Just a quick note: due to family commitments, this issue of the newsletter will only contain the review sections without the analysis part.

Welcome to issue #34 of fx:macro!

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Before diving in, I’d like to shout out to !

is a great way to stay on top of what’s going on in markets. If you like fx:macro, you will love so check it out!

One more thing. You seem to like newsletters, so here's a great way to discover new stuff to read for free: The Sample. They will regularly send you an issue of a different semi-random newsletter you might be interested in. If you sign up using my referral link, I get bonus points and my newsletter will be forwarded to others to check out.

Table of Contents

Summary (Playbook, Calendar, Levels, Downloads)Week in Review

Central Banks

Economic Data

Market AnalysisGrowth and InflationYieldsCentral BanksSectors and FlowsSentiment and PositioningMarket RisksVarious

Top 3 Macro Charts of the Week

Summary

Downloads and Links

Central bank speaker recap for the week:

Week in Review

Central Banks: Confab, Speakers, News

Federal Reserve

Williams (Neutral). Mon: Have to do more to lower inflation, more rate hikes will help restore balance in the economy, inflation to cool to 5.0-5.5% by year-end and 3.0-3.5% by late 2023, unemployment rate to rise from 3.7% to 4.5-5.0%, sees modest growth this year and 2023. Thu: Fed has a ways to go with rate hikes, seeing signs of a welcome ebb in inflation but it will take a couple of years for inflation to ease to target.

Bullard (Hawk). Mon: Rates won't come down as much as markets would like, will defer to Powell on the pace of hikes, rates need to go higher, we have a ways to go, will have to keep rates sufficiently high all through 2023 and into 2024, markets are under-pricing the risk that the Fed might be more aggressive, we can evaluate balance sheet reduction next year some time but so far so good, 200k jobs created in November would still be well-above historical trend, expected disinflation is partly leading to yield curve inversion so no necessarily sending a recessionary signal.

Mester (Hawk). Mon: Needs to see "several" more good CPI reports with more moderation and even a reduction in core services prices as well as a better balance in the labour market to consider a pause, costs of stopping tightening too early are too high, sees inflation coming down in 2023 but at 2% target not until 2024.

Barkin (Neutral). Mon: If inflation stays elevated the Fed needs to do more, our of is off the gas and on the brake, supportive of a path that is slower, longer and potentially higher for rates; how long rates will stay high depends on inflation, have to make sure inflation is under control before talking of loosening policy, moving a little slower is better risk management, labour market is still tight, expects to see continuation of solid jobs growth. Fri: Labour supply looks like it will remain constrained, efforts to bring demand back into balance won't be easy with household excess savings and fiscal stimulus.

Cook (Neutral). Wed: Prudent for the Fed to hike "in smaller steps" moving forward, how high rates go depends on the economy's response, mindful of past hikes still working through the economy, some early signs of improvement in inflation data but too soon to say inflation trend turning more friendly yet, wage growth above levels consistent with 2% inflation target.

Powell (Neutral). Wed: Makes sense to moderate the pace of rate hikes as soon as the December meeting, slowing down is a good way to balance risks, "I don't want to overtighten", have made substantial progress toward "sufficiently restrictive" policy but have more ground to cover, seems likely that rates ultimately must go "somewhat higher" than policymakers thought in September, likely need to hold policy at restrictive level "for some time", history cautions against prematurely loosening policy. Inflation remains far too high, October CPI was a welcome surprise but will take substantially more evidence. Growth has slowed to well below longer-run trend and this has to be sustained. Soft landing is plausible but won't speculate on odds.

Bowman (Neutral). Thu: It is appropriate to slow the pace of rate hikes, views on the size and pace of hikes will be guided by incoming data, expects ongoing increases at coming meetings and that policy will remain restrictive for some time, expects a slightly higher terminal rate than anticipated in September.

Barr (Neutral). Fri: We may shift to slower pace of rate increases at next meeting, makes sense to hike by 50 bps, it is smart to modulate on rate hike pace, we are now at a point where we can pay more attention to the rate we are getting to and less on the pace, policy rate will have to stay high for a long period of time, current policy is restrictive and that is broadly the view among his my colleagues, still have more work to do, change in pace of hikes does not mean a change in commitment to 2% inflation target, we are not thinking about loosening, we are not thinking about revising the 2% inflation target.

Evans (Neutral). Fri: We are probably going to have a slightly higher peak to policy rate even as we slow the pace of hikes, we're on a path to getting financial conditions appropriately restrictive to bring inflation down.

European Central Bank

Kazimir. Mon: Rate hikes will continue, risk of recession in the Eurozone is growing.

Knot (Hawk). Mon: Underlying inflation trends are worrisome, we need weaker growth for inflation to return to target, a recession is not a foregone conclusion.

Lagarde (Dove). Mon: Rates are still accommodative, we might need to move rates into restrictive territory, no indication that inflation has peaked, still have a "way to go" on hikes, will raise rates as high as needed. Will lay out key principles for reducing bond holdings in December, balance sheet normalization over time and in a measured way is appropriate, decisions will follow a meeting-by-meeting-assessment, data suggests wages are picking up and we will continue to assess that implication, strong labour markets likely to support higher wages, growth is expected to weaken through the beginning of next year. Fri: Central banks must work to make sure CPI falls back to target, hoping for short-term and bespoke fiscal policy.

De Cos (Dove). Mon: Rate hikes so far are not enough to return inflation back to target.

Enria. Thu: Underlying risks point to a likely deterioration in asset quality in the coming months, for most banks the expected increase in interest rates should enhance profitability.

De Guindos (Dove). Fri: Economic deceleration will not be as bad as expected a few weeks ago, still a high probability of a recession, inflation is starting to slow down.

Nagel (Hawk). Fri: QT should happen from Q1 2023 onwards.

Bank of England

Bailey (Neutral). Tue: Scale of QT needed is uncertain, no reason to think BOE will not meet goal to reduce gilt holdings by £80 bln in a year, gilt market is not back to normal, want to observe what happens because of current gilt sales before deciding scale of following year's programme.

Mann (Hawk). Tue: Once inflation expectations have been managed the Bank Rate can come off a future peak, medium-term inflation expectations are very important for my assessment of where the Bank Rate should go.

Pill. Wed: Our base case does not involve rates reaching 5.25%, wage growth is inconsistent with 2% inflation target, labour market remains tight, demand is easing as household incomes are squeezed.

Reserve Bank of Australia

Lowe. Mon: Demand is too strong relative to supply, wage growth is inconsistent with inflation returning to target, fiscal policy has no discernible impact on monetary policy. Fri: Inflation expectations remain well anchored, policy lags in this cycle are likely to be longer, household spending in Australia has been resilient to the higher interest rates so far.

Reserve Bank of New Zealand

Silk. Mon: Need to see inflation turn and inflation expectations coming down for a slowdown in tightening, forecast recession would be a shallow and technical one, will be closely monitoring high-frequency data and next CPI report to determine move in February, New Zealand is not being substantially more aggressive than its peers.

Bank of Canada

Bank of Japan

Kuroda. Mon: Tightening labour market will help drive up wages ahead. Fri: Rate of global inflation expected to decline in 2023 and that forecast also applies to Japan, recent market turmoil in the UK has shown that the reaction of market participants to policy decisions could significantly impact asset prices.

Noguchi. Thu: Achievement of the 2% inflation target remains uncertain, must maintain monetary easing, there is a risk monetary tightening by central banks could hurt global growth, recent rise in CPI mostly due to imported goods, cannot say Japan has stably achieved 2% inflation target yet, we must see rise wages at a faster pace than the rate of inflation.

Tamura. Fri: BOJ should conduct a review of its monetary policy framework, whether ultra-loose monetary policy needs to be tweaked will depend on the outcome of the review, should consider 2% price target as a flexible goal as that level may have been excessively high for Japan.

Suzuki (FinMin). Fri: Closely watching changes in exchange rates, no comment on FX level.

Amaiya. Fri: Japan's inflation is "very high" right now but likely to slow back below 2% next year. If yields rise by 1% for Japan's entire curve that will lead to an evaluation loss of 28.6 trillion yen in the BOJ's bond holdings, even if the BOJ incurs losses on its asset holdings that won't affect its ability to conduct monetary policy.

People's Bank of China

Liu Kun (Fin Min). Fri: Will keep yuan exchange rate generally stable at appropriate and balance level.

Yi Gang. Fri: Forecast for inflation in China in 2023 is in a moderate range, policy focus is on growth, monetary policy has been fairly accommodative.

Economic Data

Monday, 28.11.22

Tuesday, 29.11.22

Wednesday, 30.11.22

Highlights from the Australian Manufacturing PMI:

Manufacturing fell into contraction in November following three months of stability. Five of the six sectors in the PMI are now in contraction, as are six of the seven activity indicators.

Demand-side conditions have deteriorated in the face of national and global economic uncertainty. Production, new orders and sales were all significantly down in November.

Supply-side pressures on manufacturing – tight labour markets and supply chain interruptions – appear to have peaked. But these pressures are yet to materially decline, and remain well elevated on long-run trend.

Thursday, 01.12.22

Highlights from the Canadian Manufacturing PMI:

“Against a backdrop of high inflation and ongoing macroeconomic uncertainty in product markets, November’s PMI data signalled that operating conditions in Canada’s manufacturing sector remained challenging. Both output and new orders continued to fall, although perhaps of some comfort is that the degrees of decline were softer than in October.

“Moreover, cost inflation continues to ease as lower prices for several goods slowly make their way down the supply-chain, whilst several firms added to their staffing numbers as they sought to address labour shortages at their plants. Confidence in the future has also edged higher, adding to hopes that the current downturn in the sector is passing its trough.”

Highlights from the US ISM Manufacturing PMI:

Friday, 02.12.22

Top 3 Macro Charts of the Week

This section is brought to you by

1. Freight rates. "Cost to ship 40ft container from Shanghai to Los Angeles has plunged to lowest since May 2020, which means pandemic boom is close to being completely erased".

2. Easing conditions (I). "Goldman Sachs says the easing in financial conditions over the last three weeks is worth 0.4-0.5 pp of GDP in 2023".

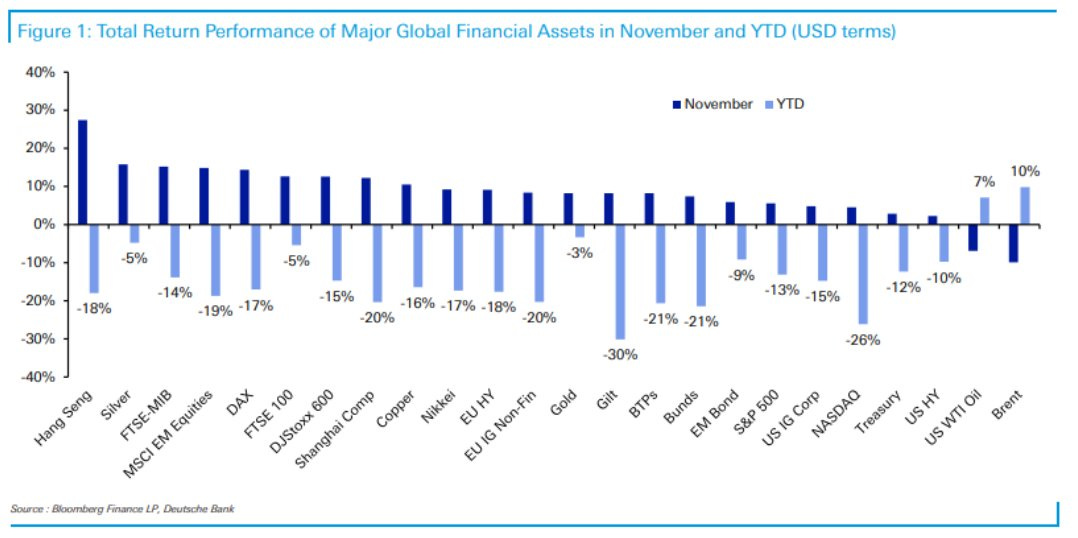

3. One trade. "Basically every single asset class in the world reversed in November".

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 47/2022 | 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 37/2022

ECB

Rate Statements: 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 47/2022 | 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 43/2022 | 36/2022

BOE

Rate Statements: 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 37/2022

RBA

Rate Statements: 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 47/2022 | 41/2022 | 34/2022 Crib Sheets: 40/2022

BOC

Rate Statements: 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022

SNB

Rate Statements: 44/2022 | 39/2022 | 25/2022 Crib Sheets: 37/2022

BOJ

Rate Statements: 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: DALL-E 2 “Heading into the Fed blackout period.”