Welcome to edition #21 of FX & Macro Weekly.

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary. The final section is a collection of things I read during the week that influence my thinking.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

If you’ve missed it, here’s my latest Wednesday podcast write-up:

One more thing. You seem to like newsletters, so here's a great way to discover new stuff to read for free: The Sample. They will regularly send you an issue of a different semi-random newsletter you might be interested in. If you sign up using my referral link, I get bonus points and my newsletter will be forwarded to others to check out.

Now let's get started…

Table of Contents

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

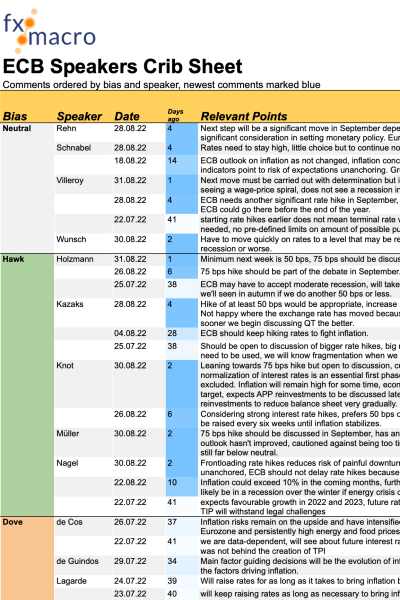

If you want to catch up on all recent comments from ECB and BOC speakers before the rate decisions next week, I've included a PDF with (hopefully) every speaker since their last meetings. The RBA didn't have any speakers out, so they aren't included. Check it out here, and feel free to share it if you find it helpful:

Relevant market risks I have on my radar (it's obviously not a comprehensive list and mostly unchanged from last week):

Europe:

Italian elections coming up, risk of a Euro-sceptic right-wing PM

huge uncertainty regarding the future of gas flows from Russia; an unexpected resolution of the conflict seems very unlikely, but it could escalate on multiple fronts (gas, energy, militarily) very quickly

UK: we should be getting an idea this week on how the Tory leadership contest and Liz Truss will impact markets

Global markets: the risk from commodity market squeezes spilling over seems to have diminished a bit

China/Taiwan: keeping an eye on the Taiwanese stock market as a risk gauge

Economic Calendar for next week

Important levels to watch and look out for in the Majors

Week in Review

Central Banks

Confab, Speakers, News

Federal Reserve

Kashkari (Dove). Mon: Happy to see how Chair Powell's Jackson Hole speech was received, shows that investors got the message that the Fed is serious about bringing inflation down.

Barkin (Hawk). Tue: Doesn't expect inflation to come down predictably, interest rates will need to be restrictive, we're not currently in a recession but recession is a risk.

Bostic (Dove). Tue: Slowing inflation may give us reasons to slow interest rate hikes. There are risk of either being too timid or too aggressive in raising rates. Fri: Fed must get the economy to slow down, may need to sell some MBS in the future.

Williams (Neutral). Tue: We will need restrictive policy for some time, need to get real interest rates above zero, we are not yet at restrictive policy rates, baseline is rates need to go somewhat above 3.5%, sees the Fed raising and holding rates through next year, will take some time before seeing adjustment downward, will take us a few years to get inflation back to 2%.

Mester (Hawk). Wed: Need to raise rates to somewhat above 4% by early next year then hold it there, real rates need to move into positive territory, does not anticipate rate cuts next year, far too soon to conclude inflation has peaked, sees unemployment somewhat above 4% by end of next year. Even if economy were to go into a recession we have to get inflation down.

Logan. Wed: Number one priority is to restore price stability.

European Central Bank

Kazaks (Hawk). Weekend: Hike of at least 50 bps would be appropriate, increase needs to be strong and significant, 50 or 75 bps. Not happy where the exchange rate has moved because it further fuels inflationary pressures. The sooner we begin discussing QT the better.

Schnabel (Neutral). Weekend: Rates need to stay high, little choice but to continue normalizing policy even if we enter a recession.

Rehn (Neutral). Weekend: Next step will be a significant move in September depending on incoming data. Exchange rate already a significant consideration in setting monetary policy. Eurozone economy is slowing down.

Villeroy (Neutral). Weekend: ECB needs another significant rate hike in September, expects neutral at 1-2% but ECB could go higher, ECB could go there before the end of the year. Wed: Next move must be carried out with determination but in an orderly and predictable way, currently not seeing a wage-price spiral, does not see a recession in Europe in 2022.

Lane (Dove). Mon: Inflation expected to remain high in the near term, long-term inflation expectations remain close to 2%, new phase of policy will be on a meeting-by-meeting basis rather than forward guidance. Tue: Sees Eurozone slowdown, does not rule out a milder technical and temporary recession.

Knot (Hawk). Tue: Leaning towards 75 bps hike but open to discussion, current market pricing of rates not unwise, swift normalization of interest rates is an essential first phase, some front-loading of rate hikes should not be excluded. Inflation will remain high for some time, economic slowdown alone unlikely to bring it down to target, expects APP reinvestments to be discussed later this year, possibly less-than-full APP reinvestments to reduce balance sheet very gradually.

Müller (Hawk). Tue: 75 bps hike should be discussed in September, has an open mind going into the meeting, inflation outlook hasn't improved, cautioned against being too timid as inflation is set to go higher and rates are still far below neutral.

Stournas (Dove). Tue: Estimates neutral between 0.5-1.5%, need to be prudent, no need for very large steps, further gradual normalization will be appropriate. We will see peak inflation this year and decline next year, risk to growth tilted towards the downside.

Nagel (Hawk). Tue: Frontloading rate hikes reduces risk of painful downturn, larger hike reduces risk of expectations getting unanchored, ECB should not delay rate hikes because of recession fears, terminal rate still unclear.

Wunsch (Neutral). Tue: Have to move quickly on rates to a level that may be restrictive, may be going towards a technical recession or worse.

Vasle. Tue: Supports a hike that could exceed 50 bps, inflation is more persistent and will ease in H1 next year.

Holzmann (Hawk). Wed: Minimum next week is 50 bps, 75 bps should be discussed.

Swiss National Bank

Jordan. Weekend: No need to adjust inflation target, dismissed the idea of average inflation targeting, prepared to act decisively if price stability is threatened.

Bank of Japan

Kuroda. Mon: We have no other choice but to continue with monetary easing, inflation is transitory and caused almost wholly by commodity prices, energy and food.

Nakagawa. Wed: BOJ must continue monetary easing to achieve inflation target in a sustained way backed by positive economic cycle. Inflation has exceeded 2% but that will not suffice.

Matsuno (Chief Cabinet Secretary). Fri: Sharp fluctuations in the exchange rate undesirable, important that currencies move stably and reflect economic fundamentals, watching FX moves with high sense of urgency, not commenting on day-to-day moves.

Suzuki (FinMin). Fri: Will take action on exchange rate if appropriate, important for the exchange rate to stably reflect economic fundamentals, recent moves in FX are big, watching them with a sense of urgency, excessive and disorderly moves can have a negative impact on the economy.

People’s Bank of China

Official. Fri: Will keep liquidity reasonably ample, will avoid flood-like stimulus and keep prices stable, monetary policy will maintain stable and moderate credit development.

Economic Data

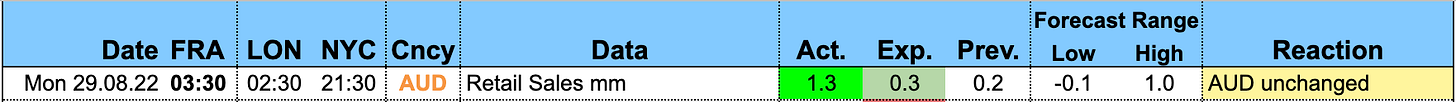

Monday, 29.08.22

Tuesday, 30.08.22

The CB Consumer Confidence surprised to the upside (emphasis mine):

“Consumer confidence increased in August after falling for three straight months,” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. “The Present Situation Index recorded a gain for the first time since March. The Expectations Index likewise improved from July’s 9-year low, but remains below a reading of 80, suggesting recession risks continue. Concerns about inflation continued their retreat but remained elevated.”

“Meanwhile, purchasing intentions increased after a July pullback, and vacation intentions reached an 8-month high. Looking ahead, August’s improvement in confidence may help support spending, but inflation and additional rate hikes still pose risks to economic growth in the short term.”

Wednesday, 31.08.22

Thursday, 01.09.22

Here are the details from the Australian Manufacturing PMI (emphasis mine):

Manufacturing fell to be broadly stable in August for the first time in six months. Activity was lower in all sectors but chemicals and TCF, paper and printing.

Labour challenges and supply chain disruption continue to plague manufacturing as in previous months. While new orders continued to grow in August the pace of growth eased and sales fell, indicating a negative direction for demand. Most manufacturing activity indicators contracted at an accelerating rate. The falling employment index reflects labour shortage pressures, with wages rising sharply.

Manufacturing exports declined further; businesses reported volatile export demand.

And here are the details from the US ISM Manufacturing PMI (emphasis mine):

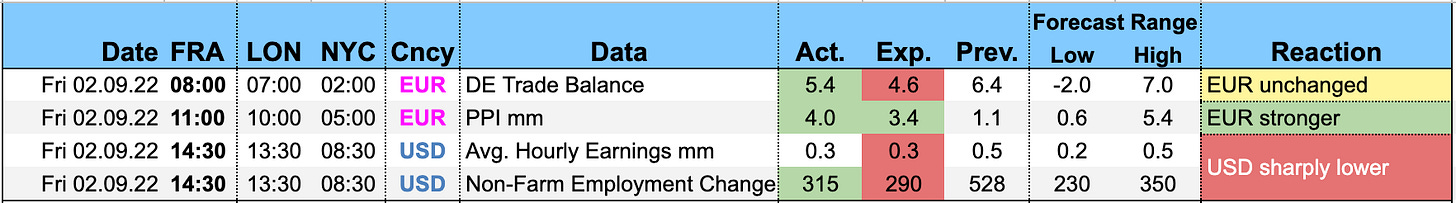

Friday, 02.09.22

Market Analysis

Growth and Inflation

The Atlanta Fed GDPNow model is up to 2.6% for Q3 thanks to the ISM:

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2022 is 2.6 percent on September 1, up from 1.6 percent on August 26. After this morning’s construction spending release from the US Census Bureau and this morning’s Manufacturing ISM Report On Business from the Institute for Supply Management, the nowcasts of third-quarter real personal consumption expenditures growth and third-quarter real gross private domestic investment growth increased from 2.0 percent and -5.4 percent, respectively, to 3.1 percent and -3.5 percent, respectively.

The NY Fed Weekly Economic Index printed down a bit to 2.53:

Citi Economic Surprise Indexes:

EUR, GBP and JPY continue to surprise to the upside

USD has been weakening, AUD has rolled over

CAD continues to trend lower

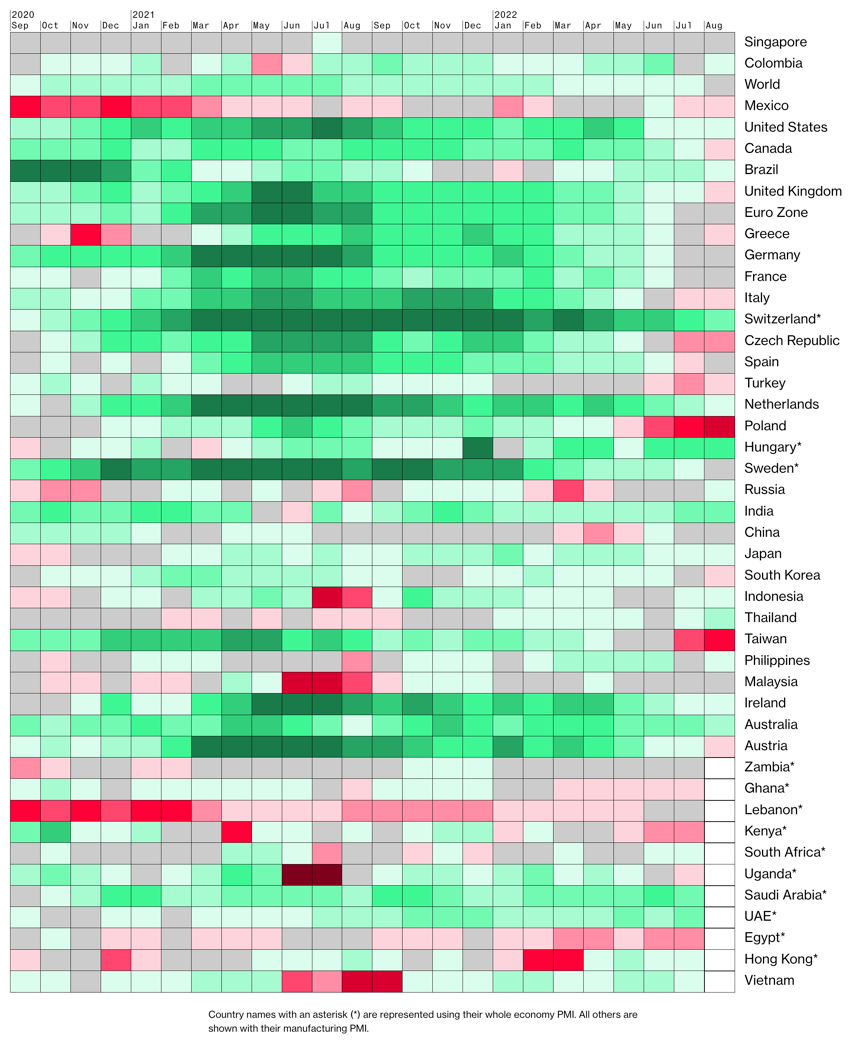

International PMIs:

Canada and the UK weaker

The US is the relative outperformer along with Europe and Japan, all of which remain unchanged

In Asia, South Korea and Taiwan have weakened further

Even more red than last month

5y5y forward inflation expectations continue to trade within their range:

… as does RINF:

Citi Inflation Surprise Indexes:

USD, AUD and CAD sharply lower

EUR and CHF a bit lower as well

GBP is up, NZD is up a bit more

Yields

See chart and table below:

Virtually all yields are up

Strongest seems to be GBP

AUD is looking comparatively week

The European periphery is imploding

Central Banks

Despite all that’s been going on over the last week with Goldilocks ISM and Non-Farm Payrolls, FedWatch is remarkably unchanged:

The September FOMC meeting is priced with a 57% chance of a 75 bps hike and 43% in favour of 50 bps.

Probabilities for November and December meetings are virtually unchanged.

The terminal rate remains at 375-400 bps.

Here’s the same data in graphic form:

Fed Funds Futures and Eurodollar Futures spreads moving sideways:

Sectors and Flows

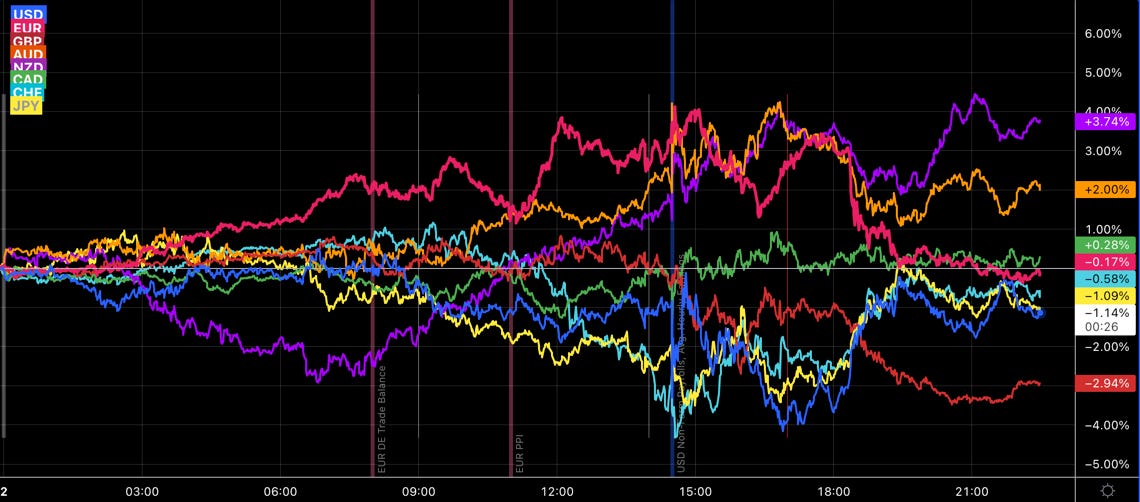

Currency strength:

USD is king over one and three months

CHF has lost its strength

EUR was strong over the last week with all the hawkish ECB speak

GBP and JPY underperform on all three timeframes: three months, one month and five days

Equity sector performance over one month is still a mixed bag:

Energy and raw materials are outperforming again (XOP, XLE, OIH, XME)

Consumer Discretionary (XLY), Healthcare (XLV), Tech (XLK) and Growth (VUG) are underperforming

Consumer Staples (XLP) are somewhere in the middle

Looking at the following chart it’s clear that the entire week was very defensive from a sector standpoint:

International stock market indexes over one month:

BOVESPA with the best performance by far

US and European indexes are the underperformers

BNY Mellon iFlow shows flows into USD and to a lesser extent into AUD and CAD. Equities see broad outflows:

Sentiment and Positioning

AAII Bull-Bear spread has taken a bit of a hit again this week, but it’s still a bit above its low:

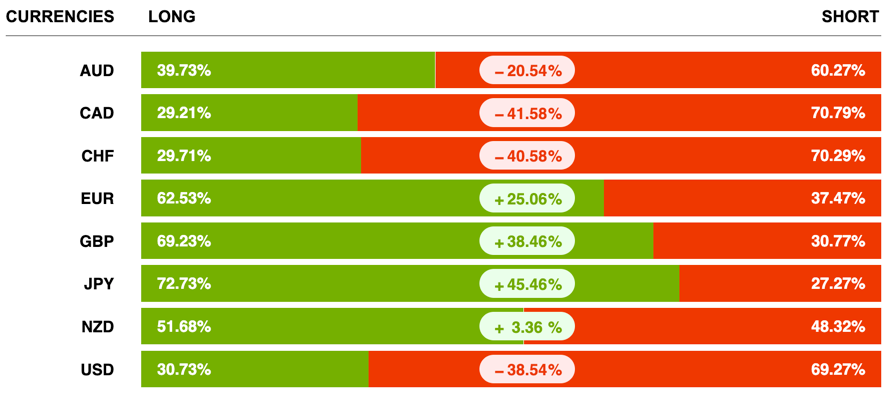

Currency sentiment:

Market is still bearish on CAD, CHF, USD and AUD…

… and bullish on JPY, GBP and EUR.

Different sentiment source, virtually unchanged from last week(s):

GBPUSD, EURUSD, NZDUSD, AUDUSD and USDJPY all have bearish sentiment on USD

All yen-pairs are bearish on JPY

EURCHF still very bullish on EUR

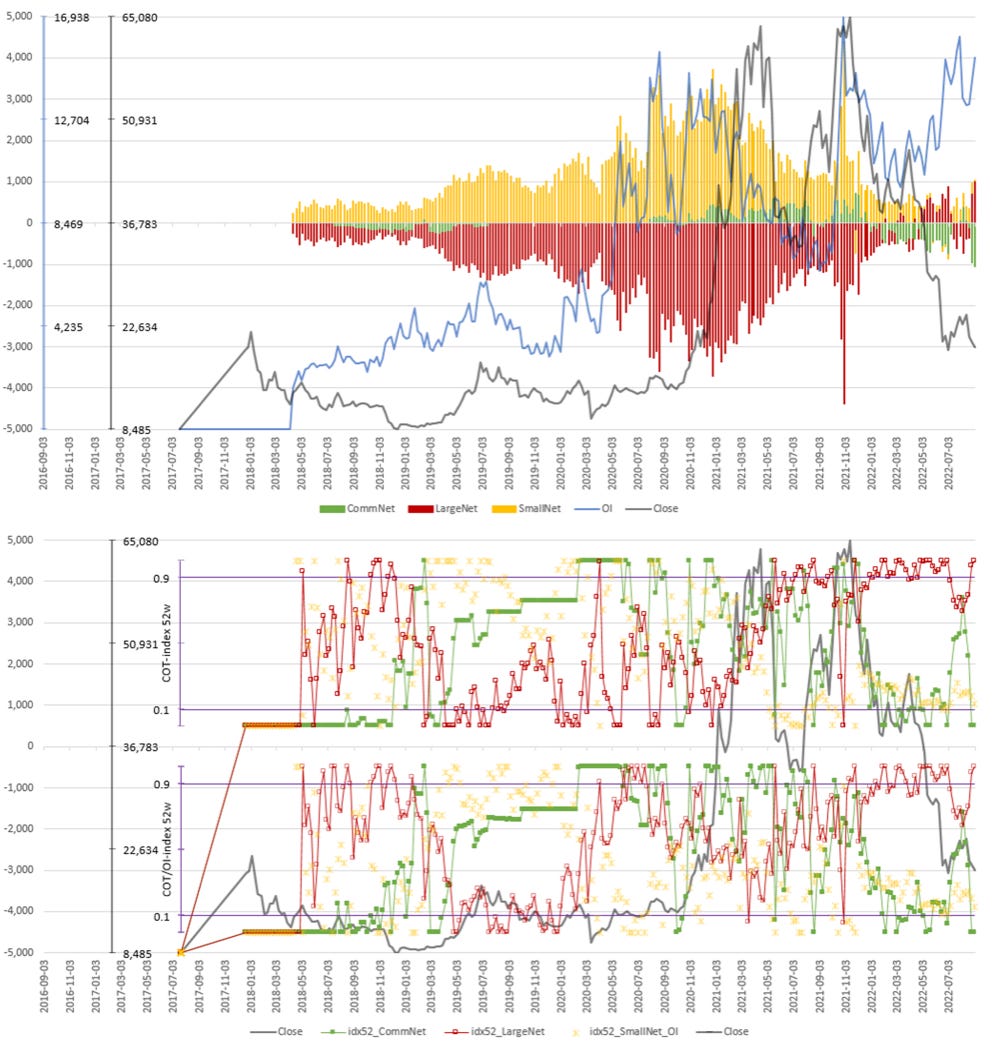

Commitment of Traders: This part is a bit longer than usual… I’m not going to turn this into a COT newsletter, but there are quite a few interesting things going on, so I’ll include a bit more info.

Equity performance has taken another hit this week, all four major indexes have a Levy Relative Strength well below 1 again. Commercial positioning in ES is still very bullish.

Bond positioning has become increasingly bullish with the move lower, see chart below the table for details.

The 6E is flat but all other G8 FX futures are down. Positioning in EUR remains very bullish.

Bitcoin has an RSL of 0.66, which means ist 34% below its 26-week moving average. Commercials are bearish, but Smalls Specs tend to be more important here. I’ll include a chart below.

Energy was hit this week as well, Crude loses strength again with an RSL of 0.93. Positioning remains bullish.

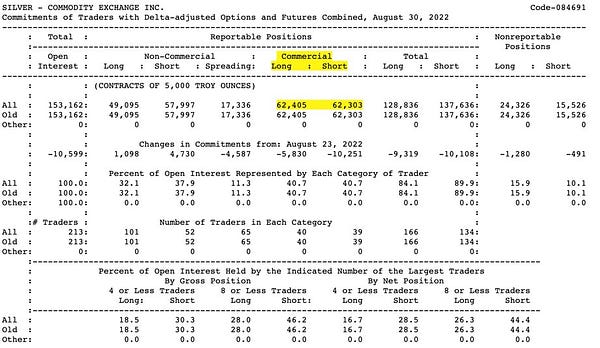

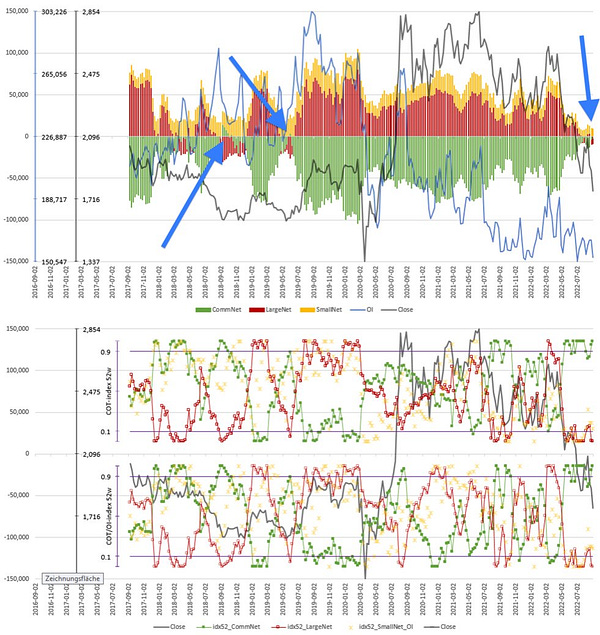

Metals have lost ground too with all five futures down for the week. Their RSLs all look bad, but Dealers are near or at bullish extremes. Commercials are net positive in Silver for only the third time ever. I tweeted it on Friday, link below.

Grains and Softs had a mixed-to-lower week.

COT details for Bonds: This is the aggregated view for treasury futures. Commercials are at their highest net positioning in almost four years, Large Traders at their shortest level in about the same time.

COT details for Bitcoin: Commercials just don’t play a very big role here, but Small Speculators trade against Large Traders. Small Specs tend to follow price and Large Traders fade them. Note the large spike down in Large Traders in November 2021 that occurred at the top.

COT details for Silver:

COT/TFF Dealers data shows EUR at a bullish extreme and the aggregated USD position approaching a 2-year low:

Citi PAIN indexes remain overbought USD and short everything else against it with CHF being the most short of the bunch:

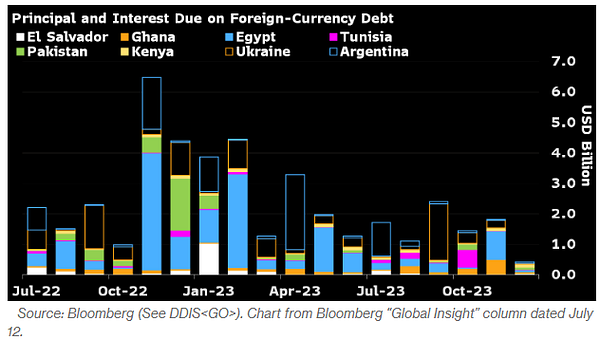

Market Risks

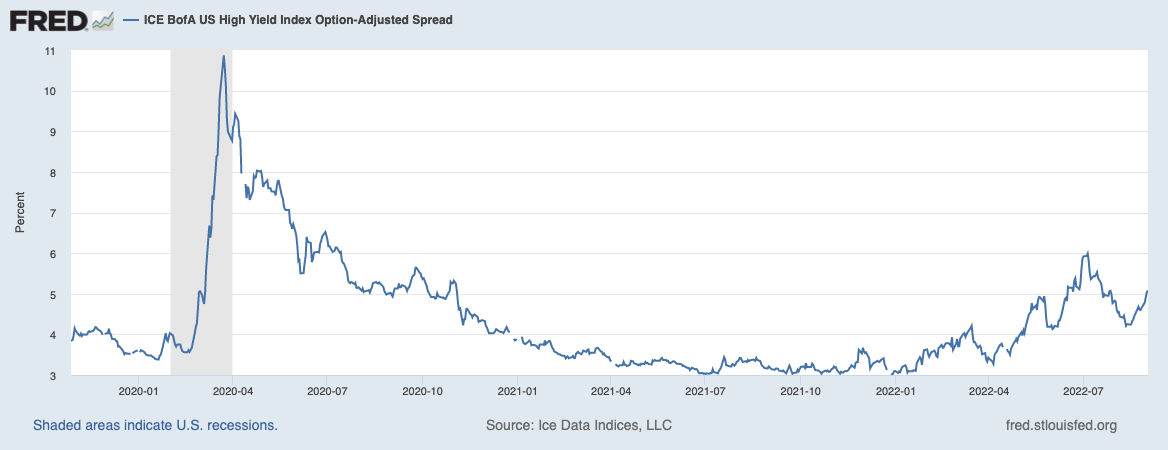

Credit spreads have widened again with the risk-off moves over the last two weeks:

Credit Spread Index approaching new highs:

The NY Fed Corporate Bond Market Distress Index (CMDI) has been updated. It shows stress predominantly in the IG bucket, which isn’t what ETFs (LQD, HYG) have been doing over the last few months.

Currency volatility remains elevated:

Despite two heavy weeks in equities, the VIX term structure remains in contango with some steepness in the front:

Volatility indexes: MOVE coming down further (now at 120), VVIX isn’t doing anything, and TDEX indicates a low demand for tail hedges.

VOLI is very moderate, Skew is flat according to SDEX and VIX/VOLI. It seems as if everybody is either flat or already hedged (or complacent).

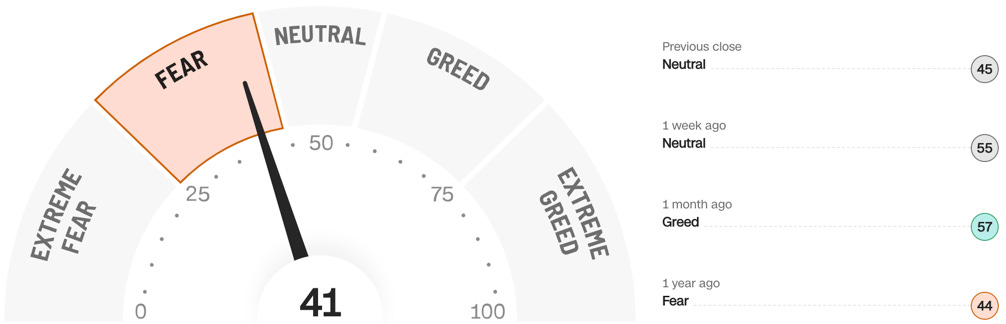

CNN Fear & Greed Index is in no-man’s-land:

Various

Breadth has been one thing why the market rallied from July to mid-August. That positive factor had shown some signs of breaking down last week, and that has continued into this week. The A/D line is following price (nothing positive there), and the percentage of S&P 500 and Nasdaq 100 members above their 100-day moving averages has fallen sharply. However, I would not interpret it as outright bearish because moves like these have in the past (in bull markets) provided good buying opportunities. Needless to say, I wouldn’t interpret breadth as bullish right now, either.

Some interesting ratios have been sceptical about this market and it looks like they are proven right: SLV/GLD and HG/GC are moving in line with equities now, and the Korean Won is also down.

25-delta risk reversals:

EURUSD is priced higher

Bullish divergences in AUDUSD and NZDUSD

Options expirations for AUDUSD: two big expirations on Tuesday at 0.6800 and 0.6875 (600 mln and 1 bln, respectively). Could be a catalyst for a move higher in AUD if dealers are short gamma (unfortunately, CME data isn’t very clear that they are).

SqueezeMetrix GEX is at a level where we’ve seen bounces in the ES happening repeatedly over the last few years:

From the latest BlackRock Geopolitical Risk Dashboard (emphasis mine):

We lower the likelihood of Gulf tensions to medium on the back of meaningful progress in Iran nuclear negotiations.

We keep the likelihood of U.S.-China strategic competition at a medium level. China is likely to ratchet up the pressure on Taiwan, but we do not see a military confrontation as likely in the near term.

We also maintain the risk of Climate policy gridlock at a medium likelihood. The Ukraine crisis has brought energy security to the fore, but recent U.S. legislation moves the world’s second-largest carbon emitter closer to its climate commitments.

Other Stuff I've been looking at

Citi’s Bear Market Checklist now has 8 sell signals within the US and 6 for the world (out of 18 total). When half the number of signals say sell (are red), a cyclical bear market typically follows.

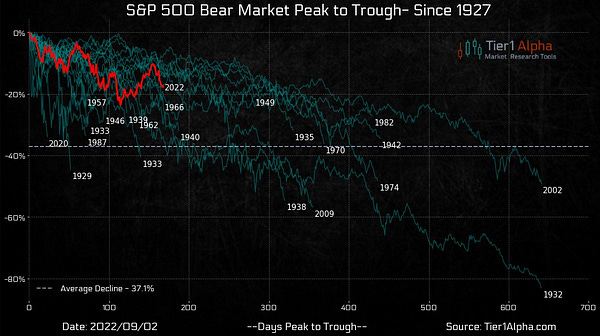

Bear markets tend to last a while:

Supply chain pressure is easing further:

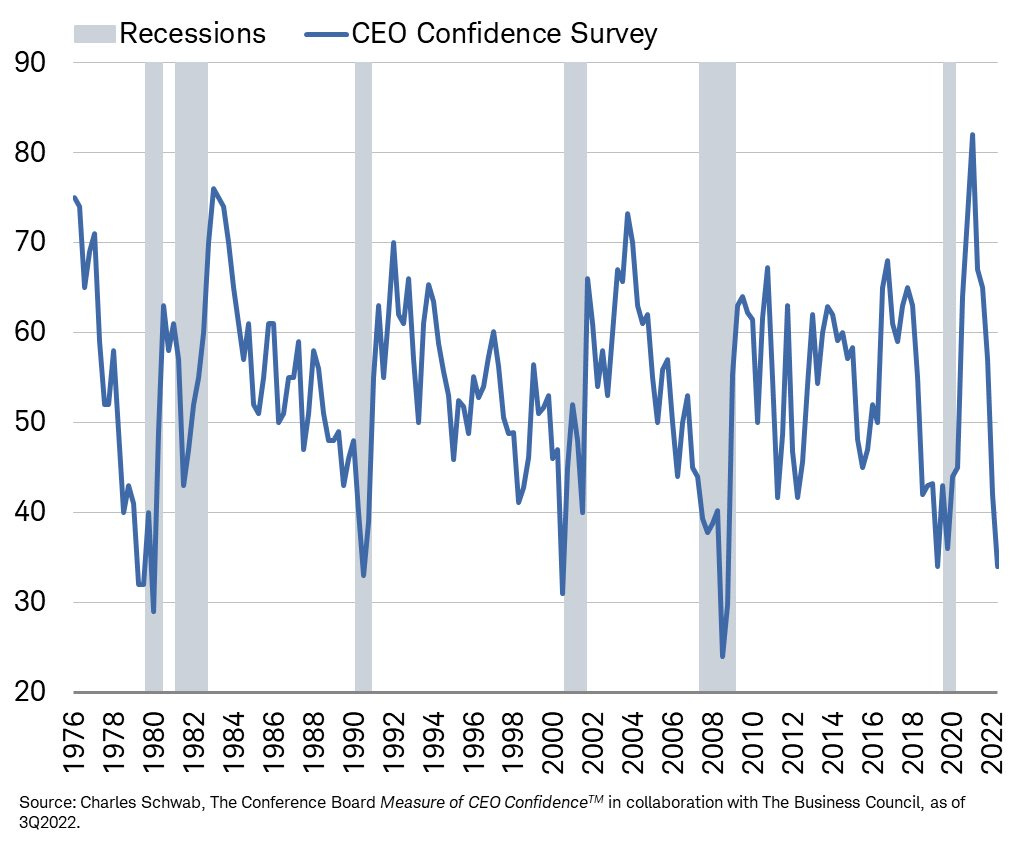

It’s not just that consumers are pessimistic, it’s also CEOs:

But investors haven’t sold yet:

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 31/2022

FOMC Meeting Minutes: 34/2022 | 28/2022 | 25/2022

ECB

Rate Statement 30/2022

Meeting Minutes: 35/2022 | 28/2022 | 21/2022

Economic Forecasts: 21/2022

BOE

Rate Statement: 32/2022 | 25/2022

Financial Stability Reports: 28/2022

RBA

Rate Statements: 32/2022 | 28/2022

Meeting Minutes: 34/2022 | 30/2022 | 26/2022 | 21/2022

Statement on Monetary Policy 32/2022

RBNZ

Rate Statements: 34/2022

SNB

Rate Statements: 25/2022

BOJ

Rate Statement: 30/2022 | 25/2022

Rate Summary of Opinions: 31/2022

Photo by Ivan Lapyrin on Unsplash

As always perfect analysis. Where do you get the intel about which currency is short gamma and what does it mean?

So happy I stumbled upon this newsletter. Great content and analysis of the weekly data. I really appreciate the currencies reaction notes to various data releases during the week.