I wish every one of you Happy Holidays, and a great time with your family and loved ones!

We are close to 3,000 readers here, so it feels special to send season's greetings to two orders of magnitude more people than usual.

The next full issue of fx:macro will be out in January.

Welcome to issue #36 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary. The final section contains the top three macro charts for the week and is brought to you by

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Before diving in, I’d like to shout out to !

is a great way to stay on top of what’s going on in markets. If you like fx:macro, you will love so check it out!

Table of Contents

Week in Review

Central Banks

Economic Data

Market AnalysisGrowth and InflationYieldsCentral BanksSectors and FlowsSentiment and PositioningMarket RisksVarious

Top 3 Macro Charts of the Week

Summary

Downloads and Links

Central bank speaker recap for the week:

Week in Review

Central Banks

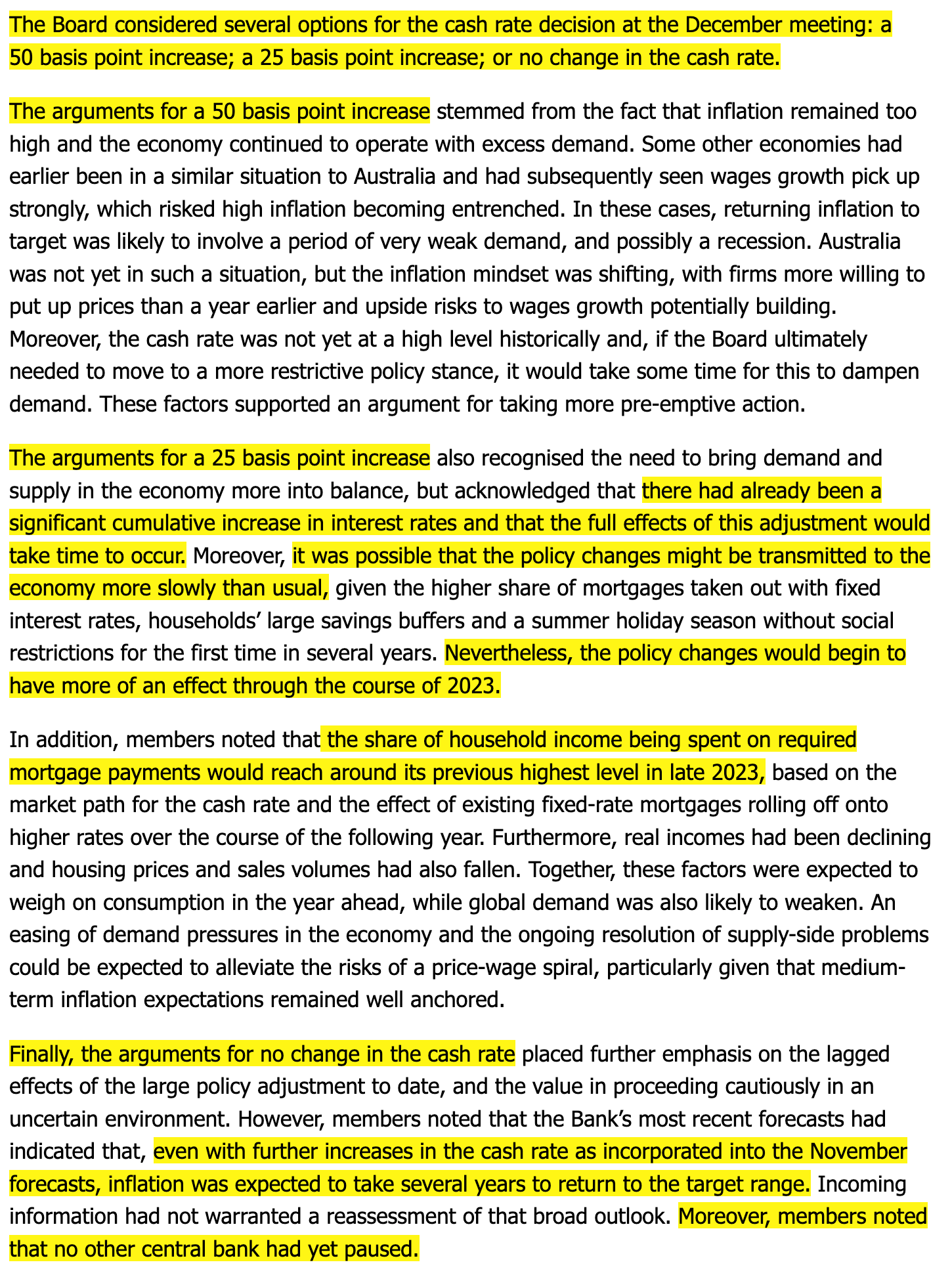

RBA Minutes (20.12.22)

Here are the main points from the RBA Minutes:

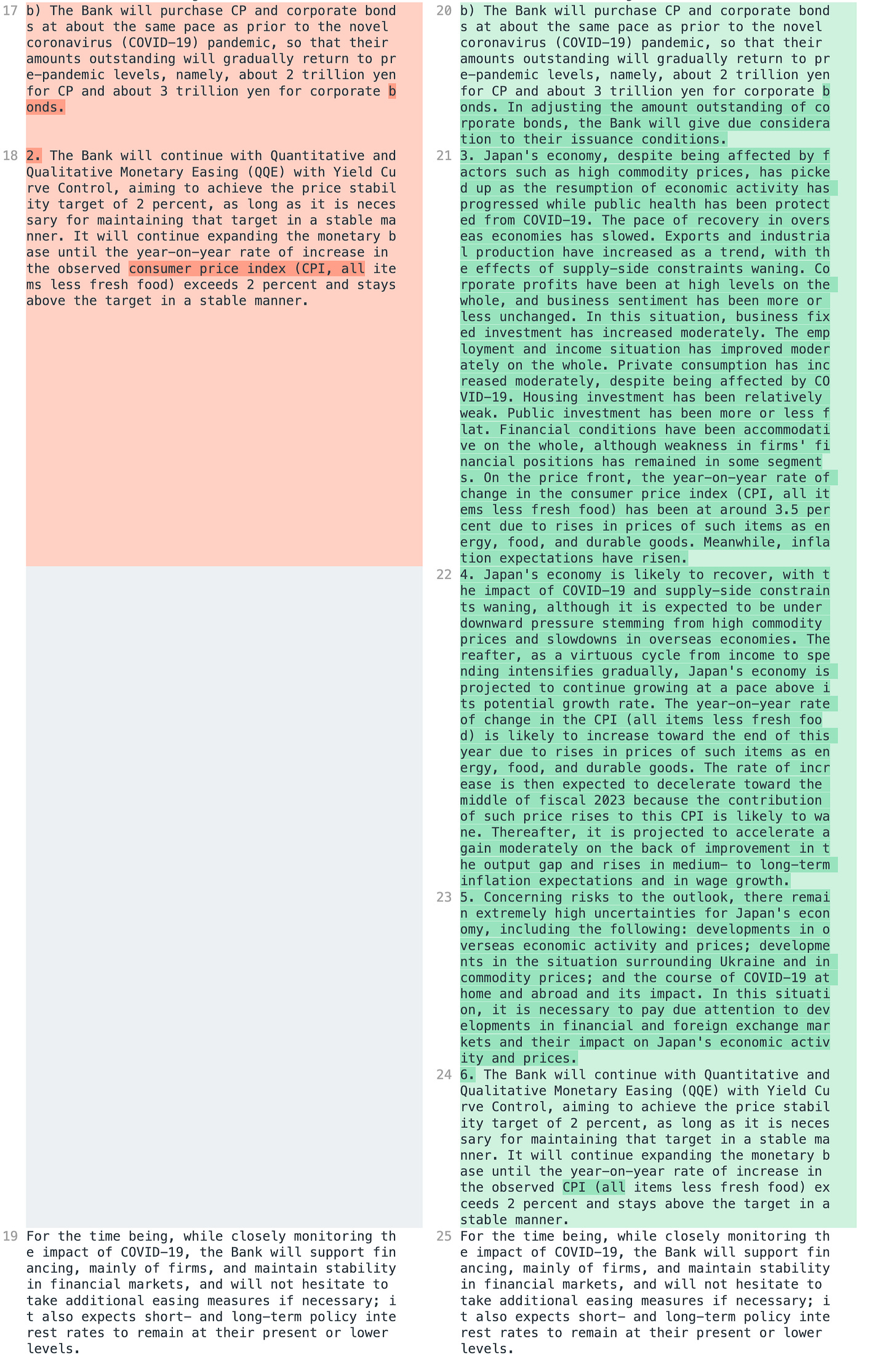

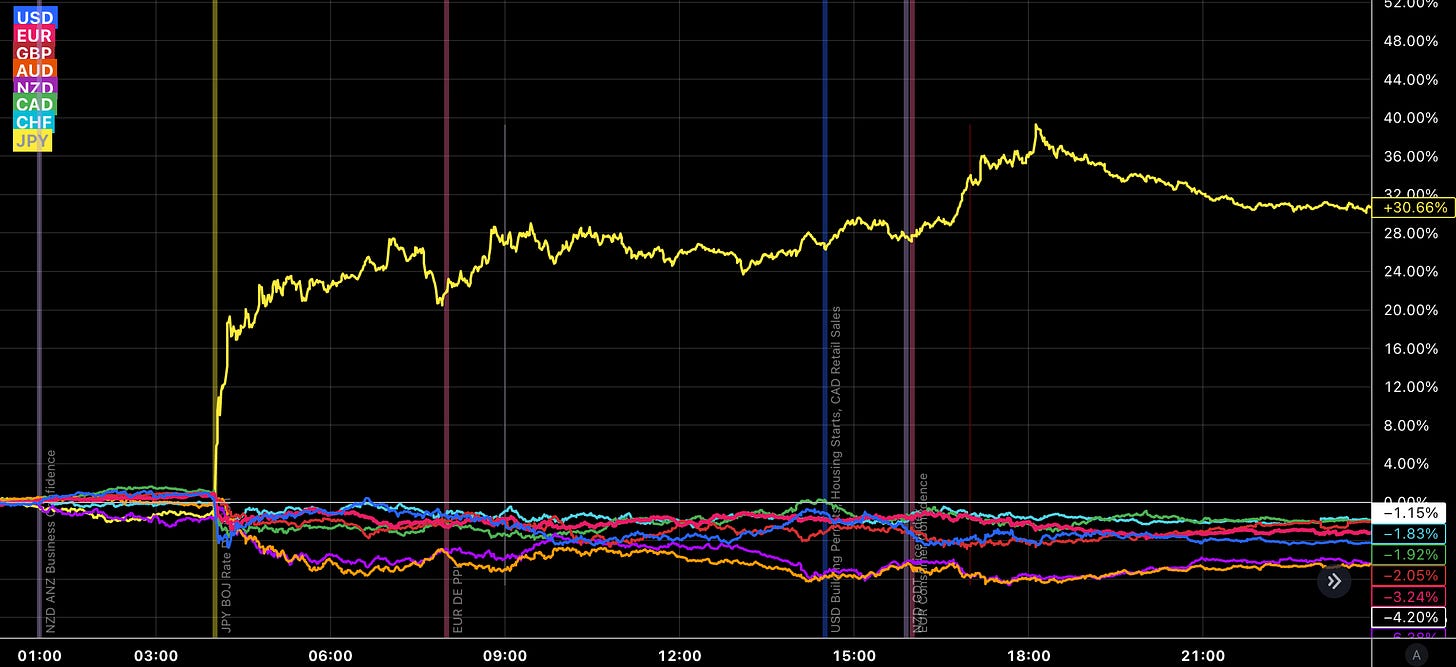

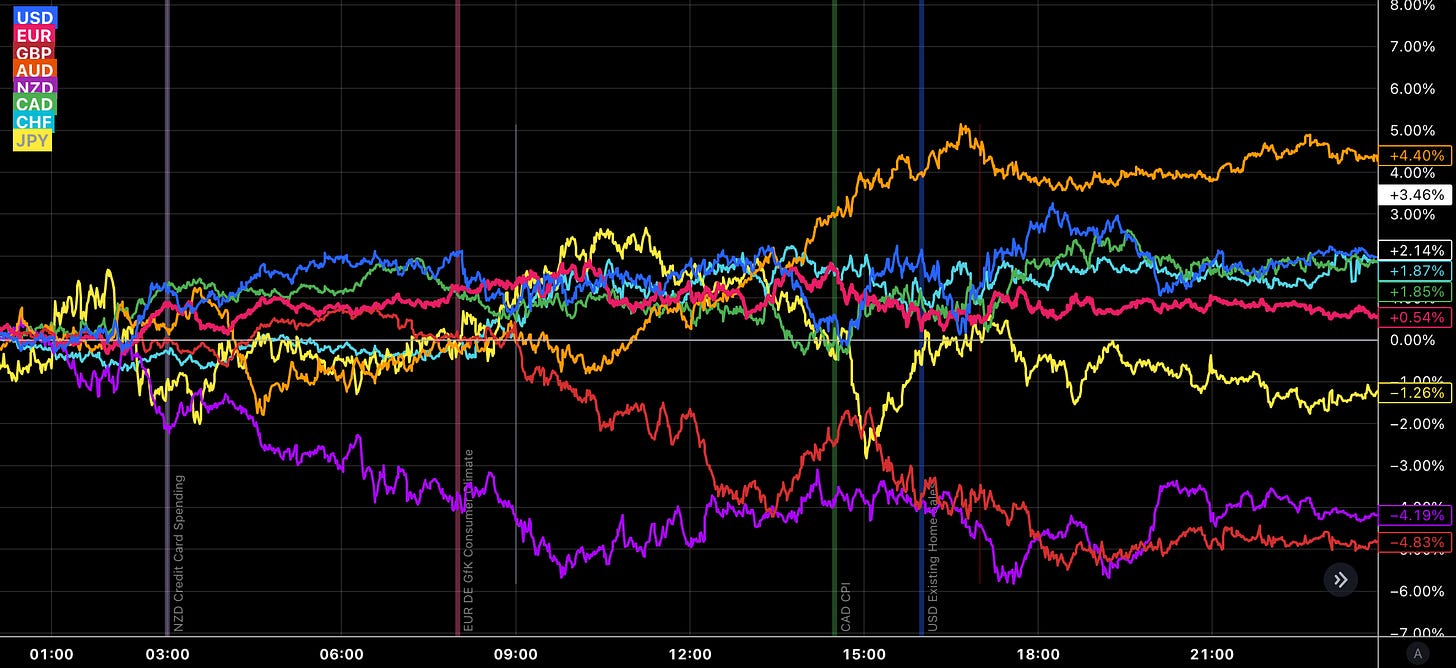

BOJ Rate Decision (20.12.22)

The BOJ left their policy rate unchanged but tweaked their YCC to allow 10y yields to move ±0.5% around their 0.0% target. Summary of the statement and difftext below:

Modification of YCC was done to “improve market functioning and encourage a smoother formation of the entire yield curve”

The functioning of bond markets has deteriorated particularly regarding relative relationships between different maturities and arbitrage between spot and futures markets

If these conditions persist it could have a negative impact on financial conditions

JGB purchases will be increased: ”the amount of monthly JGB purchases will be increased from 7.3 trillion yen to about 9 trillion yen” (not in the difftext since that was only in a footnote)

Japan’s economy has picked up, exports and industrial production have increased as a trend; the effects of supply-side constraints are waning

CPI (ex fresh food) has been around 3.5% y/y, and inflation expectations have risen

CPI is likely to increase towards the end of this year, decelerate towards the middle of FY 2023, and accelerate again moderately thereafter

Confab, Speakers, News

European Central Bank

Kazimir. Mon: Strong action will be necessary in the first half of next year, rates will not only have to go into restrictive territory but stay there much longer, risks to the economy clearly downward, inflation risks are upward, fiscal policy starting to add to inflation risks. Tue: Monetary policy should tighten at a steady pace, the question is not whether we should go to restrictive rates above 2% but how far we should go and how long we should stay at a higher base rate.

Simkus (Hawk). Mon: No doubt there will be a 50 bps rate hike in February.

De Guindos (Dove). Mon: We will continue to raise interest rates further, we do not know when rate hikes will stop. Thu: 50 bps rate hikes may become the new norm in the near term, we should expect to raise rates at this pace for a period of time, no choice but to raise rates, worried that markets are underestimating the persistence of inflation or that markets might consider fiscal policy to be incompatible with monetary policy.

Nagel (Hawk). Mon: Impact of rate hikes could take up to two years to take effect, does not expect inflation to fall significantly until 2024.

Villeroy (Neutral). Tue: The French and broader European economies should not suffer any crash or hard landing, France should be able to avoid a recession.

Centeno. Wed: All data point to inflation reaching its peak in the Eurozone in Q4 2022, expects inflation to be around 3% in December 2023.

Bank of Canada

Macklem. Mon: The BOC missed the mark on rising inflation, that's a very big forecast error, we have some explaining to do.

Bank of Japan

Matsuno (Chief Cabinet Secretary). Mon: No plans to revise the joint statement signed with the BOJ in 2013, the government hopes to continue working closely with the Bank to achieve sustained economic growth and price stability. Tue: Will carefully monitor market moves, understand that the BOJ's decision is aimed at sustainably boosting effects of monetary easing and achieving price target.

Yamaguchi (ex deputy governor). Mon: BOJ must be ready to tweak yield curve control next year if Japan's economy can withstand overseas economic risks, one idea would be to raise 10y JGB yield from current 0%, must be mindful that inflation expectations become hard to control once they're entrenched.

Nakaso (ex deputy governor). Mon: BOJ is continuing large-scale stimulus due to delay in recovery from COVID-19 slump, likely wants to achieve strong wage growth, the dollar's dominance as a global reserve currency won't be shaken easily.

Suzuki (FinMin). Tue: There has been no decision on revising the agreement with the BOJ, not the appropriate time to comment on the next BOJ governor. Later: Monetary policy is up to the BOJ to decide, no comment on reaction to the BOJ decision. Fri: Sees no change to existing BOJ policy.

Kuroda. Tue: Absolutely no intention to hike rates or tighten policy, appropriate to continue easing policy, will not hesitate to ease policy further if necessary, today's decision is not an exit of YCC or a change in policy, it is too early to debate an exit from current monetary policy, cannot yet foresee 2% inflation, if possibility of achieving 2% inflation target draws near we can discuss timing of exit, not thinking about revising the 2013 joint statement between the government and the BOJ, US inflation has clearly passed its peak, does not expect global interest rates to accelerate further, no comment on today's rise in 10y JGB yields to 0.4%.

Goto (EcoMin). Tue: BOJ's decision not meant to be a tweak or exit from monetary policy.

Economic Data

Monday, 19.12.22

Tuesday, 20.12.22

Wednesday, 21.12.22

Thursday, 22.12.22

Friday, 23.12.22

Top 3 Macro Charts of the Week

This section is brought to you by

:1. Bonds vs. pauses. "Historically, core bonds have performed well during Fed rate hike pauses".

2. Accident prone. "It seems inconceivable we won’t have a big accident, especially after 10-15yrs old low/neg yields, more debt and surge of money into illiquid".

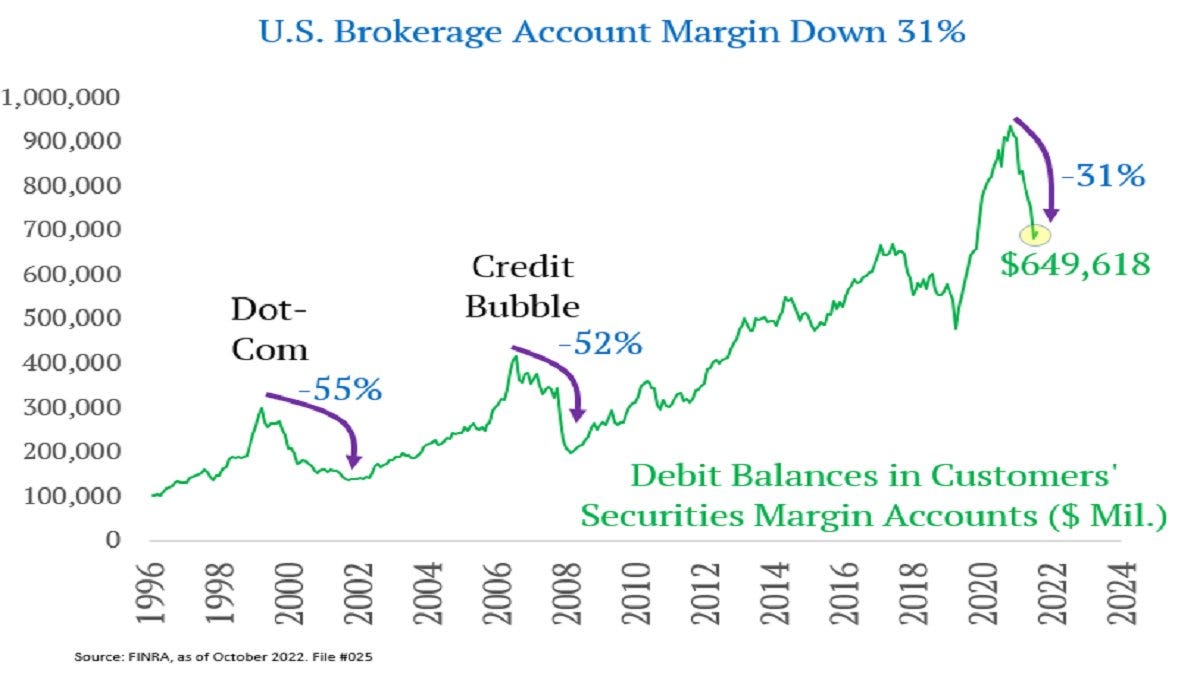

3. Margin accounts. Balances in margin accounts have a long way to go to reach GFC and Dotcom era levels.

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 50/2022 | 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 47/2022 | 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

ECB

Rate Statements: 50/2022 | 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 47/2022 | 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 50/2022 | 43/2022 | 36/2022

BOE

Rate Statements: 50/2022 | 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 50/2022 | 37/2022

RBA

Rate Statements: 50/2022 | 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 47/2022 | 41/2022 | 34/2022 Crib Sheets: 40/2022

BOC

Rate Statements: 50/2022 | 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022

SNB

Rate Statements: 50/2022 | 44/2022 | 39/2022 | 25/2022 Crib Sheets: 50/2022 | 37/2022

BOJ

Rate Statements: 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo credit: DALL-E 2 “A Christmas-themed Bloomberg terminal”

great take, thank you and have a great 2023!