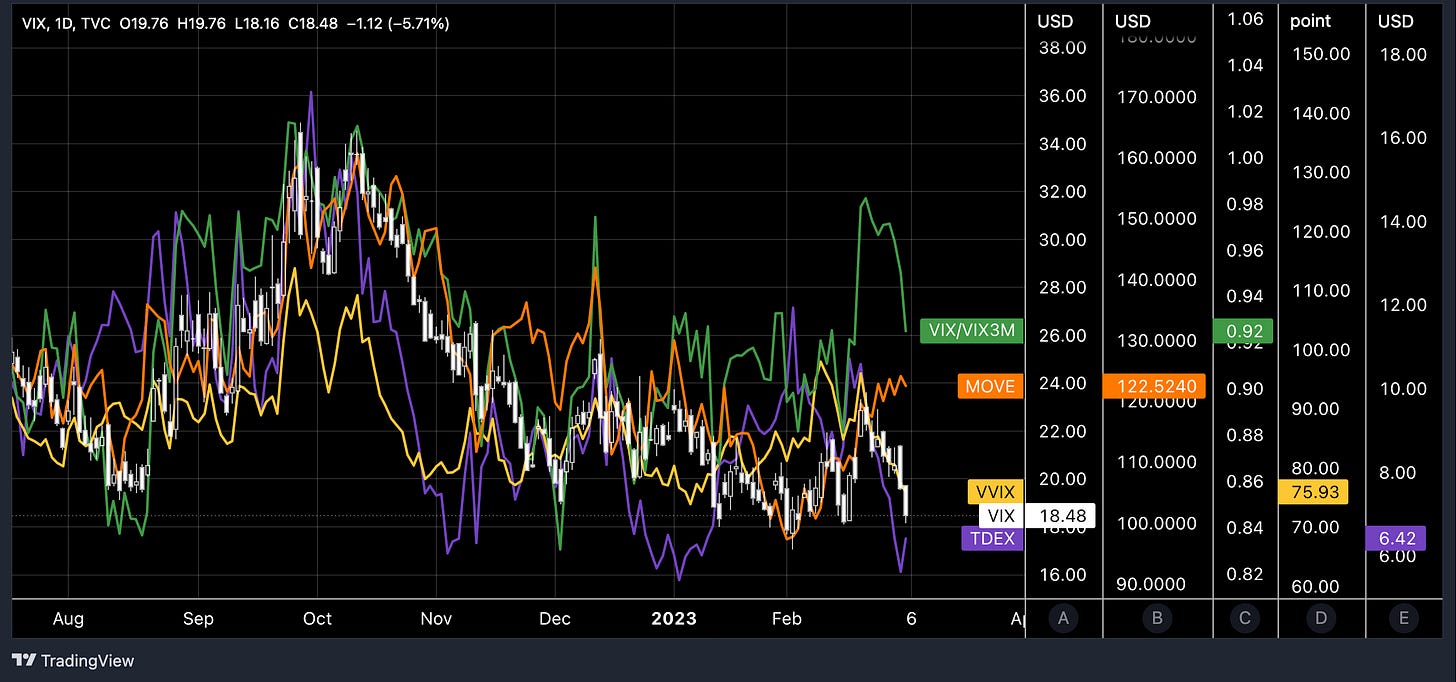

Volatility indexes:

MOVE has gone up and is now at 122.5 despite VIX declining and closing well below 20.

VIX/VIX3M has steepened again and it's below 1, which is good

VVIX is tracking VIX lower

VOLI, i.e. ATM IV, has declined along with VIX

Skew has flattened with TDEX and SDEX near lows

I like this a lot better than last week: declining volatility, a steepening of the VIX/VIX3M metric, less demand for puts (i.e. flatter skew). The only fly in the ointment is the divergence between VIX and MOVE.

The CNN Fear & Greed Index has moved back to neutral. It even grazed the middle line of 50 this week:

The BlackRock Geopolitical Risk Indicator is looking pretty calm:

Various

The NYSE Advance/Decline Line is looking very healthy:

The percentage of S&P 500 and Nasdaq 100 stocks above their 200-day moving averages isn't doing anything unexpected:

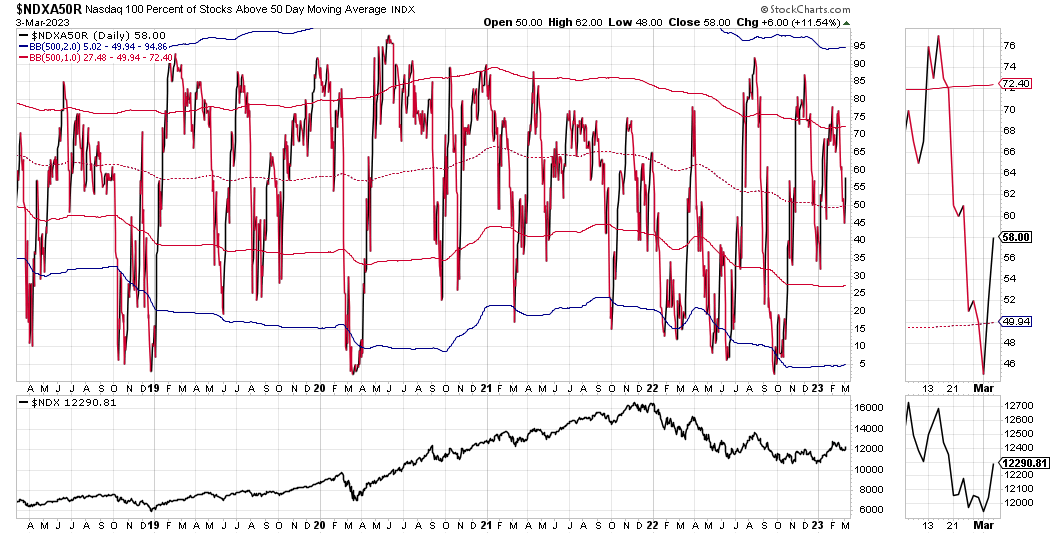

The same goes for the stocks above their 50-day MA:

25-delta risk reversals:

EURUSD, GBPUSD, AUDUSD and NZDUSD are all priced richer by the risk reversals

USDCAD and USDJPY are both priced lower

To me, this means that the options market sees downside in the dollar

Seasonality is bearish for AUD, GBP, CAD and NZD in March:

Finally, a quick look at the market dashboard:

Trend metrics have improved on Friday

The number of distribution days is still concerning and they will take time to roll off

We had three days last week where the ES and VIX both were down; another sign that volatility is calming down

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 06/2023 | 50/2022 | 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 09/2023 | 02/2023 | 47/2022 | 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

ECB

Rate Statements: 06/2023 | 50/2022 | 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 04/2023 | 47/2022 | 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 05/2023 | 50/2022 | 43/2022 | 36/2022

BOE

Rate Statements: 06/2023 | 50/2022 | 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

RBA

Rate Statements: 07/2023 | 50/2022 | 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 09/2023 | 51/2022 | 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 07/2023 | 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 09/2023 | 47/2022 | 41/2022 | 34/2022 Meeting Minutes: 07/2023 Crib Sheets: 40/2022

BOC

Rate Statements: 05/2023 | 50/2022 | 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022

SNB

Rate Statements: 50/2022 | 44/2022 | 39/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

BOJ

Rate Statements: 04/2023 | 51/2022 | 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 05/2023 | 52/2022 | 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: DALL-E 2 with the prompt: A colourful 3D rendering of a geometric shape changing frequently

Thanks alot. Your loyal reader since early this year. Would love to see if you can add some credit impulse commentary in your weekly newsletter. Thanks

Thank you as always kind Sir 😊 If we could turn back time and redo university (assuming you went), I would love to be your partner for group assignments haha. Your studiousness and generosity is evident and appreciated 😉