Outlook for Week 47/2022

The usual barrage of central bank speakers and a market that seems confusing...

Just a quick note: due to family commitments the next two newsletter issues of will only contain the review sections without the analysis part. The next complete issue should be out on the weekend of December 10/11.

Welcome to issue #32 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary. The final section contains the top three macro charts for the week and is brought to you by

If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Before we get started, I’d like to give a shout-out to Caleb Franzen from

Cubic Analytics covers macro, equities and crypto, which gives you a pretty broad and holistic view of what's going on in markets. Caleb's free posts already provide a lot of value but I can wholeheartedly recommend a paid subscription! He's also on Twitter @CalebFranzen and definitely worth a follow.

Table of Contents

Summary

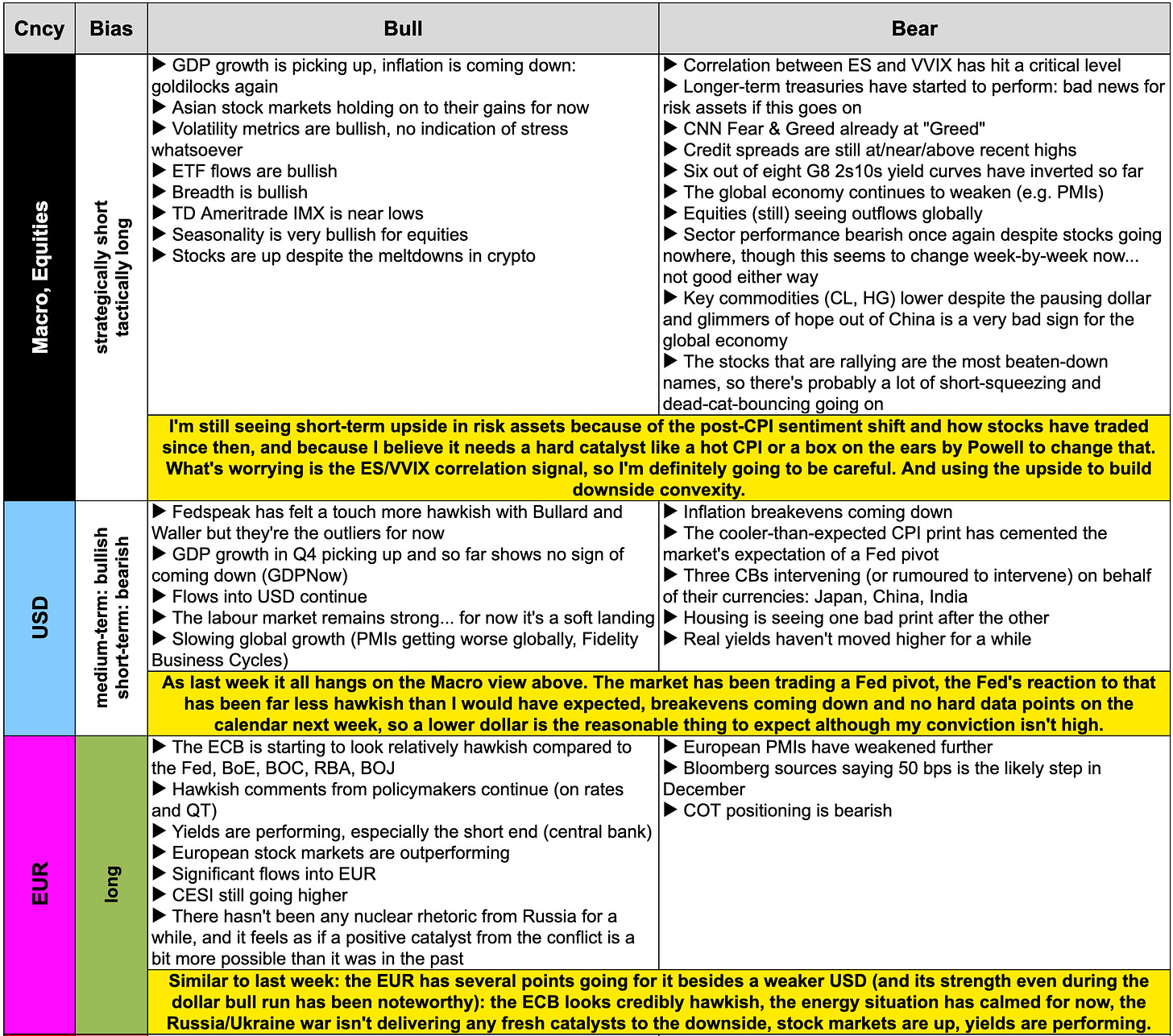

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

My overall feeling for this market hasn’t been great the last few weeks. I try to make sense of what happens but my conviction level on anything that’s short-term is pretty low and changes frequently.

Economic Calendar for next week

Important levels to watch and look out for in FX futures

Downloads and Links

Difftext of the Summary from last week: link

Central bank speaker recap for the week:

Before diving in, I’d like to shout out to !

is a great way to stay on top of what’s going on in markets. If you like fx:macro, you will love so check it out!

Week in Review

Central Banks

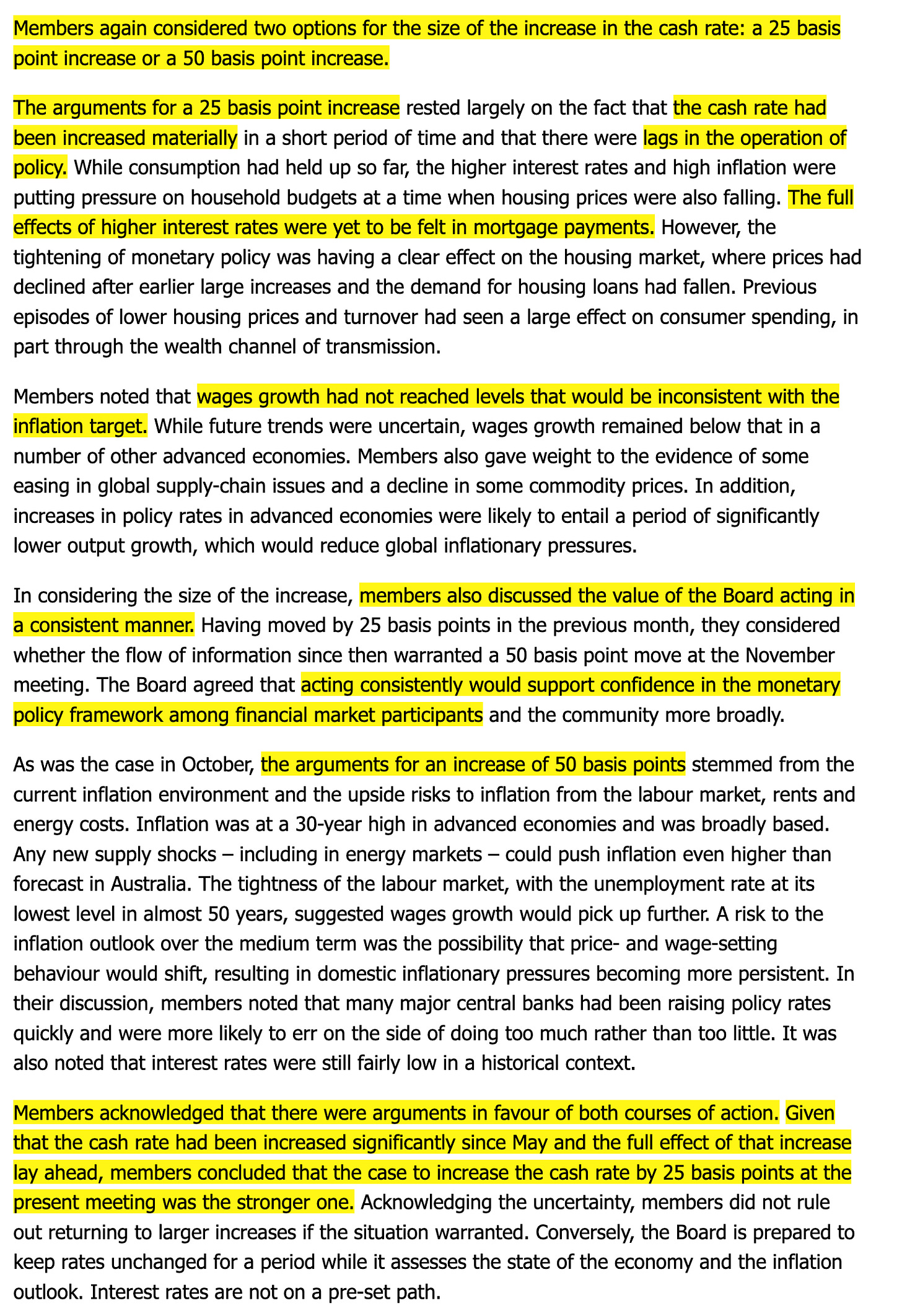

RBA Minutes (15.11.22)

There wasn't really anything new in the Minutes. Here are the highlights regarding the monetary policy decision:

Confab, Speakers, News

Federal Reserve

Waller (Hawk). Sun: November statement was designed to signal a potential step down to 50 bps, last CPI report is just one data point, markets are way out in front, will need to see a run of CPI reports before taking a foot off the break, Fed still has a long way to go, rates will stay high for a while, 7.7% CPI is "enormous", policy rate is not that high given the level of inflation, we can begin to think about moving at a slower pace. Wed: More comfortable with a 50 bps hike in December and possibly smaller after that because of recent data, watching incoming data before December meeting, we still have a ways to go on rates, need to increase into 2023, need to be aggressive to reduce inflation, higher policy rate means stronger case for slowing to 50 bps, endpoint of tightening path highly dependent on inflation data, will reach terminal rate well before inflation reaches 2%, moderation in CPI welcome but will not be headfaked by one report, will watch for moderation in shelter inflation and don't expect it for at least several more months, expects wage growth to slow.

Brainard (Dove). Mon: It will probably appropriate soon to move to a slower pace of rate hikes but it's important to emphasize we have additional work to do, very strong agreement among committee members to show resolve against inflation, peak rate will be informed by flow of data, will take time for cumulative tightening to flow through the economy, FTX failure reinforces need that crypto needs to be under regulatory perimeter. Very cognizant of potential spillovers from coordinated central bank tightening.

Barr (Neutral). Mon: Inflation is far too high, outlook has weakened amid tighter financial conditions, Fed is heightening focus on liquidity, credit, interest rate risks; monitoring crypto-related activities is another priority. Tue: Inflation is far too high, we are going to see significant softening in the economy, will see unemployment go up, will be data dependent and employment is one indicator we are looking at, we are not in a recession. Mentions the following risks in his speech: liquidity and interest rate risk, cybersecurity, commercial real estate and housing, risks in China, in crypto and the non-banking sector. Would be useful for the Fed to provide guidance to banks to safely custody crypto. Wed: Crypto finance is an urgent area for us to work on, critical to have a strong federal oversight of approval of stablecoins, paying attention to liquidity issues in treasury markets.

Cook (Neutral). Tue: Inflation is much too high, focus for the Fed is addressing inflation.

Harker (Neutral). Tue: Doesn't want to move interest rates way up and then way down, as long as we're moving consistently to collapse inflation we can pause.

Bostic (Dove). Tue: More rate hikes will be needed, once restrictive level is reached rates need to stay there until there is convincing evidence of inflation moving back to target, glimmers of hope in goods inflation but need to see services inflation slow as well. Full impact of monetary policy won't be felt for months, labour market remains tight, sees upward pressure in wages, risk of inducing a recession is preferable to high inflation becoming entrenched, a recession is not a foregone conclusion.

George (Neutral). Wed: Would make sense to slow the pace of rate hikes next year to 25 bps increments, rates might have to rise to higher levels to slow the economy, the real challenge is on the dangers of prematurely ending rate hikes, have a lot of work to do.

Williams (Neutral). Wed: Important to bolster the resilience of the Treasury market, price stability is essential for the economy to function well.

Daly (Neutral). Wed: Focusing on the terminal rate, 4.75-5.25% is reasonable, after determining the high we have to determine how long to hold, pausing is off the table right now, discussion is about the pace, we're tightening into a strong economy, we want to see the economy slow, consumers are preparing for a slower economy, unemployment rate at 4.5-5% would be reasonable.

Bullard (Hawk). Thu: Minimum level for restrictive policy would be 5-5.25%, even dovish assumptions about the state of monetary policy warrant further hikes, the Fed will want to err on the side of keeping rates higher for longer, leaving it up to Powell on how large rate hikes should be at any given meeting, can moderate based on incoming data once rates are high, October CPI encouraging but could easily go the other way next month, not seeing much cooling in the labour market.

Mester (Hawk). Thu: The gilt event is a cautionary tale about unforeseen risks around hiking rates, leverage and risk in nonbank sector remains a challenge, risk is increasingly being intermediated and held outside the banking sector, short-term funding markets continue to have vulnerabilities, low liquidity in treasury markets reflects uncertain economic outlook.

Jefferson (Neutral). Thu: Low inflation is key to achieving a long and sustained expansion.

Kashkari (Hawk). Thu: Open question how high rates need to go, there is a lot of tightening in the pipeline, cannot be persuaded by one month's data, hesitant to predict an end to rate hikes until we see evidence that underlying demand is moderating, need to stay at it until sure inflation has stopped going up, we are united in commitment to getting inflation to 2%, inflation is demand-driven and not constrained supply, economy is sending wildly mixed signals.

Collins (Neutral). Fri: Fed likely has to raise interest rates more, 75 bps still on the table, does not see clear significant evidence that inflation is coming down, there is a risk of raising rates too far, expects a modest rise in unemployment, not seeing clear and consistent evidence of softening labour markets, reasonably optimistic we can avoid a recession.

European Central Bank

Panetta. Mon: Monetary policy has to tighten to ensure inflation does not become entrenched, monetary policy should adjust and not overreact as long as inflation expectations remain anchored, being prudent does not rule out possibility of moving from withdrawing accommodation to restricting demand. Wed: Green transition need not lead to higher inflation and may even reduce it with the right policies.

De Guindos (Dove). Mon: ECB will continue to raise rates "with prudence" even if it takes an extended period of time, inflation remains far too high, wage growth may be picking up but longer-term inflation expectations remain anchored. Wed: The main risk to financial stability and growth is very high inflation, will start with passive QT, balance sheet reduction must be implemented with prudence.

Villeroy (Neutral). Tue: Will probably continue to raise rates but in a more flexible and possibly less rapid manner, we are clearly approaching "normalisation range" which can be estimated at around 2%, clear signs of a turnaround in core inflation trend would be a favourable condition to interrupt rate hikes, "jumbo" hikes will not become a new habit, need to strongly and quickly regulate crypto assets internationally.

Visco (Dove). Wed: The need for continued tightening policy is evident but the case for implementing a less aggressive approach is gaining ground.

De Cos (Dove). Wed: Still have some way to go with rate hikes, specific level is yet unknown, balance sheet reduction needs to be very gradual and predictable, inflation spike is proving highly persistent and has broadened, future decisions should account for a higher probability of a recession. Recent collapse of crypto exchange FTX should serve as a reminder of the risks of crypto assets.

Lagarde (Dove). Fri: We expect to raise rates further, withdrawing accommodation may not be enough, inflation is far too high, recession is unlikely to bring down inflation significantly, appropriate to normalize balance sheet in a measured and gradual way, interest rates will remain the main too for adjusting our policy stance.

Nagel (Hawk). Fri: Further decisive moves are necessary, we must not let up too soon, policy rate is still expansionary and needs to be moved into restrictive territory, a recession is insufficient to get inflation back to target, we should start with QT at the start of 2023.

Knot (Hawk). Fri: Long way to go until rates peak, pace of rate hikes likely to slow as policy tightens further, expects rates to reach broadly neutral in December, rates need to enter restrictive territory to dampen demand, will see first effects of our actions in the second half of next year, worried about doing too little rather than too much, earlier start to QT lowers inflation and the terminal rate, QT should be a backburner tool and be like watching paint dry.

Sources. Wed: Bloomberg: policymakers may favour a 50 bps hike in December vs. 75 bps.

Bank of England

Bailey (Neutral). Wed: Labour market still very tight, UK inflation reflects a series of supply shocks, signs that supply shocks are fading, core goods inflation appears to be coming off, QE has not made a very big contribution to UK inflation overshoot. Past couple of months have damaged the UK's reputation, concerned about potential future government intervention on financial regulation.

Mann (Hawk). Wed: More shocks have become embedded in price and wage setting.

Broadbent (Hawk). Wed: Shouldn't focus too much on length of recession as the profile is very flat, supply chain problems and the war in Ukraine were much bigger causes of inflation than sterling weakness.

Dhingra (Dove). Wed: There is now a risk of over-tightening, could get into a much deeper recession if rates continue to rise, seeing a really strong stagnation in services trade, undeniable that the UK is seeing a bigger slowdown in trade than the rest of the world.

Bank of Canada

Macklem. Mon: Once we rebalance supply and demand growth will pick up and low and predictable inflation will be restored.

Swiss National Bank

Jordan. Mon: Great probability that the SNB will need to further tighten monetary policy, ready to buy or sell to keep the exchange rate appropriate to steer inflation to target level, inflation likely to remain elevated for a while though lower than in other economies, nominal appreciation of the franc helps guard against inflation. Tue: Monetary policy is still expansionary, most likely have to adjust monetary policy again, risks that inflation will rise further.

Maechler. Thu: Will continue to raise rates if we see inflation projections above target, inflation has started with shocks but it's no longer shock-driven and has the risk of being more persistent.

Bank of Japan

Kuroda. Mon: We should continue with monetary easing to boost the economy, aiming for stable and sustainable price target achievement including wages growth, economy is improving, there is a decent chance the improving economy will drive wages higher. Sharp currency moves are undesirable. Thu: Important to continue monetary easing, recent price hikes due to cost-push factors, might take time to achieve sustainable and stable inflation, CPI will fall below 2% next fiscal year. Fri: Will maintain easy policy to support the economy and achieve 2% inflation in a stable and sustained manner, not saying we cannot raise rates indefinitely but it would be inappropriate in light of current economic conditions, inflation is accelerating quite a bit, may rise further in the coming months, core CPI likely to slow pace of increase from next year, inflation likely to slow below 2% from next fiscal year, wages need to rise about 3% for inflation to hit 2% target in a sustained fashion. Very important for FX rates to move stably reflecting fundamentals, recent sharp one-sided yen moves are absolutely undesirable.

Suzuki (FinMin). Thu: Important for the government and the BOJ to exchange opinions, specific monetary policy is up to the BOJ.

Uchida. Thu: Too early to discuss exit from monetary stimulus, financial market stability is the most important factor to consider when it comes to exit.

Nakaso. Thu: Central banks must remove emergency measures once financial crises are over.

Economic Data

Monday, 14.11.22

Tuesday, 15.11.22

Wednesday, 16.11.22

Thursday, 17.11.22

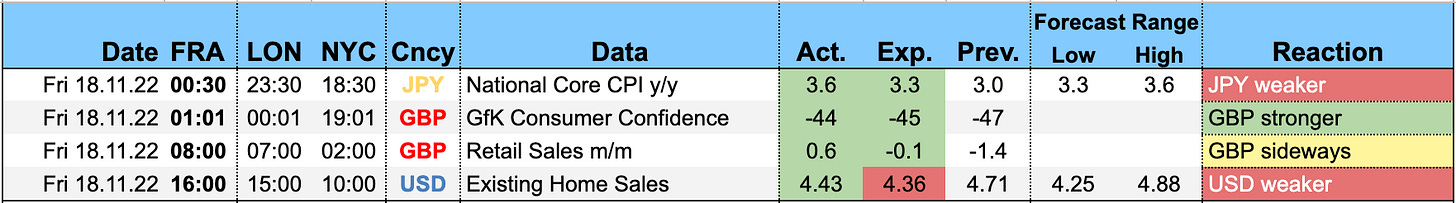

Friday, 18.11.22

Market Analysis

Growth and Inflation

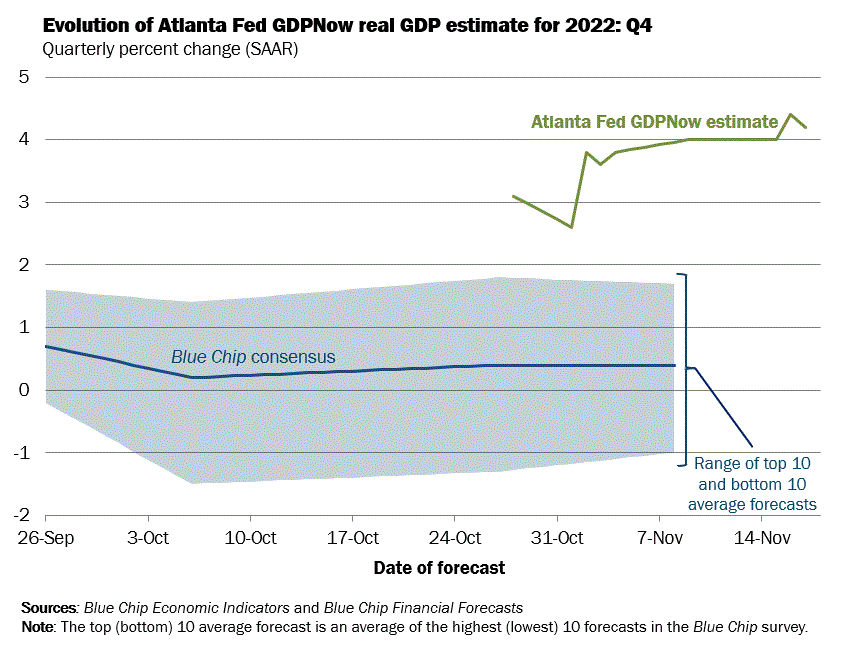

The Atlanta Fed GDPNow model estimates annualized GDP growth in Q4 at 4.2%. The difference to the Blue Chip consensus is noteworthy.

The NY Fed Weekly Economic Index ticked down to 1.72:

Citi Economic Surprise Indexes:

EUR, USD and JPY sideways

GBP and CAD higher

AUD is off its low, NZD has stalled a bit

CHF remains at its low

The Bloomberg PMI heatmap is unchanged for October:

Mostly red with hardly any bright (i.e. green) spots

Eurozone, Germany and the UK worsened

US and Canada also worse in October compared to September

Switzerland and Australia still green

China did improve a bit

South Korea stable, Taiwan also stable (but just because there's no deeper shade of red)

India is still doing pretty good

In case you’re wondering why I post data even if it hasn’t changed or updated since the last time I looked at it: it’s a high-level view and I believe it’s important to keep these things in mind.

Inflation breakevens came down this week, 5y5y forward inflation expectation swaps and RINF are also lower:

Citi Inflation Surprise Indexes also have not yet been updated and remain unchanged:

USD, AUD, CAD have all picked up a little

NZD is higher as well

CHF dropped sharply

JPY is moving higher

Yields

See charts and table below:

Swiss 2y yields are the only ones up among the G8 (Chinese 2s as well)

Bear flattening in US, UK, CA, DE and AU yields with higher 2s in charge

As written above, flatter 2s10s almost across the board:

Central Banks

FOMC meeting probabilities according to FedWatch:

The December meeting remains priced at 50 bps with a 76% probability (last week: 81%)

The following meeting in February has been priced up to another 50 bps hike with a non-negligible 11% chance of another 75 bps step

The terminal rate has been upped to 5.00-5.25% (last week: 0.25% lower)

Rate cuts are seen in Q3/23, earlier than a week before

All in all, it’s a bit of a repeat of the front-loading trade we’ve seen over the last few months

Short-term interest rates show the same thing, the Z22-Z23 spreads are higher this week and the Z23-Z24 spreads are lower:

Sectors and Flows

Currency strength charts:

USD has lost a lot of momentum, it’s the weakest currency over one month and somewhere in the middle for the week

EUR is the strongest over three months but a bit boring over the shorter timeframes

NZD is the outperformer on a weekly and monthly basis

GBP has had a good week as the second strongest currency but remains in the middle of the field over one month and three months

CAD has been on the weaker side on all three timeframes

Looking at it from a few steps away: the only consistent thing that shows up is CAD weakness.

ETF Flows show a pretty bullish picture with large net flows into the three major equity index ETFs but also into high-yield and investment-grade credit. Treasuries have also been seeing inflows.

Equity sector performance:

Semiconductors (SMH) still in the lead

Energy has dispersed a bit with OIH massively outperforming XLE and XOP

Consumer Discretionary (XLY) is barely positive over one month

Value (VTV) is still outperforming Growth (VUG)

Consumer Staples (XLP), Healthcare (XLV) and Utilities (XLU) are near the bottom

A different look at sector performance:

The week was textbook bearish with Consumer Defensive, Healthcare and Utilities all (barely) positive, and everything cyclical negative

That’s not what I want to see in a week where SPX has moved sideways, and it’s very bad when compared to last week

Over one month it’s more mixed without any clear direction

Over three months we see a bearish picture again: Energy and Basic Materials leading (top of the business cycle), Financials (why again with an inverted and flattening yield curve) and Defensives following

Also, the way we seem to flip-flop one week and flop-flip the next shows just how fragile this whole market still is.

Sector charts:

International stock markets:

As last week: European markets are leading with DAX, EuroStoxx and CAC40 at the top

Taiwanese TW50C and the KOSPI are also among the outperformers

Brazilian Bovespa is the only market with a negative performance over one month

BNY Mellon iFlow:

Equities still seeing outflows except for Japan and Asia

Financials and Tech are the only equity sectors with (small) inflows

AUD and USD both had significant outflows last week, EUR and GBP with positive flows

Sentiment and Positioning

AAII Bull-Bear sentiment has ticked up a bit and remains somewhere around a neutral zero.

Currency sentiment:

Most currencies are somewhere around 50% longs/shorts

CHF is the exception with very bearish sentiment

Different sentiment source:

Retail traders bought CL on the way down with longs increasing by about 70% (!)

USDCHF is still the currency pair with the most bullish sentiment, EURCHF isn't far behind: traders at IG hate the CHF

Commitment of Traders:

Equity indexes were sideways-to-lower for the week, performance up to eight weeks looks pretty good and the Relative Strength (RSL) is >1 for everyone except for the Nasdaq

Positioning in equities isn't anywhere extremes

Treasuries in the short end are lower and in the long end higher (bear flattener visible here as well)

Currencies were mixed vs. the dollar, positioning in DX futures and 6E is at bullish and bearish extremes, respectively. DX isn't widely traded, though.

Crude oil is 10% down for the week, positioning in energy futures is unspectacular overall

Metals also had a bad week with HG some 7% lower; all of the bullish positioning we’ve seen during the last few months has gone, and GC has seen a -2.5 SD 1-week move in Commercial net positions (and a corresponding +2.5 SD move in Large Trader positions)

Grains and softs were mostly lower, bullish positioning in Wheat and Coffee, and bearish positioning in ZL

COT/TFF dealer net positioning for FX futures: only 6C is still near a bullish extreme.

CitiFX PAIN indexes:

The dollar long has come down a bit but popped higher again over the last days

EUR and CHF are the most crowded shorts

Market Risks

Credit spreads continue to move sideways:

The Credit Spread Index remains near its high:

Currency volatility is trending lower for most currencies:

The VIX term structure is in contango with a decent premium over spot VIX:

Volatility indexes:

VIX and VVIX trending lower, VVIX even making a new low

MOVE also lower but still elevated at 129

Skew steepened a bit but demand for OTM puts was limited on the way higher in SPX: people aren’t hedging their downside with options

The short-term correlation between ES and VVIX has reached the critical level of 0.70, which is a warning sign for a correction (or move lower) in stocks in the next one to two weeks or so:

CNN Fear & Greed remains in Greed territory:

Various

The NYSE Advance/Decline line continues to track price without any relevant divergences:

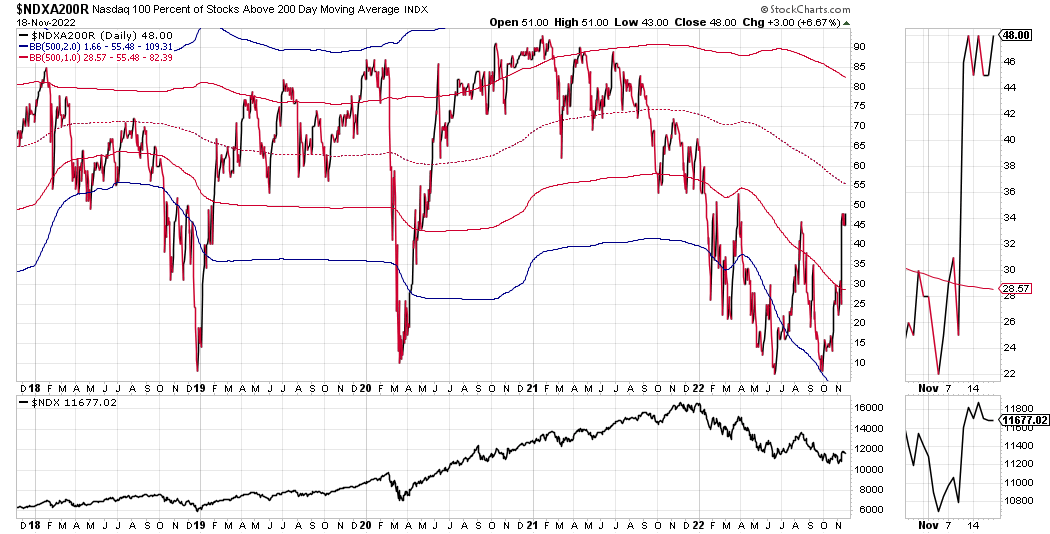

The percentage of index components above their moving averages has stalled over the last week, which is what you would expect when the stock indexes are flat:

25-delta risk reversals:

Nothing overly clear here

Maybe USDCAD lower and definitely USDCNY lower

And finally, a few useful intermarket relationships. What stands out to me is the fact that HG/GC has come down: global demand is weakening.

Top 3 Macro Charts of the Week

This section is brought to you by

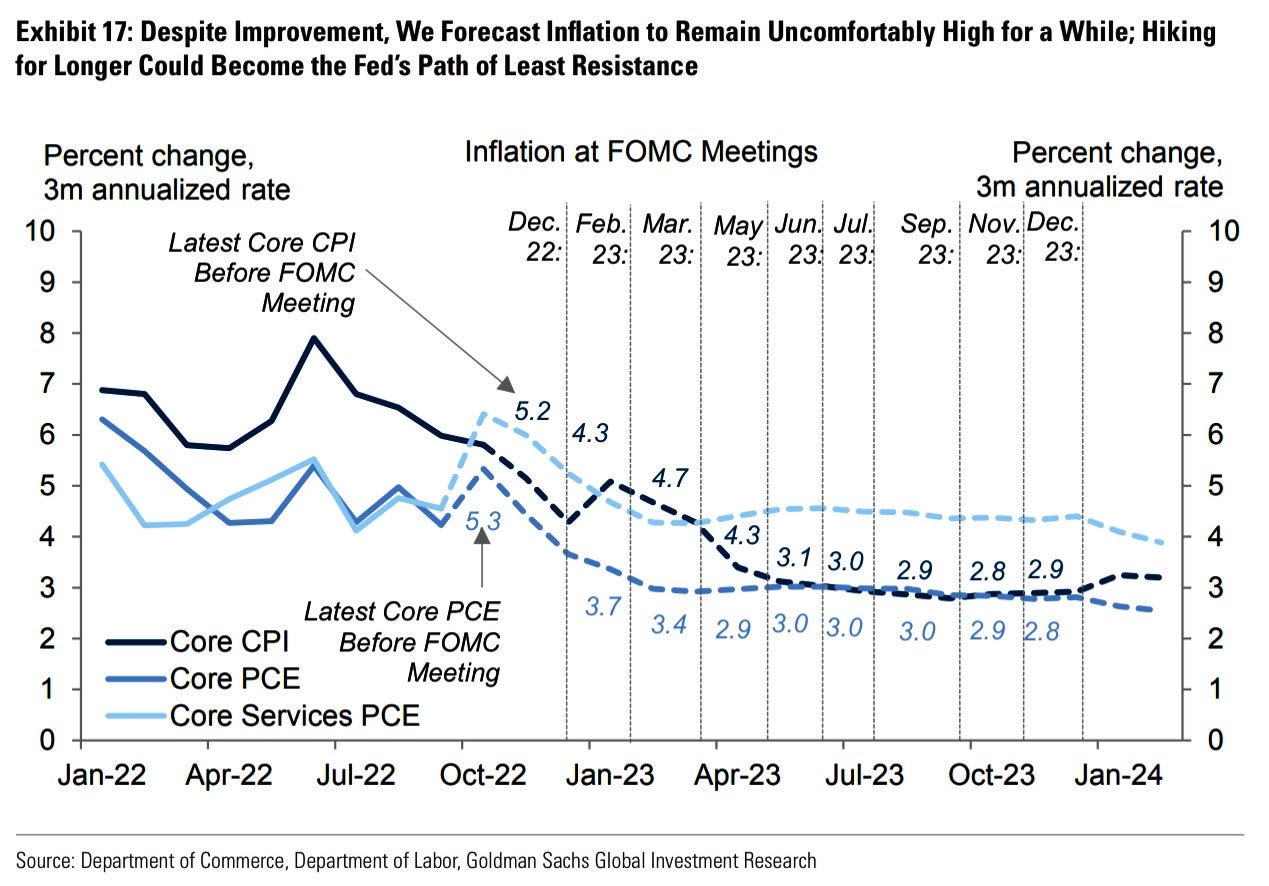

1. Inflation forecast. "We forecast inflation to remain uncomfortably high for a while; hiking for longer could become the Fed's path of least resistance".

2. Yield curve inversions. "100% of all US (Treasury) yield curves are now inverted as of Friday. The last time this happened was in 1980".

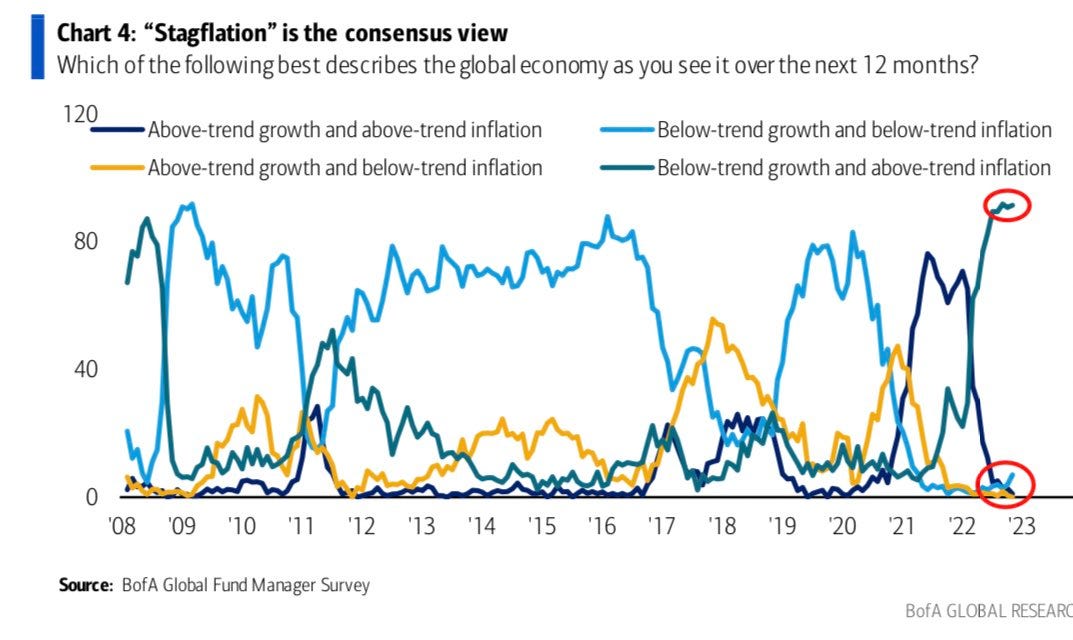

3. Slow growth, high inflation. Among global fund managers (FMS investors) "stagflation is the consensus view".

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 45/2022 | 39/2022 | 31/2022 FOMC Meeting Minutes: 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 37/2022

ECB

Rate Statements: 44/2022 | 37/2022 | 30/2022 Meeting Minutes: 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 43/2022 | 36/2022

BOE

Rate Statements: 45/2022 | 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 37/2022

RBA

Rate Statements: 45/2022 | 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 45/2022 | 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 41/2022 | 34/2022 Crib Sheets: 40/2022

BOC

Rate Statements: 44/2022 | 37/2022 Crib Sheets: 43/2022 | 36/2022

SNB

Rate Statements: 44/2022 | 39/2022 | 25/2022 Crib Sheets: 37/2022

BOJ

Rate Statements: 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 46/2022 | 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: DALL-E 2 “A confused looking trader looking at a market he doesn't understand well.”

great coverage, thank you!

Last couple points, everything inverted and stagflation, is a little too depressing to have at the end. Maybe next time some pictures of puppies or panda bears would help??