Welcome to issue #39 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary. The final section contains the top three macro charts for the week and is brought to you by

.If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

The cover image is AI-generated via DALL-E 2. If you want to guess the prompt, I put it at the end of the newsletter.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Before diving in, I’d like to give a shout-out to

TMH is a great way to stay on top of what’s going on in markets. If you like fx:macro, you will love TMH, so check it out and subscribe!

Table of Contents

Summary (Playbook, Calendar, Levels, FX Drivers, Downloads)

Market Analysis: a) Growth and Inflation, b) Yields, c) Central Banks and the US Dollar, d) Sectors and Flows, e) Sentiment and Positioning, f) Market Risks, g) Various

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Edit (Jan 16): The correlation between ES and VVIX is currently high, not between ES and VIX. That’s only a mix-up in names on my side, so the conclusion still holds true. Thanks to the reader who brought it up!

Economic Calendar for next week

Important levels to watch and look out for in FX futures

Currency Drivers

For an explanation check out this link.

Downloads and Links

Difftext of the Summary from last week: link to diffchecker.com

Central bank speaker recap for the week:

Week in Review

Confab, Speakers, News

Federal Reserve

Daly (Neutral). Mon: Case can be made for 25 and for 50 bps, too soon to stop rate hikes, reasonable for rates to be 5-5.25%, more gradual steps allow to account for lags, we haven't seen services inflation come down as we'd like, especially core services excluding shelter, agreement among policymakers that inflation is more persistent than we thought, we are determined to bring it down, wage growth coming down is consistent with labour market slowing, December wage data was one month of data so we can't declare victory.

Bostic (Neutral). Mon: Open to 25 bps if this week's CPI confirms positive trends, sees rates rising to 5-5.25%, broad consensus that Fed policy is in a restrictive place, rates will have to stay high for a long time well into 2024, does not see cuts through 2024 as a base case, fair to say the Fed is willing to overshoot, appropriate to be much more cautious, getting back to a more normal cadence of policy movements will be appropriate and important, right now the economy can absorb tightening. Thu: Comfortable moving at 25 bps if conversations with business leaders are consistent with slower inflation, today's inflation report may allow the Fed to move more slowly, signs of slowing wages also positive.

Powell (Neutral). Tue: Restoring price stability when inflation is high can require measures not popular in the short term, the Fed is not and will not be a climate policymaker, the Fed has narrow responsibilities regarding climate-related financial risks.

Bowman (Neutral). Tue: Committed to take further action to bring inflation back down, Fed needs to hold policy at restrictive levels "for some time" once they're reached, looking for compelling signs inflation has peaked, stop-start hiking cycle of the 1970s and early 1980s provides an important lesson in her thinking to avoid a repeat.

Kashkari (Hawk). Tue: Pushed back on market expectations of rate cuts: "They are going to lose the game of chicken."

Collins (Neutral). Wed: Leans towards a 25 bps hike, either 25 or 50 bps would be reasonable, expects the terminal rate to be just above 5%, expects 3x 25 bps hikes and then hold until the end of the year, we are in restrictive territory.

Harker (Neutral). Thu: Time for future Fed rate hikes to shift to 25 bps increments, likely to raise rates "a few more times" in 2023, the time of super-sized rate hikes has passed, will have to hold rates steady for a bit once hikes end, worst of inflation surge is now likely over, labour market remains in excellent shape.

Bullard (Hawk). Thu: We must maintain rates at high enough levels to make sure inflation moves down, must avoid a repeat of the 1970s, something north of 5% is the lowest level the Fed could use to credibly restrict inflation, today's CPI was encouraging but there's possibly too much optimism that inflation will come easily back to 2%, most likely scenario is that inflation will remain above 2% so policy rate will need to stay higher for longer, looks like we have above-trend growth in Q4, hard to see how unemployment is going to go up.

Barkin (Neutral). Thu: Makes sense to steer more deliberately, supportive of a rate path that is slower but potentially higher, last three months of inflation prints have been as step in the right direction, has the impression that the labour market is easing.

European Central Bank

Schnabel (Neutral). Tue: Inflation will not subside by itself, restrictive policy stance today will benefit society over the medium to long run by restoring price stability, financing conditions will need to become restrictive, the ECB needs to intensify its efforts to support the green transition.

Centeno. Tue: We are approaching the end of the interest rate rise process, inflation will fall again from March, not seeing any fragmentation risk in the euro area now.

Villeroy (Neutral). Wed: Will have to raise rates further in the coming months, should aim to reach the terminal rate by summer, we need to be pragmatic about the pace of rate hikes.

Rehn (Hawk). Wed: Rates will still have to rise significantly.

Holzmann (Hawk). Wed: Rates will have to rise significantly further to reach levels that are sufficiently restrictive, HICP is expected to subside but risks remain tilted to the upside, no signs of de-anchored inflation expectations.

De Cos (Dove). Wed: The ECB will continue raising interest rates significantly at future meetings at a sustained pace.

Kazaks (Hawk). Thu: Rates should rise well into restrictive territory, there is no rationale for market bets on rate cuts.

Enria. Fri: Low interest rate environment has incentivised some banks to increase credit volume to riskier and less transparent counterparties including non-bank institutions like family offices and hedge funds.

Bank of England

Mann (Hawk). Weekend: Caps on energy prices can lead to potentially higher inflation in other products, have to look at that carefully, concerned about what will happen to inflation if the caps are removed. Thu: We are not at the point in the hiking cycle where we need to worry about the risk of over-tightening.

Pill. Mon: Domestic factors will strongly influence my monetary policy decision in the coming months, threat of second-round inflation effects remain if imported gas prices remain significantly higher than in the past, we are starting to see labour market indicators turn, the longer firms try to maintain real profit margins and employees try to maintain real wages the more likely it is that inflation will be self-sustaining, the BOE must ensure this doesn't happen by constraining demand.

Bank of Japan

Kuroda. Tue: Central banks cannot unconditionally respond to climate change and must decide their actions within their mandate.

Saito (senior MOF official). Wed: Interest rates remain low but that won't last indefinitely, JGB coupon rates will be decided based on prevailing market conditions.

Matsuno. Wed: We welcome various companies' policies for wage hikes, hope for maximum wage increases from companies, have asked China to lift visa suspension.

Shirai (ex-BOJ). Wed: Excessive dollar strength likely to be corrected, widening of JGB yield band is aimed at sustainable policy and a reasonable decision, boosting flexibility is the way forward for Japan's monetary policy if possible.

Statement. Fri: The BOJ will conduct additional long-term bonds on Monday, will make nimble responses by conducting additional outright JGB purchases and take into account market conditions.

Economic Data

Monday, 09.01.23

Tuesday, 10.01.23

Wednesday, 11.01.23

Thursday, 12.01.23

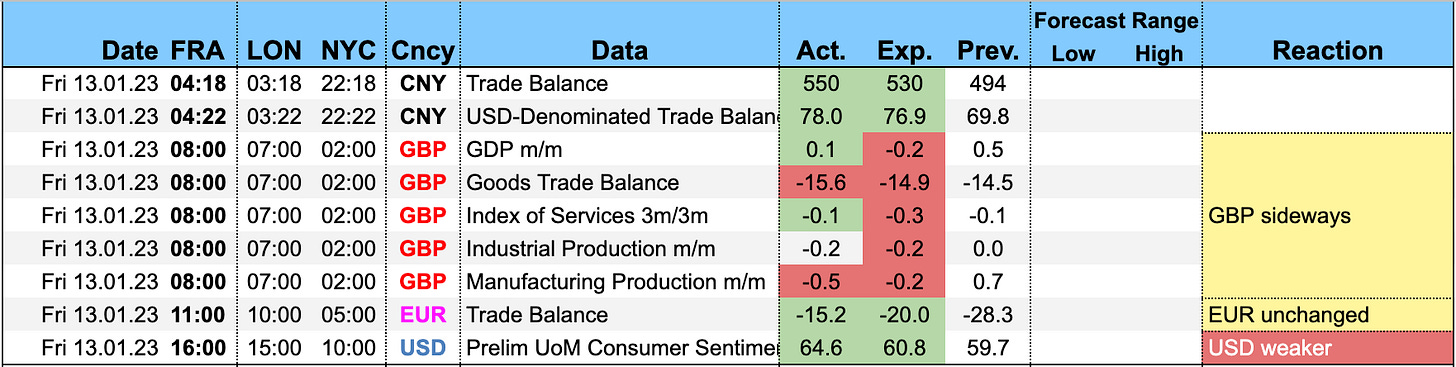

Friday, 13.01.23

Market Analysis

Growth and Inflation

The Atlanta Fed GDPNow model estimates Q4 growth at 4.1%.

The NY Fed Weekly Economic Index ticked lower to 0.87.

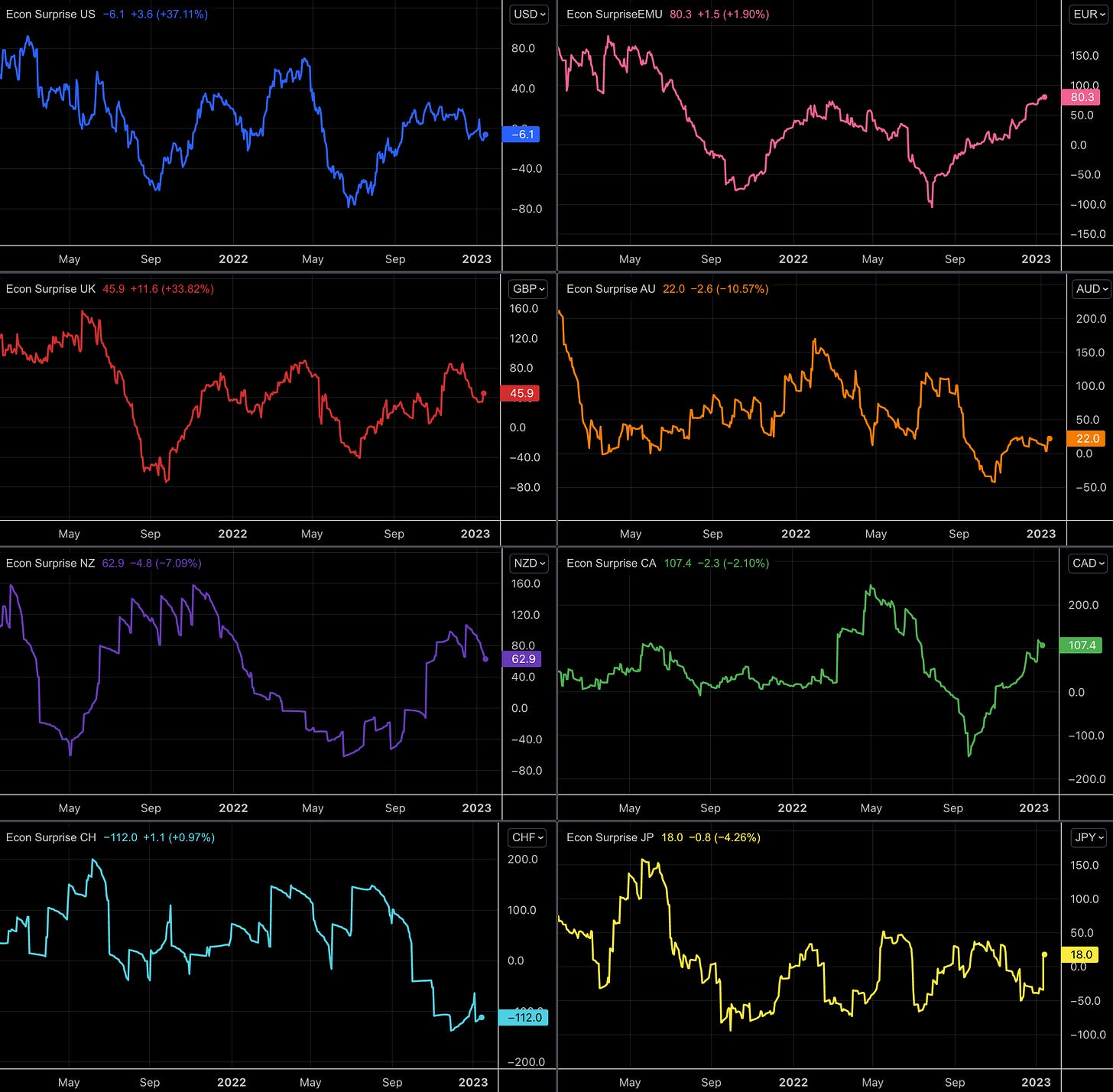

Citi Economic Surprise Indexes:

USD sideways to lower

EUR and CAD still going higher

GBP ticked up again but is still headed lower

AUD goes sideways

NZD is coming off its high

CHF can’t get off the floor, JPY picked up

Here’s the Global Citi Economic Surprise Index with the sub-indexes for the G10 and Emerging Markets. The G10 index has been moving higher since H2 last year:

The Bloomberg PMI heatmap is unchanged from last week:

US weaker

UK still red and no sign of improvement

Eurozone still red but Germany has been improving

Canada has improved a bit in November but stalled

Switzerland still green

Australia has weakened, Japan as well

Taiwan still deep in the red but not as bad as in November, Vietnam and South Korea weakening, Hong Kong has improved a bit, China remains neutral and unchanged

Brazil has taken quite a hit, India going strong

Breakeven inflation rates aren't moving much but the downward trajectory remains intact:

5y5y forward inflation expectation swaps remain in the middle of their range:

The inflations expectations ETF RINF is well off highs and also trading lower within its range:

Citi Inflation Surprise Indexes:

USD, EUR, CHF all heading lower

GBP looks like it has topped out

AUD sideways (last print surprised to the upside, though)

CAD picked up again

JPY has turned lower

Yields

See charts and table below:

German and Japanese 2y and 10y yields are still outperforming

Everything else is essentially flat

There's no sustained yield curve steepening happening in US 2s10s. The German curve is flattening further:

The bear flattener in the German 2s10s spread continues:

Central Banks and the US Dollar

FOMC meeting probabilities according to FedWatch:

The February meeting is now priced at 25 bps with a 94% probability, up from 76% the week before

The rest of the estimates has hardly changed

The terminal rate is still estimated to be at 4.75-5.00%

The first rate cut is still expected in December

A closer look at the implied Fed Funds curve:

We're still in the upper part of the last five weeks’ range

The pricing for rate cuts has become more aggressive for 2024 over the last weeks

Sectors and Flows

Currency strength:

The Yen is the strongest currency on all timeframes now

The Dollar comes in last place over one week, second to last over one month and last again over three months, similar the CAD but a tad less weak

The Kiwi has lost a lot of its strength, and while it's still doing fine over three months it's considerably weaker over shorter timeframes

The Euro is holding up pretty well on all timeframes: it's not profiting much from the Dollar's collapse but then it hasn't really weakened throughout the Dollar's run higher

Equity sectors:

Again a bit of a mixed bunch…

SMH (Semiconductors) and OIH (Oil/Gas Services) are outperforming, followed by XME and XLB (Metals, Mining, Basic Materials)

XOP (Oil/Gas Exploration), XLY (Consumer Discretionary), VUG (Growth) are underperforming

Here's a different look at sectors:

Defensives have been the clear underperformers this week

Cyclicals and Tech have outperformed

Over three months, every sector is in the green

Sector breadth has picked up a bit, and the most beaten-down sectors with the worst 52-week performance are now doing pretty well over one or two weeks:

Sector charts:

International stock indexes:

The Hang Seng is by far the best-performing index

European indexes come in second (to fifth) place

The underperformers are the Japanese Nikkei and TOPIX, the Brazilian BOVESPA, and the Indian SENSEX

Sentiment and Positioning

AAII Bull-Bear spread is improving but far from any recent extreme:

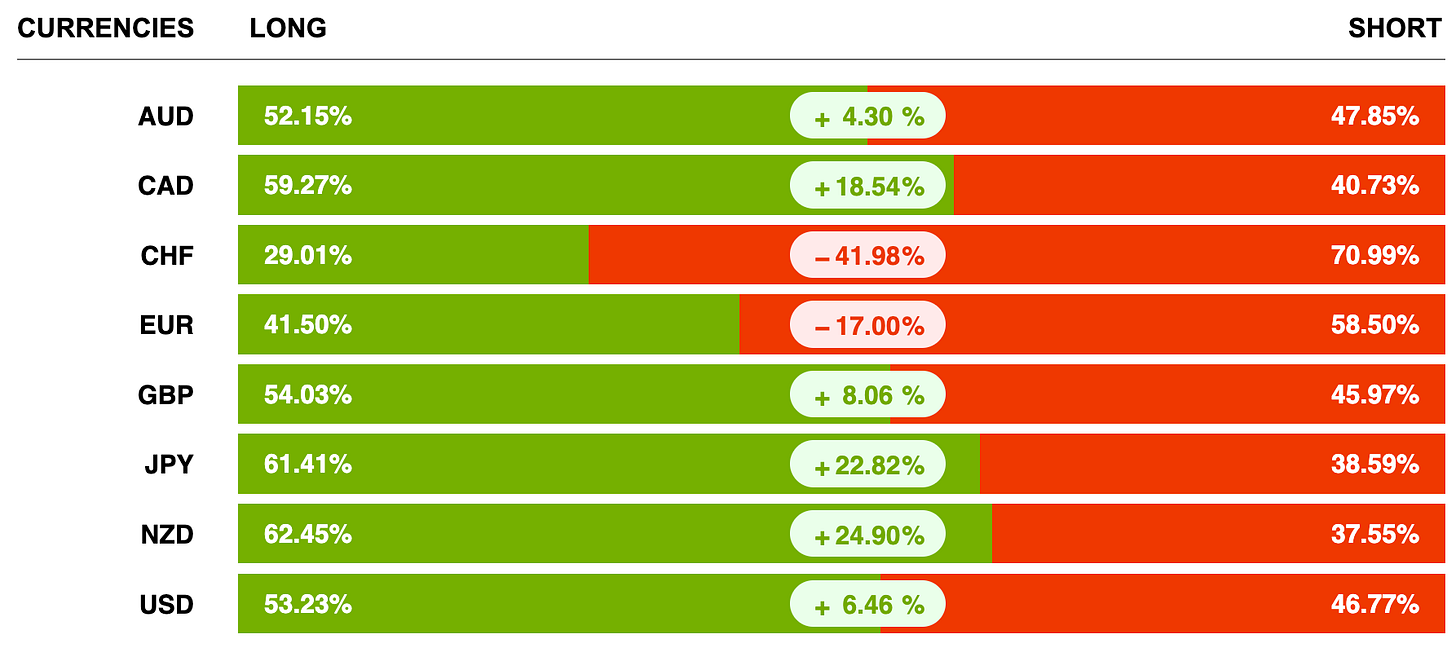

Currency sentiment:

CHF sentiment is extremely bearish

Sentiment for JPY and NZD is bullish

Another sentiment source:

USDCHF remains the FX pair with the most bullish sentiment (although the number of shorts increased significantly this week)

In EUR pairs sentiment is mostly bearish

Commitment of Traders and futures performance:

Stocks have had a few solid weeks now. NQ is the weakest index with a Levy Relative Strength (RSL) of 0.97 but every other index is above 1.00. Positioning isn't extreme in any direction.

Treasuries also put in a positive week, bullish positioning in 2y notes has been pared back towards neutral with a -1.93 SD 1-week change in Commerical net positions

All FX futures are positive except for the Dollar Index, RSL has improved for everyone (except DX). Positioning is still at a bullish extreme in DX, and near one in 6C. On the bearish side, 6E and 6C are at/near bearish extremes in Commercial and Large Trader net positions.

Energy futures were mixed with NG unable to catch a breath on its way lower, its RSL is 0.48 which means it's 52% below its 26-week moving average. Positioning remains at bullish extremes for both CL and NG.

Metals were mixed as well, RSL for Gold, Silver and Copper all improved. Positioning in Platinum is near a bearish extreme, and the 1-week change in Commercial and Large Trader net positions in Copper is at -1.99 and 2.04, respectively, which could lead to some short-term pressure.

Grains and softs. The weakness in Wheat, Cotton and Coffee isn't improving, positioning has been bullish for weeks now. Vice versa for Soybean Meal.

COT/TFF Dealer net positions for FX futures:

6C at a multi-year high (bullish)

Citi PAIN index: the USD long has been pared back a bit but it's still near an extreme vs. everyone else.

Market Risks

Credit Spreads still aren't moving much, HY OAS are trading lower:

The Credit Spread Index is also coming down:

Currency volatility has picked up markedly in the Yen, it has even exceeded its highs from October/November last year:

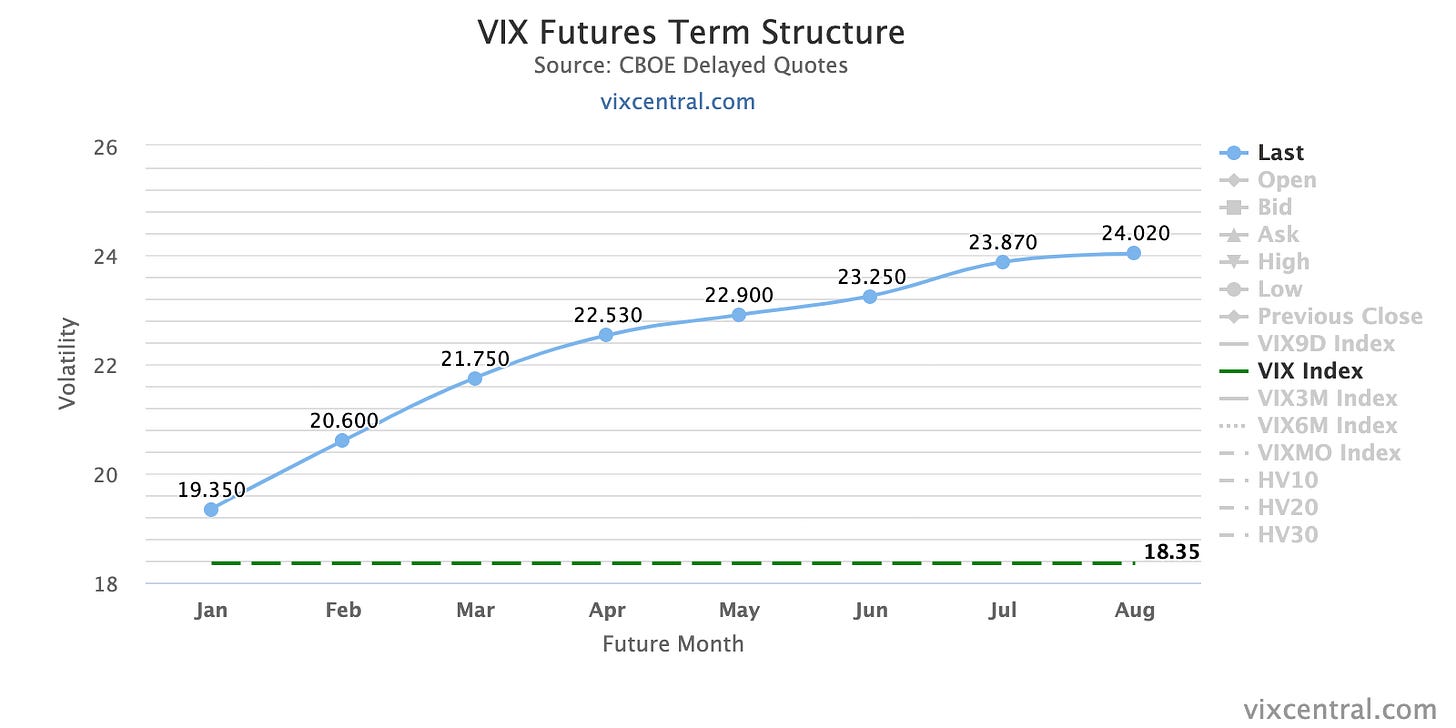

The VIX term structure is in contango:

Volatility indexes:

VIX is now below 20 again, MOVE has come down too and is at 113.5

There's been a decent steepening in skew with VIX/VOLI, SDEX and TDEX: since VIX and VOLI have been moving in parallel this seems to be driven by OTM put buying

In the overall scheme of things, it's nothing that worries me because VIX tries to hold below 20 once again, so volatility is perceived to be cheap and traders will buy OTM puts

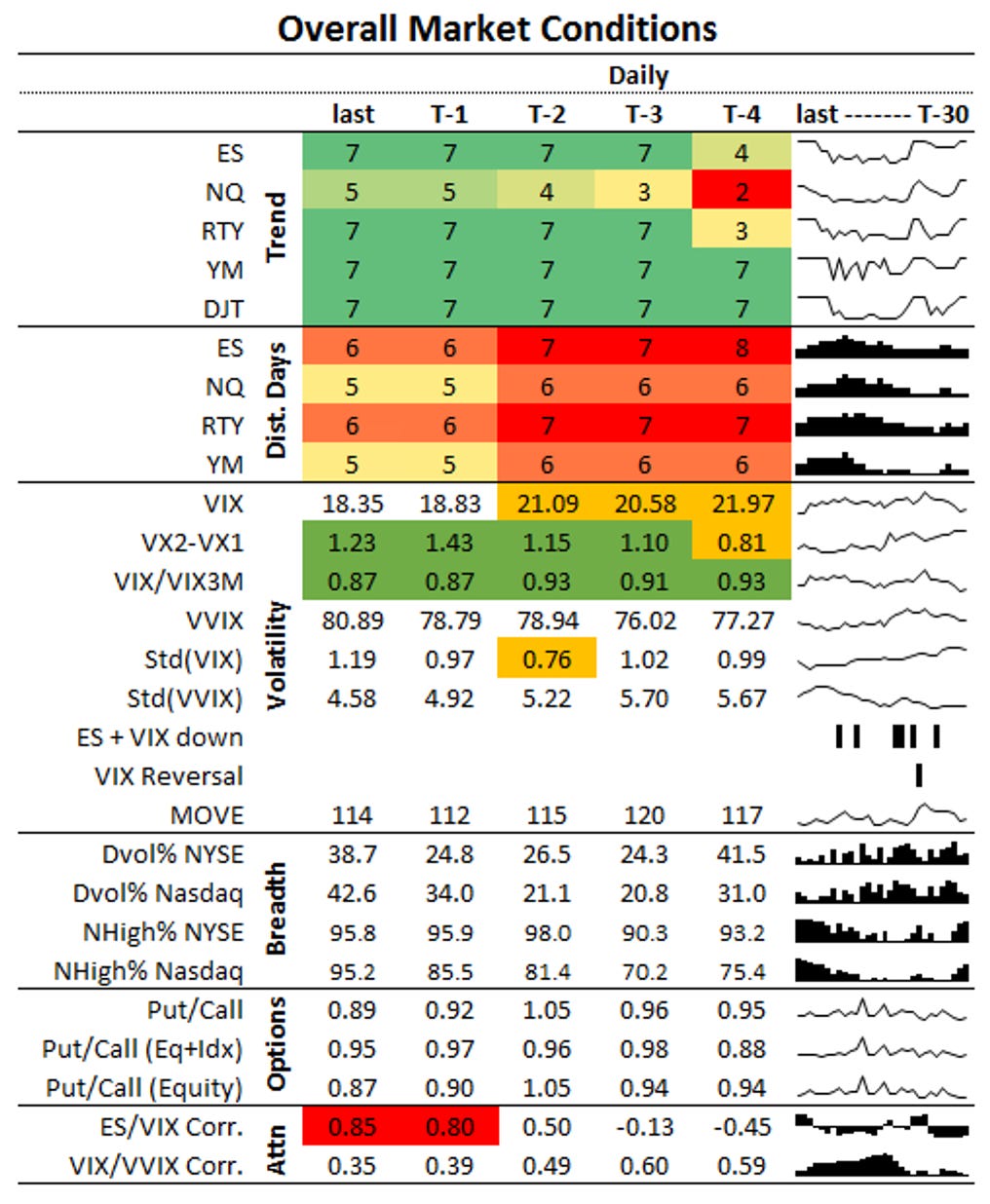

Things look decently green on the Market Conditions Dashboard:

Trend metrics have been more positive over the last few days

Distribution days are rolling off

The VIX term structure has re-steepened in the front

What's a bit worrying is the high ES/VIX correlation (see chart below).

Edit (Jan 16): The correlation between ES and VVIX is currently high, not between ES and VIX. That’s only a mix-up in names on my side, so the conclusion still holds true. Thanks to the reader who brought it up!

I've marked the last few occurrences where the correlation between ES and VIX ticked above 0.70. It's not a perfect indicator for an upcoming top in ES (because there is none) but it's the best one I know, so:

The CNN Fear & Greed Index is in Greed territory:

Various

The NYSE Advance/Decline Line is looking pretty stellar:

The percentage of index components above their moving averages also improved. The number of S&P 500 and Nasdaq 100 stocks above their 200-day MAs already have made new highs despite the indexes lagging (and especially the weakness in the Nasdaq):

Here's the shorter-term 50-day metric: it looks a bit less impressive but it's still solid.

25-delta risk reversals:

It's looking relatively bullish in GBPUSD and CNYUSD,

and relatively bearish in USDCAD

Top 3 Macro Charts of the Week

This section is brought to you by Daily Chartbook!

1. Fx vs. earnings. "Q3 conference calls mentioned FX as a major headwind. Since the start of Q4, the US Dollar index has fallen over 7%. Keep that in mind as Q4 earnings season ramps up in a couple of weeks".

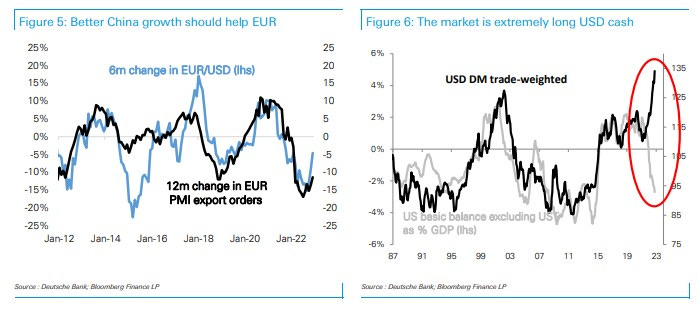

2. USD reversal. "Two charts which clearly speak for an upcoming trend reversal in the USD Index".

3. BTFD. The buy-the-dip strategy is dead.

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 50/2022 | 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 02/2023 | 47/2022 | 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

ECB

Rate Statements: 50/2022 | 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 47/2022 | 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 50/2022 | 43/2022 | 36/2022

BOE

Rate Statements: 50/2022 | 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 50/2022 | 37/2022

RBA

Rate Statements: 50/2022 | 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 51/2022 | 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 47/2022 | 41/2022 | 34/2022 Crib Sheets: 40/2022

BOC

Rate Statements: 50/2022 | 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022

SNB

Rate Statements: 50/2022 | 44/2022 | 39/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

BOJ

Rate Statements: 51/2022 | 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 52/2022 | 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: “A beautiful Japanese garden.”

the best weekly preview online!

Awesome reading. Very helpful. Thanks!