Welcome to issue #44 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary.

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

The cover image is AI-generated via DALL-E 2. If you want to guess the prompt, I put it at the end of the newsletter.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Before we get started, I’d like to give a shout-out to one of the most actionable trading newsletters out there:

Table of Contents

Summary (Playbook, Calendar, Levels, FX Drivers, Downloads)

Week in Review: a) Central Banks, b) Economic Data

Market Analysis: a) Growth and Inflation, b) Yields, c) Central Banks and the US Dollar, d) Sectors and Flows, e) Sentiment and Positioning, f) Market Risks, g) Various

Top 3 Macro Charts of the Week

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Economic Calendar for next week

Important levels to watch and look out for in FX futures

Currency Drivers

For an explanation check out this link.

Downloads and Links

Difftext of the Summary from last week: link to diffchecker.com

Central bank speaker recap for the week:

Week in Review

Central Banks

RBA Minutes (21.02.23)

The RBA discussed both a 25 bps and a 50 bps hike at their last meeting. Here are the highlights from the Minutes:

RBNZ Rate Statement (22.02.23)

The RBNZ hiked by 50 bps as expected:

Guidance: Monetary conditions need to tighten further

Early signs of price pressures easing but core inflation remains high, inflation expectations remain elevated and employment is still beyond maximum sustainable level

Prices for some goods will likely spike in the wake of cyclone Gabrielle but it’s too early to determine the monetary policy implications

Early signs of demand easing but still outpacing supply

From the meeting minutes:

Meeting minutes on the impact of cyclone Gabrielle:

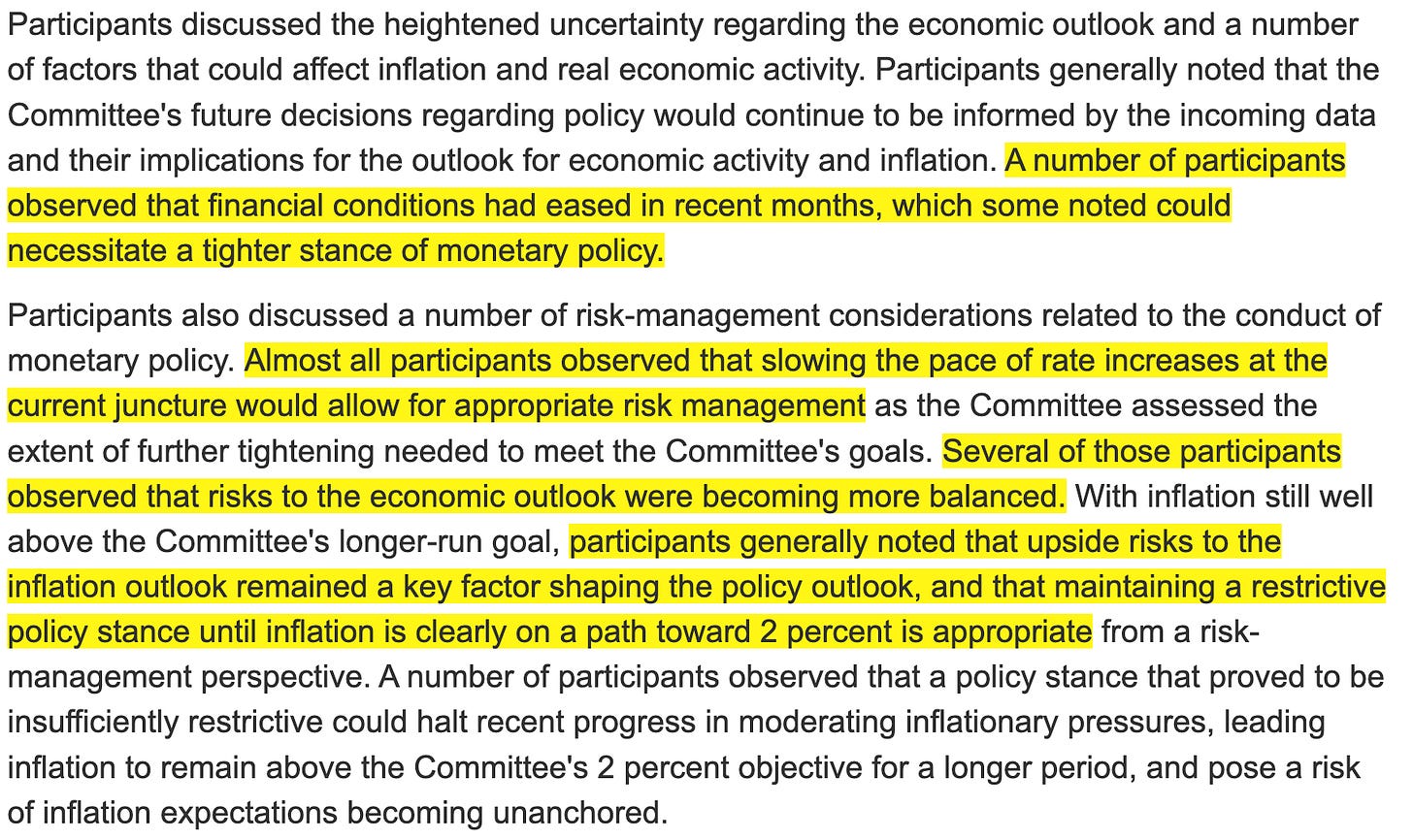

FOMC Minutes (22.02.23)

There wasn’t anything particularly new in the Minutes, and they read more hawish than dovish, especially since "a few participants" would have opted for a 50 bps hike. Here are the most important parts:

Confab, Speakers, News

Federal Reserve

Bullard (Hawk). Wed: Will have to go north of 5% to tame inflation, my projection has rates reaching 5.375%, we've got a little ways to go, Fed should only slow down once it has reached the terminal rate, markets my be overpricing the risk of a recession in 2023, not seeing financial stress right now. Fri: Current situation may fall under the term "credible" disinflation, markets expect inflation to come under control in the quarters and years ahead, soft landing is feasible in the US.

Williams (Neutral). Wed: Absolutely committed to getting inflation back to 2% over the next few years, 2% inflation is a foundational target.

Mester (Hawk). Fri: Need to get rates above 5% and stay there for a while, declines to say whether 25 or 50 bps at the next meeting, need to keep at rate hikes until inflation trend breaks lower, inflation not yet on trend to get back sustainably to 2% target, new data affirms the case for rate hikes, costs of undershooting policy still outweigh the costs of overshooting with current strong labour market, unemployment can be low without creating inflation, long-run inflation expectations are still relatively anchored.

Jefferson (Neutral). Fri: Wage growth is still running too high to be consistent with a timely and sustainable return to 2% inflation target, ongoing imbalance between supply and demand for labour suggests high inflation may come down only slowly.

Collins (Neutral). Fri: More rate hikes needed to deal with "too high" inflation, will need to get rates up and potentially hold them for a long period, optimistic that a soft landing can be reached.

European Central Bank

Rehn (Hawk). Mon: Appropriate to raise rates beyond March, hikes should not stop while core inflation is so high and rising, terminal rate could be reached this summer, rates need to be restrictive for some time, growth could be 1% in 2023.

Lagarde (Dove). Tue: Expects to hike by 50 bps in March, afterwards will be data-dependent, not seeing a wage-price spiral in the Eurozone, inflation has begun to slow.

Villeroy (Neutral). Wed: We are already in restrictive territory at 2.5% and more when we will reach 3% in March, we will be in no way obliged to raise rates at each of the meetings from now until September, markets have overreacted a little with rate hike bets to strong US data and ECB communication since last week.

Nagel (Hawk). Fri: Cannot rule out further significant rate hikes after March, latest data shows inflation is still too high, must be determined in tightening policy, headline inflation could possibly have reached a plateau but it is too early to say.

Bank of England

Mann (Hawk). Thu: More tightening is needed, does not think policy is particularly restrictive, a pivot is not imminent, failing to do enough on rates now risks the worst of both higher inflation and lower activity, financial conditions are looser than what will be needed to moderate inflation, worries about extended persistence of inflation into this year and next, public expectations for inflation next year are way above 2%.

Tenreyro (Dove). Fri: Shape of energy price shocks and monetary policy lags suggest risks of overtightening.

Reserve Bank of New Zealand

Orr. Wed: Most focus was on 50 bps, very little discussion of a 25 bps rate hike, monetary conditions need to tighten further, 75 bps would need a very large inflationary shock, demand needs to slow significantly, there are early indications that inflation is slowing but core inflation and expectations are too high, still forecasting a recession 9-12 months ahead, too early to determine impact of Cyclone Gabrielle, prices for some goods are likely to spike in the weeks ahead, may require higher rates for longer.

Conway. Wed: The impact from the cyclone has boosted demand for labour, possibility that the build-back from the cyclone boosts inflation, more uncertainty around forward GDP track.

Silk. Fri: There will be no pause in tightening, all rate hike options are on the table for the April meeting, will do all that's necessary to control inflation, still concerns about inflation.

Swiss National Bank

Schlegel. Mon: SNB is still willing to be active in FX markets, very strict about price stability mandate.

Bank of Japan

Amamiya. Mon: BOJ has the operational tools to achieve exit from ultraloose policy, what is more difficult is to decide whether the conditions to exit easy policy have been met and also how to communicate the BOJ's intentions for such a change.

Kuroda. Tue: Wage growth likely to accelerate as the economy improves given tightening labour market, outcome of spring wage negotiations likely to reflect tighter jobs market and recent price rises, will continue to watch FX moves and their impact on the economy closely. Thu: Will continue monetary easing, no longer in a deflationary environment but wage inflation is low, import prices have come down and Japanese government's energy assistence will hold inflation rate below 2% target, expects CPI to be below 2% for FY 2023 and 2024.

Suzuki. Tue: Government will watch the economy and markets carefully, important for the exchange rate to move stably reflecting fundamentals.

Tamura. Wed: Appropriate to maintain monetary easing, now at a stage where we will carefully watch whether Japan will achieve positive cycle of rising wages and inflation, will take more time to gauge impact of BOJ steps taken so far on market function, widening of the yield band in December was not aimed at monetary policy, personally feel that prolonged massive easing may have curbed the effect of the market mechanism, at some point in the future the BOJ must conduct assessment of policy framework and look at the balance of benefits and costs.

Ueda. Fri: Current monetary easing is appropriate, can move towards normalizing policy if more evidence of inflation of 2% can be foreseen, need to guide policy based on the economy and prices, wants to limit the element of surprise in monetary policy decision as much as possible but it could still be a surprise, BOJ must support corporate efforts to hike wages by supporting the economy with monetary easing, inflation rate is peaking out and expected to fall below 2% around the middle of next fiscal year, price rises will continue but rate of inflation will slow down substantially from next CPI, wants to achieve price stability sustainably and stably, Japan needs more time for inflation to reach target sustainably, will work closely with the government to guide policy appropriately, sees no need to tweak language on the price target in the joint statement. There are various possibilities on what YCC could look like including targeting shorter-dated yields, BOJ must consider ways to maintain YCC if trend inflation does not improve, BOJ won't conduct bond-selling operation, if BOJ were to normalize policy it would do so by raising interest paid to reserves at the central bank, now is not the time to think about what to do with the bank's ETF holdings, no comment on exchange rates.

Uchida. Fri: Uncertainty regarding the Japanese economy is very high, must maintain ultra-easy policy to support the economy, it is wrong to tweak monetary policy just to address side effects, the right approach is to come up with ways to mitigate side-effects and effectively maintain current policy.

Himino. Fri: Current monetary policy is appropriate, important to conduct current monetary policy flexibly, need to continue easing for now.

Kishida. Fri: No discomfort over Ueda's remarks earlier today.

Economic Data

Monday, 20.02.23

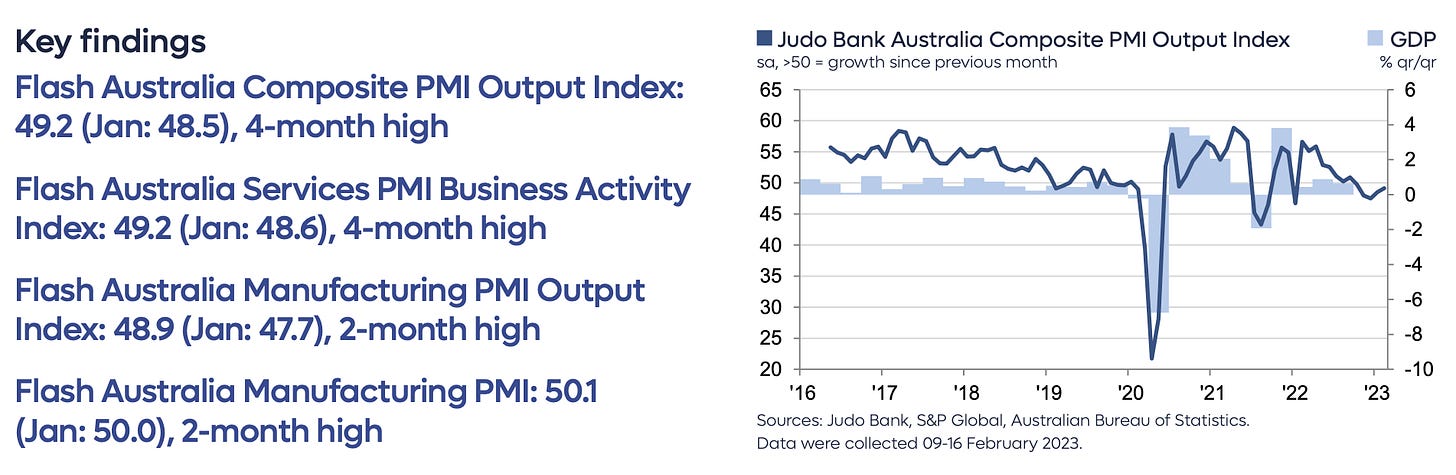

Highlights from the Australian PMIs:

“Australian business activity improved in February 2023 with a second consecutive small rise in the flash composite output index to 49.2. The economy has slowed from the strong rates of growth in 2022 to be on a more sustainable footing in early 2023.

“We still appear to be on the narrow path to achieve a soft landing for the economy in 2023.

“Labour demand also eased in February across both the services sector and manufacturing industries. Overall labour demand remains in positive territory consistent with the hoarding of labour as the economy slows. This should keep unemployment low even as economic policy makers induce a necessary economic slowdown in 2023/24.

“Prices pressures eased further in the service industries yet remain elevated, while manufacturing price indicators barely moved in February. Despite the moderation, the price indicators continue to point to above target inflation in 2023.

“At this stage the Judo Bank PMIs are pointing to a welcome slowdown in the economy that may help take upward pressure off interest rates. While this will do little to alter the RBA’s intentions to raise interest rates further over the months ahead, it does indicate that we may be close to the point where the RBA Board can pause the current tightening cycle.”

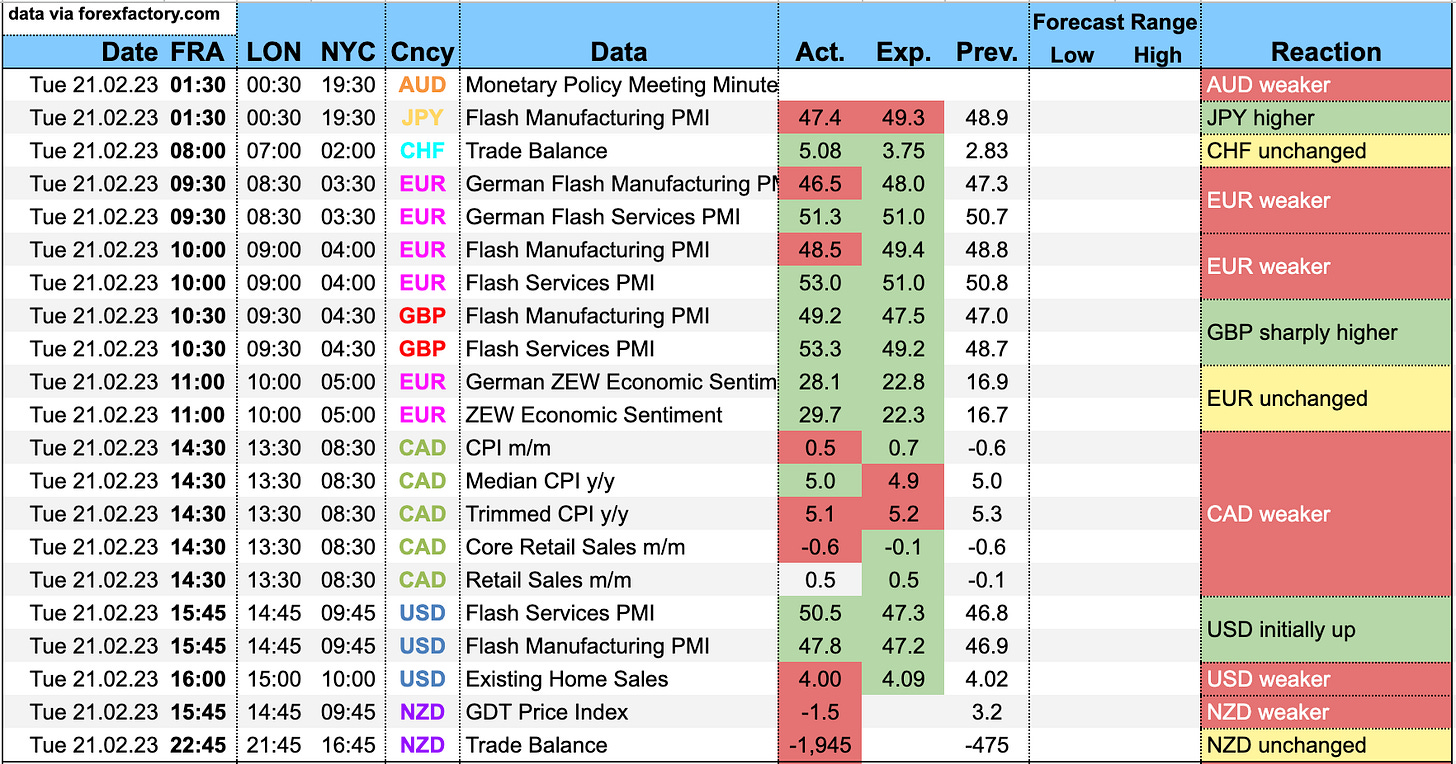

Tuesday, 21.02.23

Highlights from the German PMIs:

“February’s flash PMI survey showed the German private sector economy return to growth territory for the first time eight months, alongside continued resilience in the labour market and a further slight recovery in business confidence.

“Encouragingly, the increase in business activity was broad-based by sector. However, whereas the upturn in services activity was at least partly demand-related, higher manufacturing output owed almost exclusively to a substantial easing of supply-chain bottlenecks, which merely allowed goods producers to catch up on backlogs of work. With manufacturing new orders still in contraction territory, goods producers remain only cautiously optimistic about the year-ahead outlook, and they will likely need to see demand revive for that to change.

“The cooling of demand in the goods-producing sector and subsequent easing of supply-chain pressures has seen factory input costs start to fall. Still, like their service sector counterparts who once again highlighted particularly strong wage demands, manufacturers continued to raise their output prices at a robust rate during February, signalling that core inflationary pressures remain elevated. However, the rate of increase in average prices charged for goods and services continued to slow, down to its lowest since May 2021.”

Highlights from the Eurozone PMIs:

“Business activity across the eurozone grew much faster than expected in February, with growth hitting a nine-month high thanks to resurgent service sector activity and a recovering manufacturing economy. February’s PMI is broadly consistent with GDP rising at a quarterly rate of just under 0.3%.

“Growth has been buoyed by rising confidence as recession fears fade and inflation shows signs of peaking, though manufacturing has also benefitted from a major improvement in supplier performance.

“The pandemic-related delivery delays that dogged factories over the past two years have given way to faster delivery times, in turn meaning pricing power is shifting from suppliers to factory purchasing managers, bringing industrial price inflation down.

“However, although inflationary pressures have continued to moderate in February, the survey hints at persistent elevated price trends in the service sector, linked in part to higher wage growth, which will concern ECB policymakers.

“The combination of accelerating growth and stubbornly elevated price pressures will naturally encourage a bias towards further policy tightening in the months ahead.”

Highlights from the UK PMIs:

“Much better than anticipated PMI data for February indicate encouraging resilience of the economy in the face of headwinds which include rising interest rates, the ongoing cost of living crisis, labour shortages and strikes.

“While many companies continue to report tough operating conditions, especially in the manufacturing sector, the broader business mood has been buoyed by signs of inflation peaking, supply chains improving and recession risks easing. The stress created by last autumn's mini budget is also continuing to work its way out of the financial system.

“However, while the data suggest that near-term recession odds have fallen considerably, elevated inflation pressures clearly remain a concern, especially in the service sector. As such, the resilience of the economy and the stickiness of the survey's inflation gauges add to the likelihood of the Bank of England tightening policy further, and potentially more aggressively, which may dampen future growth expectations and suggests that the possibility of recession later in the year should not be ruled out.”

And the US PMIs:

“February is seeing a welcome steadying of business activity after seven months of decline. Despite headwinds from higher interest rates and the cost of living squeeze, the business mood has brightened amid signs that inflation has peaked and recession risks have faded. At the same time, supply constraints have alleviated to the extent that delivery times for inputs into factories are improving at a rate not seen since 2009.

"However, there are some caveats to the good news. The upturn is being driven by the services sector, which in part reflects unseasonably warm weather, and although the manufacturing survey data are showing signs of improvement, the factory sector remains in contraction and focused on inventory reduction.

“Furthermore, the improved supply situation has taken price pressures out of manufacturing supply chains, but the survey data underscore how the upward driving force on inflation has now shifted to wages amid the tight labor market. By potentially stoking concerns over a wage-price spiral, accelerating service sector price growth will add to calls for higher interest rates, which could in turn subdue the nascent expansion.”

Wednesday, 22.02.23

Thursday, 23.02.23

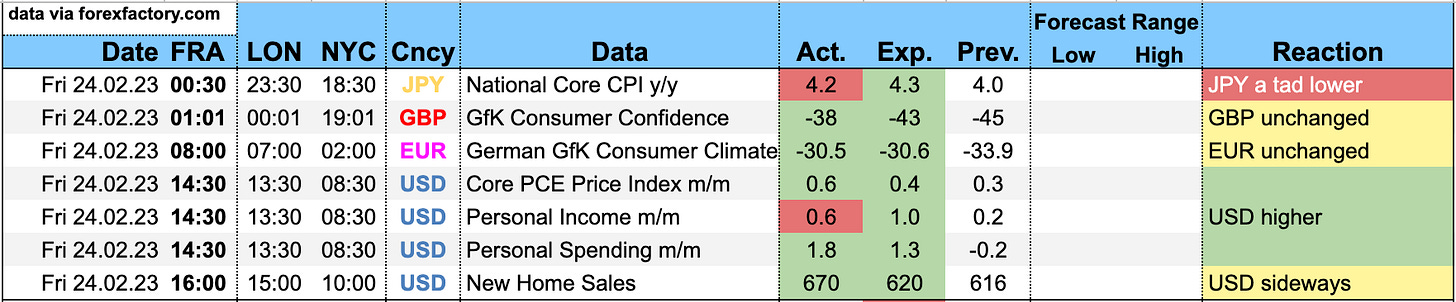

Friday, 24.02.23

Market Analysis

Growth and Inflation

The Atlanta Fed GDPNow model ticked up and now estimates annual GDP growth at 2.7%.

The NY Fed Weekly Economic Index also ticked up to 1.16:

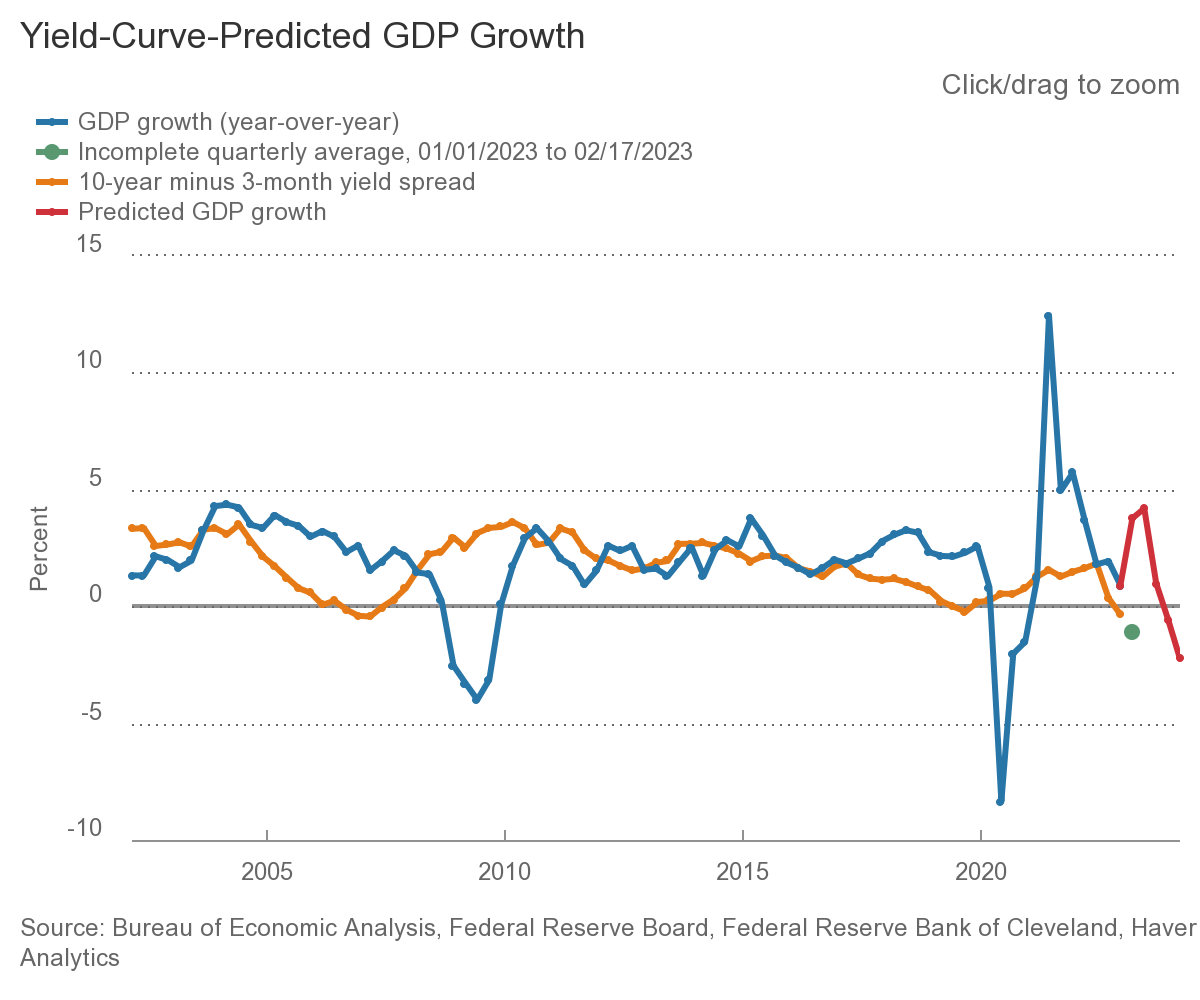

The Cleveland Fed Yield-Curve model has been updated this week: estimated GDP growth is now more negative and the odds of a recession are now north of 60%:

Citi Economic Surprise Indexes:

USD and JPY are both up

EUR has rolled over

GBP and CHF have ticked up recently

AUD, NZD and CAD are going sideways

As a side note, here’s the spread of the Aussie vs. Kiwi Economic Surprise Indexes overlayed on the AUDNZD chart. According to this, we could expect the pair to trade lower:

Bloomberg PMI heatmap:

The US and UK are improving a bit

The Eurozone remains in the red, Germany has even weakened further

Japan is unchanged

Hong Kong has been improving lately, China and South Korea were unchanged

The worse PMI in Mexico is interesting given the outperformance of its stock market

Breakeven inflation rates are still going sideways. But despite the recent upside surprises in inflation they’re still trading below their October/November highs.

The same is true for the 5y5y forward inflation rate:

… and for RINF:

Citi Inflation Surprise Indexes:

This is monthly data, and as I’ve written before, I don’t think it captures the current inflation surprises very well.

Down for USD, EUR, GBP, NZD, CAD, CHF, JPY

Up for AUD

Yields

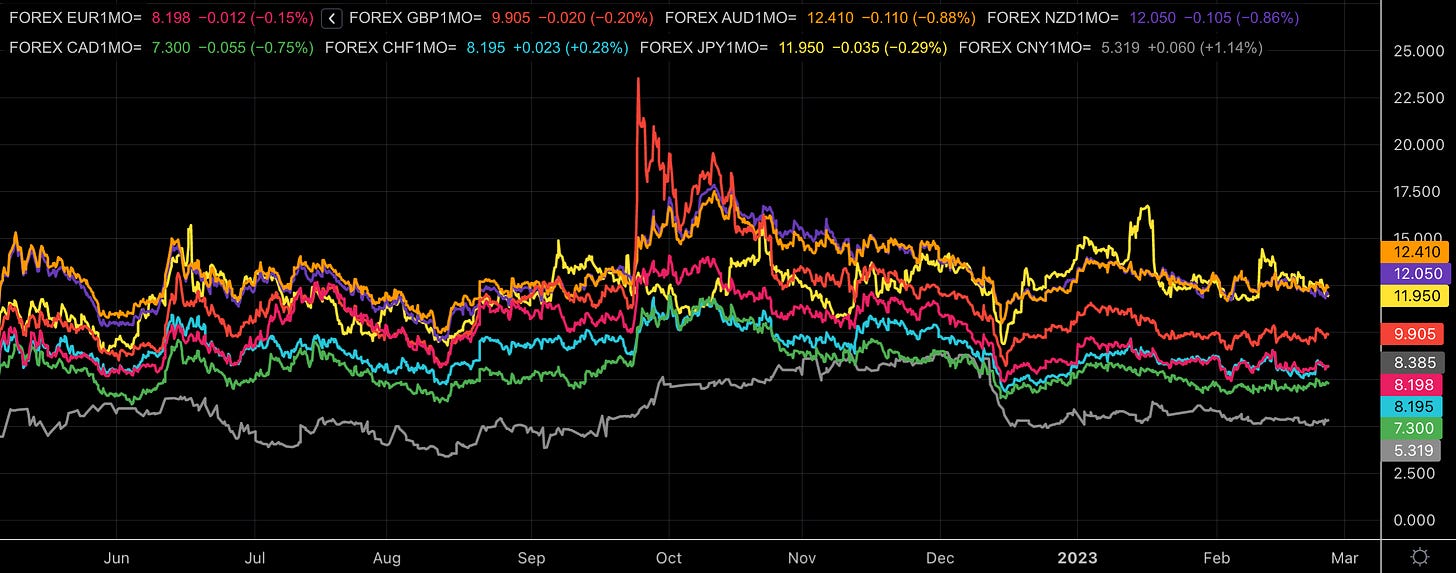

See the chart and table below:

Yields are going up synchronously

NZD, CAD and CHF look like they’re lagging behind a bit even though the former two have the highest monthly performance.

JPY 10s are glued to the 0.5% upper YCC band

Here’s a closer look at 2y and 10y yields and the 2s10s spread:

Central Banks and the US Dollar

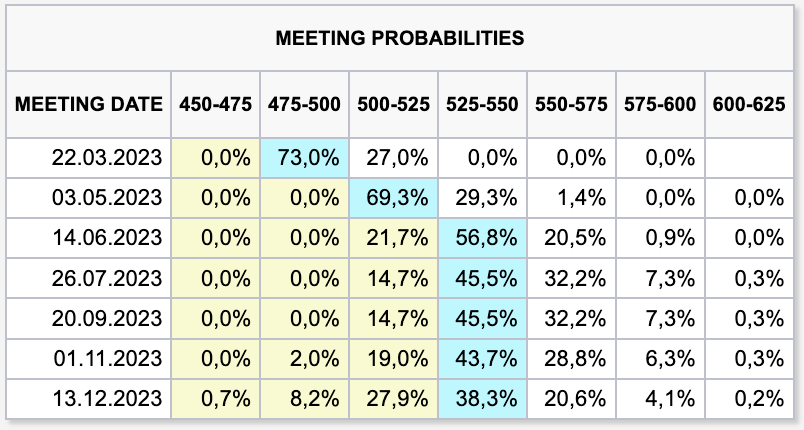

FedWatch meeting probabilities have changed a bit in the front-end:

The March meeting is now expected to deliver a 50 bps hike with a 27% probability (vs. 18% last week), and a 25 bps hike with a 73% chance

The meeting in May is seen at another 25 bps with a 69% chance

The terminal rate remains at 5.25-5.50%

The Fed Funds forward curve ended the week with a new high for the terminal rate, which is now seen a tad north of 5.375%. The market is now also expecting the Fed to hold rates higher for longer as the hump has become flatter and wider:

Sectors and Flows

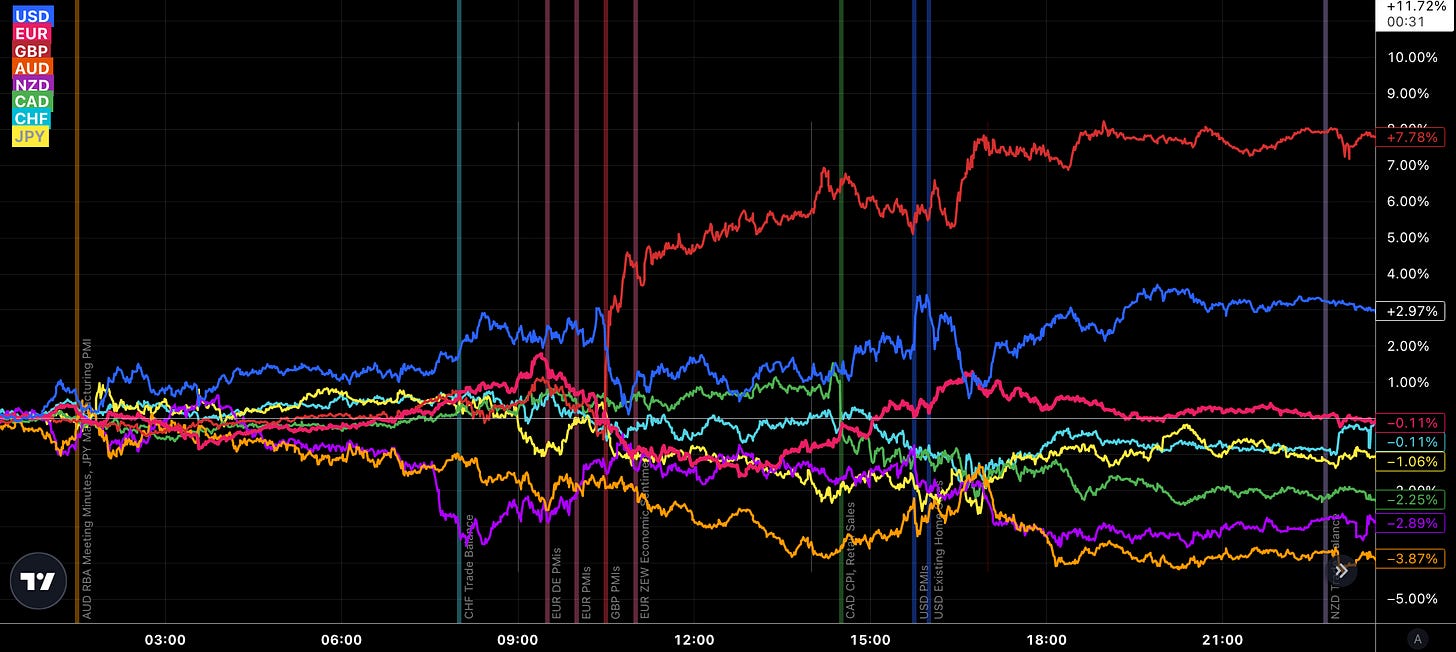

Currency strength:

The JPY is still the outperformer over three months but most/all of that comes from the BOJ’s yield curve tweak in December; the Yen has gone sideways-to-lower since then

The USD has caught up again and it’s now leading over one week and one month

NZD is basically flat for the week despite the hawkish hike by the RBNZ, and it’s the weakest currency over one month (together with AUD)

ETF flows are unequivocally bearish: we can see creations for treasuries (and hardly anything else) and redemptions for stock indexes and all sorts of corporate credit:

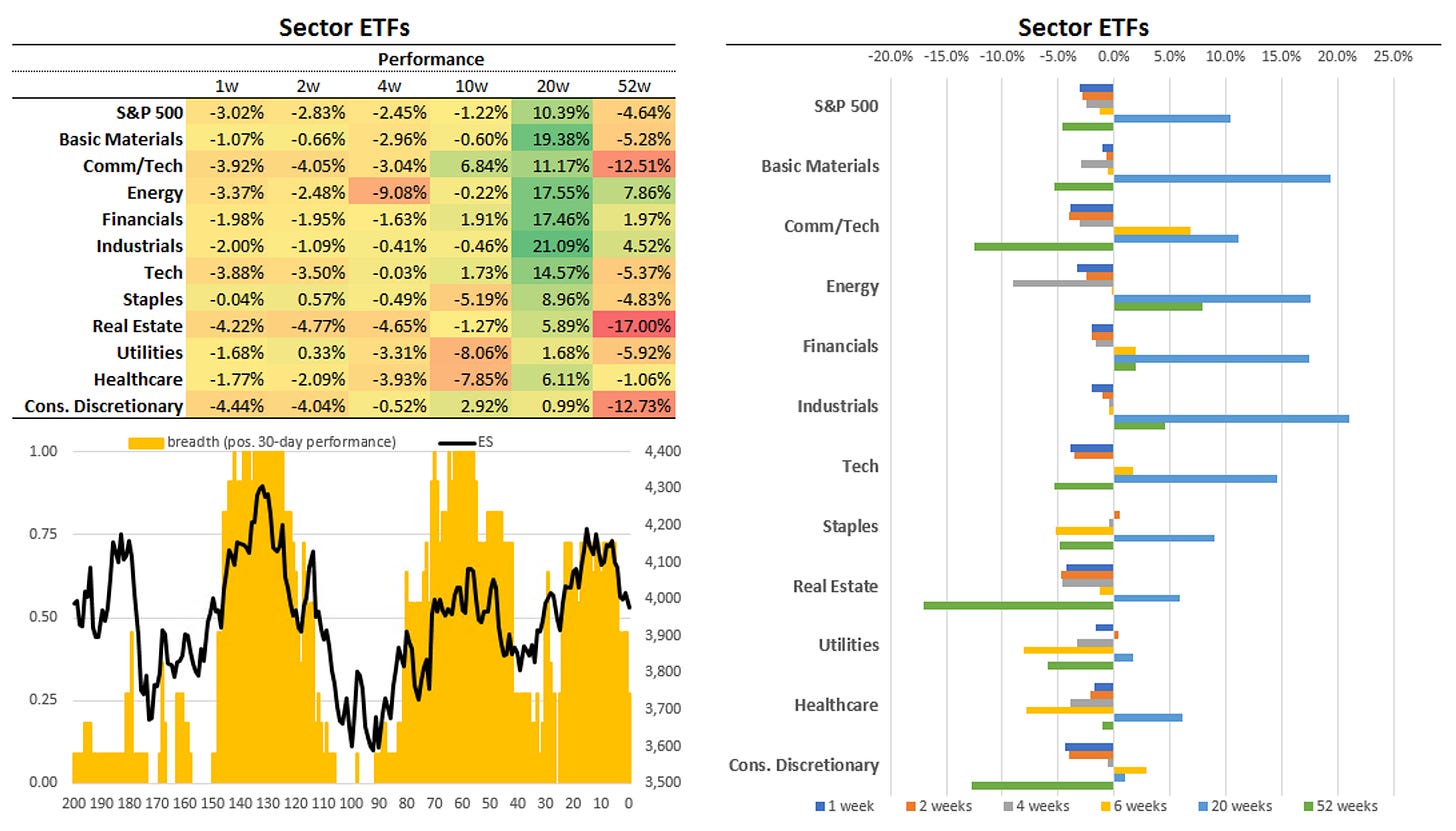

Equity sector performance:

SMH (Semiconductors), XLK (Tech), OIH (Oil Services) are the outperformers

XOP (Oil/Gas Exploration), XLV (Healthcare), XLE (Energy), XLU (Utilities), XLP (Staples) are the underperformers

Sector performance is clearly bearish over the short term with Consumer Defensives, Utilities, Healthcare outperforming on a relative basis while Cyclicals and Tech underperform. The strength in Tech that we’ve seen in the first weeks of the year is still visible when we look at one month or longer out:

Sector breadth has also taken a bit of a hit, only about a quarter of sectors now have a positive 30-day performance:

Sector charts: the first thing that catches my eye is the action in XLC, which has given back about half of its January gains in February.

International stock markets:

Hang Seng continues to weaken from its humungous outperformance

European Indexes still dominate the top: Spanish IBEX, French CAC, German DAX, UK FTSE.

Indian Sensex and Brazilian BOVESPA remain the underperformers

Sentiment and Positioning

No big change in the AAII Bull-Bear spread. Sentiment is still pretty good on a relative basis:

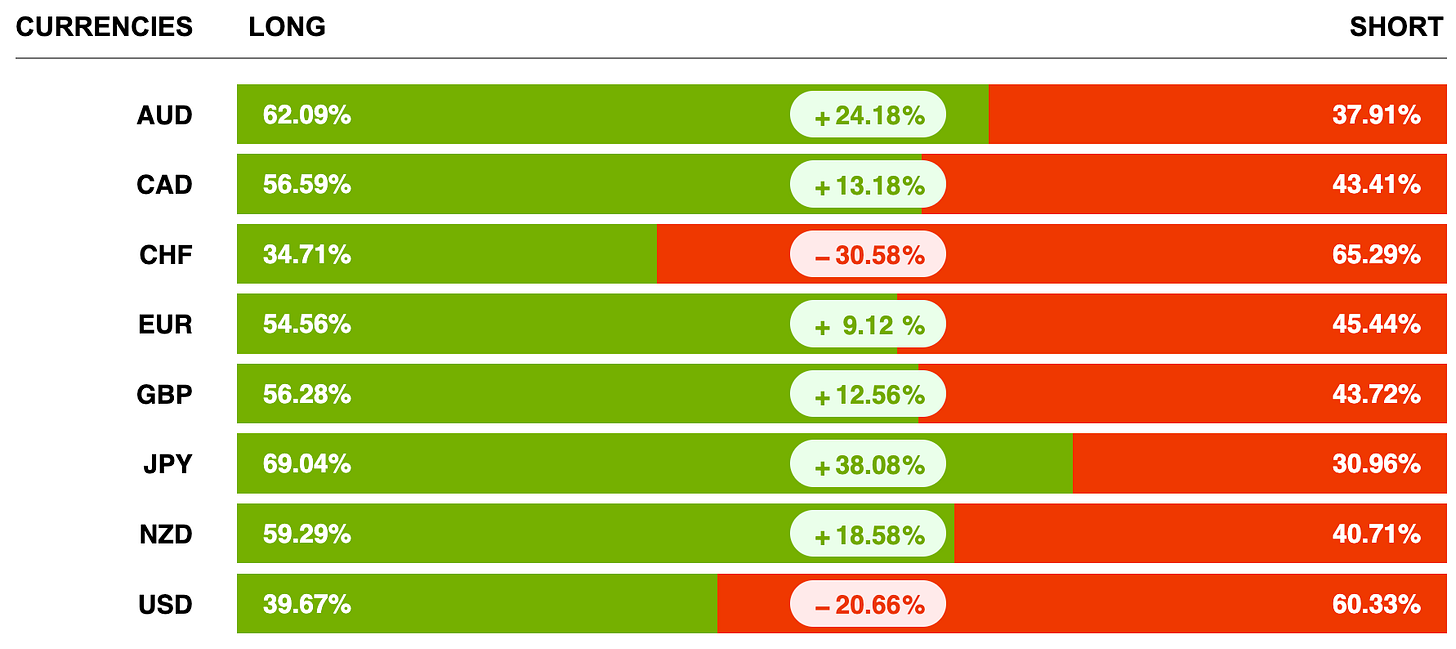

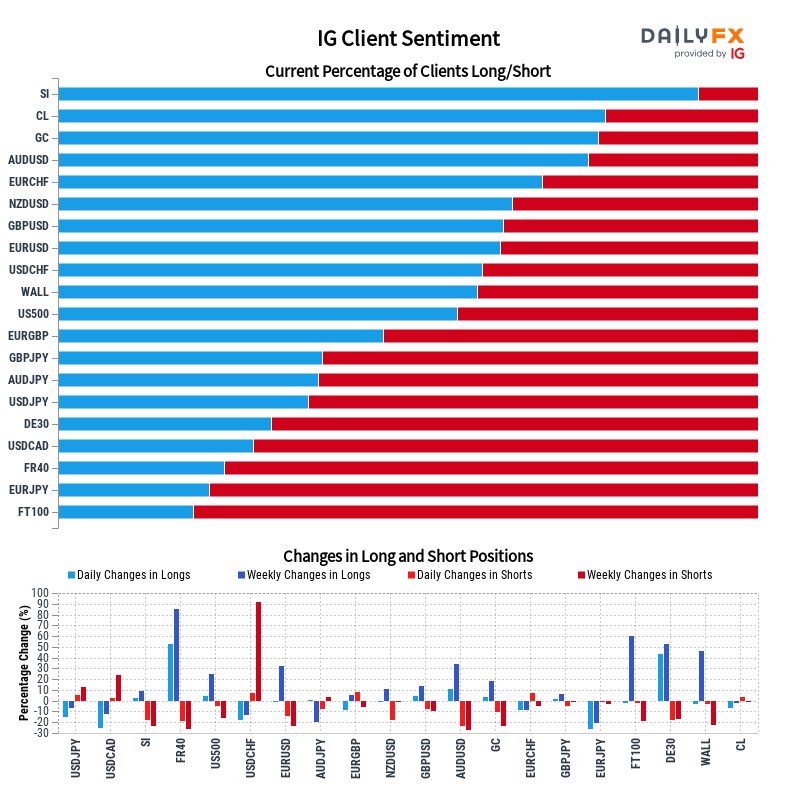

Currency sentiment:

Bullish sentiment in AUD and JPY

Bearish sentiment in CHF and USD

A different sentiment source:

AUDUSD, NZDUSD and EURUSD all have bullish sentiment, i.e. bearish sentiment for the dollar

JPY pairs all are bullish on the yen

There’s still no up-to-date Commitment of Traders data as the CFTC (once again) releases the backlog of unpublished COT data in trickles, and it doesn’t make sense to look at the data from four weeks ago. Complete and up-to-date data isn’t expected before mid-March. Please disregard the COT data in the following table.

Equity futures were all lower but bolding at or above their 26-week moving averages, i.e. their RSL is >1

Treasury futures were all lower this week

Currencies were all lower vs. the dollar 6A posting the greatest loss. Bitcoin lost about 7%.

Energy futures were mixed, CL flat and NG recovering a bit although it remains well below its 26-week moving average with an RSL of just 0.45.

Metals were all negative, and even HG, which still has the highest Relative Strength is almost 4% lower

Grains and Softs were mixed with ZC and ZW both down around 4.1 and 7.5%, respectively. Orange Juice is the place to be: RSL at 1.34 and about 64% performance in the last half year.

Since we don't have current COT data, I'll keep my assessment: EUR positioning is at a long extreme, CAD is at a short extreme.

Citi PAIN indexes show that things are pretty much back to neutral for everyone:

Here's the combined COT-PAIN chart:

Market Risks

Credit spreads have widened a bit for HY but remain near lows for IG:

The Credit Spread Index is also creeping higher:

The NY Fed Corporate Bond Market Distress Index has been updated, and it shows that stress is coming out of the IG bucket while it's ticked up the smallest bit for HY:

Corporate bond market functioning appears healthy, with the overall market-level CMDI remaining stable around its historical 30th percentile.

Market functioning in the investment-grade segment remained below its historical 75th percentile in February.

Currency volatility is going sideways. It's interesting to see that almost all of the IV that was priced into USDJPY after the Ueda name drop has already been priced out again, the market doesn't expect any surprises from the BOJ in the short term:

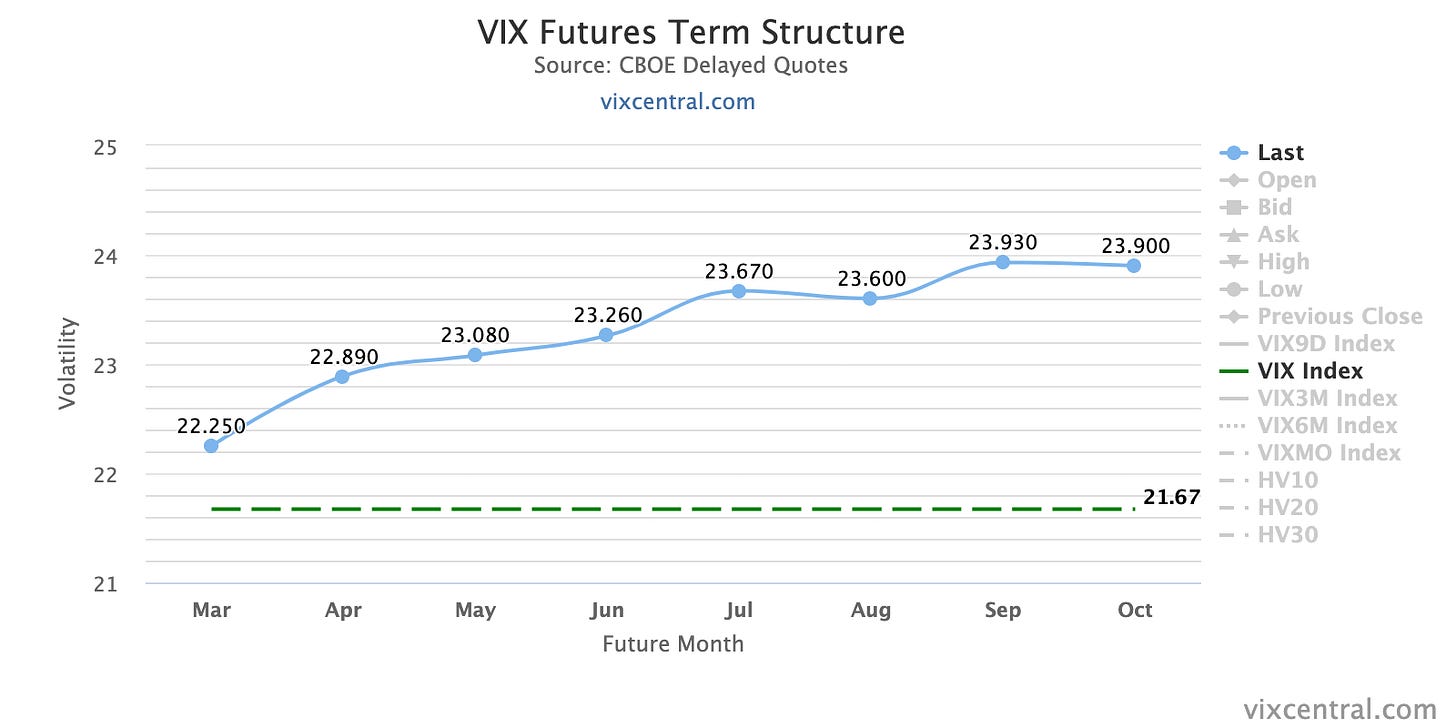

The VIX term structure is in a flat contango:

Volatility indexes:

VIX is at 21.7, MOVE at 123

The VIX/VIX3M metric is at 0.97, so it's close to inverting, and when we compare it to the level of VIX it looks like VIX is too low right now

VVIX has calmed down a bit relative to one or two weeks ago and it's still at a pretty low level at 85

Skew metrics are flattening. Not sure what to make of it right now: the last time we had VOLI rising and skew flattening was in September and in May/June, and each time we've seen the ES come down.

CNN Fear & Greed remains in Greed territory:

Various

Market breadth is still looking decent. The NYSE Advance/Decline Line is hardly coming off its high:

The number of index constituents above their 200-day moving averages is doing pretty much what we would expect it to do when the market goes down:

The same is true for the shorter 50-day moving average metric:

25-delta risk reversals:

EURUSD, AUDUSD, NZDUSD are all being priced higher

GBPUSD skew is still at a 1-year bullish high while spot is sideways-to-lower

USDCHF is priced higher and USDCAD lower

It's a bit of a mixed picture but taken together it looks to me as if the options market is expecting a lower USD

A quick look at the Market Dashboard. Trend metrics have deteriorated a bit, distribution days aren't rolling off and/or are promptly added back on and Volatility is a bit meh. (In case you're wondering why hardly anything ever lights up in the Breadth or Options section: the thresholds are purposely set at extremes because that's when these metrics are useful to me.)

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 06/2023 | 50/2022 | 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 02/2023 | 47/2022 | 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

ECB

Rate Statements: 06/2023 | 50/2022 | 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 04/2023 | 47/2022 | 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 05/2023 | 50/2022 | 43/2022 | 36/2022

BOE

Rate Statements: 06/2023 | 50/2022 | 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

RBA

Rate Statements: 07/2023 | 50/2022 | 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 51/2022 | 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 07/2023 | 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 47/2022 | 41/2022 | 34/2022 Meeting Minutes: 07/2023 Crib Sheets: 40/2022

BOC

Rate Statements: 05/2023 | 50/2022 | 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022

SNB

Rate Statements: 50/2022 | 44/2022 | 39/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

BOJ

Rate Statements: 04/2023 | 51/2022 | 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 05/2023 | 52/2022 | 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: DALL-E 2 with the prompt: Just give me something beautiful, please

If I may add on your comments related to IG and HY indices. It is of interest the way preferred stocks $PFF behave, especially compared to IG and HY. They have been outperforming significantly from the start of '23 and continue doing so. Going long LQD vs short PFF looks like an opportunity worth checking out.

As always, I am stunned by the amount of work you put in the weekly reviews. You're so under followed.

Keep it up, FX!

kudos.