Welcome to issue #29 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary. The final section is a collection of things I read during the week that influence my thinking. If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Before we get started, I’d like to give a shout-out to Yuri from Snippet Finance!

Snippet Finance is an easy-to-read newsletter with highly curated and bite-sized content on macro, stocks and investing. Here’s an example:

I know you like long newsletters (because you are reading this one right now), but I’m sure you will like Yuri’s as well. Also, check out his website where he posts daily for more great content and his Twitter @SnippetFinance!

Table of Contents

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Relevant market risks I have on my radar (it's obviously not a comprehensive list and mostly unchanged from last week). If you have any suggestions, please don’t hesitate to leave a comment:

Europe:

More and more headlines and articles about energy nationalism… could spill over into monetary policy if push comes to shove

An unexpected resolution of the Ukraine war seems very unlikely, but it could escalate very quickly

especially given the mobilization and referendums

UK: the fallout from the close shave in the gilt market and UK pension funds isn’t clear yet

Global markets:

The UK pension funds are a canary in the coal mine that signals that cracks can appear anywhere out of seemingly nowhere

The risk from commodity market squeezes spilling over seems to have diminished a bit; it's become a major factor in energy and electricity markets

China/Taiwan: keeping an eye on the Taiwanese stock market as a risk gauge

Economic Calendar for next week

If you're based in Europe: there's the daylight savings time shift.

Important levels to watch and look out for in the Majors

Downloads and Links

Difftext of the Summary from last week: link

FOMC Crib Sheet with summarized comments from every FOMC member since their September meeting:

Same for the Bank of England:

Central bank speaker recap for the week:

Before we get to the main part of the newsletter, I’d like to shout out to The Morning Hark!

For me, it’s a must-read every day. Here’s what’s in it:

Overnight action in key asset classes including commodities, fixed income and crypto,

Current macro themes with a review of the previous day’s economic data releases, central bank speakers and more,

Main highlights ahead with a comprehensive list of upcoming data and events,

The top 5 trending posts on app.harkster.com, and

A section with links to more in-depth pieces or useful information on current macro themes.

The Morning Hark is a great way to stay on top of what’s going on in markets. If you like fx:macro, you will love The Morning Hark, so check it out!

Week in Review

Central Banks

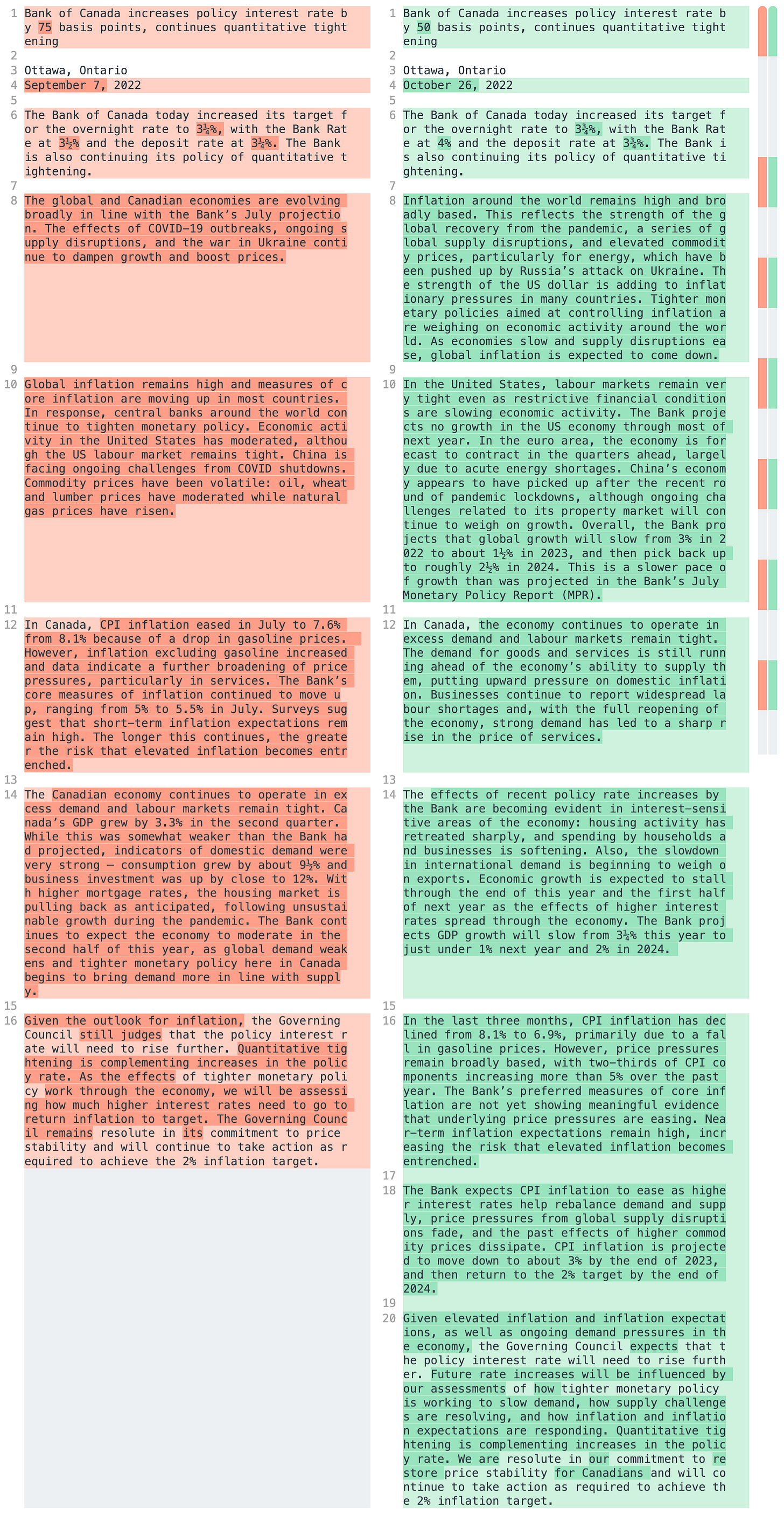

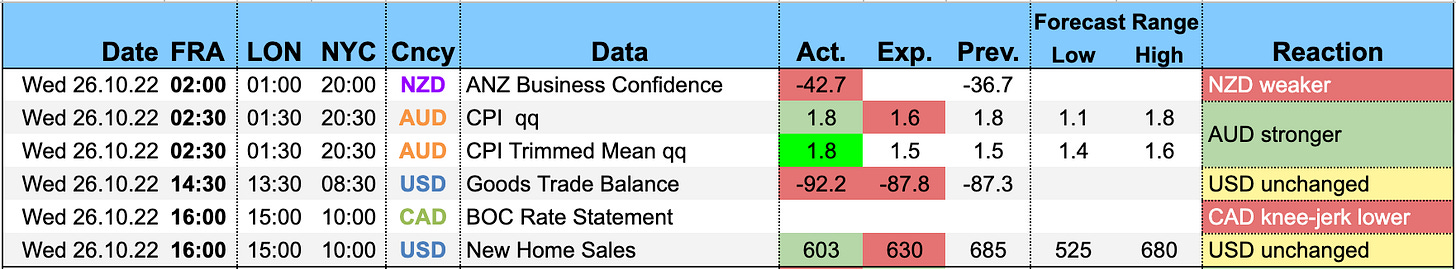

Bank of Canada Rate Decision (26.10.)

The BOC surprised to the downside with a 50 bps hike to 3.25%:

Guidance: policy rates will need to rise further, QT is complementing rate hikes, and future rate increases will depend on the evolution of demand, supply challenges, and how inflation and inflation expectations are behaving

The Canadian economy continues to operate in excess demand, the labour market remains tight, businesses report widespread labour shortages

Housing activity has retreated sharply, spending by households and businesses is slowing

Growth is expected to stall through the first half of next year, GDP growth is expected to slow from 3.25% this year to 1% in 2023 and 2% in 2024

Inflation remains broad-based, core inflation is not yet showing meaningful evidence that underlying price pressures are easing

Increasing risk of inflation expectations becoming entrenched

CPI expected to move down to 3% in 2023 and 2% in 2024

If you want to take a look at the Monetary Policy Report, you can check out my Twitter thread with the most important charts:

ECB Rate Decision (27.10.22)

The ECB hiked by 75 bps as expected:

Forward guidance remained largely unchanged: expects to raise rates further (but dropped “over next several meetings”), meeting-by-meeting approach based on outlook on inflation and the economy

The GC has made “substantial progress” in withdrawing monetary policy accommodation with today’s hike

No change to APP or PEPP; PEPP re-investments will continue to be flexible

Adjusted TLTRO III to offer additional early repayment dates for banks, applicable interest rates will be indexed to the average ECB key interest rates, remuneration of minimum reserves will be set at the ECB deposit facility rate

Bank of Japan Rate Decision (28.10.22)

As expected, the BOJ left basically everything unchanged. Their economic outlook did up the forecasts for CPI:

2.9% for 2022 vs. 2.3% projected in July

1.6% for 2023 (prev. 1.4%)

1.6% for 2024 (prev. 1.3%)

One key sentence from the Outlook: “[After 2023, CPI] is projected to accelerate again moderately on the back of improvement in the output gap and rises in medium- to long-term inflation expectations and in wage growth.”

From the bank’s Outlook for Economic Activity and Prices:

Confab, Speakers, News

Federal Reserve

European Central Bank

Lagarde (Dove). Thu: We expect to raise rates further, have made substantial progress with this third major hike in a row, we're data-dependent, ready to adjust all instruments. Did not discuss substantial APP issues today, still have ground to cover on normalization, may need to go beyond normalization, might well be "several meetings" but will be determined meeting by meeting. Inflation remains far too high, expects further economic slowdown for the remainder of the year, labour market performed well so far, somewhat higher unemployment possible, risks to economic outlook on the downside and to inflation on the upside, weakening of demand would lower price pressures.

Villeroy (Neutral). Fri: No obligation to raise by 75 bps at the December meeting, next increases will be flexible, must be quick on normalization of rates but careful on QT, QT must be started carefully and accelerated gradually.

Simkus (Hawk). Fri: Expects ECB's inflation projections to be raised in December, discussion on QT in December should be about start date and amounts.

Kazimir. Fri: Rates will go up in December and first months of next year, need to get rates into restrictive territory "like a runaway train", risk is that inflation will remain higher for longer, risks of a recession are growing, fiscal policy starting to add to inflationary pressures.

Sources. Thu: Three officials wanted to go for 50 bps instead of 75. The ECB's mention of "progress" was not meant to imply a slower pace of hikes. All sources were surprised by the market reaction (bonds and bank shares rallying).

Bank of England

Ramsden (Hawk). Mon: Will take necessary steps to get inflation back to target, today's PMI consistent with the UK being in recession, was reluctant to do bond purchases. Gilt market shows credibility is being recovered, temporary expanded collateral repo facility hasn't been called on yet, having clarity on fiscal plans by October 31 will be really important, we have built up a reasonable degree of credibility on inflation and it's obvious we're being challenged now.

Woods. Thu: De-regulating the City would be self-defeating, financial stability is the single most important ingredient of competitiveness in financial services.

Reserve Bank of Australia

Kent. Mon: Expects to increase interest rates further in the period ahead, size and timing dependent on data.

Reserve Bank of New Zealand

Conway. Tue: Early indications that the economy is cooling, hopeful that inflation has peaked, fall in house prices expected to slow consumption, China is no longer the deflationary force it once was.

Orr. Thu: Inflation is still absolutely too high, firmly committed to meeting inflation target.

Bank of Japan

Kanda (FX diplomat). Mon: No change in stance that we are ready to take necessary action 24/7, will continue to take action against excessive and disorderly markets, no comment on whether we intervened in FX markets, no comment on intervention on Monday morning. Wed: Will continue to take bold steps against excessive FX moves, in close touch with G7 and other countries every day, Yellen respects Japan's stance of not unveiling FX interventions.

Suzuki (FinMin). Mon: Monitoring the forex market with a sense of urgency, we are attempting to confront speculators. Tue: Ready to take appropriate steps on FX markets if necessary, no comment on daily FX moves, watching with a high sense of urgency, in constant touch with US authorities, aware of Yellen's comment that she did not know about Japan's intervention, no comment on whether we intervened in FX market, monetary policy is up to the BOJ to decide. Fri: Must be mindful of adhering to fiscal discipline, learned lesson from British experience that governments could come under attack from markets if trust in fiscal management is lost, continues to expect the BOJ to conduct appropriate monetary policy.

Matsuno (Chief Cabinet Secretary). Mon: No comment on FX intervention, closely watching FX moves with a high sense of urgency, will take appropriate action.

Kuroda. Tue: Recent sharp and one-sided moves in the yen are undesirable for the economy. Fri: Japan's economy is improving, will not hesitate to ease further if needed, necessary to achieve 2% inflation target in tandem with wage growth, wages are rising gradually and are expected to rise further next year. JPY weakening has been one-sided, rapid yen moves are negative for Japan's economy, not commenting on FX interventions, government has taken appropriate steps on FX volatility.

Kishida (PM). Fri: Ready to take appropriate action on excessive FX volatility, watching FX moves closely, coordinating with the BOJ, speculative and sharp FX volatility is not desirable.

Economic Data

Monday, 24.10.22

Aussie PMIs (link to full release):

“Australia’s private sector saw renewed contraction in October with the service sector primarily showing signs of stress. A fall in demand for services was underpinned by higher interest rates and prices, altogether reflective of the detriments of aggressive monetary policy tightening and capacity constraints upon business activity.

“Although input price inflation declined in October, output price inflation climbed in the private sector according to the PMI data suggesting that price pressures have yet to ease steadily. A tight labour market also indicates that wage inflation may persist.

“Overall business confidence meanwhile continued to trend lower in October to the weakest since the height of the COVID-19 pandemic in April 2020, which is not a positive sign for the Australian economy.”

German PMIs (link to full release):

“The flash PMI data show the downturn in German business activity gathering pace at the start of the fourth quarter, adding to the growing signs of an impending recession in the eurozone’s largest economy.

“We’re seeing weakness across the board in the survey data, with both the manufacturing and service sectors reporting accelerating rates of contraction, led by rapidly declining inflows of new work. Businesses are reporting a growing reluctance amongst clients due to increased strain on budgets and an uncertain economic outlook, with high energy costs compounding the situation by fuelling inflationary pressures and directly impacting factory production in some cases.

“Notwithstanding the downturn in activity and deeply negative business expectations, employment levels are yet to fall, pointing to resilience in the German labour market. Firms are showing a willingness to retain staff, and even continue to fill vacancies in some cases, despite facing sharply rising costs – including wage pressures – and the growing prospect of a recession.”

Eurozone PMIs (link to full release)

“The eurozone economy looks set to contract in the fourth quarter given the steepening loss of output and deteriorating demand picture seen in October, adding to speculation that a recession is looking increasingly inevitable.

“While October’s headline flash PMI is consistent with GDP falling at a modest rate of around 0.2%, demand is falling sharply and companies are increasingly growing worried over high inventories and weaker than expected sales, especially as winter approaches. The risks are therefore tilted towards the downturn accelerating towards the year-end.

“While the rising cost of living remains the predominant cause of the economic slowdown, the region’s energy crisis remains a major concern and a drag on activity, especially in energy intensive sectors.

“Price pressures meanwhile remain stubbornly elevated, as rising energy and staff costs, and the weakened euro, offset any lowering of commodity prices linked to improving supply conditions. As such, the elevated survey price gauges will likely add the ECB’s resolve to tighten policy further in the coming months despite the growing recession risk. But there will likely also be some growing discomfort among some policymakers regarding the economic impact of tightening policy too aggressively in the face of other economic headwinds.”

UK PMIs (link to full release):

“October's flash PMI data showed the pace of economic decline gathering momentum after the recent political and financial market upheavals. The heightened political and economic uncertainty has caused business activity to fall at a rate not seen since the global financial crisis in 2009 if pandemic lockdown months are excluded. GDP therefore looks certain to fall in the fourth quarter after a likely third quarter contraction, meaning the UK is in recession.

“Business confidence has meanwhile collapsed, sliding to a level rarely seen before in 25 years of survey history, meaning companies are becoming increasingly nervous about the outlook. As night follows day, investment and employment will suffer in the months ahead as companies adjust to the increasingly challenging environment. Hiring is already slowing sharply, with manufacturing now even shedding workers.

“While the economic downturn has led to reduced upward pressure on prices, the weak pound and high energy costs meant that input cost inflation remains higher than at any time in the survey’s history prior to the pandemic.

“The resulting elevated, albeit easing, price pressures look set to drive the Bank of England into further aggressive interest rate hikes. On top of the collapse in political stability, financial market stress and slump in confidence, these higher borrowing costs will add to speculation of a worryingly deep UK recession.”

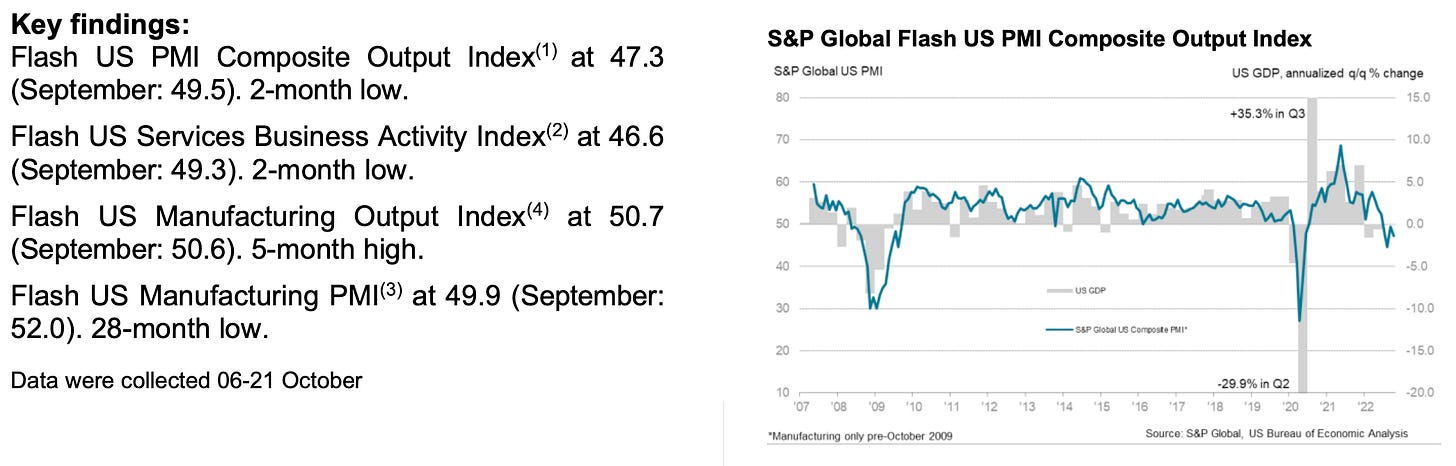

US PMIs (link to full release):

“The US economic downturn gathered significant momentum in October, while confidence in the outlook also deteriorated sharply. The decline was led by a downward lurch in services activity, fuelled by the rising cost of living and tightening financial conditions. While output in manufacturing remains more resilient for now, October saw a steep drop in demand for goods, meaning current output is only being maintained by firms eating into backlogs of previously placed orders. Clearly this is unsustainable absent of a revival in demand, and it’s no surprise to see firms cutting back sharply on their input buying to prepare for lower output in coming months.

“One upside of this drop in input buying has been a further alleviation of supply constraints, which alongside the stronger dollar have helped cool price pressures in the manufacturing sector.

“Although price pressures picked up slightly in the service sector due to high food, energy and staff costs, as well as rising borrowing costs, increased competitive forces meant average prices charged for services grew at only a fractionally faster rate. Combined with the easing of price pressures in the goods-producing sector, this adds to evidence that consumer price inflation should cool in coming months.

“The surveys therefore present a picture of the economy at increased risk of contracting in the fourth quarter at the same time that inflationary pressures remain stubbornly high. However, there are clearly signs that weakening demand is helping to moderate the overall rate of inflation, which should continue to fall in the coming months, especially if interest rates continue to rise.”

Tuesday, 25.10.22

Wednesday, 26.10.22

Thursday, 27.10.22

Friday, 28.10.22

Market Analysis

Growth and Inflation

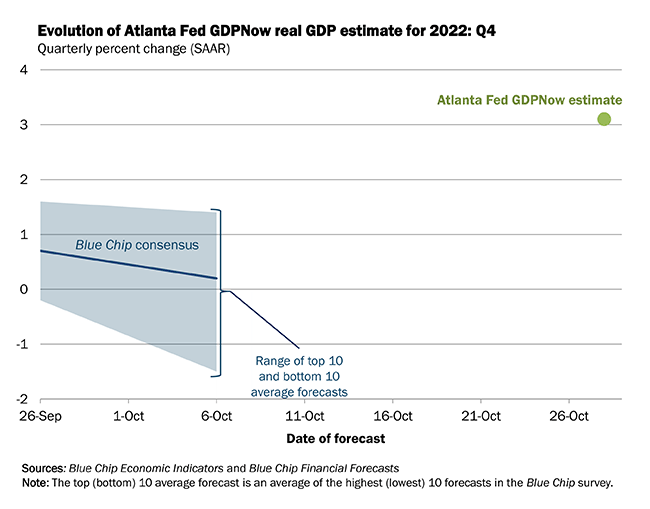

The Atlanta Fed GDPNow model estimates Q4 GDP growth at 3.1%.

The NY Fed Weekly Economic Index stands at 2.17:

Citi Economic Surprise Indexes:

US and EU still trending higher

UK moving sideways, looks like it is rolling over

CA and AU have picked up a bit from their low, NZ ticking higher

CH remains at its low, JP trends sideways

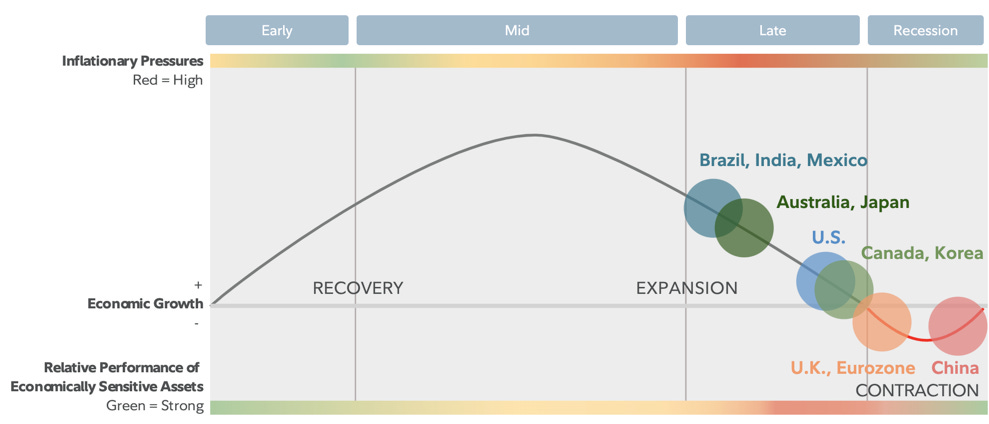

Global Business Cycles: everything is either in the (very) late stages of the cycle or in a recession.

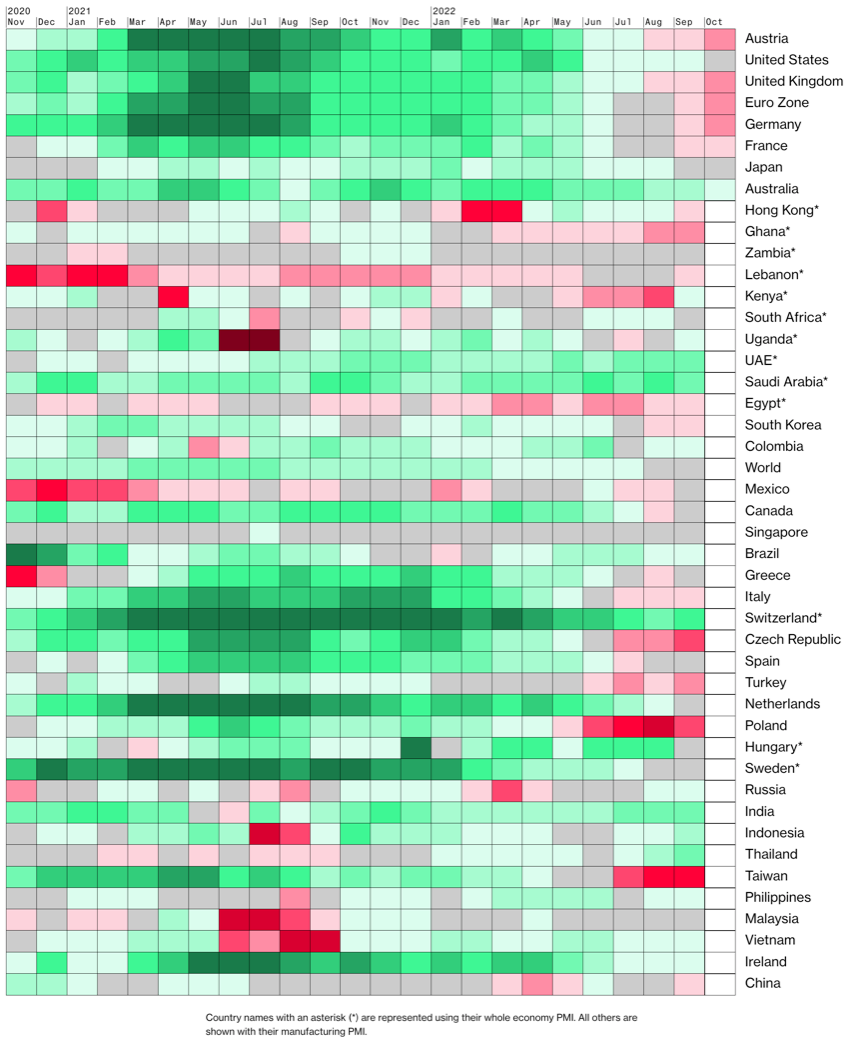

Bloomberg PMI heatmap: the prints that are in for October are almost all worse than previously.

Breakeven Inflation Rates are up from their recent low but have taken a bit of a pause:

Same for the 5y5y inflation expectations:

RINF has even broken out of its range:

Citi Inflation Surprise Indexes haven't updated yet for the month:

US, EU, AU, and CA all lower

UK had a pretty significant drop

NZ creeping higher

CH still hat its high

Overall, the global inflation surprise is behind us

Yields

See charts and table below:

Yields have been falling across the board

US remains the outperformer

UK 10y yields have dropped over 100 bps from their high this month as a sign of relief

Yield curves at the 2s10s spread:

Inverted for the US, CA and NZ

Central Banks

FedWatch before the FOMC decision on Thursday:

Another 75 bps hike is 82% priced in vs. 95% last week

The following two meetings are both priced at 50 bps each

The terminal rate is still seen around 4.75-5.00% with May 2023 being a bit of an outlier

Overall not much evidence of a Fed pivot

Sectors and Flows

Currency strength charts:

USD is still the strongest currency over three months but underperforming over 1 month and 5 days

GBP is the strongest currency over a medium and short timeframe

EUR comes in second place on all three timeframes

The worst performers are JPY, AUD and CHF; NZD comes in third place over 1 month

ETF flows are pretty interesting with significant creations of ETFs for equities, MBS, and high-yield credit:

Equity sector performance:

Energy (OIH, XLE, XOP) has been the clear outperformer once again

Industrials (XLI), Financials (XLF) and Healthcare (XLV)

Consumer Discretionary (XLY), Utilities (XLU) and Semiconductors (SMH) come in last

Value (VTV) still outperforming Growth (VUG)

Different look at sectors:

Real Estate 6.4% higher this week on the drop in yields

The S&P is up for the week but Utilities, Consumer Defensives and Healthcare are among the strong sectors while Tech/Communication and Consumer Cyclicals were rather weak

Over 1 month, it looks mixed as well

Sector performance charts:

It's not looking pretty, the only things up are Industrials, Energy, Healthcare, and (to some degree Staples)

Everything else is near lows

International stock markets:

Hong Kong deteriorating further, Taiwan isn't catching much of a break either

European indexes at/near the top

Brazil not outperforming anymore

BNY Mellon iFlow:

Equity flows broadly negative, one exception: South America (i.e. Brazil)

Flows out of AUD, GBP, and into USD

Interesting: heavy flows out of SGD

Sentiment and Positioning

Sentiment has picked up with the AAII Bull-Bear Spread off lows:

FinTwit sentiment has picked up a bit but remains pretty depressed:

Currency sentiment:

Nothing too interesting here, pretty much everything is in its 40-60% neutral range

Notable exception: bullish sentiment on NZD

Different sentiment source:

Still bullish sentiment on JPY in yen pairs

AUDNZD and NZDUSD also with pretty bullish sentiment

Commitment of Traders:

Equities

Decent performance in all four indexes, Relative Strength is back around 1

Commercial/Large Trader positioning isn't anywhere near extremes… nothing bullish but not a crowded trade, either

Treasuries: a pretty good 1-2 weeks depending on what you're looking at

Currencies

Most currencies have outperformed vs. the dollar this week

Relative Strength is still well below 1 for everything but the dollar

Commercial/Large Trader positioning is at a bearish extreme for 6E

Energy

Everything is up for the week but Relative Strength for Crude and Natural Gas is still well below 1

Heating Oil has been the clear outperformer with a +19% move this week and RLS of 1.26, i.e. it's trading 26% above its 26-week moving average

Commercial net positioning is at/near extremes in Crude and Natural Gas

Metals

Mixed week, the only future with a RSL above 1 is Platinum

Copper is especially weak, RSL 0.92 (i.e. 8% below its moving average)

Silver had a very bullish COT positioning with Commercials being net positive; it has seen some upside but remains lacklustre

Grains and Softs

Mixed performance

Extreme positioning in Wheat, Cotton, Coca and Coffee (all long)

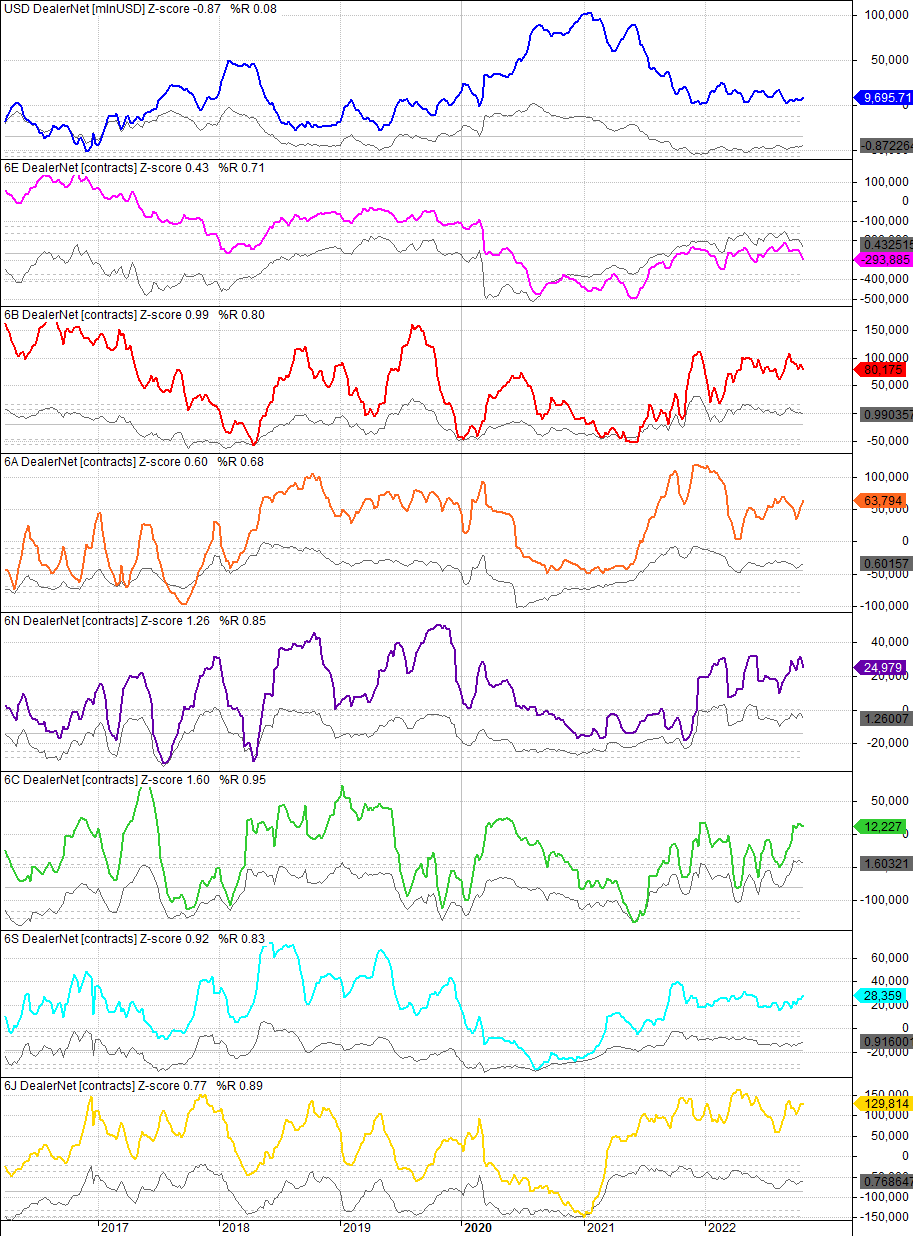

COT/TFF Dealer net positioning in FX futures:

6C is near its 104-week high

CitiFX PAIN indexes:

The long dollar trade is still pretty crowded but has backed off its high

Interestingly, shorts are being reduced for everything but the EUR and CHF

Market Risks

Credit spreads have yet to tighten:

The NY Fed Corporate Bond Market Distress Index:

Corporate bond market functioning appears healthy, with the overall market-level CMDI below its historical 65th percentile.

Market functioning continues to be somewhat more strained in the investment-grade segment of the market.

Currency volatilities: everything is elevated, JPY and CNY continue to trend higher, GBP is off highs.

The VIX term structure is back in contango, at least in the front months:

Volatility indexes:

VVIX has been tanking and is dragging VIX lower once again

VIX/VIX3M remains relatively elevated so far

TDEX also made a new low, skew is flattening with SDEX and VIX/VOLI making new lows

Volatility (and especially vol of vol) has calmed down considerably over the last two weeks

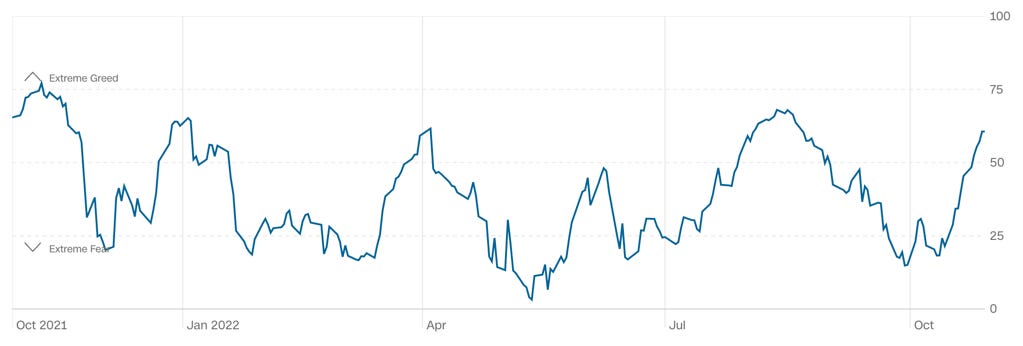

CNN Fear & Greed Index: back in Greed territory after a short bounce. If this continues we'll be at Extreme Greed pretty soon:

Various

Market breadth: The NYSE Advance/Decline Line is tracking price without any divergence at this point.

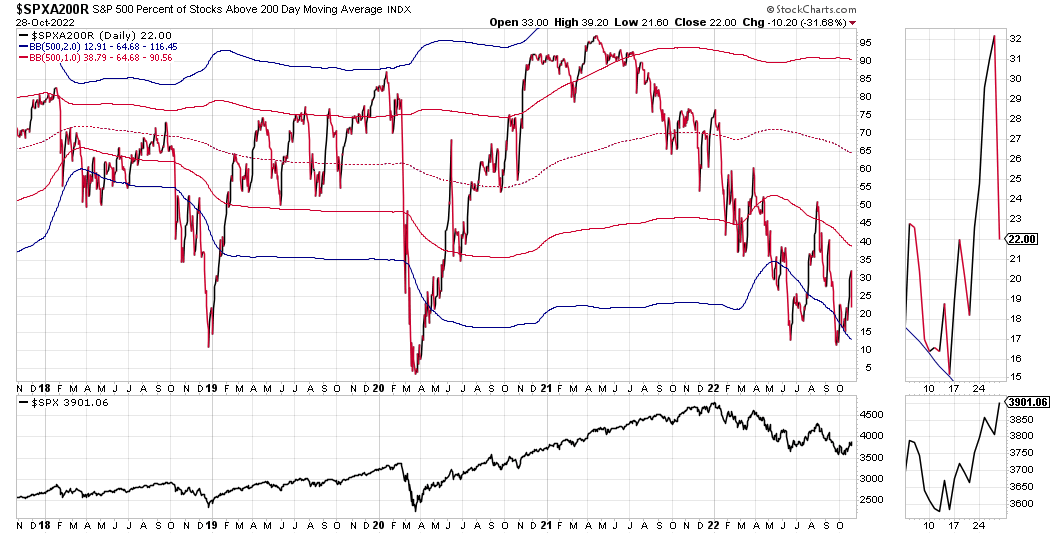

S&P 500 and Nasdaq 100 stocks above their 200-day moving averages: This is pretty disappointing with both metrics not getting off their lows. Both remain between -1 and -2 SD and both tanked despite the bullish price action on Friday:

The same is true for the shorter-term metric of stocks above their 50-day moving average: it's looking a bit better for the S&P, though both haven't even made it to their long-term average.

25-delta risk reversals:

Calls are being priced richer on AUDUSD and NZDUSD

With the Chinese FX intervention going on, it's a bit surprising to see that the risk reversal in USDCNY is barely reacting (i.e. the puts remain cheap)

Finally, seasonality for November:

Historically, the best month for Bitcoin (but: it's average returns, so distorted by large outliers… of which Bitcoin has many)

Positive for NZD

Negative for CAD, JPY, CHF

Other Stuff I've been looking at

I've decided to retire this section for the time being: I'm pretty constrained time-wise, and while I'm often seeing interesting (and important) charts on Twitter or Harkster, I don't find the time to archive them and put them in here, unfortunately.

I recommend you check out Daily Chartbook here on Substack instead:

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 39/2022 | 31/2022 FOMC Meeting Minutes: 42/2022 | 34/2022 | 28/2022 | 25/2022 Crib Sheets: 37/2022

ECB

Rate Statements: 37/2022 | 30/2022 Meeting Minutes: 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 43/2022 | 36/2022

BOE

Rate Statements: 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 37/2022

RBA

Rate Statements: 41/2022 |37/2022 | 32/2022 | 28/2022 Meeting Minutes: 43/2022 | 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 32/2022 Crib Sheets: 40/2022 Financial Stability Reports: 41/2022

RBNZ

Rate Statements: 41/2022 | 34/2022 Crib Sheets: 40/2022

BOC

Rate Statements: 37/2022 Crib Sheets: 43/2022 | 36/2022

SNB

Rate Statements: 39/2022 | 25/2022 Crib Sheets: 37/2022

BOJ

Rate Statements: 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 41/2022 | 31/2022 Crib Sheets: 43/2022

Photo Credit: DALL-E 2 “A pivot”

Pity for "Other Stuff I've been looking at", but thanks so much for the time and effort you put into your updates.

great comprehensive take, thank you, appreciate!