Welcome to edition #19 of FX & Macro Weekly.

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts because they are basically the reasoning behind the conclusions I present in the Summary. The final section is a collection of things I read during the week that influence my thinking.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroguy if you want to reach out.

I've recently started doing a series of mid-week podcast write-ups as a small side-project to the newsletter called Extras. Check out the latest one here:

One more thing. You seem to like newsletters, so here's a great way to discover new stuff to read for free: The Sample. They will regularly send you an issue of a different semi-random newsletter you might be interested in. If you sign up using my referral link, I get bonus points and my newsletter will be forwarded to others to check out.

Now let's get started…

Table of Contents

Summary (Playbook, Calendar, Levels)

Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

I’m going to cut it short this time:

The market still isn’t doing what everybody seems to be hoping for: coming down.

Everybody hates the rally, and I include myself there.

I don’t see underlying weakness in the market or a clear catalyst why we should be heading straight back to lows.

I’m still not married to my opinion on what’s going on.

Relevant market risks I have on my radar (it's obviously not a comprehensive list and mostly unchanged from last week):

Europe: huge uncertainty regarding the future of gas flows from Russia; an unexpected resolution of the conflict seems very unlikely, but it could escalate on multiple fronts (gas, energy, militarily) very quickly

UK: I don't have a clear idea about the impact of the Tory leadership race yet (potential for negative impact on the sterling is there given the comments from Liz Truss), the Northern Ireland protocol remains unresolved

Global markets: the risk from commodity market squeezes spilling over seems to have diminished a bit

China/Taiwan: keeping an eye on the Taiwanese stock market as a risk gauge

Economic Calendar for next week

Important levels to watch and look out for in the Majors

Week in Review

Central Banks

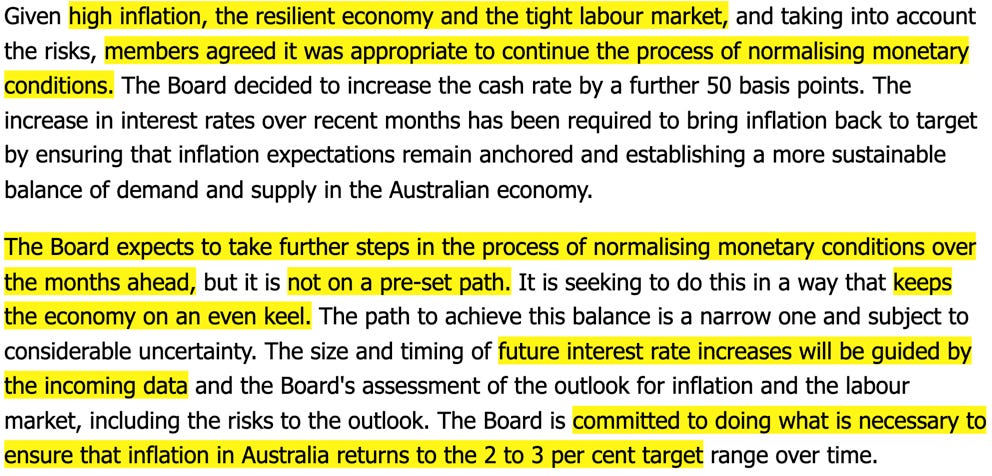

RBA Meeting Minutes (16.08.)

AUD was up on the minutes. Here are some relevant points (link to full text):

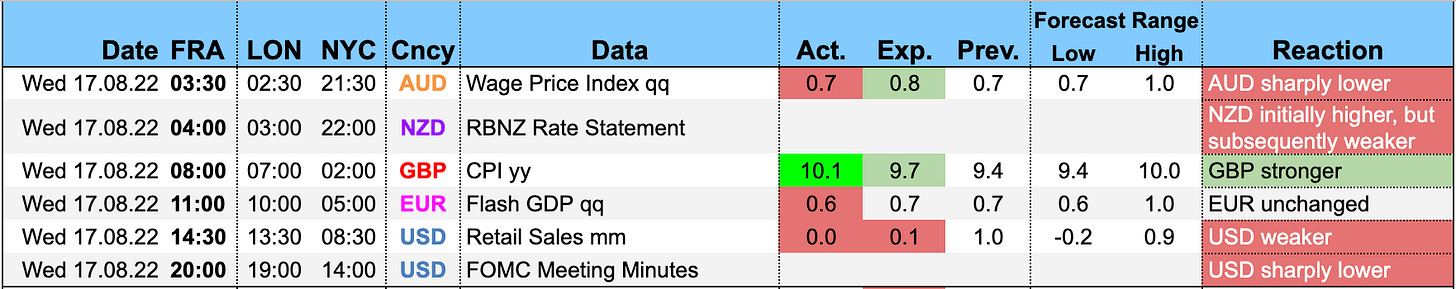

RBNZ Rate Decision (17.08.)

The RBNZ hiked the cash rate by 50 bps as expected to 3.00%. NZD was initially up but sold off subsequently after the release. Here are the main points from the statement and the difftext below (link to full text):

CPI remains too high, labour resources remain scarce

The global growth outlook is weakening, but domestic spending in New Zealand has remained resilient

Monetary policy needs to continue to tighten until committee members are confident it will bring inflation back to the 1-3% target range.

From the Summary Record:

The Committee is resolute in its commitment to ensuring CPI returns to the 1 to 3 per cent target range.

House prices have steadily dropped from high levels since November last year, and are expected to keep falling over the coming year towards more sustainable levels.

The Committee agreed that further increases in the OCR were required in order to meet their Remit objectives, and discussed the appropriate pace at which to raise rates. The Committee discussed whether more rapid increases could improve the credibility of the inflation target and reduce the risk of a significant increase in inflation expectations. However, the Committee agreed that maintaining the recent pace of tightening remains the best means by which to meet their Remit.

The Committee noted that a number of central banks had increased interest rates by more than 50 basis points recently, but that most of these countries had started increasing interest rates later than New Zealand did and were often starting at a lower level of interest rates.

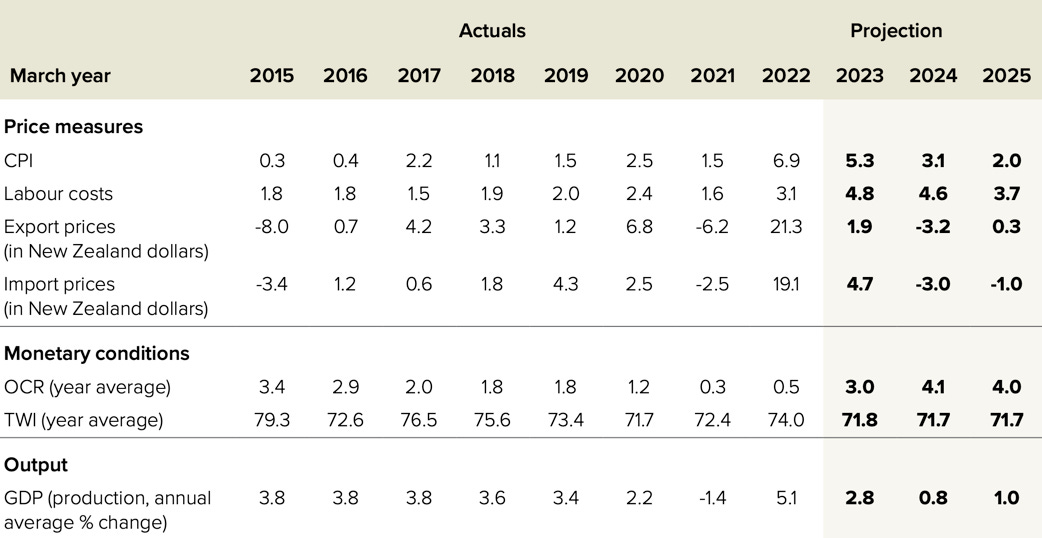

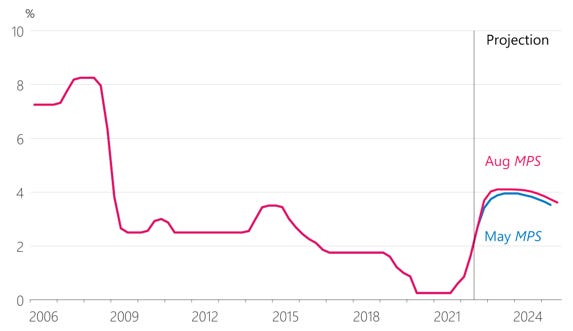

From the Monetary Policy Statement:

The projections for the OCR have been revised upward:

FOMC Meeting Minutes (17.08)

There were no hawkish surprises in the July Minutes, USD was sharply lower on the release:

They mention a risk that the FOMC might be over-tightening due to fluid economic backdrop and lags in policy transmission

On the other hand: some participants think rates have to remain above neutral for “some time”

Asset valuations have eased from elevated levels (with the dovish connotation that the Fed could be near-done on this front)

Relevant points (link to full text):

Confab, Speakers, News

Federal Reserve

Bowman (Neutral). Wed: Labour market is strong, high inflation could bring workers back to the workforce, future of labour supply is uncertain.

Daly (Neutral). Thu: 50 bps or 75 bps are reasonable for the September meeting, rates need to get a little over 3% by year-end. Markets have a lack of understanding that rates won't go down right after they've gone up, doesn't have a hump-shaped rate path on her mind. Way too early to declare victory on inflation, but doesn't want to overtighten and do more than necessary.

Kashkari (Dove). Thu: Have more work to do to bring inflation down, need to get it down urgently. Doesn't know whether the Fed can avoid a recession, economic fundamentals are strong, labour supply is fixed, need to get demand down. Fed has looked at yield curve control but not obvious that benefits outweigh costs.

George (Dove). Thu: Latest CPI was encouraging but too early for a victory lap, Fed has to be completely convinced inflation is coming down before stopping to raise rates, easing in financial conditions does not reflect how the Fed is thinking about policy.

Bullard (Hawk). Thu: Considering supporting another 75 bps hike in September, important to get rates to 3.75-4.00% by year-end, market speculation of rate cuts is definitely premature, Fed has a long way to go to get inflation back down, the idea that inflation has peaked is hope, expects high inflation to be more persistent. Growth will be stronger in H2.

Barkin (Hawk). Fri: Will take rates to restrictive levels but will take a signal from economy how high or low that has to be, no decision yet on size of September hike, Fed will do what it takes to get inflation back down to target.

European Central Bank

Schnabel (Neutral). Thu: ECB outlook on inflation has not changed, inflation concerns have not been alleviated and a number of indicators point to risk of expectations unanchoring. Growth is slowing, technical recession possible.

Reserve Bank of New Zealand

Orr. Thu: Monetary policy at times was overly loose. There is and will be stress in many households. Fri: Wants the OCR clearly above neutral. Diverse opinions on where the RBNZ should set interest rates suggests that we're close to the point where next decision will be hard to make. Monetary policy settings close to where they need to be because of diversity of opinions over the size of required rate rises.

Bank of Canada

Macklem. Tue: Inflation may have peaked but remains far too high, will likely remain high for some time. Determined to bring inflation back down, job won't be done until it is back at 2% target.

Economic Data

Monday, 15.08.22

The PBOC cut their 1-year Medium-term Lending Facility (MLF) by 10 bps to 2.75%, presumably in response to the weak data

The Empire State Manufacturing Survey made quite a few headlines because it was such a negative surprise:

Business activity declined sharply in New York State, according to firms responding to the August 2022 Empire State Manufacturing Survey. The headline general business conditions index plummeted forty-two points to -31.3. New orders and shipments plunged, and unfilled orders declined. Delivery times held steady for the first time in nearly two years, and inventories edged higher. Labor market indicators pointed to a small increase in employment, but a decline in the average workweek. While still elevated, the prices paid index moved lower, and the prices received index held steady. Looking ahead, firms did not expect much improvement in business conditions over the next six months.

Here's what the chart looks like:

Tuesday, 16.08.22

The RBA Meeting Minutes are covered in the section above.

The Canadian headline CPI printed in line, but the Common and Median metrics surprised to the upside, which explains the strength of the CAD.

Wednesday, 17.08.22

The FOMC Meeting Minutes have been covered above.

Thursday, 18.08.22

Friday, 19.08.22

Market Analysis

Growth and Inflation

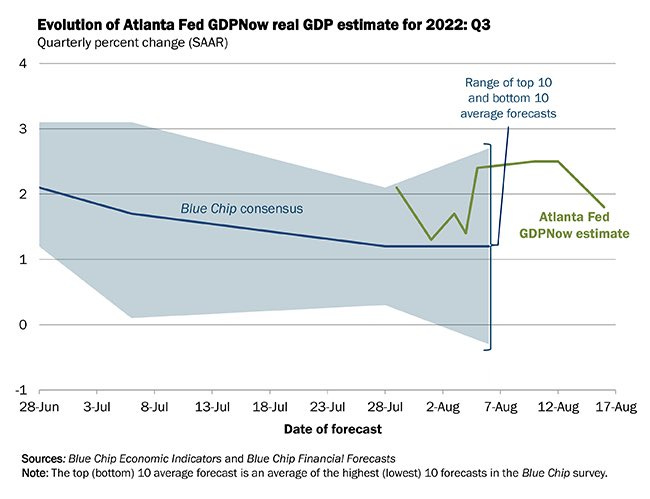

Atlanta Fed GDPNow has moved down to 1.8%.

The NY Fed Weekly Economic Index estimates four-quarter GDP growth at 2.97%:

Citi Economic Surprise Indexes:

USD, GBP and JPY continue to move up

EUR has stalled, AUD isn’t going anywhere either

CAD continues to trend lower

CHF has rolled over

Global PMIs remain unchanged from last week:

Eurozone and Canada are weakening

US, UK, Australia, and Japan remain unchanged

Taiwan has deteriorated markedly, China and South Korea are weaker as well

Overall there’s a lot more red now than during the previous months

5y5y forward inflation expectation swaps trade have traded up a bit but remain within their range:

RINF looks similar:

Citi Inflation Surprise Indexes haven’t updated yet:

Yields

See chart and table below:

GBP is the strongest, EUR and USD yields are up as well

NZD, CAD and CHF are weak

Yield curves at the 2s10s spread have now also become inverted in the UK driven by a >65 bps move in 2s in August:

Central Banks

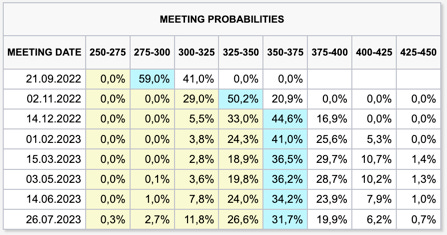

There hasn’t been a lot of change in the FOMC meeting probabilities according to FedWatch, but there are still more than 30 days to go:

59% probability of a 50 bps move vs. 41% for a 75 bps hike

The November meeting is priced with a 50 bps move, December with a 25 bps hike

After that, the market assumes the FFR will be held constant

That’s pretty much what we’ve been hearing from Fed speakers now: hike-and-hold rather than hike-and-ease.

Short-term interest rates continue to price fewer and fewer rate cuts for next year:

Sectors and Flows

Currency strength on a 1-month horizon:

CHF and JPY are the outperformers

EUR and GBP are underperforming

This week has seen flows out of JPY, CHF and CAD, and flows into AUD and USD according to BNY Mellon iFlow:

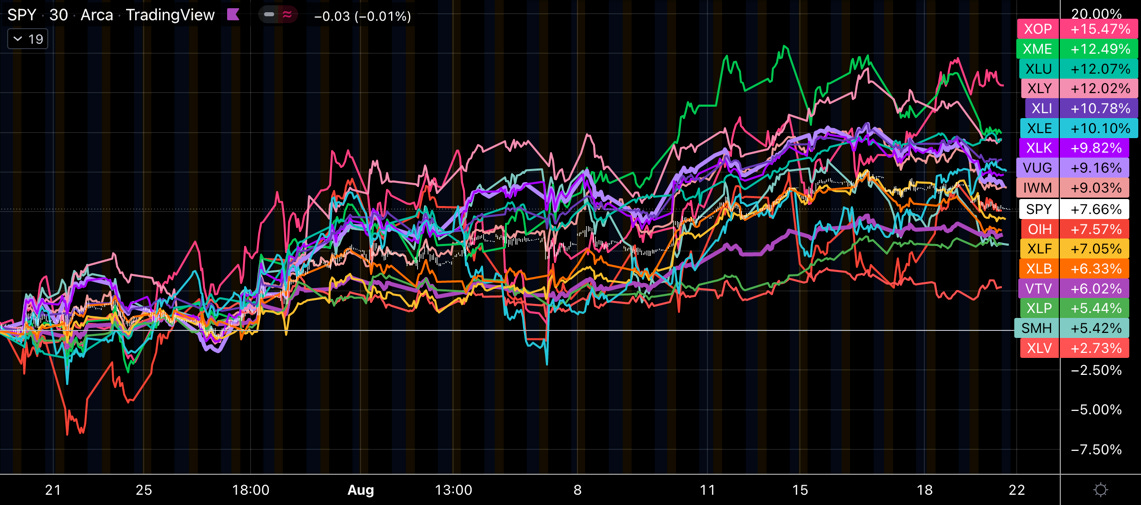

Equity sectors are very, very mixed again (1-month timeframe):

Oil/Gas and Metals/Mining are leading, Energy (XLE) somewhere near the top

Utilities (XLU) and Consumer Discretionary (XLY) are both strong

Growth outperforming Value again (VUG vs. VTV)

Consumer Staples (XLP) and Healthcare (XLV) at the bottom

The more reflationary sector performance has taken some hits and things have become a bit confusing.

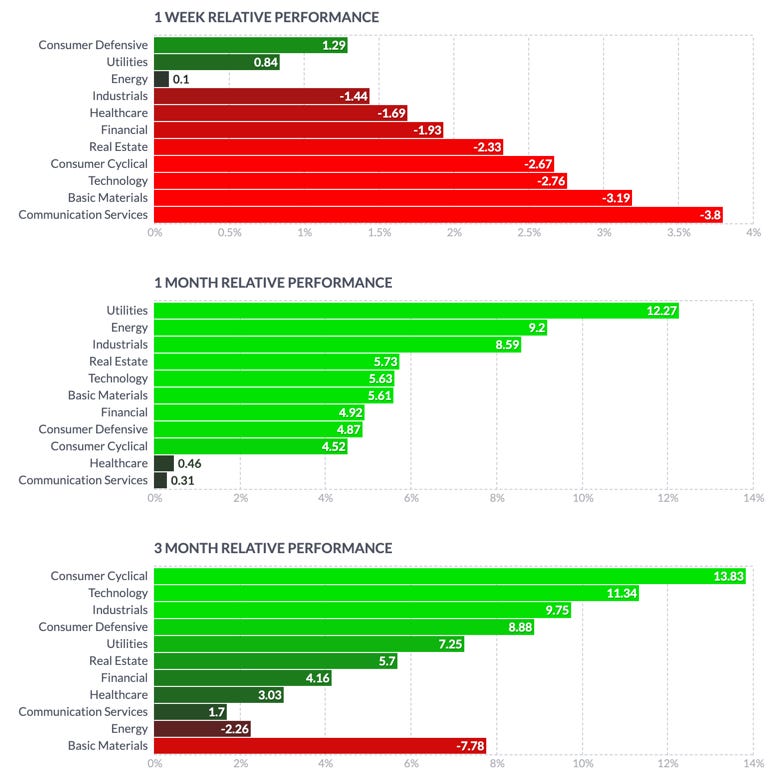

It’s also a pretty mixed bag on the following chart. This week has been on the defensive side, but over one month things are a lot less clear:

Sector charts (2 months) aren’t looking bearish at all:

International stock markets: Brazil has been outperforming hard, and the Hang Seng is still the only index underwater on a 1-month horizon.

Sentiment and Positioning

The AAII Bull-Bear spread is back to neutral levels around zero again:

Currency sentiment:

CAD and CHF still have the most bearish sentiment

Sentiment on USD is bearish as well

There’s an interesting divergence between AUD and NZD with traders being bullish on NZD and bearish on AUD… this supports an AUDNZD long

Different sentiment data:

EURCHF with bullish sentiment

USD pairs with bearish sentiment on the dollar

Every JPY pair is bullish on JPY sentiment-wise

Commitment of Traders:

Equity index futures suffered a bit this week, but they remain above their 26-week moving averages (Levy Relative Strength >1)

Commercials and Large Trader net positioning in ES and RTY is still very bullish

VIX futures also have pretty bullish positioning behind them (bullish in the sense that VIX goes up)

Performance of treasury futures is negative across the board. Positioning is often hard to interpret with vastly different results in similar futures (ZB and UB, for example). Still, Commercials and Large Traders positioning is at or near bullish extremes in the short end and the long end of the curve.

All currencies are negative against the strong dollar, and the DXY is the only FX future with an RSL >1.

Energy futures have seen mixed performance, crude oil remains very weak with an RSL of just 0.91 and weakening. Positioning in crude has been very bullish for weeks, but COT is not a timing tool.

Ags are mixed and mostly negative with the notable exception of cotton.

COT/TFF data hasn’t changed much:

EUR is just a tad below its 104-week high in Dealer net positioning

JPY Dealer net hasn’t moved much, and it remains somewhere near its neutral range

Citi PAIN indexes remain mostly unchanged: stretched long USD position vs. the other G8 currencies, the short in GBP has been reduced, CHF positioning is still the most negative (for whatever reason).

Market Risks

High-yield spreads have come down further while IG spreads just won’t move:

Credit Spread Index also heading lower:

Currency volatility has picked up again:

The VIX term structure has flattened and there’s a large premium in the front month compared to spot VIX. There’s still plenty of time until VX1 expires for the two to converge.

MOVE has picked up a bit and VVIX isn’t moving lower… or rather VIX hasn’t moved higher:

The correlation between VIX and VVIX has become more negative. As I’ve written last week, this tends to lead to a pop higher in VIX when it normalizes back to positive.

CNN Fear & Greed Index remains neutral:

Various

Market breadth remains strong: the NYSE Advance/Decline line tracks price, there’s no divergence yet.

The number of index components above their 100-day moving averages has rebounded sharply and isn’t going back down so far, which is usually a sign of a major low.

But there are clouds on the horizon: XLF/XLU, SLV/GLD and the Korean Won still aren’t buying this rally. Copper/Gold remains weak. The only confirmation comes from LQD/TLT, which has been behaving weirdly for months now:

25-delta risk reversals:

AUD and NZD have sold off but their risk reversals aren’t following

The JPY risk reversal has moved higher again, so the options market believes that the USDJPY has made a bottom

Other Stuff I've been looking at

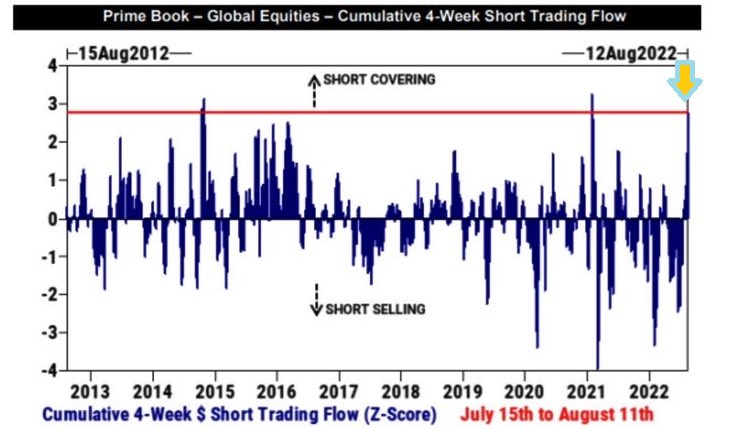

The latest rally has been the third largest hedge fund short-covering event since 2013:

End of summer, end of rally?

Chinese real estate market remains under pressure:

Global drivers of the global neutral rate:

The FreightWaves National Truckload Index is deteriorating further due to lack of demand:

Corporate insiders are buying:

US homebuilder sentiment has turned negative:

Links to relevant central bank releases in previous editions of this newsletter:

Fed

FOMC Statements: 31/2022

FOMC Meeting Minutes: 28/2022 | 25/2022

ECB

Rate Statement 30/2022

Meeting Minutes: 28/2022 | 21/2022

Economic Forecasts: 21/2022

BOE

Rate Statement: 32/2022 | 25/2022

Financial Stability Reports: 28/2022

RBA

Rate Statements: 32/2022 | 28/2022

Meeting Minutes: 30/2022 | 26/2022 | 21/2022

Statement on Monetary Policy 32/2022

SNB

Rate Statements: 25/2022

BOJ

Rate Statement: 30/2022 | 25/2022

Rate Summary of Opinions: 31/2022

Photo by Nathan Dumlao on Unsplash

Excelent work!!

As usual, the work is much appreciated.