Outlook for Week 06/2023

Covering the three central banks, two PMIs and the usual market analysis for the upcoming week...

Welcome to issue #42 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary.

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

The cover image is AI-generated via DALL-E 2. If you want to guess the prompt, I put it at the end of the newsletter.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Before we dive in, I'd like to give a shout-out to one of my favourite newsletters:

Table of Contents

Summary (Playbook, Calendar, Levels, FX Drivers, Downloads)

Week in Review: a) Central Banks, b) Economic Data

Market Analysis: a) Growth and Inflation, b) Yields, c) Central Banks and the US Dollar, d) Sectors and Flows, e) Sentiment and Positioning, f) Market Risks, g) Various

Top 3 Macro Charts of the Week

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Economic Calendar for next week

Important levels to watch and look out for in FX futures

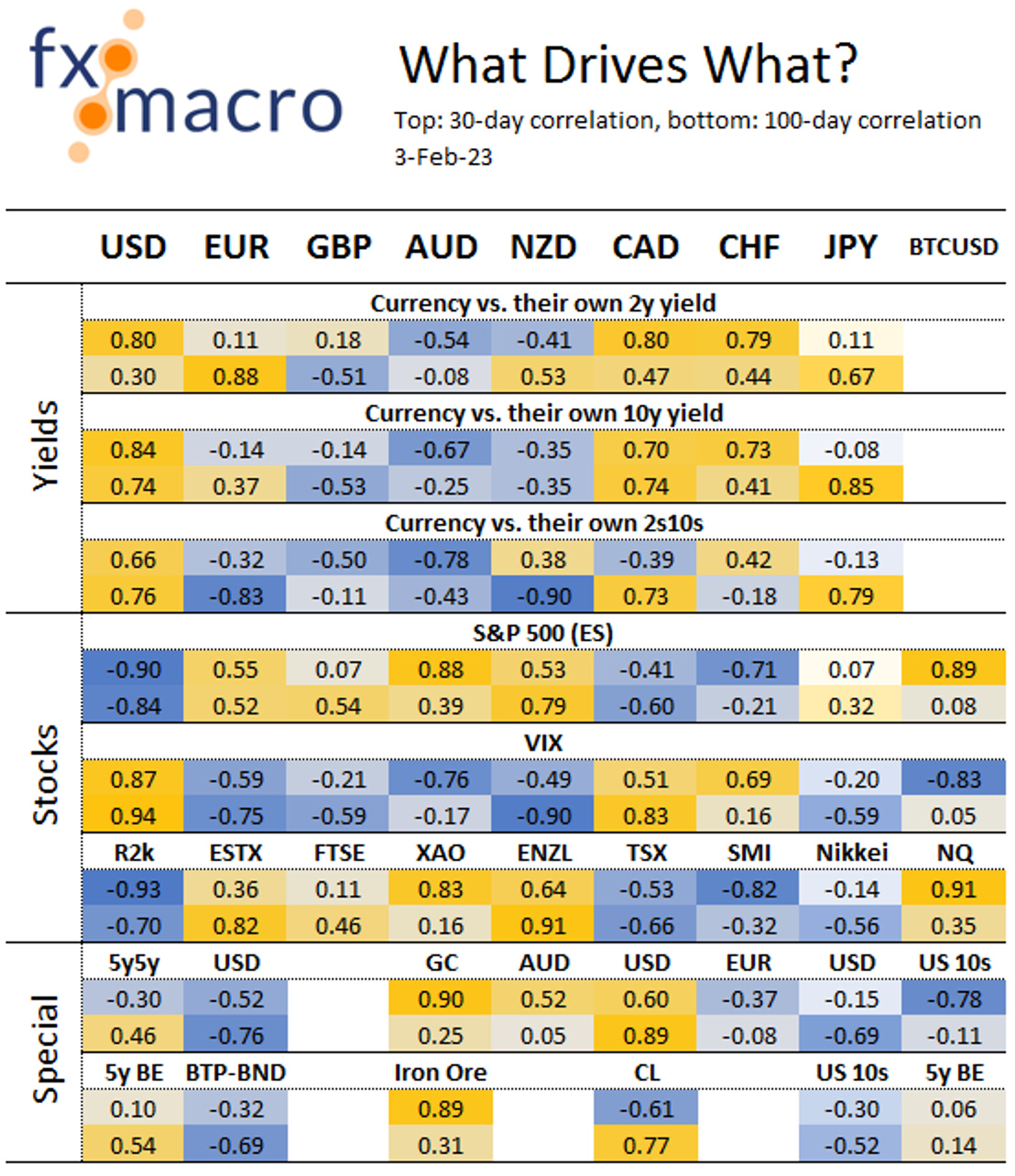

Currency Drivers

For an explanation check out this link.

Downloads and Links

Difftext of the Summary from last week: link to diffchecker.com

Central bank speaker recap for the week:

Week in Review

Central Banks

FOMC Rate Decision (01.02.23)

The Fed hiked 25 bps as expected to an FFR of 4.50-4.75%. Here's the summary and the difftext below:

Inflation has “eased somewhat but remains elevated”; they dropped the reference to “broader price pressures”

They dropped the bit about the Ukraine war contributing to upward price pressures

They are now determining the “extent” of future rate hikes instead of the "pace”

QT will remain unchanged

They have dropped the reference to “public health” in the factors they take into account when assessing the appropriate stance of monetary policy

Here's a link to

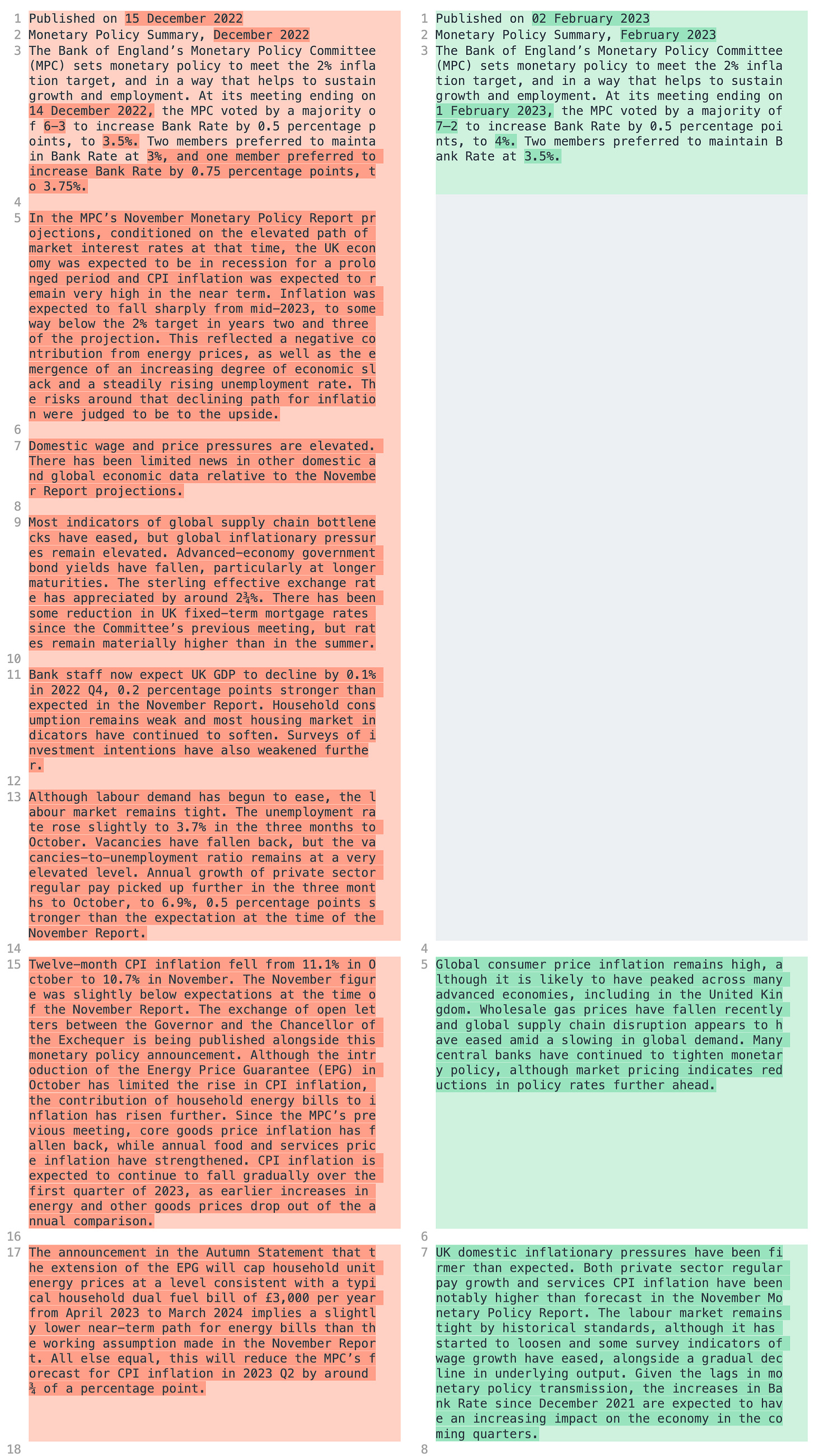

's Fed Review with more details.Bank of England Rate Decision (02.02.23)

The Bank hiked the policy rate by 50 bps to 4.00%:

Vote split: 7 in favour of the 50 bps hike, 2 in favour of no change

Guidance: further monetary policy tightening would be required "if there were to be evidence of more persistent pressures”

They dropped the “will respond forcefully” wording, the “further increases in the bank rate may be required” and the reference to deciding the appropriate level of the Bank Rate on a meeting-by-meeting basis

CPI is likely to have peaked across many advanced economies including the UK

Headline inflation is expected to fall sharply over the rest of the year

Inflation risks continue to be skewed significantly to the upside

Increases in the Bank Rate are expected to have an increasing impact in the coming quarters because of lags in policy transmission

If you don't want to go through the material below, check out

's BoE Review.Some important bits from the meeting minutes:

And from the Monetary Policy Report:

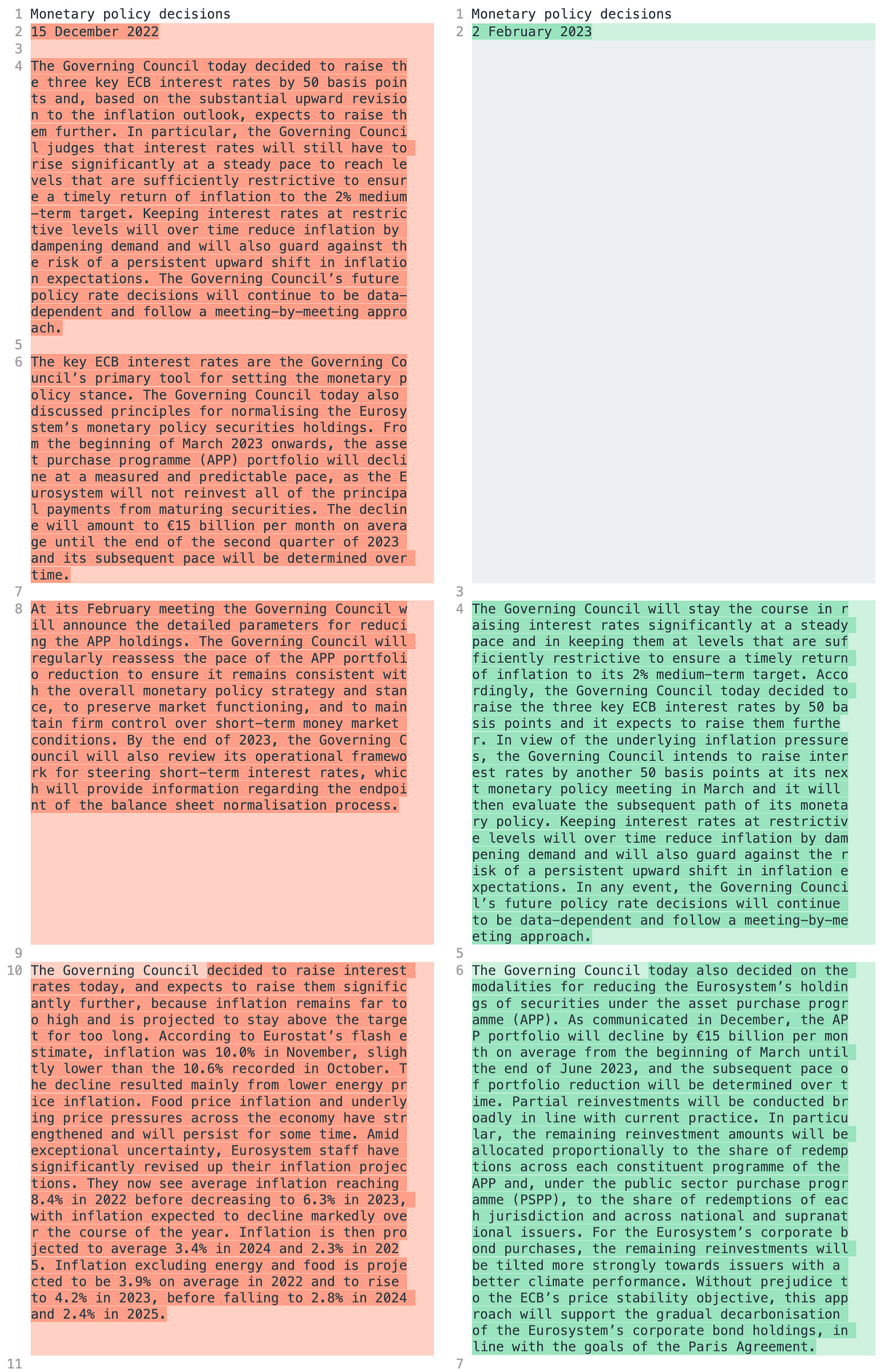

ECB Rate Decision (02.02.23)

The ECB hiked by 50 bps as expected:

Explicit guidance for another 50 bps hike in March, the bank will “then evaluate the subsequent path” of monetary policy

As announced previously: APP will begin to decline by 15 bln EUR per month from March until the end of June

Will stay the course in raising interest rates significantly at a steady pace and keep them at levels that are sufficiently restrictive to ensure a timely return of inflation to its 2% medium-term target

Future policy rate decisions will continue to be data-dependent and follow a meeting-by-meeting approach

For a more in-depth look, check out

's ECB Review.Confab, Speakers, News

Federal Reserve

Powell (Neutral). Wed: We will likely have to maintain restrictive stance for some time, policy is restrictive but not yet at sufficiently restrictive level, we have not made a decision on where exactly rates need to be, we're talking about "a couple of more hikes", full effects of hikes have yet to be felt, the disinflationary process has started, will need substantially more evidence to be confident inflation is on a downward path, not seeing inflation easing in core services ex housing but I think we will fairly soon, the historical record cautions strongly against premature easing, focus is not on short-term moves in financial conditions, according to our current outlook it will not be appropriate for us to cut rates this year.

Daly (Neutral). Fri: Today's job number was a "wow" number but trend is not surprising, the Fed is prepared to do more, rate decision will depend on inflation, too early to talk about what we will do meeting by meeting, far to early to declare victory or a peak, we will need to be in restrictive policy stance until we truly believe inflation will come down to 2%.

European Central Bank

Largarde (Dove). Thu: We will raise rates by 50 bps at the next meeting and then evaluate the path, cannot think of scenarios where a 50 bps hike would not happen unless they are quite extreme, decisions will be data-dependent, keeping rates at restrictive levels will reduce inflation and upward inflation expectations, discussion was marked by continuity and consistency, there was a large consensus today, we have not reached the peak in rates and we won't be at peak level in March, we expect growth to stay weak but the economy is more resilient than we expected, important to start rolling back fiscal support, fiscal measures could necessitate a stronger ECB response, risks to inflation and growth outlooks more balanced but there's no symmetry of risk.

Kazimir. Fri: Does not think March rate hike will be the last, will decide subsequently how many more will be needed, March won't bring us to peak of interest rates yet, the battle against inflation is far from won.

Simkus (Hawk). Fri: March rate hike may not be the last 50 bps move, May could bring 25 bps or 50 but hardly 75, rate cut this year is not very likely, headline inflation has probably peaked but core inflation has not.

Wunsch (Neutral). Fri: ECB will not go from 50 bps in March to no hike in May, 25 bps or 50 bps in May are possible, if core inflation remains persistent 3.5% terminal rate is the minimum, market reaction to Thursday's action has been surprising.

Vasle. Fri: May reach the terminal rate in Q3, we are approaching constrictive territory on rates, markets reacted positively to the ECB's rate hike, core inflation has not decreased significantly.

Sources: Thu: Policymakers see at least two more rate hikes, see 25 bps or 50 bps in May (not March!), terminal rate seen at 3.5%.

Bank of England

Bailey (Neutral). Thu: Not saying we're done with rate hikes as the world is too uncertain, not sure any future hikes will be in smaller steps, seeing first signs that inflation has turned the corner, language change reflects that but it is very early days, inflation risks skewed to the upside, private sector wage settlements have been higher than expected, full effect of what we've done on rates is yet to come through.

Broadbent (Neutral). Thu: We do not fully understand why UK labour force participation has not recovered as in other countries, factors weighing on UK growth will not be there forever.

Pill. Fri: Rate hike yesterday was necessary and appropriate, we have done a lot with monetary policy already, important not to do too much, MPC has changed language quite substantially, market has interpreted that correctly, does not want to steer market rate expectations on a day-to-day basis, we have a reasonably high degree of confidence inflation will fall this year, expects QT to proceed over the coming years, QT likely to run in the background whatever the cyclical position of monetary policy.

Swiss National Bank

Jordan. Thu: Cannot rule out that the SNB will have to raise rates further, ready to be active in currency markets when necessary, price stability does not happen automatically, no wage spiral in Switzerland, focus is on limiting second-round effects.

Bank of Japan

Kuroda. Mon: Must continue easy policy, possible to achieve 2% inflation target accompanied by wage growth by continuing current easy policy, what's most important now is to support the economy and create conditions that allow firms to hike wages, current CPI rise is mostly due to firms passing on higher import costs. Fri: Must maintain ultra easy policy to support the economy and create environment for firms to hike wages, expect wages to rise quite significantly due to very tight job market.

Kishida. Mon: The BOJ's decade of monetary easing has created a situation where the economy is no longer in deflation, hopes the BOJ continues to work closely with the government.

Suzuki. Tue: Too early to judge if the joint Government-BOJ statement needs to be revised.

Wakatabe. Thu: Absolutely no change in commitment to continue easing, easing was clearly effective in propping up the economy, what is most important is that changes in prices and wages will be sustained, outcome of annual wage negotiation not enough to change BOJ policy view.

Economic Data

Monday, 30.01.23

Tuesday, 31.01.23

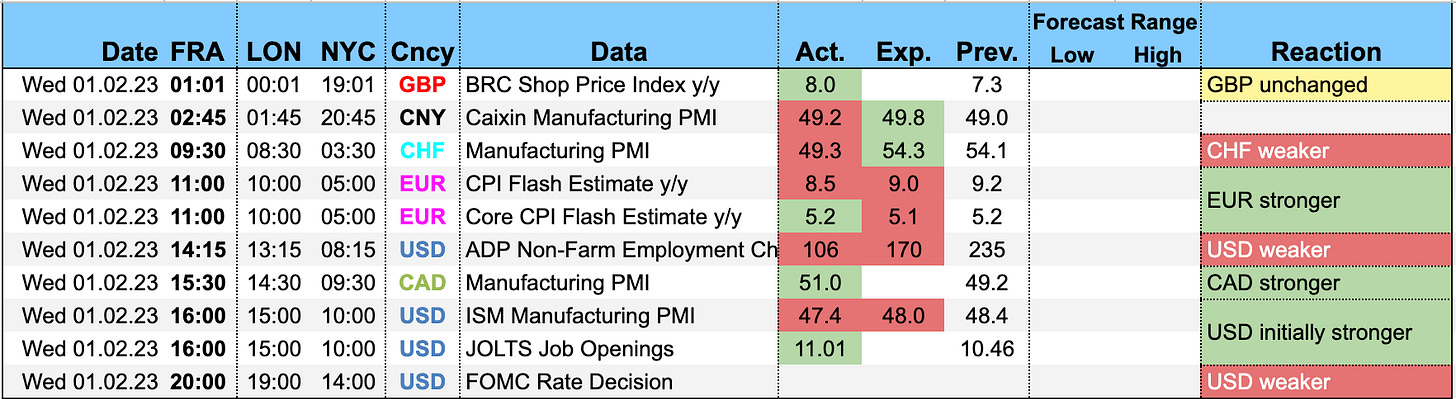

Wednesday, 01.02.23

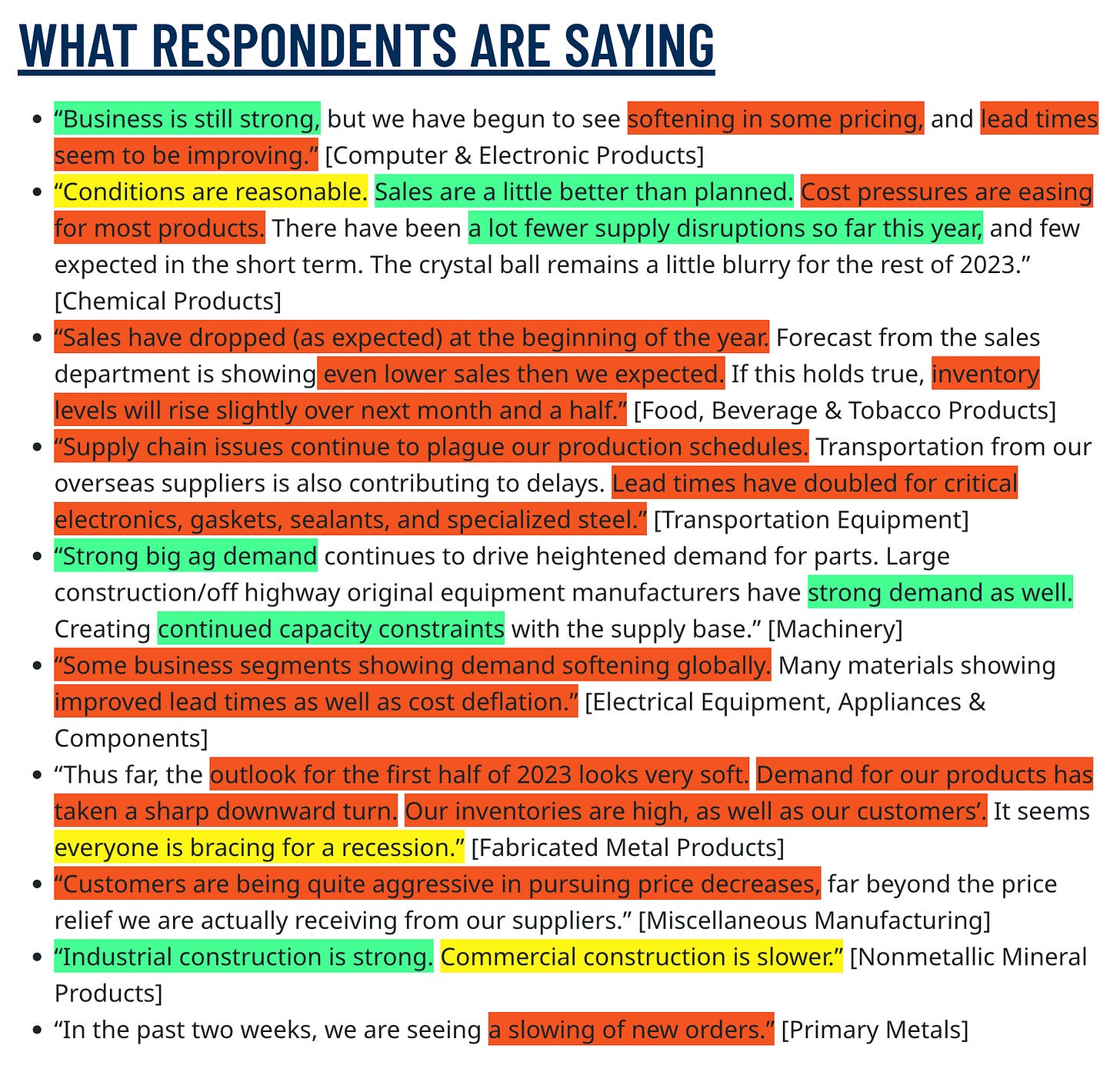

Highlights from the ISM Manufacturing PMI:

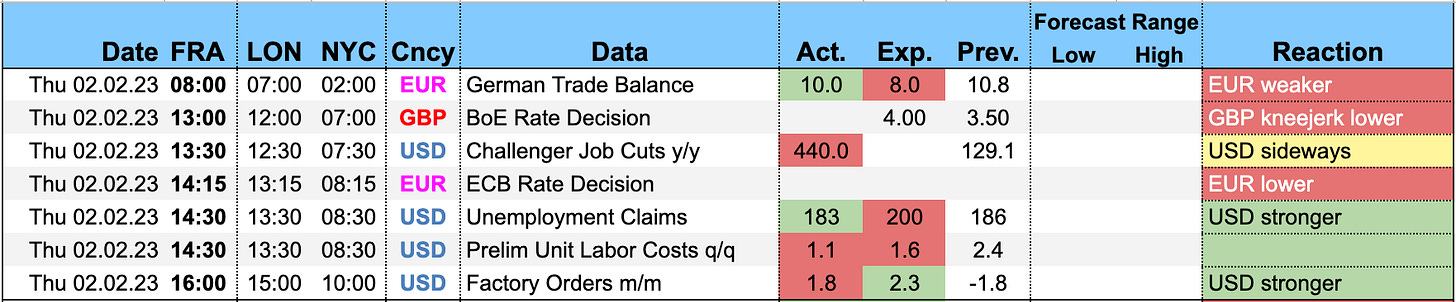

Thursday, 02.02.23

Friday, 03.02.23

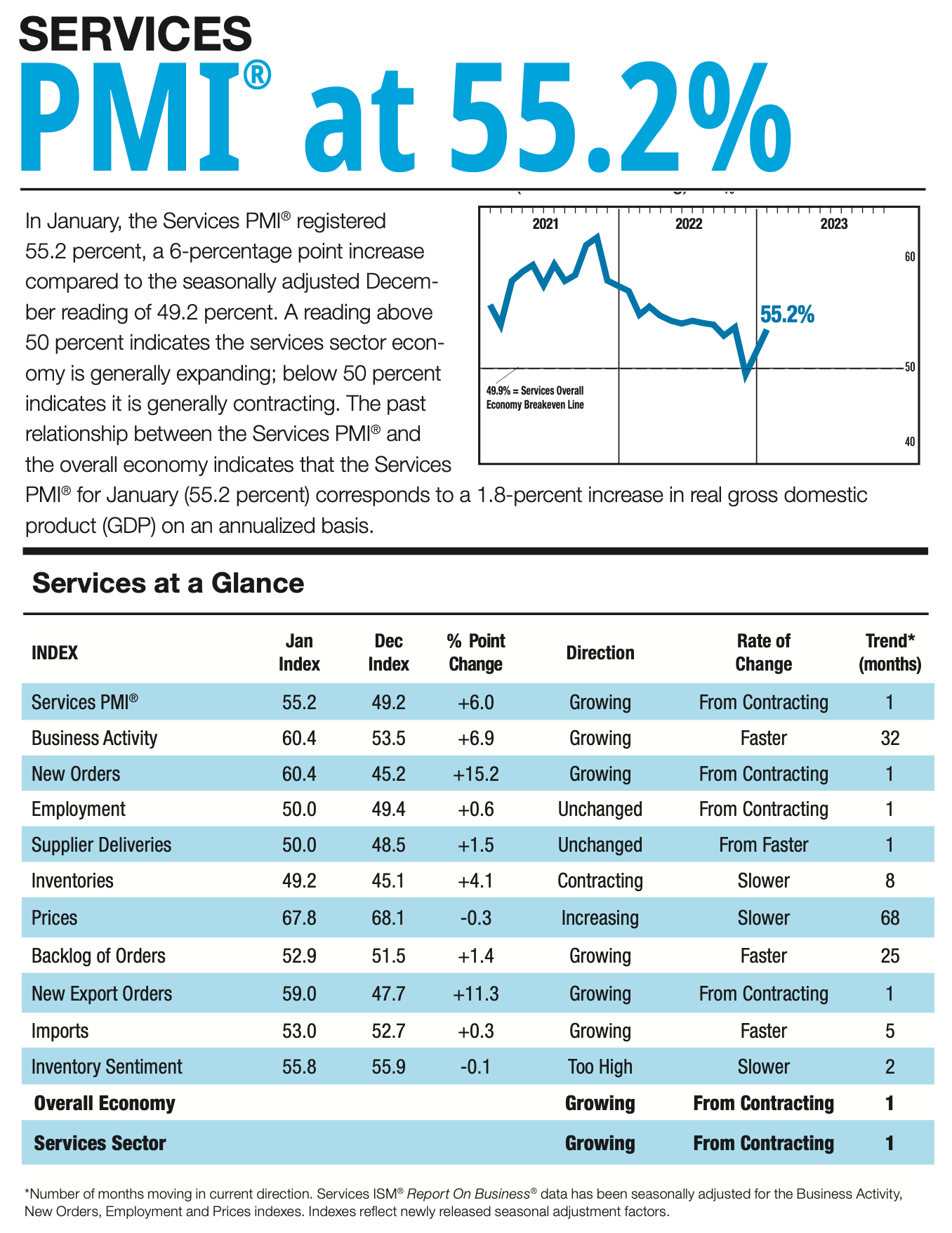

Highlights from the ISM Services PMI:

Market Analysis

Growth and Inflation

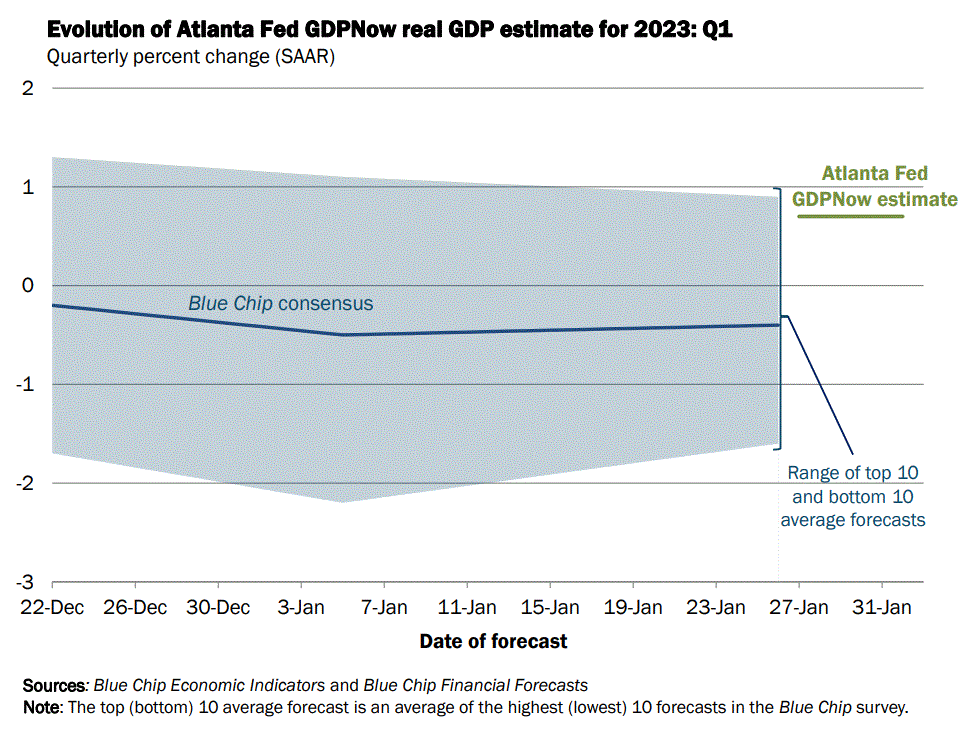

The Atlanta Fed GDPNow remains unchanged at 0.7%:

The NY Fed Weekly Economic Index ticked up to 0.99%:

Citi Economic Surprise Indexes:

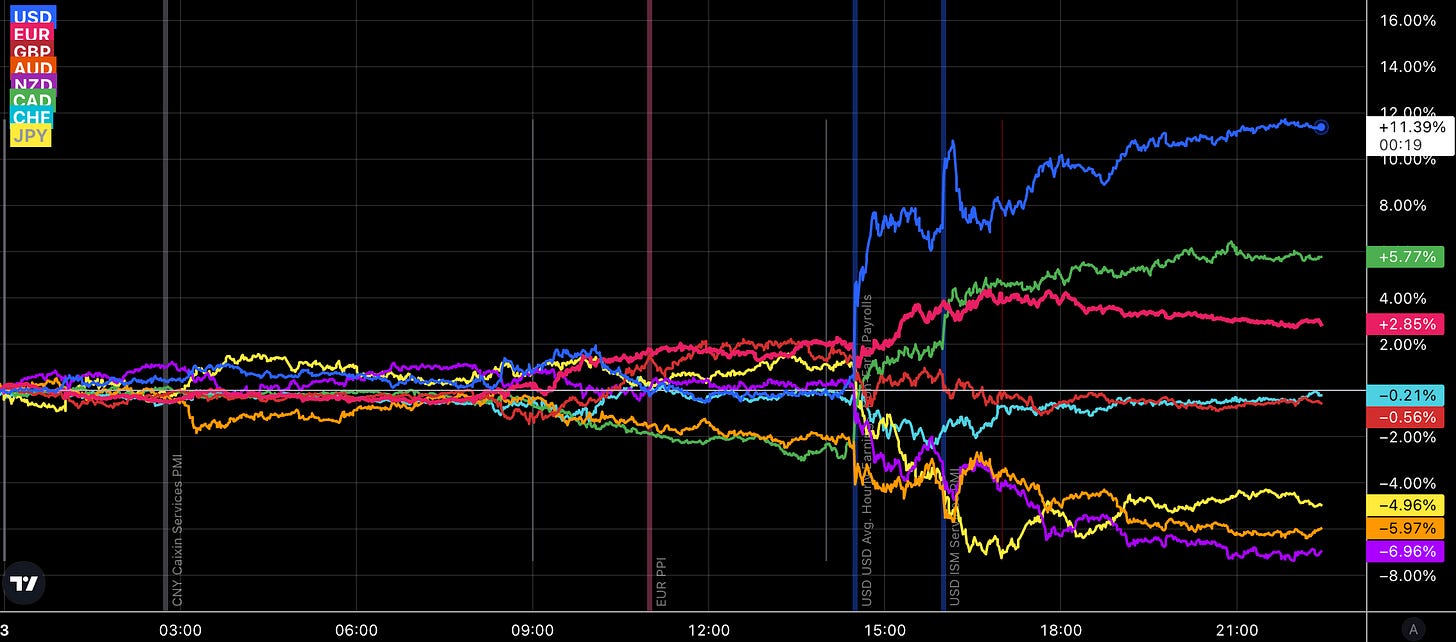

USD sharply higher after Friday's Non-Farm Payrolls data

EUR trending higher

GBP and NZD trending lower

AUD and CHF are near lows

CAD has weakened

JPY is moving sideways

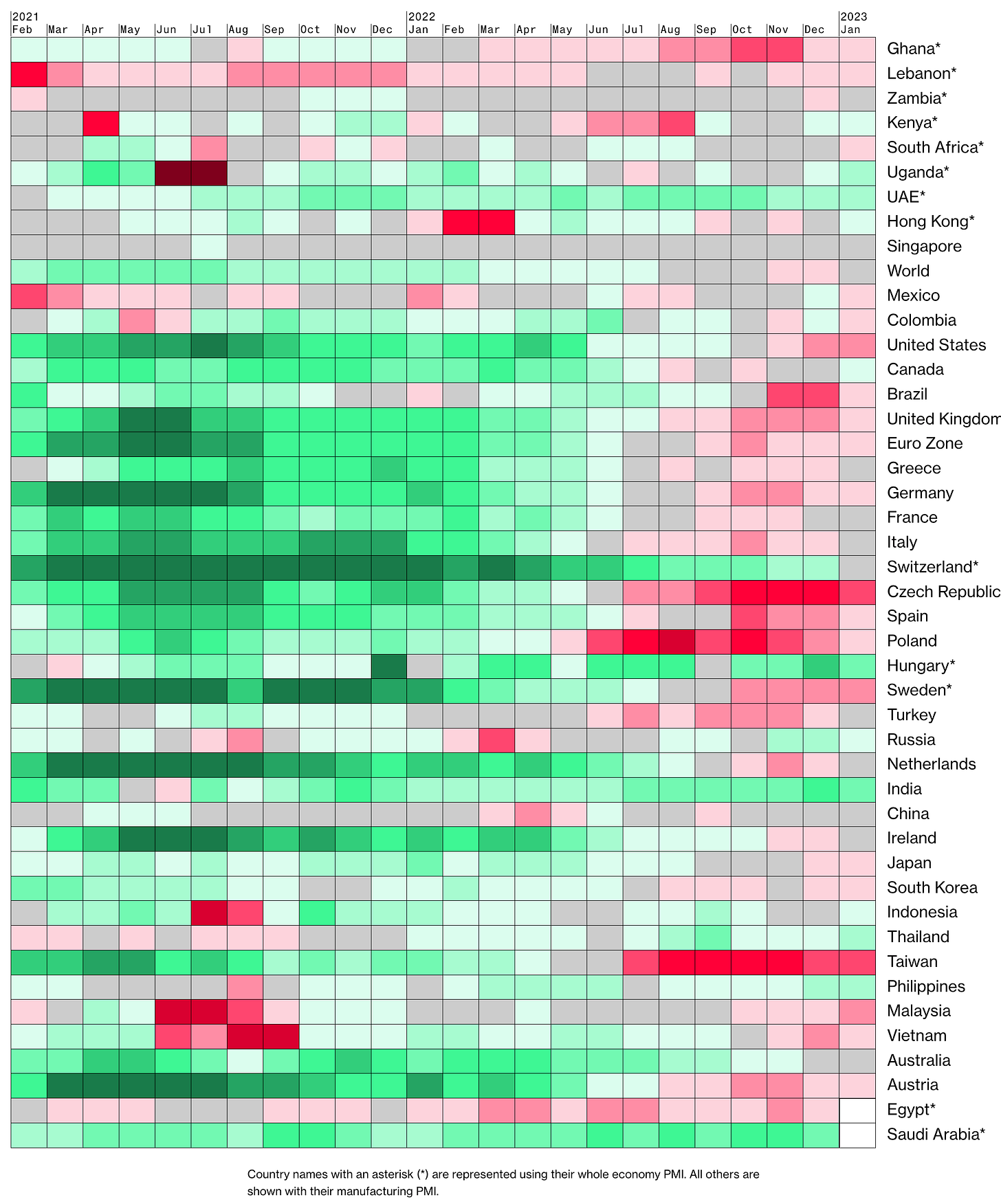

The Bloomberg PMI heatmap:

The US, Eurozone, Germany, China, Japan are unchanged

The UK and Canada have improved

Switzerland has worsened

South Korea and Taiwan are still red

Important to note, though, that these are only Manufacturing PMIs

Inflation breakevens and RINF continue to trade sideways:

Citi Inflation Surprise Indexes:

USD, EUR, GBP, CHF all lower

AUD higher

NZD and CAD sideways-to-lower

The data from the Inflation Surprise Index does not reflect my perception, so I checked against my own calendar. Here are all the CPI releases I’ve tracked since December 2022, and going through them I see the following:

US CPI is mostly coming in below expectations and below previous prints, headline as well as core

UK is mixed but core has been a) sticky and b) surprising to the upside

Eurozone: headline lower and below expectations but core up and surprising to the upside too

Aussie: both headline and core a) higher and b) surprising

Kiwi: only tracked headline but that’s been higher

Japan: Not one disinflationary print, not one downside surprise

Canada: Median and Trimmed are what count, they’ve all been higher and mostly surprising

Switzerland: only headline and only two prints but both have been disinflationary and below consensus

It’s obvious that the only two economies with disinflationary CPI prints are the US and Switzerland while the Eurozone and the UK have a sticky core problem and Japan, Australia and New Zealand are having a full-on re-inflation going on.

Yields

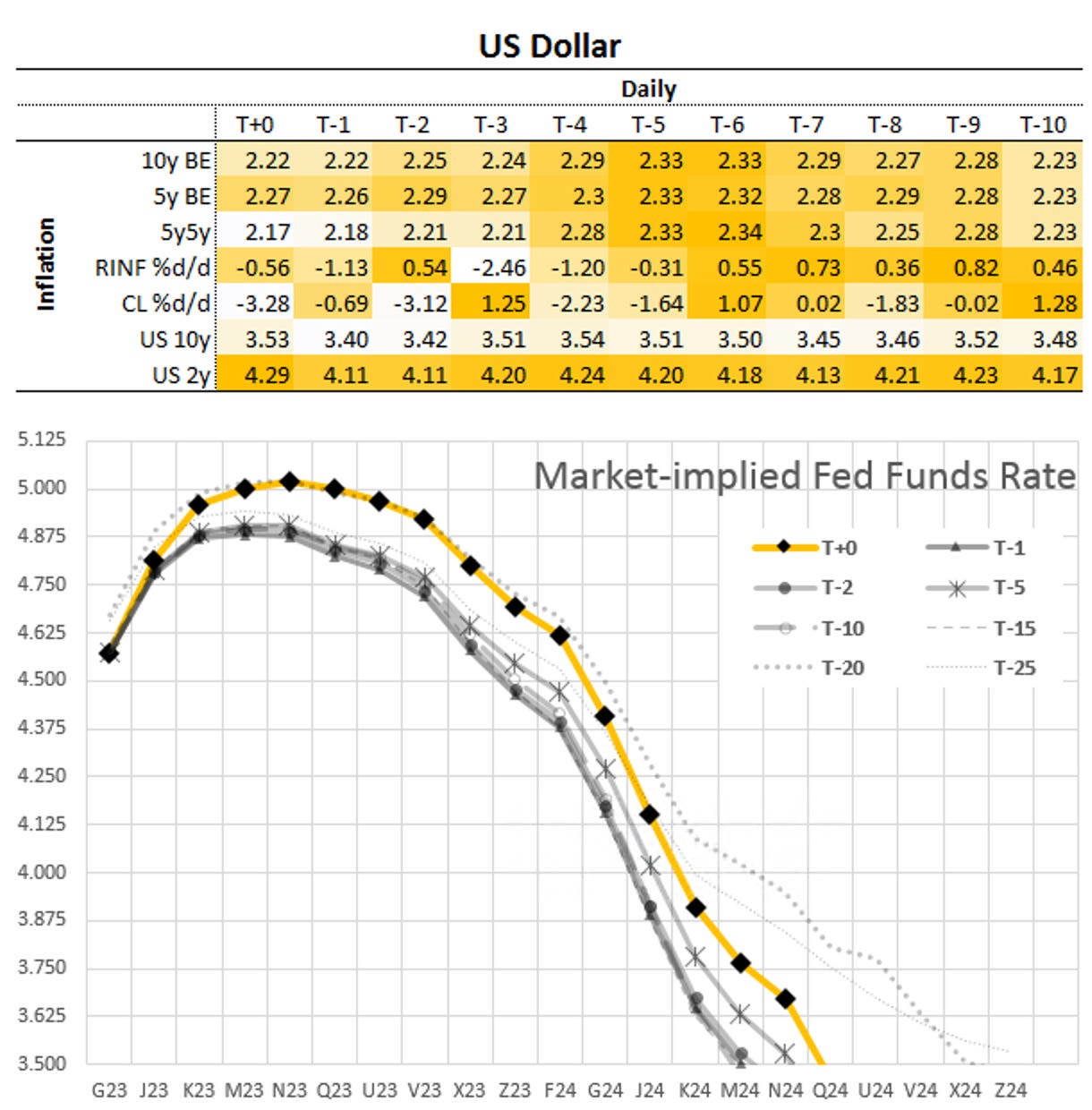

Looking at the chart and table below:

US, Canadian and German yields look strongest

AUD and NZD look weakest

Japanese 10-year yields are back up at the 0.5% ceiling again

Yield curves at the 2s10s spread: nothing new going on here, no sign of a sustained steepening in the US curve or anywhere else except for Japan.

Central Banks and the US Dollar

FOMC target rate probabilities according to FedWatch:

The March meeting is priced at 25 bps with a probability of 83%, and the rest at no change; that's remarkably unchanged from last week

The terminal rate is seen only 50 bps higher from here at 5.00-5.25%

The first rate cut is seen in June but that's looking a bit weird and could easily be a data error because I don't see that in the market-implied FFR curve below

Friday's Non-Farm Payrolls pushed the implied FFR curve higher and above 5.00% again in a parallel shift even out in 2024; 2-year yields jumped from 4.11% to 4.29%.

Sectors and Flows

Currency strength:

USD and CAD have caught up a little: they're still the underperformers over three months but over shorter time periods they look stronger

It's the opposite with JPY: it's ahead over three months but weaker over one month and one week

GBP has shown weakness recently

Everything else is somewhere in the middle

Equity sector performance:

Semiconductors, Tech, Metals/Mining, Growth, Consumer Discretionary are outperforming

Oil/Gas Exploration, Energy, Oil Services are the weakest sectors

Also weak: Healthcare, Staples, Value, Utilities

A clearly bullish overall picture here

Same situation on the following chart: the current rally is carried by the “right” sectors.

It all looks a bit like reversion to the mean on the next chart: everything that has been outperforming over 2022 (which was mostly Energy) is underperforming now vs. everything that has been beaten down (Tech, Communication, Discretionary).

Sector charts continue to look bullish with SPX breaking above a previous high, Communication at highs, Healthcare not getting into gear, Staples below resistance, Utilities breaking down further… even Real Estate looks in reasonable shape:

International stock indexes:

Hang Seng still way up at +32%

European indexes are still near the top but the Nasdaq has caught up

Japanese indexes, Brazil and India are the underperformers

Sentiment and Positioning

AAII Bull-Bear spread hasn’t changed much. We’re still far below 2021 levels but relative to 2022 the mood is already pretty good:

Currency sentiment:

CHF sentiment is still very bearish on the franc

NZD sentiment has jumped from 58% bulls last week to 66% this week

EUR sentiment is still relatively bearish

Another sentiment source:

USDCHF is still the currency pair with the most bullish sentiment

AUDUSD, NZDUSD and GBPUSD are all betting against the dollar

JPY pairs are all bullish on JPY

Commitment of Traders data has not been released due to a malware attack on a broker. We can look at futures performance but please disregard the COT data below:

Stocks were up this week with only the YM not finishing in the green. Relative Strength (RSL) is solidly above 1 for all four futures.

VIX futures also had a positive week, which is notable given that ES is also higher.

Treasuries were all lower except for the far-out end of the curve.

Bitcoin was also a tad higher, what’s notable here is that its RSL is at 1.22, i.e. it’s trading 22% above its 26-week moving average

Energy futures… CL was the outperformer with only -7.90% for the week, everything else was down double-digits, RSL for NG is at only 0.38

Metals were also lower with the exception of PA, RSL of HG is still 1.09 but it’s clearly weakening after a strong move higher

Grains and softs were mixed, OJ had a pretty stellar week. Notable is the continued weakness in ZW.

Citi PAIN indexes show the unwinding of the long dollar position vs. everything else with CAD, AUD and NZD benefiting the most, CHF and GBP are the two currencies that show the least increase in positioning.

Market Risks

High-yield OAS have been compressing and took out their mid-2022 lows:

The Credit Spread Index is moving sideways:

Currency volatility seems to be relaxing a bit:

The VIX term structure is in contango:

Volatility indexes:

MOVE is below 100, VIX is at 18.3

Skew is steepening further while ATM IV (VOLI) is dropping

Overall nothing to be concerned about here

CNN Fear & Greed index has now moved to above 75, which indicates extreme greed.

Various

The NYSE Advance/Decline Line continues to move higher:

Index components above their moving averages also look very healthy: 73% of the S&P 500 and 66% of the Nasdaq trade above their 200-day MAs.

It's a similar picture with similar numbers for the shorter-term 50-day MA metric:

25-delta risk reversals:

USDJPY and USDCHF are seen as stronger

All in all, I see USD strength here

My market dashboard is looking pretty good with trend metrics all green, hardly any new distribution days. The correlation between VIX/VVIX is still negative, which remains a warning sign.

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 50/2022 | 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 02/2023 | 47/2022 | 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

ECB

Rate Statements: 50/2022 | 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 04/2023 | 47/2022 | 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 05/2023 | 50/2022 | 43/2022 | 36/2022

BOE

Rate Statements: 50/2022 | 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 05/2023 | 50/2022 | 37/2022

RBA

Rate Statements: 50/2022 | 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 51/2022 | 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 47/2022 | 41/2022 | 34/2022 Crib Sheets: 40/2022

BOC

Rate Statements: 05/2023 | 50/2022 | 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022

SNB

Rate Statements: 50/2022 | 44/2022 | 39/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

BOJ

Rate Statements: 04/2023 | 51/2022 | 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 05/2023 | 52/2022 | 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: “A Chinese spy balloon flying over the United States”

Thank you for the wonderful weekly compilation!

What A/D line (TV-Code?) in TradingView are you using for the plot? There are so many and can't find the right one. Thanks!

great coverage, thank you