Welcome to edition #10 of FX & Macro Weekly!

I've been mostly out of the market for about four weeks. It's always a bit of a hassle to get back into the flow of things and to catch up with everything after I get back. I haven't been on Substack long, so it's really the first time I took advantage of all the good work on here during and after my holidays to get back up to speed.

I'd like to thank a couple of fellow substack writers for their efforts and their work, because the stuff they put out there is incredibly helpful to me. Check them out:

Credit from Macro to Micro… this is completely underappreciated in my opinion!

The Macro Compass by Macro Alf… I know you're already subscribed to it anyway!

Midday Macro by Michael Ball… incredible that this is free!

Anyway, let's get on: this newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts, because they are basically the reasoning behind the conclusions I present in the Summary. The final section is a collection of things I read during the week that influence my thinking.

If you like this newsletter, please consider subscribing and sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroweekly.

Now let's get started…

Table of Contents

Executive Summary (Playbook, Calendar, Levels)

Week in Review

Central Banks (ECB, Fed, BOE, SNB, BOJ)

Economic Data

Market Analysis

Growth and Inflation

Yields

Central Banks

Sectors and Flows

Sentiment and Positioning

Market Risks

Various

Other Stuff I've been looking at

Executive Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

Economic Calendar for next week

Monday is a bank holiday in the US.

Important levels to watch and look out for in the Majors

Week in Review

Central Banks

ECB ad hoc meeting (15.06.22)

This is the full text of the statement, emphasis mine:

Today the Governing Council met to exchange views on the current market situation. Since the gradual process of policy normalisation was initiated in December 2021, the Governing Council has pledged to act against resurgent fragmentation risks. The pandemic has left lasting vulnerabilities in the euro area economy which are indeed contributing to the uneven transmission of the normalisation of our monetary policy across jurisdictions.

Based on this assessment, the Governing Council decided that it will apply flexibility in reinvesting redemptions coming due in the PEPP portfolio, with a view to preserving the functioning of the monetary policy transmission mechanism, a precondition for the ECB to be able to deliver on its price stability mandate. In addition, the Governing Council decided to mandate the relevant Eurosystem Committees together with the ECB services to accelerate the completion of the design of a new anti-fragmentation instrument for consideration by the Governing Council.

FOMC Meeting (15.06.22)

My summary and the difftext of the statement below:

Expected surprise hike by 75 bps

QT to remain unchanged

Explicit mention of “strong commitment” to returning inflation to 2% goal

Esther George (Hawk) dissented and voted for a 50 bps hike

From the Summary of Economic Projections:

GDP downgraded significantly for 2022-2024 from the projections in March

PCE inflation projection raised from 4.3 to 5.2% this year and lowered slightly in 2023 and 2024

Projection of the Fed Funds Rate upped to 3.4% from 1.9% this year (!), to 3.8% from 2.8% next year (!!!) and to 3.4% from 2.8% in 2024 (!!!)

And finally, the dotplot:

SNB Rate Decision (16.06.22)

The SNB surprised with a 50 bps hike to -0.25%. Relevant points from their statement and difftext below:

Tightening is aimed at “preventing inflation from spreading more broadly”

Further increases in the policy rate might be necessary in the foreseeable future

The SNB is willing to be active in the FX market “as necessary”

Inflation is likely to remain elevated “for the time being”

Swiss economy is doing well and signals remain positive for the current quarter, labour market has also improved, Ukraine war has had comparatively little impact on the Swiss economy so far

From Jordan's press statement:

Since the last monetary policy assessment, the development of the Swiss franc exchange rate has also contributed to the rise in inflation. The Swiss franc has depreciated in trade-weighted terms, despite the higher inflation abroad. Thus the inflation imported from abroad into Switzerland has increased. Another consequence of this depreciation coupled with significantly higher inflation abroad is that the Swiss franc is no longer highly valued.

The current environment is subject to great uncertainty, also with regard to exchange rate developments. If there were to be an excessive appreciation of the Swiss franc, we would be prepared to purchase foreign currency. If the Swiss franc were to weaken, however, we would also consider selling foreign currency.

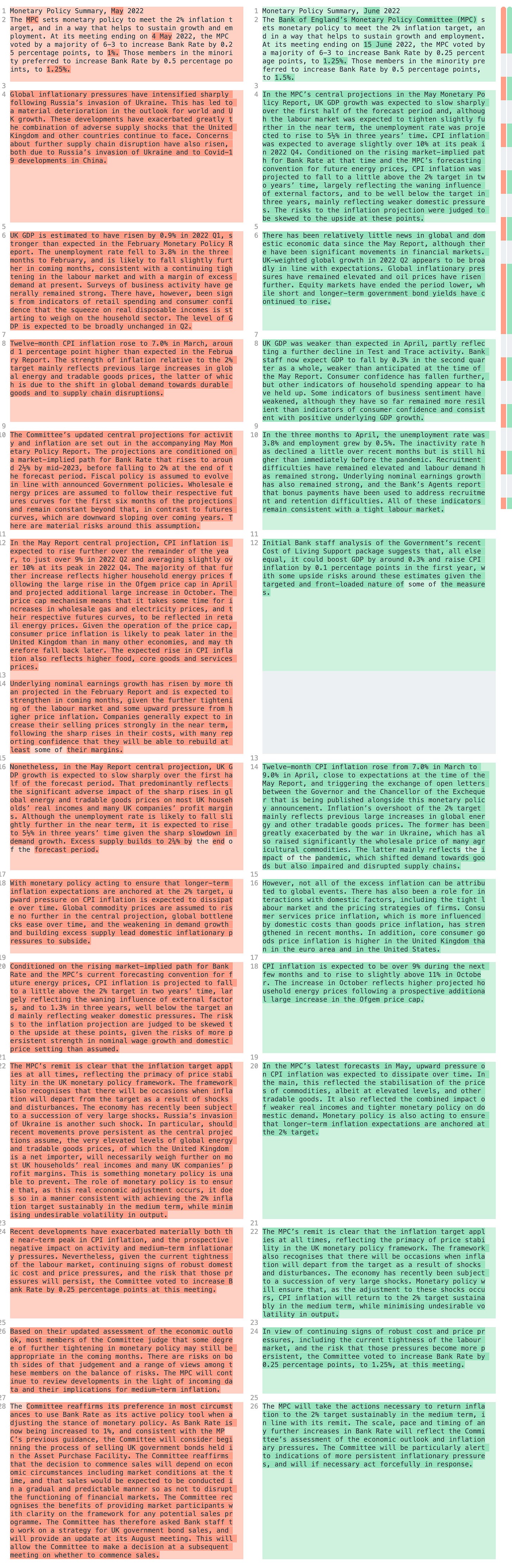

BOE Rate Decision (16.06.22)

The Bank of England hiked 25 bps to 1.25% as expected. My summary and the difftext below:

Vote split 6-3 with the minority voting for a 50 bps hike

GDP in Q2 expected to fall by 0.3% (weaker than the anticipated 0.1% growth in the May projections)

Core CPI is higher in the UK than in the Eurozone or the US, CPI is expected to rise above 11% in October

Labour market is tight

Cost of Living support package by the government could boost GDP by 0.3% and CPI by 0.1% in the first year

From the meeting minutes (emphasis mine):

39: Three members preferred a 0.5 percentage point increase in Bank Rate at this meeting. These members put a higher weight on the prospect of more resilience in demand or shortfalls in supply or both, such that cost and capacity pressures would remain relatively strong over the forecast period. These members also judged that monetary policy should lean strongly against risks that recent trends in pay growth, firms’ pricing decisions, and inflation expectations in the economy more widely would become more firmly embedded. Faster policy tightening now would help to bring inflation back to the target sustainably in the medium term, and reduce the risks of a more extended and costly tightening cycle later.

42: Six members (Andrew Bailey, Ben Broadbent, Jon Cunliffe, Huw Pill, Dave Ramsden and Silvana Tenreyro) voted in favour of the proposition. Three members (Jonathan Haskel, Catherine L Mann and Michael Saunders) voted against the proposition, preferring to increase Bank Rate by 0.5 percentage points, to 1.5%.

BOJ Rate Statement (17.06.22)

Summary and difftext below:

Policy rate and Yield Curve Control unchanged

No change to 10-year JGB target and fixed-rate operations

The Bank will “continue expanding the monetary base until the year-on-year rate of increase in the observed CPI (all items less fresh food) exceeds 2 percent and stays above the target in a stable manner.”

Confab, Speakers, News

Federal Reserve

Powell (Neutral). Post-FOMC statement and press conference:

It's essential to bring inflation down, it has surprised to the upside since the last meeting, wage growth is elevated

Does not expect 75 bps moves to be common, next meeting is either 50 or 75 bps, pace of hikes will be data dependent

Decided they needed to do more front-loading, policy is going to have to be restrictive but don't know how restrictive

Inflation needs to flatten out before it goes down, that's what they are looking to see; they have to be careful about declaring victory because inflation went down over the winter and then right back up

He's talking about a “more normal range” for interest rates rather than “neutral”

Bullard (Hawk). Fri: soft landing is feasible, Fed and ECB both have credibility

George (Hawk). Fri: dissented at the FOMC meeting in favour of a 50 bps hike, because 75 bps adds to policy uncertainty simultaneous with the balance sheet runoff, case for continuing to remove accommodation is “clear cut”, speed of policy adjustment is important

Kashkari (Dove). Fri: could support another 75 bps in July, prudent strategy might be to continue with 50 bps after July, thinks they might be able to relax policy somewhat in 2024

European Central Bank

Simkus (Hawk). Mon: not worried about the spread between German and Italian bond yields widening

Knot (Hawk). Tue: might have to raise by more than 25 bps in September, real probability rates will continue to rise in October and December, depends on data and economic situation. Wed: as for the ad hoc meeting, they have asked the committee to work in a “slightly accelerated fashion” in case PEPP flexibility was not enough. Fri: if inflation worsens several 50 bps hikes are possible

Schnabel (Neutral). Tue: more progress is needed to counter fragmentation, won't tolerate changes in financing conditions that go beyond fundamental factors, monitoring market developments closely, ECB will deploy new instruments to secure monetary policy transmission if necessary

Mahklouf. Wed: as for the September rate hike, “more than 25 bps” could mean 26 bps or 51 bps or whatever, not necessarily going to be 50 bps

Lagarde (Dove). Wed: must have the courage to act if facts are not clear, must be true to the spirit and not just the letter of the mandate

Visco (Dove). Thu: policy normalization can be gradual, i.e. 25 bps or 50 bps; gradual but sustained hikes after September, spread of 150 bps would be justified, 200 bps would be unjustified

Sources. Wed: details of the ECB's fragmentation scheme are still being ironed out, likely will have conditions (e.g. countries complying with economic recommendations), goal will likely be spelt out as keeping bond spreads in line with fundamentals rather than bringing them back close to zero. Thu: policymakers are worried market stress may hinder monetary policy, want new instrument to be ready by July meeting

Bank of England

Pill. Fri: it's up to the market to decide whether BOE is considering a 50 bps hike (!!!), trying to signal that they might have to act further

Reserve Bank of Australia

Lowe. Tue: it's time to normalize policy, Australians need to be prepared for higher rates, expects inflation at 7% by the end of the year

Bank of Japan

Kuroda. Mon: recent fall in the Yen is undesirable, will watch impact of exchange rate on prices and the economy, does not believe Japan is going into stagflation. Fri: appropriate to maintain powerful monetary easing to support the economy, YCC strongly supports the economic recovery, rapid weakening of the JPY is bad for the economy, BOJ is not targeting a specific exchange rate

Economic Data

I did not follow the individual data releases this week, so nothing here. See you again next week.

Market Analysis

Growth and Inflation

GDPNow has dropped to zero for Q2 over the last could of weeks:

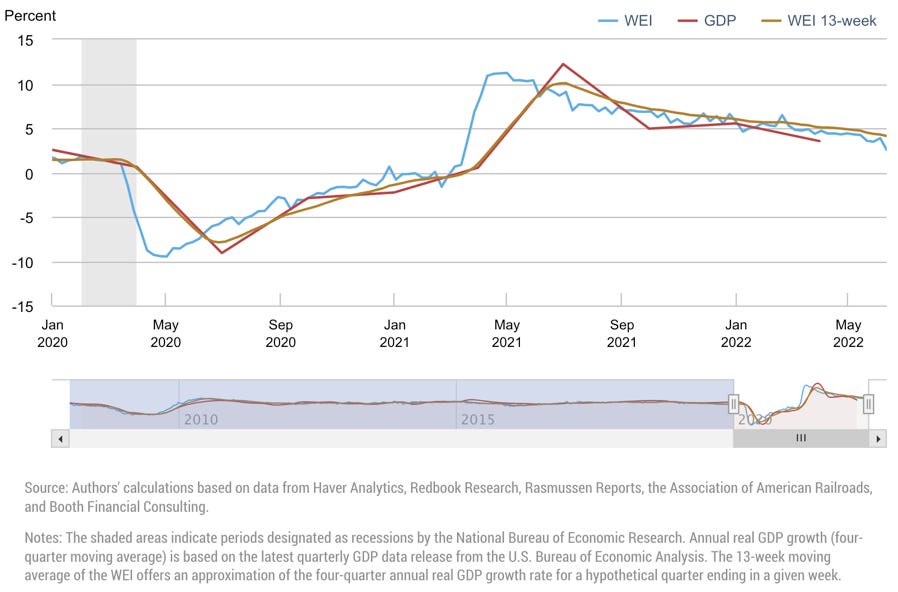

The Weekly Economic Index dropped to 2.54:

The decline in the WEI for the week of June 11 (relative to the final estimate for the week of June 4) is due to decreases in retail sales, consumer confidence, railroad traffic (relative to the same time last year), electricity output (relative to the same time last year), and fuel sales, which more than offset increases in steel production and tax withholding and a fall in initial unemployment insurance claims (relative to the same time last year).

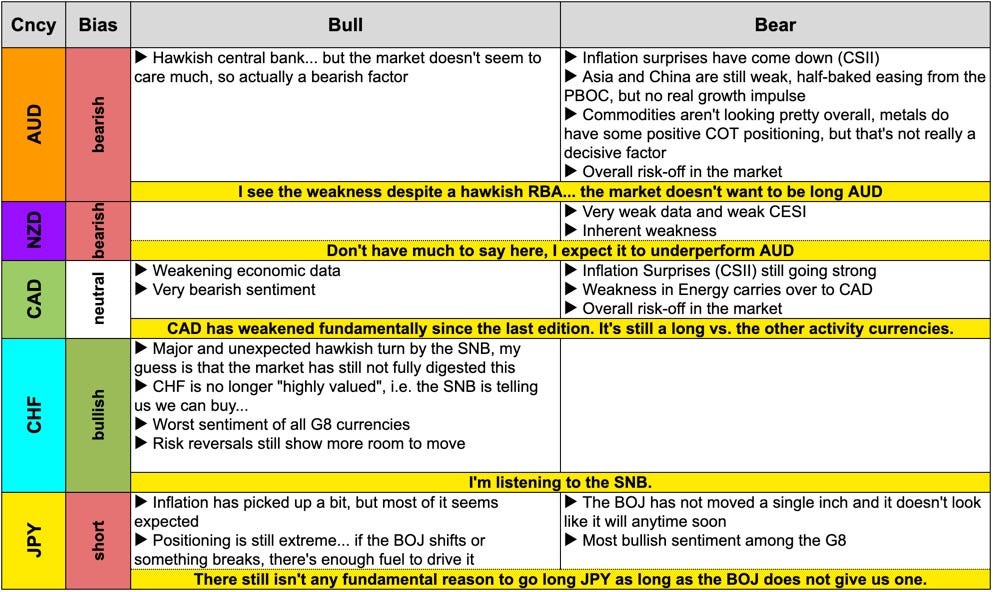

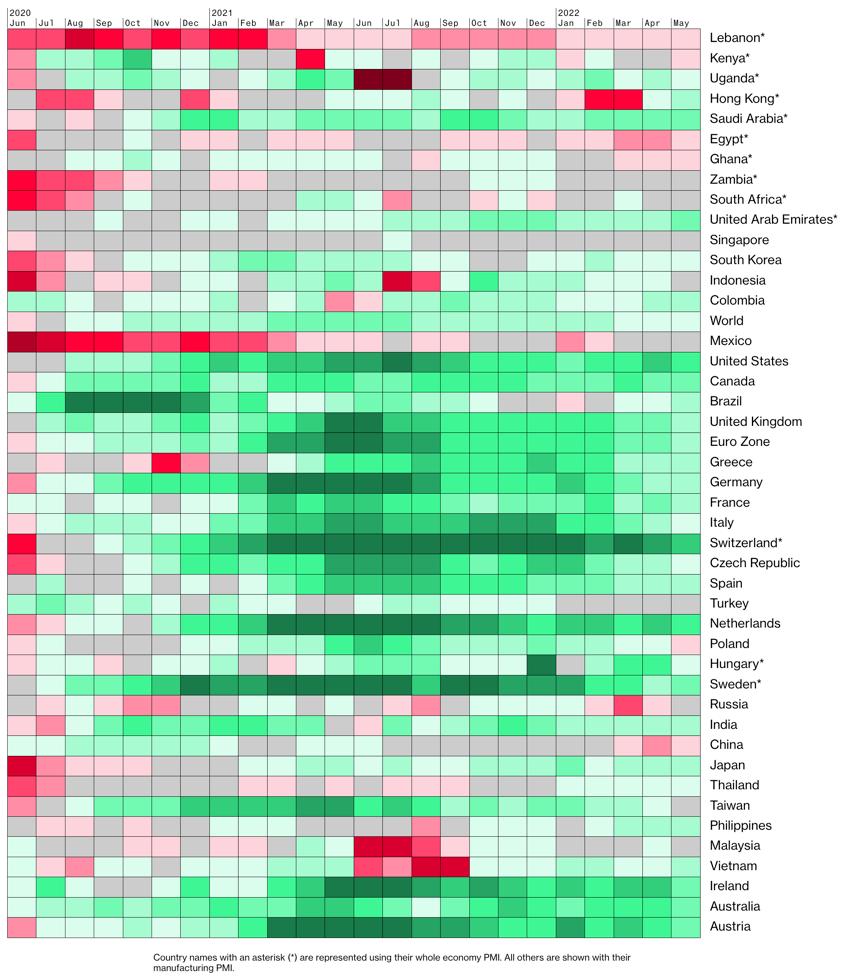

Purchasing Manager Indexes:

Most countries are weakening: US, Eurozone, Switzerland, UK, Australia

China is picking up a bit (“less bad”), Hong Kong improving as well; other than that there's not much positive coming out of Asia at this point

CitiFX Economic Surprise Indexes:

Almost everything is weakening, especially USD, GBP and CAD

EUR and JPY are surprisingly strong

AUD holding up

5y5y forward inflation expectations have been moving sideways for a while now:

The Inflations Expectations ETF is also moving sideways:

CitiFX Inflation Surprise Indexes:

USD and NZD at lows, AUD has weakened considerably

GBP still trending upwards

EUR might have rolled over

Even JPY has picked up somewhat

Yields

See chart and table below:

AUD, CHF, DE, NZD, GBP all have had similar performances

USD comparatively weak, JPY is dead overall with the BOJ cap on 10s

Widening of the BTP-Bund spread clearly visible here as well

US 2s10s are once again flirting with the zero-line as, JPY has a data bug. Steeper hiking paths are being priced in, especially for USD, EUR, GBP.

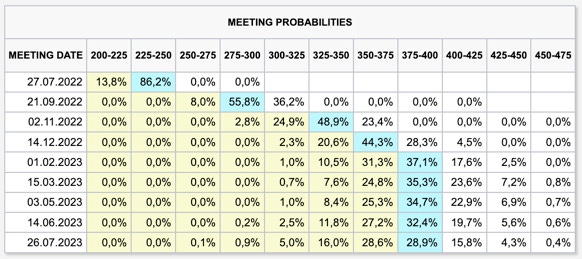

Central Banks

86% chance of a 75 bps hike in July followed by two 50 bps and two 25 bps hikes

No change in policy rate from 2023 at around 3.75-4.00%, no easing either

I don't have last week's probability map to compare

STIRs have moved to price in even more front-loading since I wrote last time. That much for “peak hawkishness.” For 2023 expectations have eased and for 2024 the market is pricing a lower Fed Funds rate:

Sectors and Flows

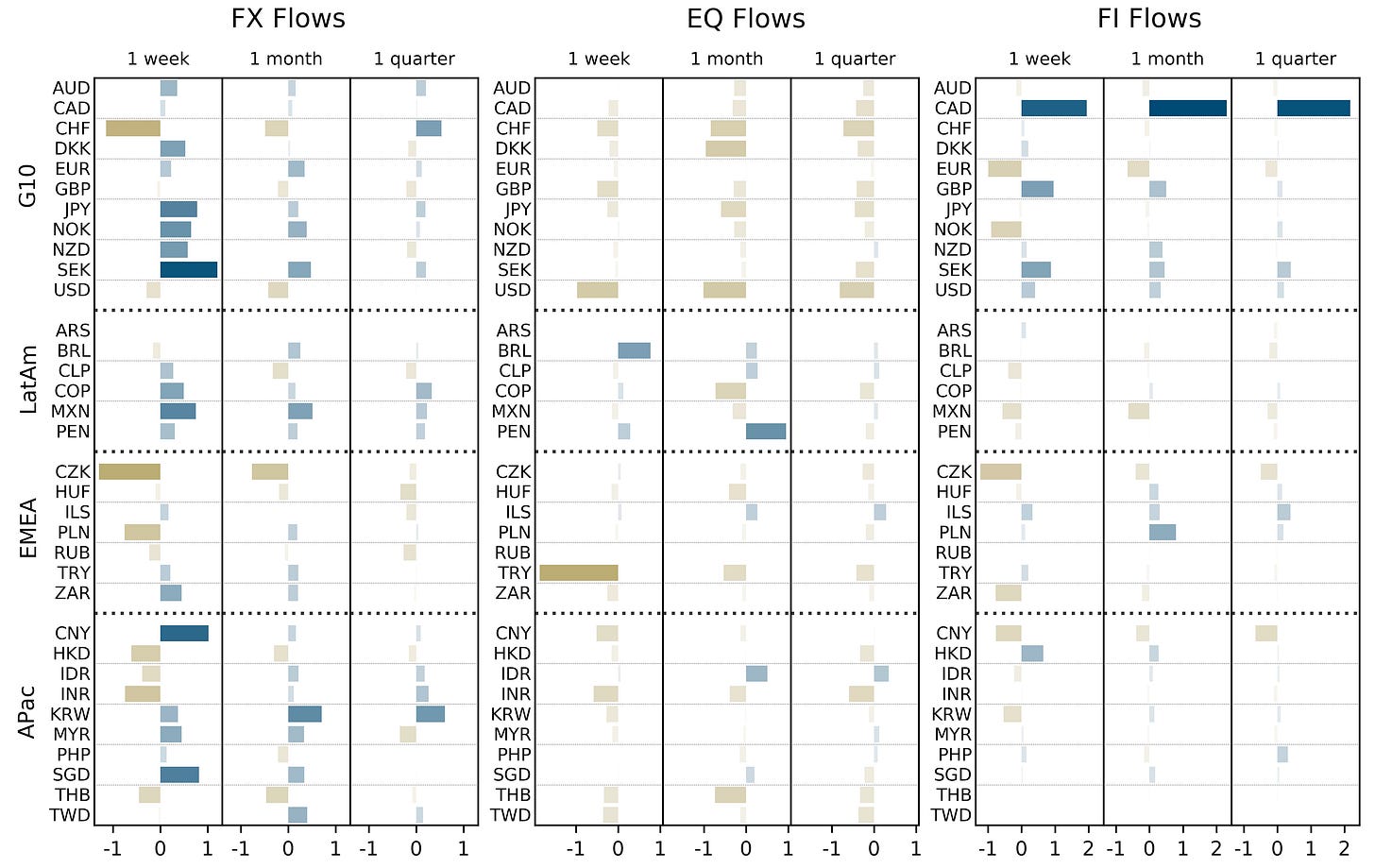

The Swissie is the strongest currency after the surprise hike by the SNB, JPY the weakest after the unchanged dovish stance of the BOJ. USD has lost some ground and EUR is surprisingly strong.

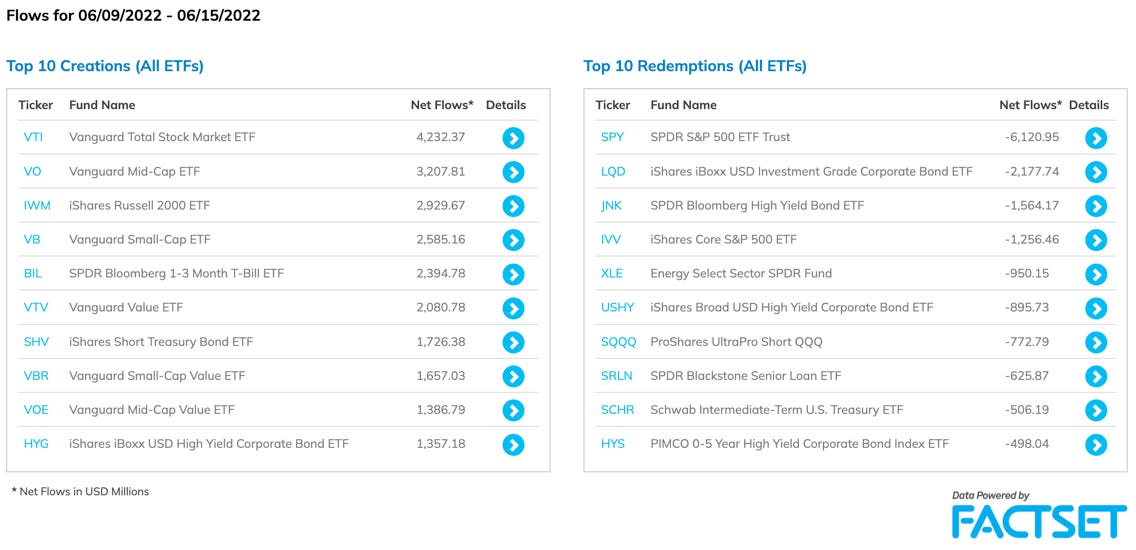

ETF flows are a bit of a mixed bag, not too sure what to make of it at this point:

Inflows for a variety of broader equity ETFs

Inflows for US government bonds/bills

Both inflows and outflows for high-yield credit

Currency flows are a bit surprising with significant flows out of CHF on a weekly basis (why? is that data correct?). Flows out of US equities continue.

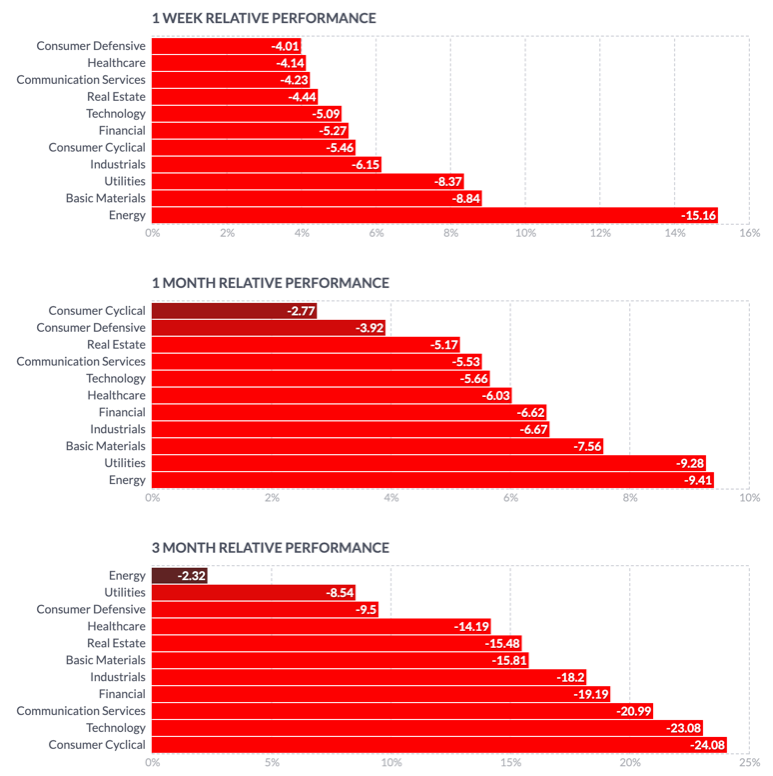

The bear market in stocks takes its toll: every sector is in the red over 1 month. The spread between Energy and everything else has narrowed considerably.

Another look at sector performance:

Energy is still outperforming relatively over a 3-month horizon, but the air is getting a lot thinner: on a 1-month timeframe it's lagging now as well (admittedly, this week has been horrible for Energy)

Why Consumer Cyclical is the relative outperformer over 1 month is totally unclear

Utilities are surprisingly weak, Healthcare is somewhere in the middle and Defensives are on top (all in the 1-month chart)… it's not really making a lot of sense to me, so back to the basics: every sector is red over every time horizon!

Weekly charts of the 24 largest Energy stocks. It's not looking pretty:

International stock markets offer a bit of a surprise:

The three US indexes (SPX, Nasdaq, R2k) are the weakest

Spain, UK and German indexes are near the top with the DAX just down under 9% over about three months

Commodity stock markets like the IBOV or the TSX have come down considerably, especially since they've been near the top of the chart only a few weeks ago

Sentiment and Positioning

AAII Sentiment had a bounce over the last few weeks, but it's back near its low. Note that this is a sentiment survey. The Asset Allocation Survey looks quite different with a relatively low cash allocation.

Callum Thomas’ FinTwit Equity Sentiment Poll hit an extreme in the Bull-Bear spread:

Similar for the US 10y bond:

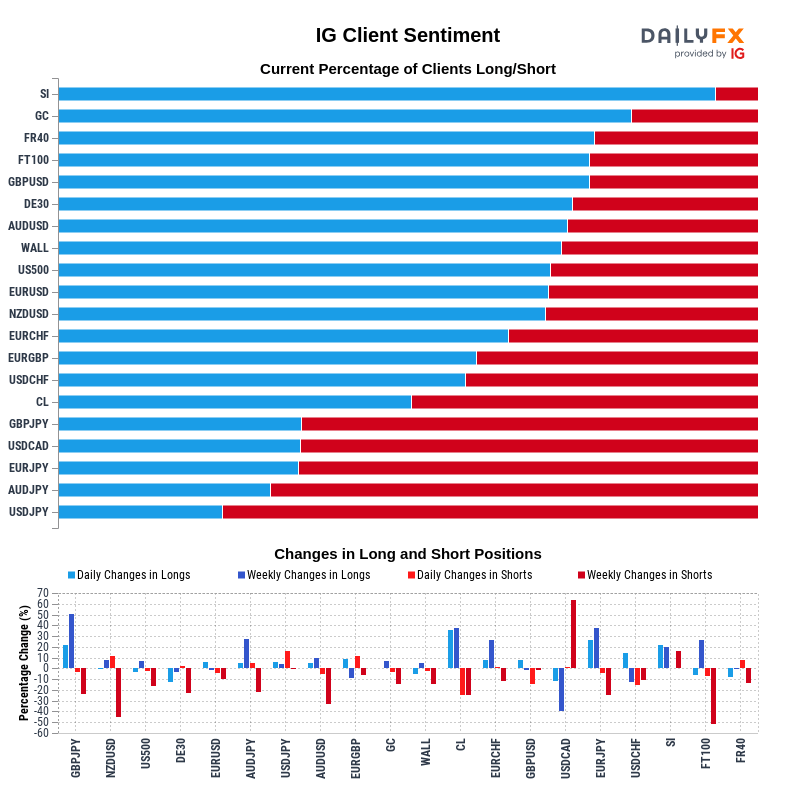

FX Sentiment:

Extremely bearish for CHF (did anyone hear what the SNB did?), CAD and USD

Very bullish for JPY (did anyone hear what the BOJ said?)

Different data source, but similar picture:

Bearish sentiment for the USD (vs. GBP, AUD, EUR, NZD)

Bullish sentiment for the JPY (vs. GBP, EUR, AUD, USD)

The TD Ameritrade Investor Movement Index for May still has room to decline:

TD Ameritrade clients were net sellers of equities in May but were buyers of fixed income instruments. On a sector basis, TD Ameritrade clients showed mild buying interest in only two sectors, Consumer Discretionary and Consumer Staples, amid broad selling that was strongest in the Information Technology sector.

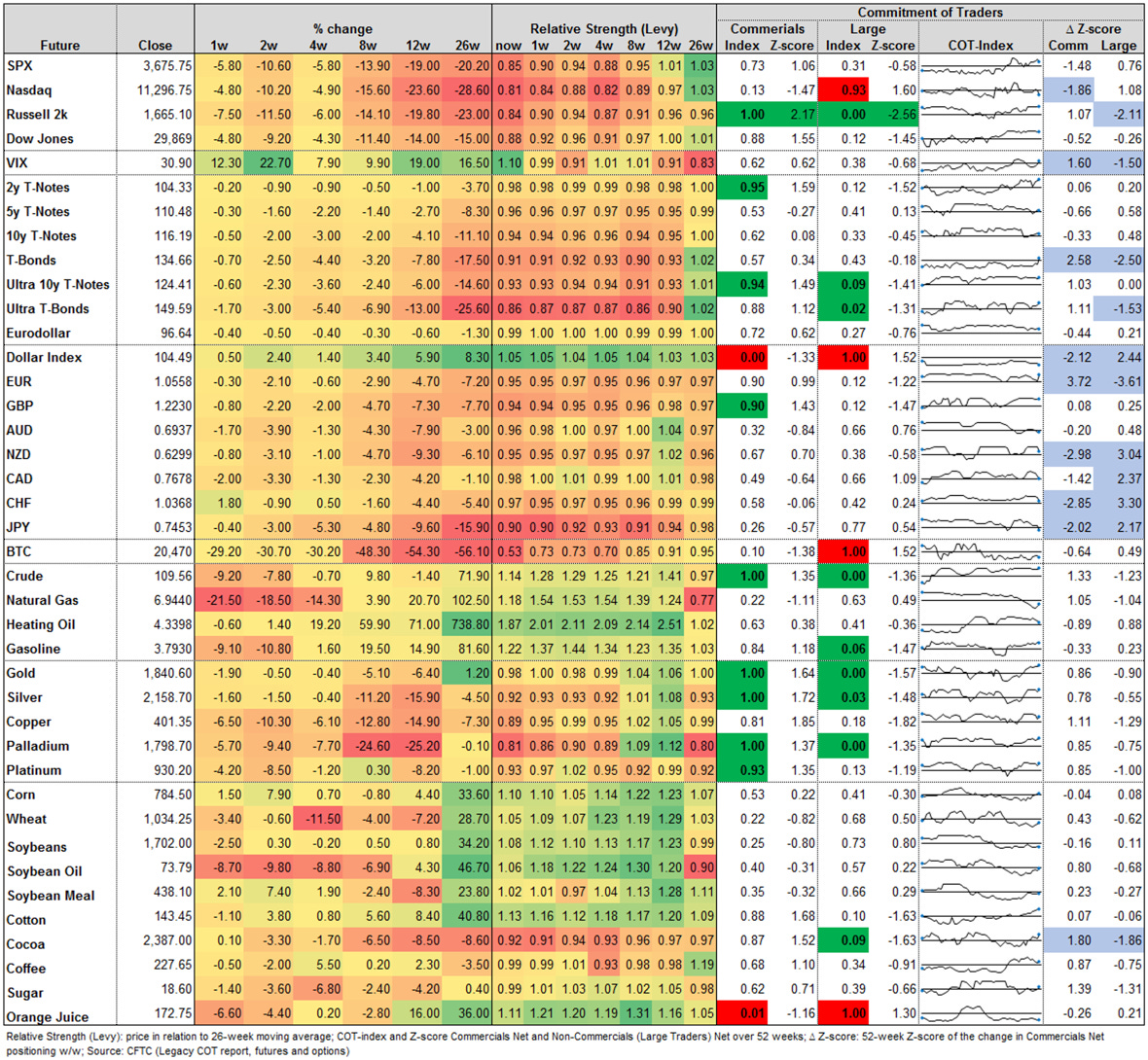

Commitment of Traders:

The Russell 2k has bullish extreme positioning, VIX futures have seen some moderate Commercial buying this week

DXY positioning is extremely bearish, EUR has seen +3.7 SD Commercial buying this week while NZD, CHF and JPY have seen significant Commercial selling. Note that COT data is based on Tuesday's positioning, so the latest central bank meetings (e.g. the SNB) are not yet reflected in the data!

Metals positioning is bullish as well with Copper being a bit of an exception

Grains and Softs aren't at extremes… unless you're watching OJ.

COT/TIFF data for FX futures:

6B is near a bullish extreme with a %R of 0.90

6J still near a bullish extreme, %R 0.90 as well. Who is still shorting it if Dealers don't have to buy?

Citi Pain Indexes:

The “long Dollar” trade is getting a bit crowded

Just a quick glance at commodity performance: it's starting to look a lot more dispersed than a few weeks ago. Energy (and Orange Juice…) still at or near the top of the list, Copper somewhere near the bottom.

Market Risks

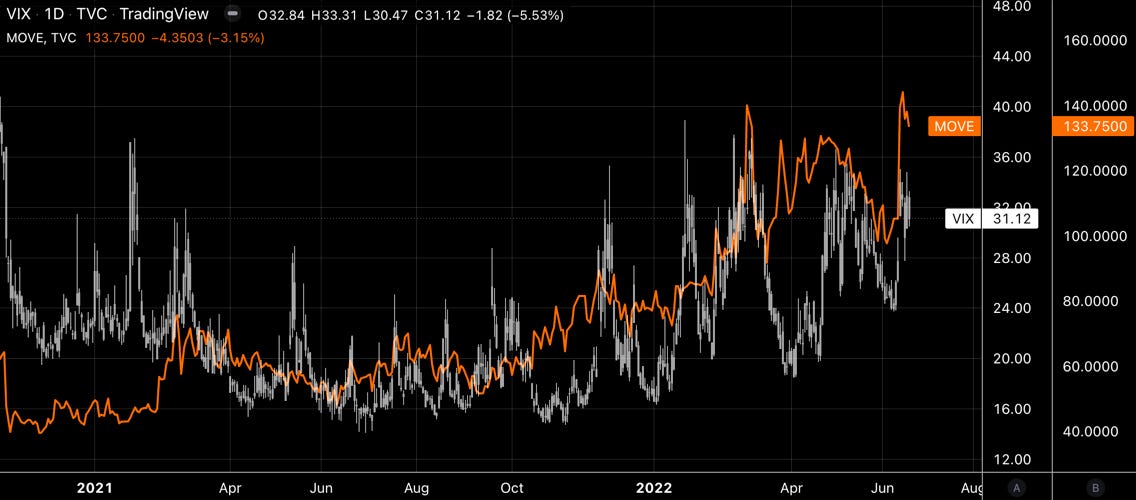

VIX and MOVE are elevated. MOVE has taken out its March high and is just about 30 points below its Covid peak. VIX looks complacent by comparison.

The VIX term structure is in backwardation and at a small discount to spot VIX. The market already seems to be looking forward to a year-end rally in December…

Credit spreads are continuing to widen:

Credit Spread Index basically showing the same:

Various

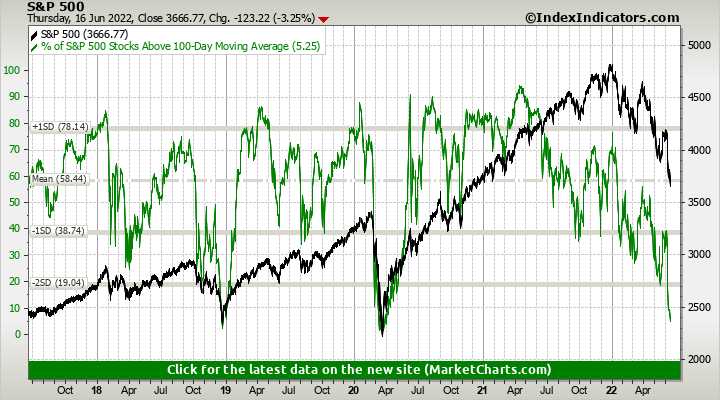

Market breadth: the percentage of S&P 500 stocks above their 100-day MA is near an extreme low. Note how well that indicator diverged during H2 of last year. Unless we're seeing a rapid recovery of breadth indicators like this it's still going to be sell the rally.

Same goes for the Nasdaq:

The CNN Fear and Greed Index is in “extreme fear” territory, but nowhere near the bottom.

FX volatility is picking up across the board:

25-delta risk reversals:

No major divergences overall

USDCHF is being priced lower

USDJPY had some interesting moves in the risk reversals prior to the BOJ this week. This looks like the market was more than just a bit concerned about a hawkish turn by the Bank of Japan.

Other Stuff I've been looking at

Nothing this week.