Outlook for Week 39/2022

What a crazy week... four central banks, a yen intervention, a few PMIs...

Welcome to issue #24 of fx:macro!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary. The final section is a collection of things I read during the week that influence my thinking.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

Before we dive in, I’d like to give a big shout-out to The Morning Hark!

For me, it’s a must-read every day. Here’s what’s in it:

Overnight action in key asset classes including commodities, fixed income and crypto,

Current macro themes with a review of the previous day’s economic data releases, central bank speakers and more,

Main highlights ahead with a comprehensive list of upcoming data and events,

The top 5 trending posts on app.harkster.com, and

A section with links to more in-depth pieces or useful information on current macro themes.

The Morning Hark is a great way to stay on top of what’s going on in markets. If you like fx:macro, you will love The Morning Hark, so check it out!

Table of Contents

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Here’s the Diffchecker link to highlight the edits in the summary from the last edition.

Relevant market risks I have on my radar (it's obviously not a comprehensive list and mostly unchanged from last week). If you have any suggestions, please don’t hesitate to leave a comment:

Europe:

Italian elections coming up, risk of a Euro-sceptic right-wing PM

An unexpected resolution of the Ukraine war seems very unlikely, but it could escalate very quickly especially given the mobilization and referendums

UK: The rabbit is out of the hat with Truss and Sunak; coordination between the government and the BOE seems non-existent, I’ve read calls for an emergency inter-meeting rate hike already

Global markets: the risk from commodity market squeezes spilling over seems to have diminished a bit; it's become a major factor in energy and electricity markets

China/Taiwan: keeping an eye on the Taiwanese stock market as a risk gauge

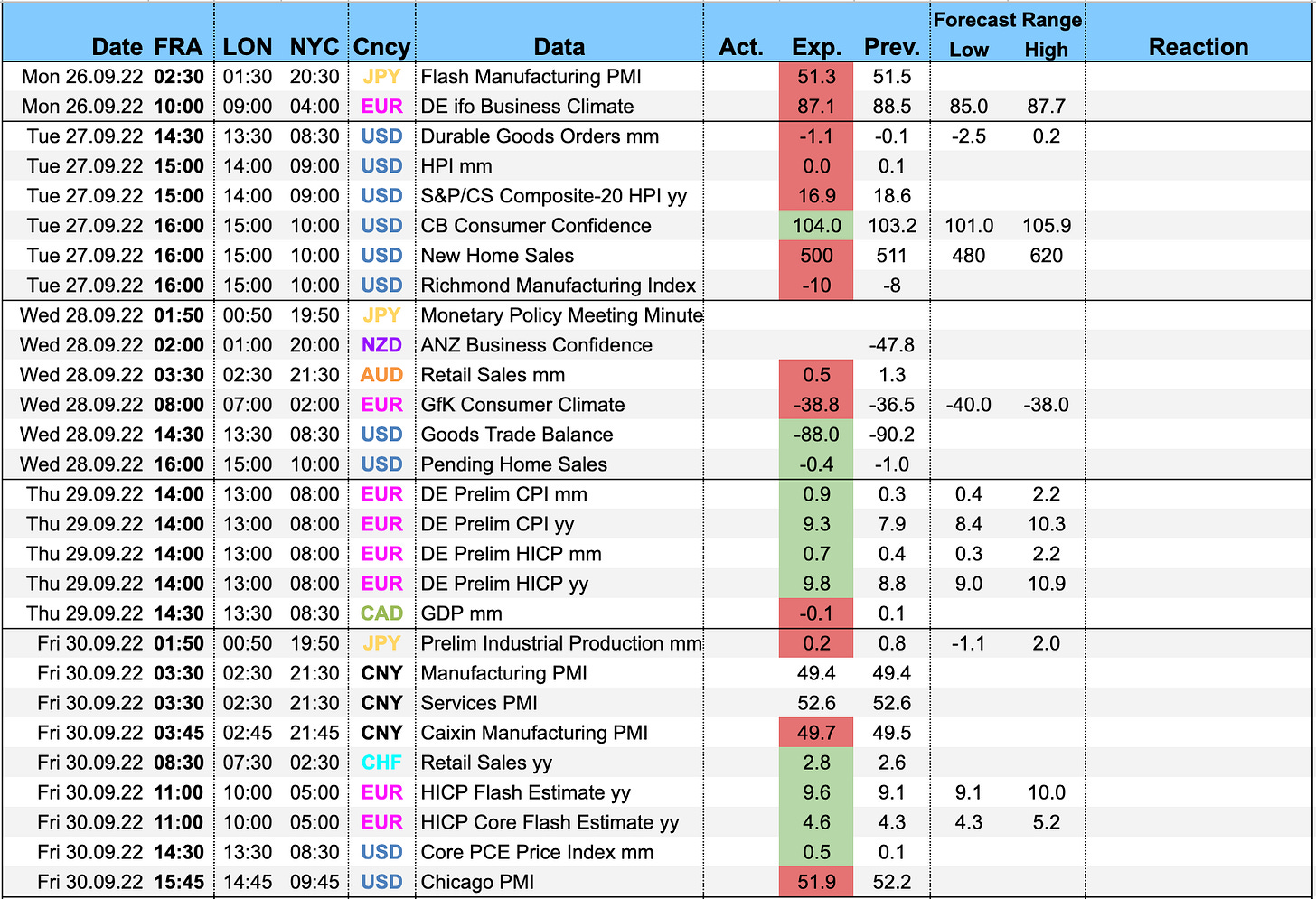

Economic Calendar for next week

Important levels to watch and look out for in the Majors

Week in Review

Central Banks

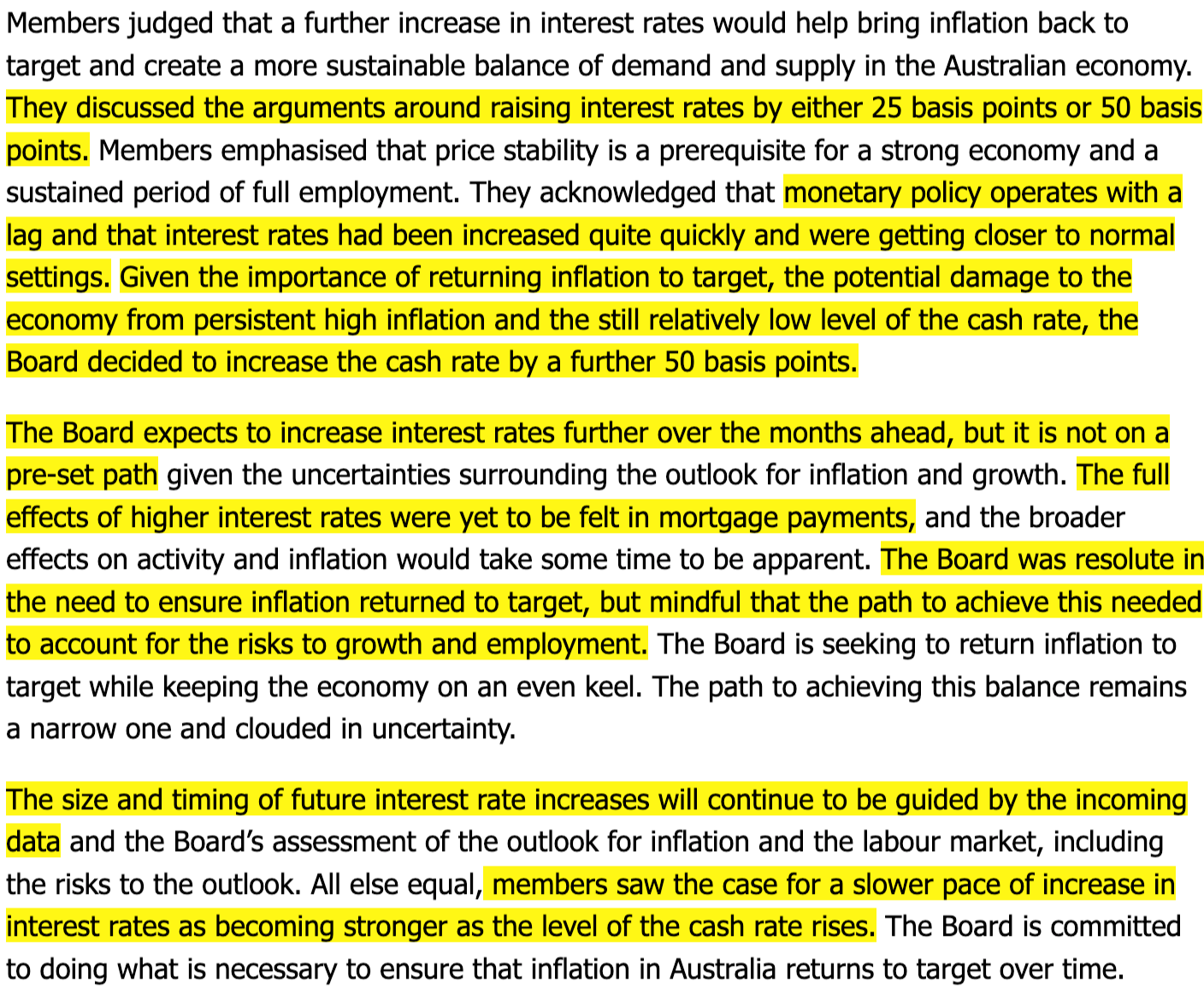

RBA Meeting Minutes (20.09.)

Nothing surprising in there. Here’s the link to the full text and some of the key points from the release:

Inflation is expected to peak later this year and then decline, medium-term inflation expectations remain well anchored

CPI forecast around 7.75% over 2022, a little above 4% over 2023 and around 3% over 2024

The Australian economy was continuing to grow solidly

The labour market remained tight, wages growth had picked up and there were some pockets where labour costs were increasing briskly

As for the monetary policy decision:

FOMC Rate Decision (21.09.)

The Fed hiked by 75 bps as expected to 3.00-3.25%. The statement was virtually unchanged from the one in July except for the growth assessment:

From the Summary of Economic Projections:

GDP has been downgraded through 2024

2022 from 1.7 to 0.2%

2023 from 1.7% to 1.2%

2024 from 1.9% to 1.7%

PCE inflation was upgraded through 2024 as well

The projected Fed Funds Rate has been upped significantly:

2022 from 3.4% to 4.4%

2023 by 0.8% from 3.8% to 4.6%

2024 by 0.5% from 3.4% to 3.9%

Here’s the dot plot (with June’s plot embedded for comparison):

The whole thing shifted up considerably

2023 does not see rate cuts

The distribution of dots for 2023 is a lot less scattered, indicating more consensus/determination among FOMC members than three months ago

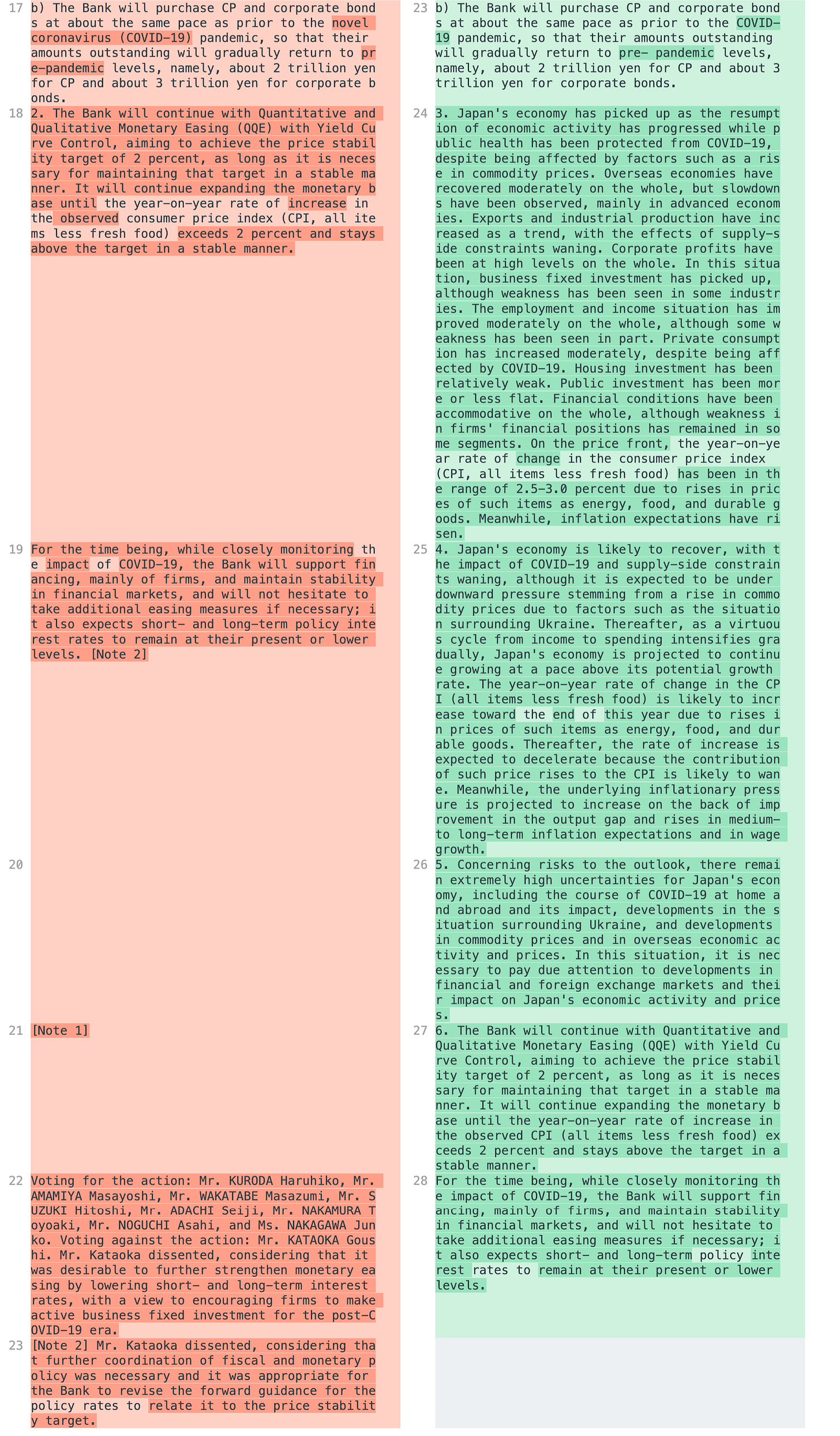

Bank of Japan Rate Decision (22.09.)

As expected, the BOJ left its policy rate and yield curve control unchanged. Link to full text here, summary and difftext below:

The BOJ will continue with QQE and YCC as long as necessary to achieve its price stability target of 2%, they will increase the monetary base until the YoY CPI exceeds 2% and stays above target in a stable manner

YoY changes CPI are expected to increase toward the end of this year but decelerate afterwards

The Special Funds-Supplying Operations to Facilitate Financing in Response to the Novel Coronavirus has been phased out in favour of unlimited Funds-Supplying Operations against Pooled Collateral

Swiss National Bank Rate Decision (22.09.)

The SNB hiked by 75 bps as expected. Here’s the link to their Monetary Policy Assessment with the summary and difftext below:

Guidance remains unchanged: “It cannot be ruled out that further increases in the SNB policy rate will be necessary…”

Inflation has spread to goods and services so far less affected, the average annual inflation forecast is now: 3%, 2.4% and 1.7% for 2022, 2023 and 2024

Domestic growth in Q2 was 1.1% and weaker than expected, the labour market remains positive, growth in 2022 is now expected to grow at around 2%, about 0.5% lower than previously projected

The SNB explicitly acknowledges the risk of gas shortages in Europe and electricity shortages in Switzerland

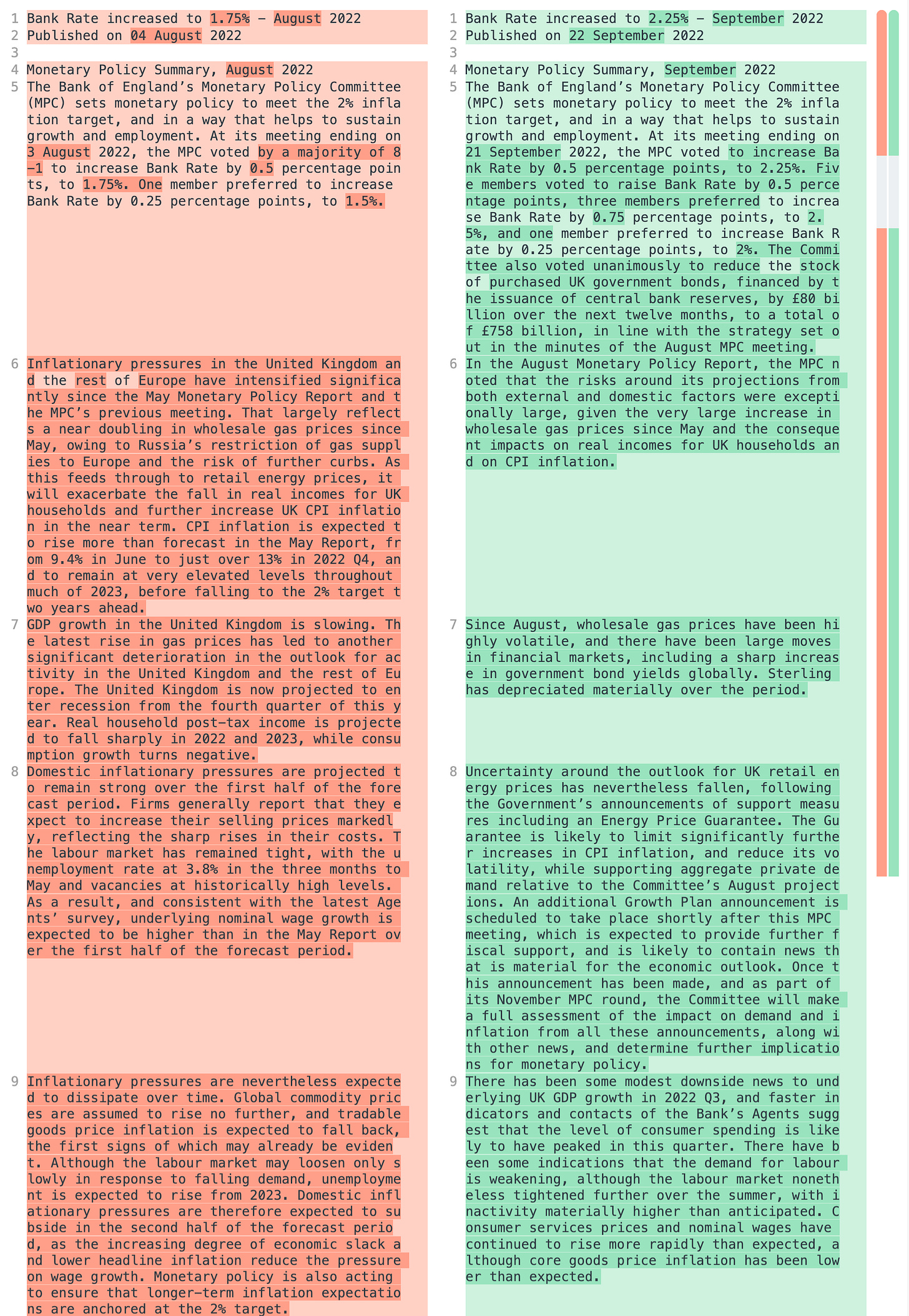

Bank of England Rate Decision (22.09.)

The BoE hiked by 50 bps along expectations. Here’s the link to the full release, summary and difftext below:

The vote to hike was unanimous:

Three members preferred a 75 bps hike

One member preferred a 25 bps hike

Unanimous vote to reduce the holdings of UK government bonds by £80 bln (maturing gilts and gilt sales) over the next twelve months as outlined in the August MPC minutes

Forward guidance softened a bit: they dropped the “particularly alert to inflationary conditions” for “should the outlook suggest more persistent inflationary pressures”

The UK government’s Energy Price guarantee is likely to limit further increases in CPI and increase demand relative to prior projections

CPI is now expected to peak at just under 11% in October, remain above 10% for a few months and then fall back

Household spending is likely to be less weak as a result, this would add to medium-term inflation

Friday’s mini-budget will have a material impact on the economic outlook and will influence the November meeting

The level of consumer spending has likely peaked, the demand for labour is weakening but the labour market remains tight

From the Meeting Minutes:

Confab, Speakers, News

Federal Reserve

Powell (Neutral). Wed post-FOMC: There's still a way to go on rates, restoring price stability will require holding rates at restrictive levels for some time, we've just moved to the "very lowest level" of restrictive, history cautions against premature rate cuts, we will keep at it until the job is done, pace of rate hikes will depend on data, at some point we will slow the pace of rate hikes to assess the impact of prior hikes. We'll need softening in the labour market, so far there's only modest evidence it's cooling off. The alternative to a recession is much worse.

European Central Bank

Nagel (Hawk). Weekend: More rate hikes have to follow if data trend continues, that's already agreed in the GC. We must bring inflation under control even if the economy worsens, have to be determined in October and beyond. Fri: ECB needs to keep raising rates and stop bond purchases once their job is done, no comment on size of October rate hike, the fight against inflation comes with burdens, must raise rates even if this dampens growth.

Lane (Dove). Weekend: Rates could go up at each remaining meeting this year and early next year, we do think this will dampen demand, not going to pretend it's pain-free, recession cannot be ruled out.

De Guindos (Dove). Mon: Further interest rate increases will depend on economic data.

De Cos (Dove). Mon: Magnitude of the slowdown is key regarding monetary policy decision.

Lagarde (Dove). Tue: Terminal rate will depend on the inflation outlook, if there were evidence of inflation expectations de-anchoring the required policy rate would lie in restrictive territory, inflation expectations remain relatively well anchored.

Schnabel (Neutral). Wed: We must further increase interest rates, recession in Germany may be unavoidable, inflation could rise further in the short term even despite rate hikes. Thu: Reasons to believe inflation will rise further, more persistent than we thought, risk of recession has gone up, labour market is quite resilient, wage data shows that second-round impact has not yet materialized.

Spokesperson. Thu: The ECB has not intervened in currency market to support the yen.

Sources. Fri: ECB focused on changing TLTRO terms to reduce payouts, scrapping ECB remuneration on mandatory reserves or some excess reserves also an option.

Bank of England

Haskel (Hawk). Thu: Not worried about the level of the sterling. It's difficult having a fiscal expansion when supply chains and jobs are tight.

Reserve Bank of Australia

Bullock. Wed: Policy not yet restrictive, will look at opportunities to slow hikes at some point, will be looking at monthly CPI figures but unlikely to have implications for October meeting. RBA is concerned about China's economy, property market and zero Covid policy. Accounting loss for the bank in 2021/22 was $36.7 bln, loss on bond holdings took net equity to -12.4 bln $, will not affect the RBA's ability to do its job, can create money to meet our obligations, will retain future profits and pay no dividend to government until capital is restored.

Reserve Bank of New Zealand

Orr. Mon: Working with 110 central banks to better understand and integrate climate change into their work.

Bank of Canada

Beaudry. Tue: Will continue to do whatever is necessary to restore price stability, inflation is still too high but we're headed in the right direction, don't want monetary policy to be an additional source of uncertainty.

Badertscher (Media Relations). Thu: The BOC is not participating in any FX interventions in support of the yen.

Swiss National Bank

Jordan. Thu: Further rate hikes cannot be ruled out, there are growing signs that inflation is spreading to goods and services not affected by Ukraine war, recent CHF strength has helped dampen inflation. No set level for interventions to weaken or strengthen the Franc, will intervene on both sides if necessary, no reason to change the assessment of the Franc as being no longer highly valued. Not taking part in coordinated measures to support the yen. Fri: Further interest rate hikes cannot be ruled out, ready to be active in the FX markets, inflation has risen much more than expected, ensuring price stability demands full attention of the bank.

Maechler. Thu: Absorbing liquidity is not intended to reduce the size of the balance sheet.

Bank of Japan

Matsuno (Chief Cabinet Secretary). Thu: Expect the BOJ to continue with appropriate monetary policy taking into account the economic situation.

Kuroda. Thu: Will continue with powerful monetary easing, will not hesitate to east further if necessary, yen weakening has been one-sided with speculative moves. Forward guidance does not need change at the moment because there are downside risks to the economy, will not rule out the possibility of altering forward guidance in the future.

Suzuki (FinMin). Thu: Decided to intervene in the FX market after examining overall trend, no comment on size of intervention or whether it was solo or concerted. Intervention cannot be tied to specific currency levels, will watch overall trend. FX intervention is having intended effects so far.

Kanda (MoF official, top FX diplomat). Thu: Size of FX intervention would normally be announced at the end of the month. Never thought about levels in deciding intervention, action can be taken any day or time including holidays, won't disclose if there were any exchanges with other countries. We are on the same page as the US, will not comment on what the US says.

Kishida (PM). Thu: Recent FX moves were rapid and one-sided, repeatedly caused by speculation that cannot be overlooked, we will take action if there's excessive volatility in the yen. Will issue instructions to ministers about economic package on Sept. 30.

Economic Data

Monday, 20.09.22

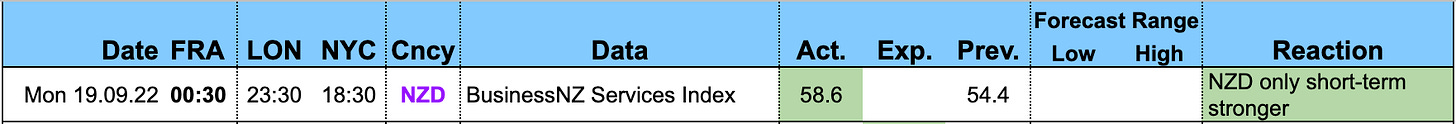

The New Zealand BusinessNZ Services PMI was pretty interesting (emphasis mine): the index is near highs and they expect 5% annualized GDP growth in Q3. Still, the NZD only showed strength for a few hours and notably underperformed the Aussie.

The two key sub-indexes of New Activity/Sales (67.1) and Orders/Business (66.5) both displayed significant gains, while stocks/inventories (59.6) were at its highest level since November 2019. Although Employment (50.8) remained somewhat lacklustre and Supplier Deliveries (49.6) remained in contraction, the positive position of the other sub-index values was more than enough to push the national result higher.

BNZ Senior Economist Doug Steel said that "overall, combining August’s strong PSI with last week’s firmer PMI yields a composite index (PCI) that suggests annual GDP growth up toward 5% in Q3 2022. We currently forecast 5%+ for that period but that strength is mostly a function of the very weak base period. If the PCI is truly bouncing, the key question is for how long?"

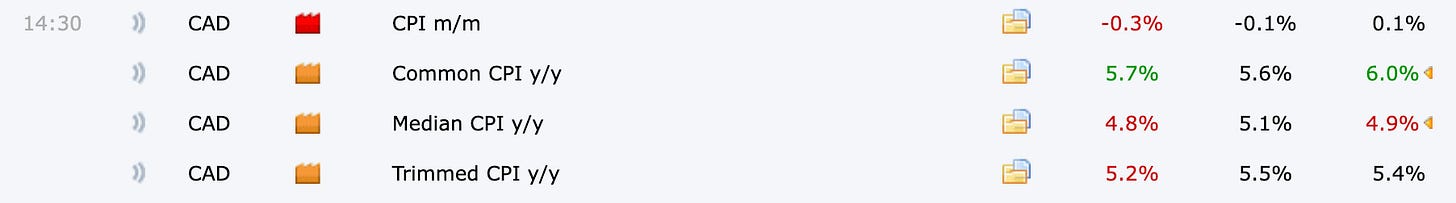

Tuesday, 21.09.22

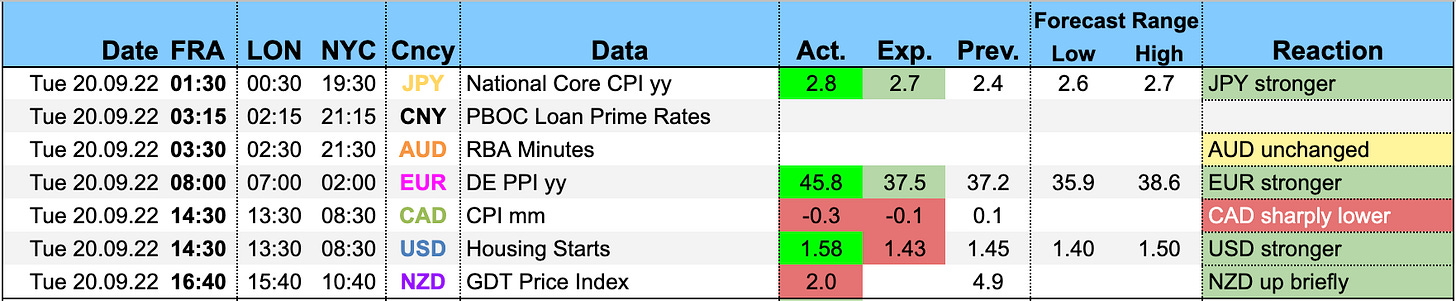

Canadian CPIs came in weaker, including Median and Trimmed:

Wednesday, 22.09.22

The FOMC Statement was covered above in detail.

Thursday, 23.09.22

What a day…

The three central bank statements have been covered in detail above.

The comments from Japanese officials and several other central banks about the intervention in the JPY are also listed in the section above.

Friday, 24.09.22

The barrage of PMI data is shown below in more detail.

Highlights from the Australian PMIs:

“Latest S&P Global PMI Flash data brought about mixed feelings towards the current and future health of Australia’s private sector economy. September data indicated that the recent interest rate hikes made by the RBA have begun to have the desired effect in terms of prices. Inflationary pressures have eased significantly, with rates of input and output cost inflation both dipping to seven-month lows. At the same time, the private sector has remained in expansion territory with the pace of growth even accelerating very slightly from August.”

“On the negative side, the full effects of recent interest rate hikes will be lagged - taking a while to feed through onto consumer demand patterns and subsequent economic data. Should the RBA continue to increase the base rate further, the private sector economy may be at risk of heading into contraction territory in the future as disposable incomes across the nation tighten and overall demand conditions remain subdued. Latest survey data has already provided some evidence of this with the rates of expansion in output and demand only mild in September, and business confidence the lowest since the outbreak of the COVID-19 pandemic.”

Highlights from the Eurozone PMIs:

“A eurozone recession is on the cards as companies report worsening business conditions and intensifying price pressures linked to soaring energy costs.

“The early PMI readings indicate an economic contraction of 0.1% in the third quarter, with the rate of decline having accelerated through the three months to September to signal the worst economic performance since 2013, excluding pandemic lockdown months.

“Germany is facing the toughest conditions, with the economy deteriorating at a rate not seen outside of the pandemic since the global financial crisis.

“With demand slumping and companies growing increasingly pessimistic about the outlook, the survey’s forward-looking indicators point to a steepening economic decline for the eurozone in the fourth quarter, adding to the likelihood of the region falling into recession.

“Although there were some signs of supply chain constraints easing, the focus of concern has clearly shifted away from supply chains to energy and the rising cost of living, which is not only hitting demand but also limiting manufacturing production and service sector activity in some cases.

“The surge in energy costs has meanwhile reignited inflationary pressures which, having shown some signs of cooling in prior months amid easing supply shortages, have reaccelerated.

“The challenge facing policymakers of taming inflation while avoiding a hard landing for the economy is therefore becoming increasingly difficult.”

Highlights from the UK PMIs:

“UK economic woes deepened in September as falling business activity indicates that the economy is likely in recession. Companies report that the rising cost of living, linked to the energy crisis, and growing concerns about the outlook are subduing demand and hitting output levels to an extent not seen since 2009, barring the pandemic lockdowns and initial 2016 Brexit referendum shock.

“Forward-looking indicators meanwhile deteriorated further in September. Both the new orders and future expectations gauges have descended to levels which have rarely been weaker in the past, and are consistent with a deepening downturn as we head into the fourth quarter.

“Inflationary pressures continue to run higher than at any time in over two decades of survey history prior to the pandemic. Renewed supply constraints, soaring energy prices and rising import costs associated with the weakened pound are adding to cost pressures, meaning the overall rate of inflation signalled will remain of great concern to policymakers at the Bank of England. However, the detrimental impact of tightening policy into a recession is becoming increasingly apparent, with the downturn likely to intensify as we head into winter.”

And finally, the US PMIs:

“US businesses are reporting a third consecutive monthly fall in output during September, rounding off the weakest quarter for the economy since the global financial crisis if the pandemic lockdowns of early-2020 are excluded. However, while output declined in both manufacturing and services during September, in both cases the rate of contraction moderated compared to August, notably in services, with orders books returning to modest growth, allaying some concerns about the depth of the current downturn.

“There was also better news on inflation, with supplier shortages easing to the lowest since October 2020, helping take some of the pressure off raw material prices. These improved supply chains, accompanied by the marked softening of demand since earlier in the year, helped cool overall the rate of inflation of both firms’ costs and average selling prices for goods and services to the lowest since early-2021.

“Inflation pressures nevertheless remain elevated by historical standards and, with business activity in decline, the surveys continue to paint a broad picture of an economy struggling in a stagflationary environment.”

Market Analysis

Growth and Inflation

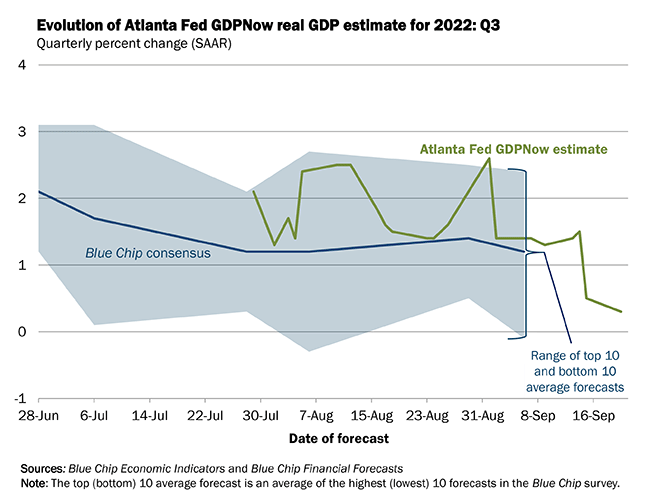

The Atlanta Fed GDPNow model estimates Q3 GDP growth at 0.3%. The trend of estimates has been steadily lower for the last weeks.

The NY Fed Weekly Economic Index is also trending lower and estimates four-quarter GDP growth at 1.82.

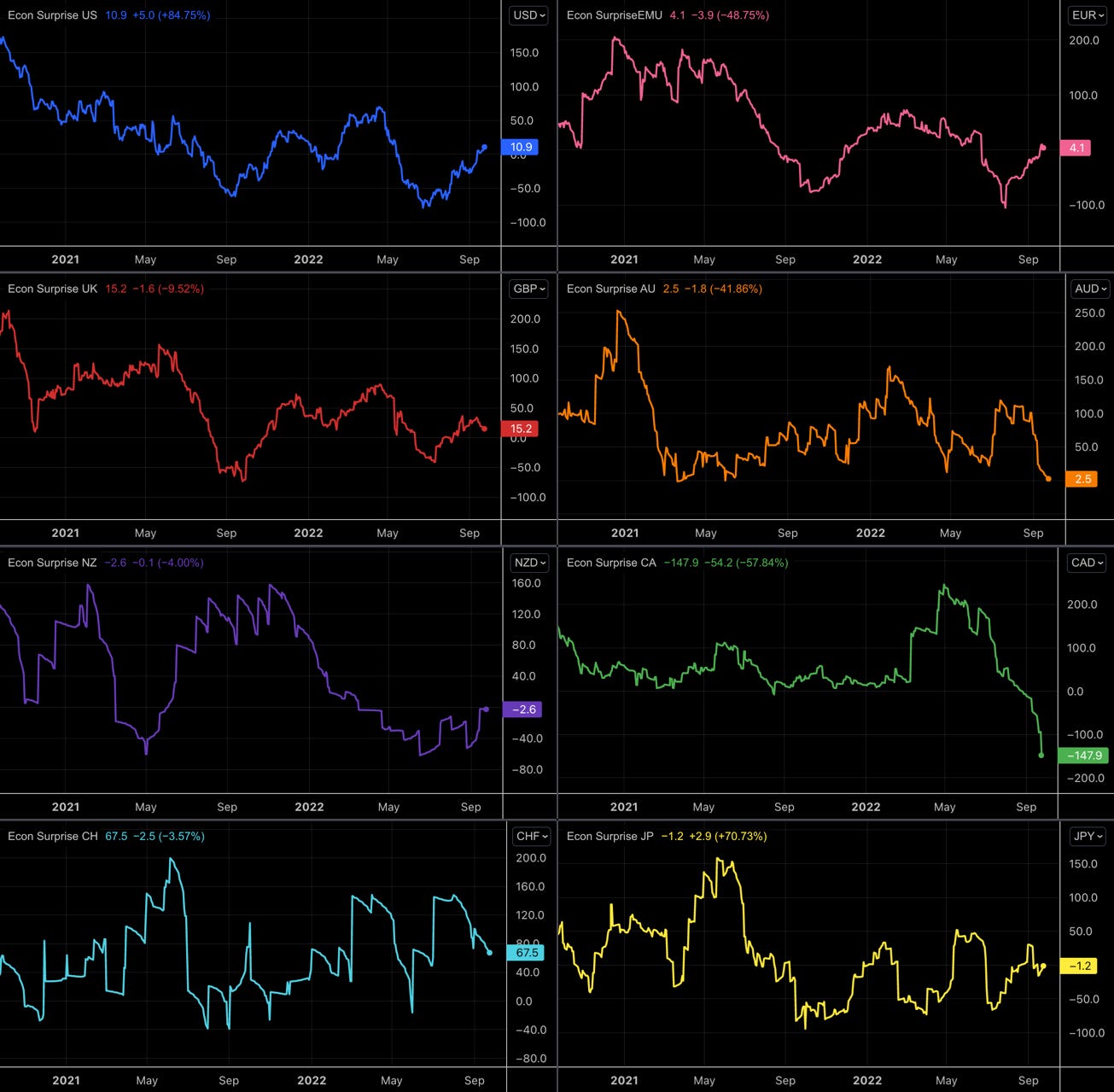

Citi Economic Surprise Indexes:

USD and EUR are moving higher

AUD and CHF are moving lower

GBP is looking like it’s rolling over

CAD is in freefall

NZD may be bottoming

Bloomberg PMI heatmap:

US and Australia remain unchanged in September, the Eurozone has worsened, the UK remains weak

Taiwan, South Korea, China are all weak or in pretty bad shape, which doesn’t bode well for the global economy

5y5y forward inflation expectations continue to trade sideways. The latest prints higher are interesting given what has happened to crude oil and the energy complex.

RINF is also in the middle of its trading range:

Inflation breakevens have been trending lower from their highs for a few months now:

Citi Inflation Surprise Indexes have not yet updated, so the overall picture remains:

USD, EUR, AUD, CAD moving lower

GBP and CHF at/near highs

Yields

See chart and table below:

UK yields have been through the roof on the “mini”-budget

US and German yields look strongest

CAD seems the weakest, AUD and NZD not much better

Yield curves along the 2s10s spread:

Flattening across all curves

Not sure if the negative prints in Swiss yields are data errors, but that would five out of eight G8 curves inverted

Central Banks

Some interesting developments in STIRs and implied rates after the FOMC meeting and hawkish dot plot:

The pricing for the November meeting at 75 bps remains but the probability for that has been upped from 55% to 73%

December is now expected to deliver a 50 bps hike (25 bps last week)

The terminal rate is now seen at 4.50-5.00%, the June meeting is a coin toss between a 25 bps hike and a hold

The first rate cut is priced for the end of next year

Fed Funds and Eurodollar futures have been pricing higher rates/less cuts next year:

Sectors and Flows

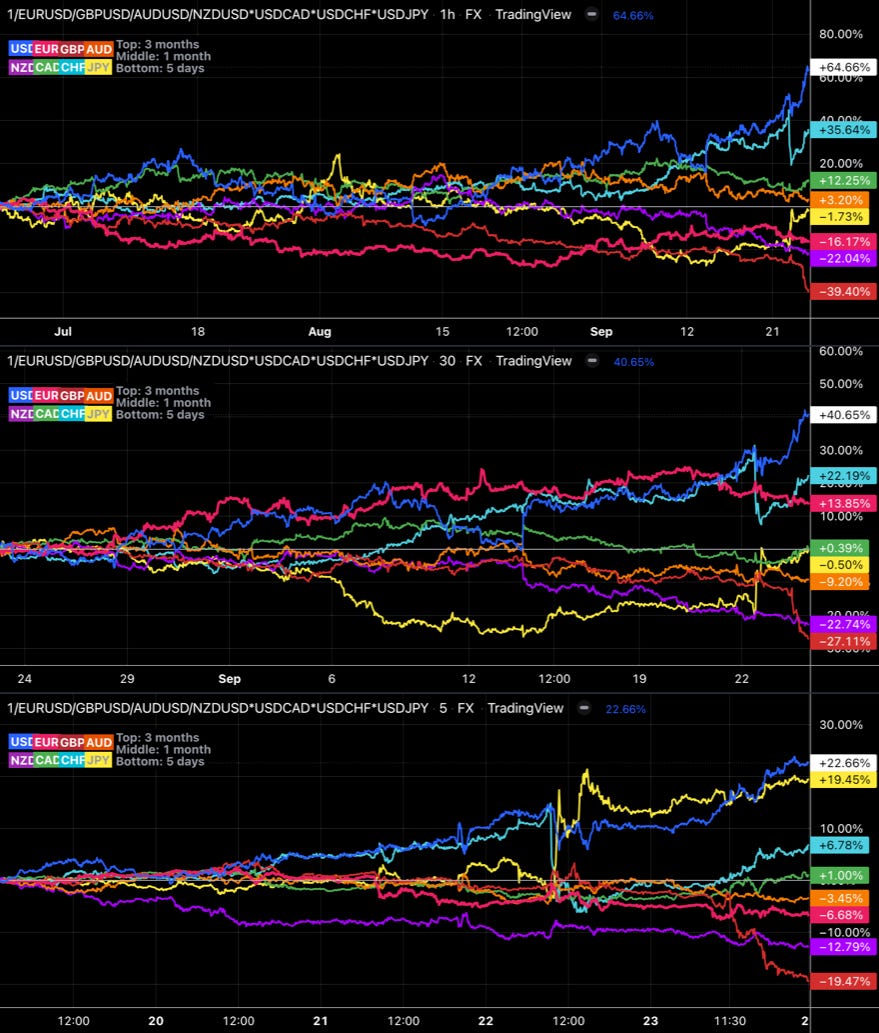

Currency strength is pretty impressive:

USD and CHF are the winners on all timeframes

GBP and NZD are the worst performing currencies

JPY has only been performing this week after an FX intervention

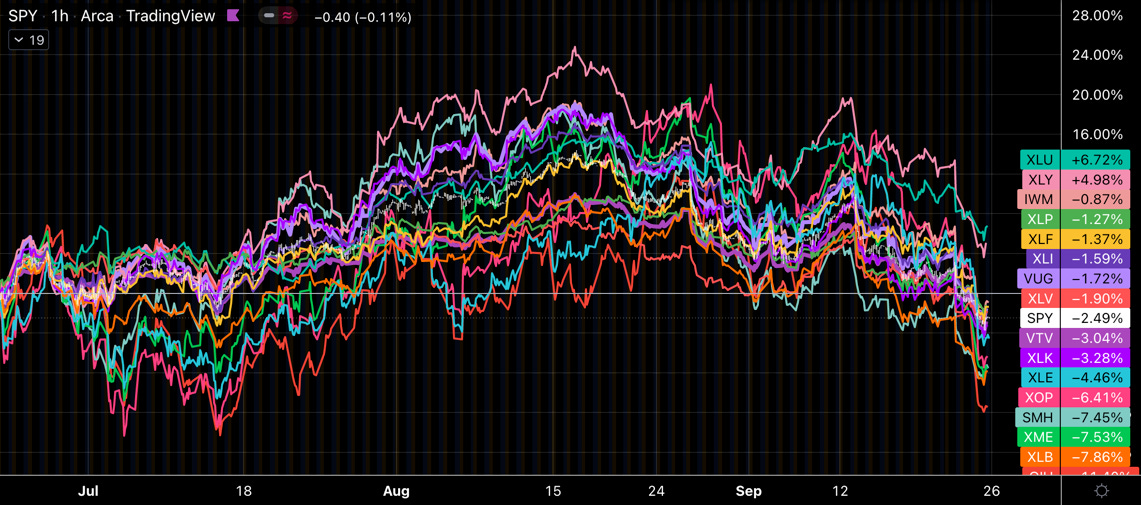

Equity sector performance:

Utilities (XLU) and Consumer Staples (XLP) outperforming

Consumer Discretionary (XLY) is still near the top of the list but it has been losing ground fast

Oil (OIH, XOP), Basic Materials (XLB), Metals and Mining (XME), Energy (XLE) are underperforming again

A different look at sector performance shows that it’s very defensive over a weekly and monthly horizon and a bit more mixed over three months:

Sector charts show the outperformance of Utilities vs. everything else. Consumer Discretionary are (surprisingly) still relatively far off lows while Staples are close to the June low already:

International stock markets:

Brazil and India are weathering the storm pretty well

Everything else is in the red

Hong Kong and Taiwanese stocks are the worst performers

A quick glance at commodity futures:

Energy has been particularly hard hit: Gasoline (RB), Crude Oil (CL), Heating Oil (HO) are among the worst performing commodities over three months

Natural Gas (NG) has lost a lot of ground

Metals are mixed with Silver (SI) and Palladium (PA) relatively strong and Gold (GC) and Copper (HG) being down

Sentiment and Positioning

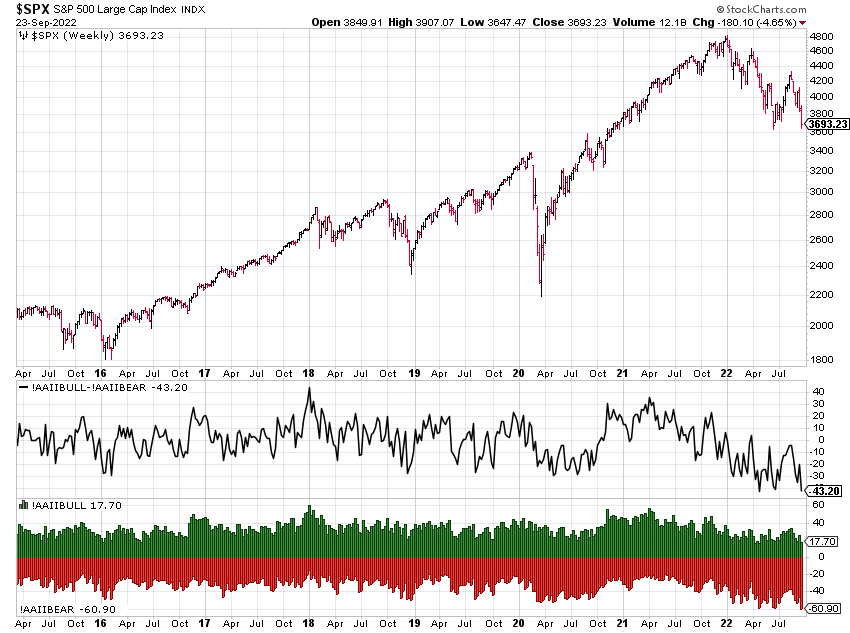

The AAII Bull-Bear spread has returned to bearish extremes. 61% of investors are bearish, and 18% are bullish:

FinTwit sentiment is also trending lower and the worst in over six years:

Currency sentiment:

CHF and USD have the worst sentiment, CAD and AUD aren’t far behind

NZD has the most bullish sentiment (why?), followed by GBP (???) and JPY

Different sentiment source:

GBPUSD longs have the most bullish sentiment on the list (!!!)

USDJPY is the most bearish

What happened to the Silver bulls? For months, sentiment in Silver has been extremely bullish but shorts have increased by almost 30%.

Every USD pair is bearish on USD

JPY pairs are bullish on JPY except for GBPJPY which is about 50/50

Commitment of Traders and futures performance:

Equities have again taken a hit over the last few weeks, Relative Strength is weak with values around 0.90 for equity indexes, positioning in the ES is still bullish, though.

Treasury futures have been sold as well, their RSL mirrors equities, especially in the long end.

FX futures are all down vs. the dollar. Commercial net positions are at a 52-week low in the 6S, and positioning in DX futures is very bullish but their OI/volume is low, so not putting too much weight into it.

6E has seen heavy Commercial selling and Large Trader buying this week with 1-week position change Z-scores of -2.6 and 2.9, respectively. This is not bullish 6E.

Energy futures had a mostly bad week with NG down 12% and CL down 7%. Commercial and Large Trader positioning remains very bullish.

Grains and Softs have been mixed. Commercial/Large Trader positioning is bullish Cotton and Cocoa, and bearish Soybean Meal.

COT/TFF Dealer positioning:

USD still near lows, which is contradictory to the bullish Commercial positioning above

6N near highs with a %R of 0.94 and a pretty decent rate of change

CitiFX PAIN indexes:

Pretty much unchanged from previous weeks

USD positioning is still near highs

Everything else is near lows

The CAD has been diverging a bit to the upside

Market Risks

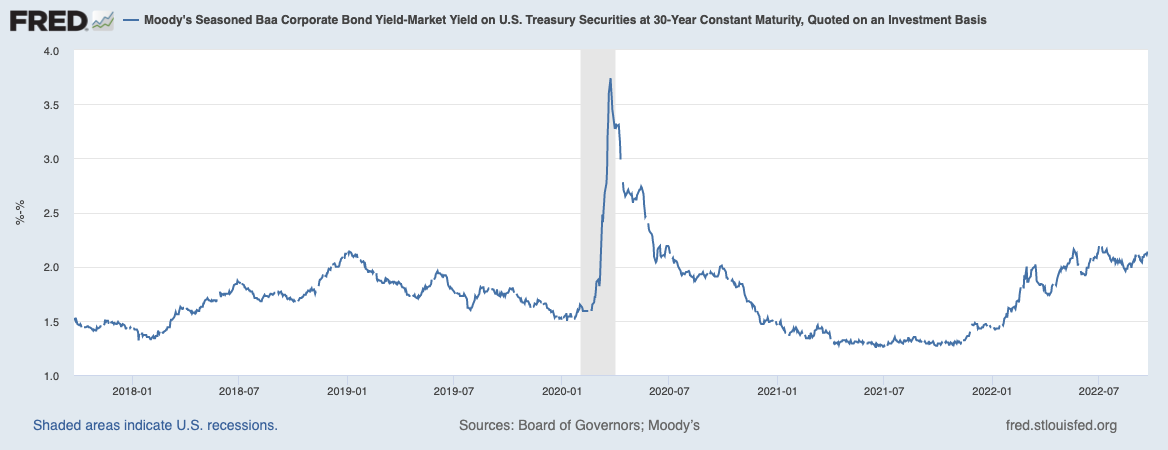

Credit spreads: HY-OAS remain firmly below their highs despite market action in equities over the last few weeks. IG spreads have been trading sideways too:

An index of credit spreads also remains below highs:

Currency volatility has picked up markedly on Friday in GBP while the FX intervention in the JPY with its huge moves across currencies is barely visible:

The VIX term structure has inverted but remains relatively flat:

Volatility indexes:

VIX and MOVE are elevated but remain below recent highs

VVIX has picked up and is above 100 for the first time in a while, this could mean higher vol ahead

Rising VIX/VIX3M reflects the inversion in the term structure

SDEX and its proxy VIX/VOLI are up but far below highs, same for TDEX: no one is frantically buying OTM puts to hedge

All in all, it’s less bad than expected given that we’re at lows in equities

The CNN Fear & Greed Index is at 24, so in “extreme fear” territory:

Various

Market breadth: The Advance/Decline line is tracking price closely, it wouldn’t have given a signal before the SPX was headed lower.

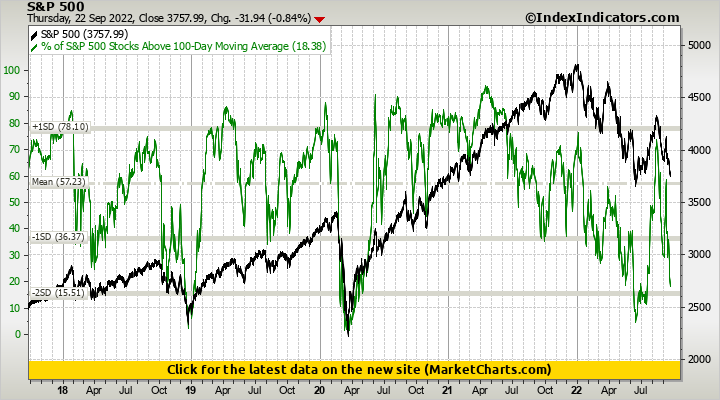

The number of stocks in the S&P 500 and the Nasdaq 100 above their 100-day moving averages has collapsed over the last two weeks. We’re almost back at the June extremes:

25-delta risk reversals:

EURUSD is still being priced higher, AUDUSD and NZDUSD are as well

The collapse in the risk reversal for GBPUSD is staggering, and it shows that the options market has been caught off guard here

USDJPY is priced lower, the Japanese intervention has led to an even more bearish repricing of the risk reversal

And finally, some other market indicators:

The Silver/Gold and Copper/Gold ratios are not selling the lows

Financials/Utilities and the Korean Won are making new lows as well, confirming the broader market action

LQD/TLT continues to do its thing that has nothing to do with reality

Other Stuff I've been looking at

It’s just one chart this time, but a pretty important one that shows inflation is here to stay for a while: potential trajectories of inflation depending on different headline numbers:

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 31/2022 FOMC Meeting Minutes: 34/2022 | 28/2022 | 25/2022 Crib Sheets: 37/2022

ECB

Rate Statements: 37/2022 | 30/2022 Meeting Minutes: 35/2022 | 28/2022 | 21/2022 Economic Forecasts: 21/2022 Crib Sheets: 36/2022

BOE

Rate Statements: 32/2022 | 25/2022 Financial Stability Reports: 28/2022 Crib Sheets: 37/2022

RBA

Rate Statements: 37/2022 | 32/2022 | 28/2022 Meeting Minutes: 34/2022 | 30/2022 | 26/2022 | 21/2022 Statements on Monetary Policy: 32/2022

RBNZ

Rate Statements: 34/2022

BOC

Rate Statements: 37/2022 Crib Sheets: 36/2022

SNB

Rate Statements: 25/2022 Crib Sheets: 37/2022

BOJ

Rate Statements: 30/2022 | 25/2022 Summary of Opinions: 31/2022

Photo Credits: DALL-E “Traders after an exhausting week, sitting on piles of money. Photograph, 21st century, realistic.”

👍