Welcome to issue #25 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary. The final section is a collection of things I read during the week that influence my thinking.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Before we dive in, I’d like to give a big shout-out to The Morning Hark!

For me, it’s a must-read every day. Here’s what’s in it:

Overnight action in key asset classes including commodities, fixed income and crypto,

Current macro themes with a review of the previous day’s economic data releases, central bank speakers and more,

Main highlights ahead with a comprehensive list of upcoming data and events,

The top 5 trending posts on app.harkster.com, and

A section with links to more in-depth pieces or useful information on current macro themes.

The Morning Hark is a great way to stay on top of what’s going on in markets. If you like fx:macro, you will love The Morning Hark, so check it out!

Table of Contents

Summary

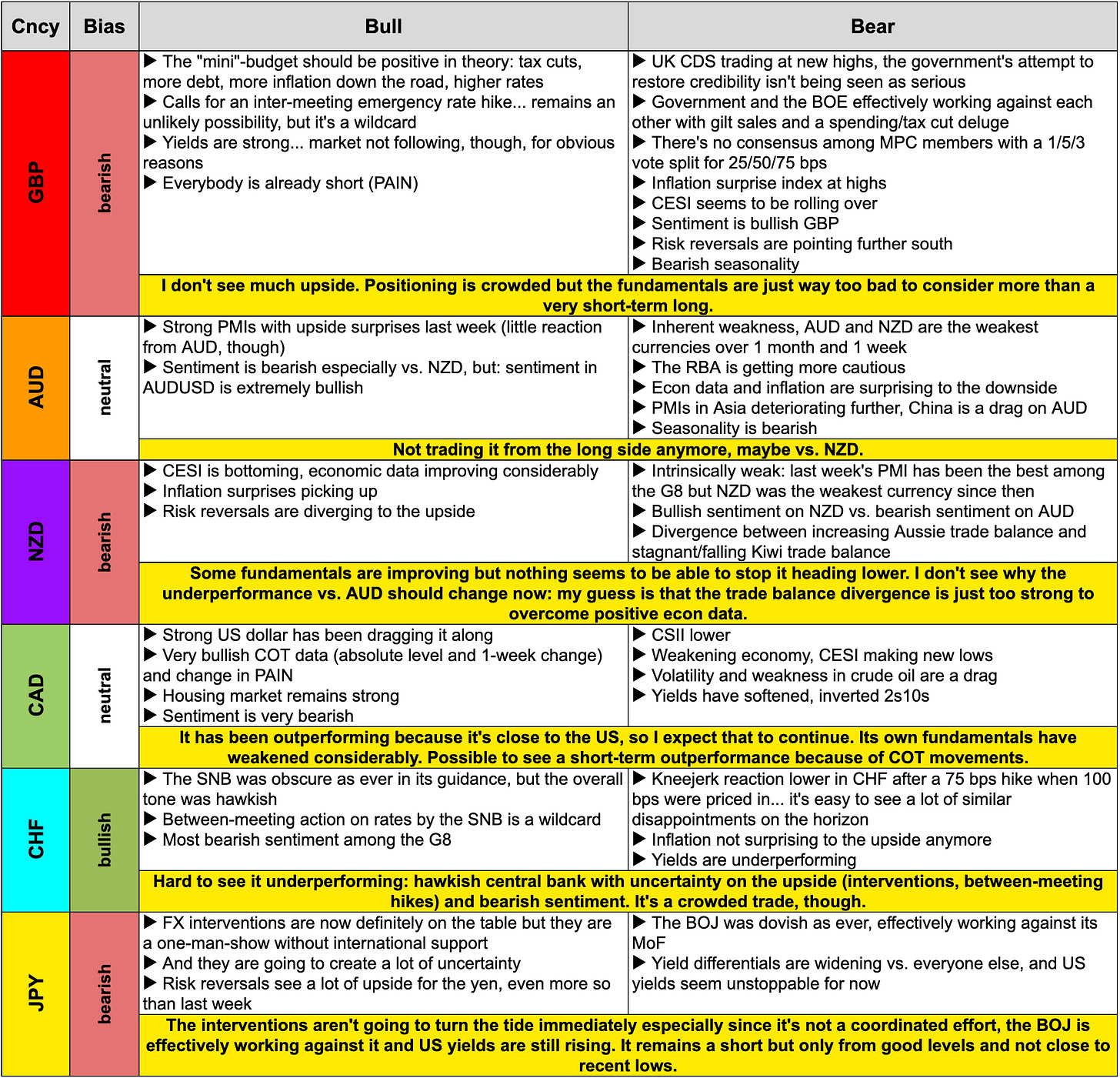

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter. The link to the difftext is in the Downloads section below.

A few words about the current market, some of which I have included in the table above but it's just too important to not repeat the message.

In the last two weeks we've seen more action than we've seen over years:

The Japanese intervened in the FX markets.

A large number of UK pension funds almost went broke, and I had never read about them being a systemic risk since ever. Nobody seems to have had this on their radar. It's been a black swan.

The war in Ukraine and the whole geopolitical situation deteriorated further to the point where the infrastructure of NATO members is being attacked, Russia makes the largest land grab since WW2 and Ukraine applies for NATO membership (who can blame them?).

And that's just the stuff I've been following. I'm trying to remain objective and stay away from doom and gloom but when I have to boil it down it's pretty simple:

Things in financial markets are messed up and seem to be deeply broken. Nothing is being done (or can be done) right now to fix that.

Geopolitics is similarly messed up, we're just one tactical nuke by Vladimir Putin away from complete mayhem that would spill over into financial markets. Nothing suggests things are getting better on that front, either.

All in all, it's hard to imagine things getting better for a (long) while. And since the trajectory of everything is headed the wrong way, it's time to load up on tail hedges and prepare for much worse things to come.

Relevant market risks I have on my radar (it's obviously not a comprehensive list and mostly unchanged from last week). If you have any suggestions, please don’t hesitate to leave a comment:

Europe:

Italian elections coming up, risk of a Euro-sceptic right-wing PMAn unexpected resolution of the Ukraine war seems very unlikely, but it could escalate very quickly especially given the mobilization and referendums

UK: The rabbit is out of the hat with Truss and Sunak; coordination between the government and the BOE seems non-existent, we've seen the gilt market and UK pension funds almost imploding last week

Global markets: the risk from commodity market squeezes spilling over seems to have diminished a bit; it's become a major factor in energy and electricity markets

China/Taiwan: keeping an eye on the Taiwanese stock market as a risk gauge

Economic Calendar for next week

Important levels to watch and look out for in the Majors

Downloads and Links

Difftext of the Summary from last week: link.

For the upcoming RBA and RBNZ meetings:

And a recap of the barrage of central bank speakers this week:

Week in Review

Central Banks

Confab, Speakers, News

The following summaries can also be found in compact form as a PDF in the Downloads section above.

Federal Reserve

Bostic (Dove). Weekend: Need to do all we can to bring inflation down, need to have a slowdown in the economy, there will be some job losses. Wed: 75 bps rate hike is baseline in November, 50 bps in December. Rates need to be moderately restrictive around 4.25-4.50% by year-end, inflation not moving down fast enough, economy and labour market have considerable momentum, signs that demand has begun to cool, expects growth to be below trend. No sign of dysfunction in the bond market.

Collins. Mon: Inflation remains too high, job number one is to bring it down, the labour market is hot, demand clearly exceeds the economy's capacity right now, important to see "clear and convincing" signs inflation is falling, this will need a somewhat higher unemployment rate, achieving a modest slowdown is challenging but achievable, policy decisions will be guided by incoming data.

Mester (Hawk). Mon: Further rate hikes needed, current policy rate not at neutral yet, will need restrictive stance for some time, rates won't come down next year, will be very cautious and need several months of declining inflation, inflation expectations not as well anchored as would hope. Need to see rates affect inflation and we haven't seen that yet. At some point it will be a case of balancing risks but this is not the moment. No active discussion of possible MBS sales. Thu: Still not in restrictive territory, not at a point where we should think about stopping rate, I'm a little bit above the median path reflected in September, US economy has so far handled Fed tightening. Challenging situation for the BOE, needed to intervene because market was not functioning properly.

Logan. Mon: Inflation is way too high.

Evans (Neutral). Tue: Expects to raise rates further and hold for quite a while, outlook is roughly in line with 4.25-4.50% at year-end, Fed's actions will result in below-trend growth and softening in the labour market, at some point it will be appropriate to slow pace of rate increases and assess the impact on the economy. Wed: Current FFR not nearly restrictive enough, good place would be 4.50-4.75% by year-end or March 2023, policy should sit at that range for a time, expects the Fed Funds Rate to top out by March. Consensus that the FFR should continue to go up, at some point we will have to slow rate hikes a little bit.

Bullard (Hawk). Tue: US policy rate arguably in restrictive territory, more hikes to come, have to stay at higher rate for some time, likely peak is at 4.5%. Serious inflation problem in the US, credibility of inflation targeting is at risk, strong labour market provides room to take care of inflation. Recession risk but more on global basis than US. Thu: We will probably need "higher for longer" on rates than markets anticipated. Jobless claims were "super low", unemployment rate at 4.5% would still be healthy, imperative to avoid 70s style inflation. Real rates in positive territory is encouraging sign, have to be careful not to over-interpret a decline in inflation.

Kashkari (Hawk). Tue: Need to keep tightening policy until compelling evidence that inflation is heading down then sit there and pause. Won't be cutting rates when the economy weakens. Committed to price stability and the market understands that, moving at an appropriately aggressively pace but there's a risk of overdoing it. Rents and wages continue to rise and this is stickier inflation.

Harker (Neutral). Tue: Housing shortage is a key driver of inflation surge, inflation is far too high across many categories.

Powell (Neutral). Tue: There's a real need for more appropriate regulation on decentralized finance.

Daly (Neutral). Wed: Wants to bring inflation down but not tip economy into a recession. Thu: Expects to raise rates further in coming meetings and early 2023, 4-4.5% by year-end and 4.5-5% in 2023, expects to hold rates steady for at least all of 2023, actual path will depend on data, have gotten rates to neutral. More sustainable path for the economy necessitates higher interest rates and a downshift in pace of economic activity and labour market, inducing a deep recession is not warranted or necessary, many risks to a soft landing. Fri: Additional rate hikes are the right thing to do but how high rates will go depends on data, no pre-set course, starting to see the benefits of rate hikes with the housing market cooling, we need to see a lot of relief on inflation.

Brainard (Dove). Fri: Monetary policy will need to be restrictive for some time, committed to avoiding pulling back on rate hikes prematurely, risks may become two-sided at some point, Fed is attentive to financial vulnerabilities that could be exacerbated by additional adverse shocks.

Barkin (Neutral). Fri: Fed will continue with tighter policy and not declare victory prematurely, promising sings inflation are easing but may take time to show up in data, inflation progress won't be predictable.

European Central Bank

De Guindos (Dove). Mon: Further rate hikes will depend on incoming data, ECB has tools to fight fragmentation, fully committed to 2% inflation target. Q3 and Q4 data points towards zero growth in Eurozone. Tue: Will continue raising rates over the coming months, number and size of hikes will be determined by data, growth will be below 1% in base case, higher rates will have impact on corporate solvency. Slowdown in growth will not be enough to bring down inflation.

Lagarde (Dove). Mon: Expects to raise interest rates further over the next several meetings, wants to reach neutral and then decide if more action is needed. Inflation risks are primarily to the upside, recent above-target revisions to inflation expectations warrants continued monitoring, depreciation of the Euro has added to inflationary pressures. Expects activity to slow substantially in the coming quarters. ECB will not activate TPI if a blowout in yields is due to policy errors at home. Wed: Will continue to hike rates over the next several meetings, need to give a strong signal we won't allow inflation expectations to unanchor.

Nagel (Hawk). Mon: Decisive rate hikes are needed, high risk that inflation expectations get unanchored.

Centeno. Tue: Rate hike cycle will continue, there's no de-anchoring of inflation expectations in Europe

Villeroy (Neutral). Tue: Any French recession would be limited and transitory.

Holzmann (Hawk). Wed: 50 bps is minimum next month, 100 bps is currently too much, 75 bps would be a "good figure", still some way from neutral.

Kazimir. Wed: 75 bps a very good option to keep pace of tightening, consensus we want to reach neutral, no consensus on where that is (!!!).

Rehn (Neutral). Wed: ECB requires a "significant" rate hike in October, be it "75 or 50 bps or something else". Thu: Small rate hikes not enough in current situation, significant hikes are needed, either 75 bps or 50 bps, expects to get to neutral rate by Christmas. Better to frontload to keep inflation expectations anchored, prospect of a recession in the Eurozone has become more likely.

Kazaks (Hawk). Wed: Expects 75 bps in October and smaller steps after that. Thu: Big step in October is appropriate, ECB should start discussing QT now, weak Euro does not help with inflation.

De Cose (Dove). Thu: QT could create market turmoil in certain segments, supply may outgrow demand and liquidity may dry up, policy rates are a more effective tool to tighten monetary policy. ECB could decide to start reducing asset stock earlier than markets anticipate.

Simkus (Hawk). Thu: My choice would be to hike by 75 bps at next meeting, 50 bps is the minimum.

Müller (Hawk). Thu: Significant rate hike is needed in October, too early to say how much in terms of bps.

Lane (Dove). Thu: Will not achieve 2% inflation target unless we normalize policy, ECB still trying to reach neutral, not yet taking a stand on whether that will be enough, European economy stalling because of energy shock.

Visco (Dove). Fri: Significant worsening of economic outlook is cause for concern, rates must keep rising, rate hikes could have the biggest impact after the economy has already slowed, approach to policy tightening will be defined based on data meeting by meeting.

Schnabel (Neutral). Fri: Further rate hikes will be needed, must take "robust" action, ECB should put a premium on incoming data instead of narrowly relying on model-based inflation forecasts.

Bank of England

For a more in-depth read on the UK government’s mini-budget check out this section in The Morning Hark from Monday. And for the market dysfunction that caused the BoE to implement a temporary YCC-style policy, check out their piece from Thursday.

Statement on Mon: MPC will make a full assessment at its next scheduled meeting of the impact on demand and inflation from the government's announcements and the fall in GBP. Will not hesitate to change interest rates as necessary to return inflation to 2% target. Monitoring developments in financial markets very closely in light of the significant repricing of financial assets.

Statement on Wed: BOE will carry out temporary purchases of long-dated gilts to restore orderly market conditions, purchases will be on whatever scale is necessary to achieve this outcome, will be strictly time-limited from today until October 14, MPC's target of 80 bln GBP stock reduction annually remains unaffected, beginning of gilt sales postponed to October 31.

Bean (ex deputy governor). Tue: Emergency bank meeting may have made sense, "The key thing is, if you call it, you have to take significant action".

Pill. Tue: BOE likely to deliver a significant policy response to announced tax cuts in November, hard not to come to the conclusion that a significant response will be required. Ready to take unpopular decisions. Repricing of assets reflects normalisation after decade of easy policy, MPC views market development through price stability lens, recent developments add to challenge on inflation target. Not selling gilts into a disorderly markets.

Ramsden (Hawk). Thu: Alert to further signs of stress, BOE purchases will be unwound in an orderly manner once risks ebb.

Pill. Thu: Fiscal easing will require a significant and necessary monetary policy response in November, yesterday's operation was intended to prevent painful and self-fulfilling market dynamic, was not a monetary policy operation, not intended to cap or control longer-term interest rates.

Reserve Bank of New Zealand

Orr. Mon: New Zealand's tightening cycle is very mature but there's still a little bit more to do.

Bank of Canada

Macklem. Mon: Inflation is too high, interest rates need to go up to slow spending and give the economy time to catch up.

Swiss National Bank

Maechler. Mon: Declines to comment on further interest rate moves, ready to buy foreign currencies if CHF is too strong and buy CHF if it is too weak, the impact of the exchange rate on inflation is important and not a set level. Sees a weakening economy but no recession in Switzerland.

Bank of Japan

Shinohara (ex FX diplomat). Mon: Further yen buying intervention will be limited in scale, aimed at smoothing volatility rather than defending a certain exchange rate.

Suzuki (FinMin). Mon: No change to stance we will respond to market moves as needed, both government and BOJ are concerned about weak yen.

Kuroda. Mon: Intervention was the appropriate move, don't think government's intervention and BOJ's policy are contradictory. Retracts comment that rate guidance would stay unchanged for 2-3 years. Uncertainty over Japan's economy extremely high, must keep up ultra-easy policy, ready to take various easing steps without hesitation as needed if risks to Japan's economy materialize.

Amamiya. Mon: Will seek to achieve price goal sustainably through monetary easing, Japan's economy is picking up, must watch carefully how FX moves affect prices and the economy.

Economic Data

Monday, 26.09.22

For a more in-depth read on the UK mini-budget and the fallout check out the links and statements in the Central Bank section on the Bank of England above.

Tuesday, 27.09.22

Consumer Confidence in the US surprised to the upside pretty significantly:

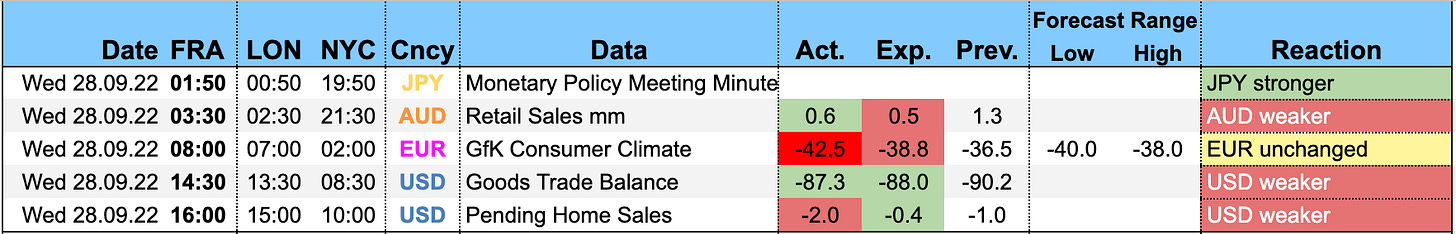

Wednesday, 28.09.22

Thursday, 29.09.22

The ANZ Business Confidence ticked up but remains pretty depressed:

Friday, 30.09.22

Market Analysis

Growth and Inflation

The Atlanta Fed GDPNow model estimates annualized Q3 growth at 2.4%, which is up by 2.1% from last week:

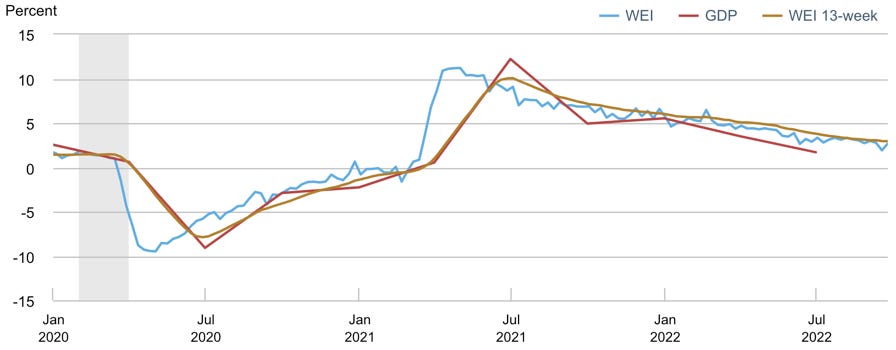

The NY Fed Weekly Economic Index puts 4-quarter GDP growth at 2.68%:

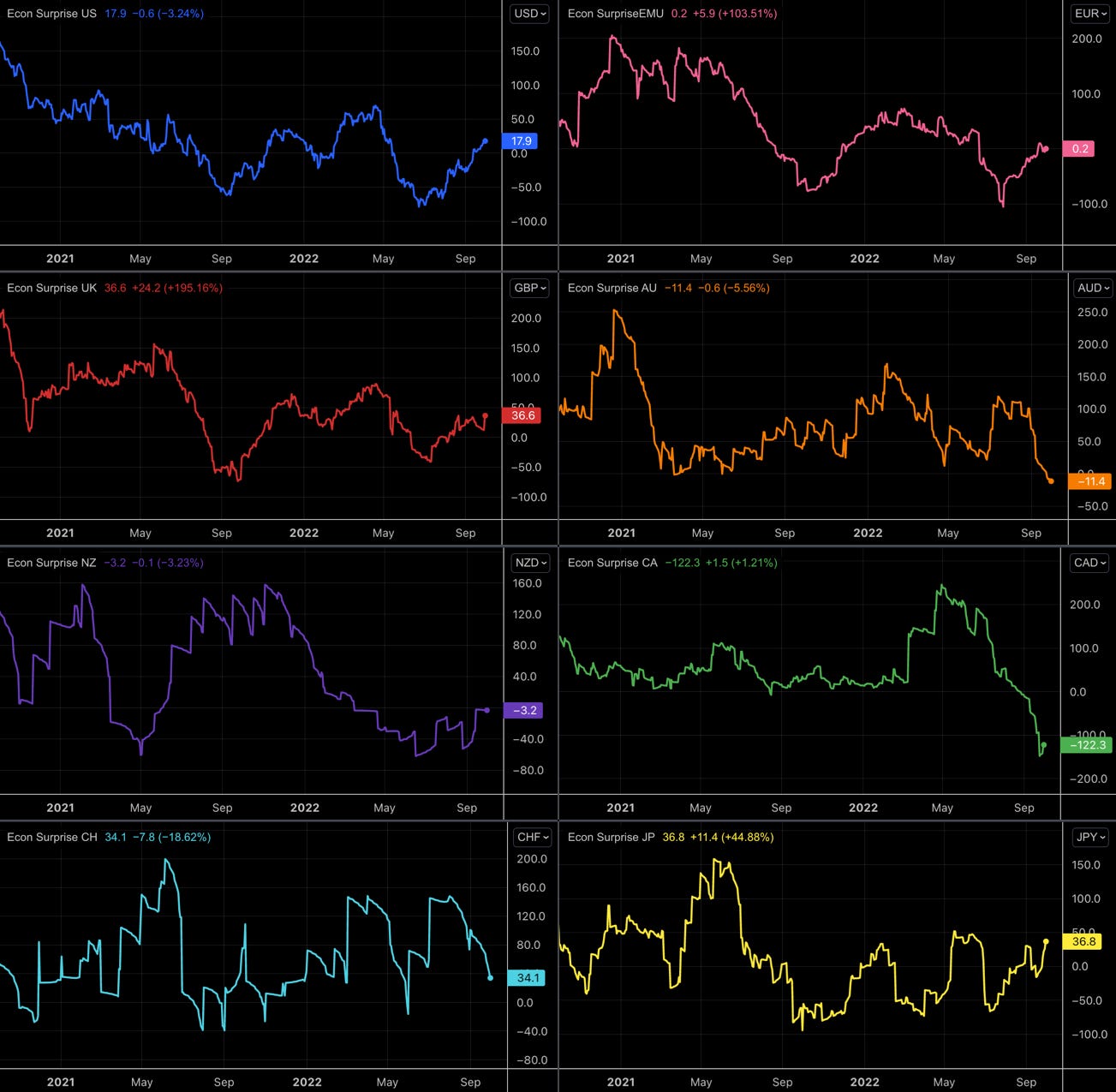

Citi Economic Surprise Index:

Trending up for USD and JPY

Up but looking less strong are EUR and GBP

Down and/or weakening are AUD, CAD, CHF

Bottoming in NZD

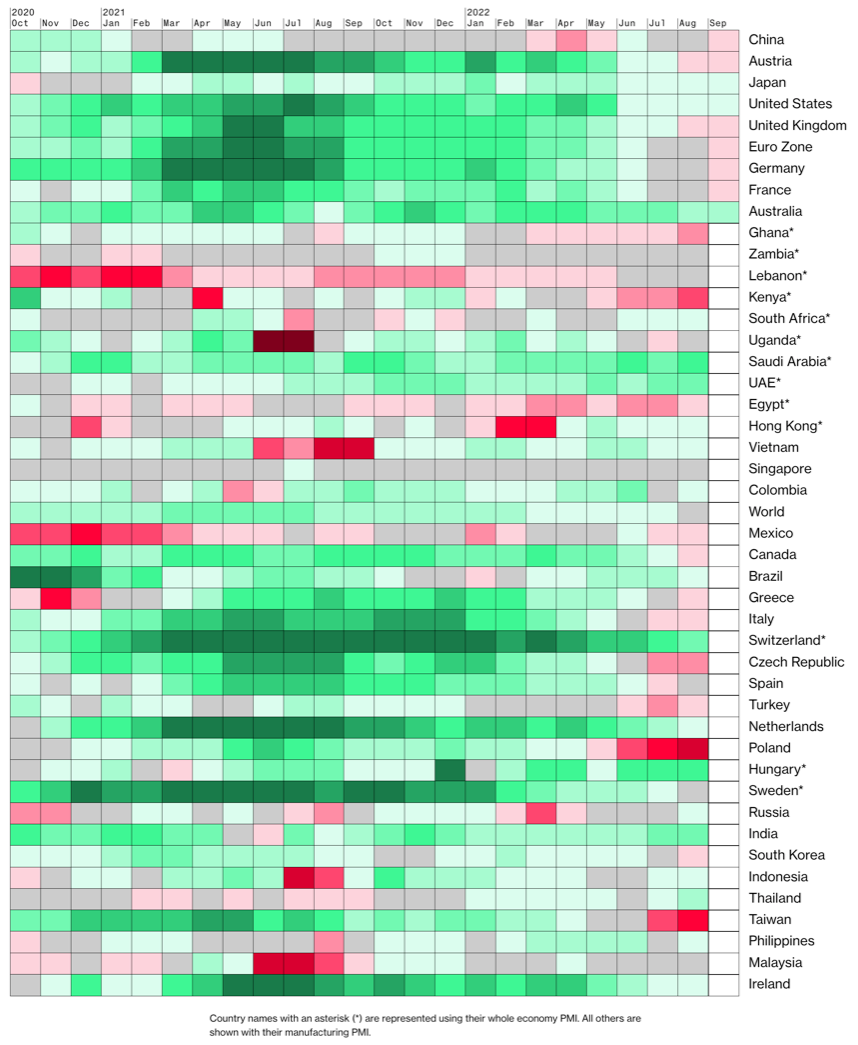

Bloomberg PMI heatmap:

Global PMIs are slowly getting worse, especially the Chinese print last week.

US and Australia remain unchanged in September, the Eurozone has worsened, the UK remains weak

Taiwan, South Korea, China are all weak or in pretty bad shape, which doesn’t bode well for the global economy

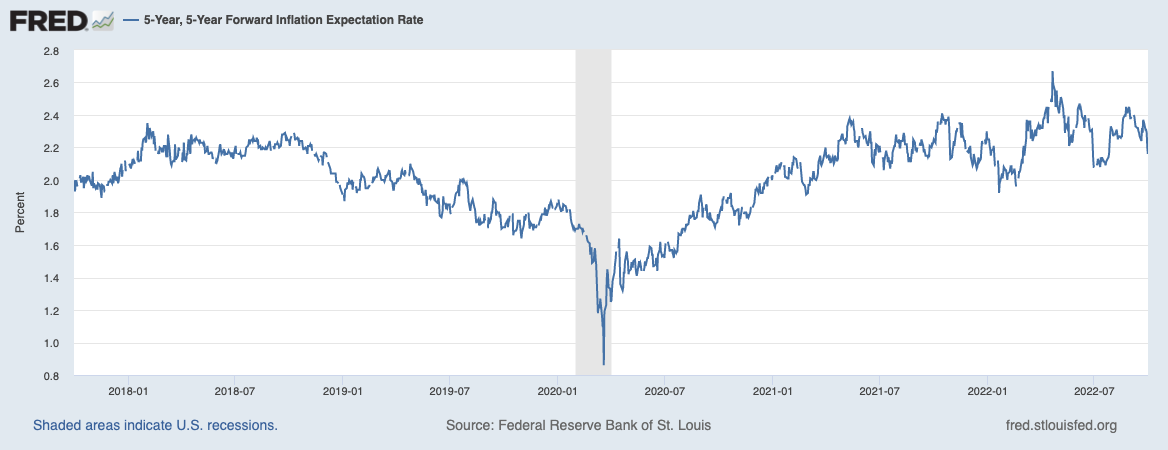

5y5y forward inflation expectations are still in the middle of their range but have lost some decent ground this week:

Breakeven inflation rates are making lower highs and now lower lows as well:

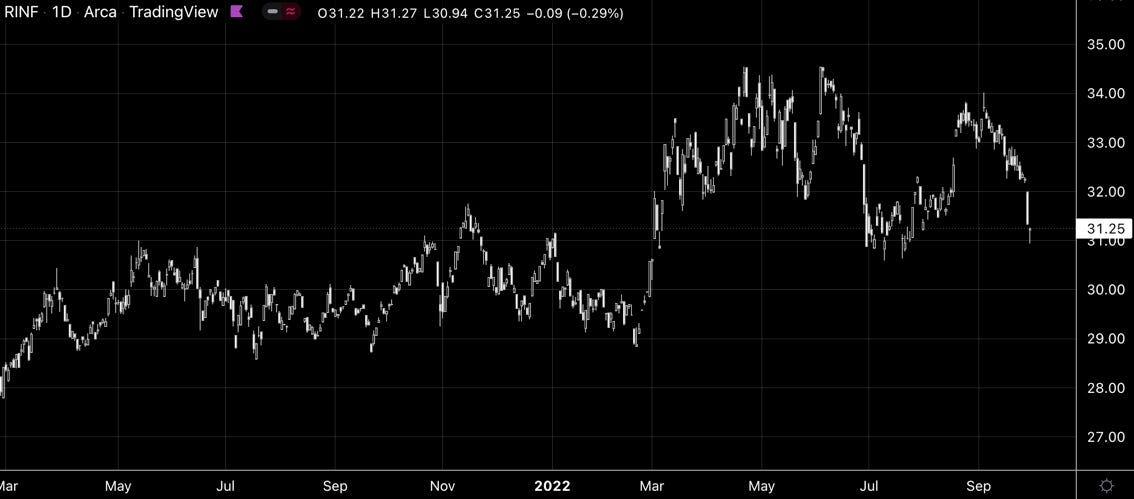

Quite a drop in RINF this week as well:

Citi Inflation Surprise Indexes have not yet updated, so the overall picture remains:

USD, EUR, AUD, CAD moving lower

GBP and CHF at/near highs

Yields

Looking at the chart and table below:

UK is the yield “outperformer”…

CAD, AUD and NZD are lagging USD and EUR

Yield curves at the 2s10s spread:

The German curve flirted with inversion this week

The US, Canadian and UK curves remain solidly negative

The global flattener continues

Central Banks

The pricing of the Fed tightening cycle softened this week according to FedWatch:

75 bps at the November meeting now 53% vs. 73% last week

December is still being priced with a 50 bps hike

The terminal rate shifted down by about 25 bps

Short-term interest rates are pricing about 3-4 more hikes this year depending on whether we're looking at Fed Funds or Eurodollar futures. Next year is a coin toss between a small hike or none. 2024 rate cuts have been priced out again to a large extent:

Sectors and Flows

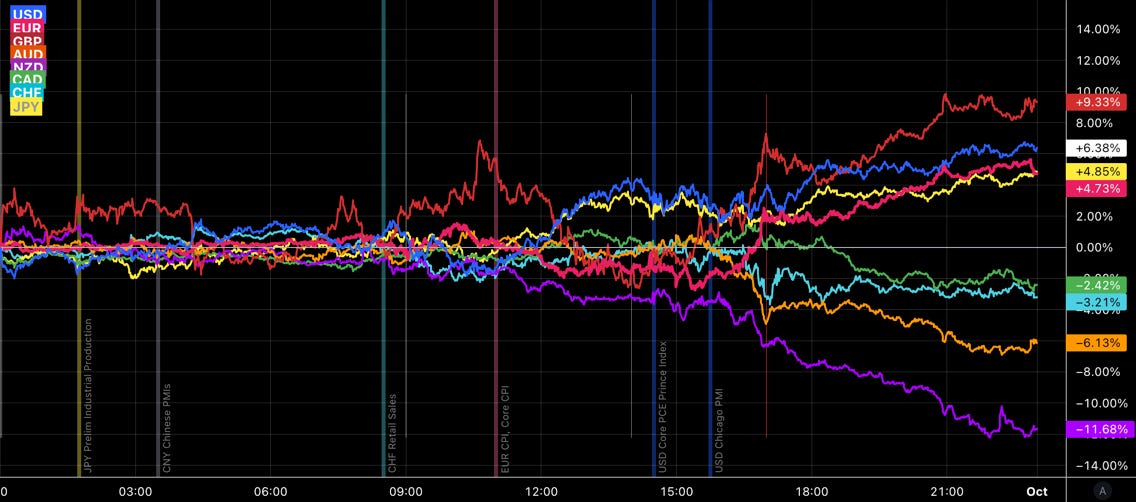

Currency strength is pretty interesting these days:

Long-term (3 months): USD and CHF are the clear outperformers while NZD, GBP and AUD are the underachievers

Medium-term (1 month): USD and CHF on top again, EUR comes in third; the weak ones are NZD, AUD and CAD

Short-term (1 week): GBP is the clear outperformer followed by EUR and USD while the trio NZD, AUD and CAD is once again far behind

ETF flows have seen some significant inflows into equities (SPY, QQQ, VOO, VTI) and short-term treasuries (BIL) while short QQQ has seen outflows (SQQQ) as well as corporate credit (LQD, EMB).

Equity sector performance:

Oil, Gas and Energy (XOP, OIH, XLE) at/near the top but barely, if at all, positive

Utilities (XLU) and Staples (XLP) are the worst performing sectors

Basic Materials and Metals/Mining (XLB, XME) are all over the place

All in all, it's a bearish-looking chaos without much clarity

A different look at sector performance makes it a (small) bit clearer:

Healthcare and Consumer Defensives on top

Financials relatively strong (I wonder why with the inverted yield curve)

Cyclicals and Industrials somewhere in the middle and solidly negative

Sector charts… it's not looking pretty. The sell-off in Utilities (XLU, bottom left) is staggering.

International stock market indexes:

Same as last week: Brazil and India (IBOV and SENSEX) continue to outperform

Hang Seng is by far the worst performing market, Taiwan and Korea are near the bottom as well

BNY Mellon iFlow:

Negative equity flows across the board for G10s, positive for Brazil, India and Thailand

FX Flows are positive for AUD, CAD, CHF

Sentiment and Positioning

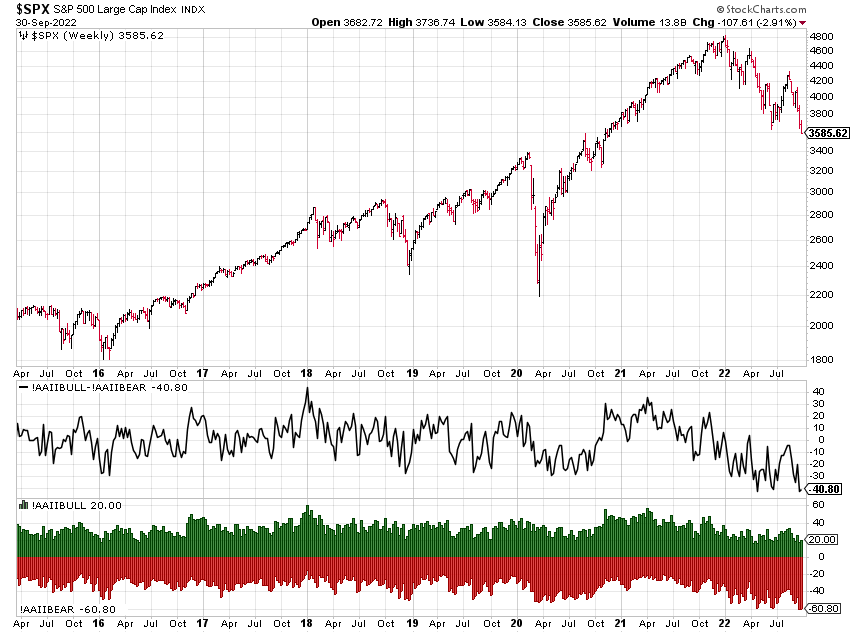

AAII Bull-Bear sentiment has made a new low with the number of bears at the highest level ever:

Currency sentiment remains broadly unchanged from last week:

Very negative for CHF and USD

Very positive for NZD, JPY and GBP

Different sentiment source:

JPY sentiment is still overwhelmingly positive

GBPUSD is still positive but the number of shorts this week has more than doubled, same for EURUSD where shorts have increased by over 60%

Commitment of Traders and futures performance:

Equities continue to have a hard time, their Relative Strength is now at an RSL of around 0.90. The bullish Commercial/Large Trader positioning we've seen over the last weeks has come off highs (see below).

Treasuries in the short end have been positive this week while the rest of the curve has seen negative performance. COT positioning is very bullish in the short end as well.

Currencies were mixed vs. the dollar. Noteworthy is the level and the 1-week change of 6C positioning: Commercials are at a 1-year high, Large Traders are at a corresponding 1-year low, and the 1-week change in Commercial and Large Trader positions is at a Z-score of 2.33 and -2.68, respectively.

Energy mixed again this week, weak overall with RSLs of around 0.86 or so. Bullish positioning in Crude and Natural Gas.

Metals had a positive week, Palladium is the outperformer.

Grains and Softs were mixed.

Combined equity positioning: as mentioned above, Commercials have come off highs, Large Traders and Small Specs off lows:

COT/TFF Dealer positioning for currencies:

USD near 104-week lows with a %R of 0.03

CAD approaching 104-week highs (%R 0.97)

CitiFX PAIN indexes:

The dollar long reached a new high

CAD shorts reached a new low as did shorts in EUR and GBP

Market Risks

Credit spreads: HY-OAS approaching their high, IG spreads remain pretty contained.

Credit Spread Index already made a new high:

The New York Fed Corporate Bond Market Distress Indexes are flying for IG while high-yield remains pretty quiet:

Currency volatility: IV in GBP has jumped higher with what went on during the last two weeks, AUD and NZD are trending higher.

The VIX term structure is flat to backwardation-ish:

Volatility indexes:

VIX/VIX3M is near highs but it's only 0.99, so there's no “top” here

MOVE made a new high of around 160

VIX remains in its range and far below 40

TDEX has come to life: there's a need for tail hedges but that's still pretty much contained comared to the May high

VIX/VOLI and SDEX are also pretty complacent

It's quite surprising that with everything that's going on that skew remains that flat and TDEX remains that quiet.

The CNN Fear & Greed Index prints 15 and is in Extreme Fear territory. Notably, we've been a good way lower in April/May this year.

Various

Market breadth isn't helping here: the NYSE Advance/Decline line is tracking price closely, there's no divergence.

The percentage of S&P 500 stocks above their 200-day moving average is below its June low:

25-delta risk reversals:

There's a clear divergence between the move higher in GBPUSD and the new low in the risk reversal. The options market thinks we're going to head lower.

The divergence in USDJPY is also widening: options traders are hedging their downside.

Various ratios are pointing to higher equities:

XLF/XLU is up

SLV/GLD and HG/GC are solidly above lows

USDKRW (light blue) is getting wrecked by the strong dollar, though

New month, new seasonality:

Bearish: CAD, EUR, CHF

Bullish: USD

Other Stuff I've been looking at

Turkey, Hungary and Chile are the most vulnerable EMs to the dollar wrecking ball:"

The current market environment hurts but it’s far from disorderly:

It might be a bear market but it’s pretty tamed so far by this metric:

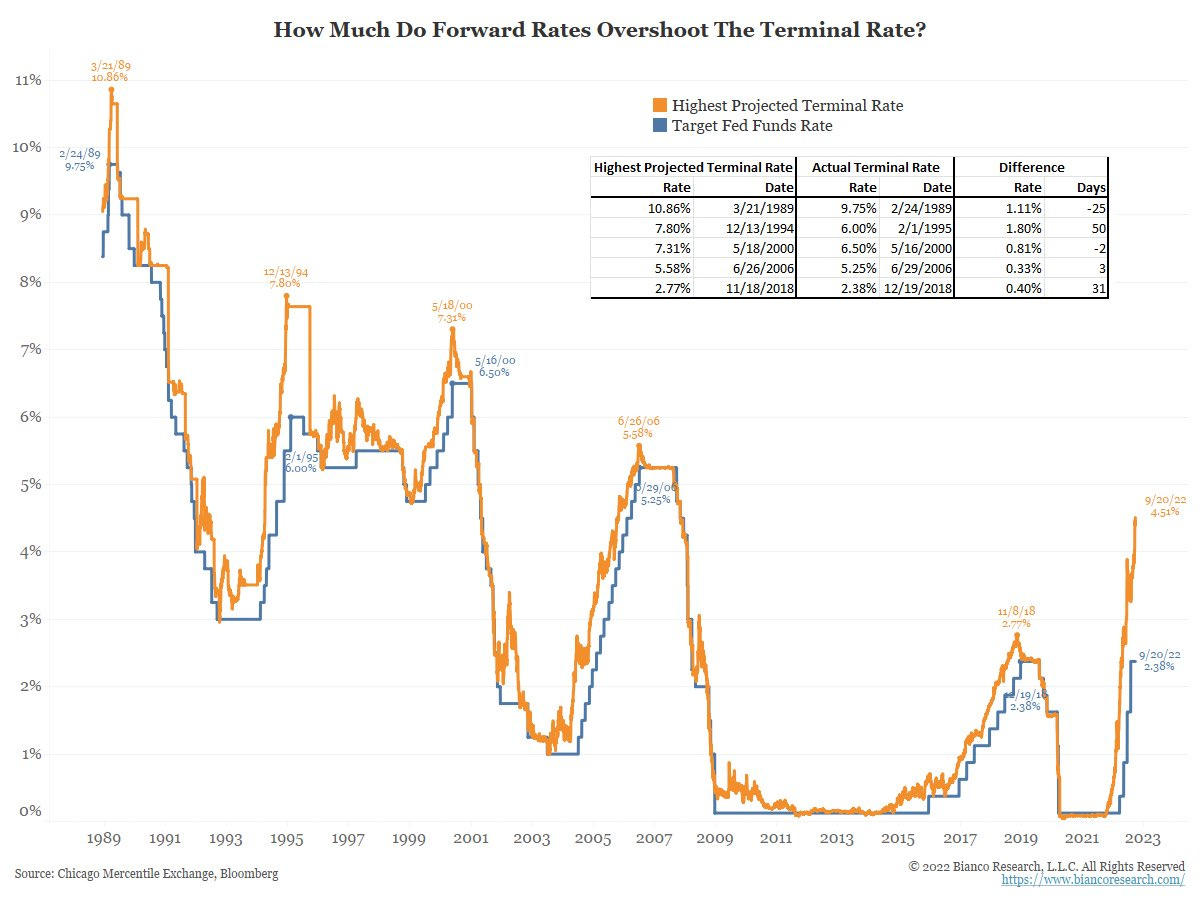

From Daily Chartbook: “The highest projected terminal Fed funds rate based on contracts 10 months out is at 4.51%. The “market has generally done OK job of seeing where rate ultimately landed”.

Cycle analysis of the US housing market:

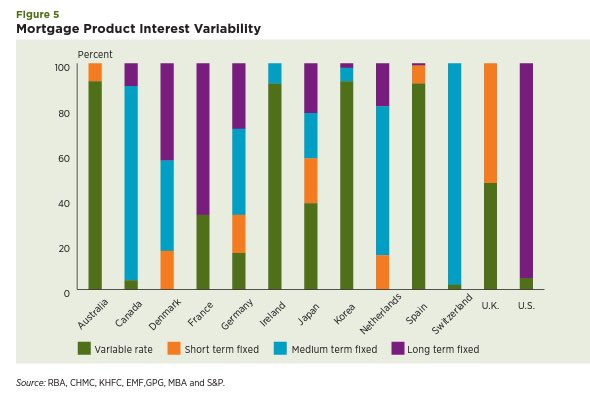

… and the US is in a pretty good spot compared to Australia, Ireland, Korea, Spain and the UK:

Earnings estimates are being downgraded:

Sentiment is wild:

LEI y/y is currently below zero and falling, that’s not a good sign for stocks:

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 39/2022 | 31/2022 FOMC Meeting Minutes: 34/2022 | 28/2022 | 25/2022 Crib Sheets: 37/2022

ECB

Rate Statements: 37/2022 | 30/2022 Meeting Minutes: 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 36/2022

BOE

Rate Statements: 39/2022 | 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 37/2022

RBA

Rate Statements: 37/2022 | 32/2022 | 28/2022 Meeting Minutes: 39/2022 | 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 32/2022

RBNZ

Rate Statements: 34/2022

BOC

Rate Statements: 37/2022 Crib Sheets: 36/2022

SNB

Rate Statements: 39/2022 | 25/2022 Crib Sheets: 37/2022

BOJ

Rate Statements: 39/2022 | 30/2022 | 25/2022 Summary of Opinions: 31/2022

Image Credit: DALL-E 2 "Doom and gloom, a sense that danger is ahead"

Great review & analysis, perfect Sunday read before the next week. Thank you, appreciate!

Awesome!!!