Welcome to edition #9 of FX & Macro Weekly. This is just the review part, because I'll be on vacation for a short while and I'm not going to be trading. The next edition should be out in four weeks! Hope you have a not-too-bad time in this bear market!

Thanks to everyone who subscribed, I really appreciate it and I hope you benefit from the content. If you do, please consider sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroweekly.

Central Banks

ECB Economic Forecasts Spring 2022 (16.05.)

Can be found here. It's a bit boring, but some interesting info:

A vulnerability matrix of every EU country re: Russia. Cyprus has a total exposure of 713% of its GDP (!), Lithuania is at 85% and Ireland still at 10.8% of GDP.

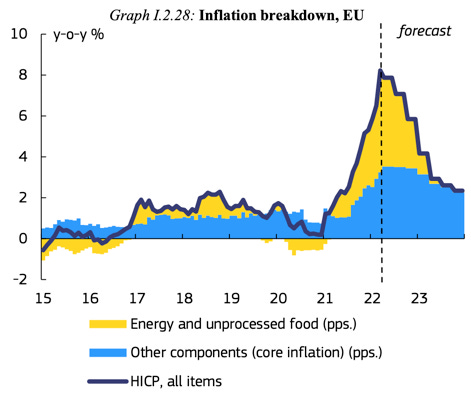

They assume energy and food inflation will go down to zero over the rest of the year while core inflation will remain elevated:

RBA Board Minutes (17.05.)

Link to full text: here. Below some relevant point (emphasis mine):

Members agreed that the condition the Board had set to increase the cash rate had been met. They also agreed that further increases in interest rates would likely be required to ensure that inflation in Australia returns to the target over time.

Members considered three options for the size of the rate increase at the present meeting – raising the cash rate by 15 basis points, 25 basis points or 40 basis points. Members agreed that raising the cash rate by 15 basis points was not the preferred option given that policy was very stimulatory and that it was highly probable that further rate rises would be required. A 15 basis point increase would also be inconsistent with the historical practice of changing the cash rate in increments of at least 25 basis points. An argument for an increase of 40 basis points could be made given the upside risks to inflation and the current very low level of interest rates. However, members agreed that the preferred option was 25 basis points. A move of this size would help signal that the Board was now returning to normal operating procedures after the extraordinary period of the pandemic. Given that the Board meets monthly, it would have the opportunity to review the setting of interest rates again within a relatively short period of time, based on additional information.

Members also discussed the reinvestment strategy for bond maturities of the stock of bonds purchased by the Bank during the pandemic. Although only a small value of government bonds held by the Bank would be maturing in 2022, the value of maturing bonds held by the Bank would start to rise with the April 2023 bond maturity.

The Board decided that it would not reinvest the proceeds of maturing government bonds, consistent with the decision to start withdrawing from extraordinary monetary policy settings. However, the Board did not currently plan for the Bank to sell the government bonds it had purchased during the pandemic and it intended to allow the portfolio to run down in a predictable way as bonds mature. While contributing to the withdrawal of monetary stimulus, this would also recognise that the cash rate remains the primary tool for achieving the desired stance of monetary policy.

ECB Meeting Minutes (19.05.)

Link to the full minutes. Relevant points here (emphasis mine):

Overall, the recent developments suggested that inflation rates would remain very high in the short term.

While various measures of longer-term inflation expectations derived from financial markets and from expert surveys were largely around 2%, initial signs of above-target revisions in a number of indicators of inflation expectations warranted close monitoring.

Against this background some members viewed it as important to act without undue delay in order to demonstrate the Governing Council’s determination to achieve price stability in the medium term. Such action was deemed necessary to prevent the temporary bout of higher inflation from becoming entrenched and to prevent inflation expectations from rising further from the Governing Council’s target, which would make it significantly more costly to bring inflation back to the target. These members judged that the highly accommodative monetary policy stance, which had been appropriate when inflation expectations risked becoming unanchored to the downside, was no longer consistent with the inflation outlook, which was characterised by high inflation levels and increasing inflation expectations. At present monetary policy was still contributing to stimulating the economy as real interest rates remained in deep negative territory.

Past projection errors, for both headline and underlying inflation, were contributing to these concerns. Many of the upside risks to the inflation outlook that the Governing Council had already discussed last summer had materialised even before the war started.

On the one hand, some members viewed the higher than expected inflation figure in March and inflation expectations moving above the 2% target as requiring an adjustment of the monetary policy stance towards a neutral position sooner rather than later and a modification of the Governing Council’s inflation narrative in line with the stated data-dependency of its monetary policy. This implied that net asset purchases should be ended as soon as possible, opening the possibility for a first interest rate hike shortly after.

Confab, Speakers, News

Federal Reserve

Williams (Dove). Mon: 50 bps hikes make sense at upcoming meetings, need to get real rates back to zero, seeing inflation in a broad set of goods, monetary policy can reduce demand and bring it back in line with supply, current tightening of financial conditions larger than in 1994

Bullard (Hawk). Tue: inflation is the most pressing issue, expects household consumption to hold up, base-case is above-trend growth for next 18 months. Fri: 50 bps is a good plan for now, wants to get to 3.5% by year-end, QT is an important part of policy, sees lower interest rates in 2023 or 2024 if inflation is under control, economy to slow down but still be growing above trend in 2022

Kashkari (Dove). Tue: Fed will get at least to neutral by end of the year, have to do more if no help from the supply side. Thu: not sure how high rates will have to go to bring inflation down, depends on the supply side, Fed has done quite a bit to remove support through forward guidance, labour market not fully healed

Powell (Neutral). Tue: broad support for 50 bps hikes at next two meetings, Fed doesn't know where neutral is, but would not hesitate to go above neutral, Fed is going to raise rates until “convincing evidence” inflation is coming down

Evans (Dove). Wed: interest rates should be raised to neutral at around 2.25-2.5% “expeditiously”, favours ongoing front-loading, policy rate may need to go “somewhat” above neutral to achieve inflation goal, back to talking about 25 bps hike by July or September, believes inflation will come down to 3% or lower by 2023, Fed will say policy isn't restrictive as long as inflation is high and trajectory is up

Harker (Hawk). Wed: expexts 50 bps hikes in June and July, “measured” moves after that until confident that inflation is moving towards 2%, inflation is a scourge and an urgent problem

George (Neutral). Thu: comfortable with 50 bps, inflation is main focus in determining when “enough is enough” in policy tightening

European Central Bank

Villeroy (Neutral). Mon: expect a decisive June meeting and an “active summer”, further steps are data dependent but should at least move to neutral rate, exchange rate is a significant driver of imported inflation, a Euro that's too weak goes against price stability objective. Fri: priority is fighting inflation, which means normalizing interest rates

De Cos (Dove). Mon: ECB likely to end APP in July and raise rates very soon after that. Wed: bond buying should end in Q3, rate hike shortly after

Knot (Hawk). Tue: 25 bps hike in July is realistic, 50 bps should not be excluded if inflation is broadening, ECB needs to normalize policy

Rehn (Neutral). Wed: necessary to move rates out of negative territory quickly, that's broadly shared by many colleagues within the ECB

Kazaks. Fri: hops the first rate hike will be in July

Müller. Fri: focus is on fighting high inflation

Visco. Fri: July might be the time to start hiking, June out of the question, must get out of negative rates

Nagel (Hawk). Fri: important to raise rates (when asked about a 50 bps hike), negative rates are a thing of the past

Sources. Thu: majority of policymakers are in support of at least two 25 bps hikes this year, 50 bps hike is also gaining traction

Bank of England

Bailey (Neutral). Mon: not happy about inflation outlook, it's a bad situation to be in, over 80% of UK inflation is due to energy and tradable goods, does not think they could reasonably have done anything differently on policy

Saunders (Hawk). Mon: we should move more quickly to a neutral stance, would not say inflation expectations are unanchored, we should lean strongly against higher inflation expectations

Cunliffe (Neutral). Tue: tightening and QT will lead to moves out of risky assets, doesn't think crypto is a systemic risk, no intrinsic value in crypto assets

Pill. Fri: tightening has further to go, potential for second round effects is obvious, no decision on Gilt sales yet

Swiss National Bank

Jordan. Wed: ready to intervene in FX markets when necessary to meet the bank's mandate, inflation will temporarily rise above target and fall back quickly

Bank of Japan

Kuroda. Mon: important to continue monetary easing to promote virtuous cycle of wage growth, will take time until inflation takes hold in Japan, BOJ not targeting exchange rate, excessive moves are undesirable

Economic Data

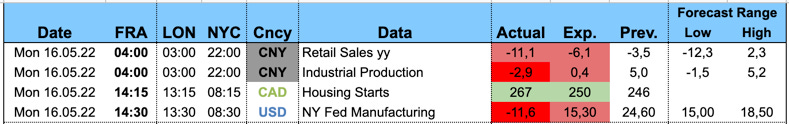

Monday, 16.05.22

Chinese Retail Sales and Industrial Production disappointed with the latter even below the forecast range. AUD was weaker

Canadian Housing Starts improved, CAD was weaker

US NY Fed Manufacturing Index was way below its forecast range, the USD weakened. Here's the relevant part from the report (emphasis mine):

After growing strongly last month, business activity declined in New York State, according to firms responding to the May 2022 Empire State Manufacturing Survey. The headline general business conditions index dropped thirty-six points to -11.6. New orders declined, and shipments fell at the fastest pace since early in the pandemic. Delivery times continued to lengthen, and inventories expanded. Labor market indicators pointed to a modest increase in employment and average workweek. Both the prices ahead, optimism about the six-month outlook remained subdued.

Tuesday, 17.05.22

UK Unemployment and Average Earnings were both better than expected, GBP was stronger

Eurozone Q1 GDP came in above expectations, EUR was unchanged

US Retail Sales and Capacity Utilization were both above consensus, Industrial Production was in line with the forecast, USD did not react too much

Global Diary Prices improved, NZD was weaker

Wednesday, 18.05.22

Aussie Wage Price Index hit below the forecast, AUD was weaker

UK CPI came in below consensus, GBP was weaker

Canadian CPI was weaker than last month, CAD was weaker as well

US Building Permits and Housing Starts were mixed, no change from USD

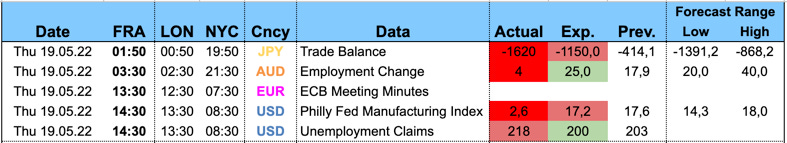

Thursday, 19.05.22

Japanese Trade Balance came in below the forecast range, JPY was weaker

Aussie Labour Market Report also hit below the forecast range, AUD zig-zagged and was stronger

ECB Meeting Minutes (see above), EUR did not react much

US Philly Fed Manufacturing ended below the forecast range and Employment Claims disappointed as well, USD was weaker. Here are the relevant points from the survey (emphasis mine):

Responses to the May Manufacturing Business Outlook Survey suggest continued overall expansion for the region’s manufacturing sector. Although the indicator for current activity fell, the new orders and shipments indexes rose. The firms continued to indicate overall increases in employment and widespread increases in prices paid and received. The survey’s future indexes suggest muted optimism for growth over the next six months.

Friday, 20.05.22

Kiwi Trade Balance improved and Credit Card Spending worsened, NZD was broadly unchanged

UK GfK Consumer Confidence hit below consensus and Retail Sales hit above, GBP was stronger on the Retail Sales beat

Japanese National Core CPI was in line, JPY did not move in a clear direction

German PPI was above the forecast range and Eurozone Consumer Confidence beat consensus, no clear reaction from the EUR