As announced last weekend, this issue will only include the review part and skip the outlook as I will be on a short break this weekend. The next issue will be out in a week.

I’m using the opportunity of a shorter edition of fx:macro to ask you a small favour: I’ve designed a short reader survey that will help me understand my audience a bit better. It’s only around ten questions and should take you no more than five minutes to complete. Thanks for taking the time to participate!

Welcome to issue #23 of fx:macro!

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

One more thing. You seem to like newsletters, so here's a great way to discover new stuff to read for free: The Sample. They will regularly send you an issue of a different semi-random newsletter you might be interested in. If you sign up using my referral link, I get bonus points and my newsletter will be forwarded to others to check out.

Now let's get started…

Table of Contents

Summary (Playbook, Calendar, Levels)Market AnalysisGrowth and InflationYieldsCentral BanksSectors and FlowsSentiment and PositioningMarket RisksVarious

Week in Review

Central Banks

There are four central bank events next week. The following three PDFs contain the relevant talking points of every central bank speaker from the Fed, BOE and SNB since their last meetings.

BOJ and Japanese officials are still out pretty much every day, so I’m going to post the full summary next week on Twitter. Follow me there @fxmacroguy if you don’t want to miss it!

Confab, Speakers, News

European Central Bank

Nagel (Hawk). Weekend: Thursday's rate hike was a clear sign, further clear steps must follow if the inflation picture stays the same. Inflation is likely to be at a far-too-high level of over 6%, may peak at over 10% in December, likely to weaken somewhat during 2023.

Elderson. Weekend: More hikes to follow, stable prices are much more important for medium- and long-term growth, looks like the decline in economic output will not be severe.

Schnabel (Neutral). Mon: More hikes needed to return inflation to target.

De Guindos (Dove). Mon: September 75 bps hike was aimed at inflation expectations, some on the committee are open to another 75 bps in October. Thu: Very high inflation is dampening spending and production, period of heightened uncertainty is "here to stay", price pressures have continued to broaden, inflation is projected to stay unacceptably high this year and next, weaker Euro also adds to inflationary pressures, growth is to slow substantially. Fri: Eurozone slowdown not enough to control inflation, we have to keep raising rates and act to keep inflation expectations anchored and avoid second-round effects. We do not have an estimate of the neutral rate.

Scicluna (from Malta, in case you wondered…). Mon: Rates need to rise but another 75 bps hike is unlikely.

Lane (Dove). Wed: Expect this transition to require further rate hikes, energy shock remains a dominant force and monetary policy should take that into account, inflation drivers in the Eurozone are different compared to demand-driven overheating dynamics.

Villeroy (Neutral). Wed: Estimates neutral at below or close to 2%, could be there by year-end, too early to say what the final interest rate will be, tightening would only begin above neutral if needed, have to act in a determined and orderly way. Fri: We are attentive to the exchange rate. The Livret A savings rate (popular bank savings product in France) will probably go up again in February.

Holzmann (Hawk). Wed: ECB has shown it's prepared to go beyond expectations, rates will be higher in a year, rate moves are data dependent, forward guidance limited the bank's actions, possibility of stagflation in the Eurozone.

Herodotou. Wed: Recent interest rate increase does not mean there's a foregone conclusion on the final level of rates.

Makhlouf. Thu: High energy prices point to slower Irish economic growth and higher inflation through 2023 than previously expected.

Centeno (Dove). Thu: ECB should take "small steps" in raising rates, monetary policy must remain predictable, clear tightening or even too abrupt normalization could destabilize transmission mechanism and the real economy. Sees no signs of inflation expectations de-anchoring.

Lagarde (Dove). Fri: Our actions may weigh on growth but it is a risk we have to take because price stability is our priority.

Sources. Weekend: From Reuters, five sources close to the matter. Many policymakers see growing probability they will need to take rates to restrictive territory (2% and above), most likely to happen if ECB's inflation projection for 2025 (due in December) remains above 2%.

Bank of Japan

Kihara (Deputy Chief Cabinet Secretary). Weekend: Will closely watch developments and take steps as needed regarding excessive one-sided currency moves.

Kanda (MoF official). Wed: Will respond appropriately to FX moves without ruling out any options.

Matsuno (Chief Cabinet Secretary). Wed: Ready to take necessary steps if recent currency moves continue without ruling out any options.

Suzuki (FinMin). Wed: Will not rule out any options (regarding FX intervention), if we were to intervene we would do so swiftly and without pause, usually will not confirm an intervention even after doing so, no comment on the BOJ rate check.

Katayama (Ruling Party Official). Thu: Japan lacks effective means to combat yen's sharp decline, conducting solo FX interventions likely won't be that effective in stemming sharp yen falls.

Economic Data

Monday, 12.09.22

Tuesday, 13.09.22

Wednesday, 14.09.22

Thursday, 15.09.22

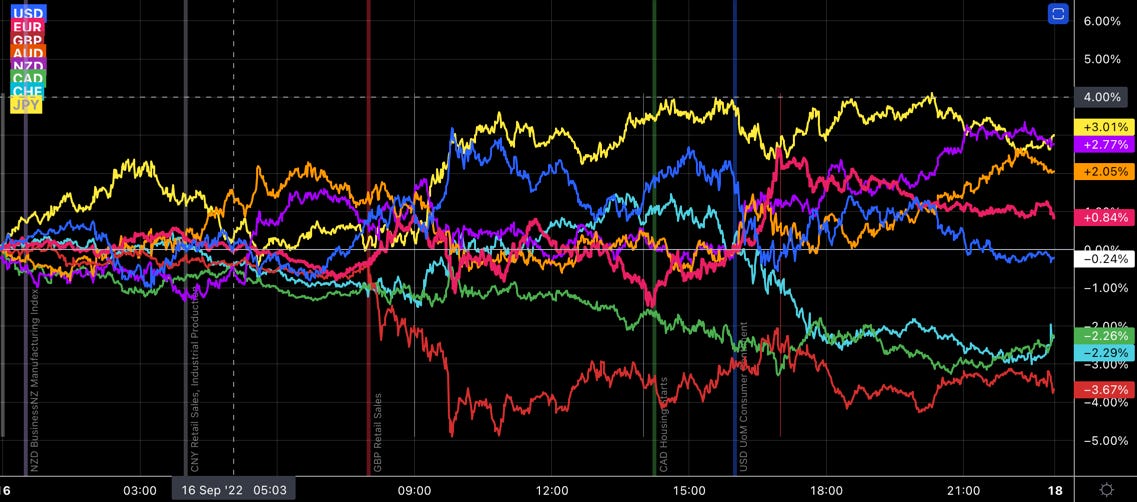

Friday, 16.09.22

Other Stuff I've been looking at

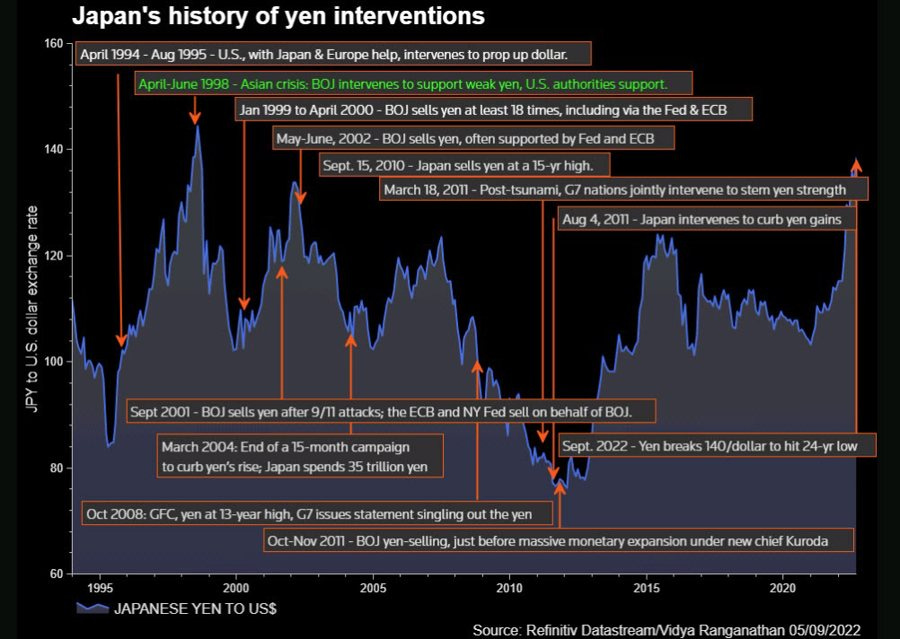

Japan’s history of yen interventions:

A record number of S&P 500 companies over the last ten years is talking about a recession:

… and the media is writing about it:

BofA Fund Manager Survey shows that recession odds are also increasing in the minds of fund managers:

…. and that risk appetite is historically low as is positioning:

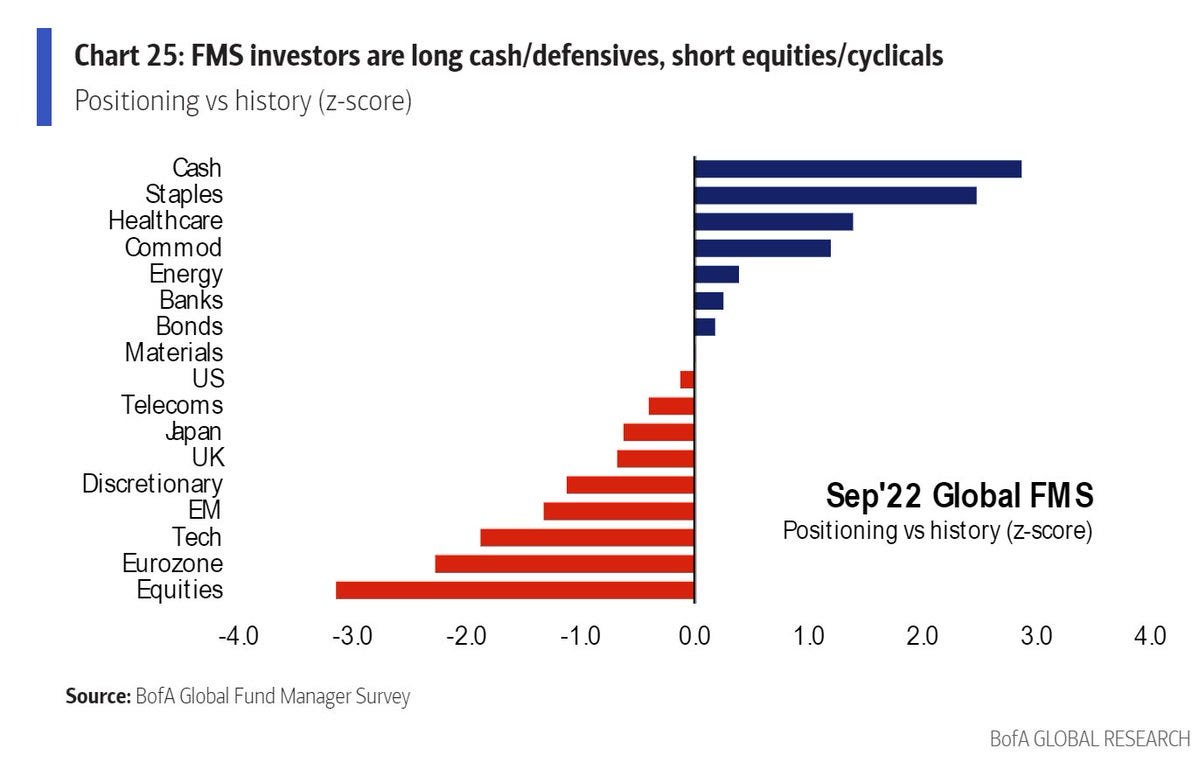

Fund Managers are long cash and defensives:

So, when is it time for a bottom in equities?

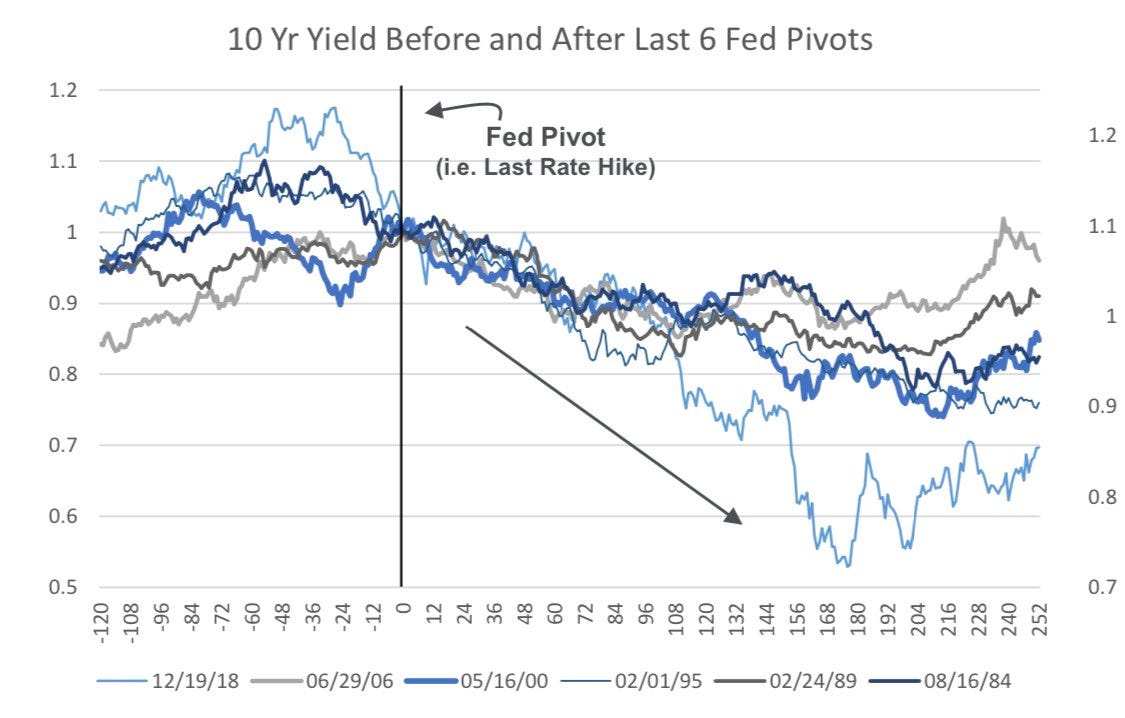

And how about a bottom in bonds? Also look for the last Fed rate hike:

Australia has a variable-rate-mortage problem:

Thankfully, they don’t have the hottest housing market on the planet:

Open interest in crude oil futures is deteriorating:

Another map:

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 31/2022

FOMC Meeting Minutes: 34/2022 | 28/2022 | 25/2022

ECB

Rate Statements: 37/2022 | 30/2022

Meeting Minutes: 35/2022 | 28/2022 | 21/2022

Economic Forecasts: 21/2022

Crib Sheets: 36/2022

BOE

Rate Statements: 32/2022 | 25/2022

Financial Stability Reports: 28/2022

RBA

Rate Statements: 37/2022 | 32/2022 | 28/2022

Meeting Minutes: 34/2022 | 30/2022 | 26/2022 | 21/2022

Statements on Monetary Policy: 32/2022

RBNZ

Rate Statements: 34/2022

BOC

Rate Statements: 37/2022

Crib Sheets: 36/2022

SNB

Rate Statements: 25/2022

BOJ

Rate Statements: 30/2022 | 25/2022

Summary of Opinions: 31/2022

Photo Credit: DALL-E 2 “A Sherlock Holmes cat looking through a magnifying glass at important papers”