FX & Macro Outlook for Week 32/2022

RBA Rate Statement and SOMP, BoE Rate Decision and Monetary Policy Report, a few PMIs and the complete FX analysis...

Welcome to edition #17 of FX & Macro Weekly.

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts, because they are basically the reasoning behind the conclusions I present in the Summary. The final section is a collection of things I read during the week that influence my thinking.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

One more thing. You seem to like newsletters, so here's a great way to discover new stuff to read for free: The Sample. They will regularly send you an issue of a different semi-random newsletter you might be interested in. If you sign up using my referral link, I get bonus points and my newsletter will be forwarded to others to check out.

Now let's get started…

Table of Contents

Summary (Playbook, Calendar, Levels)

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Just to reiterate my main message from last week:

Strong opinions, weakly held. Being nimble. Trading the market, not expectations. That's going to be even more essential for the coming weeks.

Relevant market risks I have on my radar (it's obviously not a comprehensive list and mostly unchanged from last week):

Europe: huge uncertainty regarding future of gas flows from Russia; an unexpected resolution of the conflict seems very unlikely, but it could escalate on multiple fronts (gas, energy, militarily) very quickly

UK: don't have a clear idea about the impact of the Tory leadership race yet (potential for impact on the sterling is there given the comments from Liz Trus), the Northern Ireland protocol still remains unresolved

Global markets: the risk from commodity market squeezes spilling over seems to have diminished a bit

China/Taiwan: keeping an eye on the Taiwanese stock market as a risk gauge

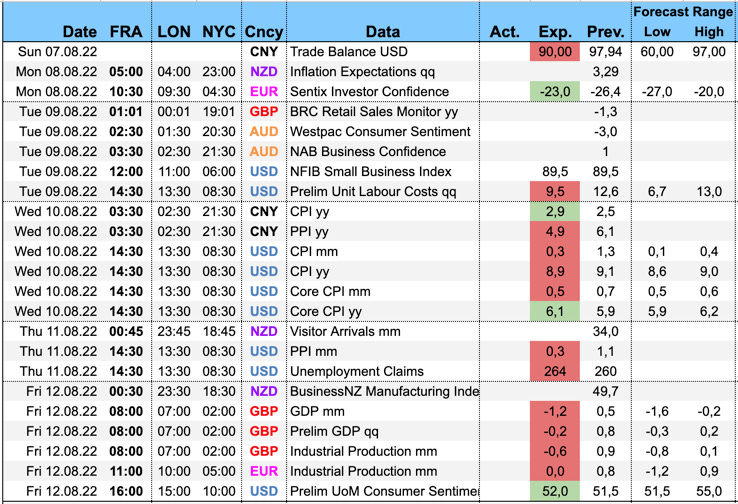

Economic Calendar for next week

Important levels to watch and look out for in the Majors

Week in Review

Central Banks

RBA Rate Statement (02.08.)

The bank hiked by 50 bps to 1.35% as expected. Summary and difftext below:

Guidance added that the process of normalizing monetary policy “is not on a pre-set path”.

Priority is bringing inflation back to 2-3% target while “keeping the economy on an even keel”.

Widespread upward pressures on prices, mostly global factors but domestic factors also play a role.

Inflation is expected to peak later this year, then decline back to 2-3%. Medium-term inflation expectations remain anchored.

CPI forecast: 7.75% in 2022, a little above 4% over 2023 and around 3% in 2024

GDP forecast: 3.75% in 2022, 1.75% in 2023 and 2024 each

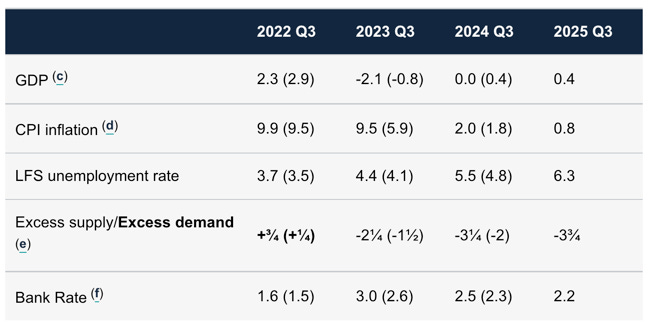

Bank of England Rate Decision and Monetary Policy Report (04.08.)

Hike 50 bps to 1.25% as expected. Summary and difftext below (link to full text):

Vote 8-1 with Tenreyo dissenting in favour of a 25 bps hike

Guidance changed: “Policy is not on a pre-set path” added

Plans to start selling gilts shortly after September meeting

CPI forecast upgraded to 13.4% in Q4, expected to remain elevated throughout much in 2023

UK is now projected to enter a recession from Q4, real household income projected to fall sharply in 2022 and 2023, consumption growth turns negative

Nominal wage growth expected to be higher than projected in May

Labour market is tight, unemployment seen rising from 2023

Regarding Gilt sales (from the meeting minutes):

The Committee judged that, over the first twelve months of a sales programme starting in September, a reduction in the stock of purchased gilts held in the APF of around £80 billion was likely to be appropriate. Given the profile of maturing gilts over this period, this would imply a sales programme of around £10 billion per quarter.

For following years, the MPC intended to set an amount for the reduction in the stock of purchased gilts over the subsequent twelve-month period, as part of an annual review.

The MPC agreed that there would be a high bar for amending the planned reduction in the stock of purchased gilts outside a scheduled annual review. That was in order to remain consistent with the principles that Bank Rate should be the active policy tool when adjusting the stance of monetary policy, and that unwind should be predictable. If such amendments were judged necessary in order to meet its remit, for example if potential movements in Bank Rate alone were judged insufficient to meet the inflation target, or if markets were judged to be very distressed, the MPC would first consider amending or halting the sales programme before considering restarting reinvestments or additional asset purchases.

The following charts and tables are from the Monetary Policy Report:

Unemployment is projected to rise steadily with no end in sight:

RBA Statement on Monetary Policy (05.08.)

Link to full text. Summary and charts below, emphasis mine:

The Board is committed to do what is necessary to ensure that inflation in Australia returns to the 2 to 3 per cent target range over time. It is seeking to do this in a way that keeps the economy on an even keel. The path to achieve this balance is a narrow one and subject to considerable uncertainty. The Board expects to take further steps in the process of normalising monetary conditions over the months ahead, but it is not on a pre-set path. The size and timing of future interest rate increases will be guided by the incoming data and the Board's assessment of the outlook for inflation and the labour market.

The Cash Rate is expected to peak around 3.25% in early 2023 before declining a bit:

Some more points:

Risk that high inflation gets built into wage and price setting behaviour

Inflation is broad based but medium, long-term inflation expectations remain anchored

Rising cost of living, higher rates and falling house prices to weigh on economy

Around 60% of firms in liaison program expect wages to be high over year ahead

Many employers report they intend to increase headcount further but finding it hard to get workers

Risks to the global outlook are skewed to the downside given synchronised policy tightening

Confab, Speakers, News

Federal Reserve

Kashkari (Dove). Sun: Committed to bringing inflation down, currently a long way from 2% target, will do what we need to do. Not seeing signs of a recession, being in a technical recession doesn't change the fact that we have work to do.

Daly (Neutral). Tue: Work on inflation is "nowhere near almost done, long way to go on achieving price stability, getting too confident would be a mistake. Expects to have a slower economy and slightly cooler labour market, no large increase in unemployment coming. Consumers are resilient. Wed: 50 bps reasonable in September, if inflation is roaring ahead then perhaps 75 bps more appropriate. Fight against high inflation not completed, 3.4% is a reasonable place to get to by year end. Rates at current levels not restrictive, restrictive level more at 3%. What happens depends on data, unemployment rising a bit is tolerable.

Mester (Hawk). Tue: We have not seen inflation cool or levelling off at all, it's not coming down quickly, have more work to on inflation. Price stability is the bedrock of a strong economy. Does not believe we're in a recession, labour market very healthy, expects some increase in unemployment but need that to happen to make sure we get back to price stability. Starting to see slowdown in consumer spending, housing. Thu: We should discuss selling some MBS given size of balance sheet. Need to see several months of monthly changes in inflation moving lower. Need to raise rates and hold them for a while. We're not in a recession right now, still path to a soft landing. Businesses not looking for as many workers as before.

Evans (Neutral). Tue: 50 bps is reasonable, 75 bps is okay, 100 bps not called for. Hopes to do 50 bps in September and then continue with 25 bps hikes until Q2/23, sees interest rates at 3.75-4.00% by the end of 2023. Need to start getting less ugly inflation prints soon. Unemployment will stay below 4% this year. Soft landing possible but a lot of risks. Looks for 1% growth or lower this year.

Bullard (Hawk). Wed: Yield curve inversion is a nominal inversion, rate path is more data dependent now, must move into restrictive territory, Fed and ECB will achieve a relatively soft landing.

Barkin (Hawk). Wed: Fed is committed to getting inflation under control, "we will do what it takes". expects inflation to come down but not immediately and not predictably. Recession fears inconsistent with job growth and unemployment rate.

Kashkari (Dove). Wed: Very unlikely scenario that Fed cuts rates next year, will probably takes several years to get inflation back to 2%, laser focused on getting inflation down, wages are climbing, inflation is broadening.

European Central Bank

Kazaks (Hawk). Thu: ECB should keep hiking rates to fight inflation.

Bank of England

Bailey (Neutral). Thu post-statement: All options on the table for September and beyond, action at current meeting not indicative of what we are going to do at next meeting, not on a pre-set path. Near-term inflationary pressures have increased significantly, uncertainty is exceptionally high. Fri: Don't know what normal rates will be in the future, not going back to pre-GFC levels, we'll have to deal with inflation for some time. Selling gilts will not have a big impact on market rates.

Pill. Fri: Shouldn't assume rates will rise another 50 bps in September. Trying to keep flexibility given the uncertainties we face, need flexibility to go further or stay where we are.

Bank of Japan

Suzuki (FinMin). Tue: Important that the exchange rate moves stably, reflecting fundamentals.

Economic Data

Monday, 01.08.22

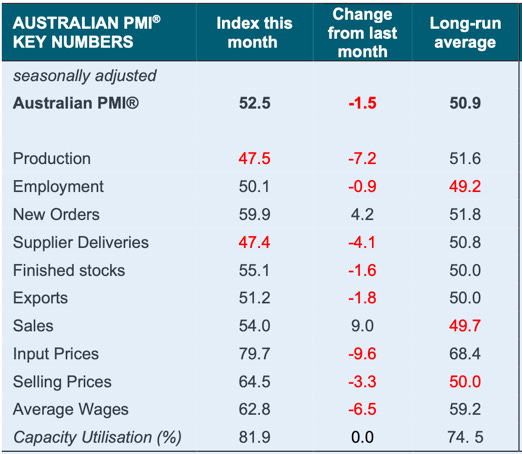

Australian AIG Manufacturing Index: below previous print, AUD weaker

Chinese Caixin Manufacturing PMI: below forecast range

German Retail Sales: below forecast range, EUR unchanged

US ISM Manufacturing PMI: worse than expected (also: Prices Paid down significantly), USD weaker

Australian AIG Manufacturing Index (link to full report). Summary, emphasis mine:

Manufacturing activity slowed in July. Most subsectors eased but the metal products sectors recovered strongly.

Labour challenges, supply chain disruptions and high energy prices remain the major structural constraints on manufacturing.

Input prices declined for the first time since February 2022 but remain at very high levels. Employment declined, reflecting labour shortage pressures on manufacturing businesses.

Most manufacturing activity indicators declined in July. However, new orders and sales strengthened, despite tight supply chain pressures.

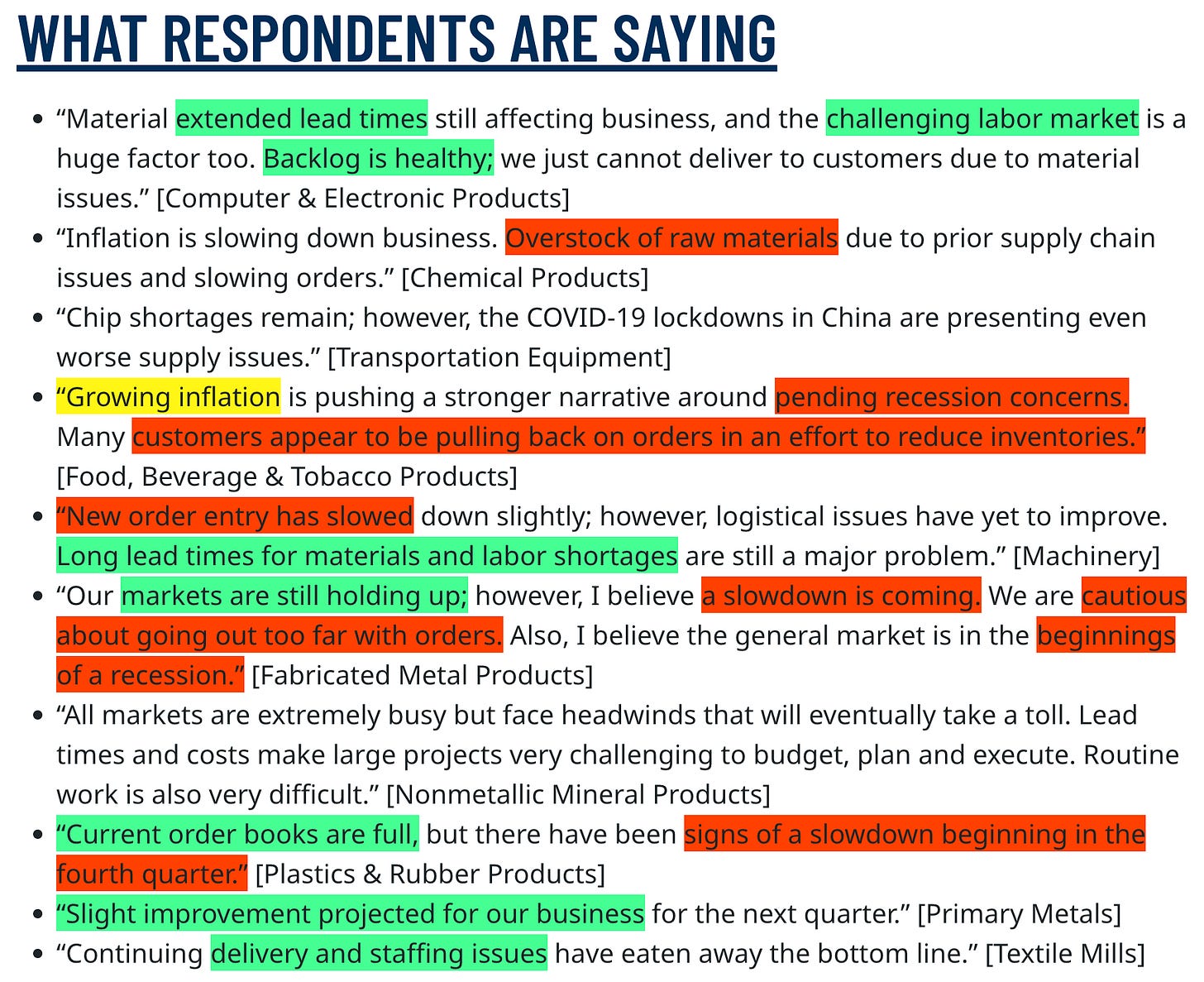

US ISM Manufacturing PMI (link to full report). Summary, emphasis mine:

“The U.S. manufacturing sector continues expanding — though slightly less so in July — as new order rates continue to contract, supplier deliveries improve and prices soften to acceptable levels. According to Business Survey Committee respondents’ comments, companies continue to hire at strong rates, with few indications of layoffs, hiring freezes or headcount reduction through attrition. Panelists reported higher rates of quits, reversing June’s positive trend. Prices expansion eased dramatically in July, but instability in global energy markets continues. Sentiment remained optimistic regarding demand, with six positive growth comments for every cautious comment. Panelists are now expressing concern about a softening in the economy, as new order rates contracted for the second month amid developing anxiety about excess inventory in the supply chain.

The Prices Index registered 60 percent, down 18.5 percentage points compared to the June figure of 78.5 percent; this is the index’s lowest reading since August 2020 (59.5 percent).

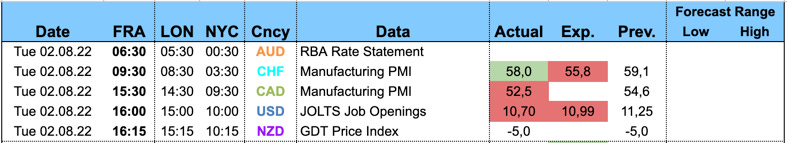

Tuesday, 02.08.22

RBA Rate Statement: covered above, AUD sold off

Swiss Manufacturing PMI: above consensus, CHF stronger

Canadian Manufacturing PMI: below previous print, CAD initially weaker

US Job Openings: below forecast, USD without clear direction

Global Dairy Price Index: unchanged, NZD unchanged

Wednesday, 03.08.22

New Zealand Employment Change: below forecast range, NZD weaker

Aussie Retail Sales: in line, AUD stronger

Chinese Caixin Services PMI: above consensus, AUD stronger

German Trade Balance: above forecast range, EUR unchanged

Swiss CPI: m/m in line and y/y below forecast, CHF weaker

Eurozone Retail Sales: below forecast range, EUR unchanged

US ISM Services: beat consensus, Factory Orders: above forecast range; USD stronger

US ISM Services PMI (link to full report). Summary, emphasis mine:

The composite index indicated growth for the 26th consecutive month after a two-month contraction in April and May 2020. Growth continues — at a faster rate — for the services sector, which has expanded for all but two of the last 150 months. The slight increase in services sector growth was due to an increase in business activity and new orders. The Employment Index (49.1 percent) contracted for the second consecutive month, and the Backlog of Orders Index decreased 2.2 percentage points, to 58.3 percent. Availability issues with overland trucking, a restricted labor pool, various material shortages and inflation continue to be impediments for the services sector.”

Thursday, 04.08.22

Australian Trade Balance: higher than the forecast, AUD was briefly stronger

German Factory Orders: above consensus, EUR stronger

BoE Rate Statement: covered above, GBP was weaker

US Unemployment Claims: worse than forecast, USD was lower

Friday, 05.08.22

Australian AIG Services Index: above previous print, AUD unchanged

RBA Monetary Policy Statement: covered above, AUD unchanged

German Industrial Production: above consensus, EUR weaker

Canadian Employment Change: below consensus but Unemployment Rate was surprisingly lower, CAD stronger

US Avg. Hourly Earnings and Non-Farm Payrolls: both above their forecast ranges, USD stronger

Canadian Ivey PMI: below forecast, CAD stronger

Summary from the Australian AIG Services Index, emphasis mine (link to full report):

The Australian PSI® indicated mild growth in the services sector in July, following two months of weak results.

Services capacity utilisation rose slightly to 80.3%, similar to the June result and above the long-term average.

Customer demand in some sectors remains robust, but increased input costs, labour shortages and concerns about future demand impacted services businesses in July.

Market Analysis

Growth and Inflation

Atlanta Fed GDPNow prints 1.4% GDP growth for Q3.

The NY Fed Weekly Economic Index estimates four-quarter GDP growth at 2.95%

Citi Economic Surprise Indexes:

USD, EUR and AUD are improving

GBP, NZD and CAD moving lower

Global PMIs:

Eurozone, China, Canada are weakening

US, UK, Australia, Japan remain unchanged

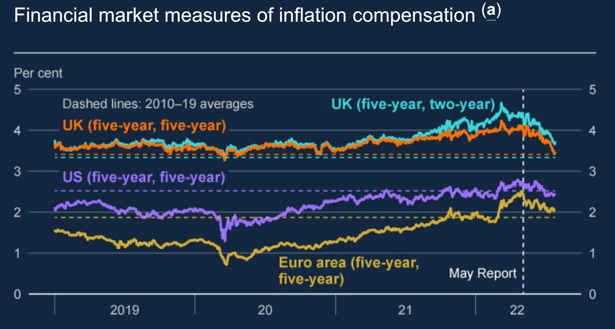

5y5y inflation expectations are back in the middle of their range:

The Inflations Expectations ETF is trading sideways as well:

Citi Inflation Surprise Indexes:

USD moving higher again, CHF still at highs

AUD and CAD are down

Yields

See chart and table below:

US yields jumped after Friday's NFP print, US 2s are the strongest

EUR and NZD yields look very weak, but it isn't pretty anywhere else

Bear flattening in most curves already visible here

Yield curves along the 2s10s spread are flattening all over. The Kiwi curve has inverted, UK is going to be next:

Central Banks

FOMC target rate probabilities according to FedWatch:

The September meeting is now priced with an 68% chance of a 75 bps hike vs. 32% for 50 bps. Interestingly, the chance of a 100 bps hike is still zero.

The terminal rate has shifted up by 25 bps as well and the first cut is now expected in July rather than in May.

Overall a steeper implied path and a longer plateau than last week.

Short-term interest rates have had quite a ride in the front-end:

Sectors and Flows

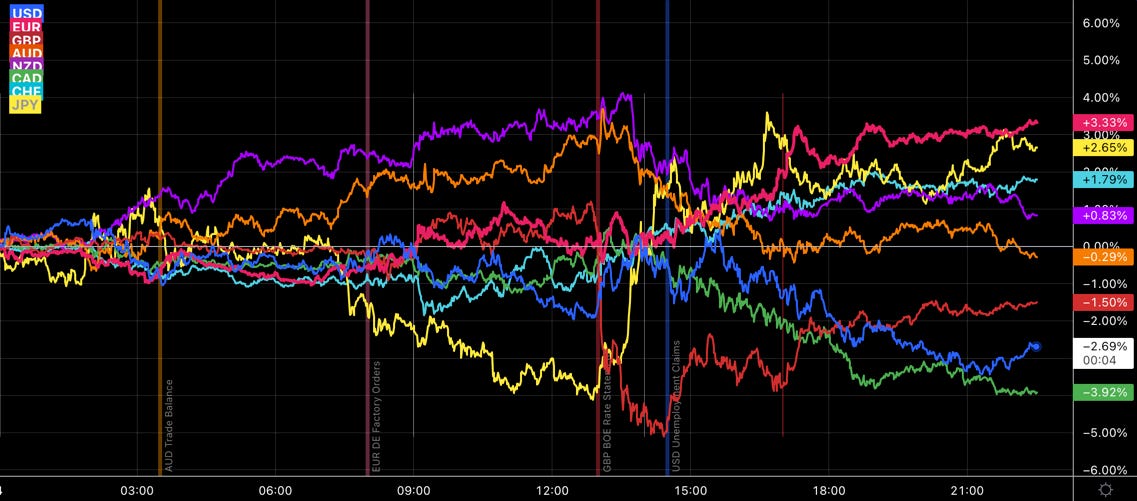

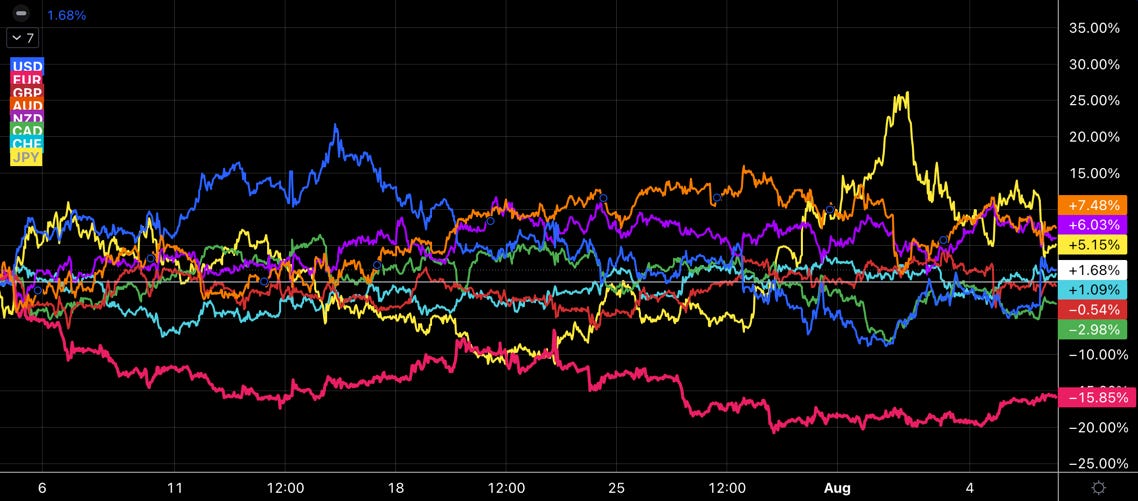

Relative currency performance: no clear outperformer over one month, but the EUR is still by far the worst off.

Equity sectors:

From the top down: Semiconductors, Metals & Mining, Consumer Discretionary, Tech, Oil & Gas, Growth, Industrials

From the bottom up: Healthcare, Staples, Value, Energy, Oil Services, Financials, Materials, Utilities

This is a lot more offensive than defensive

One-week performance has been mixed sector-wise. Tech and Communication leading, Cyclicals and Industrials all ahead of defensive sectors. Financials don't really count with an inverse yield curve, and Energy lagging equals inflation coming down. Over a 3-month horizon it looks a bit more mixed, but overall it's not really defensive.

Everything is up, except from Basic Materials, Energy and Financials:

International stock markets:

Hang Seng is the only index in the red over one month

Other than that: pretty much everyone and everything is up. Commodity indexes like the FTSE, TSX (Canada) or the BOVESPA are lagging now.

Heavy flows into the USD and out of EUR and JPY over one week while flows are going into AUD and CHF as well. Equity flows are broadly negative despite the rally in stocks:

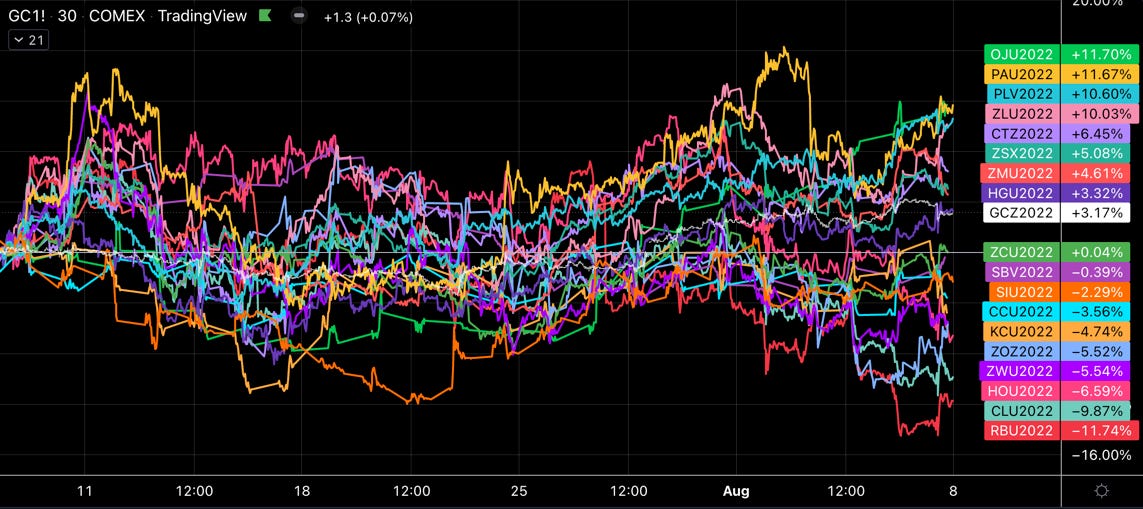

Commodity performance is dispersing further. I removed NG from the chart, because it distorts the entire scale with a +45% performance.

Sentiment and Positioning

The AAII Bull-Bear Spread is almost back to zero:

Currency sentiment:

Very bearish for CAD and CHF

Very bullish for JPY

Different sentiment source:

Overall sentiment still bearish for USD and bullish for JPY

EUR sentiment mostly bullish, especially vs. CHF

I have no experience with this one, but the weekly change in CL longs is pretty impressive. Retail traders are buying “the dip” in crude.

Commitment of Traders:

Equity performance is mostly positive over 12 weeks now, indexes are at or above their 26-week moving averages (Levy Relative Strength >1).

Positioning in stock index futures is still very bullish with Commercials net positions at 2.5 SD long while Large Traders are at -2.2 SD short in the S&P. Similar data for the Russell.

But: positioning in VIX futures is also bullish near extremes. It looks like the low volatility is being used to buy long VIX exposure.

6J saw some relevant Commercial selling and Large Trader buying this week (-1.9 SD and +1.72 SD changes in positions, respectively).

Performance in Energy is still pretty negative with 12-week changes around -23% for Crude, Heating Oil and Gasoline.

Metals have been relatively quiet this week. Positioning isn't extreme any more for the most part. The exception is Copper with Commercials net and Large Trader net positions near bullish extremes.

Grains and Softs have seen a bit of mixed performance.

Closer look at currency futures data from the COT/TFF report:

None of the futures are at extreme positions

The move in JPY has further room to the downside

Citi PAIN indexes remain mostly unchanged: USD positioning still extended to the long side vs. all other G8 currencies.

Market Risks

High-yield spreads are easing further:

IG spreads aren't moving, though:

Credit Spread Index is indicating less credit stress:

Currency volatilities are going lower except for JPY:

The VIX term structure has normalized further, it's almost back to a perfect contango:

Similar to what we've seen over the last weeks, VVIX is trending lower, VIX is trending lower, the VIX term structure is steepening (VIX/VIX3M). Volatility is sending a clear message: nothing to see here. MOVE being a bit of an exception here, because it isn't following equity volatility so far:

ATM vol (VOLI) is falling faster than overall vol (VIX), so skew is steepening a bit. Tail-hedges aren't being bought:

Various

Market breadth is going strong. The NYSE Advance/Decline line is following price well, it has taken out its June highs (the SPX hasn't so far).

Stocks in the S&P 500 and in the Nasdaq are climbing above their 100-day moving averages. The current move up in stocks is broad-based.

Not everything is rosy, though:

XLF/XLU performance isn't moving higher… the inverted yield curve and continued flattening is weighing on Financials

Copper/Gold ratio still near lows, Silver/Gold ratio is diverging lower

The Korean Won isn't budging either

Investment Grade vs. Treasuries has been an outlier so far for months

The CNN Fear & Greed Index is exactly in the middle of nowhere:

25-delta risk reversals:

EUR is being priced higher, CHF as well

Risk reversals in USDJPY have moved higher sharply, so the strengthening of the JPY might well be over by now from the perspective of the options market

Other Stuff I've been looking at

Financial conditions vs. Fed Funds Rate:

Banks are tightening lending standards:

Q2 earnings season has been worse than it looks:

ISM Manufacturing sub-index contributions over time:

Another reason why peak CPI is probably behind us:

And another one:

And one more:

Cost-of-living crisis visualized:

As for the jobs report on Friday: NFP also went up by almost 500k at the peak of the tech bubble in March 2000:

Links to relevant central bank releases in previous editions of this newsletter:

Great works. Just a question, in the Macro section under Playbook for the next week, you write "market wants to believe no forward guidance means a less dovish Fed ". Why is a less dovish Fed not less hawkish Fed? Based on my understanding, Fed removed forward guidance and became data-dependent means Fed is not at bring down inflation at all cost mood, so it should be a dovish signal, hence less hawkish.

Superlative research. I would push back however on recent equity market price action being "broad based."

To the contrary, this has been somewhat skewed by heavier weighted mega cap tech counters taking the rest of the market by the scruff of its neck & pulling it to the upside. Its all been $AAPL, $GOOG, $AMZN, a bit of $META etc.

Regardless, this is superlative work (for those who like reading) 👍