Welcome to edition #11 of FX & Macro Weekly!

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts, because they are basically the reasoning behind the conclusions I present in the Summary. The final section is a collection of things I read during the week that influence my thinking.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroweekly.

Substack introduced a new feature: polls. I'm going to experiment with that from time to time, so here's a question for you:

Now, let's get started…

Table of Contents

Executive Summary (Playbook, Calendar, Levels)

Week in Review

Central Banks

Economic Data (Daily Summary and currency reaction)

Market Analysis

Growth and Inflation

Yields

Central Banks

Sectors and Flows

Sentiment and Positioning

Market Risks

Various

Other Stuff I've been looking at

Executive Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

All in all it looks a bit like the stage is set for a bit of a relief rally in (equity) markets. The underlying macro story remains the same, though, and it's not positive. Relevant market risks I have on my radar (it's obviously not a comprehensive list):

Europe: huge uncertainty regarding future of gas flows from Russia; an unexpected resolution of the conflict seems very unlikely, but it could escalate on multiple fronts (gas, energy, militarily) very quickly

UK: the Northern Ireland protocol still remains unresolved, PM Johnson is still under pressure and could be ousted (probably short-term negative for the pound but bullish over days)

Japan: the BOJ making an unexpected U-turn

Global markets: the risk from commodity market squeezes spilling over seems to have diminished a bit

Economic Calendar for next week

Important levels to watch and look out for in the Majors

Week in Review

Central Banks

RBA Meeting Minutes (21.06.22)

On the interest rate decision (full text is here, emphasis mine):

Two options for the size of the cash rate increase were considered: raising the cash rate target by 25 basis points or by 50 basis points. Members noted that both options would leave the cash rate below 1 per cent, which would still be highly stimulatory, and that further increases would be required.

The argument for an increase of 25 basis points was that a sequence of 25 basis point moves represented a steady approach to withdrawing monetary policy stimulus and that this was appropriate in an uncertain environment. Members observed that if the cash rate were to be increased by 25 basis points at each meeting over the remainder of 2022, the cash rate would be 2.1 per cent by the end of the year. In a historical context, this would be quite a rapid tightening. While some central banks had been increasing policy rates in 50 basis points increments, these central banks meet less frequently than the Reserve Bank Board. Members also noted that, over the preceding couple of decades, increases in the cash rate had typically occurred in 25 basis point increments. The previous instance of the Board having increased the cash rate by 50 basis points was in February 2000.

Given the current inflation pressures in the economy and the still very low level of interest rates, on balance, members agreed to a 50 basis point adjustment in the cash rate target. Members also agreed that further steps would need to be taken to normalise monetary conditions in Australia over the months ahead. The size and timing of future interest rate increases will continue to be guided by the incoming data and the Board's assessment of the outlook for inflation and the labour market, including the risks to the outlook. The Board remains committed to doing what is necessary to ensure that inflation in Australia returns to the target over time.

On their botched exit from yield curve control:

Members noted that the yield target, along with the three-year Term Funding Facility, could be construed as a form of time-based forward guidance, implying that the Board's decisions were dependent on the calendar, when in fact they depended on the state of the economy. They agreed to undertake a review of the Bank's general approach to forward guidance later in 2022.

Confab, Speakers, News

Federal Reserve

Waller (Hawk). Weekend: Fed is “all-in” to re-establish price stability, markets would have a heart attack if the Fed moved 100 bps

Mester (Hawk). Weekend: wants to see a slowdown in demand and not a recession, inflation will take a couple of years to get back to 2%

Bostic (Hawk). Weekend: supported the 75 bps hike last week, Fed needs to act decisively to get inflation under control, Fed is data-dependent

Bullard (Hawk). Mon: economy is slowing as expected with monetary policy, household wealth at all-time highs, has been pleased with US market reaction to Fed policy (!). Fri: would like to see policy rate at 3.50% by end of the year, frontloading hikes is a good idea

Barkin (Neutral). Tue: open to 50 or 75 bps hike in July, wants to raise rates „as fast as feasible“, wants positive real rates across the curve, inflation is high and broad-based, there could be a couple of strong inflation readings interspersed with weaker ones, there's a recession risk but most recessions aren't long or deep, Fed can moderate demand without creating a recession

Harker (Hawk). Wed: need to get to 2.50% quickly, should be above 3% by the end of the year, not ready to decide on 50 vs. 75 bps, if demand softens then 50 bps in July would be appropriate, there could be a couple of negative GDP quarters (!), balance sheet shrinking essentially on autopilot

Powell (Neutral). Wed: ongoing rate increases will be appropriate, refuses to take 100 bps hike off the table, further inflation surprises could be in store, housing sector appears to be softening, real GDP seems to have picked up in current quarter, consumer spending remains strong. Thu: expects inflation to move down to Fed goal over the course of the next two years, intention is a soft landing but it has become more and more challenging

Evans (Dove). Wed: need to raise rates a good deal more over coming months, expects policy rate at 3.25-3.5% at the end of the year and 3.8% at the end of 2023, 75 bps hike in July would be in line with continued inflation concerns, does not think 100 bps will be necessary, does not see the need to push rates to 6% like in 1985, tremendous consensus among policymakers on path forward

Bowman (Neutral). Thu: 75 bps hike in July will be appropriate and hikes of at least 50 bps at “next few subsequent meetings”, further hikes may be needed after that, committed to bring real Fed Funds Rate back to positive territory, makes sense that the Fed eventually sells MBS holdings

Daly (Neutral). Fri: no need to think of end point for balance sheet yet, maybe start talking about ending runoff in 2024, economy likely to slow but does not see a recession, bringing inflation down is number one priority

European Central Bank

Centeno (Dove). Mon: ECB has great determination to deal with fragmentation risk. Fri: no specific spread target, flexible PEPP reinvestments are a powerful tool, does not see inflation expectations deanchoring

Kazaks. Mon: ECB tries to ensure proper transmission of monetary policy, does not target specific spread levels, widening of the spreads has been very fast and unlikely to be caused by fundamentals, expects 50 bps hike in September, inflation would have to surprise to the downside to change that, 50 bps is not going to be the default in the future

Lagarde (Dove). Mon: intends to raise policy rate by 25 bps in July and then again in September, price pressures are becoming more widespread, recession is not in the baseline, fragmentation must be preempted

Rehn (Hawk). Tue: September rate hike very likely to be bigger than 25 bps, no country will automatically be eligible to benefit from upcoming ECB tool to counter fragmentation

De Guindos (Dove). Wed: fragmentation is a significant worry for the ECB, speeding up the process to get a tool ready against fragmentation, tool should be somewhat different from OMT, PEPP or APP. Fri: inflation is primary target for the ECB, expects it to start declining in Q4, expects lower growth and higher inflation in the months ahead

Kazimir. Thu: 25 bps hike likely in July and 50 bps in September, policy rate should be at 1.50-2.00% in a year

Nagel (Hawk). Thu: increasing risk that inflation expectations are unanchoring, ECB must not fall behind the curve

Bank of England

Mann (Hawk). Mon: inflation is becoming more widespread and embedded and has increasing momentum, Fed and ECB tightening suggest depreciation of the sterling, “opens the door” to a rate reversal in the medium term when demand weakens, views on interest rates are not about defending the currency

Pill. Tue: further tightening in the coming months, narrow path between persistent inflation and a recession. Fri: as long as bond sales happen in a gradual, predictable and well-communicated manner in a reasonably benign environment, the bank rate can still be used as a marginal policy instrument

Reserve Bank of Australia

Lowe. Tue: RBA discussed a 50 bps hike at the last meeting, will discuss it again in July, path dependent on data, interest rate still low for an economy with low unemployment and high inflation, Australians should expect higher rates, cash rate at 4% by end of the year is “not particularly likely”, expects CPI to peak in Q4 at around 7% and then decline, exit from yield curve control caused some reputational damage to the RBA, in the future bond purchases are likely preferred tool rather than YCC. Fri: Australian economy is resilient, not expecting a recession but narrow path back to low inflation

Swiss National Bank

Jordan. Wed: inflation shows further tightening is necessary but unclear when, will see if one rate hike is enough to bring inflation down

Bank of Japan

Kuroda. Mon: important that exchange rate stably reflects fundamentals

Kishida (PM). Tue: rapid yen weakening a source of concern, must consider exchange rate and monetary policy separately, specific monetary policy tools up to the BOJ to decide, should not tweak monetary policy now

Economic Data

Monday, 20.06.22

The Kiwi BusinessNZ Manufacturing Index improved. Here is the summary of the report (emphasis mine):

The PSI for May was 55.2 (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). This was up 3 points from April, and above the long-term average of 53.6 for the survey.

BusinessNZ chief executive Kirk Hope said that the May result represented the highest monthly result since June 2021, and the fourth consecutive time showing increased activity from the previous month. Obviously, any rush to conclude the sector is now firmly back on track needs to be tempered with the fact that there are still a number of potential headwinds coming, both domestically and internationally."The two key sub-indexes of New Orders/Business (62.0) and Activity/Sales (59.6) both experienced a healthy pick-up in activity to lead the way in overall expansion. While Employment (48.5) went back into contraction during May, Supplier Deliveries (45.0) recovered somewhat from earlier lows."

German PPI came in above consensus, EUR was weaker

Kiwi Westpac Consumer Sentiment was below the previous value, NZD unchanged. Here's a chart and the summary, emphasis mine:

Consumer confidence continued to lose ground in March, dropping to its lowest level since the Global Financial Crisis. (…)

Our latest survey was conducted in the early part of June. While concerns about Covid have been receding, households have continued to grapple with increasingly powerful economic headwinds. That includes ongoing cost of living rises and increases in mortgage rates. The housing market has also continued to cool.

Tuesday, 21.06.22

RBA Meeting Minutes: see above, AUD was broadly unchanged

Canadian Retail Sales above consensus, CAD was unchanged

US Existing Home Sales in line with expectations, USD was weaker

Global Dairy Auctions were below the previous print, NZD was unchanged

Wednesday, 22.06.22

New Zealand Trade Balance was lower than forecast, NZD was weaker

UK CPI was in line with expectations, GBP was mixed

Canadian CPI beat expectations, CAD was mixed as well

Eurozone Consumer Confidence printed below the forecast range, EUR was stronger

Thursday, 23.06.22

Australian PMIs were mixed, AUD was weaker after the release. Here's a summary from the report (emphasis mine):

The S&P Global Flash Services Business Activity Index fell to 52.6 in June from a final reading of 53.2 in May, marking a fifth consecutive month of expansion in the Australian service sector. That said, the rate of growth was the slowest in the current sequence.

Australia’s service sector continued to experience intense inflationary pressures in June with both input cost and output price inflation remaining close to survey records. Anecdotal evidence suggested that rising supplier prices, fuel costs and higher interest rates all contributed to higher input costs. In turn, many firms chose to at least partly share increased cost burdens with their clients. Despite remaining positive, overall business confidence in the service sector dropped to its lowest in over two years in June.

Manufacturing production growth accelerated in June, extending the current sequence of expansion to five months. In line with output expansion, the rate of new order growth quickened. This was underpinned by strengthening demand conditions from both domestic and foreign sources amid reports of new client wins and projects. As a result, employment levels continued to expand in June. Manufacturers also reported increasing their purchasing activity to cope with higher demand levels.

The 12-month outlook across the Australian manufacturing sector remained positive in June. That said, the degree of confidence slipped to a 26-month low.

Eurozone PMIs were very weak, the French and German prints were way below expectations and the Eurozone print was hardly any better. The commentary reads especially bleak for virtually all of them.

Here's the summary for the German report (emphasis mine):

Latest ‘flash’ PMI® data from S&P Global showed a sharp loss of momentum in the German economy at the end of the second quarter. Falling exports acted as a drag, while there were also signs of domestic demand coming under pressure from heightened economic uncertainty and sustained strong inflation. Firms’ expectations towards future activity slumped to their lowest since the first wave of the COVID pandemic over two years ago, with manufacturers growing increasingly pessimistic about the outlook.

Here's the summary for the Eurozone report (emphasis mine):

“Eurozone economic growth is showing signs of faltering as the tailwind of pent-up demand from the pandemic is already fading, having been offset by the cost of living shock and slumping business and consumer confidence.

“Excluding pandemic lockdown months, June’s slowdown was the most abrupt recorded by the survey since the height of the global financial crisis in November 2008.

“The slowdown means the latest data signal a rate of GDP growth of just 0.2% at the end of the second quarter, down sharply from 0.6% at the end of the first quarter, with worse likely to come in the second half of the year. Inflows of new business have stalled, led by a slump in demand for goods and reduced demand for services from cash-strapped consumers in particular.

“At the same time, business confidence has fallen sharply to a level rarely seen prior to the pandemic since the region’s economic contraction during the 2012, hinting at an imminent downturn unless demand revives.

“Rising levels of unsold stocks meanwhile mean the manufacturing sector will likely seek to reduce capacity in coming months which, alongside the deteriorating picture in the service sector and drop in confidence, will inevitably hit jobs growth.

“Persistent inflationary pressures add to the woes. The survey’s price gauges, which correctly anticipated the recent surge in inflation, remain elevated at levels not seen in the history of the eurozone prior to the pandemic, with a worrying increase in costs growth in the service sector. However, the recent cooling of demand is already showing signs of calming goods prices, bringing a tentative hint of a peaking of inflation in the near future.”

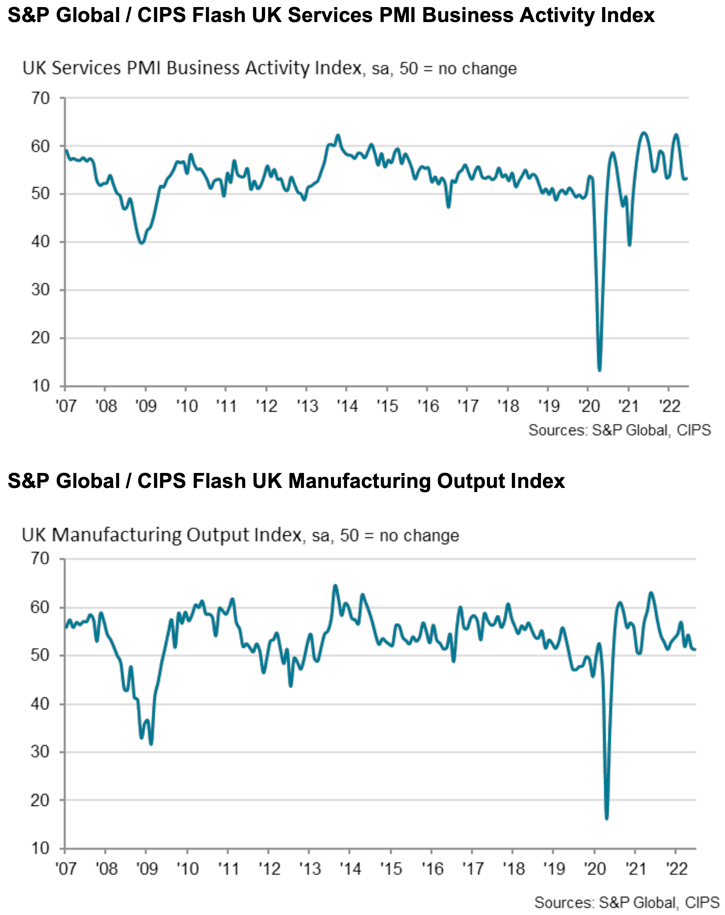

UK PMIs were the relative outperformers with the Manufacturing PMI just a tad below consensus and the Services print with a (small) surprise to the upside. Despite the surprise in the headline number, it's getting worse under the hood (emphasis mine, again):

“The economy is starting to look like it is running on empty. Current business growth is being supported by orders placed in prior months as companies report a near-stalling of demand. Manufacturers in particular are struggling with falling orders, especially for exports, and the service sector is already seeing signs of the recent growth spurt from pent-up pandemic demand move into reverse amid the rising cost of living.

“Business confidence has now slumped to a level which has in the past typically signalled an imminent recession. The weakness of the broad flow of economic data so far in the second quarter points to a drop in GDP which the forward-looking PMI numbers suggest will gather momentum in the third quarter.

“While there are some signs that the inflation could soon peak, the survey data suggest the rate of inflation will meanwhile remain historically high for some time to come, indicating that the UK looks set for a troubling combination of recession and elevated inflation as we move into the second half of the year.”

“The supply chain squeeze seemed to have little effect on the job creation numbers as the UK saw the highest staffing increase since March this year. Though, this is most likely a sign of businesses making up for the staff shortages suffered earlier in the year. So, with business expectations now the lowest since May 2020, the next few months will be a true test for how sustainable this capacity building will be.”

US PMIs also surprised to the downside. Summary (emphasis mine):

“The pace of US economic growth has slowed sharply in June, with deteriorating forward-looking indicators setting the scene for an economic contraction in the third quarter. The survey data are consistent with the economy expanding at an annualized rate of less than 1% in June, with the goods-producing sector already in decline and the vast service sector slowing sharply.

“Having enjoyed a mini-boom from consumers returning after the relaxation of pandemic restrictions, many services firms are now seeing households increasingly struggle with the rising cost of living, with producers of non-essential goods seeing a similar drop in orders.

“There has consequently been a remarkable drop in demand for goods and services during June compared to prior months.

“Businesses have become much more concerned about the outlook as a result of the rising cost of living and drop in demand, as well as the increasingly aggressive interest rate path outlined by the Federal Reserve and the concomitant deterioration in broader financial conditions. Business confidence is now at a level which would typically herald an economic downturn, adding to the risk of recession.

“A corollary of the drop in demand was less pressure on prices, with the survey’s inflation gauges for firms’ costs and their selling prices falling sharply in June to suggest that, although still elevated, price pressures have peaked.”

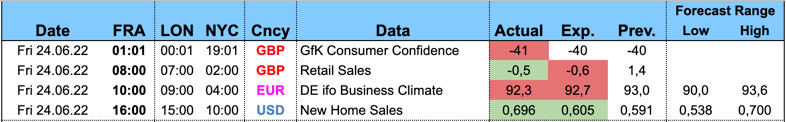

Friday, 24.06.22

UK GfK Consumer Confidence came in below expectations while Retail Sales surprised a bit to the upside; GBP was weaker

German ifo Business Climate disappointed, EUR was stronger

US New Home Sales printed above consensus, USD sold off

Market Analysis

Growth and Inflation

Atlanta Fed GDPnow still at 0.0% for Q2 (last update was June 16th).

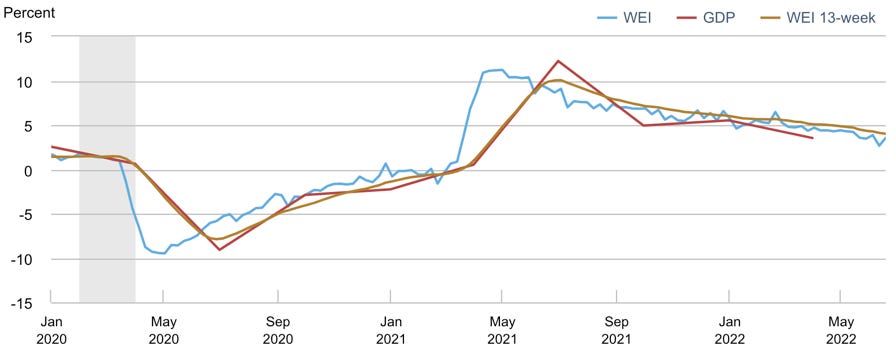

The Weekly Economic Index ticket up a bit to 3.57:

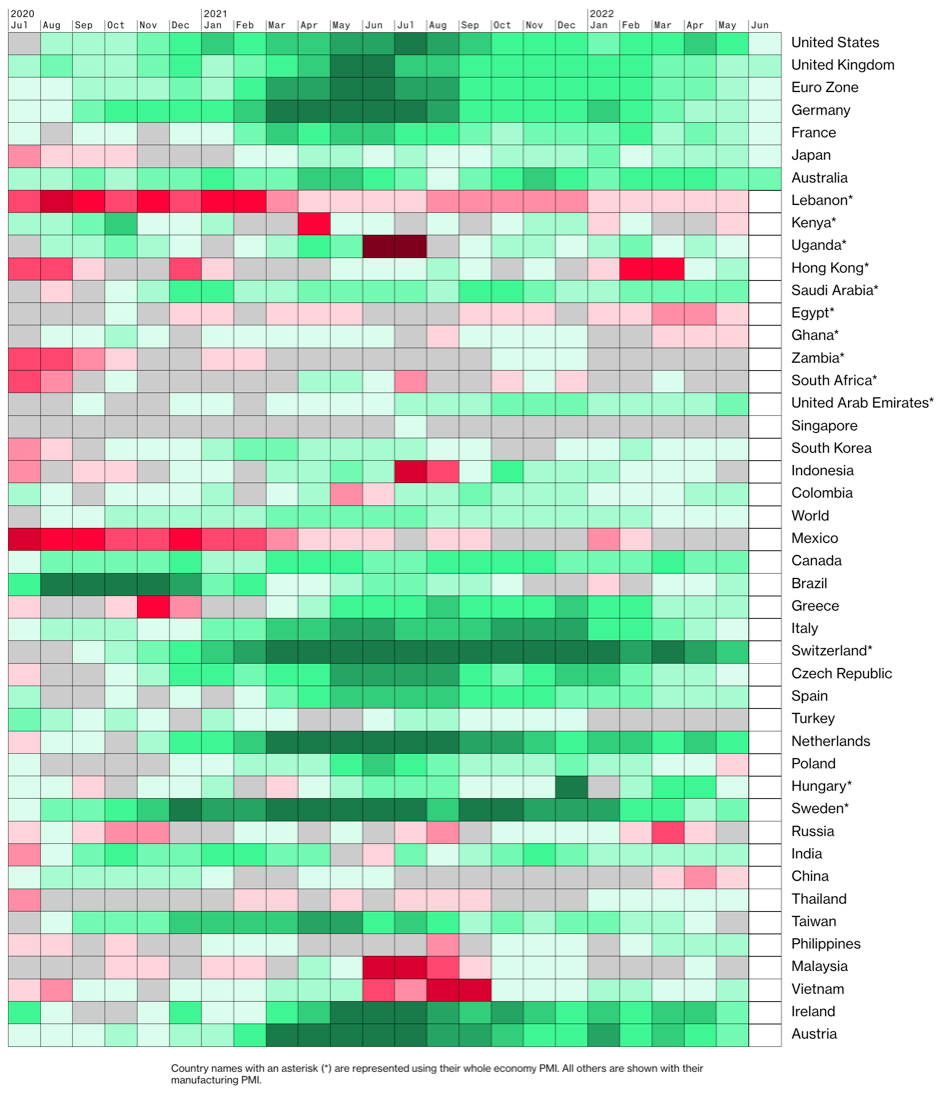

Global PMIs:

US weakening considerably

Eurozone and Japan weaker as well

Australia stable

Citi Economic Surprise Indexes:

EUR sharply lower

USD, GBP, AUD, NZD all moving lower

CAD is the strongest

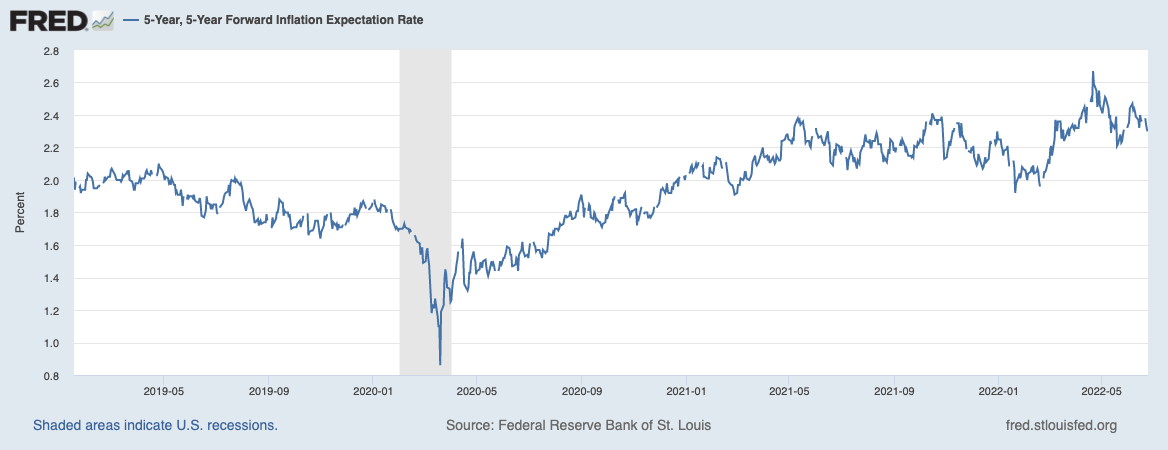

5y5y inflation expectations look like they have rolled over with a lower high:

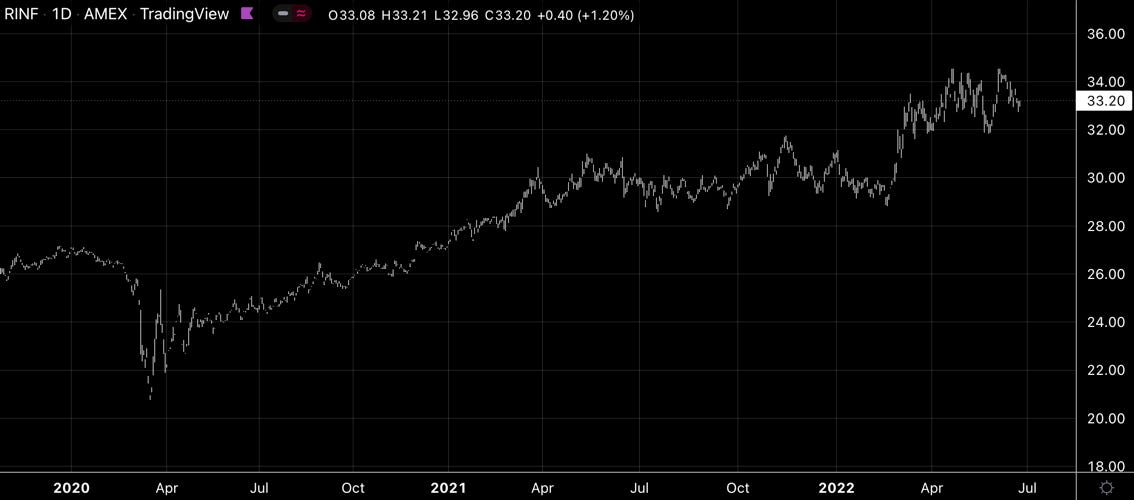

Inflations Expectations ETF RINF is off highs and moving sideways:

Citi Inflation Surprise Indexes:

GBP, CHF and JPY are the only surprisers to the upside. Note the comparatively small surprise that compelled the SNB to surprise the markets with a 50 bps hike.

USD and AUD moving lower

Yields

See chart and table below:

Yields have come down for all G8s

CAD and CHF looking comparatively strong

USD, AUD and GBP looking weakest

Yield curves at the 2s10s spread: CHF steepening, USD flirting with inversion again.

Central Banks

Fedwatch shows that the Fed hiking path has relaxed somewhat compared to the week before:

75 bps is still overwhelmingly likely in July, followed by another 50 bps hike in September

After that, however, the market expects a series of 25 bps hikes instead of another 50 bps

Maximum FFR is expected to be 350-375 bps (so 25 bps lower than last week)

There's a new rate cut priced in June 2023

STIRs are also pricing shorter-term hiking expectations lower:

Sectors and Flows

Over a 1-month horizon, the Swissie and the USD are the strongest currencies, the yen is the weakest:

The BNY Mellon iFlow model shows relevant short-term flows into JPY. Equities still seeing significant outflows:

US equity sectors are… mixed over a 1-month horizon:

Consumer Discretionary (XLY) leading, Growth (VUG), Tech (XLK) and Staples (XLP) not far behind

Energy (XOP, XLE, OIH) at the bottom of the chart, Metals & Mining (XME) and Basic Materials (XLB) also underperforming

Utilities (XLU) are surprisingly weak

Similar data, similar (slightly confusing) picture:

International stock markets over a 3-month horizon:

Commodity stock markets have diverged heavily with Brazil (IBOV) the second-worst performing market, Australia (XAO) and Canada (TSX) in the middle, and the FTSE near the top

Hang Seng has held up remarkably well over the last months

European markets heavily outperforming their US counterparts

Sideways glance at commodities: most of them underwater as well, Energy is showing an interesting divergence with Heating Oil (HO) at the top and Natural Gas (NG) at the bottom of the chart. Note that this performance chart is at least a bit misleading because of futures rollover and how that's (not) implemented in Tradingview.

Sentiment and Positioning

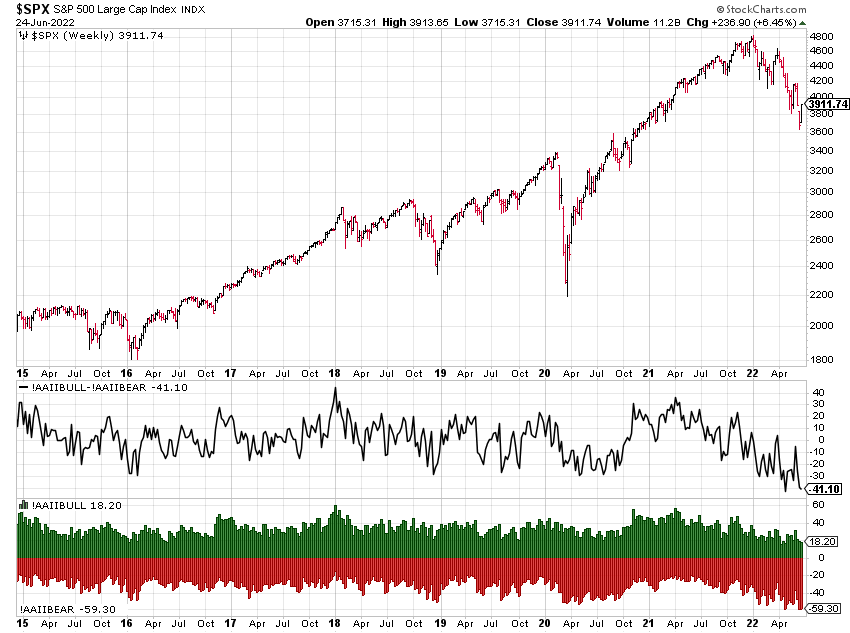

AAII Bull-Bear sentiment hovering near lows:

Currency sentiment:

Extremely bullish for JPY

Extremely bearish for CHF and CAD

Bearish for USD

Different sentiment data:

Bearish for USD (vs. AUD, GBP, NZD, EUR, CAD)

Bullish for JPY in (vs. USD, AUD, EUR, GBP)

Commitment of Traders data:

Commercials and Large Specs extreme positioning in the SPX, R2k and Dow Jones; Z-score of Commercial buying activity in the ES this week at 3.19 (!)

Relevant Commercial and Large Spec selling/buying activity in VX futures

Ultra Bonds and Notes with bullish Commercial extreme positions

Metals are still underperforming, but except for Silver they're at relevant bullish Commercial positioning levels

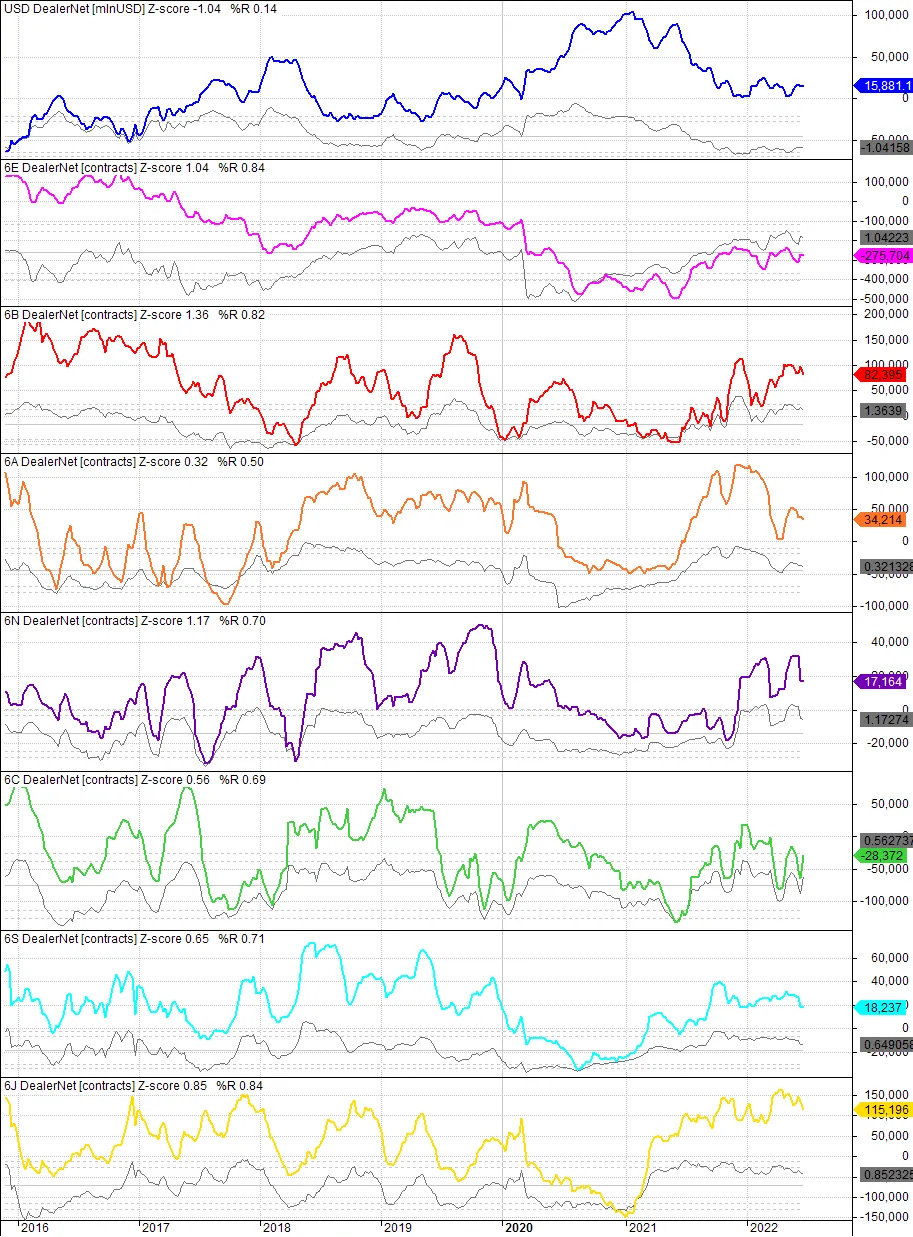

COT/TIFF data for FX futures: nothing at extremes any more.

Citi PAIN Indexes show more and more extreme USD long positioning vs. other G8 currencies.

Market Risks

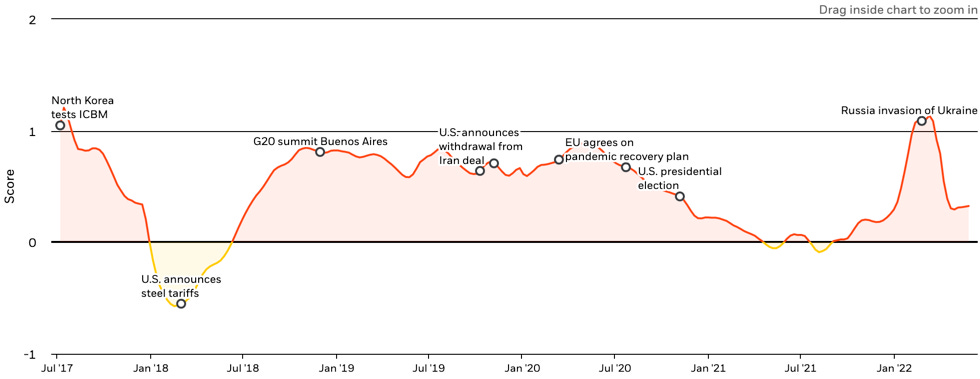

The BlackRock Geopolitical Risk Indicator has come off highs but remains elevated:

VIX has come down somewhat and VVIX is tanking, which could/should lead volatility lower. MOVE is above 120, so still not out of the woods, yet.

It might not look like it, but the VIX futures term structure is essentially flat. It's in contango, though, and the spot VIX is more than 1 point below VX1 with >20 days to go.

Credit spreads aren't easing as SPX catches a bit of breath:

Fear & Greed Index pulled back from “extreme fear”:

Various

FX Implied Volatility has come down a bit:

25-delta risk reversals:

Upside in GBP, AUD, NZD

The moves in JPY risk reversals look like there's a real concern from the options market that the Yen could appreciate rapidly… FX intervention on the horizon?

Seasonality seems to be stacked against the USD in July:

Other Stuff I've been looking at

Only during the GFC has the 60/40 portfolio had a worse drawdown:

This has led to the largest financial drawdown relative to GDP in modern history (let that sink in!):

60/40 will be in trouble as long as CPI doesn't come down:

Spending on goods still running above trend while spending on services running below:

Job listings in the US are deteriorating:

Market breadth:

PMIs point to lower earnings growth next year:

Consumer sentiment is tanking:

Germany's export orders are weakening, which isn't a good sign for the global economy:

… and global supply chains are still struggling:

So, how long does a bear market typically last and how deep is the trough?

As usual, great insights

Great read!