Welcome to issue #31 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary. The final section contains the top three macro charts for the week and is brought to you by

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Before diving in, I’d like to shout out to !

For me, it’s a must-read every day. Here’s what’s in it:

Overnight action in key asset classes including commodities, fixed income and crypto,

Current macro themes with a review of the previous day’s economic data releases, central bank speakers and more,

Main highlights ahead with a comprehensive list of upcoming data and events,

The top 5 trending posts on app.harkster.com, and

A section with links to more in-depth pieces or useful information on current macro themes.

The Morning Hark is a great way to stay on top of what’s going on in markets. If you like fx:macro, you will love The Morning Hark, so check it out!

Table of Contents

Summary

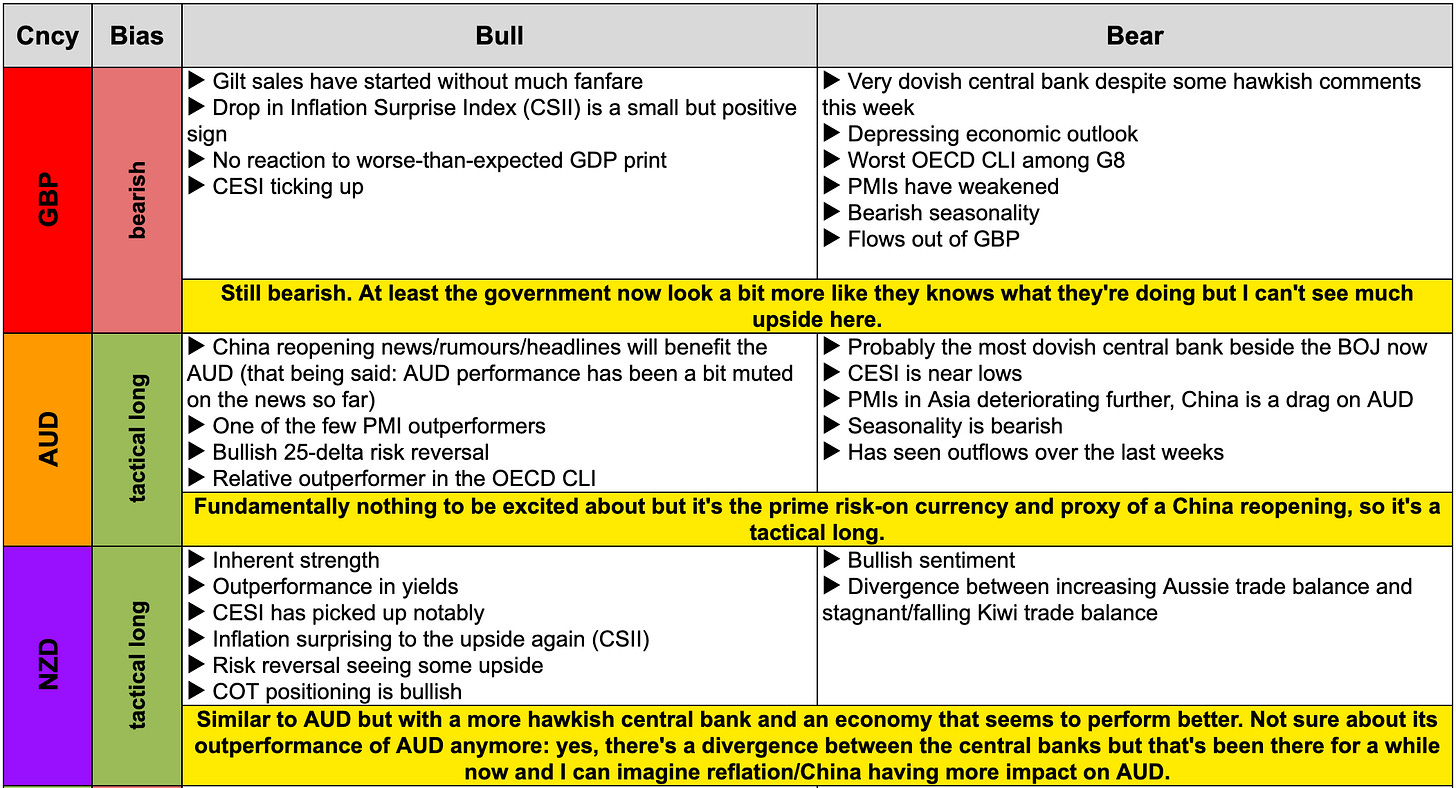

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Economic Calendar for next week

Important levels to watch and look out for in FX futures

Downloads and Links

Difftext of the Summary from last week: link to diffchecker.com

Central bank speaker recap for the week:

Week in Review

Central Banks

BOJ Summary of Opinions (08.11.22)

Quotes from the release:

It is expected that the year-on-year rate of change in the consumer price index (CPI) will continue to increase for some time with a pass-through of cost increases to consumer prices.

The inflation rate is highly likely to remain relatively elevated as signs of increases have been observed even in services prices, as well as in administered prices for items other than energy.

The year-on-year rate of change in the CPI (all items less fresh food) has been at around 3 percent. Inflation expectations have risen. The rate of change is likely to increase toward the end of this year and then decelerate toward the middle of fiscal 2023.

A prolonged disinflationary period preceded the current inflationary phase in Japan and there have been structural changes, such as reversing globalization. Therefore, past empirical findings are not directly applicable to this phase and the risk that the inflation rate will deviate significantly upward from the baseline scenario cannot be ruled out.

In achieving the price stability target, it is important that wages increase in a sustainable and stable manner.

Considering that corporate profits have been at high levels on the whole and wage increases have been observed, Japan's economy has started to exhibit signs of a virtuous cycle. Given this, it is appropriate for the Bank to maintain its current stance regarding the conduct of monetary policy for the time being.

If firms' current price-setting behavior and moves to increase wages take hold and a virtuous cycle between prices and wages operates, sustainable and stable achievement of the price stability target of 2 percent will come in sight.

Although there is no need to immediately change monetary policy, it is necessary to examine the impact of high prices on household behavior and wages humbly and without any preconceptions while paying attention to the side effects of monetary easing.

It is also important to continue to examine how future exit strategies will affect the market and whether market participants will be well prepared for them.

Confab, Speakers, News

Federal Reserve

Kashkari (Hawk). Thu: Don't know what we will do at the December meeting, talk of a pivot is premature, thinks we are on a good path right now, monetary policy operates with a lag, wants to see how the economy evolves to reduce risk of overshooting, inflation is not being driven by wages, dual mandates will come into tension at some point but we are a long long way from that. Crypto is "wild wild west" and chaos.

Waller (Hawk). Thu: Fed would take on enormous cybersecurity risk if it had a CBDC, the case for adopting a CDBC is not yet convincing.

Harker (Neutral). Thu: Expects the Fed can slow pace of hikes in coming months, favours a pause at 4.50%, Fed will hold rates at restrictive levels to assess the economy, rate hikes smaller than 75 bps are still significant, future rate hikes will be driven by data.

Logan (Dove). Thu: Decision about slowing the pace of rate hikes isn't particularly closely related to incoming data (!), CPI data is a welcome relief but still a long way to go, process of the Fed cooling the economy is just getting started, a slower pace of rate hikes shouldn't be taken to represent easier policy.

Daly (Neutral). Thu: October CPI was good news but one month of data is not victory, the time is now to step down the pace of rate hikes, likely some more rate hikes in the future, the real conversation should be about the level at which we hold the interest rate, we will probably need to tighten more than the September dot plot suggested, need to be mindful of cumulative tightening and the impact on financial conditions. Inflation is a lagging variable, need policy to be sufficiently restrictive until inflation is well on its way to 2% target, focused on raise-and-hold strategy on rates.

Mester (Hawk). Thu: October CPI shows signs of moderation of inflation, main risk on inflation is that the Fed doesn't hike rates enough.

George (Neutral). Thu: Pace of hikes is less important than strength of commitment to inflation target, more measured approach allows the Fed to judge the economy's response, steady and deliberate approach to rate hikes is advantageous, degree of tightening needed depends on the economy and can't be predetermined.

Collins (Neutral). Fri: Sees further rate hikes, too soon to call a peak in the hiking cycle, risk of overtightening has increased.

European Central Bank

Villeroy (Neutral). Mon: Not far from the neutral rate, beyond that our hiking pace could be more flexible and slower, it could take 2-3 years for inflation to return to target, inflation could peak in "first semester" of 2023.

Lagarde (Dove). Mon: Interest rates will need to rise more, must bring inflation back to 2%, inflation expectations need to remain anchored.

Enria (top bank supervisor). Mon: Banks and supervisors need to remain vigilant and prudent when looking at banks' near-term performance, we are assessing potential vulnerabilities stemming from the current environment based on capital projections. Tue: Worrying dissonance between positive expectations for banks and the unique risks we face, for some business models a standard interest rate shock could produce material depletions in net worth.

Kazaks (Hawk). Mon: There is no pivot, discussion about size of hiking steps is appropriate, December decision will depend on the economy and whether the ECB adjusts other instruments.

De Guindos (Dove). Tue: Will continue to raise rates to a level that ensures inflation comes back to target, we will start QT sooner or later but for sure in 2023, we will proceed with a lot of prudence and caution, decision in December will be based on new projections and inflation estimate for November, inflation will stay around current levels for the next few months and decline in H1 2023. Fri: Market may be underestimating inflation persistence, there needs to be a clear deceleration in headline inflation for expectations about future ECB hikes to stabilize.

Nagel (Hawk). Tue: Large rate hikes are necessary, "I will ... do my utmost to ensure that we, the Governing Council of the ECB, do not let up too early and that we continue to push ahead with monetary policy normalization - even if our measures dampen economic development." Overall economic costs of falling behind the curve would be higher. Thu: The ECB should let longer-term rates rise too, it is inconsistent to move short-end rates in one direction and longer-end rates in another, when you have two policy tools at hand it doesn't make sense to use just one of them.

Vasle. Thu: Further rate hikes are needed, need to go beyond neutral, appropriate to start QT next year, inflation is more and more broad-based.

Schnabel (Neutral). Thu: Underlying inflation tends to be more sticky, no time for monetary policy to pause, need to raise rates into restrictive territory, recession risk has gone up but if there's a recession it's unlikely to be deep and prolonged.

Holzmann (Hawk). Fri: Does not yet know how he will vote at the December meeting, everything is possible: both 75 bps and 50 bps, will depend on our forecasts.

De Cos (Dove). Fri: Recent 75 bps hike does not imply a similar move at the next meeting, start date for QT could be announced at the December meeting.

Bank of England

Breeden (executive director of markets). Mon: Transparency is a first step to apply lessons from events related to LDI funds, better transparency means non-banks' positions and interlinkages with the financial system can be stress tested comprehensively.

Pill. Tue: There is more to do, we need to raise rates to tighten monetary policy, not going to move at a pre-defined level, need to think about the broader economic outlook at some point, we cannot be indifferent to market pricing of rates at 2 or 5 year horizon, should not put the housing market on a pedestal as an economic driver. Start of bond sales shows MPC's determination to keep monetary policy separate from financial stability operations.

Bailey (Neutral). Fri: More rate hikes likely in the coming months, bringing inflation under control will likely take 18-24 months, hopeful that inflation will peak over the winter.

Tenreyro (Dove). Fri: Main rationale for further tightening was risk management, this will likely become weaker in future months, policy would have to loosen perhaps in 2024 to prevent inflation from falling below target. Most of the impact of tighter bank rate on demand has yet to appear, need to guard against over-tightening of policy, initial signs that UK labour market is starting to loosen, recession likely in Q4 due to lower real incomes, UK should avoid tracking rates abroad when economic trajectories are markedly different.

Haskel (Hawk). Fri: Important for the BOE and monetary policy to stand firm against the risk of persistent inflation, policy would have to be tighter for longer if price rises become embedded, UK growth already slowing down, signs of a slowdown do not imply less tightening given the strength of the labour market.

Reserve Bank of Australia

Bullock. Thu: Rates may have to go a little higher, getting nearer to the point where we might be able to pause and take a look, seeing wider inflation pressure in the economy, must raise rates to influence demand.

Bank of Canada

Macklem. Thu: Next hike could be another bigger-than-normal move or more normal-sized, labour market is unusually tight, we need to rebalance the labour market to reach 2% inflation and that will be a difficult adjustment, layoffs are likely to increase in the coming months, we need the economy to slow down, slightly negative growth is possible over the next few quarters, that's not a severe recession but a significantly slowing economy, particularly focused on measures of core inflation.

Swiss National Bank

Jordan. Tue: Mixed signals from inflation must not lead to indecision, determined action is required to check rising prices, there are arguments for a wait-and-see approach and more aggressive policies, monetary policy decisions are not entirely based on inflation forecast, we do not attempt to fine-tune inflation within its 0-2% target range, policy decisions must be based on a firm commitment to price stability. Fri: Current monetary policy is not restrictive enough to bring inflation back to the range of price stability, prepared to take all necessary measures.

Maechler. Thu: Inflation rate at 3% in Switzerland is still too high, no compelling advantages in introducing a CBDC for the general population. Fri: Further rate hikes may be necessary to ensure price stability, Swiss inflation remains too high, important to make overall assessment with the figures we will have in December.

Bank of Japan

Kuroda. Thu: Will maintain easy monetary policy to sustainably and stably achieve 2% inflation accompanied by wages growth, deeper negative rates are an option if needed, Japan's CPI likely to slow back below 2% next fiscal year, must leave room for policy response to ensure Japan never returns to deflation, debate on exit from easy policy can begin when 2% inflation target accompanied by wage hikes comes into sight, we are not at that stage yet. Rapid and one-sided FX moves are not desirable, BOJ policy decisions take into account various factors including the impact of FX moves on the economy. Have no personal desire to get re-appointed for another term as BOJ governor.

Suzuki (FinMin). Fri: Will respond to FX moves as needed, closely watching FX markets with a sense of urgency, concerns about expectations for global recession are rising.

Economic Data

Monday, 07.11.22

Highlights from the Australian Services PMI:

The Australian PSI® indicated contraction in the services sector in October, the second month of declining results.

Results were mixed - business & property services showed the strongest month-on-month decline and logistics the largest improvement. Logistics was the only service sector in growth.

Sales, deliveries and stocks all indicated substantial deterioration; new orders and employment were positive and improved from September.

Services capacity utilisation remained elevated, rising to 79.9%. This reflects tight employment conditions.

Wet weather and flooding events, cumulative interest rate increases, and labour shortages were key concerns for businesses.

Tuesday, 08.11.22

Wednesday, 09.11.22

Thursday, 10.11.22

Friday, 11.11.22

Market Analysis

Growth and Inflation

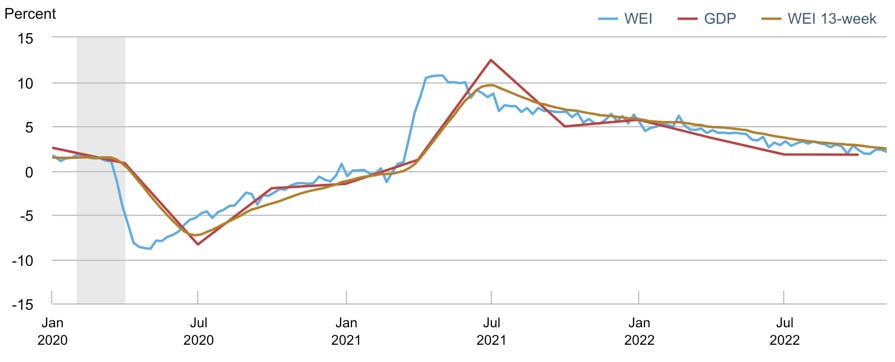

The Atlanta Fed GDPNow model ticked up to 4.0% for Q4:

The NY Fed Weekly Economic Index stands at 2.10:

Citi Economic Surprise Indexes:

USD, EUR and JPY sideways

GBP ticked up this week

AUD, NZD and CAD are also up

CHF isn't moving

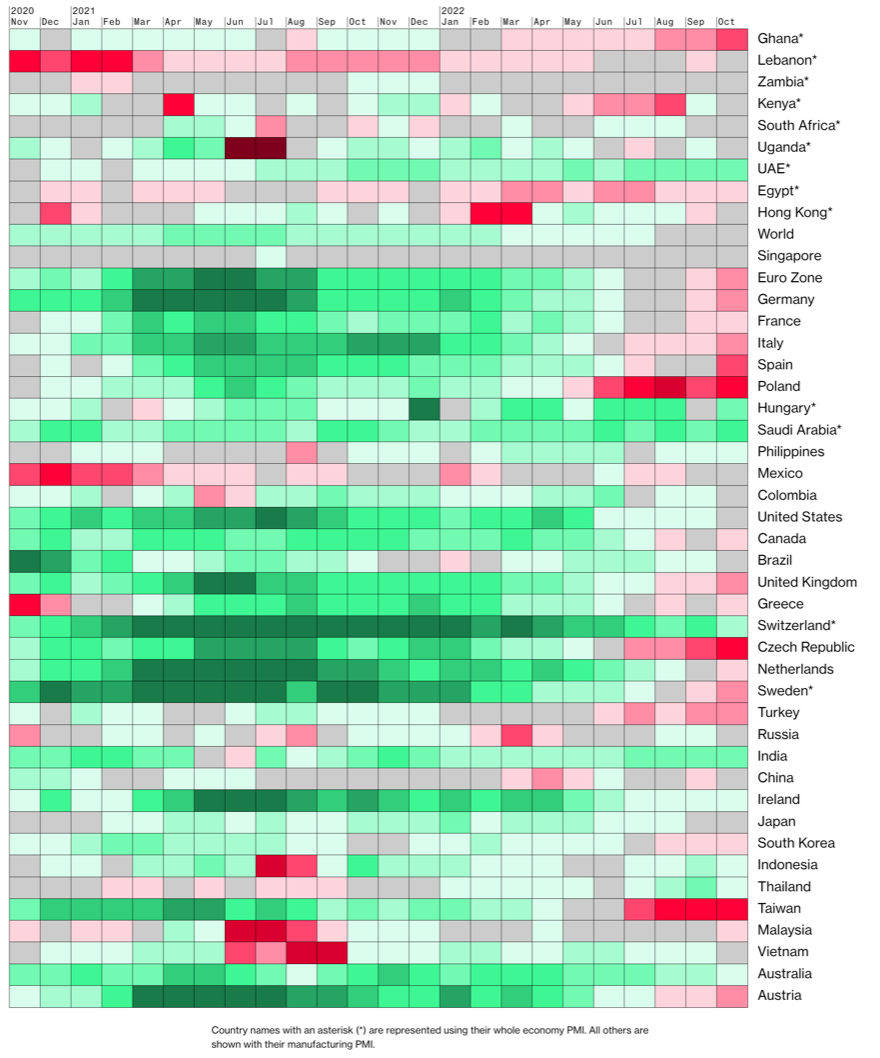

The Bloomberg PMI heatmap is unchanged from last week:

Mostly red with hardly any bright (i.e. green) spots

Eurozone, Germany and the UK worsened

US and Canada also worse in October compared to September

Switzerland and Australia still green

China did improve a bit

South Korea stable, Taiwan also stable (but just because there's no deeper shade of red)

India is still doing pretty good

OECD Composite Leading Indicators:

The UK shows the steepest decline

Australia, CAD and Japan are the relative outperformers

5y5y forward inflation expectations continue to trade sideways:

Breakeven inflation rates look like they have put in another short-term high:

RINF has also been trading sideways:

Citi Inflation Surprise Indexes remain the same as last week:

USD, AUD, CAD have all picked up a little

NZD is higher as well

CHF dropped sharply

JPY is moving higher

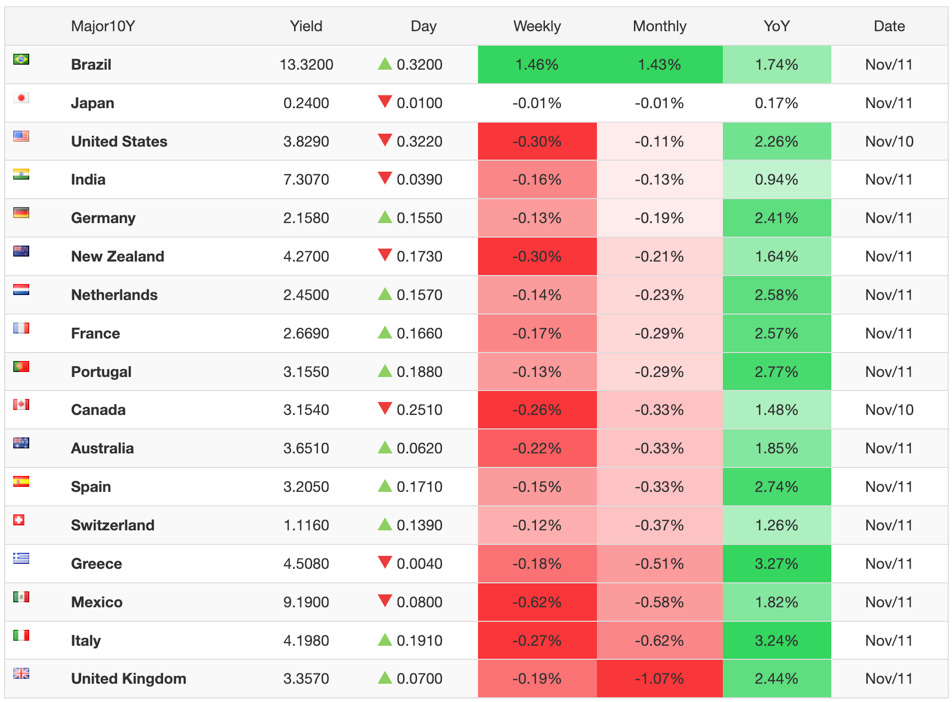

Yields

See chart and table below:

2y yields in DE/EUR and CHF have been outperforming

Bear flattening in the German 2s10s

US yields have been the hardest hit on a weekly basis

UK 2s and 10s look particularly weak

The German yield curve at the 2s10s spread is, as of this week, the sixth of the eight G8 curves that have inverted during this cycle:

Central Banks

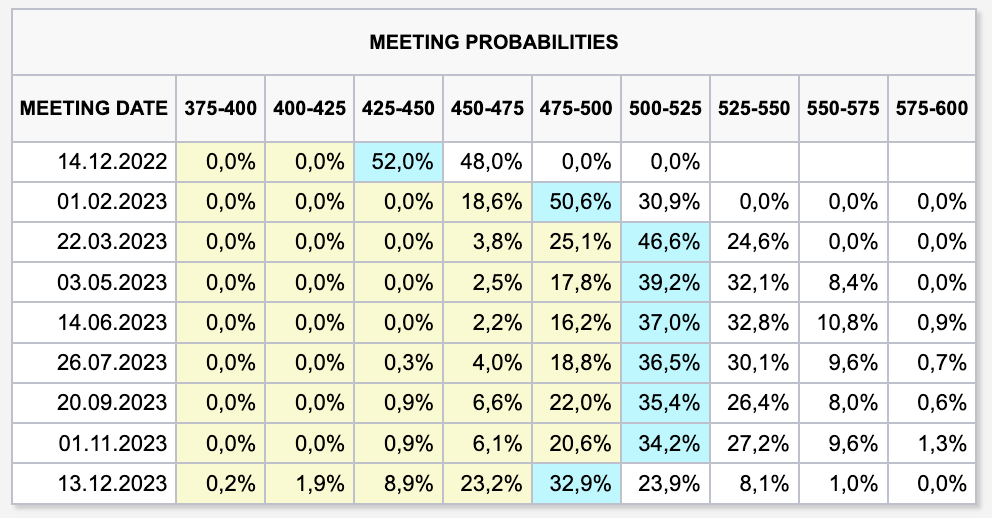

Some significant changes to the FedWatch probabilities after this week's CPI print:

The December meeting is now seen at a 81% chance of a 50 bps hike (last week: 52%)

The February meeting is now priced at 25 bps (before: 50)

The terminal rate is seen at 4.75-5.00% (last week: 25 bps higher)

2023 now sees two cuts (last week: one cut)

Short-term interest rate spreads show the repricing of 2023 expectations from 75 bps in total down to 35 bps. The pricing for 2024 has become even more dovish with more than one additional cut being priced in from 50 to 85 bps:

Sectors and Flows

Currency strength:

USD still shows up as the strongest currency over three months but over shorter timeframes, it has become the laggard

EUR remains pretty unimpressed: it's the second-strongest over three months and somewhere in the middle on a monthly and weekly chart

JPY and CHF have been the strongest currencies this week; both come from weaker spots on the charts

CAD has been dragged down with USD

AUD and NZD are interesting: both show up in the middle of the short-term 1-week chart but NZD remains the top performer over one month

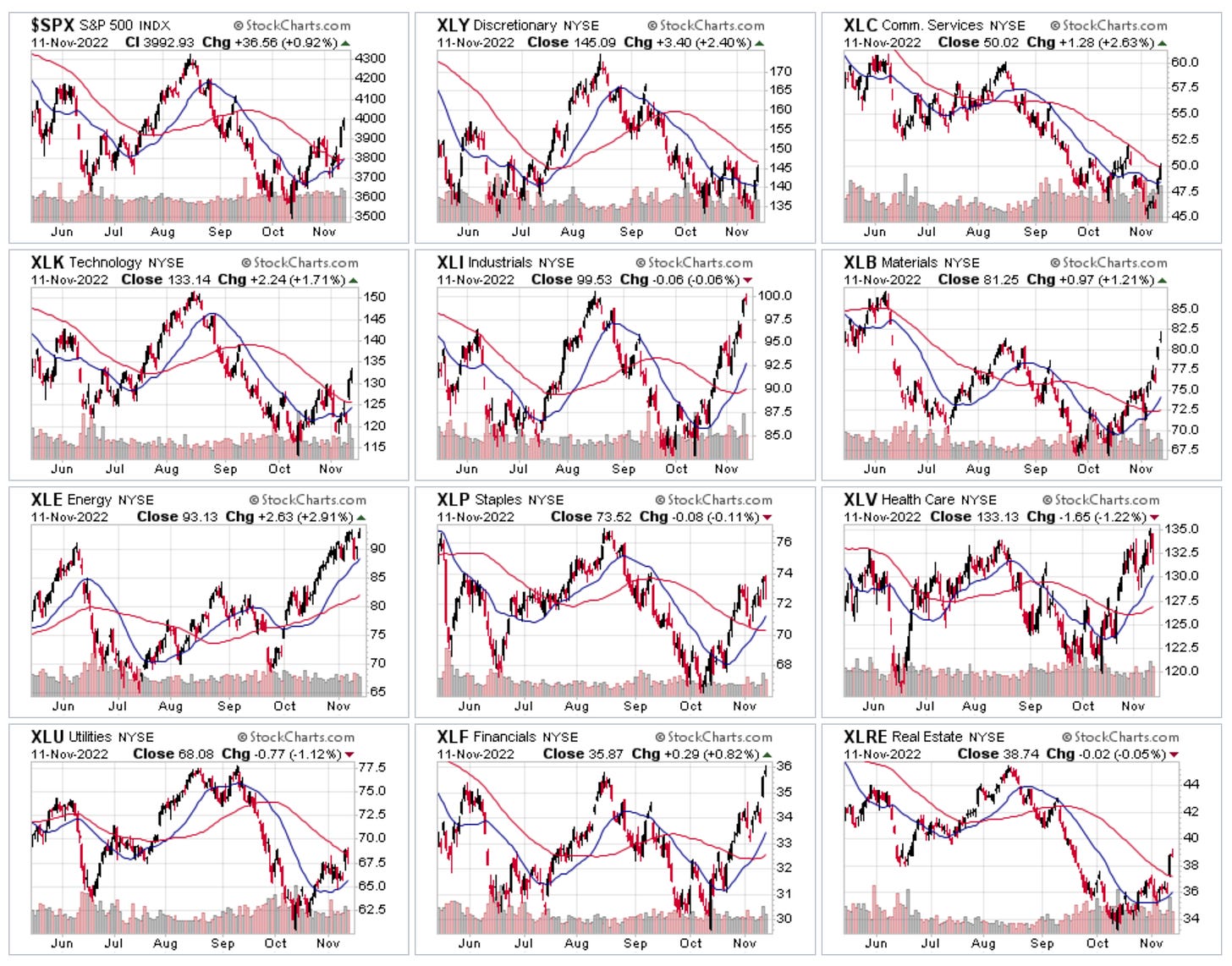

Equity sector performance:

Energy still going strong with OIH at the top but XOP and XLE considerably weaker

Semiconductors (SMH) are up 25% over one month

Utilities (XLU), Healthcare (XLV), and Staples (XLP) are near the bottom

Consumer Discretionary (XLY) shows the worst performance

Different sector perspective:

Tech/Communications have been the clear outperformers this week

Defensive sectors have been underperforming this week (Utilities, Consumer Defensive, Healthcare)

Financials performance has been lacklustre

Every sector is in the green over one month

Sector charts with some observations:

XLY and XLC are still lagging, both don't look like they've broken out of their basing patterns/areas

XLK has broken out (as opposed to XLC)

XLB is flying

XLE, XLI, XLV and XLF are at/near their highs

International stock market indexes:

Hang Seng has shown remarkable strength following the Chinese reopening rumours and headlines

Three European indexes at the top: DAX, EuroStoxx and the French CAC40

The Korean KOSPI comes in fourth place

The Taiwanese TW50C is up 8.5% and comes in somewhere in the middle

Bovespa is the underperformer and the only index in the red

BNY Mellon iFlow:

Equity flows remain broadly negative, especially in the US

This week has seen significant flows into EUR, and out of AUD and CAD

Carry flows have been improving for a while but remain neutral

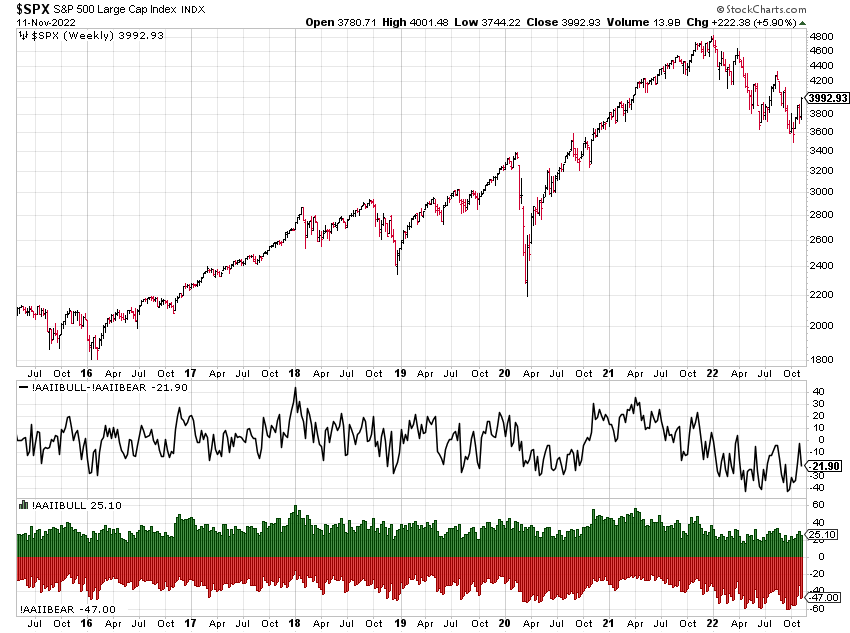

Sentiment and Positioning

AAII Bull-Bear spread has worsened but the survey has been conducted before Thursday's CPI print:

Currency sentiment:

CHF has the most bearish sentiment (last week: 60% bears, this week: 74%)

JPY has the most bullish sentiment (last week: 49% bulls, this week: 70%)

NZD still has pretty bullish sentiment (unchanged from last week)

A different sentiment source:

The bullish sentiment/positioning in USDCHF and the changes in longs and shorts is pretty striking

EURCHF also had a lot of shorts added and shows up as the fourth most-long position on the list

Commitment of Traders data is stale: due to the holiday on Friday the data will be published by the CFTC on Monday. I will post an update on Twitter as soon as the data is available. The respective columns in the following table are greyed out.

Equities had a positive week with all four indexes but the NQ having a Levy Relative Strength of >1

Treasuries were up this week but their RSLs remain deeply below 1

Currencies were all positive vs. the dollar for the week, the longer-term FX future performance is also positive for everyone vs. the dollar: NZD/6N is the outperformer with +10.2%

Bitcoin hit a new low, its RSL is just 0.73, i.e. it is 27% below its 26-week moving average

Energy futures were negative despite the weaker dollar, risk-on and the China headlines

Metals had a strong week, all of them have RSLs at/above 1.00

Grains and softs were mixed

CitiFX PAIN indexes:

I think the most recent currency moves don't yet show up in these indexes

It's going to be interesting to watch them over the coming week

Here's a different way to look at them overlayed with price:

Market Risks

The credit spreads I track from FRED aren't up to date (last print: 09-Nov), so they don't include the moves after the CPI print:

The Credit Spread Index from creditspreadalert.com has ticked up despite the rally in stocks:

Currency volatility has ticked up in (USD)JPY while it's been mostly lower for the other G8 currencies:

The VIX term structure is in contango with a decent premium and steepness in the front:

Volatility indexes:

VIX has collapsed to just 22.5, VIX/VIX3M contango steepened (flatter spread)

VVIX has ticked up a bit but remains near lows, same for TDEX

Skew is flat with SDEX and VIX/VOLI near lows

Similar to last week: this is a very calm picture

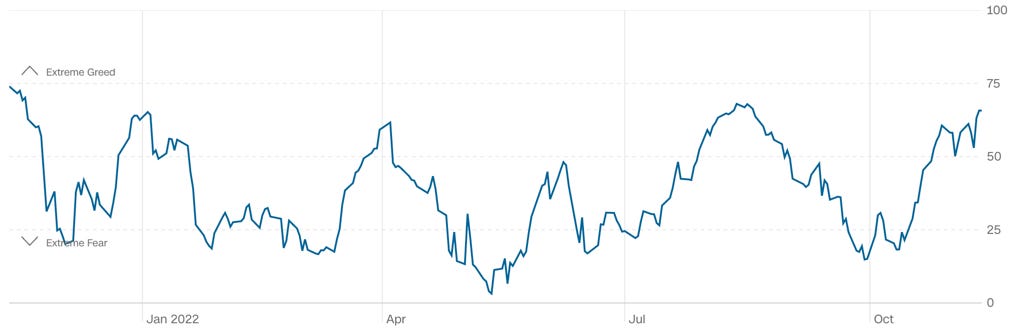

CNN Fear & Greed remains in Greed territory:

Various

The NYSE Advance/Decline line continues to track price, no divergences here:

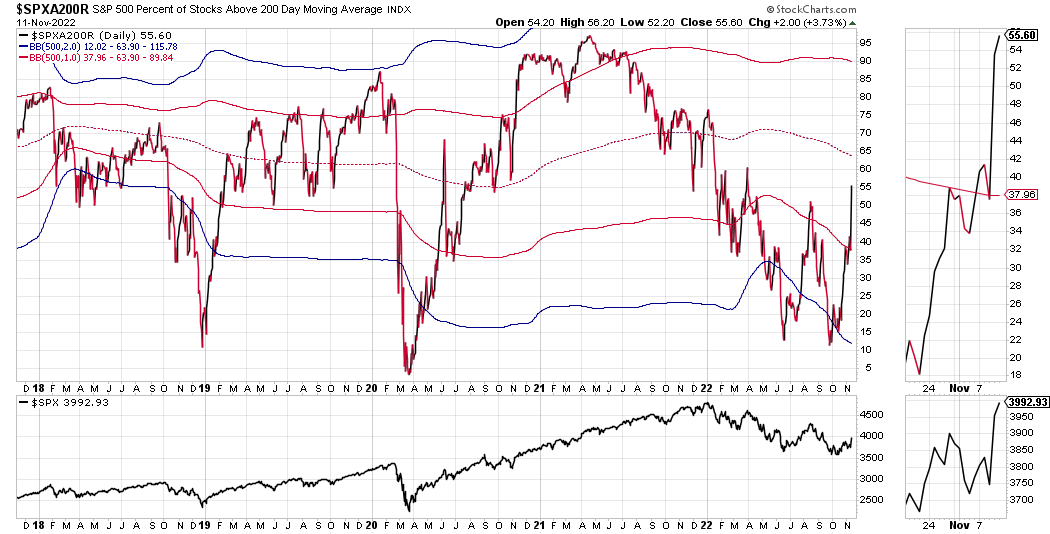

S&P 500 and Nasdaq stocks above their moving averages:

Both have seen a boost on the longer (200-day MA) and shorter (50-day MA) timeframes

This is a pretty decent reaction and it looks like the steepest increase during this bear market

Here are the charts for the 200-day moving averages:

And here for the 50-day MAs:

25-delta risk reversals:

There's no clear divergence

I've pointed out that the options market was betting against the USD in my analysis last week

This hasn't reversed so far

Another bit of intermarket analysis:

XLF/XLU, SLV/GLD and HG/GC are all buying this rally

The Korean Won as a proxy for global growth has gained significantly on the dollar selloff

I've got the idea from Check out his Substack for weekly macro updates!

Top 3 Macro Charts of the Week

This section is brought to you by

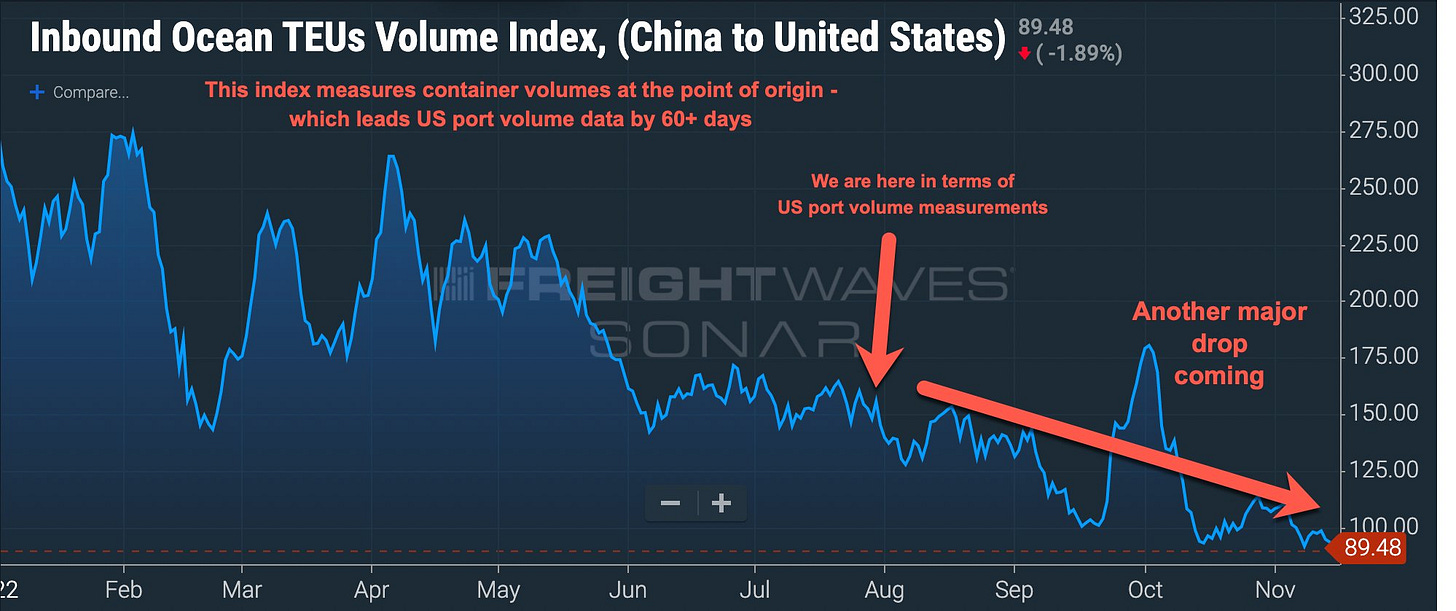

1. Winter is coming. "The volume drop at US ports is not a "blip", it is the start of a much steeper decline...The current volume drop in US container imports that is showing at US ports is going to get worse".

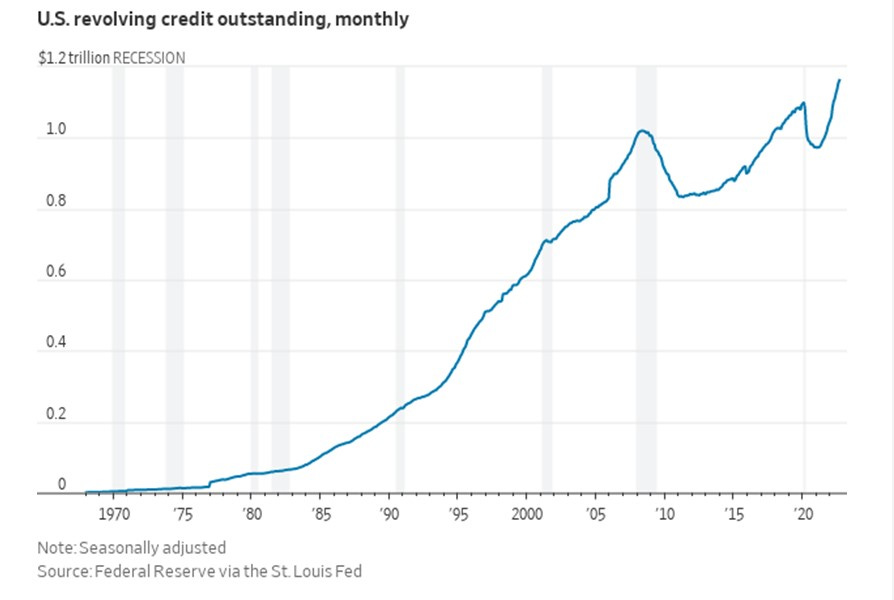

2. Revolving credit. “Americans are increasingly turning to their credit cards as they balance rising prices and strong demand for goods and services…Revolving credit...increased at an annual rate of 8.7% to $1.162 trillion in September...the highest level on record".

3. Growth vs. Value (I). "Value has just outperformed Growth by a truly anomalous amount (11.5 points, +3 standard deviations) over the last 50 days".

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 37/2022

ECB

Rate Statements: 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 43/2022 | 36/2022

BOE

Rate Statements: 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 37/2022

RBA

Rate Statements: 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 41/2022 | 34/2022 Crib Sheets: 40/2022

BOC

Rate Statements: 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022

SNB

Rate Statements: 44/2022 | 39/2022 | 25/2022 Crib Sheets: 37/2022

BOJ

Rate Statements: 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 41/2022 | 31/2022 Crib Sheets: 43/2022

Image credit: DALL-E 2 “Popart poster of everyone going crazy”

Thank you for the kind words!

If you look at last week's COT table, Commercials and Large Trader net positions for EUR/6E are at 0.00 and 1.00, i.e. both are at 52-week extremes: Commercials are extremely short and Large Traders are extremely long. That's bearish, especially since the Z-score of 1-week position changes was -1.91 for the Commercials, so their increased their short position increased by almost 2 SD. When you look at COT/TFF data, the chart for 6E is right in the middle of its 2-year range, %R is 0.59.

So, all in all I think it's a bearish positioning. I'm not reading too much into it, though, because it's not good for timing and can stay that way for a while.

Hope that helps.

thank you, appreciate!