FX & Macro Outlook for Week 35/2022

Nightmarish PMIs, neutral ECB Minutes and a hawkish Jackson Hole speech

Welcome to edition #20 of FX & Macro Weekly.

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary. The final section is a collection of things I read during the week that influence my thinking.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

If you’ve missed it, here’s my latest Wednesday podcast write-up:

One more thing. You seem to like newsletters, so here's a great way to discover new stuff to read for free: The Sample. They will regularly send you an issue of a different semi-random newsletter you might be interested in. If you sign up using my referral link, I get bonus points and my newsletter will be forwarded to others to check out.

Now let's get started…

Table of Contents

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Relevant market risks I have on my radar (it's obviously not a comprehensive list and mostly unchanged from last week):

Europe:

Italian elections coming up, risk of a Euro-sceptic right-wing PM

huge uncertainty regarding the future of gas flows from Russia; an unexpected resolution of the conflict seems very unlikely, but it could escalate on multiple fronts (gas, energy, militarily) very quickly

UK: I don't have a clear idea about the impact of the Tory leadership race yet (potential for negative impact on the sterling is there given the comments from Liz Truss), the Northern Ireland protocol remains unresolved

Global markets: the risk from commodity market squeezes spilling over seems to have diminished a bit

China/Taiwan: keeping an eye on the Taiwanese stock market as a risk gauge

Economic Calendar for next week

Important levels to watch and look out for in the Majors

Week in Review

Central Banks

ECB Meeting Minutes (25.08.)

There were no big surprises in the ECB Minutes. Here are some relevant bits (link to full text):

Jackson Hole (26.08.)

I’ve decided to include the entire speech by Jay Powell. There was nothing materially new in it, but the overall tone, focus and bluntness make it remarkable. Not to mention that he quoted Volcker, which was entirely intentional. The speech is below with yellow and green highlights if you want to skim it for the most relevant points (green = more important).

And here’s what the speech looks like if you put it into a word-cloud generator. Leaves no doubt about its focus:

Confab, Speakers, News

Federal Reserve

Kashkari (Dove). Wed: Fed needs to see compelling evidence of inflation heading back towards 2%, fear that inflation is more embedded at higher level than anticipated, biggest fear is misreading underlying inflation dynamics.

Bostic (Dove). Thu: At this point it's a coin toss between 50 bps and 75 bps, need to really make sure inflation is on its way to 2% target before taking steps towards more accommodative policy stance, some weakening in the economy is expected.

George (Neutral). Thu: Too soon to say what to expect in September decision, wants to see at least three months of consistent data to know where things are going, full effects of rate hikes may not be seen for some time, bringing inflation back down remains the main focus.

Bullard (Hawk). Thu: Rate target for year-end is 3.75-4.00%, current level not high enough to put serious pressure on inflation, need to have a 3-handle for that. Baseline is that inflation is more persistent than many on Wall Street think, risk is that we have to be higher for longer. Says he does not take many signals from equity markets.

Harker (Hawk). Thu: Wants to get rates above 3.4%, wants to see next inflation reading before deciding on next move, 50 bps is still a substantial hike, does not want to take rates way up and then right back down again, thinks we'll have to have restrictive rates for a while. Estimates medium-to-long term neutral at around 2.5%.

Powell (Neutral). Fri: see above for the full speech

Need to use our tools forcefully

Moving rates purposefully to a restrictive level

Estimates of longer-run neutral rate aren't a place to stop or pause

Bringing inflation down will take some time and will likely require a sustained period of below-trend growth

Cautious about prematurely loosening policy

There will be some pain for households.

"We are taking forceful and rapid steps to moderate demand so that it comes into better alignment with supply, and to keep inflation expectations anchored. We will keep at it until we are confident the job is done."

Bostic (Dove). Fri: Wants to get to 3.5-3.75% and then hold rates, hopeful that this does it, need to make sure we don't overreact, it's premature to think about cutting.

Bullard (Hawk). Fri: Starting to see effects of rate hikes.

Harker (Hawk). Fri: Need to move toward a clearly restrictive stance, restrictive is clearly above 3%, will do what it takes to get inflation under control. If there's a recession it will be shallow.

Mester (Hawk). Fri: We're going to be resolute in getting inflation back to target, Powell delivered a strong message (Jackson Hole), need to be cautious in thinking inflation has peaked.

European Central Bank

Nagel (Hawk). Mon: Inflation could exceed 10% in the coming months, further interest rate hikes must follow, Germany will likely be in a recession over the winter if energy crisis continues to worsen.

Panetta. Tue: Probability of a recession is increasing, ECB may have to adjust monetary policy stance further.

Holzmann (Hawk). Fri: 75 bps hike should be part of the debate in September.

Knot (Hawk). Fri: Considering strong interest rate hikes, prefers 50 bps or even 75 bps in September, interest rate should be raised every six weeks until inflation stabilizes.

Sources. Thu: From Reuters: Decision to start ending APP reinvestments isn't urgent and not likely to be taken at the September meeting. Policymakers are focused on rate hikes, see reinvestments as a secondary issue. Fri: From Reuters: policymakers want to discuss a 75 bps hike next month. Two sources: not necessarily backing 75 bps but it should be at least discussed, outlook is much worse than projected in June. One source: 50 bps is the minimum, sees a strong case for 75 bps. Another: energy won't get cheaper if we don't hike, could even become more expensive due to weak Euro.

Reserve Bank of New Zealand

Hawkesby. Mon: Rates will go to 4.0-4.25% before RBNZ has a more balanced view on policy outlook, wants to get monetary policy comfortably above neutral. Considered both a 25 bps and a 75 bps move at this month's meeting.

Richardson. Mon: Domestic inflation turns out to be a lot more persistent than imported inflation. A 25 bps hike wasn't a huge part of the discussion.

Bank of Japan

Nakamura. Thu: BOJ must patiently maintain powerful monetary easing, inflation likely to accelerate because of energy and fuel costs but slow down thereafter, wage increases are broadening reflecting a pick-up in the economy. Decline in the yen mostly driven by US rate hike outlook, pros and cons to a weak yen, BOJ can only do so much when exchange rate is driven by changes in US economy.

Economic Data

Monday, 22.08.22

Tuesday, 23.08.22

You can find the relevant parts from the important PMI releases of the day below.

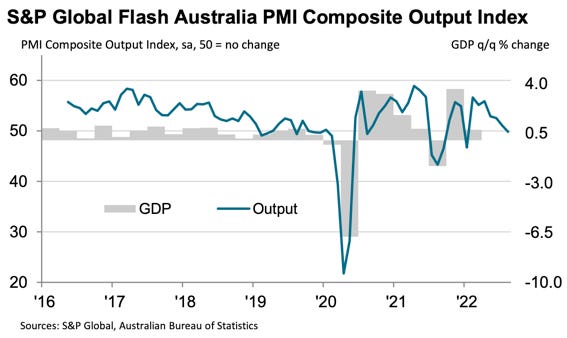

Australian PMI (emphasis mine, link to full report):

“A renewed contraction in Australia’s private sector economy indicates that recent interest rate hikes made by the RBA, as well as sustained inflationary pressures, have begun to take a toll on overall demand levels. Should new order growth remain subdued, this may help reduce demand-pull inflation factors, but survey data continue to highlight the supply issues that remain prevalent globally, which will continue to keep price levels elevated for the foreseeable. As such, the RBA will likely continue along its rate-hiking path, which bodes ill for the wider economy given the latest survey data highlight clear signs of underlying weakness.”

German PMI (emphasis mine, link to full report):

“The PMI data paint a bleak picture of the German economy midway through the third quarter, showing a deepening decline in private sector business activity. Continued weakness in manufacturing is being compounded by a slowdown in the service sector, with surveyed businesses reporting a growing strain on demand from high inflation and increased interest rates.

“The slowdown in the economy is increasingly taking a toll on firms’ hiring activity, with employment growth easing to its weakest for almost a year-and-a-half in August. A first fall in backlogs of work for more than two years points to capacity pressures across Germany’s private sector economy starting to ease and represents a downside risk to job creation going forward.

“Positively, August’s data provided evidence of a further easing of both supply side constraints and cost increases, which helped to lift business confidence from July’s recent low. However, with the threat of an energy crisis still looming large, the outlook remains riddled with uncertainty.”

UK PMI (emphasis mine, link to full report):

“The UK private sector moved closer to stagnation in August, as mild growth of activity across the service sector only just offset a deepening downturn at manufacturers. Waning customer demand amid the weaker economic outlook, and shortages of both staff and inputs, were reported to have hit goods producers hard, with firms registering the quickest drops in output and new work since May 2020. Excluding the initial phase of the pandemic in early-2020, the reduction in manufacturing output was the quickest seen since the start of 2009. Meanwhile, the service sector registered the weakest increase in activity since the recovery began in early 2021.

“More encouragingly, the latest survey also pointed to a further easing of inflationary pressure, with average input costs rising at the softest rate for nearly a year. Though still well above the historical average, the moderation in cost pressures will provide some relief to Bank of England policymakers who are keen to tame inflation, which is currently at a four-decade high.

“However, the tightening of financial conditions via interest rate hikes, the cost of living crisis, labour shortages and strained supply chains are all likely to dampen economic performance further and keep costs elevated in the months ahead.”

US PMI (emphasis mine, link to full report):

“August flash PMI data signalled further disconcerting signs for the health of the US private sector. Demand conditions were dampened again, sparked by the impact of interest rate hikes and strong inflationary pressures on customer spending, which weighed on activity. Gathering clouds spread across the private sector as services new orders returned to contractionary territory, mirroring the subdued demand conditions seen at their manufacturing counterparts. Excluding the period between March and May 2020, the fall in total output was the steepest seen since the series began nearly 13 years ago.

“Lower new order inflows and continued efforts to rein in spending led to the slowest uptick in employment for almost a year. Reports of challenges finding suitable candidates started to be countered by those companies noting that voluntary leavers would not be replaced with any immediacy due to uncertainty regarding demand over the coming months.

“One area of reprieve for firms came in the form of a further softening in inflationary pressures. Input prices and output charges rose at the slowest rates for a year- and-a-half amid reports that some key component costs had fallen. Although pointing to an ongoing movement away from price peaks, increases in costs and charges remained historically robust. At the same time, delivery times lengthened at the slowest pace since October 2020, albeit still sharply, allowing more firms to work through backlogs.”

\Wednesday, 24.08.22

Thursday, 25.08.22

The ECB Minutes have been covered in the section above.

Friday, 26.08.22

Jay Powell’s Jackson Hole speech has been covered above in detail

Market Analysis

Growth and Inflation

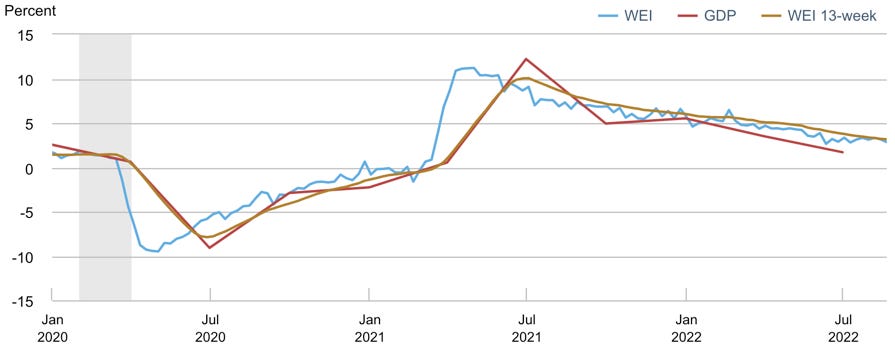

The Atlanta Fed GDPNow model estimates real GDP growth for Q3 at 1.6%.

The NY Fed Weekly Economic Index estimates 4-quarter GDP growth at 2.85%.

Citi Economic Surprise Indexes are broadly unchanged from last week:

USD, EUR, GBP and JPY still trending higher

AUD sideways

NZD, CAD and CHF lower

Global PMIs:

UK has been hit hard

Australia weaker

US and Japan stable

And from the last weeks:

Taiwan has deteriorated markedly, China and South Korea are weaker as well

Overall there’s a lot more red now than during the previous months

5y5y forward inflation expectation swaps and RINF continue to trade in their respective ranges:

Citi Inflation Surprise Indexes haven’t updated yet:

Yields

See charts and table below:

EUR and GBP look strongest

USD, AUD, NZD look weakest

The bear flattening in US 2s10s continues. The UK curve flattens hard with the 2-year yield up about 120 bps in one month.

Central Banks

Rate hike expectations according to FedWatch have shifted upwards significantly after Friday’s Jackson Hole speech by Jay Powell:

September is now priced with a 61% probability of a 75 bps hike vs. 41% last week.

The terminal rate is expected to be 3.75-4.00% and to be held there for at least a few months.

Interestingly, the chance of a 100 bps hike in September is still priced at zero.

Overall it seems like pricing is more or less in line with what we’ve been hearing from the Fed so far.

Sectors and Flows

Currency strength over one and three months:

USD and CHF have been outperforming

EUR and GBP are the weakest currencies

US equity sector performance over one month:

Leaders are all energy and raw materials: XOP, XME, OIH, XLE

Laggards are Healthcare, Semis and Staples

Growth (VUG) outperforming Value (VTV)

Consumer Discretionary (XLY) still near the top

It reminds me of the top-of-the-cycle performance we’ve seen during the first half of the year with energy outperforming by wide margins.

Different look at the same data: Energy is outperforming, followed by Materials. Defensive sectors paint a confusing picture.

International stock markets over one month are a mixed bag:

India’s Sensex is at the top, followed by Japanese Nikkei and Topix

European indexes and Taiwan are the worst performers

BNY Mellon iFlow:

Flows into USD, and out of CHF, EUR and JPY

Pretty much negative equity flows across the board

Sentiment and Positioning

AAII Bull-Bear spread remains near its neutral range:

Callum Thomas’ weekly Twitter Macro Gauge continues to trend lower:

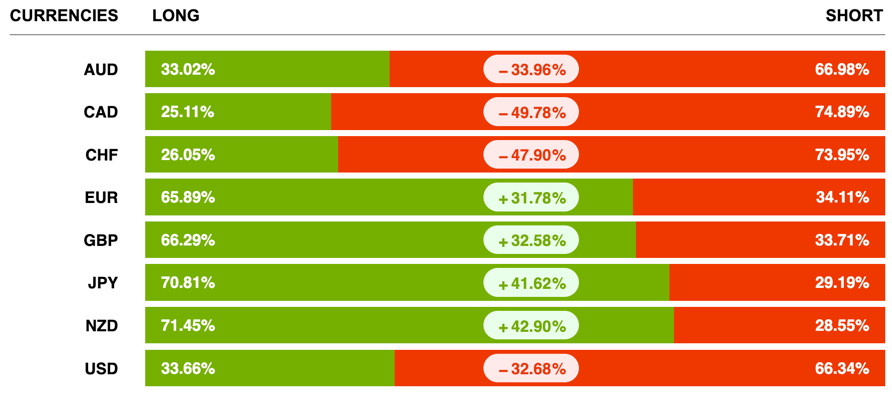

Currency sentiment:

Sentiment is bearish for CAD, CHF, AUD and USD (and it has become even bearish compared to last week)

Sentiment is bullish for NZD, JPY, GBP and EUR

Different sentiment source:

GBPUSD, EURUSD, NZDUSD, AUDUSD and USDJPY all have bearish sentiment on USD

All yen-pairs are bearish on JPY

EURCHF still very bullish on EUR

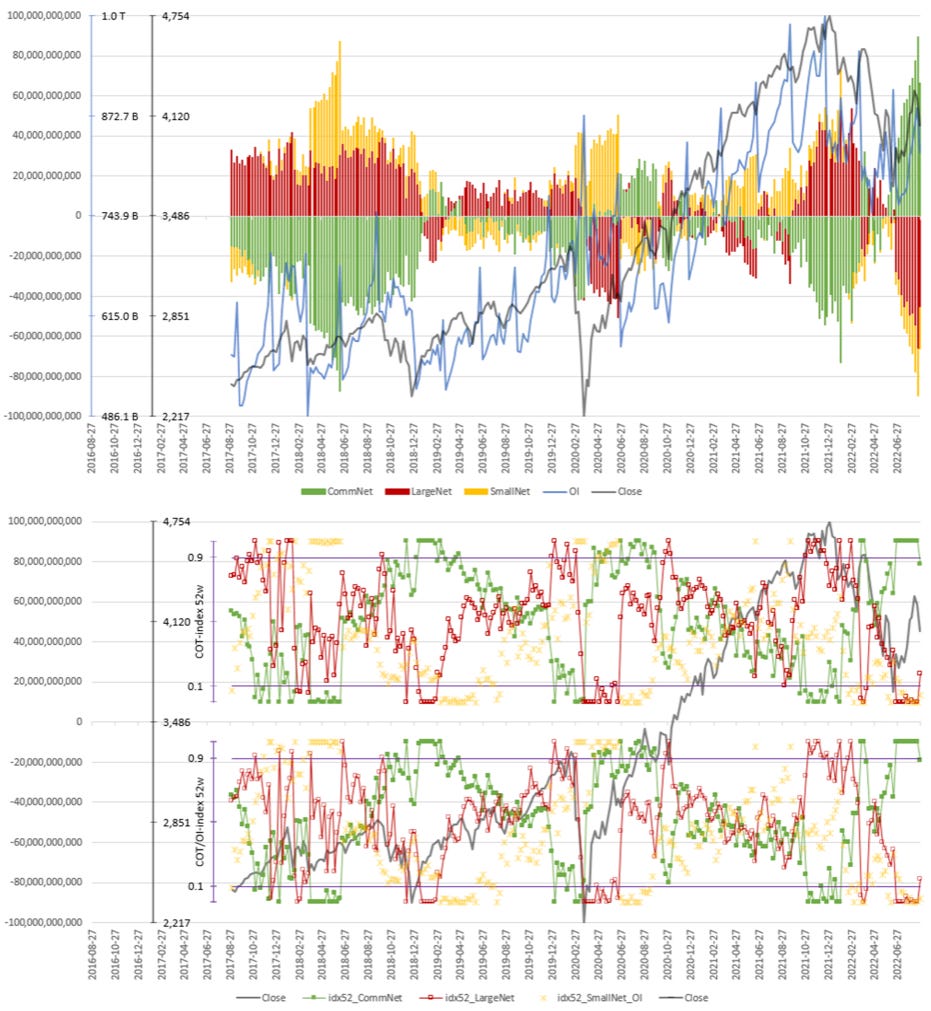

Commitment of Traders:

Equity indexes have taken a hit this week.

Commercial net positioning in the ES has been pared back a bit, Large Traders in the Nasdaq are at their highest long position in over a year (bearish). Also, Commercial and Large Trader 1-week net movements in the Nasdaq and the Russell 2k have been very bearish with Z-scores of -2.4 and -1.9 for the Commercials and 3.1 and 1.9 for the Large Traders.

Currencies are negative vs. the dollar. Commercial net positioning remains at/near a bullish extreme.

Energy performance was mixed, Crude remains pretty weak with an RSL of just 0.94

Metals were also mixed, Copper also isn’t gaining a lot of strength (RSL 0.89), Silver has near-extreme bullish Commercial and Large Trader positioning.

Grains and Softs were positive across the board.

Here’s the combined COT positioning for equity futures: well off last week’s high but still very bullish overall.

COT/TFF Dealer net positioning for currency futures: 6E is at a 2-year high (bullish), other than that there are no extreme positions.

Citi PAIN indexes: USD long still near extremes vs. the other G8s. Swissy has the biggest short position on.

Market Risks

Credit spreads haven’t moved much overall during last week and especially on Friday with the bearish action in equities:

Credit Spread Index also not doing much:

Currency volatility has picked up a bit but Friday’s action didn’t leave much of an impression:

The VIX term structure has flattened, but it’s still looking pretty solid:

Volatility indexes:

VIX has been higher the entire week, VIX/VIX3M flattened

VVIX has made a lower high

MOVE has come down (!)

If Friday had taken place on Wednesday and we had seen a bit more post-Powell action in volatility like this, I would consider this piece of the puzzle to be pretty bullish.

Skew is still flat, TDEX has moved up a bit along with VIX/VOLI. There’s not much demand for OTM puts and hedges overall:

CNN Fear and Greed Index is also relatively unimpressed:

Various

Market breadth: the NYSE A/D line is holding above its recent low (it’s just one data point, so not getting too excited about it).

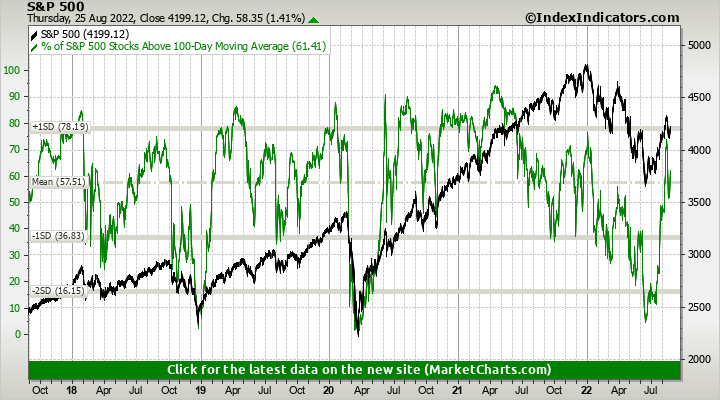

Index components above their 100-day moving averages also holding up:

Like last week: SLV/GLD, XLF/XLU and the Korean Won believe the bear market rally has ended while HG/GC is more optimistic:

25-delta risk reversals:

EURUSD, GBPUSD and NZDUSD are priced higher

USDCAD is priced lower

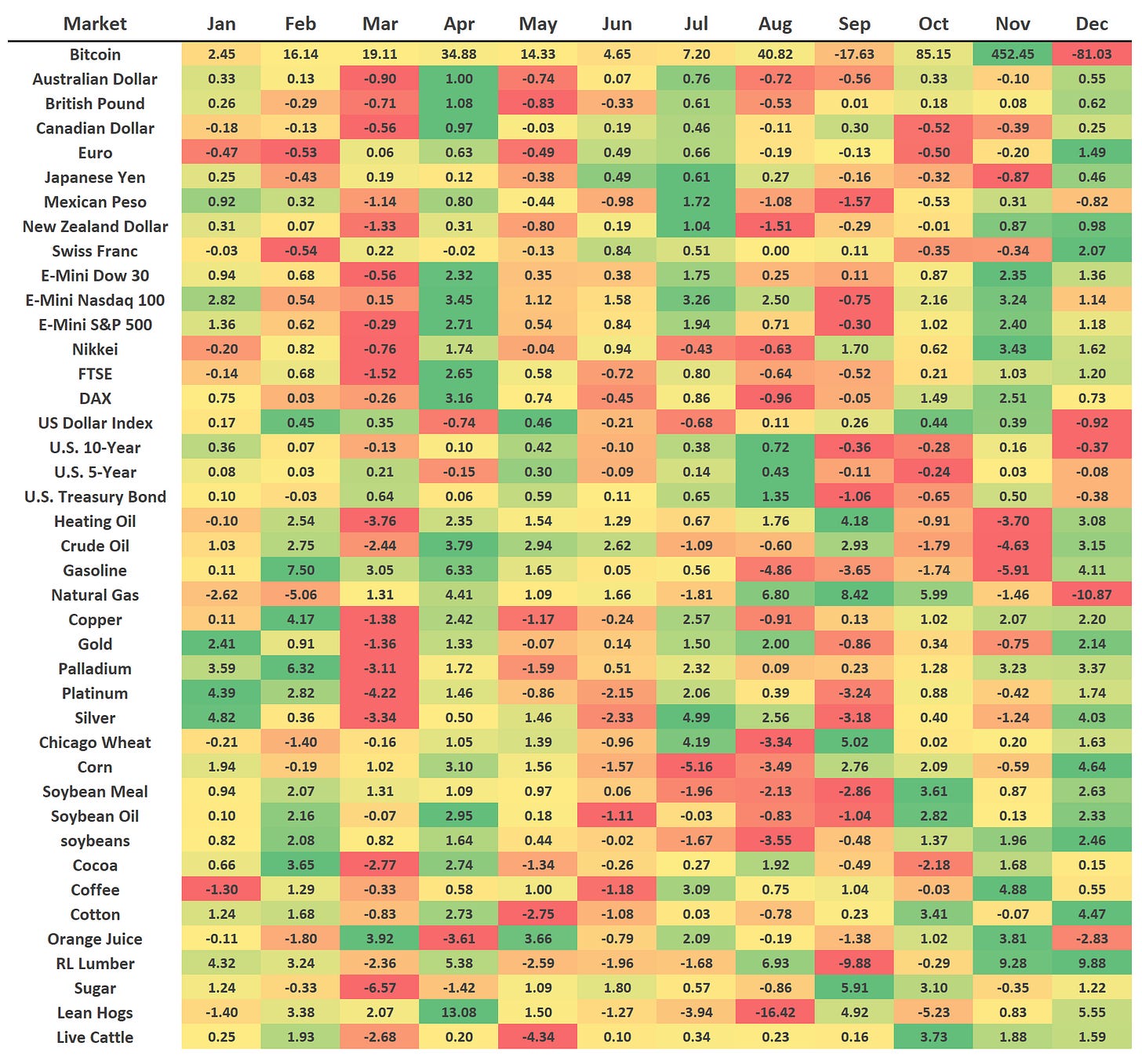

Seasonality for August sees AUD, GBP and NZD lower, and JPY higher.

Other Stuff I've been looking at

Inflation expectation swaps are diverging between the US and EU/UK:

Inflationary pressures are broadening in the US:

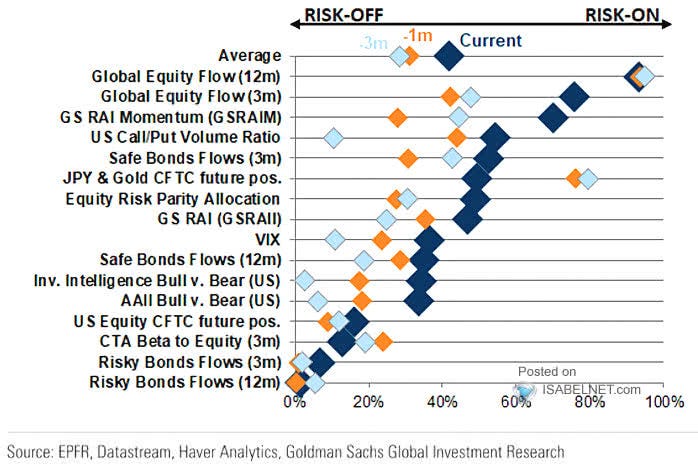

GS Sentiment indicators have improved compared to one and three months ago:

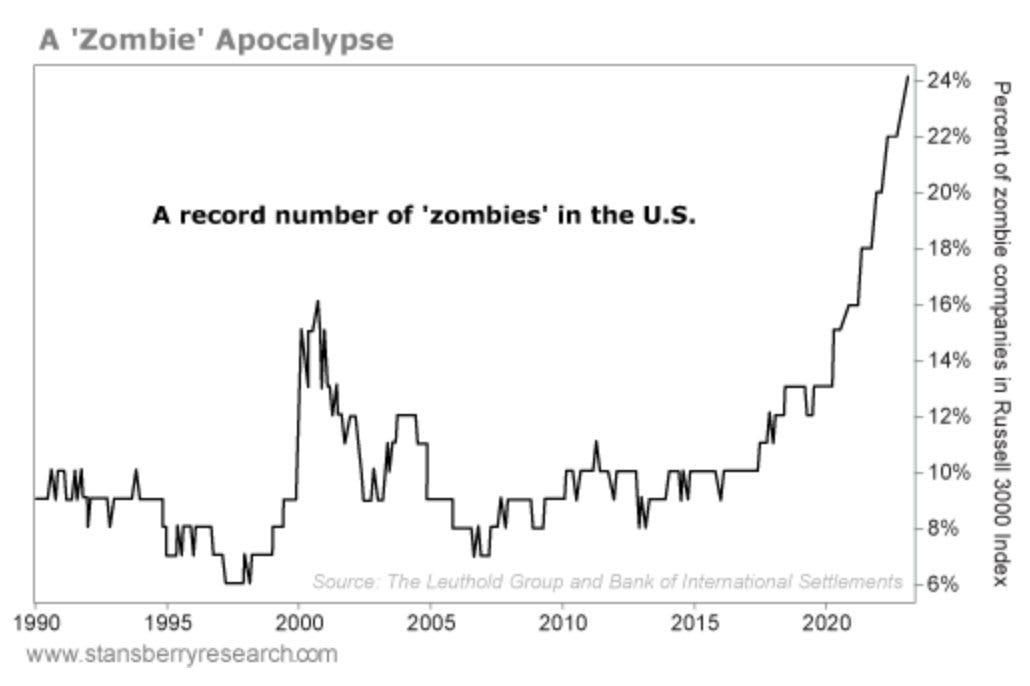

Zombie companies are businesses that can’t afford to pay the interest on their debts:

The Leading Indicator of leading indicators is dropping fast:

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 31/2022

FOMC Meeting Minutes: 34/2022 | 28/2022 | 25/2022

ECB

Rate Statement 30/2022

Meeting Minutes: 28/2022 | 21/2022

Economic Forecasts: 21/2022

BOE

Rate Statement: 32/2022 | 25/2022

Financial Stability Reports: 28/2022

RBA

Rate Statements: 32/2022 | 28/2022

Meeting Minutes: 34/2022 | 30/2022 | 26/2022 | 21/2022

Statement on Monetary Policy 32/2022

RBNZ

Rate Statements: 34/2022

SNB

Rate Statements: 25/2022

BOJ

Rate Statement: 30/2022 | 25/2022

Rate Summary of Opinions: 31/2022

Photo by Jeremy Hynes on Unsplash