Week 20/2022

Fed Financial Stability Report and Loan Officer Survey, BOJ Summary of Opinions, Central Bank Speakers, and more...

Welcome to edition #8 of FX & Macro Weekly.

Thanks to everyone who subscribed, I really appreciate it and I hope you benefit from the content. If you do, please consider sharing it or forwarding it to others who might be interested. I'm also on Twitter @fxmacroweekly.

This newsletter is quite long, so there's a Summary section at the top. Everything you find there is derived from data and news I show in detail in the second and third parts of the newsletter (Week in Review and Market Analysis). I encourage you to go through those parts, because they are basically the reasoning behind the conclusions I present in the Summary. The final section is a collection of things I read during the week that influence my thinking.

Now let's get started…

Table of Contents

Executive Summary (Playbook, Calendar, Levels)

Week in Review

Central Banks (Fed Financial Stability Report, BOJ Summary of Opinions)

Economic Data (Daily Summary and currency reaction)

Market Analysis

Growth and Inflation

Yields

Central Banks

Sectors and Flows

Sentiment and Positioning

Market Risks

Various

Other Stuff I've been looking at

Executive Summary

Playbook for next week

This is the shortest possible summary of everything you will find in the rest of this newsletter.

As for market risks (almost unchanged from last week):

Geopolitics with the Ukraine war escalating in terms of bombs or sanctions/embargoes.

Spillover of liquidity issues from commodity markets.

The Covid situation in China is still dire and unpredictable, but it's hard to imagine it blowing up even more.

The UK abandoning the Northern Ireland Protocol.

That's not a complete list, but rather things I have on the radar. If you think I missed something important, please let me know in the comments.

Economic Calendar for next week

Important levels to watch and look out for in the Majors

Week in Review

Central Banks

Fed Financial Stability Report (09.05.)

Link to the full release: here. It's a long read, but worthwhile. Here's a summary and some relevant points (emphasis mine):

Asset valuations. Heightened uncertainty about the economic outlook led to notable fluctuations in financial markets. Since the previous report, broad equity prices declined notably, and spreads in corporate bond markets widened considerably. Prices of risky financial assets remained generally high compared with corresponding expected cash flows. Since November, house prices rose at a rapid rate and continued to outstrip increases in rents. Asset prices remain vulnerable to declines in response to negative shocks (see Section 1, Asset Valuations).

Borrowing by businesses and households. Key indicators of vulnerabilities arising from business and household debt—including debt-to-GDP ratios, gross leverage, and interest coverage ratios—continued to improve and have largely recovered from the economic stresses of the COVID-19 recession. Nonetheless, rising inflation, supply chain disruptions, and ongoing geopolitical events might pose risks to the ability of some businesses and households to service their debts (see Section 2, Borrowing by Businesses and Households).

Leverage in the financial sector. Banks maintained risk-based capital ratios well above regulatory minimums. Leverage at broker-dealers stayed low, while leverage at life insurance companies and hedge funds remained high by historical standards. Issuance of non-agency asset-backed securities recovered from the low levels of the pandemic (see Section 3, Leverage in the Financial Sector).

Funding risks. Funding risks at domestic banks remained low as a result of large holdings of liquid assets and a limited reliance on short-term wholesale funding. However, some types of money market funds (MMFs) and stablecoins remain prone to runs, and many bond and bank loan mutual funds continue to be vulnerable to redemption risks. Elevated market volatility associated with the Russian invasion of Ukraine has led to increased margin calls by central counterparties (CCPs), which in turn increased the demand for liquidity from a range of market participants (see Section 4, Funding Risks).

On liquidity and market depth:

While the recent deterioration in liquidity has not been as extreme as in some past episodes, the risk of a sudden significant deterioration appears higher than normal. In addition, since the Russian invasion of Ukraine, liquidity has been somewhat strained at times in oil futures markets, while markets for some other affected commodities have been subject to notable dysfunction (…)

On life insurance companies:

Leverage at life insurers remained near its highest level of the past two decades. Life insurers continued to invest heavily in corporate bonds, collateralized loan obligations (CLOs), and CRE debt, which leaves their capital positions vulnerable to sudden drops in the value of these risky assets. Gradually rising interest rates improve the profitability outlook of life insurers, as their liabilities generally have longer effective durations than their assets, and higher interest rates may reduce life insurers’ incentives to invest in riskier assets. However, a large and unexpected increase in interest rates could induce policyholders to surrender their contracts at a higher-than-expected rate. If the increase in surrenders is substantial enough, it could put downward pressure on life insurers’ financial performance.

Margin increases as a result of volatility in commodity markets:

The initial margin increases were partly due to increases in contract values, but requirements also rose as a percentage of contract values—a more precise indicator of the risk that collateral can absorb (figure D). For European natural gas, initial margin as a percentage of contract value had been rising since late 2021 and soared to 80 percent of the contract value as the Russian invasion continued. Initial margin as a percentage of contract value also reached the top of the historical range for wheat and U.S. natural gas but remained well below the 2020 peak for oil.

On commodity markets:

Pressures on most large banks from exposures to commodity markets so far have been modest relative to the banks’ sizable capital and liquidity resources, in part because the most extreme volatility has been confined to specific commodity markets such as nickel, wheat, and European natural gas, and because clients have largely been able to cover their obligations. Nevertheless, commodity markets are stressed. Ongoing and more widespread extreme volatility associated with the Russian invasion of Ukraine or other adverse shocks could pose greater challenges, especially if major clients were to require significantly more liquidity or if defaults were to become widespread.

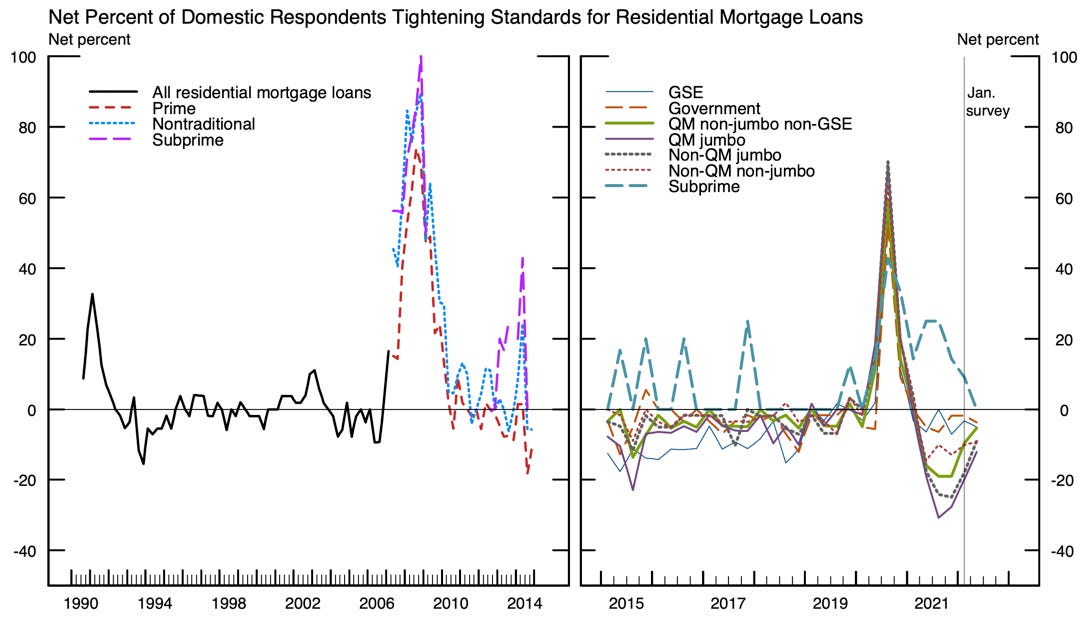

Loan Officers Survey (09.05.)

Just a few quick snippets from the Fed's Loan Officer Survey:

Lending standards are tightening:

Demand for residential mortgages if falling:

Consumers are loading up on credit card debt:

BOJ Summary of Opinions (12.05.)

From the meeting on April 27 and 28. Full text is here, relevant points below (emphasis mine):

Japan's economy is still on its way to recovery from the pandemic. Moreover, as Japan is a commodity importer, the rise in commodity prices leads to an outflow of income from Japan and thus exerts downward pressure on the economy. Given such developments in economic activity and prices, it is necessary for the Bank to continue with the current powerful monetary easing and thereby firmly support the economy.

(…) there is a significant risk that firms will become more cautious in making business decisions, it is appropriate for the Bank to make clear its stance that it will continue with the current monetary easing and thereby support the economy.

The challenge of monetary policy in Japan is not to curb inflation, but to overcome inflation that is still too low.

(…) economic conditions in Japan have been different from those in the United States and Europe, and it is not appropriate that the Bank change its policy with the aim of controlling foreign exchange rates.

The yen's depreciation works positively in the current situation where the output gap and the unemployment gap are still large in absolute terms and underlying inflation is extremely low.

The year-on-year rate of change in the consumer price index (CPI, all items less fresh food) is likely to increase temporarily to around 2 percent -- due to the impact of a significant rise in energy prices -- in fiscal 2022, when the effects of a reduction in mobile phone charges dissipate. Thereafter, however, the rate of increase is expected to decelerate because the contribution of the rise in energy prices to the CPI is likely to wane.

Japan has seen upswings in prices due to the rise in energy prices, but the situation has not been one of elevated inflation, as observed in Europe and the United States; in Japan, underlying inflation, measured by the CPI excluding such factors as energy, has remained at an extremely low level.

Confab, Speakers, News

Federal Reserve

Bullard (Hawk). Weekend: Fed is behind the curve even with current tightening in financial markets (!), need to get to the right policy rate expeditiously. Wed: goal should be 3.5% at year-end (!), 50 bps hikes at coming meetings are good benchmark for now, big chunk of current inflation is likely to be persistent and requires policy action

Waller (Hawk). Weekend: if the Fed had known what it knows now, it would have raised rates sooner (!); Tue: raising rates won't have a big impact on unemployment, pullback in demand for labour would be a good thing, this is the time to hit with rate increases because the economy can take it

Kashkari (Dove). Mon: labour market is strong, possible that inflation is starting to soften a bit, home prices have room to slow down without falling, looking at 30-year yields the Fed has removed accommodation faster than adding it in 2020. Fri: inflation much too high, hopes the Fed has to do less to bring it down, will do what needs to be done

Bostic (Hawk). Mon: sees 2-3 50 bps hikes, 50 bps is pretty aggressive, 75 bps not off the table but low probability “if things turn”, neutral at 2-2.5% and Fed needs to be there by the end of 2023 (probably meant 2022), need to remove accommodation in a purposeful and intentional way, supply chains show signs of easing. Wed: 75 bps is low probability and not his base case, supports 50 bps hikes until rate is at neutral

Brainard (Dove). Mon: large price spikes and margin calls in commodities increase risk of contagion to large financial institutions

Williams (Dove). Tue: 50 bps hikes at the next two meetings are base case, will move rates to neutral levels “expeditiously”, no hesitation to move above that if needed, labour market is “sizzling hot”, demand needs to cool to resolve supply chain issues, Fed actions will cool demand

Barkin (Neutral). Tue: inflation is high, broad-based and persistent, Fed action will not necessarily cause a recession, demand is strong and looks to remain robust, rising rates will dampen spending on housing and cars

Mester (Hawk). Tue: Fed needs to go above neutral, won't rule anything out on hikes in H2, would need to see a compelling slowdown in inflation before slowing down on rates, unemployment may need to rise to bring down inflation, there may be another negative GDP print, selling of MBS would help move the balance sheet to treasuries but could incur some losses for the Fed. Fri: favours 50 bps hikes over next two meetings, wants to see several months of lower inflation to conclude it has peaked, sees September meeting as moment to assess how policy should continue

Daly (Neutral). Thu: no reason to change course for 50 bps at next two meetings, neutral at 2.5% by end of the year, 50 vs. 75 bps is not a primary concern, recent CPI data was not very surprising

Powell (Dove). Thu: appropriate to have two more 50 bps hikes at the next meetings, answered the question what he was thinking in five words or less: “get inflation back under control”, this will include “some pain", one thing the Fed cannot do is fail to restore price stability, cannot guarantee a soft landing, would have been better to raise rates sooner

European Central Bank

Holzmann (Hawk). Weekend: two or three 25 bps hikes appropriate this year.

Rehn (Neutral). Weekend: wants to start raising rates in July and be at zero in the autumn, public needs a signal so that current higher inflation expectations do not become entrenched

Nagel (Hawk). Tue: ECB should end APP in June, raise rates in July, increasing risk of acting too late, disturbing trend that inflation is gaining momentum, expects higher inflation to prevail and expectations becoming less anchored

Villeroy (Neutral). Wed: interest rates will be raised gradually, expects inflation to stay high the whole year and be back at around 2% in 2024

Müller (Neutral-hawkish). Wed: APP should end in early July or a few weeks earlier, rate hikes must not be far behind, appropriate to get into positive territory by year-end, current policy rate inappropriate, ECB should outline rate expectations at June meeting

De Guindos (Dove). Wed: expects inflation to remain at 4-5% by the end of the year. Fri: July hike will depend on data, won't give an opinion on it, ECB will definitely stop bond buying in July, raising rates won't lower oil prices

Vasle. Wed: supports further and faster policy action, inflation becoming more broad-based

Lagarde (Dove). Wed: APP should end early in Q3, first rate hike “some time” after end of APP, could be a period of only a few weeks, normalization will be gradual after first hike, it looks increasingly unlikely that disinflationary dynamics of the past decade will return

Schnabel (Neutral). Wed: increased urgency to take action to protect price stability over recent weeks, time to end measures that were put in place to fight low inflation, have to underline determination on commitment to primary mandate more forcefully, increasing risk that current inflation is becoming entrenched in expectations

Sources. Wed: officials increasingly see rates rising above zero this year

Makhlouf (Dove). Thu: time to end APP in June or July, realistic to expect rates in positive territory early next year, current level of inflation is concerning

Kazimir (Neutral-Dove). Thu: ready to hike in July

Centeno (Dove). Fri: APP should end in the first few weeks of Q3, rate hike “some time after”

Bank of England

Saunders (Hawk). Mon: wants to move to a more neutral policy stance quickly, neutral somewhere between 1.25-2.5%, interest rate below 1% clearly below neutral, might have to go above neutral but that's not his central scenario, BOE should strongly lean against inflation expectations becoming unanchored

Bank of Canada

Gravelle. Thu: may have to raise rates above neutral, rates are too low, if inflation starts to slow and policy rate gets to neutral the bank may have to pause hikes, broadening price pressures are a cause for concern, possibility of a larger than expected slowdown in housing, recent weakness in CAD despite higher commodity prices is caused by USD strength

Bank of Japan

Suzuki (FinMin). Tue: FX stability is important, rapid moves are undesirable, watching impact of FX moves closely. Fri: same message again

Shinichi Uchida. Tue: must continue with powerful monetary easing, economy under pressure from rising commodity prices, still recovering from pandemic impact

Kuroda. Fri: massive bond buying may hurt market functioning, BOJ must continue powerful monetary easing, it's premature to discuss exit from ultra-easy policy, recent sharp moves in FX are undesirable

People's Bank of China

Chen. Thu: the bank will increase financial support for the real economy

Economic Data

Monday, 09.05.22

Nothing interesting from the BOJ Meeting Minutes

Chinese Trade Balance in USD was stronger than forecast

Eurozone Sentix Investor Confidence came in below expectations, EUR did not move anywhere

Tuesday, 10.05.22

Aussie Business Confidence was below the previous value, AUD was stronger

Eurozone ZEW Economic Sentiment hit above the forecast range, EUR was weaker

Wednesday, 11.05.22

Chinese CPI and PPI surprised to the upside

US CPI and Core CPI also came in stronger with the Core CPI landing above the forecast range. USD was up violently, came all the way down and ended stronger.

Thursday, 12.05.22

New Zealand Visitor Arrivals jumped and Inflation Expectations hit above the previous value, NZD was weaker

UK GDP was weaker than forecast, GBP was lower

US PPI was in line with expectations and Unemployment Claims were higher, USD was weaker

Friday, 13.05.22

Kiwi Manufacturing PMI was weaker than expected, the NZD was a bit stronger. Here's the summary from the report (emphasis mine):

BusinessNZ's Director, Advocacy Catherine Beard said that after steady expansionary results over recent months, the April result highlighted the fickle nature of what manufacturers are currently experiencing.

"In terms of the main sub-indices, New Orders (56.0) continued its positive stance, although Production (49.1) fell back into contraction. Employment (49.8) also contracted after two months of expansion, while Deliveries experienced its first level of contraction since November 2021."

US UoM Consumer Sentiment came in below consensus, USD was weaker. Longer-term inflation expectations from the report remain remarkably stable, while they are still going up for the short-term:

Market Analysis

Growth and Inflation

Atlanta Fed GDPNow stands at 1.8%.

The NY Fed Weekly Economic Index is 4.19:

The decline (…) is due to decreases in retail sales, tax withholding and fuel sales, and an increase in initial unemployment insurance claims (relative to the same time last year), which more than offset rises in steel production, consumer confidence, railroad traffic (relative to the same time last year) and electricity output.

Purchasing Manager Indexes are unchanged from last week:

US is improving,

UK, Eurozone, Australia and Japan are flat

Switzerland is weakening but still very strong

Still no growth impulse from Asia (China deteriorating further, South Korea flat, Taiwan weaker, only Hong Kong ticking up).

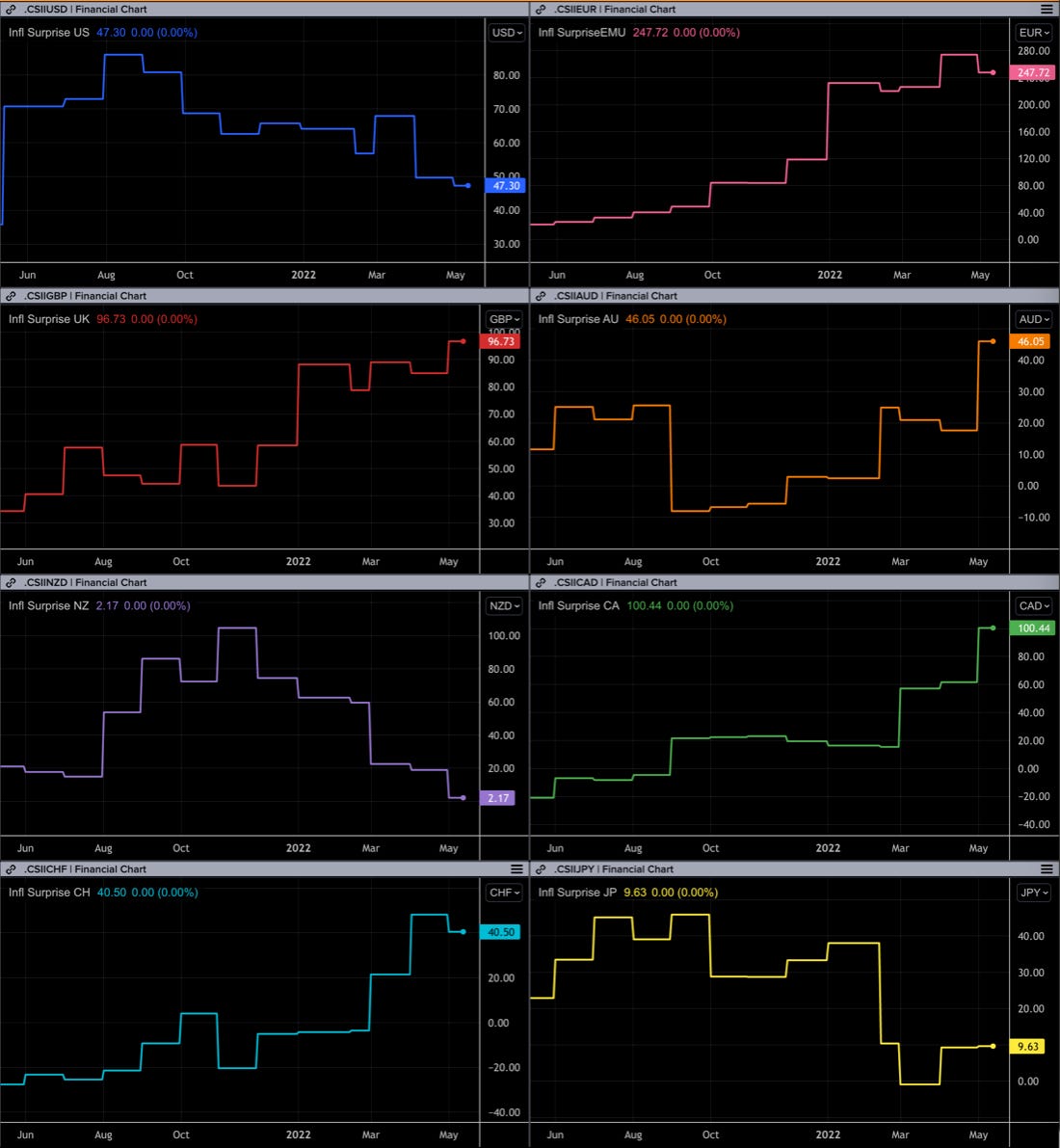

Citi Economic Surprise Indexes:

USD getting worse, GBP nosediving after this week's GDP miss

JPY very strong

CHF getting weaker

5y5y forward inflation expectations have moved down from their recent high:

The Inflations Expectations ETF isn't making new highs:

Citi Inflation Surprise Indexes are virtually unchanged from last week:

USD and NZD moving lower

EUR might have rolled over

GBP, AUD, CAD at highs

Yields

See chart and table below:

All G8 2s and 10s came down

CAD looks strongest

AUD holding up as well, especially in comparison to NZD

GBP is the weakest having moved below recent lows

Yield curves (2s10s spread) have been a bit directionless:

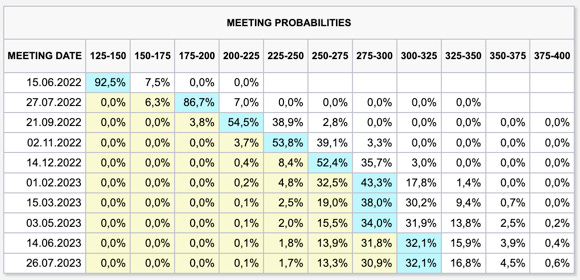

Central Banks

Market pricing for the next FOMC meeting is now pretty much in line with what comes out of the Fed in term of messaging and expectations:

Two 50 bps hikes at the meetings in June and July and 25 bps hikes after that

The far end of the expectations has moved down considerably from 350-375 bps to 300-325

It looks like we've seen peak hawkishness in terms of market pricing.

STIRs also look like they're not moving higher in the short term: peak hawkishness. Market pricing for 2023 is becoming more dovish, i.e. a harder “soft landing”.

Sectors and Flows

USD is the strongest currencies, followed by CAD

JPY has gained momentum

AUD and NZD are the weakest

Sector performance:

Energy (XLE) still leading but not making new highs for now, Oil and Gas (XOP, OIH) quite a bit below their highs or even moving lower

Growth (VUG) and Discretionary (XLY) are the worst performers

Days like Friday make it look like everything is fine, because they are reminiscent of a reflation trade, but if we zoom out and look at weekly performance it's still a disaster:

Defensives and Utilities are leading

Consumer Cyclicals is the worst performing sector

Energy isn't on top any more and Basic Materials are already near the bottom: this looks like we're already past the top of the cycle and moving into a recession

Flows into CHF continue, AUD also getting more inflows while equities continue to see outflows.

All international stock markets are in the red by now:

FTSE, Nikkei, Topix and the Australian All Ordinaries are the relative outperformers

Hang Seng, Nasdaq and Taiwanese markets are the weakest

It's been a while since there were so many bond ETFs with inflows. Not huge, but still…

Sentiment and Positioning

AAII Bull-Bear spread pulled back a bit from its historic extreme. Sentiment is still very bearish:

Fintwit equity sentiment is about as bad as it was during April 2020:

Currency Sentiment is broadly unchanged:

Bearish (long) for CAD, USD, CHF, AUD

Bullish (short) for JPY, GBP, EUR, NZD

Another sentiment/positioning data source:

USD pairs are bearish on USD

JPY pairs are bullish ob JPY

It's interesting to see that US500 is so bullish when you compare it to the AAII data above. I suspect it's because the IG Client Sentiment is based on real positions while the AAII sentiment is more purely sentiment

Here's some interesting stuff from TD Ameritrade. Looks like retail traders are buying the “dip” in Tech and selling defensives:

As the major indices experienced a sharp pullback from the March rebound, few individual names were spared. (…) Once again, TD Ameritrade clients used this opportunity to accumulate popular large cap tech names.

Amazon.com (AMZN) reported disappointing earnings, posting their first quarterly loss in seven years, and pulled back 14% the following day, leading to strong buying interest from clients.

Alphabet (GOOGL) sold off after the tech giant reported results that missed estimates on the top and bottom line; the pullback was used as a buying opportunity by clients.

Apple (AAPL) reported top and bottom lines numbers that beat analyst estimates, but warned on the impact of renewed COVID lockdowns at key manufacturing locations in China. TD Ameritrade clients seemed to look past this and bought the tech giant on the pullback.

Meta Platforms (FB) reported mixed earnings after being among the worst tech performers of the year, but was able to beat Daily Active User expectations and was net bought by TD Ameritrade clients following their report.

While shares of (TWTR) rallied on the buyout news, concerns this could have a negative impact on Tesla (TSLA) led to a strong pullback that was used as a buying opportunity.

Commitment of Traders data and commodities:

Extreme commercial long positioning in the R2k and the Dow Jones

Strong commercial buying and Large Spec selling in NZD and CAD with Z-scores above 1.5 and below -1.5, respectively

Metals are performing poorly with Relative Strength numbers below 1 and falling, but COT data is becoming supportive of higher prices, especially in Copper (Commercial positioning has a Z-score of 3.53!)

A closer look at FX futures from the COT/TIFF report (similar to last week):

Dealer positioning is starting to get a bit stretched across all currencies:

USD is near its 2-year low, EUR at its 2-year high

GBP is getting to its high, CHF as well

JPY positioning is still near its extreme long

Large moves long in AUD and NZD

Market Risks

VIX and MOVE not making new highs, which is interesting given the new lows in stocks and bonds.

High-yield OAS have broken out, Baa Corporate spreads look a bit calmer:

A composite index of credit spreads isn't holding back either:

The VIX term structure has been in a clear backwardation until Thursday, but it still looks messy after Friday (still better than expected, though):

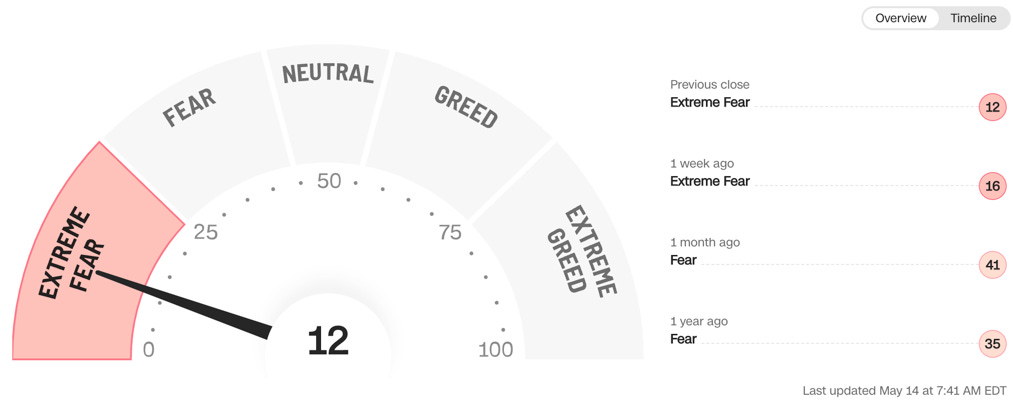

The CNN Fear & Greed Index is back in “Extreme Fear” territory.

Various

25-delta risk reversals:

EUR and GBP are priced higher

JPY is priced lower

FX volatility has moved up recently, but it's still low compared to March 2020:

Other Stuff I've been looking at

Nothing this week… no time for Twitter and just a glance of my Substack reading list.

This is amazing work, so much great content in one place. Thank you !

Thank you so much for the analysis it really means alot to me since it's been few months since I dipped my feet into the FA Waters..this is a gem thnx once again...