Welcome to issue #38 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary. The final section contains the top three macro charts for the week and is brought to you by Daily Chartbook.

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

The cover image is AI-generated via DALL-E 2. If you want to guess the prompt, I put it at the end of the newsletter.

If you like this publication, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Before diving in, I’d like to give a shout-out to

TMH is a great way to stay on top of what’s going on in markets. If you like fx:macro, you will love TMH, so check it out and subscribe!Table of Contents

Market Analysis: a) Growth and Inflation, b) Yields, c) Central Banks and the US Dollar, d) Sectors and Flows, e) Sentiment and Positioning, f) Market Risks, g) Various

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Economic Calendar for next week

Important levels to watch and look out for in FX futures

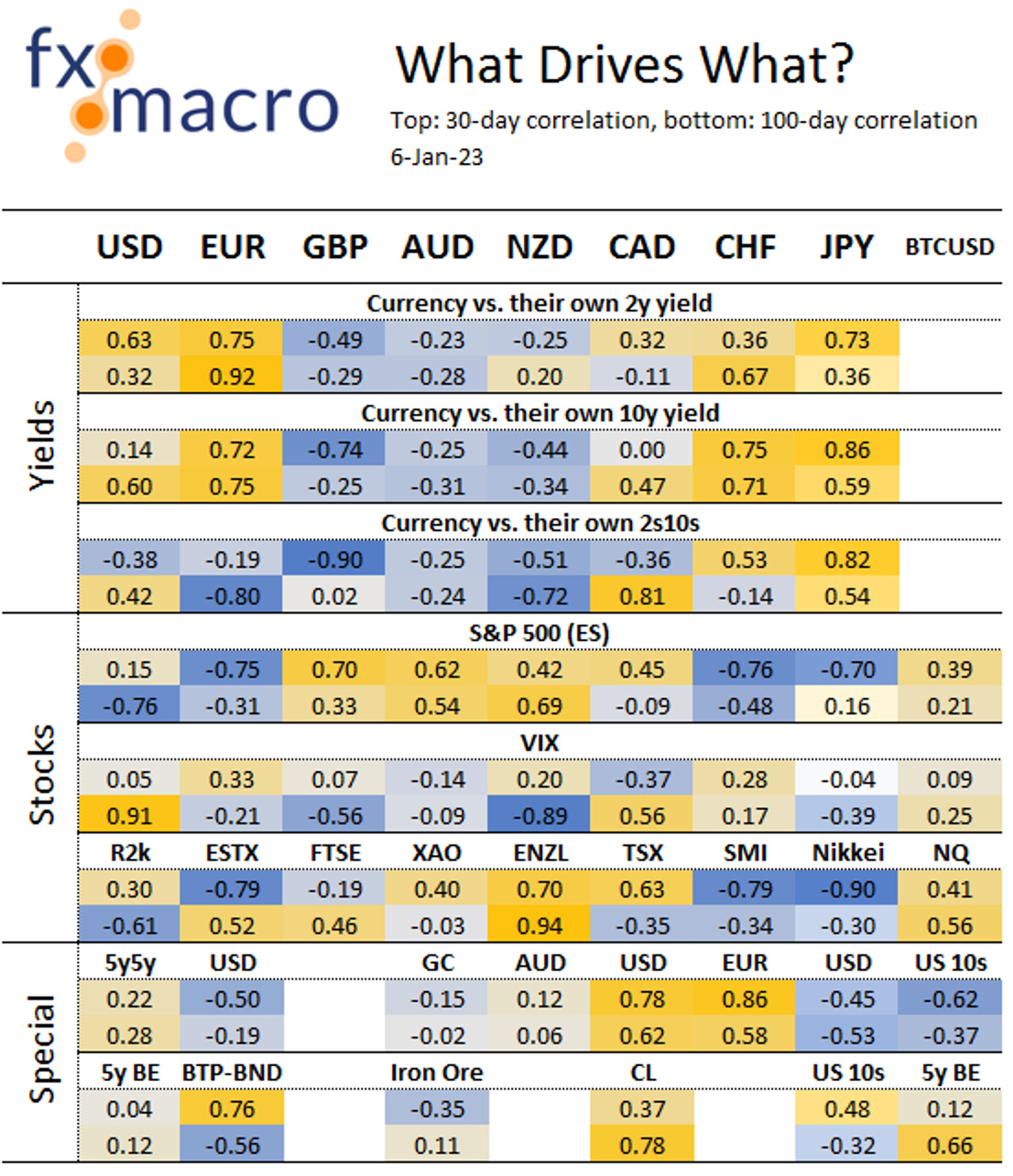

Currency Drivers

For an explanation check out this link.

Downloads and Links

Difftext of the Summary from last week: link to diffchecker

Central bank speaker recap for the week:

Week in Review

Central Banks

FOMC Meeting Minutes (04.01.22)

Here are the highlights from the Minutes:

Inflation data for October and November was promising but much more evidence of inflation coming down is needed:

Regarding the yield curve inversion:

On the monetary policy decision:

Confab, Speakers, News

Federal Reserve

Kashkari (Hawk). Wed: Appropriate to continue rate hikes at least at the next few meetings until confident inflation has peaked, sees target rate peaking at 5.4%, won't know if that is high enough until the Fed pauses for a "reasonable" amount of time, sees increasing evidence that inflation has peaked, any sign of slow progress on lowering inflation will require taking the policy rate much higher, can consider cutting rates only when convinced inflation is well on its way back down to 2%, cutting rates prematurely could be a costly error.

George (Neutral). Thu: Hard to know what the timing of rate cuts will be but my forecast is "well into 2024", our message is we will hold rates high until we're confident inflation is coming down, persistence around inflation is going to require our attention, will be watching housing, very important to continue reducing the balance sheet, the Fed still has a lot to learn how balance sheet policy works. Fri: Renewed inflation pressures from energy and crop prices are a very real risk, how much additional tightening is needed remains an essential aspect of Fed deliberations, ongoing inflationary pressures reflect the labour market tightness.

Bostic (Neutral). Thu: Inflation is the biggest headwind to the US economy. Fri: Comfortable with 25 or 50 bps at the next meeting, sees peak rate at 5.00-5.25%, we need to stay the course because inflation is too high, most important thing is to hold at high rates, not a lot of urgency to cut rates, today's jobs data not changing my mind, inflation dynamic isn't driven by wages but we need to be on top of it if things change, sees unemployment at 4% this year, recession not my baseline.

Bullard (Hawk). Thu: Inflation is still too high but it's moderating in 2023, Fed policy is not yet restrictive but it will soon be with more hikes, would be good to get there quickly, still expects to be higher for longer, the prospect of more hikes is helping dampen inflation, inflation expectations are consistent with the Fed's 2% target, balance sheet reduction is going well with still some ways to go, strong jobs market gives the Fed a great opportunity to fight inflation.

Barkin (Neutral). Fri: More gradual rate path should limit harm to the economy, makes sense for the Fed to be more deliberate on hikes in the context of policy lags, cannot repeat stop-start cycle of the 1970 inflation battle.

Cook (Neutral). Fri: Inflation is far too high despite recent encouraging signs, worker compensation is starting to decelerate.

European Central Bank

Lagarde (Dove). Sat: Wages are growing quicker than the ECB had expected, we must not allow inflation expectations to become de-anchored or wages to have an inflationary effect, must take necessary measures to lower inflation to 2% target.

Nagel (Hawk). Sun: We need to take further action on inflation, we are not seeing any wage-price spiral in the sense of a further increase in inflation due to current wage agreements.

Kazaks (Hawk). Tue: ECB can still do quite large steps in the next two meetings but steps may become smaller as necessary.

Villeroy (Neutral). Thu: Wants to reach terminal interest rates by summer but it is too soon to say at what level, we need to be pragmatic and guided by data without fetishism to mechanical rate increases, we will remain at the terminal rate as long as necessary.

Centeno. Fri: Rates are close to peaking if there are no further external shocks, today's inflation data is quite positive.

Lane. Fri: Expects a "fairly big drop" in inflation this year, if there is a recession underway it's at the mild end, sees a sizeable decline in real wages and ongoing wage negotiations will begin to make up for that which could put pressure on prices in coming years.

Bank of England

Bank of Japan

Kishida (PM). Tue: Have to discuss the joint statement including whether to review it with the new BOJ governor.

Kuroda. Wed: Will continue monetary easing to achieve price hikes in tandem with wage growth, economy to grow firmly this year backed by accommodative monetary policy.

Sources. Thu: BOJ likely to raise fiscal 2022 and 2023 forecasts for Core CPI in new projections, unlikely to trigger immediate rate rise, BOJ increasingly focused on Core CPI in gauging price trends.

Economic Data

Monday, 02.01.23

Tuesday, 03.01.23

Highlights from the Canadian Manufacturing PMI:

“The Canadian manufacturing economy turned in another relatively subdued performance as 2022 closed, with both production and order books falling since the previous month. Firms reported again that weak market demand reflected both ongoing uncertainty and the negative impact of high inflation.

“Indeed, cost pressures turned slightly upward during December, arresting the recent easing trend. With supply constraints persisting, price stickiness remains a concern for companies, who remain on average subdued and concerned about the future.

“More positive was another month of employment growth, as firms sought to fill long-held vacancies, although even here the rate of expansion was marginal amid reports to a reluctance to hire at a time when production and sales continue to fall.”

Wednesday, 04.01.23

Highlights from the ISM Manufacturing PMI:

Thursday, 05.01.23

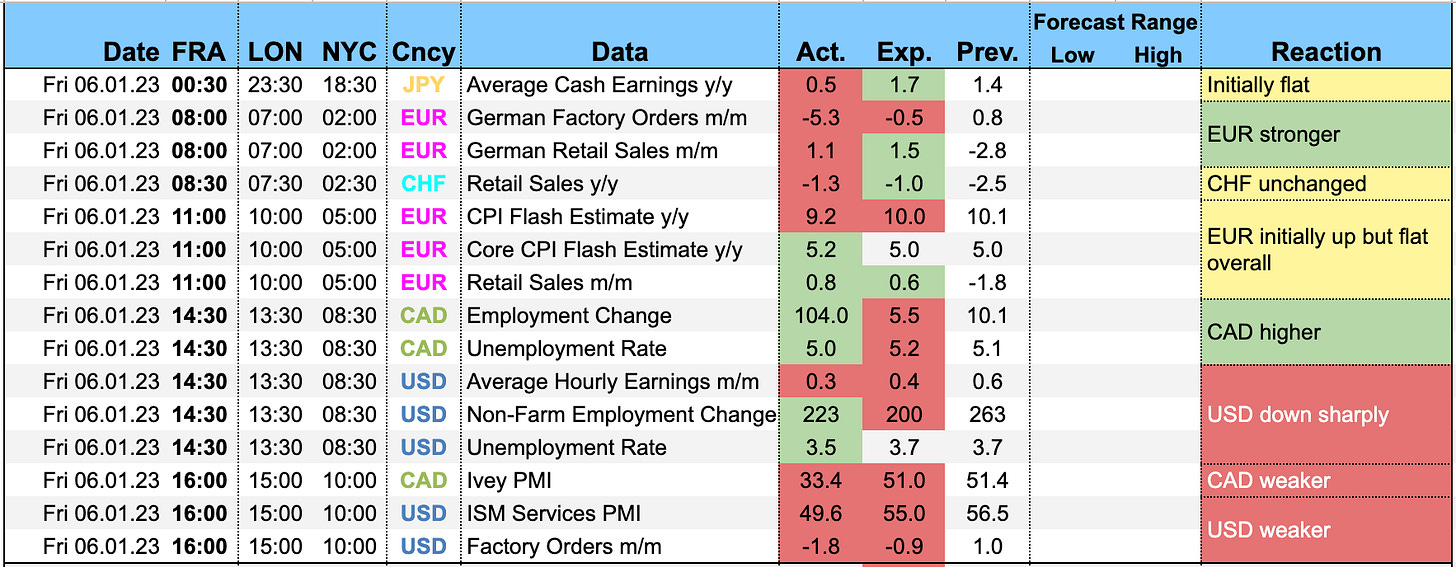

Friday, 06.01.23

Highlights from the ISM Services PMI:

Market Analysis

Growth and Inflation

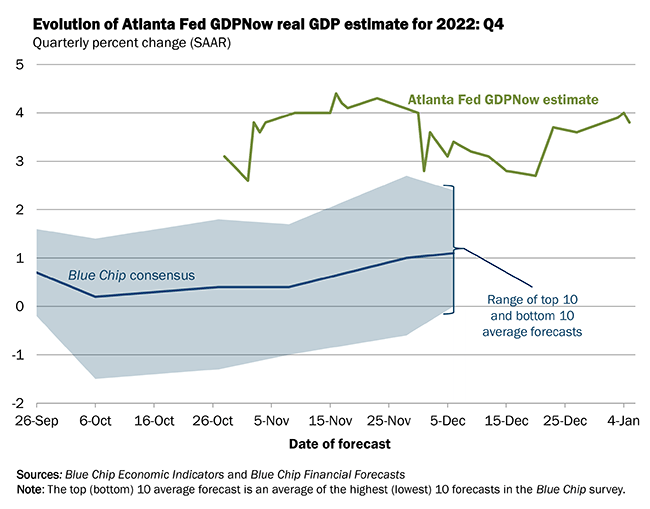

The Atlanta Fed GDPNow estimate for Q4 GDP growth declined to 3.8%:

The NY Fed Weekly Economic Index stands at 1.82:

Citi Economic Surprise Indexes:

USD is stalling-to-lower

EUR and CAD continue to surprise to the upside

GBP has rolled over

CHF isn’t getting off the floor, JPY is sideways and AUD isn’t going anywhere

NZD is stalling-to-higher

Bloomberg PMI heatmap:

US weaker

UK still red and no sign of improvement

Eurozone still red but Germany has been improving

Canada has improved a bit in November but stalled

Switzerland still green

Australia has weakened, Japan as well

Taiwan still deep in the red but not as bad as in November, Vietnam and South Korea weakening, Hong Kong has improved a bit, China remains neutral and unchanged

Brazil has taken quite a hit, India going strong

Breakeven inflation rates continue to make lower highs:

5y5y forward inflation expectation swaps and RINF are mirroring that pattern to a degree:

Citi Inflation Surprise Indexes:

US and Eurozone continue to trend lower: it's pretty remarkable that the year that saw record-high inflation had its CSII trending lower pretty much the entire time (at least in the US)

UK also lower but with less momentum

AU and NZ going sideways

CA has picked up again

CH heading lower and JP sideways

The NY Fed Survey of Consumer Expectations also shows declining inflation expectations:

Yields

Looking at the chart and table below:

EUR yields look the strongest by far, especially the 2s

JPY 10s jumped after the last BOJ meeting

US yields look comparatively weak going mostly sideways, similar to CAD

The four best-performing 10y yields in the G20 are all southern Eurozone countries… spreads in the periphery are widening but so far the market doesn't seem too concerned (30-day correlation EUR and BTP-BUND is at 0.76, see the FX Drivers table I posted above)

Yield curves along the 2s10s spread remain inverted for four of the G8 countries:

A closer look at the 2s10s:

The US has been bear flattening again for a few weeks but that reversed on Friday into a bull steepening to a degree. If the bear flattener is what has held the USD up for a while then it's hard to be bullish USD here.

Eurozone (i.e. German) flattening continues and it's driven by a comparatively strong front-end

Central Banks and the US Dollar

FedWatch meeting probabilities:

The February meeting is priced at 25 bps with a 76% probability

The terminal rate is now estimated at 4.75-5.00%

The first rate cut is expected for December

There was quite a dovish shift after Friday's data

Here's another look at the market-implied Fed Funds Rate: the curve shifted markedly lower on Friday but it remains higher than one week ago.

STIR futures also show this year's expectations being priced more dovish with both the Fed Funds Futures and Eurodollar Futures expecting between 25 and 50 bps of cuts this year. Not sure what's going on with the 2024 expiration in GE… could have something to do with the conversion to SOFR but I have no idea.

Sectors and Flows

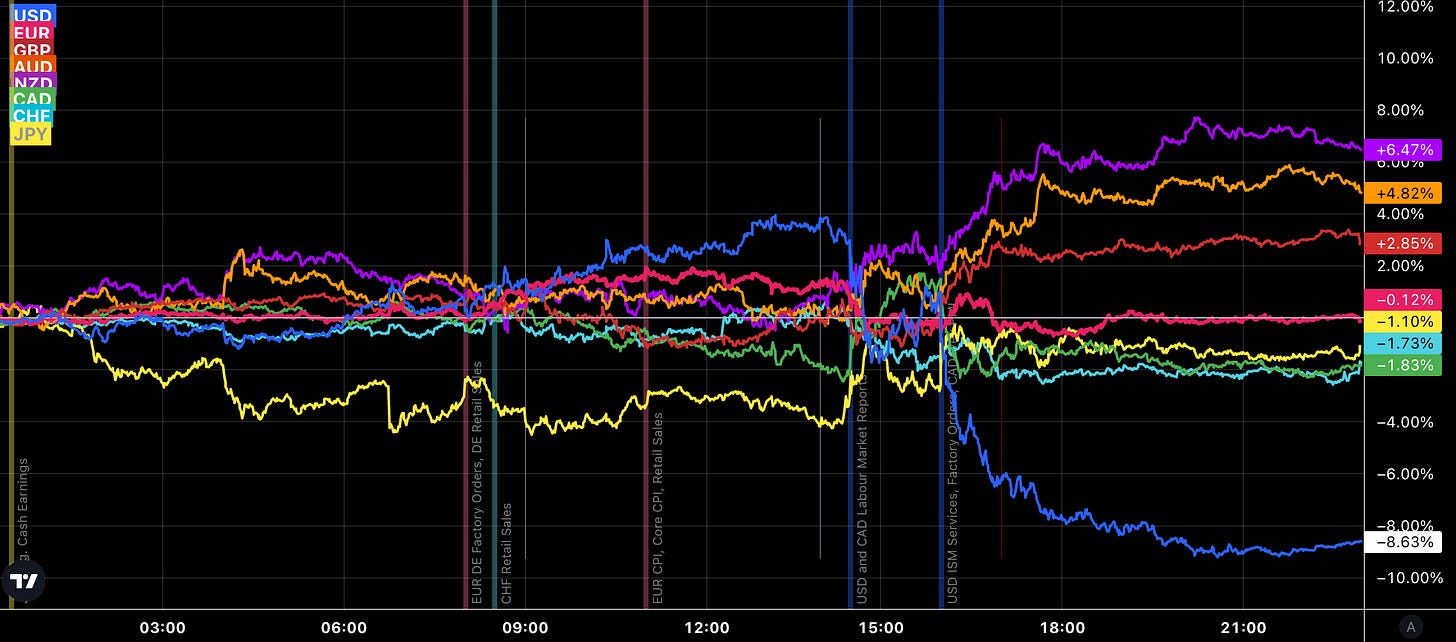

Currency strength:

JPY has been going strong since the BOJ surprise decision

USD and CAD are the weakest currencies over three months but it looks like they have found a base

AUD has been outperforming NZD lately

AUD has regained quite some strength, it comes in second over one month and first over one week

Equity sector performance:

This looks a bit… disorderly

Oil Services (OIH), Semiconductors (SMH), Industrials (XLI), Basic Materials (XLB), Financials (XLF) and Metals/Mining (XME) at the top

Oil/Gas Exploration (XOP) and Consumer Discretionary (XLY) at the bottom

Value (VTV) continues to outperform Growth (VUG)

A different look at sector performance:

Financials seem to show some inherent strength

Communication Services has been one of the most beaten-down sectors over the last year, so a rally here isn't too impressive

Tech remains very weak

Sector breadth isn't doing anything

So, overall it's neither a terribly bearish picture nor is it bullish

Finally, sector charts:

Consumer Discretionary isn't getting a bid, Communications are up but far from impressive

Energy is holding up relatively well

Staples and Healthcare are holding up too

Financials look like they've found a bottom

International stock market indexes:

Hang Seng is leading among the indexes

What is pretty surprising: the European indexes are all near the top, even the UK is doing relatively well

Japan has been underperforming (not the least on yen strength)

Brazil is the worst-performing index (remember the PMIs from above?)

Sentiment and Positioning

The AAII Bull-Bear spread remains in the middle of its neutral range:

Currency sentiment:

Mostly in the relatively neutral 40-60% range

Exceptions are the Swissie with only 28% bulls and the JPY with 63%

Another sentiment source:

USDCHF remains the currency pair with the most bulls, EURCHF comes in second

Yen pairs are mixed-to-bullish yen here too

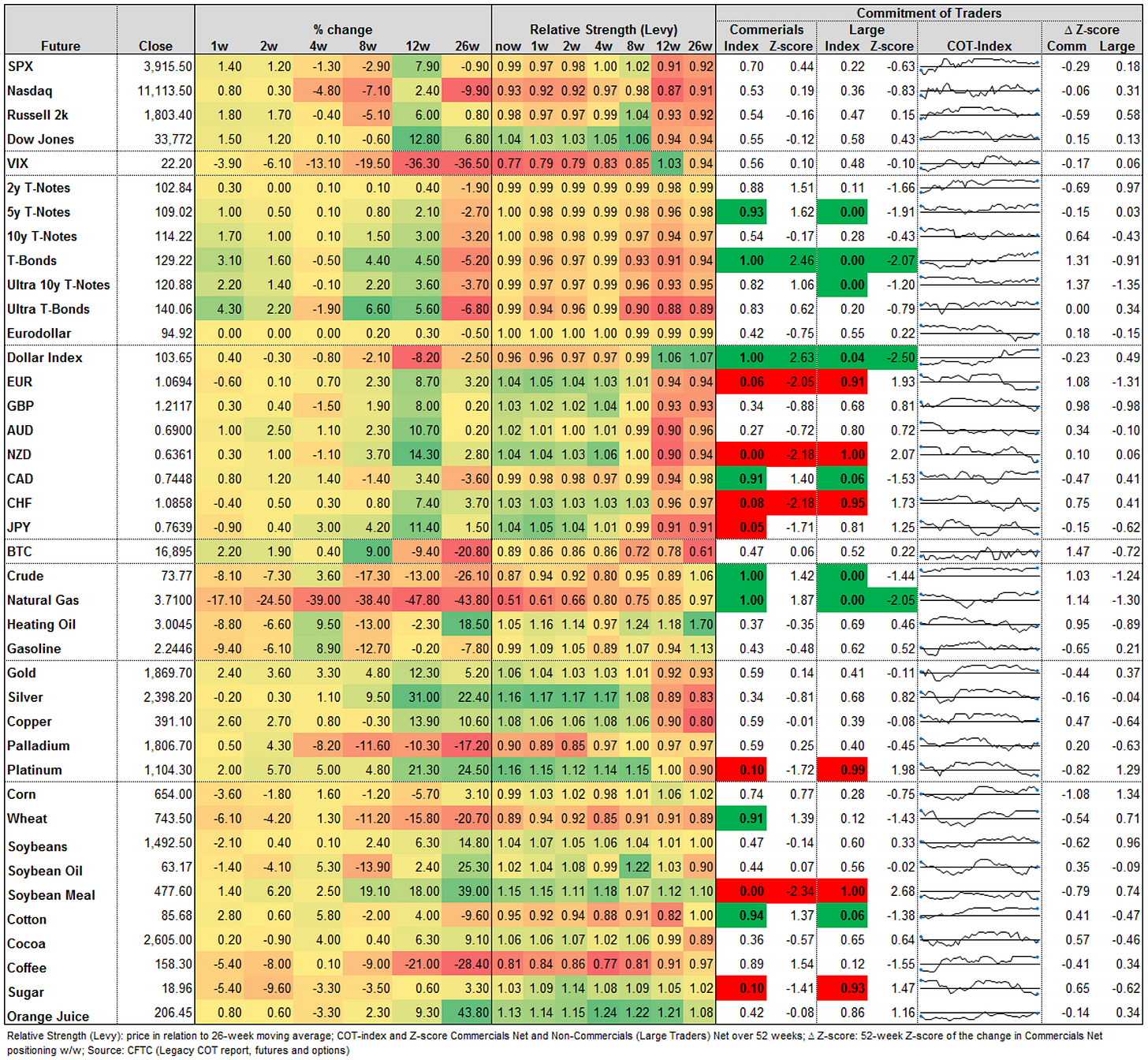

Commitment of Traders and futures performance:

Equity index futures had a positive week but the NQ remains weak with a Relative Strength of only 0.93. Positioning in equities isn't near extremes.

Treasuries also had a positive week, positioning is constructive with the 2y off extreme levels but the T-Bond future at bullish positioning extremes.

For FX futures the week was mixed: positioning in the DXY is very bullish, in the EUR it's bearish but off worst levels. Also positioning in 6N is at bearish extremes, in 6C it's bullish and in 6S bearish.

Energy futures are all down for the week, NG is especially weak with an RSL of just 0.51 (which means it's 49% below its 26-week moving average). Positioning in CL and NG remains at bullish extremes.

Metals were mixed, positioning is near (bearish) extremes only in Platinum. Of note, RSL has improved considerably over the last weeks, especially in Copper where it sits at 1.16 at the moment.

Grains and Softs were also mixed, Soybean Meal and Sugar are at/near bearish positioning extremes, Cotton is near a bullish extreme.

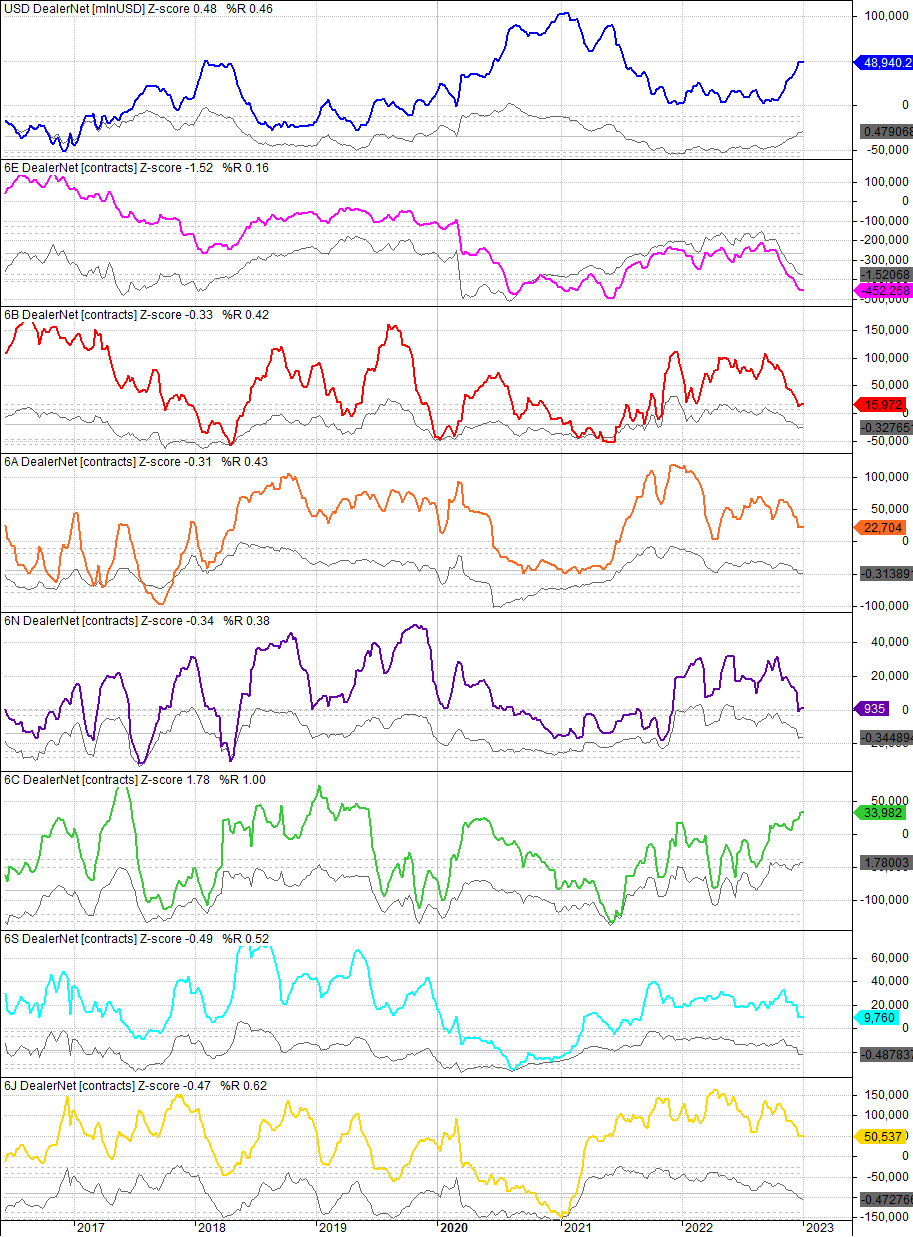

COT/TFF Dealer net positioning:

6E sits near the bearish extreme here as well

6C bullish here too

CitiFX PAIN indexes:

Pretty much unchanged for months, doesn't seem to be too helpful at the moment

USD long still going vs. everything else

Market Risks

Credit spreads have been trading a bit higher lately but overall just sideways:

A credit spread index also has ticked up a bit but remains below its recent high:

The NY Fed Corporate Bond Market Distress Index is off highs for everything it tracks:

Currency volatility has moved higher over the last few weeks for pretty much every currency:

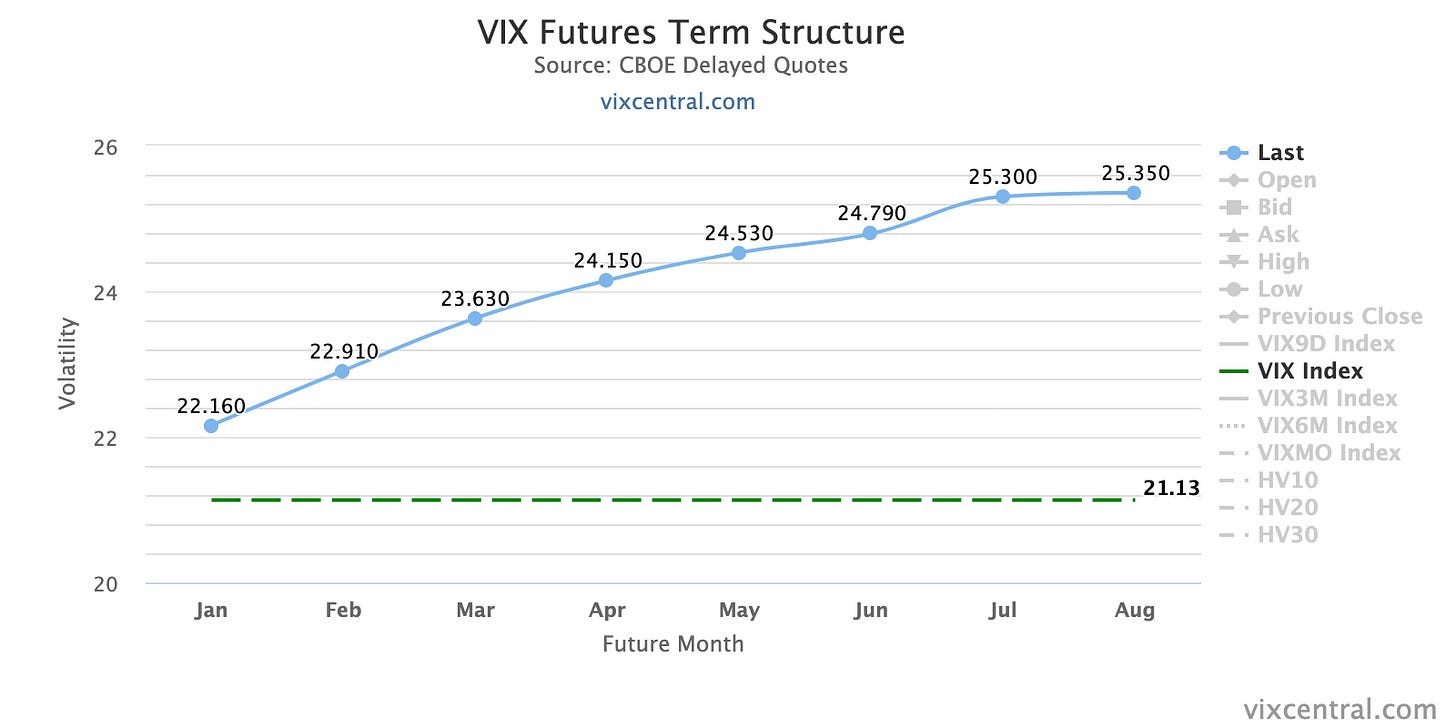

The VIX term structure is in a nice but flattish contango:

Volatility indexes:

VIX can't seem to trade below 20 sustainably

VVIX continued to make a new low this week and now is at 73.88.

VIX/VIX3M has flattened, which is a bit of a divergence from how VIX is moving

Skew metrics are all flattening and show there's no demand for OTM puts: VIX/VOLI, SDEX, TDEX

All in all, this is pretty much as carefree as it can get right now

CNN Fear & Greed is currently neutral:

Various

The NYSE Advance/Decline Line is about to make a new high. While I'm not reading much into bullish divergences like this, it's impossible to interpret it as bearish.

The percentage of S&P 500 and Nasdaq 100 stocks above their 200-day moving averages isn't looking great but neither is it looking bad:

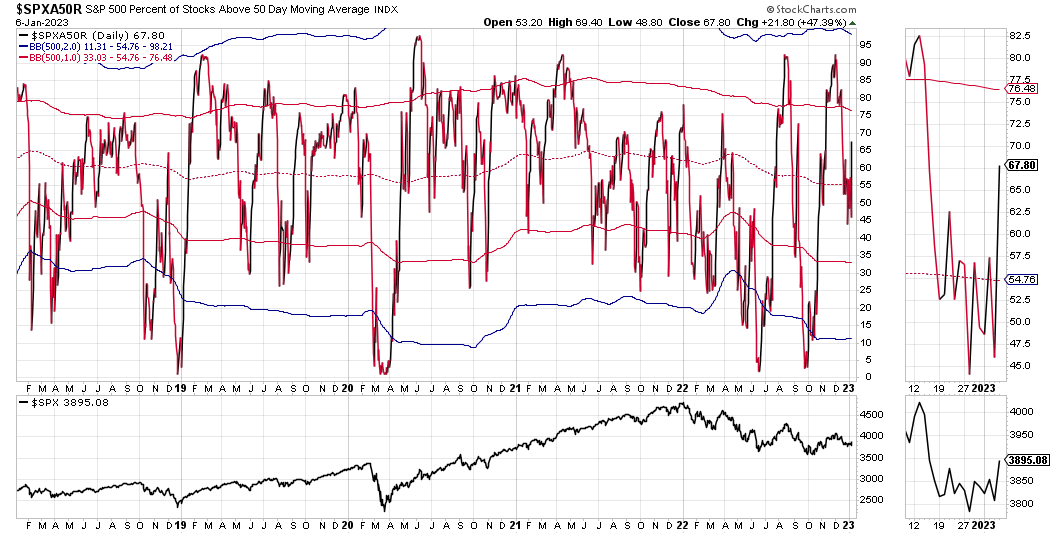

Same for the shorter 50-day moving averages:

25-delta risk reversals:

USDCAD has the only big divergence going on with the risk reversal pricing it lower

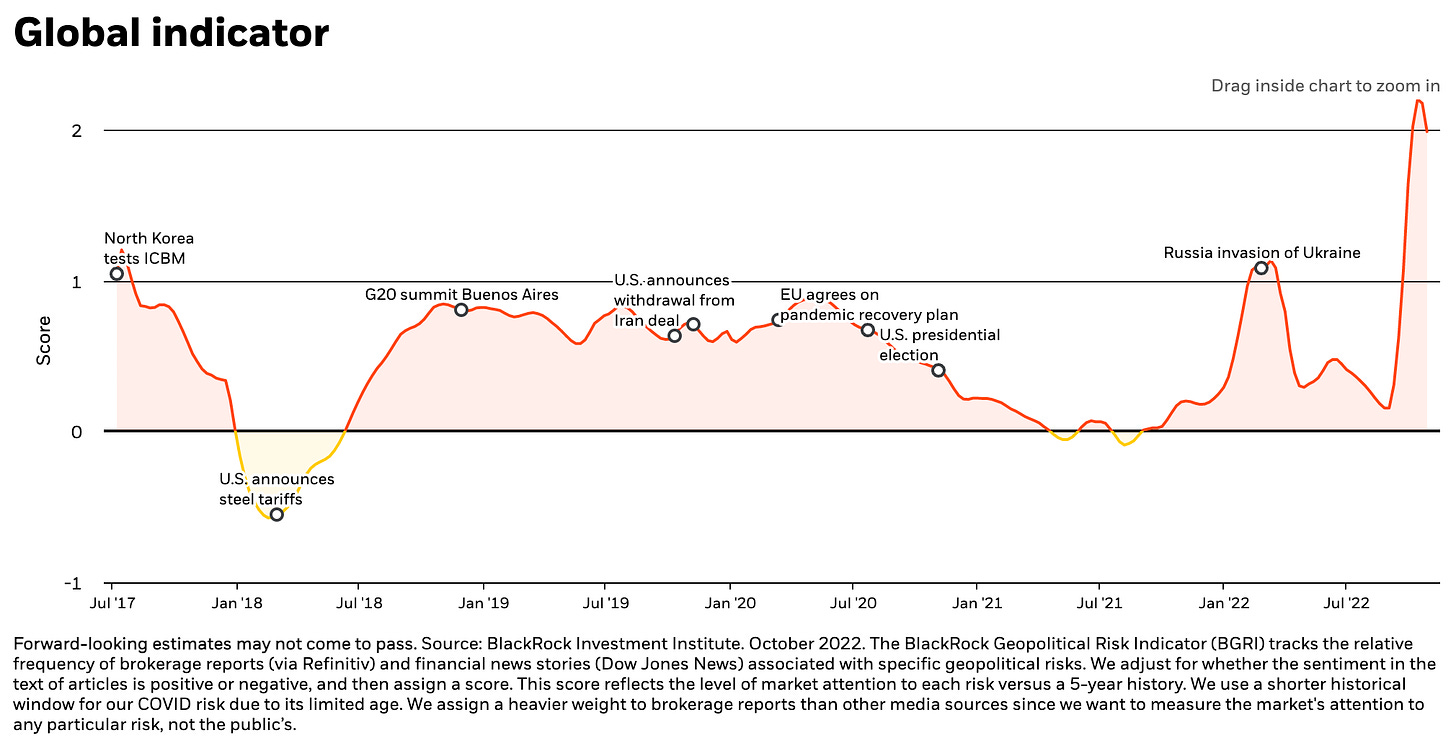

The BlackRock Geopolitical Risk Indicator has put in a new high:

Top 3 Macro Charts of the Week

This section is brought to you by Daily Chartbook!

1. Rate cut views. 42% agree rates will peak between 5-5.25%. "About 52% of individual traders are betting that the much longed-for Fed pivot will arrive sometime in 2023, while 54% of professional money managers expect it in 2024".

2. Stocks vs. bonds (I). Investors see stocks and bonds decoupling in 2023.

3. Baltic Dry plunges. "The Baltic Dry Index's usefulness as a gauge of global demand, economic activity and inflation pressures is not what it once was. Still, yesterday's record 17.5% drop is remarkable".

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 50/2022 | 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 47/2022 | 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

ECB

Rate Statements: 50/2022 | 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 47/2022 | 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 50/2022 | 43/2022 | 36/2022

BOE

Rate Statements: 50/2022 | 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 50/2022 | 37/2022

RBA

Rate Statements: 50/2022 | 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 51/2022 | 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 47/2022 | 41/2022 | 34/2022 Crib Sheets: 40/2022

BOC

Rate Statements: 50/2022 | 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022

SNB

Rate Statements: 50/2022 | 44/2022 | 39/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

BOJ

Rate Statements: 51/2022 | 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 52/2022 | 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: DALL-E 2 “A painting of what the first week of the year typically looks like.”

Simply marvellous, as usual. Thank you 😊

Hi Macro. I am really2 wanted to get in touch with you but I dont know how. I will be very2 much appreciated if you can email to me at mrhcorp@gmail.com. I am now watching your video about the hybrid technique (funda + price action). I wish I could get in touch with you like chatting or etc so that I can ask you questions. I really2 admire your work. Wish that you can be my mentor, if you dont mind. Anyway, will wait for your feedback soon. Thank you