Welcome to issue #26 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary. The final section is a collection of things I read during the week that influence my thinking. If you're using Gmail, you will need to click “View entire message” at the bottom since it can't display the whole thing.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Before diving in, I’d like to shout out to The Morning Hark!

For me, it’s a must-read every day. Here’s what’s in it:

Overnight action in key asset classes including commodities, fixed income and crypto,

Current macro themes with a review of the previous day’s economic data releases, central bank speakers and more,

Main highlights ahead with a comprehensive list of upcoming data and events,

The top 5 trending posts on app.harkster.com, and

A section with links to more in-depth pieces or useful information on current macro themes.

The Morning Hark is a great way to stay on top of what’s going on in markets. If you like fx:macro, you will love The Morning Hark, so check it out!

Table of Contents

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter. The link to the difftext is in the Downloads section below.

Most of what I’ve written last week remains true. There’s nothing to suggest things in global markets are going to get better systemically or fundamentally anytime soon. As much as I hate to sound like low-quality gloom-and-doom peddlers, but: the cracks are starting to show up and it would feel dishonest not to point out or act on that fact.

Relevant market risks I have on my radar (it's obviously not a comprehensive list and mostly unchanged from last week). If you have any suggestions, please don’t hesitate to leave a comment:

Europe:

More and more headlines and articles about energy nationalism… could spill over into monetary policy if push comes to shove

An unexpected resolution of the Ukraine war seems very unlikely, but it could escalate very quickly especially given the mobilization and referendums

UK: the fallout from the close shave in the gilt market and UK pension funds isn’t clear yet

Global markets:

The UK pension funds are a canary in the coal mine that signals that cracks can appear anywhere out of seemingly nowhere

The risk from commodity market squeezes spilling over seems to have diminished a bit; it's become a major factor in energy and electricity markets

China/Taiwan: keeping an eye on the Taiwanese stock market as a risk gauge

Economic Calendar for next week

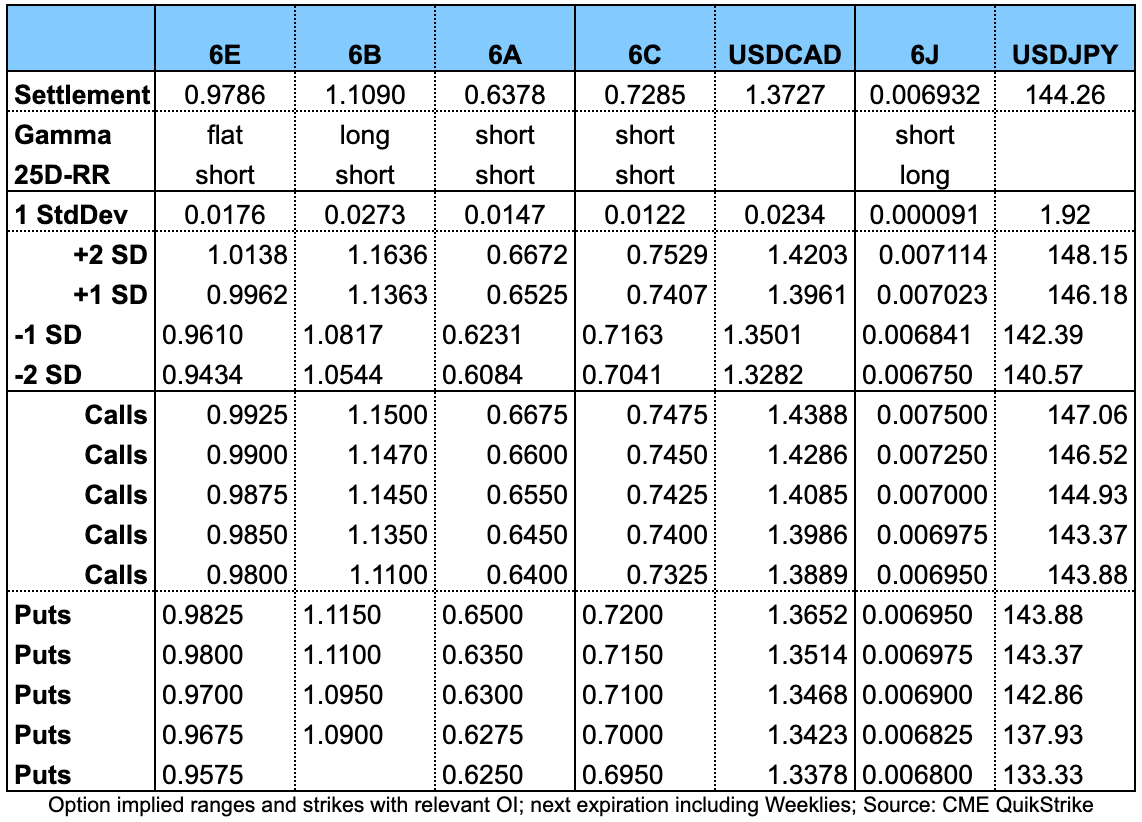

Important levels to watch and look out for in the Majors

Downloads and Links

Difftext of the Summary from last week: link

Central bank speaker recap for the week:

Week in Review

Central Banks

BOJ Summary of Opinions (03.10.)

Nothing new or surprising in the BOJ Summary. Some highlights from the release (link to full text):

CPI y/y has been in the range of 2.5-3.0%, it's likely to increase towards the end of the year, and after that, the rate of increase is expected to decelerate.

Sustained wage increases have not yet been confirmed and achieving the price stability target in a stable manner is still faced with challenges.

There is a long way to go to achieve the 2% price stability target in a sustainable and stable manner.

The impact of FX rates needs to be examined “humbly and without any preconceptions”

It is appropriate for the BOJ to firmly maintain accommodative financial conditions while scaling back acute (Covid-19) crisis measures.

Some market participants are concerned about a decline in the functioning of the bond market. It is important the BOJ continues to monitor and examine market conditions.

RBA Rate Statement (04.10.)

The RBA hiked by 25 bps, less than the expected 50 bps. Here's a summary of the statement and the difftext below:

Guidance: “Further increases are likely to be required over the period ahead."

The Board is closely monitoring the global economy, household spending and wage- and price-setting behaviour

The size and timing of future rate hikes will be determined by incoming data

The cash rate has been increased substantially in a short period of time, the Board will assess the outlook for growth and inflation

The Board's priority is to return inflation to the 2-3% target over time; seeking to keep the economy on an even keel

Further increase in inflation is expected over the coming months before declining

Unemployment is around the lowest in almost 50 years at 3.5%, and wage growth continues to pick up but remains lower than in other advanced economies

RBNZ Rate Statement (05.10.)

The RBNZ hiked the Official Cash Rate by 0.5% to 3.5% as expected. Here's a summary and the difftext below:

Global price pressures remain elevated, demand for goods is exceeding supply

A decline in oil prices and easing in some supply chains have seen headline inflation decline in some countries; core measures have risen and persist

Weaker growth outlook for New Zealand's trading partners due to tighter monetary conditions

The domestic economy remains resilient, employment levels are high, wages pressures are elevated

Household balance sheets remain resilient despite a fall in house prices

According to the Summary Record, a 75 bps hike was discussed as well:

ECB Meeting Minutes (06.10.)

The ECB Minutes were a bit more hawkish than I had expected. Here are some key passages from the release:

Confab, Speakers, News

Federal Reserve

Williams (Neutral). Mon: Fed still has a way to go, cites 4.6% median 2023 dot, rapid hikes have been very beneficial, not yet in restrictive place for growth. Inflation remains too high, the Fed's job isn't done, Fed will do whatever is necessary to lower inflation, likely to see nearly flat GDP this year, inflation likely to be down to 3% next year. Fri: Fed is a long way from where it needs to be, need to get rates up further, focussed on lowering inflation, sees positive growth next year and higher unemployment, Fed needs to slow down economic activity. UK market volatility did have an impact on US markets, Fed's mandate is domestic but takes account of global factors, no question Fed policy has big global impact.

Daly (Neutral). Tue: Need further rate hikes and then hold policy until "truly done" with getting inflation down, expect unemployment to rise to 4.5% not 6.5%, there's a lot of room to slow the labour market. Central banks are meant to create policy for the nation they serve and be aware of how this affects the global economy, Fed's mandate requires focus on domestic economy, dollar moves not focus of policy. Raising rates will affect demand more than supply, financial markets have priced in Fed's balance sheet reduction. Wed: Not raising rates until something breaks, resolute at raising rates to restrictive territory and then holding them there, committed to bringing inflation down until we are well and truly done, sees more hikes as necessary. Prepared to address market dislocations if they come about, markets are working well right now, our mandate is for domestic economy.

Jefferson. Tue: Committed to taking further steps, have to act boldly, restoring price stability may take some time and will likely entail a period of below-trend growth, elevated inflation is the problem that worries me most, job market is very tight, suppyl-demand conditions in the labour market and the economy seem likely to ease some.

Bostic (Dove). Wed: Inflation fight still in its "early days", wants rates at a moderately restrictive level from 4-4.5% and then hold to assess the impact, Fed should not be quick to cut rates even if the economy weakens, room to continue tightening without undue damage to job market.

Kashkari (Dove). Thu: We have more work to do on inflation, not comfortable with a pause until we see evidence inflation is cooling and there's almost no evidence for that, we're quite a ways away from a pause, there's a risk of overshooting, expects to see cracks in US financial markets but the bar to shifting our policy is very high.

Evans (Neutral). Thu: Need more restrictive monetary policy, have further to go on rate hikes, looking for 125 bps of hikes over the next two meetings, next meeting will be discussing whether 75 or 50 bps, headed to 4.5-4.75% likely by springtime. Every central bank has to make its own decision. Balance sheet reduction will be completed within three years.

Cook (Neutral). Thu: High inflation has required front-loading, watching broad range of indicators and willing to change course as data evolves, market continues to function well.

European Central Bank

De Cos (Dove). Tue: Spanish banks need to increase provisions amid economic slowdown, sees certain deterioration in economic and financial situation of companies most exposed to energy prices, urges caution and careful monitoring of potential risks in the banking sector.

Villeroy (Neutral). Tue: Will raise rates as much as necessary to bring core inflation down, we should go to neutral without hesitation by the end of the year, after that more flexible and possibly slower hikes, we're no longer gradual but it is important to remain orderly, i.e. not surprising markets excessively or tightening too much. European banks are more solid than feared by some.

Enria. Tue: Eurozone banks should not assume government help in balance sheet management, underperforming loans have continued to build up especially in sectors like oil and gas.

Nagel (Hawk). Fri: Interest rates must continue to rise significantly, next ECB meeting must send out clear signals on reacting to inflation, we have to reduce bond holdings in the foreseeable future. We will probably see a recession but not a lot of insolvencies, recession will not be a deep slump.

Bank of England

Mann (Hawk). Mon: Voted for 75 bps in September because of inflation expectations, sterling depreciation, energy cap impact among other factors. Concerned about medium-term upward drift of inflation expectations.

Letter to Treasury Committee. Thu, Cunliffe: Liquidity conditions were very poor in run-up to the gilt intervention, move in gilt yields threatened to exceed the size of the cushion for many LDI funds, no widespread crystallization of financial stability risks, operation will be unwound in a smooth and orderly fashion once risks to market functioning have subsided. BOE's operations in gilt market not intended to cap or control long-term rates, they are not monetary policy operations.

Haskel. Thu: BOE has the tools and the resolve to return inflation to target in the medium term, sidelined OBR creates more uncertainty, welcomes the usual involvement in the budget process of the OBR.

Ramsden (Hawk). Fri: One key consideration for the next MPC meeting will be whether recent repricing of UK assets reflects a change in markets' assessment of UK macroeconomic conditions, gilt buying operation designed to buy time.

Bank of Canada

Macklem. Thu: More rate hikes needed, more to be done on inflation, have yet to see clear evidence of inflation coming down, inflation will not fade away by itself, price pressures continue to broaden, more consumers and businesses expect inflation to be higher for longer, will focus more on CPI Trim and Median measures of inflation and reassess Common CPI which is becoming more difficult to use.

Swiss National Bank

Jordan. Weekend: Swiss Franc is not highly valued, does not want to comment on every FX move, will intervene if the Franc appreciates so strongly that the monetary policy environment becomes too restrictive, does not want to exacerbate inflation with a weak Franc, winding down the SNB balance sheet will probably take considerable time. Fri: SNB won't tolerate above-target inflation, 3% is no longer price stability, no longer describing the franc as overvalued, will intervene if franc appreciates "too much", declined to give a specific level.

Maechler. Wed: Further interest rate hikes are "quite possible", seeing more signs of second-round effects of inflation, ready to buy and sell Francs if currency becomes too weak or too strong. SNB is monitoring situation at Credit Suisse.

Bank of Japan

Offical. Mon: Firms' CPI estimates for coming five years hit 2% for the first time every since data has been compiled (March 2014).

Suzuki (FinMin). Mon: Will respond appropriately to sharp FX moves, sharp moves are undesirable, closely watching with a sense of urgency.

Economic Data

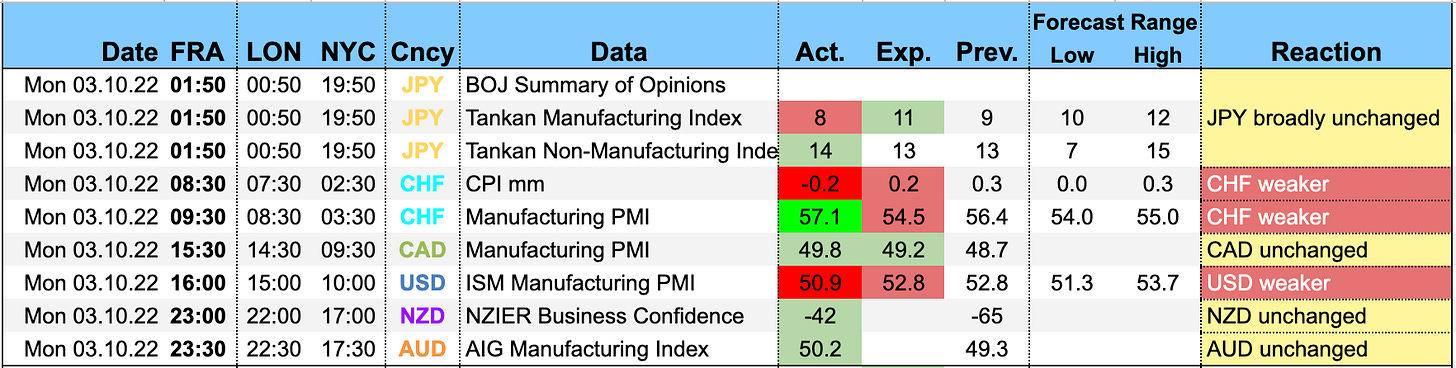

Monday, 03.10.22

Check out this write-up from The Morning Hark for more info on the UK government's U-turn on their mini-budget.

Here's the summary from the Canadian Manufacturing PMI:

"The close of the third quarter yielded a mixed bag of results for Canada's manufacturing sector with a back- to-back deterioration in operating conditions recorded during September. Output and new orders continued to fall with the sector still feeling the repercussions of material shortages and delivery delays. Demand was once again hit by client hesitancy in the wake of rising interest rates and weak macroeconomic conditions. This led to a third monthly build-up of finished items held at Canadian manufacturing firms; the longest run in over eight years.

"More concerning news came on the sentiment front with firms less optimistic about output levels in the next 12 months. Anecdotal evidence suggested that Canadian companies feared a recession which had led firms to re-evaluate their growth projections.

"That said, not all is gloom and doom with latest data also pointing to a slowdown in inflation. Both output charge and input price inflation moderated to 22-month lows and were only just above their respective long-run series averages, suggesting tighter monetary policies are having the desired effect on price pressures."

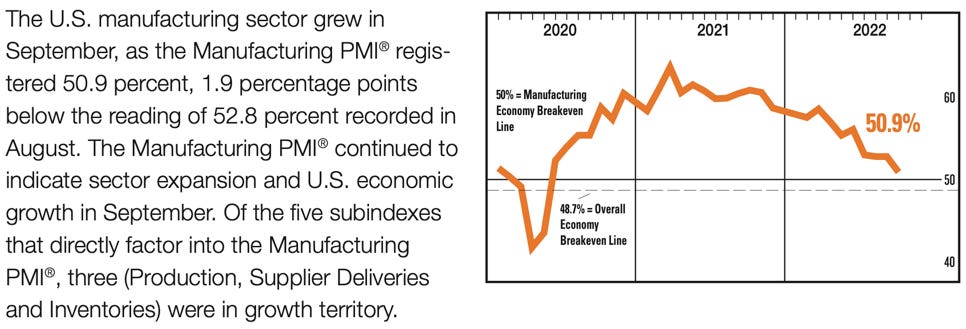

And here are the highlights from the US ISM Manufacturing PMI:

Highlights from the AIG Manufacturing Index:

Manufacturing was broadly stable in September, the second month of even results since February. Activity contracted in all sectors but chemicals and machinery & equipment.

New orders and sales grew in September, and the pace of growth improved from August.

The employment index has fallen rapidly, which reflects labour shortage pressures. The wages index remains very high.

Labour challenges remain an ongoing constraint and supply chain disruption continues to be a key concern for manufacturing similar to previous months.

Tuesday, 04.10.22

The RBA rate decision was covered in more detail above. The market didn’t like the dovish surprise at all, AUD sold off and remained weak throughout the rest of the day.

Wednesday, 05.10.22

The RBNZ rate decision was covered in the Central Banks section above.

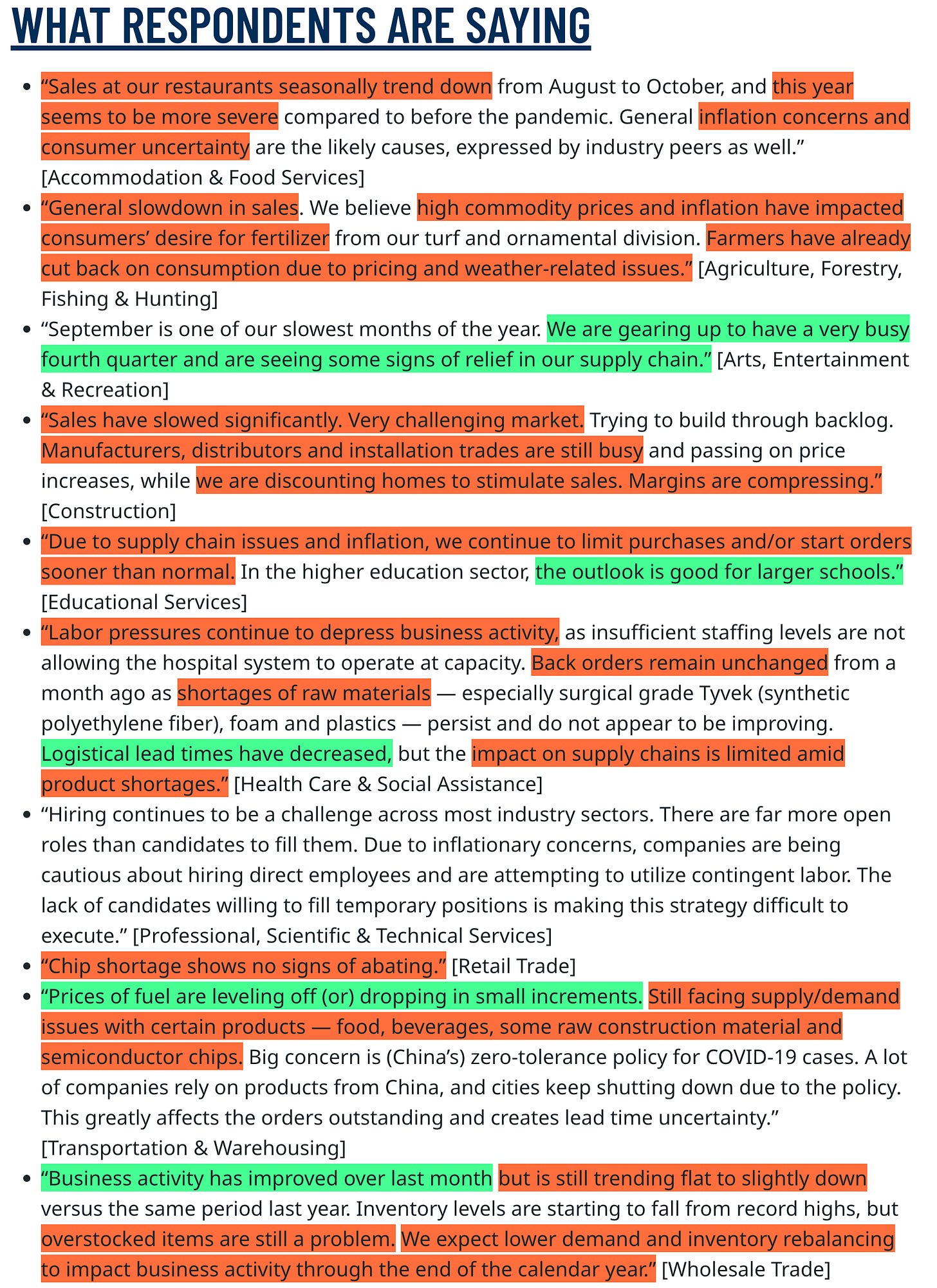

Some relevant points from the US ISM Services PMI:

Thursday, 06.10.2

Friday, 07.10.22

Market Analysis

Growth and Inflation

The Atlanta Fed GDPNow estimates annualized Q3 growth at 2.9%:

The NY Fed Weekly Economic Index decreased to 2.07:

Citi Economic Surprise Indexes:

USD and EUR trending higher, GBP has turned higher as well

AUD, CAD and CHF are down

The Bloomberg PMI heatmap is seeing more and more red prints:

Hong Kong and Japan worsened, China, Taiwan and South Korea were already in the red last week

The UK and Eurozone are worsening as well

The US and Australia are relative outperformers

Canada has improved from bad to so-so

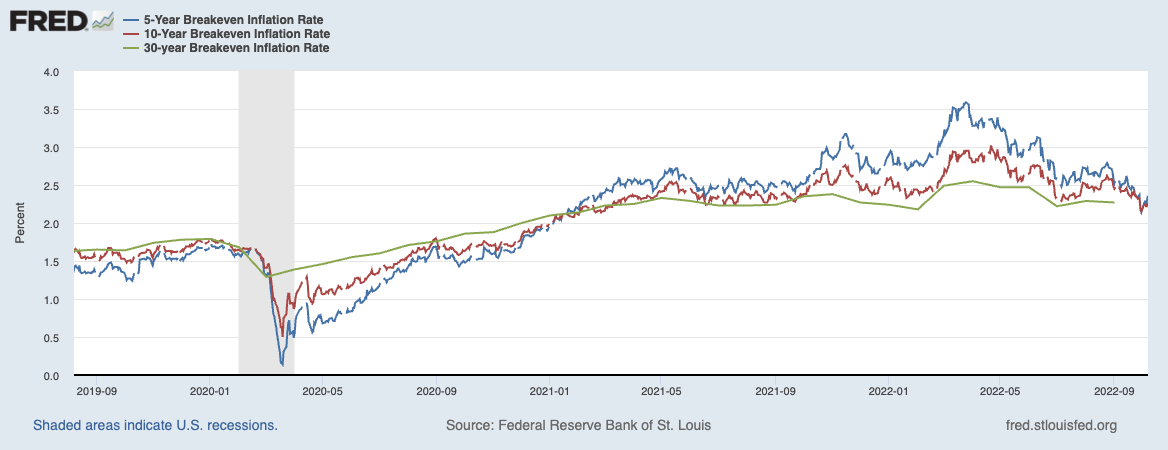

5y5y forward inflation expectations continue to trade in the middle of their range:

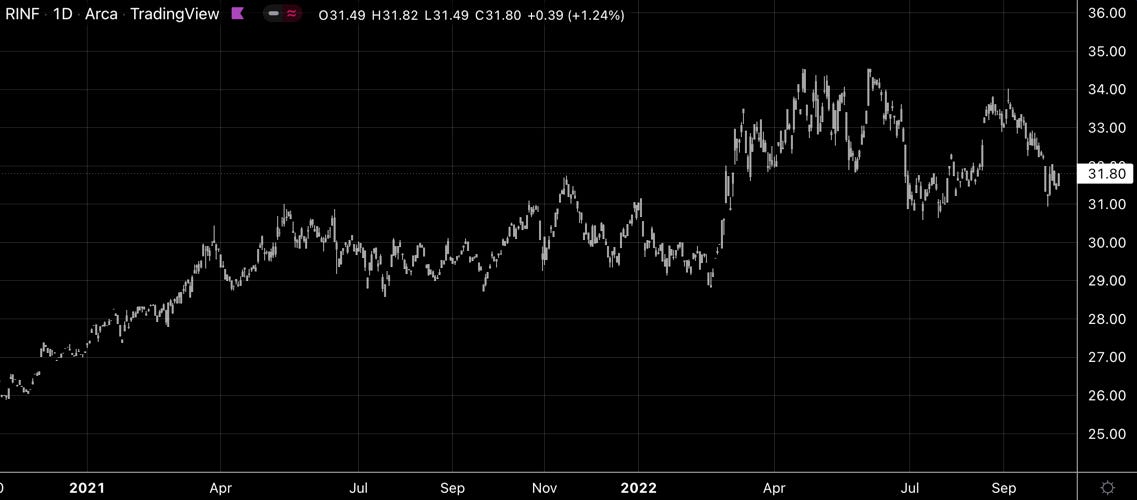

RINF also trades in the middle of its range:

5y and 10y breakevens making lower lows and trending lower:

Citi Inflation Surprise Indexes:

USD and EUR continue to trend down

GBP dropped quite a bit over the last month

CAD also dropping

CHF remains up

Yields

Looking at the chart and table below:

UK yields are the strongest, US 10s are approaching 4% once again

Swiss, Canadian, AUD and NZ yields look weakest

Some pretty interesting moves in UK 2s10s: heavy bear steepening with 10s up more than 2s down. That’s not really a reassuring sign with regards to central bank (front end) and government (back end) credibility:

Central Banks

According to FedWatch, the November FOMC meeting is now priced with an 81% chance of a 75 bps rate hike. The December meeting has a somewhat higher chance of 50 bps than last week (now: 63%), February 2023 sees a 25 bps hike. All in all, it’s a decent repricing upwards, the terminal rate is now seen at 4.50-4.75% and the probabilities for a higher rate have increased compared to last week.

It looks like the Fed pep-talk of the last two weeks has found an audience.

STIR spreads reflect that repricing: for this year, the expectation is for 5-6 more hikes while next year is being priced for fewer/no cuts during this week, and 2024 has priced in about 2 rate cuts:

Sectors and Flows

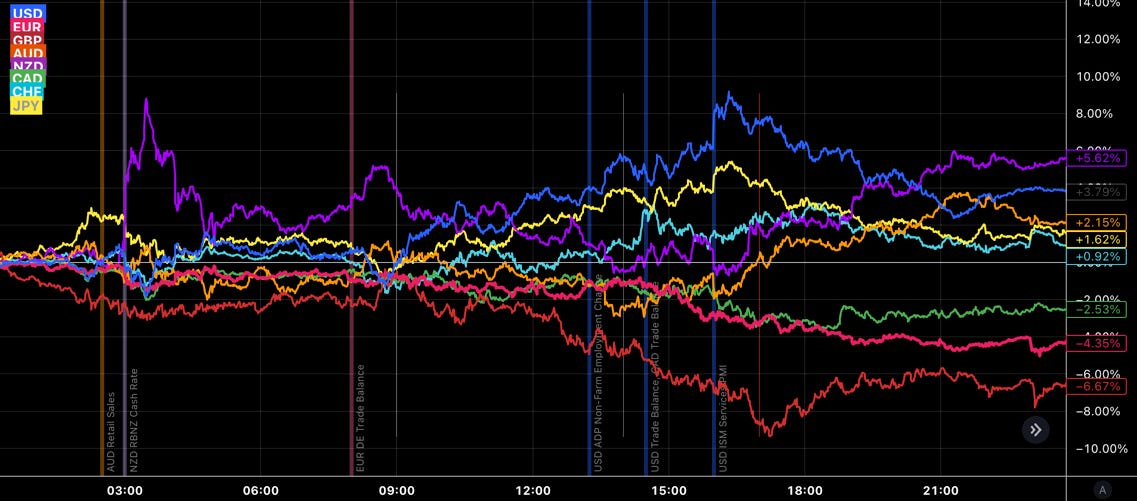

Currency strength over 1 and 3 months:

The strongest currencies are USD, CHF and EUR

The weakest currencies are AUD, NZD and GBP

For the week we’ve seen CAD as the strongest while CHF was the weakest currency.

Equity sectors are once again a mixed thing:

Energy (XOP, XLE, OIH) and Metals/Mining (XME) at the top

Defensive sectors like Utilities, Staples, Healthcare (XLU, XLP, XLV) at the bottom

Growth outperformed Value (VUG, VTV)

It doesn’t look much clearer on the following charts:

Sector charts: Energy is pretty much the only sector that hasn’t ended up in the bottom right corner of the chart. Still, I find the weakness in Utilities puzzling.

International stock markets over three months:

Brazil and India are the places to be

Hang Seng continues to be the worst performer

And here on a YTD timeframe: Brazil is the only market that remains above zero while the weakest markets are Nasdaq, Taiwan, South Korea, the Russell 2k, the S&P 500. European markets (DAX, EuroStoxx, SMI, CAC40, IBEX) all outperformed those…

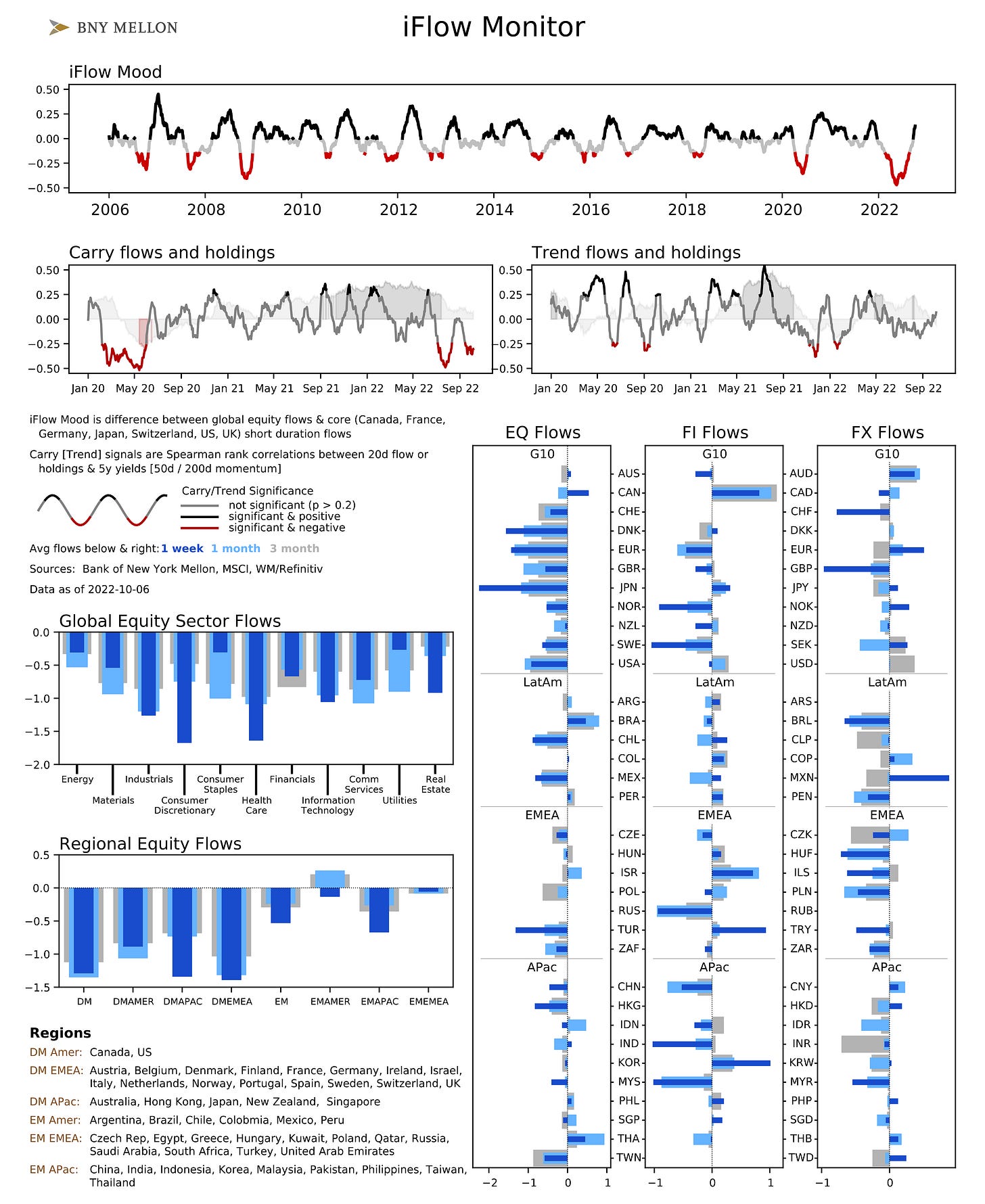

BNY Mellon iFlow:

FX flows out of CHF and GBP while flows into AUD remain positive and EUR is seeing inflows, too

Equity flows are broadly negative across the G10, Brazil seeing positive flows (fits with the stock market performance seen above)

Carry flows remain negative

Sentiment and Positioning

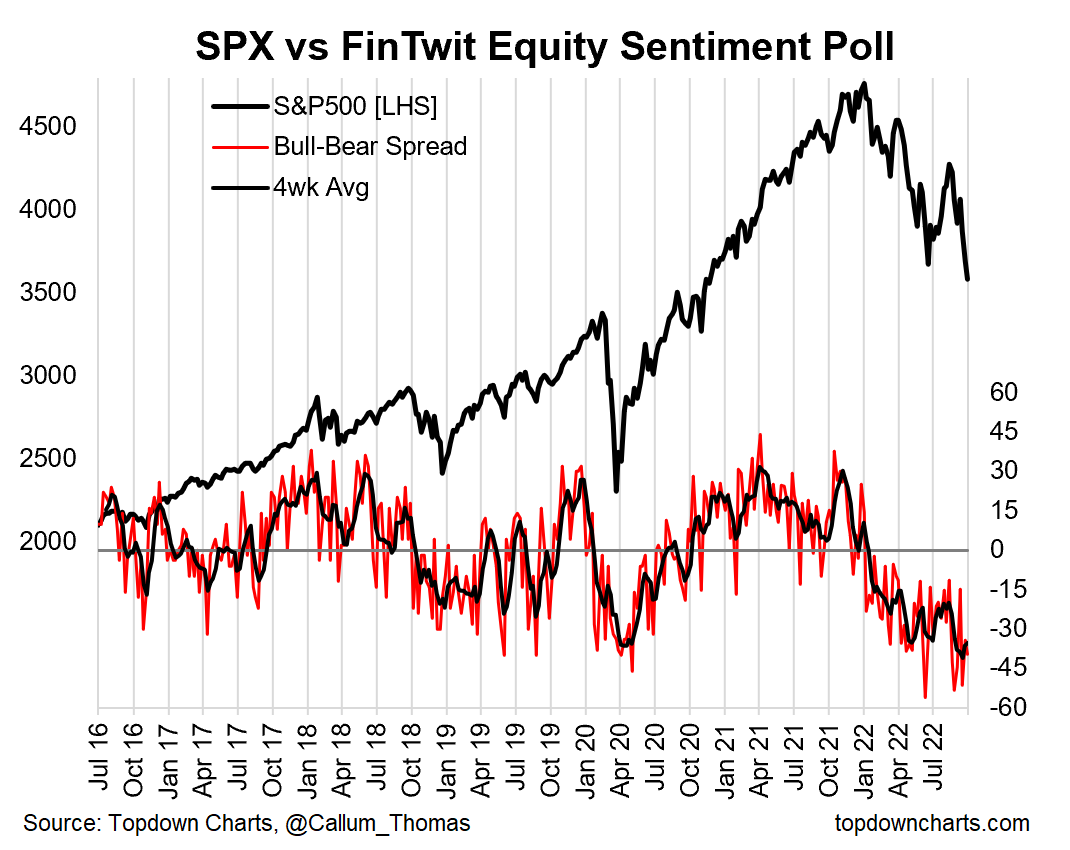

AAII sentiment remains depressed with a bull-bear spread of -31, which is near historic lows:

Sentiment on Fintwit is near lows as well:

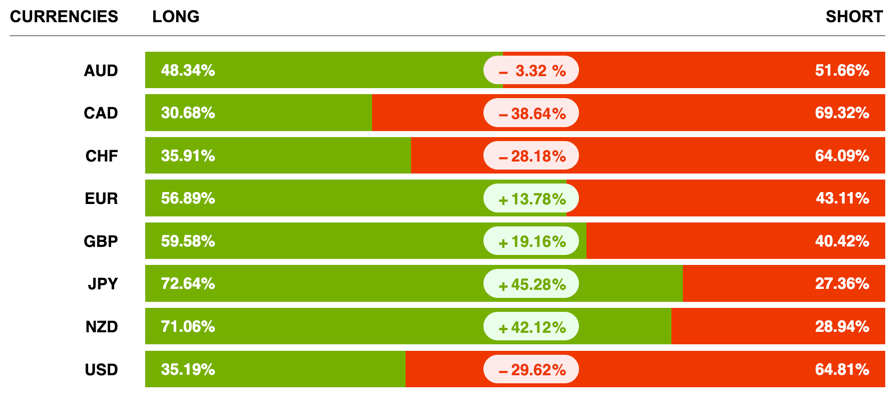

Currency sentiment:

Traders are still betting on NZD and JPY, and against USD and CHF

CAD has seen the bulls decrease by more than 10% from 41.9 to 30.7 this week

Different sentiment source:

Pretty huge increase in CL shorts over the week

AUDUSD and NZDUSD still with the most extreme positive FX sentiment

JPY pairs all have positive sentiment for the yen

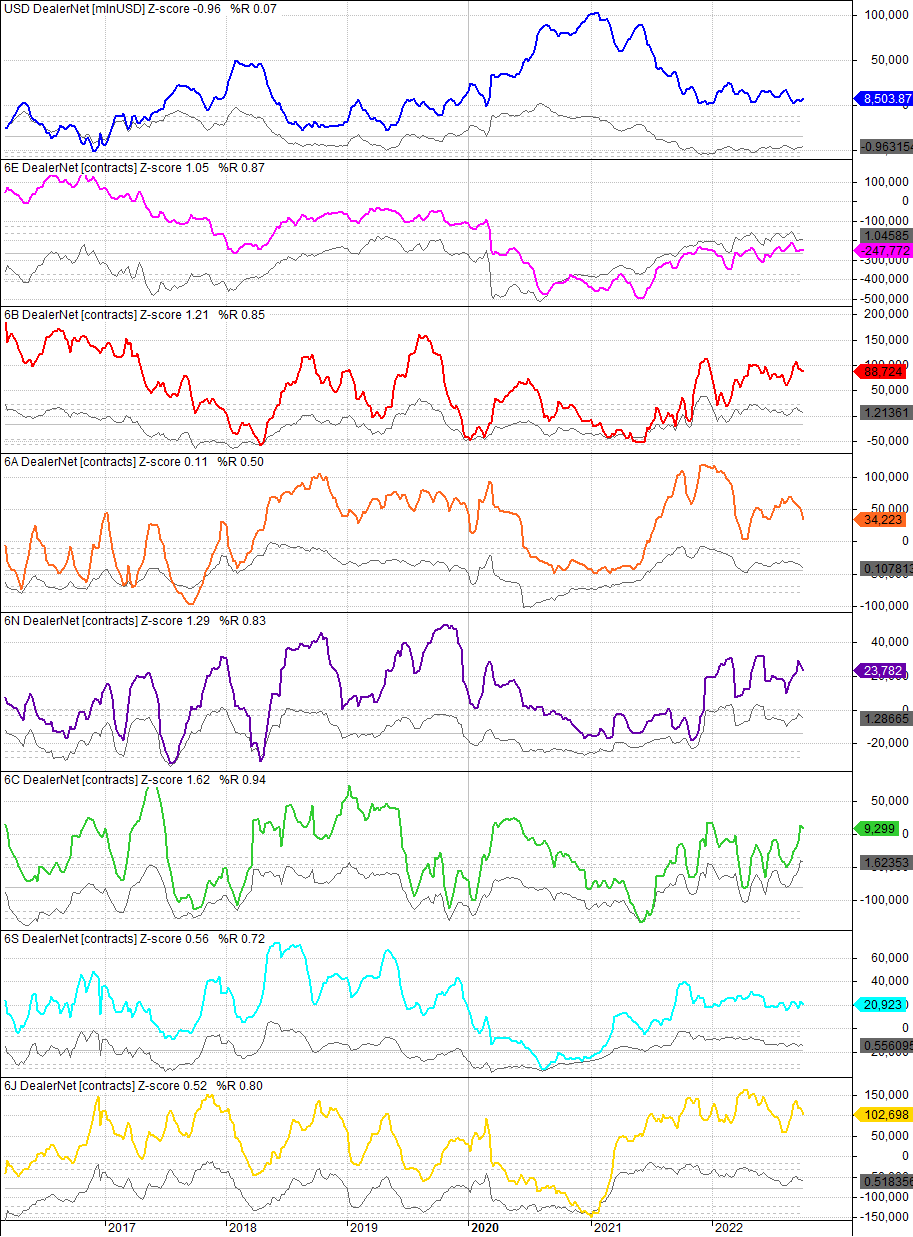

Commitment of Traders and futures performance:

Equities had a positive week despite the gloomy price action. Relative Strength (RSL) remains weak around 0.90 for all four futures. There were no notable positioning changes.

Treasuries were negative for the week, Relative Strength remains dismal, positioning doesn’t provide any clear signals.

All currencies except for CAD and NZD were down vs. the dollar this week. The only currency with a decent RSL against the dollar is the Swissie. Commercial and Large Trader positioning is positive for the Loonie.

The large moves in Crude, Heating Oil and RBOB this week have catapulted RLS to near/above 1 again. Commercial/Large Trader positioning is a bullish extreme in NG.

Metals had a mixed-to-positive week. The Commercial net long positioning in Silver has disappeared again but Silver had a few positive weeks now. One-week changes in positioning are decently bearish for GC and SI.

Grains and Softs were mixed.

COT/TFF data for currency futures: none of them is at an extreme.

CitiFX PAIN: the dollar long has taken a bit of a hit over the last few days. The currencies that have seen the most action were CAD, AUD and NZD. The shorts in EUR, CHF and GBP haven’t been affected as much:

Market Risks

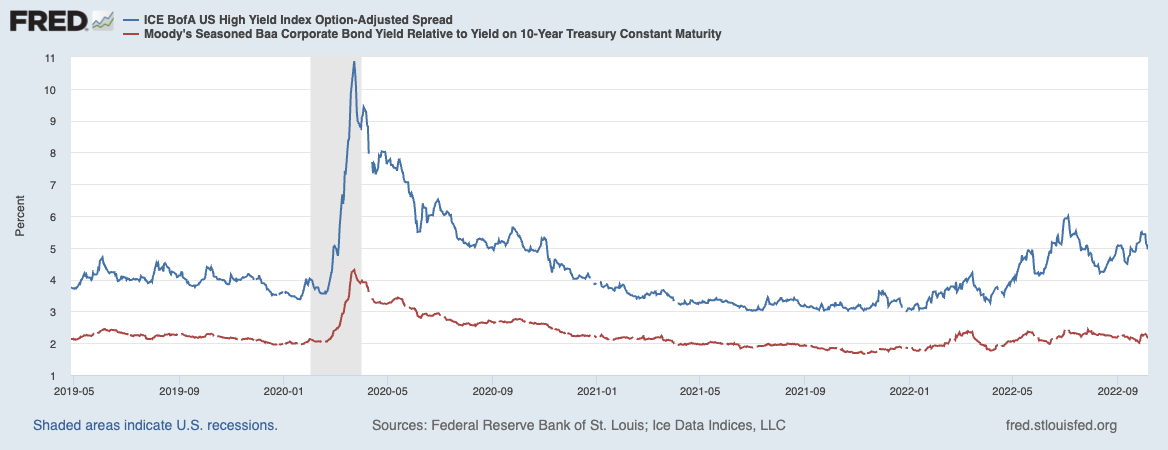

HY and IG spreads look pretty contained compared to where we find ourselves in equities, and despite the move lower in stocks over the last few days, these spreads have actually tightened a bit:

However, an index of credit spreads has blown through the July high:

FX volatility has calmed a bit for GBP but it continues to move higher for AUD and NZD. It looks like the near-blowup of the UK pension funds has somehow reset the baseline for FX vol a few points higher:

Equity volatility looks a bit stressed but the VIX term structure is flattish overall:

Volatility indexes:

Not too much change from last week.

VVIX still seems “too low” compared to what we’ve seen earlier this year, so there doesn’t seem to be much demand for long vol protection at the moment.

TDEX has picked up from lows while VIX/VOLI and SDEX seem a bit quieter. The demand for tail hedges seems to be increasing but it’s noticeably lower than when we were at the low in June.

MOVE refuses to come down.

It’s a somewhat conflicting picture between a high MOVE, a relatively low VVIX, increasing demand for tail hedges and a relatively flat skew. I don’t want to read too much into it, but “unclear” in volatility is more bearish than bullish.

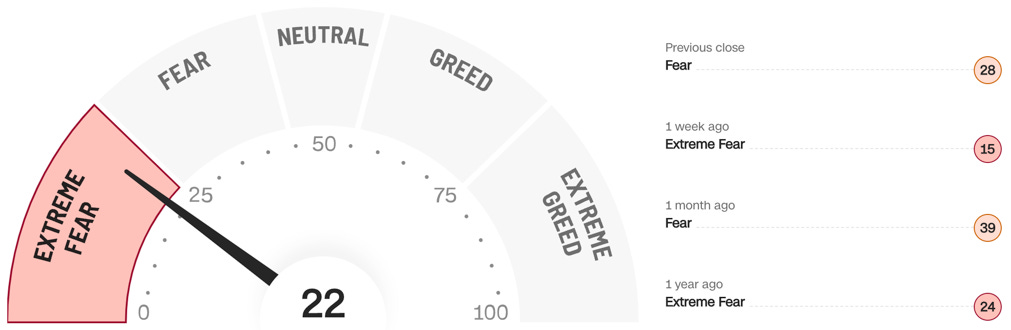

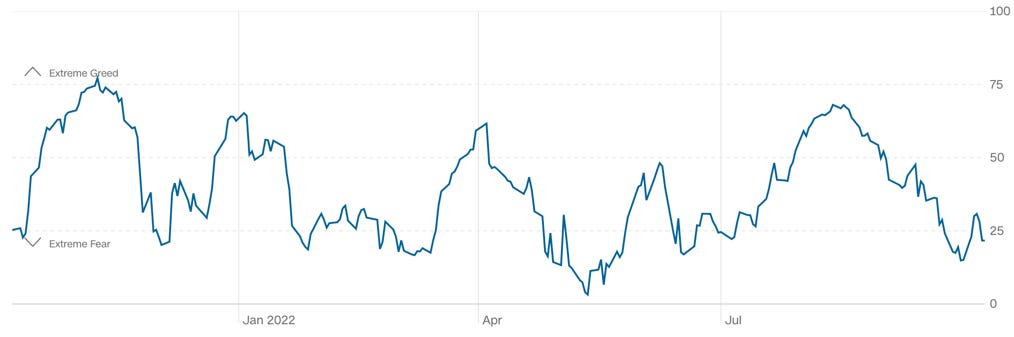

The CNN Fear & Greed Index is at 22 and in extreme fear territory:

Various

Market breadth isn’t any help: the Advance/Decline line continues to track price.

S&P 500 and Nasdaq 100 stocks above their 200-day and 50-day moving averages also remain depressed at/around the -2 SD mark. That’s nothing unexpected at a low like this. Here are the charts for the 200-day averages:

And here for the 50-day moving averages:

25-delta risk reversals:

GBPUSD is being priced lower as is USDJPY

And finally, a look at a few different ratios: Silver/Gold is buying the low in stocks while Copper/Gold isn’t. XLF/XLU is up as well but to be honest, the weakness in Utilities is a mystery to me, so I’d discount that ratio.

Other Stuff I've been looking at

Nothing here once again due to time constraints.

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 39/2022 | 31/2022 FOMC Meeting Minutes: 34/2022 | 28/2022 | 25/2022 Crib Sheets: 37/2022

ECB

Rate Statements: 37/2022 | 30/2022 Meeting Minutes: 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 36/2022

BOE

Rate Statements: 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 37/2022

RBA

Rate Statements: 37/2022 | 32/2022 | 28/2022 Meeting Minutes: 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 32/2022 Crib Sheets: 40/2022

RBNZ

Rate Statements: 34/2022 Crib Sheets: 40/2022

BOC

Rate Statements: 37/2022 Crib Sheets: 36/2022

SNB

Rate Statements: 39/2022 | 25/2022 Crib Sheets: 37/2022

BOJ

Rate Statements: 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 31/2022

Image credits: DALL-E 2 “A hawk and a dove with boxing gloves in the ring, realistic”

Awesome as always. Look forward to it.

Great coverage with a great summary, great Sunday read! Thank you!