Outlook for Week 07/2023

We've had the RBA Rate Statement this week and the first BOC Minutes...

I will be on holiday, so I will publish a shorter version of the newsletter next weekend.

Welcome to issue #42 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary.

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

The cover image is AI-generated via DALL-E 2. If you want to guess the prompt, I put it at the end of the newsletter.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

One more thing. You seem to like newsletters, so here's a great way to discover new stuff to read for free: The Sample. They will regularly send you an issue of a different semi-random newsletter you might be interested in. If you sign up using my referral link, I get bonus points and my newsletter will be forwarded to others to check out.

Before we dive in, I'd like to give a shout-out to one of my favourite newsletters:

Table of Contents

Summary (Playbook, Calendar, Levels, FX Drivers, Downloads)

Week in Review: a) Central Banks, b) Economic Data

Market Analysis: a) Growth and Inflation, b) Yields, c) Central Banks and the US Dollar, d) Sectors and Flows, e) Sentiment and Positioning, f) Market Risks, g) Various

Top 3 Macro Charts of the Week

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Economic Calendar for next week

Important levels to watch and look out for in FX futures

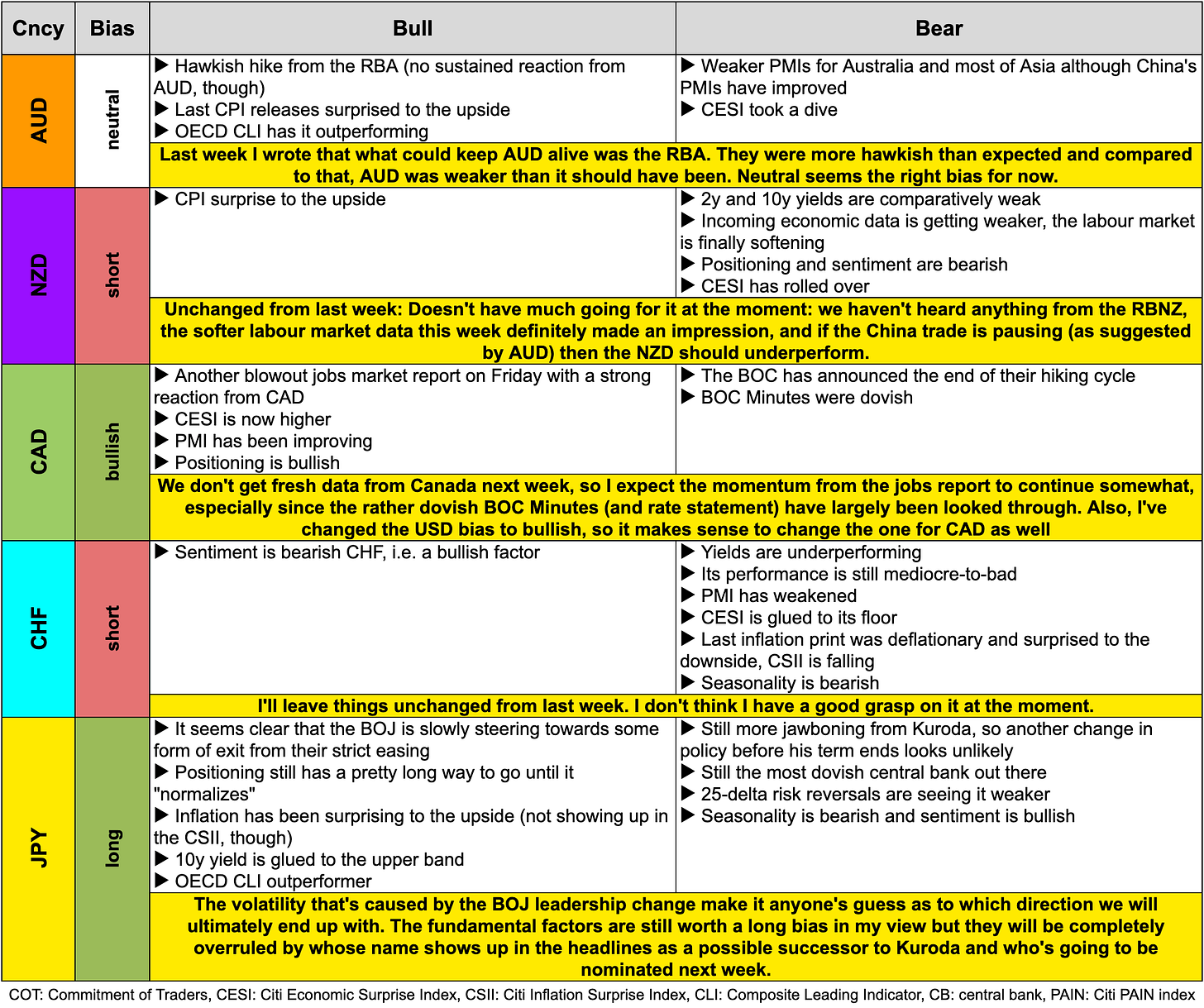

Currency Drivers

For an explanation check out this link.

Downloads and Links

Difftext of the Summary from last week: link to diffchecker.com

Central bank speaker recap for the week:

Week in Review

Central Banks

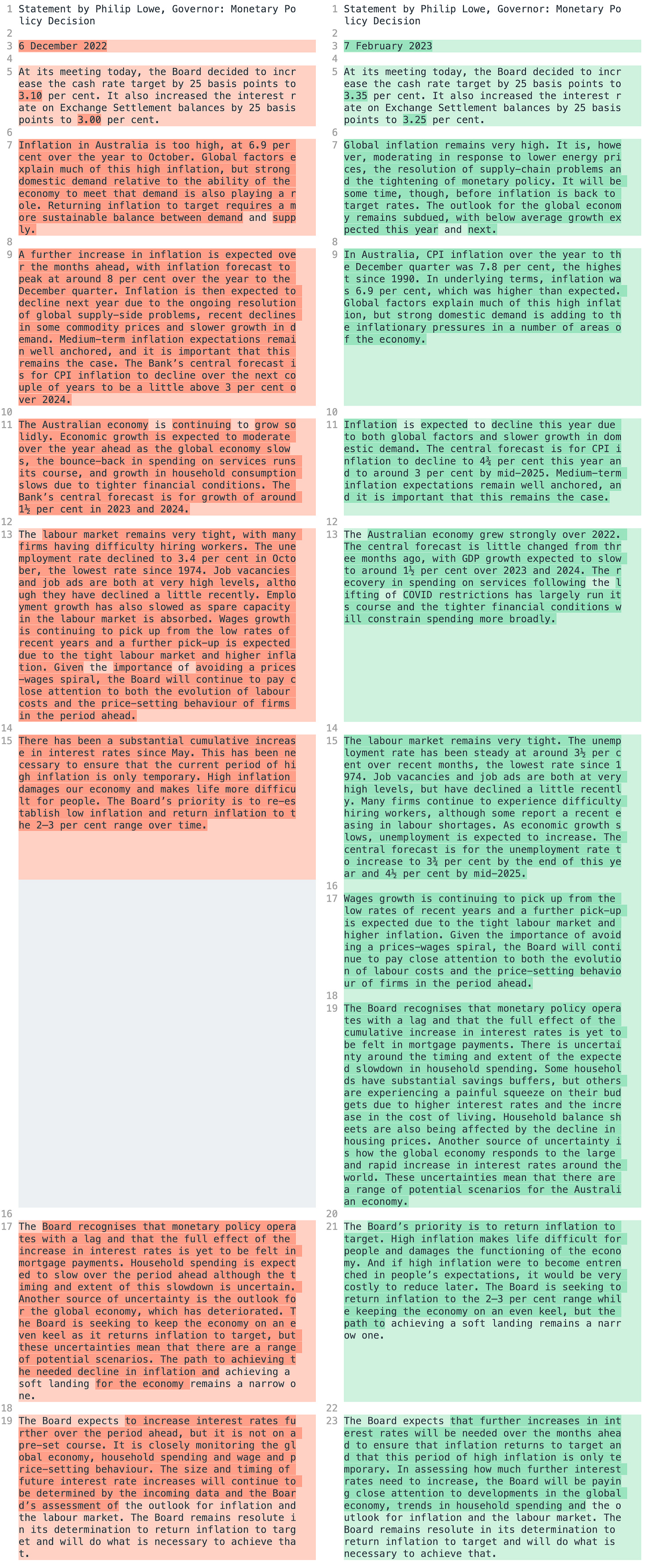

RBA Rate Statement (07.02.23)

The RBA hiked by 0.25% to a rate of 3.35%:

Guidance: “further increases” in interest rates “will be needed over the months ahead” to “ensure that this period of high inflation is only temporary”

This changed from “expects to increase rates further over the period ahead but it is not on a pre-set course”

They dropped the “not on a pre-set path” bit

Inflation remains very high but it is moderating due to lower energy prices, improving supply chains and tighter policy

Inflation is expected to decline to 4.75% this year and to around 3% by mid-2025

GDP growth is expected to slow to around 1.5% over this year and next

BOC Summary of Governing Council Deliberations (08.02.23)

This is the first release of meeting minutes from the Bank of Canada. Here are the highlights:

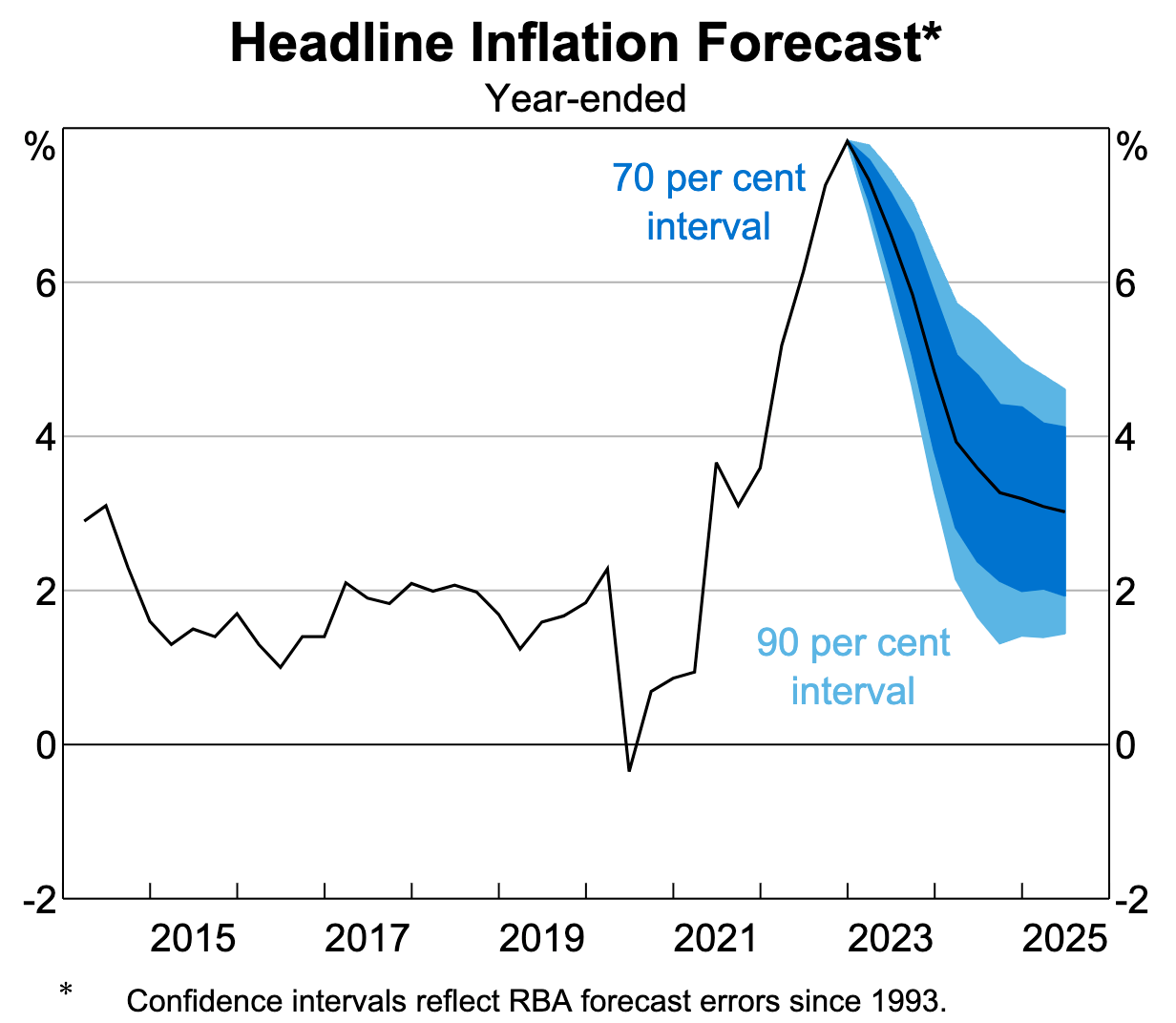

RBA Statement on Monetary Policy (10.02.23)

The new economic projections include an upgrade to headline CPI and Trimmed mean inflation. GDP growth is projected a tad higher for H1 2023 but remains unchanged through the rest of the forecast horizon:

Confab, Speakers, News

Federal Reserve

Bostic (Neutral). Mon: Higher rate hike on the table after blowout NFP, may have more work to do, expects to raise rates more than he has projected, could also consider moving back to a 50 bps hike if needed, expects inflation to be in the "low 3s" this year.

Kashkari (Hawk). Tue: Still sees rate path moving to 5.4%, wants to see more evidence that underlying inflation was trending down more, if financial conditions are easier we have to do more on rates, I am more cautious on rate path than markets, housing market starting to show signs of life which is making our job harder and means we have to do more with our other tools, nobody should overreact to one jobs report, hard to imagine strong jobs growth can occur with wage growth moderating. Wed: We need to do more but how much more is not clear, wage growth now is too high to support inflation.

Powell (Neutral). Tue: We will need further rate increases, still have not reached sufficiently restrictive level, disinflation has begun but has a long way to go, strong jobs report shows why this will be a long process, the reality is that we're going to react to the data, would certainly raise rates more if data were to come in stronger, will certainly take until next year to get down close to 2%.

Williams (Neutral). Wed: Still have some work to do to get inflation under control, maybe services prices will stay elevated and if that happens we need higher rates, seeing a significant slowdown in housing, seeing more positive signs on global growth and the US economy.

Cook (Neutral). Wed: The Fed is not done raising rates, inflation still running too high even if it has moderated, we will need restrictive policy for some time, starting to see some improvement in inflation data, combination of strong labour market and moderating prices/wages has raised hopes for a soft landing.

Waller (Hawk). Wed: The Fed will need to keep a tight stance on policy for some time to slow activity further, the job on inflation isn't done and might be a long fight, needs to see continued moderation in inflation before changing outlook, some moderation seen in compensation isn't enough. Fri: Spillover from crypto industry stress to the financial system is minimal so far, critical to ensure financial stability risks associated with crypto assets are mitigated.

Barkin (Neutral). Thu: Makes sense for the Fed to steer "more deliberately" from here due to lagged effects of policy, inflation is likely past its peak but still elevated, median inflation has stayed high, will take longer for pullback in demand to further slow the pace of price increases, data continues to push back recession risk.

Harker (Neutral). Fri: Get the Fed Funds rate to 5% and then pause, unsure how far rates have to go above 5%, 50 bps hikes not necessary right now, we do not need to keep raising rates at the pace we were, may be able to ease rates in 2024 if inflation starts abating, base case is that there is no recession, odds for a soft landing are increasing, will take a couple of years for inflation to fall back to 2% target, yield curve inversion unlikely to be sending recession signal, unsure when the process of balance sheet cuts will end.

European Central Bank

Visco (Dove). Weekend: Policy tightening can now continue with due caution, unwarranted excess tightening would have serious consequences, bank loan writedowns could double to nearly 1% in 2023 and 2024.

Holzmann (Hawk). Mon: The risk of doing too little dwarfs the risk of overtightening policy, must continue to show teeth untial a credible convergence to the inflation target.

Kazaks (Hawk). Mon: There will be a 50 bps rate hike in March barring a significant data shock. Wed: There is no reason to pause or stop hikes after March, rates must hit significantly restrictive levels, markets should listen to Lagarde.

Villeroy (Neutral). Tue: We are not very far from the peak of inflation, does not think the ECB has to choose between fighting inflation an avoiding a recession. Thu: Sees possible peak in French inflation between now and June and maybe even before that, can exclude a recession in France as of now.

Nagel (Hawk). Tue: More significant rate hikes are needed, rate cuts are not on the agenda, it would be dangerous to think inflation problem is solved. Thu: ECB must act decisively to reduce risk of de-anchoring in inflation expectations.

Schnabel (Neutral). Tue: Intends to hike by 50 bps, cannot give the all clear on inflation, inflation slowing is due to energy and not ECB policy, keeping a particularly close eye on core inflation. Fri: Whether another 50 bps in May will be needed will depend on incoming data, we still have a lot of ground to cover in terms of rates, will stay the course in raising rates to bring inflation back to 2% target, further rate hikes will help to do that, so far policy has had little impact on inflation, broad disinflation has not started in the Euro area, need to see robust evidence that underlying inflation is returning to our target in a timely and durable manner, a soft landing is possible but not guaranteed.

De Guindos (Dove). Wed: Won't rule out further hikes after March, markets may be too optimistic regarding inflation trend, a wage-price spiral must be avoided.

Knot (Hawk). Wed: Keeping current pace of hikes into may could well be needed if underlying inflation does not materially abate, headline inflation appears to have peaked, policy rates have been brought into the neutral range, once we see a clear and decisive turn in inflation I expect the ECB to move in smaller steps, we have more ground to cover than the Fed, slowdown in growth seems even more shallow and short-lived than expected.

Vujcic. Fri: Likely to see more policy tightening after March, not yet time to discuss the terminal rate, core inflation is still too high, need to see sustained decline in core inflation.

De Cos (Dove). Fri: Last week's ECB decision was well received by markets.

Bank of England

Pill. Mon: We have to guard against doing too much with monetary policy and we are reaching a point where it concerns our minds, we are prepared to do more to get inflation back to target, tightening is having an impact, still a lot to come through, chances of inflation becoming more embedded in the UK is greater than in continental Europe. Thu: There is a danger of over-steering on rates given lags in transmission and substantial further tightening is yet to come, no room for complacency, anticipates a period of economic weakness in the UK.

Cunliffe (Dove). Tue: Have made no decision yet on whether a digital pound would use digital ledger technology, we propose a limit of between 10,000 and 20,000 GBP per person to hold digital pound.

Bailey (Neutral). Thu: We have a very tight labour market, expects inflation to come down rapidly this year, base effects will put powerful negative trajectory in UK inflation, concerned about inflation persistence, need to see more evidence of inflation pressures easing, would urge that the rapid fall forecast for inflation is taken into account in pay demands.

Haskel (Hawk). Thu: Economic theory shows inflation uncertainty should be met with more forceful action.

Tenreyro (Dove). Thu: Rates are too high right now, a big recession is much needed to keep inflation at 2%, would consider a rate cut right now but can't say at which meeting she would vote for such an option.

Bank of Canada

Macklem. Tue: If the economy develops as forecast and inflation falls as predicted more hikes will not be needed, expects growth be close to zero for the first three quarters in 2023, need to pause rates before the economy slows too much which is what we're doing now, we don't know how long the pause is going to be, inflation is still too high but monetary policy is working and it's turning the corner, more hikes will be needed if wage growth doesn't moderate, risks to inflation forecast are balanced, prepared to raise rates if upside risks materialize, real estate market will probably soften further before it stabilizes later this year.

Bank of Japan

Kuroda. Mon: CPI sustainable at 2% accompanied by wage growth has not yet been achieved, there was no other monetary policy mean BOJ could have taken to achieve goals. Fri: Benefits of easing outweigh the costs of side-effects.

Suzuki: Tue: Important for exchange rates to move stably and reflect economic fundamentals, FX intervention in October 2022 had certain impacts. Fri: Inflation has yet to stably hit the BOJ's 2% inflation target, Japan's fiscal situation is severe.

Ueda. Fri: Possible candidate to succeed Kuroda. BOJ monetary policy is appropriate and needs to be continued, when asked about reports he would be nominated as next BOJ governor: nothing has been decided.

Amamiya. Fri: Appropriate to maintain current ultra-loose policy, premature to debate exit from easy policy including what to do with BOJ's ETF holdings, buying ETFs is abnormal policy from a central bank, demerits of YCC include impact on market functioning, will seek to improve market functioning via the fund supply operation against pooled collateral, no need to make YCC more flexible, 2% inflation target is a global standard and seen as appropriate.

Economic Data

Monday, 06.02.23

Tuesday, 07.02.23

Wednesday, 08.02.23

Thursday, 09.02.23

Friday, 10.02.23

Market Analysis

Growth and Inflation

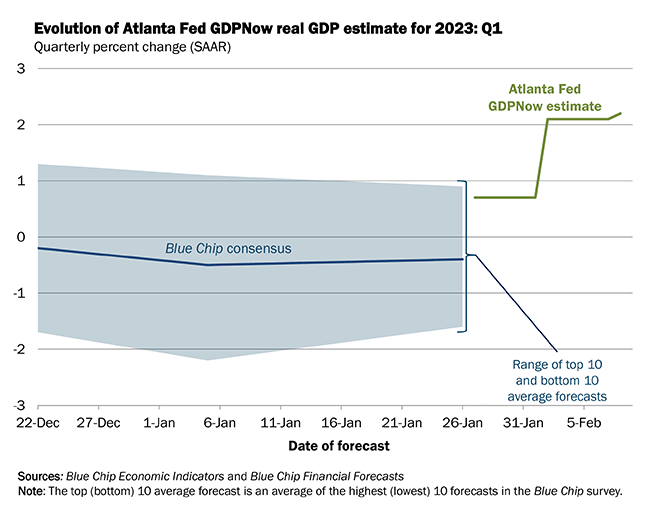

The Atlanta Fed GDPNow model ticked up to 2.2%:

The NY Fed Weekly Economic Index currently sits at 0.98:

Citi Economic Surprise Indexes:

USD jumped on last week’s NFP and remains high

EUR still not coming down

GBP, AUD, NZD are all lower

CAD is up on Friday’s labour market report

CHF and JPY are unchanged

The Bloomberg PMI heatmap is unchanged from last week:

The US, Eurozone, Germany, China, Japan are unchanged

The UK and Canada have improved

Switzerland has worsened

South Korea and Taiwan are still red, Hong Kong has improved

Important to note, though, that these are only Manufacturing PMIs

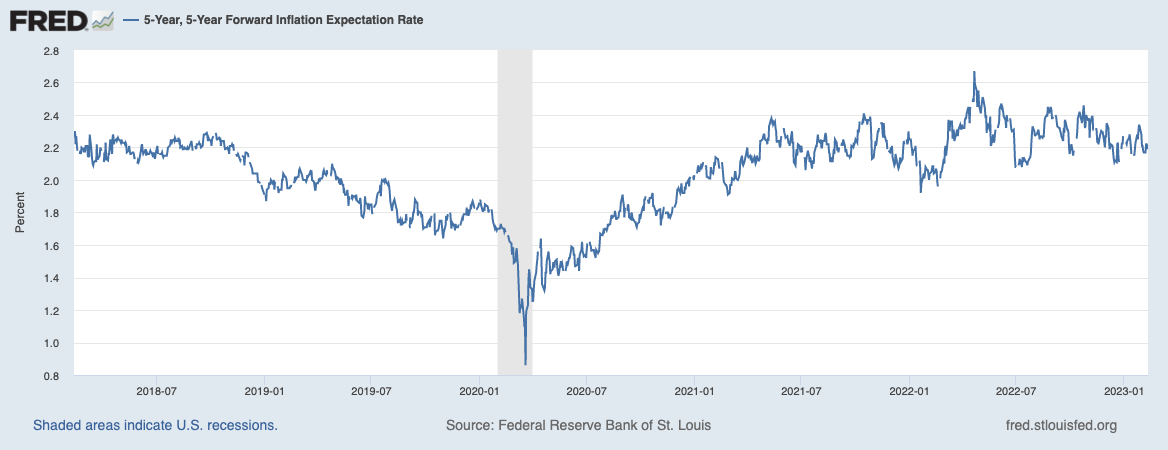

Inflation breakevens have rebounded, and we’re a bit deeper back inside the broad range. 5y5y forward inflation expectations are also range-bound.

The same goes for RINF:

Citi Inflation Surprise Indexes are unchanged from last week:

USD, EUR, GBP, CHF all lower

AUD higher

NZD and CAD sideways-to-lower

I’ve explained that these don’t fit what I see in the data very well, which is mostly upside surprises, in last week’s newsletter

Yields

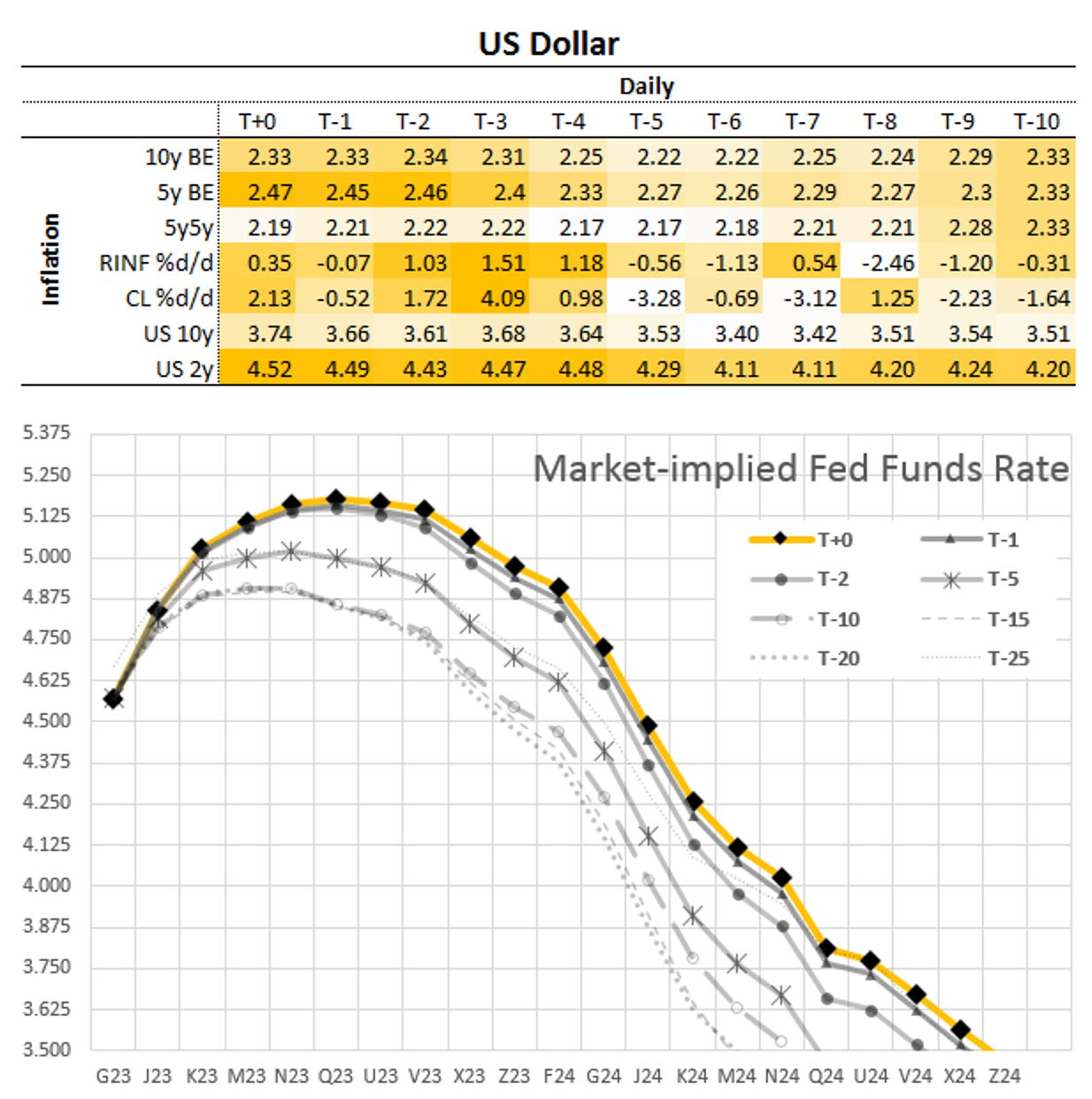

Looking at the chart and table below:

Everything looks pretty similar

UK and Swiss yields seem mostly flat

NZD yields are lower

Japanese 2s are lower too, 10s are glued to the 0.5% cap

The global flattening in yield curves continues:

Here’s a closer look at 2s, 10s and 2s10s:

Central Banks and the US Dollar

The latest FOMC meeting probabilities via FedWatch:

Last week has seen a hawkish shift in probabilities

25 bps in March is now given a 91% chance while a 50 bps hike is estimated at 9%; the week before had a slight bias towards no change and estimated 50 bps at zero percent

The terminal rate is still seen at 5.00-5.25% but with less probability towards the lower side, while the probabilities for 5.25-5.50% have increased

The Fed Funds forward curve has shifted higher along the entire curve through 2024. Interestingly, the timing of the first rate cut and the pace of rate cuts remains pretty unchanged over time:

Sectors and Flows

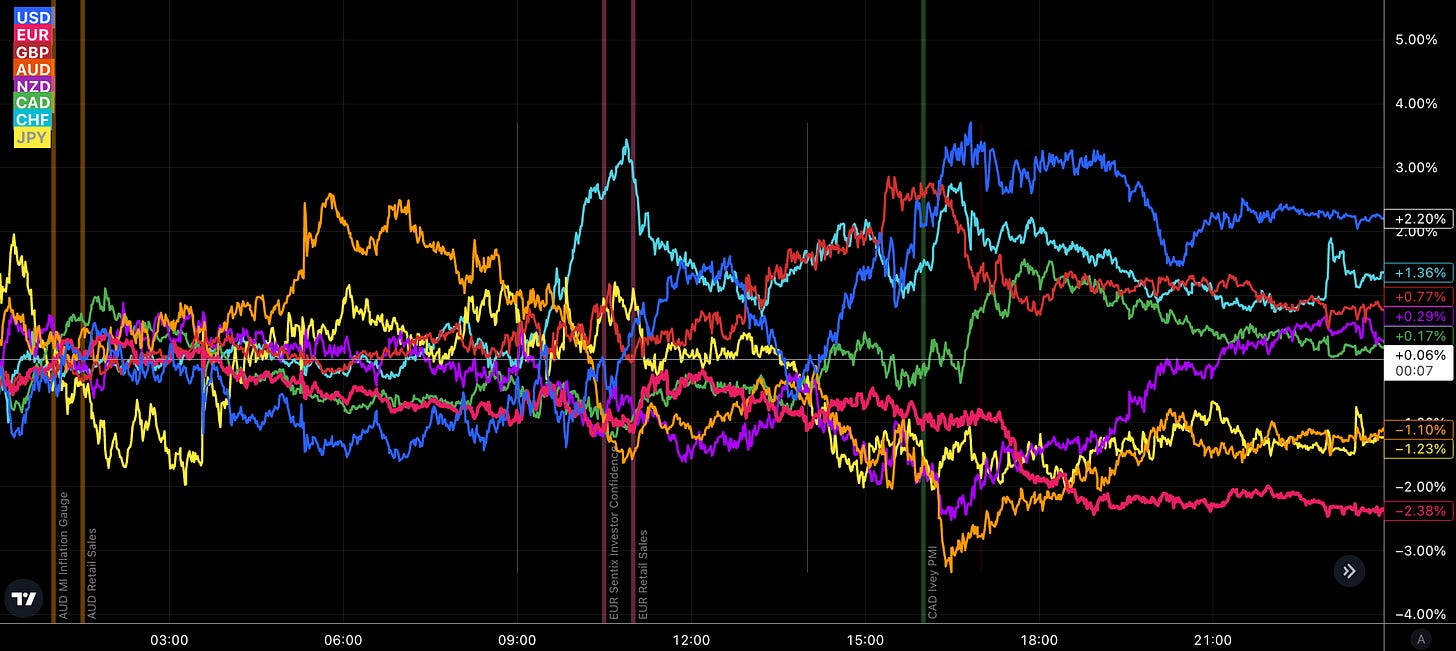

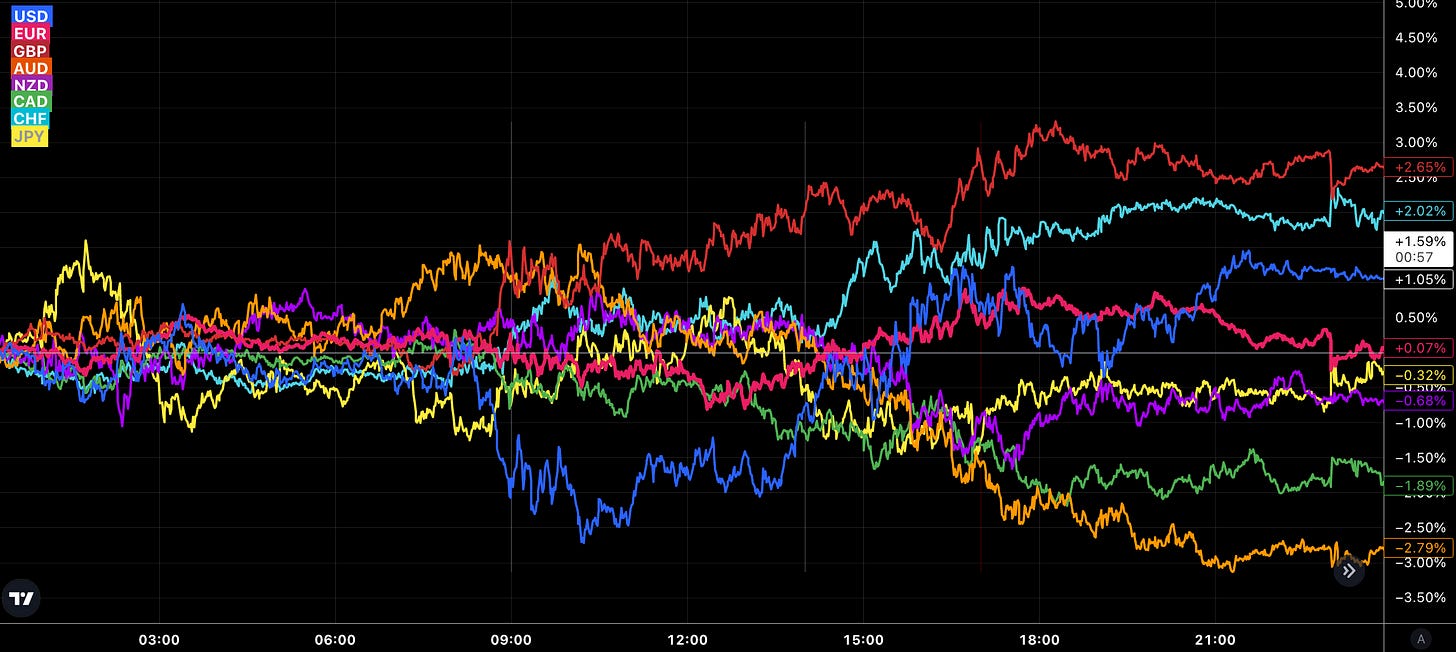

Currency strength charts:

Things are changing: the lines are still dispersed on the 3-month chart but they’re compressing on the 1-month chart

USD and CAD are still the weakest currencies over three months, they’re in the middle of the compression over one month, and they’re ahead over one week

It’s similar in reverse for JPY, AUD, NZD

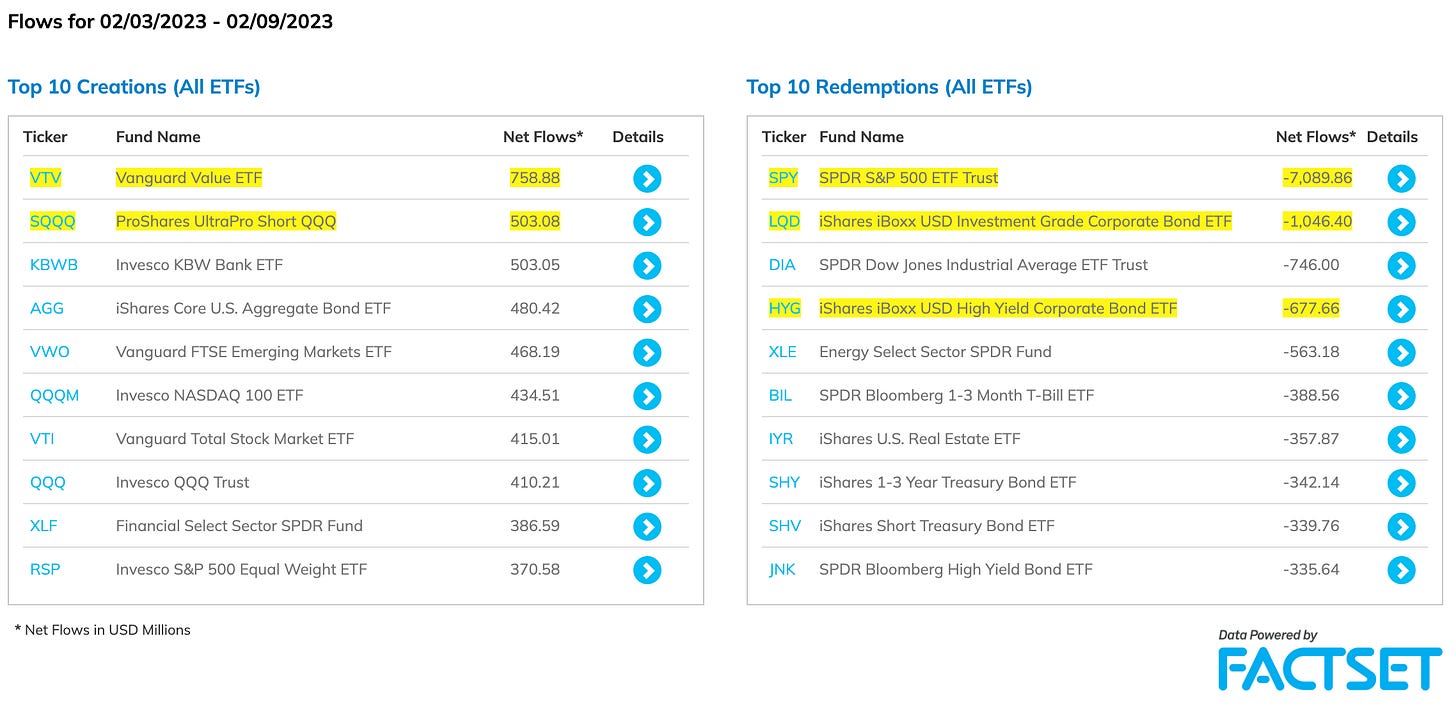

ETF creations/redemptions:

SPY has seen some pretty significant outflows

Money is also flowing out of LQD and HYG

The most inflows are seen in VTV and SQQQ

Equity sector performance:

SMH (Semiconductors), XME (Metals, Mining), XLK (Tech) are still ahead

XOP (Oil/Gas Exploration) and XLE (Energy) are catching up but they’re still the worst performing sectors

Energy has seen a bit of a comeback this week but other than that defensive sectors like Healthcare, Utilities, Consumer Defensive have been the relative performers:

Sector breadth is stalling, i.e. there are only about 75% of sectors with a positive 30-day performance, which is a bit puzzling. It could mean:

Money is rotating from defensive sectors into offensive ones (because these sectors are where the performance comes from), or

The rally isn’t seeing broad support.

The question is: is this a bullish or a bearish sign? In a true bull market, everything would perform, so it could be bearish. Also, in the previous two big bear market rallies, breadth reached 100%, now it’s stuck at 75%. But it feels like a bit more guesswork than usual.

Sector charts aren’t telling many new things: the breakdown in XLC is the only thing that stands out:

International stock markets:

Hang Seng is still ahead, followed by the European indexes we’ve seen over the last weeks and months

Brazil and India aren’t performing

Japanese indexes and the Korean KOSPI are the underperformers

Sentiment and Positioning

AAII Bull-Bear spread is shooting up, now at the highest point in over a year:

Currency sentiment:

CHF has even fewer long positions than last week

NZD still has bullish sentiment

Different sentiment source:

The change in EURCHF longs is remarkable, it’s now the most crowded currency pair, followed by USDCHF

JPY pairs are still mostly bullish on the yen but USDJPY is fairly neutral

Commitment of Traders data is still not available due to technical issues with trade reporting. Please disregard the COT data in the following table.

Equity futures ended the week lower, Levy Relative Strength (RSL) is still solid with values >1.00

Treasuries were lower this week, all their RSLs are back below 1, so they trade below their 26-week moving averages

Currency futures were mixed with 6E being down 1.3% for the week

Bitcoin is also lower but still has an RSL of 1.14 (down from 1.22 one week ago, though)

Energy futures traded higher, even NG is up although the 4.3% bounce pales in comparison to the dismal RLS of 0.43 (i.e. it’s trading 57% below its 26-week moving average)

Metals ended lower, PA just can’t catch a bid while HG is still doing relatively well with its RSL of 1.08

Grains and softs were mixed

Citi PAIN indexes: The move of the previous weeks continues with the USD long being closed out and money flowing into everything else. The “longest” currencies are AUD, CAD and NZD.

Since we don’t get fresh COT data, I played around with a different way of visualizing positioning: it shows the USD currency pairs (and DXY) overlaid with their PAIN indexes (orange) and Non-Commercial net positions from the COT report (purple).

DXY has room to go lower

EURUSD looks like the current high is already extreme in positioning

GBPUSD, AUDUSD, NZDUSD are pretty neutral

USDCAD is at an extreme and the logical way would be lower

USDCHF has seen some repositioning but there’s still some way to go

USDJPY is remarkably neutral in that chart

Market Risks

Credit spreads have compressed a small bit since last week:

The Credit Spread Index is higher as well:

Currency volatility jumped in JPY:

The VIX term structure is in contango:

Volatility indexes:

VIX has trouble staying below 20, MOVE is also back above 100

The jump in VVIX from the 80’s to around 96 is a worrying sign; it’s still not a high level for VVIX but the rate of change is atypical and it could pull VIX higher

VOLI isn’t moving as much as VIX, and skew is flattening with SDEX, TDEX and VIX/VOLI all lower

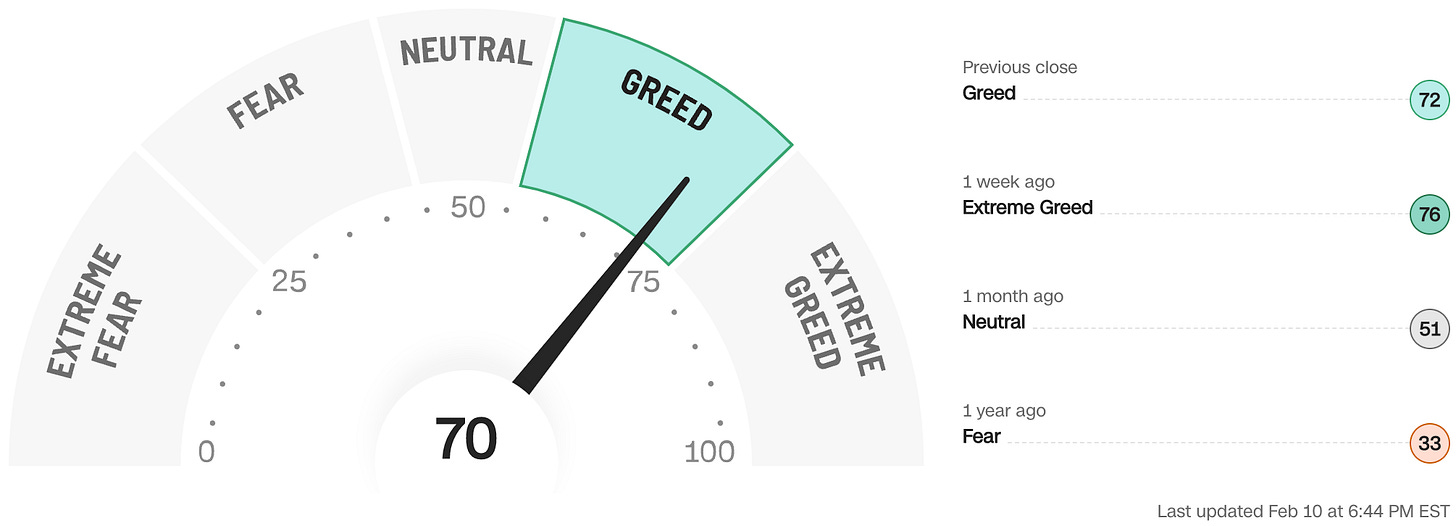

CNN Fear & Greed has left the extreme territory and now sits at “greed”:

BlackRock’s Geopolitical Risk Indicator looks a lot calmer than I’d have expected:

Various

Market Breadth

The NYSE Advance/Decline Line is still going strong:

The percentage of stocks above their 200-day moving averages isn’t looking bad for both the S&P 500 and the Nasdaq 100:

The shorter-term metric with 50-day moving averages is looking a bit worse: neither of them have reached the previous peaks or even held above the +2 SD line for a while. When you look back on the 2020 rebound or the 2021 bull market, you see that this isn’t uncommon, so I won’t put it down as a negative but it’s worth keeping in mind.

25-delta risk reversals:

USDCAD, USDCHF and USDCNY are seen higher

Again, I see USD strength here

The Market Dashboard is still showing intact trend metrics, a low number of distribution days (except for YM) and green VIX metrics. The standard deviation of VIX is still relatively low but the VIX tsunami signal only occurs when the same is true for VVIX and even then it’s not a good timing signal.

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 06/2023 | 50/2022 | 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 02/2023 | 47/2022 | 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

ECB

Rate Statements: 06/2023 | 50/2022 | 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 04/2023 | 47/2022 | 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 05/2023 | 50/2022 | 43/2022 | 36/2022

BOE

Rate Statements: 06/2023 | 50/2022 | 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

RBA

Rate Statements: 50/2022 | 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 51/2022 | 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 47/2022 | 41/2022 | 34/2022 Crib Sheets: 40/2022

BOC

Rate Statements: 05/2023 | 50/2022 | 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022

SNB

Rate Statements: 50/2022 | 44/2022 | 39/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

BOJ

Rate Statements: 04/2023 | 51/2022 | 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 05/2023 | 52/2022 | 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: DALL-E 2 with the prompt: A rapper rhyming the word "oranges" on stage

Thank you for these weekly gems you put out. It really helps especially without a solid economics background

Great stuff impressive! Just one question if I may how do you compute the market dashboard? Please what is your methodology? Thank you very much