Just a quick note: due to family commitments, this issue of the newsletter and the next one will only contain the review sections without the analysis part. The next complete issue should be out on the weekend of December 10/11.

Welcome to issue #33 of fx:macro!

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Before diving in, I’d like to shout out to !

is a great way to stay on top of what’s going on in markets. If you like fx:macro, you will love so check it out!

One more thing. You seem to like newsletters, so here's a great way to discover new stuff to read for free: The Sample. They will regularly send you an issue of a different semi-random newsletter you might be interested in. If you sign up using my referral link, I get bonus points and my newsletter will be forwarded to others to check out.

Table of Contents

Summary (Playbook, Calendar, Levels, Downloads)Market AnalysisGrowth and InflationYieldsCentral BanksSectors and FlowsSentiment and PositioningMarket RisksVarious

Summary

Downloads and Links

Central bank speaker recap for the week:

Week in Review

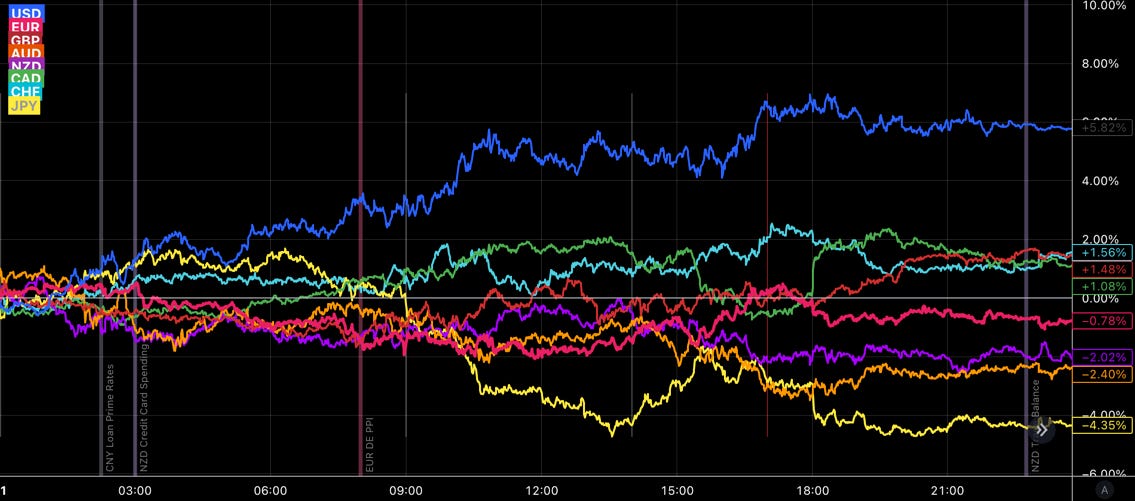

Central Banks

RBNZ Rate Decision (23.11.22)

The RBNZ hiked by 75 bps to 4.25%. Summary and difftext below:

The OCR needs to reach a higher level sooner than previously indicated

Employment is beyond its maximum sustainable level

Near-term inflation expectations have risen

The key part from the meeting minutes:

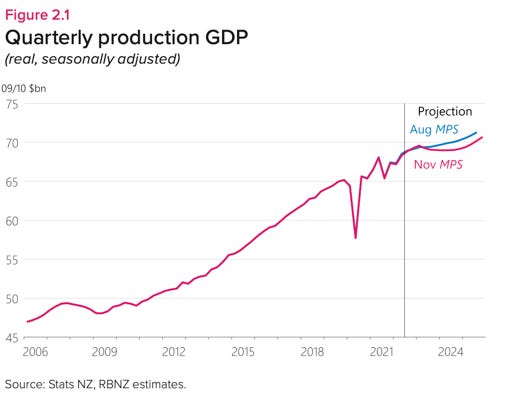

The following figures are from the Monetary Policy Statement. The forecast for the OCR has been upped, the GDP forecast has been downgraded and the CPI projection has been upgraded as well:

FOMC Minutes (23.11.22)

The FOMC minutes were clearly perceived as dovish by the market but there wasn't really much new information in them. I've highlighted some relevant passages:

ECB Minutes (24.11.22)

I read the minutes as more hawkish than dovish but the market was clearly less excited. Here are some of the highlights:

Confab, Speakers, News

Federal Reserve

Bostic (Dove). Sat: Ready to move away from 75 bps hikes at the December meeting, expects 0.75-1.00% more tightening to be sufficient to control inflation, Fed has to resist the temptation for rate cuts until inflation is back on track to 2% even if the economy weakens.

Daly (Neutral). Mon: Not ready to say what the Fed should do at the December meeting, not taking anything off the table, at some point it will be right to slow the pace of hikes, rates could peak in the 4.75-5.25% range but that is not set in stone and Fed could hike beyond that, policy is in modestly restrictive territory, financial markets are priced like the FFR is at 6% and not at 3.75-4.00%. Inflation is unacceptably high, labour market is strong, there are a lot of global headwinds including China, the war in Ukraine and the winter in Europe. Sees herself on the hawskish side of the spectrum.

Mester (Hawk). Mon: Makes sense to slow down the pace of hikes from 75 bps but nowhere near stopping hikes, need to be more judicious in balancing risks, we are beginning to see our actions working, we need to do more work, we are barely at restrictive territory, getting inflation back to 2% will take some time, doesn't think market expectations of FFR is really off, we will need to react if we don't see meaningful progress on inflation next year, doesn't have a recession in her forecast. Tue: Inflation expectations remain anchored, labour demand still outpacing supply of workers, wage gains are still behind inflation rise in most sectors.

George (Neutral). Tue: Wage growth remains strong, a calmer labour market with less churn could reduce inflationary pressures, many of my contacts report problems with low worker engagement, house prices remain above pre-pandemic trend and one can argue that's in part due to QE.

European Central Bank

Holzmann (Hawk). Mon: Supports a 75 bps hike in December if the situation stays the same, that would bring us into neutral area, strong consensus that we should start small on QT to test the market, should start with APP, PEPP much later, very much concerned about inflation expectations de-anchoring. Tue: Endorses 75 bps rate hike in December, no sign that core inflation is reducing, another big rate hike would give a strong signal about our determination, still open to changing is mind, rates need to rise to a point where they cause pain, expects only flattening of growth or a mild recession.

Lane. Mon: There will be a rate hike in December but the platform for a very large hike such as 75 bps is no longer there, pros and cons of any given increment change based on how much you've already done on a cumulative basis. Fri: Even after energy and pandemic factors fade wage inflation will be a primary driver of prices over the next several years.

Villeroy (Neutral). Mon: Inflation in France and the EU should peak in the first half of 2023, we cannot exclude the possibility of a recession.

Centeno. Mon: Sees "many conditions" for a smaller than 75 bps hike in December. Wed: 75 bps rate hikes cannot be the norm, sees a lower increase in December, getting closer to neutral rate, expects December meeting to work out what the rate ceiling could be, we are nearing rate levels compatible with price stability, underscores important message sent by dropping the word "several" regarding future rate hikes, any rate hike in Europe has more significance than in the US with greater impact on financing conditions, inflation likely to peak this quarter.

Simkus (Hawk). Tue: Both 50 and 75 bps possible in December, premature to pick next hike without updating forecasts, rate hikes will continue past March if needed, the sooner QT starts the better, a recession alone will not solve the inflation situation.

Nagel (Hawk). Tue: Rates still relatively far from restrictive territory, 50 bps rate hike is also "strong", inflation may still be above target in 2024, gradual APP unwind should start in Q1 2023, Germany will likely experience a mild recession next year.

De Guindos (Dove). Wed: Will keep raising rates to try to bring inflation down, economic slowdown will not bring down inflation on its own, very likely we will see negative growth rates in Q4 in the Eurozone, inflation will still be high but start to slow down in the first quarter of next year. Thu: Inflation may have peaked or close to a peak. Italy needs structural reforms to boost growth, their fiscal policy has been very prudent.

Makhlouf. Thu: Everyone acknowledges that we need a rate hike next month, would not rule anything out right now.

Knot (Hawk). Thu: It remains to be seen how high rates have to go to bring down inflation.

Schnabel (Neutral). Thu: Room for slowing rate hikes remains limited because if incoming data, need to raise rates further and possibly into restrictive territory, largest risk is for policy to be falsely calibrated on the assumption of a fast decline in inflation, not yet seeing an actual wage price spiral but wages can still put upward pressure on inflation, increasing evidence that the pandemic and energy crisis have more permanent negative effects on current and future potential output.

Bank of England

Cunliffe (Dove). Mon: Unbacked crypto assets are highly volatile and have no intrinsic value, regulators shouldn't wait to put in place tighter controls.

Pill. Wed: Further rate action likely required to ensure inflation will return sustainably to 2% target, does not anticipate raising bank rate to levels priced by markets ahead of the November monetary policy report. Thu: MPC was maybe a little late in deciding to mot to sales of gilts, cannot accept interference with reserve remuneration, if governments want to tax banks they should do so transparently and not through the BOE.

Ramsden (Hawk). Thu: Expects further increases in the bank rate to be required, bias is towards further tightening but would consider the case for reducing rates if the economy develops differently, not yet confident that domestically generated inflation pressures are starting to ease, impact of higher rates could take longer to come through. Premium on UK gilts has disappeared but no doubt that the UK's reputation has taken a hit.

Mann (Hawk). Thu: Market expectations before the November meeting were too high, BOE has communicated effectively that rates need to rise, UK price and wage dynamics are inconsistent with 2% inflation target but not a wage price spiral.

Reserve Bank of Australia

Lowe. Tue: Expects to increase rates further, not on a pre-set path, could return to 50 bps or leave rates unchanged.

Reserve Bank of New Zealand

Orr. Wed: More time was spent discussing 75 vs. 100 bps than 50 bps, economic activity is strong, it will be a shallow recession, we are talking about 2-3 quarters, we are closer to the end of the tightening cycle than to the beginning, the neutral rate has increased, inflation and wage expectations must decline. Thu: We are officially contractionary on policy, never before has labour been more scarce, the biggest surprise since August ist the persistence of global inflation. We've had more discussion around 75 bps vs. 100 than we had around 75 vs. 50, we're unambiguously contractionary in our monetary policy.

Conway. Thu: Decline in construction is critical to the inflation outlook, significant slowdown in home construction is on the way, it will get tougher for the building sector.

Bank of Canada

Rogers. Tue: Higher rates are starting to slow the economy and tame inflation, we have a long way to get inflation back to target, adjustment will be painful, not expecting a severe economic downturn, risk of a trigger that may affect financial stability has increased, we need lower house prices to balance housing market. Wed: It does not appear that there is much contagion between crypto and conventional financial markets, watching carefully.

Macklem. Wed: Policy rate will need to rise further, how much further depends on how monetary policy is working to slow demand, we are getting closer to the end of the tightening phase but not there yet, have yet to see generalized decline in price pressures, Canadian economy is still in excess demand and it's overheated, effects of higher interest rates will take time to spread through the economy, expects growth to slow in the next few quarters, trying to balance the risks of over- and under-tightening. The BOC balance sheet peaked in March 2021 at CAD 575 bn, as of last week it was around 415 bn.

Bank of Japan

Kishida (PM). Tue: Weak yen has both merits and demerits, monetary policy is up to the BOJ to decide.

People's Bank of China

Wang Yiming. Wed: Only limited room to lower interest rates, expects 2023 GDP growth to be above 5% if the impact of Covid ends, slower hikes from the Fed next year will allow more policy room for China.

Economic Data

Monday, 21.11.22

Tuesday, 22.11.22

Wednesday, 23.11.22

Highlights from the German PMIs:

“November’s flash PMI survey doesn’t alter the narrative that Germany is likely heading for a recession, but it does offer some hope that the contraction in the economy will perhaps be shallower than first feared. The headline PMI surprised on the upside, coming in above consensus at 46.4 and signalling the slowest rate of decline in business activity for three months.

“Positively, data showed a reduction in the downward pressure on factory production, as manufacturers reported an improvement in material availability and an overall shortening of supplier delivery times for the first time in almost two-and-a-half years.

“Not to get too carried away, however, underlying demand continues to weaken rapidly, linked to sharp price increases and hesitancy among customers, with the downturn in service sector new business even gathering pace to the quickest since May 2020.

“The PMI survey shows that pipeline price pressures are moderating, with manufacturers reporting a sharp slowdown in the rate of input cost inflation to a near two- year low in November. That said, not only are firms’ costs still rising much faster than normal, but it will take time for the softening of pipeline pressures to feed through to slower consumer price inflation.

“Business confidence has steadied somewhat, with a mild autumn having perhaps allayed concerns about gas shortages over the winter. That said, expectations have merely improved from ultra-low levels, meaning they are still rooted deeply in negative territory as firms continue to highlight concerns about the soaring cost of living, rising interest rates and still-high uncertainty.”

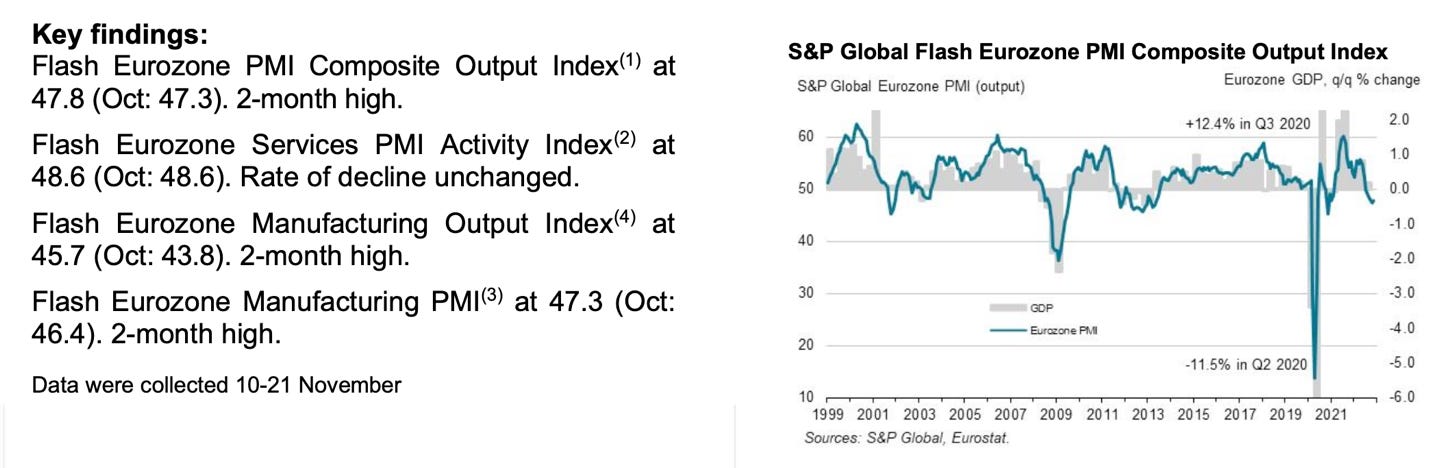

Highlights from the Eurozone PMIs:

“A further fall in business activity in November adds to the chances of the eurozone economy slipping into recession. So far, the data for the fourth quarter are consistent with GDP contracting at a quarterly rate of just over 0.2%.

“However, the November PMI data also bring some tentative good news. In particular, the overall rate of decline has eased compared to October. Most encouragingly, supply constraints are showing signs of easing, with supplier performance even improving in the region’s manufacturing heartland of Germany. Warm weather has also allayed some of the fears over energy shortages in the winter months.

“Price pressures, the recent surge of which has prompted further policy tightening from the ECB, are also now showing signs of cooling, most noticeably in the manufacturing sector. Not only should this help contain the cost of living crisis to some extent, but the brighter inflation outlook should take some pressure off the need for further aggressive policy tightening.

“However, it’s clear that manufacturing remains in a worryingly severe downturn, and service sector activity is also still under intense pressure, both largely as a result of the cost of living crisis and recent tightening of financial conditions. A recession therefore looks likely, though the latest data provide hope that the scale of the downturn may not be as severe as previously feared.”

Highlights from the UK PMIs:

“A further steep fall in business activity in November adds to growing signs that the UK is in recession, with GDP likely to fall for a second consecutive quarter in the closing months of 2022. If pandemic lockdown months are excluded, the PMI for the fourth quarter so far is signalling the steepest economic contraction since the height of the global financial crisis in the first quarter of 2009, consistent with the economy contracting at a quarterly rate of 0.4%. Forward-looking indicators, notably an increasingly steep drop in demand for goods and services, suggest the downturn will deepen as we head into the new year.

“While the recent change of government has resulted in improved business confidence, the business mood remains among the gloomiest seen over the past quarter century amid the numerous headwinds, which include the cost of living crisis, the Ukraine war, steepening export losses (often linked to Brexit), higher borrowing costs, fiscal tightening and heightened political uncertainty.

“Price pressures meanwhile remain elevated but show further signs of cooling, often linked to weakened demand, which – combined with the growing recession signals – suggest that the Bank of England may start to make less aggressive interest rate hikes in the coming months.”

Highlights from the US PMIs:

“Business conditions across the US worsened in November, according to the preliminary PMI survey findings, with output and demand falling at increased rates, consistent with the economy contracting at an annualised rate of 1%.

“Companies are reporting increasing headwinds from the rising cost of living, tightening financial conditions – notably higher borrowing costs – and weakened demand across both home and export markets.

“Skill shortages also remain a worrying constraint on expansion, but there is better news on supply chains, with supplier performance improving in November for the first time for over three years.

“While the reduced supply chain stress is partly a symptom of lower demand, the alleviation of supply delays removes a key driver of inflationary pressures and has helped moderate the overall rate of input cost inflation to a near two-year low. November even saw increasing numbers of suppliers, factories and service providers offering discounts to help boost flagging sales. Hiring has also slowed to a crawl so far in the fourth quarter as firms focus on reducing costs.

“In this environment, inflationary pressures should continue to cool in the months ahead, potentially markedly, but the economy meanwhile continues to head deeper into a likely recession.”

Thursday, 24.11.22

Friday, 25.11.22

Top 3 Macro Charts of the Week

This section is brought to you by

1. VIPs vs. most-shorted. Hedge fund's most shorted stocks are significantly outperforming hedge fund VIP stocks. Top 50 VIP names as of June 30 here.

2. Junk bonds. "There is a straight feeding frenzy for Junk Bond ETFs right now, they've taken in $14b in Oct/Nov...More evidence ETF traders are betting worst is over w/ Fed hikes".

3. Global freight. "Global shipping rates still in free-fall ... only route not participating in drop is from Rotterdam to New York".

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 37/2022

ECB

Rate Statements: 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 43/2022 | 36/2022

BOE

Rate Statements: 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 37/2022

RBA

Rate Statements: 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 47/2022 | 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 41/2022 | 34/2022 Crib Sheets: 40/2022

BOC

Rate Statements: 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022

SNB

Rate Statements: 44/2022 | 39/2022 | 25/2022 Crib Sheets: 37/2022

BOJ

Rate Statements: 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: DALL-E 2 “Bad news are all only in the rear view mirror.”

great review, thank you, appreciate!